Abstract

Student health insurance literacy is an area of limited prior knowledge, and investigations into this topic have the potential to impact students' self-care strategies, self-efficacy, decision-making, and quality of life. The purpose of this study was to examine factors associated with health insurance literacy and knowledge among undergraduate students. In this study, undergraduate students at one mid-Atlantic public university in the United States who did and did not receive instruction on health insurance were surveyed. Students were recruited from a course that offers formal instruction about health insurance and students in a comparison group at the same university were recruited from a general education participant pool. Participants (n = 364) completed an online anonymous survey that included demographics, experience with health insurance, health insurance knowledge, and health insurance literacy self-efficacy. Hierarchical multiple regression results indicated participants in the course who received health insurance instruction scored higher on a measure of health insurance knowledge. Higher levels of health insurance self-efficacy was also associated with receiving instruction related to health insurance. Female gender and higher parental education were associated with a lower self-efficacy. Improving health insurance knowledge and self-efficacy among undergraduates is an important aspect of preparing students for post-graduate life where decisions about health insurance coverage and healthcare utilization will increase. Furthermore, increasing health insurance literacy may contribute to raising standards of health literacy, health care, and health care seeking across communities.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

Health literacy determines how well individuals find, understand, evaluate, and use information and services to inform health-related decisions and actions [1]. Health literacy in a health insurance context may be referred to as health insurance literacy (HIL), defined as one’s “knowledge, ability, and confidence to find and evaluate information about [insurance] plans, select the best plan for their own (or their family’s) financial and health circumstances and use the plan once enrolled”[2, p.7]. Health insurance policies often include difficult language which results in poor literacy for health insurance jargon [3]. HIL has been less frequently studied, and evidence across many contexts has shown a lack of knowledge and awareness about how health insurance operates and what health insurance terminology means in the United States [4, 5].

Low HIL is correlated with lower use of health services, which has health effects at the individual and population levels, such as medical debt [6]. One study found patients avoided preventative services because they perceived them to be optional and costly even when they were covered by their plan at no cost [7]. Additionally, HIL generally increases for people who have prior experience with health insurance or used healthcare services themselves [8, 9]. Because HIL rates often correspond with prior experience with health insurance and health care, as well as financial literacy rates, older populations tend to have higher HIL compared to younger populations [10].

One way to address low HIL in the wider population is to begin health insurance education before most individuals will purchase or be offered it for the first time, such as when individuals are enrolled in college. Research among college populations has found that students have poor knowledge of health insurance and poor self-efficacy in appropriately choosing, understanding, and using health insurance, particularly for international students [11, 12]. Poorer health insurance knowledge and lower health insurance self-efficacy were associated with lower health service utilization among college students [13]. Further, college students have demonstrated difficulties in using quantitative skills to determine their own financial responsibilities in medical scenarios [14]. Despite these difficulties, one study found that many health insurance outreach efforts centered around young adults as they transition to their own insurance but focused on insurance enrollment rather than navigation [15].

A frequent goal of higher education institutions is to prepare students to engage as productive members of society [16]. Thus, understanding how young adults attain HIL, understand health insurance language, and navigate the health system is essential to prepare students for success post-graduation. Yet, there is a gap in understanding of the impact of educational efforts to improve HIL in college populations. Therefore, in the present study, we explore factors associated with HIL among undergraduate students and examine the impact of coursework related to health insurance on student’s health insurance self-efficacy and knowledge.

Methods

Procedures

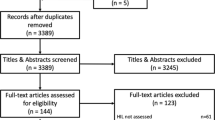

After obtaining IRB approval for the study, participants were recruited from undergraduate students at one mid-Atlantic state university during spring 2021. Students enrolled in an upper-level, undergraduate course on U.S. and global health care systems were invited to participate after receiving course instruction on health insurance. Approximately one week of content (150 min) is dedicated to instruction on health insurance plans, health insurance terminology, and cost-sharing. This course is required for three health-related majors at the institution and taught across multiple sections (n = 7) by three different instructors. Instructors posted information about the survey to their course learning management system to invite participation in the anonymous, online survey in QuestionPro. Extra credit was offered to students for completing the survey. A comparison group of undergraduate students at the same university who had not received formal instruction about health insurance was recruited from the psychology department SONA participant pool, which consists of students from multiple sections of two lower-level psychology courses that meet general education requirements for all undergraduates at the institution. Students in this participant pool can choose among psychological research studies at the institution to complete as part of their course credit. A total of 425 undergraduate students participated in the survey, with the analytic sample consisting of 364 participants with complete survey data.

Measures

All participants completed identical online, anonymous survey instruments after reading the IRB cover letter and consenting to participate. The survey included demographic measures including age and gender identity, both measured with open-ended questions. Gender was recoded to “male” and “female.” Race was measured with a list of options where participants could check all that applied. Due to the overwhelming number of those identifying only as “white,” this variable was dichotomized into those who selected only “white” and all others. Class standing was categorized as first-year student, sophomore, junior, or senior. Participants' self-identified socio-economic status was collapsed and recoded into “Lower/Lower Middle Class,” “Middle Class,” and “Upper Middle/Upper Class.” Participants also indicated the highest level of education of their parent/guardian, which was collapsed into the categories of “High school Diploma/GED or lower,” “some college, Associates, or Bachelors,” and “Masters/Professional.” Participants also indicated yes or no to the following items: if they currently have health insurance, had ever been offered health insurance by an employer, and whether they had any long-term health conditions. An item was added to determine whether participants who completed the survey were in the health care systems course at the time of completion.

Health insurance knowledge was measured using the Kaiser Family Foundation health insurance terminology quiz [5]. This validated 10-item multiple choice quiz measures knowledge of important health insurance concepts and health insurance cost calculation. Correct answers were coded “1” and incorrect answers were coded “0”. Scores were summed resulting in possible scores ranging from 0 to 10.

Health insurance literacy self-efficacy was measured using the Health Insurance Literacy Measure (HILM), a validated 21-item self-assessment measuring dimensions of health literacy self-efficacy [17]. Subscales measured confidence in choosing health insurance (6 items), confidence in comparing health insurance plans (6 items), confidence in using health insurance (5 items), and confidence using health insurance proactively (4 items) answered on a 5-point Likert scale. A total HILM score was summed, ranging from 21 to 105, with higher scores indicating greater levels of health insurance self-efficacy. Cronbach’s alpha for the HILM indicated a high level of internal consistency (α = 0.94). In addition, subscales were also analyzed as separate response variables as they represent distinct aspects of health insurance self-efficacy. All subscales also indicated high internal consistency, with Cronbach's alpha scores ranging from 0.84 to 0.94.

Analyses

Aggregate quantitative data from the surveys were analyzed using IBM SPSS Statistics (Version 27). Descriptive statistics including frequencies and means with standard deviations were calculated for all study variables to provide a descriptive summary analysis. T-tests were used to examine differences in the outcome variables, health insurance knowledge and self-efficacy, among students who were and were not enrolled in the course providing health insurance education.

To assess the impact of health insurance education while controlling student characteristics, two-stage hierarchical multiple regression models were used with health insurance knowledge and self-efficacy as the dependent variables. Hierarchical multiple regression is useful to assess the effect of an independent variable after controlling for potential confounders and to assess how much additional variation in the dependent variable is explained [18]. The assumptions of hierarchical linear regression were met prior to conducting the multivariate analyses [18]. An examination of correlations revealed age and class standing were highly correlated, so only age was used in the regression analyses. The collinearity statistics (Tolerance and Variance Inflation Factor) were all within normal limits in the final models. Student characteristics were entered into the first block of the model with enrollment in the health care systems course entered in the second block. Adjusted R2 and change in R2 were examined to assess how the addition of course instruction impacted health insurance knowledge and self-efficacy.

Results

Sample Characteristics

The demographic characteristics of the sample (n = 364) are presented in Table 1. The students ranged in age from 18 to 26 (M = 19.86, SD = 1.28), and the majority identified as women (84%) and white (87%). Of the respondents, 18% were freshmen, 29% were sophomores, 41% were juniors, and 12% were seniors. Respondents equally indicated their socioeconomic status as middle class (43%) or upper middle/upper class (43%), and their parents were mostly college educated at the undergraduate (51%) or graduate level (38%). Additionally, most students were currently insured (98%), mostly through their parents' health insurance plan (92%). Few students (19%) had ever been offered health insurance through an employer. One-quarter of the sample indicated they have one or more chronic health conditions. Half (52%) of the sample were enrolled in the health care systems course.

In Table 1, scores on the Kaiser Family Foundation health insurance knowledge scale in the sample ranged from 1 to 10 with a mean of 5.12 (SD = 1.85). Participants in the health systems course who learned about health insurance performed better on the knowledge scale (5.68 versus 4.51, t = − 6.38, p < 0.001) than those who were not. Figure 1 presents the percentage of respondents that correctly answered each health insurance knowledge item by course enrollment. Participants in the health systems course received a higher percentage of correct answers on 8 out of the 10 questions. Four of the ten items appeared to give all participants difficulty, including two items with calculations of out-of-pocket costs, the definition of a health insurance formulary, and understanding that individual providers may be considered out-of-network at an in-network facility.

The total HILM score and subscales are also presented in Table 1. Total scores ranged from 21 to 105 with a mean of 68.46 (SD = 16.85). Participants scored highest on the being proactive subscale, which includes researching what a health plan will and will not cover, finding out if a provider is in-network, and reviewing insurance statements. Based on the subscale scores, participants were least confident in being able to choose the best health insurance plan for them. Students in the health systems course scored significantly higher on the HILM (74.69 versus 61.65, t = − 7.99, p < 0.001).

Hierarchical Regression Results for Health Insurance Knowledge and Self-efficacy

Table 2 presents the hierarchical multiple regression results for both health insurance knowledge (e.g., Kaiser Family Foundation Health Insurance Knowledge) and self-efficacy (e.g., HILM). For health insurance knowledge, only the HILM and enrollment in the health systems course were significantly associated with higher health insurance knowledge. Enrollment in the health systems course explained an additional 3% of the variation in health insurance knowledge, and this change in R2 significantly improved model fit [F (1, 353) = 12.02, p = 0.001].

For health insurance literacy self-efficacy as measured by the HILM (Table 2), health insurance knowledge and enrollment in the health systems course were associated with a higher HILM score whereas female gender and higher parental education were associated with a lower HILM score. A positive relationship between higher socioeconomic status and self-efficacy approached significance (p < 0.10). Furthermore, the course explained an additional 9% of the variation in health insurance self-efficacy, and this change in R2 was significant [F (1, 353) = 40.81, p < 0.001].

Discussion

Overall, college students in this study had lower knowledge of health insurance definitions and calculations (5.12) compared to a nationally representative sample (5.8) [5]. Though both were adult samples, 74% of the nationally representative sample was over the age of 29. Therefore, they were more likely to have higher knowledge because of experience using health insurance over their lifetime. Four items with the lowest scores in our study were also among the lowest performing in the general population, including calculations of out-of-pocket costs, defining a health insurance formulary, and understanding not all providers at an in-network facility will be in-network with the insurance plan [5].

Participants in the health systems class had higher health insurance knowledge (5.68) compared to those in the general education psychology classes (4.51) and scored higher on 8 out of 10 knowledge items. In addition, 75.8% of health systems class participants answered at least half of the knowledge questions correctly compared to 72% of the nationally representative public [5] and performed better on four knowledge items: definition of premium and annual out-of-pocket limit, ability to appeal plan denials, and when premiums must be paid [5]. These results suggest access to educational materials related to health insurance, in an engaging setting such as a college class, may increase objective health insurance knowledge among young adults.

When looking at self-efficacy related to choosing and using health insurance, participants scored on average 68.46/105 on the HILM scale, which was significantly lower than a nationally representative sample (79.3) of older and more diverse adults [7]. Higher health insurance knowledge and enrollment in the health systems course were significantly associated with a higher health insurance self-efficacy in this study. Participants enrolled in the health systems course also had higher levels of health insurance knowledge, which may have contributed to greater confidence in their abilities related to health insurance. However, even when controlling for the health insurance knowledge score, enrollment in the course remained positively associated with self-efficacy, suggesting that formal instruction improved not only knowledge of health insurance but confidence in understanding and navigating the health care system.

Interestingly, female participants and participants whose parents had higher educational attainment tended to have decreased health insurance self-efficacy in this study. Female participants in our study had lower health insurance confidence compared to male participants. Previous studies have found women to have higher health insurance knowledge because of a higher likelihood of needing and using health-care services [9, 14]. However, these studies looked at knowledge of health insurance terms and ability to calculate costs, rather than health insurance self-efficacy. Previous research has found conflicting results, with several studies finding that women had higher self-efficacy than men [13, 19]. However, Adepoju et al. [20] reported inconsistent findings related to women’s self-efficacy, with women having lower confidence in choosing and managing health insurance but not in comparing and using.

Parents or guardians with higher educational attainment may manage all health insurance decisions without discussion with their children, explaining the lower HIL among those with higher parental educational attainment. In addition, lower educational attainment is associated with lower paying jobs [20]. Those with lower income may participate in more frequent discussions of medical expenses and insurance around/with their children given the proportion of overall household expenses used for medical costs. Thus, participants whose parents have lower educational attainment/household income may have greater knowledge because of vicarious learning.

Implications of this study suggest that educating students about health insurance during their undergraduate education is crucial to a university’s mission to prepare students for life after college with the skills and knowledge they need to be productive employees and members of society. In addition, one component of employee responsibility is utilizing benefits appropriately because it impacts their health and is cost saving for employers. Along with skills on resume development, interviewing, salary negotiation, and other job seeking skills, understanding health insurance and gaining confidence in navigating decisions about health insurance should also be considered professional skills that universities and colleges invest in making sure their students gain experience with prior to graduation, either through a course, or career and academic planning services. Our study found improved health insurance knowledge and self-efficacy in participants who had covered health insurance learning objectives for less than 150 min of classroom instruction. Therefore, improvements in health insurance literacy among student populations may be made with less intensive investments in time and resources.

Limitations

There are some limitations to consider in the current study. First, this study is limited in its generalizability as it is a single university sample. Second, it is also a cross-sectional design that compares the two groups of participants without a pre-test and post-test comparison measure to account for the effect of the health systems course. Third, participant’s self-selection of their major of study may possibly result in the health course students having greater knowledge about HIL compared to the students in the psychology department participant pool. Some health-related majors may also be in the psychology participant pool to meet general education requirements; however, they would not be taking core coursework for their major yet, so the pool is likely to represent all majors at the university.

Conclusion

There is a need to improve HIL among young adults who are entering the workforce and making independent health insurance coverage decisions for the first time [12]. Our study demonstrates that young adults have unmet HIL needs which college-based courses may partially meet. Educational institutions have a unique advantage to provide a large proportion of young adults with basic HIL while they are enrolled, better information than they may receive from some employers [21]. Improved health insurance literacy can help create more informed students who are able to take responsibility for their health, pursue future physical and mental health-enhancing actions, and perhaps encourage others around them to do the same [22]. This may lead to a large-scale improvement in raising the standards of health literacy, health care, and health care seeking across communities.

Data Availability

Not applicable.

Code Availability

Not applicable.

References

Kleinman, D., Baur, C., Rudd, R., & Rubin, D. (2019). Health Literacy, in issue briefs to inform development and implementation of healthy people 2030; Secretary’s Advisory Committee on National Health Promotion and Disease Prevention Objectives for 2030. Retrieved May 9, 2022, from https://www.healthypeople.gov/sites/default/files/HP2030_Committee-Combined-Issue%20Briefs_2019-508c.pdf

Consumers union, university of maryland college park, American institutes for research. (2012) Measuring health insurance literacy: A call to action report from the health insurance literacy expert roundtable. Retrieved May 9, 2022, from https://www.air.org/sites/default/files/Health-Insurance-Literacy-Roundtable.pdf

Joseph, R., Fernandes, S., Hyers, L., & O’Brien, K. (2016). Health literacy: A cross-disciplinary study in American undergraduate college students. Journal of Information Literacy, 10(2), 26. https://doi.org/10.11645/10.2.2103

Brown, V., Russell, M., Ginter, A., Braun, B., Little, L., Pippidis, M., & McCoy, T. (2016). Smart choice health insurance©: A new, interdisciplinary program to enhance health insurance literacy. Health Promotion Practice, 17(2), 209–216. https://doi.org/10.1177/1524839915620393

Norton, M., Hamel, L., & Brodie, M. (2014). Assessing Americans' familiarity with health insurance terms and concepts. Kaiser Family Foundation. Retrieved May 9, 2022, from https://www.kff.org/health-reform/poll-finding/assessing-americans-familiarity-with-health-insurance-terms-and-concepts/

Wiltshire, J., Liu, E., Dean, C. A., Colato, E. G., & Elder, K. (2021). Health insurance literacy and medical debt in middle-age Americans. Health Literacy Research and Practice, 5(4), e319–e332.

Tipirneni, R., Politi, M. C., Kullgren, J. T., Kieffer, E. C., Goold, S. D., & Scherer, A. M. (2018). Association between health insurance literacy and avoidance of health care services owing to cost. JAMA Network Open. https://doi.org/10.1001/jamanetworkopen.2018.4796

Barnes, A. J., & Hanoch, Y. (2017). Knowledge and understanding of health insurance: Challenges and remedies. Israel Journal of Health Policy Research, 6(1), 40. https://doi.org/10.1186/s13584-017-0163-2

Politi, M. C., Kaphingst, K. A., Kreuter, M., Shacham, E., Lovell, M. C., & McBride, T. (2014). Knowledge of health insurance terminology and details among the uninsured. Medical Care Research and Review, 71(1), 85–98. https://doi.org/10.1177/1077558713505327

McCormack, L., Bann, C., Uhrig, J., Berkman, N., & Rudd, R. (2009). Health insurance literacy of older adults. Journal of Consumer Affairs, 43(2), 223–248. https://doi.org/10.1111/j.1745-6606.2009.01138.x

Adegboyega, A., Nkwonta, C., & Edward, J. (2020). Health insurance literacy among international college students: A qualitative analysis. Journal of International Students, 10(1), 50–68.

Edward, J., Wiggins, A., Young, M. H., & Rayens, M. K. (2019). Significant disparities exist in consumer health insurance literacy: Implications for health care reform. Health Literacy Research and Practice, 3(4), e250–e258.

James, T. G., Sullivan, M. K., Dumeny, L., Lindsey, K., Cheong, J., & Nicolette, G. (2020). Health insurance literacy and health service utilization among college students. Journal of American College Health, 68(2), 200–206. https://doi.org/10.1080/07448481.2018.1538151

Nobles, A. L., Curtis, B. A., Ngo, D. A., Vardell, E., & Holstege, C. P. (2019). Health insurance literacy: A mixed methods study of college students. Journal of American College Health, 67(5), 469–478. https://doi.org/10.1080/07448481.2018.1486844

Tilley, L., Yarger, J., & Brindis, C. D. (2018). Young adults changing insurance status: Gaps in health insurance literacy. Journal of Community Health, 43(4), 680–687. https://doi.org/10.1007/s10900-018-0469-1

Association of public and land grant universities. (2021). How do college graduates benefit society at large? Retrieved May 9, 2022, from https://www.aplu.org/projects-and-initiatives/college-costs-tuition-and-financial-aid/publicuvalues/societal-benefits.html

Paez, K. A., Mallery, C. J., Noel, H., Pugliese, C., McSorley, V. E., Lucado, J. L., & Ganachari, D. (2014). Development of the health insurance literacy measure (HILM): Conceptualizing and measuring consumer ability to choose and use private health insurance. Journal of Health Communication, 19(sup2), 225–239. https://doi.org/10.1080/10810730.2014.936568

Laerd statistics. (2021). Hierarchical multiple regression: SPSS statistics. Retrieved May 9, 2022, from https://statistics.laerd.com/premium/spss/hmr/hierarchical-multiple-regression-in-spss-4.php

O’Connor, G. E., & Kabadayi, S. (2020). Examining antecedents of health insurance literacy: The role of locus of control, cognitive style, and financial knowledge. Journal of Consumer Affairs, 54(1), 227–260. https://doi.org/10.1111/joca.12266

Adepoju, O., Mask, A., & McLeod, A. (2019). Factors associated with health insurance literacy: proficiency in finding, selecting, and making appropriate decisions. Journal of Healthcare Management, 64(2), 79–89.

National center for education statistics. (2021). Immediate college enrollment rate national center for education statistics. Retrieved May 9, 2022, from https://nces.ed.gov/programs/coe/indicator/cpa

Yang, S. C., Luo, Y. F., & Chiang, C. H. (2017). The associations among individual factors, ehealth literacy, and health-promoting lifestyles among college students. Journal of Medical Internet Research, 19(1), e15. https://doi.org/10.2196/jmir.5964

Funding

The authors received no financial support for the research, authorship, and/or publication of this article.

Author information

Authors and Affiliations

Contributions

SSNU creating surveys for data collection, writing, formatting, and submission of manuscript. LKM data coding, cleaning, and analysis, writing of manuscript. AT data analysis, creating tables and figure, and writing of manuscript. DSH conceptualization of research, writing of manuscript.

Corresponding author

Ethics declarations

Conflict of interest

The authors have not disclosed any competing interests.

Ethical Approval

All data collection was in accordance with IRB ethical standards of the APA (Research with Human Participants).

Consent to Participate

Consent was provided by participants in the survey.

Consent for Publication

Not applicable.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Upadhyay, S.S.N., Merrell, L.K., Temple, A. et al. Exploring the Impact of Instruction on College Students' Health Insurance Literacy. J Community Health 47, 697–703 (2022). https://doi.org/10.1007/s10900-022-01096-2

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10900-022-01096-2