Abstract

This paper empirically explores the dynamic relationships between financial development, globalization, energy consumption, economic growth, and ecological footprint in G7 countries over the period 1980–2015. Using a recently introduced threshold cointegration test with an endogenous structural break, the paper aims primarily to determine the effects of financial development and globalization on environmental degradation. The results confirm the presence of cointegration in Canada, Italy, and Japan. The long-run estimates indicate that globalization significantly reduces ecological footprint in Canada and Italy, while financial development reduces pollution in Japan. The findings also demonstrate that energy consumption stimulates environmental degradation in these three countries. Furthermore, the causality test that considers smooth structural breaks via a fractional frequency flexible Fourier function indicates that globalization causes ecological footprint in all the G7 countries except France, while financial development causes ecological footprint in France, Japan, and the United Kingdom. Finally, the overall results suggest that globalization is a more effective tool than financial development in regulating ecological footprint for G7 countries. Therefore, we recommend that policymakers should make use of the opportunities that globalization offers to solve environmental problems.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Environmental problems such as desertification, deforestation, global warming, and climate change have adverse social and economic effects on societies. Climate change, which disrupts the balance of the ecosystem, can cause air pollution and serious climate events (Charfeddine and Khediri 2016). Over the past three decades, the underlying causes and consequences of global warming and climate change problems have been empirically analyzed in various studies. According to energy economics literature, the two factors that have the most significant impact on the environment are energy consumption and economic growth (Rahman et al. 2019a). High natural resources and fossil fuel energy consumption have caused a significant increase in environmental destruction in the industrialization process. The increase in carbon dioxide (CO2) emissions—regarded as the cost of fossil energy consumption and economic growth—is an important challenge to be addressed in global environmental debates. In these discussions and meetings, some measures have been taken to reduce the increase rate of CO2, which is the most abundant greenhouse gas emission. However, CO2 emission is only an indication of air pollution. For this reason, a more comprehensive environmental indicator, including air, water, and soil pollution, was formulated by Rees (1992) and Wackernagel (1994). This indicator, namely ecological footprint (EF), reflects human demand for natural resources. Human demand changes the ecosystem and causes climate change, biodiversity loss, soil degradation, and pollution problems (Rudolph and Figge 2017). In global terms, EF, as a measure of human consumption of natural resources, has increased by approximately 190% over the past 50 years due to increasing affluence, population, prosperity, mobility, and changing consumption patterns (Hoekstra and Wiedmann 2014; WWF 2018). Therefore, it is necessary to change production and consumption practices to create a more sustainable system.

The unconscious use of natural resources and the increasing level of pollution have caused environmental problems, and EF can reflect many of these issues. The EF can be used to examine the distribution and limits of natural resources on a global scale (Borucke et al. 2013). It is calculated in global hectares (gha), which reflect bioproductive areas, and was developed due to insufficient monetary measurements for the depletion of natural capital stock (Figge et al. 2017). Therefore, EF and biocapacity represent human demands for nature and the reproduction capacity of nature that can meet these demands, respectively. By comparing these two environmental indicators, policymakers and researchers can identify solutions to environmental problems. Some studies have determined that economic growth and fossil fuel consumption have an impact on EF (see Ulucak and Bilgili 2018; Balsalobre-Lorente et al. 2019; Destek and Sinha 2020). In addition to these factors, globalization and financial development may also be regarded as a significant explanatory variable for environmental change. The effects of globalization and financial development on environmental quality is a relatively new concern to the economic growth-environment nexus (Zafar et al. 2019).

The modern trend towards globalization promotes the prosperity of countries in various ways. It results in a number of nations having an increased comparative advantage, improves total factor productivity through increased trade, and creates investment opportunities through an increase in foreign direct investment, thus affecting the environment through enhancing trade and development (Shahbaz et al. 2017). Globalization that supports the spread of cultural, social, and political values (Saud et al. 2020) affects human life socially, politically, and economically by increasing investment and trade activities among countries (Haseeb et al. 2018) and accelerates the economic development process by removing the barriers to the free movement of goods and people (Saint Akadiri et al. 2019a). Every person is affected by the effects of globalization on energy consumption and intensity, employment, industrial production, and environmental changes (Zaidi et al. 2019). While globalization contributes to economic growth through the expansion of trade and investment flows, it can affect the environment in various ways. In the globalization process, the industry sector produces products to meet foreign demand, thereby increasing resource utilization and atmospheric pollution. In this case, environmental degradation may be exacerbated due to market failures and policy distortions (Shahbaz et al. 2015). Environmental problems such as global warming, desertification, deforestation, and depletion of the ozone layer and natural resources have emerged with the globalization process and continue to deteriorate (Shahbaz et al. 2017). Globalization creates more production and consumption with the interaction of societies. In this process, increasing natural resource consumption and environmental pollution causes the above-mentioned environmental problems. On the other hand, the effective use of conventional energy sources, which occurs through the technology transfer provided by globalization, can reduce environmental pollution (Saud et al. 2020). Since globalization increases economic efficiency, energy efficiency, and provides new technologies, it can contribute to controlling environmental degradation (Balsalobre-Lorente et al. 2020). Economic globalization can help improve environmental quality by reducing waste and material input per unit output through increased efficiency and competition (Tisdell 2001). Economic, political, and social globalization can reduce human demands on the ecosystem by enhancing the effectiveness of government institutions, increasing technology development, and providing education, information, and knowledge (Rudolph and Figge 2017).

The financial sector plays an important role in transferring savings and resources to productive activities and ensuring economic efficiency in general (Nasreen et al. 2017). Financial development, which is characterized as an improvement in a country's banking, stock market, and foreign direct investment activities, may cause an increase in energy consumption by supporting economic growth (Sadorsky 2010; Riti et al. 2017; Adams and Klobodu 2018; Haseeb et al. 2018). This development provides various benefits to economies, such as eliminating information loss, establishing effective financial institutions, and allowing technological development and profitable investments (Shahbaz and Lean 2012). Progress in the financial sector provides more access to financial capital to both households and firms (Shahzad et al. 2017). Thus, it can encourage economic growth by providing new tools and equipment at low costs. Financial development that affects the economic structures of countries also has an impact on the environment. The impact of financial development on the environment can be positive or negative. On the one hand, the financial sector can cause environmental pollution through an increase in fossil energy demand. Moreover, financial development may lead to further industrial pollution by stimulating economic growth (Tamazian et al. 2009). On the other hand, it can support low-cost environmental regulations that can be made effectively when increasing investments are transferred to abatement equipment. In addition, small-size companies that reduce their costs with economies of scale can increase their environmental performance. Similarly, banks can encourage the investments of companies that reduce environmental pollution (Yuxiang and Chen 2011). An effective financial system can ensure the efficient use of scarce resources. With a sound financial sector, resources can be transferred to clean technologies, thus reducing environmental pollution. Financial development can positively affect the environment with increasingly energy-efficient technologies and environmental protections (Zafar et al. 2019). It can also help improve environmental quality by supporting financial development research and development activities (Shahzad et al. 2017). All these effects of financial development can provide a better environment for future generations.

In this study, we aimed to determine the effects of globalization and financial development on EF for G7 countries, namely Canada, France, Germany, Italy, Japan, the United Kingdom (UK), and the United States (US). According to World Development Indicators (World Bank 2019), these countries account for almost half of the gross domestic product worldwide. Moreover, G7 countries with high production levels are also in the leading position in the field of globalization and financial development. Figures 1 and 2 present the globalization and financial development indices of the G7 countries from 1980 to 2015.

It is seen that the financial development levels of the countries are approaching each other. For nearly four decades, the G7 countries demonstrated significant financial development. In 2015, the US, Canada, and Japan were the three most financially developed of the G7 countries.

The G7 countries have made significant progress in terms of globalization as well as financial development. Japan lags other G7 countries, but she has managed to close the gap. Besides the increasing level of globalization and financial development over the years, the situation of environmental pollution in G7 countries is also critical. Figure 3 presents the per capita EF in G7 countries.

The figure indicates that the per capita EF has decreased in all countries. The EF has decreased significantly in Germany, France, and the UK. It decreased by 31% in Germany, 22.7% in France, and 21% in the UK. This environmental pollution indicator decreased by 19.5% and 17% in Canada and the US. However, the pressure of the Italian and Japanese societies on the environment has not changed much in the 38-year period. Moreover, six of these seven countries have an ecological deficit according to Global Footprint Network (2019). Among the G7 countries, Canada is the only country where biocapacity is more than EF. In other countries, environmental conditions are not sustainable. Although EF tends to decrease in G7 countries, there are many ways to go. Currently, among the G7 countries, the US, Japan, Germany, and the UK are among the top 10 countries with the largest EF in the world (Global Footprint Network 2019). In countries with high EF, combating environmental problems is important for sustainable ecological development. Therefore, identifying factors that reduce EF in G7 countries and thus determining effective environmental policies is an exciting research topic.

Our paper provides three main contributions to the current literature. First, to the best of the authors' knowledge, no empirical research has been performed so far to examine the effects of globalization and financial development on the EF for G7 countries. Second, the study provides robustness and comprehensive analysis by using financial development and globalization indices. The financial development index developed by the International Monetary Fund addresses financial institutions and markets in terms of depth, accessibility, and efficiency. In previous studies analyzing environmental pollution, the ratio of private credit to GDP has often been used as an indicator of financial development (e.g., Adams and Klobodu 2018; Salahuddin et al. 2018; Zakaria and Bibi 2019), and therefore the complex multidimensional nature of financial development has been neglected. Similarly, studies that consider only international trade as an indicator of globalization neglect other economic aspects of globalization such as FDI, tariffs, trade agreements, and foreign debt, as well as financial and political aspects (e.g., Ulucak and Bilgili 2018; Park et al. 2018; Pata 2019). Our study fills these gaps in the literature and addresses the omissions. Third, we use a recently developed threshold cointegration test and suggest using a frequency causality test with a fractional Fourier function. Ignoring nonlinearity or structural changes in the long-run relationship leads to false inferences about the null hypothesis. There are some studies in the literature that examine the relationship using nonlinear cointegration tests (see Charfeddine 2017; Baz et al. 2020, Bilgili et al. 2020 among others), and some other studies consider only structural breaks in the long-run relationship (see Charfeddine and Khediri 2016; Katircioğlu and Taşpinar 2017 among others). Contrary to these studies that ignore either nonlinearity or structural changes, we employ a novel cointegration test that allows an endogenous structural break with threshold effects. For these reasons, the study is expected to provide new research opportunities by presenting new findings to the energy economics literature.

The rest of the paper is structured as follows. The next section presents the literature on the relationship between financial development, globalization, and environmental pollution. Section 3 explains the data and model used in this paper, while Sect. 4 discusses results. Finally, Sect. 5 concludes the paper and offers certain policy implications for the G7 countries.

2 Literature review

The persistent evidence of increasing environmental pressure calls for research on the determinants of environmental pollution. Financial development and globalization are two important factors affecting environmental quality. We divide the literature review into two main topics: the effect of the relevant variables on CO2 emissions and EF. First, we briefly present the findings of the studies conducted for CO2 emissions.

Many recent studies in the literature have examined the impact of financial development on CO2 emissions. Farhani and Ozturk (2015) for Tunisia, Omri et al. (2015) for 12 Middle East and North Africa countries, Charfeddine and Khediri (2016) for the United Arab Emirates, Dogan and Turkekul (2016) for the US, Shahzad et al. (2017) for Pakistan, Amri (2018) for Tunisia, Pata (2018a, b) for Turkey, and Zakaria and Bibi (2019) for five South Asian countries found that financial development leads to an increase in CO2 emissions.

Contrary to the findings of these studies, Tamazian et al. (2009) for Brazil, Russia, Indonesia, and China, Abbasi and Riaz (2016) and Shahbaz et al. (2016) for Pakistan, Riti et al. (2017) for 90 countries, Saidi and Mbarek (2017) for 19 emerging countries, Adams and Klobodu (2018) for 26 African countries, Park et al. (2018) for selected 23 European Union countries, and Salahuddin et al. (2018) for Kuwait determined that financial development decreases environmental pollution.

Among the studies that investigated the globalization and CO2 emissions nexus, Dreher et al. (2008) and Saint Akadiri et al. (2019b) found that globalization does not affect CO2 emissions in 92 countries and Turkey, respectively. Lee and Min (2014) for 255 countries, Shahbaz et al. (2017) for China, and You and Lv (2018) for high-income countries revealed that globalization reduces CO2 emissions. In contrast, Twerefou et al. (2017) for 36 Sub-Saharan African countries, Shahbaz et al. (2018) for Japan, and Saint Akadiri et al. (2019a) for 15 selected tourism destinations argued that globalization increases these emissions.

From studies that simultaneously examine the effects of these two variables on CO2 emissions, Shahbaz et al. (2015) and Khan et al. (2019) concluded that both financial development and globalization increase environmental pollution in India and Pakistan, respectively. Haseeb et al. (2018) found that financial development increases pollution, whereas globalization has a negative but insignificant effect on CO2 emissions in BRICS countries. Xu et al. (2018) argued that financial development degrades environmental quality, while globalization has an insignificant effect on pollution in Saudi Arabia. Rahman et al. (2019b) found that globalization decreases environmental pollution, while financial development does not affect CO2 emissions in 16 Central and Eastern European countries. Zafar et al. (2019) and Zaidi et al. (2019) concluded that both financial development and globalization decrease environmental degradation by reducing CO2 emissions in Organisation for Economic Co-operation and Development (OECD) and Asia Pacific Economic Cooperation (APEC) countries. In the literature consisting of these studies, no consensus has been reached on whether the variables cause an increase or decrease in CO2 emissions.

Second, we review the studies that analyzed the effects of financial development and globalization on EF. Although the effects of globalization and financial development on CO2 emissions have been examined in various studies, there are a limited number of studies examining the effects of these variables on EF.

In recent years, several studies have empirically analyzed the impact of financial development on the EF. Baloch et al. (2019) utilized the Driscoll-Kraay panel regression method for 59 Belt and Road countries covering the period 1990–2016 and determined that financial development increases EF. Destek (2019) employed heterogeneous panel estimators and causality tests for 17 emerging countries from 1991 to 2013 and concluded that the overall financial development index and stock market development reduce EF. The author also found unidirectional causality from the overall financial development index to the ecological footprint. Destek and Sarkodie (2019) used the augmented mean group estimator and heterogeneous panel causality test for 11 newly industrialized countries for the period 1977–2013. They found that financial development reduces EF in China and Malaysia, and increases pollution in Singapore. The authors also concluded unidirectional causality from EF to financial development for the panel as a whole. Hafeez et al. (2019) performed panel regression analysis for 49 Belt and Road initiative countries from 1990 to 2017 and found that financial development has an adverse effect on carbon footprint. Rahman et al. (2019a) used the generalized method of moment models, dynamic seemingly unrelated regression, and Dumitrescu-Hurlin panel causality for 16 Central and Eastern European Countries from 1991 to 2014. They found that financial development contributes to environmental pollution and that there is bidirectional causality between financial development and EF.

The effect of globalization on the EF has also been investigated in the literature. Figge et al. (2017) analyzed the effect of the Maastricht Globalization Index (MGI) on EF in 183 countries and found that overall globalization increases the EF of consumption and trade. They also concluded that, except for the political dimension, all globalization indicators harm the environment. Rudolph and Figge (2017) analyzed the relationship between KOF and EF in 146 countries over the period 1981–2009 using a fixed-effect panel estimator and Granger causality test. They found that economic (social) globalization increases (decreases) the EF of consumption and production. The authors also stated that the effects of globalization on EF could vary depending on the sub-components such as consumption, exports, imports, and production. Sabir and Gorus (2019) used panel cointegration and causality tests, and long-run estimators for the South Asian countries for the period 1975–2017. They determined that globalization has a positive effect on EF and found unidirectional causality from globalization to EF. Sharif et al. (2019) performed the Granger causality test in quantiles and quantile-on-quantile regression for 15 globalized countries from 1970 to 2016. They revealed that globalization increases EF in Belgium, Denmark, Canada, the Netherlands, Norway, Portugal, Sweden, and Switzerland, whereas globalization decreases pollution in France, Germany, Hungary, and the UK. The authors also determined a unidirectional causality from globalization to EF in all quantile distributions. Bilgili et al. (2020) analyzed the impact of KOF on the EF in Turkey from 1970 to 2014 using Markov regime-switching models and determined that financial, political, and trade globalization reduce EF, whereas economic and social globalization increase it.

Finally, there are few studies examining the effect of two variables on EF simultaneously. Ahmed et al. (2019) performed a Bayer-Hanck cointegration test and vector error correction model for Malaysia for the period 1971–2014. They found that globalization does not affect EF, whereas it decreases carbon footprint. The authors also concluded that financial development mitigates EF and that there is unidirectional causality from financial development to EF. Saud et al. (2020) investigated the relationship between financial development, globalization, and the EF for 49 selected One-Belt-One-Road initiative countries covering the period of 1990–2014 using pooled means group estimator and a Dumitrescu-Hurlin panel causality test. They found that the effects of globalization and financial development on EF vary for country-specific results, while financial development increases EF and globalization decreases pollution level for the panel as a whole. The authors also reached bidirectional causality between the variables.

In the literature, different results have been obtained in studies examining the effects of financial development and globalization on EF. Besides, no studies have simultaneously tested the effects of financial development and globalization on EF for the G7 countries. Therefore, further findings reached using new methods could be beneficial for policymakers and related institutions.

3 Data set, model, and methodology

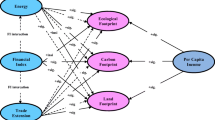

The study uses annual time series data of the G7 countries over the period 1980–2015. Following Xu et al. (2018) and Saud et al. (2020), we use Eq. (1) to analyze the effect of various macroeconomic indicators on environmental pollution.

where \({\delta}_{0}\) is the intercept, \({\delta}_{1}\), \({\delta}_{2}\), \({\delta}_{3}\) and \({\delta}_{4}\) are the long-term coefficients, \({\text{e}}_{\text{t}}\) is the standard error term. EF represents the logarithmic per capita ecological footprint, FD, GDP, KOF, and EC indicate logarithmic financial development indices (sum of the financial institutions and financial markets indices), logarithmic reel per capita gross domestic product (constant 2010 US$), logarithmic globalization indices (sum of the economic, politic and social globalization indices), and logarithmic per capita energy consumption (kg of oil equivalent), respectively. Because all the series are in logarithmic form, the coefficients express the elasticities. The data set used in the study was obtained from four different sources. The KOF, FD, and EF were collected from Gygli et al. (2019), the International Monetary Fund (IMF 2019), and Global Footprint Network (2019). The GDP and EC were derived from World Development Indicators (World Bank 2019).

In the literature, two different indices are generally used as a criterion of globalization. Martens and Zywietz (2006) developed and Figge and Martens (2014) improved MGI. Another globalization index, called KOF, was developed by Dreher (2006) and Dreher et al. (2008), and updated by Gygli et al. (2019). Because the indexes by themselves do not indicate that the effects of globalization are good or bad, the effects of globalization indexes on ecological, social, and economic indicators should be analyzed empirically (Figge et al. 2017). We preferred to use KOF as an indicator of globalization because it is a more comprehensive indicator than MGI. KOF consists of three different globalization criteria: economic, social, and political. Economic globalization reflects international trade flows, social globalization shares ideas and information among people, and political globalization indicates the dissemination of government policies.

Globalization has three different effects on environmental pollution (Grossman and Krueger 1991; Shahbaz et al. 2015). The scale effect indicates that the foreign direct investments provided by globalization increase environmental pollution through their production activities, while the technical effect suggests that clean technologies provided by these investments reduce environmental pollution. The increase or decrease in pollution as a result of structural changes in the economy through globalization is defined by the composition effect. This effect demonstrates that, along with globalization, service sector-oriented production leads to a decrease in environmental pollution, and industrial sector-oriented production leads to an increase in pollution level. Depending on the effects, the coefficient of globalization (\({\delta}_{3}\)) can be positive or negative. Financial development can also affect environmental pollution positively or negatively. Therefore, the sign of the coefficient of financial development (\({\delta}_{1}\)) may vary depending on country conditions.

3.1 Cointegration test

Considering structural breaks in the time series literature has become a common practice since most of the time-series data are affected by structural changes that occur when there is an economic crisis, or a war, or a considerable change in government policy. Ignoring these changes leads to the non-rejection of the null hypothesis. Consequently, several unit root and cointegration tests have been introduced to the literature (see Zivot and Andrews 1992; Narayan and Popp 2010; Gregory and Hansen 1996; Hatemi-J 2008, among others). It is not only structural breaks that play a crucial role in unit root and cointegration testing, but nonlinearity is also an important property that should be carefully handled. There are several reasons for the presence of nonlinearity such as exceptionally large exogenous shocks (Teräsvirta 1995), the existence of transaction costs (McMillan 2003), and market imperfections (Lim and Hinich 2005); and ignoring the nonlinear effect could cause conclusions similar to those caused by ignoring structural breaks. Therefore, to make reliable inferences, we should consider both nonlinearity and structural change. In this study, we employ a recently suggested nonlinear cointegration with an endogenous structural break suggested by Schweikert (2019). We estimate the following test equation in the first step:

We model the structural change in the cointegration equation with a dummy variable that is defined as follows:

where \(t\), and \(T\) show the time and the sample size, respectively, and \(\tau \in \left( {0,1} \right)\) is the relative change date. Interaction variables in Eq. (2) demonstrate the effect of the structural break, that is while \(\alpha_{1}\) indicate the slope coefficient of FD before the structural change, \(\alpha_{5}\) represent the effect of the break, accordingly \(\alpha_{1} + \alpha_{5}\) indicate the slope coefficient after the break date. To consider nonlinearity, Schweikert (2019) suggests estimating Eq. (2) for each breakpoint after excluding the trimming regionFootnote 1 from the sample and then estimating a two-regime momentum threshold autoregressive (MTAR) model as follows:

where \(I\left( . \right)\), and \(\lambda\) indicate the Heaviside indicator function and a threshold value, respectively. The MTAR model captures the possibility of asymmetrically steep movements in the residuals. \(\rho_{1}\) measures the mean-reversion toward the attractor if a shock has momentum greater or equal to \(u_{t}\), while \(\rho_{2}\) measures the mean-reversion toward the cointegrating vector if a shock has a momentum less then \(u_{t}\). To test the null hypothesis of no cointegration, \(\rho_{1} = \rho_{2} = 0\), we first compute the test statistic for each sequence of residuals as follows:

where \(t_{1}^{{}}\), and \(t_{2}^{{}}\) are the \(t\) ratios for \(\rho_{1}\) and \(\rho_{2}\) from Eq. (3). The following supremum statistic is then used to test the null:

The necessary critical values are tabulated in Schweikert (2019).

3.2 Causality test

Structural changes in causality analysis were generally ignored until the study of Enders and Jones (2016) who introduce a novel causality test by accommodating a variant of the flexible Fourier form to consider the possibility of multiple smooth breaks in the vector autoregressive (VAR) model. To employ the causality test of Enders and Jones (2016), one must test the stationarity characteristics of the variables and take differences of the variables if the series has a unit root. Since this modification could cause long-run information loss, we follow Nazlioglu et al. (2016) and use the Fourier causality test in the Toda-Yamamoto framework, where the VAR model is augmented with the maximum integration level of the variables.

In this study, we use the following lag augmented VAR (LA-VAR) model incorporated with a Fourier function:

where \(l\), and \(d\max\) indicate the optimal lag length of the VAR model, and the maximal integration level of the variables. In this LA-VAR system, k, t, and T indicate the particular frequency, trend, and the number of observations, respectively. Nazlioglu et al. (2016) recommend selecting the optimal frequency value (k) by estimating the model for the integer values in \(1 \le k \le 5\) and choosing the k that produces the minimum sum of squared residuals. However, as recommended by Christopoulos and Leon-Ledesma (2011), while an integer frequency supports the evidence of temporary breaks, fractional frequencies are able to capture permanent breaks. Therefore instead of searching optimal frequency in the interval of integer frequencies, we also consider fractional frequencies to allow for permanent breaks in the causality testing and choose the optimal k in the interval of [0.1, 0.2, 0.3,…,5]. We refer to this test as the fractional frequency flexible Fourier form Toda-Yamamoto (FFFF-TY) causality test. We test the null hypothesis of \(\phi_{l} = 0,\,\,\forall_{i} = 1,2,\ldots,l\) using the Wald statistic and obtain critical values through bootstrap simulations.

4 Empirical results and discussions

As a first step of the analysis, we test the stationarity of the variables using a well-known unit root test that allows an endogenous break introduced by Zivot and Andrews (1992). Test results are presented in the following Table 1.

According to the results of the unit root test, all the series contain unit root at their levels. Therefore, we pass to the next level to test the presence of the cointegration relationship among the variables using a threshold cointegration test with an endogenous break and report the results in Table 2.

The results of the threshold cointegration tests confirm a long-run relationship among the discussed variables only for Canada, Italy, and Japan. The date of structural change was determined as 1994 for Japan and Italy, and 1996 for Canada. We could not find a cointegration relationship for the remaining countries. To observe the effects of the variables on the ecological footprint, we estimate the long-run relationship as presented in Table 3.

Long-run estimation results indicate that globalization has a significant and negative effect on EF for all three countries. These results contradict the findings of Figge et al. (2017), denoting that globalization adversely affects the environment. Our findings support the studies of Rudolph and Figge (2017) and Bilgili et al. (2020). Consistent with the findings of Baloch et al. (2019), energy consumption has a significantly positive effect on environmental degradation in these countries. Moreover, structural breaks are statistically significant in Japan and Canada at 5% and 10% levels, respectively. In terms of break dates, Ogura (2011) has argued that the Japanese demand system had undergone structural change since March 1994. After 1994, the interest rate in Japan has remained below 1%. At the same time, Japan introduced the electoral reform law in this year. All these events affected the social and economic structure of Japan. In addition, Canada experienced an economic slowdown in 1995 and 1996 (Fortin 1996). Table 3 presents some interesting results when we focus on the dummy variables that reflect the effect of structural breaks. In Japan, while the effect of financial development is positive before the break, it turns to negative after 1994 (0.208–0.555). The effect of globalization becomes more negative after the break, while the effect of energy consumption decreases. Next, we carry out the FFFF-TY causality test, and the results are presented in Tables 4 and 5 as follows.

The results demonstrate that there is a unidirectional causality that runs from globalization to EF for Canada, Germany, the UK, and the US, consistent with the findings of Ahmed et al. (2019) and Sharif et al. (2019). Moreover, bidirectional causality exists for Italy and Japan, which supports the results of Saud et al. (2020). Contrary to the findings of Destek and Sarkodie (2019) that there is a unidirectional causality from EF to financial development, there is unidirectional causality from financial development to EF for France and the UK, which supports the results of Destek (2019). Moreover, bidirectional causality exists for these variables for Japan. We can reject the null hypothesis that there is not a causality relationship from EF to energy consumption for Germany, Italy, and Japan, and reverse causality is observed in the UK. In addition, there is causality from GDP to EF for the UK, and from EF to ln GDP for France only. Finally, the cointegration and causality findings are summarized in Table 6.

In Canada, Italy, and Japan, energy consumption increases EF in the long run; and energy consumption causes EF in the UK. For these countries, it is necessary to increase the efficiency of energy consumption and use more renewable energy sources instead of fossil fuels in order to reduce environmental pollution. The existence of unidirectional causality from EF to energy consumption in Germany, Italy, and Japan demonstrates that increasing environmental pollution affects energy policies.

The effect of globalization on the environment is negative and has an impact on the EF in six out of the G7 countries. Therefore, globalization should be used as an important policy tool in reducing EF. In addition, the bidirectional causality relationship between the two variables in Italy and Japan indicates that EF affects globalization activities in these countries. The impact of financial development on environmental pollution is less than that of globalization. Financial development reduces environmental pollution only in Japan and causes EF in the UK and France. Environmental pollution can be reduced by financial development in these three countries.

5 Conclusion and policy recommendations

This paper primarily examines the effect of energy consumption, economic growth, financial development, and globalization indices on EF in G7 countries. To this end, we performed a newly developed threshold cointegration test and offered a new approach based on the Fourier Toda-Yamamoto causality test with fractional frequencies. With these two new approaches, we aimed to obtain more reliable and robust findings. At the same time, we hoped to contribute to the literature by using comprehensive indices for both financial development and globalization.

We can summarize the study’s findings under two headings, as cointegration and causality results. (I) The threshold cointegration test reveals that a long-run relationship exists between the variables for Canada, Italy, and Japan. The long-run estimator demonstrates that globalization significantly reduces EF, while energy consumption increases environmental pollution in the three countries. Financial development has a negative impact on EF only in Japan. Moreover, economic growth is positively related to environmental pollution after the threshold value in the country. In the remaining countries, there is no long-run relationship between the variables. These findings do not provide information about causal relations.

(II) The Fractional Fourier form Toda-Yamamoto causality test indicates that that EF causes energy consumption in Germany, Italy, and Japan, whereas a reverse causality is observed in the UK. This situation demonstrates that environmental pollution should be taken into consideration when implementing energy policies in Germany, Italy, and Japan. In addition, we found that EF causes economic growth in Germany, while economic growth causes environmental pollution in the UK. These findings imply that the use of fossil fuel energy and natural resources to stimulate economic growth in the UK cause negative effects on the environment. Therefore, the UK government needs to promote the efficient use of renewable energy and natural resources. Moreover, we found unidirectional causality from financial development to EF for France and the UK, while bidirectional causality is found in Japan. More importantly, the empirical results confirm a unidirectional causality from globalization to EF in Canada, Germany, the UK, and the US, and a bidirectional causal association between the variables in Italy and Japan.

The results of the study provide two main policy implications. First, based on the results of this study, we concluded that financial development plays an effective role in reducing EF for three out of seven countries. Since the 2000s, per capita EF in G7 countries has started to decrease (see Fig. 3). To improve the environment, the positive effects of financial development on the environment need to be better assimilated and used more effectively in policy instruments. Along with financial development, G7 countries can encourage the use of renewable energy sources by lowering interest rates and imposing additional taxes and carbon pricing on companies that pollute the environment. Furthermore, additional funds should be allocated to research and development expenditure for environmentally friendly technologies in France, the UK, and Japan, and the banking sector should support environmental policies. In these countries, financial development can support the improvement of environmental quality by providing cleaner abatement technology and an increase in productivity. Moreover, environmentally friendly investments and initiatives funded by the financial sector can help raise the environmental awareness of people.

Second, our results suggest that globalization is the most important factor in reducing EF. We used an overall globalization index covering the economic, social, and political dimensions. Our findings demonstrate that globalization helps improve environmental quality in six out of the seven countries. Policymakers and responsible authorities should support environmental institutions and organizations resulting from globalization in these countries. Globalization creates societies that are more conscious of environmental pollution by supporting both social awareness and greener technologies in these countries. Developed countries carry out polluting production processes in developing countries. Thus, environmental pollution is prevented, and the cost advantage is obtained from the labor force. This production process also creates additional income for developing countries. Developing countries, whose income levels are rising, and whose technology levels increase with globalization, can also spend more on environmental protection over time. With such a goal in mind, the G7 countries should not impose tariffs and barriers that hamper international trade; instead, they should promote the exchange of goods and services that provide cleaner technologies for developing countries.

As a result, the key findings of this study indicate that globalization is more effective than financial development in reducing EF. The success of G7 countries in globalization and financial development should also be followed by developing countries, thus reducing EF on a global scale.

Finally, this study offers new research opportunities. Future research can be carried out for developing countries with the same methods. This study focuses only on the total per capita EF. Future studies could analyze the effects of globalization and financial development on the six EF sub-components: built-up land, carbon footprint, cropland, fishing grounds, forest land, and grazing land can be analyzed. At the same time, the effects of political, social, and economic globalization can be addressed separately for G7 countries. Thus, it can be determined which type of globalization is more effective in reducing environmental pollution.

Notes

Trimming regions is; \({\rm T} = \left( {0.15,0.85} \right)\)

References

Abbasi F, Riaz K (2016) CO2 emissions and financial development in an emerging economy: an augmented VAR approach. Energy Policy 90:102–114. https://doi.org/10.1016/j.enpol.2015.12.017

Adams S, Klobodu EKM (2018) Financial development and environmental degradation: does political regime matter? J Cleaner Prod 197:1472–1479. https://doi.org/10.1016/j.jclepro.2018.06.252

Ahmed Z, Wang Z, Mahmood F, Hafeez M, Ali N (2019) Does globalization increase the ecological footprint? Empirical evidence from Malaysia. Environ Sci Pollut Res 26(18):18565–18582. https://doi.org/10.1007/s11356-019-05224-9

Amri F (2018) Carbon dioxide emissions, total factor productivity, ICT, trade, financial development, and energy consumption: testing environmental Kuznets curve hypothesis for Tunisia. Environ Sci Pollut Res 25(33):33691–33701. https://doi.org/10.1007/s11356-018-3331-1

Baloch MA, Zhang J, Iqbal K, Iqbal Z (2019) The effect of financial development on ecological footprint in BRI countries: evidence from panel data estimation. Environ Sci Pollut Res 26(6):6199–6208. https://doi.org/10.1007/s11356-018-3992-9

Balsalobre-Lorente D, Gokmenoglu KK, Taspinar N, Cantos-Cantos JM (2019) An approach to the pollution haven and pollution halo hypotheses in MINT countries. Environ Sci Pollut Res 26(22):23010–23026. https://doi.org/10.1007/s11356-019-05446-x

Balsalobre-Lorente D, Driha OM, Sinha A (2020) The dynamic effects of globalization process in analysing N-shaped tourism led growth hypothesis. J Hosp Tourism Manag 43:42–52. https://doi.org/10.1016/j.jhtm.2020.02.005

Baz K, Xu D, Ali H, Ali I, Khan I, Khan MM, Cheng J (2020) Asymmetric impact of energy consumption and economic growth on ecological footprint: using asymmetric and nonlinear approach. Sci Total Environ 718:137364. https://doi.org/10.1016/j.scitotenv.2020.137364

Bilgili F, Ulucak R, Koçak E, İlkay SÇ (2020) Does globalization matter for environmental sustainability? Empirical investigation for Turkey by Markov regime switching models. Environ Sci Pollut Res 27:1087–1100. https://doi.org/10.1007/s11356-019-06996-w

Borucke M, Moore D, Cranston G, Gracey K, Iha K, Larson J, Morales JC, Wackernagel M, Galli A (2013) Accounting for demand and supply of the biosphere's regenerative capacity: the National Footprint Accounts’ underlying methodology and framework. Ecol Indic 24:518–533. https://doi.org/10.1016/j.ecolind.2012.08.005

Charfeddine L, Khediri KB (2016) Financial development and environmental quality in UAE: cointegration with structural breaks. Renew Sustain Energy Rev 55:1322–1335. https://doi.org/10.1016/j.rser.2015.07.059

Charfeddine L (2017) The impact of energy consumption and economic development on Ecological Footprint and CO2 emissions: evidence from a Markov Switching Equilibrium Correction Model. Energy Econ 65:355–374. https://doi.org/10.1016/j.eneco.2017.05.009

Christopoulos DK, Leon-Ledesma MA (2011) International output convergence, breaks, and asymmetric adjustment. Stud Nonlinear Dyn Econ 15(3):67–97. https://doi.org/10.2202/1558-3708.1823

Destek MA, Sarkodie SA (2019) Investigation of environmental Kuznets curve for ecological footprint: the role of energy and financial development. Sci Total Environ 650:2483–2489. https://doi.org/10.1016/j.scitotenv.2018.10.017

Destek MA (2019) Financial Development and Environmental Degradation in Emerging Economies. In: Energy and Environmental Strategies in the Era of Globalization. Springer, Cham, pp. 115–132. https://doi.org/10.1007/978-3-030-06001-5_5

Destek MA, Sinha A (2020) Renewable, non-renewable energy consumption, economic growth, trade openness and ecological footprint: evidence from organisation for economic Co-operation and development countries. J Cleaner Prod 242:118537. https://doi.org/10.1016/j.jclepro.2019.118537

Dogan E, Turkekul B (2016) CO2 emissions, real output, energy consumption, trade, urbanization and financial development: testing the EKC hypothesis for the USA. Environ Sci Pollut Res 23(2):1203–1213. https://doi.org/10.1007/s11356-015-5323-8

Dreher A (2006) Does globalization affect growth? Evidence from a new index of globalization. Appl Econ 38(10):1091–1110. https://doi.org/10.1080/00036840500392078

Dreher A, Gaston N, Martens P (2008) Measuring globalisation, gauging its consequences. Springer, New York. https://doi.org/10.1007/978-0-387-74069-0

Enders W, Jones P (2016) Grain prices, oil prices, and multiple smooth breaks in a VAR. Stud Nonlinear Dyn Econ 20(4):399–419. https://doi.org/10.1515/snde-2014-0101

Farhani S, Ozturk I (2015) Causal relationship between CO2 emissions, real GDP, energy consumption, financial development, trade openness, and urbanization in Tunisia. Environ Sci Pollut Res 22(20):15663–15676. https://doi.org/10.1007/s11356-015-4767-1

Figge L, Martens P (2014) Globalisation continues: the Maastricht globalisation index revisited and updated. Globalizations 11(6):875–893. https://doi.org/10.1080/14747731.2014.887389

Figge L, Oebels K, Offermans A (2017) The effects of globalization on Ecological Footprints: an empirical analysis. Environ Dev Sustain 19(3):863–876. https://doi.org/10.1007/s10668-016-9769-8

Fortin P (1996) The great Canadian slump. Can J Econ 29(4):761–787. https://doi.org/10.2307/136214

Global Footprint Network (2018) Has humanity’s Ecological Footprint reached its peak? https://www.footprintnetwork.org/2018/04/09/has_humanitys_ecological_footprint_reached_its_peak/ Accessed 6 Aug 2020

Global Footprint Network (2019) National footprint accounts, ecological footprint. https://data.footprintnetwork.org/#/ Accessed 5 Apr 2020

Gregory AW, Hansen BE (1996) Practitioners corner: tests for cointegration in models with regime and trend shifts. Oxford Bull Econ Stat 58(3):555–560. https://doi.org/10.1111/j.1468-0084.1996.mp58003008.x

Grossman GM, Krueger AB (1991) Environmental Impacts of a North American FreeTrade Agreement. National Bureau of Economic Research, New York

Grossman GM, Krueger AB (1995) Economic growth and the environment. Q J Econ 110(2):353–377. https://doi.org/10.2307/2118443

Gygli S, Haelg F, Potrafke N, Sturm JE (2019) The KOF globalisation index–revisited. Rev Int Org 14(3):543–574. https://doi.org/10.1007/s11558-019-09357-x

Hafeez M, Yuan C, Shahzad K, Aziz B, Iqbal K, Raza S (2019) An empirical evaluation of financial development-carbon footprint nexus in One Belt and Road region. Environ Sci Pollut Res 26(24):25026–25036. https://doi.org/10.1007/s11356-019-05757-z

Haseeb A, Xia E, Baloch MA, Abbas K (2018) Financial development, globalization, and CO2 emission in the presence of EKC: evidence from BRICS countries. Environ Sci Pollut Res 25(31):31283–31296. https://doi.org/10.1007/s11356-018-3034-7

Hatemi-J A (2008) Tests for cointegration with two unknown regime shifts with an application to financial market integration. Empirical Econ 35(3):497–505. https://doi.org/10.1007/s00181-007-0175-9

Hoekstra AY, Wiedmann TO (2014) Humanity’s unsustainable environmental footprint. Science 344(6188):1114–1117. https://doi.org/10.1126/science.1248365

IMF (2019) Access to macroeconomic and financial data. https://data.imf.org/?sk=F8032E80-B36C-43B1-AC26-493C5B1CD33B Accessed 12 Apr 2020

Katircioğlu ST, Taşpinar N (2017) Testing the moderating role of financial development in an environmental Kuznets curve: empirical evidence from Turkey. Renew Sustain Energy Rev 68:572–586. https://doi.org/10.1016/j.rser.2016.09.127

Khan MK, Teng JZ, Khan MI, Khan MO (2019) Impact of globalization, economic factors and energy consumption on CO2 emissions in Pakistan. Sci Total Environ 688:424–436. https://doi.org/10.1016/j.scitotenv.2019.06.065

Lee KH, Min B (2014) Globalization and carbon constrained global economy: a fad or a trend? J Asia-Pacific Business 15(2):105–121. https://doi.org/10.1080/10599231.2014.904181

Lim KP, Hinich MJ (2005) Cross-temporal universality of non-linear dependencies in Asian stock markets. Econ Bull 7(1):1–6

Martens P, Zywietz D (2006) Rethinking globalization: a modified globalization index. J Int Dev 18(3):331–350. https://doi.org/10.1002/jid.1223

McMillan DG (2003) Non-linear predictability of UK stock market returns. Oxford Bull Econ Stat 65(5):557–573. https://doi.org/10.1111/j.1468-0084.2003.00061.x

Narayan PK, Popp S (2010) A new unit root test with two structural breaks in level and slope at unknown time. J Appl Stat 37(9):1425–1438. https://doi.org/10.1080/02664760903039883

Nasreen S, Anwar S, Ozturk I (2017) Financial stability, energy consumption and environmental quality: evidence from South Asian economies. Renew Sustain Energy Rev 67:1105–1122. https://doi.org/10.1016/j.rser.2016.09.021

Nazlioglu S, Gormus NA, Soytas U (2016) Oil prices and real estate investment trusts (REITs): gradual-shift causality and volatility transmission analysis. Energy Econ 60:168–175. https://doi.org/10.1016/j.eneco.2016.09.009

Ogura M (2011) Testing for structural break in Japanese demand system after the bubble era. Struct Change Econ Dyn 22(3):277–286. https://doi.org/10.1016/j.strueco.2011.03.003

Omri A, Daly S, Rault C, Chaibi A (2015) Financial development, environmental quality, trade and economic growth: what causes what in MENA countries. Energy Econ 48:242–252. https://doi.org/10.1016/j.eneco.2015.01.008

Pata UK (2018a) The influence of coal and noncarbohydrate energy consumption on CO2 emissions: revisiting the environmental Kuznets curve hypothesis for Turkey. Energy 160:1115–1123. https://doi.org/10.1016/j.energy.2018.07.095

Pata UK (2018b) The effect of urbanization and industrialization on carbon emissions in Turkey: evidence from ARDL bounds testing procedure. Environ Sci Pollut Res 25(8):7740–7747. https://doi.org/10.1007/s11356-017-1088-6

Pata UK (2019) Environmental Kuznets curve and trade openness in Turkey: bootstrap ARDL approach with a structural break. Environ Sci Pollut Res 26(20):20264–20276. https://doi.org/10.1007/s11356-019-05266-z

Park Y, Meng F, Baloch MA (2018) The effect of ICT, financial development, growth, and trade openness on CO2 emissions: an empirical analysis. Environ Sci Pollut Res 25(30):30708–30719. https://doi.org/10.1007/s11356-018-3108-6

Rahman S, Chen S, Saud S, Saleem N, Bari MW (2019a) Nexus between financial development, energy consumption, income level, and ecological footprint in CEE countries: do human capital and biocapacity matter? Environ Sci Pollut Res 26(31):31856–31872. https://doi.org/10.1007/s11356-019-06343-z

Rahman S, Chen S, Saud S, Bano S, Haseeb A (2019b) The nexus between financial development, globalization, and environmental degradation: fresh evidence from Central and Eastern European Countries. Environ Sci Pollut Res 26(24):24733–24747. https://doi.org/10.1007/s11356-019-05714-w

Rees WE (1992) Ecological footprints and appropriated carrying capacity: what urban economics leaves out. Environ Urban 4(2):121–130. https://doi.org/10.1177/095624789200400212

Riti JS, Shu Y, Song D, Kamah M (2017) The contribution of energy use and financial development by source in climate change mitigation process: a global empirical perspective. J Cleaner Prod 148:882–894. https://doi.org/10.1016/j.jclepro.2017.02.037

Rudolph A, Figge L (2017) Determinants of ecological footprints: what is the role of globalization? Ecol Indic 81:348–361. https://doi.org/10.1016/j.ecolind.2017.04.060

Sabir S, Gorus MS (2019) The impact of globalization on ecological footprint: empirical evidence from the South Asian countries. Environ Sci Pollut Res 26(32):33387–33398. https://doi.org/10.1007/s11356-019-06458-3

Sadorsky P (2010) The impact of financial development on energy consumption in emerging economies. Energy Policy 38(5):2528–2535. https://doi.org/10.1016/j.enpol.2009.12.048

Saidi K, Mbarek MB (2017) The impact of income, trade, urbanization, and financial development on CO2 emissions in 19 emerging economies. Environ Sci Pollut Res 24(14):12748–12757. https://doi.org/10.1007/s11356-016-6303-3

Saint Akadiri S, Lasisi TT, Uzuner G, Akadiri AC (2019a) Examining the impact of globalization in the environmental Kuznets curve hypothesis: the case of tourist destination states. Environ Sci Pollut Res 26(12):12605–12615. https://doi.org/10.1007/s11356-019-04722-0

Saint Akadiri S, Alola AA, Akadiri AC (2019b) The role of globalization, real income, tourism in environmental sustainability target. Evidence from Turkey. Sci Total Environ 687:423–432. https://doi.org/10.1016/j.scitotenv.2019.06.139

Salahuddin M, Alam K, Ozturk I, Sohag K (2018) The effects of electricity consumption, economic growth, financial development and foreign direct investment on CO2 emissions in Kuwait. Renew Sustain Energy Rev 81:2002–2010. https://doi.org/10.1016/j.rser.2017.06.009

Saud S, Chen S, Haseeb A (2020) The role of financial development and globalization in the environment: accounting ecological footprint indicators for selected one-belt-one-road initiative countries. J Cleaner Prod 250:119518. https://doi.org/10.1016/j.jclepro.2019.119518

Schweikert K (2019) Testing for cointegration with threshold adjustment in the presence of structural breaks. Stud Nonlinear Dyn Econ 24(1):20180034. https://doi.org/10.1515/snde-2018-0034

Shahbaz M, Lean HH (2012) Does financial development increase energy consumption? The role of industrialization and urbanization in Tunisia. Energy Policy 40:473–479. https://doi.org/10.1016/j.enpol.2011.10.050

Shahbaz M, Mallick H, Mahalik MK, Loganathan N (2015) Does globalization impede environmental quality in India? Ecol Ind 52:379–393. https://doi.org/10.1016/j.ecolind.2014.12.025

Shahbaz M, Shahzad SJH, Ahmad N, Alam S (2016) Financial development and environmental quality: the way forward. Energy Policy 98:353–364. https://doi.org/10.1016/j.enpol.2016.09.002

Shahbaz M, Khan S, Ali A, Bhattacharya M (2017) The impact of globalization on CO2 emissions in China. Singapore Econ Rev 62(04):929–957. https://doi.org/10.1142/S0217590817400331

Shahbaz M, Shahzad SJH, Mahalik MK (2018) Is globalization detrimental to CO2 emissions in Japan? New threshold analysis. Environ Model Assess 23(5):557–568. https://doi.org/10.1007/s10666-017-9584-0

Shahzad SJH, Kumar RR, Zakaria M, Hurr M (2017) Carbon emission, energy consumption, trade openness and financial development in Pakistan: a revisit. Renew Sustain Energy Rev 70:185–192. https://doi.org/10.1016/j.rser.2016.11.042

Sharif A, Afshan S, Qureshi MA (2019) Idolization and ramification between globalization and ecological footprints: evidence from quantile-on-quantile approach. Environ Sci Pollut Res 26(11):11191–11211. https://doi.org/10.1007/s11356-019-04351-7

Tamazian A, Chousa JP, Vadlamannati KC (2009) Does higher economic and financial development lead to environmental degradation: evidence from BRIC countries. Energy Policy 37(1):246–253. https://doi.org/10.1016/j.enpol.2008.08.025

Teräsvirta T (1995) Modelling nonlinearity in US gross national product 1889–1987. Emp Econ 20(4):577–597. https://doi.org/10.1007/BF01206058

Tisdell C (2001) Globalisation and sustainability: environmental Kuznets curve and the WTO. Ecol Econ 39(2):185–196. https://doi.org/10.1016/S0921-8009(01)00234-8

Twerefou DK, Danso-Mensah K, Bokpin GA (2017) The environmental effects of economic growth and globalization in Sub-Saharan Africa: a panel general method of moments approach. Res Int Bus Finance 42:939–949. https://doi.org/10.1016/j.ribaf.2017.07.028

Ulucak R, Bilgili F (2018) A reinvestigation of EKC model by ecological footprint measurement for high, middle- and low-income countries. J Cleaner Prod 188:144–157. https://doi.org/10.1016/j.jclepro.2018.03.191

Wackernagel M (1994) Ecological footprint and appropriated carrying capacity: a tool for planning toward sustainability (Doctoral dissertation, University of British Columbia). https://doi.org/10.14288/1.0088048

World Bank (2019) World development indicators. https://datacatalog.worldbank.org/dataset/world-development-indicators Accessed 22 Apr 2020

WWF (2018) Living planet report 2018: Species and spaces, people and Places. https://s3.amazonaws.com/wwfassets/downloads/lpr2018_full_report_spreads.pdf Accessed 1 May 2020

Xu Z, Baloch MA, Danish MF, Zhang J, Mahmood Z (2018) Nexus between financial development and CO2 emissions in Saudi Arabia: analyzing the role of globalization. Environ Sci Pollut Res 25(28):28378–28390. https://doi.org/10.1007/s11356-018-2876-3

You W, Lv Z (2018) Spillover effects of economic globalization on CO2 emissions: a spatial panel approach. Energy Economics 73:248–257. https://doi.org/10.1016/j.eneco.2018.05.016

Yuxiang K, Chen Z (2011) Financial development and environmental performance: evidence from China. Environ Dev Econ 16(1):93–111. https://doi.org/10.1017/S1355770X10000422

Zaidi SAH, Zafar MW, Shahbaz M, Hou F (2019) Dynamic linkages between globalization, financial development and carbon emissions: evidence from Asia Pacific Economic Cooperation countries. J Cleaner Prod 228:533–543. https://doi.org/10.1016/j.jclepro.2019.04.210

Zakaria M, Bibi S (2019) Financial development and environment in South Asia: the role of institutional quality. Environ Sci Pollut Res 26(8):7926–7937. https://doi.org/10.1007/s11356-019-04284-1

Zafar MW, Saud S, Hou F (2019) The impact of globalization and financial development on environmental quality: evidence from selected countries in the Organization for Economic Co-operation and Development (OECD). Environ Sci Pollut Res 26(13):13246–13262. https://doi.org/10.1007/s11356-019-04761-7

Zivot E, Andrews DWK (1992) Further evidence on the great crash, the oil-price shock, and the unit-root hypothesis. J Bus Econ Stat 10(3):25–44. https://doi.org/10.1198/073500102753410372

Funding

None.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflicts of interest

None.

Additional information

Handling Editor: Pierre Dutilleul.

Rights and permissions

About this article

Cite this article

Pata, U.K., Yilanci, V. Financial development, globalization and ecological footprint in G7: further evidence from threshold cointegration and fractional frequency causality tests. Environ Ecol Stat 27, 803–825 (2020). https://doi.org/10.1007/s10651-020-00467-z

Received:

Revised:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10651-020-00467-z