Abstract

Previous research has demonstrated that adult pathological gamblers (compared to controls) show risk-proneness, foreshortened time horizon, and preference for immediate rewards. No study has ever examined the interplay of these factors in adolescent gambling. A total of 104 adolescents took part in the research. Two equal-number groups of adolescent non-problem and problem gamblers, defined using the South Oaks Gambling Screen-Revised for Adolescents, were administered the Balloon Analogue Risk Task (BART), the Consideration of Future Consequences (CFC-14) scale, and the Monetary Choice Questionnaire (MCQ). Adolescent problem gamblers were found to be more risk-prone, more oriented to the present, and to discount delay rewards more steeply than adolescent non-problem gamblers. Results of logistic regression analysis revealed that BART, MCQ, and CFC scores predicted gambling severity. These novel finding provides the first evidence of an association among problematic gambling, high risk-taking proneness, steep delay discounting, and foreshortened time horizon among adolescents. It may be that excessive gambling induces shortsighted behaviors that, in turn, facilitate gambling involvement.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

Gambling involvement has been associated with different risky behaviors, such as substance use and dangerous driving (see Van Brunschot 2009 for a review). This is probably because gambling is itself a risk-taking activity given that it involves choices between options with a high probability of losing and a smaller probability of winning (e.g., MacPherson et al. 2010). Indeed, by definition, gambling means to risk losing something of value (generally, money) in the hope of gaining something of greater financial value. In all gambling activities, hope of future gain and consciousness of risk are arguably two sides of the same coin. Anyone who gambles hopes to gain, but the way in which individuals evaluate risk varies greatly across people and as a function of age (including risk perception in gambling; see a recent review by Spurrier and Blaszczynski 2014).

Previous studies have demonstrated that, compared with non-gamblers, problem/pathological gamblers are more risk-prone and that continued gambling involvement may increase the level of monetary risk-taking that gamblers are willing to take (e.g., Ciccarelli et al. 2016; Ladouceur et al. 1987; Ledgerwood et al. 2009; Martins et al. 2004; Petry 2001b). However, other studies have failed to find statistically significant associations between gambling severity and behavioral preference for risk in adult substance abusers with or without pathological gambling relative to controls (Krmpotich et al. 2015), as well in a sample of university students with different degrees of gambling involvement (Mishra et al. 2010).

With the exception of Mishra et al.’s study (2010), which examined risk-proneness in a sample of undergraduates (mean age = 20.0 years; SD = 2.0) with different levels of involvement in gambling, research concerning risk-taking in gambling has focused mainly on adults. The lack of studies examining the relationship between problem gambling and risk-taking in adolescence is even more surprising, given that adolescents tend to engage in more risky behavior than adults (Steinberg 2004, 2007, 2008). From a developmental perspective, there is a temporal imbalance between the slow maturation of circuitry underlying the ability to control impulses and the faster development of circuitry responsible for impulsive and reward-seeking behaviors (Blakemore and Robbins 2012; Dougherty et al. 2015; Ernst et al. 2006; Ernst and Fudge 2009; Geier and Luna 2009; see also Potenza 2013). This is most probably the reason why adolescence is a period of vulnerability for the engagement in risky behaviors (Figner et al. 2009; Spear 2000; Steinberg 2010).

Adolescents show a similar shortsightedness by devaluing rewards that are delayed in time (i.e., delay discounting). Some cross-sectional studies (e.g., Green et al. 1994; Harrison et al. 2002; Steinberg et al. 2009; Yoon et al. 2007) have demonstrated that younger individuals discount delayed rewards more steeply than older individuals, and that the tendency to choose small immediate rewards, rather than larger delayed rewards declines with age (e.g., Olson et al. 2007; Scheres et al. 2006; Steinberg et al. 2009; see Albert and Steinberg (2011) for a review). This is probably due to individual difference factors (such as future orientation and impulsivity), cognitive functioning (such as the ability to imagine and experience pleasure or pain in advance of future events), and the maturation of brain system during adolescence (Banich et al. 2013). A recent study by Anokhin et al. (2015) demonstrated that, in spite of the presence of systematic age-related changes from age 16 to 18 years, individual differences in delay discounting showed considerable stability over this period.

Research examining delay discounting in disordered gambling indicates that pathological gamblers differ from healthy controls by devaluating rewards that are delayed in time (Alessi and Petry 2003; Billieux et al. 2012; Dixon et al. 2003; Holt et al. 2003; Kräplin et al. 2014; MacKillop et al. 2006; Michalczuk et al. 2011; Petry 2001a; Petry and Casarella 1999; Petry and Madden 2010; Reynolds et al. 2006). Only four studies have examined the relationship between gambling and delay discounting among late adolescents. Holt et al. (2003) found that young gamblers did not discount delayed rewards more steeply than non-gamblers, whereas MacKillop et al. (2006), Cosenza and Nigro (2015), and Nigro and Cosenza (2016) all reported that at-risk and problem gamblers more steeply discounted delayed monetary outcomes than non-problem gamblers.

Risk-taking and delay discounting appear to be associated with the general tendency to ignore the future consequences of actual behavior (Whiteside et al. 2005). According to Strathman et al. (1994), the consideration of future consequences refers to “the extent to which people consider the potential distant outcomes of their current behaviors and the extent to which they are influenced by these potential outcomes” (p. 743). Toplak et al. (2007), using the Strathman et al.’s consideration of future consequence (CFC) scale, a self-report measure of time orientation, found that adult pathological gamblers show a foreshortened time horizon compared to non-problem gamblers. Recently, using the more recent version of the CFC, namely the 14-item CFC-14 scale (Joireman et al. 2012), Cosenza and Nigro (2015) also found that adolescent at-risk and problem gamblers were more insensitive to future consequences of current behavior than non-gamblers.

Even though time perspective and delay discounting appear similar, they are not overlapping constructs (Daugherty and Brase 2010). Despite the conceptual similarities, the few studies attempting to compare future time perspective and delay discounting do not give reason to suppose a robust relation between them (Teuscher and Mitchell 2011). In particular, Joireman et al. (2008) found a positive correlation between delay discounting and the Immediate subscale of the CFC, and a negative association between delay discounting and scores on the CFC Future scale (for similar results, see Daugherty and Brase 2010). Finally, Steinberg et al. (2009) found a significant but modest positive correlation between delay discounting and future orientation. Furthermore, their results indicated that “age differences in delay discounting are significantly mediated by differences in orientation to the future but not by differences in impulsivity” (p. 39).

The Present Study

The aim of this study was to investigate, for the first time, the interplay of risk-taking propensity, delay discounting, and time perspective in two equal-number groups of male non-problem and problem gambling Italian adolescents. Male adolescents were focused on not only because the prevalence of problem gambling is considerably greater in males than in females, but also because some studies report females initiating gambling later than males (Blanco et al. 2006). In line with previous research on adults, it was expected that, relative to non-problem gamblers, problem gamblers would show more risk propensity, steeper delay discounting, and that gambling severity would be associated with foreshortened time horizon.

Method

Participants and Procedure

The sample comprised 104 Italian males adolescents aged between 16 and 19 years (M = 17.65 years; SD = 1.05), attending the third, fourth and fifth year of the secondary school (lyceums and technical/trade schools) in Southern Italy. The study was approved by the research team’s University Ethics Committee. Prior to participation, all participants provided informed consent. For minors, informed consent was obtained from parents.

The participants were selected randomly from two larger samples of high school student non-problem gamblers and problem gamblers, who had completed the Italian version of the South Oaks Gambling Screen-Revised for Adolescents (SOGS-RA; Colasante et al. 2014). The final sample comprised two equal-number groups defined using the scoring rules for SOGS-RA. The non-problem gamblers group included participants who reported a score of 0 or 1, whereas the problem gamblers group included participants who obtained a score of 4 or above. The two groups were matched for age, school, and class attended. Automated matching was performed using the Fuzzy extension command in SPSS (20.0).

All participants were tested individually in a quiet room of the school. They were administered the Balloon Analogue Risk Task (BART; Lejuez et al. 2002), the Monetary Choice Questionnaire (MCQ; Kirby and Maraković, 1996; Kirby et al. 1999), and the 14-item Consideration of Future Consequences scale (CFC-14; Joireman et al. 2012). The only exception was the SOGS-RA that was administered prior to the actual study as this determined participant allocation to each experimental group. The order of presentation of measures was counterbalanced. Administration of the instruments took between 25 and 35 min to complete.

Measures

Problem Gambling

The SOGS-RA is one of the most widely used instruments for studying the prevalence of problem gambling among adolescents. It comprises 12 scored items assessing gambling behavior and gambling-related problems over the past 12 months. These items are scored as either 0 or 1. The SOGS-RA score range varies from 0 to 12. In addition to the scored items, the SOGS-RA assesses the frequency of participation in different gambling activities. Consistent with Winters et al.’s (1993, 1995) original scoring system, Level 0 comprises individuals who reported no past year gambling, a score of 0 to 1 (Level 1) is indicative of “non-problem” gambling, a score between 2 and 3 reflects an “at-risk” level of gambling (Level 2), whereas a score of 4 or more is indicative of “problem” gambling (Level 3). The Italian version of the SOGS-RA (Colasante et al. 2014) was found to have acceptable internal consistency (Cronbach’s alpha = 0.78).

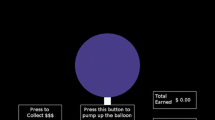

Risk-Taking

The BART is a computerized laboratory-based measure of risk-taking behavior that involves actual risky behavior for which, similar to real-world situations, riskiness is rewarded up until a point at which further riskiness results in poorer outcomes. In the task, the participant is presented with a balloon and offered the chance to earn money by pumping the balloon up by clicking a button. Each pump inflates the balloon and with each pump 5 cents are accrued in a temporary reserve, but after every pump the balloon may explode. In such a case, all money in temporary bank is lost. The participants can stop pumping and accumulate their earnings in a permanent bank. After each balloon explosion or money collection, the participant’s exposure to that balloon ends, and a new balloon appears until a total of 30 balloons have been pumped (i.e., 30 trials). The participant’s task is to maximize profits, acting as if the money involved was real. The primary score used to measure BART performance is the adjusted average number of pumps on unexploded balloons, with higher scores indicative of greater risk-taking propensity.

Delay Discounting

The MCQ is a measure of delayed reward discounting that presents participants with 27 hypothetical choices between a smaller reward available immediately, and a larger reward available at some point in the future, with delays ranging from 7 days to 186 days. The 27 items are grouped into three categories on the basis of the approximate magnitudes (small, medium, and large) of the delayed rewards. Participants are instructed to respond in the same manner as they would with real money. The pattern of responding can be used to determine an estimate of the participant’s overall discounting rate parameter (k), and temporal discounting of rewards at the three levels of magnitude (k small, k medium, and k large). Delay discounting is described by the following hyperbolic function (Mazur, 1984): V = A/(1 + kD), where V is the present value of a reinforcer delivered at delay D, A is the amount of the reward, and k is a constant that describes the steepness of the discount function. Mazur’s hyperbolic function estimated delay discounting rates (the parameter k) based on the indifference points obtained through the questionnaire. The indifference point is the point at which the subjective value of both alternatives (immediate and postponed) is equal.

To determine participants’ k values, MCQ items are ordered with respect to the k values reflecting indifference points at each choice. Following the example by Kirby and Maraković (1996) and Kirby et al. (1999), Question 19 required participants to choose between “$33 today” and “$80 in 14 days”. A discount rate of 0.10 indicates that the participant is indifferent between these two rewards. As a result, if a participant chooses the immediate reward on this trial (“$33”), their discount rate is greater than 0.10. In the Question 4 participant is required to choose between “$31 today” and “$85 in 7 days”. A discount rate of 0.25 indicates that the participant is indifferent between these two rewards. Therefore, if the same participant chooses the delayed reward on this trial, the discount rate is <0.25. The two trials together imply that this person has a discount rate between 0.10 and 0.25. The geometric mean of this interval (k = 0.16) is used to estimate the participant’s k value. This procedure minimizes the number of choices that would be errors with respect to the assigned k value (Kirby 2009; p. 459). Scores range varies from 0.00016 to 0.25. Higher k values reflect a greater proportion of choices for the smaller immediate monetary amounts.

Estimating discount rates separately for each level of magnitude allows assessing the magnitude effect on discount rates, that is, the tendency for discount rates to decrease as reward level increases (Green et al., 1981). One difference from the original versions of the two behavioral tasks was that, in the present version, money was converted from U.S. dollars to Euros.

Time Perspective

The CFC-14 assesses the extent to which individuals focus on the future consequences of their current behavior in 14 items scored using a 7-point scale (from 1 = “extremely uncharacteristic” to 7 = “extremely characteristic”). Items are equally divided into two subscales: Immediate (CFC-I) that concerns orientation toward the present, and Future (CFC-F) that concerns the consideration of the future consequences of actual behavior. The total score (ranging from 14 to 98) is obtained by summing up the values from the seven items of each subscale. Higher scores on the instrument indicate a greater future orientation. In the present study internal consistency for both CFC-14 subscales was acceptable (Cronbach’s alphas: CFC-I = 0.70 and CFC-F = 0.74).

Statistical Analysis

All data analyses were conducted using IBM SPSS version 20.0. The alpha level was set at p = .05. All variables were initially screened for missing data, distribution abnormalities, and outliers (Tabachnick and Fidell 2013). Responses from the MCQ were analyzed using the approach described by Kirby et al. (1999). Since the k values were positively skewed, a natural log transformation was conducted and used for all analyses. The magnitude effect on the discounting task was examined using a paired sample t test (Kirby et al. 1999). Pearson’s correlations among all variables were computed separately for the two groups. All dependent measures were compared using between-subjects and mixed-model ANOVAs. For these analyses, SOGS group (non-problem gamblers vs. problem gamblers) and age group (16, 17, 18, and 19 years) were the grouping variables. MCQ scores were analyzed using a 2 (group) X 4 (age) X 3 (reward magnitude) mixed-model ANOVA. Analogously, CFC-14 scores were submitted to repeated measures ANOVA, with group and age as a between-subjects factors and scores on the two subscales as dependent variables. Finally, the independent associations between BART, MCQ, CFC-14 subscales, and gambling status were analyzed using logistic regression.

Results

Means and standard deviations for the BART, MCQ and CFC-14 for the entire sample and by gambling status are presented in Table 1. For ease of interpretation, descriptive statistics are reported for the untransformed variables.

Zero-order correlations revealed a moderate negative association between the two subscales of the CFC-14 only in non-problem gamblers group (r = −0.28; p < .05). Two-way ANOVA yielded significant main effects of SOGS-RA group for the BART (F 1, 96 = 11.75; p < .01, η 2p = 0.075), but no significant main effects of age or interactions between group and age. Compared to non-problem gamblers, problem gamblers reported significantly higher BART scores. As regards delay discounting performance, all participants showed higher k values for smaller compared to larger delayed rewards. All pair-wise differences in k between reward magnitudes were highly reliable overall and within the two groups (all ps < 0.001). Results of repeated measures ANOVA yielded a significant within-subjects effect of group (F 1, 96 = 7.39; p < .01, η 2p = 0.071), with problem gamblers showing higher rates of delay discounting than did non-problem gamblers. Regarding CFC-14 scores, results of ANOVA for repeated measurements did not reveal any significant main effects of group and age or interactions. However, within-subjects contrasts revealed a significant interaction effect between groups and CFC-14 subscales (F 1, 96 = 29.05; p < .001, η 2p = 0.232), showing that, relative to non-problem gamblers, problem gamblers scored significantly higher on the CFC-14 Immediate dimension, but significantly lower on the CFC-14 Future subscale.

Finally, to assess the relative contribution of risk-taking propensity, delay discounting, and time orientation for gambling involvement a hierarchical logistic regression analysis was conducted, using the two groups as the criterion variable. BART, MCQ and CFC-14 scores were added sequentially to logistic regression models. For the regression, the Hosmer and Lemeshow test was not significant (χ2[8, N = 104] = 3.11; p = .927), indicating an adequate model fit. The results of the final regression model indicated that all variables are significant predictors of gambling status (see Table 2). More specifically, results clearly indicate that high risk-taking propensity, steep delay discounting, and foreshortened time horizon (i.e., high scores on the CFC-14 Immediate subscale and low scores on the Future one), contributed significantly to predicting gambling severity.

Discussion

The present study is the first to compare risk-taking propensity, delay discounting, and time perspective in two groups of problem and non-problem adolescent gamblers. Consistent with the initial hypotheses, results indicated that, relative to non-problem gamblers, adolescent problem gamblers were more risk-prone, showed steeper delay discounting, and were more oriented to the present, rather than to the future. Furthermore, results of logistic regression analysis demonstrated that strong risk-taking tendencies, steep delay discounting, and a foreshortened time horizon were all significant predictors of gambling status. Regarding risk-taking that was assessed by using a well validated laboratory risk-taking task, the results are in line with previous research on adults (e.g., Lejuez et al. 2002; MacKillop et al. 2014), but inconsistent with Mishra et al. (2010) who failed to found an association between problem gambling and behavioral preferences for risk outcomes among undergraduates.

In relation to delay discounting, the results corroborate and further extend previous studies on both adults (for a review see Wiehler and Peters 2015) and adolescents (Cosenza and Nigro 2015; MacKillop et al. 2006; Nigro and Cosenza 2016), which found that problem gamblers devalue or discount delayed rewards to a greater extent than non-problem gamblers do. Finally, the findings concerning time perspective confirm previous studies on both adults and adolescents (Ciccarelli et al. 2016; Cosenza and Nigro 2015; Hodgins and Engel 2002; MacLaren et al. 2012), which found that pathological and problem gamblers show a foreshortened time horizon, with orientation to the present and an inability to consider a long period of time into the future.

On the whole, the findings of the present study suggest that there is a relationship among problematic gambling, risk-taking propensity, the preference for immediate rewards, and foreshortened time horizon. However, it remains unclear whether these deficits are a consequence of prolonged gambling, a risk factor for the development gambling addiction, or a combination of the two. It is not surprising that adolescents prefer short-term benefits (see Dahne et al., 2013). Several authors described adolescence as a period of increased risk-taking (e.g., Romer 2010; Steinberg et al. 2008; Willoughby et al. 2013; for reviews see Braams et al. [2015] and Crone et al. [2016]). What remains unclear is whether this myopic view of life is a hallmark of adolescents, or is present only in a subset of individuals (see Bjork and Pardini 2015).

The results obtained clearly indicate that adolescent problem gamblers are significantly more myopic for the future than non-problem gamblers. It may be that, apart from age, other individual and social (such as peer pressure) or contextual factors play a prominent role in behavioral addictions such as gambling. Recently, Defoe et al. (2015) made reference to risk-taking opportunities and suggested a hybrid developmental neuroecological model of risk-taking that includes a risk opportunity component.

Given that over the last two decades, gambling opportunities and the accessibility to gamble (both online and offline) have greatly increased (Meyer et al. 2009), gambling accessibility itself represents a risk-taking opportunity. Furthermore, Miedl et al. (2014) demonstrated that problem gamblers discount more steeply the value of delayed rewards when gambling-related scenes are presented in the background. So, it may be that, alongside individual differences, the frequent exposure to gambling related-cues represents a kind of background that affects delay discounting performance. Although results obtained in correlational studies make it difficult to distinguish whether risk propensity, steep delay discounting, and short time horizon are acquired characteristics or risk factors for gambling, it may be that excessive gambling leads some myopic behaviors to grow into a habit that, in turn, facilitates addiction (Nigro and Cosenza 2016).

Finally, it is worth noting that both BART and MCQ are monetary reward tasks. Since gamblers attach great value to money, because it is a necessity to gamble, it may be that the extensive experience with monetary rewards might substantially affect performance on tasks involving money. After all, “money is a conditioned reinforcer, meaning that it is not innately rewarding, but that its value is acquired through extensive pairing with primary rewards and through vicarious, cultural learning” (Clark 2010, p. 324).

Although there are several strengths of the present study, including a relatively large sample of participants for an experimental study, there are two limitations that should be considered when interpreting the present results. First, gambling severity was assessed using self-report measures. Secondly, even if several studies demonstrated that there is no difference across hypothetical and potentially real rewards (e.g., Johnson and Bickel 2002; Lagorio and Madden 2005; Madden et al. 2003), delay discounting was evaluated using a behavioral measure that relies on hypothetical monetary choices. Despite these limitations, to the authors’ knowledge, the present study is the first to investigate the interplay of risk-taking, delay discounting, and time perspective on gambling severity among adolescents.

References

Albert, D., & Steinberg, L. (2011). Judgment and decision making in adolescence. Journal of Research on Adolescence, 21(1), 211–224.

Alessi, S. M., & Petry, N. M. (2003). Pathological gambling severity is associated with impulsivity in a delay discounting procedure. Behavioural Processes, 64, 345–354.

Anokhin, A. P., Golosheykin, S., & Mulligan, R. C. (2015). Long-term test–retest reliability of delayed reward discounting in adolescents. Behavioural Processes, 111, 55–59.

Banich, M. T., De La Vega, A., Andrews-Hanna, J. R., Mackiewicz Seghete, K., Du, Y., & Claus, E. D. (2013). Developmental trends and individual differences in brain systems involved in intertemporal choice during adolescence. Psychology of Addictive Behaviors, 27(2), 416–430.

Billieux, J., Lagrange, G., Van der Linden, M., Lançon, C., Adida, M., & Jeanningros, R. (2012). Investigation of impulsivity in a sample of treatment-seeking pathological gamblers: A multidimensional perspective. Psychiatry Research, 198(2), 291–296.

Bjork, J. M., & Pardini, D. A. (2015). Who are those “risk-taking adolescents”? Individual differences in developmental neuroimaging research. Developmental Cognitive Neuroscience, 11, 56–64.

Blakemore, S. J., & Robbins, T. W. (2012). Decision-making in the adolescent brain. Nature Neuroscience, 15(9), 1184–1191.

Blanco, C., Hasin, D. S., Petry, N., Stinson, F. S., & Grant, B. F. (2006). Sex differences in subclinical and DSM-IV pathological gambling: Results from the National Epidemiologic Survey on Alcohol and Related Conditions. Psychological Medicine, 36(7), 943–953.

Braams, B. R., van Duijvenvoorde, A. C., Peper, J. S., & Crone, E. A. (2015). Longitudinal changes in adolescent risk-taking: A comprehensive study of neural responses to rewards, pubertal development, and risk-taking behavior. Journal of Neuroscience, 35(18), 7226–7238.

Ciccarelli, M., Malinconico, R., Griffiths, M. D., Nigro, G., & Cosenza, M. (2016). Reward preferences of pathological gamblers under conditions of uncertainty: An experimental study. Journal of Gambling Studies,. doi:10.1007/s10899-016-9593-y. Epub ahead of print.

Clark, L. (2010). Decision-making during gambling: An integration of cognitive and psychobiological approaches. Philosophical Transactions of the Royal Society of London B: Biological Sciences, 365(1538), 319–330.

Colasante, E., Gori, M., Bastiani, L., Scalese, M., Siciliano, V., & Molinaro, S. (2014). Italian adolescent gambling behaviour: Psychometric evaluation of the South Oaks Gambling Screen: Revised for Adolescents (SOGS-RA) among a sample of Italian students. Journal of Gambling Studies, 30(4), 789–801.

Cosenza, M., & Nigro, G. (2015). Wagering the future: Cognitive distortions, impulsivity, delay discounting, and time perspective in adolescent gambling. Journal of Adolescence, 45, 56–66.

Crone, E. A., Duijvenvoorde, A. C., & Peper, J. S. (2016). Annual research review: Neural contributions to risk-taking in adolescence–developmental changes and individual differences. Journal of Child Psychology and Psychiatry,. doi:10.1111/jcpp.12502. Epub ahead of print.

Dahne, J., Richards, J., Ernst, M., MacPherson, L., & Lejuez, C. W. (2013). Assessment of risk taking in addiction research. In J. MacKillop & H. de Wit (Eds.), The Wiley-Blackwell handbook of addiction psychopharmacology (pp. 209–231). New York: Wiley.

Daugherty, J. R., & Brase, G. L. (2010). Taking time to be healthy: Predicting health behaviors with delay discounting and time perspective. Personality and Individual Differences, 48(2), 202–207.

Defoe, I. N., Dubas, J. S., Figner, B., & van Aken, M. A. (2015). A meta-analysis on age differences in risky decision making: Adolescents versus children and adults. Psychological Bulletin, 141(1), 48–84.

Dixon, M. R., Marley, J., & Jacobs, E. A. (2003). Delay discounting by pathological gamblers. Journal of Applied Behavior Analysis, 36(4), 449–458.

Dougherty, D. M., Lake, S. L., Mathias, C. W., Ryan, S. R., Bray, B. C., Charles, N. E., et al. (2015). Behavioral impulsivity and risk-taking trajectories across early adolescence in youths with and without family histories of alcohol and other drug use disorders. Alcoholism, Clinical and Experimental Research, 39(8), 1501–1509.

Ernst, M., & Fudge, J. L. (2009). A developmental neurobiological model of motivated behavior: Anatomy, connectivity and ontogeny of the triadic nodes. Neuroscience and Biobehavioral Reviews, 33(3), 367–382.

Ernst, M., Pine, D. S., & Hardin, M. (2006). Triadic model of the neurobiology of motivated behavior in adolescence. Psychological Medicine, 36(03), 299–312.

Figner, B., Mackinlay, R. J., Wilkening, F., & Weber, E. U. (2009). Affective and deliberative processes in risky choice: Age differences in risk taking in the Columbia Card Task. Journal of Experimental Psychology. Learning, Memory, and Cognition, 35(3), 709–730.

Geier, C., & Luna, B. (2009). The maturation of incentive processing and cognitive control. Pharmacology, Biochemistry and Behavior, 93(3), 212–221.

Green, L., Fisher, E. B., Perlow, S., & Sherman, L. (1981). Preference reversal and self control: Choice as a function of reward amount and delay. Behaviour Analysis Letters, 1, 43–51.

Green, L., Fry, A. F., & Myerson, J. (1994). Discounting of delayed rewards: A life-span comparison. Psychological Science, 5(1), 33–36.

Harrison, G. W., Lau, M. I., & Williams, M. B. (2002). Estimating individual discount rates in Denmark: A field experiment. American Economic Review, 92(5), 1606–1617.

Hodgins, D. C., & Engel, A. (2002). Future time perspective in pathological gamblers. Journal of Nervous and Mental Disease, 190, 775–780.

Holt, D. D., Green, L., & Myerson, J. (2003). Is discounting impulsive?: Evidence from temporal and probability discounting in gambling and non-gambling college students. Behavioural Processes, 64(3), 355–367.

Johnson, M. W., & Bickel, W. K. (2002). Within-subject comparison of real and hypothetical money rewards in delay discounting. Journal of the Experimental Analysis of Behavior, 77(2), 129–146.

Joireman, J., Balliet, D., Sprott, D., Spangenberg, E., & Schultz, J. (2008). Consideration of future consequences, ego-depletion, and self-control: Support for distinguishing between CFC-Immediate and CFC-Future sub-scales. Personality and Individual Differences, 45(1), 15–21.

Joireman, J., Shaffer, M. J., Balliet, D., & Strathman, A. (2012). Promotion orientation explains why future-oriented people exercise and eat healthy evidence from the two-factor consideration of future consequences-14 scale. Personality and Social Psychology Bulletin, 38(10), 1272–1287.

Kirby, K. N. (2009). One-year temporal stability of delay-discount rates. Psychonomic Bulletin & Review, 16(3), 457–462.

Kirby, K. N., & Maraković, N. N. (1996). Delay-discounting probabilistic rewards: Rates decrease as amounts increase. Psychonomic Bulletin & Review, 3(1), 100–104.

Kirby, K. N., Petry, N. M., & Bickel, W. K. (1999). Heroin addicts have higher discount rates for delayed rewards than non-drug-using controls. Journal of Experimental Psychology: General, 128(1), 78–87.

Kräplin, A., Dshemuchadse, M., Behrendt, S., Scherbaum, S., Goschke, T., & Bühringer, G. (2014). Dysfunctional decision-making in pathological gambling: Pattern specificity and the role of impulsivity. Psychiatry Research, 215, 675–682.

Krmpotich, T., Mikulich-Gilbertson, S., Sakai, J., Thompson, L., Banich, M. T., & Tanabe, J. (2015). Impaired decision-making, higher impulsivity, and drug severity in substance dependence and pathological gambling. Journal of Addiction Medicine, 9(4), 273–280.

Ladouceur, R., Mayrand, M., & Tourigny, Y. (1987). Risk-taking behavior in gamblers and non-gamblers during prolonged exposure. Journal of Gambling Behavior, 3(2), 115–122.

Lagorio, C. H., & Madden, G. J. (2005). Delay discounting of real and hypothetical rewards III: Steady-state assessments, forced-choice trials, and all real rewards. Behavioural Processes, 69(2), 173–187.

Ledgerwood, D. M., Alessi, S. M., Phoenix, N., & Petry, N. M. (2009). Behavioral assessment of impulsivity in pathological gamblers with and without substance use disorder histories versus healthy controls. Drug and Alcohol Dependence, 105(1), 89–96.

Lejuez, C. W., Read, J. P., Kahler, C. W., Richards, J. B., Ramsey, S. E., Stuart, G. L., et al. (2002). Evaluation of a behavioral measure of risk taking: The Balloon Analogue Risk Task (BART). Journal of Experimental Psychology: Applied, 8(2), 75–84.

MacKillop, J., Anderson, E. J., Castelda, B. A., Mattson, R. E., & Donovick, P. J. (2006). Divergent validity of measures of cognitive distortions, impulsivity, and time perspective in pathological gambling. Journal of Gambling Studies, 22, 339–354.

MacKillop, J., Miller, J. D., Fortune, E., Maples, J., Lance, C. E., Campbell, W. K., et al. (2014). Multidimensional examination of impulsivity in relation to disordered gambling. Experimental and Clinical Psychopharmacology, 22, 176–185.

MacLaren, V. V., Fugelsang, J. A., Harrigan, K. A., & Dixon, M. J. (2012). Effects of impulsivity, reinforcement sensitivity, and cognitive style on pathological gambling symptoms among frequent slot machine players. Personality and Individual Differences, 52, 390–394.

MacPherson, L., Magidson, J. F., Reynolds, E. K., Kahler, C. W., & Lejuez, C. W. (2010). Changes in sensation seeking and risk-taking propensity predict increases in alcohol use among early adolescents. Alcoholism, Clinical and Experimental Research, 34(8), 1400–1408.

Madden, G. J., Begotka, A. M., Raiff, B. R., & Kastern, L. L. (2003). Delay discounting of real and hypothetical rewards. Experimental and Clinical Psychopharmacology, 11(2), 139–145.

Martins, S. S., Tavares, H., da Silva Lobo, D. S., Galetti, A. M., & Gentil, V. (2004). Pathological gambling, gender, and risk-taking behaviors. Addictive Behaviors, 29, 1231–1235.

Mazur, J. E. (1984). Tests of an equivalence rule for fixed and variable reinforcer delays. Journal of Experimental Psychology: Animal Behavior Processes, 10(4), 426–436.

Meyer, G., Hayer, T., & Griffiths, M. D. (2009). Problem gaming in Europe: Challenges, prevention, and interventions. New York: Springer.

Michalczuk, R., Bowden-Jones, H., Verdejo-Garcia, A., & Clark, L. (2011). Impulsivity and cognitive distortions in pathological gamblers attending the UK National Problem Gambling Clinic: A preliminary report. Psychological Medicine, 41, 2625–2635.

Miedl, S. F., Büchel, C., & Peters, J. (2014). Cue-induced craving increases impulsivity via changes in striatal value signals in problem gamblers. Journal of Neuroscience, 34, 4750–4755.

Mishra, S., Lalumière, M. L., & Williams, R. J. (2010). Gambling as a form of risk-taking: Individual differences in personality, risk-accepting attitudes, and behavioral preferences for risk. Personality and Individual Differences, 49(6), 616–621.

Nigro, G., & Cosenza, M. (2016). Living in the now: Decision-making and delay discounting in adolescent gamblers. Journal of Gambling Studies,. doi:10.1007/s10899-016-9595-9. Epub ahead of print.

Olson, E. A., Hooper, C. J., Collins, P., & Luciana, M. (2007). Adolescents’ performance on delay and probability discounting tasks: Contributions of age, intelligence, executive functioning, and self-reported externalizing behavior. Personality and Individual Differences, 43(7), 1886–1897.

Petry, N. M. (2001a). Pathological gamblers, with and without substance abuse disorders, discount delayed rewards at high rates. Journal of Abnormal Psychology, 110, 482–487.

Petry, N. M. (2001b). Substance abuse, pathological gambling, and impulsiveness. Drug and Alcohol Dependence, 63, 29–38.

Petry, N. M., & Casarella, T. (1999). Excessive discounting of delayed rewards in substance abusers with gambling problems. Drug and Alcohol Dependence, 56, 25–32.

Petry, N. M., & Madden, G. J. (2010). Discounting and pathological gambling. In G. J. Madden & W. K. Bickel (Eds.), Impulsivity: The behavioral and neurological science of discounting (pp. 273–294). Washington, DC: American Psychological Association.

Potenza, M. N. (2013). Biological contributions to addictions in adolescents and adults: Prevention, treatment, and policy implications. Journal of Adolescent Health, 52(2), S22–S32.

Reynolds, B., Ortengren, A., Richards, J. B., & de Wit, H. (2006). Dimensions of impulsive behavior: Personality and behavioral measures. Personality and Individual Differences, 40, 305–315.

Romer, D. (2010). Adolescent risk taking, impulsivity, and brain development: Implications for prevention. Developmental Psychobiology, 52(3), 263–276.

Scheres, A., Dijkstra, M., Ainslie, E., Balkan, J., Reynolds, B., Sonuga-Barke, E., et al. (2006). Temporal and probabilistic discounting of rewards in children and adolescents: Effects of age and ADHD symptoms. Neuropsychologia, 44(11), 2092–2103.

Spear, L. P. (2000). Neurobehavioral changes in adolescence. Current Directions in Psychological Science, 9(4), 111–114.

Spurrier, M., & Blaszczynski, A. (2014). Risk perception in gambling: A systematic review. Journal of Gambling Studies, 30(2), 253–276.

Steinberg, L. (2004). Risk taking in adolescence: What changes, and why? Annals of the New York Academy of Sciences, 1021(1), 51–58.

Steinberg, L. (2007). Risk taking in adolescence new perspectives from brain and behavioral science. Current Directions in Psychological Science, 16(2), 55–59.

Steinberg, L. (2008). A social neuroscience perspective on adolescent risk-taking. Developmental Review, 28(1), 78–106.

Steinberg, L. (2010). A dual systems model of adolescent risk-taking. Developmental Psychobiology, 52(3), 216–224.

Steinberg, L., Graham, S., O’Brien, L., Woolard, J., Cauffman, E., & Banich, M. (2009). Age differences in future orientation and delay discounting. Child Development, 80(1), 28–44.

Strathman, A., Gleicher, F., Boninger, D. S., & Edwards, C. S. (1994). The consideration of future consequences: Weighing immediate and distant outcomes of behavior. Journal of Personality and Social Psychology, 66(4), 742–752.

Tabachnick, B. G., & Fidell, L. S. (2013). Using multivariate statistics (6th ed.). Boston: Pearson.

Teuscher, U., & Mitchell, S. H. (2011). Relation between time perspective and delay discounting: A literature review. Psychological Record, 61(4), 613–632.

Toplak, M. E., Liu, E., MacPherson, R., Toneatto, T., & Stanovich, K. E. (2007). The reasoning skills and thinking dispositions of problem gamblers: A dual-process taxonomy. Journal of Behavioral Decision Making, 20(2), 103–124.

Van Brunschot, E. G. (2009). Gambling and risk behaviour: A literature review. Alberta: Gaming Research Institute.

Whiteside, S. P., Lynam, D. R., Miller, J. D., & Reynolds, S. K. (2005). Validation of the UPPS impulsive behaviour scale: A four-factor model of impulsivity. European Journal of Personality, 19(7), 559–574.

Wiehler, A., & Peters, J. (2015). Reward-based decision making in pathological gambling: The roles of risk and delay. Neuroscience Research, 90, 3–14.

Willoughby, T., Good, M., Adachi, P. J., Hamza, C., & Tavernier, R. (2013). Examining the link between adolescent brain development and risk taking from a social–developmental perspective. Brain and Cognition, 83(3), 315–323.

Winters, K. C., Stinchfield, R. D., & Fulkerson, J. (1993). Toward the development of an adolescent gambling problem severity scale. Journal of Gambling Studies, 9(1), 63–84.

Winters, K. C., Stinchfield, R. D., & Kim, L. G. (1995). Monitoring adolescent gambling in Minnesota. Journal of Gambling Studies, 11(2), 165–183.

Yoon, J. H., Higgins, S. T., Heil, S. H., Sugarbaker, R. J., Thomas, C. S., & Badger, G. J. (2007). Delay discounting predicts postpartum relapse to cigarette smoking among pregnant women. Experimental and Clinical Psychopharmacology, 15(2), 176–186.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

The authors declare that they have no conflict of interest.

Ethical Approval

All procedures performed in studies involving human participants were in accordance with the ethical standards of the institutional and/or national research committee and with the 1964 Helsinki declaration and its later amendments or comparable ethical standards.

Rights and permissions

About this article

Cite this article

Cosenza, M., Griffiths, M.D., Nigro, G. et al. Risk-Taking, Delay Discounting, and Time Perspective in Adolescent Gamblers: An Experimental Study. J Gambl Stud 33, 383–395 (2017). https://doi.org/10.1007/s10899-016-9623-9

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10899-016-9623-9