Abstract

This paper develops a general equilibrium endogenous growth model that highlights the scale-independent mechanisms through which trade-induced North-South technological-knowledge diffusion affects the technological-knowledge bias and, thus, the paths of intra-country wage inequality. In contrast with the market-size effect, stressed in the previous literature on skill-biased technological change, the operation of the emphasized price channel following openness predicts, in line with the recent trends in developed and developing countries, an increasing skilled technological-knowledge bias, which, in turn, rises wage inequality in favor of skilled labor.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Recent interpretations of trends in intra-country wage inequality provide the main motivation for writing this paper. Richardson (1995), among others, emphasizes two major trends, since the early 1980s, regarding unskilled versus skilled wage inequality in developed and (newly industrialized) developing countries: rise in wage inequality in favor of skilled labor; and rise in the proportion of skilled labor. These trends are concomitant with strong technological-knowledge progress and enlarged trade flows between those countries.

Analyzing recent literature, one concludes that each major explanation explored to date contradicts at least one of these observed trends. Following Wood (1998), the mechanisms behind these explanations are grouped into two categories: technology, which is indeed the leading explanation, and trade.

According to the technology approach, prominently explored by, for example, Acemoglu and Zilibotti (2001) and Acemoglu (1998, 2002), the technological-knowledge bias and the resulting path of the wage premium are driven by the rise in skilled labor supply. Thus, this explanation emphasizes the market-size effect on technological-knowledge progress. However, the operation of this very same effect with trade openness can contradict the argument—with an increase in trade between a skilled abundant country and an unskilled one, the effect of the effective market-size channel under trade (size of the domestic and foreign markets) can generate a reduction in the skilled technological-knowledge bias. Nevertheless, by considering the closed-economy context, this explanation excludes the effects of international technological-knowledge diffusion and, by emphasizing the scale effects, contradicts the dominant literature on scale effects, which proposes its removal (Jones 1995a, b).

As to the trade mechanism, adopted, e.g., by Leamer (1996) and Wood (1998), the explanation does not account for the role of technological knowledge (progress and diffusion) and relies mainly on the application of the Stolper–Samuelson theorem: imports of goods produced by unskilled labor reduce unskilled wages in the skilled abundant country. However, the same argument applied to the exporter country would predict a rise in the unskilled wage premium, which contradicts the trend in developing countries. As a result, there is a vibrant revived literature on trade and wage inequality, which, by trying to rethink the effects of trade on wages, reveals the recent increase in interest to the topic. Footnote 1

Both sides of this debate have been, in fact, dominated by labor endowments, either in a Heckscher–Ohlian (trade explanation) way or through research and development (R&D) intensity (technology explanation). In the latter case, a larger skilled labor endowment, for example, creates a larger demand for R&D directed towards improvements in inputs used in goods produced by skilled labor, thus increasing relative skilled wages. However, in addition to this market-size channel, the direction of R&D is also influenced by the price of goods (price channel), since more expensive goods command higher profits for the producers of the respective inputs.

For instance, the relative abundance of skilled labor increases the competitive price of goods produced by unskilled workers and, thus, the demand for R&D directed towards improvements in goods produced by unskilled labor. Pursuing this argument, when the skilled labor abundant North (developed) country exports inputs incorporating its R&D results to an unskilled abundant South (developing) country, it benefits from the higher prices of goods produced by skilled workers in the South. The resulting profit opportunities redirect R&D towards inputs that increase the marginal productivity, and thus wages, of skilled labor in the North and, due to technological-knowledge diffusion, in the South.

In order to accommodate this point of view, we develop a scale-independent dynamic general equilibrium North-South model of endogenous growth, which, as is empirically supported by, e.g., Jaumotte et al. (2009) merges the technology and the trade approaches. The connection of both approaches is achieved by shifting the focus to the price channel (instead of the market size) (Afonso 2008) and by accounting for technological-knowledge diffusion (Barro and Sala-i-Martin 1997), which we deem as non-dissociable from intermediate-good trade (Amiti and Konings 2007 and Goldberg et al. 2008). As a result, we follow and contribute to: (i) the technology and trade approaches, but in a context of technological-knowledge diffusion under trade and without scale effects; (ii) the international technological-knowledge diffusion models (Grossman and Helpman 1991; Barro and Sala-i-Martin 1997), but in a scenario with wage-inequality implications and without scale effects; (iii) the literature on scale effects, which omits the analysis of wage inequality issue (Jones 1995a, b).

Our stylized North and South countries differ in levels of productivity, labor endowments and R&D capacity. These differences are assumed to have historical roots that are reflected in current institutional characteristics. Our main concern is not to explain these differences, but rather to take them as given at time zero and analyze the subsequent path of both economies.

The North is more productive than the South due to domestic institutions, is endowed with a higher initial level of skilled labor, and its R&D activities result in innovations that improve the quality of products—Schumpeterian (vertical) R&D, as formalized by Aghion and Howitt (1992). The South has a marginal cost advantage in the production of final goods, and also conducts R&D, but its best results are imitations of the North’s innovations—as in Grossman and Helpman (1991, chs. 11 and 12). Since we want to focus on technological-knowledge diffusion through trade, it is reasonable to consider that the South is not too backward relative to the developed North. The degree of backwardness is acknowledged by making the South’s imitation of existing technology conditional to the distance to the technological-knowledge frontier.

Additional features of our model relate the technology of production, in both the North and South, to the structure of international trade. Each economy produces final goods with labor and intermediate goods, where R&D is directly applied. We focus on international trade of intermediate goods, since it is most relevant for technological-knowledge diffusion. Indeed, the recent empirical studies by Amiti and Konings (2007) and Goldberg et al. (2008) provide strong evidence showing that imports of these goods improve productivity in developing countries. Moreover, in line with the dominant literature on scale effects, Footnote 2 we isolate the price mechanisms of technological-knowledge diffusion through international trade. As for the production of (non-traded) final goods, the crucial feature is the concurrence of complementarity in the use of inputs and substitutability between types of technology, following Acemoglu and Zilibotti’s (2001) model. However, this scale-dependent horizontal R&D model without trade and thus without international technological-knowledge diffusion contrasts with our proposal, which, as stressed above, is a scale-independent vertical R&D model with trade and, thus, with international technological-knowledge diffusion.

By shifting to the price channel (instead of the market size) and by accounting for technological-knowledge diffusion, which we deem as non-dissociable from trade, we propose a framework capable of generating predictions compatible with the trend described above of wage inequality in developed and developing countries. In particular, as the North-South average relative price of final goods produced by skilled labor (the one that becomes relevant under international trade) is always higher than the one prevailing in pre-trade North, through the price channel, trade redirects technological knowledge in favor of intermediate goods used with skilled labor. This, in turn, relatively increases wages of skilled workers in both countries. The path followed by prices is empirically supported by empirical studies, such as Krueger (1997) and Broda and Romalis (2009).

To sum up, we follow and hope to contribute to three main lines of research previously incorporating scale effects and explored, notably, by: (i) technological-knowledge diffusion growth models of, e.g., Grossman and Helpman (1991, chs. 11–12) and Barro and Sala-i-Martin (1997); (ii) technological-knowledge bias and wage inequality growth models of, e.g., Acemoglu and Zilibotti (2001) and Acemoglu (2002); (iii) trade and wage inequality models of, e.g., Leamer (1996) and Wood (1998). In particular, our results relate closely to Thoenig and Verdier (2003) and Helpman et al. (2008), in as much as the analysis is consistent with empirical findings of increased wage inequality in both developed and developing countries following trade liberalization. However, to the best of our knowledge, our model is unique in that it brings together scale-independent technological-knowledge progress (Northern innovation and Southern imitation, induced by the price channel) and its diffusion through trade (of intermediate goods).

After these introductory remarks, the paper proceeds to characterize the North and South economies and the international market. Then, in Sect. 3, the dynamic general equilibrium is derived and, resorting to numerical computation, steady-state and transitional dynamics effects are analyzed. Section 4 concludes the paper with an assessment of the current state of this research.

2 Economic structure

Each economy produces final goods in perfect competition and intermediate goods under monopolistic competition. R&D activities, when successful, result in innovations (in the North) and imitations (in the South) that are used by the intermediate-goods sector, as in Romer (1990). Labor and quality-adjusted intermediate-goods are the inputs of final goods. The fraction of the aggregate final good that is not consumed is, in turn, used in the production of intermediate goods and in R&D.

2.1 Consumers

A time-invariant number of heterogeneous individuals—continuously indexed by \(i\in \left[ 0,1\right] \)—decide the allocation of income, which is partly spent on consumption of the composite final good, and partly lent in return for future interest. For simplicity, we consider an exogenous threshold individual \(\overline{i}\), such that individuals \(i>\overline{i}\) are skilled workers, whereas individuals \(i\leq \overline{i}\) are unskilled workers.

With a constant intertemporal elasticity of substitution (CIES) instantaneous utility function, the infinite horizon lifetime utility of an individual i is

where c(i, t) is individual consumption at time t, ρ > 0 is the homogeneous subjective discount rate and θ > 0 is the constant elasticity of marginal utility with respect to consumption.

The budget constraint of individual i equalizes income earned to consumption plus savings, at each t. Savings consists of accumulation of financial assets—K, with return r—in the form of ownership of the firms that produce intermediate goods in monopolistic competition. As will be clear below, the value of these firms, in turn, corresponds to the value of patents in use. The budget constraint, expressed as savings = income − consumption, is

where \(m=\left\{\begin{array}{ll} H, \hbox{ if }i>\overline{i} \\ L, \hbox{ if }i\leq \overline{i}\\ \end{array}\right.\) indexes the type of labor specific to the individual, with H and L representing, respectively, skilled and unskilled labor.

Each individual maximizes lifetime utility Eq. (1), subject to the budget constraint Eq. (2). The solution for the consumption path, which is independent of the individual, is the standard Euler equation

where \(\widehat{c}\) is the growth rate of c.

2.2 Final-goods sector and intra-country wage inequality

Following Acemoglu and Zilibotti (2001) and Afonso (2008), each final good—indexed by \(n\in \left[ 0,1\right] \)—is produced by one of two technologies. The L-technology uses L complemented with a continuum of L-specific intermediate goods indexed by \(j\in \left[ 0,J\right] \). The H-technology’s inputs are H complemented with a continuum of H-specific intermediate goods indexed by \(j\in \left[ J,1\right] \). That is, each set of intermediate goods complements either type of labor, but not both. The constant returns to scale production function at time t is

where A is a positive exogenous variable representing the level of productivity, dependent on the country’s domestic institutions (i.e., non-international trade related), namely property rights, tax laws and government services. Indexing the South by S and the North by N, we consider A S < A N as the only North-South difference in the parameters of the production function of final goods.

By considering z n (j, t) = q k(j,t) x n (j, t), the integral terms are the contributions of quality-adjusted intermediate goods to production. The size of each quality upgrade obtained with each success in R&D is denoted by q, an exogenously determined constant greater than 1. The rungs of the quality ladder are indexed by k, with higher ks denoting higher quality. At time 0, the highest quality good in each intermediate good has a quality index k = 0. At t the highest quality good produced by j has a quality index k(j, t), which is actually used due to profit maximizing limit pricing by the monopolist producers of intermediate-goods. The quantity x n (j, t) of j is used, together with its specific labor, to produce Y n (t). The term \(\left( 1-\alpha \right)\) is the aggregate intermediate-goods input share, \(\alpha \in \left] 0,1\right[ \) being the labor share.

The labor terms include the quantities employed in the production of the nth final good—L n and H n —and two types of corrective factors accounting for productivity differentials. An absolute productivity advantage of skilled over unskilled labor is accounted for by the parameter h, assuming h > 1. A relative productivity advantage of either type of labor is captured by the terms n and (1 − n). The use of these adjustment terms transforms the index n into a relevant ordering index: meaning that skilled labor is relatively more productive in producing final goods indexed by larger ns, and vice versa. Since \(n \in \left[ 0,1\right] \), there is a threshold final good, \(\overline{n}(t)\), endogenously determined, where the switch from one technology to another becomes advantageous, as will become clear below. In this sense, \(\overline{n}(t)\) defines the structure of final-goods production.

The production function Eq. (4) combines complementarity between inputs with substitutability between the two technologies. The optimal choice of technology is reflected in the equilibrium threshold final good, \(\overline{n}(t)\), which results from profit maximization (by perfectly competitive final-goods producers and by intermediate-goods monopolists) and full-employment equilibrium in factor markets, given the supply of labor and the current state of technological knowledge,

are aggregate quality indexes of the stocks of technological knowledge. The ratio \(\frac{Q_{H}}{Q_{L}}\) is an appropriate measure of the technological-knowledge bias.

Thus, optimally only L-technology is used to produce final goods indexed by \(n\leq \overline{n}(t)\), and only H-technology is used to produce goods with \(n>\overline{n}(t)\); i.e., in production function Eq. (4), H n (t) = x n (j, t) = 0, for \(0\leq j\leq J, \forall 0\leq n\leq \overline{n}(t)\) and L n (t) = x n (j, t) = 0, for \(J<j \leq 1,\forall \overline{n}(t)\leq n\leq 1\); and the demand for each j by the representative producer of nth final good is

where p n (t) is the price of final good n, p(j, t) is the price of intermediate good j (prices given for the perfectly competitive producers of final goods). Plugging Eq. (7a) and (7b) into the production function Eq. (4), the supply of final good n is

Equation (8) clearly shows how growth of final production is driven by growth of technological knowledge.

The threshold \(\overline{n}(t)\) can be implicitly expressed in terms of price indexes. This is achieved by taking into account that in the production of the threshold \(n=\overline{n}(t)\) both a firm that uses L-technology and a firm that uses H-technology should break even. This turns out to yield, at each moment in time, the following ratio of index prices of goods produced with H- and L-technologies:

Moreover, taking into consideration that the aggregate (or composite) final good is obtained by integration over final goods,

and Eqs. (5) and (9), the price-indexes of L and H final goods are, respectively,

where MC is the marginal cost of producing the composite final good.

Full-employment in the labor market, implicit in \(\overline{n}\), yields the following equilibrium skilled premium, measuring intra-country wage inequality:

where w H (t) and w L (t) are, respectively, wages per unit of H- and L-type labor.

Together, Eqs. (5), (9) and (12) are useful in foreseeing the operation of the price (of final goods) channel from the stocks (of labor and technological knowledge) to the flows of resources used in R&D and to wage inequality. For example, in a country relatively H-abundant and (or) with a large technological-knowledge bias, \(\overline{n}(t)\) is small, i.e., many final goods are produced with the H-technology and sold at a relatively low price. Profit opportunities in the production of intermediate goods used by the relatively high-priced L-technology final goods induce a change in the direction of R&D against the technological-knowledge bias and in favor of unskilled wages, i.e., there are stronger incentives to develop technologies when the final goods produced by these technologies command higher prices.Footnote 3

2.3 International trade of intermediate goods

Recent empirical studies provide strong evidence showing that imports of intermediate goods improve productivity in developing countries (Amiti and Konings 2007; Goldberg et al. 2008). Thus, in order to emphasize the diffusion of technological knowledge embodied in intermediate goods, we assume that only these goods are internationally traded, while final goods and assets are internationally immobile.Footnote 4 Each intermediate good in the international market is produced either in the North or in the South. In the former case, it embodies the latest innovation, while in the latter it results from the imitation, at a lower cost, of the latest innovation. In either case, internationally traded intermediate-goods embody the state-of-the-art technological knowledge accumulated in the North, which is summarized in Q H (t) and Q L (t).

2.3.1 Level effects in the South

When compared with a pre-trade situation, the improvement in the level of technological knowledge available to the South—through access to the state-of-the-art intermediate-goods—is a static benefit of international trade.

The structure of final-goods production in the South is also affected, as the North’s technological-knowledge bias, \({\frac{Q_{H}}{Q_{L}}}\), is transmitted to the South. In fact, comparing the threshold final good in the South—given, in general, by Eq. (5)—immediately before and immediately after entry into trade at time t 0,

where \(\frac{Q_{H,S}}{Q_{L,S}}\) is the South’s technological-knowledge bias.

While before trade the level of technological knowledge available to the South is just the domestic technological knowledge—Q H,S and Q L,S —under trade the state-of-the-art intermediate goods available internationally embody the North’s technological knowledge—Q H and Q L .

Since the technological-knowledge gap is always favorable to the North in either specific knowledge, i.e., Q m > Q m,S since, even under trade, at each t not all innovations have been imitated yet, the South enjoys an immediate absolute and relative (to the North) benefit in terms of aggregate product and factor prices. In fact, both the level of the composite final good—see together Eqs. (10) and (8)—and the marginal productivity of H and L increase with Q m .

Assuming that endowments of labor are such that the North is relatively H-abundant, i.e.,

comparison of Eq. (13) with the respective expression for the North—applying Eq. (5)—shows that \(\overline{n}_{S}>\overline{n}_{N}\). In other words, since Northern and Southern producers have access to the same state-of-the-art intermediate goods, differences in the structure of final-goods production is determined exclusively by differences in domestic labor endowments, which imply that, under international trade, the North produces more H-technology final goods than the South.

Notice that, through the operation of the price channel, the \(\overline{n}_{S}\) is larger than in pre-trade. This is because, as discussed above, labor endowments influence the direction of R&D in such a way that there are stronger incentives to improve technological knowledge that saves the relatively scarce type of labor. Since the South is H-scarce, its pre-trade technological-knowledge bias is \(\frac{Q_{H,S}} {Q_{L,S}}>\frac{Q_{H}}{Q_{L}}\).Footnote 5

Concerning the level effect on wages, the access to more productive intermediate goods shifts upwards the demand for both labor types in the South. The resulting absolute (and relative to the North) benefit to both Southern labor types is not balanced. Indeed, the level effect reduces intra-South wage inequality (skilled labor premium), as shown by plugging the technological-knowledge bias implied by the assumed relative labor endowments Eq. (14) into Eq. (12),

In other words, the shift in the demand for L is more pronounced due to complementarity between intermediate goods and labor, together with the Northern technological-knowledge bias. This is a typical Stolper–Samuelson effect, with the relative wage of the relatively scarce factor (H, in the South) suffering with international trade.

2.3.2 International limit pricing of intermediate goods

We turn now to the production and international pricing of intermediate goods. Since, by assumption, the production of intermediate goods and R&D are financed by the resources saved after consumption of the composite final good, the simplest hypothesis is to consider that, in each country, the production function of intermediate goods is identical to the composite final good specified by Eqs. (4) and (10).Footnote 6 Given this convenient simplification, the marginal cost of producing an intermediate good equals the marginal cost of producing the composite final good, MC, which, due to perfect competition in the final-goods sector, equals the price of the composite final good. Thus, in each country, the marginal cost of producing an intermediate good is independent of its quality level and is identical across all domestic industries.

Regarding inter-country differences, we assume that the marginal cost of producing the composite final good in the South is smaller than in the North, in order to allow for the entry of the South’s intermediate goods in international markets (recall that the composite final good is the input to the production of intermediate goods). Normalizing to one the marginal cost in the North, the assumption is 0 < MC S < MC N = 1, allowing Southern producer of the same quality rung, k, to underprice its Northern competitor.

The manufacture of an intermediate good requires a start-up cost of R&D, either in a new design invented in the North or in its imitation (through reverse engineering) by a Southern researcher. This investment in a blueprint can only be recovered if profits are positive within a certain period in the future. This is guaranteed by costly R&D together with domestically enforced patents, i.e., there is a domestic system of intellectual property rights (IPRs), which protect, domestically but not internationally, the leader firm’s monopoly of that quality good, while at the same time disseminating acquired knowledge to other domestic firms. Under these assumptions, knowledge of how to produce the latest quality good is public (non-rival and non-excludable) within each country and semi-public internationally (non-rival and partially non-excludable).

Even without international protection of patents, the current producer of each intermediate good enjoys some international monopoly power: for example, if the current producer is from the North, thus being challenged by either another Northerner or a Southerner imitator, monopoly is temporarily assured by IPRs in the North and costly imitation in the South. Notice that the length and magnitude (measured by the mark-up) of the monopoly power are shortened by international competition—without international trade of intermediate goods the current producer in the North is challenged only by other Northerner and not by a Southern imitator with lower marginal cost.

In general, there are three possible sequences of successful R&D outcomes and their limit pricing consequences at time t, given quality k at time t − dt, are depicted in Table 1:Footnote 7

The first mark-up is the highest: the Northern entrant (N) competes with a Northern incumbent (N) at the same marginal cost but with better quality. The second one is smaller: the Southern entrant (S), with lower marginal cost, competes in the same quality rung with a Northern incumbent (N). Compared with the first, the third mark-up is again smaller, but due to a different reason: the Northern entrant improves quality as in the first case, but competes with an incumbent with lower marginal cost.

In order to pin down which intermediate goods are produced in each country at each moment in time, let: (i) \(\Upphi _{m}\) and \((1-\Upphi_{m})\) be the proportion of intermediate goods of m-type with production in the North and in the South, respectively; (ii) \(\Uppsi_{m}\) be the proportion of intermediate goods of m-type produced in the North having overcome imitator competition; (iii) \((1-\Uppsi_{m})\) be the proportion of intermediate goods of m-type produced in the North having overcome innovator competition.

The specification of these proportions as functions of the probabilities of successful R&D follows Dinopoulos and Segerstrom (2007), such that the proportion of intermediate goods produced in the North increases with the probability of innovation and decreases with the probability of imitation.

We can now define a price index for the m-type intermediate goods—at each moment in time—as a weighted average of the limit prices in Table 1,

2.4 Research and development sector

Research and development drives the North and South economic growth. A more detailed description of the technology of R&D activities is thus in order, with the purpose of closing the characterization of the North and South domestic economies.

The R&D activities in the North result in innovative designs for the manufacture of intermediate goods, which increase their quality. The designs are domestically patented and the leader firm in each intermediate-goods industry—the one that produces according to the latest patent—uses limit pricing to assure monopoly. The value of the leading-edge patent depends on the profit-yields accruing during each period t to the monopolist, and on the duration of the monopoly power. The duration, in turn, depends (i) on the probability of a new innovation, which creatively destroys the current leading-edge design or (ii) on the probability of an imitation in the South.Footnote 8 The probabilities of successful innovation and imitations are, thus, at the heart of R&D.

Let I N (j, t) denote the instantaneous probability at time t—a Poisson arrival rate—of Northern successful innovation in the next higher quality \(\left[ k(j,t)+1\right] \) in intermediate-goods industry j,

where:

-

(i)

y N (j, t) is the flow of domestic final-good resources devoted to R&D in intermediate good j, which defines our framework as a lab equipment model (Rivera-Batiz and Romer 1991);

-

(ii)

β N q k(j,t), β N > 0, represents learning by past domestic R&D, as a positive learning effect of accumulated public knowledge from past successful R&D (Grossman and Helpman 1991, ch. 12; Connolly 2003);

-

(iii)

\(\zeta_{N}^{-1}q^{-\alpha^{-1}k(j,t)}, \zeta _{N}>0\), is the adverse effect—cost of complexity—caused by the increasing complexity of quality improvements (Kortum 1997 and Dinopoulos and Segerstrom 2007);Footnote 9

-

(iv)

\((m_{N}+m_{S})^{-\xi _{N}}, m=L\) when 0 ≤ j ≤ J and m = H when J < j ≤ 1, ξ N > 0, is the adverse effect of market size, capturing the idea that the difficulty of introducing new quality intermediate goods and replacing old ones is proportional to the size of the market measured by the respective labor. That is, for reasons of simplicity, we reflect in R&D the costs of scale increasing, due to coordination among agents, processing of ideas, informational, organizational, marketing and transportation costs, as reported by works such as Becker and Murphy (1992), Alesina and Spolaore (1997), Dinopoulos and Segerstrom (1999) and Dinopoulos and Thompson (1999).Footnote 10

In the absence of international trade, the South mimics the R&D process of the North, but less efficiently, i.e., with k S ≤ k in expression Eq. (17). Since the South is less developed, but not too backward, we assume that there are some intermediate goods j, but not all, for which k S < k, implying that even in the absence of trade there are some state-of-the-art intermediate goods produced in both countries (i.e., for which k S = k).

Once the South has access to all the best quality intermediate goods through international trade, it becomes an imitator, improving the probability of successful R&D. Hence, the South’s R&D activities, when successful, result in imitation of current worldwide best qualities. Denoting the probability of successful imitation by I S (j, t)—the instantaneous probability of successful imitation of the current higher quality k(j, t) in intermediate-goods industry j,

where:

-

(i)

y S (j, t) is the flow of domestic final-good resources devoted to R&D in intermediate good j;

-

(ii)

\(\beta _{S}\,q^{k_{S}(j,t)}, 0<\beta _{S}<\beta _{N}, k_{S}\leq k\); i.e., we consider that the learning by past imitations is lower that the learning by past innovations;

-

(iii)

\(\zeta_{S}^{-1}q^{-\alpha^{-1}k(j,t)}, \zeta _{N}>\zeta _{S}>0\); i.e., we assume that the complexity cost of imitation is lower than the innovation’s, in line with Mansfield et al. (1981) and Teece (1977);

-

(iv)

\((m_{S}+m_{N})^{-\xi _{S}}, \xi _{S}>0\), is the adverse effect of market size;

-

(v)

\(B_{D}(j,t)\;B_{T}(j,t)\;f(\widetilde{Q}_{m}(t),d)^{-\sigma +\widetilde{Q}_{m}(t)}, 0<\widetilde{Q}_{m}(t)<1, \sigma >0\); this is a catching-up term, specific to the South, which sums up positive effects of imitation capacity and backwardness.

Further remarks on each term of the catching-up factor Eq. (18)-(v) are in order.

Terms B D (j, t) and B T (j, t) are positive exogenous variables, which capture important determinants of imitation capacity. The former represents the level of imitation productivity dependent on domestic causes, which includes domestic policies promoting R&D (Aghion et al. 2001, 2004). The latter embodies the level of imitation productivity dependent on external causes, and thus comprises the degree of openness to international trade (Coe and Helpman 1995; Coe et al. 1997) and other trade policies, namely international integration (Grossman and Helpman 1991, ch. 11), as well as the South’s relative level of labor. Therefore, we assume that labor enhances the imitation capacity, thereby speeding up convergence with the North—as argued by Nelson and Phelps (1966) and, more recently, by Benhabib and Spiegel (1994) and Aghion et al. (2004), among others.

In order to capture the benefits of relative backwardness, function \(f(\widetilde{Q}_{m}(t),d)\)—similar to Papageorgiou (2002)—is

where \(\widetilde{Q}_{m}(t)\equiv \frac{Q_{m,S}(t)}{Q_{m}(t)}\) is the relative technological-knowledge level of the South’s m-specific intermediate goods.Footnote 11 Provided that the gap is not large—i.e., if \(\widetilde{Q}_{m}(t)\) is above threshold d—then the country can benefit from an advantage of backwardness, as in Barro and Sala-i-Martin (1997). When the gap is wider—so that \(\widetilde{Q}_{m}(t)\) is below threshold d—backwardness is no longer an advantage (in line with Verspagen, 1993, for example).

Function \(f(\widetilde{Q}_{m}(t),d)\) is quadratic over the range of main interest, and, once affected by the exponent function (\(-\sigma +\widetilde{Q}_{m}\)) in Eq. (18)-(v), yields an increasing (in the technological-knowledge gap) advantage of backwardness—where the size of σ affects how quickly the probability of successful imitation falls as the technological-knowledge gap falls.

In addition to the direct effect of openness on the capacity of imitation, the level effect of entry into international trade (see Sect. 2.3) also involves immediate changes in the allocation of resources to R&D. In particular, the amount of Southern resources devoted to R&D increases for two reasons. On the one hand, incentives to imitation increase through the positive effect of openness on the probability of successful imitation Eq. (18)-(v); and, on the other hand, access to enlarged markets requires more resources due to the adverse effect of market size on the probability of successful imitation Eq. (18)-(iv).Footnote 12

3 General equilibrium

Once the countries’ economic structure has been characterized for given states of technological knowledge, we now proceed to include the equilibrium dynamics of technological knowledge, which, in the absence of labor or human-capital accumulation, drives economic growth and wage dynamics. The interaction effects between the North and South, arising from international trade of intermediate goods, play a crucial role in the dynamic general equilibrium.

3.1 Equilibrium R&D

Given the functional forms Eqs. (17) and (18) of the probabilities of success in R&D, which rely on the resources—composite final goods—allocated to it, free-entry equilibrium is defined by the equality between expected revenue and resources spent. Taking, for example, the case of imitation, such equality takes the form

where V S (k, j, t) is the expected current value of the flow of profits to the monopolist producer of intermediate good j, or, in other words, the market value of the patent.Footnote 13

The expected flow of profits depends on the amount in each period, the interest rate, and the expected duration of the flow, which is the expected duration of the imitator’s technological-knowledge leadership. Such duration, in turn, depends on the probability of a successful innovation in the North, which is the potential challenger.Footnote 14 The expression for V S is

The amount of profits, \(\Uppi _{S}\), at time t, for the monopolist producer of intermediate good j, using an imitation of quality k, depends on the marginal cost, the mark-up, and the world demand for intermediate good j by the final-goods producers. Its expression, for a H-specific j and recalling that S − N indexes the second sequence in Table 1, is

Differentiating Eq. (21) using Leibniz’s rule, we obtain the dynamic arbitrage equation:

Bearing in mind Eqs. (18) and (22) with ξ S = 1 , plugging Eq. (23) into Eq. (20) and solving for I N , the equilibrium probability of a successful innovation in a H-specific intermediate good—given the interest rate and the price indexes of final goods—is

where:

The equilibrium m-specific I m,N turns out to be independent of j and k. There are two reasons behind this independence. The first and most substantial one is the removal of scale of technological-knowledge effects—the positive influence of the quality rung on profits and on the learning effect is exactly offset by its influence on the complexity cost—see the exponents of q in Eq. (22) and in Eq. (18)-(ii) and (iii). The second reason is the simplifying assumption that the determinants of imitation capacity, B D and B T in the catching-up term in Eq. (18)-(v), are not specific to each intermediate good.

Additional scale effects could arise through market size, as has been intensely discussed in the R&D endogenous growth literature since Jones’ (1995a, b) critique. Due to the technological complementarity in the production function Eq. (4), the size of the market for m-specific intermediate goods in our model is the m-type labor. Then, the scale effect is apparent in the size of the profits Eq. (22)—see the labor terms within square brackets. Since we aim at understanding international trade effects other than market size, the removal of scale is in order. The adverse effect of market size due to the scale-proportional difficulty of introducing new quality intermediate goods—term (iv) in Eqs. (17) and (18)—is designed to offset the scale effect on profits. With ξ = 1, the offsetting is such that the influence of market size becomes negligible, as is apparent in expression D H in Eq. (24).

Since the probability of successful innovation—as a Poisson arrival rate—determines the speed of technological-knowledge progress, equilibrium can be translated into the path of Northern technological knowledge, from which free trade in intermediate goods allows the South to benefit as well. The relationship turns out to yield the expression, where Eq. (24) is plugged in, for the equilibrium rate of growth of, for example, H-specific technological knowledge:

It is clear in Eq. (25) that there are trade feedback effects from imitation to innovation. That is, the positive level effect from the innovator to the imitator—the access to the state-of-the-art intermediate goods increases production and thus the resources available to imitation R&D—feeds back into the innovator, affecting the Northern technological knowledge through creative destruction.

Due to the technological complementarity in the production of final goods, the rate of growth of m-specific technological knowledge—Eq. (25) for the South and m = H—translates into the growth of demand for m-type labor interrelated with the dynamics of the price indexes of final and intermediate goods (p m,S and \(\overline{p}_{m}\), respectively), such that

Thus, the path of m-wages in each country relies on the path of domestic demand for m-type labor, which, in turn, relies on the path of: (i) the domestic range of the m-technology, established by threshold \(\overline{n}\), which determines prices of (non-tradable) final goods; (ii) the world demand for m-specific intermediate goods, reflected in international prices and driven by technological knowledge.

3.2 Steady-state growth

Since, by assumption, both countries have the access through free trade to the same state-of-the-art intermediate goods and the same technology of production of final goods,Footnote 15 the steady-state growth rate must be the same as well. This implies, through the Euler equation (3), that interest rates are also equalized between countries in steady-state.

As for the sectorial growth rates, we note first that the instantaneous aggregate resources constraint in the South, for example, is

where: (i) Y S (t) is total resources, the composite final good; (ii) \(C_{S}(t)=\int_{0}^{1}c_{S}(i,t)di\) is aggregate consumption; (iii) \(X_{S}(t)=\int_{0}^{1}\int_{0}^{1}x_{n,S}(j,t)dndj\) is aggregate intermediate goods; (iv) \(R_{S}(t)=\int_{0}^{1}y_{S}(j,t)dj\) is total resources spent in R&D.

In other words, the aggregate final good is used for consumption and savings, which in turn are allocated between production of intermediate goods and R&D.Footnote 16 This implies that the steady-state growth rate of each of these variables is equal to the North’s growth rate of technological knowledge.

Since the composite final-good production is constant returns to scale in the inputs from Eqs. (8) and (10), the constant, common to both countries, steady-state growth rate, designated by \(g^{\ast }\), is

implying constant steady-state levels of threshold final goods, final and intermediate-goods price indexes, wage premia, and North-South gaps in both technological-knowledge types.Footnote 17 Although levels remain different (due to international immobility of labor and differences in exogenous productivity and marginal costs), steady-state growth of wages is equalized between countries as derived by plugging in constant steady-state prices in Eq. (26), which is a Schumpeterian dynamic equivalent to the static factor-price equalization Samuelson’s result.

Clearly, R&D drives steady-state endogenous growth. The intensity of the driving force is, in turn, influenced by international trade. In order to look at the steady-state effects of international trade we must investigate \(g^{\ast}\) further. To this end, since \(g^{\ast}\) results directly from plugging \(r^{\ast}\) into the Euler equation (3), it is sufficient to compare the steady-state interest rate

obtained by setting the growth rate of consumption in Eq. (3) equal to the growth rate of Northern technological knowledge in Eq. (25) with the one that would prevail in a pre-trade steady state. Considering that, in the absence of international trade, the advantages of backwardness and openness terms vanish from the probability of successful imitation Eq. (18) and that the relevant market size in each country is its own domestic labor, the increment in the steady-state interest rate, from pre-trade to trade in intermediate goods, relies on the difference

While evaluation of Eq. (30) requires solving for transitional dynamics through calibration and simulation, we can, however, emphasize four ways, in addition to the level effects, through which international trade influences, in opposite directions, steady-state growth.

The first way in which international trade influences steady-state growth is the positive catching-up effect on the probability of successful imitation. Imitation capacity increases with the degree of openness, which is captured by B T , and the advantages of backwardness are only obtained in the presence of international trade. Through the feedback effect described above, the probability of successful innovation, and thus the steady-state growth rate, are also affected—see Eqs. (24) and (25).

The second way is the positive spillovers from North to South. Each innovation in the North tends to lower the cost of Southern imitation because the backwardness advantage is strengthened with each improvement of the technological-knowledge frontier.

The third—counteracting—channel is the monopolistic competition mark-up. The Northern monopolist loses profits with the entry into international trade: the average mark-up between the first and third situations in Table 1 above is smaller than (q − 1), which is the pre-trade mark-up. The reason for this is that in pre-trade successful innovators are protected from international competition. Once engaged in international trade and imitation becomes profitable (provided that the technological-knowledge threshold d is overcome), profit margins in the North are reduced, which discourages R&D activities.Footnote 18

The fourth—counteracting as well—way through which trade influences steady-state growth, is that Southern firms have to support the R&D imitative cost of state-of-the-art intermediate-goods, possibly several quality rungs above (and thus more complex) their own experience level in pre-trade. This is captured by the presence of the technological-knowledge ratio, \(\widetilde{Q}_{H}^{\ast }\), in Eq. (30).

The effect of trade on the steady-state growth rate is, thus, ambiguous. However, the comparative statics (numerically computed based on the calibration in Table 2 in the appendix) are not affected by such ambiguity because the reported changes in \(g^{\ast}\) (the first column of Table 3 in the appendix) refer to steady-state growth under trade. This rate is affected by the levels of exogenous variables and parameters, which is to be expected in an endogenous growth model. In particular, both countries’ exogenous levels of productivity (A N and A S ) and parameters of R&D technology (β, B D and B T ) improve the common growth rate through their positive effect on the profitability of R&D, as Eqs. (22) and (24) demonstrate. The impact on steady-state growth of an increase in the Southern marginal cost of final-goods production, MC S , results from the combination of typical Schumpeterian R&D effects: (i) by reducing productivity, it reduces resources available to R&D, and, consequently, both imitation and innovation (feedback effect); it also implies a smaller mark-up for the intermediate-goods producers in the South, thereby (ii) discouraging imitative R&D and (iii) encouraging innovative R&D; in our numerical calculations, the effects (i) and (ii) clearly dominate (iii).

3.3 Transitional dynamics and steady-state effects of international trade

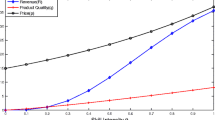

Numerical calculations describing dynamic general equilibrium—which have involved parameter calibration and sensitivity analysis based on empirical literature and theoretical conditions, as presented in the appendix—confirm that optimal paths converge to the stable steady-state.Footnote 19 The main value added of the calculations, however, is to uncover the price-channel effects of international trade on the dynamics of technological knowledge, relative prices and wages, assuming the starting condition stated in Eq. (14). Figures 1, 2, 3, 4, and 5, using those calculations, illustrate the analysis.

3.3.1 Technological-knowledge gap

While internationally available technological knowledge, Q H and Q L , is the same in both countries, South’s domestic technological knowledge, Q H,S and Q L,S , remains lower because at each point in time, not all innovations have been imitated yet. The distance to the frontier of technological knowledge defines the South’s backwardness—the converse of each ratio \(\widetilde{Q}_{m}\). Figure 1 shows a reduction (after t 0, when entry into free trade of intermediate goods occurs) of this distance in both types of technological knowledge during the transition to the steady state under international trade.Footnote 20

Domestic accumulation of technological knowledge, through R&D, depends on the probability of success. Therefore, the reduction of the gaps must reflect differentiated changes in the probabilities of successful innovation and imitation. In addition to the advantage-of-backwardness effect on the probability of imitation, differentiated changes in the probabilities arise from inter-country differences in the allocation of resources to R&D. In fact, while increasing in both countries at rates higher than \(g^{\ast}\) during transition, R&D resources increase more in the South due to stronger incentives—reflected in higher interest rates. Incentives remain stronger in the catching-up South as long as the effect of the fall in the cost of imitation relative to innovation prevails, i.e., during transition after entry into international trade.

3.3.2 Technological-knowledge bias and wage inequality

Figures 2, 3, 4, and 5 show transitional dynamics to steady states, triggered by North-South trade of intermediate goods that starts at t 0. The figures depict the paths of threshold final goods, relative prices of final goods, technological-knowledge bias and wage inequality, and are arranged in a suitable order to accompany the sequence of analytical steps that follows.

Due to complementarity, the threshold final good, \(\overline{n}\), and relative prices of H-technology final goods, \(\frac{p_{H}}{p_{L}}\), are determined by the combination of the two types of technological knowledge with the respective labor—recall Eqs. (5) and (9). Resulting from the steady-state relationships in Eq. (28) above, such a combination tends to a constant in each country and, consequently, so do \(\overline{n}\) and \(\frac{p_{H}}{p_{L}}\). As explained above in Sect. 2.3, the access to the Northern state-of-the-art intermediate goods, coupled with the relative scarcity of skilled labor in the South, implies that relatively more L-technology final goods are produced in the South (i.e., \(\overline{n}_{S}>\overline{n}_{N}\)), where, consequently, H-technology final goods are relatively more expensive—as results from Eq. (9).

Once international trade is introduced, both \(\overline{n}\) and \(\frac{p_{H}}{p_{L}}\) fall towards the steady-state. But since \(\frac{p_{H,N}}{p_{L,N}}\) remains always lower than \(\frac{p_{H,S}}{p_{L,S}}\) due to relative labor endowments, the North-South average (the one that becomes relevant under international trade) relative price of H-technology final goods is higher than the one prevailing in the North alone. The path of the relevant North-South average relative price of H-technology final goods is empirically supported by empirical studies, such as Krueger (1997) and Broda and Romalis (2009). As a result, the price channel—discussed above in Sect. 2.2—enhances, at t 0, relative demand for H-specific new designs, biasing innovation R&D in that direction, as shown in Fig. 4. Subsequently, this bias increases the world supply of H-specific intermediate goods, thereby increasing the number of H-technology final goods and lowering their relative price in both countries along the transition.Footnote 21

Due to complementarity between inputs in the production of final goods, changes in intra-country wage inequality are closely related to the technological-knowledge bias as Eq. (12) clearly shows. The stimulus to the demand for H—arising from the technological-knowledge bias induced by trade—increases the skilled labor premium in the North, relative to what would have prevailed under pre-trade (Fig. 5).

In pre-trade South, relative scarcity drives a higher H premium, which is reduced at t 0, as explained above in Sect. 2.3. This immediate effect in the level of the relative wage of H is partially reverted in the transition to the steady state as Fig. 5 shows due to the Northern technological-knowledge bias, which, under trade, is embodied in the intermediate goods available to the South. Once in steady state, with a constant technological-knowledge bias implied by Eq. (28), intra-country wage inequality in both the North and South remains constant.

The wage-inequality paths in Fig. 5 are compatible with the trends (described by, for example, Richardson 1995, and Meschi and Vivarelli 2009) that point to an increase in wage inequality (in favor of skilled labor) in developed as well as in developing countries. In our model, such an increase is related to the bias in technological knowledge, which spreads from the more developed to the developing country through international trade. However, with fixed and immobile labor endowments, the Stolper–Samuelson trade level effect in the South, in favor of the relatively abundant less-skilled labor, dominates the subsequent dynamic path of increasing wage inequality.

In addition to the transition from pre-trade, the results of steady-state comparative statics under trade also reflect the mechanisms that closely connect the direction of technological knowledge with the path of intra-country wage inequality. Table 3 in the appendix shows partial derivatives (analytically or numerically computed) of the relevant variables with respect to exogenous variables, parameters and initial conditions, in steady-state with free trade of intermediate goods.Footnote 22

The effects that exogenous changes have on technological-knowledge bias (column 2 in Table 3) and on intra-country wage inequality (columns 3 and 4, Table 3) are, thus, closely related. Take, for example, an increase in h, the absolute productivity advantage of skilled labor, which can be interpreted as the first stage of a new general-purpose technology. The increase in h not only increases the skilled wage premium, but it also favors H-technology in the production of final goods (i.e., the threshold final good, \(\overline{n}\), falls). Consequently, relative demand for H-specific intermediate goods rises, enhancing, in turn, profits of H-specific R&D and thereby biasing technological knowledge in that direction.

In what respects the influence of initial relative levels on the steady state, Table 3 shows that when the South is initially closer to the North in one type of technological knowledge—higher \(\widetilde{Q}_{H}(t_{0})\) or \(\widetilde{Q}_{L}(t_{0})\)—the steady-state technological knowledge becomes more biased towards that type of knowledge, relative to the other. For example, an increase in \(\widetilde{Q}_{H}(t_{0})\), which improves, at t 0 and subsequently, the probability of successful innovation in H-technological knowledge. The mechanism is the following: with larger domestic H-technological knowledge, each H-imitator faces less quality rungs to reach the state-of-the-art, thereby enhancing H-imitation, which, in turn, feeds back, under trade, into the North (as explained above in Sect. 3.1). Then, complementarity between inputs implies that the rising technological-knowledge bias increases the skilled wage premium.

The effects of exogenous changes in labor endowments are straightforward. With scale effects removed, the technological-knowledge bias is not affected, and so an increase in the supply of one type of labor relative to the other simply diminishes its relative wage. If, for instance, the more productive labor becomes relatively more abundant in the North, then the wage premium of the less productive labor increases, as implied by Eq. (12). In our context of international immobility of labor, these changes do not extend to the South, and so inter-country wage inequality increases in favor of the North in unskilled labor and in favor of the South in skilled labor (columns 5 and 6 of Table 3).Footnote 23

4 Concluding remarks

The recent widening in wage inequality, in developed and developing countries, has been mainly attributed by some to technology and by others to trade. The technology explanation operates in a closed-economy context, relies on the market-size channel and excludes the effects of international technological-knowledge diffusion; applied to trade with (unskilled abundant) developing countries, it would predict reduction of skilled technological-knowledge bias and, thus, in the skilled-labor premium. Moreover, by emphasizing the scale effects, it contradicts the dominant literature on scale effects. In turn, the trade approach omits the role of technological knowledge (progress and diffusion) and depends on the Stolper–Samuelson theorem; applied to developing countries, it would predict a reduction of the high-skilled premium.

By building a dynamic scale-independent North-South technological-knowledge diffusion model of endogenous growth, we connect the two explanations within a unified framework and we are able to explain the above mentioned wage-inequality path. The relationship between both explanations is achieved by shifting the focus to the price channel, instead of the market size, and by accounting for technological-knowledge diffusion under trade.

In particular, by considering international trade between two countries with different levels of development, but both capable of conducting R&D (innovative in the North and imitative in the South), we connect technological-knowledge diffusion with the direction of technological change. Thus, we relate technological-knowledge diffusion with the dynamics of intra-country wage inequality. This connection is analyzed in a model where: (i) technological-knowledge progress drives steady-state endogenous growth and its direction determines relative wages; (ii) the intensity of the driving force is influenced by international trade; and (iii) price changes induced by international trade affect the direction of technological knowledge and, thus, relative wages.

Therefore, we follow and hope to contribute to the literature: (i) on the direction of technological knowledge and wage inequality in a context of technological-knowledge diffusion through trade of intermediate goods and without scale effects; (ii) on international technological-knowledge diffusion in a scenario with wage-inequality implications and without scale effects; and (iii) on scale effects in a setting with wage-inequality analysis.

Our simulation results can be interpreted in comparison with previous literature about skill-biased technological change. In that literature, the bias that causes wage inequality is induced through the market-size channel. In our case, however, changes in the paths of intra-country wage inequality result similarly from the direction of technological-knowledge progress, but are induced through the price channel under international trade. In contrast with the market-size channel, the operation of the price-channel yields an increase in the skilled technological-knowledge bias following openness, which is more in line with the path of wage inequality observed in developed and developing countries. The use of our model, which allows for simultaneous scale and price effects, in future research should be able to assess the strength of the market-size versus price channels.

Further details of the dynamics of wage-inequality following trade provide another step for this research. Since in this paper, the relative-wage paths hinge, among other factors, on the assumption of fixed endowments, we intend to explore the effects of endogenous human-capital accumulation.

Finally, still another promising extension of the research follows from a recent characterization, by Aghion et al. (2003), of the explanations for rising wage inequality, stressing the importance of institutions. Our framework can accommodate the North-South spread of exogenous innovations of the general-purpose-technology type, which is interpretable and, thus, can be modeled as an institutional change.

Notes

Thus, in order to import some intermediate goods, the South has to be able to export other intermediate goods, since we consider balanced trade.

This is clearly in contrast with what would be predicted by the market-size channel, through which the opposite would occur.

Or, equivalently, that the composite final good is the input in the production of each intermediate good, as in Barro and Sala-i-Martin (1997), for example.

We follow Grossman and Helpman (1991, ch. 12), by assuming that limit pricing by each leading monopolist is optimal. In general, depending on whether q(1 − α) is greater or lesser than MC, the leader of each industry would, respectively, use the monopoly pricing \(p=\frac{MC}{1-\alpha}\) or the limit pricing p = q MC to capture the entire domestic market (Barro and Sala-i-Martin 2004, ch. 7). In order to rule out monopoly pricing, we assume that the size of each quality improvement, q, is not large enough.

This complexity cost is modeled in such a way that, together with the positive learning effect (ii), exactly offsets the positive influence of the quality rung on the profits of each leader intermediate-good firm—calculated below; this is the technical reason for the presence of the production function parameter α in the expression—see also Barro and Sala-i-Martin (2004, ch. 7).

Dinopoulos and Thompson (1999), in particular, provided micro foundations for this effect in a model of growth through variety accumulation.

Thus, we assume that the probability of successful imitation in intermediate good j is state dependent on all past successful R&D in all intermediate goods of its type in both countries, contrary to the probability of successful innovation, which is state dependent only on the stock of past successful R&D in intermediate good j in the North.

Resources devoted to R&D immediately increase in the North as well, but only for the second reason, i.e., the adverse effect of market size on the probability of successful innovation Eq. (17)-(iv). Northern resources are reallocated at the expense of current consumption, differently form the South, where consumption increases with the immediate increase in income.

Still in other words, V is the value of the monopolist firm, owned by domestic consumers.

In the case of the value of a patented innovation—V N —the challenge comes from both a new Northern innovation and a Southern imitation.

Except for the levels of exogenous productivity, A, and labor, m, in production function Eq. (4), implying differences in the levels but not in the growth rates.

Net exports are always zero since, by assumption, trade is balanced.

Indeed, while complete convergence in available technological knowledge is instantaneous with international trade (level effect), domestic levels may not converge completely, that is, \(\widetilde{Q}_{H}\) and \(\widetilde{Q}_{L}\) may remain below one.

Contrary to previous models in which the reduction of margins is offset by market enlargement, e.g., Rivera-Batiz and Romer (1991), we have removed the scale effect, as explained above.

To solve numerically the system of differential equations (available upon request), we use the fourth-order Runge–Kutta classical method.

Reduction of the gap occurs at decreasing rates because backwardness becomes less and less advantageous as the steady state is approached.

The significant impact of the price-channel on the direction of technological knowledge is well apparent if one compares calculations with ξ = 1 (price channel only) and with ξ < 1 (market-size channel also present). In fact, if we compute transitional dynamics with ξ = 0.4 (for example, results not shown), the market-size channel dominates and, thus, the bias in technological knowledge changes, at t 0, in the opposite direction; i.e., there is relatively more demand for L-specific new designs, driven by higher relative demand for L-specific intermediate goods, once the South (relatively abundant in L) engages in international trade.

Transitional dynamics is not shown, as its behavior is not qualitatively affected.

Table 3 shows that inter-country wage inequality is also straightforwardly affected by changes in a country’s exogenous productivity, and by changes in marginal cost—an increase in the marginal cost in our lab-equipment model corresponds to an increase in wages.

References

Acemoglu, D. (1998). Why do new technologies complement skills? Directed technical change and wage inequality. Quarterly Journal of Economics, 113(4), 1055–1089.

Acemoglu, D. (2002). Directed technical change. Review of Economic Studies, 69(4), 781–809.

Acemoglu, D., & Zilibotti, F. (2001). Productivity differences. Quarterly Journal of Economics, 116(2), 563–606.

Afonso, O. (2008). The impact of government on wage inequality without scale effects. Economic Modelling, 25(2), 351–362.

Aghion, P., & Howitt, P. (1992). A model of growth through creative destruction. Econometrica, 60(2), 323–352.

Aghion, P., Garcia-Penalosa, C., & Howitt, P. (2004). Knowledge and development: A Schumpeterian approach. In S. Dowrick, R. Pitchford and S. Turnovsky, (Eds.), Economic Growth and Macroeconomic Dynamics: Some Recent Developments. Cambridge: Cambridge University Press.

Aghion, P., Harris, C., Howitt, P., & Vickers, J. (2001). Competition, imitation and growth with step-by-step innovation. Review of Economic Studies, 68(3), 467–492.

Aghion, P., Howitt, P., & Violante, G. (2003). Wage inequality and technological change: A Nelson-Phelps approach. In P. Aghion, R. Frydman, J. Stiglitz and M. Woodford (Eds.), Knowledge, Information, and Expectations in Modern Economics. Princeton: Princeton University Press.

Alesina, A., & Spolaore, E. (1997). On the number and size of nations. Quarterly Journal of Economics, 112(4), 1027–1056.

Amiti, M., & Konings, J. (2007). Trade liberalization, intermediate inputs, and productivity: Evidence from Indonesia. American Economic Review, 97(5), 1611–1638.

Barro, R., & Sala-i-Martin, X. (1997). Technological diffusion, convergence, and growth. Journal of Economic Growth, 2(1), 1–26.

Barro, R., & Sala-i-Martin, X. (2004). Economic Growth (2nd ed.). Cambridge, MA: MIT Press.

Becker, G., & Murphy, K. (1992). The division of labor, coordination costs, and knowledge. Quarterly Journal of Economics, 107(4), 1137–1160.

Benhabib, J., & Spiegel, M. (1994). The role of human capital in economic development: Evidence from aggregate cross-country and regional U.S. data. Journal of Monetary Economics, 34(2), 143–174.

Broda, C. and Romalis, J. (2009). The welfare implications of rising price dispersion (Working paper). Available at (December 2009). http://faculty.chicagobooth.edu/john.romalis/research/Draft_v7.pdf.

Burstein, A., & Vogel, J. (2010). Globalization, technology, and the skill premium: A quantitative analysis (NBER Working paper, 16459). Cambridge, MA: National Bureau of Economic Research.

Coe, D., & Helpman, E. (1995). International R&D spillovers. European Economic Review, 39(5), 859–897.

Coe, D., Helpman, E., & Hoffmaister, A. (1997). North-South R&D spillovers. Economic Journal, 107(440), 134–149.

Connolly, M. (2003). The dual nature of trade: Measuring its impact on imitation and growth. Journal of Development Economics 72(1), 31–55.

Dinopoulos, E., & Segerstrom, P. (1999). A Schumpeterian model of protection and relative wages. American Economic Review, 89(3), 450–473.

Dinopoulos, E. and Segerstrom, P. (2007). North-South trade and economic growth (Working paper). Available at (December 2009). http://www2.hhs.se/personal/segerstrom/NorthSouth3.pdf.

Dinopoulos, E., & Thompson, P. (1998). Schumpeterian growth without scale effects. Journal of Economic Growth, 3(4), 313–335.

Dinopoulos, E., & Thompson, P. (1999). Scale effects in Schumpeterian models of economic growth. Journal of Evolutionary Economics, 9(2), 157–185.

Egger, H., & Kreickemeier U. (2009). Firm heterogeneity and the labor market effects of trade liberalization. International Economic Review 50, 187–216.

Grossman, G., & Helpman, E. (1991). Innovation and growth in the global economy. Cambridge, MA: MIT Press.

Goldberg, P., Khandelwal, A., Pavcnik, N., & Topalova, P. (2008). Imported intermediate inputs and domestic product growth: Evidence from India (NBER Working Paper 14416). Cambridge, MA: National Bureau of Economic Research.

Helpman, E., Itskhoki, O., & Redding, S. (2008). Wages, Unemployment and Inequality with Heterogeneous Firms and Workers (NBER Working Papers No.14122.) Cambridge, MA: National Bureau of Economic Research.

Howitt, P. (1999). Steady endogenous growth with population and R&D inputs growing. Journal of Political Economy, 107(4), 715–730.

Jaumotte, F., Lall, S., & Papageorgiou, C. (2009). Rising income inequality: Technology, or trade and financial globalization (Working paper). Available at (December 2009). http://www.chrispapageorgiou.com.

Jones, C. (1995a). R&D-based models of economic growth. Journal of Political Economy, 103(4), 759–784.

Jones, C. (1995b). Time series tests of endogenous growth models. Quarterly Journal of Economics, 110(2), 495–525.

Jones, L., Manuelli, R., & Rossi, P. (1993). Optimal taxation in models of endogenous growth. Journal of Political Economy, 101(3), 485–517.

Kortum, S. (1997). Research, patenting and technological change. Econometrica, 65(6), 1389–1419.

Krueger, A. (1997). Labor market shifts and the price puzzle revisited (NBER working paper series 5924). Cambridge, MA: National Bureau of Economic Research.

Krugman, P. (2008). Trade and wages, reconsidered. Brookings Papers on Economic Activity, Spring 2008(1):103–154. http://muse.jhu.edu/journals/brookings_papers_on_economic_activity/toc/eca.2008.1.html

Kwan, Y., & Lai, E. (2003). Intellectual property rights protection and endogenous economic growth. Journal of Economic Dynamics and Control, 27(5), 853–873.

Leamer, E. (1996). Wage inequality from international competition and technological change: Theory and country experience. American Economic Review, 86(2), 309–314.

Mansfield, E., Swartz, M., & Wagner, S. (1981). Imitation costs and patents: An empirical study. Economic Journal, 91(364), 907–918.

Meschi, E., & Vivarelli, M. (2009). Trade and income inequality in developing countries. World Development, 37(2), 287–302.

Nelson, R., & Phelps, E. (1966). Investment in humans, technological diffusion, and economic growth. American Economic Review, 56(1/2), 69–75.

Papageorgiou, C. (2002). Technology adoption, human capital, and growth theory. Review of Development Economics, 6(3), 351–368.

Richardson, D. (1995). Income inequality and trade: How to think, what to conclude. Journal of Economic Perspectives, 9(3), 33–56.

Rivera-Batiz, L., & Romer, P. (1991). Economic Integration and endogenous growth. Quarterly Journal of Economics, 106(2), 531–555.

Romer, P. (1990). Endogenous technological change. Journal of Political Economy, 98(5), S71–S102.

Segerstrom, P., Anant, T., & Dinopoulos, E. (1990). A Schumpeterian model of product life cycle. American Economic Review, 80(5), 1077–1092.

Teece, D. (1977). Technology transfer by multinational firms: The resource cost of transferring technological know-how. Economic Journal, 87(346), 242–261.

Thoenig, M., & Verdier, T. (2003). A theory of defensive skill-biased innovation and globalization. American Economic Review, 93(3), 709–728.

Verhoogen, E. (2008). Trade, quality upgrading and wage inequality in the Mexican manufacturing sector. Quarterly Journal of Economics, 123(2), 489–530.

Verspagen, B. (1993). Uneven growth between interdependent economies: An evolutionary view on technology gaps, trade and growth. Aldershot: Avebury.

Wood, A. (1998). Globalisation and the rise in labour market inequalities. Economic Journal, 108(450), 1463–1482.

Author information

Authors and Affiliations

Corresponding author

Appendix: Baseline calibration (Table 2) and comparative statics (Table 3)

Appendix: Baseline calibration (Table 2) and comparative statics (Table 3)

Parameter calibration is based on empirical literature and theoretical conditions.

The final-goods technology parameter α has two interpretations in the model—the labor share in production, α, and the mark-up ratio, \(q=\frac{1}{1-\alpha}\). Its value is set accordingly, in line with the mark-up estimates of Kwan and Lai (2003).

The baseline value for θ is in line with previous calibrations of growth models, where it is assumed to exceed one—e.g., Jones et al. (1993). The annualized rate of time preference, ρ, also follows from previous works on growth—e.g., Dinopoulos and Segerstrom (1999).

The other parameters have been calibrated taking into account our theoretical assumptions and considering a pre-trade Northern steady-state growth rate of 2%, which approximately matches the average per capita growth rate of the United States over the post-war period, as pointed out by Jones (1995a).

About this article

Cite this article

Afonso, O. Scale-independent North-South trade effects on the technological-knowledge bias and on wage inequality. Rev World Econ 148, 181–207 (2012). https://doi.org/10.1007/s10290-011-0109-7

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10290-011-0109-7