Abstract

Negotiations on the liberalization of environmental goods (EGs) and services within the WTO Doha Round (mandated in November 2001) are facing specific challenges. Conflicting interests and differing perceptions of the benefits of increased trade in EGs were reflected in different approaches proposed for determining EGs. Using import data of 34 Organisation for Economic Co-operation and Development (OECD) member countries and from a sample of 167 countries, from 1995 to 2012, we discuss the trade effect of reducing barriers on EGs. We analyze the lists of EGs proposed by the Asia-Pacific Economic Cooperation and OECD using a Translog gravity model. We found that removing tariff barriers for EGs will have a modest impact because for the biggest importers and exporters, elasticities of trade costs are very low while for most trading relationships they are very high, making it difficult for exporters to maintain their markets. Overall, our results suggest that, because of their substantial effect on international trade, future negotiations on EGs should also address the issues of standards and nontariff barriers.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Several studies have investigated the environmental impact of international trade, yet their results are inconclusive (Managi et al. 2009; Copeland and Taylor (2004). This ambiguity comes from the three channels of transmission of the effects of trade on environmental quality, i.e. scale effects associated with income level, composition effects (the different sectors of the economy have different effects on emissions) and technical effects that cause some production techniques to be less polluting than others. However, Frankel and Rose (2005) also emphasize the importance of the assumption of gains from trade whereby trade leads to “cleaner” consumption patterns through higher incomes. In this case, trade would promote the diffusion and use of technological innovations. The acceleration of trade and clean technology transfer are central to the sustainable development strategy of the World Trade Organization (WTO). One of the options discussed in the two institutions involves tariff liberalization in environmental goods and services.Footnote 1

According to the WTO, liberalizationFootnote 2 of trade in environmental goods (EGs hereafter) would simultaneously favor environmental protection and economic development.Footnote 3 Better environmental protection results from two distinct effects. First, firms would probably increase their pollution abatement efforts because of the reduced prices resulting from an import tariff cut. Second, because of this reduction in environmental compliance costs, governments would be encouraged to set more ambitious environmental standards.Footnote 4

In the ongoing discussions at the WTO, several approaches to identify EGs have been proposed: list of products, requests and offers, integrated projects and a mix of the previous approaches. For Balineau and de Melo (2013), conflicting interests and differing perceptions of the benefits of the intensification of trade in EGs explain the different approaches proposed. Each approach has implications for the impact of liberalization on sustainable development. Indeed, an approach based on lists of products could increase the comparative advantage of certain economies because international trade of EGs is dominated by developed countries, which represent 90% of world supply (GIER 2009). Given that developing countries are net importers, greater liberalization of trade in environmental goods could worsen their trade deficits. This pattern of the world trade of EGs has an implication that Vikhlyaev (2004) describes as uncomfortable: trade gains would be for developed countries and environmental gains for developing countries. Moreover, the applied tariffs of EGs are relatively low and are not much higher than those of other industrial products (Balineau and de Melo 2013; Vossenaar 2013).

In 1997, the Organization of Economic Cooperation and Development (OECD) carried out a list and brought up to date in 2012. It is established on the base of general categories of goods and services used to measure, prevent and reduce environmental damages and to manage natural resources. It identifies EGs products based on 6-digit HS (Harmonized System) trade nomenclature. However this system does not allow isolating the products used only for an environmental scope. The Asia Pacific Economic Cooperation (APEC) list, realized between 1998 and 2000 identifies EGs according to national customs nomenclatures with eight or ten digits. In September 2012, Asia-Pacific Economic Cooperation Leaders endorsed the APEC List of EGs. In addition, the commitment adopted in 2011 to reduce applied tariffs to 5% or less by the end of 2015 was reaffirmed.Footnote 5 At the 2014 Davos Summit, 14 World Trade Organization membersFootnote 6 announced their intention to negotiate a plurilateral agreement that would eliminate tariffs on an array of environmental goods.Footnote 7 However, very few studies have addressed the impact of EGs liberalization, even though this is a timely issue. Because of low tariff levels, differentiated liberalization of trade of EGs may not result in environmental gains. The objective of this paper is to assess the extent to which the sustainable development objectives can be achieved by increasing trade in EGs following a differentiated liberalization.

The theoretical and empirical literature on industries producing environmental goods and services (eco-industries) is relatively recent. Examples of theoretical works are Nimubona and Benchekroun (2015), David and Sinclair-Desgagne (2010), and Canton et al. (2008). One of the recurring problems noted is the existence of entry barriers in this specialized industry, and its concentration (David et al. 2011). The empirical implication of the structure of the eco-industry on international trade flows of EGs is of interest. In fact, international trade of EGs has been poorly studied empirically. Zugravu (2010) addresses the EGs issue systematically using the approach proposed by Frankel and Rose (2005), which features an estimation of a system of equations. The author shows that for “transition countries”, EGs’ trade intensity has a negative net impact on pollution, and that EGs classification is important when analyzing the impacts.Footnote 8 More recently, He et al. (2015) studied the impact of trade liberalization on EGs exports within 20 Asia-Pacific Economic Cooperation members. These authors show that even if tariff and nontariff barriers reduction would have a positive impact on exports, considerable heterogeneity exists according to countries’ income levels.

However, the empirical studies on EGs assume a constant elasticity of substitution even if recent research has highlighted the fact that reducing trade costs may lead to increased competition and lower margins (e.g. Feenstra and Weinstein 2010; Chen et al. 2009; Melitz and Ottaviano 2008; Badinger 2007). Given the structure of production and international trade in the EGs sector, assuming a constant elasticity of substitution is more difficult to justify. For instance, one can expect a high absolute value of elasticity of substitution when imports are low, or when the importer is much larger than the exporter.Footnote 9 These conditions make it harder for small exporters of EGs to defend their market share (also see He et al. 2015; Balineau and de Melo 2013. The situation should be better modeled by functions where the elasticity of substitution is not constant (Novy 2013; Feenstra 2003, 2010).

Arkolakis et al. (2012) show that gravity modelling is all what needed to calculate policy impact on trade. Trade costs elasticities are important to assess the potential trade-effect of liberalization because they determine the extent of the increase in trade after liberalizing trade (Head and Mayer 2013; Arkolakis et al. 2012). Following the few empirical studies on this topic, we specify a gravity model with non-constant elasticity of substitution (Novy 2013; Gohin and Féménia 2009 Footnote 10). We assume Translog preferences because, as mentioned by Novy (2013: 272), they are more flexible and allow a richer substitution patterns. Non-constant elasticity of substitution assumption is appropriate when analyzing EGs, given the particular structure of production and international trade within this industry.

Our results confirm the hypothesis that the elasticities of substitution and therefore trade costs elasticities depend on the size of the importing country and the number of EGs imported from a specific supplier. The gains from liberalization would be modest for most countries, and those already dominating international trade in EGs would strengthen their positions. Reducing tariffs on the APEC List of EGs should be more favorable to international trade than those on the list proposed by the OECD. Our results show that the attainment of environmental and development objectives of the WTO could be attained through (i) parsimonious identification of EGs and (ii) the establishment of mechanisms for the transfer of clean technologies because trade costs impacts are greater for “small” economies. Overall, our study contributes to the growing body of trade and environment literature that consider that the EGs are provided by an eco-industry operating under imperfect competition (Schwartz and Stahn 2014; Nimubona 2012; David and Sinclair-Desgagne 2010; Canton et al. 2008; Greaker and Rosendahl 2008).

The rest of the paper is structured as follows. Section 2 presents some facts about international trade of EGs, while Sect. 3 presents the empirical modelling. Section 4 describes the data and discusses the estimation methods. The estimation results and robustness check are presented in Sect. 5. Section 6 discusses trade costs elasticities (TCEs) on EGs’ trade, and the last section concludes the paper.

2 International Trade of EGs

EUROSTAT (2009) suggests that only technologies, goods and services that have been produced for environmental purpose should be included in the environmental sector. Nonetheless, according to the US Office of Technology Assessment (1994, p. 149), cited by the OECD (2006), there is no “environmental goods sector” that is fully defined as such. Rather, this sector comprises suppliers of many types of goods, services and technologies that are integrated in regular production processes, and it is often difficult to treat them as separate elements. Balineau and de Melo (2013) discuss the difficulties and obstacles in selecting environmental goods. Few countries (only 13) have adopted a list approach, and there is little overlap across submissions (Balineau and de Melo 2013). The lists of EGs that serve as a framework for discussions have been developed by the OECD and APEC. The OECD List resulted from joint OECD and Eurostat work on a manual designed to help national statisticians to measure their environmental industries (OECD 2006). The list is broad because adding products to the list had no particular policy consequences. However, because it first identified goods, the APEC approach yielded a smaller list of goods. Table 1 presents the number of goods included in the two lists.Footnote 11 Goods included in the lists are defined by the harmonized system at 6 digits (HS6).

Table 2 presents the relative share of trade for the ten leading countries for the years 2003 and 2012, when considering the APEC and OECD proposals. It indicates that even if the two lists differ, the same countries are represented. In 2012, total exports of EGs by the ten leading countries represent 76.03% of the trade value of goods included in the APEC List and 69.19% for the OECD List. In 2003 the picture was similar for the APEC List (77.49%), whereas for the OECD List the share of trade value of the ten leading countries was higher, at 82.47%. The total share of imports of the ten leading countries is more stable: from 74.63 to 61.41% for the APEC List and from 61.14 to 56.42% for the OECD List.

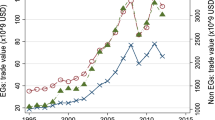

From 2003 to 2012, trade of EGs under the APEC List grew by 156.44%, whereas growth was 133% for the OECD List.Footnote 12 Fig. 1 indicates that the value of trade in environmental goods increased continually since 2003 (except in 2008–2009 due to the economic crisis). It also indicates that the growth occurs mainly at the intensive marginFootnote 13 because of an increase in the average value of a bilateral trade flow.

Current negotiationsFootnote 14 intend to build on and expand a list of 54 environmental goods for which APEC countries agreed in 2011 to reduce tariffs to 5% or less by 2015. As mentioned by the OECD (2006), both the OECD and the APEC lists have helped frame the WTO negotiations on EGs. Balineau and de Melo (2013), among others, also mention the WTO list of 411 goods. This list merges the lists of EGs proposed by some countries. The core list of WTO List of EGs includes 26 goods. However in our paper we analyze the APEC and OECD lists because they are central to current negotiations, especially the APEC list.

3 Empirical Model

Our specification of the gravity equation closely follows Novy (2013). We deal with the non-constant elasticity of substitution regarding the country’s market share and the number of EGs being traded. The Translog expenditure function denoted by \(E_j\) is given by (see Feenstra 2003):

where \(U_j\) is the utility level of country j with m and k the goods and \(\gamma _{km} =\gamma _{mk} \).Footnote 15 The price of good m in country j is \(p_{mj}\). The expenditure share \(s_{mj}\) of country j for good m can be obtained by differentiating the expenditure function (1) with respect to \(ln \left( {p_{mj} } \right) \):

Defining by \(y_j\) country j’s expend on EGs and \(x_{ij}\) its imports from country i. The import share \({x_{ij} }/{y_j}\) is then the sum of expenditures share \(s_{mj}\) over the range of good that originate country i:

Using the relation in Eq. (3) and market clearing condition \(y_i =\sum \nolimits _{j=1}^J {x_{ij}}\), Novy (2013) derivesFootnote 16 a Translog gravity equation from the import share by solving for the equilibrium prices:

where \(x_{ij}\) represents country j’s imports from country \(i,y_j \left( {y_i}\right) \) represents country j’s (i) expend on EGs, \(y^{W}\) denotes world expend on EGs, defined as \(y^{W}\equiv \sum \nolimits _{j=1}^J {y_j}\) and \(n_i \equiv N_i -N_{i-1}\) denotes the number of EGs traded by the exporter country i. Thus, \(ln ({T_j})\) is the weighted average of logarithm of trade costs:

where \(\omega _k ={x_{kj} }\Big /{\sum \nolimits _{k=1}^N {x_{kj}}}\) is the weight of the importing country k from the exporting country j. The trade-adjusted Translog gravity equationFootnote 17 is then:

where \(S_j \equiv \gamma \, ln \left( {T_j } \right) \) is the importer fixed effect and \(S_i \equiv \frac{y_i }{y^{w}}+\gamma n_i \sum \nolimits _{s=1}^j {\frac{y_i }{y^{w}}\, ln \left( {\frac{\tau _{is} }{T_s }} \right) } \) the exporter fixed effect. From Eq. (6), the estimating equationFootnote 18 is:

where \(\Gamma _i \equiv {S_i}/{n_i}\) and \(\varepsilon _{ij}\) is a mean-zero error term. Trade costs \(\tau _{ij}\) includes the effect of distance and some factual factors of trade preference (trade agreement, common language and borders, etc.):

where the variable language takes the value of 1 if the trading partners share a common language and 0 otherwise, the variable border takes the value of 1 if the trading partners share a common border and 0 otherwise and the variable legal takes the value of 1 if the two trading partners have a common legal system and 0 otherwise. Finally the variable RTA takes the value of 1 if the two trading partners are both members of at least one regional trading agreement. The parameter \(\beta \) measuring the impact of distance in trade costs elasticity and the vector of parameters \({\varvec{\upkappa }}\) represents the impacts of the other trade costs factors. Given the gravity equation (7) and trade costs equation (8), we define our Translog trade costs elasticity (TCE) as:

Ceteris paribus, the absolute value of the elasticity increases (i) when import share decreases (imports are small and importers are sensitive to small changes in prices), (ii) when the size of the importing country increases (because of a like monopsony power of the importer) and (iii) when the number of exported goods increases (because of higher competition between substitute goods). As a result, it is more difficult for small exporters to defend their market share. All these conditions are expected for international trade in environmental goods.

4 Data and Estimation Methods

4.1 Data Description and Sources

Our sample data include OECD importing countries and 167 exporting countries. (see Table 8 in the “Appendix”). This study covers the period of 1995–2012. Trade data on EGs are obtained from the UN Comtrade databaseFootnote 19 referring to the EGs lists proposed by APEC and OECD. EGs trade is defined at the six-digit level using the harmonized system (HS6). Transport cost proxies are important variables in gravity models. Previous studies have found that trade elasticities with respect to transport cost and other transaction cost variables are sensitive to the method used to proxy transport cost (Head and Mayer 2002). Some authors designed more intricate measures that take into consideration the dispersion of economic activity within a region. Head and Mayer (2002) suggest the following indicator:

where \(d_{gh}\) is the distance between the two sub-regions \(g\in i\) and \(h\in j\) and \(\varpi _g\) and \(\varpi _h\) represent the economic activity share of the corresponding sub-region. The Centre d’Études Prospectives et d’Informations Internationales (CEPII) uses the above formula to create a dataset. To take into account a potential impact of the crisis of 2008–2009, we add a dummy variable that controls for this impact when estimating the gravity equation. Data on language, legal system and sharing a common border also come from the CEPII database. Table 3 presents some descriptive statistics of the variables of interest.

4.2 Expend on EGs \(\left( {y_j } \right) \) and Number of Traded Goods \(\left( {n_i } \right) \)

The number of traded goods \(\left( {n_i } \right) \) and country j’s expend on EGs \(\left( {y_j } \right) \) are sensitive when computing trade elasticities. Thus, the number of EGs from the exporting country \((n_i)\) is defined as a proxy of the extensive margin to trade. However, the values of \(n_i\) have been normalized by dividing it by its maximum value.Footnote 20

Expend on EGs is calculated using the following formula:

where, for country \(j, Production_{j}\) is industrial production in the EGs sector, \(\sum _{-j} {Exports}\) are total exports of EGs and \(\sum _{-j} {Imports}\) are total imports of EGs. Data on production come from United Nations Industrial Development Organization (UNIDO) Statistical Databases.Footnote 21

4.3 Estimation Procedure

To estimate the gravity equation, we use Heckman’s two-step estimation procedure (1979) when correcting for zeroes.Footnote 22 As shown by Baldwin and Taglioni (2006) and many others, to properly identify the elasticity of trade policy in a gravity panel setting, you need to control for time-varying importers’ and exporters’ fixed effects. This is because multilateral resistances are not time-invariant. Moreover, Baier and Bergstrand (2007) suggest that the best way to account for endogeneity due to omitted variable bias (and other endogeneity issues) is to also use time invariant pair-fixed effects (see also Raimondi et al. 2012; Martínez-Zarzoso et al. 2009). Accordingly, our estimating Eq. (7) includes exporter and importer time-variant fixed effects respectively and a time-invariant country-pair effect \(\Upsilon _{ij}\) with \(\Upsilon _{ij} \ne \Upsilon _{ji}\).

5 Estimation Results

5.1 Benchmark Results

Table 4 presents the estimation results based on Eq. (7).Footnote 23 As in Novy (2013), overall our estimates are smaller than those found in the literature using a CES gravity model (e.g. Head and Mayer 2013). For the two models (Translog and CES gravity), the estimated coefficients of the variables are significant at least at 1% level and have the expected sign. Our results also confirm that EGs’ trade flows are fostered by sharing a border and/or language, and a common legal system. From Translog results only “common language” and “common legal system” appear statistically non-significant at 5% (but with the expected sign) respectively for OECD List and APEC List. As anticipated, the import share divided by the extensive margin \(\left( {\frac{{x_{ij} }/{y_j }}{n_i }} \right) \) as a dependent variable is negatively correlated with geographic distances between trading countries. And, the distance coefficient of OECD List (column 1) is smaller in absolute value than those of the APEC List (column 2). Finally, the control parameter for correcting selection bias, the Inverse Mills Ratio (IMR), is highly significant (at 1% level). These results suggest that the 2-stage Heckman model is relevant.

5.2 Robustness Checks

5.2.1 Alternative Costs Specifications

We test the stability and consistency of our results regarding the estimated coefficient on “distance” which is at the core of our study on trade costs elasticities. In doing so, we use three different modifications of the benchmark model. Table 5 presents the estimated results. In Column 1, we use a specification with only the distance as a proxy of trade costs. Column 2 presents our estimation results with variable distance as well as interaction variables between distance and the factors variables included in the benchmark model (i.e. “common border”, “common language”, “common legal” and “RTA”). Finally in Column 3, the model includes the variables considered in the benchmark model as well as interaction variables between distance and the factors variables. Overall the estimated coefficients of the distance are close to those of the benchmark estimations.

5.2.2 Alternative Expend Specification

Expend on EGs is calculated using the following formula of Eq. (11). However, environmental goods trade data are at a more disaggregated level (HS6) than production data (ISIC 3) because the latter encompass more than environmental sectors. As a robustness check we re-estimate the model using total imports \(\left( {\sum _{-j} {Imports}}\right) \) as a proxy of total expenditures on EGs. The estimated results presented on Column (4) of Table 5 are qualitatively similar to those of the benchmark model. The use of the formula of Eq. (11) or the total imports as the proxy of total expend would not change the estimated values of TCEs.

6 Analysis of Trade Costs Elasticities (TCEs) and Environmental Goods Trade

Referring to the two main EGs lists (APEC and OECD), we discuss the potential trade effect of a possible liberalization of EGs (e.g. reducing barriers to trade on EGs). To discuss the trade implications of potential liberalization, we calculate the TCEs.

Recall that the TCE \(\eta _{ij}^{TL}\) depend on the Translog parameter \(\gamma \), the import share \({x_{ij} }/{y_j}\) and the number of goods of the exporting country \(n_j\) (Eq. 9). We directly obtain the values for \({x_{ij} }/{y_j}\) and \(n_j\) from the data. In the Translog gravity equation (6), the distance coefficient corresponds to the parameter combination \(\gamma \beta \). Thus, the value for parameter \(\gamma \) can be retrieved from the estimated distance coefficient in Translog estimates, but we need the value for parameter \(\beta \). As suggested by Novy (2013, p. 278), we retrieve the value of \(\beta \) from the standard gravity equation where the estimated distance coefficient corresponds to the parameter combination \(-\left( {\sigma -1} \right) \beta \). According to the gravity literature, we assume elasticity of substitution equal to \(\sigma =8\) as used by Novy (2013),Footnote 24 which simply gives a constant equal to \(\sigma -1=7\). In sum, the value for parameter \(\gamma \) can be obtained by \(7*\left( {{\beta ^{translog}}/{\beta ^{traditional}}} \right) \).Footnote 25

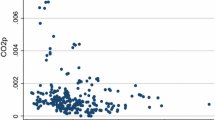

6.1 Analyses of TCEs by Import Shares

Based on import shares \(\left( {{x_{ij} }/{y_j }} \right) \), we subdivide our sample into ten quantiles and calculate the mean TCE for each quantile reported on Table 6. Indeed, the estimated TCEs vary across import shares. As expected, TCEs are higher when import shares are low and this is the case for most of the quantiles. It is only for the higher 30% trade flows that elasticity of trade costs is “reasonable.” These results suggest that the reduction of trade protection in EGs, featured prominently in the Doha Round negotiations and decided by the APEC, could have a modest trade effect when considering the main importers of EGs (see last quantiles) while implying that majority of the “small” exporters could not maintain their access to international markets.

6.2 Analyses of TCEs by Lists of EGs

Figure 2 illustrates the relationship between TCEs and import shares for each EGs list and for the periods 2003–2007 and 2008–2012. TCEs exhibit more heterogeneity within the APEC List, and this heterogeneity comes from the number of imported goods from a given origin. One interpretation for this is that the APEC’s EGs list is more specific and “specialized” than the OECD List, which identifies more products.

Otherwise, Fig. 3, which represents the TCEs for six selected countries (Germany, United States of America, Canada, France, Japan, and Great Britain), indicates that, for the members of APEC (United States of America, Canada and Japan), the elasticity of trade costs has the same pattern for the two lists. This is not the case for Germany, Great Britain and France, where the difference in trade costs between the two lists is clearly highlighted. These results suggest that the members of APEC have a greatest comparative advantage in producing EGs included in the APEC List (also see Manzano and Prado 2015).

However, Fig. 2 indicates that, when comparing the period 2003–2007 to the period 2008–2012, TCEs decline over time for the APEC List while it is relatively stable for the OECD one. For selected countries, Fig. 5 confirms that the pattern of TCEs remains relatively stable from the period 1998–2002 to the period 2008–2012 for the OECD List, but this is not the case for the APEC List, for which the trade costs declined. This consequently reduces the differences between the two lists.

Finally, we graphically analyze TCEs regarding (i) EGs trade intensity defined by \(\left( {import+export} \right) _{List=APEC, OECD} \) and (ii) EGs trade openness index defined as \(\left( {\frac{import+export}{EGs\,production\,value}} \right) _{List=APEC, OECD}\).

As pointed out in Fig. 4 (top panel), the biggest trading countries of EGs (e.g. Japan, United States and Germany) have low TCEs on average. Figure 4 also shows, for example, that TCEs for EGs for Canada and Mexico are the highest for the OECD List, while these costs are highest for Poland and Canada for the APEC List.Footnote 26 When considering countries’ EGs trade openness index, the bottom panel of Fig. 4 shows that TCEs are more dispersed when considering the APEC List of EGs while they are less dispersed for the OECD List. This result confirms that the APEC List is more specific and specialized than the OECD one.

Relation between elasticity of trade costs and trade intensity for some selected countries. AUS Australia, AUT Austria, BEL Belgium, CAN Canada, CHE Switzerland, CHL Chile, CZE Czech Republic, DEU Germany, DNK Denmark, ESP Spain, EST Estonia, FIN Finland, FRA France, GBR United Kingdom, GRC Greece, HUN Hungary, ISL Iceland, NOR Norway, NZL New Zealand, POL Poland, PRT Portugal, SVK Slovak Republic, SVN Slovenia, SWE Sweden, TUR Turkey, USA United States. a APEC List of EGs. b OECD List of EGs. c APEC List of EGs. d OECD List of EGs

6.3 Analyses of TCEs by Exporters’ Income

As shown in Sect. 6.1. TCEs are very low for the last quantile. In this section, we analyze the TCEs while considering the income of the exporter. We follow the classification of The World BankFootnote 27 and create 5 groups of exporters: Low income, Low middle income, High middle income, High income non-OECD, High income OECD. Table 7 shows that TCEs are low when imports are from high income economies while they are very high for low and middle income economies. These results could explain the difficulties faced by WTO in adopting a list of EGs (De Melo 2015; Balineau and de Melo 2013; Sugathan 2013). They also corroborate the suggestion of Vikhlyaev (2004) that, liberalizing trade, trade gains would be for developed countries and environmental gains for developing countries. Several studies also point out the difficulties faced by exporters from developing countries and especially from the Least developed countries (LDCs) because of non-harmonized international standards and nontariff barriers (e.g., Cosbey 2008). The main raison for this result is that, on average, in most of the developed countries, EGs are less tariff-protected than other goods. Countries reduced protection by about 50% from 1996 (Balineau and de Melo 2013, p. 715) which favored the increase of international trade in EGs. For these countries, tariffs are less important in restricting imports over time, while nontariff barriers (NTBs) are more commonly used to regulate imports of EGs (He et al. 2015; De Melo 2015). Suggesting standards as a way of implementing the future WTO plurilateral trade agreement on EGsFootnote 28 could worsen trade deficit of developing countries (see e.g. Cosbey et al. 2010).

In Table 7, we also analyze the evolution of TCEs for the sub-group of sample by considering the year 2001 (beginning of the Doha Round) and 2012. TCEs decreased for high income economies while it increased for low and middle income economies.

7 Concluding Remarks

The negotiations on the liberalization of environmental goods within the WTO Doha Round face some specific challenges: (a) definitional issues related to environmental goods (EGs), (b) complexities regarding their classification for customs purposes, and (c) development issues and North–South cleavages. In sum, the modalities of liberalization remain contentious.

Little progress has been made to define an approach to reducing protection of EGs. However, the “list approach,” even if controversial, seems to be favored in current negotiations on environmental goods liberalization. Conflicting interests and differing perceptions of the benefits provided by EGs were reflected in different proposals determining EGs (APEC List, OECD List, Integrated List, etc.). In principle, trade liberalization by lowering the costs of EGs allows consumers (industries and/or households) to purchase them. Using an analysis of trade costs elasticities (TCEs), our paper indirectly explores the impact of trade liberalization on EGs when considering the lists proposed by APEC and OECD.

Given the particular structure of production and international trade within EGs industries, we present one of the very few empirical studies to specify a gravity model that assumes Translog preferences. Our results confirm the hypothesis of non-constant elasticities of substitution, in that elasticities of substitution are a function of the size of the importing country and the number of EGs imported from a specific supplier.

Removing trade protection for EGs will have a modest impact on their trade for two reasons. First, for most trading relationships, TCEs are very high, making it difficult for exporters to maintain their markets. This result could explain why developing countries have been reluctant to negotiate tariff reductions. Second, for the biggest importers and exporters, TCEs are very low. Our TCEs analysis pointed out that the countries that trade EGs the most (e.g. Japan, United States and Germany) have low average trade costs elasticities. Therefore, the expected gains of developed countries from participating in multilateral negotiations on EGs would come from reductions in trade protection for developing countries, where tariffs are higher than in developed countries. Overall, our results suggest that, because of their substantial effect on international trade, future negotiations on the liberalization of trade in environmental goods should also address the issue of nontariff barriers (NTBs) raised by recent studies. Indeed, because low and middle income economies have very high TCEs the expected benefits of reducing NTBs should be important for these economies.

Notes

See OECD (2006) for a definition.

Lovely and Popp (2011) find that economic integration increases access to environmentally friendly technologies and leads to earlier adoption.

See Article 31.3 of the Doha Declaration for WTO Strategy at http://www.international.gc.ca/media/comm/news-communiques/2014/01/24a.aspx [Accessed January 25, 2015].

The impacts of environmental taxation on the competitiveness and the location of polluting industries have received much attention in trade literature. A stricter environmental regulation is potentially harmful to competitiveness of firms because of higher productive costs and may lead to relocation of dirty industries towards countries with a lower environmental taxation (e.g. Copeland and Taylor 2004; Muradian et al. 2002). In contrast, according to the Porter hypothesis, more stringent but properly designed environmental regulations may induce innovation and, in turn, could enhance competitiveness. Tsurumi et al. (2015) and Costantini and Mazzanti (2012) recently investigated on this Porter hypothesis, and confirm that environmental policies may foster international competiveness by inducing technological innovation.

See at http://www.apec.org/Press/Features/2014/0115_egs.aspx [Accessed January 25, 2015].

These countries are Australia, Canada, China, Costa Rica, the European Union, Hong Kong, Japan, Korea, New Zealand, Norway, Singapore, Switzerland, Taiwan, and the United States. They account for 86% of global trade in environmental goods and by the end of 2015 they were 11 rounds of negotiations. See the US government website at http://www.ustr.gov/about-us/press-office/press-releases/2014/January/Froman-ministers-launch-new-talks-toward-increased-trade-environmental-goods [Accessed January 25, 2015]. At the end of 2015, Iceland, Israel and Turkey joined the group (http://www.international.gc.ca/trade-agreements-accords-commerciaux/topics-domaines/env/plurilateral.aspx?lang=eng, Accessed March, 2016).

De Melo (2015) asserts that climate change negotiations faced difficulties because of the inability to obtain full participation. However, an EGs agreement requires the participation of only a small number of countries to reach the level of 90% of world trade in EGs, which is the condition for extending the reductions negotiated to all WTO members.

Zugravu (2010) shows that, to increase EGs trade, attention must be paid not only to liberalization issues but also to cross-country harmonization of institutional quality, and especially, to environmental regulations.

Also see a discussion on the implications of relaxing CES preferences in Mrazova and Neary (2014).

Feenstra and Weinstein (2010) also provide theory and some evidences for the US.

In the present study we adjust the OECD List by dropping services, and keeping only goods.

During the same period, the growth in value of trade of industrial goods including environmental goods was 133.59%.

In the literature, the term extensive margin refers to the growth in exports stemming from the emergence of new destinations (e.g. Felbermayr and Kohler 2006) or new exported varieties (e.g. Hummels and Klenow 2005), or the participation of new firms on export markets (Chaney 2008; Helpman et al. 2008). Growth in trade at the intensive margin refers to an increase in the trade volume between existing partners, in the trade volume of existing varieties or in the export volume of firms currently engaged in export activities.

See the US government website at http://www.ustr.gov/about-us/press-office/press-releases/2014/January/Froman-ministers-launch-new-talks-toward-increased-trade-environmental-goods [Accessed January 25, 2015].

Homogeneity condition requires that \(\sum \nolimits _{m=1}^N {\alpha _m } =1\) and \(\sum \nolimits _{k=1}^N {\gamma _{km}} =0\).

The corresponding “traditional” or CES gravity equation is: \(ln \left( {{x_{ij} }/{y_j }} \right) =ln \left( {\tau _{ij}^{1-\sigma } } \right) +S_i +S_j +\xi _{ij} \) where \(S_i =\left( {\Pi _i } \right) ^{\sigma -1}+{y_i }/{y^{W}}\) and \(S_j =\left( {P_j } \right) ^{\sigma -1}\). This specification implies a constant elasticity of substitution \(\eta ^{CES}=\left( {1-\sigma } \right) \).

This specification is preferred because “any possible measurement error surrounding \(n_i \)is passed on to the left-hand side and estimation can be carried out with both exporter and importer fixed effects, as is frequently done in the gravity literature” (Novy 2013, p. 275).

Data on trade were collected using World Integrated Trade Solution (WITS) software (See http://wits.worldbank.org/wits/).

Before normalization, the number of EGs from the exporting country (\(n_i )\) is widely dispersed: with a maximum value of 112 (and a minimum value = 0) for OECD List, and a maximum value of 54 (and a minimum value = 0) for the APEC List. This requires standardization to control the effects of higher/lower values. Also see Hummels and Klenow (2005).

See https://stat.unido.org/home [Accessed March 2, 2015] and the concordances at http://unstats.un.org/unsd/cr/registry/regot.asp?Lg=1 [Accessed January 25, 2015], and http://wits.worldbank.org/wits/product_concordance.html [Accessed January 25, 2015].

Santos Silva and Tenreyro (2006) suggest the use of the Poisson pseudo-maximum likelihood (PPML) procedure to estimate the multiplicative form of the gravity equation. They showed that the PPML procedure yields consistent estimates in the presence of heteroskedasticity. However, as indicated by Olivero and Yotov (2012), in estimating a size-adjusted gravity model we deal with expenditure endogeneity as well as the important issue of heteroscedasticity.

The first stage Probit results are reported on Table 9 in the “Appendix”.

Based on survey data, Anderson and van Wincoop (2004) suggest that the elasticity of substitution is approximately the middle of the range [5; 8].

The parameters \(\beta ^{translog}\) and \(\beta ^{traditional}\) are respectively the estimated distance coefficient from the Translog and CES gravity models.

From 1996 to 2011, the average share of duty-free imports of EGs rose by 73.17 percentage points (He et al. 2015).

See at http://data.worldbank.org/about/country-and-lending-groups . Accessed March 15, 2016.

See e.g. Cosbey et al. (2010).

References

Anderson JE, van Wincoop E (2003) Gravity with gravitas: a solution to the border puzzle. Am Econ Rev 93:170–192

Anderson JE, van Wincoop E (2004) Trade costs. J Econ Lit 42:691–751

Arkolakis C, Costinot A, Rodríguez-Clare A (2012) New trade models, same old gains? Am Econ Rev 102:94–130

Badinger H (2007) Has the EU’s Single Market Programme fostered competition? Testing for a decrease in mark-up ratios in EU industries. Oxf Bull Econ Stat 69:497–519

Baier SL, Bergstrand JH (2007) Do free trade agreements actually increase members’ international trade? J Int Econ 71:72–95

Balineau G, de Melo J (2013) Removing barriers to trade on environmental goods: an appraisal. World Trade Rev 12:693–718

Baldwin R, Taglioni D (2006) Gravity for dummies and dummies for gravity equations. NBER working papers 12516. National Bureau of Economic Research

Canton L, Soubeyran A, Stahn H (2008) Environmental taxation and vertical Cournot oligopolies: how eco-industries matter. Environ Resour Econ 40:369–382

Chaney T (2008) Distorted gravity: the intensive and extensive margins of international trade. Am Econ Rev 98:1707–1721

Chen N, Imbs J, Scott A (2009) The dynamics of trade and competition. J Int Econ 77:50–62

Copeland B, Taylor MS (2004) Trade, growth and the environment. J Econ Lit 42:7–71

Cosbey A (2008) Trade and climate change: issues in perspective. International Institute for Sustainable Development, Winnipeg

Cosbey A, Aguilar A, Ashton M, Ponte S (2010) Environmental goods and services negotiations at the WTO: lessons from multilateral environmental agreements and ecolabels for breaking the impasse. International Institute for Sustainable Development, March 2010

Costantini V, Mazzanti M (2012) On the green and innovation side of trade competitiveness? The impact of environmental policies and innovation on EU exports. Res Policy 41:132–153

David M, Sinclair-Desgagne B (2010) Pollution abatement subsidies and the eco-industry. Environ Resour Econ 45:71–282

David M, Nimubona A-D, Sinclair-Desgagne B (2011) Emission taxes and the market for abatement goods and services. Resour Energy Econ 33:179–191

De Melo J (2015) Trade liberalization at the environmental goods agreement negotiations: what is on the table? How much to expect? In: GGKP green growth knowledge platform-third annual conference fiscal policies and the green economy transition: generating knowledge—creating impact

EUROSTAT (2009) The environmental goods and services sector. A data collection handbook. 2009 edition

Feenstra R (2003) A homothetic utility function for monopolistic competition models, without constant price elasticity. Econ Lett 78:70–86

Feenstra R (2010) New product with a symmetric AIDS expenditure function. Econ Lett 7106:108–111

Feenstra RC, Weinstein DE (2010) Globalization, markups, and the US price level. National Bureau of Economic Research, Cambridge

Felbermayr GJ, Kohler W (2006) Exploring the intensive and extensive margins of world trade. Rev World Econ 142:642–674

Frankel JA, Rose AK (2005) Is trade good or bad for the environment? Sorting out the causality. Rev Econ Stat 87:85–91

GIER [German Institute for Economic Research-DIW Berlin] (2009) Global demand for environmental goods and services on the rise: good growth opportunities for German suppliers, vol 5. Weekly report no. 20/2009, Sept 3

Gohin A, Féménia F (2009) Estimating price elasticities of food trade functions: how relevant is the CES-based gravity approach? J Agric Econ 60:253–272

Greaker M, Rosendahl KE (2008) Environmental policy with upstream pollution abatement technology firms. J Environ Econ Manag 56:246–259

He Q, Fang H, Wang M, Peng B (2015) Trade liberalization and trade performance of environmental goods: evidence from Asia-Pacific economic cooperation members. Appl Econ 47:3021–3039

Head K, Mayer T (2002) Illusory border effects: distance mismeasurement inflates estimates of home bias in trade. Centre d’Etudes Prospectives et d’Informations Internationales (CEPII). Working paper no. 2002-01

Head K, Mayer T (2013) Gravity equations: workhorse, toolkit, and cookbook. In: Gopinath G, Helpman E, Rogoff K (eds) Handbook of international economics, vol 4. North Holland, Amsterdam

Heckman JJ (1979) Sample selection bias as a specification error. Econometrica 47:153–161

Helpman E, Melitz MJ, Rubinstein Y (2008) Estimating trade flow: trading partners and trading volumes. Q J Econ 123:444–487

Hummels D, Klenow PJ (2005) The variety and quality of nation’s exports. Am Econ Rev 95:704–723

Lovely M, Popp D (2011) Trade, technology, and the environment: does access to technology promote environmental regulation? J Environ Econ Manag 61:16–35

Managi S, Hibiki A, Tsurumi T (2009) Does trade openness improve environmental quality? J Environ Econ Manag 58:346–363

Manzano GN, Prado SA (2015) Evaluation of the APEC environmental goods initiative: a dominant supplier approach. Philippine Institute for Development Studies. DP 2015-34

Martínez-Zarzoso I, Felicitas NLD, Horsewood N (2009) Are regional trading agreements beneficial? Static and dynamic panel gravity models. N Am J Econ Finance 20:46–65

Melitz MJ, Ottaviano GI (2008) Market size, trade, and productivity. Rev Econ Stud 75:295–316

Mrazova M, Neary P (2014) Together at last: trade costs, demand structure, and welfare. Am Econ Rev 104:298–303

Muradian R, O’Connor M, Martinez-Alier J (2002) Embodied pollution in trade: estimating the ‘environmental load displacement’ of industrialised countries. Ecol Econ 41:51–67

Nimubona AD (2012) Pollution policy and trade liberalization of environmental goods. Environ Resour Econ 53:323–346

Nimubona AD, Benchekroun H (2015) Environmental R&D in the presence of an eco-industry. Environ Model Assess 20(5):491–507

Novy D (2013) International trade without CES: estimating translog gravity. J Int Econ 89:271–282

OECD [Organization of Economic Cooperation and Development] (2006) Étude sur la politique commerciale, Biens et services environnementaux, Paris

Olivero MP, Yotov Y (2012) Dynamic gravity: theory and empirical implications. Can J Econ 45:64–92

Raimondi V, Scoppola M, Olper A (2012) Preference erosion and the developing countries exports to the EU: a dynamic panel gravity approach. Rev World Econ 148:707–732

Santos Silva JMC, Tenreyro S (2006) The log of gravity. Rev Econ Stat 88:641–658

Schwartz S, Stahn H (2014) Competitive permit markets and vertical structures: the relevance of imperfectly competitive eco-industries. J Public Econ Theory 16(1):69–95

Sugathan M (2013) List of environmental goods: an overview. Information note, Environmental goods and services series. International Centre for Trade and Sustainable Development, Geneva

Tsurumi T, Managi S, Hibiki A (2015) Do environmental regulations increase bilateral trade flows? BE J Econ Anal Policy 15:1549–1577

Vossenaar R (2013) The APEC list of environmental goods: an analysis of the outcome & expected impact. International Centre for Trade and Sustainable Development, Geneva. www.ictsd.org

Vikhlyaev A (2004) Environmental goods and services-defining negotiations or negotiating definitions? J World Trade 38:93–122

Zugravu N (2010) Trade and sustainable development: should “transition countries” open their markets to environmental goods? Unpublished paper

Author information

Authors and Affiliations

Corresponding author

Additional information

The authors wish to thank Vramah S. M. Gbagbeu for providing valuable ideas at the early stage of this research. Financial support of the Fonds Québecois de Recherche – Société et Culture (FQRSC) is gratefully acknowledged.

Rights and permissions

About this article

Cite this article

Tamini, L.D., Sorgho, Z. Trade in Environmental Goods: Evidences from an Analysis Using Elasticities of Trade Costs. Environ Resource Econ 70, 53–75 (2018). https://doi.org/10.1007/s10640-017-0110-2

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10640-017-0110-2