Abstract

The aim of this paper is to examine whether changes in nominal oil prices (Brent and West Texas Intermediate (WTI)) affect the stock market returns in the context of an emerging market framework. The Autoregressive Distributed Lag bounds testing approach of cointegration is used to test for the long run relation between the two variables, where the daily stock market index return is calculated using the first difference in the natural logarithms of stock market index. Further, we test for the stability of the cointegration relationship by examining the sensitivity analysis where diagnostic tests for serial correlation (namely the Breusch–Godfrey serial correlations LM test) and cumulative sum of recursive residuals (CUSUM) are employed. Using daily data from January 3, 2000 to December 9, 2015, the findings suggest that there is long run integration between oil prices and stock returns series in which the daily oil price shocks have a negative impact on stock returns. The highly significant error correction coefficient indicates high rate of convergence to equilibrium. In addition, the Toda and Yamamoto (J Econom 66(2):225–250, 1995) Granger non‐causality test indicates significant bidirectional causality between stock market returns and Brent nominal oil price, meanwhile there is unidirectional causality running from WTI oil price to stock market returns. These findings are, up to some extent, meaningful for investors, portfolio managers and policy makers.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Changes in global oil prices have generated considerable anxiety for policy makers and market participants, given its critical impact on the economy. Indeed, while the stock market acts as the barometer of the economy, change in oil prices also, presumably, have an influence on stock prices behavior. This fact is evident from the substantial bulk of research that has emerged to examine the association between oil price changes and stock market returns. However, there is no consensus about the sign and scale of such association, reflecting the need for more work on the oil prices-stock market returns nexus, particularly for emerging markets, which have become increasingly appealing destinations for enormous volumes of capital movement from key economies.

One of those appealing emerging economies is Kuwait which has stable lookout with high ranks in terms of its economic and fiscal conditions.Footnote 1 Nevertheless the country’s high economic outlook is affected by the latest volatile oil prices since the country has a significant reliance on oil revenues. Thus far, volatile oil prices have triggered a negative influence on the overall economic performance, including the country’s equity market. During the last 5 years, the Kuwait Stock Exchange (KSE) has revealed volatile trend in terms of performance given its exposure to changes in crude oil prices.Footnote 2 The market rendered returns reflect a notable impact on corporate earrings where a slowdown in the earrings growth rates was reported for most listed corporations, generating a pressure on investors’ financing and investment decisions, in addition to the impact on the country’s monetary policy agenda.Footnote 3

From an equity market perspective, the theoretical argument presumes that volatility in crude oil prices would have an impact on equity prices as changes in oil prices would be transmitted to macroeconomic fundamentals, causing a pressure on both the supply-side as well as the demand-side of the financial market liquidity positions. This supposedly leads to a significant impact on stock market returns (See, among many others, Ciner 2001; Jones et al.(2004); El-Sharif et al. 2005; Park and Ratti 2008; Nandha and Faff 2008; Issac and Ratti 2009; Tang et al. 2010; Rahman and Serletis 2010; Arouri and Rault 2011; Baumeister and Peersman 2012; Broadstock and Filis 2014; Ghosh and Kanjilal 2014).

As far as we are concerned, we argue that changes in crude oil prices would be transmitted to the equity market negatively. A negative impact may be justified in case of an increase in oil prices as it leads to an increase in the cost of inputs, upsurge in imports, causing in turn a proliferation in the inflation rate. An increase in inflation would cause an increase in interest rate in the market place, signaling a higher cost of capital for most corporations, leading to lower stock returns.Footnote 4 The effect of oil price changes on stock returns is also supported by the common theory of stock valuation where a stock price is valued based on the sum of its discounted expected future cash flows at different time horizons, reflecting the crucial need of recognizing factors influencing these cash flows. Therefore, oil price is among those major inducing factors that cause volatility in the estimated corporate cash flows, causing a transmission of shocks in oil prices to equity markets, creating volatility of stock returns. From the market participants’ perspective, the resulting impact between the two macro variables (positive or negative) would have tremendous effect on their investment decisions, given the investors’ decisions in oil related businesses, portfolio allocations and risk management outlooks (See for example: Arouri et al. 2011; Broadstock and Filis 2014; Aye 2015; Kang et al. 2015).

To this end, this paper tests for cointegration, that is the long run relationship, between oil prices and Kuwait stock market returns using Autoregressive Distributed Lag (ARDL) bounds testing approach of cointegration for daily data that spans from January 3, 2000 to December 20, 2015. The long run association between oil price changes and Kuwait stock market returns is estimated by applying the Dynamic Ordinary Least Squares (DOLS). Furthermore, we test for the stability of the cointegration relationship by examining the sensitivity analysis where diagnostic tests for serial correlation (namely the Breusch–Godfrey serial correlations LM test) and cumulative sum of recursive residuals (CUSUM) are employed. The paper additionally examines the direction of causality between the oil price changes and stock market returns using Toda and Yamamoto (1995) Granger Non‐Causality Testing. In the paper, we adopt Brent and West Texas Intermediate (WTI) nominal prices as proxies for oil prices, while Kuwait daily stock market index return is calculated using the first difference in the natural logarithms of stock market index.

This paper contributes to the literature in the following aspects. First, there is lack of coverage of emerging economies in general and Kuwait in particular and this paper tries to contribute to bridge this gap. Under this contribution, we highlight that the overall risk of oil price changes would have increased the downside risk facing Kuwait which has a much lower breakeven oil price of US$ 47.1 per barrel compared to the rest of GCC countries.Footnote 5 Second, there is growing body of literature arguing that supply-side oil price changes do not exercise any influence on either the economy or the financial markets (stock prices), while, on the contrary other related studies conclude the opposite, in which the supply-side price do have a tenacious impact on stock prices.Footnote 6 Having said this, it is praiseworthy to test if oil price changes do have influence on market stock index, given the oil supply-side price changes for key suppliers of energy worldwide. This is quite crucial where testing for the long term cointegration between oil price changes and Kuwait stock market returns would be interesting as oil corporations are totally state-owned oil firms.

Third, our data spans over a daily period starting from January 3, 2000 to December 9, 2015, hence we claim that testing for the long run relationship between oil prices and stock market returns in the context of Kuwait would add value to energy policy planning and financial portfolio diversification in terms of policy implications, particularly those related to hedging against risk exposure. In other terms, we propose that understanding the influence of crude oil prices on Kuwait stock market returns is possibly helpful for investors, market participants, regulators and researchers, as it is expected to reveal different features from those noted in other emerging markets. Fourth, the notable contribution of this paper comes from employing the ARDL bounds testing approach of cointegration, as mainstream of previous studies in testing the relationship between stock market returns and oil prices adopted conventional Johansen Cointegration Test (1988) or Johansen et al. (2000) that require all variables to be of order I(1).

The empirical findings provide evidence that both oil prices (Brent and WTI) and Kuwait stock market returns are cointegrated and exhibit a long run relationship, where the daily oil price shocks have a negative impact on stock returns. Furthermore, this cointegration association is supported by sensitivity analysis results which show that the equation is stable over data time range. The findings also suggest a bidirectional causality between Kuwait stock market returns and Brent nominal oil price, in addition to a unidirectional causality running from WTI nominal oil price to Kuwait stock market returns.

The rest of this paper is structured as follows. Section 2 reviews the related literature. Section 3 provides a brief summary of oil price changes and the downward pressure on Kuwait’s economic fronts. Section 4 discusses the data and methodology, while Sect. 5 outlines the empirical results. Finally, summary and concluding remarks together with their policy implications are given in Sect. 6.

2 Brief literature review

The literature has considerable studies that are aimed at testing the association between oil price changes and stock returns where the results are ambiguous. Sadorsky (1999) show the pivotal contribution of oil price changes towards explaining stock returns for the US market. This result is supported by Papapetrou (2001), Nandha and Faff (2008) as for the Greek stock market and for the stock markets of US, UK and France, respectively, whereas Broadstock and Filis (2014) show that the association between oil price shocks and stock market returns are noticeably and systematically time-varying.

In terms of the sign effect, substance work of the literature suggest a negative association between the two macro variables which is suggested for developed and emerging economies (See Millar and Ratti 2011; Chen 2010; Lee and Chiou 2011; Asteriou and Bashmakova 2013; Ciner 2013; Filis and Chatziantoniou 2014). Further, many studies reveal non-linear association between the two variables where negative oil price change (appreciation in oil prices) tend to cause wider influence on economic growth, while positive oil price change (depreciation in oil prices) tend to have lower impact on growth (See Zhang 2008; Cologni and Manera 2009; Arouri and Fouquau 2009). By using a Vector Autoregressive (VAR) model, Huang et al. (2006) found no significant impact of daily oil returns on the board-based market indexes such as S&P 500. The non-significant impact of oil price changes on stock market returns were likewise supported by Apergis and Miller (2009) and Reboredo and Rivera-Castro (2013). The later confirmed the interdependence association after the financial crisis period (after 2008), while this is not the case for the period before the financial crisis. Kilian and Park (2009) demonstrated that supply and demand changes in the oil market would have different effects on the economy, US economy as per their case, where reaction of stock returns to an oil price change depends on the source of the underlying cause of the oil price change. Basher et al. (2012) concluded that positive changes in oil prices tend to depress emerging market stock prices; also they provided evidence that increases in emerging markets stock prices increase oil prices. Building on Kilian and Park (2009) conclusion, Kang et al. (2016) highlighted the importance of differentiating between US and non-US oil supply changes for investigating the impact of structural shocks in the oil market on US stock returns, concluding statistically significant positive association between shocks to US oil production with US stock returns.

From regional perspective, by adopting the Johannsen cointegration mechanism, Hamoudeh and Aleisa (2004) show that oil future prices assist in forecasting stock market returns for Saudi Arabia. They provide significant evidence of bidirectional causality association between oil prices and stock returns for Saudi Arabia; however, they show that this association is insignificant for the rest of GCC countries. Bashar (2006) used the VAR mechanism and conclude that only Saudi Arabia and Oman stock markets have projecting power of oil price appreciation. Hamoudeh and Choi (2006) test for the short term bilateral causality association between oil prices and the GCC weekly stock index returns where no direct causal association is found by using the Vector Error Correction (VEC) model. The weak association between oil prices and stock markets was similarly confirmed by their findings one year after (2007). Hamoudeh and Choi (2007) display highly regional integration among the GCC markets, limiting in turn the regional diversification recompenses, while it is not the case for the US capital markets, indicating chance for cross diversification advantages.

By using a non-parametric technique, the findings of Arouri and Fouquau (2009) reveal that stock markets in Qatar, Oman and UAE unveil asymmetric association with variations in oil prices, while no effect is found for Kuwait stock market by Choi and Hammoudeh (2009). The panel data methodology adopted by the Arouri and Rault (2010) reveal significant evidence where oil price instabilities Granger cause volatility in stock prices. They conclude a bidirectional causal association between the two variables that exists only when applying the data on weekly or quarterly basis. Ravichandran and Alkhathlan (2010) confirm the long run impact of oil price changes on the GCC stock markets returns, where they describe the long run as the period of time needed in order to have an impact on major macroeconomic indicators to influence listed firms profitability.

Mohanty et al. (2011) conclude that, except for Kuwait, GCC stock markets have significant exposure to oil price shockwaves. Non-linear association between oil prices and GCC stock returns is found by Arouri and Fouquau (2011). Their test failed to reject the null of no cointegration hypothesis. On the basis of short term analysis, they provide evidence of significant association between the two variables for Qatar and UAE. They show that causality goes from oil price changes to stock market returns, meanwhile, no long term association is found, except for Bahrain. Azar and Basmajian (2013) test the impact of oil price shocks on stock markets for Kuwait and Saudi Arabia, and they show heterogeneity in responses in which the two markets react similarly to oil price shocks.

On the whole, many studies have verified that changes in oil prices would have significant impact on stock returns over the short and long terms, however, the scale and sign of the impact differ from one region to another and from one market to another, depending on the extend of reliance on oil-related products (See Basher and Sadorsky 2006; Park and Ratti 2008; Apergis and Miller 2009; Narayan and Narayan 2010; Arouri et al. 2011). Further, the reaction of stock returns to an oil price changes may differ significantly depending on whether the change in the oil price is driven by demand or supply changes in the oil market, where oil supply and/or oil demand shocks are of comparable importance in explaining stock returns, see Kilian and Park (2009) and Kang et al. (2016). Also, the rapidity of oil price changes and oil rents would have an impact on the sign of association between the targeted variables, economic growth in specific; see Papapetrou (2013) for the former and Fuinhas et al. (2015) for the later.

3 Oil price changes and downward pressure on Kuwait’s economic fronts: an overview

For the GCC countries, including Kuwait, it is not surprising to state that crude oil amenities are extremely vital for most if not all these economies. For the last few years, changes in oil prices have caused ambiguous influences on these economies as signified by the impact on their public budgets where the positive (negative) effect will be more beneficial (harmful) to budgets as long as the oil industry is state-owned enterprises.Footnote 7

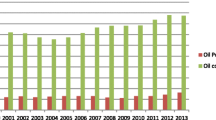

Historically, as a member of Organization of the Petroleum Exporting Countries (OPEC), Kuwait oil industry is the largest and it counts for more than 60% of the country’s GDP and about 94% of export revenues ($92 billion in 2013). The country’s exports are the 5th largest volume of crude oil after Saudi Arabia, United Arab Emirates, Iraq and Nigeria (Energy Information Administration 2014). All-inclusive, it is estimated that Kuwait has 102 billion barrels of oil reserves, roughly 6% of the world overall oil reserves (4th largest), the country accounts for 7% of world-wide oil production, OPEC’s 4th largest crude oil producer, and it is considered the 7th largest exporter. Out of these indicators, the impact of low oil prices would develop significant downward pressure on the country’s economic fronts. This claim is supported by many attributes. Of which, first, the sharp decline in oil prices, as it dropped from $128 in March 2012 to $45.13 in January 2015 (decrease by 65%).

Second, compared to other GCC economies, Saudi Arabia for example, Kuwait is much more strenuous on oil exporting which typified 95% of its total exports, reflecting vital need to launch new economic reforms with emphasis on trade, manufacturing and services revenues against the complete dependency on oil revenues. Third, Kuwait has low diversified budget financing discretions as typified by the very low financing contribution of non-oil sector, low groundwork investments, less capital investment, i.e., less investment in energy projects, transportation and health infrastructure. Fourth, the continuous increase in the current expenditure that derives consumption and imports (80% of the workforce is employed in the public sector, low competitiveness of business environment as indicated by the low inwards rates of Foreign Direct Investment (FDI)).

Furthermore, the economic performance as well as the country’s fiscal accounts could exert more downward pressure, given the nearby regional geopolitical unstable conditions, the continuous structural increase in the current expenditures that make up around 70% of total expenditures as driven by enlarged subsidies and upsurge in salaries for public sector employees (25% as by March 2012).Footnote 8 The pressure on the economic performance would be intensified given the possibility of lengthy phase of low oil prices (See Moody’s Investors’ Service, October 2013). An extra outdoor influential factor is demand for oil which is evolving slowly at a global level where the lowest demand growth was recorded by 2014 of 600,000 barrels per day (bpd) which is the lowest since the financial crisis in 2008, while supply has rushed ahead with an expansion over 2–3 million bpd in 2014, leading to significant stockpiles around the universe (See Bhatia 2015). To conclude, gradual decline in the country’s monetary surpluses is expected given the above mentioned downward influences pressures, keeping in mind the country’s heavy reliance on oil revenues which counts for 63% of GDP and 86% of total exports, causing more volatility to the country’s nominal GDP per capita ($ terms). Such conclusion is reinforced by the continuous increase in the government’s current accounts spending, revealing real growth decline and ramification across social infrastructure, future-wise.

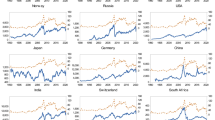

From analytical perception, the downturn in oil prices led to slow down Kuwait’s GDP growth which decreased to 1.5 and 1.3% in 2013 and 2014, respectively, compared to 6.6% growth rate in 2012. Slow GDP growth is expected to persist as per the years 2015 and 2016, given the diminishing oil sector real GDP growth, i.e. −0.8, 0.0, 0.3 and 0.2% as for the years 2013, 2014, 2015 and 2016 (expected), causing lower contribution of the oil sector to GDP which records decreasing trend, i.e. 62.6, 58 and 55.1% for the years 2012, 2013 and 2014, respectively (See KAMCO, May 2015). The country’s exports also got affected by the decreasing oil prices where exports decreased by 4% in 2013 and 3.1% 2014, while public consumption rose by 8.8% in 2014 compared to 6.6% in 2013. Given the sharp decline in crude oil prices, as for the fiscal year 2014/2015, there was a 20% decline in public revenues as compared to the fiscal year 2013/2014, while there was a 13.3% increase in expenditure in the fiscal year 2014/2015 relative to the year 2013/2014. The budget records its first deficit since 1998 where a deficit of 5.6% of GDP is reported in the year 2014/2015. The reported deficit was $ 5.3 billion compared to a surplus of $ 34.8 billion in 2013/2014. The budget deficit is expected to continue as for the fiscal year 2015/2016, KAMCO, May (2015).

The above macro-economic downward trends would indicate an increase of total risk confronting Kuwait. This risk is related to upholding the one-to-one inclusive market share in light of deteriorating oil prices, which with no doubt would result in low government outlays and slow-down non-oil businesses through its significant impact on current account balance, causing reliance on using the accumulated financial buffers to restrain some of the impact on the overall growth of economy. For the KSE, its performance is rendered given the changes in oil prices together with the above retreating economic fronts. For example, in line with the rest of the GCC markets, KSE has shown volatile index trend where the change was −16.2, 3, 8.4, −3.1 and −12.2% as for the years 2011, 2012, 2013, 2014 and August 15, 2015. In US$ terms, the overall cumulative value traded of stocks reports a decline, i.e., 39.5 billion, 21.4 billion and 9.4 billion as for the years 2013, 2014 and August 15, 2015. The corporate earning percentage growth rates similarly declined from 12.7% in 2013 to 0.90% in 2014 (See KAMCO 2015).

4 Data and methodology

In this paper, to investigate the link between stock market returns and oil prices, the daily data on Brent and West Texas Intermediate nominal crude oil prices are taken from the website of Energy Information Administration (EIA) (www.eia.doe.gov). Data on daily Kuwait stock market index is extracted from Kuwait Stock Exchange (KSE) historical data base profile. Our daily data spans over a period of January 3, 2000 to December 9, 2015, inclusive. For proxy purposes, daily stock market index return is calculated using the first difference in the natural logarithms of stock market index, \(R_{m} = In(P_{t} ) - In(P_{t - 1} )\) * 100 where R m denotes the stock market index return at time t.Footnote 9

The foremost input of this paper comes from employing Autoregressive Distributed Lag (ARDL) bounds testing approach of cointegration suggested by Pesaran and Shin (1999) and Pesaran et al. (2001), as majority of previous work in testing the relationship between stock market returns and oil prices adopted conventional Johansen Cointegration Test (1988) or Johansen et al. (2000) that require certain pre-testing for unit roots and that the underlying variables to be integrated of order one, I(1). The ARDL cointegration methodology, which has become widespread in recent years, is constructed on the estimation of an Unrestricted Error Correction Model (UECM). This approach has numerous improvements in contrast to the other cointegration methods. First, in case of small samples with several endogenous regressors, the ARDL approach is still efficient estimator. Second, this approach removes problems joined with autocorrelation and omitted variables by estimating both the short and long-run components of the model simultaneously. Third, it has less loss of degrees of freedom by using a single reduced form equation, besides allowing the variables to have different optimal lags. Finally, the standard F-statistics used in the bounds test (provided by Pesaran et al. 2001) has a nonstandard distribution under the null hypothesis of no-cointegration relationship between the inspected variables, nonetheless whether the primary variables are I(0), I(1) or fractionally integrated (variables should not be of order of I(2) as such data will invalidate the methodology because the computed F-statistics are not valid).

Following the empirical literature, the paper is structured around the simple association framework of investigating the long run relationship between stock market returns and oil prices. The model is expressed as:

where R t is stock market return, P t is nominal spot oil price, and ε t is the error term. All variables are measured in logarithms. In this paper, we use nominal oil prices as consumer price index at daily basis is not available. Narayan et al. (2008) illustrate that using daily data does not require identifying real values. This approach was also adopted by Ghosh and Kanjilal (2014).

According to Ghosh and Kanjilal (2014), an ARDL model is a general dynamic specification, which uses the lags of the dependent variable and the lagged and contemporaneous values of the independent variables, through which the short-run effects can be directly estimated, and the long-run equilibrium relationship can be indirectly estimated. ARDL model involves estimating unrestricted error correction model. The ARDL representation of Eq. (1) for testing the long run relation between stock market return (R t ) and nominal spot oil price (P t ) is given as follows:

where \(\Delta\) is the difference operator, \(p\) and \(q\) are the lags length, and \(u_{t}\) is serially uncorrelated error term. The first step in the ARDL bounds testing approach is to estimate Eq. (2) by Ordinary Least Squares (OLS) in order to test for existence of a long-run relationship among the variables by conducting an F-test for the joint significance of the coefficients of the lagged level variables. The null hypothesis of no cointegration (\(H_{0} : \theta_{1} = \theta_{2} = 0\)) is tested against the alternative of cointegration (\(H_{1} : \theta_{1} \ne \theta_{2} \ne 0\)). Two sets of critical value bounds for the F-statistic are generated by Pesaran et al. (2001). One set (lower bound) assumes that all variables are I(0) and the other (upper bound) assumes they are all I(1). If the computed F-statistic falls below the lower bound critical value, the null hypothesis of no-cointegration cannot be rejected. On the other hand, if the computed F-statistic exceeds the upper bound critical value; the null hypothesis is rejected, implying a long-run cointegration relationship among the variables in the model. However, if the computed F-statistic value falls within the bounds, the test is inconclusive.

Once cointegration is established, then the short-run dynamic parameters can be estimated using an error correction model associated with the long-run estimates that takes the following specification:

where \(\delta_{1}\) and \(\delta_{2}\) are the short-run dynamic coefficients of the model’s convergence to equilibrium, \(\varphi\) is the parameter measuring the speed of adjustment to the equilibrium level after a shock, and ECM is the error correction term that is derived from the estimated equilibrium relationship of Eq. (2). The coefficient of the error correction term (\(\varphi\)), that shows how quickly variables converge to equilibrium, should have a statistically significant coefficient with a negative sign.

It is noted that when series are cointegrated, Ordinary Least Squares (OLS) estimation of the cointegrating vector generates estimates with non-Gaussian asymptotic distribution and exhibits asymptotic bias. For this reason, we apply Dynamic Ordinary Least Squares (DOLS) to empirically estimate the long run relationship between oil prices and stock market returns for Kuwait. DOLS, proposed by Saikkonen (1992) and Stock and Watson (1993), is a simple approach to constructing an asymptotically efficient estimator that eliminates the feedback in the cointegrating system. Technically speaking, DOLS involves augmenting the cointegrating regression with lags and leads of (\(\Delta X_{t}\)) so that the resulting cointegrating equation error term is orthogonal to the entire history of the stochastic regressor innovations:

Under the assumption that adding q lags and r leads of the differenced regressors soaks up all of the long-run correlation between υ1t and υ2t, least squares estimates of θ = (β’, γ’)’ is free of non-scalar nuisance parameters and permits asymptotic Chi square testing. An estimator of the asymptotic variance matrix of \(\hat{\theta }\) may be computed by computing the usual OLS coefficient covariance, but replacing the usual estimator for the residual variance of υ1t with an estimator of the long run variance of the residuals.

The paper furthermore explores the direction of causality between the oil prices and stock market returns using Toda and Yamamoto (1995) Granger Non‐Causality Testing. This test disregards any possible non-stationary or cointegration between series when examining causality. Kisswani (2016) clarifies the Toda and Yamamoto technique. It is implemented in three parts. First, the maximum order of integration of each series (d max) is constructed. Second, a VAR model in levels is estimated and the optimal lag order (m) is determined accordingly. Finally, the VAR model with additional d max lags is re-estimated, where the VAR order becomes k = m + d max . To apply Toda and Yamamoto causality test for the stock market return (\(R_{t}\)) and oil price (\(P_{t}\)) series, we use the following VAR specifications:

where the null hypothesis of non-causality from \(P_{t}\) to \(R_{t}\) in Eq. (5) can be stated as: \(H_{0} :\theta_{1i} = 0\), for \(\forall_{i}\), and the null of non-causality from \(R_{t}\) to \(P_{t}\) in Eq. (6) is: \(H_{0} :\eta_{1i} = 0\), for \(\forall_{i}\).

5 Empirical results

It is important, before performing the ARDL bounds test, to examine the stationary condition of the variables to verify their order of integration. This is done to assure that none of the variables are I(2), as the computed F-statistics generated by Pesaran et al. (2001) are valid only when the variables are I(0) or I(1). Thus, we proceed with the unit root test to ensure that all the variables satisfy the fundamental assumption of the ARDL bounds testing of cointegration. There are several ways of testing for the unit root; however, we focus our attention on the Augmented Dickey Fuller unit root test (ADF; 1979, 1981). For the proper lag lengths, we apply the Akaike Information Criterion (AIC). The ADF test takes the following form:

The null hypothesis of non-stationary Yt (H 0 : β = 0) is tested against the stationary linear alternative (H A : β < 0). According to this specification, the speed of adjustment parameter (β) is assumed to occur continually and at a constant rate, regardless of the size of the deviation from equilibrium. The ADF test is conducted with and without trend.

Table 1 demonstrates the results of the unit root tests, according to AIC optimal lag length. The Table clearly shows that none of the variables is integrated of order two, I(2). The unit root test results show that the stock market return is stationary with and without a trend, that is integrated of order zero (I(0)), at the 1% significance level suggesting that deviations are mean-reverting. As for both nominal oil prices, the results indicate that both variables are not stationary at levels, that are integrated of order one (I(1)), but they are first difference stationary, I(0), at the 1% significance level with and without a trend, suggesting that deviations are not mean-reverting. Consequently, as the ADF results indicate that the variables are not I(2), then we can advance to employ the ARDL bounds test to examine the impact of nominal oil prices on Kuwait stock market return.

5.1 ARDL cointegration test Footnote 10

As the order of integration shows none of the variables is I(2), the ARDL bounds test for the cointegration relationship based on Eq. (2) is employed. The results of ARDL bounds tests are displayed in Table 2. Selecting the orders of the ARDL (p, q) model was done by selecting the appropriate lag length on the basis of AIC. The results from Table 2 illustrate that the computed F-statistic is noticeably above the upper bound critical value of 5.58 at the 1% significance level. Thus, the null hypothesis of no cointegration is rejected, suggesting that there is a long-run cointegration relationship between Kuwait stock market returns and both oil prices. The evidence of long-run cointegration relationship goes in line with Ravichandran and Alkhathlan (2010), Arouri and Fouquau (2011) and Azar and Basmajian (2013) where the long run impact of oil price changes on the GCC stock markets returns is likewise recognized.

We also estimate the cointegration form (short run) and long run coefficients of the model for both oil prices. The results are reported in Tables 3 and 4. The results in Table 3 exhibit a negative error correction coefficient for Brent oil price (−0.67), as required, and is highly significant, which indicates high rate of convergence to equilibrium. This indicates that any deviation from the long run equilibrium between variables is adjusted and corrected about 67% for each period and takes about 1.5 periods to return to the long-run equilibrium level. Notably, the table reports the short run coefficients from the cointegrating equation, with their standard errors, t-statistics, and p values. All the variables are highly significant at the 1% level. Table 4 describes the same results for WTI oil prices. The error correction coefficient is also negative (−0.66) and highly significant, indicating likewise high rate of convergence to equilibrium. Besides, the table alike reports the short run coefficients from the cointegrating equation, and likewise, all variables are highly significant at the 1% level.

5.2 Dynamic ordinary least squares (DOLS)

As mentioned before, OLS generates estimates with non-Gaussian asymptotic distribution and exhibits asymptotic bias when series are cointegrated. Hence, we apply DOLS in estimating the relationship between oil prices and stock market returns for Kuwait. Findings are reported in Table 5. The findings represent the elasticity between oil price and stock market return, where a 1% increase in Brent oil price is associated by almost 0.143% decrease in the returns, and a 1% increase in WTI oil price is associated by almost 0.137% decrease in the returns, and both are highly significant at the 1% level. The estimates represent inelastic response for Kuwait Stock Market return. These results go in line with Sadorsky (1999), Balaz and Londarev (2006), Nandha and Faff (2008), Millar and Ratti (2011), Chen (2010), Lee and Chiou (2011), Asteriou and Bashmakova (2013), Ciner (2013), Filis and Chatziantoniou (2014) and Aye (2015).

5.3 Sensitivity analysis

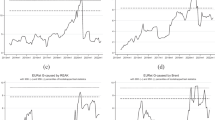

In addition, we test the stability of the cointegration relation by testing the stability of the short run and long run coefficients. We run diagnostic tests for serial correlation ((Breusch–Godfrey serial correlation LM test) and cumulative sum of recursive residuals (CUSUM) of Brown et al. (1975). The results are reported in Table 6, for serial correlation, and Figs. 1 and 2, for CUSUM test. The results indicate that there is no evidence of serial correlation among variables as the functional form of the model is well specified. Also, it can be seen from the figures that the plot of CUSUM stay within the critical 5% bound for all equations as it does not exceed the critical boundaries. This evidence suggests that the parameters are stable over the data period and it confirms the long-run relationship between oil prices and stock market returns.

5.4 Toda and Yamamoto Granger non‐causality testing

Now we turn for Toda-Yamamoto test to examine the direction of causality between stock market returns and nominal oil prices over the sample period for Kuwait. The advantage of this test over other conventional causality tests is that it disregards any possible non-stationary or cointegration between series when causality is examined. The findings are depicted in Table 7. It is clear that there is bidirectional causality between Kuwait stock market returns and Brent nominal oil price, meanwhile there is unidirectional causality running from WTI oil price to Kuwait stock market return, and the causality results are significant. The bidirectional causal association between the two macro-variables goes in line with Hamoudeh and Aleisa (2004) and Arouri and Rault (2010), where the former verify the bidirectional causality association between oil prices and stock returns for Saudi Arabia, while the later shows the bidirectional effects in terms of the US context.

6 Summary and concluding remarks

By using Autoregressive Distributed Lag (ARDL) bounds testing approach of cointegration for a daily data which spans over January 3, 2000 to December 20, 2015, this paper tests for the cointegration, long run relationship, between oil prices and Kuwait stock market returns. The cointegration assessment is also evidenced by applying the Dynamic Ordinary Least Squares (DOLS). To test for the stability of the cointegration, the sensitivity analysis is used where diagnostic tests for serial correlation (namely the Breusch–Godfrey serial correlations LM test) and cumulative sum of recursive residuals (CUSUM) test are applied,. The paper additionally tests for the direction of causality between the oil price changes and stock market returns using Toda and Yamamoto (1995) Granger Non‐Causality Testing.

The findings suggest that the null hypothesis of no cointegration is rejected, signifying that there is a long-run relationship between Kuwait stock market returns and both oil prices (Brent and WTI). This result is moreover supported by the sensitivity analysis where both diagnostic tests provide evidence in which the cointegration equation is stable over the data time range. Furthermore, the findings suggest a negative association between the daily oil price shocks and stock returns. Finally, the paper provides support for a bidirectional causality between Kuwait stock market returns and Brent nominal oil price, while it suggests a unidirectional causality running from WTI nominal oil price to Kuwait stock market return using Toda and Yamamoto (1995) Granger Non‐Causality Testing.

The findings have the following policy implications: First, the long-run cointergration implies that oil price changes (demand-side or supply-side changes) are of comparable significance in explaining stock returns in emerging markets, hence, changes in oil prices will unavoidably affect equity markets in oil-exporting economy such as Kuwait. Second, the negative association implies that an increase in oil prices would lead to an increase in the cost of inputs, causing higher level of inflation rates, hence, market interest rates, leading to higher levels of cost of capital that would lower stock returns. Third, for equity market investors, during periods of predominantly increasing oil prices (positive oil price changes), stock returns will significantly decrease, hence stock returns are highly interrelated and not qualified for portfolio diversification during increasing oil prices times. Hence, investors are advised to revise their optimal portfolio weight that can be located for particular stock i.e., oil reliant stock has to have lower weight than oil-less reliant stock. This is very much crucial for investors’ portfolio asset allocation decisions and risk management outlooks.

Notes

Kuwait is the 8th world’s top exporter of oil and gas with relatively low production costs. The country is assessed as “Aa2” sovereign rating and competitive GDP per capita in purchasing power terms where it is ranked second from global perspective. Historically, the country has not incurred a fiscal deficit since 1995. The country has balance of payment surpluses that enable the country to accrue substantial net foreign assets together with very low burden of government debt which is mostly held by national banks for liquidity management perspectives. These macro-indicators, aside other, counts positively to the country’s long-term economic robustness and volatility absorption capacity towards fluctuation in many structural economic and wealth influencing factors, See Moody’s Investors’ Service, October (2013).

The KSE is one of the oldest among the Gulf Cooperation Council (GCC) stock markets where it is established in August 1983. In 1995, the electronic trading system is instigated. Forwards, Futures and options contracts were introduced to the market in 1998, 2003 and 2005, respectively. The listed firms in the KSE market approaches the 200 firms with market value totaling over US$100 billion. The listed firms were classified in sectors given an international classification benchmark, KSE outlook.

Since establishment (August 1983), the market has perfected the growth progression significantly, given the stock regulating reforms during the 1960 s and 1970 s. Over the past 20 years the market has grown tremendously in terms of size of trading and volume of investment.

Having said this, for a main producer of oil, an impact on the country’s economic growth is granted since budgetary spending derives the country’s economic and social advancement. It can be proposed that having budget sustainability is a prerequisite towards having economic growth where the later cannot slowdown, particularly for the GCC economies, including Kuwait, that are confronting high growth rates of population whom normally expecting high living values.

See KAMCO, May (2015).

In case of lower oil price, a negative impact is conceded as per the public budget and aggregate demand, inverse-versa, in case of increase in oil prices. So far, during the last five years in particular, GCC economies were confronted by complications in balancing their budgets throughout controlling the oil break-even price, signaling to struggles to have sustainable budget given the changing global oil supply dynamics where new suppliers may inter the oil supply-side market i.e., Iran and non OPEC producers such as US and Canadas. By result, the recent budgetary spending designs of most GCC governments has indicate a slowdown trend towards growth expenditures, reflecting their caution concern of the surrounding conditions, geopolitically and economically. Yet, oil production continued to be the key driver of growth for most if not all GCC economies, including Kuwait. This sole product dominates the invention of revenues in the region with low contribution of non-oil sectors towards growth. Based on the depression in oil prices, the GCC region is anticipating a decline in their real GDP growth which is projected to be 3.4% in 2015 and a further decline to 3.2% in 2016. See the International Monetary Fund (IMF) annual assessment of GCC economies, May 2015.

For example, between the fiscal year 2010/2011 and 2012/2013, expenditures in salaries has increased 50.3%, reflecting an increase of total expenditures from 21 to 24%.

Daily data was adjusted to match the sequence of the differences between the working days between Kuwait Stock Market and oil markets.

We applied the ARDL model for monthly data for the same variables but by adding the monthly oil supply of Kuwait to check the robustness of the results. This point was raised by one referee. The results are reported in the Appendix. The findings still show consistent results.

This point was raised by one of the referees.

References

Apergis N, Miller S (2009) Do structural oil-market shocks affect stock prices? Energy Econ 31:569–575

Arouri M, Fouquau J (2009) On the short run influence of oil prices changes on stock markets in GCC countries; linear and nonlinear analysis. Econ Bull 29:806–815

Arouri M, Fouquau J (2011) How do oil prices affect stock returns in GCC markets? An asymmetric cointegration approach. Bank Mark Invest 111:5–16

Arouri M, Rault C (2010) Oil prices and stock markets; What drives what in the Gulf Corporation Council countries? CESifo Working Paper: 2934. http://ssrn.com/abstract=1549536

Arouri M, Rault C (2011) On the influence of oil prices on stock markets; evidence from panel analysis in GCC countries. Int J Finance Econ 3:242–253

Arouri M, Jouini J, Nguyen D (2011) Volatility spillovers between oil prices and stock sector returns: implications for portfolio management. J Int Money Finance 30:1387–1405

Asteriou D, Bashmakova Y (2013) Assessing the impact of oil return on emerging stock markets: a panel data approach for ten Central and Eastern European Countries. Energy Econ 38:204–211

Aye G (2015) Does oil price uncertainty matter for stock returns in South Africa? Invest Manag Financ Innov 12(1):179–188

Azar S, Basmajian L (2013) Oil prices and the Kuwaiti and the Saudi Stock markets: the contrast. Int J Econ Financ Issues 3(2):294–304

Balaz P, Londarev A (2006) Oil and its position in the process of globalization of the world economy. Politicka Ekonomie 54(4):508–528

Bashar Z (2006) Wild oil prices, but brave stock markets! The case of Gulf Cooperation Council (GCC) stock markets. Middle East Economic Association Conference, Dubai

Basher S, Sadorsky P (2006) Oil price risk and emerging stock markets. Global Finance J 17:224–251

Basher S, Haug A, Sadorsky P (2012) Oil prices; exchange rates and emerging stock markets. Energy Econ 34:227–240

Baumeister C, Peersman G (2012) Time-varying effects of oil supply shocks on the US economy. Bank of Canada, Working paper Series (WP) 02

Bhatia N (2015) How will oil price volatility affect GCC budgets? Construction weekonline.com, September 12

Broadstock D, Filis G (2014) Oil price shocks and stock market returns: new evidence from the United States and China. J Int Financ Mark Inst Money 33:417–433

Brown R, Durbin J, Evans J (1975) Techniques for testing the constancy of regression relations over time. J Royal Stat Soc 37:149–163

Chen S (2010) Do higher oil prices push the stock market into bear territory? Energy Econ 32(2):490–495

Chen W, Hamori S, Kinkyo T (2014) Macroeconomic impacts of oil prices and underlying financial shocks. J Int Financ Mark Inst Money 29:1–2

Choi K, Hammoudeh S (2009) Long memory in oil and refined products markets. Energy J 30(2):97–116

Ciner C (2001) Energy shocks and financial markets; nonlinear linkages. Stud Nonlinear Dyn Econom 5:203–212

Ciner C (2013) Oil and stock returns; frequency domain evidence. J Int Financ Mark Inst Money 23:1–11

Cologni A, Manera M (2009) The asymmetric effects of oil shocks on output growth; A Markov-Switching Analysis for the G-7 Countries. Econ Model 26:1–29

Degiannakis S, Filis G, Kizys R (2014) The effects of oil shocks on stock market volatility: evidence from European data. Energy J 35:35–56

Dickey D, Fuller W (1979) Distribution of the estimators for autoregressive time series with a unit root. J Am Stat Assoc 74:427–431

Dickey D, Fuller W (1981) Likelihood ratio statistics for autoregressive time series with a unit root. Econometrica 49:1057–1072

El-Sharif I, Brown D, Burton B, Nixon B, Russel A (2005) Evidence on the nature and extent of the relationship between oil prices and equity values in the UK. Energy Econ 27:819–830

Energy Information Administration (EIA) (2014) International energy data analysis. Kuwait. Available at:https://www.eia.gov/

Filis G, Chatziantoniou I (2014) Financial and monetary policy response to oil prices shocks; evidence from oil-importing and oil-exporting countries. Rev Quant Financ Acc 42:709–729

Fuinhas J, Marques A, Couto A (2015) Oil rents and economic growth in oil producing countries: evidence from a macro panel. Econ Change Restruct 48:257–279

Ghosh S, Kanjilal K (2014) Oil price shocks on Indian Economy; evidence form Toda Yamamoto and Markov regime-switching VAR. Macroecon Finance Emerg Mark Econ 7(1):122–139

Hamilton J (2009) Understanding crude oil prices. Energy J 30:179–206

Hamoudeh S, Aleisa E (2004) Dynamic relationship among GCC stock markets and NYMEX oil futures. Contemp Econ Policy 22:250–269

Hamoudeh S, Choi K (2006) Behavior of GCC stock markets and impacts of US oil and financial markets. Res Int Bus Finance 20:22–44

Hamoudeh S, Choi K (2007) Characteristics of permanent and transitory returns in oil sensitive emerging stock markets; the case of GCC countries. J Int Financ Mark Inst Money 17:231–245

Huang R, Masulis R, Stoll H (2006) Energy shocks and financial markets. J Futures Mark 16(1):1–27

International Monetary Fund (2015) Annual assessment of GCC economy. Alkhabeer Capital, GCC Budget Analysis, August 2014

Issac M, Ratti R (2009) Crude oil and stock markets; stability, instability, and bubbles. Energy Econ 31:559–568

Johansen S (1988) Statistical analysis of cointegration vectors. J Econ Dyn Control 12(2):231–254

Johansen S, Mosconi R, Nielsen B (2000) Cointegration analysis in the presence of structural breaks in the deterministic trend. Econom J 3:216–249

Jones D, Lelby P, Paik I (2004) Oil prices shocks and the macro-economy: what has been learned since. Energy J 25:1–32

KAMCO (2015) Investment research. GCC Economic Report

Kang W, Rati R (2013) Oil shocks, policy uncertainty and stock market return. J Int Financ Mark Inst Money 26:305–318

Kang W, Rati R, Yoon K (2015) The impact of oil price shocks on the stock market return and volatility relationship. J Int Financ Mark Inst Money 34:41–54

Kang W, Ratti R, Vespignani J (2016) The impact of oil price shocks on the US stock market: a note on the roles of US and non-US oil production. Econom Lett 145:176–181

Kilian L, Lewise I (2011) Does the fed respond to oil price shocks? Econ J 121:1047–1072

Kilian L, Park C (2009) The impact of oil price shocks on the US stock market. Int Econ Rev 50(4):1267–1287. doi:10.1111/j.1468-2354.2009.00568.x

Kisswani K (2016) Does oil price variability affect Asian exchange rates? Evidence from panel cointegration test. Appl Econ 48(20):1831–1839

Lee Y, Chiou J (2011) Oil sensitivity and its asymmetric impact on the stock market. Energy 36:168–174

Lescaroux F, Mignon V (2009) The symposium on China’s impact on the global economy; measuring the effects of oil prices on China’s economy: a factor-augmented vector autoregressive approach. Pacific Econ Rev 14:410–425

Mackinnon J (1996) Numerical distribution functions for unit root and cointegration tests. J Appl Econ 11(6):601–618

Millar J, Ratti R (2011) Crude oil and stock markets; stability, instability and bubbles. Energy Econ 31(4):559–568

Mohanty S, Nandha M, Turkistani A, Alaitani M (2011) Oil price movements and stock market returns; evidence from Gulf Cooperation Council (GCC) countries. Global Finance J 22:42–55

Moody’s Investors’ Service (2013) Credit analysis. Government of Kuwait, Kuwait, pp 1–22

Nandha M, Faff R (2008) Does oil move equity prices? A global view. Energy Econ 30:986–997

Narayan P, Narayan S (2010) Modelling the impact of oil prices on Vietnam’s stock prices. Appl Energy 87:356–361

Narayan P, Narayan S, Smyth R (2008) Are oil shocks permanent or temporary? Panel data evidence from crude oil and NGL production in 60 countries. Energy Econ 30(3):919–936

Papapetrou E (2001) Oil price shocks, stock market, economic activity and employment in Greece. Energy Econ 23:511–532

Papapetrou E (2013) Oil prices and economic activity in Greece. Econ Change Restruct 46:385–397

Park J, Ratti R (2008) Oil price shocks and stock markets in the US and 13 European countries. Energy Econ 30:2587–2608

Pesaran M, Shin Y (1999) An autoregressive distributed lag modelling approach to cointegration analysis. In: Strom S (ed) Econometrics and economic theory in the 20th century: the Ragnar Frisch Centennial Symposium. Cambridge University Press, Cambridge

Pesaran M, Shin Y, Smith R (2001) Bounds testing approaches to the analysis of level relationships. J Appl Econom 16:289–326

Rahman S, Serletis A (2010) The asymmetric effects of oil price shocks. Macroecon Dyn 15:437–471

Ravichandran K, Alkhathlan K (2010) Impact of oil prices on GCC stock market. Res Appl Econ 2(1):1–12

Reboredo J, Rivera-Castro M (2013) Wavelet-based evidence of the impact of oil prices on stock returns. Inte Rev Econ Finance. doi:10.1016/j.iref.2013.05.014

Sadorsky P (1999) Oil price shocks and stock market activity. Energy Econ 21:449–469

Saikkonen P (1992) Estimation and testing of cointegrated systems by an autoregressive approximation. Econom Theory 8:1–27

Stock J, Watson M (1993) A simple estimator of cointegrating vectors in higher order integrated systems. Econometrica 61:783–820

Tang W, Wu L, Zhang Z (2010) Oil price shocks and their short and long-term effects on the Chinese economy. Energy Econ 32:S3–S14

Toda H, Yamamoto T (1995) Statistical inference in vector autoregressions with possibly integrated processes. J Econom 66(2):225–250

Zhang D (2008) Oil shock and economic grown in Japan: a nonlinear approach. Energy Econ 30:2374–2390

Acknowledgements

The authors would like to thank the Editor-in-Chief of the journal and two anonymous reviewers for their constructive and helpful comments on an earlier draft of this paper that greatly helped to improve this article enormously.

Author information

Authors and Affiliations

Corresponding author

Appendix

Appendix

In this part, we applied the ARDL model by using monthly data and adding the monthly oil supply of Kuwait.Footnote 11 This was done to test if the results would change or remain consistent with the findings of using daily data, which could indicate our daily models were suffering from omitted variable bias. The new model uses monthly data for real oil prices (deflated by US consumer price index), monthly stock market returns besides the monthly oil supply.

The results are reported in Tables 8, 9 and 10. The findings continue to show that oil prices and stock market returns are still cointegrated as the computed F-statistic is noticeably above the upper bound critical value at the 1% significance level. The results in Tables 9 and 10 exhibit a negative error correction coefficients for both oil prices and are highly significant, which indicates high rate of convergence to equilibrium. The long run coefficients of oil prices are still negative, indicating an opposite relation between oil prices and stock market returns. These findings go in line with the same findings of the daily data models.

To sum up, our results are still consistent which means that the daily models did not suffer any omitted variable bias.

Rights and permissions

About this article

Cite this article

Elian, M.I., Kisswani, K.M. Oil price changes and stock market returns: cointegration evidence from emerging market. Econ Change Restruct 51, 317–337 (2018). https://doi.org/10.1007/s10644-016-9199-5

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10644-016-9199-5