Abstract

In this paper, we study the impact of environmental taxation on trade in environmental goods (EGs). Using a trade model in which demand for and supply of EGs are endogenous, we show that the relationship between environmental taxation and demand for EGs follows a bell-shaped curve. Above a cutoff tax rate, a higher tax rate can reduce bilateral trade in EGs because there are too many low-productivity EG suppliers. Based on trade data from 1995 to 2012 across the EU-27 countries, our empirical results are in accordance with the predictions of our model when we use the Asia-Pacific Economic Cooperation (APEC) list of EGs. We find that environmental taxation (measured as the ratio of environmental tax revenoe to GDP) has a monotonically positive impact on the number of trading partners. Furthermore, we show that if countries were to apply an environmental tax rate equal to \(3.96\%\) (e.g., the tax rate maximizing international trade in EGs), then trade in EGs across the EU-27 members would experience an increase of 25.33 percentage points. The results are mixed when we analyse the EGs on the OECD list. While the results for the the number of trading partners are confirmed when we use this list, there is no effect of environmental taxation on import demand.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

The acceleration of trade in environmental goods and services is at the heart of the sustainable development strategies of the World Trade Organization (WTO), Asia-Pacific Economic Cooperation (APEC) forum, and European Union (EU).Footnote 1 According to OECD [Organization of Economic Cooperation and Development], (2006), “The environmental goods and services industry consists of activities which produce goods and services to measure, prevent, limit, minimise or correct environmental damage to water, air and soil, as well as problems related to waste, noise and eco-systems.” Policymakers have adopted different measures that encourage or force firms to acquire environmentally friendly technologies and equipment to prevent and abate pollution (Sauvage 2014; Zugravu-Soilita 2018, 2019; de Melo and Solleder 2020). Indeed, a distinguishing characteristic of the market for environmental goods (EGs) is that its growth is largely driven by public intervention. Academics have paid considerable attention to the impacts of tariffs on trade in EGs. Indeed, a large share of world production of EGs occurs in a limited number of countries (e.g., China, Germany, Japan, and the US) to take advantage of gains associated with specialization. After an import tariff reduction, firms are likely to increase their pollution abatement efforts because of the lower prices (Lovely and Popp 2011). However, tariffs applied to EGs are now very low, so trade policy cannot be used as a tool to favour the expansion of EGs (Tamini and Sorgho 2018; de Melo and Solleder 2020). Although environmental regulations play a decisive role in creating demand for EGs, little attention has been devoted to the effects of national environmental regulations on trade in EGs. However, if more stringent environmental policies induce a higher demand for EGs, we could expect higher international trade in EGs since the production of EGs is internationally concentrated.Footnote 2

In this paper, we study the impact of environmental taxation on import demand for EGs. We first develop a trade model in which demand and supply of EGs are endogenous and adjust in response to the environmental tax rate. In accordance with the empirical evidence, we assume that the suppliers of EGs are heterogeneous and operate under oligopolistic competition (see Sinclair-Desgagné 2008; Perino 2010; David et al. 2011). It follows that the price of EGs depends on both the price elasticity of demand and the dispersion of costs of EGs producers. Hence, environmental taxes modify demand for EGs both directly and indirectly through their impacts on the market prices of EGs as the number and average productivity of EGssuppliers adjusts. Our framework captures the interplay among polluting firms’ adoption technology decisions, EGsprices and environmental taxation.

Our theory reveals a bell-shaped curve between the environmental tax rate and import demand for EGs because two opposing effects are at work. On the one hand, the import demand for EGs from polluting firms increases with environmental taxation, ceteris paribus. On the other hand, a higher tax burden favours the entry of foreign EGs suppliers with higher marginal costs of production, thus leading to higher EGs prices, which, in turn, reduce demand for EGs. Starting from low pollution tax rates, a higher tax burden increases import demand for EGs, while their prices remain relatively low. However, above a cutoff tax rate, a higher tax burden strongly increases the price of EGs, thereby reducing demand for EGs. In other words, excessive environmental taxation can reduce import demand for EGs because foreign firms with excessively high costs enter the market.

To test our predictions, we construct a dataset on the import demand of the EU-27 members at the HS6 digit level. Following recent papers on EGs (Tamini and Sorgho 2018; Zugravu-Soilita 2019; de Melo and Solleder 2020), we use the list of EGs provided by the APEC and OECD, which is also used for discussion purposes in international negotiations (see Sugathan 2013). In addition, we need information about environmental taxation for different countries and years. We examine the member states of the EU-27 because information on environmental taxes (on energy, transport, pollution and resources) is available. More precisely, environmental taxes are measured as the ratio of total environmental tax revenue to gross domestic product (GDP).

The bilateral trade equation that we estimate is a reduced form derived from our theory and differs from the standard gravity model (Anderson 2010). As environmental taxation drives the size of the market for EGs, our model yields a gravity equation that considers a country’s environmental taxation in addition to its income. Furthermore, the relationship between imports of EGs and the environmental tax rate prevailing in a country is non-log-linear in equilibrium. Such a difference occurs because we use a Cournot model instead of a monopolistic competition model (or a perfect competition model) to take into account the characteristics of the eco-industry (Sinclair-Desgagné 2008).

To estimate the impact of environmental taxation on the number of trading partners (extensive margin) and import demand (intensive margin), we use flexible specifications based on Santos Silva and Tenreyro (2006) and Santos Silva et al. (2014). We find that higher environmental taxation in the EU increases the number of exporter countries serving the EU countries. More precisely, our results indicate that an increase in our measure of environmental taxation of 1 percentage point should be followed by an increase of \(5.64\%\) in the number of EU member countries’ trading partners. In addition, considering the APEC list of EGs, the relationship between environmental taxation and import demand for EGs from the EU-27 countries follows a bell-shaped curve. Provided that the tax burden is not excessively high (lower than \(3.96\%\)), the import demand for EGs can increase if environmental taxation in the EU, measured as the ratio of environmental tax revenues to GDP, marginally rises because it is still on the increasing side of the bell-shaped curve. Our analysis shows that if importing countries apply a ratio equal to \(3.96\%\) (e.g., the ratio maximizing intra-EU-27 international trade in EGs), then trade in the EGs on the APEC list would experience an increase of 25.33 percentage points. It is also worth stressing that we find no effect of environmental taxation when we use the OECD list of EGs and when we focus our analysis on the “Air pollution control” subgroup of the APEC list. The bell-shaped curve is obtained for the APEC list subgroups “Waste water management” and “Energy/heat saving and management,” while we find a positive relationship between environmental taxation and trade for the subgroups of “Solid waste management,” “Renewable energy plant” and “Environmental monitoring, analysis and assessment; Noise and vibration abatement,” indicating that there is room to increase environmental taxes to boost intra-EU trade.

Related literature The literature on the impact of national environmental policies on trade in EGs is sparse. Much attention has been paid to the impacts of environmental taxation on the competitiveness and location of polluting industries.Footnote 3 However, this body of literature disregards the effects of environmental taxation on trade in EGs. Recent empirical contributions have analysed the impact of environmental regulation on exports of the EU-15 countries (Costantini and Mazzanti 2012), of the energy sector (Costantini and Crespi 2008), and of US environmental product manufacturers (Becker and Shadbegian 2008). Unlike these studies, we provide clear microeconomic foundations for the relationship between environmental taxes and import flows in EGs.

Our study also contributes to a growing body of trade and environment literature that considers the production of EGs under imperfect competition in the eco-industry (Baumol 1995; Avery and Boadu 2004; Canton et al. 2008; Greaker and Rosendahl 2008; David and Sinclair-Desgagné 2010; Nimubona 2012; Schwartz and Stahn 2014). Theoretical approaches commonly consider a closed economy with a price-taking polluting industry that contracts out EGs from identical suppliers competing à la Cournot (with a fixed number of EGs providers). In our framework, polluting firms and EGs suppliers are heterogeneous in terms of productivity.

Note that Perino and Requate (2012) find that the theoretical relationship between the rate of advanced technology adoption and the stringency of environmental policy has an inverted U shape. Their approach is very different from ours because it includes neither an output market nor an eco-industry. Their result is driven by the assumption that the marginal abatement cost curves of conventional and new technologies intersect. Without this assumption, we also show the existence of a non-monotonic relationship between environmental policy stringency and the rate of technology adoption.

The rest of the paper is organized as follows. Section 2 describes our model and presents our main predictions. The data and the empirical model are detailed in Sect. 3, whereas Sect. 4 provides the results and analysis of the estimations. We conclude in Sect. 5.

2 Theory

We consider a multicountry model with one upstream industry providing tradable EGs that are used by a downstream industry producing a polluting product. We focus on end-of-pipe pollution abatement. In each country, a tax rate is applied to each unit of pollution. Demand from polluting firms for abatement activities is created by this environmental tax rate. In our approach, firms decide whether to purchase EGs to reduce their level of pollution. We assume that polluting firms are heterogeneous in terms of their ability to reduce emissions and that countries are heterogeneous in terms of their ability to develop an EG-producing industry.

It should be noted that our model cannot capture all characteristics of the EGs industry. Indeed, this industry includes not only the production of cleaner technologies but also the production of products and services that reduce environmental risk and minimize pollution and resource use. However, our approach allows us to explain why some countries export/import EGs and the magnitude of bilateral trade in this type of product.

2.1 The Polluting Industry (or Downstream Industry)

We consider that abatement activities, which are related to treatment/capture, recycling, disposal, and pollution prevention, use environmental goods purchased from the eco-industry (\(a_{j}\)) and require a fixed requirement \(\phi _{j}\) of labour. We assume that labour is inelastically supplied in a competitive market and is chosen as the numé raire. The cost \(g\text {{}}\)associated with pollution of a firm located in country j producing variety v is given by

where \(t_{j}\) is the environmental taxation and \(e_{j}\) is the quantity of pollution, while \(a_{j}\) is the quantity of EGs purchased by the firm and \(z_{j}\) is the price of EGs used in country j. The quantity of pollution emitted by each firm is expressed as

with \(\xi _{j}>0\) and \(\alpha <1\). Hence, the level of emissions for a firm increases with the production of the final product \(q_{j}(v)\) and decreases with abatement activities \(\theta _{j}(v)\). We assume diseconomies of scale in the use of abatement services (\(\alpha <1\)), and \(\varphi\) reflects the ability of firms to reduce pollution for the same level of EGs. The effects of abatement activities (\(a_{j}\)) increase with firm efficiency \(\varphi\). We consider that firms belonging to the final sector differ in \(\varphi \in [\varphi _{\min },\infty )\) such that the level of pollution varies across firms adopting an abatement technology.Footnote 4

The cost associated with pollution can be rewritten as

with

Note that if the firm does not purchase EGs, then it has to pay a tax equal to \(t_{j} \xi _{v} q_{j} (\upsilon )\). It follows that a firm invests in abatement activity provided that \(\psi _{j} (\varphi ) >0\).

Demand for EGs (\(a_{j}(\upsilon )\)) differs across firms as d\(g_{j}/\)d\(a_{j}=0\) yields

Demand for the environmental product is positively affected by the pollution tax rate and the ability of firms to reduce their emissions. More interestingly, the positive effect of the pollution tax rate on demand for EGs increases with firm productivity. In other words, the effect of pollution taxation on the diffusion of EGs is strong in countries that host high-productivity firms. Inserting (5) into (4) yields the gain associated with the use of EGs by a \(\varphi\)-type firm:

Hence, there exists a productivity cutoff above which demand for EGs is positive. Formally, \(a_{j}(\upsilon )>0\) if and only if \(\varphi >\overline{ \varphi }_{j}\) with \(\overline{\varphi }_{j}\) such that \(\psi ( \overline{\varphi }_{j})=0\) or, equivalently,

In other words, the probability of purchasing the environmental good is positively related to the pollution tax rate and negatively related to the fixed and variable costs associated with the use of the abatement technology. For a given \(z_{j}\), if \(t_{j}\) tends to zero, then \(\overline{ \varphi }_{j}\) tends to infinity such that no polluting firms introduce an abatement technology.

We now determine the mass of firms adopting an abatement technology. We assume that the polluting firms do not have a priori knowledge of their ability to curb pollution (\(\varphi\)). Indeed, introducing an abatement technology pulls a firm away from its core competency. In addition, we consider that firms are risk neutral and must pay a sunk cost equal to \(f_{e}\) units of labour to enter the abatement market.

Hence, demand of the downstream industry for EGs is given by \(A_{j}=\int _{\Omega _{j}^{e}}a_{j}(\varphi )\)d\(G(\varphi )\), where \(\Omega _{j}^{e}\) is the set of firms using EGs and \(G(\varphi )\) is the cumulative density function of \(\varphi\). Using (5), we obtain the aggregate demand for EGs in country j

where \(M_{j}^{e}\) is the mass of firms purchasing EGs in country j, \(g(\varphi )\) is the density function, and \(1-G(\overline{\varphi }_{j})\) is the probability of purchasing EGs. Note that \(M_{j}^{e}=[1-G(\overline{ \varphi }_{j})]M_{j}\), where \(M_{j}\) is the total mass of firms in country j. (In “Appendix A”, we extend our model by considering the case where \(M_{j}\) is endogenous.)

We assume that \(\varphi\) follows a Pareto distribution with a lower bound \(\varphi _{\min }\) for the support of the productivity distribution and a shape parameter \(\gamma\) such that \(G(\varphi )=1-(\varphi /\varphi _{\min })^{-\gamma }\) and \(g(\varphi )=\gamma \varphi _{\min }^{\gamma }\varphi ^{-\gamma -1}\). Smaller values of the shape parameter \(\gamma\) correspond to a greater dispersion in productivity. We assume that \(\varphi _{\min }=1\) without loss of generality such that \(\gamma >\eta /\alpha\) for the distribution of firm revenue associated with the use of EGs has a finite mean. Using the Pareto productivity distribution assumption, \(A_{j}\) can be rewritten as

where it is assumed that \(\gamma -1/\alpha >0\) to ensure that \(A_{j}>0\). It is worth stressing that \((t_{j}/z_{j})^{1/\alpha }\gamma (\gamma -1/\alpha )^{-1}\overline{\varphi }_{j}^{1/\alpha }\) can be viewed as an intensive margin (average demand) and \(M_{j}\) as an extensive margin (the number of firms purchasing EGs). Note that \(A_{j}\rightarrow 0\) when \(\overline{ \varphi }\rightarrow \infty\). In addition, as expected, aggregate demand for EGs depends positively on the tax rate and negatively on the price of EGs (\(z_{j}\)). However, we have to consider the impact of the tax rate on price formation. As we will see below, the price of EGs increases with the tax rate, thus implying an ambiguous effect of the pollution tax rate on demand for EGs.

A manufacturer enters the green market as long as the expected value of entry is higher than the sunk cost of entry (\(f_{e}\)). The expected gain of a manufacturer prior to entering the green market is given by \([1-G( \overline{\varphi }_{j})]\psi _{j}^{e}\), where \(\psi _{j}^{e}\) is the expected gain associated with the use of EGs conditional on successful entry and \(1-G(\overline{\varphi }_{j})=\overline{\varphi }_{j}^{-\gamma }\). Because the ex post productivity distribution of firms purchasing EGs is \(g(\varphi )/[1-G(\overline{\varphi }_{j})]\), we have

where we have inserted (7) in (6). Because \(\overline{ \varphi }_{j}\) is such that \(\overline{\varphi }_{j}^{-\gamma }\psi _{j}^{e}=f_{e}\), we obtain

It is worth stressing that our assumptions related to emissions abatement differ from those on the standard abatement technology developed in Copeland and Taylor (2003). As in Copeland and Taylor (2003), labour can be allocated to production and emissions reduction. However, we consider that the cost of abatement depends not only on fixed requirements in labour \(\phi _{j}\) but also on a market price of abatement \(z_{j}\). Polluting firms behave as price takers in this market, and \(z_{j}\) also depends on the market structure prevailing in the eco-industry as well as on the costs of producing and distributing EGs. The cost associated with abatement activity in Copeland and Taylor (2003) is implicit and is modeled as an opportunity cost: the cost of diverting production factors from production of manufactured good. In addition, the gains associated with abatement technology are assumed to be uncertain. A manufacturer adopts an abatement technology if the expected gains are higher than the sunk cost of entry. In Copeland and Taylor (2003), there are neither sunk costs nor uncertainty associated with abatement activity.

2.2 Eco-Industry (The Upstream Industry)

We consider that each country can host at most a single producer of EGs. The EGs producers serve each country j under oligopolistic competition. The profit of a supplier of EGs located in country i with \(i=j\) or \(i\ne j\) is given by \(\pi _{i}=\sum _{j}\Pi _{ij}\), with

where \(c_{ij}\equiv \tau _{ij}/\zeta _{i}\) is the marginal cost of serving market j, \(\tau _{ij}\) is an iceberg trade cost between countries i and j (with \(\tau _{jj}<\tau _{ij}\) when \(i\ne j\)) and \(\zeta _{i}\) is the productivity of the firm. \(F_{j}\) is the fixed cost of distributing and adapting to serve market j, and \(a_{ij}\) is the volume of EGs supplied by the firm. The EGs provider sets its quantity \(a_{ij}\) knowing \(A_{j}\) (see ( 8)), but it does not internalize the impact of its choice on the mass of polluting firms purchasing EGs. The market clearing condition implies that \(A_{j}=a_{ij}+\sum _{k}a_{kj}\), where \(a_{kj}\) is the supply of rivals located in country \(k\ne i\). Using (8) implies

Equivalently, the inverse demand of country j is

with \(\Lambda _{j}\equiv \left[ \frac{\gamma }{\gamma -1/\alpha }\overline{ \varphi }_{j}^{-(\gamma -1/\alpha )}M_{j}\right] ^{\alpha }\). Maximizing \(\Pi _{ij}\) with respect to \(a_{ij}\) leads to

where \(a_{ij}/A_{j}\) is the share of imports of country j from country i and \(m_{ij}\) is the margin of an exporter located in country i serving country j. As expected, this share and the margin decrease with bilateral trade costs (\(\tau _{ij}\)) and increase with the productivity prevailing in the exporting country. As a result, bilateral trade volumes in EGs are higher between more industrialized countries. Using (14) and (15) yields

Using the market clearing condition \(A_{j}=\sum _{k}a_{kj}\) (including \(k=i\) ), we obtain the equilibrium price

where \(\overline{c}_{j}\) is the unweighted average cost to produce the EGs consumed in country j and \(N_{j}\) is the number of firms (or trade partners) supplying the EGs consumed in country j. As expected, lower trade barriers, more producers, and higher elasticity of demand for EGs (lower \(\alpha\)) reduce the price of EGs. Note that in a heterogeneous-cost Cournot oligopoly, total output \(A_{j}\) decreases with the average cost, regardless of the cost distribution, for a given number of firms (see Van Long and Soubeyran 1997; Février and Linnemer 2004). Consequently, under free entry, pollution taxation can also modify the average cost of a change in the number of firms and thus in demand for EGs.

We now determine the number of firms (and the average cost of) supplying an abatement technology in country j. A supplier of EGs serves country j as long as \(\Pi _{ij}\ge 0\). Equivalently, \(c_{ij}\le c_{j}^{\max }\)

The cutoff cost level \(c_{j}^{\max }\) is defined as the level at which a firm would remain in market j. In equilibrium, only firms with \(c_{ij}\le c_{j}^{\max }\) can stay in the market. Using (9), it is straightforward to verify that \(\partial c_{j}^{\max }/\partial t_{j}>0\) for a given \(z_{j}\). Hence, ceteris paribus, a higher tax burden in a country allows more firms with lower productivity to serve that market and therefore implies a higher average cost of \(\overline{c}_{j}\). As a result, a higher pollution tax rate has an ambiguous effect on the demand for environmental products \(A_{j}\). If the tax burden has a positive direct effect on demand for EGs, there exists a negative indirect effect through an increase in the average marginal cost of production (and in the price of EGs). Notice also that environmental taxes lead to the emergence of a domestic eco-industry provided that the productivity of the domestic firm \(\zeta _{j}\) is high enough (\(\zeta _{j}>\tau _{jj}/c_{j}^{\max }\)). Due to its advantage in trade costs, a domestic provider can serve its own country even though its productivity is relatively low.

Because the number of firms responds to a change in the tax burden, we need to specify the cost distribution \(c_{ij}\) to study the impact of \(t_{j}\) on \(z_{j}^{*}\). We assume without loss of generality that the marginal production cost of the \(i^{th}\) firm serving country j is given by \(c_{ij}=c_{0}i^{\mu }\), with \(c_{0}>0\) and \(\mu >0\). Hence, the supplier of EGs located in country j produces at the lowest marginal cost \(c_{0}\), whereas the marginal cost of producing EGs is higher in country i. Consequently, if \(N_{j}\) producers of EGs serve country j, then the highest marginal cost is given by \(c_{j}^{\max }=c_{0}N_{j}^{\mu }\), and \(\overline{c}_{j}=c_{0}\frac{1}{N_{j}}\sum _{i=1}^{N_{j}}i^{\mu }\). From (17), it follows that \(\partial z_{j}^{*}/\partial N_{j}>0\), as long as the elasticity of the average cost to a change in the number of EGs producers (\((\partial \overline{c}_{j}/\partial N_{j}).(N_{j}/\overline{c}_{j})\)) is greater than \(\alpha /(N_{j}-\alpha )\). In other words, such a configuration occurs when the cost distribution is not too concave (i.e., when \(\mu\) is not excessively low) and when the price elasticity of demand for EGs (\(1/\alpha\)) is sufficiently high. Because suppliers of EGs are heterogeneous in terms of their production costs, an increased number of firms has two opposite effects on equilibrium prices. On the one hand, more firms make competition tougher through more fragmented individual demand (\(A_{j}/N_{j}\)). On the other hand, less efficient firms can enter the market, thereby inducing a higher average cost. The net effect on equilibrium prices is positive when the cost distribution is not too concave. Using \(\Pi _{ij}(c_{j}^{\max })=0\), we obtain

where \(\partial \Pi _{ij}/\partial t_{j}>0\) (via an increase in \(A_{j}\)). Some standard calculations show that \(\partial \Pi _{ij}/\partial z_{j}<0\) when \(c_{ij}<z_{j}(1-\alpha )/(1+\alpha )\). This condition holds when the price elasticity of demand for EGs (\(1/\alpha\)) is sufficiently high. Remember that when \(1/\alpha\) is not excessively low, we also have \(\partial z_{j}^{*}/\partial N_{j}>0\). Hence, an increase in the pollution tax rate can favour the entry of less efficient suppliers, thus implying an increase in the average cost and the equilibrium price of EGs when the price elasticity of demand for EGs is not excessively low.

2.3 Environmental Taxation and Equilibrium Trade

We are now equipped to study the impact of environmental taxation when the price of EGs adjusts to a change in the tax burden. The impact of the pollution tax rate on demand for EGs is given by

with \(\varepsilon _{z,t}\equiv \frac{\mathrm {d}z_{j}}{\mathrm {d}t_{j}}\frac{ t_{j}}{z_{j}}>0\). Clearly, a higher tax burden increases demand for EGs provided that the tax elasticity of the EGs price (\(\varepsilon _{z,t}\)) is not excessively high. It follows that there exists a tax rate that maximizes demand for EGs when the relationship between the price and the tax burden is positive and convex. In this case, there is a bell-shaped relationship between environmental taxation and demand for EGs. Starting from pollution tax rates, a higher tax burden increases demand for EGs. Above the cutoff tax rate, an increase in the price of EGs increases the tax burden and reduces demand for EGs. Hence, excessively high pollution tax rates can reduce demand for EGs because there are too many high-cost entrants.

We have shown that a higher pollution tax rate favours the entry of new firms/countries and may reduce demand for EGs when the tax burden reaches high values. Consequently, the effect of the tax rate on bilateral trade is ambiguous, as

which is positive if and only if

It follows that exports from countries with low production costs decrease when the tax burden increases because new firms/countries serve the market. Even though the output sizes of low-production-cost countries attain high values, their market shares erode when pollution tax rates increase.

3 Data and Empirical Strategy

The objective of our empirical application is to check the validity of our theory. More precisely, we test whether (i) a higher pollution tax rate increases the number of partner countries (a positive effect of environmental taxation on the extensive margin) and (ii) whether we observe a bell-shaped relationship between the environmental tax rate and bilateral trade in EGs (a non-linear effect of environmental taxation on the intensive margin). Unfortunately, the empirical work relies on aggregated data, and we do not observe the market prices of EGs. As a result, we cannot directly test whether higher environmental tax rates favour the entry of low-productivity suppliers of EGs as predicted by theory. Hence, we cannot precisely identify the mechanisms that might explain the bell-shaped relationship between the environmental tax rate and import demand for EGs.

3.1 Data Description

Our study covers the period of 1995–2012. We examine the imports of the EU member states from their EU trading partners because information on environmental taxation is available for these countries. We describe our two main data sources on EGs trade and taxation. The description of the data used and descriptive statistics are presented in “Appendix B”.

There is no universally accepted definition of EGs. For example, there is no consensus at the WTO regarding the definition of EGs. The difficulty in reaching a consensus lies in the fact that some products are used for both environmental and non-environmental purposes. In addition, there is no guarantee that a product reported on an EGs list has a lower environmental impact than that of another product. Despite this difficulty, to inform multilateral discussions, some organizations compile lists of environmental products. The lists composed by the APEC and OECD are used as references for environmental goods classification. Based on the EU definition of EGs, the OECD list developed in 1997 was brought up to date in 2012 and was established on the basis of general categories of goods and services used to measure, prevent and reduce environmental damage and to manage natural resources.Footnote 5 It identifies EGs based on the HS6 trade nomenclature. However, this system does not allow the isolation of products used only for environmental purposes. The APEC list, which was created between 1998 and 2000, identifies EGs according to national customs nomenclatures using eight- or ten-digit codes. It is more pragmatic and more precise than the OECD list. In addition, the APEC list is used in the trade literature because this list has served as a point of departure in WTO negotiations for the Environmental Goods Agreements (Zugravu-Soilita 2019; de Melo and Solleder 2020). Because of technological progress, no list can be exhaustive, and each must allow for regular updates. The goods referenced on the OECD and/or APEC lists include a wide variety of basic industrial products, such as valves, pumps and compressors, that can be specifically employed for environmental purposes. Table 1 reports the subgroups of EGs from these lists. Because we exclude services, our sample concerns 112 HS6 products from the OECD list and 54 HS products from the APEC list. When we merge the two lists, we obtain a list of 138 HS6 products (hereafter referred to as the merged list). As shown in Table 8 reported in “Appendix B”, only 27 products are common to the two lists. The detailed lists of EGs are presented in Steenblik (2005) and Sugathan (2013).

The data cover the bilateral trade flows of the EU member states and were collected at the HS6 digit level. Trade data regarding EGs were obtained from the UN Comtrade database. Figure 1 indicates that there was continuous growth in intra-EU-27 trade in EGs over this period, and there are no significant differences in trade in EGs between the APEC list and the OECD listFootnote 6. We provide additional summary statistics for the trade data in “Appendix B”. Note that even though the two lists are different, with one exception, the leading importing and exporting countries are the same (see Tamini and Sorgho 2018). The EU-27 is a good example for analysing the impact of regulation on trade in EGs, as tariffs are nonexistent and its members all apply the same standards.

We now describe our variables capturing environmental taxation. As defined by the EU, “an environmental tax is one whose tax base is a physical unit (or a proxy of a physical unit) of something that has a proven, specific negative impact on the environment.”Footnote 7. There are four types of environmental taxes: (i) energy taxes, (ii) transport taxes, (iii) pollution taxes and (iv) resource taxes. The EU data provide information regarding environmental taxation asthe ratio of total environmental tax revenue to GDP (in percent) for each EU member state. Our measure is a kind of apparent tax. Even if such a measure is imperfect, it helps to provide an understanding of the tax burden and to compare the environmental taxes across countries. Metcalf (2009) as well asDe Santis and Jona Lasinio (2016) use the same measure to capture the stringency of environmental policy. The difficulty of having a more precise measure is related to the diversity of taxes that have to be taken into account. In our case, a higher ratio may capture the fact that the stringency of EU policy has increased (a tax rate effect) and/or that the EU is less clean (a tax base effect). However, if a rise in the ratio is only due to a rise in the tax base, demand for EGs (and, in turn, import demand) should not increase. Hence, our estimations may underestimate the effect of environmental taxation on import demand for EGs. Descriptive statistics are reported in Table 2.Footnote 8

However, there are missing data regarding environmental taxation and public environmental protection expenditure (one of the control variables included in the models) for some countries included in the database (newer members of the EU). This leads to 268 observations for the model of the extensive margin of trade and 4198 observations for the model of the intensive margin of trade.

3.2 Empirical Model of Extensive Margin

As previously mentioned, our theoretical model implies a positive relationship between environmental taxation \(t_{j}\) and the number of countries serving country j. There are different identification problems to address.

First, our dependent variable is a count variable bounded from below by zero and from above by the number of available trading partners. The doubly bounded nature of the data implies that the partial effects of the regressors on the conditional mean of the extensive margin (the dependent variable) cannot be constant and must approach zero as the conditional mean approaches its bound (Santos Silva et al. 2014). Thus, standard count data estimators (such as the Poisson maximum likelihood estimator or the negative binomial estimator) may be unsuitable. These approaches ignore the upper bound of the number of trading partners. Therefore, we follow Santos Silva et al. (2014) and use a flexible specification that takes into account the doubly bounded nature of the data. Let \(\overline{N}\) denote the maximum number of trading partners that can potentially serve each country and \(N_{j t}\) the number of countries serving country j in year t. It is possible to write the conditional expectation of the number of countries exporting to j as \(E (N_{j t}\vert \varvec{x}_{j t})\), where \(\varvec{x}_{j t}\) denotes a set of explanatory variables. By construction, \(0 \le N_{j t} \le \overline{N}\); thus, the expected value of the number of countries exporting to j in year t can be expressed as

where \(\mathbf {\beta }\) is a vector of parameters, \(f \left( \varvec{x} _{j t}^{ \prime } \mathbf {\beta }\right) =1 -[1 +\lambda \exp \left( \varvec{x}_{j t}^{ \prime } \mathbf {\beta }\right) ]^{ -\frac{1}{\lambda }}\) is the probability that a randomly drawn country exports to j, and \(\lambda >0\) is the shape parameter. The estimated model is

where \(t_{j t}\) is environmental taxation expressed as the revenue share of GDP and \(\varvec{W}_{j t}\) is a set of control variables. In (24), the parameter of interest is \(\beta _{1}\) for the environmental taxation variable, which is expected to be positive.

Second, we have to control for taxes being endogenous (Tosun 2013; Vollenweider 2013; Castro et al. 2014), as confirmed by Durbin-Wu-Hausman tests. We use the two-year lagged value of the environmental tax rate as an instrument. Durbin-Wu-Hausman tests reveal that these lagged values are exogenous with respect to current-period effects.Footnote 9

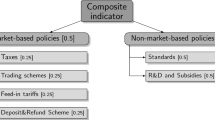

Control variables (\(\varvec{W}_{jt}\)) Environmental taxation only captures part of existing environmental policies (Brunel and Levinson 2016). To control for other policies when analysing the impact of environmental taxation, we also consider the number of international environmental agreements (IEAs) signed by a country as a proxy of environmental regulation stringency, which could determine demand for EGs in the country. Compliance with IEAs requires more stringent domestic policy. Thus, having signed an IEA signals high environmental sensitivity and a government’s willingness to harmonize its environmental policy with international standards to make it more effective (Rose and Spiegel 2010; Vollenweider 2013; Zugravu-Soilita 2019), thus implying higher demand for EGs. However, stringent domestic policy could be linked to the ability of the domestic industry to comply with the policy. In this case, stringent domestic policy reveals that the country has a competitive advantage in producing EGs (Steinberg and VanDeveer 2012; Birkland 2014), so stricter environmental policy does not imply more imports of EGs.Footnote 10 Because of these two potential effects as well as the fact that some policies are harmonized within the EU, we do not have expectations regarding the sign of the estimated coefficient of this variable. We control for the possibility that the number of IEAs is endogenous (Simmons 2010; Tosun, 2013; Vollenweider 2013; Castro et al. 2014). We follow the approach proposed by Baier et al. (2014) to control for the impact of the number of signed IEAs by using as instrument \(\text {{}}\Delta IEA_{t}=IEA_{t}-IEA_{t-3}\). Using this approach and the fixed effects in our estimation allows us to control for the number of IEAs and their possibility of being endogenous (Baier and Bergstrand 2007; Head and Mayer 2014; Baier et al. 2018) while we analyse the impact of environmental taxation.Footnote 11 Furthermore, we consider public expenditures on environmental protection as a control variable.Footnote 12 By introducing public environmental protection expenditures, we control for domestic policies that could boost domestic eco-industries (a supply-side effect) and/or demand for EGs (Brunel and Levinson 2016; Costantini and Mazzanti 2012). We have no expectation about the sign of the coefficient associated with the latter variable.

Our estimation includes various other control variables based on the empirical literature on international trade (Egger et al. 2011). We introduce year fixed effects. In addition, we have to control for time-varying, country-specific determinants. Because countries differ in terms of the global tax burden imposed on industries, the effect of a given change in environmental taxation may vary across countries. To control for international differences in terms of business taxation, we introduce a measure of total tax income less environmental tax income as a share of GDP. Indeed, a high global tax burden can make firms more sensitive to changes in environmental taxation. In other words, national industries facing the same level of environmental taxation may exert different levels of pollution abatement effort because their global tax burden differs. We also introduce a variable Eurozone that takes the value of 1 for a destination country in the eurozone. Finally, because we consider the 27 members in the entire dataset, we introduce a variable taking the value of 1 for a destination country that is a member of the European Union.

3.3 Empirical Model of the Intensive Margin

By extending our model, we can derive a gravity-type trade equation (Anderson and van Wincoop 2003).Footnote 13 From the framework developed in Sect. 2, we use the value of the total output of country i given by \(Y_{i} =\sum _{j}z_{j} a_{i j}\) with \(z_{j} a_{i j} =\frac{1}{\alpha } m_{i j} (t_{j}) A_{j}\). In equilibrium, \(Y_{i}\) equals total sales to all destination countries j, such that

where \(\Pi _{i} \equiv \sum _{j}m_{i j} (t_{j}) A_{j}\) can be interpreted as an “outward multilateral resistance” (see Anderson 2010). In “Appendix A”, we show that demand for EGs is given by

Equation (26) provides the bilateral trade equation to be estimated. This trade equation shares some similarities with the standard gravity model of bilateral trade flows (Anderson 2010). The level of imports is a function of the size of the exporting country (through \(Y_{i}\)) and the size of the importing country (through the total mass of firms \(M_{j} (t_{j})\), which also depends on the mass of labour \(L_{j}\)). Furthermore, as in Anderson (2010), \(\Pi _{i}\) captures outward multilateral resistance (OMR). In addition, because \(z_{j}^{ *} =N_{j} \overline{c}_{j}/(N_{j} -\alpha )\), with \(\overline{c}_{j}\) \(=(\sum _{k}\tau _{k j}/\zeta _{k})/N_{j}\), \(\overline{c}_{j}\) can be viewed as inward multilateral resistance (IMR).Footnote 14 The OMR subsumes the impact of outward policy frictions and technologies available in the downstream industry and affects the probability of using an abatement technology. The IMR consistently aggregates inward frictions, subsumes the impact of international technology available in the eco-industry and affects the probability of using an abatement technology and thus of demanding EGs.

However, our equation (26) differs from the standard gravity model. First, in the case of EGs, we cannot use national income only because the size of the market for EGs also depends on environmental regulations and the share of firms purchasing EGs. This is why our gravity equation considers environmental taxation in addition to income. Second, as shown above, the relationship between export sales of EGs and the pollution tax rate prevailing in the importing country is non-log-linear in equilibrium. Recall that the standard gravity model specifies bilateral trade as a log-linear function of the income of the two trading partners. This second difference arises from the fact that we use a Cournot model instead of a monopolistic or perfect competition model.Footnote 15 In our framework, the markup over the marginal cost (\(m_{i j} (t_{j})\)) is not constant but instead depends on environmental taxation. It follows that bilateral trade is not a log-linear function of the environmental tax rate.

Therefore, we use a “general gravity” model, defined formally in Head and Mayer (2014) and in Fally (2015), into which we insert environmental taxation. Hence, we estimate the reduced-form equation

where \(a_{ijt}\) is the bilateral trade value in year t, \(t_{jt}\) is environmental taxation, expressed as the ratio of environmental tax revenue to GDP, \(\varvec{X}_{ijt}\) is a vector of control variables, \(\mathbf {FE }\) a set of fixed effects, and \(\epsilon _{ijt}\) is the error term. To consistently estimate equation (27), we use a Poisson pseudo-maximum-likelihood (PPML) estimator with clustering.Santos Silva and Tenreyro (2006) showed that the PPML procedure yields consistent estimates in the presence of heteroskedasticity. We also control for the possibility that taxes are endogenous using the two-year lagged value of taxes as an instrument. Because we introduce environmental taxation variables as simple and squared values, we can test the hypothesis that a non-linear relationship exists between environmental taxation and bilateral trade in EGs.

Control variables The vector of control variables \(\varvec{X} _{ijt}\) includes the business tax burden, which is measured as total tax revenues minus environmental tax revenues as a percent of GDP, the numbers of IEAs signed by the origin country and the destination country, and public environmental protection expenditure in the origin and destination countries (for the same reasons as explained for the extensive margin). As for the extensive margin model, we control for the possibility that the number of IEAs is endogenous. We expect a positive effect of the number of IEAs and public environmental protection expenditure on the intensive margin.Footnote 16

We also consider the variables suggested in the gravity model literature (Anderson and van Wincoop 2004; Head and Mayer 2014) for country pairs: distance, common legal system and shared borders. Furthermore, the variable Eurozone takes the value of 1 if the (origin or destination) country is in the eurozone, and the variable Productivity measures the (log) value of output per worker in the manufacturing sector in the destination and origin countries to capture the economic performance of the countries and thus implicitly of the downstream industry.

Finally, we include exporter, importer, and year fixed effects, and the standard errors are clustered by country pair. Because our key variable (\(t_{jt}\)) varies both over time and across countries, we cannot include time-varying exporter or importer fixed effects.Footnote 17 To check the robustness of our results, we use an alternative specification to control for the presence of unobserved time-invariant bilateral factors that influence the relationship (Baier and Bergstrand 2007; Raimondi et al. 2012; Fally 2015).Footnote 18

4 Empirical Results

4.1 The Extensive Margin of Trade

The results of the model of the extensive margin of trade are reported in Table 3, while Table 4 reports the average marginal effect of environmental taxation. The tables present the results when we estimate equation (24) with the Bernoulli pseudo-maximum-likelihood estimators (taking into account the doubly bounded nature of the dependent variable) considering the EU countries as the only sources of imports in Panel A and the dataset with 155 countries as sources of imports in Panel B).Footnote 19

Our results suggest that increasing environmental taxation boosts the number of trading partners. Based on the results of the estimations and the mean number of trading partners throughout the entire dataset, the increase in the number of trading partners following an increase in environmental taxation of 1 percentage point is \(5.64\%\), \(5.40\%\) and \(5.67\%\) for the APEC, OECD and merged lists, respectively, in the sample of intra-EU-27 trading partners. Based on partial effects of environmental taxation on the conditional mean of the number of trade partners (reported in Table 4), a country with environmental taxation that is 1 point higher is predicted to have 1.2more EU trade partners, other things being equal (note that the average number of trade partners is approximatively 20). When considering all trading partners (155 countries), the increase on the extensive margin is \(3.05\%\), \(2.81\%\)and \(2.56\%\)for the APEC, OECD and merged lists, respectively. The effects of environmental taxation are less significant when we introduce non-EU countries because the distance to these countries (which acts as a barrier to trade) is higher.

We go further in analysing the impact of environmental taxation the number of products imported (at the HS6 digit level) and the number of shipments) and the number of “shipments” (at the country-product level). The results are reported in “Appendix C” (see Tables 10 and 11). We find that environmental taxation has a significant positive impact on both the number of products imported and the number of “shipments” for the APEC list of EGs, while the impact is non-significant for the OECD list and the merged list. As in Tamini and Sorgho (2018) and Zugravu-Soilita (2019), our results depend on the list of EGs that we use.

An interesting result is the negative impact on the extensive margin of public environmental protection expenditure, while the number of signed IEAs does not have an impact on the extensive margin of intra-EU trade of EGs. These results suggest that these measures are oriented toward domestic industry or industries with established trading partners (see Table 3). Finally, non-environmental taxation has a negative impact when we consider the extensive margin of intra-EU trade, while the impact is positive when we consider the larger database, the latter being expected.

4.2 The Intensive Margin of Trade

4.2.1 Results of the Aggregated Lists

The results of our estimations are reported in Table 5. Columns I and II report the results for the APEC and OECD EGs lists, respectively. Column III presents the estimation results for the merged lists.

Standard gravity variables The bilateral trade effects of the standard variables (distance, contiguity, and common legal system) are as expected. The estimated coefficients associated with distance are similar to those reported in the literature (e.g., Head and Mayer 2014; Tsurumi et al. 2015; He et al. 2015). However, our results indicate that the magnitude of the coefficient associated with distance is greater for trade in N-EGs (Table 12) than for trade in EGs (Table 5). This finding can be explained by the relatively high concentration of the eco-industry (Nimubona 2012; Tamini and Sorgho 2018), thus implying lower substitution capabilities between countries of origin. Having a common legal system has a positive and significant impact on the intensity of trade. The coefficient associated with contiguity is non-significant, which indicates that a common border does not have an impact on the intensity of trade in EGs within the EU. The same result holds for being in the eurozone.

Environmental taxation Our results confirm the non-linear impact of environmental taxation on intra-EU-27 trade when the APEC list of EGs is considered. While the coefficients are significant for the APEC list, this is not the case for the OECD list (no coefficients associated with the destination country are significant). For the APEC list of EGs, a bell-shaped relationship between environmental taxation and trade is confirmed. The coefficient associated with environmental taxation is positive, whereas its squared value is negative. The cutoff environmental taxation ratio is \(3.961\%\) (\(= \frac{1.006}{2\times (0.127)}\)).Footnote 20 Above this threshold, a higher environmental taxation ratio reduces intra-EU-27 trade in EGs. The estimated marginal effect of the environmental taxation ratio within our dataset is represented in Figure 2. For a large majority of countries, a marginal increase in the environmental taxation ratio would increase their imports of EGs because they are still on the increasing segment of the bell-shaped curve.Footnote 21

For purposes of comparison, Table 12 in “Appendix D” reports the results for N-EGs when the effect of environmental taxation is assumed to be linear (Column I) and non-linear (Column II). Additionally, Table 12 presents the results of estimations when we consider bilateral trade in all types of products (EGs and N-EGs) with (Column III) and without (Column IV) environmental variables. It is worth stressing that environmental taxation does not have a significant impact on trade in N-EGs when the value and squared value of taxation are used (Table 12, Column II). This suggests that our proxy (apparent environmental taxation) can be used as a measure of environmental taxation policy. When environmental taxation is included with an assumption of a linear impact on imports, the coefficient is positive but only significant at 10%. Footnote 22 The results presented in Column IV of Table 12 indicate that the coefficients associated with non-environmental variables do not vary significantly, thus implying that the inclusion of environmental variables does not alter the quality of the model.

Public expenditure on environmental protection and signed international environmental agreements

We now discuss the effects of the other variables relative to the other environmental tools. The coefficients associated with the number of IEAs in force in the destination and origin countries are non-significant for the APEC and OECD lists. As mentioned above, stringent domestic policy may reveal a competitive advantage of the destination country (Steinberg and VanDeveer 2012; Birkland 2014). However, when we consider N-EGs, the coefficient is also non-significant. These results suggest that in our estimated model, the number of IEAs in force does not capture the competitiveness of countries producing not only EGs but also N-EGs.Footnote 23

Public expenditure on environmental protection as a percentage of GDP in the origin country has a non-significant impact on either trade in the EGs on the APEC and OECD lists or trade in N-EGs. The coefficients are positive and significant when we consider the destination country including N-EGs. Hence, public expenditure on environmental protection as a percentage of GDP captures the effects of omitted variables. This is confirmed by specification I reported in Table 6. In this specification, we introduce time-varying country fixed effects, and the coefficients are no longer significant. We can conclude that public expenditure on environmental protection does not distort trade flows of EGs within the EU-27. Indeed, if expenditures on environmental protection in the country of destination (origin) favour the growth of the domestic eco-industry at the expense of foreign eco-industries, we should observe a negative (positive) impact on bilateral trade in EGs.

Robustness check

As a robustness check, we estimate alternative specifications of the equation of trade. As in Zugravu-Soilita (2019), we focus our attention on the APEC list, which is used most often in the trade literature because this list has served as a point of departure in the WTO negotiations on Environmental Goods Agreements. The results are reported in Table 6. First, if we introduce the standard set of exporter-time and importer-time fixed effects in our estimations of trade equation, those fixed effects absorb the key variables of interest. However, failure to account for the time-varying resistances may mean that the current results are biased. In the first column (Specification I), we employ a two-stage estimation procedure, where in the first stage, we use country-pairs and importer time-varying fixed effects and exporter time-varying fixed effects; in the second stage, we use the estimates of the fixed effects as the dependent variables, where the regressors include the country-specific policy variables of interest (see Fally 2015). Second, we estimate the intensive margin model using country-pair fixed effects and exporter time-varying fixed effects, whereas importer fixed effects do not vary with time (Specification II). Third, non-homotheticity of income regarding demand for EGs (Caron and Fally 2018) could cause the bell-shaped relationship between income and the pollution intensity of consumption goods. As a robustness check, we run an estimation that includes as control variables log GDP per capita and its squared value (Specification III). Because the importing countries included in the dataset are all high-income countries, we do not expect these variables to play a significant role. Fourth, we run a specification that includes bilateral fixed effects (Specification IV). Fifth, we use environmental taxation measured as the ratio of total tax revenue to the value of production in the APEC list EGs sector (Specification V). In doing so, we deal at least partially with some omitted variable bias in the empirical analysis. Indeed, if environmental tax rates in a country become high, foreign suppliers of EGs would prefer to substitute foreign investments (and increase local production in the destination country) rather than to export. Hence, imports could decrease when tax rates reach high values because local EGs supply increases due to the increasing presence of foreign investments.Footnote 24 Sixth, environmental taxation is measured as the ratio of total tax revenue to the sum of value added of “Agriculture, forestry and fishing, ”“Industry, ”“Construction” and “Wholesale and retail trade, transport, accommodation and food service activities” (Specification VI).Footnote 25 Our estimations indicate that the results reported in Table 6 regarding the environmental taxation ratio, our main variable of interest, are robust even if the absolute values of the coefficients differ.

We finally run an estimation that includes the sample of 155 countries serving the EU-27 countries. We control for exporter-specific variables by using time-varying exporter fixed effects and for bilateral variables by using country-pair fixed effects. The estimated results are presented in Table 13 of “Appendix D”. For our benchmark estimation, the bell-shaped curve is obtained for the APEC list, while the environmental taxation ratio has no impact when we use the OECD list. The result is different when we consider the merged list, with the negative value of the squared variable being non-significant, indicating a monotonic positive impact of overall import demand for EGs.

4.2.2 Intensity of Trade by Subgroups of EGs in the APEC List

We use the APEC list of EGs to identify subgroups of products (see Table 2). We have six subgroups: “Air pollution control,” “Waste water management,” “Solid waste management,” “Environmental monitoring, analysis and assessment + noise and vibration abatement,” “Renewable energy plants” and “Energy/heat savings and management.” We still use global environmental taxes instead of specific taxes related to each subset.Footnote 26 We do not use specific environmental taxes related to a subgroup of EGs because our estimations may be affected by reverse causality running from trade to taxation policy. We expect that the global environmental taxation ratio affects disaggregated trade patterns but not necessarily the reverse. Table 7 reports the results of the estimations.

For most of the subgroups of EGs, the structural variables (distance, contiguity, common legal system, and being in the eurozone) have signs and magnitudes similar to those reported in the literature (Head and Mayer 2014). As in Zugravu-Soilita (2019), the results associated with environmental variables differ regarding the subgroup of products. The bell-shaped curve of the relationship between environmental taxation and import demand for EGs is observed for the subgroups of “Waste water management,” and “Energy/heat savings and management.” For these two subgroups, the cutoff tax rate is, respectively, \(3.05\%\) and \(4.01\%\). As indicated in Table 2, the mean of total environmental taxes in the dataset is \(2.744\%\) with a maximum of \(5.170\%\). Our results indicate that some countries are in the negative area of the marginal impact of environmental taxation even if, on average, there is room to increase taxes to boost intra-EU trade in EGs. For the subgroups of “Solid waste management,” “Renewable energy plant” and “Environmental monitoring, analysis and assessment + noise and vibration abatement,” the estimated coefficients associated with environmental taxation are positive, while the squared values are non-significant. For this subgroup of products, there is room to increase environmental taxes to boost intra-EU trade in EGs. Finally, as for the EGs included on the OECD list, the environmental taxation ratio has no effect on the intensive margin for the subgroup of “Air pollution control.”

4.3 Decomposing Import Adjustments Along the Intensive and Extensive Margins

We evaluate the expected change in aggregate imports of EGs and its decomposition on the extensive and intensive margins due to a change in the environmental taxation ratio \(t_{jt}\). The expected change can be written as

where \(A_{jt}\) is observed aggregate imports (for a given destination-year pair) and \(\overline{a}_{jt}\) is observed average imports (at the destination-year pair level) with \(A_{jt}=N_{jt}\overline{a}_{jt}\), while \(N_{jt}^{e}\) and \(\overline{a}_{jt}^{e}\) are the expected number of trade partners and expected average imports, respectively, if the level of environmental taxation ratio prevailing in destination country j takes a new value (with \(A_{jt}^{e}=N_{jt}^{e}\overline{a}_{jt}^{e}\)). Aggregate imports can be decomposed into the number of trade partners that trade with country j \(N_{jt}\) (the extensive margin) and the average value of imports per destination-year \(\overline{a}_{jt}\) (the intensive margin). Hence, we can rewrite the expected change (28) as

so that

with

where \(\widehat{\lambda }=0,292\). We consider two counterfactual scenarios. Using the results associated with the APEC list, we evaluate the expected change in aggregate imports if all countries apply an environmental tax rate equal to the minimum observed tax rate (\(t_{jt}^{e}=\min t_{jt}\)) and to the cutoff tax rate (\(t_{jt}^{e}=3,96\)). Applying an environmental tax rate equal to the minimum observed tax rate would induce a decrease of \(54.33\;\) percentage points of trade in EGs, while trade would experience an increase of 25.33 percentage points from applying the cutoff tax rate. Our counterfactual analysis also suggests that the effect of a change in the environmental taxation ratio on imports is primarily driven by the extensive margin. For example, if all countries within the EU-27 have an environmental taxation ratio equal to the minimum observed ratio (\(t_{jt}^{e}=\min t_{jt}\) ), the average decrease in imports can be decomposed into a \(68.46\%\) decrease at the extensive margin and a \(31.54\%\) decrease at the intensive margin.

5 Concluding Remarks

Promoting the use of environmental technologies is expected to bring economic and environmental benefits worldwide. Thus, the acceleration of trade in EGs is at the heart of the sustainable development strategy of the EU. Policymakers and academics have paid much attention to the impact of lower tariffs on trade in EGs, but the literature is silent regarding the impact of environmental policies on such trade. However, higher emission tax rates could make the use of EGs or clean technologies more attractive to polluting firms, thus increasing their willingness to pay for EGs. It is expected that more stringent environmental policies should induce a higher demand for EGs and possibly increase international trade in EGs.

In this paper, we theoretically and empirically study the impact of environmental taxation on trade in EGs. To achieve our goal, we first develop a trade model in which demand for and supply of EGs are endogenous and adjust to the pollution tax rate. In accordance with empirical evidence, we assume that the suppliers of EGs are heterogeneous and operate under imperfect competition. Our theory reveals that (i) a higher pollution tax rate increases the number of partner countries (a positive effect of environmental taxation on the extensive margin) and that (ii) there is a bell-shaped relationship between the pollution tax rate and bilateral trade in EGs (a non-linear effect of environmental taxation on the intensive margin). Our empirical results confirm our main findings using data for the EU-27 countries when we consider the APEC list of EGs at the aggregated level. If we consider the OECD list of EGs, our results associated with the extensive margin hold, whereas environmental taxation has no effect on the intensive margin. However, the results obtained when we use the OECD list of EGs are very similar to the results when we consider N-EGs. This suggests that the OECD list of EGs, which is less restrictive than the APEC list, is not sufficiently precise in identifying EGs. When we analyse the products included in the APEC list by subgroup, a positive relationship between the environmental taxation ratio and the intensive margins is observed for the subgroups of “Solid waste management,” “Renewable energy plant” and “Environmental monitoring, analysis and assessment; Noise and vibration abatement,” indicating that there is room to increase environmental taxes to boost intra-EU trade. The bell-shaped curve is obtained for the APEC list subgroups of “Waste water management” and “Energy/heat saving and management,” while for the EGs included on the OECD list, the environmental taxation ratio has no effect on the intensive margins on the “Air pollution control” subgroup.

Notes

See annex C of the 2012 leaders’ declaration at http://www.apec.org/Meeting-Papers/Leaders-Declarations/2012/2012_aelm/2012_aelm_annexC.aspx (accessed January 03, 2013) and Article 31.3 of the Doha Declaration of the WTO at http://www.international.gc.ca/media/comm/news-communiques/2014/01/24a.aspx (accessed January 25, 2014).

Higher environmental tax rates make the use of EGs or clean technologies more attractive to polluting firms, thus increasing these firms’ willingness to pay for EGs (Wan et al. 2018).

This literature shows that stricter environmental regulations induce higher production costs, which may lead to relocation of dirty industries to countries with lower environmental taxation (Letchumanan and Kodama 2000; Muradian et al. 2002; Copeland and Taylor 2004; Levinson 2009). In contrast, according to the Porter hypothesis, more stringent but properly designed environmental regulations may yield innovation and, in turn, enhance competitiveness.

Note that the pollution intensity (\(e_{j}(v)/q_{j}(v)\)) is equal to \(\xi _{j}-\theta _{j}(v)/q_{j}(v)\). It is straightforward to verify that pollution intensity decreases with firm efficiency (see “Appendix A”).

Non-environmental goods (N-EGs) are goods other than the EGs included on the OECD and APEC lists (merged list).

Note that energy taxes represent the highest share of overall environmental tax revenue, accounting for approximately 75% of the EU-27 total in 2012 (see Table 2). The second-highest environmental tax revenues are from transport taxes, representing 20% of the EU-27 total in 2012. Pollution and resource taxes represent a small share (approximately 5%) of total environmental tax revenues (see Table 2). This category of taxes was implemented more recently than the others in Europe.

The 2-year lagged values of the environmental taxes pass the tests for the APEC as well as the OECD lists. The contemporary values for the APEC list and the 1-year lagged values for the two lists do not pass the Durbin-Wu-Hausman tests of endogeneity at 10% or lower. The results are available upon request.

In “Appendix D”, as a robustness check, following Egger et al. (2011), we use GDP per capita, land area, and the share of EG production (from the APEC and OECD lists) in total production as instruments. The results of our estimations regarding the impact of environmental taxation remain robust.

These data are available from EUROSTAT (http://appsso.eurostat.ec.europa.eu/nui/show.do?).

See “Appendix A” for the details of the derivation of a structural equation.

The OMR indexes are defined as if the sellers in each country shipped to a single world market, whereas the IMR indexes are defined as if buyers in each country imported from a single country. The two indexes consistently aggregate bilateral trade costs and decompose their incidence on producers and consumers. See Anderson (2010), Anderson and Yotov (2010) and Olivero and Yotov (2012) for further discussions.

In the standard approach, the price paid by the end consumer is the factory-gate price times a trade cost.

A positive result could also be due to a pollution haven effect (Mulatu et al. 2010). However, the results regarding the pollution haven hypothesis in Europe are inconclusive. Mulatu et al. (2010) find evidence in favor, whileCave and Blomquist (2008) and Raspiller and Riedinger (2008) do not find any such evidence. Moreover, Leiter et al. (2011) find a positive but diminishing impact of environmental regulation on investment.

Using panel data would help solve problems associated with omitted variables bias (Martıinez-Zaroso, Nowak-Lehmann and Horsewood, 2009).

The list of 155 countries is available upon request.

The cutoff ratio is obtained by using \(\frac{\partial a_{ijt}}{\partial t_{jt}}=(\widehat{\alpha }_{1}+2\widehat{\alpha }_{2}t_{jt})a_{ijt}=0\) or, equivalently, \(t_{jt}=-\widehat{\alpha }_{1}/(2\widehat{\alpha }_{2})\).

The negative marginal effects are associated with Denmark, a country that is characterized by a high level of environmental taxation (Klinge et al. 2003; Kosonen 2012) and that is a net exporter of EGs (Zugravu-Soilita 2019). Our results suggest that an increase in environmental taxes in Denmark would not be followed by a rise in import demand for EGs because the rivals of Danish firms seem to have higher production costs.

This result suggests that we are capturing an indirect effect of environmental taxation on domestic producers of N-EGs (polluting firms). If the environmental tax rate increases, then the price of N-EGs supplied by domestic firms increases, inducing higher imports of N-EGs (substitution effect).

These results are robust when we instrument the number of signed IEAs (see Table 14).

The data were collected from EUROSTAT (see http://appsso.eurostat.ec.europa.eu/nui/submitModifiedQuery.do).

We exclude services. The data were collected from EUROSTAT (see http://appsso.eurostat.ec.europa.eu/nui/submitModifiedQuery.do).

These specific taxes include energy taxes for trade in EGs in the energy sector (“Renewable energy plant” and “Energy/heat savings and management” in Group C of Table 1), pollution and resource taxes for the pollution management group (“Air pollution control,” “Waste water management”, “Solid waste management”, and “Environmental monitoring, analysis and assessment + noise and vibration abatement” in Group A of Table 1). The correlation coefficient between global environmental taxes and the specific taxes is 0.52 for energy taxes and 0.61 for pollution and resource taxes.

Data on trade were collected using the World Integrated Trade Solution (WITS) software (see http://wits.worldbank.org/wits/).

See https://stat.unido.org/home (accessed March 2, 2015) and the concordances at http://unstats.un.org/unsd/cr/registry/regot.asp? Lg=1 (accessed January 25, 2015) and http://wits.worldbank.org/wits/product_concordance.html (accessed January 25, 2015).

References

Ambec S, Cohen MA, Elgie S, Lanoie P (2013) The porter hypothesis at 20: can environmental regulation enhance innovation and competitiveness? Rev Environ Econ Policy 7:2–22

Anderson JE (2010) The incidence of gravity. In: van Bergeijk PAG, Brakman S (eds) The gravity model in international trade Advances and applications. Cambridge University Press, Cambridge

Anderson JE, van Wincoop E (2003) Gravity with gravitas: a solution to the border puzzle. Am Econ Rev 93:170–192

Anderson JE, van Wincoop E (2004) Trade costs. J Econ Lit 42:691–751

Anderson JE, Yotov YV (2010) The changing incidence of geography. Am Econ Rev 100:2157–86

Avery B, Boadu FO (2004) Global demand for US environmental goods and services. J Agric Appl Econ 36:49–64

Baier SL, Bergstrand JH (2007) Do free trade agreements actually increase members’international trade? J Int Econ 71:72–95

Baier SL, Bergstrand JH, Clance MW (2018) Heterogeneous effects of economic integration agreements. J Dev Econ 135:587–608

Baier SL, Bergstrand JH, Feng M (2014) Economic integration agreements and the margins of international trade. J Int Econ 93:339–350

Baumol WJ (1995) Environmental industries with substantial start-up costs as contributors to trade competitiveness. Ann Rev Energy Environ 20:71–81

Becker RA, Shadbegian RJ (2008) The green industry: An examination of environmental products manufacturing. US Census Bureau Center for Economic Studies Paper No. CES-WP-08-34

Birkland TA (2014) An introduction to the policy process: theories, concepts and models of public policy making. Routledge, London

Brunel C, Levinson A (2016) Measuring the stringency of environmental regulations. Rev Environ Econ Policy 10:47–67

Canton L, Soubeyran A, Stahn H (2008) Environmental taxation and vertical cournot oligopolies: how ecoindustries matter. Environ Resour Econ 40:369–82

Caron J, Fally T (2018) Per capita income, consumption patterns, and CO2 emissions. National Bureau of Economic Research, Cambridge, p w24923

Castro P, Hörnlein L, Michaelowa K (2014) Constructed peer groups and path dependence in international organizations: the case of the international climate change negotiations. Glob Environ Change 25:109–120

Cave LA, Blomquist GC (2008) Environmental policy in the European union: fostering the development of pollution havens? Ecol Econ 65(2):253–261

Chaney T (2008) Distorted gravity: the intensive and extensive margins of international trade. Am Econ Rev 98:1707–1721

Copeland B, Taylor MS (2004) Trade, growth and the environment. J Econ Lit 42:7–71

Costantini V, Crespi F (2008) Environmental regulation and the export dynamics of energy technologies. Ecol Econ 66:447–460

Costantini V, Mazzanti M (2012) On the green and innovative side of trade competitiveness? The impact of environmental policies and innovation on EU exports. Res Policy 41:132–153

David M, Nimubona AD, Sinclair-Desgagné B (2011) Emission taxes and the market for abatement goods and services. Res Energy Econ 33:179–191

David M, Sinclair-Desgagné B (2010) Pollution abatement subsidies and the eco-industry. Environ Resour Econ 45:271–282

de Melo J, Solleder JM (2020) Barriers to trade in environmental goods: how important they are and what should developing countries expect from their removal. World Dev 130:104910

De Santis R, Jona Lasinio C (2016) Environmental policies, innovation and productivity in the EU. Glob Econ J 16:615–635

Egger P, Larch M, Staub KE, Winkelmann R (2011) The trade effects of endogenous preferential trade agreements. Am Econ J: Econ Policy 3:113–143

Fally T (2015) Structural gravity and fixed effects. J Int Econ 97:76–85

Felbermayr GJ, Kohler W (2006) Exploring the intensive and extensive margins of world trade. Rev World Econ 142:642–674

Février P, Linnemer L (2004) Idiosyncratic shocks in an asymmetric Cournot oligopoly. Int J Ind Organ 22:835–848

Greaker M, Rosendahl KE (2008) Environmental policy with upstream pollution abatement technology firms. J Environ Econ Manag 56:246–259

He Q, Fang H, Wang M, Peng B (2015) Trade liberalization and trade performance of environmental goods: evidence from Asia-Pacific economic cooperation members. Appl Econ 47:3021–3039

Head K, Mayer T (2002) Illusory border effects: distance mismeasurement inflates estimates of home bias in trade. Centre d’Etudes Prospectives et d’Informations Internationales (CEPII). Working Paper No. 2002-01

Head K, Mayer T (2014) Gravity equations: workhorse, toolkit, and cookbook. In: Helpman Gopinath, Rogoff (eds) Handbook of International Economics. Elsevier, North Holland

Helpman E, Melitz MJ, Rubinstein Y (2008) Estimating trade flow: trading partners and trading volumes. Q J Econ 123:444–487

Hummels D, Klenow PJ (2005) The variety and quality of nation’s exports. Am Econ Rev 95:704–723

Klinge J, Birr-Pedersen K, Wier M (2003) Distributional implications of environmental taxation in Denmark. Fisc Stud 24:477–499

Kosonen K (2012) Regressivity of environmental taxation: myth or reality? In handbook of research on environmental taxation. Edward Elgar Publishing, Cheltenham

Leiter AM, Parolini A, Winner H (2011) Environmental regulation and investment: evidence from European industry data. Ecol Econ 70:759–770

Letchumanan R, Kodama F (2000) Reconciling the conflict between the pollution-haven’hypothesis and an emerging trajectory of international technology transfer. Res Policy 29:59–79

Levinson A (2009) Technology, international trade, and pollution from US manufacturing. Am Econ Rev 99:2177–2192

Levinson A, Taylor MS (2008) Unmasking the pollution haven effect. Int Econ Rev 49:223–254

Lovely M, Popp D (2011) Trade, technology, and the environment: does access to technology promote environmental regulation? J Environ Econ Manag 61:16–35

Martínez-Zarzoso IF, Nowak-Lehmann D, Horsewood N (2009) Are regional trading agreements beneficial? Static and dynamic panel gravity models. N Am J Econ Finance 20:46–65

Melitz MJ (2003) The impact of trade on intra-industry reallocations and aggregate industry productivity. Econometrica 71:1695–1725

Metcalf G (2009) Environmental taxation: what have we learned in this decade? In: Alan Viard (ed) Tax policy lessons from the 2000s. AEI Press, Washington, D.C

Mulatu A, Gerlagh R, Rigby D, Wossink A (2010) Environmental regulation and industry location in Europe. Environ Resour Econ 45(4):459–479

Muradian R, O’Connor M, Martinez-Alier J (2002) Embodied pollution in trade: estimating the ‘environmental load displacement’ of industrialised countries. Ecol Econ 41:51–67

Nimubona AD (2012) Pollution policy and trade liberalization of environmental goods. Environ Resour Econ 53:323–346

Novy D (2013) International trade without CES: estimating translog gravity. J Int Econ 89:271–282

OECD [Organization of Economic Cooperation and Development], (2006) É tude sur la politique commerciale. Biens et services environnementaux, Paris, France

Olivero MP, Yotov Y (2012) Dynamic gravity: theory and empirical implications. Can J Econ 45:64–92

Perino G (2010) Technology diffusion with market power in the upstream industry. Environ Resour Econ 46:403–428

Perino G, Requate T (2012) Does more stringent environmental regulation induce or reduce technology adoption? When the rate of technology adoption is inverted u-shaped. J Environ Econ Manag 64:456–467

Raimondi V, Scoppola M, Olper A (2012) Preference erosion and the developing countries exports to the EU: a dynamic panel gravity approach. Rev World Econ 148:707–732

Raspiller S, Riedinger N (2008) Do environmental regulations influence the location behavior of French firms? Land Econ 84(3):382–395

Rose AK, Spiegel MM (2010) International arrangements and international commerce. In: van Bergeijk PAG, Brakman S (eds) The gravity model in international trade advances and aplications. Cambridge University Press, Cambridge

Rubashkina Y, Galeotti M, Verdolini E (2015) Environmental regulation and competitiveness: empirical evidence on the porter hypothesis from european manufacturing sectors. Energy Policy 83:288–300

Santos Silva JMC, Tenreyro S (2006) The log of gravity. Rev Econ Stat 88:641–658

Santos Silva JMC, Tenreyro S, Wei K (2014) Estimating the extensive margin of trade. J Int Econ 93:67–75

Sauvage J (2014) The Stringency of Environmental Regulations and Trade in Environmental Goods. OECD Working Paper, 2014-03

Schwartz S, Stahn H (2014) Competitive permit markets and vertical structures: the relevance of imperfectly competitive ecoindustries. J Public Econ Theory 16:69–95

Simmons B (2010) Treaty compliance and violation. Ann Rev Political Sci 13:273–296

Sinclair-Desgagné B (2008) The environmental goods and services industry. Int Rev Environ Resour Econ 2:69–99

Steenblik R (2005) Environmental goods: A comparison of the APEC and OECD lists, OECD Trade and Environment Working Papers 2005/4, OECD Publishing