Abstract

In this paper, we discuss a patented emission reduction technology that a monopolistic upstream eco-industry licenses to the polluting firms in a downstream oligopolistic industry, which is subject to command-and-control regulation. We explicitly model the interaction between the outside innovator and the polluting firms, using a non-cooperative game-theoretical framework. We find that full and partial diffusion can both occur in equilibrium, depending on the relationship between environmental regulation stringency and cleanliness improvement of the new technology. Furthermore, we study the impacts of environmental regulation stringency and the improvement in cleanliness on the adoption and the diffusion of the emission reduction technology.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

In many industries, licensing plays an important role in the technology transfer and the diffusion of innovations. Patent licensing provides an innovator (the patent holder) with an opportunity to reap the benefits of its research and development (R&D). The profit it gains may rely on the licensing contract, the magnitude of the innovation, and the market structure as well. The theoretical literature on patent licensing has focused mainly on comparing and analyzing the performance of different instruments for the licensing of patented cost-reducing innovations from the patent holder’s perspective. Three types of licensing schemes have been commonly considered in the literature—fixed fee, royalties, and two-part tariff (fixed fee plus royalties). Kamien and Tauman (1984, 1986) and Katz and Shapiro (1985, 1986) have first analyzed cost-reducing innovation licensing under an oligopolistic market structure. Kamien et al. (1992) show that licensing a non-radical innovation by means of royalties is less profitable for an outside patent holder than licensing it by means of a fixed fee or an auction. The patent holder can be an outside innovator (e.g., an independent R&D organization that is not a competitor of the firms in the product market) or an inside producer that competes directly with the producers in the product market. Wang (1998), Wang and Yang (1999), and Kamien and Tauman (2002) consider the case of a patent holder that is itself a producer within the industry. Sen and Tauman (2007) study the licensing of a cost-reducing innovation by means of combinations of upfront fees and royalties in a Cournot oligopoly for both outside and incumbent innovators.

Different from the literature that examines cost-reducing innovation licensing, in this paper, we consider the licensing of a certain emission reduction innovation to a polluting industry, subject to command-and-control regulation. Command-and-control regulation is the direct regulation of an industry or an activity by legislation that states what is permitted and what is illegal (McManus 2009). Compared with market-based economic instruments (e.g., carbon tax), command-and-control policies focus on preventing environmental problems by specifying how a company should manage a pollution-generating process. It is widely accepted that using command-and-control policies can provide a clear outcome, while making it easy to monitor compliance.

A key factor in carbon emission control is the adoption of more efficient emission abatement technologies by polluting firms. Hence, it is important to examine a firm’s incentives to adopt new emission abatement technologies under different environmental policies. Malueg (1989) shows that the induction of trading may actually weaken some firms’ incentives to invest in new technology. Milliman and Prince (1989) compare five regulatory regimes, as follows: direct controls, emission subsidies, emission taxes, free marketable permits, and auctioned marketable permits. Jung et al. (1996) evaluate the incentive effects of five environmental policy instruments to promote the development and adoption of an advanced pollution abatement technology in a heterogeneous industry. Requate and Unold (2003, 2001) reexamine the situation considered by Milliman and Prince (1989) and Jung et al. (1996), while not assuming that the adoption of new technology is an industry-wide decision. Montero (2002) compares environmental R&D incentives offered by four policy instruments—emission standards, performance standards, tradable permits, and auctioned permits—under non-competitive circumstances and finds that the results are less clear than when perfect competition is assumed. Requate (2005) presents a comprehensive review of the incentives for the adoption and development of pollution abatement innovations provided by different environmental policies. Bauman et al. (2008) analyze the influence of clean technology adoption on marginal abatement cost (MAC) and find that MAC curves can cross; (see also the works of Amir et al. 2008; Baker et al. 2008; Bréchet and Jouvet 2008). Arguedas et al. (2010) examine the incentives to adopt advanced abatement technologies in the presence of imperfect compliance and find that imperfect compliance can increase firms’ incentives to invest under emission standards.

Recently, polluters have increasingly relied on a growing number of specialized firms for the provision of abatement goods and services, the so-called “eco-industry.” David and Sinclair-Desgagné (2010) consider the combination of emission taxes and abatement subsidies when some polluting firms purchase abatement goods and services from an oligopolistic eco-industry. Perino (2010) compares taxes and tradable permits for regulating a competitive polluting industry that can procure abatement technology from a monopolistic upstream eco-industry. Canton et al. (2008) consider polluting firms that outsource their abatement activities to an upstream eco-industry and find that the optimal tax depends on the relative degree of market imperfection existing between the upstream and the downstream industries. David et al. (2011) examine the effects of emission taxes on pollution abatement and social welfare when abatement goods and services are provided by a Cournot oligopoly with free entry. Schwartz and Stahn (2014) study the consequences of the imperfect competition of the eco-industry on the equilibrium choices of the polluting firms in a competitive market.

Perino and Requate (2012) assume perfect competition in an output market and consider the cases where the MACs of conventional and clean technologies intersect. They find an inverted U-shaped relationship between regulatory stringency and the rate of clean technology adoption. In our paper, we consider an oligopolistic market structure and explicitly model the interaction among the polluting firms as a Cournot competition. Bréchet and Meunier (2014) also explicitly model the output market and analyze the impacts of environmental regulation on the diffusion of a clean technology. In their model, the adoption cost is assumed to be exogenously fixed; in our study, we model the adoption cost as the fixed fee set by the outside innovator, which is an endogenous decision variable.

In our model, a monopolistic upstream eco-industry licenses a patented emission reduction technology to polluters in a downstream oligopolistic industry, subject to command-and-control regulation. Our paper’s main contribution is the introduction of a non-cooperative game-theoretical framework in the analysis of the relationship between clean technology diffusion and environmental regulation stringency. We explicitly model the competition between the outside innovator (i.e., the clean technology supplier) and the polluting firms. Each participant acts individually and strategically in our model. Furthermore, we study the impacts of environmental regulation stringency and cleanliness improvement on the adoption and the diffusion of the emission reduction technology. Our model’s main findings are as follows: (1) Full and partial diffusion can both occur in equilibrium, depending on the relationship between environmental regulation stringency and cleanliness improvement of the new technology. (2) A U-shaped relationship exists between the clean technology diffusion and environmental regulation stringency; hence, a stricter environmental regulation (i.e., a lower emission cap) need not induce more widespread diffusion of clean technology. (3) A cleaner technology may only spread to a smaller number of producers. (4) A stricter emission cap policy may even induce more emissions. (5) Tightening the emission cap may not always benefit the patent holder or may be detrimental to the producers.

The remainder of this paper is organized as follows. Section 2 presents the model. The emission reduction technology licensing game is studied in Sect. 3. Section 4 provides an analysis of the impacts of the emission cap and the cleanliness improvement on the emission reduction technology diffusion, the aggregate emissions from the industry, and the profits for the outside innovator and producers as well. The last section draws the conclusions.

2 The Model

Consider an industry that consists of n producers \((n \ge 2)\) manufacturing a homogeneous product with an identical technology. The n producers compete à la Cournot in a market and face a downward-sloping inverse demand, which is given by \(p=a-Q\), where a is the market size, and \(Q=\sum _{i=1}^n {q_i } \) is the total output of the industry, where \(q_{i}\) is the output of producer i. Using the present technology, the production process generates \(e_{0}\) carbon emissions from producing each unit of the product. Without loss of generality, we normalize \(e_{0}\) to the unity. Each producer is subject to a mandated emission cap, denoted by\(\kappa \). To make the command-and-control regulation effective, we propose that emission cap \(\kappa \) be strictly less than \(\bar{\kappa }=a/{(n+1)}\) in our model.Footnote 1 We also assume that all firms produce goods at zero marginal cost.

Suppose an upstream innovator (e.g., a research institute) has developed a certain emission reduction technology. By adopting this new technology, a downstream producer can reduce the emission rate from \(e_{0} = 1\) to e, where \(e< 1\). Let \(\Delta e=1-e\) represent the innovation magnitude of the emission reduction technology. We assume that marginal costs remain unchanged by using the new technology in production to focus on the effect of the new technology on emission reduction.

The outside innovator (patent holder) can license the emission reduction technology to all or some of the n firms in the downstream industry so as to maximize its own benefit. In this model we consider that the new technology supplier sells the license through a fixed-fee contract. The interaction between the innovator and the downstream producers is characterized by the following three-stage game. At the first stage, the outside innovator offers a fixed-fee licensing contract F to the downstream producers. A firm that accepts to be a licensee pays fee F upfront to the patent holder. At the second stage, the producers decide simultaneously and independently to accept or to reject the contract. We suppose that when a producer is indifferent about accepting or rejecting the offer, it accepts the offer. At the final stage, the downstream producers compete in quantities.

3 Emission Reduction Technology Licensing Game

Let N be the set of n downstream producers, G be the subset of producers that purchase the license to adopt the emission reduction technology (i.e., licensees), and B be the subset of producers that still use conventional technology in their production (i.e., non-licensees); thus, \(N=G\cup B\). For ease of description, we refer to the producers in subset G as “green producers” or “licensees” and the producers in subset B as “brown producers” or “non-licensees”.

To find the subgame perfect Nash equilibrium, we solve the game by working backwards. At the third stage, knowing the number of licensees, each producer chooses an output level in maximizing its own profit. The problem for each green producer can be formulated as follows:

where \(q_{g}\) is the output of a green producer. And the problem for each brown producer can be formulated as follows:

where \(q_{b}\) is the output of a brown producer. Solving the problems for each green producer and each brown producer simultaneously yield the following lemma.

Lemma 1

Given that \(m\in [0,n]\) producers purchase the patent of emission reduction technology, the equilibrium output of each green producer (licensee) is given by

and the equilibrium output of each brown producer (non-licensee) is given by

For the proof, see the “Appendix”.

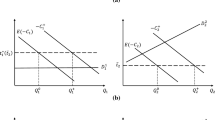

From Lemma 1, under the command-and-control regulation each brown producer chooses the output level such that the constraint of emission cap is binding, i.e., \(q_b^{*} =\kappa \). Note that the output of each brown producer is independent of both the number of green producers and the efficiency of the emission reduction technology. In terms of the equilibrium output of each green producer, there are three cases to distinguish, see Fig. 1. In Case A1, the emission rate of the clean technology satisfies \(e\ge \hat{{\hat{{e}}}}(\kappa )\), where \(\hat{{\hat{{e}}}}(\kappa )=\kappa /{\bar{{\kappa }}}\). In this case, the equilibrium output of each green producer is \(\kappa /e\) which remains unchanged as the number of licensees varies; see Fig. 2a. In Case A2, the emission rate of the clean technology satisfies \(\hat{{e}}(\kappa )\le e\le \hat{{\hat{{e}}}}(\kappa )\), where \(\hat{{e}}(\kappa )=\kappa /{\left[ {(n+1)\bar{{\kappa }}-n\kappa } \right] }\). In this case, there exists a threshold \(\hat{{m}}\in [0,n]\); thus, each green producer’s equilibrium output level is \(\kappa /e\) for \(m\le \hat{{m}}\) and \({\left[ {a-(n-m)\kappa } \right] }/{(m+1)}\) for \(m\ge \hat{{m}}\). As shown in Fig. 2b, the equilibrium output of each green producer is weakly decreasing as the number of licensee increases in this case. In Case A3, the emission rate of the clean technology satisfies \(e\le \hat{{e}}(\kappa )\). In this case, the equilibrium output level of each green producer is \({\left[ {a-(n-m)\kappa } \right] }/{(m+1)}\) which is strictly decreasing as more producers purchase the patent; see Fig. 2c. Note that if there is no outside innovator (i.e., \(m = 0\)), then all the producers use the conventional technology, and the equilibrium quantity for each producer is \(q_b^{*} =\kappa \). If all the producers use the emission reduction technology, i.e., \(m=n\), then the resulting equilibrium quantity for each producer is \(q_g^{*} =\min \left\{ {\bar{{\kappa }},\kappa /e} \right\} \), where \(\bar{{\kappa }}=a/{(n+1)}\). From Lemma 1, we can easily obtain the following corollary, which shows that the equilibrium output of each green producer is strictly greater than that of each brown producer.

Corollary 1

For any \(m\in (0,n)\), each green producer’s equilibrium output is strictly greater than that of each brown producer, that is, \(q_g^{*} >q_b^{*} \).

Since the number of licensees \(m\in (0,n)\) and the emission rate of the clean technology \(e<1,{[a-(n-m)\kappa ]}/{(m+1)}>\kappa \) and \(\kappa /e>\kappa \) both hold. Hence the minimum of \({[a-(n-m)\kappa ]}/{(m+1)}\) and \(\kappa /e\) (i.e., \(q_g^{*} )\) is strictly greater than \(\kappa \) (i.e., \(q_b^{*} )\). We can see that although each green producer’s equilibrium quantity may be influenced by the diffusion of the emission reduction technology, one can be sure that such quantity is always greater than that of each brown producer. Hence, the new emission reduction technology provides the green producers with a competitive advantage vis-à-vis the brown producers.

Now let us proceed with the first two stages of the game. At the first stage, the outside innovator offers a fixed-fee licensing contract F to the downstream producers. At the second stage, the producers decide simultaneously and independently to accept or to reject the contract. Since the equilibrium output of each green producer is different in each of the above three cases, in the following we study the equilibrium in Case A1, Case A2, and Case A3 respectively.

Lemma 2

To induce m producers to accept the offer, the maximum fixed fee the patent holder can charge is as follows:

-

(i)

in Case A1, i.e., \(e\ge \hat{{\hat{{e}}}}(\kappa ),\)

$$\begin{aligned} F^{A1}(m)=\left[ {a-\left( n+\frac{(1-e)m}{e}\right) \kappa } \right] \frac{(1-e)\kappa }{e}. \end{aligned}$$(7) -

(ii)

in Case A2, i.e., \(\hat{{e}}(\kappa )\le e\le \hat{{\hat{{e}}}}(\kappa )\), there exists a threshold \(\hat{{m}}=\frac{(n+1)e\bar{{\kappa }}-(1+ne)\kappa }{(1-e)\kappa }\in \left[ {0,n} \right] \) such that

$$\begin{aligned} F^{A2}(m)=\left\{ \begin{array}{l@{\quad }l} \left[ {a-\left( n+\frac{(1-e)m}{e}\right) \kappa } \right] \frac{(1-\,e)\kappa }{e},&{} \textit{if}\;m\le \hat{{m}} \\ \frac{\left[ {a-(n-m)\kappa } \right] }{(m+1)}\frac{\left[ {a-(n+1)\kappa } \right] }{(m+1)},&{} \textit{if}\;m\ge \hat{{m}} \\ \end{array} \right. . \end{aligned}$$(8) -

(iii)

in Case A3, i.e., \(e\le \hat{{e}}(\kappa )\),

$$\begin{aligned} F^{A3}(m)=\frac{\left[ {a-(n-m)\kappa } \right] }{(m+1)}\frac{\left[ {a-(n+1)\kappa } \right] }{(m+1)}. \end{aligned}$$(9)

For the proof, see the “Appendix”.

From (7), in Case A1 the maximum fixed fee set by the outside innovator is the equilibrium price for the product \((\left[ {a-(n+{(1-e)m}/e)\kappa } \right] =p^{A1{*}})\) multiplied by the output difference between each green producer and each brown producer (\({(1-e)\kappa }/e=q_g^{A1{*}} -q_b^{A1{*}} )\). In this case, the increase in the number of licensees (m) does not weaken the green producers’ competitive advantage in quantity over the brown producers since \(q_g^{A1{*}} -q_b^{A1{*}} \) is independent of m. However, with the increasing number of green producers, the total output will increase, and the equilibrium price for the product will decrease as a result. Thus, the optimal fixed fee set by the outside innovator decreases when the number of licensees increases, that is, \({\partial F^{A1}(m)}/{\partial m}<0\). From (9), in Case A3 the maximum fixed fee the patent holder can charge is the equilibrium price for the product \(({\left[ {a-(n-m)\kappa } \right] }/{(m+1)}=p^{A3{*}})\) multiplied by the output difference between each green producer and each brown producer \(({\left[ {a-(n+1)\kappa } \right] }/{(m+1)}=q_g^{A3{*}} -q_b^{A3{*}} )\). In this case, the output difference \(q_g^{A3{*}} -q_b^{A3{*}} \) and the equilibrium price \(p^{A3{*}}\) are both decreasing with the increasing number of green producers. Hence, the optimal fixed fee set by the outside innovator will decrease in m, that is, \({\partial F^{A3}(m)}/{\partial m}<0\). In Case A2, there exists a threshold \(\hat{{m}}\in [0,n]\); thus, the equilibrium output level of each green producer is \(\kappa /e\) for \(m\le \hat{{m}}\) and \({\left[ {a-(n-m)\kappa } \right] }/{(m+1)}\) for \(m\ge \hat{{m}}\). As a result, the maximum fixed fee charged by the patent holder is also a piecewise function on m, which is given in (8). If the outside innovator wants to induce m\((\le \hat{{m}})\) producers to accept her offer, she will set the fixed fee at \(F^{A2}(m)=F^{A1}(m)\). If the patent holder wants to induce m\((\ge \hat{{m}})\) producers to accept her offer to be licensees, she will charge at \(F^{A2}(m)=F^{A3}(m)\). Note that in all three cases, the maximum fixed fee charged by the outside innovator is strictly decreasing as m increases which implies that the outside patent holder must make a tradeoff between selling more patents with a lower price and selling fewer patents with a higher price. In the following, we determine the optimal number of licensees chosen by the patent holder.Footnote 2

Theorem 1

In Case A1 , i.e., \(e\ge \hat{{\hat{{e}}}}(\kappa )\) , the optimal number of licensees chosen by the patent holder is given as follows:

-

i)

if \(\kappa \ge \hat{{\kappa }}\), \(m^{A1{*}}=n\);

-

ii)

if \(\kappa <\hat{{\kappa }}\), then

where \(\hat{{\kappa }}=\frac{(n-1)}{n}\bar{{\kappa }}\), \(\bar{{e}}(\kappa )=\frac{2n\kappa }{a+n\kappa }\).

For the proof, see the “Appendix”.

As we shown in Lemma 2, each producer’s willingness to pay for the license of the emission reduction technology is dependent not only on both the technological efficiency and environmental regulation stringency, but also on the number of licensees chosen by the outside innovator. All else being equal, as the number of licensees increases, the value of the license of the clean technology decreases for each downstream producer and thus the fixed fee set by the patent holder must decline. Hence, the patent holder should make a tradeoff between selling fewer patents with a higher price and selling more patents with a lower price. Indeed, increasing the number of licenses has two effects on the profit of the patent holder. On the one hand, it brings the outside innovator the revenue of licensee fees paid by the additional purchasers (licensee number increasing effect). On the other hand, it leads to a reduction in the fixed fee paid by each licensee (fixed license fee reduction effect). The two effects combine to determine the optimal number of licensees chosen by the patent holder. From Theorem 1, in Case A1 if the environmental regulation is sufficiently lax, i.e., \(\kappa \ge \hat{{\kappa }}\), we find that the licensee number increasing effect always dominates the license price reduction effect for the patent holder’s revenue and a full diffusion of the clean technology occurs in equilibrium. While if the environmental regulation is sufficiently strict, i.e., \(\kappa <\hat{{\kappa }}\), we find that the benefit of increasing the number of licensees may not always outweigh the cost it brings to the outside innovator and it depends on whether the emission rate of the clean technology is lower than \(\bar{{e}}(\kappa )\) or not. Specifically, if the emission rate of the new technology e is lower than \(\bar{{e}}(\kappa )\), the outside innovator prefers licensing the emission reduction technology to part of the downstream producers and thus a partial diffusion occurs in the equilibrium. And if the emission rate of the clean technology is higher than \(\bar{{e}}(\kappa )\), a full diffusion of the new technology is the patent holder’s best choice. Figure 3a depicts the diffusion of the clean technology in Case A1.

Theorem 2

In Case A2, i.e.,\(\hat{{e}}(\kappa )\le e\le \hat{{\hat{{e}}}}(\kappa )\) , the optimal number of licensees chosen by the patent holder is given as follows:

-

i)

if \(\kappa \ge \hat{{\kappa }}\), \(m^{A2{*}}=n\);

-

ii)

if \(\kappa \le \hat{{\kappa }},\) then

where \({e}(\kappa )=\frac{2\kappa }{a-n\kappa }\).

Similar to Case A1, in Case A2 if the environmental regulation is sufficiently lax, i.e., \(\kappa \ge \hat{{\kappa }}\), we also find that the benefit of increasing the number of licensees definitely outweighs the cost it brings to the outside innovator. Hence a full diffusion of the emission reduction technology occurs in equilibrium. While when the emission regulation the producers facing is sufficiently stringent, i.e., \(\kappa <\hat{{\kappa }}\), we find that the patent holder prefers to disseminate the clean technology to part of the downstream producers; thus, a partial diffusion will occur in equilibrium. The diffusion of the emission reduction technology in Case A2 is shown in Fig. 3b.

Theorem 3

In Case A3, i.e., \(e\le \hat{{e}}(\kappa )\), the optimal number of licensees chosen by the patent holder is given as follows:

For the proof, see the “Appendix”.

In Case A3 we can also find that if the emission cap regulation is sufficiently lax, i.e., \(\kappa \ge \hat{{\kappa }}\), then the licensee number increasing effect always dominates the license price reduction effect for the patent holder’s revenue. Thus the optimal number of licenses chosen by the outside innovator is \(m^{A3{*}}=n\) when \(\kappa \ge \hat{{\kappa }}\) and a full diffusion of the emission reduction technology occurs in equilibrium. When the emission cap regulation is sufficiently stringent, i.e., \(\kappa <\hat{{\kappa }}\), we find that the optimal number of licensees for the patent holder is strictly less than n and a partial diffusion occurs in equilibrium. Figure 3c depicts the diffusion of the emission reduction technology in Case A3.

In ligh \(m^{A1}=\frac{e\left( {a-n\kappa } \right) }{2(1-e)\kappa }q_g^{*} \frac{a-n\kappa }{a-(2+n)\kappa }q_g \le \kappa /{(1-g)}\) the results we have derived in the preceding three cases (Cases A1, A2 and A3), we shall repartition the areas in Fig. 1, dividing them into four zones — Zones I–IV, see Fig. 4. In Zones I and Zone IV, the relationship between the emission cap and the emission rate of the clean technology ensures that a full diffusion of the new technology appears in equilibrium. On the other hand, in Zones II and Zone III, a partial diffusion of the emission reduction technology will be the outside innovator’s optimal choice. Table 1 presents the equilibrium number of licensees \((m*)\), the optimal fixed fee \((F*)\), each green and brown producer’s equilibrium output \((q_g^{*} ,q_b^{*})\), the aggregate quantities \((Q*)\), the aggregate emissions (CE*), the patent holder’s equilibrium profit, and each green and brown producer’s equilibrium profit \((\pi _g^{*} ,\pi _b^{*} )\) in the four zones.

4 Impacts of Environmental Regulation Stringency and Cleanliness Improvement of the Emission Reduction Technology

Let \(\Delta e=1-e\) be the improvement in cleanliness of the emission reduction technology. Define the diffusion coefficient r to be the proportion of green producers in all producers and it measures the degree of diffusion of the clean technology in the downstream industry. In this section, we investigate the impacts of environmental regulation stringency and cleanliness improvement on the diffusion of the emission reduction technology, the equilibrium quantities and price, the aggregate emissions from the industry, and the profits for the outside innovator and producers as well. All the following propositions can easily be derived from the results presented in Table 1; thus, we omit the proofs.

Proposition 1

Given cleanliness improvement \(\Delta e\), the impact of the emission cap on the diffusion of the clean technology can be stated as follows:

-

(1)

A full diffusion will always occur in equilibrium if the cleanliness improvement \(\Delta e\) is sufficiently small (i.e., \(\Delta e\le 1/n)\) regardless of emission cap \(\kappa \).

-

(2)

Given the cleanliness improvement \(\Delta e > 1/ n\), the number of licensees is weakly monotonically increasing in \(\kappa \) for \(\kappa \ge \kappa ^{\circ }\) while weakly monotonically decreasing in \(\kappa \) for \(\kappa \le \kappa ^{\circ }\) , where \(\kappa ^{\circ }={ae}/{(2+ne)}\).

As we can see from Theorems 1–3, the equilibrium number of licensees (which represents the degree of diffusion of the clean technology) chosen by the outside innovator is heavily dependent on the environmental regulation stringency and cleanliness improvement of the emission reduction technology Proposition 1 shows the impact of environmental regulation stringency on the diffusion of emission reduction technology. From the proposition, we can see that the relationship between emission cap policy and the diffusion of the clean technology depends on whether or not the cleanliness improvement of the new technology exceeds a certain threshold. Specifically, if the cleanliness improvement of the clean technology is smaller than the threshold (1/n), we find that the environmental regulation does not influence the equilibrium number of licensees and the outside innovator always chooses to disseminate the clean technology to all the downstream producers, i.e., a full diffusion of the emission reduction technology. While it should be noted that although the number of licensees is not affected by the regulation stringency in this case, the fixed fee set by the outside innovator does depend on the emission cap. We can easily verify this; when the environmental regulation becomes more stringent, the innovator will increase the fixed fee as a result. The effect that an increase in regulatory stringency reduces price elasticity and enhances the license fee has been pointed out several times in the literature, see e.g. David and Sinclair-Desgagné (2005), David et al. (2011) or more recently by Goeschl and Perino (2017).

An interesting case occurs when the cleanliness improvement of the new technology \((\Delta e)\) exceeds the threshold (1 / n). In this case we find that there exists a U-shaped relationship between the diffusion of emission reduction technology and the environmental regulation stringency (see Fig. 5). To be specific, if the emission cap regulation is sufficiently lax, i.e., \(\kappa \ge \hat{{\kappa }}\), where \(\hat{{\kappa }}={(n-1)\bar{{\kappa }}}/n\), the equilibrium number of licensees is \(m^{I}=n\) (see Table 1) which means the patent holder always prefers a full diffusion of the emission reduction technology in Zone I. If the emission cap \(\kappa \in [\kappa ^{o},\hat{{\kappa }})\), where \(\kappa ^{\circ }={ae}/{(2+ne)}\), from Table 1 the optimal number of licensees chosen by the patent holder is \(m^{\textit{II}}={(a-n\kappa )}/{[a-(2+n)\kappa ]}\). We can easily verify that \({\partial m^{\textit{II}}}/{\partial \kappa }>0\), which means that the equilibrium number of licensees in Zone II declines when the emission cap policy is tightened. This implies that a stricter environmental regulation may hinder the diffusion of the clean technology when the emission cap \(\kappa \in [\kappa ^{o},\hat{{\kappa }})\). If the emission cap \(\kappa \in (\tilde{\kappa },\kappa ^{o}]\), where \(\tilde{\kappa }={ae}/{[(2-e)n]}\), the optimal number of licensees for the outside innovator is \(m^{\textit{III}}={e(a-n\kappa )}/{[2(1-e)\kappa ]}\). It is easy to verify that \({\partial m^{\textit{III}}}/{\partial \kappa }<0\), which means that the number of licensees increases as the environmental regulation becomes more stringent. Finally, when the emission cap is below the threshold \(\tilde{\kappa }\), we find that the optimal number of licensees chosen by the patent holder is \(m^{IV}=n\) which means that a full diffusion of the clean technology occurs in equilibrium.

The intuition behind the U-shaped relationship between the diffusion of the clean technology and the environmental regulation stringency is as follows. When the environmental regulation is sufficiently lax, the value of the license of the clean technology is very low for each potential licensee and thus the patent holder sets a sufficiently low price (fixed fee) to induce as many producers as possible to adopt the clean technology in maximizing its profit and this leads to a full diffusion. When the environmental regulation is very tough, adopting the emission reduction technology can provide the green producers with substantial competitive advantages. Thus the patent holder can ask for a high price (fixed-fee) of the clean technology to the potential licensees. Although the outside innovator must lower the fixed fee imposed on each licensee as the number of licensee increase, the benefit of selling more patents (with relatively high price) dominates the reduction effect it brings to the price of the patent. Hence the patent holder also prefers to promote its innovation to all the downstream producers in this case. While for intermediate environmental policies the fixed license fee reduction effect is sufficiently strong to prevent the outside innovator from disseminating the clean technology to all the producers and thus a partial diffusion occurs in equilibrium.

The non-monotonicity of the relationship between regulatory stringency and the diffusion of a clean technology is the key result of Perino and Requate (2012). By assuming that the marginal abatement cost (MAC) curves of the conventional and the new technology intersect each other, they find an inverted U-shaped relationship between the stringency of policy instruments and the equilibrium rate of diffusion. In contrast with Perino and Requate (2012), in this model we consider that a monopolistic upstream outside innovator licenses the emission reduction technology to polluters in a downstream oligopolistic industry by using a non-cooperative game-theoretical framework and explicitly model the interaction between the clean technology supplier and the polluting firms. In our model the diffusion of the clean technology chosen by the outside innovator depends not only on both the cleanliness improvement of the new technology and the environmental regulation stringency, but also on the strategic interactions between the licensees and non-licensees shaping the fixed-fee that the patent holder can extract from each of the licensees.

Proposition 2

Given emission cap \(\kappa \), the impact of cleanliness improvement \(\Delta e\) on the diffusion of the clean technology can be stated as follows:

-

(1)

A full diffusion will always occur in equilibrium if the emission cap is sufficiently high (i.e., \(\kappa \ge \hat{{\kappa }})\) regardless of cleanliness improvement \(\Delta e\).

-

(2)

Given the emission cap \(\kappa <\hat{{\kappa }}\) , the number of licensees is weakly monotonically decreasing in \(\Delta e\) and strictly monotonically decreasing in \(\Delta e\) for \(\Delta e\in \left( {1-\bar{{e}}(\kappa ),1-{e}(\kappa )} \right) \).

Proposition 2 indicates the impact of the cleanliness improvement on the emission reduction technology diffusion. From the proposition, the relationship between the improvement in cleanliness of the clean technology and the diffusion of this technology depends on whether or not the emission cap exceeds the threshold \(\hat{{\kappa }}\). Specifically, if the emission cap is above \(\hat{{\kappa }}\), we find that the cleanliness improvement cannot influence the equilibrium number of licensees and in this case the outside patent holder always chooses to disseminate the emission reduction technology to all the downstream producers, i.e., a full diffusion of the clean technology. While if the environmental regulation is sufficiently strict (i.e., \(\kappa <\hat{{\kappa }})\), we find that there exists a Z-shaped relationship between the clean technology diffusion rate and the cleanliness improvement (see Fig. 6). Specifically, in this case if the improvement in cleanliness is sufficiently small, i.e., \(\Delta e\le 1-\bar{{e}}(\kappa )\), the outside innovator also prefers a full diffusion of the new technology. While if the cleanliness improvement \(\Delta e\in \left( {1-\bar{{e}}(\kappa ),1-{e}(\kappa )} \right) \), the equilibrium number of licensees is given by \(m^{\textit{III}}={e(a-n\kappa )}/{[2(1-e)\kappa ]}\). Since \({\partial m^{\textit{III}}}/{\partial \Delta e}<0\), the patent holder will reduce the number of licensees (or equivalently, the diffusion coefficient r of the clean technology) as \(\Delta e\) increases. Finally, if the cleanliness improvement \(\Delta e\ge 1-{e}(\kappa )\), the number of licensees chosen by the outside innovator is given by \(m^{\textit{II}}={(a-n\kappa )}/{[a-(2+n)\kappa ]}\) and we can easily see that in this case the improvement in cleanliness does not influence the diffusion of the clean technology.

Proposition 3

Given that the improvement in cleanliness of the emission reduction technology is \(\Delta e\), the impact of emission cap \(\kappa \) on aggregate emissions CE* can be stated as follows:

-

(1)

If \(\Delta e\le 1/n\), then CE* will remain fixed over \(\kappa \in \left[ {\bar{{\kappa }}e,\bar{{\kappa }}} \right) \) and strictly monotonically increasing in \(\kappa \) for \(\kappa <\bar{{\kappa }}e\).

-

(2)

If \(\Delta e>1/n\), then CE* will remain fixed over \(\kappa \in \left[ {\hat{{\kappa }},\bar{{\kappa }}} \right) \), strictly monotonically decreasing in \(\kappa \) over \(\kappa \in [\kappa ^{\circ },\hat{{\kappa }})\), and strictly monotonically increasing in \(\kappa \) for \(\kappa <\kappa ^{\circ }\).

In Proposition 3, we show the relationship between the environmental regulation stringency and total carbon emissions. From the proposition, to make the command-and-control regulation effective in reducing the carbon emissions, the emission cap must be lower than certain thresholds. The thresholds are dependent on the improvement in cleanliness of the emission reduction technology and the environmental regulation stringency as well. If the cleanliness improvement \(\Delta e\le 1/n\), once the emission cap becomes lower than \(\bar{{\kappa }}e\), the aggregate emissions will decrease linearly when the environmental regulation is tightened (see Fig. 7a). A surprising case occurs when the improvement in cleanliness \(\Delta e>1/n\); in this case, a stricter environmental regulation (i.e., a lower emission cap) can even lead to higher aggregate emissions from the industry for a certain range of the emission cap \(\varvec{\kappa }\) (see Fig. 7b). The reason is that within this range of emission cap (i.e., \(\kappa ^{\circ }\le \kappa <\hat{{\kappa }})\), a partial diffusion will occur in equilibrium. And as the emission cap becomes lower, less downstream producers will accept the fixed-fee contract to be licensees. It is this reduction in the number of green producers that has led to an increase in overall industry emissions.

The relationship between the cleanliness improvement of the emission reduction technology and the aggregate emissions from the downstream industry is given in the following proposition.

Proposition 4

Given emission cap \(\varvec{\kappa }\), aggregate emissions CE* are weakly monotonically decreasing in cleanliness improvement \(\Delta e\) and strictly monotonically decreasing in \(\Delta e\) for \(\Delta e>\max \{ {1-\hat{{\hat{{e}}}}(\kappa ),1-{e}(\kappa )}\}\).

From Proposition 4, an increase in the improvement in the cleanliness of the new technology can help reduce the aggregate emissions from the downstream industry only when \(\Delta e\) exceeds certain thresholds. Furthermore, the thresholds are dependent on the environmental regulation, that is, the emission cap in our model. If emission cap \(\kappa \ge \hat{{\kappa }}\), the aggregate emissions will decline in the cleanliness improvement only when \(\Delta e\) exceeds the threshold \(1-\hat{{\hat{{e}}}}(\kappa )\). If emission cap \(\kappa <\hat{{\kappa }}\), the threshold for inducing a negative relationship between aggregate emissions and the cleanliness improvement of the new technology will be \(1-{e}(\kappa )\). Moreover, we can easily verify that \(1-{e}(\kappa )>1-\hat{{\hat{{e}}}}(\kappa )\) must hold for any \(\kappa <\hat{{\kappa }}\). Figure 8 illustrates the impact of the cleanliness improvement of the new technology on the aggregate emissions from the industry.

Proposition 5

Given that the improvement in cleanliness of the emission reduction technology is \(\Delta e\), the outside innovator’s equilibrium profit is initially increasing and then decreasing as the emission cap policy becomes more stringent.

Proposition 5 analyzes the impact of the stringency of command-and-control regulation on the outside innovator’s equilibrium profit. Intuitively, the patent holder will benefit from stricter environmental regulations. From the proposition, however, we find that a non-monotonic relationship exists between environmental regulation stringency and the outside innovator’s equilibrium profit. A stricter environmental regulation can help increase the patent holder’s profit if the emission cap \(\kappa \) is above the threshold ea / 2n; however, when the emission cap \(\kappa \le {ea}/{2n}\), tightening the emission cap will be unfavorable to the profit of the outside innovator. Figure 9 illustrates the impact of the emission cap on the outside innovator’s profit.

Proposition 6

Given emission cap \(\varvec{\kappa }\), the outside innovator’s equilibrium profit is weakly monotonically increasing in cleanliness improvement \(\Delta e\) and strictly monotonically increasing in \(\Delta e\) for \(\Delta e<\min \{ {1-\hat{{\hat{{e}}}}(\kappa ),1-\bar{{e}}(\kappa )} \}\).

It is not surprising that the outside innovator’s profit will increase as the improvement in cleanliness of the new technology \(\Delta e\) increases. On the other hand, from Proposition 6, we can observe that the positive relationship between the cleanliness improvement \(\Delta e\) and the patent holder’s profit only occurs when \(\Delta e\) is below a certain threshold even we do not consider the outside innovator’s R&D cost for developing the clean technology in this model (see Fig. 10). Furthermore, the threshold below which the strictly positive relationship between the patent holder’s profit and \(\Delta e\) holds is dependent on the environmental regulation stringency. And we can easily verify that a stricter emission cap policy leads to a wider range of cleanliness improvement \(\Delta e\), which can positively influence the outside innovator’s profit.

Proposition 7

Given that the improvement in cleanliness of the emission reduction technology is \(\Delta e\), the impact of emission cap \(\varvec{\kappa }\) on each producer’s equilibrium profit can be stated as follows:

-

(1)

If \(\Delta e\le 1/n\), then each producer’s equilibrium profit is increasing in emission cap \(\kappa \) for \(\kappa \in \left( {0,{ea}/{2n}} \right] \cup \left[ {\bar{{\kappa }}e,\bar{{\kappa }}} \right) \) and is decreasing in \(\kappa \) for \(\kappa \in \left( {{ea}/{2n},\bar{{\kappa }}e} \right) \).

-

(2)

If \(\Delta e>1/n\), then each producer’s equilibrium profit is increasing in emission cap \(\kappa \) for \(\kappa \in \left( {0,{ea}/{2n}} \right] \cup \left[ {\tilde{\kappa },a/{2n}} \right] \cup \left[ {\hat{{\kappa }},\bar{{\kappa }}} \right) \) and is decreasing in \(\kappa \) for \(\kappa \in \left( {{ea}/{2n},\tilde{\kappa }} \right) \cup \left( {a/{2n},\hat{{\kappa }}} \right) \).

Figure 11 depicts the non-monotonic relationship between environmental regulation stringency and each producer’s equilibrium profit. It is somewhat surprising that a stricter regulation can even help increase the downstream producer’s equilibrium profit when the emission cap varies within certain ranges. The reason is that tightening the emission cap can weaken the competition within the downstream industry, which may lead to a profit increase for each producer. Moreover, we find that the relationship between environmental regulation stringency and the producer’s equilibrium profit is more complicated when cleanliness improvement \(\Delta e\) exceeds the threshold 1 / n. The reason is that in this case, partial diffusion and full diffusion of the emission reduction technology can both occur in equilibrium when the emission cap varies (see Fig. 10b). The results regarding the effect on the firms’ profits can be linked somehow to the literature on the Porter Hypothesis, according to which, under some conditions, a tougher environmental policy can make firms become better off. For some surveys of this literature, see Ambec et al. (2013), André (2015), Brännlund and Lundgren (2009).

Proposition 8

Given emission cap \(\varvec{\kappa }\), each producer’s equilibrium profit is weakly monotonically decreasing in the improvement in cleanliness of the new technology \(\Delta e\) and is strictly monotonically decreasing in \(\Delta e\) for \(\Delta e<\min \left\{ {1-\hat{{\hat{{e}}}}(\kappa ),1-\bar{{e}}(\kappa )} \right\} \).

Proposition 8 shows the impact of environmental efficiency improvement of the clean technology on each producer’s equilibrium profit. From the proposition, there exists a (weakly) negative relationship between the cleanliness improvement of the emission reduction technology and each downstream producer’s equilibrium profit. Furthermore, we find that if the cleanliness improvement of the new technology \(\Delta e<\min \left\{ {1-\hat{{\hat{{e}}}}(\kappa ),1-\bar{{e}}(\kappa )} \right\} \), an increase in \(\Delta e\) has a strictly negative influence on each producer’s profit (Fig. 12).

5 Conclusions

In this paper, we have investigated the impacts of command-and-control regulation on the emission reduction technology licensing and diffusion in an oligopolistic market. This study involves an industry that consists of n producers manufacturing a homogeneous product with an identical technology. A monopolistic outside innovator has developed a certain emission reduction technology and wants to license the patent to the downstream producers by means of a fixed-fee contract. We have explicitly modeled the interaction between the patent holder and the producers as a three-stage non-cooperative game and have derived the equilibrium strategies for the outside innovator and the downstream producers. The results show that both full diffusion and partial diffusion of the emission reduction technology can occur in equilibrium and a stricter environmental regulation may not always promote the diffusion of the clean technology. Instead, there exists a U-shaped relationship between the diffusion of emission reduction technology and the environmental regulation stringency. When the emission cap is sufficiently strict, we find that the outside innovator tends to disseminate the clean technology to less downstream producers as the improvement in cleanliness increases. Another counter intuitive finding of our model is that if the improvement in cleanliness of the emission reduction technology exceeds the threshold 1 / n, a stricter environmental regulation (i.e., a lower emission cap) can even lead to higher aggregate emissions from the industry when the emission cap varies within a certain range. The reason is the following. Within this range of emission cap, a partial diffusion of the emission reduction technology occurs in equilibrium. Furthermore, as the environmental regulation becomes more stringent, the degree of diffusion of the clean technology in the downstream industry is declining which means less downstream producers accept the outside innovator’s fixed-fee contract to be licensees. The reduction in the number of green producers has eventually led to an increase in overall industry emissions.

Notes

In the absence of environmental regulation, the resulting emission for each producer is \(a/(n+1)\).

Strictly speaking, the optimal number of licensees should take integer values. In the following, we ignore the integer constraint on m and consider m as a continuous variable to facilitate the analysis. The introduction of integer constraint does not change the key insights in our model. A similar simplification is also made in Bagchi and Mukherjee (2014).

References

Ambec S, Cohen MA, Elgie S, Lanoie P (2013) The Porter hypothesis at 20: can environmental regulation enhance innovation and competitiveness? Rev Environ Econ Policy 7(1):2–22

Amir R, Germain M, van Steenberghe V (2008) On the impact of innovation on the marginal abatement cost curve. J Public Econ Theory 10(6):985–1010

André FJ (2015) Strategic effects and the Porter hypothesis. Munich Personal RePEc archive, MPRA Paper No. 62237

Arguedas C, Camacho E, Zofío JL (2010) Environmental policy instruments: technology adoption incentives with imperfect compliance. Environ Resour Econ 47(2):261–274

Bagchi A, Mukherjee A (2014) Technology licensing in a differentiated oligopoly. Int Rev Econ Finance 29:455–465

Baker E, Clarke L, Shittu E (2008) Technical change and the marginal cost of abatement. Energy Econ 30(6):2799–2816

Bauman Y, Lee M, Seeley K (2008) Does technological innovation really reduce marginal abatement costs? Some theory, algebraic evidence, and policy implications. Environ Resour Econ 40(4):507–527

Brännlund R, Lundgren T (2009) Environmental policy without costs? A review of the Porter Hypothesis. Int Rev Environ Resour Econ 3(2):75–117

Bréchet T, Jouvet PA (2008) Environmental innovation and the cost of pollution abatement revisited. Ecol Econ 65(2):262–265

Bréchet T, Meunier G (2014) Are clean technology and environmental quality conflicting policy goals? Resour Energy Econ 38:61–83

Canton J, Soubeyran A, Stahn H (2008) Optimal environmental policy, vertical structure and imperfect competition. Environ Resour Econ 40(3):369–382

David M, Sinclair-Desgagné B (2005) Environmental regulation and the eco-industry. J Regul Econ 28(2):141–155

David M, Sinclair-Desgagné B (2010) Pollution abatement subsidies and the eco-industry. Environ Resour Econ 45(2):271–282

David M, Nimubona AD, Sinclair-Desgagné B (2011) Emission taxes and the market for abatement goods and services. Resour Energy Econ 33:179–191

Goeschl T, Perino G (2017) The climate policy hold-up: green technologies, intellectual property rights, and the abatement incentives of international agreements. Scand J Econ 119(3):709–732

Jung C, Krutilla K, Boyd R (1996) Incentives for advanced pollution abatement technology at the industry level: an evaluation of policy alternatives. J Environ Econ Manag 30(1):95–111

Kamien MI, Tauman Y (1984) The private value of a patent: a game theoretic analysis. Zeitschrift für Nationalokonomie/J Econ 4(Supplement):93–118

Kamien MI, Tauman Y (1986) Fee versus royalties and the private value of a patent. Q J Econ 101(3):471–491

Kamien MI, Tauman Y (2002) Patent licensing: the inside story. Manch Sch 70(1):7–15

Kamien MI, Oren SS, Tauman Y (1992) Optimal licensing of cost-reducing innovation. J Math Econ 21(5):483–508

Katz ML, Shapiro C (1985) On the licensing of innovation. Rand J Econ 16(4):504–520

Katz ML, Shapiro C (1986) How to license intangible property. Q J Econ 101(3):567–590

Malueg DA (1989) Emission credit trading and the incentive to adopt new pollution abatement technology. J Environ Econ Manag 16(1):52–57

McManus P (2009) Environmental regilation. Elsevier Ltd, Chatswood

Milliman SR, Prince R (1989) Firm incentives to promote technological change in pollution control. J Environ Econ Manag 17(3):247–265

Montero JP (2002) Permits, standards and technology innovation. J Environ Econ Manag 44(1):23–44

Perino G (2010) Technology diffusion with market power in the upstream industry. Environ Resour Econ 46(4):403–428

Perino G, Requate T (2012) Does more stringent environmental regulation induce or reduce technology adoption? When the rate of technology adoption is inverted U-shaped. J Environ Econ Manag 64(3):456–467

Requate T (2005) Dynamic incentives by environmental policy instruments—a survey. Ecol Econ 54(2–3):175–195

Requate T, Unold W (2001) On the incentives created by policy instruments to adopt advanced abatement technology if firms are asymmetric. J Inst Theor Econ 157(4):536–554

Requate T, Unold W (2003) Environmental policy incentives to adopt advanced abatement technology: will the true ranking please stand up? Eur Econ Rev 47(1):125–146

Schwartz S, Stahn H (2014) Competitive permit markets and vertical structures: the relevance of imperfectly competitive eco-industries. J Public Econ Theory 16(1):69–95

Sen D, Tauman Y (2007) General licensing schemes for a cost-reducing innovation. Games Econ Behav 59(1):163–186

Wang XH (1998) Fee versus royalty licensing in a Cournot duopoly model. Econ Lett 60(1):55–62

Wang XH, Yang BZ (1999) On licensing under Bertrand competition. Aust Econ Pap 38(2):106–119

Acknowledgements

We are grateful to Co-Editor and three anonymous referees, whose comments greatly improved the paper. The authors also acknowledge financial support from the National Natural Science Foundation of China (71202052, 71431004, 71573087, 71473085), Program for New Century Excellent Talents in University (NCET-11-0637), Humanities and Social Science Youth Foundation of the Ministry of Education of China (12YJC630240) and the Fundamental Research Funds for the Central Universities.

Author information

Authors and Affiliations

Corresponding author

Appendix

Appendix

1.1 Proofs

Proof of Lemma 1

The first order conditions for each green and brown producer are given by

Hence the best response functions:

Solving first order conditions simultaneously and we have \(q_g^{*} =q_b^{*} =a/{(n+1)}\). However \(q_b^{*} =a/{(n+1)}\) is not feasible since the carbon cap \(\kappa <a/{(n+1)}\) requires \(q_b <a/{(n+1)}\).

Take the first order derivative of \(q_b^{*} (q_g )\) on m:

Hence if \(q_g \ge a/{(n+1)}\), \({\partial q_b^{*} (q_g )}/{\partial m}\le 0\), which means the brown producer’s quantity will decline with mincreases. Therefore, if \(q_g \ge a/{(n+1)}\), we have

Hence with the constraint \(q_b \le \kappa <a/{(n+1)}\), the optimal output for the brown producer is \(q_b^{*} =\kappa \).

Now consider the case \(q_g <a/{(n+1)}\). In this case, \({\partial q_b^{*} (q_g )}/{\partial m}>0\), which means the brown producer’s quantity will increase with s increases. Therefore, if \(q_g <a/{(n+1)}\), we have

Again with the constraint \(q_b \le \kappa <a/{(n+1)}\), the optimal output for the brown producer is \(q_b^{*} =\kappa \).

Therefore the optimal output for each brown producer is \(q_b^{*} =\kappa \).

Next let us consider the green producers’ production quantity. Since \(q_b^{*} =\kappa \), the green producer’s optimal output when there is no carbon emission constraint is

And the emission constraint requires \(q_g \le \kappa /{(1-g)}\). Hence the optimal output for each green producer is \(q_g^{*} =\min \left\{ {\frac{a-(n-m)\kappa }{m+1},\frac{\kappa }{1-g}} \right\} \). \(\square \)

Proof of Corollary 1

Since \(e\in (0,1)\), \(\kappa /e>\kappa \) always holds. We only need to check if \(\frac{a-(n-m)\kappa }{m+1}>\kappa \).

Since \(\left[ {\frac{a-(n-m)\kappa }{m+1}} \right] ^{\prime }_m =\frac{n+1}{(m+1)^{2}}\left[ {\kappa -\frac{a}{n+1}} \right] <0\), we have

\(\square \)

Proof of Lemma 2

In Case A1, from Lemma 1, each licensee’s equilibrium output level is \(\kappa /e\), and each non-licensee’s output level is \(\kappa \). Given fixed-fee contract F, the profit of a producer that accepts the contract to be a licensee is \(\pi _g^{A1} (m,F)=\left[ {a-(n+{(1-e)m}/e)\kappa } \right] \kappa /e-F\), where m is the total number of licensees. The profit of a producer that rejects the contract is \(\pi _b^{A1} (m)=\left[ {a-(n+{(1-e)m}/e)\kappa } \right] \kappa \). Hence, if the outside innovator wants m producers to accept its offer to be licensees, it is optimal for the innovator to set the upfront fee F high enough till \(\pi _g^{A1} (m,F)=\pi _b^{A1} (m)\). Thus, in Case A1, given that the number of licensees is m, the optimal fixed fee set by the patent holder is

In Case A2, there exists a threshold \(\hat{{m}}\in [0,n]\); thus, the equilibrium output level of each green producer is \(\kappa /e\) for \(m\le \hat{{m}}\) and \({\left[ {a-(n-m)\kappa } \right] }/{(m+1)}\) for \(m\ge \hat{{m}}\). First, we consider the case \(m\le \hat{{m}}\). In this case, given fixed-fee contract F, the profit of a producer that accepts the contract to be a licensee is \(\left. {\pi _g^{A2} (m,F)} \right| _{m\le \hat{{m}}} =\left[ {a-(n+{(1-e)m}/e)\kappa } \right] \kappa /e-F\). The profit of a producer that rejects the contract is \(\left. {\pi _b^{A2} (m)} \right| _{m\le \hat{{m}}} =\left[ {a-(n+{(1-e)m}/e)\kappa } \right] \kappa \). Hence, if the outside innovator wants m producers to accept its offer to be licensees, it is optimal for her to set the upfront fee F high enough till \(\left. {\pi _g^{A2} (m,F)} \right| _{m\le \hat{{m}}} =\left. {\pi _b^{A2} (m)} \right| _{m\le \hat{{m}}} \). Thus, in the case of \(m\le \hat{{m}}\), the optimal fixed fee set by the patent holder is

Now let us consider the case \(m\ge \hat{{m}}\). In this case, given the fixed-fee contract F, the profit of a producer that accepts the contract to be a licensee is \(\left. {\pi _g^{A2} (m,F)} \right| _{m\ge \hat{{m}}} =\left[ {{\left( {a-(n-m)\kappa } \right) }/{(m+1)}} \right] ^{2}-F\).

The profit of a producer that rejects the fixed-fee contract is \(\left. {\pi _b^{A2} (m)} \right| _{m\ge \hat{{m}}} \!=\!\big [ {\left( {a\!-\!(n\!-\!m)\kappa } \right) }/{(m+1)} \big ]\kappa \). If the outside innovator wants m producers to accept the fixed-fee contract, it is optimal for her to set the upfront fee F high enough till \(\left. {\pi _g^{A2} (m,F)} \right| _{m\ge \hat{{m}}} =\left. {\pi _b^{A2} (m)} \right| _{m\ge \hat{{m}}} \). Hence, in the case of \(m\ge \hat{{m}}\), given that the number of licensees is m, the optimal fixed fee set by the patent holder is

In Case A3, the equilibrium output of each green producer is \({\left[ {a-(n-m)\kappa } \right] }/{(m+1)}\). Given the fixed-fee contract F, the profit of a producer that accepts the contract to be a licensee is \(\pi _g^{A3} (m,F)=\left[ {{\left( {a-(n-m)\kappa } \right) }/{(m+1)}} \right] ^{2}-F\). The profit of a producer that rejects the contract is \(\pi _b^{A3} (m)=\left[ {{\left( {a-(n-m)\kappa } \right) }/{(m+1)}} \right] \kappa \). If the outside innovator wants the number of licensees to be m, it is optimal for her to set the upfront fee F high enough till \(\pi _g^{A3} (m,F)=\pi _b^{A3} (m)\). Hence, in Case A3, given that the number of licensees is m, the optimal fixed fee set by the patent holder is

\(\square \)

Proof of Theorem 1

From Lemma 2, in Case A1 the optimal fixed fee is the equilibrium price \((\left[ {a-(n+{(1-e)m}/e)\kappa } \right] )\) multiplied by the output difference between each green producer and each brown producer \(({(1-e)\kappa }/e=q_g^{*} -q_b^{*} )\). In this case, the increase in m does not diminish the green producers’ competitive advantage in quantity over the brown producers since \(q_g^{*} -q_b^{*} \) is independent of m. However, with the increasing number of green producers, the total output will increase, and the equilibrium price for the product will decrease as a result. Thus, the optimal fixed fee set by the outside innovator decreases when the number of licensees increases, that is, \({\partial F^{A1}(m)}/{\partial m}<0\).

Next, let us consider the patent holder’s decision on the number of licensees (i.e., m), which can be formulated as follows:

where \(\Pi ^{A1}\) denotes the outside innovator’s profit in Region A1.

The first derivative of the function \(\Pi ^{A1}(m)\) is

The second derivative of the function \(\Pi ^{A1}(m)\) is

Since the second derivative of the function \(\Pi ^{A1}(m)\) is negative, using first order condition we have \(m^{A1}=\frac{e\left( {a-n\kappa } \right) }{2(1-e)\kappa }\). And \(m^{A1}\le n\) iff \(e\le \frac{2n\kappa }{a+n\kappa }\). Hence, if \(e\le \frac{2n\kappa }{a+n\kappa }\), the optimal number of licensees for the patent holder is \(m^{A1{*}}=\frac{e\left( {a-n\kappa } \right) }{2(1-e)\kappa }\), otherwise \(m^{A1{*}}=n\).

Let \(\hat{{\kappa }}=\frac{(n-1)}{n}\bar{{\kappa }}\), we have \(\hat{{\hat{{e}}}}(\kappa )=\kappa /{\bar{{\kappa }}}\ge \frac{2n\kappa }{a+n\kappa }\)for \(\kappa \ge \hat{{\kappa }}\). Hence, if \(\kappa \ge \hat{{\kappa }}\), then \(m^{A1{*}}=n\). If \(\kappa \le \hat{{\kappa }}\), then

\(\square \)

Proof of Theorem 2

In Case A2, for \(m\le \hat{{m}}\), the optimal fixed fee set by the patent holder is

where \({(1-e)\kappa }/e=q_g^{*} -q_b^{*} \) is the output difference between each green producer and each brown producer, and \(\left[ {a-(n+{(1-e)m}/e)\kappa } \right] =p^{{*}}\) is the equilibrium price for the product. Since the equilibrium price for the product decreases with more producers become licensees, the optimal fixed fee set by the outside innovator will decrease in m, that is, \({\partial F^{A1}(m)}/{\partial m}<0\).

The problem encountered by the outside innovator can be formulated as follows:

where \(\Pi ^{A2}\) represents the outside innovator’s profit in Case A2.

For \(m\ge \hat{{m}}\), given that the number of licensees is m, the optimal fixed fee set by the patent holder is

where \({\left[ {a-(n+1)\kappa } \right] }/{(m+1)}=q_g^{*} -q_b^{*} \) is the output difference between each green producer and each brown producer, and \({\left[ {a-(n-m)\kappa } \right] }/{(m+1)}=p^{{*}}\) is the equilibrium price for the product. In contrast to the case of \(m\le \hat{{m}}\), in the case of \(m\ge \hat{{m}}\), the output difference \(q_g^{*} -q_b^{*} \) is decreasing with the increasing number of green producers. This implies that the increase in the number of licensees does diminish each green producer’ competitive advantage in quantity over each brown producer.

Thus, for \(m\ge \hat{{m}}\), the problem faced by the outside innovator is

In Case A2, from Lemma 1 the equilibrium output for each green producer is

Equivalently, since \(\hat{{e}}(\kappa )\le e\le \hat{{\hat{{e}}}}(\kappa )\), the equilibrium output for each green producer is

where \(\hat{{m}}=\frac{(n+1)e\bar{{\kappa }}-(1+ne)\kappa }{(1-e)\kappa }\), and it is easily to verify that \(0\le \hat{{m}}\le n\) in Case A2.

First let us consider the case \(m\le \hat{{m}}\) and the resulting equilibrium output for each green producer is \(q_g^{A2} \left| {_{m\le \hat{{m}}} } \right. =\kappa /e\). Given \(m\le \hat{{m}}\), the optimal fixed fee for the patent holder is \(F^{A2}(m)\left| {_{m\le \hat{{m}}} } \right. =\left[ {a-(n+\frac{(1-e)m}{e})\kappa } \right] \frac{(1-e)\kappa }{e}\) and the problem facing by the outside innovator is

Apply a similar analysis as in the proof of theorem 1 we have the following results:

-

(i)

if \(\kappa \ge \hat{{\kappa }}\), then \(m^{A2{*}}\left| {_{m\le \hat{{m}}} } \right. =\hat{{m}}\).

-

(ii)

if \(\kappa \le \hat{{\kappa }}\), then

$$\begin{aligned} m^{A2{*}}\left| {_{m\le \hat{{m}}} } \right. =\left\{ {\begin{array}{l@{\quad }l} \frac{e\left( {a-n\kappa } \right) }{2(1-e)\kappa },&{} \textit{if}\frac{2\kappa }{a-n\kappa }\le e\le \hat{{\hat{{e}}}}(\kappa ) \\ \hat{{m}},&{} \textit{if}\;\hat{{e}}(\kappa )\le e\le \frac{2\kappa }{a-n\kappa } \\ \end{array}} \right. . \end{aligned}$$

Now let us consider the case \(m\ge \hat{{m}}\) and the resulting equilibrium output for each green producer is \(q_g^{A2} \left| {_{m\ge \hat{{m}}} } \right. =\frac{a-(n-m)\kappa }{m+1}\). Given \(m\ge \hat{{m}}\), the optimal fixed fee set by the patent holder is \(F^{A2}(m)\left| {_{m\ge \hat{{m}}} } \right. =\frac{\left[ {a-(n-m)\kappa } \right] \left[ {a-(n+1)\kappa } \right] }{(m+1)^{2}}\) and the problem facing by the outside innovator is

The results are following:

-

(i)

if \(\kappa \ge \hat{{\kappa }}\), then \(m^{A2{*}}\left| {_{m\ge \hat{{m}}} } \right. =n\).

-

(ii)

if \(\kappa \le \hat{{\kappa }}\), then

$$\begin{aligned} m^{A2{*}}\left| {_{m\ge \hat{{m}}} } \right. =\left\{ {\begin{array}{l@{\quad }l} \hat{{m}},&{} \textit{if}\frac{2\kappa }{a-n\kappa }\le e\le \hat{{\hat{{e}}}}(\kappa ) \\ \frac{a-n\kappa }{a-(2+n)\kappa },&{} \textit{if}\;\hat{{e}}(\kappa )\le e\le \frac{2\kappa }{a-n\kappa } \\ \end{array}} \right. . \end{aligned}$$

Based on the above analysis we have:

-

(i)

if \(\kappa \ge \hat{{\kappa }}\), \(m^{A2{*}}=n\).

-

(ii)

if \(\kappa \le \hat{{\kappa }}\), then

where\({e}(\kappa )=\frac{2\kappa }{a-n\kappa }\). \(\square \)

Proof of Theorem 3

From Lemma 2, in Case A3, given that the number of licensees is m, the optimal fixed fee set by the patent holder is

where \({\left[ {a-(n+1)\kappa } \right] }/{(m+1)}=q_g^{*} -q_b^{*} \) is the output difference between each green producer and each brown producer, and \({\left[ {a-(n-m)\kappa } \right] }/{(m+1)}=p^{{*}}\) is the equilibrium price for the product. In this region, the output difference \(q_g^{*} -q_b^{*} \) and the equilibrium price \(p^{{*}}\) are both decreasing with the increasing number of green producers. Hence, the optimal fixed fee set by the outside innovator will decrease in m, that is, \({\partial F^{A3}(m)}/{\partial m}<0\).

The problem encountered by the outside innovator can be formulated as follows:

Let \(\Lambda (m)=\frac{m\left[ {a-(n-m)\kappa } \right] }{(m+1)^{2}}\), to maximize \(\Pi ^{A3}(m)\) equals to maximize \(\Lambda (m)\). The first derivative of the function \(\Lambda (m)\) is

Using first order condition we have

The second derivative of the function \(\Lambda (m)\) at \(m^{A3}\) is

which means \(\Lambda (m)\) is concave at \(m^{A3}\).

Firstly, if \(\kappa \ge \frac{a}{2+n}\), then \({\Lambda }'(m)=\frac{a(1-m)+\kappa \left[ {m\left( {2+n} \right) -n} \right] }{\left( {1+m} \right) ^{3}}\ge \frac{2a}{\left( {1+m} \right) ^{3}\left( {2+n} \right) }>0\), which means the patent holder’s profit is increasing with the number of licensee increases. Hence the optimal number of licensees for the outside innovator is \(m^{A3{*}}=n\). Secondly, if \(\kappa <\frac{a}{2+n}\), then we have\(m^{A3{*}}=\frac{a-n\kappa }{a-(2+n)\kappa }>0\). We know that \(m^{A3}=\frac{a-n\kappa }{a-(2+n)\kappa }\le n\) iff \(\kappa \le \hat{{\kappa }}\). And \(\hat{{\kappa }}<\frac{a}{2+n}\) holds for sure. Hence in Region A3, the optimal number of licensees for the patent holder is

\(\square \)

Rights and permissions

About this article

Cite this article

Xia, H., Fan, T. & Chang, X. Emission Reduction Technology Licensing and Diffusion Under Command-and-Control Regulation. Environ Resource Econ 72, 477–500 (2019). https://doi.org/10.1007/s10640-017-0201-0

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10640-017-0201-0