Abstract

Many scholars have empirically tested the influence of geopolitical risk on economic activities and financial indicators. This paper attracts a new research strand by investigating the geopolitical risk determinants. More precisely, we examine if the international geopolitical risk of a selected group of countries spills over to Russia. Alternatively, it inspects if the geopolitical tension among nations is cointegrated. This group of countries includes the United States, Germany, China, and Ukraine. The current paper designed and computed an empirical model using the Autoregressive Distributed Lag model (ARDL) during the period 1993:01–2022:05. The results reveal that the international geopolitical risk of Russia is cointegrated with the other four nations. In the short run, the international geopolitical risk of the four nations spills over to Russia by increasing its international geopolitical risk. While in the long run, the same impacts persist. But the effect of the United States' geopolitical risk becomes statistically insignificant. The results also show that Germany has the largest effect on Russia’s geopolitical risk in the long run. Moreover, the increase in oil prices overflows Russia by decreasing its international geopolitical risk. Thus, rival nations should reach a settlement to reduce the geopolitical tension. Otherwise, the world economic performance will deteriorate.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

Recently, a new strand of research has been evolving about geopolitical risk. This new trend of empirical works concentrates on exploring the effects of geopolitical risk on various economic sectors and financial indicators. A sample of these recent empirical studies includes oil price volatility (Qian et al., 2022), economic fluctuations (Akadiri et al., 2020), renewable energy sector (Sweidan, 2021a), environmental degradation (Riti et al., 2022), tourism sector (Hailemariam & Ivanovski, 2021), the stock market (Abbass et al., 2022), natural resources rents (Sweidan & Elbargathi, 2022), bank stability (Phan et al., 2022), government investment (Bilgin et al., 2020), and Trade flows (Gupta et al., 2019) commodity markets (Gong & Xu, 2022). Various empirical studies proved that geopolitical risk significantly influences the economy. It does not always have unfavorable effects. However, it encourages some economic sectors, such as renewable energy, and causes significant energy returns for oil-exporting countries.

In a seminal work, Caldara and Iacoviello, (2022, 1197) defined geopolitical risk as “the threat, realization, and escalation of adverse events associated with wars, terrorism, and any tensions among states and political actors that affect the peaceful course of international relations.” It presents geopolitical risk as an international institutional ambiguity arising from wars or tensions, including severe economic conflicts. This uncertainty among nations reduces all aspects of economic activities, i.e., trade, consumption, and investment, and restraints the economic policies’ effectiveness (Bhattarai et al., 2020; Choi, 2018; Stockhammar & Osterholm, 2016; Baker et al., 2016). Within their work, Caldara and Iacoviello (2022) constructed the international geopolitical index for the world and 43 countries.

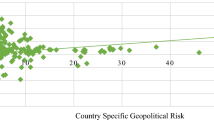

Recently, some studies examined the determinants of geopolitical risk. Sweidan (2022) explored the influence of the United States macroeconomic variables on the international geopolitical risk. His results confirmed that this impact is statistically significant. Similarly, Lee (2022) investigated the relationships among oil shocks, geopolitical uncertainties, and green bond returns. He concluded that an unexpected positive adjustment in oil prices increases geopolitical risks. Faruk et al. (2022) tested the cross-countries pairwise transmission of international geopolitical risk. They used a sample of 19 countries covers the period 1985:01 to 2016:12 and utilized the spillover model of Diebold and Yilmaz (2012). Their results illustrate a considerable amount of pairwise geopolitical transmission across their sample countries. The spillover can be justified by bilateral trade, geographical closeness, debt burdens, fiscal imbalance, geographical sizes, and economic size.

The international geopolitical risk is fluctuating sharply among nations and geographical areas. The best example is to explore that for Russia. This paper explores this new strand of research within the geopolitical risk area. We aim to investigate if the geopolitical tension among nations is cointegrated or spillover to another country. Precisely, we focus on the overflow of the international geopolitical risk from a group of countries to Russia. Figure 1 presents Russia’s international geopolitical risk during the period 1993:01–2022: 05. It displays permanent fluctuations with spikes during some periods, mainly starting from 2014 to beyond. Russia went through many regional conflicts and clashes, mainly after dissolving the former Soviet Union. These events justify the spikes in the international geopolitical risk index. Below are the most important wars and conflicts from 1993 to 2022. Russia contributed directly to these geopolitical events. During 1990–1992, an armed conflict broke out in Transnistria/Moldova. In 1992–1993, the Abkhazian war in Georgia. The first and second Russian-Chechen wars were between 1994 and 1996 and 1999–2009. In 2008, the Russian-Georgian war started for around two weeks. In 2014, Russia annexed the Crimean Peninsula from Ukraine, and after that, many conflicts and clashes arose in eastern Ukraine. During 2015–2022, Russia started its military operations in Syria. Finally, on February 24, 2022, Russia officially attacked Ukraine.

A cointegration relationship among a group of series implies that they are combined in the long run. If they depart from each other in the short run, they will return to the long-term trend. Technically, it means that the geopolitical risk in one country can explain the movement of the geopolitical risk in another country. Our paper contributes to the literature by understanding in-depth how geopolitical risk among nations reacts to each other. Besides, it helps various stakeholders, i.e., government, firms, and investors, to adopt national security policies and risk management strategies. Based on our knowledge, literature lacks such a vital study. Contrary to the work of Faruk et al. (2022), we use the Autoregressive Distributed Lag (ARDL) approach to cointegration analysis and concentrate on Russia. The rest of the paper is structured as follows in “Literature review and theoretical framework” section introduces a related literature review and the paper’s theoretical context. In “Data and methodology” section submits the data and methodology of the paper. In “Results” section reveals the empirical results and analysis. Conclusions and policy implications are offered in “Conclusions and policy implication” section.

Literature review and theoretical framework

After the collapse of the former Soviet Union in 1991, many American politicians believed that it was time to support Russia in throwing the communist ideology and joining the Western countries. Thus, the U.S. sent economic and political advisers to work with the Russians to promote democracy, freedom, and the free-market philosophy. However, it turned out that the history of Russia established a unique and exclusive thought about its role in the world and managing the economy. Russia believes that it still has the right to affect the post-Soviet states, meaning that Russians do not desire to be part of the North Atlantic Treaty Organization (NATO) or the European Union (EU). Alternatively, Russians believed that the border of its security line does not include the borders of the Russian Federation but also the borders of the former Soviet Union. Thus, the U.S. and the Western countries denied Russia’s legitimate desires. They requested that Russia respect the neighboring countries’ rights. Polak and Polakova (2022) highlighted that Russians are sensitive to their security, and thus they maintain a zone of influence around themselves. By that, they hold a degree of control over neighboring countries. Undoubtedly, these political disagreements boosted the political tension between Russia and the Western countries. Simultaneously, we cannot ignore that the world is witnessing fierce rivalries between the West and the East regarding economic interests and ideologies (Sweidan, 2021b).

In 1991, Ukraine declared its independence. Ninety-two percent of voters supported this action in a referendum, and the Western countries encouraged too. In 1994, Under the Budapest Memorandum, Ukraine delivered its nuclear arsenal to Russia in exchange for an obligation to respect its independence, sovereignty, and borders. Then, in 2014, a protest was waged in Ukraine against President Viktor Yanukovych, an ally of Russia, and thus Moscow lost its close friend in Ukraine. The protestors chanted for more alignment with the Western countries. After that, Russia, Ukraine, Germany, and France, signed an agreement to reduce the tension between the two countries known as the Minsk Accords. This series of events tells that the independence of Ukraine created a severe threat to Russia and thus the geopolitical risk between Russia and the Western countries increased. This threat was enlarged when the Ukrainian government expressed interest in joining the North Atlantic Treaty Organization (NATO). Thus, the announced reason for invasion Ukraine was to depose the Ukrainian government and end for good its desire to join NATO.

On the economic side, Russia plays a significant role in the international oil and gas market. It controls around 19.9% and 6.2% of the world’s proven natural gas and oil reserves, respectively (British Petroleum, 2021). It is well-known that Russia is the major oil and gas exporter to the EU. Around half of the Russian natural gas to the EU is carried via pipelines passing through Ukraine. In 2006 and 2009, there was a crisis between the two countries because of a price dispute. It led to temporary interruptions in the gas flow to the EU (Erşen & Çelikpala, 2019). The invasion of Ukraine deepens the crisis between Russia and the Western countries. Thus, Russia and the EU’s long interdependence on one another for gas and oil has become a critical bargaining debate on both sides. All these events increase the geopolitical tension between Russia and Western countries. In contrast, Russia has close economic and political relationship with China. Russia is a primary oil exporter to China.

Thus, the current paper assumes that the international geopolitical risk in Russia \(\left( {GRU_{t} } \right)\) relies on the international geopolitical risk of major international powers in the global scene that directly have economic and political links with Russia. This includes the geopolitical risk of Ukraine \(\left( {GUK_{t} } \right)\), Germany \(\left( {GGR_{t} } \right)\), the United States \(\left( {GUS_{t} } \right)\), and China \(\left( {GCH_{t} } \right)\), in addition to the oil prices \(\left( {OP_{t} } \right)\). Hence, the general functional form of the current paper’s empirical model is as follows:

Data and methodology

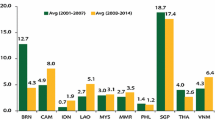

Our data is extracted from Caldara and Iacoviello, (2022). It covers the period from January 1993 to May 2022, and thus we have 353 observations. The six variables are transformed by using the natural logarithm. Figure 2 shows that the five countries normalized international geopolitical risk fluctuated sharply. Moreover, Table 1 illustrates our data descriptive statistics and correlation coefficients. The independent variables’ correlation coefficients are within the acceptable scope. Hence, our data sample does not have the warning sign of multicollinearity. Equation (1) can be written in a linear regression form as follows:

where \(\rho_{0}\) to \(\rho_{5}\) are the model parameters, and \(v_{t}\) is the white noise error term.

Our paper employs the ARDL approach to cointegration analysis to estimate Eq. (2) parameters. It is a well-known time series methodology developed by Pesaran et al. (2001). It explores the existence of a long-run relationship among the models’ variables. If it exists, the econometric software will estimate short-run and long-run parameters, and the error correction term \(\left( {ECM_{t} } \right).\) \(ECM_{t}\) measures the speed of adjustment toward the long-run equilibrium. These estimated parameters are the principal tool for analyzing the relationship among the variables. This approach can be applied to a group of variables regardless if they are integrated of order I (0) or I (1) or a combination. Thus, it is critical to inspect the stationarity of our data. The general functional formula of the ARDL (p, q) is as follows:

where \(L_{t}\) stands for the dependent variable, \(M_{t}\) represents a group of explanatory variables, \(\phi_{0}\) to \(\phi_{2}\) are the model’s coefficients, \(\varepsilon_{t}\) is the random disturbance. We can re-write Eq. (2) to match the shape of ARDL approach as shown in Eq. (3) and as follows:

where the mathematical symbol \(\Delta\) stands for the first difference process. The coefficients \(\alpha_{1}\) to \(\alpha_{6} { }\) are the short-run parameters, while the coefficients \(\beta_{2}\) to \(\beta_{6}\) are the long-run parameters after normalizing them by \(\beta_{1}\). This paper set a maximum of 8 lags and allowed the automatic selection option to select the optimum lags that minimize the Akaike information criterion (AIC). This step was accompanied by estimating diagnostic and stability tests to assure robust results.

This approach uses two techniques to test if a long-run relationship exists among the series. First, it calculates and contrasts with the upper and lower critical F-values of Pesaran et al. (2001). If the F-statistic exceeds the upper bound critical values, the null hypothesis of no cointegration can be rejected, and the long-run relationship exists. However, if the F-statistic falls behind the lower bound critical values, the null hypothesis cannot be rejected, and the long-run relationship is invalid. The conclusion will be uncertain if it is in between the range. In special cases, if all the series are I (1), the upper critical bounds are the criteria. Likewise, if all the variables are I (0), the lower critical bounds are the standards. Second, the \(ECM_{t }\) is computed and replaced the long-run series in Eq. (4). The long-run relationship is valid if the computed coefficient is statistically significant, negative, and less than one.

Results

As stated above, inspecting the stationarity of our data is a crucial step to guarantee that our data meets the ARDL approach condition. We computed three-unit root tests: the Augmented Dickey-Fuller (1981) (ADF), Phillips-Perron (1988) (PP), and Elliott-Rothenberg-Stock (1996) (ERS). They have the same null hypothesis: the series has a unit root. The results are reported in Table 2, which illustrates that the three tests can reject the null hypothesis for all five international geopolitical risk series. It means that they are stationary at the level. However, for the oil price, only one test (ERS) reveals that it is stationary at the level. Meanwhile, the three-unit root tests confirmed that it is stationary at the first difference. Therefore, our data meets the ARDL approach condition, and we can proceed to estimate our model’s parameters.

Table 3 introduces the ARDL cointegration test. The estimated F-test statistic (4.792) exceeds the upper critical values of Pesaran et al., (2001) and Narayan (2005). All the critical values are reported under Table 3. Hence, the null hypothesis of no cointegration is rejected. Moreover, Table 4 shows that the \(ECM_{t}\) is statistically significant, negative, and less than one. These results approve the existence of a long-run association among the paper’s series over the period 1993: 01–2022: 05. Moreover, the diagnostic and stability tests examined the error terms normality, autocorrelation, white heteroscedasticity, autoregressive conditional heteroscedasticity, the model’s functional form, and the parameters’ stability. The stability test outcomes are presented in Fig. 3, while that of the diagnostic tests are reported in panel C of Table 4. All tests confirm that our ARDL model satisfies the assumptions of the classical linear regression.

In the short run, the results show that the effect of the international geopolitical risk of the four countries, Ukraine, Germany, the United States, and China, on that of Russia is statistically significant and positive. However, the influence turned out to be negative for the late lags (4 and 6) of the United States and China's international geopolitical risk. This sign flip because the behavior in the short-run transfers new information on the nature of the relationship. More procedures, information, and compromise among the nations mitigate the risk. Meanwhile, the impact of oil prices on Russia’s international geopolitical risk is statistically significant and negative. This result is expected because oil and gas are primary source of revenue for the Russian economy; an increase in oil prices helps the Russian’s government achieve its intended plans and reduces the tension. Additionally, Table 5 introduces the Wald test of the joint short-run dynamic coefficient for three explanatory variables reported in Table 3 (the international geopolitical risk of Ukraine, the United States, and China). The null hypothesis presumes that the joint short-run dynamic parameters are equal to zero, i.e.,\(\mathop \sum \limits_{j = 1}^{N} \alpha_{t - j} = 0\). The null hypothesis can be rejected based on the Wald test results. Thus, The international geopolitical risk of Ukraine, the United States, and China Granger cause Russia’s international geopolitical risk in the short run. Recall that the short run coefficient of Germany (0.209) is statistically significant at 1% level. Likewise, the international geopolitical risk of Germany Granger cause Russia’s international geopolitical risk too.

These behavioral impacts proceed in the long run with a minor change. The effect of the United States geopolitical risk became statistically insignificant. It means that Russia is more sensitive to the geopolitical risk within its region, where its primary economic transactions and strategic decisions. Since we use the same scaled variables, then we can compare the spillover effect of the different nations on Russia’s geopolitical risk. It is obvious that this effect is heterogenous and the size differs from one country to another. The long-run coefficients in Table 4 reveal that Germany has the largest effect (0.307) on Russia’s geopolitical risk, then China (0.223), and finally Ukraine (0.155). Additionally, the past years’ errors are amended in the current period with a modest speed reaching 32 percent. Moreover, the statistically significant negative coefficient of \(ECM_{t}\) confirms the presence of a long-run Granger causality from the explanatory variables to Russia’s geopolitical risk.

All in all, our paper provides evidence that the international geopolitical risk among nations is moving together. Therefore, the international geopolitical risk of Russia can be explained by that of Ukraine, Germany, China, and the United States. The justification for this outcome is that we live in a globalized world with highly interconnected economic transactions and interests.

Conclusions and policy implication

Lately, many scholars empirically inspected the impact of geopolitical risk on various economic series and financial variables. It is encouraged by the geopolitical risk index produced by Caldara and Iacoviello (2022) and their earlier versions. Our paper attracts new research by examining the geopolitical risk determinants. Unambiguously, we explore if the international geopolitical risk of a selected group of countries spills over to Russia. Alternatively, we test if the international geopolitical risk of Russia cointegrated with that of a group of countries. Up to our knowledge, literature lacks such a critical study.

The findings show that the international geopolitical risk of Ukraine, Germany, the United States, and China spills over to Russia by increasing its international geopolitical risk. However, the increase in oil prices overflows Russia by decreasing its international geopolitical risk. This conclusion tells that the various determinants of geopolitical risk can easily and quickly move from one country to another. We cannot neglect the fierce rivalry between the West and East regarding economic performance and ideologies. The world is deeply interconnected, and any severe shock to any part will overflow to the remaining parts in terms of inflation and economic recession. The best example is the latest severe negative consequences of the invasion of Ukraine and the global supply chain on the global economy. Thus, our paper calls world nations to coordinate and cooperate to resolve economic and political malfunctions. Unquestionably, international polarization and increasing geopolitical tension among nations will worsen international economic development.

References

Abbass, K., Sharif, A., Song, H., Ali, M. T., Khan, F., & Amin, N. (2022). Do geopolitical oil price risk, global macroeconomic fundamentals relate Islamic and conventional stock market? empirical evidence from QARDL approach. Resources Policy, 77, 102730. https://doi.org/10.1016/j.resourpol.2022.102730

Akadiri, S., Eluwole, K. K., Akadiri, A. C., & Avci, T. (2020). Does causality between geopolitical risk, tourism and economic growth matter? evidence from Turkey. Journal of Hospitality and Tourism Management, 43, 273–277. https://doi.org/10.1016/j.jhtm.2019.09.002

Baker, S. R., Bloom, N., & Davis, S. J. (2016). Measuring economic policy uncertainty. The Quarterly Journal of Economics, 131(4), 1593–1636. https://doi.org/10.1093/qje/qjw024

Bhattarai, S., Chatterjee, A., & Park, W. Y. (2020). Global spillover effects of US uncertainty. Journal of Monetary Economics, 114, 71–89. https://doi.org/10.1016/j.jmoneco.2019.05.008

Bilgin, M. H., Gozgor, G., & Karabulut, G. (2020). How do geopolitical risks affect government investment? an empirical investigation. Defence and Peace Economics, 31(5), 550–564. https://doi.org/10.1080/10242694.2018.1513620

Caldara, D., & Iacoviello, M. (2022). Measuring geopolitical risk. American Economic Review, 112(4), 1194–1225. https://doi.org/10.1257/aer.20191823

Choi, S. (2018). The impact of us financial uncertainty shocks on emerging market economies: An international credit channel. Open Economies Review, 29(1), 89–118. https://doi.org/10.1007/s11079-017-9471-y

Dickey, D. A., & Fuller, W. A. (1981). Likelihood ratio statistics for autoregressive time series with a unit root. Econometrica, 49, 1057–1072. https://doi.org/10.2307/1912517

Diebold, F. X., & Yilmaz, K. (2012). Better to give than to receive: Predictive directional measurement of volatility spillovers. International Journal of Forecasting, 28(1), 57–66. https://doi.org/10.1016/j.ijforecast.2011.02.006

Elliott, G., Rothenberg, T. J., & Stock, J. H. (1996). Efficient tests for an autoregressive unit root. Econometrica, 64(4), 813–836.

Erşen, E., & Çelikpala, M. (2019). Turkey and the changing energy geopolitics of Eurasia. Energy Policy, 128, 584–592. https://doi.org/10.1016/j.enpol.2019.01.036

Faruk, B., Balli, H. O., Mudassar, H., & Gregory-Allen, R. (2022). Geopolitical risk spillovers and its determinants. The Annals of Regional Science, 68(2), 463–500. https://doi.org/10.1007/s00168-021-01081-y

Gong, X., & Xu, H. (2022). Geopolitical risk and dynamic connectedness between commodity markets. Energy Economics, 110, 106028. https://doi.org/10.1016/j.eneco.2022.106028

Gupta, R., Gozgor, G., Kaya, H., & Demir, E. (2019). Effects of geopolitical risks on trade flows: Evidence from the gravity model. Eurasian Economic Review, 9, 515–530. https://doi.org/10.1007/s40822-018-0118-0

Hailemariam, A., & Ivanovski, K. (2021). The impact of geopolitical risk on tourism. Current Issues in Tourism, 24(22), 3134–3140. https://doi.org/10.1080/13683500.2021.1876644

Lee, C.-C., Tang, H., & Li, D. (2022). The roles of oil shocks and geopolitical uncertainties on China’s green bond returns. Economic Analysis and Policy, 74, 494–505. https://doi.org/10.1016/j.eap.2022.03.008

Narayan, P. K. (2005). The saving and investment nexus for China: Evidence from cointegration tests. Applied Economics, 17, 1979–1990. https://doi.org/10.1080/00036840500278103

Pesaran, M. H., Shin, Y., & Smith, R. J. (2001). Bounds testing approaches to the analysis of level relationships. Journal of Applied Econometrics, 16(3), 289–326. https://doi.org/10.1002/jae.616

British, Petroleum. (2021). BP Statistical review of the world energy. Edition 70, June.

Phan, D. H. B., Tran, V. T., & Iyke, B. N. (2022). Geopolitical risk and bank stability. Finance Research Letters, 46, 102453. https://doi.org/10.1016/j.frl.2021.102453

Phillips, P. C. B., & Perron, P. (1988). Testing for a unit root in time series regression. Biometrika, 75, 335–346. https://doi.org/10.2307/2336182

Polak, P., & Polakova, B. (2022). Changes in the EU’s geopolitical position and energy doctrine in light of the Ukraine invasion. Society, 59(3), 254–258. https://doi.org/10.1007/s12115-022-00700-4

Qian, L., Zeng, Q., & Li, T. (2022). Geopolitical risk and oil price volatility: Evidence from Markov-switching model. International Review of Economics and Finance, 81, 29–38. https://doi.org/10.1016/j.iref.2022.05.002

Riti, J. S., Shu, Y., & Riti, M.-K.J. (2022). Geopolitical risk and environmental degradation in BRICS: Aggregation bias and policy inference. Energy Policy, 166, 113010. https://doi.org/10.1016/j.enpol.2022.113010

Stockhammar, P., & Osterholm, P. (2016). The Impact of US uncertainty shocks on small open economies. Open Economies Review, 28(2), 1–22. https://doi.org/10.1007/s11079-016-9424-x

Sweidan, O. D. (2021a). The geopolitical risk effect on the US renewable energy deployment. Journal of Cleaner Production, 293, 126189. https://doi.org/10.1016/j.jclepro.2021.126189

Sweidan, O. D. (2021b). State capitalism and energy democracy. Geoforum, 125, 181–184. https://doi.org/10.1016/j.geoforum.2021.04.008

Sweidan, O. D. (2022). The effect of the US macroeconomic indicators on the international geopolitical risk. Defence and Peace Economics, Forthcoming. https://doi.org/10.1080/10242694.2022.2034103

Sweidan, O. D., & Elbargathi, K. (2022). The effect of oil rent on economic development in Saudi Arabia: Comparing the role of globalization and the international geopolitical risk. Resources Policy, 75, 102469. https://doi.org/10.1016/j.resourpol.2021.102469

Acknowledgements

The author would like to thank the editor and anonymous referee of GeoJournal for the valuable and helpful comments. The author is responsible for any remaining errors.

Funding

The author declare that no funds, grants, or other support were received during the preparation of this manuscript.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

The author does not have any conflict of interest.

Human and animals rights

No, it does not include Human Participants and/or Animals.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Sweidan, O.D. Geopolitical risk spillover among nations: evidence from Russia. GeoJournal 88, 3029–3037 (2023). https://doi.org/10.1007/s10708-022-10792-4

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10708-022-10792-4