Abstract

We investigate the causes of the decline in the labor share, exploring the effect of technology vis-à-vis the role of market regulations, namely employment protection legislation, product market regulation, and intellectual property rights (IPR) protection. Our results show that, in the long run, productivity upgrades and information and communication technology capital diffusion are major sources of the decline in the labor share. IPR protection is the only dimension of the institutional setting that affects (positively) the share of industry income accruing to labor. Our results also show that hysteresis characterizes the dynamics of the labor share in all countries. This further corroborates the idea that institutional differences are not the main source of variation in labor share movements, as the negative trend is common to countries with different regulatory settings.

Access provided by Autonomous University of Puebla. Download chapter PDF

Similar content being viewed by others

Keywords

JEL Classification

1 Introduction

The decline in the labor share has attracted increasing interest among economists, policy makers, and the press. Although conceptually different, researchers have often discussed it in conjunction with wage inequality, an issue with a wider understanding. While wage inequality relates to the distribution of wages across the employed, the labor share is concerned with the division of the income (output) generated between workers and capital. The decline in the labor share means that workers earn comparatively less than capital owners due to fewer job opportunities or lower wages. From a social viewpoint, workers, especially those with a lower skill endowment, have experienced sluggish wages for several decades in most developed countries, a situation that can lead to lower job participation rates and higher welfare costs (Juhn and Potter 2006). Workers typically have a greater propensity to consume than capital owners, and, in the long run, a smaller labor share can lead to a decrease in the aggregate demand, with adverse effects on economic growth and employment (OECD 2015).

The initial research on the decline in the labor share emphasized the role of technological change and globalization. Recent technologies have been increasingly capital augmenting and have made production activities more capital intensive (Bentolila and Saint-Paul 2003; Lawless and Whelan 2011; Piketty and Zucman 2014). A decrease in the price of capital goods has facilitated this trend (Karabarbounis and Nieman 2014). The new vintages of capital goods are not only cheaper but also increasingly able to substitute routinized workers’ tasks, thanks to the development of automation and the diffusion of information and communication technology (ICT).

Research has often blamed globalization for the decline in job opportunities and wage rates in the advanced countries, particularly for low-skilled workers. However, the empirical evidence is more divided on this issue. Elsby et al. (2013) argued that globalization is the main reason behind the decrease in the labor share in the US, supporting Gushina’s (2006) earlier work. However, examining a global sample of countries, Guerriero and Sen (2012) found that the overall impact of trade on the labor share is positive. More recently, Autor et al. (2017a) showed that the decline in the labor share involves both traded and non-traded goods sectors, further weakening the hypothesis that globalization is a key driver of the labor share decline.

Although technological conditions determine factor substitutability, the speed at which firms replace inputs depends on frictions in factor markets, which countries’ institutional settings determine. The literature has considered various types of market regulations, but the estimated effect has tended to differ across studies. For example, studies have generally associated increasing competitiveness with increasing labor shares, as the fall in barriers to entry decreases the rents that firms appropriate and increases those accruing to workers (Bassanini and Manfredi 2012). However, the privatization of network services in the OECD has contributed to the reduction of the labor share by shifting the focus of managers away from employment targets and toward profitability targets (Azmat et al. 2012).Footnote 1 Studies have often considered labor market deregulation as one of the main causes of the decline in the labor share (Blanchard and Giavazzi 2003; Bassanini and Duval 2009; Suchanek 2009), yet Azmat et al. (2012) did not find any evidence for this effect.

The main objective of this paper is to contribute to this important debate by providing new evidence on the role of technology and institutional factors. Although researchers have widely recognized the importance of technological factors, we extend the current literature by focusing on a large group of OECD countries, hence contributing to a debate that the US evidence has largely dominated. The role of institutional factors has been one of the most challenging issues to assess, partly because of the difficulty in finding reliable proxies to measure their impact. In fact, little time and cross-sectional variation generally characterizes the available measures of market regulations. The recent results that Autor et al. (2017b) obtained showed that increasing market concentration, fostered by new technological advances, is likely to drive the decline in the labor share in the US. Hence, the role of market regulations is now at the forefront of the different explanations for the decline in the labor share and deserves further investigation.

To explore these issues, we make use of data for 14 European countries, Australia, the US, and Japan. For each country, we collect data on 20 industries, covering manufacturing and services, over the 1970–2007 period. We account for the impact of technological factors by including a measure of total factor productivity (TFP) and by dividing the total capital assets into non-ICT and ICT components. We capture the role of market regulations using three variables that vary across countries and industries and over time: the employment protection burden indicator, which we construct following the methodology of Bassanini et al. (2009); the regulation impact indicator (Conway et al. 2006), which accounts for the impact of service regulation on downstream industries (Bourlés et al. 2013); and the indicator of the enforcement of intellectual property rights (IPR) protection (Aghion et al. 2015).

Our analysis also accounts for the impact of market regulations in an indirect way by testing for the presence of hysteresis in the labor share. Studies have often used the concept of hysteresis to explain persistence in unemployment as a consequence of institutional factors (labor unions pushing for high wages for their members) and workers’ skill deterioration while unemployed. If regulations play a role in the labor share movements, our results should be consistent with those that the unemployment literature has found; that is, we should find evidence of hysteresis only in countries with stricter regulations. As for skill deterioration, in an environment characterized by fast technological developments, skills can quickly become obsolete. Following a recession, workers who lose their jobs might not be able to re-enter the labor market with the same job specification and wage level, and this will lead to a persistent decline in the labor share. Given that all the countries in our sample have access to the same technologies, whilst greatly differing in terms of regulatory setting, widespread support for the presence of hysteresis would indicate that technology, rather than institutional factors, is responsible for the labor share decline. The analysis of hysteresis associated with the labor share is another novel contribution of our paper.

Our results show that the impact of technological change is strong, negative, and statistically significant across industries and countries. The effect of institutional factors is always positive but not always significant. The protection of intellectual property rights displays the most robust and significant effect, while we do not find evidence of a long-run impact of employment protection legislation and competitiveness. Our analysis also reveals the presence of hysteresis in the majority of countries. This suggests that technological factors, rather than institutions, are the main drivers of labor share movements.

We organize the remainder of the paper as follows. Section 2 describes the background theoretical framework and the empirical approach used. Section 3 presents the data and descriptive statistics. Section 4 contains our results. Section 5 presents some policy implications and then concludes the paper.

2 Empirical Approach

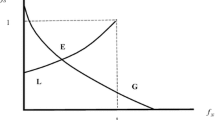

We study the determinants of the labor share dynamics following Bentolila and Saint-Paul (2003) and Bassanini and Manfredi (2012) by expressing the labor share of output (value added) as a function of a set of technology factors:

We derive this equation from a constant elasticity of substitution (CES) output production function, where θ is a parameter reflecting the degree of substitutability between factor inputs (namely capital and labor). A is the level of total factor productivity (TFP), which we use as a proxy for input-specific technical change, and k is the capital-value added ratio, which we measure in real terms. In the following, we decompose the capital-to-output ratio into ICTFootnote 2 and non-ICT assets, which we denote respectively with ki and kn, and we estimate a long-run approximation of Eq. (1) as follows:

where j denotes industries and i countries. αijo are industry-country fixed effects, and εijt is a spherical error term. A negative coefficient for A would indicate that technical change is not neutral but biased toward the use of capital assets, that is, capital augmenting (α1 < 0). Similarly, if labor and capital were gross substitutes, we would expect the coefficients of capital intensities to be negative (α2 < 0 and α3 < 0). We estimate this empirical model with a dynamic formulation and by means of an estimator that is robust to several econometric issues (augmented mean group, AMG). The Appendix provides all the methodological details.

In model (1), the technology parameter (θ) determines the degree of factor substitutability. However, the way in which firms exchange capital for labor strongly depends on the functioning of factor markets. Research has shown the regulatory framework of factor markets to influence production efficiency (Foster-McGregor et al. 2013), investment in capital goods (Alesina et al. 2005), and ICT endowment (Cette et al. 2013). Consequently, omitting institutional factors from our labor share specification may result in an overstatement of the impact of technology factors (A and ki). Therefore, we extend Eq. (2) to include three indicators for different types of market regulations.

To identify the role played by the weakening of labor market institutions, we investigate how the reduction in the severity of employment protection legislation (EPL) affects the labor share. This set of rules determines how firms can hire and fire workers, and, by influencing wage setting and firms’ employment choice, EPL may ultimately determine the evolution of the labor share (Bassanini and Manfredi 2012).

Firms’ decision to substitute capital for labor depends not only on the labor market regulations but also on the set of rules governing the other factor markets, such as intermediate inputs and technology. For instance, pro-competition policies, by removing barriers to the service supply, may lead firms to reconsider all the production phases and contract out less profitable tasks, hence affecting the occupational or wage levels. Azmat et al. (2012) studied the direct effect of pro-competition policies on deregulated (network) industries in OECD countries. Here, we extend this type of analysis to consider how deregulation in the (upstream) service sector exerts an impact on the dynamics of the labor share in other (downstream) industries by means of inter-industry intermediate inputs’ transactions (Conway and Nicoletti 2006; Bourlés et al. 2013).

We also investigate whether the regulatory setting governing the technology market has some influence on the labor share dynamics, using, as our third indicator, the enforcement of intellectual property rights (IPRs). In the presence of well-defined rules on the degree of appropriability of innovation output, the incentives to undertake R&D are larger. This may exert a threefold positive effect on the labor share. First, it may increase investments in research activities, which are intensive in the use of highly educated/highly paid workers. Second, greater appropriability conditions on research outcomes grant firms larger profits and hence larger rents to share with workers. Third, by raising the volume of R&D, a higher level of IPR protection makes firms less sensitive to the competitive pressure of low-income countries.

3 Data Description and Summary Statistics

Our analysis is based on a large cross-industry, cross-country data sample that extends the EU KLEMS dataset (release 2009) to include countries’ institutional characteristics. Our dataset covers 17 OECD countries and 20 market industries (12 manufacturing and 8 service industries), spanning from 1970 to 2007.Footnote 3 The exclusion of the latest years after the financial turmoil allows us to isolate the long-run impact of technological and institutional changes from the effect of the crisis.

The EU KLEMS dataset provides information on industry accounts (labor compensation, value added, and ICT and non-ICT stock).Footnote 4 The labor share is defined as the ratio of total compensation (including non-wage labor costs) to gross value added. Our measure includes the remuneration of the self-employed, which is classified as mixed income in national accounts, assuming that their compensation equals the industry average for employees. We measure the TFP levels in relative terms with respect to those that the US industries showed in 1997. We obtain the capital measures using the perpetual inventory method and geometric depreciation (see Timmer et al. 2007 for full details). We distinguish between ICT and non-ICT capital and express these variables as ratios to the real value added. We make all the monetary variables comparable using the relative PPP of industry output (1997 base), following Inklaar and Timmer (2008).

Tables 1 and 2 report the summary statistics. On average, the labor share is 0.70, showing wide variation among countries (from 0.81 in Sweden to 0.58 in the Czech Republic) and industries (from 0.86 in hotels and restaurants, H, to 0.31 in electricity, E, etc.). Sweden stands out for having the highest ratio of ICT capital to value added. At the industry level, the highest ratios are evident for post and communications (64) and electrical and optical equipment (30t33).

As discussed above, we consider the institutional characteristics of the labor and other factor markets. Aside from a few exceptions, information on the institutional setting governing the functioning of such markets is only available at the country level. Hence, to capture the variation in the impact of these factors across industries, we adopt the procedure that Rajan and Zingales (1998) devised, interacting country-level, time-varying variables with an industry-specific, time-invariant indicator reflecting how the effectiveness (enforcement) of institutional factors differs structurally among sectors.

We define our industry-level measure of the employment protection legislation (EPL) burden as the interaction between the country-level index of total employment protection legislation (i.e. covering both temporary and performance labor contracts) and a time-variant measure of the sector propensity to lay off workers for the UK. The former variable ranges between 0 and 6 and comes from an OECD labor market institution dataset (Venn 2009). We benchmark the latter to the US, and it ranges from 0 to 8 (Bassanini et al. 2009). Figure 1 displays the values of this indicator by industries, averaged across countries.Footnote 5 Larger values indicate more stringent regulations.

Source Bassanini et al. (2009). See footnote 3 for the industry list

EPL burden by industry.

We also use an indicator defining how the degree of service regulation influences downstream (manufacturing and services) industries using services’ input in production (PMR). We define this indicator as the interaction of a country-level measure capturing anti-competitive practices in service industries (entry regulation, the extent of public ownership, vertical integration, and the market structure) and the industry intensity in the use of service inputs. We take the latter from the OECD input–output tables and benchmark it to the year 2000. We normalize the regulation impact so that it ranges from 0 to 1; see Fig. 2 for an industry overview.

Source Conway and Nicoletti (2006). See footnote 3 for the industry list

Upstream regulation by industry.

Finally, we assess the role of the enforcement of IPRs at the industry level following the procedure that Aghion et al. (2015) devised. We multiply the Ginarte–Park index of the strength of the legal protection of innovation (available at the country level) with the patent intensity of the sectors. We define this weighting variable as the share of each sector in the total number of patent applications of the country. We take this variable as the average value over the 1980s (i.e. in the initial years of the period under examination). We base the index of IPR protection, ranging from 0 to 5, on information on the coverage of patents, membership of international treaties, enforcement mechanisms, restrictions on patent rights, and duration (see Ginarte and Park 1997 and subsequent updates).Footnote 6 This interaction variable assumes that variation in the enforcement of IPR laws changes among sectors depending on the relative importance of patenting in industry production. Figure 3 shows the cross-industry differentials in this indicator, which is available only for the manufacturing industries and uses data on European Patent Office (EPO) applications.

Notes Our elaboration on Ginarte and Park’s (1997) data and updates. See footnote 3 for the industry list

IPR enforcement by industry.

4 Regression Results

4.1 Baseline Specification

Table 3 presents the results for a baseline specification, which only includes TFP and total capital. To check whether the imputation of self-employed wages can affect our results, we run the same specification using a definition of the labor share that we base only on the wages of employees. The first column of Table 3 shows the results for the pooled sample, while columns 2–4 refer to subgroups of industries, constructed according to their intensity in the use and production of ICT, following the classification that O’Mahony and van Ark (2003) devised. This distinction is crucial to identify the impact of new digital technologies, which the earlier literature identified as one of the most relevant drivers of economic growth and income inequalities (Acemoglu 2002). The impact varies between those industries that produce such technologies, those industries that make intensive use of ICT, and, finally, the residual group of industries in which the development of computers and software has not been particularly relevant (see also Stiroh 2002).

The results in Table 3 are consistent across the different specifications in terms of the direction of the effect and the statistical significance. For example, the impact of TFP is always negative and statistically significant, confirming the outcome of the existing studies (Bentolila and Saint-Paul 2003; Bassanini and Manfredi 2012). Hence, technical change is biased toward the use of capital assets. Our results for the total capital to value added ratio confirm the presence of capital-labor substitution, as the coefficient is always negatively signed. Only among ICT producers is this effect not statistically significant. Overall, these results are consistent with the evidence of Karabarbounis and Neiman (2014) and provide further support for their claim that one of the main factors behind the decline in the labor share is the decreasing price of investment goods. Table 3 also shows that, when using a labor share measure that does not account for the self-employed, the findings are largely unchanged. Hence, in the remainder of our analysis, we will continue with the more standard definition of the labor share, which includes both employees and self-employed workers.

In Table 4, we extend our model by accounting for different types of capital assets, that is, distinguishing between ICT and non-ICT capital. The results show that the capital–labor substitution is driven by the ICT capital only, while non-ICT capital is not statistically significant in any of the industry groups that we consider. Looking at the role of ICT capital across different types of industries, we can see that its impact on the labor share is rather heterogeneous, ranging between –0.032 in the total sample and –0.159 in the ICT-producing sectors. Hence, workers in these sectors, which include, for example, office machinery and scientific instruments, are particularly affected by increasing investments in new digital technologies.

The insignificant coefficient for non-ICT capital, although different from some of the recent evidence (Checchi and Garcia-Penalosa 2010; Bassanini and Manfredi 2012), is not surprising, as ICT is the most innovative form of capital asset and has experienced a fast price decline over the last twenty years. Therefore, our results are in line with Karabarbounis and Neiman’s (2014) discussion of the role that advances in information and communication technology play in shifting resources away from labor and toward capital. However, differently from earlier studies, our results reflect a long-run equilibrium condition, which implies that the negative impact of TFP and ICT capital on the labor share is long lasting.

4.2 Accounting for Institutional Factors

We now extend our baseline specification to include three indicators of countries’ institutional framework: the EPL burden indicator, the upstream regulation index (PMR), and the intellectual property rights protection index (IPR). Table 5 presents our results. We assess the impact of each indicator individually to avoid collinearity problems, which arise from the fact that such indicators, although they vary across industries, are characterized by little time variation. The coefficient estimates are consistent with the previous results for TFP and capital assets, hence confirming the negative impact of technical change on the labor share and the fact that ICT capital is a substitute for labor. Employment protection never displays a significant effect. More stringent regulations on competition, PMR, and IPR are positively associated with the labor share, although the effect is not always significant. The direction of the impact of our indicator of PMR contradicts our expectations and part of the existing evidence, which indicated a negative effect of barriers to entry on the labor share. The IPR index is significant for the overall sample and for the group of ICT users and producers taken together, while the upstream regulation index is only significant in the ICT producer sectors.

Overall, we do not find evidence of an impact of market regulations on the labor share dynamics. A similar finding emerges when we include alternative indicators that we construct by interacting country-level wage coordination and industry union density (not reported for simplicity). One possible explanation for this outcome is the difficulty in measuring market regulations. Secondly, the effect of regulation can be ambivalent and can interfere with the technology effect, which makes the estimation of individual coefficients quite challenging, particularly when using measures that are characterized by small time variation. We therefore attempt to assess the importance of market regulation indirectly by testing for the presence of hysteresis in labor share series.

The earlier literature associated the evidence of non-stationarity in unemployment with support for the hysteresis hypothesis, that is, the increase in the natural rate of unemployment (NAIRU) following temporary shocks (Clarke and Summers 1982; Blanchard and Summers 1986; Cross 1995). In our setting, evidence of non-stationarity would imply that the long-run equilibrium level of the labor share depends on its own history and therefore shows a high degree of persistence.Footnote 7 If we find the decline in the labor share to have a broad scope across countries and industries and to be persistent over time, we should seek the key drivers of this trend elsewhere than among the institutional factors, in the light of the wide differences existing across countries in the legal discipline of factor and product markets.

To test for the presence of hysteresis in the labor share, we implement the standard procedure for running unit root tests (Cross 1995). This consists of testing whether the labor share series fluctuate around a constant mean value (stationarity) or rather denote a downward (or upward) trend (non-stationarity). Failure to reject the hypothesis of non-stationarity provides evidence for the presence of hysteresis. Table 6 presents the probability values for these tests, which we base on the procedure that Pesaran (2007) devised, so-called Cross-sectionally Augmented Dickey Fuller (CADF) test.

The results strongly support the hysteresis assumption, as the large probability values in the vast majority of countries and industries imply that we cannot reject the hysteresis hypothesis. These findings have important implications for the analysis of the causes that drive movements in the labor share. In fact, if the institutional differences were important, we should have been able to reject the hysteresis hypothesis in countries characterized by more flexible institutional arrangements. Our results suggest that the factors responsible for the declining trends in the labor share are more pervasive.

5 Policy Implications and Conclusions

This paper provides new evidence on the decline in the labor share for a large sample of OECD countries over a 40-year period. Our results show that technology factors play an important role. We find ICT capital to reduce the labor share throughout the whole economy, albeit with heterogeneous effects across industries and countries. Our measure of technical change, TFP, always plays a strong, negative, and significant role, which is pervasive across countries and industries.

The second novel feature of our analysis is the use of indicators of countries’ institutional framework that are characterized by time and industry variation. The results based on these indicators are, however, quite weak. In general, low competitiveness, stronger labor protection, and strong protection of intellectual property rights have a positive impact on the labor share. However, only for the intellectual property rights indicator is this effect statistically significant. We argue that the role of institutional factors is difficult to assess because of measurement errors and their interaction with other factors, such as technical change. More research effort is necessary to try and disentangle these effects, as the policy implications can be very important.

The third feature of our study is the in-depth investigation of the time series properties of labor share series. Existing studies have observed that the labor share is characterized by a high degree of persistence; here, we take this observation a step further and statistically assess the dynamic properties of the labor share, showing that this is widely characterized by hysteresis. This suggests that technological rather than institutional factors are the main drivers of the decline in the labor share since the 1980s.

Our analysis offers some insights for policy making with a long-term horizon. Given the role that technological factors play, public policies should be oriented toward expanding the proportion of the workforce with skills that are complementary to the new technology and facilitating the reallocation of workers to expanding sectors.

Notes

- 1.

The fact that wages tend to rise after privatization can only partially compensate for this effect (La Porta and Lopez-de-Silanes 1999).

- 2.

ICT stands for information and communication technology (computers, software, and communication equipment).

- 3.

Following Bassanini and Manfredi (2012), we exclude agriculture, mining, refining and petroleum, and real estate activities. The list of industries is (ISIC Rev. 2): food, beverages, and tobacco (15t16); textiles, textile products, and leather (17t19); wood and products of wood and cork (20); pulp, paper, paper products, and printing (21t22); chemicals (24); rubber and plastics (25); other non-metallic minerals (26); basic metals and fabricated metal (27t28); machinery, NEC (29); electrical and optical equipment (30t33); transport equipment (34t35); manufacturing, NEC (36t37); electricity, gas, and water supply (E); construction (F); wholesale and retail trade (G); hotels and restaurants (H); transport and storage (60t63); post and communications (64); financial intermediation (J); and business services (71t74). The list of countries is: Austria (AT), Australia (AU), Belgium (BE), the Czech Republic (CZ), Denmark (DK), Germany (DE), Finland (FI), France (FR), Hungary (HU), Ireland (IE), Italy (IT), Japan (JP), the Netherlands (NL), Spain (ES), Sweden (SE), the UK, and the US.

- 4.

O’Mahony and Timmer (2009) provided a general overview of this dataset.

- 5.

The EPL indicator is missing for the industry 71t74, as no information was available for the industry lay-off propensity.

- 6.

Data on patent protection are available on a five-year basis. We interpolate intermediate values between benchmark years.

- 7.

The literature has mainly focused on the European labor markets, which in that period were characterized by rising unemployment rates (Blanchard and Summers 1986). One of the causes of this phenomenon is the asymmetry in the wage-setting process between those who are employed (the insiders) and those who search for jobs (the outsiders). Another reason relates to the loss of skill that the unemployed experience, particularly those who have been without a job for a long time (Clarke and Summers 1982).

References

Acemoglu, D. (2002). Technical change, inequality, and the labour market. Journal of Economic Literature, 40(1), 7–72.

Aghion, P., Howitt, P., & Prantl, S. (2015). Patent rights, product market reforms, and innovation. Journal of Economic Growth, 20(3), 223–262.

Alesina, A., Ardagna, S., Nicoletti, G., & Schiantarelli, F. (2005). Regulation and investment. Journal of the European Economic Association, 3, 1–35.

Autor, D., Dorn, D., Katz, L. F., Patterson, C., & Van Reenen, J. (2017a). Concentrating on the fall of the labour share. Working Paper 23108. National Bureau of Economic Research, Cambridge, MA.

Autor, D., Dorn, D., Katz, L. F., Patterson, C., & Van Reenen, J. (2017b). The fall of the labour share and the rise of superstar firms. Working Paper 23396. National Bureau of Economic Research, Cambridge, MA.

Azmat, G., Manning, A., & Van Reenen, J. (2012). Privatization and the decline of labour’s share: International evidence from network industries. Economica, 79, 470–492.

Bassanini, A., & Duval, R. (2009). Unemployment, institutions and reform complementarities: Re-assessing the aggregate evidence for OECD countries. Oxford Review of Economic Policy, 25, 40–59.

Bassanini, A., & Manfredi, T. (2012). Capital’s grabbing hand? A cross-country/cross-industry analysis of the decline of the labour share. OECD Social, Employment and Migration Working Papers 133. Paris: OECD Publishing.

Bassanini, A., Nunziata, L., & Venn, D. (2009). Job protection legislation and productivity growth in OECD countries. Economic Policy, 58, 349–402.

Bentolila, S., & Saint-Paul, G. (2003). Explaining movements in the labour share. Berkeley Journal of Macroeconomics Contributions, 9(1), Berkeley, CA.

Blanchard, O., & Giavazzi, F. (2003). Macroeconomic effects of regulation and deregulation in goods and labour markets. Quarterly Journal of Economics, 115, 879–907.

Blanchard, O., & Summers, L. H. (1986). Hysteresis and the European unemployment problem. NBER Macroeconomics Annual. Cambridge, MA: MIT Press.

Bourlés, R., Cette, G., Lopez, J., Mairesse, J., & Nicoletti, G. (2013). Do product market regulations in upstream sectors curb productivity growth? Panel data evidence for OECD countries. Review of Economics and Statistics, 95, 1750–1768.

Cette, G., Lopez, J., & Mairesse, J. (2013). Upstream product market regulations, ICT, R&D and productivity. Working Paper 19488. National Bureau of Economic Research, Cambridge, MA.

Checchi, D., & Garcia-Penalosa, C. (2010). Labour market institutions and the personal distribution of income in the OECD. Economica, 77, 413–450.

Clarke, K. B., & Summers, L. H. (1982). Labour force participation: Timing and persistence. Review of Economic Studies, 49, 825–844.

Conway, P., & Nicoletti, G. (2006). Product market regulation in the non-manufacturing sectors of OECD countries: Measurement and highlights. OECD Economics Department Working Papers 530, Paris.

Conway, P., De Rosa, D., Nicoletti, G., & Steiner, F. (2006). Regulation, competition and productivity convergence. OECD Economic Studies, 2, 9.

Cross, R. (1995). The natural rate of unemployment: Reflections on 25 years of the hypothesis. New York and Melbourne: Cambridge University Press.

Eberhardt, M., & Bond, S. (2013). Accounting for unobserved heterogeneity in panel time series models. University of Oxford, Mimeo.

Elsby, M. W. L., Hobijn, B., & Sahin, A. (2013). The decline of the U.S. labor share. Brookings Papers on Economic Activity, 44, 1–63.

Foster-McGregor, N., Poschl, J., Rincon-Aznar, A., Stehrer, R., Vecchi, M., & Venturini, F. (2013). Reducing productivity and efficiency gaps: The role of knowledge assets, absorptive capacity and institutions. European Competitiveness Report, Background Study, Bruxelles.

Ginarte, J. C., & Park, W. G. (1997). Determinants of patent rights: A cross-national study. Research Policy, 26, 283–301.

Guerriero, M., & Sen, K. (2012). What determines the share of labour in national income? A cross-country analysis. IZA Discussion Papers 6643. Institute for the Study of Labour (IZA).

Gushina, A. (2006). Effects of globalization on labors share in national income. IMF Working Paper, 06/294, Washington, DC.

Inklaar, R., & Timmer, M. P. (2008). GGDC productivity level database: International comparisons of output, inputs and productivity at the industry level. Groningen Growth and Development Centre Research Memorandum GD-104. Groningen: University of Groningen.

Juhn, C., & Potter, S. (2006). Changes in labor force participation in the United States. Journal of Economic Perspectives, 20, 27–46.

Karabarbounis, L., & Neiman, B. (2014). The global decline of the labour share. Quarterly Journal of Economics, 61, 61–103.

La Porta, R., & Lopez-de-Silanes, F. (1999). The benefits of privatization: Evidence from Mexico. Quarterly Journal of Economics, 114, 1193–1242.

Lawless, M., & Whelan, K. T. (2011). Understanding the dynamics of labour shares and inflation. Journal of Macroeconomics, 33, 121–136.

OECD. (2015). The labour share in G20 economies. Turkey: G20 Employment Working Group.

O’Mahony, M., & Timmer, M. P. (2009). Output, input and productivity measures at the industry level: The EU KLEMS database. Economic Journal, 119, F374–F403.

O’Mahony, M., & van Ark, B. (2003). EU productivity and competitiveness: An industry perspective. Can Europe resume the catching-up process? Bruxelles: Enterprise Publications, European Commission.

Pesaran, M. H. (2007). A simple panel unit root test in the presence of cross-section dependence. Journal of Applied Econometrics, 22, 265–312.

Piketty, T., & Zucman, G. (2014). Capital is back: Wealth–income ratios in rich countries 1700–2010. Quarterly Journal of Economics, 1255–1310.

Rajan, R. G., & Zingales, L. (1998). Financial dependence and growth. American Economic Review, 88, 559–586.

Stiroh, K. J. (2002). Information technology and the U.S. productivity revival: What do the industry data say? American Economic Review, 92, 1559–1576.

Suchanek, L. (2009). Labour shares and the role of capital and labour market imperfections. Bank of Canada Discussion Paper No. 2, Ottawa.

Timmer, M., van Moergastel, T., Estuivenwold, E., Ypma, G., O’Mahony, M., & Kangasniemi, M. (2007). EU KLEMS growth and productivity account: Methodology part 1. EU KLEMS Project, Groningen.

Venn, D. (2009). Legislation, collective bargaining and enforcement: Updating the OECD employment protection indicators. OECD Social, Employment and Migration Working Papers, No. 89. Paris: OECD Publishing.

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Appendix

Appendix

1.1 Econometric Method

We consider the standard specification for the labor share that Bentolila and Saint-Paul (2003) devised, which expresses the total labor compensation as a percentage of the gross value added:

We derive this expression from a constant elasticity of substitution (CES) output production function within a closed-economy framework, where θ is a substitution parameter between capital and labor. A is the total factor productivity (TFP) level, which we use here as a proxy for input-specific technical change, and k is the capital-value added ratio, which we measure in real terms. In the following, we decompose capital input into ICT and non-ICT assets and denote their ratio to value added with ki and kn, respectively.

Expressing the previous equation as a first-order Taylor approximation yields (in logs):

We can formulate the static version of the labor share equation as follows:

where j denotes industries and i countries, αijo are industry-country fixed effects, and εijt is a spherical error term. A negative coefficient for A would indicate that technical change is not neutral but biased toward the use of capital assets, that is, capital-specific technical change (α1 < 0). Similarly, if labor and capital were gross substitutes, we would expect the coefficients of capital intensities to be negative (α2 < 0 and α3 < 0).

The coefficients of Eq. (5) represent long-run elasticities. Empirically, we can identify these by rewriting a dynamic version of the labor share equation using an autoregressive distributed lag process, ARDL(p, q), in which we assume a maximum lag order of one for simplicity:

We can reformulate this as an error correction mechanism (ECM) as follows:

Equation (7) represents our benchmark specification, which we estimate with the augmented mean group estimator that Eberhardt and Bond (2013) devised. This procedure estimates the specification of interest separately for each panel unit, controlling for the presence of cross-sectional dependence via the inclusion of a common dynamic effect. We derive the common dynamic effects from an auxiliary regression based on a standard first-difference OLS model that includes year dummies. We then include the coefficients for the year dummies in the industry regressions as an additional variable. We derive the AMG coefficients by averaging the individual industry estimated parameters. We obtain sample coefficients by averaging the parameters obtained for single industries. To account for the effect of outliers, we report the robust mean of individual-specific coefficients. The advantage of using this estimator, compared with standard fixed effects, is that it can better account for industry heterogeneity, non-stationarity, and cross-sectional dependence, that is, the possible correlation in the disturbances across panel units.

We obtain the long-run coefficients by combining the parameters of Eq. (7). For instance, for ICT capital intensity, we define the cointegration parameter as: \( \alpha_{2ij} = - \gamma_{6ij} /\gamma_{4i} \). We check the significance level of the long-run coefficients using the nonlinear test of the delta method. The coefficient γ4 indicates the speed at which the economy returns to its long-run equilibrium. Inference on this parameter will provide insights into the presence of a long-run equilibrium relationship.

Rights and permissions

Copyright information

© 2019 Asian Development Bank Institute

About this chapter

Cite this chapter

O’Mahony, M., Vecchi, M., Venturini, F. (2019). Technology, Market Regulations, and Labor Share Dynamics. In: Fields, G., Paul, S. (eds) Labor Income Share in Asia. ADB Institute Series on Development Economics. Springer, Singapore. https://doi.org/10.1007/978-981-13-7803-4_4

Download citation

DOI: https://doi.org/10.1007/978-981-13-7803-4_4

Published:

Publisher Name: Springer, Singapore

Print ISBN: 978-981-13-7802-7

Online ISBN: 978-981-13-7803-4

eBook Packages: Economics and FinanceEconomics and Finance (R0)