Abstract

In this paper, we generalize the Markowitz measure of the risk proposed in a stationary setting. We provide an evolutionary Markowitz-type measure of the risk with a memory term and show that this function is effective, namely an existence theorem for the general financial problem can be proved.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

In the previous papers [1–3], where the authors deal with the financial equilibrium problem, they assume that significant utility functions there exist and provide the properties they need to have in order to ensure the existence of solutions to the financial equilibrium problem. This paper aims at covering a lack providing the existence of a significant evolutionary measure of the risk, which satisfies all the assumptions requested to ensure the existence of a solution to the financial equilibrium problem. This evolutionary financial measure of the risk is obtained by generalizing the celebrated measure of the financial risk introduced by Markowitz in [4, 5] in the stationary setting. So this paper gives an example of an evolutionary risk measure which plays in the evolutionary case the same role as the Markowitz risk measure plays in the stationary case.

Then, such a concrete example of evolutionary risk measure of Markowitz type allows us to be sure that in the previous papers [1–3], we are not working on empty sets. Of course, the evolutionary measure is interesting in itself because we can see how to pass from the stationary to the evolutionary case.

The measure of the risk due to Markowitz in the stationary case is a quadratic form built starting from a variance–covariance matrix \(Q^i\) which denotes the sector i’s assessment of the standard deviation of prices for each instrument j. Markowitz’s fundamental idea is that the variability of the prices is an index of the increase in risk.

The evolutionary Markowitz-type measure of the risk is a function constituted of two terms: The first one is a quadratic form built starting from the variance–covariance matrix \(Q^i\), and the second one is a memory term, which expresses the influence of the previous equilibrium solutions in the evolution of the risk. Here the evolutionary nature of the new risk measure appears. The variance–covariance matrix \(Q^i\) is calculated at a certain instant which is called instant zero, taking into account the equilibrium prices in a finite set of previous times. We note that without the memory term, the prices in the period \([0,\varDelta ]\) would not have influence on the measure of the risk. Then, we consider a financial equilibrium problem equipped with this risk measure and we show that the new risk measure is effective, namely an existence theorem of equilibrium solution holds true. Since we are in an infinite-dimensional setting, to prove the existence theorem, we need to verify a lot of functional tools, as, for instance, we need to show that the related utility function is Fan-hemicontinuous and so on, and these proofs are demanding and very delicate.

Further, we make a comparison between the solution of the financial problems with and without memory terms (see Remark 4.1) and we obtain that the model without memory terms is the first approximation of the other one.

Here, it is not worth to spend many words on the importance of the memory term. We only refer to the papers [6–8] for the interested readers.

In the general model, we are considering, using this new evolutionary Markowitz-type measure of the risk, the amount of investments as assets and as liabilities is assumed depending on the expected solutions, namely we require that the set of feasible solutions is flexible and adaptive and this objective is achieved just assuming that the equality constraints depend on the expected solution in an average manner. We make such an assumption in order to take into account that when one chooses an investment, he takes care of the expected forecasts of the market. This is realistic because none invests without having an idea of the future behavior. Since our model evolves in time, surely investors cannot have an evaluation instant by instant, but they use a mean evaluation. This is the reason why imposing a dependence on the mean value is not an ad hoc requirement, but it is what happens in real life. In many fields of mathematical physics and engineering, the elastic or adaptive dependence is a characterizing phenomenon. For the seminal work on elastic constraints, see the book [9]. We point out that we are able to derive a quasi-variational formulation of this financial equilibrium problem with memory and adaptive constraints. For the previous papers on the evolutionary financial model, see [10–24].

Of course many of the examined phenomena are affected by intrinsic randomness. However, this paper is deterministic and can be extended to a stochastic financial model where the used time variable can be replaced by a random variable. Some authors have already presented papers in this field (see [25–27]).

In the evolutionary formulation and in the considered functional spaces \(L^p\), our paper has common points with some consumption-based capital asset pricing model studied, for instance, by Duffie and Zame (see [28]), who present the existence of equilibria of the above problem. However, we have used a different methodology to develop the research of existence.

Finally, it is worth remarking that the financial equilibrium problem equipped with the evolutionary Markowitz measure of the risk turns out to be continuous. Indeed, we show that, in a special but sufficiently general case, the obtained utility function satisfies all the properties which lead to the continuity of the solution.

A similar methodology, based on variational inequalities, has been used in [29] (see also [30]) and in the field of the Walras general equilibrium model of economy.

The paper is organized as follows. In Sect. 2, we present the financial model with memory terms and adaptive constraints. In Sect. 3, we prove the main results of this paper. In Sect. 4, we study two concrete examples of financial networks.

2 The Financial Model

We consider a financial economy consisting of m sectors, for example households, domestic businesses, banks and other financial institutions, as well as state and local governments, with a typical sector denoted by i, and of n instruments, for example mortgages, mutual funds, saving deposits, money market funds, with a typical financial instrument denoted by j, in the time interval \([0, \varDelta ]\). At time t, we denote the amount of instrument j held as an asset in sector i’s portfolio by \(x_{ij} (t)\) and the amount of instrument j held as a liability in sector i’s portfolio by \(y_{ij} (t)\). The assets and liabilities in all the sectors are grouped into the \(m\times n\) matrices x(t) and y(t). We denote the price of instrument j held as an asset at time t by \(r_j (t)\) and the price of instrument j held as a liability at time t by \((1 + h_j(t)) r_j (t)\), where \(h_j\) is a nonnegative function defined into \([0,\varDelta ]\) and belonging to \(L^{\infty }([0,\varDelta ])\). We introduce the term \(h_j(t)\) not just for mathematical generality, but because there are real-world effects that one fails to capture by neglecting this. Indeed, as it is continuously shown by experience, the prices of liabilities are generally greater than or equal to the prices of assets. A fundamental reason for this is that these increments are necessary to pay the bank expenses, the financial intermediation, the salaries, etc. We group the instrument prices held as assets into the vector \(r(t)=[r_1(t), \ldots , r_n(t)]^T\) and the instrument prices held as liabilities into the vector \(\displaystyle (1+h(t))r(t)=\left[ (1+h_j(t))r_j(t)\right] ^T_{j=1,\ldots , n}.\) In our problem, the prices of each instrument appear as unknown variables. Under the assumption of perfect competition, each sector will behave as if it has no influence on the instrument prices or on the behavior of the other sectors, but the equilibrium prices depend on the total amount of investments and the liabilities of each sector.

In order to express the time-dependent equilibrium conditions by means of an evolutionary variational inequality, we choose as a functional setting the very general Lebesgue space

where

To denote the norm in the Hilbert space \(L^2([0, \varDelta ],\mathbb {R}^p)\), we shall use the symbol \(\left\| f\right\| _{L^2}\) when there is no possibility of confusion. As it is well known, the dual space of \(L^2([0, \varDelta ],\mathbb {R}^p)\) is still \(L^2([0, \varDelta ],\mathbb {R}^p)\) and we define the canonical bilinear form in \(L^2([0, \varDelta ], \mathbb {R}^p) \times L^2([0, \varDelta ],\mathbb {R}^p)\) as

where \(\left\langle G(t),f(t)\right\rangle \) denotes the scalar product in \(\mathbb {R}^p\).

Now let us define the feasible set for each sector \(i=1,\ldots ,m\). Let \(s_i (t)\) and \(l_i(t)\) denote the total financial volume held by sector i at time t as assets and let \(l_i(t)\) as liabilities, respectively. We assume that the total financial volumes \(s_i\) and \(l_i\) depend besides on time also on the expected solution \(w^*(t)\), in an average way, namely by \( \int _0^\varDelta w^*(s) \hbox {d}s\), so \(s_i\) is given by \(s_i\left( t, \int _0^\varDelta w^*(s) \hbox {d}s \right) \) and \(l_i\) is given by \(l_i\left( t, \int _0^\varDelta w^*(s) \hbox {d}s \right) \).

Then, in order to define the constraint set, let us introduce the set

with \(0 \le \underline{r}(t) \le \overline{r}(t) \in L^2([0,\varDelta ], \mathbb {R}^n)\). We denote by \(\overline{r}(t)_j\) the ceiling price associated with instrument j and by \(\underline{r}_j\) the nonnegative floor price associated with instrument j. The meaning of the constraint \(\underline{r}_j(t) \le r_j(t)\) a.e. in \([0,\varDelta ]\) is that to each investor, a minimal price \(\underline{r}_j\) for the assets held in instrument j is guaranteed, whereas each investor is requested to pay for the liabilities not less than the minimal price \((1+h_j) \underline{r}_j\). Analogously each investor cannot obtain for an asset a price greater than \(\overline{r}_j\) and as a liability the price cannot exceed the maximum price \((1+h_j) \overline{r}_j\). Let us group the instrument ceiling prices \(\overline{r}_j\) into the column vector \(\overline{r}(t) = [\overline{r}_1(t), \ldots , \overline{r}_n(t)]^T\), the instrument floor prices \(\underline{r}_j\) into the column vector \(\underline{r}(t) = [\underline{r}_1(t), \ldots , \underline{r}_n(t)]^T\).

It is easy to verify that E is a convex, bounded and closed subset of \(L^2([0,\varDelta ], \mathbb {R}^{2mn+n}).\)

If \(K: E \rightrightarrows 2^E\) is the set-valued map defined as

then \(K(w^*)\) is the feasible set for every \(w^* \in E.\)

As it is well known, the governments impose some taxes on the financial operations and the reason is that the state wants to ensure a certain welfare. In our situation, the state control can be formulated by means of a given tax rate \(\eta _{ij}\) levied on sector i’s net yield on financial instrument j. We group the tax rates into the matrix \(\eta (t) \in \mathbb {R}^{mn}\). Assume that the tax rates lie in the interval [0, 1) and belong to \(L^\infty ([0,\varDelta ])\). Therefore, the government in this model has the flexibility of levying a distinct tax rate across both sectors and instruments.

In order to determine for each sector i the optimal composition of instruments held as assets and as liabilities, we consider, as usual, the influence due to risk-aversion and the process of optimization of each sector in the financial economy, namely the desire to maximize the value of the asset holdings and to minimize the value of liabilities. Then, for each sector i, we introduce the utility function:

where the term \(-u_i(x_i(t), y_i(t))\) represents a measure of the risk of the financial agent and \(r_j(t) (1- \eta _{ij}(t)) [x_i (t) - (1 + h_j(t)) y_i (t)]\) represents the value of the difference between the asset holdings and the liabilities.

In this paper, as we said, we consider a particular but significant example of utility function \(u_i(x_i(t),y_i(t))\), namely:

In order to determine the equilibrium prices, we establish the equilibrium condition which expresses the equilibration of the total assets, the total liabilities and the portion of financial transactions per unit \(F_j\) employed to cover the expenses of the financial institutions including possible dividends, as in [1–3]. Hence, the equilibrium condition for the price \(r_j\) of instrument j is the following:

Now, we can give different but equivalent equilibrium conditions, each of which is useful to illustrate particular features of the equilibrium. To this end, let us recall that we have:

The aim of the financial sectors is to maximize the utility function, namely to maximize the assets and to minimize the risk and the liabilities, simultaneously. Such an optimization is obtained using some necessary and sufficient conditions expressed by the following equilibrium conditions by means of the Lagrange multipliers.

Definition 2.1

A vector of sector assets, liabilities and instrument prices \(\displaystyle w^*=(x^*(t), y^*(t), r^*(t)) \in K (w^*)\) is an equilibrium of the dynamic financial model if and only if \(\forall i = 1, \ldots , m,\) \(\forall j=1, \ldots , n,\) and a.e. in \([0,\varDelta ],\) it satisfies the system of inequalities

and equalities

and

where \(\mu ^{(1)*}_i(t)\), \(\mu ^{(2)*}_i(t) \in L^2([0, \varDelta ])\) are Lagrange functions, and verify conditions (3) a.e. in \([0,\varDelta ]\) and \(u_i\) is given by (2).

Let us explain the meaning of the above conditions. To each financial volume \(s_i\) and \(l_i\) held by sector i, we associate the functions \(\mu ^{(1)}_i(t), \mu ^{(2)}_i(t)\), related, respectively, to the assets and to the liabilities and which represent the “equilibrium disutilities” per unit of sector i. Then, (6) and (8) mean that the financial volume invested in instrument j as assets \(x^*_{ij}\) is greater than or equal to zero if the jth component \(- \frac{\partial u_i(x^*, y^*)}{\partial x_{ij}} - (1- \eta _{ij}(t)) r_j^* (t)\) of the disutility is equal to \(\mu ^{(1)}_i(t)\), whereas if \(- \frac{\partial u_i( x^*, y^*)}{\partial x_{ij}} - (1- \eta _{ij}(t)) r_j^* (t)> \mu ^{(1)}_i(t)\), then \(x^*_{ij}(t)=0\). The same occurs for the liabilities and (3) represents the equilibrium of prices.

Using the same technique as in [3] and [1] (see Theorem 2.1), it is possible to prove the following theorem which shows the equivalence between Definition 2.1 and a quasi-variational inequality.

Theorem 2.1

A vector \(\displaystyle ( x^*, y^*, r^*) \in K (w^*)\) is a dynamic financial equilibrium if and only if it satisfies the following quasi-variational inequality

We want to stress that the variational inequality obtained from (11) setting \(r = r^*,\) namely:

is equivalent to the maximization problem:

where

Then, variational inequality (11) expresses both the optimality conditions (12) and the price equilibrium conditions (3).

Let us remark that, with the simple substitution \(t-z=\tau \), the memory term can be rewritten in the following way:

and

Hence, taking into account (4) and (5), our quasi-variational inequality, becomes:

In compact form:

where \(A:\left[ 0,\varDelta \right] \times E \rightarrow L^2 ([0,\varDelta ], \mathbb {R}^{2mn+n})\) is defined by the following components:

Let us assume that the following conditions are satisfied:

ASSUMPTIONS (\(\overline{\alpha }\)):

- \(\overline{\alpha } 1\) :

-

: \(Q^i\) is symmetric and positive defined;

- \(\overline{\alpha } 2\) :

-

: \(s_i\left( t, x \right) \) and \(l_i\left( t, y \right) \) are continuous in t w.r.t. the second variable;

- \(\overline{\alpha } 3\) :

-

: \(\exists \) \(\delta _1 \in L^2([0,\varDelta ])\) and \(\exists c_1 \in \mathbb {R}^+\) such that \(|s_i (t,x)| \le \delta _1 (t) + c_1\);

- \(\overline{\alpha } 4\) :

-

: \(\exists \) \(\delta _2 \in L^2([0,\varDelta ])\) and \(\exists c_2 \in \mathbb {R}^+\) such that \(|l_i(t,y)| \le \delta _2 (t) + c_2\);

- \(\overline{\alpha } 5\) :

-

: the functions \(\eta _{ij}, h_j, F_j \in L^\infty ([0,\varDelta ])\) and \(\eta _{ij} \in [0,1), \;\forall i\) and \(\forall j.\)

Let us remark that these assumptions are quite general, essential and minimal for justifying the integral formulation.

Our aim is to prove the following existence theorem:

Theorem 2.2

(Existence) If Assumptions (\(\overline{\alpha }\)) are satisfied, then variational inequality (13) admits a solution.

Now, we shall state the following regularity theorem, which holds true in the special case when \(s_i\) depend on \(x^*\) and \(l_i\) depend on \(y^*,\) for all \(i=1, \ldots , m\), namely when we choose:

Under the assumptions (\(\overline{\alpha }\)), the functions

are continuous functions, and \(x^*(s)\) and \(y^*(s)\) are the first and the second component of a solution \(w^*(s) \in L^2([0, \varDelta ],\mathbb {R}^{2mn+n})\) to problem (11), respectively.s

Theorem 2.3

Let all assumptions (\(\overline{\alpha }\)) be satisfied. Let \((x^*, y^*, r^*)\) be a solution to problem (11). Assume that \(\underline{r}(t),\) \(\overline{r}(t) \in C^0([0, \varDelta ], \mathbb {R}^n_+).\) Then, problem (11) admits a continuous solution \(\tilde{w}^* (s)\) such that \(x^*(t) = \tilde{x}^*(t),\) \(y^*(t) = \tilde{y}^*(t),\) whereas \(r^*(t)\) can be different than \(\tilde{r}^*(t).\)

3 Proof of Theorems 2.2 and 2.3

In order to prove Theorem 2.1, let us recall some definitions and a general existence result (see [18, 31]).

Let \(F: [0,\varDelta ] \times E \rightarrow \mathbb {R}^{2mn+n}\) be such that the following conditions F are satisfied:

- CONDITIONS F :

-

F is measurable in t \(\forall w \in \mathbb {R}^{2mn+n},\) continuous in w a.e. in \([0,\varDelta ],\) and there exists \(\overline{\delta }\in L^2([0, \varDelta ])\) such that \(\Vert F(t, w) \Vert \le \overline{\delta }(t) + \Vert w \Vert \) a.e. in \([0,\varDelta ], \; w \in \mathbb {R}^{2mn+n}.\)

Moreover, let us recall the definitions of a strongly monotone and a Fan-hemicontinuous mapping.

Definition 3.1

Let \(F: [0,\varDelta ] \times E \rightarrow \mathbb {R}^{2mn+n}\). We say that F is strongly monotone in x and y and monotone in r if there exists \(\nu > 0\):

Definition 3.2

Let \(F: [0,\varDelta ] \times E \rightarrow \mathbb {R}^{2mn+n}\). We say that F is Fan-hemicontinuous if, \(\forall \, v \in E\), the function

is weakly lower semicontinuous on E.

Further, we make the following ASSUMPTIONS (\(\alpha \)):

-

the functions s, l are Carathéodory functions, which means they are measurable in t and continuous with respect to the second variable;

-

\(\exists \delta _1(t) \in L^{2} ([0,\varDelta ])\) and \(\exists c_1 \in \mathbb {R}:\) \(\left\| s(t, x) \right\| \le \delta _1(t)+c_1, \forall x \in \mathbb {R}^{mn};\)

-

\(\exists \delta _2(t) \in L^{2} ([0,\varDelta ])\) and \(\exists c_2 \in \mathbb {R}:\) \(\left\| l(t, x) \right\| \le \delta _2(t)+c_2, \forall y \in \mathbb {R}^{mn}.\)

Now let us consider the following variational inequality:

where \(K(w^*)\) is given by (1).

Then, the following existence theorem holds true (see [18], Theorem 2.2):

Theorem 3.1

Let \(F: [0,\varDelta ] \times E \rightarrow \mathbb {R}^{2mn+n}\) be a bounded, strongly monotone in x and y, monotone in r, Fan-hemicontinuous mapping and satisfying conditions (F) and \((\alpha )\). Then, variational inequality (15) admits a solution.

Let us show that our operator A satisfies all the assumptions of Theorem 3.1.

First let us prove that A(t, w) is strongly monotone with respect to x and y and monotone with respect to r, namely that

We have:

Setting, for \(i = 1,\ldots ,m, j = 1,\ldots ,n\):

and denoting by \(\left[ Q_{hk}^i\right] _j^k\) the kth element of the jth column of \(Q_{hk}^i\), the memory terms can be rewritten in the following way:

Therefore, we have:

namely we proved the strongly monotonicity with respect to x and y and the monotonicity with respect to r.

Let us prove that A(t, w) is Fan-hemicontinuous, that is:

We need to prove that:

We have:

For the weak continuity:

The other terms in (16) are continuous functions with respect to w in \(L^2\) and for the assumption on Q are convex functions with respect w. In virtue of a theorem which states that a convex and continuous function is also weakly lower semicontinuous, we get:

Then, the operator A, defined by (14), is Fan-hemicontinuous.

It is easy to show that the operator A is bounded, and hence, the existence of solutions to the quasi-variational inequality (13) is ensured. \(\square \)

Now let us prove Theorem 2.3. To this end, we recall that in Section 5 in [32] the following generalized version of Theorem 1.1 in [33] has been proved.

Theorem 3.2

Let assumptions \((\overline{\alpha })\) be satisfied and let \(A \in C^0([0, \varDelta ], \mathbb {R}^{2mn+n})\) be strongly monotone w.r.t. x and y and monotone w.r.t. r. Let \(s_i,\) \(l_i \in C^0([0, \varDelta ], \mathbb {R}^n_+),\) let \(\underline{r}(t),\) \(\overline{r}(t) \in C^0([0, \varDelta ], \mathbb {R}^n_+).\) Then, variational inequality (11) admits a continuous solution.

Now we prove that all the assumptions of Theorem 3.2 are satisfied. It is easy to see that the operator A(t, x, y, r) with \((x,y,r) \in \mathbb {R}^{2mn+n}\) is continuous w.r.t. t. Moreover, in Theorem 2.2 we proved that the operator A is strongly monotone w.r.t. x and y and monotone w.r.t. r. Since \(\underline{r}(t),\) \(\overline{r}(t)\) are continuous and all the assumptions (\(\overline{\alpha }\)) are satisfied, then the existence of a solution \(\tilde{w}^*(s) = (\tilde{x}^*(t), \tilde{y}^*(t), \tilde{r}^*(t)) \in C^0([0, \varDelta ], \mathbb {R}^{2mn+n})\) to variational inequality (11) follows from Theorem 3.2. Moreover, from the same Section 5 in [32], being the operator A strictly monotone w.r.t. x and y, it derives that the solution to problem (11) w.r.t. x and y is unique, whereas there is no uniqueness w.r.t. r. Then, \(\tilde{x}^*(t)\) and \(\tilde{y}^*(t)\) coincide, under the above assumptions, with the first and the second component of any solution to variational inequality (11). \(\square \)

4 Numerical Examples

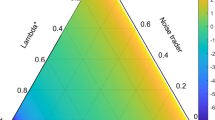

We consider an economy with two agents and two financial instruments and we choose as the feasible set for assets, liabilities and prices:

where \(\alpha ,\) \(\beta \), \(\gamma \) and \(\delta \) are positive parameters to be appropriately fixed. The variance–covariance matrices of the two agents are:

By applying the direct method (see [10, 34]) to variational inequality (11) and by choosing \(\displaystyle \tau _{ij} = {1 \over 4}\) \(\forall i, \, j\) and \(h_j = 1\) \(\forall j,\) we get:

The solution to the variational inequality is given by solving the system:

Since \(\varGamma _4 > 0\), \(\varGamma _5 > 0\) and \(\varGamma _6 > 0,\) the direct method ensures that

Moreover, since

conditions:

yield:

Further, \(\varGamma _5 > 0\) and \(\varGamma _6 > 0\) mean:

Let us observe that \(\alpha \), \(\beta \), \(\delta \), \(\gamma \) must satisfy the following conditions in [0, 1]:

If we choose \(\alpha = 15\), \( \beta = 14\), \(\delta = 1\), \(\gamma = 11,\) these conditions are fulfilled. Replacing these values in the equilibrium solution, we obtain a.e. in \(t \in [0,1]\):

Finally, conditions \(\varGamma _5 >0\) and \(\varGamma _6 >0\) in [0, 1] yield:

From the formulas related to the Lagrange multipliers associated with the price (see, for instance, [1, 3, 17]), namely:

and

we know that:

and

Since \(r_1^*(t) = \underline{r}_1(t),\) we obtain \(\rho _1^{(1)*}(t) > 0\) and \(\rho _1^{(2)*} (t) = 0;\) hence:

Analogously, since \(r_2^*(t) = \underline{r}_2(t),\) we obtain \(\rho _2^{(1)*}(t) > 0\) and \(\rho _2^{(2)*} (t) = 0;\) hence:

But \(\rho _1^{(1)*}(t)\) and \(\rho _2^{(1)*}(t)\) are the deficit variables and are positive. So the economy is in a phase of regression.

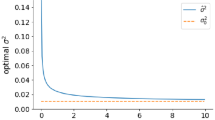

Now we would like to make a comparison between the solution to the same problem but with and without considering the memory term in the utility function. To this end, we have the same matrices \(Q^1\) and \(Q^2\), but \(u_i(x_i(t), y_i(t)) = - \left[ x_i(t) \quad y_i(t) \right] Q^i \left[ x_i(t)\quad y_i(t) \right] ^T.\) Now, the feasible set for assets, liabilities and prices is:

where \(\alpha ,\) \(\beta \) and \(\delta \) are positive parameters to be appropriately fixed.

Solving the associated variational inequality with the same technique (see [18]) and choosing \(\displaystyle \tau _{ij} = {1 \over 4}\) \(\forall i, \, j\) and \(h_j = 1\) \(\forall j,\) we find that the solution is given by:

Further, \(\varGamma _5 > 0\) and \(\varGamma _6 > 0\) mean:

provided that the following conditions are fulfilled:

Now we choose \(\alpha = 15\), \( \beta = 14\), \( \delta = 1\), \(\gamma = 11\) and it is easy to verify that conditions (20) and (21) are fulfilled and, replacing these values in the equilibrium solution, we obtain a.e. in [0, 1] :

Further, replacing \(\alpha = 15\), \( \beta = 14\), \( \delta = 1\), \(\gamma = 11\) in (18) and (19), conditions \(\varGamma _5 >0\) and \(\varGamma _6 >0\) mean, in [0, 1]:

Then, we get:

But \(\rho _1^{(1)*}(t)\) and \(\rho _2^{(1)*}(t)\) are the deficit variables and are positive. So the economy is in a phase of regression.

Remark 4.1

Now we can make the comparison between the solution to the model with memory terms and the solutions to the one without memory terms. Specifically, we can observe that both the solutions in (17) and in (22) are the same when \(t=0\). Moreover, when \(t > 0\), then the solutions in (17) and in (22) are increasing. In addition, we have calculated the differences:

So, we derive that we can calculate the solutions in (22) as the first approximation of the solutions in (17).

5 Conclusions

In this paper, we have provided an evolutionary measure of the risk of Markowitz type satisfying the assumptions which are necessary for ensuring the existence of a solution to the financial equilibrium problem in the dynamic case. Such a function gives us a continuous solution and future research could include the study of its Lipschitz continuity under general assumptions.

References

Barbagallo, A., Daniele, P., Giuffrè, S., Maugeri, A.: Variational approach for a general financial equilibrium problem: the Deficit Formula, the Balance Law and the Liability Formula. A path to the economy recovery. Eur. J. Oper. Res. 237, 231–244 (2014)

Barbagallo, A., Daniele, P., Lorino, M., Maugeri, A., Mirabella, C.: Recent results on a general financial equilibrium problem. In: AIP Conference Proceedings, pp. 1789–1792 (2013)

Barbagallo, A., Daniele, P., Maugeri, A.: Variational formulation for a general dynamic financial equilibrium problem. Balance law and liability formula. Nonlinear Anal. 75, 1104–1123 (2012)

Markowitz, H.M.: Portfolio selection. J. Finance 7, 77–91 (1952)

Markowitz, H.M.: Portfolio Selection: Efficient Diversification of Investments. Wiley, New York (1959)

Boltzman, L.: Zur theorie der elastichen Nachwirkung. Sitzber. Kaiserl. Akad. Wiss. Wien Math.-Naturw. Kl 70(II), 275–300 (1874)

Scrimali, L.: Global Lipschitz continuity of solutions to parameterized variational inequalities. Boll. UMI 9(II), 45–69 (2009)

Volterra, V.: Sulle equazioni integro-differenziali della teoria della elasticità. Rend. Acc. Naz. Lincei XVIII 2, 295–301 (1909)

Bensoussan, A., Lions, J.-L.: Impulse Control and Quasi-variational Inequalities. Gaunthier-Villars, Paris (1984)

Daniele, P.: Dynamic Networks and Evolutionary Variational Inequalities. Edward Elgar, Cheltelham (2006)

Daniele, P., Maugeri, A.: On dynamical equilibrium problems and variational inequalities. In: Giannesi, F., Maugeri, A., Pardalos, P. (eds.) Equilibrium Problems: Nonsmooth Optimization and Variational Inequality Models, pp. 59–69. Kluwer Academic, Dordrecht (2001)

Daniele, P., Maugeri, A., Oettli, W.: Variational inequalities and time-dependent traffic equilibria. C. R. Acad. Sci. Paris 326(Serie I), 1059–1062 (1998)

Daniele, P., Maugeri, A., Oettli, W.: Time-dependent traffic equilibria. J. Optim. Theory Appl. 103, 543–555 (1999)

Daniele, P.: Evolutionary variational inequalities applied to financial equilibrium problems in an environment of risk and uncertainty. Nonlinear Anal. 63, 1645–1653 (2005)

Daniele, P., Giuffrè, S., Pia, S.: Competitive financial equilibrium problems with policy interventions. J. Ind. Manag. Optim. 1, 39–52 (2005)

Daniele, P., Giuffrè, S., Lorino, M., Maugeri, A., Mirabella, C.: Functional Inequalities and Analysis of Contagion in the Financial Networks. In: Rassias, T.M. (ed.) Handbook of Functional Equations- Functional Inequalities, vol. 95, pp. 129–146. Springer-Verlag, New York (2014)

Barbagallo, A., Daniele, P., Lorino, M., Maugeri, A., Mirabella, C.: A variational approach to the evolutionary financial equilibrium problem with memory terms and adaptive constraints. In: Kalyagin, V.A., et al. (eds.) Network Models in Economics and Finance, pp. 13–24. Springer, Basel (2014)

Ciarcià, C., Daniele, P.: New existence theorems for quasi-variational inequalities and applications to financial models. European Journal of Operations Research 251(1), 288–299 (2016)

Nagurney, A.: Variational inequalities in the analysis and computation of multi-sector, multi-instrument financial equilibria. J. Econ. Dyn. Control 18, 161–184 (1994)

Nagurney, A.: Finance and variational inequalities. Quant. Finance 1, 309–317 (2001)

Nagurney, A., Dong, J., Hughes, M.: Formulation and computation of general financial equilibrium. Optimization 26, 339–354 (1992)

Nagurney, A., Siokos, S.: Financial Networks: Statics and Dynamics. Springer, Heidelberg (1997)

Nagurney, A., Siokos, S.: Variational inequalities for international general financial equlibrium modelling and computation. Math. Comput. Model. 25, 31–49 (1997)

Nagurney, A., Zhang, D.: Projected Dynamical Systems and Variational Inequalities with Applications. Kluwer Academic, Boston (1996)

Daniele, P., Giuffrè, S.: Random variational inequalities and the random traffic equilibrium problem. J. Optim. Theory Appl. 167, 363–381 (2015)

Daniele, P., Giuffrè, S., Maugeri, A.: General traffic equilibrium problem with uncertainty and random variational inequalities. In: Rassias, T.M., et al. (eds.) Optimization in Science and Engineering: In Honor of the 60th Birthday of Panos M. Pardalos, pp. 89–96. Springer, New York (2014)

Gwinner, J., Raciti, F.: Random equilibrium problems on networks. Math. Comput. Model. 43(7–8), 880–891 (2006)

Duffie, D., Zame, W.: The consumption-based capital asset pricing model. Econometrica 57(6), 1279–1297 (1989)

Naniewicz, Z., Nockowska, M.: Systems of variational inequalities related to economic equilibrium. Control Cybern. 36(4), 889–909 (2007)

Mordukhovich, B.: Variational Analysis and Generalized Differentiation II: Applications. Springer, New York (2013)

Scrimali, L.: Evolutionary quasi-variational inequalities and the dynamic multiclass network equilibrium problem. Numer. Funct. Anal. Optim. 35(7–9), 1225–1244 (2014)

Daniele, P., Giuffrè, S., Lorino, M.: Functional inequalities, regularity and computation of the deficit and surplus variables in the financial equilibrium problem. J. Glob. Optim. 65, 575–596 (2016)

Barbagallo, A., Daniele, P., Lorino, M., Maugeri, A., Mirabella, C.: Further results for general financial equilibrium problems via variational inequalities. J. Math. Finance 3, 33–52 (2013)

Maugeri, A.: Convex programming, variational inequalities and applications to the traffic equilibrium problem. Appl. Math. Optim. 16, 169–185 (1987)

Acknowledgments

The research of the first author was partially supported by INdAM GNAMPA Project 2015: Nuove frontiere dei problemi di equlibrio su rete: dallo sviluppo sostenibile alla dinamica dei disastri ambientali ai crimini informatici. This support is gratefully acknowledged.

Author information

Authors and Affiliations

Corresponding author

Additional information

Communicated by Jean-Pierre Crouzeix.

Rights and permissions

About this article

Cite this article

Daniele, P., Lorino, M. & Mirabella, C. The Financial Equilibrium Problem with a Markowitz-Type Memory Term and Adaptive Constraints. J Optim Theory Appl 171, 276–296 (2016). https://doi.org/10.1007/s10957-016-0973-3

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10957-016-0973-3