Abstract

In the recent past, geopolitical tension has taken center stage in defining macroeconomic dynamics. Given that, this study examines the impact of geopolitical risk on economic growth for 41 countries from 2000 to 2020. Our panel estimations using the feasible generalized least square (FGLS) technique show that geopolitical risk positively and significantly impacts economic growth. The results are consistent even after addressing endogeneity concerns using system GMM and auto-correlated explanatory growth variables using the PCSE estimation. Our results indicate that a percent increase in geopolitical risk increases economic growth to 3.3%. For the cohort of advanced and emerging economies, our result shows that the advanced economies can better mitigate any geopolitical shocks and experience favorable growth rates. On the other hand, emerging economies posit a detrimental impact of geopolitical risk on their economic growth, thereby indicating an asymmetric effect between the two sets of economies. Further, macroeconomic conditions and institutional factors play a significant role in determining the impact of geopolitical risk on the economic growth of 41 countries. In the presence of institutional factors like democracy and economic freedom, the relationship between geopolitical risk and economic growth remains intact. In the context of geopolitical risk, these institutional factors stimulate economic growth.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

The economic consequences of conflict and peace are a century-old study. For instance, in the years following World War I and before World War II, prominent economists like Keynes (1919), Pigou (1940), Meade (1940), and Robbins (1942) tried to understand the relationship between war, peace, and the economy. Eventually, many studies discussed and pondered the impact of external and internal conflicts like war, coups, and terrorism on the economy (Collier and Sambanis 2003; Blomberg et al. 2004; Gaibulloe and Sandler 2009). However, the macroeconomic consequences of growing geopolitical tensions among nations have attracted less attention so far. How do the growing tensions among nations impact the overall growth rate of the economies? Does it have a different impact on emerging and advanced economies? We contribute to answering these questions by focusing on the growing geopolitical tensions and their consequences on economic growth.

Dijkink (2009) defines, geopolitics as a study of the effects of geographical factors on politics and international relations. However, in the current scenario, the usage of the term “geopolitics” has been more complex and perplexing. It now includes a spectrum of very limited to a broad concept of what “geography” really is and who “the key political players” are, i.e., the definition of geopolitics is not just concerned with “zero-sum” behavior and “geographical expansionism,” but the inclusion of statecraft and state assets (such as geographic, economic, military, demographic, environmental, and cultural factors) to gain influence in international affairs (Al-Rodhan 2009). The media defines “geopolitical tensions” as the consequence of international conflicts and violence (Rogers et al. 2013). In this view, Caldara and Iacoviello (2022) construct a geopolitical risk (GPR) index that describes the effects of international conflict and violence, actual or perceived. Accordingly, they define "geopolitical risk as the threat, realization, and escalation of adverse events associated with wars, terrorism, and any tensions among states and political factors that affect the peaceful course of international relations." We use this GPR index as a proxy for geopolitical tensions as our variable of interest.

Economic growth and GPR are deeply interconnected. For instance, a rise in GPR can encourage people to reduce their expenditures and increase their savings. Likewise, rising tensions within or outside the country's borders force investors to postpone their investment decisions (Bloom 2009). These economic uncertainties and tensions disrupt the supply chain, production, and other economic activities, resulting in fluctuations across business cycles.Footnote 1 GPR has increased substantially in recent years, negatively impacting the global economy. In fact, global evidence suggests that the increasing GPR adversely affects macroeconomic factors. Most countries, for example, are experiencing higher inflation, frequent stock market fluctuations, redirecting government expenditure, and regulating the outflow and inflow of foreign direct investments, highlighting the significant role GPR now appears to be playing in the standard macroeconomic framework (see Das et al. 2019; Tiwari et al. 2019; Cunado et al. 2020; Lee and Lee 2020; Wang et al. 2023a, b). Considering the important place that GPR now takes in any macroeconomic decision, the Bank of England has started considering GPR as part of what they call an "uncertainty trinity" that could significantly adversely affect economic activities (Carney 2016).

GPR can affect economic growth through a number of channels. First, increasing GPR limits investment and diverts foreign direct investment (Abadie and Gardeazabal 2003, 2008; Enders and Sandler 1996; Enders et al. 2006). Second, a heightened GPR leads to government expenditure on defensive actions. This increasing government expenditure on security may impede growth-promoting public and private investments (Blomberg et al. 2004; Gaibulloev and Sandler 2009). Public investments in the form of social overhead capital (e.g., canals, roads, and bridges) are particularly important in emerging economies for promoting economic growth. GPR can also affect growth by increasing the cost of doing business through wage increases, insurance premiums, and security costs. Reduced profitability due to these greater costs translates into lower returns on investment. Further, a conflict-torn developing country may see a decline in economic growth due to a reduction in aid because donor nations are concerned that aid would be used to finance military activities rather than alleviate poverty (Gaibulloev and Sandler 2009).

This study has three purposes. Firstly, we present panel estimates for a sample of 41 countriesFootnote 2 to quantify the impact of GPR on economic growth from 2000 to 2020. Second, these impacts are investigated for cohorts of advanced and emerging economies to determine if development can help a country absorb the effects of geopolitical uncertainty. Thirdly, we address the role of institutions like democracy and economic freedom on economic growth in the presence of GPR.

The contribution of this study is multi-folded. Firstly, we check the impact of GPR on economic growth. GPR data have been chiefly explored with stock market volatility, tourism, and trade (see Cunado et al. 2020; Lee and Lee 2020). Soybilgen et al. (2019) is the only work that ponders the effect of GPR on economic growth for 18 emerging countries from 1986 to 2016. We look at the same relationship in 41 countries from 2000 to 2020. Secondly, we explore this relationship in light of different institutional setups. As a proxy for institutional setup, we consider democracy and economic freedom. The premise we explore here is the impact of GPR on economic growth in a setup of a democratic and more economically free country. Democracy's impact on economic growth has attracted mixed reviews in the literature. For example, Sandler and Enders (2008) argue that a democratic country could withstand terrorist attacks more than any other form of government. Therefore, we propose that any additional geopolitical tension would be suppressed if the government is more liberal and democratic and has freedom of speech and media. Thirdly, considering that GPR and economic growth could exhibit different consequences, we empirically test the relationship between the cohort of advanced and emerging economies.

Our analysis strongly suggests that increasing GPR impacts economic growth. But the direction of this impact depends upon the economic condition of the countries. Advanced countries exhibit a positive and significant impact with increased geopolitical tensions, whereas, for emerging countries, this impact is detrimental. Our results also highlight that institutions like democracy and economic freedom stimulate economic growth in the presence of GPR.

The remainder of the paper contains seven main sections. Section 2 presents motivation and a related literature review. Section 3 presents the overview of the GPR index; Section 4 describes the dataset. Section 5 presents the empirical methodology. Sections 6 and 7 discuss the empirical and robust results, respectively. Concluding remarks are presented in Sect. 8.

2 Motivation and literature review

Because the GPR is a conglomeration of internal and external conflicts like terror, war, and coup that jeopardize the peaceful development of international relations, we try to map the relationship between these conflicts on economic growth. Literature related to this domain has indicated a negative relationship between political instability, terrorism, war, coups, revolution, and economic activity.Footnote 3 Hence, the growing GPR may also negatively impact economic activity, leading to diminishing economic growth. Indeed, Soybilgen et al. (2019) have proven a negative and significant impact of GPR on economic growth for 18 emerging countries from 1986 to 2016. Theoretically, GPR also alters the economy's demand and supply dynamics. On the supply side, GPR hampers human capital, affects trade, alters government expenditure, and impacts the global supply chain. On the demand side, the sentiment among investors and consumers is badly impacted, creating volatility in the financial market.

The influence of GPR extends to other non-economic variables that affect the flux of economic activities. For example, the influx of tourists in a country. Tourism is an important variable for growth as it boosts both aggregate demand and supply of the destination country. Studies have identified that a rise in GPR adversely impacts the demand for tourism (Ghosh 2022; Reivan-Ortiz et al. 2023). The heightened GPR also influences environmental degradation. For example, Uddin et al. (2023) have identified a positive relationship between CO2 emission and GPR for BRICS countries for the time period 1990 to 2018. However, in a time series analysis for India, Adebayo et al. (2023) identify that heightened GPR increases environmental degradation in the middle quantile, whereas it decreases in the lower and higher quantile. In the context of this, the price of precious metals and natural resources are also shaken by growing GPR (see Su et al. 2019; Li et al. 2022; Shahzad et al. 2023). This recent empirical evidence identifies an adverse impact of GPR on economic and non-economic variables, thereby indicating an adverse impact on the overall growth and development of an economy.

Is GPR always detrimental to economic growth? We try to answer this question in this study. Figure 1 provides preliminary evidence that the answer to this question is likely no. With higher economic growth, Fig. 1 indicates higher GPR, and lower economic growth induces a lower GPR. Historically, evidence does support such conjecture. In contrast to the poor, rich countries are more vigorous in the military and are also more resource-endowed (Fearon and Laitin 2003; Lai 2007); thereby, the probability of such countries getting involved in these activities is very high. The recent invasion of Russia on Ukraine is one such example that proves this conjecture.

Moreover, Arenas (2018) indicates a similar relationship between GPR and economic growth. The study found that during the period of expansionary growth from 2000 to 2007, geopolitical tension contributed 49% to the global growth fluctuations, whereas, during the period 2008 to 2012 (financial crisis), the only contribution of geopolitical tension in creating the growth volatility was 13%. Further, the study also develops insight into the fact that despite the heightened geopolitical uncertainty from 2000 to 2007 (for example, the Afghanistan invasion in 2001 and the Iraq invasion in 2003), the world experienced high and sustainable economic growth. Figure 2 depicts a similar relationship for our sample countries.

In the context of GPR and its influence on economic performance, only a few pieces of the literature could be traced. Yildirim (2021) finds an asymmetric nonlinear relationship between economic growth and GPR in the presence of stock market globalization for Brazil, advocating the conjecture that GPR can hold both the relationship with economic growth. Further, the study by Middeldorp et al. (2017) reveals a positive correlation between GPR and economic expansion for the Dutch economy. The GPR may also lead to economic growth, according to Akadiri et al. (2020), who identify a unidirectional causal relationship between GPR and Turkish economic growth. For Malaysia, Adedoyin et al. (2022) confirm this relationship between GPR and economic growth, demonstrating positive and negative long-term and short-run relationships. When looking at data for China from 1983 to 2021, Wang et al. (2023a, b) find a similar correlation between GPR and economic growth. In another study based on a panel of 4 biggest economies (USA, Japan, India, and China) for the time period 1989 to 2021, Wang and Liu (2023) find a positive association between heightened GPR and economic growth of these countries.

3 Overview of the geopolitical risk index

Caldara and Iacoviello (2022) proposed a dataset that gauges GPR in 43 countries. We use this dataset as a proxy to assess the impact of GPR on economic growth.

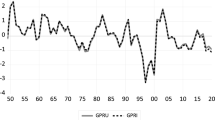

Caldara and Iacoviello (2022) constructed a monthly GPR index from leading newspapers since 1985. This index's main contribution is that it provides real-time data on indices while maintaining their consistency over time and reflecting the views of the press, the public, global investors, and policymakers. Figure 3 plots the GPR index from January 1985 till May 2021. Several peaks appear during the period, each corresponding to a significant event in international politics worldwide.

The GPR index is a text-based indicator that measures the frequency of articles published in a major newspaper that reports unfavorable global developments. This index is compiled using electronic archives from 10 of the most widely read newspapers in the world, including the Chicago Tribune, the Daily Telegraph, the Financial Times, the Globe and Mail, the Guardian, the Los Angeles Times, the New York Times, USA Today, the Wall Street Journal, and The Washington Post. The index is a ratio of the number of articles reporting on adverse geopolitical events to the total number of articles published in these ten newspapers.

The searches were clubbed into eight categories: War Threats (Category 1), Peace Threats (Category 2), Military Buildups (Category 3), Nuclear Threats (Category 4), Terror Threats (Category 5), Beginning of War (Category 6), Escalation of War (Category 7), and Terror Acts (Category 8). Additionally, Caldara and Iacoviello (2022) construct two sub-indexes based on the aforementioned search groups. Words from categories 1 through 5 constitute the Geopolitical Threats index. The Geopolitical Acts index contains words from categories 6 through 8. In this paper, we consider the overall GPR index as a proxy of geopolitical uncertainties.

As indicated by Caldara and Iacoviello (2022) that the GPR index constructed considers only those factors for which the peace negotiations between the powerful countries could not resolve the struggles over territories, i.e., they built the index on the threat caused by wars, terrorist attacks, and state tensions that disrupt the normal and peaceful conduct of international relations. Therefore, geopolitical tensions like climate change, major democratic political events (for example, Brexit), and global economic events (like the global financial crisis and Covid-19) are not considered while framing the index. The detailed methodology, word choices, and other information could be traced from Caldara and Iacoviello (2022).

4 Data

Annual data on economic, GPR, and institutional variables from 2000 to 2020 were collated for 43 countries, but missing values for a few countries reduced the number of countries for estimation to 41.Footnote 4 The economic data sources were the World Bank’s World Development Indicators (WDI) and the Penn World Table Version 10.00–PWT (Feenstra et al. 2015). Data on GPR are collected on June 08, 2022, from the https://www.matteoiacoviello.com/gpr.htm. The Varieties of Democracy V-Dem, v11 dataset, and Index of Economic Freedom are collected from www.fraserinstitute.org/studies/economic-freedom-of-the-world-2020-annual-report, on June 10, 2022.

We test for the impact of geopolitical risk in the presence of other economic and institutional variables by estimating feasible generalized least squares (FGLS) on the GDP per capita growth of these countries (taken from WDI). Our baseline model includes the following explanatory variables:

-

Initial GDP per capita (log) (WDI). The log of real GDP per capita lagged by one year. A negative coefficient is expected, indicating the existence of conditional convergence among countries.

-

Investment (percent of GDP) (WDI). A positive coefficient is expected. An increase in the proportion of GDP spent on investments is expected to stimulate the economy (Mankiw et al. 1992).

-

Human capital (PWT). PWT measures human capital by the number of years spent in school and the rate of return on that investment; therefore, it stands to reason that higher levels of educational attainment will result in higher levels of human capital and, in turn, boost economic growth. The likelihood of a positive coefficient follows.

-

Population growth (WDI). There will be less economic expansion due to a rise in the population. For this reason, we anticipate a negative coefficient.

-

Trade openness (WDI). Given that international trade openness is advantageous to the economy, a positive coefficient is anticipated.

-

Geopolitical risk (Caldara and Iacoviello 2022). Since geopolitical risk could have a beneficial effect on developed economies while detrimental to emerging economies, it is reasonable to anticipate both positive and negative signs.

Following Aisen and Viega (2013), we capture the macroeconomic stability by adding two additional macroeconomic variables to our baseline model:

-

Inflation rate (WDI). The relationship between inflation and economic growth should be inverse; hence, a negative coefficient is anticipated. Edison et al. (2002) establish an inverse relationship between inflation and economic growth; higher inflation negatively affects economic growth. Aisen and Viega (2013) define the inflation rate as a log (1 + inflation rate/100) to prevent heteroskedasticity resulting from the inflation rate's large variability. We convert our inflation rate to the same line to eliminate heteroskedasticity bias in our results.

-

Government expenditure (percent of GDP) (WDI). A large government expenditure intends to crowd out the private sector's resources. It is reasonable to anticipate a negative coefficient.

We augment our baseline model by including democracy and the index of economic freedom as the institutional variable:

-

Varieties of Democracy (V-Dem): Varieties of Democracy (V-Dem) is a novel approach to conceptualizing and measuring democracy. It provides a multidimensional and disaggregated dataset that illustrates the complexity of democracy as a system of government that extends beyond the mere occurrence of elections. The V-Dem project defines five high-level democratic principles, including electoral, liberal, participatory, deliberative, and egalitarian, and gathers data to quantify these principles. V-Dem has developed unique approaches for pooling expert opinions to estimate hard-to-observe notions. Pemstein et al. (2018) devised a Bayesian IRT estimation technique that compensates for several issues with expert-coded data and estimates residual random measurement error. This approach converts ordinal expert replies into continuous idea estimations. The V-Dem dataset provides democracy index data for 39 countries since 1789 on five democracy principles and the overall democracy level for each country.

-

Index of economic freedom (Fraser Institute, Economic Freedom of the World Index dataset (EFW)). The index of economic freedom measures the degree of economic freedom in five major areas: Size of Government, Legal System and Security of Property Rights, Sound Money, Freedom to Trade Internationally, and Regulation. These measures are favorable to economic growth; hence, a positive coefficient is expected.

Tables 1 and 2 present descriptive statistics and correlations between the variables.

5 Empirical methodology

For our cross-country analysis, we use the model Barro (1991) proposed, which has mostly been for empirical growth analysis. The workhorse model used in our study is as follows:

where, \({g}_{{\text{it}}}\) is the growth rate (i.e., real GDP per capita growth rate), \({Y}_{{\text{i}}, {\text{t}}-1}\) level of the initial level of real GDP per capita, \({X}_{{\text{i}},{\text{t}}}\) is a vector including other economic variables, \({\eta }_{{\text{i}}}\) is the unobserved country-specific effects, and \({\epsilon }_{{\text{it}}}\) is an error term. Since growth rate is the logarithmic difference in GDP per capita, we have the following dynamic panel data model.

or equivalently,

where, \({\beta }^{*}=(1+\beta )\). Thereby, our cross-country regression model becomes:

where \(\Delta {\text{ln}}{Y}_{{\text{it}}}\) is the log of growth rate of real GDP per capita, \({{\text{ln}}Y}_{0{\text{i}}}\) is the log of initial level of real GDP per capita, \({X}_{{\text{it}}}\) is the vector of variables. Blomberg et al. (2004) include terrorism and internal conflict in Eq. (4) to analyze the impact on economic growth. We replace terrorism and internal conflict with our variable of interest, i.e., the GPR index.

Therefore our baseline cross-country regression model is as follows:

where \({\Delta {\text{ln}}Y}_{{\text{it}}}\) stands for the log of growth rate of real GDP per capita (in PPP terms taken at constant 2017 international $), \({{\text{ln}}Y}_{{\text{i}},\mathrm{ t}-1}\) is the log of initial GDP per capita of country i at the end of period t, \({X}_{{\text{it}}}\) for a vector of economic determinants of economic growth, which consists of gross fixed capital formation, human capital, trade openness, and population growth; \({{\text{GPR}}}_{{\text{i}},{\text{t}}},\) the variable of interest, is the geopolitical risk; \({\eta }_{{\text{i}}}\) are country-specific effects, \({\mu }_{t}\) are period/time-specific effects, and \({\epsilon }_{{\text{it}}}\) is the identically and independently distributed error term.

Following Aisen and Viega (2013), who accounted for macroeconomic stability in a growth regression by incorporating the inflation rate and the size of government, we also have included the same by adding these two additional macroeconomic variables (\({\varnothing {\text{MI}}}_{{\text{i}},{\text{t}}})\) in our baseline model (1), Eq. 5. We represent Model 2 as follows:

Model 2:

The extended model (3) includes the democracy level and economic freedom as institutional variables denoted by \({W}_{{\text{it}}}\) as such institutions are also the determinants of economic growth (Acemoglu et al. 2003).

Model 3:

At last, we estimate Model 4 by incorporating all factors in our growth model.

Model 4:

Given the data sample and variables, the presence of heteroscedasticity among panels is quite likely. Hence, the traditional approach of estimation may provide unreliable results. Thereby, we fixed the feasible generalized least square (FGLS) method for examining the relationship. FGLS is suitable for small panel data where T is short and N is large (Schneider and Wagner 2001). As part of the robustness test, we employ panel-corrected standard error (PCSE) models and a two-step system GMM.

6 Empirical results

The findings of the Granger causality test are the primary motivation for our study. We use the Granger non-causality test developed by Juodis et al. (2021) in our panel model. The novelty of this method is that under the null hypothesis, the Granger-causation parameters are all equal to zero; thus, they are homogeneous, making it the appropriate test for both homogenous and heterogenous panel data. Table 3 presents the results.

The null hypothesis that GPR does not granger cause economic growth vis-à-vis economic growth does not granger cause GPR is rejected at a 1% significance level, indicating a bidirectional relationship between the two. In the case of other macroeconomic variables, we find GPR asserting a bidirectional relationship with investment (significant at 1 and 5%) and trade (significant at 10 and 1%, respectively). However, for government expenditure and inflation, we find a unidirectional relationship with respect to GPR. These findings suggest that macroeconomic instability leads to geopolitical concerns, whereas other macroeconomic variables like trade, investment, and economic growth both generate and exacerbate geopolitical tensions.

6.1 The full sample

To begin, we examine the impact of GPR on economic growth for 41 countries from 2000 to 2020.

The estimation result for Model 1 shows that investment, trade openness, and human capital have significantly positive influences on economic growth for the whole sample, as expected in theory. Investment is an important input for an economy's output; consequently, a rise in gross capital formation improves production capabilities, positively impacting economic growth. Further, trade openness supports economic growth by expanding access to goods and services, enhancing resource efficiency, and enhancing total factor productivity via technology diffusion and information dissemination (Barro and Sala-i-Martin 1995). Human capital is key to economic growth both in terms of labor productivity and technology innovation. On the other hand, population growth will negatively impact economic growth, which is statistically significant in our case. This is consistent with the idea that increasing population affects various phenomena like the age structure of the workforce, international migration, and income inequality, which adversely affect economic growth. Initial GDP per capita has a negative coefficient, consistent with conditional income convergence across countries.

The main interest of this study is to examine the impact of GPR on economic growth. Table 4, Model 1 indicates a positive and significant impact of GPR on economic growth in the full sample case. The coefficient on GPR is positive (0.033) and statistically significant at the 1% level, suggesting that a 1% point increase in GPR increases economic growth by 3%. The findings of the study are in line with (Wang and Liu 2023; and Akadiri et al. 2020), which indicate that during the heightened GPR, the countries expand their resource extraction, thereby boosting investment in the economy, hence building up on the growth and the overall development. We augment Model 1 by adding government consumption expenditure and inflation GDP deflator. Fischer (1993) has denoted these variables as macroeconomic instability in a standard growth theory. An excessive government expenditure could induce a crowding-out effect, thereby reducing the rate of investment, which could further be exaggerated with high inflation, creating instability in the economy. Table 4, Model 2 presents the result. A one percentage point increase in GPR increases economic growth by 2.6%. The coefficient on GPR is positive and significant at the 1% level. In the presence of macroeconomic instability, our results show that increased GPR reduces economic growth by 0.007 (0.033–0.026) percentage points.

Institutions are key determinants of economic incentives and significantly impact economic development, growth, income inequality, and poverty (Acemoglu et al. 2003). North (1990) states, “Institutions are the rules of the game in a society or, more formally, are the humanly devised constraints that shape human interactions.” Different societies have different institutions because they employ different formal approaches to collective decision-making, for example, choosing to be more democratic versus autocratic. In our estimation, Model 3 captures the impact of institutions on GPR and economic growth. We proxy democracy and the index of economic freedom as the variable of institutions. Much empirical research has pondered the relationship between democracy and growth. There is a mixed review of the relationship, for example, Gerring et al. (2005) indicate a negative relationship between the two, whereas Doucouliagos and Ulubaşoğlu (2008) identify indirect significant and profound effects of democracy on economic growth. Hence, no consensus is drawn in the literature about the impact of democracy on economic growth. We do not advocate the relationship between democracy and economic growth; instead, we try to explore the impact of GPR on economic growth in the presence of democracy and the index of economic freedom.

The coefficient of GPR in Model 3 is positive (0.018) and significant at the 10% level, indicating an increase of 1% point in GPR increases economic growth by 1.8% points. The coefficient on democracy is negative (0.346) and significant at a 1% level, establishing an inverse relationship between economic growth and democracy. In the presence of GPR, a democratic country may witness less growth in comparison to the countries that are more authoritative in nature. The probable reason for such a transition could be that a democratic country has to be more responsive to the poorer section of society by providing access to basic facilities like education and health. These expenses are made at the cost of physical capital accumulation, thereby causing a decline in the growth of the country (Tavares and Wacziarg 2001). The index of economic freedom exhibits a positive and significant relationship (0.277). The impact of GPR on economic growth further reduces by 0.015 (0.033–0.018) percentage points in the presence of an institutional variable. Model 4 evaluates the impact of GPR on economic growth in the presence of macroeconomic instability and institutional variables. The GPR coefficient is positive (0.015) and significant at the 10% level, indicating that amid macroeconomic instability and a domestic political regime, the influence of GPR on economic growth is minimal.

The interesting conclusion that our results show here is that GPR is only sometimes deterrents to economic growth. What could be a possible justification for such a relationship between GPR and economic growth? One reason for such a relationship could be extracted from Organski and Kugler's (1977, 1980) work. Their work explains the growth led by innovation by combining the technological innovation adoption and the direct resource-destruction channel of the neoclassical theory. They argue that countries with higher industrial growth capacity could rebuild because rebuilding is a form of increased investment that takes the form of a higher growth rate. Thereby, innovations could lead to higher growth despite countries losing the war, which the author terms the Phoenix factor.

Similarly, Schumpeter et al. (2017) suggest that technological innovation benefits the economy and encourages economic growth. In the spur of geopolitical uncertainty, economies capable enough to siphon their resources for technological innovation witness a higher growth rate, whereas economies that lack resources fail to achieve a higher growth rate. We thereby conjecture that while developed countries can quickly redirect their resources toward technical innovation when faced with geopolitical unpredictability, emerging economies cannot do so due to a lack of necessary resources. This may be one reason advanced economies expand at favorable rates despite rising GPR while emerging economies contract at negative rates. In order to test this conjecture, we divide our full sample into cohorts of advanced and emerging economies. The following subsection provides the results.

6.2 Subsample

The relationship between GPR and economic growth may depend upon the level of development of particular economies. We estimate our models for cohorts of advanced and emerging economies. We divide the 41 countries into 20 advanced and 21 emerging economies.Footnote 5 Table 5 presents the results for advanced and emerging economies for all Models.

The findings suggest that GPR positively impacts economic growth for advanced economies. With a 1% increase in GPR in advanced economies, the economic growth increases by 2.3, 1.6, 2.3, and 2.1% points in Model 1, 2, 3, and 4, respectively. These findings support the theory proposed by Organski and Kugler (1977, 1980) and Schumpeter et al. (2017) that advanced countries are more likely to experience higher growth with growing GPR due to advancement in technological innovation.

Expenditure on research and development (R&D) is the best proxy to measure the improvement of technology (Pakes and Sokoloff 1996). In the seminal work of Jaffe (1996), it is identified that the share percentage in the R&D expenditure has increased for advanced economies like the USA and its counterpart countries like Germany, Japan, France, and the United Kingdom. Further, the study also highlights that the USA has spent a higher proportion of the R&D share in defense and life sciences than their counterparts, indicating that developed economies are more inclined to innovation-led growth.

We now test the impact of GPR on emerging economies. For Models 1, 2, and 4, our results show an insignificant impact of GPR on economic growth. However, in Model 3, i.e., in the presence of institutional variables, the GPR inversely impacts the economic growth of emerging economies by a 13.6% point significance at a 10% level. This shows that as GPR increase, more democratic and economically free emerging economies experience a negative growth rate. Our findings on emerging economies are also confirmed by Soybilgen et al. (2019), who find a similar relationship for 18 emerging economies.

A striking finding identified in our analysis is the role of institutions in assessing the impact of GPR on economic growth for advanced and emerging economies. Institutions act as a stimulus in building the relationship between GPR and economic growth. For example, for a democratic and economically free country, the impact of GPR on economic growth remains unchanged (despite democracy not being significant). Similarly, for emerging economies, GPR is significant only in the presence of institutional variables. Thereby, we corroborate institutions to be a procyclical variable for GPR and economic growth in a standard growth model.

7 Robust analysis

7.1 Addressing the endogeneity concern

One of the methodological issues to which growth models are subjected is the endogeneity concern, for example, in a regression equation that relates growth to the share of investment to GDP. There is a high likelihood that investment share could be endogenously associated with the GDP. When the variables are endogenously determined, it means that the variables are correlated with the error term in the model. For instance, in a case of political instability and economic growth, considering political instability lowers growth that this lower economic growth further feeds political instability. The estimated regression coefficient will combine these two effects, resulting in an inconsistent estimate of the causal influence of instability (Durlauf et al. 2005).

The system GMM approach suggested by Arellano and Bover (1995) is employed to tackle the endogeneity issue. It solves this problem by instrumenting the differenced predetermined and endogenous variables with their available lags in levels: levels of the dependent and endogenous variables, lagged one or more periods; levels of the predetermined variables, lagged one or more periods (Sakyi et al. 2018; Jiahao et al. 2022). We estimate our model using a two-step system GMM as a robust measure. All the exogenous variables are used as their own instruments, where their lag for one period was used as instruments in the first-difference equations, and their once-lagged first differences were used in the levels equation. The lag for the dependent variables and the instruments is considered for up to one and two periods, respectively. Tables 6 and 7 exhibit the results of system GMM for the full sample and the cohort of advanced and emerging economies, respectively. The results align with FGLS, full samples (Table 4), and advanced economies (Table 5). In the case of emerging economies, the results are more robust and significant for Models 3 and 4, which further confirms the detrimental impact of GPR on the economic growth of emerging economies.

7.2 Alternate estimation measure

We begin with estimating the statistical robustness of our findings. We re-estimate the model by modifying the full GLS—Park estimator called panel-corrected standard error (PCSE) (Beck and Katz 1995) model. PCSE serves the weighting of observations for autocorrelation but uses a sandwich estimation to incorporate cross-sectional dependence when calculating standard errors. It also accounts for heteroscedastic, contemporaneously cross-sectionally correlated, and autocorrelated (AR1) errors. Tables 8 and 9 report the results. The results align with FGLS results (Tables 4 and 5).

8 Conclusion

This study establishes a robust relationship between GPR and economic growth for a panel of 41 countries from 2000 to 2020. Our one-year panel analysis indicates that GPR has a significant growth-accelerating effect. For developing economies, however, the impact of GPR is negative on economic growth. The advanced economies exhibit a positive relationship indicating the minimal impact the rising geopolitical tension induces on overall growth. This also ascertains that the advanced economies could sustain the jolt of GPR and thereby display less growth consequences, unlike the developing economies. For developing economies, GPR curb growth primarily by redirecting government expenditure, i.e., diverting resources from more productive private and public investment to military and security spending.

A few policy insights that can be drawn from this study is as follows: first, because developing economies are negatively affected by GPR, these countries must start considering GPR as an important determinant of macroeconomic stability, similar to the Bank of England’s “uncertainty trinity.” Second, the advanced economies should be assisting developing economies to address the tensions arising due to rising GPR, similar to how Ukraine is being assisted by advanced economies today. Because advanced economies are less affected by GPR, it is also the responsibility of these economies to support and promote the growth-accelerating activities of the victim country. Lastly, this also induces a moral responsibility for the World Bank and International Monetary Fund (IMF) to provide aid once the conflict ends to assist in reconstruction (Bannon and Collier 2003).

This study has few limitations, suggesting a direction for future research. The study is limited to 41 countries, with inadequate representation of regions like Africa and Asia. The study could be extended to more countries if the data on GPR is made available. Further, the paper has analyzed the impact of GPR on economic growth in the presence of different political institutions, such as democracy and economic freedom, in a linear model framework. A further extension to this work could be examining a nonlinear relationship between the two variables. As stated in the literature and also our own intuition indicates, an interactive or a nonlinear regression model will provide a better explanation of the relationship between the two variables. However, this analysis is beyond the scope of this study, but a study exclusively based on an interactive regression model might enhance the results of the study.

Notes

See Fig. 2.

The GPR index is a monthly index constructed by Caldara and Iacoviello (2022) from 10 leading newspapers. At the time of analysis the data on GPR is available for 43 countries only. Due to lack of few macroeconomic variables, we had to drop 2 countries restricting our analysis to 41 countries. A detailed explanation on GPR index is presented in Sect. 3.

These countries are Argentina, Australia, Belgium, Brazil, Canada, Chile, China, Columbia, Denmark, Egypt, Finland, France, Germany, Hong Kong, Hungary, India, Indonesia, Israel, Italy, Japan, Malaysia, Mexico, Norway, Peru, Poland, Portugal, Russia, Saudi Arabia, South Africa, South Korea, Spain, Sweden, Switzerland, Thailand, The Netherlands, The Philippines, Tunisia, Turkey, Ukraine, UK, and USA.

We categorize advanced and emerging economies following the definition of IMF. Table 10 in the Appendix indicates the list of advanced and emerging economies. Figure 4 in the Appendix provides a visual presentation of average geopolitical risk and economic growth of 41 economies from 2000 to 2020. The link for the same could be assessed here https://www.imf.org/external/pubs/ft/weo/2022/01/weodata/groups.htm

References

Abadie A, Gardeazabal J (2003) The economic costs of conflict: a case study of the Basque Country. Am Econ Rev 93(1):113–132

Abadie A, Gardeazabal J (2008) Terrorism and the world economy. Eur Econ Rev 52(1):1–27

Acemoglu D, Johnson S, Robinson J, Thaicharoen Y (2003) Institutional causes, macroeconomic symptoms: volatility, crises and growth. J Monet Econ 50(1):49–123

Adebayo TS, Akadiri SS, Riti JS, Tony Odu A (2023) Interaction among geopolitical risk, trade openness, economic growth, carbon emissions and its implication on climate change in India. Energy & Environment 34(5):1305–1326

Adedoyin FF, Afolabi JO, Yalçiner K, Bekun FV (2022) The export-led growth in Malaysia: does economic policy uncertainty and geopolitical risks matter? J Public Aff 22(1):e2361

Aisen A, Veiga FJ (2013) How does political instability affect economic growth? Eur J Polit Econ 29:151–167

Akadiri S, Eluwole KK, Akadiri AC, Avci T (2020) Does causality between geopolitical risk, tourism and economic growth matter? Evidence from Turkey. J Hosp Tour Manag 43:273–277

Alesina A, Özler S, Roubini N, Swagel P (1996) Political instability and economic growth. J Econ Growth 1:189–211

Al-Rodhan NR (2009) Neo-statecraft and meta-geopolitics: reconciliation of power, interests and justice in the 21st century. LIT Verlag Münster, Münster

Arellano M, Bover O (1995) Another look at the instrumental variable estimation of error-components models. J Econom 68(1):29–51

Arenas J (2018) Geopolitical uncertainty and economics: deep impact? Caxia Bank Research. https://www.caixabankresearch.com/en/economics-markets/activity-growth/geopolitical-uncertainty-and-economics-deep-impact

Bannon I, Collier P (eds) (2003) Natural resources and violent conflict: options and actions. World Bank Publications, New York

Barro RJ (1991) Economic growth in a cross section of countries. Q J Econ 106(2):407–443

Barro RJ, Sala-i-Martin XI (1995) Economic growth. MIT Press, Cambridge

Beck N, Katz JN (1995) What to do (and not to do) with time-series cross-section data. Am Polit Sci Rev 89(3):634–647

Blomberg SB, Hess GD, Orphanides A (2004) The macroeconomic consequences of terrorism. J Monet Econ 51(5):1007–1032

Bloom N (2009) The impact of uncertainty shocks. Econometrica 77(3):623–685

Caldara D, Iacoviello M (2022) Measuring geopolitical risk. Am Econ Rev 112(4):1194–1225

Carney M (2016) Uncertainty, the economy and policy. Bank of England, London

Collier P, Hoeffler A (2004) Greed and grievance in civil war. Oxf Econ Pap 56(4):563–595

Collier P, Sambanis N (2002) Understanding civil war: a new agenda. J Confl Resolut 46(1):3–12

Cunado J, Gupta R, Lau CKM, Sheng X (2020) Time-varying impact of geopolitical risks on oil prices. Def Peace Econ 31(6):692–706

Das D, Kannadhasan M, Bhattacharyya M (2019) Do the emerging stock markets react to international economic policy uncertainty, geopolitical risk and financial stress alike? N Am J Econ Financ 48:1–19

Dijkink G (2009) Geopolitics and religion. In: Kitchin R, Thrift N (eds) The international encyclopedia of human geography. Elsevier, Amsterdam

Doucouliagos H, Ulubaşoğlu MA (2008) Democracy and economic growth: a meta-analysis. Am J Polit Sci 52(1):61–83

Durlauf SN, Johnson PA, Temple JR (2005) Growth econometrics. Handb Econ Growth 1:555–677

Edison HJ, Levine R, Ricci L, Sløk T (2002) International financial integration and economic growth. J Int Money Financ 21(6):749–776

Enders W, Sandler T (1996) Terrorism and foreign direct investment in Spain and Greece. Kyklos 49(3):331–352

Enders W, Sachsida A, Sandler T (2006) The impact of transnational terrorism on US foreign direct investment. Polit Res Q 59(4):517–531

Fearon JD, Laitin DD (2003) Ethnicity, insurgency, and civil war. Am Polit Sci Rev 97(1):75–90

Feenstra RC, Inklaar R, Timmer MP (2015) The next generation of the Penn World table. Am Econ Rev 105(10):3150–3182

Fischer S (1993) The role of macroeconomic factors in growth. J Monet Econ 32(3):485–512

Gaibulloev K, Sandler T (2009) The impact of terrorism and conflicts on growth in Asia. Econ Polit 21(3):359–383

Gerring J, Bond P, Barndt WT, Moreno C (2005) Democracy and economic growth: a historical perspective. World Polit 57(3):323–364

Ghosh S (2022) Geopolitical risk, economic growth, economic uncertainty and international inbound tourism: an Indian illustration. Rev Econ Polit Sci 7(1):2–21

Jaffe AB (1996) Trends and patterns in research and development expenditures in the United States. Proc Natl Acad Sci 93(23):12658–12663

Jiahao S, Ibrahim RL, Bello KA, Oke DM (2022) Trade facilitation, institutions, and sustainable economic growth: empirical evidence from Sub-Saharan Africa. Afr Dev Rev 34(2):201–214

Juodis A, Karavias Y, Sarafidis V (2021) A homogeneous approach to testing for Granger non-causality in heterogeneous panels. Empir Econ 60(1):93–112

Keynes JM (1919) The economic consequences of the peace. Macmillan, London, UK

Lai B (2007) Draining the swamp: an empirical examination of the production of international terrorism, 1968–1998. Confl Manag Peace Sci 24(4):297–310

Lee CC, Lee CC (2020) Insurance activity, real output, and geopolitical risk: fresh evidence from BRICS. Econ Model 92:207–215

Li Y, Cong Z, Xie Y, Wang Y, Wang H (2022) The relationship between green finance, economic factors, geopolitical risk and natural resources commodity prices: evidence from five most natural resources holding countries. Resour Policy 78:102733

Mankiw NG, Romer D, Weil DN (1992) A contribution to the empirics of economic growth. Q J Econ 107(2):407–437

Meade JE (1940) The economic basis of a durable peace. Oxford University Press, New York, NY

Middeldorp M, Groenewegen J, Vreede I (2017) Outlook 2018: the economic impact of geopolitical risks and events on the Dutch economy. RaboResearch—Economy Research

Murdoch JC, Sandler T (2002) Economic growth, civil wars, and spatial spillovers. J Confl Resolut 46(1):91–110

Murdoch JC, Sandler T (2004) Civil wars and economic growth: spatial dispersion. Am J Polit Sci 48(1):138–151

North DC (1990) Institutions, institutional change and economic performance. Cambridge University Press, Cambridge

Organski AF, Kugler J (1977) The costs of major wars: the phoenix factor. Am Polit Sci Rev 71(4):1347–1366

Organski AF, Kugler J (1980) The war ledger. University of Chicago Press, Chicago

Pakes A, Sokoloff KL (1996) Science, technology, and economic growth. Proc Natl Acad Sci 93(23):12655–12657

Pemstein D, Marquardt KL, Tzelgov E, Wang YT, Krusell J, Miri F (2018) The V-Dem measurement model: latent variable analysis for cross-national and cross-temporal expert-coded data. In: V-Dem working paper, pp 21

Pigou AC (1940) The political economy of war. MacMillan, London, UK

Reivan-Ortiz GG, Cong PT, Wong WK, Ali A, Thu HTT, Akhter S (2023) Role of geopolitical risk, currency fluctuation, and economic policy on tourist arrivals: temporal analysis of BRICS economies. Environ Sci Pollut Res. https://doi.org/10.1007/s11356-023-27736-1

Robbins L (1942) The economic causes of war. Jonathan Cape, London, UK

Rogers A, Castree N, Kitchin R (2013) A dictionary of human geography. University Press, Oxford

Sakyi D, Bonuedi I, Opoku EEO (2018) Trade facilitation and social welfare in Africa. J Afr Trade 5(1–2):35–53

Sandler T, Enders W (2008) Economic consequences of terrorism in developed and developing countries: an overview. Terror Econ Dev Polit Openness 17:1–43

Schneider F, Wagner AF (2001) Institutions of conflict management and economic growth in the European Union. Kyklos 54(4):509–531

Schumpeter JA, Clemence RV, Swedberg R (2017) Essays: on entrepreneurs, innovations, business cycles, and the evolution of capitalism. Routledge, Oxford

Shahzad U, Mohammed KS, Tiwari S, Nakonieczny J, Nesterowicz R (2023) Connectedness between geopolitical risk, financial instability indices and precious metals markets: Novel findings from Russia Ukraine conflict perspective. Resour Policy 80:103190

Soybilgen B, Kaya H, Dedeoglu D (2019) Evaluating the effect of geopolitical risks on the growth rates of emerging countries. Econ Bull 39(1):717–725

Su CW, Khan K, Tao R, Nicoleta-Claudia M (2019) Does geopolitical risk strengthen or depress oil prices and financial liquidity? Evid Saudi Arabia Energy 187:116003

Tavares J, Wacziarg R (2001) How democracy affects growth. Eur Econ Rev 45(8):1341–1378

Tiwari AK, Das D, Dutta A (2019) Geopolitical risk, economic policy uncertainty and tourist arrivals: evidence from a developing country. Tour Manag 75:323–327

Uddin I, Usman M, Saqib N, Makhdum MSA (2023) The impact of geopolitical risk, governance, technological innovations, energy use, and foreign direct investment on CO2 emissions in the BRICS region. Environ Sci Pollut Res. https://doi.org/10.1007/s11356-023-27466-4

Wang F, Liu X (2023) Resources extraction and geopolitical risk: a novel perspective of World’s biggest economies. Resour Policy 85:103717

Wang G, Gu X, Shen X, Uktamov KF, Ageli MM (2023a) A dual risk perspective of China’s resources market: geopolitical risk and political risk. Resour Policy 82:103528

Wang W, Niu Y, Gapich A, Strielkowski W (2023b) Natural resources extractions and carbon neutrality: the role of geopolitical risk. Resour Policy 83:103577

Yildirim EU (2021) Globalization of stock market, economic growth, and geopolitical risk: evidence from Brazil. In: Bayar Y (ed) Handbook of research on institutional, economic, and social impacts of globalization and liberalization. IGI Global, Pennsylvania, pp 157–168

Acknowledgements

The authors thank Sohini Sahu, Siddhartha Chattopadhyay, and Vimal Kumar for their valuable suggestions and comments.

Funding

No funding was received for conducting this study.

Author information

Authors and Affiliations

Contributions

All authors contributed to the study's conception and design. Material preparation and data collection were performed by Saakshi Jha and Sunny Bhushan. An econometric analysis was done by Nupur Nirola. The first draft of the manuscript was written by Saakshi Jha, and all authors commented on previous versions of the manuscript. All authors read and approved the final manuscript.

Corresponding author

Ethics declarations

Conflict of interest

There is no conflict of interest. The authors have no competing interests to declare that are relevant to the content of this article.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendix: A

Appendix: A

The categorization of countries is based on the classification followed in the World Economic Outlook (WEO), published by International Monetary Fund (IMF). The WEO classifies countries into two categories: advanced economies and emerging and developing economies. See Table 10 and Fig. 4.

Source: Authors' calculation. Note: The map presents the average geopolitical risk and economic growth of 41 economies from 2000 to 2020. The map shows that advanced economies, on average, experienced heightened geopolitical risks during the study period, whereas emerging economies experienced moderate geopolitical risks barring China and Russia. The map presented here is just for representational purposes

Geopolitical risk and economic growth of all countries.

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Jha, S., Bhushan, S. & Nirola, N. Is geopolitical risk always detrimental to economic growth?. Econ Change Restruct 57, 25 (2024). https://doi.org/10.1007/s10644-024-09585-1

Received:

Accepted:

Published:

DOI: https://doi.org/10.1007/s10644-024-09585-1