Abstract

Taxes often face public opposition, which hinders their implementation since people envision them as costs without a return. Taxes on emissions are one of the most common instruments to tackle environmental problems. If their revenues are used to subsidize renewables, and a double dividend is achieved, public opposition may decrease. Focusing solely on total emissions and total output to measure the first and the second dividend of a combination of policies may be misleading. Indeed, total emissions may increase with economic growth, but relative emissions may decrease, indicating the generation sector’s desired decarbonization. Hence, a wider group of indicators can provide a better insight into the desirability of environmental policies. Our work discusses alternative indicators for the first and the second dividends in the context of a third-generation Environmental Tax Reform (ETR) where emissions tax revenues are used to finance renewable energy sources. The results of our simulation model highlight the relevance of the choice of the indicators for each dividend. Considering alternative indicators provides a better insight into policy impacts. If emissions per output indicate the environmental dividend and consumers’ utility/welfare indicates the economic dividend, the ETR always provides a double dividend. If we choose the traditional indicators, the ETR may not seem particularly interesting. However, with alternative indicators, which still reflect crucial aspects of the environment-economy relationship, the ETR is desirable. Hence, we argue that the attractiveness of a certain ETR and its double dividend should be evaluated under a broader range of indicators.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Over the last decades, environmental problems have become a fundamental issue, with the energy sector contributing to a large share of emissions. The current economic crisis deviated attention from the environment, but the relationship between the economy and the environment remains a top priority, especially in energy generation. A critical problem of this economy-energy-environment relationship is that energy generation still requires polluting nonrenewable resources. With the current technology, dominated by fossil fuels, economic growth (more production) is frequently accompanied by more pollution (emissions). Some options appear as promising to deal with this problem: increasing resource use efficiency, using carbon capture and sequestration technologies, and replacing polluting for non-polluting resources. This last route, which has been particularly appealing in the previous decades with a strong emphasis on the promotion of renewable energy sources (RES) worldwide, is explored in this paper.

Governmental policy is essential to promote resource substitution, e.g., penalizing polluting resources and supporting non-polluting ones. Notwithstanding, governmental intervention in this area faces some challenges even though subsidies to RES are common and generally accepted (Skolrud and Galinato 2017). However, these subsidies can face opposition depending on the revenues’ origin to finance them (Pereira and Pereira 2019). For example, when financed through general tax funds, such as income and labor taxes, these subsidies can generate distortions, which is generally not well accepted (Galinato and Yoder 2010). Alternatively, RES subsidies can be financed through taxes on polluting resources, changing relative prices, and guaranteeing that the burden remains within the energy system. This second alternative is generally better received by the public. Some studies consider carbon taxes and RES subsidies as independent alternatives (e.g., Silva et al. 2013b; Abolhosseini and Almas 2014) and do not study the advantages of using them simultaneously. In this regard, it is possible to follow the logic of an Environmental Tax Reform (ETR) in which the use of polluting resources is taxed, and the revenues are used (maintaining revenue-neutrality) to finance renewables use.

There is a vast literature on traditional ETRs, which shift the burden from positive economic aspects, such as employment and income, to negative environmental externalities, such as carbon emissions. In the context of an ETR, a vital issue is the analysis of the existence of a double dividend (DD) (Bovenberg 1999). The DD exists when there are simultaneously environmental advantages (the first dividend) and economic/welfare progresses (the second dividend). This literature has been developed after the initial works by Pearce (1991) and Goulder (1995). Due to the vast literature, some authors, such as Freire-González (2018), Patuelli et al. (2005), and Bosquet (2000), performed literature reviews and meta-analysis on the results obtained regarding the DD. Freire-González (2018) found that only 55% of the studies under consideration achieved a strong DD. Bosquet (2000) surveyed empirical studies on this theme and concluded that the economic dividend was small in the short-run and ambiguous in the long-run. Results remain mixed, controversial, and not completely understood. Additionally, review studies concluded that a DD also depends on the type of tax recycling-policy, but none of them covered the new ETR as the one we have in this study.

Studies on a new generation of ETRs are relatively recent and still scarce. In these reforms, tax revenues are used to, for example, promote renewable energies, develop energy efficiency, distributional offsets, or fiscal consolidation (Gago et al. 2014). These reforms are known as third-generation ETR (Gago et al. 2014). Some authors performed modelizations close to such new ETRs, even though some do not fit perfectly into the ETR literature. A vast set of policies is often analyzed, including carbon taxes and RES support, among other policies. Additionally, revenue neutrality is not always maintained (e.g., Yi et al. 2016; Kalkuhl et al. 2013; Bohringer et al. 2013). Yi et al. (2016) evaluated a set of policies that combined a CO2 tax with subsidies to low carbon electricity generation sources (including natural gas) for a Chinese city. These authors did not focus solely on RES and only covered the simulated policies’ environmental impacts. Kalkuhl et al. (2013) evaluated several policy options to promote renewables regarding their welfare and energy price effects under the central planner simulation. There was a ‘carbon-trust’ theoretically close to the ETR we implement among the policies under analysis. Bohringer et al. (2013) considered several options to finance renewables, including an electricity tax, and studied the employment and welfare impacts of those options for Germany.

Only a few studies considered a pure third generation ETR, with a carbon tax and subsidies to renewables (or similar policies) and revenue neutrality (e.g., Pereira and Pereira 2019; Skolrud and Galinato 2017; Galinato and Yoder 2010). Pereira and Pereira (2019) provided a carbon tax-financed simulation of a case where RES feed-in tariffs in Portugal. The authors found that this reform was better than the carbon tax used alone but did not discuss the dividends’ indicators. Skolrud and Galinato (2017) simulated a model where an optimal integrated tax-subsidy program existed together with Renewable Fuel Standard policies. Taxes were imposed on blended fuel, while subsidies were provided to cellulosic ethanol production. Revenue neutrality was maintained. This study departs from our case because our empirical simulation focuses on the electricity sector and considers the decentralized equilibrium rather than the central planner case. Galinato and Yoder (2010) assumed a carbon tax with a fixed net-revenue (for high emitting energy sources) and a subsidy program (for low emitting energy sources). These authors did not study the substitution between non-polluting and polluting resources since emissions resulted from each sector’s output and not from resource use. Additionally, by considering a welfare-maximizing, central planner situation, these authors diverge from our analysis.

The existence of an environmental dividend when applying environmental taxes is relatively consensual in the literature (Freire-González 2018). Among the existing studies, most find a positive environmental effect of the policy mix, i.e., a first dividend (e.g., Pereira and Pereira 2019; Galinato and Yoder 2010; Kalkuhl et al. 2013). However, it can be of interest to consider other indicators for the existence of this first dividend. There is an ongoing debate on the relationship between the environment and the economy. Some evidence indicates that more economic growth harms the environment at least until a specific output level. This trade-off may compromise the conclusions about a DD and hence, the desirability of a certain ETR.

Notwithstanding, a relative measure such as emissions per output reflects that the economy is becoming less intensive on emissions. Even if emissions still grow, they grow less than output, which means relative decoupling between economic growth and environmental quality (Everett et al. 2010). With the current technology, especially in the energy sector, which is still intensive in fossil fuels, it is challenging to decrease total emissions without harming output. However, it is possible to transition to a production system that is less intensive in emissions. For example, Liddle et al. (2020) refer to reducing energy intensity (and not of total energy consumption) as a desirable goal. Relative measures instead of absolute ones can then be relevant.

The existence of an economic dividend is not as consensual in the literature and needs further exploration (Freire-González 2018). For example, Galinato and Yoder (2010) found welfare gains from their policy program relative to the no-tax-scenario and the no-policy situation. Skolrud and Galinato (2017) found only marginal or zero welfare gains from their integrated tax-subsidy policy in a posterior study. Bohringer et al. (2013) found minor benefits for small renewable subsidy levels, while there were substantial losses for higher subsidy levels. On the other hand, Kalkuhl et al. (2013) and Pereira and Pereira (2019) found welfare and GDP/income losses, respectively, from the simulated policies. Still, Kalkuhl et al. (2013) showed that a RES subsidy used alone would imply significantly larger welfare losses. Welfare measured by consumers’ utility is a relevant alternative indicator to total output. Nowadays, it is generally accepted that economic growth is necessary to economic development but is not the only relevant issue. It is realistic to assume that in an era where pollution problems and related health problems exist, agents care about the consumption (which in developed countries is already at a high level) and about the environment.

Additionally, consumers’ welfare is currently frequently used as an essential economic indicator (Melamed and Petit 2019; Albaek 2013). In this perspective, we consider consumers’ utility/welfare as a relative measure since it includes the relative preferences of individuals regarding the valuation of consumption and environmental quality. Hence, it may be essential to expand the concept of the economic dividend.

In sum, when assessing the existence of a DD and the desirability of a certain ETR, it may be of interest to consider alternative indicators for the first and second dividends. Pondering only total emissions and total output may be misleading regarding the interest of a certain policy instrument.

Our contribution to the literature is twofold. Firstly, we model the third generation ETR and examine the possible existence of a DD, in a non-traditional and non-common context. Secondly, we discuss the importance of the environmental and economic dividends indicators under a specific third-generation ETR, proposing alternative indicators. Notably, we compare the results using absolute indicators, such as total emissions and total output, with the results obtained by using relative indicators, such as emissions per output and consumers’ utility/welfare. To the best of our knowledge, this discussion has never been done. Almeida et al. (2017) provided a critical analysis of the environmental indicators used in assessing the existence of an Environmental Kuznets Curve. These authors were concerned about the type of indicators used, as we do here, but in a different context. Freire-González (2018) briefly referred to the possible existence of other determinants of the economy-wide effects of an ETR but did not focus on any specific indicators.

Our stylized analytical model studies the fuel-switching (production structure) responses when tax revenues finance a subsidy to RES. We assess the possibility of achieving a DD through this new ETR considering alternative indicators for each dividend. Our results demonstrate the importance of the choice of the indicators, which policymakers should consider. Additionally, the empirical simulation reveals that the ETR achieves a better performance than the tax used alone, which is in line with, e.g., Pereira and Pereira (2019). Our model’s effects occur through resource substitution toward higher renewables’ intensity, reflecting the energy sector’s decarbonization.

The remaining of the article is organized as follows: Sect. 2 explores the model and its equilibrium conditions; Sect. 3 analyzes the possible existence of a DD of the ETR; Sect. 4 shows a numerical simulation of the model; Sect. 5 provides the conclusions and some policy implications of the article.

2 The model

Our stylized model builds on the one created in Silva et al. (2013a) and comprehends the production of three perfectly competitive sectors: final-goods, renewable resources (R-sector), and nonrenewable resources (F-sector). Our analysis is in continuous time and focuses on the decentralized equilibrium.Footnote 1

2.1 Consumers

In this economy, representative consumers own assets and value both consumption, C, and environmental quality. Hence, their utility decreases with emissions, E. The two elements of the logarithmical instantaneous utility function are separable:

We assume constant population in such a way that aggregate variables are interpreted as per capita amounts. In equilibrium, consumption is a given proportion of the output (\({C}_{t}=\Lambda {Y}_{t}\)).

2.2 Government

Since F consumption generates pollution, to achieve higher output without harming the environment, it is necessary to replace F for R. This is the government’s challenge in this model. The government taxes (\({\tau }_{t}\)) F use and subsidizes (\({\sigma }_{t}\)) R production; that is, the government uses taxes for fiscal policy purposes to finance the subsidies’ costs. Thus, taxes are needed for a balanced government budget each moment. The government’s budget is thus always in equilibrium and, following the ETR logic, tax revenues are entirely destined to support renewables:

With this procedure, we wish to remain on the sidelines of the debate on the equivalence between the financing of public expenditure (subsidies in our case) by public debt or taxation, considering that taxes are necessary for a balanced government budget at all times. Therefore, we make this procedure merely instrumental in isolating the effects of taxes and subsidies in this context.Footnote 2

2.3 Final-goods sector

A larger number of identical and perfectly competitive final-good producers act in this sector. The aggregated production function is given by:

where: Y is output, \(\phi\) represents economic efficiency, R is the quantity of renewables use, \(\alpha\) can be read as the elasticity of output regarding R, F is the quantity of nonrenewables use, and \(\left(1-\alpha \right)\) is the elasticity of output regarding F. Fossil fuels use causes emissions with a factor of \(\psi\), i.e., aggregate emissions are \({E}_{t}=\psi {F}_{t}\).

Final-good producers maximize their profit function where the final-good price is normalized to one. The first-order conditions (FOCs) provide the demand equations of R and F, respectively, which may be aggregated for the economy (for simplicity, hereafter, we omit the time argument):

where \({p}_{R}\) and \({p}_{F}\) are, respectively, the price of R and F. Accordingly, both resources are always necessary for production, given their complementarity due to back-up needs. Next, we determine the R and F supply functions.

2.4 Renewable resources sector

There are many perfectly competitive firms in this sector that “extract” R and provide them to the final-goods sector. Extraction costs, \({c}_{R}\), are constant. These costs may refer to the Levelized costs of generating electricity from RES. Each firm maximizes its instantaneous profit, and the FOC gives:

which tells, as usual, that the firm’s marginal cost equals its marginal revenue. The subsidy must be lower than \({c}_{R}\); otherwise, the price would be negative.

Gathering (4) and (6), we obtain:

To achieve compatibility between economic growth and lower emissions, the government needs a subsidy to promote R utilization.

2.5 Nonrenewable resources sector

In this sector, many perfectly competitive firms extract F and provide them to final-good firms. Firms face resource scarcity since the F stock follows the law: \(\dot{{S}_{t}}=-{F}_{t}\). Additionally, extraction costs, \({c}_{F}\), are constant.

Firms maximize intertemporal profits, and the Current Value Hamiltonian (CVH) is:

where: \({\lambda }_{t}\) is the F stock’s dynamic multiplier; and j is the firm index. The aggregated FOCs give:

The firms’ marginal revenue equals their marginal costs. Both extraction costs and the reserve shadow price increase the nonrenewables resources’ price. Tax burdens are not reflected in \({p}_{F}\) due to the “polluter pays principle.” Final good firms are deciding F use; thus, they are the ones paying the tax, which is reflected in their profits. Gathering (5) and (8):

From (7) and (10), we obtain the relationship:

Using the ETR logic where \(\tau \psi F=\sigma R\) or \(\frac{R}{F}=\frac{\tau \psi }{\sigma }\), and replacing \(\sigma\) we obtain:

The renewables intensity of production can be simplified to:

Given the previous relationship, and using the ETR logic where \(\tau \psi F=\sigma R\), we obtain the following relationship between the tax and the subsidy:

As expected, the subsidy increases with the tax level.

The emissions per output ratio, which can be considered an alternative indicator for the first dividend, are given by:

For the second dividend, we analyze welfare. Given that \(C = \Lambda \mathrm{Y}\), we may write:

3 The double dividend

To assess the existence of a DD with the ETR proposed, we provide a sensitivity analysis to the tax and the subsidy variations (Table 1). All simulations were performed using Mathematica Wolfram®.

A higher tax increases \({p}_{F}\) but has no direct effect on the renewables price. Since F use becomes more expensive, final good producers will use these resources less. However, R use also decreases (intuitively because producers have less available money and due to the degree of complementarity between resources). R use decreases less than F use such that \(\frac{R}{F}\) increases. Since the use of both types of resources decreases, output also decreases. Simultaneously, emissions decrease more than the output such that \(\frac{E}{Y}\) decreases, which determines an increase in the agents’ utility.

Analogously, a higher subsidy makes R use cheaper and has no direct effect on F cost of use. Since the use of R is less expensive, final good producers will use these resources relatively more. Although F use also increases (using the same intuition as before), R use increases more than F use such that \(\frac{R}{F}\) increases. Since the use of both types of resources increases, output also increases, and so do emissions. However, output increases more than the emissions such that \(\frac{E}{Y}\) decreases, which, as before, determines an increase in utility.

The effect of the ETR on total emissions and total output is uncertain and depends on the specific model calibration. This happens because the two policy instruments have opposite effects. The tax decreases both output and emissions, while the subsidy increases them. Contrarily, both policy instruments reduce emissions per output and increase utility. Hence, if those are the indicators under analysis, it is inevitable that the ETR will achieve a double dividend, which makes the reform desirable. This happens because production becomes less intensive on polluting resources and more intensive on non-polluting ones. These results show that the choice of indicators is key to a full evaluation of the ETR.

4 Empirical simulation

Now, we perform empirical analysis to compare several scenarios and illustrate the evolution of the main variables under the ETR proposed. First, we describe the calibration process, and then we present the results.

4.1 Calibration

For our empirical simulation, we concentrate on the electricity sector (as, e.g., Yi et al. 2016), because it is the one where RES penetration is more common/easier, and choose the case of the United States of America (the US) given its worldwide importance. To simplify, we select only one F and one R for electricity generation. According to their energy balances, we have considered the energy mix of the US’s electric sector for this selection. For the F sector, we choose coal, the most used, pollutant, and cheapest nonrenewable generation source for this country. We focus on wind power for the R sector, given its high growth rate over the last decades and significant potential. It is the second most crucial RES for electricity generation in the US, after hydropower, which we exclude because it is already a mature source with steady costs and shares. Our base year is 2015.

Table 2 summarizes the model’s calibration, which are the only values necessary for the simulation and represents the most recent data publicly available.

4.2 Empirical results

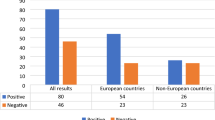

This section examines the evolution of the relative indicators proposed in our paper for different tax levels. Besides the indicator for the environmental dividend (emissions per output) and the one for the economic dividend (welfare/consumers’ utility), we also show the evolution of renewables’ ratio over nonrenewable. This ratio captures changes in the production structure and therefore indicates the process of energetic transition. The analysis is performed under three scenarios: the no-policy case, the implementation of only a tax on the nonrenewable resources use, and the ETR. Figure 1 shows the results.

As in Galinato and Yoder (2010), any policy instrument achieves welfare gains and emission reductions regarding the no policy case. Emissions per output decline as the tax rate increases, but at decreasing rates. This happens because the technical substitution of fossil fuels for RES becomes increasingly more demanding. Simultaneously, for each tax level, the ratio is lower if there is an ETR since the subsidy is promoting RES use, stimulating the substitution between polluting and non-polluting resources without significantly harming total generation. Additionally, and for the same reason, utility increases with the tax but achieves higher values with the ETR. This contrasts with the results in Kalkuhl et al. (2013) and Pereira and Pereira (2019), who always found welfare costs of policy interventions.

Additionally, with the revenue neutrality, the RES subsidy does not imply the costs found in Bohringer et al. (2013). Regarding the production structure, the renewables intensity of production always increases with the tax, following a linear function. However, as expected, it is higher if the tax is used to finance the subsidy. Both policy instruments promote the decarbonization of the energy generation structure. Thus, our results show that for the indicators under analysis, the ETR is better than the tax when used alone, which is preferable to the no-policy case. This shows the importance of environmental policy to improve the relationship environment-economy.

Contrary to Kalkuhl et al. (2013), we found welfare gains from our ETR. This difference in results may be explained, to a certain degree, by the fact that for them, emissions were not included in the utility function, i.e., agents did not value a clean environment. Our results suggest that considering alternative or additional indicators is essential to assess the existence of a DD. Thus, the consideration of such indicators could increase the number of studies that achieved a DD from 55% (Freire-González 2018) to a higher percentage.

5 Conclusions and policy implications

We intend to shed some light on discussing the double dividend of an Environmental Tax Reform (ETR). Within the framework of a third-generation ETR, we compare the results obtained using the traditional indicators for the first and second dividends with alternative ones (emissions per output and consumers’ utility/welfare, respectively). We argue that these relative measures may provide additional information on the desirability of a certain ETR. Emissions per output account for the relative decoupling of economic growth and the environment, while welfare/consumers’ utility accounts for the agents’ preferences. We build a stylized model where final-goods production uses polluting nonrenewable resources and non-polluting renewable resources to perform the analysis. The ETR taxes the use of polluting resources and subsidizes renewable ones. Revenue neutrality is maintained.

Our results indicate that the selection of the indicators for each dividend is critical for the results. In our stylized model, considering the traditional indicators does not allow concluding for the existence of the double dividend. On the other hand, the alternative, relative indicators we propose will enable us to complete that the ETR always achieves a double dividend. Hence, the ETR is still desirable compared to the no-policy situation and does not imply costs, contrary to what was previously found in the literature, e.g., in Pereira and Pereira (2019), Kalkuhl et al. (2013), and Bohringer et al. (2013). This happens because the environment-economy relationship improves. Even if total emissions increase, they increase less than output, reflecting the generation process’s desirable decarbonization. Additionally, since agents value not only consumption but also a clean environment, total utility increases. Nowadays, with growing environmental concerns, it is reasonable to assume that agents value the environment’s quality.

Our study intends to show the importance of considering a broader range of indicators when assessing a particular political package’s feasibility and importance. Policymakers can take into consideration that a specific ETR may appear as undesirable or non-effective if the goals are too strict or even misleading (e.g., reduction in total emissions and increase in total output), while in reality, the ETR does, in fact, improve essential aspects of the environment and the economy, such as the emissions intensity of production and the general wellbeing of the population. In our case, these effects are achieved by transforming the production side of the economy, which becomes more intensive in renewables use.

Our results show that environmental policy is crucial to improve the relationship between the economy and the environment. Policymakers can make use of combined policies, using revenue neutrality to improve results. To guarantee public acceptance, communication of these policies’ advantages is critical, highlighting the welfare benefits and the decarbonization of the production sector.

Notes

We abstract from all unnecessary aspects (such as capital accumulation and the labor market) to highlight key features regarding the effects of natural resource substitution on the economy and the environment.

Thus, it is not our objective to discuss the Ricardian equivalence according to which, for a given spending path, the substitution of debt by taxes does not affect aggregate demand nor interest rates. That is, to a certain extent, the public debt has no wealth effect, and for the economy, the financing of public spending by debt or taxation is equivalent. However, the verification of equivalence requires a restrictive set of assumptions, which are out of this paper’s scope.

References

Abolhosseini, S., & Almas, H. (2014). The main support mechanisms to finance renewable energy development. Renewable and Sustainable Energy Reviews, 40, 876–885.

Afonso, O. (2012). Scale-independent North-South trade effects on the technological knowledge bias and on wage inequality. Review of World Economics, 148, 181–207.

Albaek, S. (2013). Consumer welfare in EU competition policy. In C. Heide-Jørgensen, C. Bergqvist, U. Neergaard, & S. T. Poulsen (Eds.), Aims and values in competition law (pp. 67–88). Copenhagen: DJØF Publishing.

Almeida, T., Cruz, L., Barata, E., & García-Sánchez, I. (2017). Economic growth and environmental impacts: An analysis based on composite index of environmental damage. Ecological Indicators, 76, 119–130.

Bohringer, C., Keller, A., & van der Werf, E. (2013). Are green hopes too rosy? Employment and welfare impacts of renewable energy promotion. Energy Economics, 36, 277–285.

Bosquet, B. (2000). Environmental tax reform: Does it work? A survey of the empirical evidence. Ecological Economics, 34, 19–32.

Bovenberg, A. (1999). Green tax reforms and the double dividend: An updated reader’s guide. International Tax and Public Finance, 6, 421–443.

Everett, T., Ishwaran, M., Ansaloni, G., & Rubin, A. (2010). Economic growth and the environment, Department for Environment Food and Rural Affairs Evidence and Analysis Series, Paper 2.

Freire-González, J. (2018). Environmental taxation and the double dividend hypothesis in CGE modelling literature: A critical review. Journal of Policy Modeling, 40, 194–223.

Gago, A., Labandeira, X., & López-Otero, X. (2014). A panorama on energy taxes and green tax reforms. Hacienda Pública Española, IEF, 208(1), 145–190.

Galinato, G., & Yoder, J. (2010). An integrated tax-subsidy policy for carbon emission reduction. Resources and Energy Economics, 32, 310–326.

Goulder, L. (1995). Environmental taxation and the double dividend: A reader’s guide. International Tax and Public Finance, 2, 157–183.

International Energy Agency. (2018). Global Energy & CO2 status Report.

Kalkuhl, M., Edenhofer, O., & Lessmann, K. (2013). Renewable energy subsidies: Second-best policy or fatal aberration for mitigation? Resources and Energy Economics, 35, 217–234.

Liddle, B., Smyth, R., & Zhang, X. (2020). Time-varying income and price elasticities for energy demand: Evidence from a middle-income panel. Energy Economics. https://doi.org/10.1016/j.eneco.2020.104681.

Lin, C., & Zhang, W. (2011). Market power and shadow prices for nonrenewable resources: an empirical dynamic model. Annual Meeting, July 24–26, 2011, Pittsburg, Pennsylvania.

Melamed, A., & Petit, N. (2019). The misguided assault on the consumer welfare standard in the age of platform markets. Review of Industrial Organization, 2019(54), 741–774.

NEA; IEA; OECD. (2015). Projected Costs of Generating Electricity 2015 Edition. Nuclear Energy Agency, International Energy Agency, Organisation for Economic Co-operation and Development , Paris.

Patuelli, R., Nijkamp, P., & Pels, E. (2005). Environmental tax reform and the double dividend: A meta-analytical performance assessment. Ecological Economics, 55(4), 564–583.

Pearce, D. (1991). The role of carbon taxes in adjusting to global warming. The Economic Journal, 101(407), 938–948.

Pereira, R., & Pereira, A. (2019). Financing a renewable energy feed-in tariff with a tax on carbon dioxide emissions: A dynamic multi-sector general equilibrium analysis for Portugal. Green Finance, I(3), 279–296.

Silva, S., Soares, I., & Afonso, O. (2013a). Economic and environmental effects under resource scarcity and substitution between renewable and nonrenewable resources. Energy Policy, 54(C), 113–124.

Silva, S., Soares, I., & Afonso, O. (2013b). Economic growth and polluting resources: Market equilibrium and optimal policies. Economic Modelling, 30, 825–834.

Skolrud, T., & Galinato, G. (2017). Welfare implications of the renewable fuel standard with an integrated tax-subsidy policy. Energy Economics, 62, 291–301.

Yi, J., Zhao, D., Hu, X., & Cai, G. (2016). Na integrated CO2 tax and subsidy policy for low carbon electricity in Guangdong, China. Energy Sources, Part B: Economics, Planning, and Policy, 11(1), 44–50.

Acknowledgements

This research has been financed by Portuguese public funds through FCT—Fundação para a Ciência e a Tecnologia, I.P., in the framework of the Project UID/ECO/04105/2019.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

The authors declare that they have no conflict of interest.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Silva, S., Soares, I. & Afonso, O. Assessing the double dividend of a third-generation environmental tax reform with resource substitution. Environ Dev Sustain 23, 15145–15156 (2021). https://doi.org/10.1007/s10668-021-01290-7

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10668-021-01290-7