Abstract

The characteristics and behavior of university spinoff activity is an important subject in economic and management studies literature. Such studies merit research because it is suggested that university innovations stimulate economies by spurring product development, by creating new industries, and by contributing to employment and wealth creation. For this reason, universities have come to be highly valued in terms of the economic potential of their research efforts. The aim of this paper is to offer a framework for the study of academic entrepreneurship that explains different aspects of university spinoff behavior in a coherent way. We suggest that the existing literature on this topic can be categorized into six separate streams and synthesized in a framework that captures the determinants and consequences of spinoff activity.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

According to the Association of University Technology Managers (2004), federal government in the US now provides more than $27.7 billion annually to university researchers to conduct scientific research. This continuing investment expands human knowledge and helps to educate the next generation of science and technology leaders. Furthermore, this research can also have a large impact on the “discovery of innovation” element of the technology transfer process (Murray 2006). Although university research in many developed countries has spun-off numerous high impact start-up ventures, most of these companies originated from a small number of highly entrepreneurial universities. According to a recent study by O’Shea et al. (2005) the average research university in the US generates an average of 1.91 spinoffs per annum. This mean value also masks a highly skewed distribution in the data in which the most productive university, MIT, spawned 31 spinoffs in one year alone (O’Shea et al. 2005). A study by Lockett and Wright (2005) provides similar findings for the UK.

With increasing pressure on universities to generate economic returns from government research support, how policy makers and academics can stimulate technology-based entrepreneurship from universities is an important issue. The challenge lies in identifying and replicating the processes that facilitate swift movement of technology from the ivory tower of academia to the front-line of industry (Allen et al. 1979; Allen and Sosa 2004; Birley 2002; Lacetera 2006; Mowery and Shane 2002; Wright et al. 2004a; Markman et al. 2004). This growing acceptance of the importance of academic entrepreneurship to national economies has been reflected in the explosion of policy and research publications seeking to better understand and address the forces that shape spinoff activity in higher education institutions. This recent research has served to refine, supplement, and in some cases, challenge our understanding of the complex forces shaping university spinoff creation in higher education institutions.

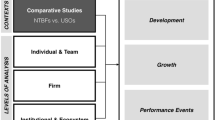

The objective of this article is to review the university spinoff literature, to synthesize this research, and identify the determinants and consequences of university spinoff activity. We argue that the extant literature can be divided into six distinct research streams: (1) studies that focus on the individual and the personality of the individual as the key determinant of whether spinoff activity occurs; (2) organizational configuration studies that seek to explain spinoff activity in terms of university resources; (3) socio-cultural development studies that explain spinoff activity in terms of culture and the rewards within the university; (4) studies that explain spinoffs in terms of external environmental influences; (5) studies that examine the development and performance of spinoffs; and (6) studies that seek to measure the economic impact of spinoff activity. While these research domains are clearly not orthogonal, we employ them as a method of classification to facilitate a discussion of the literature.

This paper is organized in the following manner. Section 2 provides an overview of the existing spinoff definitions in the academic entrepreneurship literature. Section 3 outlines six distinct research streams we have identified in this literature. Section 4 builds on our review of the literature by presenting a theoretical framework of the determinants and consequences of spinoff activity. We conclude by drawing implications for policy makers and university heads.

2 Spinoff definition

To provide a conceptual framework, we first assess the existing definitions of spinoffs in the academic entrepreneurship literature. Roberts and Malone (1996) define spinoffs as a mechanism in which governments seek to generate economic impact from their R&D by transferring technology from the R&D function to a commercial organization. Similarly, Steffensen et al. (1999) and Rogers et al. (2001) define spinoffs based on the parent R&D organization. They include the government R&D laboratory, the university, the university research center, and private R&D organizations as examples. Nicolaou and Birley (2003a) and Smilor et al. (1990) take account of the human element and state a spinoff is formed by individuals who were former employees of the parent organization. Nicolaou and Birley (2003a) build further on this work and put forward a trichotomous grouping of spinoff formation. Their model looks at the type of network the academic may be embedded in prior to initiation of the spinoff. These are: orthodox—both the technology and the academic inventor(s) spin off from the institution; hybrid—the technology spins out from the institution but the academic inventor(s) place in the university is retained and may hold some other part time position in the company; and technology—only the technology spins out and the academic inventor(s) maintain no connection with new firm but may have equity. On making that critical career choice, the authors also put forward the notion that academic may exist in either one of two conditions, which are: (1) academic exodus—the inventor leaves the university to be solely with the firm; and (2) academic stasis—the inventor stays in the university and may or may not have a position in the company (Nicolaou and Birley 2003b). For the purposes of this study, we draw from the definition provided by Nicolaou and Birley (2003a). According to the authors a university spinoff involves:

-

1.

The transfer of a core technology from an academic institution into a new company.

-

2.

The founding member(s) may include the inventor academic(s) who may or may not be currently affiliated with the academic institution.

3 Literature review

Our review of the academic literature suggests six primary research groups or domains. The first four focus on the determinants of spinoff activity within a university context. These include: (1) the attributes and the personality characteristics of academic entrepreneurs; (2) the resource endowments and capabilities of the university; (3) university structures and policies facilitating commercialization; and (4) environmental factors influencing academic entrepreneurship. The remaining two factors focus on the consequences of spinoff activity; (5) the development and performance of spinoffs; and (6) studies that measure the economic impact of spinoffs on regional economies. We now present each of these in more detail leading to the development of our conceptual framework.

3.1 Individual attributes as determinants of spinoff activity

A number of studies highlight the importance of entrepreneurial attributes in shaping the individual’s behavior and whether an academic will establish a spinoff. Other researchers have stressed the role personality, motivation and disposition play in influencing academic entrepreneurship. Some studies have used psychological models to explain spinoff departure from universities. These studies emphasize the impact of individual abilities and dispositions on the entrepreneurial behavior of academics.

Roberts (1991) for example, found that academic entrepreneurs with outgoing, extroverted personalities were more likely to engage in spinoff activity. Furthermore, from a study of almost 130 technical entrepreneurs and almost 300 scientists and engineers, he concluded that personal characteristics such as the need for achievement, the desire for independence and an internal locus of control were common in both groups. Tenure in universities and occupational and research skill levels amongst academics are also found to impact university spinoff behavior. Audretsch’s (2000) analysis of academic entrepreneurs found that university entrepreneurs tended to be older and more scientifically experienced than “typical” high-technology entrepreneurs. Similarly, Zucker et al. (1998a) used data on California biotechnology companies and found scientific “stars” collaborating with firms had substantially higher citation rates than pure academic “stars”. Overall, the common theme shared by this stream of research is that spinoff behavior is a reflection of individual actions and therefore is largely due to the personality, ability, career choice, or willingness of the individual to engage successfully in entrepreneurial behavior.

3.2 Organizational determinants of university spinoff activity

Social scientists operating at the organizational level have adopted a different approach to the study of spinoff activity. Rather than focusing on broad social or economic forces, such researchers have centered their attention on organizational and human resource aspects of the university. Specifically, they have sought to establish links between spinoff activity and the level and nature of research funding, the quality of the researchers, the nature of the research within the university, and the presence of technology incubators and technology transfer offices.

One factor that has received attention is the level and nature of funding for R&D activities within the university. For example, Lockett and Wright (2005) found the number of spinoff companies created from UK universities was positively associated with R&D expenditure. Blumenthal et al. (1996) surveyed 2,052 faculties at 50 universities in the life sciences field and found industry-funded faculty members to be more commercially productive (i.e. patent applications and new products brought to the market) than their government-funded counterparts. In a cross-sectional study of doctoral granting research universities, Powers & McDougall (2005) found a positive and statistically significant relationship between annual university-wide R&D expenditure and spinoff activity. Similarly Lenoir and Gianella (2006) show the extent to which funding can potentially have an effect on research. The authors explore the influence of federal funding on gene chip development and document the role of technology change in catalyzing the creation of a powerful new approach to gene research and the emergence of an entire sector in the biotech industry.

The nature of research engaged in by the university also seems to be important in spinoff activity. One piece of empirical evidence in the literature supports this view. O’Shea et al. (2005) examined the spinoff rate at 141 US universities from 1995 to 2001 and found evidence that the nature of university science and engineering funding with a particular orientation in the biological sciences, computer science and chemistry disciplines had a positive and statistically significant effect on spinoff formation rates.

Faculty quality has also been cited as another factor that influences spinoff activity. Zucker et al. (1998b) linked the intellectual human capital of ‘star’ scientists to the founding of new firms in the American biotechnology industry and to their growth and location. Stuart and Ding (2006) have more recently shown that, although it was distinguished scientists who made the transition into academic entrepreneurship, the professional gap between participants and non-participants in academic entrepreneurship was diminishing over time. DiGregorio and Shane (2003) also demonstrate that faculty members who develop leading edge innovations may wish to earn economic rents on valuable asymmetric information. They suggest it may be easier for academics from top tier universities to assemble resources to create start-ups for reasons of credibility.

In recent years, the question of how universities are supporting the development of spinoffs is attracting increased attention. For example, in a study of 43 research institutions in five European countries, Clarysse et al. (2005) showed three different incubation strategies were used to manage the spinoff process. These models were Low Selective (oriented towards maximizing the number of spinoffs created), Supportive (oriented towards generating revenue from spinoffs) and the Incubator model (oriented towards a financial gain at the point of exit). Davenport et al. (2002) examined spinoff strategies of industrial research centers and uncovered four different parent support strategies in the development of high technology spinoffs. These include: (1) spinoffs by exception—unintentionally initiated by the entrepreneur where support from the parent organization may be on a contingent basis; (2) spinoffs by occasion—may be intentionally initiated by the entrepreneur where support and management for the spinoff is on a case-by-case basis; and (3) spinoffs as strategy—formed intentionally with a formal strategy and procedures in place. Degroof and Roberts (2004) also examined university spinoff policies with respect to the growth potential of spinoffs. They argue that in order for more growth-oriented ventures to emerge from research institutions located within weak entrepreneurial infrastructures, there is a need for universities to adopt a proactive highly selective and supportive model for spinoff development.

In order to improve university and commercial ties with industry, some universities operate a technology transfer office (TTO) as a vehicle to support the creation of spinoff companies (Hague and Oakley 2000). Their role has been described as facilitating technological diffusion from university research to industry (Siegel et al. 2003); managing and enhancing the value of the university’s intellectual property (Meseri and Maital 2001); and assisting researchers in disseminating research results for the public good (Carlsson and Fridh 2002). Roberts & Malone describe the TTO’s involvement as:

-

assuming the role of principal decision maker while they evaluate the invention;

-

making arrangements for the legal protection of the technology;

-

directing the entrepreneurs to venture capitalists;

-

establishing their representation on the board of the company.

The TTO role has also been seen in a less positive light with regard to their behavior towards spinoffs. For example, Siegel et al. (2003) found the marketing and negotiation skills of the TTO personnel to be seen as dissatisfactory by 55% of the entrepreneurs, scientists and administrators they interviewed. According to the study, the TTO was shown to be inflexible and conservative in some respects.

From an organizational structure perspective, understanding the design and the development of productive TTO organizations has become another area of fruitful research. For example, in a case analysis of K.U. Leuven Research & Development (LRD), Debackere (2000) found that having the right mix of governance structures (i.e. matrix structures facilitating interdisciplinary research), processes (i.e., seed capital fund, patent protection, business plan and new venture development services) and context (historic embeddedness of LRD) contributed to K.U. Leuven’s success at generating 34 spinoff companies up until 1999. Furthermore, Markman et al. (2005) found the greater the innovation speed of TTOs, the greater the propensity to generate returns to the university via higher rates of startup formation.

There have also been organizational models put forward to describe the trajectories of spinoff formation based on the individuals and processes involved. For example, Roberts and Malone (1996) put forward five alternative structural models involving four principal groups to describe the formal process by which spinoffs were formed from government-owned (R&D) organizations. The principal groups were: (1) the technology originator—an individual or group of engineers/scientists that work in the organization and bring the technology to the point where it is ready to be commercialized; (2) the entrepreneur—the individual entrepreneur or entrepreneurial team who take the technology from the technology originator and attempt to create the new venture from it; (3) the R&D organization—this is the source institution and is formally represented by the technology transfer office; and (4) the venture investor—a venture capital organization in most cases. Different combinations of the four parties groups were involved at different stages ranging from invention to sale or initial public offering (IPO), each constituting a different path in the creation of a spinoff. The authors provide details of the inter-group processes that occur and describe how each group is involved at different points. A brief description of the differences between the five models is given in Table 1.

Roberts and Malone’s (1996) models involved both the process and the individual agents in technology transfer. However, one model which looks at the individual to describe spinoff formation has been put forward by Radosevich (1995). The author puts forward two alternative models, which include: (1) the inventor-entrepreneur—the inventor leaves the technology source so they may become the entrepreneur; and (2) the surrogate-entrepreneur—an external or independent entrepreneur is given rights by the technology source if the inventor does not wish/is not able to leave the technology source.

3.3 Institutional determinants of spinoff activity

The central tenet of the third stream of research is that university spinoff activity is a reflection of institutional behavior. This research suggests that universities with cultural norms that support commercialization activity will have higher levels of commercialization and higher rates of spinoff activity. For example, O’Shea at al. (2007) argue that MIT’s founding mission and institutional support towards entrepreneurial activities played an important role in the development of academic entrepreneurship at MIT. Similarly, George et al. (2006) develop a grounded and micro-level understanding of factors that influence the degree of their involvement in commercialization activities. By undertaking a two-part inductive-deductive study of 796 scientists at a large public research university, the authors find that the perceptions of institutional support in terms of department norms and technology transfer office (TTO) receptiveness played a crucial role. More specifically the authors find the extent to which institutional factors were viewed as being supportive, the more likely scientists were prepared to participate in technology transfer activity. Kenney and Goe (2004) also contend that ‘the involvement of professors in entrepreneurial activity is influenced by the social relationships and institutions in which a professor is embedded. Djokovic and Souitaris (2007) concur with this view that: ‘the changing role of universities towards commercialization activities combined with governmental and institutional support mechanisms is creating a fertile ground for the seeds of university spinoffs’. Louis et al. (1989) also found local group norms were important in predicting active involvement in commercialization.

In contrast, some cultural factors such as the ‘publish or perish’ drive, the ambiguous relationship of researchers to money, and the ‘disinterested’ nature of academic research to industry are seen as inhibitors to the valorization process of academic research (Ndonzuau et al. 2002). Thursby and Kemp (2002) found less than half of faculty inventions with commercial potential are disclosed to the TTO. In some cases this may be because those involved do not realize the commercial potential of their ideas, but often it is due to the unwillingness to delay publication that results from the patent and licensing process (Thursby and Kemp 2002). Restrictive leave of absence policies, whereby academics find it difficult to move between academia and the private sector, have also been shown to negatively impact spinoff activity. For example, DiGregorio and Shane (2003) found evidence that university technology transfer policies that allocate a higher share of inventors’ royalties decrease spinoff activity because of the increased opportunity cost in engaging in firm formation. In contrast, other research has shown universities that give higher percentages of royalty payments to their faculty members positively impacts the efficiency of university technology transfer activities (Link and Siegel 2005).

Universities that lack a culture supportive of commercialization activity may take a number of actions. For example, Stuart and Ding (2006) found strong evidence of the socially and spatially localized spread of commercial science in the US. According to the authors, scientists are more likely to become entrepreneurs when they work in departments where colleagues had previously made the transition, particularly when the individuals who had become commercialists were prestigious scientists. Furthermore, Siegel et al. (2004) propose that in order to foster a climate of entrepreneurship within academic institutions, university administrators should focus on five organizational and managerial factors: (1) reward systems for University Industry Technology Transfer (UITT); (2) staffing practices in the TTO; (3) university policies to facilitate university technology transfer; (4) increasing the level of resources devoted to UITT; and (5) working to eliminate cultural and informational barriers that impede the UITT process. These processes however take time to embed into practice. For example, Kirby (2006) posits that universities need to go beyond putting short-term initiatives in place and build an entrepreneurial culture whereby commercialization activity is encouraged and entrepreneurial behavior runs through the whole organization.

3.4 External determinants of spinoff activity

The fourth stream of research emphasizes the impact of broader economic factors on academics within universities. Four factors that could impact spinoff activity are access to venture capital, the legal assignment of inventions (or more specifically in the US, the enactment of the Bayh-Dole Act), the knowledge infrastructure in the region, and industry structure.

Florida and Kenney (1988) highlight the central role of the availability of venture capital in encouraging the formation of high-technology companies. However, more recent research shows that access to venture capital is the most important resource constraint faced by universities (Wright et al. 2006). In fact, early on in the spinoff process, Wright et al. (2006) found that spinoffs view venture capital as more important than internal funds. In contrast to this, their findings from venture capitalists showed they prefer to invest after the seed stage, therefore implying a mismatch between the expectations of spinoffs and venture capitalists. Wright et al. (2004b) have also suggested the involvement of industry functioning as venture capitalists via joint venture spinoffs may facilitate the emergence of university spinoffs as they have the necessary financial resources and commercial expertise to launch successful start-ups.

A growing number of studies have recently investigated the geographic localization effects of venture capital investments. Sorenson and Stuart (2001) found the probability that a venture capital firm will invest in a start-up decreases with the geographical distance between the headquarters of the venture capital firm and the start-up firm. In contrast, DiGregorio and Shane (2003) found no evidence that the number of venture capital investments, or the presence of university venture capital funding are related to the amount of university spinoff activity.

According to Shane (2004b), another significant impetus in the generation of university spinoffs in the US was the enactment of the Bayh-Dole Act whereby inventions were assigned to academic institutions rather than individual inventors. US universities then became directly involved in patenting and licensing activities and set up TTOs to manage this activity (Sampat 2006), the number of which has dramatically increased since Bayh-Dole (Colyvas et al. 2002). Some European studies show national policies which allow inventions to be assigned to academic inventors, have inhibited spinoff activity (Wallmark 1997). Other researchers suggest national policies of assigning inventions to individuals can lead to an anti-entrepreneurial attitude among faculty and university administrators who do not gain from inventors’ entrepreneurial activity (Goldfarb and Henrekson 2003).

The knowledge infrastructure of a region is also cited as a key factor determining spinoff activity. The phenomenon of entrepreneurial universities supported by incubating technopole regions such as Route 128 and Kendall Square in Cambridge, MA with a strong commercialization tradition is well documented in the literature (O’Shea et al. 2007). However, Feldman and Desrocher’s (2004) study on John Hopkins also highlight difficulties faced by universities’ in promoting academic entrepreneurship with surrounding weak entrepreneurial infrastructure of a region. Feldman and Francis (2003) argue that even though universities seem to be necessary for the development of biotech concentration, the existence of a high ‘knowledge base’ alone might not be enough. Kenney (2000) supports this view and shows that Silicon Valley continues to be successful because all the ‘regional infrastructure’ elements needed to create new industries exist there. According to Saxenian (1994), the entire network infrastructure of entrepreneurial managers, customers and suppliers, tend to be present in those areas and perhaps more importantly the barriers to starting a university spinoff firm.

3.5 The development and performance of university spinoffs

In the fifth stream of research of literature, we review studies on the development and performance as consequences of university spinoff activity. In a recent cohort of studies, a small number of researchers have moved to a neglected area by exploring spinoff development (Mustar et al. 2006) and have put forward several different phases of development that spinoffs go through. Vohora et al. (2004) found the series of distinct phases that the ventures went through were: (1) research; (2) opportunity framing; (3) pre-organization; and (4) re-orientation and sustainability. The three quite different phases put forward by Degroof and Roberts (2004) in proactive spinoff processes were: (1) origination; (2) concept testing; and (3) start-up support. In their study looking at team development patterns, Vanaelst et al. (2006) concur with Vohora et al. (2004) that spinoffs must pass through the previous phase to be able to move to the next one. The phases Vanaelst et al. (2006) found spinoffs go through are: (1) research commercialization and opportunity screening; (2) the organization-in-gestation phase; (3) proof of viability of the newly established venture; and (4) the maturity phase. In addition, Vohora et al. (2004) found the spinoff faces critical junctures at the end of each phase which they have to overcome before moving onto the next phase. These critical junctures were opportunity recognition, entrepreneurial commitment, threshold of credibility and threshold of sustainability (Vohora et al. 2004). In passing from one phase to the next, Druilhe and Garnsey (2004) found spinoffs modify, refine and develop their business model as they improve their knowledge of resources and opportunities. They are also in agreement with Vohora et al. (2004) that spinoff development is an iterative and non-linear process.

A small but growing number of studies deal with the performance of academic spinoffs. According to Shane (2004a), spinoff companies are 108 times more likely than the average new firm to go public and also to create more jobs than the average new business in the United States. Furthermore, the survival rate of university spinoff companies is extremely high. According to AUTM (2001), of the 3,376 university spinoffs founded between 1980 and 2000, 68% remained operational in 2001, which again is a higher number than the average survival rate of new firms in the US. Similar results have been found in other countries. For example, Mustar (1997) found that only 16% of the French spinoffs he studied failed over the 6-year period that he tracked them. Dahlstrand (1997) found that only 13% of the spinoffs from Chalmers Institute of Technology in Sweden founded between 1960 and 1993 had failed by 1993. Furthermore, Nerkar and Shane (2003) analyzed the entrepreneurial dimension of university technology transfer, based on an empirical analysis of 128 firms that were founded between 1980 and 1996 to commercialize inventions owned by MIT. Their findings suggest that new technology firms are more likely to survive if they exploit radical technologies and if they possess patents with a broad scope.

In a study of start-up teams, Ensley and Hmieleski (2005) compared the performance of university-based start-ups with independently started ventures and found lower performance with regard to net cash flow and revenue growth in the university-based ventures. They attributed this to the teams not being as well developed as their independent venture counterparts due to a difficulty in finding the level of expertise required on the university campus, thus highlighting the importance of networks. Shane and Stuart (2002) offered empirical evidence of the network-performance relationship, analyzing how social capital endowments of the founders affect the likelihood of three critical outcomes of spinoffs: attracting venture capital financing, experiencing initial public offerings (IPOs) and failure. Direct and indirect linkages to investors were found to be important determinants of whether the business received venture funding and in reducing the likelihood of spinoff failure.

3.6 The economic impact of spinoffs

University spinoffs are an important subset of start-up firms because they are an economically powerful group of high-technology companies. Among them are several billion dollar public corporations, including Cirrus Logic, Google, Genentech, and Chiron (Shane 2004a, b). A small number of policy reports have looked at the impact of universities and their respective spinoff companies on regional economic development. The ‘MIT: The Impact of Innovation’ report, which was prepared by the BankBoston Economics Department, finds that the economic impact of companies founded by MIT alumni and alumnae (Bank Boston 1997). Among other findings, the study reveals that MIT graduates had founded 4,000 companies by 1997, creating 1.1 million jobs worldwide and generating annual sales of $232 billion. In fact, the study stated that if the companies founded by MIT graduates and faculty formed an independent nation, the revenues produced by the companies would make that nation the 24th-largest economy in the world. According to the Association of University Technology Managers (AUTM 2001), spinoffs from American academic institutions between 1980 and 1999 have contributed 280,000 jobs to the US economy and $33.5 billion in economic value-added activity (Shane 2004a). This stream of literature reviewed the economic impact of university spinoffs and concludes the literature review of the six determinants and consequences of university spinoff activity. In the next section, we use these six streams of literature to develop a conceptual framework for future research on university spinoffs.

4 Developing a conceptual framework for the study of spinoffs

We have identified six streams of research relating to university spinoff activity within the domain of academic entrepreneurship. We have specifically focused on research that identifies the determinants and consequences of this activity. We now seek to integrate these perspectives into a university spinoff framework. We believe this framework provides a useful organizing scheme for understanding existing literature on academic research, for explaining the determinants and consequences of spinoff activity and for guiding future studies on this subject.

This framework (Fig. 1) represents a conceptual integration of elements found in the academic entrepreneurship literature. The framework assumes a socio-psychological perspective, in that we suggest that spinoff creation not only varies due to the characteristics of individual academics but also due to variation in environments and university contexts. The framework suggests that four factors (shaded in Fig. 1) influence the rate of spinoff activity: (1) engaging in entrepreneurial activity (individual characteristics studies); (2) the attributes of universities such as human capital, commercial resources and institutional activities (organizational-focused studies); (3) the broader social context of the university, including the ‘barriers’ or ‘deterrents’ to spinoffs (institutional and cultural studies); (4) the external characteristics such as regional infrastructure that impact on spinoff activity (external environment studies). We also incorporate two streams of research by suggesting the consequences of spinoff activity can be considered in terms of (5) the development and performance of spinoffs; and (6) the spillover effect of spinoffs on the regional economy.

5 Conclusion

In this paper we organized the growing body of theory and research on university entrepreneurship into six different research streams. Specifically, we argue for the existence of an underlying set of individual and contextual factors that need to be recognized by universities implementing technology transfer policies. In addition, the two other primary streams of research identified (i.e., development and performance of spinoffs and the economic impact of spinoff activity) provide a parsimonious description of the outcomes of spinoff activity.

We also argued spinoffs are increasingly important for economic development. Policy makers and universities are increasingly seeking to understand how best higher educational institutions can contribute to both their traditional functions and the added function of making the regional or national economy more competitive. We presented a conceptual framework that should aid researchers in completing a much-needed assessment of the impact of organizational policies, practices and structures on university entrepreneurship. Specifically our framework should lead to the development of organizational interventions that facilitate technology transfer and spinoff activity. The integrative framework we presented suggests that university heads and policy makers can encourage and develop university entrepreneurship by using a comprehensive systems approach for the identification, protection and commercialization of university intellectual property.

References

Allen, T. J., & Sosa, M. L. (2004). 50 years of engineering management through the lens of the IEEE Transactions; T-EM Nov. 391–395.

Allen, T. J., Tushman, M. L., & Lee, D. M. (1979). Technology transfer as a function of position in the spectrum from research through development to technical services. Academy of Management Journal, 22(4), 694–708.

Association of University Technology Managers FY (2001). The AUTM Licensing Surveys; University Start-up Data. AUTM Inc., Norwalk, Connecticut.

Association of University Technology Managers FY (2004). The AUTM U.S. Licensing Survey.

Audretsch, D. (2000). Is University Entrepreneurship Different? Mimeo, Indiana University.

Bank Boston (1997). MIT: The Impact of Innovation. Bank Boston Economics Department Special Report, Boston, MA.

Birley, S. (2002). Universities, academics and spinout companies: lessons from imperial. International Journal of Entrepreneurship Education, 1(1), 1–21.

Blumenthal, D., Campbell, E. G., Causino, N., & Louis, K. (1996). Participation of life science faculty in research relationships with industry. New England Journal of Medicine, 335, 1734–1739.

Carlsson, B., & Fridh, A.-C. (2002). Technology transfer in United States universities: a survey and statistical analysis. Journal of Evolutionary Economics, 12, 199–232.

Clarysse, B., Wright, M., Lockett, A., Van de Velde, E., & Vohora, A. (2005). Spinning out new ventures: A typology of incubation strategies from European research institutions. Journal of Business Venturing, 20, 183–216.

Colyvas, J., Crow, M., Gelijns, A., Mazzoleni, R., Nelson, R. R., Rosenberg, N., & Sampat, B. N. (2002). How do university inventions get into practice? Management Science, 48(1), 61–72.

Dahlstrand, A. (1997). Growth and inventiveness in technology-based spinoffs firms. Research Policy, 26(3), 331–344.

Davenport, S., Carr, A., & Bibby, D. (2002). Leveraging talent: Spin-off strategy at industrial research. R & D Management, 32(3), 241–254.

Debackere, K. (2000). Managing academic R&D as business at K.U. Leuven: Context, structure and process. R&D Management, 30(4), 323–328.

Degroof, J.-J., & Roberts, E. B. (2004). Overcoming weak entrepreneurial infrastructures for academic spin-off ventures. Journal of Technology Transfer, 29(3–4), 327–354.

DiGregorio, D., & Shane, S. (2003). Why do some universities generate more start-ups than others? Research Policy, 32(2), 209–227.

Djokovic, D., & Souitaris, V. (2007). Spinouts from academic institutions. A literature review with suggestions for further research. Journal of Technology Transfer (forthcoming).

Druilhe, C., & Garnsey, E. (2004). Do academic spin-outs differ and does it matter? Journal of Technology Transfer, 29(3–4), 269–285.

Ensley, M. D., & Hmieleski, K. M. (2005). A comparative study of new venture top management team composition, dynamics and performance between university-based and independent start-ups. Research Policy, 34, 1091–1105.

Feldman, M. P., & Desrochers, P. (2004). Truth for Its own sake: Academic culture and technology transfer at the Johns Hopkins University. Minerva, 42(2), 105–126.

Feldman, M. P., & Francis, J. (2003). Fortune favors the prepared region: The case of entrepreneurship and the capitol region biotechnology cluster. European Planning Studies, 11, 765–788.

Florida, R., & Kenney M. (1988). Venture capital-financed innovation and technological change in the United States. Research Policy, 17, 119–137.

George, G., Jain, S., & Maltarich, M. (2006). Academics or entrepreneurs? Entrepreneurial identity and invention disclosure behavior of university scientists. Paper presented at the University Technology Transfer and Commercialization of Research: Antecedents and Consequences Symposium, Academy of Management Conference, Atlanta, USA.

Goldfarb, B., & Henrekson, M. (2003). Bottom-up vs. top-down policies towards the commercialization of university intellectual property. Research Policy, 32(4), 639–658.

Hague, D., & Oakley, K. (2000). Spin-offs and Start-Ups in UK Universities. Committee of Vice-Chancellors and Principals (CVCP) Report.

Kenney, M. (2000). Understanding Silicon Valley: The anatomy of an entrepreneurial region. Stanford, California: Stanford University Press.

Kenney, M., & Goe, W. R. (2004). The role of social embeddedness in professorial entrepreneurship: A comparison of electrical engineering and computer science at UC Berkeley and Stanford. Research Policy, 33, 691–707.

Kirby, D. A. (2006). Creating entrepreneurial universities in the UK: applying entrepreneurship theory to practice. Journal of Technology Transfer, 31(5), 599–603.

Lacetera, N. (2006). Different missions and commitment power in R&D organization: Theory and evidence on industry-university relations. MIT Sloan School Working Paper 4528-05.

Lenoir, T., & Giannella, E. (2006). Mapping the impact of federally funded extra-university research and development on the emergence of self-sustaining knowledge domains: The case of microarray technologies. Paper presented at the University Technology Transfer and Commercialization of Research: Antecedents and Consequences Symposium, Academy of Management Conference, Atlanta, USA.

Link, A. N., & Siegel, D. S. (2005). Generating science-based growth: An econometric analysis of the impact of organizational incentives on university-industry technology transfer. European Journal of Finance, 11(3), 169–181.

Lockett, A., & Wright, M. (2005). Resources, capabilities, risk capital and the creation of university spin-out companies. Research Policy, 34(7), 1043–1057.

Louis, K. S., Blumenthal, D., Gluck, M. E., & Stoto, M. A. (1989). Entrepreneurs in academe: An exploration of behaviors among life scientists. Administrative Science Quarterly, 34(1), 110–131.

Markman, G. D., Gianiodis, P. T., Phan, P. H., & Balkin, D. B. (2004). Entrepreneurship from the ivory tower: Do incentive systems matter? Journal of Technology Transfer, 29(3–4), 353–364.

Markman, G. D., Gianiodis, P. T., Phan, P. H., & Balkin, D. B. (2005). Innovation speed: Transferring university technology to market. Research Policy, 34, 1058–1075.

Meseri, O., & Maital, S. (2001). A survey of university-technology transfer in Israel: Evaluation of projects and determinants of success. Journal of Technology Transfer, 26(1–2), 115–126.

Mowery, D. C., & Shane, S. (2002). Introduction to the special issue on university entrepreneurship and technology transfer. Management Science, 48(1), v–ix.

Murray, F. (2006). Exchange relationships & cumulative innovation: standing on the shoulders of oncomouse. Paper presented at the University Technology Transfer and Commercialization of Research: Antecedents and Consequences Symposium, Academy of Management Conference, Atlanta, USA.

Mustar, P. (1997). spin-off enterprises: how french academics create Hi-Tech companies: The conditions for success or failure. Science and Public Policy, 24(1), 37–43.

Mustar, P., Renualt, M., Colombo, M.G., Piva, E., Fontes, M., Lockett, A., Wright, M., Clarysse, B., & Moray, N. (2006). Conceptualising the heterogeneity of research-based spin-offs: A multi-dimensional taxonomy. Research Policy, 35, 289–308.

Ndonzuau, F. N., Pirnay, F., & Surlemont, B. (2002). A stage model of academic spin-off creation. Technovation, 22(5), 281–289.

Nerkar, A., & Shane, S. (2003). When do startups that exploit academic knowledge survive? International Journal of Industrial Organization, 21(9), 1291–1410.

Nicolaou, N., & Birley, S. (2003a). Academic networks in a trichotomous categorisation of university spin-outs. Journal of Business Venturing, 18(3), 333–359.

Nicolaou, N., & Birley, S. (2003b). Social networks in organizational emergence: The university spinout phenomenon. Management Science, 49(12), 1702–1725.

O’Shea, R. P., Allen, T. J., Chevalier, A., & Roche, F. (2005). Entrepreneurial orientation, technology transfer and spinoff performance of U.S. Universities. Research Policy, 34, 994–1009.

O’Shea, R. P., Allen, T. J., Morse, K. P., O’Gorman, C., & Roche, F. (2007). Delineating the anatomy of an entrepreneurial university: The Massachusetts Institute of Technology Experience. R&D Management, 37(1), 1–16.

Powers, J., & McDougall, P. (2005). University start-up formation and technology licensing with firms that go public: A resource based view of academic entrepreneurship. Journal of Business Venturing, 20(3), 291–311.

Radosevich, R. (1995). A model for entrepreneurial spin-offs from public technology sources. International Journal of Technology Management, 10(7/8), 879–893.

Roberts, E. (1991). Entrepreneurs in high technology, lessons from MIT and beyond. Oxford: Oxford University Press.

Roberts, E., & Malone, D. E. (1996). Policies and structures for spinning off new companies from research and development organizations. R&D Management, 26, 17–48.

Rogers, E. M., Takegami, S., & Yin, J. (2001). Lessons learned about technology transfer. Technovation, 21(4), 253–261.

Sampat, B. N. (2006). Patenting and US academic research in the 20th century: The world before and after Bayh-Dole. Research Policy, 35, 772–789.

Saxenian, A. (1994). Regional advantage: Culture and competition in silicon valley and route 128. Cambridge, MA: Harvard University Press.

Shane, S. (2004a). Academic entrepreneurship: University spin-offs and wealth creation. Cheltenham, UK: Edward Elgar.

Shane, S. (2004b). Encouraging university entrepreneurship: The effect of the Bayh-Dole act on university patenting in the United States. Journal of Business Venturing, 19(1), 127–151.

Shane, S., & Stuart, T. (2002). Organizational endowments and the performance of university start-ups. Management Science, 48(1), 154–170.

Siegel, D. S., Waldman, D., & Link, A. (2003). Assessing the impact of organizational practices on the relative productivity of university technology transfer offices: An exploratory study. Research Policy, 32, 27–48.

Siegel, D. S., Waldman, D., Atwater, L., & Link, A. (2004). Toward a model of the effective transfer of scientific knowledge from academicians to practitioners: Qualitative evidence from the commercialization of university technologies. Journal of Engineering and Technology Management, 21, 115–142.

Smilor, R. W., Gibson, D. V., & Dietrich, G. B. (1990). University spinout companies: Technology start-ups from UT-austin. Journal of Business Venturing, 5, 63–76.

Sorenson, O., & Stuart, T. E. (2001). Syndication networks and the spatial distribution of venture capital financing. American Journal of Sociology, 106, 1546–1588.

Steffensen, M., Rogers, E. M., & Speakman, K. (1999). Spin-offs from research centers at a research university. Journal of Business Venturing, 15, 93–111.

Stuart, T. E., & Ding, W. W. (2006). When do scientists become entrepreneurs? The social structural antecedents of commercial activity in the academic life sciences. American Journal of Sociology 112(1), 97–144.

Thursby, J., & Kemp, S. (2002) Growth and productive efficiency of university intellectual property licensing. Research Policy, 31, 109–124.

Vanaelst, I., Clarysse, B., Wright, M., Lockett, A., Moray, N., & S’Jegers, R. (2006). Entrepreneurial team development in academic spinouts: An examination of team heterogeneity. Entrepreneurship Theory and Practice, 30(2), 249–271.

Vohora, A., Wright, M., & Lockett, A. (2004). Critical junctures in the development of university high-tech spin-out companies. Research Policy, 33, 147–175.

Wallmark, J. T. (1997). Inventions and patents at universities: The case of Chalmers University of Technology. Technovation, 17(3), 127–139.

Wright, M., Birley, S., & Mosey, S. (2004a). Entrepreneurship and university technology transfer. Journal of Technology Transfer, 29(3–4), 235–246.

Wright, M., Lockett, A., Clarysse, B., & Binks, M. (2006). University spin-out companies and venture capital. Research Policy, 35, 481–501.

Wright, M., Vohora, A., & Lockett, A. (2004b). The formation of high-tech university spinouts: The role of joint ventures and venture capital investors. Journal of Technology Transfer, 29(3–4), 287–310.

Zucker, L. G., Darby, M. R., & Armstrong, J. (1998a). Geographically localized knowledge: Spillovers or markets? Economic Inquiry, 36, 65–86.

Zucker, L. G., Darby, M. R., & Brewer, M. B. (1998b). Intellectual human capital and the birth of U.S. biotechnology enterprises. American Economic Review, 88(1), 190–305.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

O’Shea, R.P., Chugh, H. & Allen, T.J. Determinants and consequences of university spinoff activity: a conceptual framework. J Technol Transfer 33, 653–666 (2008). https://doi.org/10.1007/s10961-007-9060-0

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10961-007-9060-0