Abstract

In emerging nations, green tax benefits pertaining to environmental sustainability, such as taxable tax income adjustments and the ITC (investment tax credit), are gaining popularity. On the other hand, implementing green tax incentives that address climate change in achieving the growth goals for sustainability measures. This research uses environment, social and governance (ESG) scores to construct our dependent variable. To determine which firms and how long the sample observations alter, this study employs a longitudinal research methodology. Probit and logistic regression are then used to determine who will benefit from the tax incentives. It has been noted that a company's more sustainable production methods are reflected in its higher ESG score. For this reason, our analysis employs dummy 1 for companies at the top of the ESG ranking and 0 otherwise.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Climate change and deterioration of the environment are two of the biggest problems the global economy is currently experiencing. This problem is dangerous not only for the health of individuals but also for their earnings and level of productivity (Mao & Wang, 2016). The expansion of economic activity is accompanied by an increase in energy consumption, which raises greenhouse gas emissions that are bad for the environment. With the Paris Agreement, nearly all countries have joined forces to address the global challenge of climate change by committing to reducing the emissions of greenhouse gases. Sweden has also set a target to reduce emissions of greenhouse gases by more than half from 1990 levels by 2030 in order to accomplish its sustainability targets (Dahlberg & Wiklund, 2018).

The greenhouse gas (CO2) pollutants of the Swedish economy increased between 1960 and 1976, but they decreased between 1976 and 2015. The sharp drop in pollutants persisted from 2010 to 2019. Conversely, Norway's pollutants have increased constantly throughout the 1960s but only decreased between 1990 and 1995. They then rose once again between 2005 and 2010, after which they have decreased till 2019. In order to curb this expansion, both nations implemented a carbon price, which came about as a result of unstable macroeconomic conditions (low growth in the economy in Sweden during the 1990s), new energy technological initiatives and a greenhouse gases cap (Jagers & Hammar, 2009). According to Andersson (2019), Sweden's carbon tax structure has demonstrated higher success in accomplishing its stated goals, which include a decrease in consumption of energy, an increase in energy efficiency, and increased accessibility and utilization of renewable energy sources. Organizations are now required to include manageability initiatives in their annual reports after Nasdaq Stockholm introduced manageable securities in 2017 and became the first stock exchange to launch a business prospect for controllable bonds (Erhart, 2018).

The principal aim of this analysis is to examine the recipients of the green tax scheme via tax-payer level assessments, thereby addressing the research gap in the literature review. Thus, this empirical study identifies those who benefit of green tax strategy and examines its repercussions. To be more precise, we take the top 90 listed firms concerning Nasdaq Stockholm and use several firm-specific characteristics to look into who receives the advantages of green tax measures. ESG scores are used to build our dependent factor. For companies that obtained ESG scores more than 60, our regressand dummy will be 1; otherwise, it will be 0. The ESG ranking is important because it reveals how businesses feel about green tax legislation. Several firm-level attributes, including firm size, age, capital, investment, assets, capacity, net income, and net capital are used in this analysis as an explanatory factors.

The rest of the investigation is organized as: Sect. 2 uncover previous literature; Sect. 3 discovers Methodology; Sect. 4 disclose result and finally Sect. 5 gives conclusion of the study.

2 Literature review

Environmental regulation's effect on green innovation practices has long been an influential field of academic study. According to "The Potter hypothesis," "innovative compensation" can be achieved by environmental legislation, particularly when it is implemented well (see specifically market-based methods) (Milne, 2003, 2007).

The restricted Porter hypothesis, which maintains that only well-constructed and well executed policies may produce these outcomes, is further advanced by Jaffe and Palmer (1997). There are two types of ecological legislation that encourage innovation that have been studied: supply-push and demand-pull strategies (Lanoie et al., 2008; Jin et al., 2022; Bhatti et al., 2023; Rawoof et al., 2023; Ur Rehman et al., 2023; Xue et al 2024; Yan et al 2024; Shabbir et al., 2023; Wang et al., 2023a, 2023b; Cao et al., 2022; Liu et al., 2022a, 2022b; and Wu et al., 2020). There are two ways the administration innovation can be promoted: One way to lower the cost of innovation production for entrepreneurs and create a technology supply push is to implement policies that directly fund government projects, offer tax advantages, and advocate for R&D learning and instruction. However, additional actions, including norms, taxes on the atmosphere, and the safeguarding of creative works, can also be implemented to raise the private rewards on discoveries that are successful in driving demand.

Wang et al. (2022) research findings demonstrate that: environmental management and ecotax may greatly enhance happiness through and indirectly increase happiness; environmental taxes have a notable positive impact on happiness; and also there are disparities in wealth, regions, and educational attainment, as well as direct and indirect impacts of environmental management on happiness. These conclusions compel us to aggressively support environmental management and ecology in the modern period.

Globalization is an all-encompassing process that lessens cross-border barriers to encourage international collaboration and conflict among nations (Rehman et al., 2023). According to research by Fareed et al. (2022), financial inclusion causes the environment in the Eurozone to deteriorate. The empirical results show that mineral markets play a major role in the energy transformation process that enables the G-7 countries to generate electricity with low emissions. On the other hand, financial growth has a negative impact on the shift to renewable energy, albeit an insignificant impact for the E-7 states (Irfan et al., 2023). Furthermore, in developed nations, imports are positively correlated with consumption-based emissions of carbon dioxide, but exports are negatively correlated (Liang et al 2023; Mughal et al 2023; Wang et al., 2023a, 2023b).

Telatar et al. (2022) Non-linear approaches have only been used in a few research to investigate this relationship. The long-term effects of ET on EFP, one of the most significant indications of erectile dysfunction, have not yet been examined in research utilizing non-linear analysis. This paper makes a contribution to the field by utilizing a non-linear methodology to look at the long-term effects of ET on EFP and CO2 emissions in Turkey. In order to assess a model, Dufrénot et al. (2006) used a non-linear cointegration test with yearly data for the years 1994 to 2019. ET has no long-term effects on EFP and CO2 emissions, according to the assessment's findings. Consequently, it can be said that ET in Turkey has no effect in preventing erectile dysfunction.

The study conducted by Chen et al. (2022) establishes a three-game model in which the roles of the government, households, and polluting agents are positioned within rational boundaries. In addition to environmental stability, they look at Nash equilibrium.

Fang et al. (2022) examine how floods affect the use of renewable energy. A panel autoregressive distributed latency model was constructed using data from 1998 to 2019 for 15 representative Belt and Road nations. According to the estimate used by the pooling group, the short-term effect of the green tax on these nations' usage of renewable energy is negative.

3 Methodology

On the basis of theoretical foundations, this research develop the following hypotheses:

H1: There is no difference in the likelihood of receiving benefits from the green tax incentives program for overseas firms and domestic firms.

H2: There is no difference in the likelihood of receiving benefits from the green tax incentives program for older or younger organizations.

H3: Companies of all sizes have the same chance of benefiting from the green tax incentive program.

H4: Firms are more likely to profit from the tax incentives if they have larger levels of fixed capital and fresh investment than if they have lower levels of both.

H5: More profitable firms are more likely to gain from the tax breaks than less profitable businesses.

In order to explore the above hypotheses we consider the annual reports of the top 90 NASDAQ Stockholm-listed companies in our analysis for the period starts from 2016 to 2021. A probit regression examination is carried out in order to determine the recipients of tax incentives that the Swedish government has made available. Our reliant variable is a dummy that indicates 0 for firms that did not utilize the investment tax credit and 1 for those who did. The dependent factor is constructed using ESG scores. Because a company's approach to operation is more sustainable when it has a higher ESG score. Consequently, we utilize dummy 1 for companies at the peak of the ESG ranking as well as 0 for those at the bottom. We employ various firm-level factors, including size, age, investment, capacity, net capital, capital, net capital, and assets, as explanatory factors. The application of the probit model, particularly with dummy dependents, enables us to pinpoint certain firm-level attributes that significantly influence the likelihood of receiving an ITC benefit.

Several statistical attributes of the data, like the standard deviations, mean, and observation range, would be emphasized. Descriptive statistics are primarily intended to verify the data set's stationarity. The correlation matrix is then displayed to verify the model's multicollinearity (Table 2). Multicollinearity in the equation is brought about by a highly correlated factor with other regressors employing Person correlation as a benchmark. The probit regression analysis's regression output is subsequently provided together with default as well as robust standard errors. A marginal impact examination of the indicators is also included. Our independent variable includes: State Owned Enterprises (SOE) taken as 0 for private-owned and 1 for state-owned firms; capacity is proxied by inventory; Foreign and taken as 1 for foreign import importing cost and 0 for domestic; Capital that is calculated by the net value of fixed assets; Age that is calculated as foundation date; Investment that is taken as fresh assets (fixed in nature); Size which is proxied by the strength of employees; Net Income and Net Capital is utilized by calculating weighted growth of real output and net investment. However, when a company uses the GTI, a dummy displays 1, otherwise it represents 0. Which denotes the beneficiary of GTI which is our regressand.

4 Results and discussion

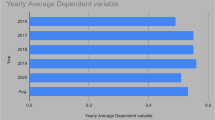

For the present data set (Table 1), the average dependent variable's value is 0.5, with a 0.5 standard deviation. According to this, 47% of observations in the regressand have a value of 0, and 53% of observations have a value of 1. In contrast, 53% of the top-listed businesses achieved an ESG rating of at least 60 between 2016 and 2021. ESG ratings of under sixty are obtained by 47 percent of the top-listed corporations. Our predictive variable, which takes value 1 for a foreign company, is likewise a dummy variable that indicates whether a company is a domestic or foreign enterprise. With an average value of 0.47, it can be inferred that 47% of the top-listed companies are based abroad and 54% are local. Our other regressor, the age of the firm, gauges the duration a company has been in business. The average age of the selected companies is inferred from the top-ranked companies' mean age of 82. For example, as Table 1 below illustrates, a company's highest age in this data set is 149, and its minimum age is 7. The size variable, which represents the aggregate amount of employees, is our explanatory factor. The average employee count for the organizations that were chosen between 2016 and 2021 is 17,801, which represents the mean of size. Its substantial standard deviation, however, suggests a greater difference between the lowest and maximum number. One could argue that the normalcy assumption is violated in the Size variable's distribution.

The dependent variable's average was 0.48 in 2016 and 0.56 in 2020. It displays how the chosen businesses' early adopting of sustainable practices developed. In 2016, for example, just 48% of the enterprises that were chosen were involved in sustainable operations; by 2019, that number had risen to 58%. According to the average regressand, 53% of the businesses obtained ESG ratings higher than 60. In summary, just 5% of businesses have integrated and given priority to sustainable practices in their everyday workflow (Fig. 1). Furthermore, the correlation results shows that there is a correlation between Capital and Investment; and capital and foreign; and Net Income and capital (Table 2).

The fundamental claim is that the likelihood of benefiting from a green tax incentive program is significantly influenced by various firm-level factors. We postulate this notion and look into how various firm-level attributes affect the likelihood of receiving a green tax incentive package. Table 3 displays the findings of the hypothesis analysis.

Table 3 lists the variables in the first column and their corresponding coefficients in the subsequent column. For example, the coefficient for foreign-based businesses is negative, suggesting that these businesses are less inclined to profit from the green tax benefits. At the conventional 5% significance level, this coefficient is not statistically significant. For example, the probability value linked with it is about 90%. Examining whether or not the Z statistic exceeds 2 is another method to assess the statistical importance of the explanatory factors. It is significantly less than the critical region of 2 in this instance. It might be argued that even if domestic businesses are more inclined than foreign-based businesses to profit from the green tax incentive program, this likelihood lacks statistical rigor. Since our specification did not change the statistical significance of this variable. For example, we modified the robust mood mode of standard errors in Table 4 from state of default mood, but the coefficient still seemed negligible. Furthermore, the same narrative is conveyed by the Foreign-dummy marginal impact seen in Table 5. On the other hand, the foreign dummy is consistent with a negative insignificant coefficient for foreign-based enterprises in Mao and Xu (2018) and looks statistically insignificant in all three specifications.

The age coefficient, however, is negative, meaning that older businesses have a lower chance of profiting from the green tax incentives program than do younger businesses. Because the likelihood value in Table 3 is 11%, this is statistically insignificant; nevertheless, with robust standard error regression, Table 4 shows that it is statistically significant. Thus, we infer that younger businesses are more involved in sustainable activities than older businesses and accept H2, which states that both older and younger businesses have an equal impact on the likelihood of being beneficiaries under the tax incentive program.

These results are similar with Mao and Wang (2016) and show that companies with a greater number of employees are more probable to profit from the tax incentives, as indicated by the favorable and significant coefficient for size. As a result, we find that our H3 is accepted and that companies with more employees have a higher chance of profiting from the tax advantages than companies with fewer employees.

According to H4, businesses are more inclined to profit from the tax advantages if they have larger levels of fixed capital and fresh investment than if they have lower levels of these resources. For example, Table 4 shows that the investment and capital probability values are 0.09 and 0.07, respectively. Compared to Liu and Mao (2019), the coefficient of capital has an almost twofold increase in magnitude.

Lastly, our final proposition makes the assumption that a corporation's capacity and profitability level have no bearing on the likelihood of the firm becoming a beneficiary of the tax incentives. As a result, we find that our previous premise is once more invalidated and that companies with greater asset returns are much more probable than those with a lower return to profit from the tax incentives (Table 6).

After reporting the initial outcomes of the regression, a goodness of fit test must be performed. The goodness of fit test's null hypothesis states that there exists no discernible difference between the values seen and those predicted. If this hypothesis is wrong, then there must be a big discrepancy between the actual and predicted values. However, given the likelihood of Chi2 is 75%, we are unable to reject the null hypothesis at a 5% significance level. Since there is no discernible discrepancy between the observed and expected values in Table 7, it may be said that the model is well fitted.

Our hypothesis analysis is shown in Table 7. Based on the coefficients and t-statistics values, we draw a decision on our hypothesis. For example, the first hypothesis argues that both domestic and international enterprises have an equal chance of becoming beneficiaries. Concerning H2, it is assumed that both younger and older enterprises have an equal chance of benefiting. The plan of green tax incentives is less likely to help older enterprises than younger firms, as indicated by the negative coefficient. We accept H2 since, additionally, the coefficient is highly significant at a 5% level of significance. In summary, younger enterprises have a higher chance of being beneficiaries than older firms. Similarly, the third, fourth, and fifth hypotheses are also accepted at a 10% level of significance, as can be seen by applying the same reasoning.

5 Conclusion and recommendations

The aim of the present research was to examine the effects of various firm-specific factors on the likelihood of receiving benefits from the Swedish government's green tax incentive program. We gathered information on firm-specific attributes by analyzing the yearly reports of the most prominent 90 companies listed between 2016 and 2021 on the Nasdaq Stockholm stock exchange. To find out how likely it is that we will benefit from the green tax incentives program, we developed estimators for Probit regression. Since the ESG scores are the factor that depends in the present investigation, we translated them to binary results with values 0 and 1. In particular, companies with an ESG score of 60 or more were deemed dummy 1, whereas companies with a score of 60 or lower were deemed dummy 0. As an explanatory variable, we employed a foreign dummy to indicate whether the firm's owner is based domestically or abroad. Dummy 0 denotes domestic ownership and Dummy 1 denotes foreign ownership. Aside from that, this study has employed the capacity, firm's size, age, capital, investment, and return on assets, as explanatory factors.

According to the study's findings, only two firm-specific variables—the foreign dummy and age—secure negative coefficients, with the remaining coefficients all suggesting a significant and positive influence on the likelihood of receiving benefits from the green tax incentives initiative. For example, the foreign and age dummy variables have significant and negative coefficients. However, for capacity, size, capital, investment, and asset return, the coefficients are substantial and positive. Based on the results, it can be said that certain firm-specific traits have a significant role in predicting a firm's likelihood of receiving benefits from the green tax incentive program.

6 Policy recommendations

In light of the research findings, we suggest the accompanying strategy proposals: Concerning first hypothesis, we affirmed that overseas firms exploited the green tax motivating forces conspire, subsequently, it is basic to upgrade the green tax motivators programs trying to draw in foreign-based firms; We observed in this investigation that more youthful firms are participated in additional sustainable exercises than more older firms and exploited the tax impetuses conspire than more established firms. It is recommended in light of this particular finding that forthcoming green tax bundles should incorporate incentives to more seasoned firms; this proposal should be stretched out to the size factor.

Availability of data and materials

The data is available on request from corresponding author.

References

Acemoglu, D., Aghion, P., & Hémous, D. (2014). The environment and directed technical change in a North-South model. Oxford Review of Economic Policy, 30(3), 513–530.

Andersson, J. J. (2019). Carbon taxes and CO2 emissions: Sweden as a case study. American Economic Journal: Economic Policy, 11(4), 1–30.

Bhatti, F. A., Aslam, E., ur Rehman, A., Ashraf, S., Aslam, M., & Shabbir, M. S. (2023). Does intellectual capital efficiency spur the financial performance of banks? A comparative analysis of Islamic and conventional banks in Pakistan. Al-Qanṭara, 9(3), 55–67.

Cao, X., Kannaiah, D., Ye, L., Khan, J., Shabbir, M. S., Bilal, K., & Tabash, M. I. (2022). Does sustainable environmental agenda matter in the era of globalization? The relationship among financial development, energy consumption, and sustainable environmental-economic growth. Environmental Science and Pollution Research, 1–11.

Dahlberg, L., & Wiklund, F. (2018). ESG Investing In Nordic Countries: An analysis of the Shareholder view of creating value.

Erhart, S. (2018). Exchange-traded green bonds. Journal of Environmental Investing, 1–41.

Fang, G., Yang, K., Tian, L., & Ma, Y. (2022). Can environmental tax promote renewable energy consumption? An empirical study from the typical countries along the Belt and Road. Energy, 260, 125193.

Fareed, Z., Rehman, M. A., Adebayo, T. S., Wang, Y., Ahmad, M., & Shahzad, F. (2022). Financial inclusion and the environmental deterioration in Eurozone: The moderating role of innovation activity. Technology in Society, 69, 101961.

Irfan, M., Rehman, M. A., Razzaq, A., & Hao, Y. (2023). What derives renewable energy transition in G-7 and E-7 countries? The role of financial development and mineral markets. Energy Economics, 121, 106661.

Jaffe, A. B., & Palmer, K. (1997). Environmental regulation and innovation: A panel data study. Review of Economics and Statistics, 79(4), 610–619.

Jagers, S. C., & Hammar, H. (2009). Environmental taxation for good and for bad: The efficiency and legitimacy of Sweden’s carbon tax. Environmental Politics, 18(2), 218–237.

Jin, C., Tsai, F. S., Gu, Q., & Wu, B. (2022). Does the porter hypothesis work well in the emission trading schema pilot? Exploring moderating effects of institutional settings. Research in International Business and Finance, 62, 101732.

Lanoie, P., Patry, M., & Lajeunesse, R. (2008). Environmental regulation and productivity: Testing the porter hypothesis. Journal of Productivity Analysis, 30, 121–128.

Liu, C., Ni, C., Sharma, P., Jain, V., Chawla, C., Shabbir, M. S., & Tabash, M. I. (2022). Does green environmental innovation really matter for carbon-free economy? Nexus among green technological innovation, green international trade, and green power generation. Environmental Science and Pollution Research, 1–9.

Liang, X., Zhang, Y., Tan, J., Chen, H., & Shabbir, M. S. (2023). The dynamic relationship between multidimensional energy poverty and social wellbeing’s. Social Indicators Research, 1–14.

Liu, Y., & Mao, J. (2019). How do tax incentives affect investment and productivity? Firm-level evidence from China. American Economic Journal: Economic Policy, 11(3), 261–291.

Mao, J., & Wang, C. (2016). Tax incentives and environmental protection: Evidence from China’s taxpayer-level data. China Finance and Economic Review, 4(1), 1–30.

Mughal, N., Zafar, S. Z., Rawoof, H. A., Maria, S. C., Zhilin, Q., Magdalena, R., & Shabbir, M. S. (2023). The dynamic effects of socioeconomic factors on different crime levels: Evidence from south asian countries. Journal of the Knowledge Economy, 1–14.

Milne, J. E. (2003). Environmental taxation: Why theory matters. Critical Issues in Environmental Taxation, 1, 3–26.

Milne, J. E. (2007). Green taxes and climate change: Theory and reality. Cesifo DICE Report, 5(4), 8–12.

Rawoof, H. A., Said, L. R., Irmak, E., Pelit, I., & Malik, S. S. (2023). The dynamic effects of foreign direct investment services and energy consumption on information and communication technology sector. International Journal of Energy Economics and Policy, 13(5), 553.

Rehman, M. A., Sabir, S. A., Bukhari, A. A. A., & Sharif, A. (2023). Do globalization and human capital an opportunity or threat to environmental sustainability? Evidence from emerging countries. Journal of Cleaner Production, 418, 138028.

Shabbir, M. S., Said, L. R., Pelit, I., & Irmak, E. (2023). The dynamic relationship among domestic stock returns volatility, oil prices, exchange rate and macroeconomic factors of investment. International Journal of Energy Economics and Policy, 13(3), 560–565.

Ulucak, R. (2020). How do environmental technologies affect green growth? Evidence from BRICS economies. Science of the Total Environment, 712, 136504.

Ur Rehman, A., Aslam, E., Muhammad, R. S., Aslam, M., Iqbal, A., & Shabbir, M. S. (2023). Consumer awareness and knowledge about Takaful (Islamic Insurance): A survey of Pakistan. Journal of Namibian Studies: History Politics Culture, 35, 4101–4118.

Wang, J., Ramzan, M., Makin, F., Mahmood, C. K., Ramos-Meza, C. S., Jain, V., & Shabbir, M. S. (2023). Does clean energy matter? The dynamic effects of different strategies of renewable energy, carbon emissions, and trade openness on sustainable economic growth. Environment, Development and Sustainability, 1–10.

Xue, M., Mihai, D., Brutu, M., Popescu, L., Sinisi, C. I., Bansal, A., & Shabbir, M. S. (2024). Examining the impact of energy policies on CO2 emissions with information and communication technologies and renewable energy. Studies in Nonlinear Dynamics & Econometrics. https://doi.org/10.1515/snde-2022-0065

Yan, X., Abdalla, A. A., Zhu, G., Uslu, Y. D., Mohamed, M. A. A., Muhammad, T., & Shabbir, M. S. (2024). Does natural resources matter? Nexus among renewable energy policies, technological innovation, environmental protection, and economic growth. Energy Strategy Reviews, 51, 101272.

Acknowledgement

This work was supported by the National Natural Science Foundation of China [Grant Number: 71771023].

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Competing interests

The authors have declared no potential conflicts of interest concerning the research, and publication of this article.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Ahmad, M.N., Zhou, X., Muhammad, S. et al. Does green tax theory affect the environmental sustainability and protection?. Environ Dev Sustain (2024). https://doi.org/10.1007/s10668-024-04601-w

Received:

Accepted:

Published:

DOI: https://doi.org/10.1007/s10668-024-04601-w