Abstract

Obtaining environmental certification (such as the ISO-14,001) has become a status symbol for adopting greener practices for the corporate sector in emerging economies. Such certification can help improve the global visibility of firms and is mandated in international trade. This paper attempts to examine the impact of such certifications on technical efficiency of firms belonging to the manufacturing sector in India. In analyzing the impact of ISO Certification on technical efficiency, this paper uses data from the CMIE Prowess from 2007 to 2012. In the first step, the paper estimates technical efficiency for the sample firms and then examines the determinants of inter-firm differences in technical efficiency using firm specific characteristics. The results of this study conclude that there are substantial inter-firm differences in technical efficiency and they are systematically different based on firm age, firm size, debt capital, MNE affiliation, and ISO certification. ISO certification, especially maintaining the standards associated with it, turned out to be an important factor in making the firms achieve higher technical efficiency. In addition, the results of this study also confirm that firms that are ISO certified and doing R&D are better off in technical efficiency as compared to others.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

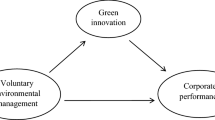

Dominant thinking in economic theory holds that regulation imposes a cost-burden on firms, causing them to reallocate their spending away from investments in innovation, to meet the standards set by regulations. On the other side, the environmental movement along with greater public concern about social health and safety has fuelled arguments that economic efficiency is a necessary sacrifice for improved social welfare. The “Porter Hypothesis Footnote 1” goes even further arguing that environmental, health, and safety regulations, regularly induces innovation and may even enhance the competitiveness of the regulated industry. Schumpeter (1942) distinguished innovation, the commercially successful application of an idea, from invention, the initial development of a new idea, and from diffusion, the widespread adoption of the innovation (Ashford and Heaton 1981 Footnote 2). Based on the Schumpeterian definition of innovation, at the highest level of analysis, there are two competing ways in which government regulation impacts innovation. First, regulation places a compliance burden on firms, which can cause them to divert time and money from innovative activities to compliance efforts. Counter to this, secondly firms may be unable to achieve compliance with existing products and processes and thus, assuming that the firms do not shut down, regulation may spur either compliance innovation or circumventive innovation. Circumventive innovation occurs when the scope of the regulation is narrow and the resulting innovation allows the firms to escape the regulatory constraints. Compliance innovation occurs, when the scope of the regulation is broad and the resulting product or process innovations remain within the scope of the regulation. Firms’ R&D efforts create new technologies, products, and solutions designed to satisfy customer needs that are not easily imitated by competitors and hence, gain competitive advantages. This behaviour of a firm enables it to differentiate itself from other firms. This also motivates a firm to focus more on innovation activity to survive in the global competitive markets.

In the debate of global climate change and contribution to Greenhouse Gases (GHGs) emission at firm level; so far a number of research and policy papers has been published. Most of the papers deal with the implication of GHGs emission on firms’ behaviour. However, studies that relate regulation or policy instrument such as the International Organization of Standardization (ISO) certification that might enhance the quality of product and minimise the output at the firm level are few. ISO develops new standards in response to sectors and stakeholders that express a clearly established need for them. ISO standards are voluntary, and based on a solid consensus of international expert opinion. ISO standards are among the leading objective tools that assist policymakers in decisions related to public incentives, regulations, and use of standards to foster energy-efficiency and new green technologies. Out of a total of over 18,500 ISO standards, and related documents, over 570 are directly related to environmental subjects, including the environmental management systems, climate change, energy management, and many more that can help in reducing negative environmental impacts. The ISO-14,000 family of standards for environmental management is firmly established as the global benchmark for good practice in this area. ISO has been a leader in preparing climate change relevant standards that help streamline procedures and unify definitions and requirements for the climate mitigation and related actions of corporations, organizations and governments. ISO not only helps streamline GHGs accounting with its policy-neutral tools, but it also develops climate change monitoring tools.

In the case of innovative technologies, standards can reduce the time to market of products and services based on them, create global interest and develop a critical mass of support to ensure the economic success of such technologies. ISO has already developed standards with an impact on climate change for areas such as building environment design, energy efficiency of buildings and sustainability in building construction, intelligent transport systems, solar energy, wind turbines, nuclear energy and hydrogen technologies. As one indicator of the use of ISO-14,000, up to the end of December 2009, more than 223,149 ISO-14,001 certificates of conformity had been issued to private and public sector organizations in 159 countries and economies. The ISO-14,000 family of standards also includes supporting tools for environmental management and designing environmentally friendly products and services. A well-defined environmental management system is essential for an organization to manage environmental aspects like emission and handling of waste. It is important for the efficient utilization of resources and energy (Whitelaw 2004). Some of the benefits of the ISO-14,001 certification are:

-

1.

reduction in insurance premiums: waste handling costs; water and air permitting fees;

-

2.

improved corporate image: strategic investment; improved regulatory relations; and

-

3.

evaluates system performance through management review and correct management system deficiencies

Technology acquisition has traditionally been viewed as a source of techniques necessary for initiating production and hence, is considered as substituting domestic research and development (R&D). In the absence of the inflows of new and advanced technologies, however, there has been little incentive, direction and capability to update the existing technologies. Sound product design and engineering work could have greater impact on product cost, value and quality than comparable efforts undertaken further down the manufacturing chain (UNIDO). India has the technical ability to achieve a high level of precision, yet Indian firms are unable to produce quality products due to lack of supporting technologies, such as precision measuring, material engineering and process control. The defect rates of final products are 5 to 10 time than that of Japan and those of the USA. In addition, about 20 % of the firms have equipments that are more than 20 years old, and therefore, obsolete. Most Indian firms are vertically integrated and rely far less on subcontracting arrangements, although such trend is beginning to emerge (Point of view: National Manufacturing Policy, 2012).

During the early 1990s, the Indian policy makers acknowledged that improved performance and efficiency is supposed to be a prerequisite for growth. The liberalization policy created a technological paradigm shift in various forms which encouraged competition in a number of ways like increased import and entry of new firms etc. After liberalization, firms are putting in particular efforts to acquire technological capabilities through rigorous investments in various sources of technology such as in-house R&D, import of capital goods, import of designs, drawings and blueprints, and import of raw materials. Given the newly industrialized and globalized economy and increasing emphasis on technology and in-house R&D in a developing country such as India, whether technical efficiency is related to firms’ decision on environmental certification remains an empirical question in manufacturing firms in India.

Based on the discussion above, this study looks at the determinants of technical efficiency including regulations in terms of ISO certification, for the Indian manufacturing firms. The ISO certification is defined in terms of the ISO-14,001 families of certification that is energy saving technologies through the clean development mechanism (CDM) in India. The reminder of the paper is as follows. The next section of the paper discusses the review of literature, section three describes the methodology and definition of variables, section four describes the results and final section concludes with a discussion.

2 Related Literature

Marcus (1988) studied the effect of regulation, on social innovation in the nuclear power industry. Marcus finds that flexibility helps promote social innovation. Through examining the safety regulations implemented by the Nuclear Regulatory Commission (NRC) following the 1979, Three Mile Island accident, he finds that regulations affected plants differently depending upon their prior safety records. By regressing human error events on the compliance implementation strategy undertaken by each plant, Marcus finds that poor safety records resulted in less flexible regulation, which restricted plants’ implementation choices, and this in fact perpetuated poor safety performance in future. On the other hand, a good safety record allowed for a “zone of discretion” in implementation, which resulted in continued strong safety performance. Marcus goes on to note, “if poor performers are given more autonomy, their safety record is likely to improve”.

In understanding the impact of Natural Gas Policy Act of 1978, Sickes and Streitweiser (1991)) use statistical analysis which altered existing well-head price controls such that gas prices could rise more rapidly to curtail shortages during the 1973 oil price shock. They found both technical efficiency and the productivity of gas transmission firms fell over the period 1977–1985, which is indicative of flagging innovative activity. They attribute these results to a lack of flexibility in economic regulations that “could neither anticipate changing market conditions nor rapidly adjust to those changes”.

To understand the relationship between stringency of environmental regulations and innovation in the USA manufacturing industries, Jaffe and Palmer (1996) uses regression analysis and found the results to be mixed. The result confirmed no relationship between environmental compliance costs and patent counts while a significant relationship between compliance costs and R&D expenditures was found in their analysis. Furthermore, the authors cannot distinguish whether the increase in R&D activity is an indicator of market innovation or social innovation-they are unable to discern whether the regulation has caused firms to “wake up and think in new and creative ways about their products and processes,” or whether firms are increasing R&D to comply with regulation at the expense other, potentially more profitable R&D investments.

The study by Lyon (1996) focused on the compliance uncertainty caused by economic regulation has a negative impact on market innovation. Lyon examined the regulatory “hindsight reviews” that were adopted by regulators in the 1980s in response to a series of poor investments made by electric utilities. Hindsight reviews assess whether a utility’s investment was “used and useful” and is a cost-effective source of power, from which the regulator determines whether the utility’s investment should be disallowed. Lyon performed simulation, using data from coal-burning steam plants and concluded that “hindsight reviews” can cause a utility to forgo investing in risky innovation and instead utilize more costly conventional technologies. Furthermore, utilities may cease making technological investments at all and instead switch to purchasing power from third-party producers.

Pickman (1998) performs a test similar to that of Jaffe and Palmer (1996) and finds that social regulation causes firms to change the direction of innovation, from market innovation to social innovation. Pickman employs more complex regression analysis and limits innovation proxy to environmental patents thus she focuses exclusively on “environmental innovation”. Pickman finds a statistically significant positive relationship between environmental compliance costs and environmental patenting, indicating that regulation does indeed spur environmental innovation. The findings may go some way toward answering the question posed by Jaffe and Palmer (1996) to comply with social regulation firms tend to divert R&D expenditures from market-oriented innovation to compliance-oriented social innovation.

Using cost data as a proxy for innovation, Bellas (1998) performs a regression analysis to examine whether the desulfurization (scrubbing) units utilized by coal power plants underwent technological improvement during the regulatory regimes specified by the environmental performance standards of the Clean Air Act and the Power-plant and Industrial Fuel Act of 1978 importantly, the stringency of Sulfur emissions regulation is subject to increase as soon as costs fall. Bellas finds little evidence that the cost of scrubber units fell since their introduction, indicating that there had been little technological progress. Importantly, Bellas observes that the market innovation of scrubbers is greater when power plants are subject to regulations that do not change in response to innovation, rather than moving-target regulations that increase in stringency as soon as costs fall.

Through regression analysis, Majumdar and Marcus (2001) find that incentives-based regulation of electric utilities leads to higher productivity “a proxy for market innovation” compared to command-and-control regulations. They analyze the time period around the 1990 Clean Air Act Amendments, which established the system of tradable permits for pollution control. Their productivity measure includes total sales and energy disposition as outputs, and total production, transmission, distribution, employees, and purchasing power as inputs. Their results show that the productivity of electric utilities was lower during the prior command-and-control regime. Additionally, their results indicate that regulations that are stringent but flexible in terms of the firm’s path to implementation are more effective at promoting market innovation.

Brunnermeier and Cohen (2003) examine the impact of environmental regulation on environmental innovation, but they include the degree of enforcement as an explanatory variable. They find a small but statistically significant effect of compliance costs on environmental innovation, as measured by environmental patent activity. They test enforcement’s effect on innovation using pollution inspection data and find no significant relationship between enforcement and innovation. Lange and Bellas (2005) apply the model of Bellas (1998) to the system of tradable permits established by the 1990 Clean Air Act Amendments and find more flexible incentives-based regulation to be somewhat more effective at inducing market innovation than the previous command-and-control regulatory regime. The amendments established a system of tradable permits for sulfur dioxide emissions. The authors’ results show a significant drop in the cost of scrubber units following the legislation, however, when they looked at the rate of change in costs over time, it was no different than the rate before the regulation. In other words, the tradable permit system induced a sudden flurry of innovation, but the innovation then subsided, occurring at a lower rate than it did prior to the system, offsetting the increased innovation from the sudden flurry. The authors suggest that market-based policies may be useful for inducing sudden breakthrough innovation, but less suited for stimulating incremental innovation over time, although they offer little explanation for this theory. Instead of cost data, Popp (Popp 2003) examines scrubber innovation using patent counts. Through estimating a regression model, Popp finds that, contrary to Lange and Bellas (2005), the level of market innovation decreased following the incentives-based social regulation of the 1990 Clean Air Act Amendments, but that social innovation increased.

Taylor et al. (2005) take a more qualitative look at the Clean Air Act’s effect on the market innovation of scrubber units. Using patent counts, R&D investment figures and expert interviews, they find that Government regulation precipitated by policy uncertainty can stimulate market innovation. And contrary to Popp (2003), they find that the incentive-based standards of 1990 did not lead to more innovation than the prior regime of performance standards. However, this does not refute incentives-based regimes in general, they argue; rather, the incentives system simply came too late in the maturation of scrubber technology to have an effect.

Huang and Liu (2005) examined the relationship between innovation capital and firm performance for top 1000 Taiwan firms using a multiple regression model. The authors included both R&D intensity and its squared term in their regression equation to examine the existence of nonlinear relationship between R&D investment and firm performance. Their analysis found that R&D intensity has a curvilinear inverted U-shape relationship with firm performance measured by return on assets as well as return on sales. Popp (2006) employs a regression model with patent data from the USA, Japan, and Germany to measure the impact of sulfur dioxide and nitrogen oxide emissions standards on pollution control innovations among electric utilities. He finds that more stringent USA emissions standards resulted in greater innovation in the United States but had no effect on innovation in Japan and Germany. Popp concludes that USA firms innovate in response to domestic regulations, but not foreign regulations. Furthermore, he finds that domestic firms innovate even for technologies that have already experienced significant innovative activity abroad, although his results also show that earlier foreign patents serve as an important building block for USA Nitrous Oxide emissions innovations.

Feng and Rong (2007) measured firms profitability and examine the association among firm’s profitability, innovation capacity and firm value (Tobin’s q) using a sample of 228 firms listed in Japanese electricity machinery industry from 2000 to 2005. They conducted a regression model based on fixed and random effects to investigate the association between Tobin’s q and the R&D expenditure along with firm efficiency and advertisement. Their findings reveals that R&D intensity is basically negative and significantly related to Tobin’s q whereas the cumulative R&D intensity (representing long run impact) is positive and significantly related to Tobin’s q. This suggests that R&D intensity is positively related to firm value in the long run but not in short run.

Johnstone et al. (2008) examined the effect of various economic regulations on the market innovation of renewable energy technologies in the OECD countries, and they find that the effect of different regulatory regimes varies across energy sources. Their regression models specify a relationship between renewable energy patent counts, as a proxy for innovation, and policy instruments, including public R&D support, investment incentives, tax incentives, voluntary programs, quantity obligations, and tradable permits. Regressing the patent counts for each renewable on an aggregate policy variable representing the effect of regulation in general, they find that, in general, economic regulation has a positive effect on the innovation of all energy sources. Regressing an aggregate patent count representing all renewable on each policy instrument, they find that only tax incentives, quantity obligations, and tradable certificates have a positive effect on renewable energy innovation overall. Then they regress each energy source on each policy instrument. These estimations show that investment incentives stimulate innovation on solar and waste-to-energy technologies, that tariff structures spur biomass energy innovation, and that production obligations (often linked to tradable certificates) support wind technology innovation. Only tax incentives stimulated innovation for a wide range of renewable energy sources.

From the review of literature it is evident that studies relating economic and environment regulations are well researched in the international context. The relationship is also quite clear that regulation helps firm to innovate, involve in research and development, and increases the efficiency at firm level. However, studies pertaining to Indian economy are scanty. With this motivation, this paper estimates technical efficiency in the first step and further, identifies the determinants of technical efficiency including various indicators related to ISO certification at the firm level.

3 Methodology

Technical efficiency is the effectiveness with which a given set of inputs is used to produce an output. A firm is said to be technically efficient if a firm is producing the maximum output from the minimum quantity of inputs, such as labour, capital and technology. For example, a firm would be technically inefficient, if a firm employed too many workers than was necessary or used outdated capital. In this paper, the concept of technical efficiency is related to productive efficiency. Productive efficiency is concerned with producing at the lowest point on the short run average cost curve. Thus, productive efficiency requires technical efficiency.

3.1 Measuring Technical Efficiency

To begin with, a stochastic frontier production function, that can be expressed as:

Where Y it is the output of the ith firm (i = 1,…, N) in period t = 1,…,T; f(X it , t; β) represents the production technology; X it is a (1 × K) vector of inputs and other factors influencing production associated with the ith firm in period t; β is a (K × 1) vector of unknown parameters to be estimated; vit is a vector of random errors that are assumed to be iid N(0,σ2 v); and uit is a vector of independently distributed and nonnegative random disturbances that are associated with output-oriented technical inefficiency. Specifically, uit measures the extent to which actual production falls short of maximum attainable output. If the firm is efficient, the actual output is equal to potential output.

Thus, \( {Y}_{it}-{Y}_{it}^{*}={u}_{it} \), where, uit = inefficiency. The technical efficiency of a producer at a certain point in time can be expressed as the ratio of actual output to the maximum potential output and the technical efficiency can be calculated as \( T{E}_{it}=\frac{Q_{it}}{f\left({X}_{it,}t;\beta \right){e}^{-{u}_{it}}}={e}^{-{u}_{it}} \).

The error term representing technical inefficiency is specified as:

Under this specification, inefficiencies in periods prior to T depend on the parameter, η. As t tends to T, uit approaches uΤ. Inefficiency prior to period T is the product of the terminal year’s inefficiency and exp. (−η(t-T)). If η is positive, then exp. (−η(t-T)) = exp. (η(t-T)) and it is always greater than 1 and increases with the distance of period t from the last period T. The positive value of η indicates inefficiencies fall overtime whereas, negative value of η indicates inefficiencies increase overtime.

The above model can be estimated by the maximum likelihood estimates. Restricting μ = 0 in the model, it reduces the model to the traditional half normal distribution. If μ is not restricted then μ follows truncated normal distribution. If η = 0, then technical efficiency is time-invariant i.e., firms never improve their efficiency. The value of γ = σ2 u/σ2 (where σ2 = σ2 u + σ2 v) will lie between 0 and 1. If uit equals zero (which indicates full technical efficiency) then γ equals zero and deviations from the frontier are entirely due to noise vit. If γ equals one all deviations from the frontier are due to technical inefficiency. Besides on the above rationality, a Cobb-Douglas specification of functional form is employed to specify the parameters of the model to estimate the efficiency since it is widely used in efficiency studies. The functional form, in present case is:

Where, Q = Output; C = Capital; L = Labour; M = Material; and E = Energy.

The parameters of the stochastic frontier model, defined in equation (3), is estimated using Frontier 4.1 computer program under the ‘production function’ option, developed by Coelli (1996). For estimating the productive efficiency and technical change specified above we have used data drawn from the Prowess database of the Center for Monitoring Indian Economy (CMIE) a corporate firm level industrial database for Indian economy. In this study, gross output at constant prices is used as a measure of real output. Prowess reports gross output data in value terms (Rs. in Million). Nominal values of gross output are deflated by the wholesale price indices for industrial goods. Wages and salaries of employees are considered for the labour input. Unlike other factors of production, capital is used beyond a single accounting period and measuring capital stock input is rather problematic. For capital stock we have followed, perpetual inventory method (PIM), as followed in Goldar et al. (2004) and many other studies on Indian manufacturing sector. Further, to understand the inter-firm difference of technical efficiency along with the ISO certifications and other firm’s characteristics, we estimate the following regression equation.

The description of the variables and definitions used in equation (4), are presented in Table 1. We have used firm level data from CMIE Prowess database from 2007 to 2012. The structure of data is unbalanced panel in nature with annual frequency.

4 Empirical Results

Table 2 presents the maximum likelihood estimates. The coefficients of σ2 and γ, are positive and statistically significant for all the cases. It reveals that estimated levels of all outputs considerably differ from their potential levels due to factors, which are within the control of firms. The estimated values of γ indicate the efficiency gap that existed between actual and potential level of performance which is mainly due to technical inefficient performance of firms. The statistically significant of coefficient μ term indicates it follows truncated normal distribution whereas the significant of η indicates that inefficiency of firms change over time. The negative of η in advances case indicates that inefficiency increase in producing advances overtime whereas, the positive value of η in other output cases indicates that inefficiencies decrease in production of outputs overtime.

The estimated technical efficiency are presented in Fig. 1. The estimated technical efficiency is cherecterised by firms wih higher and lower values of technical efficiency, however it should be noted that maximum firm lie around the average technical efficiency level. Further, mean technical efficiency is higher for the firms with ISO certification (ISO) compared to the firms with no certification (Non-ISO). This result not only holds true for the full sample, but also for the sub-samples for the years 2007, 2011 and 2012. For the Non-ISO firms, technical efficiency continued to increase for three years from 2007, and hereafter the estimated value for technical efficiency has declined. However, the estimated technical efficiency is steady for ISO firms during the study period. If we observe the minimum technical efficency of ISO and Non-ISO certified category, the technical efficicney of Non-ISO firms always lies above ISO firms. Similarly, for the maximum technical efficency the value of ISO firms always lies above the Non-ISO firms. Table 3 presents the time-variant average technical efficiency of the ISO and Non-ISO firms. The ISO firms achieved highest level of technical efficiency followed by the Non-ISO firms. The following observations can be derived from the Table 3. There are higher variations in terms of technical efficiency for Non-ISO firms than the ISO firms; the minimum value of technical efficiency for ISO certified firms lies above the Non-ISO certified firms; and firms that are ISO certificated exhibits similar of technical efficiency, whereas the distribution of Non-ISO firms in terms of technical efficiency has a wide range.

Further, we compare the technical efficiency and R&D intensity of firms for both the categories. From the tabulated result (presented in Table 4) we can see that on an average Non-ISO firms are technically less efficient than the ISO firms and ISO certified firms report higher R&D intensity and higher technical efficiency. The table on the mean difference between the technical efficiency and research and development intensity statistically establish that ISO firms are better off than that of Non-ISO firms. However, it should be noted that R&D intensity is down scaled by net sales. Table 5 reports for descriptive statistics of the sample. From the descriptive statistics, we can observe that higher standard deviation is found for the share of debt capital, profit margin and firm age. This indicated that inter-firm differences are higher for the indicators such as debt capital, profit and firm age. Other statistical indices of the sample are presented in Table 5 in detail.

Before estimating equation (4), we attempted to understand the correlation among the variables of interest. The result is reported in Table 6. From Table 6 we can observe that, R&D is positively related to firm age and negatively related to profit margin, firm size, share of debt capital of firm, and technical efficiency. Technical efficiency is positively related to profit margin, firm age, firm size and share of debt capital of firm. To check for the multicolinearity in the sample we have estimated the variance inflation factor (VIF) where the mean VIF of 3.89, suggests that the sample is not suffering from the multicolinearity problem. The review of the literature suggests that because of regulations in market there are several benefits on which a firm that operates in a domestic setup can be in an advantage position. This might increase productivity and efficiency in general at firm level. In addition, we also assume that regulated markets with policy as the instrument can also help firms in increasing the technical efficiency. Product or process, research or development through R&D expenditure for any given firm stimulates the capacity and hence the efficiency. The estimation of technical efficiency confirms that technical efficiency is different for firms classified as ISO categories. The ISO firms are technically efficient as compared to the Non-ISO firms however; dispersion in terms of the technical efficiency for ISO and Non-ISO is not homogenous. The sample consists of firms which are highly technically efficient in either of this group.

The determinants of technical efficiency are given in Table 7. The initial estimate is based on the OLS and OLS robust regression procedure. However, as the data is an unbalanced panel; we have also estimated using fixed and random effects models. The efficiency of the model is based on the Hausman statistics, and confirms that fixed effects model is efficient compared to the random effects estimates. Except model (M1) and (M2) other two models are the estimates with time and firm effects. As stated earlier, the objective of the paper is to find out the determinants of technical efficiency and relate it with ISO certification. In understanding the determinants of technical efficiency and ISO certification, we have used firm characteristics that include (1) profit margin, (2) share of debt capital, (3) export intensity, (4) R&D intensity, (5) firm size and (6) firm age. We have also used dummy variables capturing the foreign affiliation (MNE dummy), ISO certification dummy and interaction dummy between ISO certified firms and firms that are doing R&D.

The result indicates that debt capital is negatively related and statistically significant with technical efficiency, meaning firms with less debt capital are technically more efficient. Export intensity is positively related to technical efficiency. This result indicates that firms that are exporting more in proportion to their sales are also having higher technical efficiency. Higher expenses in research and development also make firms technical efficient. This result is confirmed with a positive and statically significant result of R&D intensity. A non-linear relationship is found between technical efficiency and firm size. The result suggests that technical efficiency and firm size are non-linearly related and they exhibit an inverted U shaped relation. This indicates that, medium sized firms are more technical efficient when compared to the small and large firms. Further, firm age is negatively related to technical efficiency, indicating younger firms are technical efficient as compared to the older firms. ISO certification has played a major indicator in determining technical efficiency. The result suggests that ISO certified firms are higher technically efficient compared to the Non-ISO firms. Further, we have tried to create an interaction dummy that captures ISO certification and involvement in R&D. The result of such an exercise indicates that firms that are ISO certified and doing R&D are technically efficient compared to the rest in the sample.

The empirical results presented above remains with a question of causality. The regression framework suggests that ISO certified firms report higher technical efficiency, whereas one may argue that the statistical association comes from selection effect, namely that more efficient firms apply for ISO standards. In practice, both effects are likely to appear simultaneously. Therefore, to identify the actual causal structure, the next step of robustness check deals with a propensity score matching technique. The propensity score is the probability of firms switching from remaining a Non-ISO to becoming an ISO certified conditional on relevant firm characteristics as discussed earlier. To compute the propensity score for each firm at each point in time, we first specify the propensity score function as:

Where Φ is the normal cumulative distribution function, ISO i,t is the certification dummy that is 1 if firm i have ISO certificate at period t. Combining the firms those have ISO certification in year 1, with those firms that do not have ISO certification at any point in the sample period, we estimated above equation where covariates x i,t include variables listed in equation (4).

The estimated propensity score function yields the propensity score \( {P}_{i,t}=\phi \left(\widehat{\gamma}{x}_{i,t}\right) \)of firm i at year t. For each ISO firm, we then search for a single Non-ISO counterpart based on the nearest-neighbour matching method with replacement. Denote by Ji the set of all Non-ISO categorized in the same industry as ISO i and by T the set of years contained in the sample period. Non-ISO j i , t ∈ J i at years i , t ∈ Tis matched with ISO firm i at year t if

Once we have assembled appropriate ISO and Non-ISO pairs, it is straightforward to estimate the effect of ISO certification. What we are interested in here is the average effect of the treatment on the treated (ATT). Conceptually, ATT compares the average technical efficiency among ISO with what the average would have been had these same firms remained Non-ISO. To this end, we substitute the matched Non-ISO for each ISO firm’s unobservable counterfactual. The estimation is carried out for the full sample as well for the sub-sample characterized with the multinational affiliation.

The results of the propensity score matching is presented in Table 8. First, considering the full sample, a considerable improvement is observed in the technical efficiency of firms with ISO certification. Table 8 shows that ISO certified firms achieve a 17 % increase in technical efficiency. The results are statistically significant at the 1 % level. Moreover, the effects ISO certification identified here are stronger than those reported in Table 7. This indicates that the fixed effects estimated, which are confounded by the endogenous ISO certification decision, underestimate the causal effect of certification on technical efficiency. We therefore conclude that, at least on average, ISO certification does improve technical efficiency at the firm level. As is clear from the same table, however, the estimated effects vary quantitatively across sub-sample classified based on the multinational affiliation. For the domestic firms, the improvement on technical efficiency is 11 % compared to 42 % for the multinational affiliated firms. Therefore, we conclude that foreign affiliated firms attain higher technical efficiency after ISO certification, compared to the domestic firms. This might be due to the fact that multinational affiliated firms already have the advantage in knowledge spillover from the association with the foreign firms hence; the impact is relatively higher compared to the domestic firms.

5 Conclusion

The objective of this research is to check the relationship between ISO certifications on technical efficiency for a sample of manufacturing firms in India. We have used firm level data from CMIE Prowess database from 2007 to 2012. First, we have estimated the technical efficiency and analysed the determinants of technical efficiency using firm characteristics. From the descriptive analysis it is clear that except for some years, the mean technical efficiency is higher for the ISO certified firms. Yearly technical efficiency at minimum is always less for the ISO certified firms and yearly technical efficiency at maximum is always higher for the ISO certified firms. Therefore, the conclusion from this analysis suggests that ISO-Certified firms show higher variability in technical efficiency, with a minimum that is consistently lower than the minimum for Non-ISO firms every year. However, the comparison of the mean test clearly shows a difference in technical efficiency between the groups with significant at 10 % level. In addition to the technical efficiency; the mean difference between the R&D intensity of both the groups are also statistically different. Therefore, we conclude that firms classified based on the ISO certification differs not only in technical efficiency but also in R&D intensity. In this case, ISO certified firms have both higher technical efficiency and R&D intensity. However, the results obtained from the t-test are not comparable between the groups. Further, the regression estimation in finding out the determinants of technical efficiency confirms that R&D intensity is positively related to technical efficiency. Similarly the interaction variable that captures the participation in R&D and ISO certification has a positive and significant coefficient. This result confirms that firms that are ISO certified and participating in R&D have higher technical efficiency.

We conclude from the study that there are inter-firm differences in technical efficiency and they are systematically different based on firm age, firm size, debt capital, MNE affiliation, and ISO certification. Specifically, meeting the requirements of ISO certification has helped firms to achieve higher technical efficiency. Therefore, ISO certification has become an important factor in making the firms improve their technical efficiency. In addition, the result of this study also confirms that firms that are ISO certified and doing R&D are better off in technical efficiency when compared to others. Hence, ISO certification, especially because of the conditionalities attached to maintaining the standards, appears to positively enhance the efficiency of firms in the manufacturing sector of India which is also confirmed by the propensity score matching results.

The policy implications of the papers are as follows. Firms should be encouraged to involve in research and development which will lead firms in obtaining ISO certification. Innovation through research and development will also help firms in obtaining higher technical efficiency. This paper clearly establishes that firms with ISO-14,001 certification and those are affiliated to multinationals are technical efficient. Therefore, affiliation with foreign firms might help in technology transfer and obtain the certification. Therefore, in the era of increasing concerns of negative externalities of industrial production and inefficiencies at firm level these certification coupled with research and development activities, will not only help in better environmental management and designing environmentally friendly products but also increase the technical efficiency at firm level.

Notes

According to the Porter hypothesis, strict environmental regulations can induce efficiency and encourage innovations that help improve commercial competitiveness. The hypothesis was formulated by Michael Porter in 1995. The hypothesis suggests that strict environmental regulation triggers the discovery and introduction of cleaner technologies and environmental improvements, the innovation effect, making production processes and products more efficient. The cost savings that can be achieved are sufficient to overcompensate for both the compliance costs directly attributed to new regulations and the innovation costs. In the first mover advantage, a company is able to exploit innovation by learning curve effects or patenting and attains a dominating competitive position compared to companies in countries where environmental regulations were enforced much later.

According to Jaffe et al. (2002), “A firm can innovate without ever inventing, if it identifies a previously existing technical idea that was never commercialized, and brings a product or process based on that idea to the market”.

References

Ashford AA, Heaton GR (1981) Regulation and technological innovation in the chemical industry. Law Contemp Probl 46(3):109–157

Bellas AS (1998) Empirical evidence of advances in Scrubber Technology. Resour Energy 20(4):327–343

Brunnermeier SB, Cohen MA (2003) Determinants of Environmental innovation in US Manufacturing Industries. J Environ Econ Manag 45(2):278–293

Coelli TJ (1996) A guide to frontier version 4.1: a computer program for stochastic frontier production and cost function estimation. Working paper no. 07. C, University of New England, Armidale, Australia

Feng H, Rong C (2007) Innovation, firm efficiency and firm value: firm level evidence in Japanese Electricity machinery industry. In: Wireless Communications, Networking and Mobile Computing, international conference on Sept. 21–25, pp. 4217–4220

Goldar BN, Renganathan VS, Banga R (2004) Ownership and efficiency in engineering firms: 1990–91 to 1999–2000. Econ Polit Wkly 39(5):441–447

Huang CJ, Liu CJ (2005) Exploration for the relationship between innovation, IT and performance. J Intellect Cap 6(2):136–159

Jaffe AB, Palmer K (1996) Environmental Regulation and Innovation: A Panel Data Study. In: Working Paper. National Bureau of Economic Research, Cambridge

Jaffe AB, Newell RG, Stavins RN (2002). Environmental policy and technological change. Environ Resour EconI, Vol. 22(1–2), pp. 41–69

Johnstone N, Hascic I, Popp D (2008) Renewable energy policies and technological innovation: evidence based on patent counts. In: Working paper. National Bureau of Economic Research, Cambridge

Lange I, Bellas A (2005) Technological change for sulfur dioxide scrubbers under market-based regulation. Land Econ 81(4):546–556

Lyon TP (1996) Regulatory hindsight review and innovation by electric utilities. J Regul Econ 7(3):233–254

Majumdar SK, Marcus AA (2001) Rules versus discretion: the productivity of flexible regulation. Acad Manag J 44(1):170–179

Marcus AA (1988) Implementing induced innovations: a comparison of rule-bound and autonomous approaches. Acad Manag J 31(2):235–256

Pickman HA (1998) The effect of Environmental regulation on Environmental innovation. Bus Strateg Environ 7(4):223–233

Point of view: National Manufacturing Policy, (2012) https://www.pwc.in/en_IN/in/assets/pdfs/industries/industrial-manufacturing/national-manufacturing-policy-pov.pdf

Popp D (2003) Pollution control innovations and the Clean Air Act of 1990. Journal of Policy Analysis And Management 22(4):641–660

Popp D (2006) International innovation and diffusion of air pollution control technologies: the effects of NOx and SO2 regulation in the US, Japan, and Germany. J Environ Econ Manag 51(1):46–71

Schumpeter J (1942) Capitalism, Socialism and Democracy. Harper, New York

Sickes RC, Streitweiser ML (1991) Technical inefficiency and productive decline in the U.S. interstate natural gas pipeline industry under the natural gas policy act, Discussion Paper

Taylor MR, Rubin ES, Hounshell DA (2005) Control of SO2 emissions from power plants: a case of induced technological innovation in the U.S. Technol Forecast Soc Chang 72(6):697–718

Whitelaw, K (2004) ISO 14001 Environmental systems handbook. Second edition, Elsevier Butterworth-Heinemann, Linacre House, Jordan Hill, Oxford OX2 8DP, 30 Corporate Drive, Burlington, MA 01803, ISBN 0 7506 4843 0

Acknowledgments

We are grateful to Prof. N. S. Siddharthan, Prof. Bino Paul and Prof. B. N. Goldar for their comments and suggestions during the Ninth Annual Conference of Knowledge Forum organized at NIAS Bangalore during October 27-29, 2014. Thanks are due, to the participants of the conference for the insightful discussions during the conference. We are also thankful to the anonymous reviewers for the comments and suggestions in the earlier draft of the paper.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Sahu, S.K., Narayanan, K. Environmental Certification and Technical Efficiency: A Study of Manufacturing Firms in India. J Ind Compet Trade 16, 191–207 (2016). https://doi.org/10.1007/s10842-015-0213-9

Received:

Revised:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10842-015-0213-9