Abstract

The objectives of this research are to identify theoretically the resources and competences critical for ASO development, and to analyse empirically the actors from the academic and market contexts who supply them at two stages of development: creation and initial development and consolidation stages. Departing from the resource-based view, path dependence theory, and the stage-based model, and inspired by Vohora et al. (Res Policy 33(1):147–175, 2004), our starting point is the thesis that an ASO makes a successful transition to the next stage of development when it has acquired the resources critical for success in the previous stage and that this acquisition depends on the relationships established with actors from different contexts. From an analysis of 167 Spanish ASOs, our results show that in the creation and initial development stage, academic actors do not provide ASOs critical resources and competences for growth. Technological transfer offices and university incubators only supply managerial competences, while research colleagues provide technological support. However, government institutions and Science park are very relevant actors that assume a key role for future ASOs consolidation. In the consolidation stage, customers and suppliers provide solid commercial competences. In both stages, venture capital firms are relevant market actors that provide not only financial resources, but also market credibility to make the successful transition from one stage to another. Our findings offer significant implications, both theoretical and practical, for networks and the academic entrepreneurship literature.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

1 Introduction

Academic spin-offs (ASOs) are a significant means for some exploitation of innovations developed by academic scientists (Vohora et al. 2004). As stated by Vanaelst et al. (2006), the core of an ASO consists of the research and associated knowledge generated inside a university that is commercialized in the corresponding markets through the creation of a new company. However, the development of an ASO is challenging for academics, who face important obstacles that can reduce an ASO’s chance of survival and success, particularly because growth implies that ASOs must compete in a commercial environment that is very different from the university context in which they are created (Vanaelst et al. 2006; Vohora et al. 2004).

The difficulties facing ASOs are well documented in the literature (Moray and Clarysse 2005; Mustar et al. 2006; Saetre et al. 2009; Van Geenhuizen and Soetanto 2009; Vohora et al. 2004). Given their academic origin, founders possess considerable experience in research and scientific education but they tend to lack competences related to business management, experience competing in industry, and skills in recognizing and exploiting market opportunities (De Cleyn et al. 2011; Franklin et al. 2001). These deficiencies create problems related to lack of credibility in the markets and lack of funding, which, during their initial phases, limit the capacity of ASOs to become companies consolidated in their respective markets capable of obtaining returns (Vohora et al. 2004). Therefore, in order for an ASO to grow and develop, it must progressively distance itself from the academic environment in which it relied on actors closest to its founders and instead immerse itself in an environment that is essentially commercial and highly competitive (Gübeli and Doloreux 2005; Vohora et al. 2004). This reality, which is the inevitable point of departure for an ASO, has led some authors to state that the process of evolution from creation to consolidation will depend crucially on the support it receives from a variety of different actors capable of providing it with the resources and competences needed in each phase (Bjørnåli and Gulbrandsen 2010; McAdam and Marlow 2008; Timmons and Spinelli 1994; Vohora et al. 2004). In this respect, Vohora et al. (2004: 148) state that “in order to progress through different phases of development, ASOs need to develop both resources and internal capabilities over time.”

The objective of this research is twofold. First, departing from some inductive studies, to propose theoretically the critical resources and competences that ASOs, once formally created, need to acquire in two stages of development. Second, to analyse empirically which actors, and actors from which contexts supply critical resources in each stage. Our research questions are: Which actors are supplying Spanish ASOs the critical resources and competences at (1) the stage of creation and initial development and (2) the stage of consolidation? Do the actors from the academic context and the market context have the same relevance at each stage? To this end, and inspired by Vohora et al. (2004), we test the thesis that, at each stage, the resources and competences needed are different, and that an ASO can make a transition at each critical juncture of its growth only after it has acquired the resources and competences critical for success in the preceding stage. The success of the transition from one phase to another will depend, to a large extent, on the actors to whom the ASO may have access for the required resources and competences.

The frameworks adopted for this research are based on resource-based view, path dependence theory and non linear stage based model literature. We use these theoretical bases to explain the development of ASOs through a process not merely linear, but path dependent on the accumulation of critical resources that allows the new company to evolve from one phase to the next, and thus to explain the success of these companies (Barney 1991; Vohora et al. 2004).

Research that analyses the evolution of ASOs using stage models, linking that evolution to the acquisition of resources and competences from diverse actors, is extremely scarce and recent (Gübeli and Doloreux 2005; Patzelt and Shepherd 2009; Rasmussen 2011; Saetre et al. 2009; Soetanto and Van Geenhuizen 2010; Vohora et al. 2004). Moreover, there are no quantitative investigations using databases of ASOs. For these reasons, this study contributes significantly to empirical and theoretical research within the field of academic entrepreneurship, adding value to network content research in the context of ASOs and reporting significant conclusions about the roles of key actors as sources of critical resources at different stages in the growth of ASOs (McAdam and McAdam 2008; Soetanto and Van Geenhuizen 2010). Through the analysis of 167 Spanish ASOs, our empirical study offers a better understanding of the key actors from both academic and market contexts that provide the resources and competences critical to the transition from one stage of growth to the next. Recent studies emphasize the need to consider how networks should evolve in order to generate the resources needed at the different stages of a new company’s development (McAdam and Marlow 2008).

The structure of the paper is as follows. In the next section we establish the theoretical background that supports this research. Next, we provide some analysis of the characteristics, obstacles, and critical resources at the stage of creation and initial development and the subsequent stage of consolidation, from which we deduce hypotheses about the actors who are providing them. In the following sections we describe the methods, specifications of the variables, and results of our empirical study. The final section presents the findings, conclusions, limitations, and practical implications of the research.

2 Theoretical background

To guide our research we have relied on three types of literature. First, we draw on the resource-based view and path dependence theory. The first approach stresses that organizations need to access different resources and capabilities to develop and obtain sustainable returns over time (Barney 1991; Penrose 1959; Wernerfelt 1984). On the other hand, the path dependence view points out that “an organization contains the seed of its own transformation” (Blau 1955: 9). This theory’s core feature states that organizational evolution follows an idiosyncratic path dependent on the initial configuration of resources and capabilities (Heine and Rindfleisch 2013). By relying on both approaches, we start with the premise that the resources and competences developed by a company, or the ones it has access to at its initial stages, are going to condition the creation and the access to other necessary resources at later stages and, therefore, its evolution. In the context of ASOs, Vohora et al. (2004) state that these companies face difficult obstacles when it comes to having access to initial critical resources and capabilities and that as a consequence, their future growth and development can be limited. “Path dependence of ASOs, emerging from a university environment, may present specific challenges to ASOs as opposed to new high-tech ventures in general” (Vohora et al. 2004:166). Amongst these obstacles the literature has mainly highlighted the lack of competence and experience of the founding teams’ management in competitive markets, which leads to a lack of credibility, and therefore, to serious problems regarding funding and the access to critical resources (De Cleyn et al. 2011; Van Geenhuizen and Soetanto 2009; Vohora et al. 2004; Wright et al. 2006).

However, the resource-based view and path dependence theory only allow us to explain the relevance that access to critical resources from the initial stages has for the evolution of ASOs, and the limitations on said evolution when the access to these resources is not possible. That is why, in order to link the needs and limitations in access to critical resources to the evolution of ASOs, the nonlinear stage-based model has worked as a reference framework. In this regard, some authors have remarked that the nonlinear stage-based model is a suitable framework for understanding how the entrepreneurial process of ASOs develops over time (Rasmussen 2011; Vohora et al. 2004).

According to the traditional stage-based model, organizations grow through predetermined stages of their life cycle, assuming that development and growth are synonymous (Lichtenstein 2000). However, according to Lichtenstein (1999, 2000), the transition from the development stage to the next is not linear or incremental. The transition takes place when the company crosses a critical threshold of limitations on its ability to grow (Lichtenstein 2000). Threshold limitations have their origin in the increase or decrease of resources and activities that are big enough that if firms do not trigger a change, they can not obtain their goals or even survive. To the same extent, in the context of ASOs, Vohora et al. (2004) use the non-linear stage-based model, introducing the “critical juncture” concept to explain the transition between different stages of an ASO’s development. This research identified that ASOs emerge not so much through discrete stages of growth but rather through nonlinear phases of development separated by critical junctures. These authors define a critical juncture as “a complex problem that occurs at a point along a new high-tech venture’s expansion path preventing it from achieving the transition from one development phase to the next” (Vohora et al. 2004: 159). Critical junctures are produced from a conflict between the level of existing resources, capabilities, and social capital in ASOs and the resources required to perform in the next development stages (Wright et al. 2007). Overcoming several “critical juncture” will allow ASOs to make the transition from a development stage to the next and to generate sustainable returns.

Recent pioneering studies have examined the development of ASOs from a process perspective, mainly relying on stage-based models and a resource-based view (Clarysse and Moray 2004; Gübeli and Doloreux 2005; Rasmussen 2011; Vohora et al. 2004). From a review of this literature, we find that there is no consensus related to the number of phases of evolution ASOs undergo, which stages must be included in each phase of evolution, or even the method that has been used to identify such stages. Some studies have identified the stages of evolution of ASOs from inductive research (Clarysse and Moray 2004; Degroof and Roberts 2004; Ndonzuau et al. 2002; Vohora et al. 2004; Rasmussen 2011), while other studies are based on predetermined stages of development suggested in other studies (Gübeli and Doloreux 2005; Vanaelst et al. 2006), such as the one by Vohora et al. (2004) or the one by Roberts (1991). Some authors have found inductively that the academic entrepreneurial process encompasses four (Clarysse and Moray 2004; Ndonzuau et al. 2002; Rasmussen 2011) or five stages (Vohora et al. 2004). This lack of consensus on the number of stages of development is more pronounced regarding the previous phases of the formal establishment of the ASO and its initial development. Thus, some studies place the start of the development of ASOs at the research phase (Vohora et al. 2004), others at opportunity recognition (Vanaelst et al. 2006), or at the pre-foundation stage, when the decision to set up an ASO has been made (Gübeli and Doloreux 2005). Furthermore, not all the studies have considered the complete development process from research or opportunity recognition through to maturity.

The stages considered by each of these studies seem to depend, in part, on the research questions they have posed. Most of these studies have focused on identifying the stages in the development process of ASOs from the moment the knowledge is generated in the core of the university until they operate and compete actively in the markets. By doing so they have analysed a fairly large number of stages (Ndonzuau et al. 2002; Rasmussen 2011; Vanaelst et al. 2006; Vohora et al. 2004). Other studies, which use the stage-based models approach, have focused on studying specific topics within the evolution process of these companies and not on the process itself by taking into account, within their research, those stages suitable for analyzing the research questions posed by the studies. In this regard Clarysse and Moray (2004) analyse the evolution of the entrepreneurial team throughout different stages of the start-up stage of ASOs. On the other hand, Gübeli and Doloreux (2005) focus on the characteristics these companies show at three development stages, and the relationship they have with the parent organization and the local environment during this process.

Based on the arguments that have been established in this paper, in order to answer the research question, Which actors and from what contexts are supplying ASOs, once these have been formally created, with the critical resources and competences at each stage of their development? We have considered a limited number of stages: the stage of creation and initial development and the stage of consolidation. There are several reasons for this. (1) Our objective is not focused on analysing the complete entrepreneurial process of an ASO from the moment the idea or knowledge for the business springs forth until the ASO operates competitively in the markets. (2) Our unit of analysis is formed by ASOs that have been formally set up. Our focus must be on the evolution of these companies from the moment they begin their activity in the markets until they have built up credibility outside the scientific community and are attempting to generate sustainable returns. (3) Finally, the literature has noted that in order to drive the development of an ASO forward, founders should distance themselves from the academic environment and act with more self-sufficiency to access resources from market actors (Gübeli and Doloreux 2005; Pérez and Martínez 2003; Vohora et al. 2004). Hence, the specific analysis of these two stages allows the resolution of one of our research questions concerning the origin of the actors that supply the critical resources at each stage of development.

3 Stages in the evolution of an ASO: critical resources and actors

3.1 Stage of creation and initial development of the ASO

In the creation and initial development stage, ASOs must begin to implement strategic plans regarding the acquisition and development of the resources necessary to start their business activity (Vohora et al. 2004; Wright et al. 2007). In this phase, ASOs that are immersed in the university context, with mainly academic networks, have to face four main obstacles. The first obstacle is related to the founding team of the ASO, formerly academics but now entrepreneurs, who often lack the business competence and experience necessary to convert their discoveries into commercially viable innovations (Lockett et al. 2003; Stuart and Abetti 1990; Van Geenhuizen and Soetanto 2009; Vohora et al. 2004). These deficiencies will also affect the academic founders’ capacity to develop a business plan attractive enough to financial actors who might supply seed funding; thus, ASO financing is a second obstacle (Lockett et al. 2002; Vohora et al. 2004). A third obstacle is related to the acquisition of complementary technological resources that ASOs need for the successful evolution of technology from an embryonic state to a prototype state. Finally, ASOs have difficulties in obtaining the market credibility needed to successfully commercialize their knowledge (Vohora et al. 2004). A new ASO has no track records in the markets, which makes it difficult for actors to evaluate and support their activities and thereby confer them credibility. In order to overcome these obstacles, previous studies using inductive research have concluded that the main critical resources are related to the acquisition of business competences, complementary technological resources, seed capital, and market credibility (Mosey and Wright 2007; Ndonzuau et al. 2002; Vohora et al. 2004).

In this early stage, the first problem is related to the deficiencies in business competences often presented by the founding academic team (Vohora et al. 2004). Business competence includes managerial and commercial competences. Managerial competence, which addresses how to develop and manage a new company, includes negotiating, leading, planning, decision-making, problem-resolving, organizing, and communication (Shane 2003). Commercial competence is related to knowledge about products and services and their capacity to satisfy customers´ needs and, therefore, knowledge about the particular market in which the company operates. Commercial competences contribute to overcoming significant market uncertainty and helps to gain information about customer needs and potential price, alternative products and services of competitors, how to choose a market application for the ASO’s inventions, and how to sell new products and services to customers (Shane 2004).

To develop managerial and commercial competences, the founding team usually resorts to the advice and consultancy offered by academic actors such as transfer technology offices (TTOs), university incubators, and research colleagues with entrepreneurial experience. Limited relationships with market actors, together with the shortage of financial resources ASOs have at this stage, make them turn to close academic actors that can supply these competences at a lower cost. Through relationships with academic actors, the ASO can acquire managerial and commercial competences through consultancy, training, mentoring, and transfer of experiences (Carayannis et al. 2006; Patzelt and Shepherd 2009; Van Burg et al. 2008; Zucker et al. 2002). TTOs usually offer training and experience in preparing business plans (Lockett et al. 2003; O’Shea et al. 2004; Rodeiro et al. 2010). University incubators can also provide advisory and training services in the entrepreneurial capacities that are essential at this initial stage (Clarysse et al. 2005; McAdam and McAdam 2008; Rodeiro et al. 2010). Finally, colleagues with entrepreneurial experience can offer useful managerial advice in a manner that responds to the contingencies of entrepreneurial activity (Clarysse et al. 2005; 2011; Mosey and Wright 2007; Rappert et al. 1999; Rasmussen 2011; Rodeiro et al. 2010; Sarasvathy 2001; Shane 2004).

A second resource that is critical for ASOs at this stage is related to technological support, as this will enable the scientific discoveries to evolve into products and services that can be commercially exploited (Link and Scott 2005; Lockett et al. 2005; McAdam and McAdam 2008; Rodeiro et al. 2010; Vohora et al. 2004). At this stage, academics possess the technical abilities and basic scientific and technological knowledge fundamental to developing the invention (Saetre et al. 2009; Van Geenhuizen and Soetanto 2009). However, to commercially exploit this knowledge, ASOs need complementary technological resources that will enable their technology to evolve from an embryonic state to a prototype state, allowing the new product/service to mature and increase its commercial potential (Swamidass 2013).

Academic entrepreneurs usually acquire these complementary technological resources through academic actors because their proximity represents a saving in costs and the assumption of less risk (Saetre et al. 2009). These technological resources may be either tangible or intangible. Among the more important are laboratories; testing and measurement equipment; technological advice in the use of sophisticated technologies; evaluation of the technical feasibility of research results; advice on the identification of possible applications and functionality; and assistance in determining the optimal design of new products and the technical processes that lead to industrial exploitation. All these resources, especially the intangible ones that are usually supplied by research colleagues, enable the ASO to convert its basic technology into applied technology in markets (Ndonzuau et al. 2002; Pérez and Martínez 2003; Saetre et al. 2009).

Based on the analysis of the actors who provide the ASO with business competences and complementary technological resources, we formulate our first hypothesis.

Hypothesis 1:

At the creation and initial development stage, ASOs acquire managerial and commercial competences and complementary technological resources through academic actors.

A third resource that is critical at this early stage is seed capital. Securing adequate financing is one of the principal and most difficult tasks an ASO needs to achieve in this phase (Patzelt and Shepherd 2009; Shane and Stuart 2002; Vohora et al. 2004). ASOs have difficulty accessing adequate financing because, in the first place, their founding teams usually lack the competences required to design an attractive business plan for investors (Munari and Toschi 2011; Wright et al. 2006). A second difficulty is essentially one of asymmetry of information. In this early stage of the ASO, development of the prototype product or service is often still in an incipient phase, which creates difficulties for investors attempting to evaluate the commercial potential of that technology. Thus, many investors are dissuaded from backing the ASO financially at this initial stage (Lockett et al. 2002). Thirdly, ASOs’ lack of credibility makes potential investors see them as not very attractive businesses, given their lack of trustworthiness, expertise, and reliability.

Most of the studies in the literature have stated that venture capital firms (VCs) may constitute the most important sources of funding for ASOs because they have the business competence and industry experience needed to judge entrepreneurial projects. VCs have also developed specific financial instruments to moderate the adverse effects arising from information asymmetries (Colombo and Grilli 2010; Kaplan and Strömberg 2003). Nevertheless, VCs usually only fund ASOs at early stages when they present very promising technologies, projects, or scientific teams (Degroof and Roberts 2004; Wright et al. 2007). When this is not the case, accessing private funding from a VC may be especially difficult for an ASO for at least two reasons (Moray and Clarysse 2005; Wright et al. 2006). In the first place, academic entrepreneurs usually lack the commercial ability to transmit to the VCs credible forecasts of the profits that can be expected from their scientific innovations (Lockett et al. 2002; Moray and Clarysse 2005; Vohora et al. 2004). Second, academic entrepreneurs are often reluctant to reveal details of their new technology to other parties (Munari and Toschi 2011). Limits on access to information and uncertainty are serious obstacles preventing a VC from evaluating the technical feasibility and market potential of the new technologies that an ASO plans to exploit, and thus many VCs are discouraged from getting involved financially in these start-ups.

Difficulties in accessing private financing at this initial phase usually cause ASOs to try to obtain their seed capital through government institutions that provide financial resources to ASOs at reduced cost in conditions of uncertainty (Ortín et al. 2007; Rodeiro et al. 2010; Wright et al. 2006). Government institutions have also tried to operate financing systems for start-ups through a variety of public instruments (Ortín et al. 2007; Shane 2004; Wright et al. 2006). Wright et al. (2006) identify several European countries that have developed government initiatives directed at financing high-technology ASOs at their initial stages of evolution; these include The Netherlands (Twinning Growth Fund, Biopartner), Denmark (Danish Growth Fund) and France (Fond of Co-investissement des Jeunes). Rasmussen (2008) finds that several Canadian programs have been set up to provide grants and seed funding to early development stage of ASOs.

From the arguments put forward, we derive the following hypothesis.

Hypothesis 2:

At the creation and initial development stage, ASOs acquire seed capital through market actors (VCs) and government institutions.

An intangible critical resource for ASOs in this phase is credibility. This resource is especially important for the ASO because to overcome the credibility threshold means overcoming the critical juncture, which is necessary to effect the transition from one phase of development to the next.

In the creation and initial development stage, an ASO usually lacks market credibility because it has no history and the founding entrepreneurs have no track record of working in the particular market; therefore, actors lack the evidence on which to evaluate the ASO (Vohora et al. 2004). However, acquiring this credibility is fundamental for obtaining critical resources of market actors (investors, suppliers, customers and employees) in later stages of development (McAdam and Marlow 2008).

There seem to be some contradictions in the literature concerning how ASOs can acquire market credibility. On the one hand, some authors argue, theoretically and from case studies, that credibility can be established through links with academic actors. For example, Ndonzuau et al. (2002) state that the brand name, prestige, and reputation of the university from which the ASO is spun off may act as an endorsement of the business project, facilitating its funding (Di Gregorio and Shane 2003; Munari and Toschi 2011; Rasmussen and Borch 2010; Rodeiro et al. 2010; Saetre et al. 2009). And some authors find evidence that ASOs can acquire market credibility through university incubators (McAdam and Marlow 2008; Rasmussen and Borch 2010; Salvador 2011).

However, other researchers state that academic entrepreneurs should move to distance themselves from the academic context so they will be be perceived as professional and credible by the various market actors (Vohora et al. 2004). On this point, several authors state that, for an ASO, overcoming the threshold of credibility will depend on its capacity to establishing relationships with market actors (Di Gregorio and Shane 2003; MacMillan et al. 1989; Salvador 2011; Van Geenhuizen and Soetanto 2009; Walter et al. 2006). The credibility provided by market actors is fundamental if the ASO is going to make a successful transition from the creation and initial development phase to the next phase because credibility helps the company obtain the key resources necessary for its growth (Liao et al. 2003). Salvador (2011), has found that the brand name of the science park may serve a function of “certification” for newly founded firms that need to demonstrate to the market that they are reliable and trustworthy business partners. Finally, MacMillan et al. (1989) state that VCs serve to validate and support an ASO, giving it credibility in its markets through their positive evaluation of the entrepreneurial team, the products/services of the ASO, its target market, and its financial forecasts.

Given the scarcity of empirical evidence for these conflicting arguments, we propose formulating our next hypothesis on the two arguments indicated above, considering that the credibility required by an ASO may be acquired from both academic and market actors.

Hypothesis 3:

At the creation and initial development stage, ASOs acquire market credibility through academic and market actors.

3.2 Stage of consolidation of the ASO

The consolidation phase is characterized by ASOs that have built up credibility outside the scientific community and have been able to attract, integrate, and reconfigure new resources with its existing ones to obtain sustainable returns. Therefore, the ASOs’ growth is conditional upon their capacity to reconfigure the way resources from the early stage are deployed (Vanaelst et al. 2006; Vohora et al. 2004; Wright et al. 2007). For this reason, ASOs face two main obstacles at their consolidation stage. First, ASOs and their founding team must distance themselves with more determination from academic context to compete in a dynamic and competitive market context, which requires more complex business competences. The second obstacle is also related to the limited social capital, which hinders access to a second round of funding (Benneworth and Charles 2005; Clarysse et al. 2005; Gübeli and Doloreux 2005; Mosey and Wright 2007; Rasmussen 2011; Vohora et al. 2004).

In sum, the development of complex business competences and access to a second round of funding are two crucial resources in order to face both obstacles.

Business competences would include solid commercial competences and complex managerial competences. With regard to the former, the ASO needs to recognize new market opportunities and new clients’ needs in order to consolidate its market position. At this stage, ASOs sometimes have to focus on changing products/services to meet new customer needs, and even on shifting markets when the initial market proves to be insufficient (Vohora et al. 2004; Wright et al. 2007). The limited commercial and market experience of most academic entrepreneurs is the reason ASOs need to develop more complex and solid commercial competences geared to the development of products and the search for new markets that will give the entrepreneurial team a better chance to grow and hold onto markets (Van Geenhuizen and Soetanto 2009). To acquire these competences, the training courses and consultancy supplied by the academic actors in the initial stages are not sufficient; nor are they the most appropriate way to develop them (Van Geenhuizen and Soetanto 2009). In this regard, Van Geenhuizen and Soetanto (2009) argue that academic entrepreneurs will only be able to acquire these competences from market actors. The literature shows that customers, suppliers, and science parks can be considered as actors critical for enhancing commercial competences (Lechner et al. 2006; Löfsten and Lindelöf 2005; Walter et al. 2006). First, ASOs that develop strong links with customers and suppliers are able to improve their skills in assessing future markets to enter and how to exploit market opportunities effectively. This is because these actors can provide valuable information about effective distribution channels and customer needs (Sullivan and Marvel 2011). In addition, the acquisition of detailed knowledge from customers regarding, for example, product improvement possibilities or new functional requirements will help the ASOs to be more competitive in their markets (Atuahene-Gima and Ko 2001; Yli-Renko et al. 2001). Second, ASOs can develop solid commercial competences through contacts with science parks. Administrators of science parks run training courses and offer advisory services to help ASOs develop capabilities such as knowing how to identify and satisfy evolving customer needs in dynamic markets and how to select effective future markets (Löfsten and Lindelöf 2005; Phan et al. 2005).

In respect to complex managerial competences, Vanaelst et al. (2006) and Wright et al. (2007) state that entrepreneurial teams need to acquire the ability to continuously reconfigure existing resources and gain access to new key resources, and integrate them within the organization. In this sense, some authors from the resource-based view point out that the firm’s optimal growth involves a balance between exploitation of existing resources and development of new resources by managers (Penrose 1959; Wernerfelt 1984). These competences should be developed internally by the ASOs’ management teams from their experience and from the dynamic of the teams accumulated since the creation of the company. The access to complex managerial competences through market actors is difficult and expensive. In this sense, Penrose (1959) points out that the growth of the firm is limited by the capacity of the management team to internally manage resources and that the training of new managers and their integration into the organization occupies the time and efforts of existing managers and thus reduces even more the managerial service available for growth (Mahoney and Pandian 1992; Penrose 1959). Because complex managerial competences should be developed internally by the management team of the ASO and not through relationships with actors, they are not included in our research hypothesis.

Access to financing for the successive rounds of funding constitutes another critical resource for ASOs. As several authors state, the ability to reconfigure and increase existing funding is essential for expanding the commercialization of the ASO’s products/services and for increasing the value of the new venture in competitive markets (Hsu 2007; Vohora et al. 2004). However, the acquisition of these resources is usually conditional upon the acquisition of credibility in the earlier phase of development. In other words, when the ASO has gained the necessary credibility, it will be better placed to access sources of finance available in the market—principally through VCs (Sorheim et al. 2011). On this point, Wright et al. (2006) find that VCs prefer to invest after the seed stage, when there is less risk and the concept of the new product or service offered has been accepted in the market. Factors such as the achievement of credibility by the ASO and the availability of a viable business plan increase the chances of obtaining financing from private investors (Lockett et al. 2002; Munari and Toschi 2011; Vohora et al. 2004).

Based on these arguments we put forward the following hypothesis.

Hypothesis 4:

At the consolidation stage, ASOs acquire solid commercial competences and a second round of financing from market actors.

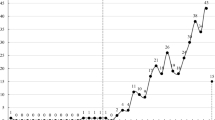

The relationships proposed are illustrated in Fig. 1.

4 Methods

4.1 Sample

The population for our study is the total number of ASOs created in Spain during the period 2003–2011. ASOs were identified by contacting the TTOs of all the Spanish universities, who provided us with information on 555 ASOs created in Spain during this period.

To collect the information, we designed two questionnaires based on a review of the existing literature. The questionnaires were pretested via interviews with 12 academics who had founded an ASO. Their suggestions were incorporated into the final versions of the questionnaires. One questionnaire was sent to each ASO’s main academic founder and another to a member of the founding team directly linked with the management of the ASO who was, if possible, also an academic. We received valid responses from 167 ASOs, a valid return rate of 30 %.

At the time of the interview, the ASOs in the sample employed an average of 7.2 persons and had an average age of 4.4 years. As many as 70 % of the 167 companies surveyed stated that they were still in the creation and initial development phase, while the other 30 % defined themselves as consolidated companies.

To analyse the non-response bias, we compared responding and non-responding ASOs by company age and size (number of employees). T-tests revealed no significant differences between the two groups of ASOs; therefore, we conclude there is no non-response bias in our data by age and company size.

4.2 Dependent variables

4.2.1 Acquisition of resources

Based on prior inductive studies (Mosey and Wright 2007; Ndonzuau et al. 2002; Vohora et al. 2004), we took the following resources and competences as critical to the development of an ASO: business competence (managerial and commercial competences); seed capital; complementary technological resources; market credibility; solid commercial competences; and second round of financing. To measure access to managerial and commercial competences, seed capital, and complementary technological resources; solid commercial competences; and second round of financing, the principal academic founder was asked to indicate which resource or competence was obtained by the ASO from each type of actor with whom a useful relationship was maintained. From this information, six dummy variables were created, one for each type of resource and competence, which take the value 1 when the ASO has obtained the resource or competence in question, and 0 otherwise (Table 1). Second, to measure market credibility, the principal academic founder was asked to indicate whether the ASO had been able to form its management team with external expert members and if financing had been obtained from a private investor not formally connected to the entrepreneurial team. With this information, a dummy variable was created that takes the value 1 when the company has been successful in meeting both requirements, and 0 otherwise (Rasmussen et al. 2011; Vohora et al. 2004) (Table 1).

4.3 Independent variables

4.3.1 Relationships with actors

Following Mosey and Wright (2007), we identified six types of actors relevant to ASOs: academic support units (TTOs and university incubators); research colleagues, government institutions, VCs, customers and suppliers, and science parks. To measure these variables, the principal academic founder was asked to indicate, on a Likert scale of 5 points (1 = not very important; 5 = very important) the degree to which the relationship with each of these actors was important to the ASO (Table 1).

4.4 Control variables

We used the age and size of the ASO as control variables, as do many studies in the literature on ASOs (Hayter 2013; Walter et al. 2006). Both the size and age of the company can impact strongly on its organizational resources and its performance (Aldrich and Auster 1986; Venkataraman and Low 1994). In addition, the size of a small company can limit its access to financial, human, and organizational resources (Cooper and Dunkelberg 1986). We measured size by taking the logarithm of the number of employees of the ASO, because of the high dispersion of the variable number of employees, obtained through the standard deviation of this variable. The age of the ASO was measured by taking the number of years from the founding of the ASO up to the year 2012 (Table 1).

4.5 Stages of evolution

Given that the main objective of the study is to identify which types of actors provide the resources that ASOs need in the two successive stages of development described (creation and initial development, and consolidation), we asked the member of the founding team directly involved in the management of the ASO to indicate the current stage of the ASO. For this, we provided two options: (1) The ASO was still in the creation and initial development stage in which has accessed and is accessing some critical resources to start the commercialization of its knowledge; or (2) the ASO was in a consolidated stage, in which it was trying to reconfigure new resources with relatively stable results, so that the survival of the company was no longer the principal objective.

5 Analysis and results

With the object of testing the hypotheses proposed, we used a binary logistic regression model because the dependent variables are coded as dichotomous variables that take the value 1 when the ASO has obtained the resource or competence in question, and 0 otherwise (Hair et al. 1998). To test the hypotheses relating to the stage of creation and initial development of the ASO, five logistic regression models were applied. In these, the dependent variables were managerial competences, commercial competences, seed capital, complementary technological resources, and market credibility. To test Hypothesis 4, on the consolidation stage of the ASO, two logistic regression models were applied. In these, the dependent variables are solid commercial competences and second round of financing. In all models, the age and size control variables were included.

We examined the goodness of fit of the models using the model χ2 test. We assessed the percentage of variance explained by our models and the overall rate of correct classification of the models using both the Cox and Snell statistic and the Nagelkerke statistic (Tables 2, 4).

5.1 Creation and initial development stage of the ASO

Table 2 contains the descriptive statistics of the variables that are included in the models and the results of the correlation analysis. We observed that the mean age of the ASOs reported to be still in the creation and initial development stage is 4 years. Almost all the ASOs (92 %) acquired managerial competences, more than 80 % acquired commercial competences, about 75 % acquired seed capital, somewhat more than 60 % acquired complementary technological resources, and less than 25 % acquired market credibility. In Table 2 we see that the values of the significant correlations are not sufficiently high to indicate that multicollinearity exists between the variables.

Table 3 summarizes the five logistic regression models proposed for ASOs in the creation and initial development stage, in which the control variables are included.

With respect to Hypothesis 1, first, the results of Model 1a show that the “instead of support units’” have a positive and significant relationship to the acquisition of managerial competences (β = 0.746; p < 0.01), whereas the variable “research colleagues” is not significant. In addition, in Model 1a the variable “government institutions” is associated positively with the acquisition of managerial competences (β = 0.393; p < 0.10). Second, the results of Model 1b show that “science parks” have a positive and significant relationship with the access to commercial competences (β = 0.524; p < 0.01), while “academic support units” and “research colleagues” are not significant. Third, with respect to the acquisition of complementary technological resources, the results of Model 1c indicate that both the variables “research colleagues” (β = 0.320; p < 0.01) and “science parks” (β = 0.224; p < 0.10) are significant and are associated positively with the acquisition of these resources. However, the variable “academic support units” is not significant. Therefore, Hypothesis 1 is not supported, because some academic actors do not have a significant relationship with the some of analysed resources, whereas other actors—science parks and government institutions—which were not considered in the formulation of Hypothesis 1, presented a significant relationship with some of these resources.

Regarding Hypothesis 2, in Model 2 both the variables “government institutions” (β = 0.518; p < 0.001) and “VCs” (β = 1.227; p < 0.01) are associated positively with the acquisition of seed capital. Therefore, the second hypothesis is fully accepted.

With respect to Hypothesis 3, the variable “VCs” is significant and presents a positive relationship (β = 0.660; p < 0.001) with the acquisition of market credibility, whereas, unexpectedly, none of the other types of actors considered was found to be significant. Therefore, this hypothesis has been partially supported since we have found evidence of the VCs being the ones that supply credibility to ASOs in contrast to other actors from the market and academic contexts, which we had also considered in the formulation of Hypothesis 3.

Finally, regarding the control variables introduced, company size is not significant in any of the models tested. The ASO age variable is significant only in the case of the acquisition of market credibility.

5.2 Consolidation stage of the ASO

Table 4 gives the descriptive statistics and results of the correlation analysis of all the variables that are incorporated in the consolidation stage models. The data indicate that the mean size of the ASOs reported to be in the consolidation stage is almost 6 years. Of these longer-established ASOs, 90 % acquired solid commercial competences, and 67 % of them acquired a second round of financing. As there was no correlation greater than 0.55, there is no multicollinearity between the variables (Table 4).

Table 5 shows the results of the logistic regressions of Models 4a and 4b constructed for testing Hypothesis 4, including the control variables.

With regard to Hypothesis 4, first, the results of Model 4a show that the variable “customers and suppliers” is significant and presents a positive relationship (β = 0.766; p < 0.05) with the acquisition of solid commercial competences; however, unexpectedly, the variable “science parks” is not significant. Second, with respect to the acquisition of a second round of financing, the results of Model 4b indicate that the variable “VCs” affects the ASOs’ access to these resources positively and significantly (β = 0.876; p < 0.05). Therefore, on the basis of the results of both models, the fourth hypothesis is partially accepted.

With respect to the control variables, ASO size is not significant in any of the models tested. In the case of the age of the ASO, this variable is significant only in the case of the acquisition of a second round of financing.

6 Discussion

The objectives of this research are to analyse which actors supply Spanish ASOs with critical resources and competences at the stage of creation and initial development as well as at the stage of consolidation and to determine the relevance of the actors that come from the academic and market context at each of those stages. To do so, we began with some inductive studies, to propose theoretically the critical resources and competences that ASOs need to acquire in two stages of development (Ndonzuau et al. 2002; Mosey and Wright 2007; Vohora et al. 2004).

The results obtained in the creation and development stage partially support our hypotheses (h1, h2, h3) because it has not been possible to demonstrate the greater relevance of the academic actors in providing managerial and commercial competences and the provision of complementary technological resources. However, regarding seed capital, the results show that VCs (market actors), as well as government institutions, supply such resources. Finally, we have found evidence that the VCs are the only market actor that provides credibility to ASOs.

A more detailed analysis and interpretation of the results obtained at this stage show us that the academic actors, specifically the TTOs and university incubators, initially play a key role in the training, mentoring, and transfer of experience to the development of managerial competences. These results have been supported by prior research that has shown academic support units to be sources of supportive activities such as consultancy services, management training, administrative and legal tasks, intellectual property advice, and human resources services that facilitate the development of ASOs in their early stages (McAdam and Marlow 2008; Rodeiro et al. 2010; Van Burg et al. 2008). In this sense, Rodeiro et al. (2010: 51) explain that “the TTOs (…) possess experience in conducting market research, and preparing business plans (…) and the members of these TTOs assist the entrepreneur in the acquisition of managerial capabilities.” Furthermore, our findings show that government institutions in Spain also provide ASOs with managerial competences at this stage. In the literature, the role given to government institutions at early stages has essentially been that of financial support to ASOs, with no evidence of their contribution to the development of managerial competences. For this reason, this result should be analysed in more depth in the context of Spanish ASOs. These results might show that ASOs could be accessing these competences through governmental training programmes of support to start-ups and entrepreneurs. To the same extent, one of the main points of action stated in the Spanish Strategy of Science and Technology and Innovation (2012–2020) is to establish specific measures to support the creation and development of technology-based companies. We think that these programmes, which encourage entrepreneurs’ culture and training, may be producing results in Spain.

With regard to commercial competences, the results obtained for this stage do not support our hypothesis since academic actors do not appear as suppliers of this type of competence. Contrary to all expectations, we found that science parks are the actors that provide commercial competences to ASOs. These findings are in line with some studies that question the role of TTOs and university incubators as providers of commercial competence (Siegel et al. 2003; Van Geenhuizen and Soetanto 2009). More specifically, the evidence found is supported by other studies that have shown that ASOs could access commercial competences through market programs to help ASOs understand customer needs, to select effective markets, to design a viable business plan and to develop market studies (Díez-Vial and Fernández-Olmos 2014; Löfsten and Lindelöf 2005; Phan et al. 2005; Salvador 2011; Siegel et al. 2003; Sofouli and Vonortas 2007).

With respect to complementary technological resources, our results suggest that TTO and university incubators are not relevant actors in accessing these resources. Research colleagues seem to be the academic actors who supply the intangible complementary technological resources through counselling and transfer of experiences that enable the ASO to convert its basic technology into applied technology in markets. To the same extent, some studies have stated that academic actors could help ASOs to access complementary technological resources by means of the assessment of the technical feasibility of the research results, advice on identifying potential applications and functionality, and participation in the design of new products (Link and Scott 2005; Lockett et al. 2005; McAdam and McAdam 2008; Ndonzuau et al. 2002; Pérez and Martínez 2003; Saetre et al. 2009; Swamidass 2013).

An unexpected result in this research is the role that science parks play in the supply of complementary technological resources at the first development stages of ASOs. These findings seem to indicate that science parks provide a social environment where the physical proximity between firms promotes a process of the transfer of key information, which facilities the development of technological innovation. Additionally, as administrators of science parks meet the operational needs of ASOs, they provide these start-ups with technological advice related to product design and technological process (Löfsten and Lindelöf 2005; Montoro et al. 2011). In this sense, Sofouli and Vonortas (2007) have evidenced the existence of specific programs for ASOs to access both intangible technological resources such as technical assistance and tangible technological resources such as laboratories, equipment, and instruments.

Regarding actors who provide seed capital (h2), the results show that government institutions and VCs are important funding providers. In Spain, as in other European countries, government institutions provide public funds to high-tech ASOs at an early stage (Ortín et al. 2007; Shane 2004; Wright et al. 2006). Furthermore, our results show, as was established in our hypothesis, the relevant role of VCs. These results seem to show that, in the Spanish context, VCs value positively those ASOs that show certain characteristics and/or send out specific signals to the markets. To the same extent, some studies point out that ASOs with high potential or promising technologies, projects, or scientific teams are more likely to be funded by VCs in early phases of development (Degroof and Roberts 2004; Wright et al. 2007). A relevant quality signal that ASOs can exploit to attract external financing in the early stage is the number of patents the ASO holds (Munari and Toschi 2011). Munari and Toschi (2011:405) suggest that “patents provide external evidence of a firm’s competitive advantage, which investors positively evaluate to differentiate firms in terms of level of innovation.”

Finally, regarding the acquisition of credibility (h3), our results offer evidence that from the set of market actors considered, VCs are the actors that provide this resource. The VCs seem to play an essential and necessary role in the development of ASOs by providing credibility as well as funding (MacMillan et al. 1989). A VC’s positive evaluation and support for a business project send signals to the market that enhance the credibility necessary for an ASO to access other key resources for its transition to the next stage in its process of evolution.

To support these results, several authors have stated that VCs are the external actors best able to carry out a realistic assessment of the reliability of an ASO because they have instruments that allow them to overcome the effect of information asymmetries when evaluating the potential of an ASO (MacMillan et al. 1989; Salvador 2011). To this point, Knockaert et al. (2010:572) state that “VCs focus mainly on (…) establishing the venture’s credibility.” Bonardo et al. (2010:170), for their part, conclude that “VCs have a signalling role that improves the international exposure and credibility of a company.”

The results of this research do not support our arguments stating that academic actors confer credibility on these new companies. One interpretation we give to these results is that Spanish universities do not yet have a consolidated entrepreneurial tradition; therefore, their reputation is insufficient to confer credibility on the ASOs that emanate from them. In the Spanish context, the transfer of new knowledge from university to society is still in its early stages, and university rankings that include the number of ASOs created as a criterion of classification are only recent. In the Spanish context, as in other countries, universities are less oriented to the commercial exploitation of the discoveries made by their researchers (i.e., less interested in promoting entrepreneurship) and more centered on the traditional academic activities of teaching and research, which are important for the career paths of Spanish academics (Lockett et al. 2003; Rodeiro et al. 2010; Stuart and Ding 2006).

In the consolidation stage, the results have supported our hypothesis (h4) to a greater extent since they reveal that the market actors are providing the critical solid commercial competences and the second round funding.

Regarding solid commercial competences, we found that customers and suppliers are providing them. However, our results do not show that science parks are relevant in the provision of resources of this type at this stage. These results seem to show that once an ASO is consolidated and is competing in dynamic sectors, it will need a continuous flow of new knowledge acquired from customers and suppliers that would enable the company to advance in its commercial competences in line with evolving industry trends. These commercial relationships are important means or channels for the ASO to learn about changing customer needs and tendencies of its markets, with the object of developing new marketable offerings. In addition, the fact that ASOs usually operate in specialist niches of their markets would explain why customers are key actors in the consolidation stage (Walter et al. 2006). Regarding science parks, prior research has emphasized the relevant role of science parks in the supply of commercial competences for the creation and growth of start-ups (Löfsten and Lindelöf 2005; Phan et al. 2005; Salvador 2011; Sofouli and Vonortas 2007), and some studies have also shown empirically that firms located on science parks demonstrate a better performance than those located off science parks because of the support of these actors in the supply of certain resources (Díez-Vial and Fernández-Olmos 2014; Ferguson and Olofsson 2004; Lindelöf and Löfsten 2003). However, these studies do not distinguish the ASO’s stage of evolution and, therefore, provide no evidence about the contribution of the supply of commercial capabilities in different stages of development, suggesting a relevant research field.

Our evidence seems to indicate that due to the limited social capital of these firms in the early stages, Spanish ASOs are supported by science parks, but once they have established relationships with customers, the role of science parks as suppliers of commercial competences becomes residual.

The results also reveal the importance of VCs as financial investors in ASOs at the consolidation stage. At this stage, the technologies of ASOs present less risk for investors because the new products are already accepted in the market, and therefore there is generally less uncertainty. VCs have had the opportunity to evaluate the viability of the company and ASOs have been able to establish relationships with significant market actors. All this enhances the credibility of these new companies and improves their ability to attract funds from market actors, particularly from VCs (Sorheim et al. 2011; Wright et al. 2006). This finding would also explain why VCs provide further financial resources to those ASOs that, according to their evaluations, have successfully passed the threshold of credibility (Gübeli and Doloreux 2005; Saetre et al. 2009).

Some final conclusions can be derived from our results. First, academic actors do not provide ASOs some critical resources and competences for growth in the creation and initial development stage and, therefore, do not contribute to the consolidation of these firms in the market. Specifically, and in relation to TTOs, the literature is not conclusive regarding the role that these actors play in the early stage of ASOs. On the one hand, some studies have emphasized the prominent role of TTOs as providers of business competences, technological resources, and credibility (Algieri et al. 2013; Rasmussen et al. 2011; Rodeiro et al. 2010; Swamidass 2013). Other studies have questioned the role of TTOs underlying their residual role (Clarysse et al. 2011; Muscio 2010; Siegel et al. 2004). Our results, in line with Rodeiro et al. (2010), can be a consequence of the limited tradition of Spanish universities and TTOs in academic entrepreneurship as a form of knowledge transfer. Spanish TTOs, as in other contexts, may have been constituted in bureaucratic units more focused on technology protection and other forms of transfer such as licences, contracts, and patents than in firm creation (Clarysse et al. 2011; Muscio 2010; O’Shea et al. 2005, 2008).

A second conclusion is that science parks are very relevant actors in the creation and initial development stage, playing a key incubation role for ASOs. Finally, VCs constitute critical market actors that supply funding to ASOs during their entire life as well as lending credibility to make the successful transition from the creation and initial development stage to the consolidation stage.

Our work adds to existing research on academic entrepreneurship in a number of ways. First, we contribute to a better understanding of how ASOs can successfully make the transition from initial development to consolidation; this is a topic on which quantitative research is nonexistent. Inspired by Vohora et al. (2004), we have been able to show that the evolution of ASOs in Spain, as in other European countries, depends on successfully coping with a series of critical junctures where significant changes are needed. We demonstrate that path dependence in the accumulation of diverse resources enables an ASO to advance from one phase of evolution to the next. Second, we contribute to the network content research in the context of ASOs, reporting relevant conclusions about the critical resources and competences that ASOs obtain from various actors in the academic and market contexts. Recent researchers have emphasized the need to consider how networks should evolve in order to generate the resources necessary at these new companies’ different stages of development (McAdam and Marlow 2008).

7 Limitations and areas for future research

Although our study offers several new insights, it presents some limitations that serve to highlight promising avenues for future research. One limitation is the use of cross-sectional data, which precludes drawing inferences about the causal direction of the relationships established. The causal relationships established in our study are the result of accepting the premises inherent in network theory. Moreover, in prior literature causal relationships similar to those of our model are reported (Shane and Stuart 2002). We must recognize that, given that the data are cross-sectional, we are not able to check the possibility that the relationships of causality established might also operate in the opposite direction. Therefore, conducting longitudinal studies to explore and understand the causal relationships among the variables would be desirable.

Second, the literature is calling for studies that evaluate the effects of multiple relationships with different actors on performance measures (Baum et al. 2000; Lechner et al. 2006). Therefore, analysing these relationships would be desirable in future research.

8 Implications for practitioners

Some practical implications derived from this research are useful for academic actors, academic entrepreneurs, and government institutions. First, Spanish universities should assume a more active role in the stimulus of academic entrepreneurship, establishing closer relationships with market actors, modifying their structures, and focusing their strategies to assist researchers. This would have a positive influence on the number of ASOs created in the Spanish context, and on the probability of these firms’ successful development. Specifically, TTOs should be professionalized, developing a business-oriented management through the recruitment of professional managers, non-academics with proven business competences and experience (Muscio 2010; Siegel et al. 2007a, b). Second, academic entrepreneurs should be aware at early stages that creating and maintaining relations with market actors is key to overcoming limitations and deficiencies in competences related to business management, skills in recognizing and exploiting market opportunities, and funding. Third, government institutions should support the development of science parks near universities because they perform a critical incubation function. Finally, the support of VC sector should be priority by Spanish policymakers, because our evidences suggest that VCs provide an important contribution to the creation of wealth in a knowledge-based economy that cannot be obtained through government subsidies.

References

Aldrich, H., & Auster, E. R. (1986). Even dwarfs started small: Liabilities of age and size and their strategic implications. Research in Organizational Behavior, 8, 165–198.

Algieri, B., Aquino, A., & Succurro, M. (2013). Technology transfer offices and academic spin-off creation: The case of Italy. The Journal of Technology Transfer, 38(4), 382–400.

Atuahene-Gima, K., & Ko, A. (2001). An empirical investigation of the effect of market orientation and entrepreneurship orientation alignment on product innovation. Organization Science, 12(1), 54–74.

Barney, J. (1991). Firm resources and sustained competitive advantage. Journal of Management, 17(1), 99–120.

Baum, J. A., Calabrese, T., & Silverman, B. S. (2000). Don’t go it alone: Alliance network composition and startups’ performance in Canadian biotechnology. Strategic Management Journal, 21(3), 267–294.

Benneworth, P. S., & Charles, D. R. (2005). University spin-off companies and the territorial knowledge pool: Building regional innovation competencies. European Planning Studies, 13(4), 537–557.

Bjørnåli, E. S., & Gulbrandsen, M. (2010). Exploring board formation and evolution of board composition in academic spin-offs. The Journal of Technology Transfer, 35(1), 92–112.

Blau, P. M. (1955). Dynamics of bureaucracy: A study of interpersonal relations in two government agencies. Chicago, IL: University of Chicago Press.

Bonardo, D., Paleari, S., & Vismara, S. (2010). The M&A dynamics of European science-based entrepreneurial firms. The Journal of Technology Transfer, 35(1), 141–180.

Carayannis, E. G., Popescu, D., Sipp, C., & Stewart, M. (2006). Technological learning for entrepreneurial development (TL4ED) in the knowledge economy (KE): Case studies and lessons learned. Technovation, 26(4), 419–443.

Clarysse, B., & Moray, N. (2004). A process study of entrepreneurial team formation: The case of a research-based spin-off. Journal of Business Venturing, 19(1), 55–79.

Clarysse, B., Tartari, V., & Salter, A. (2011). The impact of entrepreneurial capacity, experience and organizational support on academic entrepreneurship. Research Policy, 40(8), 1084–1093.

Clarysse, B., Wright, M., Lockett, A., Van de Velde, E., & Vohora, A. (2005). Spinning out new ventures: A typology of incubation strategies from European research institutions. Journal of Business Venturing, 20(2), 183–216.

Colombo, M. G., & Grilli, L. (2010). On growth drivers of high-tech start-ups: Exploring the role of founders’ human capital and venture capital. Journal of Business Venturing, 25(6), 610–626.

Cooper, A. C., & Dunkelberg, W. C. (1986). Entrepreneurship and paths to business ownership. Strategic Management Journal, 7(1), 53–68.

De Cleyn, S. H., Braet, J., & Klofsten, M. (2011). How do human and social capital contribute to the early development of academic spin-off ventures? Frontiers of Entrepreneurship Research, 31(17), 3., 566–581.

Degroof, J., & Roberts, E. (2004). Overcoming weak entrepreneurial infrastructures for academic spin-off ventures. The Journal of Technology Transfer, 29(3–4), 327–352.

Di Gregorio, D., & Shane, S. (2003). Why do some universities generate more start-ups than others? Research Policy, 32(2), 209–227.

Díez-Vial, I., & Fernández-Olmos, M. (2014). Knowledge spillovers in science and technology parks: How can firms benefit most? The Journal Technology Transfer, 1–15. doi:10.1007/s10961-013-9329-4.

Ferguson, R., & Olofsson, C. (2004). Science parks and the development of NTBFs—Location, survival and growth. The Journal of Technology Transfer, 29(1), 5–17.

Franklin, S. J., Wright, M., & Lockett, A. (2001). Academic and surrogate entrepreneurs in university spin-out companies. The Journal of Technology Transfer, 26(1–2), 127–141.

Gübeli, M. H., & Doloreux, D. (2005). An empirical study of university spin-off development. European Journal of Innovation Management, 8(3), 269–282.

Hair, J., Anderson, R., Tatahm, R., & Black, W. (1998). Multivariate data analysis: With readings. New Jersey: Prentice-Hall.

Hayter, C. S. (2013). Harnessing university entrepreneurship for economic growth factors of success among university spin-offs. Economic Development Quarterly, 27(1), 18–28.

Heine, K., & Rindfleisch, H. (2013). Organizational decline. A synthesis of insights from organizational ecology, path dependence and the resource-based view. Journal of Organizational Change Management, 26(1), 8–28.

Hsu, D. H. (2007). Experienced entrepreneurial founders, organizational capital, and venture capital funding. Research Policy, 36(5), 722–741.

Kaplan, S. N., & Strömberg, P. (2003). Financial contracting theory meets the real world: An empirical analysis of venture capital contracts. The Review of Economic Studies, 70(2), 281–315.

Knockaert, M., Wright, M., Clarysse, B., & Lockett, A. (2010). Agency and similarity effects and the VC’s attitude towards academic spin-out investing. The Journal of Technology Transfer, 35(6), 567–584.

Lechner, C., Dowling, M., & Welpe, I. (2006). Firm networks and firm development: The role of the relational mix. Journal of Business Venturing, 21(4), 514–540.

Liao, J., Welsch, H., & Stoica, M. (2003). Organizational absorptive capacity and responsiveness: An empirical investigation of growth-oriented SMEs. Entrepreneurship Theory and Practice, 28(1), 63–85.

Lichtenstein, B. M. B. (1999). A dynamic model of non-linearity in entrepreneurship. Journal of Business & Entrepreneurship, 11(Special Issue), 27–43.

Lichtenstein, B. M. B. (2000). Self-organized transition: A pattern amid the chaos of transformative change. The Academy of Management Executive, 14(4), 128–141.

Lindelöf, P., & Löfsten, H. (2003). Science park location and new technology-based firms in Sweden–implications for strategy and performance. Small Business Economics, 20(3), 245–258.

Link, A. N., & Scott, J. T. (2005). Opening the ivory tower’s door: An analysis of the determinants of the formation of US university spin-off companies. Research Policy, 34(7), 1106–1112.

Lockett, A., Murray, G., & Wright, M. (2002). Do UK venture capitalists still have a bias against technology investments? Research Policy, 31(6), 1009–1030.

Lockett, A., Siegel, D., Wright, M., & Ensley, M. D. (2005). The creation of spin-off firms at public research institutions: Managerial and policy implications. Research Policy, 34(7), 981–993.

Lockett, A., Wright, M., & Franklin, S. (2003). Technology transfer and universities’ spin-out strategies. Small Business Economics, 20(2), 185–200.

Löfsten, H., & Lindelöf, P. (2005). R&D networks and product innovation patterns—Academic and non-academic new technology-based firms on science parks. Technovation, 25(9), 1025–1037.

MacMillan, I. C., Kulow, D. M., & Khoylian, R. (1989). Venture capitalists’ involvement in their investments: Extent and performance. Journal of Business Venturing, 4(1), 27–47.

Mahoney, J. T., & Pandian, J. R. (1992). The resource-based view within the conversation of strategic management. Strategic Management Journal, 13(5), 365–380.

McAdam, M., & Marlow, S. (2008). A preliminary investigation into networking activities within the university incubator. International Journal of Entrepreneurial Behaviour & Research, 14(4), 219–241.

McAdam, M., & McAdam, R. (2008). High tech start-ups in university science park incubators: The relationship between the start-up’s lifecycle progression and use of the incubator’s resources. Technovation, 28(5), 277–290.

Montoro, A., Ortíz, M., & Mora, E. (2011). Effects of knowledge spillovers on innovation and collaboration in science and technology parks. Journal of Knowledge Management, 15(6), 948–970.

Moray, N., & Clarysse, B. (2005). Institutional change and resource endowments to science-based entrepreneurial firms. Research Policy, 34(7), 1010–1027.

Mosey, S., & Wright, M. (2007). From human capital to social capital: A longitudinal study of technology-based academic entrepreneurs. Entrepreneurship Theory and Practice, 31(6), 909–935.

Munari, F., & Toschi, L. (2011). Do venture capitalists have a bias against investment in academic spin-offs? Evidence from the micro- and nanotechnology sector in the UK. Industrial and Corporate Change, 20(2), 397–432.

Muscio, A. (2010). What drives the university use of technology transfer offices? Evidence from Italy. The Journal of Technology Transfer, 35(2), 181–202.

Mustar, P., Renault, M., Colombo, M. G., Piva, E., Fontes, M., Lockett, A., et al. (2006). Conceptualising the heterogeneity of research-based spin-offs: A multi-dimensional taxonomy. Research Policy, 35(2), 289–308.

Ndonzuau, F. N., Pirnay, F., & Surlemont, B. (2002). A stage model of academic spin-off creation. Technovation, 22(5), 281–289.

O’Shea, R., Allen, T. J., O’Gorman, C., & Roche, F. (2004). Universities and technology transfer: A review of academic entrepreneurship literature. Irish Journal of Management, 25(2), 11–29.

O’Shea, R. P., Chugh, H., & Allen, T. J. (2008). Determinants and consequences of university spinoff activity: A conceptual framework. The Journal of Technology Transfer, 33(6), 653–666.

Ortín, P., Salas, V., Trujillo, M., & Vendrell, F. (2007). La creación de spin-off universitarias en España: Características, determinantes y resultados. Economía Industrial, 368, 79–95.

O’Shea, R. P., Allen, T. J., Chevalier, A., & Roche, F. (2005). Entrepreneurial orientation, technology transfer and spinoff performance of US universities. Research Policy, 34(7), 994–1009.

Patzelt, H., & Shepherd, D. A. (2009). Strategic entrepreneurship at universities: Academic entrepreneurs’ assessment of policy programs. Entrepreneurship Theory and Practice, 33(1), 319–340.

Penrose, E. T. (1959). The theory of the growth of the firm. New York: Wiley.

Pérez, M., & Martínez, A. M. (2003). The development of university spin-offs: Early dynamics of technology transfer and networking. Technovation, 23(10), 823–831.

Phan, P. H., Siegel, D. S., & Wright, M. (2005). Science parks and incubators: Observations, synthesis and future research. Journal of Business Venturing, 20(2), 165–182.

Rappert, B., Webster, A., & Charles, D. (1999). Making sense of diversity and reluctance: Academic–industrial relations and intellectual property. Research Policy, 28(8), 873–890.

Rasmussen, E. (2008). Government instruments to support the commercialization of university research: Lessons from Canada. Technovation, 28(8), 506–517.

Rasmussen, E. (2011). Understanding academic entrepreneurship: Exploring the emergence of university spin-off ventures using process theories. International Small Business Journal, 29(5), 448–471.

Rasmussen, E., & Borch, O. J. (2010). University capabilities in facilitating entrepreneurship: A longitudinal study of spin-off ventures at mid-range universities. Research Policy, 39(5), 602–612.

Rasmussen, E., Mosey, S., & Wright, M. (2011). The evolution of entrepreneurial competencies: A longitudinal study of university spin-off venture emergence. Journal of Management Studies, 48(6), 1314–1345.

Roberts, E. B. (1991). Entrepreneurs in high technology: Lessons from MIT and beyond (pp. 46–99). New York: Oxford University Press.

Rodeiro, D., Fernández, S., Otero, L., & Rodríguez, A. (2010). Factores determinantes de la creación de spin-offs universitarias. Revista Europea de Dirección y Economía de la Empresa, 19(1), 47–68.

Saetre, A. S., Wiggins, J., Atkinson, O. T., & Atkinson, B. K. E. (2009). University spin-offs as technology transfer: A comparative study among Norway, the United States, and Sweden. Comparative Technology Transfer and Society, 7(2), 115–145.

Salvador, E. (2011). Are science parks and incubators good “brand names” for spin-offs? The case study of Turin. The Journal of Technology Transfer, 36(2), 203–232.

Sarasvathy, S. D. (2001). Causation and effectuation: Toward a theoretical shift from economic inevitability to entrepreneurial contingency. Academy of Management Review, 26(2), 243–263.

Shane, S. (2003). A general theory of entrepreneurship: The individual-opportunity nexus. Cheltenham: Edward Elgar.

Shane, S. (2004). Academic entrepreneurship: University spinoffs and wealth creation. Cheltenham: Edward Elgar Publishing.

Shane, S., & Stuart, T. (2002). Organizational endowments and the performance of university start-ups. Management Science, 48(1), 154–170.

Siegel, D. S., Veugelers, R., & Wright, M. (2007a). Technology transfer offices and commercialization of university intellectual property: Performance and policy implications. Oxford Review of Economic Policy, 23(4), 640–660.

Siegel, D. S., Waldman, D., Atwater, L., & Link, A. (2004). Toward a model of the effective transfer of scientific knowledge from academicians to practitioners: Qualitative evidence from the commercialization of university technologies. Journal of Engineering and Technology Management, 21(1–2), 115–142.

Siegel, D. S., Westhead, P., & Wright, M. (2003). Science parks and the performance of new technology-based firms: A review of recent UK evidence and an agenda for future research. Small Business Economics, 20(2), 177–184.

Siegel, D. S., Wright, M., & Lockett, A. (2007b). The rise of entrepreneurial activity at universities: Organizational and societal implications. Industrial and Corporate Change, 16(4), 489–504.

Soetanto, D. P., & Van Geenhuizen, M. (2010). Social capital through networks: The case of university spin-off firms in different stages. Tijdschrift Voor Economische en Sociale Geografie, 101(5), 509–520.

Sofouli, E., & Vonortas, N. (2007). S&T parks and business incubators in middle-sized countries: The case of Greece. The Journal of Technology Transfer, 32(5), 525–544.

Sorheim, R., Widding, L. O., Oust, M., & Madsen, O. (2011). Funding of university spin-off companies: A conceptual approach to financing challenges. Journal of Small Business and Enterprise Development, 18(1), 58–73.

Stuart, R. W., & Abetti, P. A. (1990). Impact of entrepreneurial and management experience on early performance. Journal of Business Venturing, 5(3), 151–162.

Stuart, T. E., & Ding, W. W. (2006). When do scientists become entrepreneurs? The social structural antecedents of commercial activity in the academic life sciences. American Journal of Sociology, 112(1), 97–144.