Abstract

The paper empirically examines whether and how political institutions shape the nexus between finance and carbon dioxide (CO2) emissions. In a sample of developing and developed countries, it finds that financial development impedes green technology development and thus raises energy use and CO2 emissions, the effects that moderate with improvements in institutional quality. Despite so, there are differences between banks and stock markets, banking competition and concentration, and household and firm credit. Specifically, a more concentrated, less competitive bank-based financial system that lends more to households hinders green technology development and exaggerates energy use and CO2 emissions, and the impacts diminish when institutional quality enhances. Conversely, a more market-oriented financial system with a more competitive and less concentrated banking sector that lends more to private non-financial enterprises promotes green technology development and decreases energy use and CO2 emissions, the effects that weaken when the quality of political institutions betters.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

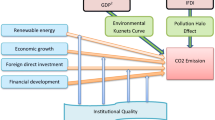

Significant debate continues about how to reduce greenhouse gas emissions in general and carbon dioxide (CO2) emissions in particular. Conventional wisdom holds that economic growth mitigates environmental degradation within the framework of the Kuznets curve hypothesis. The major argument for economic growth to improve environmental quality is that the government is responsive to increased demand for environmental quality by strengthening environmental regulation, which creates the motive for enterprise innovations toward technology with clean and environment-friendly production processes that improve the environment. Since a country’s political institutions affect the way policymakers respond to environmental concerns and the financial sector provides financial resources to support environmental-related investment projects, the environmental repercussion of economic growth depends crucially on a country’s quality of political institutions and financial sector development. Given that countries differ in their institutional quality and extent of financial development, it thus comes as no surprise why there is no clear-cut in the environmental consequence of economic growth.

In an attempt to contribute to this line of inquiry, the paper brings a country’s financial sector and political institutions into the analysis of pollution emissions. Specifically, we investigate the consequence of financial sector development on CO2 emissions and how the quality of political institutions influences this repercussion during the process of economic development. To the best of our knowledge, this is among few studies that emphasize the role of institutional quality in the nexus between financial development and CO2 emissions. This contribution is crucial from the policy perspective. Although many policies have been implemented to influence, directly or indirectly, economic agents to internalize environmental externalities, the success of these policies hinges on the institutional quality of a country (Goel et al. 2013). Likewise, it is argued that varying growth performance of financial development across countries may reflect differences in the quality of finance, which is determined by the quality of financial regulation and rule of law (Demetriades and Andrianova 2004). Since both financial development and environmental problems are a matter of policy, the nexus between financial development and environmental quality cannot be formed in isolation from political institutions that are related to the process of environmental protection and financial liberalization policymaking in a country. Furthermore, the exploration allows one to address the question of whether there exists a certain quality level of political institutions for a country to benefit or lose from financial development.

To provide further insights into the issue, the paper checks also other aspects of financial development. It is well recognized that in the process of financial development, the financial sector has gone through significant structural changes from 1990 onward, the era characterized by frequent financial (particularly banking) crises. When countries develop economically and financially, their financial sector tends to be more stock-market-oriented because entrepreneurs are more likely to need a rich set of risk management tools and flexible vehicles for raising capital (Boyd and Smith 1998; Levine 2005). The banking industry is more concentrated and competitive because of financial globalization, deregulation, privatization and consolidation. Also, in facing greater competition banks tend to lend more to households than enterprises relative to total credit. It is thus interesting to know how these changes would affect the environment. In this respect, our second contribution is to explore whether and how the structure of financial development (i.e., bank- versus market-based) and banking sector (i.e., concentration versus competition and credit composition) affect CO2 emissions, conditional on the quality of political institutions.

Green technological progress is considered as one major factor impacting the CO2 emissions in the long run. For instance, studies including Grossman and Krueger (1995), Buonanno et al. (2003), and Gerlagh and Lise (2005) stress the importance of endogenous green technological progress in reducing the costs of achieving pollution mitigation targets. Green technology innovations can reduce raw material waste, improve energy efficiency and alleviate environment pollution. It can help enterprises strengthen their competitive advantages and promote the development of a global low carbon economy (Porter and van der Linde 1995). Since energy, as both a final good for end-users and an input into the production processes of many businesses, plays a unique role in the supply chain and is the direct source of CO2 emissions, the last main contribution of the paper is to investigate the green technology channel for finance to influence energy use and CO2 emissions, conditional on institutional quality.

Methodologically, we employ the system GMM estimator for panel data, given the dynamic nature of CO2 emissions and potential endogeneity of finance and political institutions (and other regressors). In a sample of developed and developing countries, we find that financial development promotes green technology development and then alleviates energy use and CO2 emissions but only for countries with high institutional quality. Despite so, there are significant differences between banks and stock markets, banking competition and concentration, and household and firm credit. Specifically, a more concentrated, less competitive bank-based financial system that lends more to households is conductive to green technology development, thus reducing energy use and CO2 emissions for countries with high institutional quality. On the contrary, a more market-oriented financial system with a more competitive and less concentrated banking sector that lends more to private non-financial enterprises is beneficial for green technology development and hence decreases energy use and CO2 emissions for countries with low institutional quality.

The remainder of the paper is organized as follows. Section 2 gives a brief review of related literature. In Sect. 3, we discuss our empirical models, introduce estimation strategies and describe the data. Section 4 analyzes the empirical results, and Sect. 5 concludes.

2 A brief review of related literature

The theoretical explanation of the environmental consequences of financial development is based on the environmental Kuznets curve (EKC) hypothesis, according to which environmental deterioration rises in the early stages of economic development, and reduces as the economy develops beyond a certain point. The inverted U-shaped Kuznets curve effect has become empirical regularity since Grossman and Krueger (1993, 1995) and has been taken to suggest that economic growth, instead of being a threat to the environment, is a means to environmental improvement.Footnote 1 Among determinants of economic growth, the financial sector, arising to ameliorate credit market frictions, performs vital functions in an economy, including mobilization of saving, information production and monitoring, risk sharing, and facilitation of capital formation and technology innovation (Levine 2005). Insofar as financial sector development influences economic growth, an improvement in a country’s financial sector will play a role in shaping environmental quality via the EKC effect.

To be more specific, financial development can have both positive and negative effects on the environment. Financial development eases borrowing constraints of households and firms and allows greater consumption and investment, which would result in more energy use, industrial pollution and hence environmental degradation (Sadorsky 2010). On the contrary, financial development might reduce environmental pollutants by promoting technological innovations in the energy sector (Kumbaroglu et al. 2008a, b) and by redirecting the financial resources to environment-friendly investment projects (Tamazian and Rao 2010; Kim et al. 2020; Zeqiraj et al. 2020). Financial development also supports economic transitions from manufacturing to high-tech and service-based industries, and intensifies demand for cleaner products. Besides, financial development may impose a disciplinary effect on firms’ pollution control (Lanoie et al. 1998; Dasgupta et al. 2001). For instance, efficient capital markets, if properly informed with improved governance, may react negatively to adverse environmental incidents such as violation of permits, spills, court actions, complaints but positively to greater pollution control effort such as the adoption of cleaner technologies, and thus create incentives for pollution control (Capelle-Blancard and Laguna 2010).

On the empirical front, studies both in a cross-country and country-specific setting also provide mixed results using various model specifications with different control variables and different econometric techniques. Some studies such as Sadorsky (2010), Abbasi and Riaz (2016), Shahbaz et al. (2016), and Shahzad et al. (2017) find that financial development increases CO2 emissions. Others show that CO2 emissions decrease with financial development. Examples include Lanoie et al. (1998), Dasgupta et al. (2001), Kumbaroglu et al. (2008a), Tamazian et al. (2009), Bekhet et al. (2017), Paramati et al. (2017), Shahzad et al. (2018), Acheampong et al. (2020) and Zhao and Yang (2020). Still, work by Ozturk and Acaravci (2013), Omri et al. (2015), Abbasi and Riaz (2016) and Acheampong (2019) indicates no significant influence of financial development on CO2 emissions. Nonlinearity is also detected. Zakaria and Bibi (2019) find that carbon emissions increase when institutions are weak but decrease when institutions are strong. Kim et al. (2020) suggest that the effect of finance on CO2 emissions is nonlinear and depends on the type of finance.

When it comes to the quality of political institutions, it is argued that governments in countries with better and inclusive political institutions such as democracy are more responsive to people’s environmental concerns and the influence from environmentalists on policy (Payne 1995; Torras and Boyce 1998; Barrett and Graddy 2000; Farzin and Bond 2006; Bernauer and Koubi 2009). However, more democratic governments are also sensitive to the economic concerns of the majority of the voting public and influenced by industry lobbying groups and multinational corporations that seek to maximize their profit (Congleton 1992; Midlarsky 1998). While environmental protection generates widespread long-term benefits, the pro-environment policies are often regarded as harmful to short-term economic growth (Kirchgässner and Schneider 2003). Thus, elected politicians may overweigh short-run economic interests at the expense of long-term environmental benefits (Congleton 1992; Midlarsky 1998). Democracy may actually lead to environmental degradation. Please see Li and Reuveny (2006), Bernauer and Koubi (2009) and Carlitz and Povitkina (2021) for detailed discussions and references therein.

On the empirical front, most studies find that democracy positively affects environmental policy stringency and/or environmental quality (see, e.g., Congleton 1992; Murdoch and Sandler 1997; Neumayer 2002; Fredriksson et al. 2005; Farzin and Bond 2006; Li and Reuveny 2006; Fredriksson and Wollscheid 2007; Bernauer and Koubi 2009; Tamazian and Rao 2010; Fredriksson and Neumayer 2013; Policardo 2016; Halkos and Paizanos 2017; Iwińska et al. 2019; Ren et al. 2020). However, several scholars including Midlarsky (1998), Scruggs (1998) and Roberts and Parks (2007) show that democracy may not improve the environmental quality or may even worsen it. Still, You et al. (2015) find that democracy is positively associated with emissions for the least emissions countries, while the relationship is negative for the most emissions countries. Povitkina (2018) shows that more democracy is associated with lower CO2 emissions only in countries with low corruption.

Depart from current empirical studies, the paper brings the two lines of literature together and takes a step further to check whether institutional quality makes a difference for financial development to shape environmental quality. We base our testable hypothesis on the following observations. It is argued that political institutions that can effectively enforce property and contract rights and impose constraints on rulers create an environment conducive to financial development (Haber et al. 2007; Girma and Shortland 2008; Huang 2010; Roe and Siegel 2011; Law and Azman-Saini 2012; Khalid and Shafiullah 2021). Recent research also suggests that countries with better political institutions are in a better position to benefit from financial development (e.g., Law et al. 2013, 2018 for economic growth; Law et al. 2014 and Kim et al. 2021 for income inequality).

We therefore build the following hypotheses to test whether political institutions play an important role in moderating the effect of financial development on pollution emissions:

Hypothesis 1

Financial development promotes green technology innovation and hence reduces energy use and CO2 emissions in a regime with better institutional quality.

Hypothesis 2

This beneficial effect of political institutions is more pronounced for bank-based financial systems with the dominance of big banks.

As argued, banks are inherently conservative in the investment strategy and avoid to fund innovative projects (Weinstein and Yafeh 1998). Moreover, powerful banks often stymie innovation by extracting informational rent and protecting established firms (Hellwig 1991; Rajan 1992). It is also argued that state-owned banks are less likely to supply credit to support strategic industries with possible innovation and growth opportunities (La Porta et al. 2002). Efficient political institutions may help reduce the degree of uncertainty and corruption in the banking system, hence encouraging productive economic activities that possibly improve the environment.

3 Data and empirical strategy

3.1 Data

The paper examines the determinants of CO2 emissions using a large panel dataset that includes as many countries and years as possible. Our dataset spans from 1984 up to 2017 and includes 82 countries that have at least half of observations for finance and institution variables during the sample period. Table 7 of Appendix lists countries included in the analysis. As typical in the empirical literature, all data are averaged over non-overlapping 4 years during the sample period to mitigate business fluctuation effects and measurement error.

Regarding the dependent variable, we consider CO2 emissions per capita. The main reason for studying CO2 emissions is that they have been recognized by most scientists as a major source of global warming through its greenhouse effects. Another reason is that CO2 emissions are directly related to the use of energy, which is an essential factor both for production and consumption in the world economy. To check for the impact of finance on energy use, we consider energy use (kg of oil equivalent) per capita. These data are in logs and sourced from the World Development Indicators (WDI) of the World Bank and the World Data Atlas of Knoema.Footnote 2 To explore the effect of finance on green technology, we consider the (log of) number of inventions developed by country's inventors as a share of population sourced from the OCED database.

Regarding financial development, we follow Beck and Levine (2002) to use a composite measure, denoted as \(findev\_aggreagte,\) which equals the first principal component of three underlying measures of the size, activity and efficiency of banks and stock markets. Each of the underlying variables is constructed so that higher values suggest a better developed financial system. The first variable (\(findev\_activity\)) is a measure of the overall activity of the financial intermediaries and markets. It equals the log of the product of private credit (the value of credits by financial intermediaries to the private sector divided by GDP) and value traded (the value of total shares traded on the stock market exchange divided by GDP). The second variable (\(findev\_size\)) is a measure of the overall size of the financial sector and equals the log of the sum of private credit and market capitalization (the value of listed shares divided by GDP). The last variable (\(findev\_efficiency\)) is a measure of the overall efficiency of the financial sector and equals the logarithm of the total value traded ratio divided by overhead costs. Efficiency of banking is measured by overhead costs defined to be the ratio of banking overhead costs to banking assets. Large overhead costs may reflect inefficiencies in the banking system.

With respect to financial structure, the extent to which a country’s financial system is bank- or market-oriented, we consider also a composite measure of the comparative role of banks and markets in the economy, denoted as \(finstr\_aggregate\), following Beck and Levine (2002), as our indicator of the extent of stock market orientation. \(finstr\_aggregate\) is the first principal component of three variables that measure the comparative activity, size and efficiency of markets and banks. Each of the underlying variables is constructed so that higher values indicate more liquid, active and efficient stock markets, and hence more market-based financial systems. The first variable (\(finstr\_activity\)) measures the relative size of stock markets to that of banks in the financial system and equals the log of the ratio of value traded to bank credit. Bank credit equals the claims of the banking sector on the private sector as a share of GDP. The second variable (\(finstr\_size\)) measures the activity of stock markets relative to that of banks and equals the log of the ratio of market capitalization to bank credit. The last variable (\(finstr\_efficiency\)) measures the relative efficiency of a country’s stock markets relative to that of its banks and is the log product of turnover ratio (the value of stock transactions relative to market capitalization) and overhead costs.

As for bank market power, we consider both the Lerner index and the Boone indicator to proxy for the extent of competition in the banking sector. The Lerner index measures bank competition based on markups in banking and is defined as the difference between output prices and marginal costs (relative to prices). Higher values of the Lerner index signal less bank competition. The Boone indicator measures the effect of efficiency on performance in terms of profits and is calculated as the elasticity of profits to marginal costs. The main idea of the Boone indicator is that more-efficient banks achieve higher profits. The more negative the Boone indicator is, the higher the level of competition is in the market, because the effect of reallocation is stronger. We also consider concentration in the banking sector measured by the (logarithm of) sum of market shares (in terms of total assets) of the three largest banks. All finance variables are sourced from the World Bank Global Financial Development (GFD) database.

Data on household credit and enterprise credit are obtained from the Credit Structure Database of Léon (2018). Household credit is the logarithm of credit to household, credit to individuals or a similar item as a percentage of GDP. Enterprise credit is the logarithm of credit to private non-financial corporations as a share of GDP.

As regards the quality of political institutions (\(polins\)), we consider democracy, a political system characterized by popular participation, political competition for public office, and institutional constraints on the rulers. The first measure of democracy is derived from the data on political rights published by Freedom House, denoted as \(free\). The data range from one to seven. A rating of one implies “there are competitive parties or other political groupings, the opposition plays an important role and has actual power” and a rating of seven indicates that political rights are absent. The second measure is the Polity2 score from the Polity IV database, denoted as \( polity\), and it reflects the openness and the competitiveness of the political process as well as the presence of institutions that foster political participation. The index ranges from zero to ten, where a higher rating implies higher levels of democracy. The third measure is democratic accountability from the International Country Risk Guide, denoted as \(icrg\). The data are published by Political Risk Services and reflect the extent to which elections are free and fair, and the degree to which the government is accountable to its electorate. The index ranges from one to six, a higher score implies more democracy and accountability. To ease comparison between the different measures of the quality of political institutions, we follow Acemoglu et al. (2008) and normalize these measures to lie between zero and one, such that a higher number implies more democracy and better quality of political institutions.

In addition to linear and quadratic terms of log real income per capita \(\left( {gdppc} \right)\) to account for the environmental Kuznets effect, we include control variables to alleviate the omitted-variable bias. These include the (logarithm of) urban population as a percentage of total population to capture the effect of urbanization, trade openness, the (logarithm of the) sum of exports and imports as a percentage of GDP to account for the pollution haven or race to the bottom effect, and industrialization, the (logarithm of) value added as a share of GDP to control for the effect of industry production. To account for the environmental effect of education, we consider also the (logarithm of) percentage of the population with secondary education. Data on these variables are taken from WDI. Tables 8 and 9 report summary statistics and the correlation matrix.

3.2 Empirical strategy

To examine the effect of financial development \(\left( {findev} \right)\), financial structure \(\left( {finstr} \right)\), and political institutions \( \left( {polins} \right)\) on the environment, we follow Shahzad et al. (2018), Acheampong (2019) and Acheampong et al. (2020) to add these variables into the EKC regression:

where \(i = 1,2, \ldots ,N\) and \(t = 1,2, \ldots ,T.\) \(y \) is CO2 emissions, energy use or green technology. \(\alpha_{i} \) is a country-specific effect and \(d_{t}\) is a set of period dummies. \(gdppc\) is real GDP per capita, and \(control\) s is a set of control variables.

To further explore the potential conditionality in the effect of financial variables on the environment, we add the interaction term of financial development and structure with political institutions to (1):

The marginal effect of financial development and structure on CO2 emissions depends on institutional quality:

To evaluate the marginal effect, we compute the standard error as suggested by Brambor et al. (2006):

To look at the effect of bank market power (BMP) and bank credit composition, i.e., household credit (HC) versus enterprise credit (\(EC\)), we then estimate the following equations:

The estimation of these equations is carried out using the general method of moments (GMM) estimator for dynamic panels put forth by Arellano and Bover (1995) and Blundell and Bond (1998), also known as system GMM. Apart from accounting for the specified dynamics, the estimator accommodates the possible endogeneity between pollution emissions and some of the independent variables by means of appropriate instruments. The system GMM is derived from the estimation of a system of two simultaneous equations: one in levels (with lagged first differences as instruments) and the other in first differences (with lagged levels as instruments).

However, the consistency of the system GMM estimator depends on two specification tests, the Hansen (1982) J test of over-identifying restrictions and a serial correlation test in the disturbances (Arellano and Bond 1991). Failure to reject the null of the Hansen J test would imply that the instruments are valid and the model is correctly specified. With respect to the serial correlation test, one should reject the null of the absence of the first-order serial correlation (AR1) and not reject the absence of the second-order serial correlation (AR2). These tests, however, lose power when the number of instruments is large relative to the cross section sample size. We then limit the number of lagged levels to be included as instruments to reduce the instrument count (Roodman 2009). We also report Windmeijer’s (2005) corrected standard errors to mitigate the small sample bias.

4 Empirical results

The empirical analysis first focuses on the effects of financial development and financial structure and then moves to the consequences of bank market power, followed by the differences between household credit and firm credit.

4.1 Effects of financial development and structure

Table 1 reports the direct effects of financial development and financial structure using \(free\) as a measure of institutional quality. As observed, all regressions are correctly specified because the diagnostic statistics are satisfied. The Hansen J test shows that estimated equations are not over identified. The null hypothesis of absence of first-order serial correlation is rejected, but the null hypothesis of the absence of second-order serial correlation is not rejected. The number of instruments is smaller than the number of countries.

Move to estimates of interest. Financial development has a positive and significant effect on CO2 emissions across different measures (size, activity, efficiency and aggregate) of financial development (Columns (1)–(4)). It is also found that, using the aggregate indicator of financial development, energy use increases but green technology deteriorates as a country’s financial sector develops (Columns (5) and (6)), consistent with Sadorsky (2010, 2011), Shahbaz and Lean (2012), and Lv et al. (2021). The data suggest that financial development expands production and consumption but undermines green technology development, thereby increasing energy use and CO2 emissions.

On the other hand, a more stock-market-based financial system has a negative and significant effect on CO2 emissions except for the case when considering the size measure of stock market orientation. It is also shown that, using the aggregate indicator of financial structure, a more stock-market-led financial system lowers energy use but facilitates green technology development, in line with Shahbazet al. (2016) and Lv et al. (2021). The evidence seems to support the arguments that a more stock-market-based financial system plays a better role in disciplining firm pollution and encouraging the use of energy-saving production technology, thus reducing energy use and CO2 emissions (Tamazian et al. 2009; Capelle-Blancard and Laguna 2010).

However, these effects hold only for countries with low institutional quality as shown in Table 2 where we interact institutional quality with financial development and stock market orientation. In Columns (1)–(5), the respective estimate on financial development and on its interaction with institutional quality, \(free\), are positive and negative, both of which are statistically significant. This suggests that political institutions significantly alter the relationship between financial development and CO2 emissions and energy use by reducing the positive effect of financial development on CO2 emissions and energy use. Moreover, this positive effect eventually turns negative for institutional quality above the critical level of between 0.27 and 0.73. Similarly, political institutions mitigate the detrimental effect of financial development on green technology development. As shown in Column (6), the respective estimate on financial development and its interaction with institutional quality are negative and positive, and both are of statistical significance. Besides, the negative effect turns positive for institutional quality above the critical level of 0.15. The remaining columns confirm the finding with different measures of institutional quality, \( icrg\) (Columns (7)-(9)) and \(polity\) (Columns (10)-(12)). The positive effect of financial development on CO2 emissions and energy use turns negative for \(icrg \left( {polity} \right)\) above the critical level of 0.62 (0.76) and 0.61 (0.69). Also, the negative effect of financial development on green technology development becomes positive for \(icrg \left( {polity} \right)\) above the critical level of 0.50 (0.51).

To elucidate our results, we evaluate \(\frac{{\partial y_{it} }}{{\partial findev_{it} }}\) based on the sample average value of \(free\), \(\overline{free}\), calculated for each country. Figure 1 reports the respective marginal effect of financial development on CO2 emissions (a), energy use (b) and green technology (c) from the Columns (4)-(6) regressions. The marginal effect of financial development on CO2 emissions is positive and significant up to 0.51 of \(free\) (close to the level of Ghana), and then loses significance, but turns negative and significant at 0.63 of \(free \)(close to the level of Chile). Likewise, the marginal effect of financial development on energy use is positive and significant up to 0.47 of \(free\) (close to the level of South Africa), and then loses significance, but turns negative and significant at 0.62 of free (close to the level of Chile). On the contrary, the marginal effect of financial development on green technology is negative and significant up to 0.06 of \(free\) (about the level of Uganda), and then loses significance, but turns positive and significant at 0.22 of free (about the level of Indonesia). Also see Column (1) of Table 6 where we evaluate the estimated value of \(\frac{{\partial y_{it} }}{{\partial findev_{it} }}\) and the associated standard deviation at different percentiles of \(\overline{free}\).

The respective marginal effects of financial development, financial structure on CO2 emissions, energy use and green technology with 95% confidence intervals. This figure plots the marginal effects obtained from Columns (4)–(6) of Table 2

As for stock market orientation, its negative effect on CO2 emissions and energy use decreases when the quality of political institutions improves and becomes positive when institutional quality crosses the threshold level of between 0.20 and 0.47. The respective estimate on stock market orientation and on its interaction with institutional quality are negative and positive, and both are of statistical significance as illustrated in Columns (1)–(5). This indicates that institutional quality undermines the efficacy of stock-market-based (bank-based) financial systems in alleviating (aggravating) CO2 emissions and energy use. Likewise, the positive effect of stock market orientation on green technology development turns negative for institutional quality above the critical value of 0.76. The estimate on both the linear and interaction term of financial structure is positive and negative, both of which are statistically significant, as shown in Column (6). Institutional quality weakens the effectiveness of stock-market-based (bank-based) financial systems in supporting (hampering) green technology development. The finding holds using \(icrg\) (Columns (7)–(9)) and \(polity\) (Columns (10)-–(12)). The positive effect of financial structure on CO2 emissions and energy use turns negative for \(icrg \left( {polity} \right)\) above the critical level of 0.54 (0.53) and 0.57 (0.69). Likewise, the negative effect of financial structure on green technology development becomes positive for \(icrg \left( {polity} \right)\) above the critical level of 1.57 (0.75).

For illustration, Fig. 1 (d)–(f) shows the respective marginal effect of financial structure on CO2 emissions, energy use and green technology. The marginal effect of financial structure on CO2 emissions is negative and significant up to 0.18 of \(free\) (close to the level of Tunisia) and becomes insignificant, but turns positive and significant at 0.38 of \(free\) (about the level of India). Similarly, the marginal effect of financial structure on energy use is negative and significant up to 0.37 of \(free\) (close to the level of Bolivia) and becomes insignificant, but turns positive and significant at 0.51 of \(free\) (close to the level of Ghana). However, the marginal effect of financial structure on green technology is positive and significant up to 0.63 of \(free\) (close to the level of Chile) and then loses significance. Column (2) of Table 6 reports the estimated value of \(\frac{{\partial y_{it} }}{{\partial finstr_{it} }}\) and its standard deviation at different percentiles of \(\overline{free}\).

It is noted that for all regressions, in addition to the indirect interacting effect, political institutions have a direct effect. Specifically, better quality of political institutions rises CO2 emissions and energy use, implying that democracy is unable to save the environment possibly because of collective action problems, interest capture and frequent election, albeit it improves green technology. The environmental Kuznets curve—CO2 emissions increase and then decrease over the course of economic development—is supported by the data as (log) real GDP per capita and its squared term are positive and negative, both of which are of statistical significance. An inverted U relation between energy use and real GDP per is also found but a U-shaped relation between green technology and real GDP per capita.

Trade facilitates green technology development and decreases energy use, supporting the views that trade accelerates greater access to greener production technology (Thoenig and Verdier 2003). Despite so, trade is found to raise CO2 emissions. Urbanization decreases CO2 emissions and energy use, consistent with the view that urbanization provides better opportunities to achieve economies of scale and to use energy more efficiently or induces greater political pressure to reduce pollution (Damania et al. 2003). However, urbanization decreases green technology development. It is argued that the educated are more aware of environmental issues and thus are likely to have more intense preferences for environmental quality and behave more consistently with protection of the environment (Raffin 2014). Our data indeed show that schooling decreases energy use and CO2 emissions and promotes green technology. Industrialization reduces green technology development and rises energy use and CO2 emissions (Sadorsky 2013).

4.2 Effects of bank market power

Thus far, the evidence seems to support the view that it is better quality of financial development that is beneficial to emission mitigation. With better quality of political institutions, improved wealth due to financial development may trigger increasing political demand for better environmental quality and can afford costly investment in environmental protection. This is particularly so for countries with more bank-based financial systems. Compared to market-based financial systems, the banking sector can be more subject to private (regulatory) capture when the institutional setting is weak. In this subsection, we further investigate whether there are differences in bank market power.

Table 3 reports the direct effect of bank market power using \(findev\_aggregate \) and free as a measure of financial development and institutional quality. In Columns (1), (2), (4) and (5), both the Boone and Lerner indicators are positive and statistically significant, indicating that greater bank competition reduces CO2 emissions and energy use. By contrast, in Columns (3) and (6), bank concentration raises CO2 emissions and energy use as its estimate is positive and statistically significant. A more competitive or less concentrated banking system seems to strengthen firms’ incentive to control pollution. The last three columns further suggest that a more competitive or less concentrated banking system tend to promote green technology progress, as the estimates on both banking competition and concentration variables are negative and significant.

When we include the interaction terms of institutional quality with bank market power variables and financial development, Table 4 shows that these effects hold only for countries with low institutional quality, irrespective of different measures of the quality of political institutions. In Columns (1), (2), (4) and (5), both the Boone and Lerner indicators keep positive and significant. However, their interaction terms with institutional quality are negative and statistically significant. This suggests that institutional quality lessens the effectiveness of a competitive banking system in reducing CO2 emissions and energy use. Columns (7) and (8) also point to institutional quality in ameliorating the efficacy of banking competition in supporting green technology development, as the respective estimates on banking competition and on its interaction with institutional quality are negative and positive, and both are of statistical significance.

To illustrate, Fig. 2 reports the respective marginal effect of bank competition on CO2 emissions (a), energy use (b) and green technology (c) from the Column (1), (4) and (7) regressions of \({\text{Panel A}}\). The marginal effect of bank competition on CO2 emissions is positive and significant up to 0.67 of \(free\) (close to the level of Hungary), and then loses significance, but turns negative and significant at 0.84 of \(free\) (about to the level of Uruguay). Likewise, the marginal effect of bank competition on energy use is positive and significant up to 0.21 of \(free\) (close to the level of Indonesia) and then loses significance but turns negative and significant at 0.62 of \(free\) (close to the level of Chile). Equally, the marginal effect of bank competition on green technology is negative and significant up to 0.17 of \(free\) (about the level of Paraguay) and then loses significance but turns positive and significant at 0.51 of \(free\) (close to the level of Ghana). Also see Columns (3) of Table 6 where we evaluate the estimated value of \(\frac{{\partial y_{it} }}{{\partial Boone_{it} }}\) and the associated standard deviation at different percentiles of \(\overline{free}\).Footnote 3

The respective marginal effects of competition and concentration on CO2 emissions, energy use and green technology with 95% confidence intervals. The top panel plots the marginal effects obtained from Columns (1), (4), and (7) of Panel A in Table 4, whereas the bottom panel plots the marginal effects from Columns (3), (6) and (9) of Panel A in Table 4

In Columns (3) and (6), bank concentration and its interaction with institutional quality are positive and negative, and both are of statistical significance. Institutional quality clearly moderates the effect of bank concentration in aggravating CO2 emissions and energy use. Moreover, the positive effect of bank concentration on CO2 emissions (energy use) becomes negative when institutional quality crosses the critical level, i.e., 0.74 (0.77), 0.87 (0.69) and 0.86 (0.86), respectively, of \(free \left( {\text{Panel A}} \right)\), \(icrg\) \(\left( {\text{Panel B}} \right)\), and \(polity \left( {\text{Panel C}} \right)\). Column (9) also shows that institutional quality weakens the effect of banking concentration in containing green technology development, as the respective estimate on banking competition and its interaction with institutional quality are negative and positive, and both are of statistical significance. Moreover, the negative effect of bank concentration on green technology becomes positive when institutional quality crosses the critical level, i.e., 0.68, 0.86 and 0.90, respectively, of \(free \left( {\text{Panel A}} \right)\), \(icrg \left( {\text{Panel B}} \right)\), and \(polity \left( {\text{Panel C}} \right)\).

As illustrated in (d)-(f) of Fig. 2, the marginal effect of bank concentration on CO2 emissions is positive and significant up to 0.63 of \(free\) (close to the level of Slovak Rep.) and then loses significance. Likewise, the marginal effect of bank concentration on energy use is positive and significant up to 0.70 of \(free\) (close to the level of Hungary) and then loses significance, but turns negative and significant at 0.85 of \(free\) (close to the level of Israel). Besides, the marginal effect of bank concentration on green technology is negative and significant up to 0.58 of \(free\) (close to the level of Latvia), and then loses significance, but turns positive and significant at 0.82 of \(free\) (close to the level of Germany). Also see Column (5) of Table 6 where we evaluate the estimated value of \(\frac{{\partial y_{it} }}{{\partial concentration_{it} }}\) and the associated standard deviation at different percentiles of \(\overline{free}\).

4.3 Effects of household and enterprise credit

Table 5 reports the effects of household credit and enterprise credit. There are sharp differences between household credit and enterprise credit. In Columns (1) and (3), household credit tends to raise CO2 emissions and energy use, whereas enterprise credit has a positive and significant effect. Likewise, in Column (5), green technology decreases with household credit but increases with enterprise credit. While both types of credit are related to economic growth, enterprise credit seems to be more subject to pollution control and funding investment in energy-saving production processes.

When including the interaction terms of institutional quality with household credit and enterprise credit in Columns (2), (4) and (6), we find that these effects hold only for countries with low-quality political institutions. For the CO2 emissions and energy use regression, the respective estimate on household credit and its interaction with institutional quality, \(free\), are positive and negative, both of which are statistically significant. This suggests that political institutions mitigate the positive effect of household credit on CO2 emissions and energy use. Moreover, this positive effect on CO2 emissions (energy use) becomes negative for \(free\) above the critical level of 0.38 (0.61). As for green technology, the negative effect of household credit turns positive for \(free\) above the critical level of 0.22. We find similar results using \(polity \)(Columns (7)–(9)) and \(icrg\) (Columns (10)–(12)). The positive effect of household credit on CO2 emissions and energy use becomes negative for \(icrg \left( {polity} \right)\) above the critical level of 0.54 (0.42) and 0.69 (0.89). Also, the negative effect of household credit on green technology development turns positive for \(icrg \left( {polity} \right) \) above the critical level of 0.60 (0.61).

Figure 3 reports the respective marginal effect of household credit on CO2 emissions (a), energy use (b) and green technology (c) from the Columns (2), (4) and (6) regressions. The marginal effect of household credit on CO2 emissions is positive and significant up to 0.30 of \(free\) (about the level of Ecuador) and then loses significance, but turns negative and significant at 0.48 of \(free\) (close to the level of South Africa). Likewise, the marginal effect of household credit on energy use is positive and significant up to 0.53 of \(free\) (close to the level of Korea, Rep.) and then loses significance, but turns negative and significant at 0.72 of \(free\) (close to the level of Poland). Regarding green technology, the marginal effect of household credit is negative and significant up to 0.14 of \(free\) (about the level of Russia) and then loses significance, but turns positive and significant at 0.30 of \(free\) (about the level of Ecuador). Also see Column (6) of Table 6 where we evaluate the estimated value of \(\frac{{\partial y_{it} }}{{\partial household credit_{it} }}\) and the associated standard deviation at different percentiles of \(\overline{free}\).

The respective marginal effects of household credit and enterprise credit on CO2 emissions, energy use and green technology with 95% confidence intervals. This figure plots the marginal effects obtained from Columns (2), (4) and (6) of Table 5

As for enterprise credit, its negative effect on CO2 emissions (energy use) decreases when the quality of political institutions improves and becomes positive when institutional quality crosses the critical level of 0.53 (0.85). The respective estimates on enterprise credit and on its interaction with institutional quality are negative and positive, and both are of statistical significance. Institutional quality clearly reduces the effectiveness of enterprise credit in mitigating CO2 emissions and energy use. Regarding green technology, the positive effect of enterprise credit turns negative for \(free\) above the critical level of 0.81. We find similar results using \(polity \)(Columns (7)–(9)) and \(icrg\) (Columns (10)–(12)). The negative effect of enterprise credit on CO2 emissions and energy use becomes positive for \(icrg \left( {polity} \right)\) above the critical level of 0.72 (0.61) and 0.93 (0.80). Also, the positive effect of enterprise credit on green technology development turns negative for \(icrg \left( {polity} \right)\) above the critical level of 0.95 (0.97).

As illustrated in (d), (e) and (f) of Fig. 3, the marginal effect of enterprise credit on CO2 emissions is negative and significant up to 0.43 of \(free\) (close to the level of Bulgaria) and then loses significance, but turns positive and significant at 0.73 of \(free\) (close to the level of Poland). Likewise, the marginal effect of enterprise credit on energy use is negative and significant up to 0.65 of \(free\) (close to the level of Slovak Rep.) and then loses significance. Concerning green technology, the marginal effect of enterprise household credit is positive and significant up to 0.55 of \(free\) (close to the level of Panama) and then loses significance. Also see Column (7) of Table 6 where we evaluate the estimated value of \(\frac{{\partial y_{it} }}{{\partial enterprise credit_{it} }}\) and the associated standard deviation at different percentiles of \(\overline{free}\).

5 Conclusion

This paper examines the roles of financial development, institutional quality and their interaction in explaining CO2 emissions. To the best of our knowledge, this paper is the first one to bring political institutions into the analysis of the nexus between the level and structure of financial development and CO2 emissions. In a panel of advanced and developing countries during the period 1984–2017, it finds that financial development alleviates energy use and CO2 emissions but worsens green technology development above the critical value of institutional quality, below which financial development increases energy use and CO2 emissions but reduces green technology development. It accords with the recent literature showing that it is better-quality finance (i.e., a financial system embedded in a sound institutional framework), rather than more finance, that is conducive to the economy (Law et al. 2013). Despite so, significant variations are observed between banks and stock markets, banking competition and concentration, and household and firm credit.

Specifically, a more market-based financial system improves (deteriorates) green technology development and thus mitigates (raises) energy use and CO2 emissions in a regime with low (high) institutional quality. A more competitive and less concentrated banking system promotes (worsens) green technology and then decreases (increases) energy use and CO2 emissions in a regime with high (low) institutional quality. Household (enterprise) credit exacerbates (promotes) green technology development and hence exaggerates (reduces) energy use and CO2 emissions in a regime with low institutional quality. However, in a regime with high institutional quality, household (enterprise) credit encourages (deteriorates) green technology development and decreases (rises) energy use and CO2 emissions.

From a policy perspective, the evidence suggests that for countries with low institutional quality, financial reforms toward a more stock-market-led financial system, a more competitive and/or less concentrated banking sector, and/or greater bank lending to enterprises relative households are conducive to pollution mitigation. By contrast, financial reform policy toward a bank-led financial system, a less competitive and more concentrated banking system, and/or greater lending to households relative to enterprises is beneficial for the environment for countries with high institutional quality.

6 Availability of data and Code

Data are available at: https://dataverse.harvard.edu/dataset.xhtml?persistentId=doi:10.7910/DVN/XEWLXY

Notes

In Column (4) of Table 6, we evaluate the estimated value of \(\frac{{\partial y_{it} }}{\partial Lerner}\) and the associated standard deviation at different percentiles of \(\overline{free}\). We find a similar pattern.

References

Abbasi F, Riaz K (2016) CO2 emissions and financial development in an emerging economy: an augmented VAR approach. Energy Policy 90:102–114

Acemoglu D, Johnson S, Robinson J, Yared P (2008) Income and democracy. Am Econ Rev 98:808–842

Acheampong AO (2019) Modelling for insight: does financial development improve environmental quality? Energy Econ 83:156–179

Acheampong AO, Amponsah M, Boateng E (2020) Does financial development mitigate carbon emissions? Evidence from heterogeneous financial economies. Energy Econ https://doi.org/10.1016/j.eneco.2020.104768

Arellano M, Bond S (1991) Some tests of specification for panel data: Monte Carlo evidence and an application to employment equations. Rev Econ Stud 58:277–297

Arellano M, Bover O (1995) Another look at the instrumental variable estimation of error-component models. J Econ 68:29–52

Barrett S, Graddy K (2000) Freedom, growth, and the environment. Environ Dev Econ 5:433–456

Beck T, Levine R (2002) Industry growth and capital allocation: Does having a market- or bank-based system matter? J Financ Econ 64:147–180

Bekhet HA, Matar A, Yasmin T (2017) CO2 emissions, energy consumption, economic growth, and financial development in GCC countries: dynamic simultaneous equation models. Renew Sustain Energy Rev 70:117–132

Bernauer T, Koubi V (2009) Effects of political institutions on air quality. Ecol Econ 68:1355–1365

Blundell R, Bond S (1998) Initial conditions and moment restrictions in dynamic panel data models. J Econom 87:115–143

Boyd JH, Smith BD (1998) Capital market imperfections in a monetary growth model. Econ Theor 11:241–273

Brambor T, Clark WR, Golder M (2006) Understanding interaction models: improving empirical analyses. Polit Anal 14:63–82

Buonanno P, Carraro C, Galeotti M (2003) Endogenous induced technical change and the costs of Kyoto. Resour Energy Econ 25:11–34

Capelle-Blancard G, Laguna M-A (2010) How does the stock market respond to chemical disasters? J Environ Econ Manag 59:192–205

Carlitz RD, Povitkina M (2021) Local interest group activity and environmental degradation in authoritarian regimes. World Dev 142:105425

Congleton RD (1992) Political institutions and pollution control. Rev Econ Stat 74:412–421

Damania R, Fredriksson PG, List JA (2003) Trade liberalization, corruption, and environmental policy formation: theory and evidence. J Environ Econ Manag 46:490–512

Dasgupta S, Laplante B, Mamingi N (2001) Pollution and capital markets in developing countries. J Environ Econ Manag 42:310–335

Demetriades P, Andrianova S (2004) Finance and growth: what we know and what we need to know. In: Goodhart C (ed) Financial development and growth: explaining the links, chapter 2. Palgrave Macmillan, Basingstoke, pp 38–65

Dinda S (2004) Environmental Kuznets curve hypothesis: a survey. Ecol Econ 49:431–455

Farzin H, Bond CA (2006) Democracy and environmental quality. J Dev Econ 81:213–235

Fredriksson PG, Neumayer E (2013) Democracy and climate change policies: Is history important? Ecol Econ 95:11–19

Fredriksson PG, Neumayer E, Damania R, Gates S (2005) Environmentalism, democracy, and pollution control. J Environ Econ Manag 49:343–365

Fredriksson PG, Wollscheid RJ (2007) Democratic institutions versus autocratic regimes: The case of environmental policy. Public Choice 130:381–393

Gerlagh R, Lise W (2005) Carbon taxes: a drop in the ocean, or a drop that erodes the stone? The effect of carbon taxes on technological change. Ecol Econ 54:241–260

Girma S, Shortland A (2008) The political economy of financial development. Oxf Econ Pap 60:567–596

Goel R, Herrala R, Mazhar U (2013) Institutional quality and environmental pollution: MENA countries versus rest of the world. Econ Syst 37:508–521

Grossman GM, Krueger AB (1993) Environmental impacts of the North American free trade agreement. In: Garber P (ed) The US -Mexico free trade agreement. MIT Press, Cambridge, MA, pp 165–177

Grossman GM, Krueger AB (1995) Economic environment and the economic growth. Quart J Econ 110:353–377

Haber SH, North D, Weingast BR (2007) Political institutions and financial development. Stanford University Press, Stanford, CA

Halkos GE, Paizanos EA (2017) The channels of the effect of government expenditure on the environment: evidence using dynamic panel data. J Environ Plann Manage 60:135–157

Hansen LP (1982) Large sample properties of generalized method of moments estimators. Econometrica 50:1029–1054

Hellwig M (1991) Banking, financial intermediation and corporate finance. In: Giovanni A, Mayer C (eds) European financial integration. Cambridge University Press, Cambridge, pp 35–63

Huang Y (2010) Political institutions and financial development: an empirical study. World Dev 38:1667–1677

Iwińska K, Kampas A, Longhurst K (2019) Interactions between democracy and environmental quality: toward a more nuanced understanding. Sustainability 11:1728

Khalid U, Shafiullah M (2021) Financial development and governance: a panel data analysis incorporating cross-sectional dependence. Econ Syst 100855. https://doi.org/10.1016/j.ecosys.2021.100855

Kim D-H, Hsieh J, Lin S-C (2021) Financial liberalization, political institutions, and income inequality. Empir Econ 60:1245–1281

Kim DH, Wu YC, Lin SC (2020) Carbon dioxide emissions and the finance curse. Energy Econ 88:104788

Kirchgässner G, Schneider F (2003) On the political economy of environmental policy. Public Choice 115:369–396

Kumbaroglu G, Karali N, Arıkan Y (2008a) CO2, GDP and RET: an aggregate economic equilibrium analysis for Turkey. Energy Policy 36:2694–2708

Kumbaroglu G, Madlener R, Demirel M (2008b) A real options evaluation model for the diffusion prospects of new renewable power generation technologies. Energy Econ 30:1882–1908

La Porta R, Lopez-de-Silanes F, Shleifer A (2002) Government ownership of banks. J Finance 57:265–301

Lanoie P, Laplante B, Roy M (1998) Can capital markets create incentives for pollution control? Ecol Econ 26:31–41

Law SH, Azman-Saini WNW (2012) Institutional quality, governance and financial development. Econ Governance 13:217–236

Law SH, Azman-Saini WNW, Ibrahim MH (2013) Institutional quality thresholds and finance–growth nexus. J Bank Finance 37:5373–5381

Law SH, Kutan AM, Naseem NAM (2018) The role of institutions in finance curse: Evidence from international data. J Comp Econ 46:174–191

Law SH, Tan HB, Azman-Saini WNW (2014) Financial development and income inequality at different levels of institutional quality. Emerg Mark Financ Trade 50:21–33

Léon F (2018) The credit structure database. CREA Discussion Paper Series 18–07, Center for Research in Economic Analysis. University of Luxembourg

Levine R (2005) Finance and growth: theory and evidence. In: Aghion P, Durlauf S (eds) Handbook of economic growth 1, chapter 12. North-Holland, Amsterdam, pp 865–934

Li Q, Reuveny R (2006) Democracy and environmental degradation. Int Stud Quart 50:935–956

Lv C, Shao C, Lee CC (2021) Green technology innovation and financial development: Do environmental regulation and innovation output matter? Energy Econ 98:105237

Midlarsky MI (1998) Democracy and the environment: an empirical assessment. J Peace Res 35:341–361

Murdoch JC, Sandler T (1997) The voluntary provision of a public good: the case of reduced CFC emissions and the Montreal Protocol. J Public Econ 63:331–349

Neumayer E (2002) Do democracies exhibit stronger international environmental commitment? A cross country analysis. J Peace Res 39:139–164

Omri A, Daly S, Rault C, Chaibi A (2015) Financial development, environmental quality, trade and economic growth: what causes what in MENA countries. Energy Econ 48:242–252

Ozturk I, Acaravci A (2013) The long-run and causal analysis of energy, growth, openness and financial development on carbon emissions in Turkey. Energy Econ 36:262–267

Paramati SR, Mo D, Gupta R (2017) The effects of stock market growth and renewable energy use on CO2 emissions: evidence from G20 countries. Energy Econ 66:360–371

Payne RA (1995) Freedom and the environment. J Democr 6:41–55

Policardo L (2016) Is democracy good for the environment? Quasi-experimental evidence from regime transitions. Environ Resour Econ 64:275–300

Porter ME, van der Linde C (1995) Toward a new conception of the environment-competitiveness relationship. J Econ Perspect 9:97–118

Povitkina M (2018) The limits of democracy in tackling climate change. Environ Polit 27:411–432

Raffin N (2014) Education and the political economy of environmental protection. Ann Econ Stat 115(116):379–407

Rajan RG (1992) Insiders and outsiders: the choice between informed and arm’s-length debt. J Financ 47:1367–1400

Ren Y, Liu L, Zhu H, Tang R (2020) The direct and indirect effects of democracy on carbon dioxide emissions in BRICS countries: Evidence from panel quantile regression. Environ Sci Pollut Res 27:33085–33102

Roberts JT, Parks BC (2007) A climate of injustice: global inequality, North-South politics, and climate policy. MIT Press, Cambridge, MA

Roe MJ, Siegel JI (2011) Political instability: effects on financial development, roots in the severity of economic inequality. J Comp Econ 39:279–309

Roodman D (2009) A note on the theme of too many instruments. Oxford Bull Econ Stat 71:135–158

Sadorsky P (2010) The impact of financial development on energy consumption in emerging economies. Energy Policy 38:2528–2535

Sadorsky P (2011) Financial development and energy consumption in Central and Eastern European frontier economies. Energy Policy 39:999–1006

Sadorsky P (2013) Do urbanization and industrialization affect energy intensity in developing countries? Energy Econ 37:52–59

Scruggs LA (1998) Political and economic inequality and the environment. Ecol Econ 26:259–275

Shahzad SJH, Kumar RR, Zakaria M, Hurr M (2017) Carbon emission, energy consumption, trade openness and financial development in Pakistan: a revisit. Renew Sustain Energy Rev 70:185–192

Shahbaz M, Lean HH (2012) Does financial development increase energy consumption? The role of industrialization and urbanization in Tunisia. Energy Policy 40:473–479

Shahbaz M, Shahzad SJH, Ahmad N, Alam S (2016) Financial development and environmental quality: the way forward. Energy Policy 98:353–364

Shahbaz M, Sinha A (2019) Environmental Kuznets curve for CO2 emissions: a literature survey. J Econ Stud 46:106–168

Tamazian A, Chousa JP, Vadlamannati KC (2009) Does higher economic and financial development lead to environmental degradation: evidence from BRIC countries. Energy Policy 37:246–253

Tamazian A, Rao BB (2010) Do economic, financial and institutional developments matter for environmental degradation? Evidence from transitional economies. Energy Econ 32:137–145

Thoenig M, Verdier T (2003) A theory of defensive skill-biased innovation and globalization. Am Econ Rev 93:709–728

Torras M, Boyce JK (1998) Income, inequality, and pollution: A reassessment of the environmental Kuznets curve. Ecol Econ 25:147–160

You W-H, Zhu H-M, Yu K, Peng C (2015) Democracy, financial openness, and global carbon dioxide emissions: heterogeneity across existing emission levels. World Dev 66:189–207

Weinstein DE, Yafeh Y (1998) On the costs of a bank-centered financial system: Evidence from the changing main bank relations in Japan. J Financ 53:635–672

Windmeijer F (2005) A finite sample correction for the variance of linear efficient two-step GMM estimators. J Econom 126:25–51

Zakaria M, Bibi S (2019) Financial development and environment in South Asia: the role of institutional quality. Environ Sci Pollut Res 26:7926–7937

Zeqiraj V, Sohag K, Soytas U (2020) Stock market development and low-carbon economy: the role of innovation and renewable energy. Energy Econ 91:104908

Zhao B, Yang W (2020) Does financial development influence CO2 emissions? A Chinese provincial-level study Does financial development influence CO2 emissions? Energy 200:117523

Acknowledgements

We are grateful to the editor G. Hondroyiannis and two anonymous referees for their constructive comments and suggestions that significantly improve the quality of our paper. This work was supported by a Korea University Grant. The usual disclaimer applies.

Author information

Authors and Affiliations

Contributions

YCW contributed to software, validation and investigation. DHK was involved in the visualization, writing–reviewing and editing. SCL was involved in the conceptualization, methodology, software and writing—original draft preparation.

Corresponding author

Ethics declarations

Conflicts of interest

The authors, Dong-Hyeon Kim, Yi-Chen Wu and Shu-Chin Lin, declare that they have no relevant or material financial interests that relate to the research described in this paper.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Kim, DH., Wu, YC. & Lin, SC. Carbon dioxide emissions, financial development and political institutions. Econ Change Restruct 55, 837–874 (2022). https://doi.org/10.1007/s10644-021-09331-x

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10644-021-09331-x