Abstract

Concerns about a sustainable environment are increasing and have attained significant attention among policy experts worldwide. Therefore, the current research investigated to what extent financial innovations, green energy, and economic growth impacted Indian transport-based carbon (TCO2) emissions from 1990 to 2018. This research applied quantile autoregressive distributed lag (QARDL) model and the Wald test for parameter consistency. The QARDL approach proves valuable as it illustrates the causal patterns across different quantiles of financial innovations, green energy, economic growth, and environmental degradation. It offers a more comprehensive understanding of the overall relationships among these variables, which conventional methods such as ARDL and OLS often overlook. The outcomes reveal that financial innovation and green energy negatively affect TCO2 emissions, suggesting that transportation sector emissions will likely decline because of a rise in green energy and financial innovation. In contrast, GDP positively affects TCO2 emissions which deteriorate the environment. Furthermore, the findings of GDP2 found significant and negative effects on TCO2 for all quantiles, affirming the inverse U-shaped curve for the Indian economy. Overall, the study suggests that Indian governments should promote the development of green financial innovation and focus their priorities on sustainable energy to attain carbon neutrality and sustainable development goals.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Carbon neutrality has gained significant recognition as a pivotal measure in the ongoing battle against the repercussions of global warming (Xia, 2023). This initiative aims to establish regulations that effectively reduce both direct and indirect emissions of greenhouse gases (hereafter GHGs), such as carbon dioxide (CO2), methane (CH4), and nitrous oxide (N2O) (Parravicini et al., 2022). These GHGs contribute considerably to climate catastrophe and threaten human survival (Jianguo et al., 2022; Liu et al., 2023; Sofuoğlu & Kirikkaleli, 2023). In 2021, the United Nations Climate Change Conference (UNCCC) urged countries worldwide to address environmental concerns and take decisive actions to cut CO2 emissions and keep global warming to 1.5 °C by 2050 (Dwivedi et al., 2022). In this regard, UN General Assembly embraced the 2030 agenda, including 17 sustainable development goals (SDGs) that tackle various socioeconomic and climate-related development challenges. However, this study focuses on constructing a comprehensive measurement framework by considering carbon neutrality goals and SDG indicators, such as UN-SDGs (7, 13), by analyzing transportation’s carbon (TCO2) emissions.

The transportation industry significantly contributes to global warming, as millions of automobiles release huge GHGs into the environment (Zahoor et al., 2023). Since 1990, this sector has been involved in an eightfold rise in the ultimate oil use, which comprises 17% of the total GHG emissions produced worldwide (Javed & Cudjoe, 2022). Likewise, road transportation accounted for 7.3 billion metric tons of CO2 in 2020, which makes up 41% of worldwide emissions (Zahoor et al., 2023). If there is no curative intervention, it is anticipated that CO2 emissions from transportation will experience a 60% increase by the year 2050; hence, evaluating transportation sector emissions is crucial and a substantial contribution to the existing literature of environmental sustainability (Luderer et al., 2022).

Financial innovation (hereafter FI) is related to novel financial instruments designed to observe and control risks, insecurities, credit, and liquidity (Fareed et al., 2022). The presence of financing and innovation is crucial for the economy's advancement. Although the contribution of FI to environmental sustainability is limited and controversial, it is anticipated as a way to fund projects that are good for the environment (Chishti & Sinha, 2022). Several studies have demonstrated a correlation (either positive or negative) between FI and sustainable development. For example, Kirikkaleli et al. (2022) and Adebayo et al. (2022) found that FI had a decelerating effect on environmental degradation. In contrast, the outcomes of Jianguo et al. (2023) suggest that FI damages the environment by increasing CO2 emission in BRICS nations; while, Ahmad and Zheng (2021) demonstrated that FI may indirectly impact climate change. Some other researchers also reported that environmental regulations in the financial sector have led FI to favor green activities.

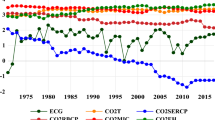

Energy Agency report (2021) stated that reducing fossil fuels in energy generation is a practical approach to mitigate the release of pollutants and curbing global warming. According to the International Renewable Energy Agency (IRENA), the amount of green energy (hereafter GRE) produced worldwide is expected to rise by fifty percent between 2019 and 2024. Similarly, International Energy Agency (IEA) predicted that GRE consumption would be the fastest growing component of global energy demand. GRE significantly improves environmental quality as these resources have no emissions and are used as a substitute for conventional fuels (Danish Godil et al., 2021). Therefore, reducing CO2 emissions through the development of GRE sources can mitigate the adverse effects of climate change and assist in achieving SDGs (Belaïd & Zrelli, 2019). Further, the graphical trends of variables are mentioned in Fig. 1. The graphical demonstrations show a rising trend for all variables indicating a good sign for India, except for CO2 emission because it can cause damage to the environment. However, the figure shows a declining trend in financial innovation at the end of the study period.

This study mainly focuses on the goals outlined in SDGs (7 and 13) and made efforts to examine the most efficient methods for achieving carbon neutrality. In the context of India, several studies were conducted on CO2 emission efficiency in different sectors (Rao & Sekhar, 2022; Rasoulinezhad & Taghizadeh-Hesary, 2022; Zhang et al., 2022a, 2022b); however, mostly ignored the transportation sector. India is the third largest CO2 emitter in the world, while the transport sector is the fourth most significant contributor to the economy. However, being the fifth largest economy, they require a vast transportation network to support their economic setup and activities. The transportation arrangements in India are still not extensively sustainable, producing harmful air and pollutant gases to degrade the environment. Therefore, it is essential to examine transportation emissions, and the current study formulated two research questions in this regard. (1) Is it worthwhile to examine the relationship between FI, GRE, GDP, and TCO2 for India in achieving carbon neutrality and SDGs? (2) In which direction and to what extent FI, GRE, and GDP can influence the TCO2 emission of India?

Furthermore, the present research empirically answers the above research questions and examines the relationship between mentioned variables from 1990 to 2018 using quantile autoregressive distributed lag (QARDL) approach. This method was established by Cho et al. (2015) to show quantile asymmetries in the long- and short-run adjustments between variables. QARDL model allows the cointegrating coefficient to vary across different levels of innovation quantiles caused by shocks. The QARDL model is superior to other linear (autoregressive distributed lag) and nonlinear (nonlinear autoregressive distributed lag) models since nonlinearity is exogenously defined and the threshold is set to zero instead of being determined by a data-driven process. The advantage of acknowledging quantile-based asymmetric relationships is that they capture the evolving impact within the time-series spanning low, medium, and high quantiles. The stated benefits establish the QARDL approach's suitability to effectively capture the nonlinear and asymmetric relationships between FI, GRE, GDP, and TCO2 for India.

Moreover, the relationship between FI and TCO2 emissions provides uncertain and inconclusive findings, thus provide motivation for further research. In this regard, the current study aims to provide substantial contributions to the existing knowledge by examining the influence of FI on TCO2 emission in the Indian context. FI is used as the proxy of broad money (M3) and narrow money (M1) and is calculated as the ratio of M3:M1. At the same time, prior studies measured FI using automated teller machines and debit and credit cards etc. In addition, environmental Kuznet curve (EKC) hypothesis was also examined through GDP and its square term. The present analysis offers comprehensive guidelines and suggestions for implementing environmentally sustainable policies and measures to reduce carbon intensity in India.

The remaining sections of this manuscript are as follows: The preceding literature is reviewed in Sect. 2. Data sources and econometric model is described in Sect. 3. Estimations and discussion of the study are presented in Sect. 4. Section 5 concludes the article and offers some helpful recommendations.

2 Literature review

2.1 Financial innovation and transport-based CO2 emissions

FI has recently attracted legislators' and researchers' interest as a sustainable planning tool, and its role in promoting financial inclusion is indispensable. The outcome of previous researchers that investigated the link between FI, financial development, and environmental degradation can be divided into two categories. The first category claims that FI may help to reduce environmental corrosion. The second one asserts that it drives ecological deterioration and stimulates its progression. Likewise, Ali and Kirikkaleli (2022) evaluated the link between FI growth and China's transport sector by applying wavelet techniques from 1971 to 2018. They found that increased development in financials may efficiently decline CO2 emissions. Shabir et al. (2022) used AMG methodology to investigate the link between FI, technological innovation, and other environmental characteristics for the Asia–Pacific region from 2004 to 2018. The findings demonstrate that expanding access to financial services improves ecological sustainability in the region. Chishti and Sinha (2022) used AMG and most miniature squares models to analyze the link between FI and ecological deterioration in BRICS nations. According to their research findings, positive FI shocks can decrease CO2 emissions, while the adverse impacts of the FI lead to a rise in emissions.

On the contrary, according to the findings of Lebdaoui et al. (2021), FI contributes to environmental degradation in the West African Economic Community States block. Similarly, using OLS and GMM for BRICS countries from 2007 to 2019, Rehman et al. (2022) found that increasing access to digital financial services boosts economic development and negatively impacts environmental sustainability. Fareed et al. (2022) examined the impact of FI on ecological sustainability and the moderating effect of technological innovation in 27 European nations using the MMQ method from 1995 to 2018. They discovered that FI exacerbates environmental deterioration; however, the moderating effect shows that FI mitigates ecological sustainability. In addition, several studies shed light on the distinction between financial inclusion and financial development, while the interaction between FI and TCO2 emissions has received limited attention. A few studies were conducted on FI in the financial sector and relatively found it a new idea that describes the process through which innovation is utilized to enhance financial operations (Palmié et al., 2020). Consequently, evaluating FI concerning transport sector CO2 emissions in the Indian context becomes imperative, contributing valuable insights to the existing body of literature.

2.2 Green energy and transport-based CO2 emissions

Green energy (GRE), called renewable energy, is produced from sources without adverse environmental impact. It includes hydro, bioenergy, geothermal, solar, wind, and ocean energy which have grown in popularity as an environmentally acceptable substitute for traditional fuels. Multiple studies have analyzed the impact and potential of GRE in mitigating CO2 emissions. Raihan and Tuspekova (2022) examine the correlation between GRE and CO2 emissions using data from 1990 to 2018 and show a negative correlation between GRE and CO2 emissions in Malaysia. Sharif et al. (2019) claim that GRE is responsible for CO2 reduction in a panel of 74 countries from 1990 to 2015. Accordingly, Sharif et al. (2020) examine the impact of GRE on CO2 emission in Turkey using the QARDL approach from 1965 to 2017. Their findings reveal that GRE significantly reduces the ecological footprint for each quantile. Likewise, Jamil et al. (2022) found a negative correlation between GRE and CO2 emissions in G-20 countries from 1970 to 2013. On the contrary, GRE positively impacts CO2 emissions in some countries because such countries have not yet reached the threshold at which renewables may effectively cut CO2 emissions (Ben Jebli et al., 2015). This argument is consistent with the findings of Apergis et al. (2010). Thus, this study seeks to make significant contributions to the existing knowledge by examining the impact of GRE on TCO2 emissions. Doing so enhances understanding of the relationship between GRE deployment and TCO2 emissions, particularly within the Indian context.

2.3 Economic growth and transport-based CO2 emissions

Various researchers assessed the GDP and CO2 emission relationship, which signifies the importance of this association. For example, Wan et al. (2022) used a novel bootstrap ARDL approach to evaluate the GDP relationship with CO2 emissions for China during 2000–2019 and indicated GDP as a contributor to emissions. Kirikkaleli et al. (2023) explored the asymmetric and long-term impact of CO2 intensity on GDP in Portugal from 1990 to 2019. Their results showed a positive relationship between GDP and CO2 intensity, suggesting that it can contribute to higher CO2 emissions. Jian & Afshan (2023) investigated the effect of GDP on CO2 emissions in G10 countries using the CS-ARDL approach from 2000 to 2018. The outcomes of their study found a positive impact of GDP on CO2 emissions in the short and long run. In contrast, Naseem et al. (2020) examined the relationship between GDP and CO2 emissions in India. Their findings revealed that GDP significantly reduces CO2 emissions. Liobikienė & Butkus (2019) used the system GMM approach to assess the relationship between GDP and CO2 emissions for 147 countries. Their findings demonstrated that improvements in energy efficiency could lead to decreased CO2 emissions.

Likewise, Grossman & Krueger (1991) established the EKC hypothesis and argued that GDP and CO2 emissions posit a nonlinear and inverse U-shaped link. Dogan & Seker (2016) examined the EKC theory and suggested no connection between CO2 emission and GDP. Suki et al. (2020) researched the existence of EKC in Malaysia using QARDL methodology from 1970 to 2018 and endorsed an inverted U-shaped curve. In another study, Dogan & Turkekul (2016) found bidirectional causality between CO2 emission and GDP. The present study investigates the relationship between GDP and TCO2 emissions by its square term as independent variables. This analysis allows us to examine the potential impact of GDP growth on TCO2 emissions and assess whether it aligns with the theoretical expectations of the EKC theory.

2.4 Knowledge gap

Various scholars have researched CO2 emissions with different macroeconomic factors such as energy consumption, technology innovation, population, urbanization, and economic growth and discovered that CO2 emissions are a global concern. Studies are yet to arrive at a conclusive argument regarding the relationship between these factors. The findings were vulnerable in study design, data, and methodology, and the results were highly responsive to the specific energy-related practices of each nation. Previous studies have predominantly focused on different regions and subgroups for their evaluation with other proxies and periods (Jianguo et al., 2023; Pholkerd & Nittayakamolphun, 2022; Rao & Sekhar, 2022; Sofuoğlu & Kirikkaleli, 2023). However, the role of TCO2, FI, GRE, and GDP as environmental parameters in achieving carbon neutrality and SDGs (7, 13) goals has not been investigated, especially in the context of India. Therefore, this study is needed to fill this void and shed light on the particular dynamics and difficulties encountered by the country on its path to carbon neutrality and SDGs. To conclude, there is a need to conduct this research to contribute toward a more nuanced comprehension of the interconnections within India's distinctive economic and environmental context. By doing so, it can facilitate targeted insights and solutions to address the specific challenges and opportunities present in the country.

3 Methodology

3.1 Data source

The present research examines the association between financial innovation, green energy, economic growth, and CO2 emission from transportation in India 1990 to 2018. Barut (2023) and Jianguo et al. (2023) utilized CO2 emissions of total GDP ratio and green logistics in G7, E7, and BRICS nations, respectively. However, in the present research, we examine the country-specific effect, which is rare in the prior literature. We used the intensity index of all GHGs, i.e., CO2, N2O, CH4, and various hydrofluorocarbons, to generate TGI (transportation gases index). We have used the carbon neutrality goal in our study as a dependent indicator and adopted transportation emissions as a proxy, measured by metric tonne (mt) per capita. The independent variable involves financial innovation (FI), and M1–M3 is used as a proxy by following the study of Chishti and Sinha (2022) and Jianguo et al. (2023), where M1 is the narrow money and M3 broad money, a seasonally adjusted index based on 2015 = 100. Green energy (GRN) measures as a tonne of oil equivalent, including hydro, bioenergy, solar, wind, and ocean energy sources, and economic development is measured as GDP per capita growth (annual %). The data on variables were gathered from the OECD, World Bank (WDI), and Climate Watch. The details of the variables used in the study are explained in Table 1.

This study converts data into quarterly form to enable a more comprehensive analysis. Quarterly data provide a higher frequency of data points, allowing for a closer examination of short-term fluctuations and trends. By capturing more frequent observations, we can better identify seasonality effects that may be present in specific sectors or industries. Moreover, the conversion to quarterly data enhances the accuracy and reliability of econometric models and statistical analyses by reducing potential biases associated with annual data. Overall, the utilization of quarterly data offers a more detailed and nuanced understanding of the underlying dynamics and variations in the variables under investigation. The variables were transformed into natural log form to eliminate the chances of unevenness and scale discrepancies in data. The flowchart of the study is presented in Fig. 2.

3.2 Econometric specification

This study utilized the QARDL cointegration approach to analyze the relationship between FI, GRE, GDP, and TCO2, and the primary form of simulation is:

where \({\epsilon }_{t}\) is the white noise error illustrated through the lowest ground made by \(({\mathrm{TCO}}_{2\mathrm{t}},{\mathrm{FI}}_{\mathrm{t}},{\mathrm{GRE}}_{\mathrm{t}}, {\mathrm{GDP}}_{\mathrm{t}}, {\mathrm{GDP}}_{\mathrm{t}}^{2},{\mathrm{TCO}}_{2\mathrm{t}-1},{\mathrm{FI}}_{\mathrm{t}-1},\dots )\) and j, k, l, m, and n represent Schwarz information criterion lag orders. Further, i represents India, t is 1990–2018; and TCO2, GRE, FI, GDP, and GDP2 denote transportation carbon emission, green energy, financial innovation, economic growth, and its square term, respectively.

Using standard econometric techniques, such as the linear ARDL model and the Johansen cointegration test, Danish Iqbal Godil et al. (2020) identify the direction of a lack of cointegration among various time series. In contrast, the current analysis used the QARDL model, where shocks cause the cointegrating coefficient to change across the innovation quantile. Regarding quantiles, Eq. (1) is represented by the QARDL model as:

where \({\epsilon }_{t}\)(τ) = \({T\mathrm{CO}}_{t}-{Q}_{T\mathrm{CO}t}(\partial /{\forall }_{t-1})\) (Kim and White, 2003) and 0 < τ < 1 simplifies quantile. The present research uses successive pair of quantiles (τ) links to (0.10, 0.20, 0.30, 0.40, 0.50, 0.60, 0.70, 0.80, and 0.90). The QARDL approach, suggested by Cho et al. (2015), is an appropriate way to inspect nonlinear and asymmetric links between the variables. It is an expansion of the ARDL model that allows for the assessment of linear and nonlinear nexus between the above-mentioned variables. QARDL model counts locational asymmetries, where results and variables may vary according to the dependent variable (Wang, 2019). Due to the probability of serial correlation in Eq. (2) error term, QARDL can be rewritten as:

Equation (3) can be reviewed and updated after considering the error correction measurement of QARDL as follows:

The short-term influence of the previous TCO2 on current TCO2 was measured using the delta technique and shown through\(\tau\). Likewise, the aggregate short-run influence of previous and prevailing GRE, FI, and GDP on the current level of TCO2 was gauged \(\tau o^{{\text{GRE}_{*} }} = \mathop \sum \nolimits_{i = 1}^{k} \tau_{o}^{{\text{GRE}}} ,\;\;\updelta _{o}^{{\text{FI}_{*} }} = \mathop \sum \nolimits_{i = 1}^{l}\updelta _{o}^{{\text{FI}}} ,\,\; \varphi_{o}^{{\text{GDP}_{*} }} = \mathop \sum \nolimits_{i = 1}^{m} \text{ }\varphi_{o}^{{\text{GDP}_{i} }} ,\,\omega o^{{\text{GDP}_{*}^{2} }} = \mathop \sum \nolimits_{i = 1}^{n} \,\omega o^{{\text{GDP}^{2} i}}\). In Eq. (4), the sign of the parameter must be adverse and substantial. The parameter for the long-run cointegration of GRE, FI, and GDP is denoted by\(\beta\). There has been the use of the following formula:

Moreover, before examining the long-run quantile effect, we summarized the dataset through descriptive statistics and checked the correlation between the study variables. Consequently, this study utilized ADF, PP, and KPSS unit root tests to check the integration level. Check data stationarity before the main results are critical because non-stationary data can provide misleading outcomes, which may not be appropriate for policy suggestions. Further, Brock, Dechert, and Scheinkman (BDS) test introduced by Brock et al. (1996) is applied, in which frequency was assessed using the correlation integral approach. This method helps to distinguish between chaotic and nonlinear processes. The test is referred to as having a greater accuracy relative to linear chaos; nonetheless, it was noticed that it might be used to analyze several different forms of nonlinearity. The BDS test statistic can be written as follows:

where \([{C}_{\varepsilon , m}-{\left({C}_{\varepsilon , 1}\right)}^{m}\) denote asymptotic normal distribution with zero mean and \({V}_{\varepsilon , m}\) is the variance. Subsequently, the Wald test checks the integration and reliability factors that change over time for short- and long-term equilibrium. For instance, if ρ represents the speed of adjustment parameter, then the null assumption is ρ*(0.10)…… = ρ*(0.90). The same approach was used for βFI, βGRE, and βGDP indicators and short-run components for lags exhibiting \({\vartheta }_{\mathrm{o}}^{\mathrm{FI}}\), \({\vartheta }_{\mathrm{o}}^{\mathrm{GRE}}\), \({\omega }_{\mathrm{o}}^{\mathrm{GDP}}\), and \({\mu }_{\mathrm{o}}^{{\mathrm{GDP}}^{2}}\). Lastly, the robustness of main estimations was examined using DOLS and FMOLS methods to warrant the sensitivity estimation of the main results.

4 Results and discussion

Table 2 shows descriptive statistics of the study variable. All mean values have a positive indication, and GRE reported the highest value, 11.897, ranging from 11.645 to 12.264. GDP2 has the second highest value, 2.311, with a minimum and maximum of 0.002 and 3.794, respectively. The mean value of TCO2 is 2.170, with the lowest and highest values being 1.488 and 2.607, respectively. It is followed by a GDP value of 1.435, with a minimum of 0.044 and a maximum of 1.948. The FI has the lowest value, 0.883, ranging from 0.620 to 1.010. Furthermore, the Jarque–Bera test results show that all the variables were not normally distributed at a significance level of 1%. It demonstrates that more analysis can be conducted using the QARDL model. The values of SD show how firmly data are adjacent to the mean; a lesser SD indicates a higher concentration. This interpretation provides that FI is more adjacent to its mean, followed by GRE, TCO2, GDP, and GDP2.

In Fig. 3, the statistical parameters are described through box plots, where 25, 50, and 75% were characterized across all graphs correspondingly. The circles and squares denote median and mean values, whereas the bottom and top small lines exhibit the minimum and maximum values, respectively.

Next, the ADF, PP, and KPSS unit root test results are displayed in Table 3. In the ADF test, all the variables are stationary at the first difference form apart from FI, which is stable at the level. PP test results stated GDP2 is stationary at level form, but all other parameters are statistically stable at the first difference. Furthermore, KPSS findings depict that variables are stationary at the level form. Unit root outcomes specify that the data are statistically stable and no second difference variable is involved; thus, the main model will provide accurate results.

The outcomes of the BDS test are depicted in Table 4, which indicates the non-acceptance of the null assumption that the series is linearly correlated. Since the BDS test reported significant results for all integrating parameters, it validates nonlinearity for the variables incorporated. The BDS stats increased as the integrating parameters rose, indicating that large dimensions had substantial nonlinearity.

Short-run results from the QARDL model are depicted in Table 5. The φ represents the results of a short-term relationship between independent variables (FI, GRE, GDP, and GDP2) and dependent variables (TCO2). The outcomes of FI quantiles were significant and negative, except for 0.80 and 0.90. It illustrates that FI does not affect TCO2 at the upper quantiles but substantially affects ranging from 0.10 to 0.70 quantiles. Furthermore, the value of GRE is significant and negative for all quantiles, which vary from 0.10 to 0.90. According to this result, if there is an upsurge in GRE, there will be a reduction in TCO2 in India. These results are consistent with Lak Kamari et al. (2020) and aligned with what we already know about this type of energy and how it affects the environment. Moreover, the GDP results showed significant positive effects from quantiles 0.10 to 0.60, while the later quantiles indicated insignificant outcomes. However, GDP2 outcomes were reported as significant and negative for all quantiles. These findings are consistent with the past studies of Shahnazi & Shabani (2021) and Jamshidi et al. (2023).

Long-run results from the QARDL model are reported in Table 6. The \(\mathrm{\alpha }\) indicates constant term value, which is positive and significant for all quantiles apart from 0.30. The FI findings showed a significant negative relation with TCO2 for all quantiles, suggesting that FI is better and more helpful for India in improving its environment. An increase in the FI ratio will decrease TCO2 emissions, and the outcomes are consistent with the past studies of Chishti & Sinha (2022) for BRICS countries and Tian et al. (2017) for China. In the meantime, the results of Jianguo et al. (2023) determined that FI causes environmental degradation in BRICS countries. The contradiction reported is due to methodology or variable index difference or because of panel analysis. By creating innovative financial instruments such as green bonds, carbon credits, and clean energy investment funds, financial institutions can attract investment toward sustainable projects and help accelerate the transition to low-carbon energy sources. Further, FI can promote energy efficiency initiatives by developing innovative financing models and mechanisms. Energy performance contracting and green leasing enable businesses and individuals to access capital for energy-efficient upgrades and technologies. This encourages the adoption of energy-saving measures and reduces the overall energy consumption and associated emissions.

In addition, the output of GRE is similar to the short-run findings; it shows a substantial negative relationship with TCO2 emissions for all quantiles ranging from 0.10 to 0.90. Considering the role of GRE in the environment, Wang (2019) explained that renewables might play a dominant role in creating an eco-friendly economy. It helps to achieve sustainability by enhancing resource efficiency, conserving energy, and reducing CO2 emissions. The deployment of green technologies can contribute to decarbonizing other sectors of the economy, such as transportation. Electric vehicles powered by green energy can reduce or eliminate tailpipe emissions associated with conventional internal combustion engines. GRE is seen as an essential element in forming policies related to environmental safety, which may decrease CO2 emissions and ultimately improve the environment's quality (Naseem & Ji, 2020).

In contrast, GDP reported significant and positive findings regardless of the quantile difference. The output illustrates that as the economy grows, there is a corresponding increase in industrial activity and energy consumption, adding pollutants to the environment. Economic growth typically accompanies increased transportation demand, including increased road traffic, air travel, and shipping activities. Transportation significantly contributes to CO2 emissions, mainly when fossil fuels are the primary energy source. The increased movement of goods, services, and people associated with economic growth leads to higher emissions from the transportation sector. Addressing this issue requires a comprehensive approach, including the adoption of sustainable and low-carbon technologies, energy efficiency measures, and policies that promote decoupling economic growth from carbon emissions. Most scholars previously narrated similar results for GDP and TCO2 nexus (Akalpler & Hove, 2019; Aslam et al., 2021; Namahoro et al., 2021).

In addition, GDP2 detailed opposite results to GDP, indicating a substantial negative link with TCO2 for all quantiles. The positive and negative GDP measures align with the EKC hypothesis, which recommends economic activities raise pollution initially, and then decline after reaching a specific level. It can cause an improvement in the environment, and the relationship becomes negative. The findings of the EKC assumption are coherent with Zhaomin Zhang et al. (2022a, 2022b). Figure 4 depicts the EKC demonstration, which shows an upward trend for pollution and growth in the initial phase. However, growth continuously rises after the turning level, but pollutants decline.

The results of the Wald test on parameter consistency for short and long-term parameters are presented in Table 7. The findings of the Wald test do not support the validity of the null assumption for any of the variables considered in the long run, including FI, GDP, and GRE. The Wald test rejects the null assumption in the short run for all variables except GDP2. It indicates that GRE, FI, and GDP have an asymmetric or nonlinear link, so the Wald test accepts the null assumption and shows a symmetric link in the short term.

The robustness outcomes using DOLS and FMOLS methodologies are shown in Table 8. It confirms the baseline findings and demonstrates the dependability of the analysis. The coefficients of FI and GRE are negative and significant at a 1% level, indicating that both improve environmental health. Positive and significant results of GDP suggest it damages the environment. India must take swift measures to combine their goals with environmentally friendly procedures. The graphical interpretation of the main findings using QARDL and robustness methods are depicted in Fig. 5.

5 Conclusion and policy implications

This research contributes to the literature on the interrelation between financial innovation (FI), green energy (GRE), economic growth (GDP), and transport-based carbon (TCO2) emissions in India. The present research used quantile autoregressive distributed lag (QARDL) approach and Wald test to analyze the long- and short-run asymmetries between the variables, using quarterly data from 1990 to 2018. The QARDL technique assesses how different FI, GRE, and GDP quantiles influence TCO2, offering a more detailed insight into the overall relationship among these variables. The results of QARDL indicate that FI has a negative significant association with TCO2 emission for all quantiles, while GRE has the same relationship with TCO2 emission for each quantile (0.10–0.90). The result of GDP has a favorable effect on TCO2, while GDP2 shows a significant negative impact on TCO2 for all quantiles, which supports the environmental Kuznet curve hypothesis. In addition, the null assumption was rejected for all variables in the Wald test for the long run, while the null assumption was unable to deny in the short run for GDP2.

This paper focuses on achieving carbon neutrality and SDGs (7 and 13) through implementing sustainable practices and procedures for India. Government and policymakers should consider the findings of this study and adopt more sustainable strategies in their decision-making processes. Educating the general population about environmentally friendly and sustainable options is essential to attain carbon neutrality and SDGs. Moreover, lowering CO2 emissions can be accomplished by investing more in financial innovation, such as green infrastructure, and embracing new technologies. These innovations have the potential to enable the use of less energy while still achieving the same level of output. If India focuses on implementing financial innovation through environmentally friendly initiatives, it can effectively enhance energy efficiency and reduce its carbon footprint. Similarly, the Indian government should enhance its transportation infrastructure and drive innovation by introducing nonpolluting and hybrid vehicles. Encouraging the development of electric cars and electrified railway systems among the population can substantially reduce CO2 emissions in the transportation sector. The implementation of alternative carbon policies has the potential to play a significant role in curtailing emissions within this sector.

Further, the Indian government should promote the adoption of renewable energy across all sectors by increasing investments in advanced technologies for a more effective and efficient energy generation system. This approach would aid in decreasing the levels of CO2 emissions. Moreover, shifting the economic growth paradigm toward a strategy that transitions from nonrenewable to renewable energy sources holds significant advantages. This transformation meets energy requirements more sustainably and effectively reduces CO2 emissions. Consequently, it becomes imperative for India to embrace climate change-focused policies, especially targeting pivotal sectors like transportation, which is a key contributor to CO2 emissions. Such policies would reduce energy consumption while aligning with environmental preservation goals. Therefore, the Indian government must prioritize implementing effective environmental policies to mitigate the adverse impact of economic advancement on the environment.

Apart from contributions, we also encountered limitations. This study utilized the maximum available data and converted it to a quarterly form for a comprehensive assessment. However, the study period can be extended through monthly or daily datasets, which could provide improved outcomes. Moreover, we utilized M1 and M3 for financial innovation proxy, while upcoming studies can make more indexes by incorporating M2 or M4, or other instruments. This study tried to explore the damaging impact of CO2 from the transportation sector, while other sectors, such as energy and agriculture, can also be examined. The country-specific effect can be replaced with a panel analysis of SAARC, OECD, EU, G7, E7, or BRICS countries. We used the QARDL method, which may be substituted with the latest models, i.e., CS-ARDL, MMQR, bootstrap ARDL, or spatial. The current issues have a tremendous perspective for further research from different dimensions and models.

Data availability

All data generated or analyzed during this study are included in this published article, and sources are mentioned in Table 1 of the manuscript.

References

Adebayo, T. S., AbdulKareem, H. K., Kirikkaleli, D., Shah, M. I., & Abbas, S. (2022). CO2 behavior amidst the COVID-19 pandemic in the United Kingdom: The role of renewable and non-renewable energy development. Renewable Energy, 189, 492–501.

Ahmad, M., & Zheng, J. (2021). Do innovation in environmental-related technologies cyclically and asymmetrically affect environmental sustainability in BRICS nations? Technology in Society, 67, 101746.

Akalpler, E., & Hove, S. (2019). Carbon emissions, energy use, real GDP per capita and trade matrix in the Indian economy-an ARDL approach. Energy, 168, 1081–1093.

Ali, M., & Kirikkaleli, D. (2022). The asymmetric effect of renewable energy and trade on consumption-based CO2 emissions: The case of Italy. Integrated Environmental Assessment and Management, 18(3), 784–795.

Apergis, N., Payne, J. E., Menyah, K., & Wolde-Rufael, Y. (2010). On the causal dynamics between emissions, nuclear energy, renewable energy, and economic growth. Ecological Economics, 69(11), 2255–2260.

Aslam, B., Hu, J., & Shahab, S. (2021). The nexus of industrialization, GDP per capita and CO2 emission in China. Environmental Technology & Innovation, 23, 101674.

Barut, e. a. (2023). How do economic and financial factors influence green logistics? A comparative analysis of E7 and G7 nations. Environmental Science and Pollution Research, 30(1), 1011–1022.

Belaïd, F., & Zrelli, M. H. (2019). Renewable and non-renewable electricity consumption, environmental degradation and economic development: Evidence from Mediterranean countries. Energy Policy, 133, 110929.

Ben Jebli, M., Ben Youssef, S., & Ozturk, I. (2015). The role of renewable energy consumption and trade: Environmental kuznets curve analysis for sub-saharan Africa countries. African Development Review, 27(3), 288–300.

Brock, W. A., & ScheinkmanDechert, J. A. (1996). A test for independence based on the correlation dimension. Econometric Reviews, 15(3), 197–235.

Chishti, M. Z., & Sinha, A. (2022). Do the shocks in technological and financial innovation influence the environmental quality? Evidence from BRICS economies. Technology in Society, 68, 101828.

Cho, J. S., Kim, T.-H., & Shin, Y. (2015). Quantile cointegration in the autoregressive distributed-lag modeling framework. Journal of Econometrics, 188(1), 281–300.

Dogan, E., & Seker, F. (2016). The influence of real output, renewable and non-renewable energy, trade and financial development on carbon emissions in the top renewable energy countries. Renewable and Sustainable Energy Reviews, 60, 1074–1085.

Dogan, E., & Turkekul, B. (2016). CO2 emissions, real output, energy consumption, trade, urbanization and financial development: Testing the EKC hypothesis for the USA. Environmental Science and Pollution Research, 23(2), 1203–1213.

Dwivedi, Y. K., Hughes, L., Kar, A. K., et al. (2022). Climate change and COP26: Are digital technologies and information management part of the problem or the solution? An editorial reflection and call to action. International Journal of Information Management, 63, 102456.

Fareed, Z., Rehman, M. A., Adebayo, T. S., Wang, Y., Ahmad, M., & Shahzad, F. (2022). Financial inclusion and the environmental deterioration in Eurozone: The moderating role of innovation activity. Technology in Society, 69, 101961.

Godil, D. I., Sharif, A., Afshan, S., Yousuf, A., & Khan, S. A. R. (2020). The asymmetric role of freight and passenger transportation in testing EKC in the US economy: Evidence from QARDL approach. Environmental Science and Pollution Research, 27(24), 30108–30117.

Godil, D., Yu, Z., Sharif, A., Usman, R., & Khan, S. A. R. (2021). Investigate the role of technology innovation and renewable energy in reducing transport sector CO2 emission in China: A path toward sustainable development. Sustainable Development, 29(4), 694–707.

Grossman, G. M., & Krueger, A. B. (1991). Environmental impacts of a North American free trade agreement. National Bureau of economic research Cambridge Mass.

Jamil, K., Liu, D., Gul, R. F., Hussain, Z., Mohsin, M., Qin, G., & Khan, F. U. (2022). Do remittance and renewable energy affect CO2 emissions? An empirical evidence from selected G-20 countries. Energy & Environment, 33(5), 916–932.

Jamshidi, N., Owjimehr, S., & Etemadpur, R. (2023). Financial innovation and environmental quality: Fresh empirical evidence from the EU Countries. Environmental Science and Pollution Research, 30, 73372–73392.

Javed, S. A., & Cudjoe, D. (2022). A novel grey forecasting of greenhouse gas emissions from four industries of China and India. Sustainable Production and Consumption, 29, 777–790.

Jian, X., & Afshan, S. (2023). Dynamic effect of green financing and green technology innovation on carbon neutrality in G10 countries: Fresh insights from CS-ARDL approach. Economic Research-Ekonomska Istraživanja, 36(2), 2130389.

Jianguo, D., Ali, K., Alnori, F., & Ullah, S. (2022). The nexus of financial development, technological innovation, institutional quality, and environmental quality: Evidence from OECD economies. Environmental Science and Pollution Research, 29(38), 58179–58200.

Jianguo, D., Cheng, J., & Ali, K. (2023). Modelling the green logistics and financial innovation on carbon neutrality goal, a fresh insight for BRICS-T. Geological Journal, 58(7), 2742–2756.

Kirikkaleli, D., Awosusi, A. A., Adebayo, T. S., & Otrakçı, C. (2023). Enhancing environmental quality in Portugal: Can CO2 intensity of GDP and renewable energy consumption be the solution? Environmental Science and Pollution Research, 30(18), 53796–53806.

Kirikkaleli, D., Güngör, H., & Adebayo, T. S. (2022). Consumption-based carbon emissions, renewable energy consumption, financial development and economic growth in Chile. Business Strategy and the Environment, 31(3), 1123–1137.

Lak Kamari, M., Isvand, H., & Alhuyi Nazari, M. (2020). Applications of multi-criteria decision-making (MCDM) methods in renewable energy development: A review. Renewable Energy Research and Applications, 1(1), 47–54.

Lebdaoui, H., Asri, M. E., & Chetioui, Y. (2021). Environmental Kuznets curve for CO2 emissions-an ARDL-based approach for an emerging market. Interdisciplinary Environmental Review, 21(3–4), 269–289.

Liobikienė, G., & Butkus, M. (2019). Scale, composition, and technique effects through which the economic growth, foreign direct investment, urbanization, and trade affect greenhouse gas emissions. Renewable Energy, 132, 1310–1322.

Liu, M., Chen, Z., Sowah, J. K., Jr., Ahmed, Z., & Kirikkaleli, D. (2023). The dynamic impact of energy productivity and economic growth on environmental sustainability in South European countries. Gondwana Research, 115, 116–127.

Luderer, G., Madeddu, S., Merfort, L., et al. (2022). Impact of declining renewable energy costs on electrification in low-emission scenarios. Nature Energy, 7(1), 32–42.

Namahoro, J., Wu, Q., Zhou, N., & Xue, S. (2021). Impact of energy intensity, renewable energy, and economic growth on CO2 emissions: Evidence from Africa across regions and income levels. Renewable and Sustainable Energy Reviews, 147, 111233.

Naseem, S., & Ji, T. G. (2020). A system-GMM approach to examine the renewable energy consumption, agriculture and economic growth’s impact on CO2 emission in the SAARC region. GeoJournal, 86, 1–13.

Naseem, S., Ji, T. G., Kashif, U., & Arshad, M. Z. (2020). Causal analysis of the dynamic link between energy growth and environmental quality for agriculture sector: A piece of evidence from India. Environment, Development and Sustainability, 23, 7913–7930.

Palmié, M., Wincent, J., Parida, V., & Caglar, U. (2020). The evolution of the financial technology ecosystem: An introduction and agenda for future research on disruptive innovations in ecosystems. Technological Forecasting and Social Change, 151, 119779.

Parravicini, V., Nielsen, P. H., Thornberg, D., & Pistocchi, A. (2022). Evaluation of greenhouse gas emissions from the European urban wastewater sector, and options for their reduction. Science of the Total Environment, 838, 156322.

Pholkerd, P., & Nittayakamolphun, P. (2022). Nexus financial innovation and economics growth in Thailand. ABAC Journal, 42(3), 148–161.

Raihan, A., & Tuspekova, A. (2022). Toward a sustainable environment: Nexus between economic growth, renewable energy use, forested area, and carbon emissions in Malaysia. Resources, Conservation & Recycling Advances, 15, 200096.

Rao, V. T., & Sekhar, Y. R. (2022). Comparative analysis on embodied energy and CO2 emissions for stand-alone crystalline silicon photovoltaic thermal (PVT) systems for tropical climatic regions of India. Sustainable Cities and Society, 78, 103650.

Rasoulinezhad, E., & Taghizadeh-Hesary, F. (2022). Role of green finance in improving energy efficiency and renewable energy development. Energy Efficiency, 15(2), 14.

Rehman, A., Ma, H., Ozturk, I., & Ulucak, R. (2022). Sustainable development and pollution: The effects of CO2 emission on population growth, food production, economic development, and energy consumption in Pakistan. Environmental Science and Pollution Research, 29(12), 17319–17330.

Shabir, M., Gill, A. R., & Ali, M. (2022). The impact of transport energy consumption and foreign direct investment on CO2 emissions in ASEAN countries. Frontiers in Energy Research, 10, 1–12.

Shahnazi, R., & Shabani, Z. D. (2021). The effects of renewable energy, spatial spillover of CO2 emissions and economic freedom on CO2 emissions in the EU. Renewable Energy, 169, 293–307.

Sharif, A., Baris-Tuzemen, O., Uzuner, G., Ozturk, I., & Sinha, A. (2020). Revisiting the role of renewable and non-renewable energy consumption on Turkey’s ecological footprint: Evidence from Quantile ARDL approach. Sustainable Cities and Society, 57, 102138.

Sharif, A., Raza, S. A., Ozturk, I., & Afshan, S. (2019). The dynamic relationship of renewable and nonrenewable energy consumption with carbon emission: A global study with the application of heterogeneous panel estimations. Renewable Energy, 133, 685–691.

Sofuoğlu, E., & Kirikkaleli, D. (2023). The effect of mineral saving and energy on the ecological footprint in an emerging market: Evidence from novel Fourier based approaches. Letters in Spatial and Resource Sciences, 16(1), 3.

Suki, N. M., Sharif, A., Afshan, S., & Suki, N. M. (2020). Revisiting the environmental Kuznets curve in Malaysia: The role of globalization in sustainable environment. Journal of Cleaner Production, 264, 121669.

Tian, Y., Chen, W., & Zhu, S. (2017). Does financial macroenvironment impact on carbon intensity: Evidence from ARDL-ECM model in China. Natural Hazards, 88, 759–777.

Wan, Q., Miao, X., & Afshan, S. (2022). Dynamic effects of natural resource abundance, green financing, and government environmental concerns toward the sustainable environment in China. Resources Policy, 79, 102954.

Wang, Z. (2019). Does biomass energy consumption help to control environmental pollution? Evidence from BRICS countries. Science of the Total Environment, 670, 1075–1083.

Xia, Q. (2023). Does green technology advancement and renewable electricity standard impact on carbon emissions in China: Role of green finance. Environmental Science and Pollution Research, 30(3), 6492–6505.

Zahoor, A., Mehr, F., Mao, G., Yu, Y., & Sápi, A. (2023). The carbon neutrality feasibility of worldwide and in China’s transportation sector by E-car and renewable energy sources before 2060. Journal of Energy Storage, 61, 106696.

Zhang, K., Lau, H. C., Bokka, H. K., & Hadia, N. J. (2022a). Decarbonizing the power and industry sectors in India by carbon capture and storage. Energy, 249, 123751.

Zhang, Z., Bashir, T., Song, J., Aziz, S., Yahya, G., Bashir, S., & Zamir, A. (2022b). The effects of Environmental Kuznets Curve toward environmental pollution, energy consumption on sustainable economic growth through moderate role of technological innovation. Environmental Science and Pollution Research, 29, 405–416.

Funding

No funding was received to assist with the preparation of this manuscript.

Author information

Authors and Affiliations

Contributions

SN was involved in conceptualization; writing—original draft preparation; formal analysis and investigation; and writing—review and editing; UK was involved in conceptualization; methodology; formal analysis and investigation; writing—original draft preparation; funding acquisition; and supervision; YR was involved in formal analysis and investigation and writing—review and editing; and MA was involved in methodology and writing—review and editing.

Corresponding author

Ethics declarations

Conflict of interest

The authors declare no competing interests.

Ethical approval

The authors all agree to ethical approval and understand its related rules and content.

Consent to participate

The authors of this manuscript are all aware of the journal to which the manuscript was submitted, and all agree to continue to support the follow-up work.

Consent to publish

This manuscript has not been submitted or published in other journals, and the authors agree to consent to publish.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Naseem, S., Kashif, U., Rasool, Y. et al. The impact of financial innovation, green energy, and economic growth on transport-based CO2 emissions in India: insights from QARDL approach. Environ Dev Sustain (2023). https://doi.org/10.1007/s10668-023-03843-4

Received:

Accepted:

Published:

DOI: https://doi.org/10.1007/s10668-023-03843-4