Abstract

Several studies examining the relationship of affective decision-making and delay discounting in disordered gambling demonstrated that adult pathological gamblers differ from healthy controls on both reward-related decision tasks. To date no study analyzed the relative contribution of these variables in adolescent gambling. This study was designed to compare affective decision-making and delay discounting in gamblers and nongamblers Italian adolescents, controlling for alcohol consumption. A total of 138 adolescents took part in the research. Two equal-number groups, defined according to the scoring rules for the South Oaks Gambling Screen-Revised for Adolescents, were administered the Iowa Gambling Task (IGT), the Monetary Choice Questionnaire (MCQ), and the Alcohol Use Disorders Identification Test (AUDIT). Zero-order correlations among all variables revealed a moderate negative association between IGT and MCQ scores only in nongamblers group. Results of mixed-model ANOVAs indicated that, compared with nongamblers, adolescent gamblers performed worse on the IGT, showed steeper delay discounting, and scored significantly higher on the AUDIT. Results of logistic regression analysis indicated that IGT, MCQ, and AUDIT scores are all significant predictors of gambling status. This novel finding provides the first evidence of an association among problematic gambling, maladaptive decision-making, and steep delay discounting among adolescents, as already observed in adults.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

Converging evidence from studies examining affective decision-making and delay discounting in disordered gambling suggests that pathological gamblers differ from healthy controls on both reward-related decision tasks. In a recent review Wiehler and Peters (2015) reported that ten out of fourteen studies observed that pathological gamblers perform worse than healthy controls on the Iowa Gambling Task (IGT; Bechara 2007; Bechara et al. 1994). Furthermore, eight out of the ten studies that examined performance changes over time, demonstrated that controls showed improvements in performance, whereas gamblers did not.

It seems that, during the IGT, pathological gamblers are unable to consider long-term benefits probably due to a lack of response flexibility or chasing losses (Goudriaan et al. 2005; Kertzman, et al. 2011; Linnet et al. 2006). Other authors claim that poor decision-making depends on a decreased reward sensitivity (Goudriaan et al. 2006), an exaggerated response to cues predicting immediate and large monetary rewards (Brevers et al. 2013, p. 9; see also Lakey et al. 2007), an aberrant reward processing (Lorains et al. 2014), or a disrupted basic emotional processing (Brevers et al. 2012). Despite a large body of research analyzed the association between gambling severity and IGT performance in adults, and several developmental studies on decision-making in adolescence (Cassotti et al. 2011; Cauffman et al. 2010; Crone and Dahl 2012; Crone and van der Molen 2004; Hooper et al. 2004; see Beitz et al. 2014 and Cassotti et al. 2014 for reviews), to the best of our knowledge yet surprisingly no study has focused on affective decision-making among in adolescent gambling.

Pathological gamblers exhibit a similar “myopia for the future”, by devaluating rewards that are delayed in time. Indeed, when performing behavioral tasks assessing delay discounting, they show steeper delay discounting than healthy controls (Alessi and Petry 2003; Billieux et al. 2012; Dixon et al. 2003; Holt et al. 2003; Kräplin et al. 2014; MacKillop et al. 2006; Michalczuk et al. 2011; Petry 2001; Petry and Casarella 1999; Petry and Madden 2010; Reynolds 2006). The three studies that examined the relation between gambling and delay discounting among late adolescents yielded inconsistent results. Indeed, Holt et al. (2003) reported that young gamblers did not discount delayed rewards more steeply than non-gamblers, whereas MacKillop et al. (2006) and Cosenza and Nigro (2015) found that (at-risk and problem) gamblers more steeply discounted delayed monetary outcomes than did nonproblem gamblers.

Several studies have demonstrated that younger individuals discount delayed rewards more steeply than older individuals (Green et al. 1994; Steinberg et al. 2009; Yoon et al. 2007), and that the tendency to choose small immediate rewards, rather than larger delayed rewards declines with age (e.g., Olson et al. 2007; Steinberg et al. 2009; see Albert and Steinberg 2011 for a review). However, why do adolescent gamblers discount delayed rewards more steeply than do nongamblers still remains largely unclear.

The goal of the current study was to compare, for the first time, affective decision-making and delay discounting in two groups of gamblers and non-gamblers Italian adolescents. In addition, since alcohol and gambling problems show high co-occurrence (e.g. Barnes et al. 2009; Grant et al. 2002; see Rahman et al. 2014 for a review), we controlled for alcohol consumption.

If adolescent gambling shares with adult gambling a myopic view of the future, we expect that adolescent gamblers would show poorer decision-making and steeper delay discounting than nongamblers.

Methods

Participants

A total of 138 Italian high school students (79.7 % boys), ranging in age between 16 and 19 years (M = 17.64; SD = .743), participated in the study. This research was approved by the Ethics Committee of the Department of Psychology of the Second University of Naples. Prior to participation, all subjects provided informed consent. For minors informed consent was obtained from parents.

The subjects were selected randomly from two larger samples of nongamblers and (at-risk and problem) gamblers high school students, who had completed the Italian version of the South Oaks Gambling Screen-Revised for Adolescents (SOGS-RA; Colasante et al. 2013). The final sample comprised two equal-number groups defined according to the scoring rules for SOGS-RA. The two groups were matched in terms of gender and age. Automated matching was performed using the Fuzzy extension command in SPSS (20.0). The first group (nongamblers group) included participants who reported not having gambled in the past 12 months. Because adolescent at-risk and problem gamblers showed similar profiles (see Hardoon and Derevensky 2002), they were grouped together in the present study. From this point on we will refer to this group as “gamblers”.Footnote 1

All participants were tested individually. They were administered the computerized version of the IGT, the Monetary Choice Questionnaire (MCQ; Kirby and Maraković 1996; Kirby et al. 1999), and the Alcohol Use Disorders Identification Test (AUDIT; Saunders et al. 1993).

Measures

The SOGS-RA (Winters et al. 1993, 1995) is the most widely used instrument for studying the prevalence of problem gambling among adolescents. It consists of twelve scored items assessing gambling behavior and gambling-related problems during the past 12 months. In addition to the scored items, the SOGS-RA measures the frequency of participation in different gambling activities. Consistent with Winters et al.’s original scoring system (1993, 1995), Level 0 comprises individuals who reported no past year gambling, a score of 0–1 (Level 1) is indicative of ‘‘no-problem’’ gambling, a score between 2 and 3 reflects an ‘‘at-risk’’ level of gambling (Level 2), whereas a score of 4 or more is indicative of ‘‘problem’’ gambling (Level 3).

The IGT is a measure of affective decision-making. In the IGT participants make a series of choices from a set of four computerized ‘decks of cards’, labeled A, B, C and D. The decks of the IGT differ in terms of long-term outcome and punishment frequency. Playing mostly from disadvantageous decks (A and B) leads to an overall loss, while playing from advantageous decks leads to an overall gain. The players cannot predict when a penalty will occur, nor calculate with precision the net gain or loss from each deck. Because it is impossible to calculate the best option from the beginning of the task, players have to learn to avoid bad decks by following their feeling and hunches, and by using the feedback they get after each choice. Since in a standard administration of the task there are 100 trials, divided in five blocks of 20 cards, the most common method for scoring the IGT is to calculate Net scores from each blocks of trials. Net scores for individual blocks (NET 1, NET 2, NET 3, NET 4, and NET 5) and the total score (NET Total) consist of the difference between the total number of cards selected from both advantageous decks and the total number of cards select from the disadvantageous decks. A positive score indicates that decision-making performance was advantageous, whereas a negative one indicates that the decision-making performance was disadvantageous (Bechara 2007).

The MCQ is a measure of delayed reward discounting that presents participants with 27 hypothetical choices between a smaller reward available immediately, and a larger reward available at some point in the future, with delays ranging from 7 to 186 days. The 27 items are grouped into three categories on the basis of the approximate magnitudes of the delayed rewards. The three levels of magnitude are: small ($25–$35), medium ($50–$60), and large ($75–$85). Participants are instructed to respond in the same manner as they would with real money. The pattern of responding can be used to determine an estimate of the participant’s overall discounting rate parameter (k), and temporal discounting of rewards at the three levels of magnitude (k small, k medium and k large). Higher k values reflect a greater proportion of choices for the smaller immediate monetary amounts. Estimating discount rates separately for each level of magnitude allows assessing the magnitude effect on discount rates, that is, the tendency for discount rates to decrease as reward level increases (Green et al. 1981).

One difference from the original versions of the two behavioral tasks was that, in our versions, money was converted from US dollars to Euros.

The AUDIT is a 10-item measure of alcohol consumption, drinking behavior, and alcohol-related problems. Responses to each item are scored from 0 to 4, giving a maximum possible score of 40.

Results

All data analyses were conducted using IBM SPSS version 20.0. The alpha level was set at p = .05. All variables were initially screened for missing data, distribution abnormalities, and outliers (Tabachnick and Fidell 2001). Responses from the MCQ were analyzed using the approach described by Kirby et al. (1999). Because the k values were positively skewed, a natural log transformation was conducted and used for all analyses. The magnitude effect on the discounting task was examined using paired samples t test (Kirby et al. 1999). Pearson’s correlations among all variables were computed separately for the two groups. All dependent measures were compared using separate between subjects two-way ANOVAs. For these analyses, gender and group were the grouping variables. IGT and MCQ performances were examined using mixed-model ANOVAs. In order to control for the potential important confound of alcohol consumption, AUDIT score was included as covariate in the analyses. Finally, the independent associations between IGT, MCQ, AUDIT, and gambling status were analyzed using logistic regression.

Means and standard deviations for the IGT, the MCQ and the AUDIT for the entire sample and by gambling status are presented in Table 1.

Zero-order correlations revealed a moderate negative association between IGT and MCQ scores only in nongamblers group (r = .25; p < .05).

Two-way ANOVAs yielded significant main effects of group for the IGT (NET Total), the MCQ (overall k), and the AUDIT scores, but no significant main effects of gender or interactions between gender and group. Compared to nongamblers, gamblers reported significantly lower NET total scores (F 1, 134 = 15.9; p < .001, \(\eta_{p}^{2} = .106\)) and higher scores on both the MCQ (F 1, 134 = 7.14; p < .01, \(\eta_{p}^{2} = .051\)) and the AUDIT (F 1, 134 = 7.32; p < .01, \(\eta_{p}^{2} = .052\)).

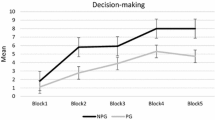

For analyzing the profile of the IGT performances of the two groups per block we run a repeated measures ANOVA with group as a between-subjects factor and scores on the five subsequent IGT blocks as dependent variables. The analysis revealed a significant within-subjects effect of block (F 3.66, 497.2 = 14.28; p < .001, \(\eta_{p}^{2} = .095\)),Footnote 2 reflecting the fact that task performance increased over time, and a significant main effect of group (F 1, 136 = 27.01; p < .001, \(\eta_{p}^{2} = .166\)), indicating that gamblers performed worse than nongamblers. This latter remained significant after controlling for alcohol use (F 1, 135 = 23.54; p < .001, \(\eta_{p}^{2} = .148\)). Within-subjects contrasts revealed significant differences between groups for all the five blocks (F 1, 136 = 25.84; p < .001, \(\eta_{p}^{2} = .160\)), showing that gamblers performed significantly poorer than nongamblers across all blocks of the IGT (see Fig. 1, top panel).

As regards delay discounting performance, all participants showed higher k values for smaller, compared to larger delayed rewards. All pair-wise differences in k between reward magnitudes were highly reliable overall and within the two groups (all ps < .001). Choice behavior was analyzed using a 2 × 3 mixed-model ANOVA of group by magnitude (small, medium, and large). The analysis yielded a significant within-subjects effect of reward magnitude (F 2, 272 = 84.06; p < .001, \(\eta_{p}^{2} = .382\)), indicating that rewards of larger magnitude are discounted less steeply than rewards of smaller magnitude, and group (F 1, 136 = 13.04; p < .001, \(\eta_{p}^{2} = .088\)), with gamblers showing higher rates of delay discounting than did nongamblers (see Fig. 1). Within-subjects contrasts revealed significant differences between groups for all the three rewards magnitude (F 1, 136 = 152.57; p < .001, \(\eta_{p}^{2} = .529\)), showing that gamblers performed significantly poorer than nongamblers across the three rewards magnitude (see Fig. 1, bottom panel). Covariate analysis indicated that group differences remained statistically significant after controlling for alcohol use (F 1, 135 = 10.38; p < .01, \(\eta_{p}^{2} = .071\)).

Finally, to assess the relative contribution of decision-making, delay discounting, and alcohol consumption for gambling involvement we conducted a hierarchical logistic regression analysis using the two groups as the criterion variable. IGT, MCQ and AUDIT scores were added sequentially to logistic regression models. The results of the final regression model (see Table 2) indicated that IGT, MCQ, and AUDIT scores are all significant predictors of gambling status.

Discussion and Conclusions

The present study is the first research that compares affective decision-making and delay discounting in two groups of gamblers and non-gamblers Italian adolescents controlling for alcohol consumption. Consistent with our initial hypotheses, results indicated that, compared with nongamblers, adolescent gamblers performed worse on the IGT and showed steeper delay discounting. Interestingly, although gamblers scored significantly higher on the AUDIT than did nongamblers, alcohol use had no meaningful effect on both decision-making and delay discounting performances.

Regarding decision-making, our results indicated not only that among adolescents gambling status is associated with poor decision-making, but also that gamblers do not show improvement of performance over time, whereas nongamblers learn to pick more cards from the advantageous decks over the consecutive task blocks. These findings are consistent with previous research on adults that showed diminished performance on the IGT in pathological gamblers (e.g. Brevers et al. 2012, 2014; Cavedini et al. 2002; Goudriaan et al. 2005, 2006; Kertzman et al. 2011; Ledgerwood et al. 2012; Lorains et al. 2014; Power et al. 2012).

The most intriguing question remains, however, why adolescent gamblers do not learn to stop playing from disadvantageous decks in the IGT. Although, from the existing data on pathological gambling it is not yet clear whether impairments of decision-making are a consequence or a precursor of addictive behaviors (Brevers et al. 2012), both individual differences and prolonged gambling could undermine harm avoidance.

Generally speaking, several studies stressed the role of individual differences (such as impulsivity, present orientation, and risk propensity) in reward-related decision tasks (e.g. Banich et al. 2013; Buelow and Suhr 2013; Cosenza et al. 2014b; Dunn et al. 2006; Steinberg et al. 2009; Upton et al. 2011). Analogously, a large body of research on adults and adolescents have showed that cognitive distortions about gambling play a prominent role in the development of disordered gambling and foster the persistence of gambling despite negative outcomes (Cosenza et al. 2014a; Donati et al. 2015; Johansson et al. 2009; Oei et al. 2008; Taylor et al. 2014; see Fortune and Goodie 2012 for a review). However, until now no study demonstrated that there are individuals “born to gamble”. Among others, there is a memory paradox in heavy gamblers: On the one hand, they recall wins more easily than losses; on the other hand, losses are so unforgettable that recovering them (loss-chasing) becomes a fixed idea. It may be that such memory distortions (a subtype of erroneous beliefs about gambling) are fueled by frequent play.

The idea that prolonged gambling contribute to harm decision-making is also consistent with the somatic markers hypothesis (Bechara and Damasio 2005; Damasio 1994, 1996) according to which there are primary and secondary inducers. The former are stimuli that are innately set as pleasurable or aversive, and when they are present in the immediate environment, they automatically elicit a somatic response, whereas the latter are entities generated by recall or by thought, and when they are brought to memory they elicit a somatic response (Bechara 2003, pp. 26–27). It could be that frequent play alters at least secondary inducers through erroneous memories and (positive) thoughts associated with gambling.

With respect to delay discounting, our results corroborate previous studies indicating that pathological gamblers devalue delayed rewards to a greater extent than nonproblem gamblers do (MacKillop et al. 2006; for reviews see Madden et al. 2011; Michalczuk et al. 2011). However, similarly to previous studies that assessed delay discounting by using tasks that involve monetary rewards or losses, this result does not reveal whether the delay discounting effect reflects a deficit in monetary decision-making, or whether other internal (e.g. gamble for easy money) and external factors (e.g. the financial situation of participants) influence the performance (see Goudriaan et al. 2004). For instance, Shah et al. (2012) suggested that scarcity modifies how people allocate attention. According to Cosenza and Nigro (2015), preferring less rewarding over more rewarding monetary alternatives might depend also on attentional neglect. It is common knowledge that there is a close tie between gambling and money, and that severe gambling involvement is often associated with financial difficulties. Since heavy gamblers face several problematic financial situations, the promising of easy money may be too captivating to resist. Gamblers win or lose money and raising funds is of primary importance for them. Furthermore, loss-chasing (Lesieur 1979) fosters a vicious cycle into which gamblers are trapped. Gamblers attach great value to money, because it is required to gamble, but, paradoxically, they squander money on gambling. The extensive experience with monetary rewards might affect substantially performance on task involving money (such as IGT and MCQ). Ultimately, “… money is a conditioned reinforcer, meaning that it is not innately rewarding, but that its value is acquired through extensive pairing with primary rewards and through vicarious, cultural learning” (Clark 2010, p. 324). Some cross-sectional studies examining differences in delay discounting as a function of age (e.g. Green et al. 1994; Harrison et al. 2002; Scheres et al. 2006; Steinberg et al. 2009) found that delay discounting decreases across the life span, probably due to individual difference factors, cognitive functioning, and the maturation of brain system during adolescence (Banich et al. 2013; Olson et al. 2007). Taking for granted that adolescents discount monetary delayed rewards more steeply than adults, the differences in delay discounting rates between adolescent gamblers and nongamblers might depend on individual differences and/or to the context (Dixon et al. 2006). For instance, a recent study by Miedl et al. (2014) demonstrated that problem gamblers discount more steeply the value of delayed rewards when gambling-related scenes are presented in the background. So, it may be that, alongside with individual differences, the frequent exposure to gambling related-cues represents a kind of background that affect delay discounting performance.

Although results obtained in correlational studies make it difficult to differentiate whether impaired decision-making and steeper delay discounting are acquired characteristics or risk factors for gambling, it may be that excessive gambling leads some myopic behaviors to grow into a habit that, in turn, nourishes addiction.

Though a detailed discussion of preventive strategies and targeted intervention programs is beyond the scope of this article, it is worth to underline that clinical interventions should be focused on correcting the myopia for the future associated with gambling problems in adolescence. Recent studies suggest that imagining the future by using mental time travel—that is the faculty that allows humans to mentally project themselves backward in time to re-live, or forward in time to pre-live, events—reduces impulsive delay discounting (e.g. Cheng et al. 2012; Daniel et al. 2013; Lin and Epstein 2014). If Episodic Future Thinking (EFT; Atance and O’Neill 2001) actually reduces delay discounting and promotes future orientation, future event simulation could potentially be used as intervention and prevention strategy for gambling addiction among adolescents.

Even if several strengths characterized this study, including a relatively large sample of participants, there are two limitations that should be considered when interpreting the present results. First, gambling severity and habitual alcohol use were assessed using self-report measures. Secondly, even if several studies have demonstrated that there is no difference across hypothetical and potentially real rewards (e.g. Johnson and Bickel 2002; Lagorio and Madden 2005; Madden et al. 2003), delay discounting was evaluated using a behavioral measure that relies on hypothetical monetary choices. Despite these limitations, to our knowledge, the present study is the first research that investigates the relationship of affective decision-making and delay discounting to gambling severity in adolescents.

Notes

Results of preliminary one-way ANOVAs indicated that at-risk and problem gamblers were similar in terms of their levels of decision-making, delay discounting and alcohol consumption (all ps > .05).

Because the assumption of sphericity was not met (Mauchly’s W = .83, p < .05), the degrees of freedom for tests of within-subjects effects were conservatively adjusted using the Greenhouse–Geisser F test.

References

Albert, D., & Steinberg, L. (2011). Judgment and decision making in adolescence. Journal of Research on Adolescence, 21, 211–224.

Alessi, S. M., & Petry, N. M. (2003). Pathological gambling severity is associated with impulsivity in a delay discounting procedure. Behavioural Processes, 64, 345–354.

Atance, C. M., & O’Neill, D. K. (2001). Episodic future thinking. Trends in Cognitive Sciences, 5, 533–539.

Banich, M. T., De La Vega, A., Andrews-Hanna, J. R., Mackiewicz Seghete, K., Du, Y., & Claus, E. D. (2013). Developmental trends and individual differences in brain systems involved in intertemporal choice during adolescence. Psychology of Addictive Behaviors, 27, 416–430.

Barnes, G. M., Welte, J. W., Hoffman, J. H., & Tidwell, M. C. O. (2009). Gambling, alcohol, and other substance use among youth in the United States. Journal of Studies on Alcohol and Drugs, 70, 134–142.

Bechara, A. (2003). Risky business: Emotion, decision-making, and addiction. Journal of Gambling Studies, 19, 23–51.

Bechara, A. (2007). Iowa gambling task professional manual. Lutz, FL: Psychological Assessment Resources Inc.

Bechara, A., & Damasio, A. R. (2005). The somatic marker hypothesis: A neural theory of economic decision. Games and Economic Behavior, 52, 336–372.

Bechara, A., Damasio, A. R., Damasio, H., & Anderson, S. W. (1994). Insensitivity to future consequences following damage to human pre-frontal cortex. Cognition, 50, 7–15.

Beitz, K. M., Salthouse, T. A., & Davis, H. P. (2014). Performance on the Iowa gambling task: From 5 to 89 years of age. Journal of Experimental Psychology: General, 143, 1677–1689.

Billieux, J., Lagrange, G., Van der Linden, M., Lançon, C., Adida, M., & Jeanningros, R. (2012). Investigation of impulsivity in a sample of treatment-seeking pathological gamblers: A multidimensional perspective. Psychiatry Research, 198, 291–296.

Brevers, D., Bechara, A., Cleeremans, A., & Noël, X. (2013). Iowa gambling task (IGT): Twenty years after-gambling disorder and IGT. Frontiers in Psychology, 4, 665.

Brevers, D., Cleeremans, A., Goudriaan, A. E., Bechara, A., Kornreich, C., Verbanck, P., & Noël, X. (2012). Decision making under ambiguity but not under risk is related to problem gambling severity. Psychiatry Research, 200, 568–574.

Brevers, D., Koritzky, G., Bechara, A., & Noël, X. (2014). Cognitive processes underlying impaired decision-making under uncertainty in gambling disorder. Addictive Behaviors, 39, 1533–1536.

Buelow, M. T., & Suhr, J. A. (2013). Personality characteristics and state mood influence individual deck selections on the Iowa gambling task. Personality and Individual Differences, 54, 593–597.

Cassotti, M., Aïte, A., Osmont, A., Houdé, O., & Borst, G. (2014). What have we learned about the processes involved in the Iowa gambling task from developmental studies? Frontiers in Psychology, 5, 1–5.

Cassotti, M., Houdé, O., & Moutier, S. (2011). Developmental changes of win-stay and loss-shift strategies in decision making. Child Neuropsychology, 17, 400–411.

Cauffman, E., Shulman, E. P., Steinberg, L., Claus, E., Banich, M. T., Graham, S., & Woolard, J. (2010). Age differences in affective decision making as indexed by performance on the Iowa gambling task. Developmental Psychology, 46, 193–207.

Cavedini, P., Riboldi, G., & Keller, R. (2002). Frontal lobe dysfunction in pathological gambling patients. Biological Psychiatry, 51, 334–341.

Cheng, Y. Y., Shien, P. P., & Chiou, W. B. (2012). Escaping the impulse to immediate gratification: The prospect concept promotes a future-oriented mindset, prompting an inclination towards delayed gratification. British Journal of Psychology, 103, 129–141.

Clark, L. (2010). Decision-making during gambling: An integration of cognitive and psychobiological approaches. Philosophical Transactions of the Royal Society B: Biological Sciences, 365, 319–330.

Colasante, E., Gori, M., Bastiani, L., Scalese, M., Siciliano, V., & Molinaro, S. (2013). Italian adolescent gambling behaviour: Psychometric evaluation of the South Oaks gambling screen: revised for adolescents (SOGS-RA) among a sample of Italian students. Journal of Gambling Studies, 30, 789–801.

Cosenza, M., Baldassarre, I., Matarazzo, O., & Nigro, G. (2014a). Youth at stake: Alexithymia, cognitive distortions, and problem gambling in late adolescents. Cognitive Computation, 6, 652–660.

Cosenza, M., Matarazzo, O., Baldassarre, I., & Nigro, G. (2014b). Deciding with (or without) the future in mind: Individual Differences in decision-making. In S. Bassis, A. Esposito, & F. C. Morabito (Eds.), Recent advances of neural network models and applications (pp. 435–443). Cham: Springer International Publishing.

Cosenza, M., & Nigro, G. (2015). Wagering the future: Cognitive distortions, impulsivity, delay discounting, and time perspective in adolescent gambling. Journal of Adolescence, 45, 56–66.

Crone, E. A., & Dahl, R. E. (2012). Understanding adolescence as a period of social–affective engagement and goal flexibility. Nature Reviews Neuroscience, 13, 636–650.

Crone, E. A., & van der Molen, M. W. (2004). Developmental changes in real-life decision-making: Performance on a gambling task previously shown to depend on the ventromedial prefrontal cortex. Developmental Neuropsychology, 25, 251–279.

Damasio, A. R. (1994). Descartes’ error: Emotion, reason, and the human brain. New York: Putnam.

Damasio, A. R. (1996). The somatic marker hypothesis and the possible functions of the prefrontal cortex. Philosophical Transactions of the Royal Society B: Biological Sciences, 351, 1413–1420.

Daniel, T. O., Stanton, C. M., & Epstein, L. H. (2013). The future is now: Comparing the effect of episodic future thinking on impulsivity in lean and obese individuals. Appetite, 71, 120–125.

Dixon, M. R., Jacobs, E. A., & Sanders, S. (2006). Contextual control of delay discounting by pathological gamblers. Journal of Applied Behavior Analysis, 39, 413–422.

Dixon, M. R., Marley, J., & Jacobs, E. A. (2003). Delay discounting by pathological gamblers. Journal of Applied Behavior Analysis, 36, 449–458.

Donati, M. A., Ancona, F., Chiesi, F., & Primi, C. (2015). Psychometric properties of the gambling related cognitions scale (GRCS) in young Italian gamblers. Addictive Behaviors, 45, 1–7.

Dunn, B. D., Dalgleish, T., & Lawrence, A. D. (2006). The somatic marker hypothesis: A critical evaluation. Neuroscience and Biobehavioral Reviews, 30, 239–271.

Fortune, E. E., & Goodie, A. S. (2012). Cognitive distortions as a component and treatment focus of pathological gambling: A review. Psychology of Addictive Behaviors, 26, 298–310.

Goudriaan, A. E., Oosterlaan, J., de Beurs, E., & Van den Brink, W. (2004). Pathological gambling: A comprehensive review of biobehavioral findings. Neuroscience and Biobehavioral Reviews, 28, 123–141.

Goudriaan, A. E., Oosterlaan, J., de Beurs, E., & van den Brink, W. (2005). Decision making in pathological gambling: A comparison between pathological gamblers, alcohol dependents, persons with Tourette syndrome, and normal controls. Cognitive Brain Research, 23, 137–151.

Goudriaan, A. E., Oosterlaan, J., de Beurs, E., & van den Brink, W. (2006). Psychophysiological determinants and concomitants of deficient decision making in pathological gamblers. Drug Alcohol Dependence, 84, 231–239.

Grant, J. E., Kushner, M. G., & Kim, S. W. (2002). Pathological gambling and alcohol use disorder. Alcohol Research and Health, 26, 143–150.

Green, L., Fisher, E. B, Jr, Perlow, S., & Sherman, L. (1981). Preference reversal and self control: Choice as a function of reward amount and delay. Behaviour Analysis Letters, 1, 43–51.

Green, L., Fry, A., & Myerson, J. (1994). Discounting of delayed rewards: A life-span comparison. Psychological Science, 5, 33–36.

Hardoon, K. K., & Derevensky, J. L. (2002). Child and adolescent gambling behavior: Current knowledge. Clinical Child Psychology and Psychiatry, 7, 263–281.

Harrison, G. W., Lau, M. I., & Williams, M. B. (2002). Estimating individual discount rates in Denmark: A field experiment. The American Economic Review, 92, 1606–1617.

Holt, D. D., Green, L., & Myerson, J. (2003). Is discounting impulsive?: Evidence from temporal and probability discounting in gambling and non-gambling college students. Behavioural Processes, 64, 355–367.

Hooper, C. J., Luciana, M., Conklin, H. M., & Yarger, R. S. (2004). Adolescents performance on the Iowa gambling task: Implications for the development of decision making and ventromedial prefrontal cortex. Developmental Psychology, 40, 1148–1158.

Johansson, A., Grant, J. E., Kim, S. W., Odlaug, B. L., & Götestam, K. G. (2009). Risk factors for problematic gambling: A critical literature review. Journal of Gambling Studies, 25, 67–92.

Johnson, M. W., & Bickel, W. K. (2002). Within-subject comparison of real and hypothetical money rewards in delay discounting. Journal of the Experimental Analysis of Behavior, 77, 129–146.

Kertzman, S., Lidogoster, H., Aizer, A., Kotler, M., & Dannon, P. N. (2011). Risk-taking decisions in pathological gamblers is not a result of their impaired inhibition ability. Psychiatry Research, 188, 71–77.

Kirby, K. N., & Maraković, N. N. (1996). Delay-discounting probabilistic rewards. Rates decrease as amounts increase. Psychonomic Bulletin and Review, 3, 100–104.

Kirby, K. N., Petry, N. M., & Bickel, W. K. (1999). Heroin addicts have higher discount rates for delayed reward than non-drug-using controls. Journal of Experimental Psychology: General, 128, 78–87.

Kräplin, A., Dshemuchadse, M., Behrendt, S., Scherbaum, S., Goschke, T., & Bühringer, G. (2014). Dysfunctional decision-making in pathological gambling: Pattern specificity and the role of impulsivity. Psychiatry Research, 215, 675–682.

Lagorio, C. H., & Madden, G. J. (2005). Delay discounting of real and hypothetical rewards III: Steady-state assessments, forced-choice trials, and all real rewards. Behavioural Processes, 69, 173–187.

Lakey, C. E., Goodie, A. S., & Campbell, W. K. (2007). Frequent card playing and pathological gambling: The utility of the Georgia gambling task and Iowa gambling task for predicting pathology. Journal of Gambling Studies, 23, 285–297.

Ledgerwood, D. M., Orr, E. S., Kaploun, K. A., Milosevic, A., Frisch, G. R., Rupcich, N., & Lundahl, L. H. (2012). Executive function in pathological gamblers and healthy controls. Journal of Gambling Studies, 28, 89–103.

Lesieur, H. R. (1979). The compulsive gambler’s spiral of options and involvement. Psychiatry, 42, 79–87.

Lin, H., & Epstein, L. H. (2014). Living in the moment: Effects of time perspective and emotional valence of episodic thinking on delay discounting. Behavioral Neuroscience, 128, 12–19.

Linnet, J., Røjskjær, S., Nygaard, J., & Maher, B. A. (2006). Episodic chasing in pathological gamblers using the Iowa gambling task. Scandinavian Journal of Psychology, 47, 43–49.

Lorains, F. K., Dowling, N. A., Enticott, P. G., Bradshaw, J. L., Trueblood, J. S., & Stout, J. C. (2014). Strategic and non-strategic problem gamblers differ on decision making under risk and ambiguity. Addiction, 109, 1128–1137.

MacKillop, J., Anderson, E. J., Castelda, B. A., Mattson, R. E., & Donovick, P. J. (2006). Divergent validity of measures of cognitive distortions, impulsivity, and time perspective in pathological gambling. Journal of Gambling Studies, 22, 339–354.

Madden, G. J., Begotka, A. M., Raiff, B. R., & Kastern, L. L. (2003). Delay discounting of real and hypothetical rewards. Experimental Clinical Psychopharmacology, 11, 139–145.

Madden, G. J., Francisco, M. T., Brewer, A. T., & Stein, J. S. (2011). Delay discounting and gambling. Behavioural Processes, 87, 43–49.

Michalczuk, R., Bowden-Jones, H., Verdejo-Garcia, A., & Clark, L. (2011). Impulsivity and cognitive distortions in pathological gamblers attending the UK national problem gambling clinic: A preliminary report. Psychological Medicine, 41, 2625–2635.

Miedl, S. F., Büchel, C., & Peters, J. (2014). Cue-induced craving increases impulsivity via changes in striatal value signals in problem gamblers. The Journal of Neuroscience, 34, 4750–4755.

Oei, T. P. S., Lin, C. D., & Raylu, N. (2008). The relationship between gambling cognitions, psychological states, and gambling: A cross-cultural study of Chinese and Caucasians in Australia. Journal of Cross-Cultural Psychology, 39, 147–161.

Olson, E. A., Hooper, C. J., Collins, P., & Luciana, M. (2007). Adolescents’ performance on delay and probability discounting tasks: Contributions of age, intelligence, executive functioning, and self-reported externalizing behavior. Personality and Individual Differences, 43, 1886–1897.

Petry, N. M. (2001). Pathological gamblers, with and without substance use disorders, discount delayed rewards at high rates. Journal of Abnormal Psychology, 110, 482–487.

Petry, N. M., & Casarella, T. (1999). Excessive discounting of delayed rewards in substance abusers with gambling problems. Drug and Alcohol Dependence, 56, 25–32.

Petry, N. M., & Madden, G. J. (2010). Discounting and pathological gambling. In G. J. Madden & W. K. Bickel (Eds.), Impulsivity: The behavioral and neurological science of discounting (pp. 273–294). Washington, DC: American Psychological Association.

Power, Y., Goodyear, B., & Crockford, D. (2012). Neural correlates of pathological gamblers preference for immediate rewards during the Iowa gambling task: An fMRI study. Journal of Gambling Studies, 28, 623–636.

Rahman, A. S., Balodis, I. M., Pilver, C. E., Leeman, R. F., Hoff, R. A., Steinberg, M. A., et al. (2014). Adolescent alcohol-drinking frequency and problem-gambling severity: Adolescent perceptions regarding problem-gambling prevention and parental/adult behaviors and attitudes. Substance Abuse, 35, 426–434.

Reynolds, B. (2006). A review of delay-discounting research with humans: Relations to drug use and gambling. Behavioural Pharmacology, 1, 651–667.

Saunders, J. B., Aasland, O. G., Babor, T. F., de la Fuente, J. R., & Grant, M. (1993). Development of the alcohol use disorders identification test (AUDIT): WHO collaborative project on early detection of persons with harmful alcohol consumption. II. Addiction, 88, 791–804.

Scheres, A., Dijkstra, M., Ainslie, E., Balkan, J., Reynolds, B., Sonuga-Barke, E., & Castellanos, F. X. (2006). Temporal and probabilistic discounting of rewards in children and adolescents: Effects of age and ADHD symptoms. Neuropsychologia, 44, 2092–2103.

Shah, A. K., Mullainathan, S., & Shafir, E. (2012). Some consequences of having too little. Science, 338, 682–685.

Steinberg, L., Graham, S., O’Brien, L., Woolard, J., Cauffman, E., & Banich, M. (2009). Age differences in future orientation and delay discounting. Child Development, 80, 28–44.

Tabachnick, B. G., & Fidell, L. S. (2001). Using multivariate statistics (4th ed.). Needham Heights, MA: Allyn & Bacon.

Taylor, R. N., Parker, J. D., Keefer, K. V., Kloosterman, P. H., & Summerfeldt, L. J. (2014). Are gambling related cognitions in adolescence multidimensional?: Factor structure of the gambling related cognitions scale. Journal of Gambling Studies, 30, 453–465.

Upton, D. J., Bishara, A. J., Ahn, W. Y., & Stout, J. C. (2011). Propensity for risk taking and trait impulsivity in the Iowa gambling task. Personality and Individual Differences, 50, 492–495.

Wiehler, A., & Peters, J. (2015). Reward-based decision making in pathological gambling: The roles of risk and delay. Neuroscience Research, 90, 3–14.

Winters, K. C., Stinchfield, R. D., & Fulkerson, J. (1993). Toward the development of an adolescent gambling problem severity scale. Journal of Gambling Studies, 9, 63–84.

Winters, K. C., Stinchfield, R. D., & Kim, L. G. (1995). Monitoring adolescent gambling in Minnesota. Journal of Gambling Studies, 11, 165–183.

Yoon, J. H., Higgins, S. T., Heil, S. H., Sugarbaker, R. J., Thomas, C. S., & Badger, G. J. (2007). Delay discounting predicts postpartum relapse to cigarette smoking among pregnant women. Experimental and Clinical Psychopharmacology, 15, 176.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

The authors declare that they have no conflict of interest.

Ethical Approval

All procedures performed in the study were in accordance with the ethical standards of the Ethics Committee of the Department of Psychology of the Second University of Naples and with the 1964 Helsinki declaration and its later amendments or comparable ethical standards.

Rights and permissions

About this article

Cite this article

Nigro, G., Cosenza, M. Living in the Now: Decision-Making and Delay Discounting in Adolescent Gamblers. J Gambl Stud 32, 1191–1202 (2016). https://doi.org/10.1007/s10899-016-9595-9

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10899-016-9595-9