Abstract

We develop a dynamic stochastic general equilibrium model to understand how environmental policy instrument choice affects trade. We extend the existing literature by employing an open economy model to evaluate three environmental policy instruments: cap-and-trade, pollution taxes, and an emissions intensity standard in the face of two types of exogenous shocks. We calibrate the model to Canadian data and simulate productivity and import price shocks. We evaluate the evolution of key macroeconomic variables, including the trade balance in response to the shocks under each policy instrument. Our findings for the evolution of output and emissions under a productivity shock are consistent with previous closed economy models. Our open economy framework allows us to find that a cap-and-trade policy dampens the international trade effects of the business cycle relative to an emissions tax or intensity standard. Under an import shock, pollution taxes and intensity targets are as effective as cap-and-trade policies in reducing variance in consumption and employment. The cap-and-trade policy limits the intensity of the import competition shock suggesting that particular policy instrument might serve as a barrier to trade.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

The linkages between international trade and environmental policy have been extensively documented. Economists, policy makers and environmentalists have long worried about how environmental regulations affect the location decisions of firms and the flow of goods between countries. The relationship between environmental regulation and trade plays a role in the distribution of costs of complying with environmental regulation and the efficacy of environmental regulation in reducing pollution emissions. Free trade advocates have argued that some environmental regulations are simply trade restrictions in disguise. While the importance of the relationship between environmental policy and international trade is undisputed, there has been relatively little work on how the form that environmental regulation takes affects trade flows.

In this paper, we analyze the properties of environmental policy instruments for an economy open to international trade and capital flows. We document the economic responses to environmental regulation across the business cycle and unanticipated import surges. To do so, we develop a small open economy (SOE) dynamic stochastic general equilibrium (DSGE) model that incorporates three environmental policy instruments which are certainty equivalent in emissions: cap-and-trade, pollution tax, and an emission intensity standard, which sets an allowed emissions level per unit of output. We introduce exogenous temporary productivity shocks to simulate economic growth and an exogenous consumption price shock to simulate an unanticipated import surge. We then compare the evolution of key macroeconomic variables across cap-and-trade, pollution tax, and emissions intensity standard policy instruments. The results shed light on how policy instrument choice affects trade flows across the business cycle and in response to import competition.

For example, Copeland (1994) and Copeland and Taylor (2003) recognize the interaction between international trade and pollution in a small open economy. Ederington et al. (2005) shows that environmental regulations have a significant impact on trade flows between developed and developing nations, particularly in more mobile industries. McAusland (2008) analyzes environmental regulation’s impact on international trade flows while comparing pollution associated with production and consumption. This literature relies on static models and assumes a constant marginal utility of consumption. We relax those assumptions to incorporate environmental regulation’s intertemporal effects under unanticipated shocks. The intertemporal effects are important in consumers’ investment decisions in the face of unanticipated growth shocks because regulations like cap-and-trade fix the amount of emissions despite shocks to compliance costs. An emissions tax fixes the abatement cost while inducing uncertain outcomes in emissions. These effects are even more important in economies open to international trade and capital because of the additional investment channel. We contribute to this literature by showing that the choice of environmental policy instrument affects the levels of international trade and investment flows regardless of the amount of emissions reduction the policy generates.

Since Weitzman (1974) seminal article, economists have been weighing the merits of different environmental policy instruments. More recently, environmental policy’s ability to respond to the business cycle has been an important metric in evaluating the policy instrument choice. Pizer (2005), Webster et al. (2010) and Ellerman and Wing (2003) compare policies indexing emissions’ levels to output (known as intensity targets) to pollution taxes, and to cap-and-trade policies.Footnote 1 Fischer and Springborn (2011) and Angelopoulos et al. (2013) are among the few researchers who compared the performance of emission caps, emission taxes, and indexed standards under real business cycles. Annicchiarico and Dio (2015) compares the performance of these policy instruments under nominal shocks. We contribute to this literature by introducing an open economy model and tracking the effects of policy instruments on trade flows under real business cycles. The open economy model also allows us to evaluate environmental policy instruments performance in response to an import shock.

We develop a small economy model in which production generates pollution and the economy is open to international trade and capital movement. We solve a steady state version of the model and introduce each of the policy instruments. We then calibrate a numerical model to Canadian data and solve for the impact of a twenty percent reduction in emissions through three policy instruments. We introduce an exogenous productivity shock and track the effect of the shock on a number of variables: output, consumption, emissions and the trade balance among others, until the model has returned to its steady state. We simulate the model for a no environmental regulation baseline and compare the results to those from a model with a tax, cap-and-trade or intensity target environmental regulation. We report these results in a series of impulse response graphs and by calculating the coefficient of variation in macroeconomic variables across the shock. Using an open economy model allows us to confirm the robustness of the results in the existing closed economy models. More importantly, it allows us to evaluate how different environmental policy instruments affect trade flows across the business cycle and how different policy instruments respond to import competition.

Our results suggest that cap-and-trade policies reduce the business cycle’s intensity relative to a pollution tax or intensity target. This is consistent with the findings of Fischer and Springborn (2011), Annicchiarico and Dio (2015) in closed economy models. Allowing the regulated economy to access global product and investment markets does not affect the key findings of the existing literature. Employing an open economy model allows us to assess the impact of the business cycle on the trade balance. We find that a cap-and-trade policy dampens the effects of the business-cycle on the trade balance, reducing exports during an expansion and imports during a recession.

Employing an open economy model also allows us to understand how the economy as a whole responds to an import shock under different environmental policy instruments. We model the import shock as an unanticipated change in the relative price of consumption, which makes imports less expensive. In response to an import shock all three policy instruments have a similar impact on key economic variables like consumption and employment. The cap-and-trade policy is most effective in reducing the surge in imports. In this way cap-and-trade policies can act as an unintended trade barrier, reducing the severity of import competition during times when it is most intense.Footnote 2

The mechanism is straightforward. A cap-and-trade program fixes the level of emissions, while the price of complying with the environmental regulation varies with economic conditions. The change in the price of polluting acts as a dampening mechanism on unanticipated shocks. After an unanticipated increase in economic growth the price of complying with the regulation increases as the demand for pollution permits goes up. This acts as an increase in input prices which reduces economic growth, consumption and imports. During an unanticipated decrease in the price of imports, the same thing happens in reverse. As domestic consumers switch to consuming imports, domestic production falls and with it the demand for pollution permits. The falling price of permits reduces the cost of domestic production helping reduce the cost advantage enjoyed by imports and dampening the effects of the surge in imports.

Most similar to our study are recent papers examining the robustness of different environmental policy instruments to business-cycle shocks.Footnote 3 Heutel (2012) evaluates the optimal evolution of dynamic environmental regulation across the business cycle and finds that the optimal carbon taxes and cap-and-trade policies to be pro-cyclical. We employ a static exogenous environmental regulation to evaluate how economies respond to the exogenous environmental regulation rather than evaluating the path for optimal policy that policy makers may not implement during business-cycle peaks and troughs. Fischer and Springborn (2011) evaluates carbon taxes, emissions caps, and emissions intensity standards across the business cycle in a closed economy model. We expand on this approach by incorporating a labor-leisure choice in a small open-economy model. Most recently, Annicchiarico and Dio (2015) compare a cap-and-trade policy with an emissions tax and an intensity target in a New Keynesian model and shows that cap-and-trade policies dampen the macroeconomic dynamics but that the degree of price rigidity matters in terms of welfare. We extend these results by comparing exogenous environmental policy instruments across the business cycles for economies open to international trade and capital mobility. We also evaluate the policy instruments’ response to an international trade shock, an exercise beyond the scope of previous work.

The remainder of this paper is organized as follows. Section 2 outlines the model. Section 3 solves the model in the steady state and evaluates the policies in the absence of exogenous shocks. Section 4 presents the model’s numerical analysis, including calibration to Canadian data and evaluates environmental policy instruments’ response to the business cycle and import shocks. Section 6 concludes.

2 The Model

Households supply labor and capital to firms, which produce goods using two factor inputs: labor and capital. The economy is open to free trade and capital is allowed to flow internationally; however, labor is immobile. The domestic government’s role is limited to implementing an environmental policy and redistributing revenues, if any, to households in a lump-sum. Therefore, in this economy, outputs are either domestically consumed, invested, or exported. If domestic absorption (consumption plus investment) exceeds production, the economy imports from the rest of the world. This implies that households can satisfy both their consumption and investment needs by raising foreign debt if needed. This point is the key point of departure from models in the literature.Footnote 4 We assume that our economy is small compared to the rest of the world, meaning domestic environmental policy changes will not affect capital’s international interest rate and is exogenous to this economy. The firms are price takers, and they make export and import decisions given the world’s fixed prices.

2.1 Households’ Problem

With imperfect capital mobility, households can borrow internationally but face an upward-sloping supply schedule of borrowing because of a country-specific risk premium that increases with the level of debt (see Schmitt-Grohé and Uribe 2003; Mendoza and Uribe 2000; Schmitt-Grohé and Uribe 2001). Under the debt-elastic interest rate, the domestic interest rate is a function of an exogenous international interest rate and a premium

where \(R^*\) is the exogenous interest rate in international capital markets, P(.) is the economy’s risk premium, \(\widetilde{D_t}\) is the economy’s aggregate debt, and \(\overline{D}\) is the steady-state debt level. Borrowing costs increase with the stock of debt issued (\(P^\prime >0\)).

The representative household maximizes her expected lifetime utility in present value

where \(\beta \in (0,1)\) is the fixed subjective discount factor, \(C_{t}\) is consumption, and \(H_{t}\) represents the amount of labor the household supplies. Note that pollution does not appear in the utility function. This captures households ignoring emissions in their optimization decision, but makes welfare comparisons between different pollution levels impossible. Because we consider environmental policies that are certainty equivalent in emissions reduction, the results can be used for cost effectiveness type analysis. We assume that the representative household is endowed with one unit of time, and we abstract from population growth. The household is subject to the following budget constraints:

where \(D_t\) is the household’s stock of foreign debt, \(p_t\) is the relative price of consumption, \(K_t\) is the stock of capital, \(I_t\) is investment, \(\Phi\)(.) is investment-related adjustment cost (with \(\Phi (0) = 0, \Phi ^\prime (0)= 0\)), \(w_t\) is the wage-per-unit of labor supplied to firms, \(r_t\) is the rental rate per unit of capital supplied to firm, \(G_t\) is a real lump-sum transfer from the government (if any), and \(\Pi _t\) represents a dividend from firms. We consider the debt to be denominated in terms of the world’s export price of outputs. In our model, all prices are relative to the world’s price of outputs.

Capital depreciates at the rate of \(\delta\). With \(\lambda _{1_{t}}\) being the Lagrangian multiplier for the budget constraint, the representative household’s maximization problem can be represented by the following optimality conditions:

These are standard Euler equations. Equation (4) shows that households’ optimal consumption level occurs when marginal utility from consumption is equal to the marginal utility from wealth. In Eq. (5), we see that households optimally supply labor when marginal utility from leisure is equal to the wage per unit of labor supplied. Equation (6) shows that households optimally invest one unit of capital when marginal cost of the investment (in terms of utils) is equal to the expected present value of marginal benefit of the investment next period. The investment’s marginal cost is shown in the LHS of Eq. (6), and the expected present value of marginal benefit of the investment next period is shown in the equation’s RHS. Likewise, Eq. (7) shows the cost and benefit of borrowing a unit of debt. The LHS of Eq. (7) is the utility the agent receives from one unit of borrowing while the RHS is the expected present value of the debt’s repayment cost (in utils).

2.2 Firms’ Problem

The structure of the government’s environmental policy and the representative firm’s problem are similar to Fischer and Springborn (2011). The firm’s output in a period is denoted by \(Y_t\). We model pollution as an input to production.Footnote 5 We define emissions as \(M_t\) and denote \(q_t\) as the cost of emissions. Since, we are modeling emission as one-to-one to output, modeling \(M_t\) as either fossil-fuels i.e. an input or as emissions i.e. an output, will have no difference in our model if these terms are correctly calibrated. In case of fossil-fuels, \(q_t\) will represent fossil-fuels cost and if emissions, \(q_t\) will represent existing regulatory costs against polluting. To address the externalities associated with pollution, we assume the government imposes an environmental policy, which could be a cap-and-trade (CAP), an emissions tax (T), or an emission intensity target (a ratio RATIO). These policies are cost-less to administer, and firms comply with the environmental policies. Also, these policies are exogenously chosen to reduce emissions and could be sub-optimal.Footnote 6 The benchmark case in our analysis is the absence of environmental policy.

Under cap-and-trade, emissions are capped at an exogenous level (CAP) below the emissions level in the no policy case. In the no policy case in our model, output and emissions have one-to-one relationship, so the capped level is pinned down as a portion of the level of output. Under the cap-and-trade policy firms are required to possess a permit to emit a unit of pollution in each period and pay a permit price (the constraint’s shadow value in the case of cap-and-trade). In this case, \(CAP(Y_t) = M_t\), which is exogenously fixed. Under an emissions-tax policy, firms are required to pay a tax T for each unit of emissions generated, and the tax revenue is transferred back to households as a lumpsum government transfer. In the case of an emission intensity target, the policy exogenously fixes a ratio \(RATIO(Y_t) = \frac{M_t}{Y_t}\).

We present separate Lagrangians of the representative firm’s problem under each of the environmental policies.

2.3 No Policy

where \(Y_t = A_t K_{t-1}^{\alpha _1} M_t^{\alpha _2} H_t^{1-\alpha _1 - \alpha _2}\), \(A_t\) is the total factor productivity (exogenous). The capital share in output is \(\alpha _1\), and the emissions expenditure’s share in output is \(\alpha _2\); thus, \(1-\alpha _1-\alpha _2\) is the share of labor in production. The factor shares, \(\alpha _1\) and \(\alpha _2\), are bounded by (0, 1). The fossil-fuel expenditure revenue \(q_t M_t\) is transferred to households in a lumpsum government transfer (G\(_t\)) so that \(G_t = q_t M_t\). Note that output is the numeraire good; thus, the prices are relative to the output’s international price.Footnote 7

2.4 Cap and Trade

where \(CAP(Y_t)\) an exogenous cap on emissions and \(\lambda _{2_t}\) is the permit price (the policy constraint’s shadow price). The revenue from the permit is transferred to households as a real lumpsum government transfer, so that \(G_t = (q_t +\lambda _{2_t}) M_t\).

2.5 Emissions Tax

where T an exogenous tax on per unit emissions generated, and the tax revenue (\(TM_t\)) is transferred to households as a real lumpsum government transfer (G\(_t\)), so that \(G_t = (q_t +T) M_t\).

2.6 Intensity Target

where \(RATIO(Y_t)\) is an intensity target ratio and \(\lambda _{3_t}\) is the policy’s scarcity rent which is transferred to the households as a real lumpsum government transfer, so that \(G_t = (q_t +\lambda _{3_t}) M_t\).

The economy responds to two exogenous shocks: home productivity and the relative price of consumption. The economy may face a sudden improvement in technology, leading to a boom in the economy. We model such economic growth through a temporary positive shock to the total factor productivity. At the same time, an economy may face changes in the intensity of import competition driven by changes in foreign prices. We model these shocks as an exogenous positive temporary shock to consumption’s relative price, in other words imports become less expensive reducing the domestic price of consumption. To keep the model bounded, we assume that these two shocks follow stationary autoregressive processes as below:

where, \(\rho _A\) and \(\rho _p\) are persistency parameters of the shocks and are bounded by 0 and 1. The parameters \(\epsilon _{A_t}\) and \(\epsilon _{p_t}\) are serially uncorrelated shocks normally distributed with mean zero and standard deviations \(\sigma _{A}\) and \(\sigma _{p}\), respectively.

The trade balance is defined as domestic production minus domestic absorption. Domestic absorption is the sum of domestic consumption, domestic investment and investment-related expenditures \((\hbox{p}_{t}\hbox{C}_t + \hbox{I}_t + \Phi (\cdot ))\). It is the sum of all domestic expenditures. The difference between domestic production and domestic absorption is the amount of resources that must flow internationally. Therefore, the trade balance is:

The current account is defined as the sum of the trade balance and the net investment income on the country’s net foreign asset position, \(R_{t-1}D_{t-1}\). The current account (denoted by \(ca_t\)) in period t is defined as:

Now combining Eqs. (3), (14) and (15), we obtain the following alternative expression for the current account: \(ca_t=-(D_t-D_{t-1})\). This expression is known as the fundamental balance of payments identity. It shows that the current account equals the change in the country’s net foreign asset position. In other words, a current account surplus is associated with a reduction in the country’s external debt of equal magnitude.

To solve the model we need to assume functional forms for utility and the production function. We employ a Cobb–Douglas utility function with an intertemporal elasticity of substitution across periods as is standard in the literature

where, \(\alpha\) is the share of income that households spend on consumption, and \(\sigma\) is the intertemporal elasticity of substitution across periods (also known as the relative risk-aversion parameter).

Production has a Cobb–Douglas function with the constant returns to scale \(Y_t = A_t \; K_{t-1}^{\alpha _1} \; M_t^{\alpha _2} \; H_t^{1-\alpha _1 - \alpha _2}\). The adjustment cost of investment has a quadratic function \(\Phi (K_{t} - K_{t-1}) = \frac{\phi }{2} (K_{t} - K_{t-1})^2\) where, \(\phi (>0)\) is an adjustment cost shift parameter.

3 Steady State Analysis

This section solves for the economy’s response to the introduction of each of the selected policies in the absence of shocks. The derived first order conditions are shown in the appendix. In the steady state, there is no uncertainty in the economy, and the system is in long-run equilibrium; therefore, we abstract from using time subscripts. Incorporating the functional forms and the household’s and firm’s problems, we represent the steady state by four ratios: labor-to-leisure (z), capital-to-output (k), emission-to-output (m) and consumption-to-output (c).

4 No Policy

In the environmental policy’s absence, the capital-to-output ratio \(k = \frac{\alpha _1}{R^* + \delta }\), emission-to-output ratio \(m = \frac{\alpha _2}{q}\), and the consumption-to-output ratio \(c = \left( 1 - \frac{\delta \alpha _1}{R^* + \delta } - R^* \bar{d}\right) \frac{1}{p}\). We note that the ratio c is smaller compared to that in a closed economy because of the debt-servicing requirement in an open economy. We find the labor-leisure ratio \(z = \frac{\alpha }{1-\alpha }\frac{(1-\alpha _1-\alpha _2)}{\left( 1 - \frac{\delta \alpha _1}{R^* + \delta } - R^* \bar{d}\right) }\) under no policy. Increases in the debt-to-output ratio are associated with increased employment in this economy compared to the closed economy since more output is needed to service the debt.

4.1 Cap and Trade

Under a cap-and-trade system, the emission is bounded by exogenous level of \(\bar{M} = CAP\). This provides emission-to-output ratio \(m = \frac{\alpha _2}{q+\lambda _2}\), capital-output ratio \(k = \frac{\alpha _1}{R^* + \delta }\), and consumption-to-output ratio of \(c = \left( 1 - \frac{\delta \alpha _1}{R^* + \delta } - R^* \bar{d}\right) \left( \frac{1}{p}\right)\). We find the labor-leisure ratio \(z = \frac{\alpha }{1-\alpha }\frac{(1-\alpha _1-\alpha _2)}{\left( 1 - \frac{\delta \alpha _1}{R^* + \delta } - R^* \bar{d}\right) }\). Under this policy, the emission permit \(\lambda _2 = \frac{\alpha _2 - q\;m}{m}\) restricts the emissions level to \(\bar{M}\). The revenue from permits are distributed to households in a lumpsum government transfer.

4.2 Tax

In the case of an environmental tax policy, the government imposes a constant pollution tax (T) charged for each unit of pollution. The tax rate is imposed such that the tax policy restricts the emissions level in the steady state equivalent to that under the cap-and-trade policy. In such a case, tax revenue is distributed to households in a lump sum transfer. We find the emission-to-output ratio \(m = \frac{\alpha _2}{q+T}\), capital-to-output ratio \(k = \frac{\alpha _1}{R^* + \delta }\), and consumption-to-output ratio of \(c = \left( 1 - \frac{\delta \alpha _1}{R^* + \delta } - R^* \bar{d}\right) \left( \frac{1}{p}\right)\). We find the labor-leisure ratio \(z = \frac{\alpha }{1-\alpha }\frac{(1-\alpha _1-\alpha _2)}{\left( 1 - \frac{\delta \alpha _1}{R^* + \delta } - R^* \bar{d}\right) }\). We impose a tax T equivalent to the permit price \(\lambda _2\) under cap-and-trade and this yields the ratios similar to that under the cap-and-trade policy. The tax rate required to restrict the emission under this policy is \(T = \frac{\alpha _2-q\;m}{m}\).

4.3 Intensity Target

For an intensity target, the government requires a maximum fixed ratio of emissions-per-unit output \(\bar{m} = \frac{M}{Y}\). We represent the intensity target policy by \(RATIO =\bar{m}\) which yields \(CAP = \bar{M} = \bar{m} \; Y\), where \(\bar{M}\) is the emission level restricted under the cap-and-trade policy. Since, RATIO restricts emission-to-output ratio \(m = \bar{m}\), we find the capital-to-output ratio \(k = \frac{\alpha _1 (1 + \lambda _3 \bar{m})}{R^* + \delta }\). The consumption-to-output ratio \(c = \frac{1}{p}\left( 1 - \frac{\delta \alpha _1 (1 + \lambda _3 \bar{m})}{R^* + \delta } - R^*\bar{d}\right)\). The labor-leisure ratio \(z = \frac{\alpha }{1-\alpha }\frac{(1-\alpha _1-\alpha _2)(1+\lambda _3 \bar{m})}{\left( 1 - \frac{\delta \alpha _1 (1 + \lambda _3 \bar{m})}{R^* + \delta } - R^*\bar{d}\right) }\). In our model, the scarcity rent \(\lambda _3 = \frac{\alpha _2 - q\bar{m}}{\bar{m}(1-\alpha _2)}\) restricts emissions to the same level as the cap-and-trade policy. The scarcity rent is bigger than the permit price under the cap-and-trade policy, meaning the emission-to-output ratio under the intensity target that restricts the emissions level equivalent to the cap-and-trade policy is smaller, yielding outputs under this policy higher than those under the cap-and-trade policy.

5 Numerical Analysis

5.1 Data Aggregation and Model Calibration

In this section, we summarize the long-run empirical relationships used to identify our model’s deep structural parameters. The long-run relationship corresponds to Canada’s historical annual expenditure-based GDP for 1981–2010. This information is available from Statistics Canada.Footnote 8 The model is further parameterized such that the calibrated economy’s structure simulates the Canadian economy’s business cycles.Footnote 9 To be consistent with our model specification, GDP is calculated by netting out government expenditure. Households’ consumption includes goods and services, investment includes gross fixed-capital formation, and net export of goods and services accounts for trade flows. For the relative price of consumption, we use the export and import prices in the Penn World Table, which is available for 1950–2010.Footnote 10

The deep structural parameter values used in the steady state to represent Canada’s historical economy are shown in Table 1, and the key macroeconomic ratios in the steady state are shown in Table 2. During the period considered, households’ consumption of goods and services accounts for 68% of GDP, investment accounts for 26%, and the net export of goods and services accounts for the remaining GDP (6%). The average compensation to employees is 45% of gross outputs during the period.Footnote 11 We set 0.45 as the labor share in outputs. For the share of pollution costs, we follow Fischer and Springborn (2011) who use expenditures on fossil fuel as a proxy for expenditures on polluting inputs. They find those costs to be around 9% of GDP in Canada.Footnote 12 We set the share of capital \(\alpha _1=0.46\) and the share of polluting inputs as \(\alpha _2=0.09\). The exogenous international interest rate is fixed at 4% per annum; the annual depreciation rate of capital is fixed at 10%; the intertemporal elasticity of substitution across periods is fixed at 2. These amounts are standard in the literature. The persistency parameters and the standard deviation correspond to data from the Penn World Table.Footnote 13 We estimate uni-variate AR(1) processes for the total factor productivity and the relative price of imports-to-exports to set the persistency parameters of total factor productivity and import shocks, which are 0.533 and 0.319, respectively. The corresponding standard deviations of the shocks are 0.0149 and 0.0296, respectively. Since our sample period captures recent years, the estimates for the total factor productivity shock are a slightly higher than those in the literature (Uribe and Schmitt-Grohé, 2017).

The parameters’ values \(\bar{d}\), \(\alpha\), \(\psi\) and \(\phi\) are chosen to mimic the dynamic performance of the Canadian economy’s business cycles as found in the literature. We set \(\bar{d} = 0.909\) such that the long-run trade balance to GDP ratio in our model is 0.0639 to match the historical average trade flow share of goods and services to the GDP in the sample period. The share of income that households spend on consumption is calibrated as 33% (\(\alpha = 0.33\)) such that households’ labor supply in the steady state is 27%. The country-specific risk premium is set at \(\psi = 0.0742\) to match the dynamic performance of trade balance and current account as found in the literature. The relative prices of consumption and polluting inputs in terms of the output’s world price are set at 1 in the steady state. The total factor productivity is also set at 1 in the steady state. These normalizations let us evaluate the model’s responses to shocks as cyclical responses rather than as a trend.

5.2 Steady State Responses to Environmental Policies

We model the cap-and-trade policy by setting the emissions level at 0.041, which represents a 20% reduction in emissions level from the no policy case. The emissions tax is set at 0.207 per unit which represents the emissions cap’s shadow price set in the cap-and-trade policy. We set an emission-to-output ratio of 0.722 as the intensity target, which yields 0.041 emissions level in the steady state. Note that the three policies are certainty equivalent in emissions level. In the steady state each of the three policies yield a 20% reduction of emissions from the no policy case.

The economic responses in the steady state is shown in Table 3. In the absence of shocks, no difference exists between the cap-and-trade and tax policies; but the intensity target produces higher levels of consumption, labor supply, outputs, investment, and capital stocks than the cap-and-trade or tax policies. These findings are consistent with our analytical results. GDP decreases by 3.4% under the cap-and-trade and tax cases while it decreases by 0.2% under the intensity target. Consumption falls by 3.8% from no policy under the cap-and-trade or tax cases, but the fall is 1.3% under the intensity target.

Investment decreases by 3.4% under the cap-and-trade and tax cases while investment increases by 1.7% under the intensity target case. Under the cap-and-trade and tax cases, the labor supply remains similar to the no-policy case, but the supply of labor increases by 2.2% under the intensity target. This means, to maintain the same emissions level from the cap-and-trade case under the intensity target, firms substitute emissions with labor and capital which are clean inputs. Furthermore, the required ratio under the intensity target to maintain the same level of emissions, as explained in the analytical analysis, is stricter than under the cap-and-trade. As a result, the labor supply and investment are higher than the no-policy baseline, but the increment to these inputs is small and has little effect on output. Also, the permit price under the intensity target case must increase by 27.4% compared to the cap-and-trade case. This may be the reason that developing countries, which expect higher levels of future growth have been more likely to commit to intensity standards as a part of the Paris Climate Agreement.Footnote 14

5.3 Unanticipated Shocks and Environmental Policy

We now evaluate the dynamic properties of the emissions tax, cap-and-trade, and intensity target in the presence of shocks. We simulate an economic growth shock through an exogenous, temporary, and positive stochastic shock to the total factor productivity. We simulate an import shock through an exogenous, temporary, and positive stochastic shock to the world’s relative price of imports to exports, which is equivalent to an adverse terms of trade shock. We compute the first and second moments of the key macroeconomic variables and trace their impulse response functions. The simulation results are computed using the “pure” perturbation method, which relies on a second-order Taylor approximation of the model around its initial steady state.Footnote 15

We simulate the model recording trajectories of each endogenous variables for a duration of 300 periods by randomly drawing each unanticipated temporary shock 1000 times. We drop the first 100 periods of the series assuming a burn-in period and we use the remaining 200 periods in the series to generate model statistics. Then, we compare key macroeconomic variables’ variations across policies.Footnote 16

5.3.1 Productivity Shock

In this section, we describe the economy’s responses to an economic growth shock from a one period unanticipated, temporary, one standard deviation productivity shock.Footnote 17 First, we solve the model for the no-policy case, a baseline scenario with no additional environmental regulations. Then as in Fischer and Springborn (2011), we model a 20% emission reduction from the steady-state level of emissions from the no-policy case.Footnote 18 Therefore, we model an emissions cap at 20% below the baseline emissions level and then introduce emission taxes and intensity targets such that the amount of emission reductions is the same across each of the environmental policies in the steady state.

The simulated trajectories of macroeconomic variables following the shock to the total factor productivity are shown in Fig. 1. In response to the shock, the variation in consumption is the smallest followed by labor, capital, output, emissions and investment. The variation in current account and trade balance are found to be relatively bigger. Figure 2 plots the impulse response functions after the shock for key macroeconomic variables across four scenarios: (i) no policy, (ii) cap-and-trade, (iii) emission tax, and (iv) intensity target. The responses are plotted in terms of deviation from the steady-state level of each variable. The model predicts an increase in output, consumption, labor, investment, debt and interest rate as well as a deterioration of the trade-balance.

First, we discuss the impact of shock on the economy then we compare the impacts of the different policy instruments. Figure 2 shows the evolution of output, consumption, labor demand and emissions for the sixty periods following the shock in separate panels. The top left graph shows that output increases after the shock and then returns to steady state as the shock fades. Consumption increases less and declines more gently as households take advantage of saving to smooth the effects of the shock. The bottom left panel of the graph reports labor supply. It increases to respond to the shock and then fades quickly, falling below the steady state level for a few periods, before returning to steady state. Finally, the bottom right panel shows emissions. Under the no policy baseline, an emissions tax or an intensity standard, emissions increase quickly, but return to the steady state after around twenty periods. The cap maintains a fixed level of emissions throughout.

Simulated trajectories of macroeconomic variables in response to the productivity shock. Note: The figures show simulated mean trajectory of output, consumption, labor, capital, investment, emissions, current account, trade balance and total factor productivity in response to a random shock to total factor productivity. The figure presents the mean of 1000 randomly drawn shocks. For each draw the trajectory of variables is simulated for 300 periods. The first 100 periods are dropped assuming a burn-in period. Using the empirical mean of the remaining 200 periods, we construct the simulated trajectory for each variable

Macroeconomic variables under different policy instruments—productivity shock. Note: The figures show the impulse response functions of output, consumption, labor, emissions, interest rate, and total factor productivity in response to the positive productivity shock of one standard deviation. Zero on the vertical axis on each graph represents corresponding variable’s steady-state level. The responses are in terms of deviation from the steady-state level

Now we analyze the differential effects of the policy instruments on these macroeconomic variables. Each panel reports the results for all four scenarios separately. The differences between policies are small relative to the impact of the shock, but differences are plainly visible. Under the cap-and-trade policy, which fixes the emissions level, output’s response is dampened. As a result, households save relatively less to smooth consumption compared to the no-policy case. The effective interest rate increases less than in the no-policy case, leading to dampened consumption over time. However, under the emissions tax policy, which fixes the emissions’ price emissions increase leading to relatively big increases in output compared to the cap-and-trade policy. As a result, households save relatively more under the emissions tax policy to smooth consumption but not as much as in the no-policy case. The intensity target’s effect on the macroeconomic variables is very close to the tax, but emissions increase by slightly more under the tax and consumption is correspondingly higher.

Recall that previous models of environmental policy instrument choice were unable to model the effects of policy instruments on trade flows. Figure 3 reports the impact of the productivity shock on the trade balance (defined as positive for exports, negative for imports) and the current account, defined as the trade balance minus payments to foreign debt holders. In response to the increase in productivity, the trade balance initially decreases followed by a sharp increase in the next period. It then gradually decreases over time, creating an upside-down U-shape. Note that a negative deviation in the trade balance is not necessarily a negative trade balance in level. The negative deviation of the trade balance is a decline in trade balance from its initial steady-state level and the country may still be a net exporter.

The improvement in factor productivity increases output and households respond to the increased productivity by increasing consumption and labor supply. Households smooth the increased consumption over time by increasing investment. This leads to an increase in foreign debt and thus the interest rate on foreign debt. Note that the Households find it optimal to invest domestically as long as the effective rate of return on the investment is higher than the interest rate on the foreign debt. It turns out that the increase in the domestic absorption (consumption, investment and fossil fuels) is much higher than the increase in output which leads to a decline in the trade balance.

As the shock subsides in the next period, households respond with a decrease in investment. A relatively small decline in output and a relatively high decline in the domestic absorption (essentially the domestic investment) leads to an increase in the trade balance. The current account increases as households have less need to tap debt markets which reduces borrowing and debt payments. Following the shock, the trade balance gradually declines.

Under a cap-and-trade policy, the improvement in productivity leads to output growth. The increase in emissions permit prices dampens the increase in output and thus consumption and investments. The deviations of output, consumption and investment from their initial levels are smaller in magnitude than under no environmental policy. Under the emissions tax output, consumption and investment increase more than under cap-and-trade. Intensity targets increase the scarcity rent to emissions through the implicit subsidy on output. These two effects counteract, but the output subsidy dominates and output increases more than in the cap-and-trade case. Larger output increases lead to increases in consumption and investment as well. The trade balance evolves similarly across each environmental policy, but the deviations are dampened under cap-and-trade.

International trade under different policy instruments—productivity shock. Note: The figures show the impulse response functions the trade balance and current account in response to the positive productivity shock of one standard deviation. Zero on the vertical axis on each graph represents corresponding variable’s the steady state level. The responses are in terms of deviation from the steady state level

We can also compare the effects of policy instrument choice on international trade using Fig. 3. The cap-and-trade policy increases the price of emissions, which dampens the increase in output relative to the no policy baseline and the other two policy instruments. This smaller reduction in output leads to a smaller increase in exports and a lower trade balance under cap-and-trade. Because the trade balance increases by less under cap-and-trade the current account also increases by less. The other two policies are similar to each other and the no-policy baseline. The trade balance is somewhat higher under the no-policy baseline than cap-and-trade, around 4% just after the shock, but the difference is small relative to the shock and the difference with the cap-and-trade policy. The trade balance is persistently, but larger higher under the intensity target. Because most variation in the current account is driven by the trade balance the results across trade policies there are similar.

The literature discusses variations in economic variables across the business cycle to evaluate environmental policies. We follow this precedent by calculating the coefficient of variation (CV) across the business cycle for each environmental policy and for the no-policy baseline. The results are reported in Table 4. Each CV provides a measure of the corresponding variable’s dispersion as a percentage of its theoretical mean. We find that the cap-and-trade policy consistently has the lowest CV for the economic variables. For emissions, this finding is obvious; after the positive productivity shock, the emissions level remains unchanged at 20% below the baseline case, so there is no variation. This inflexible emissions cap reduces the positive productivity shock’s benefits so that output, consumption, investment, labor, capital, debt, and trade flows all increase less under a cap-and-trade policy than under the other policy instruments. Thus, the cap-and-trade policy reduces the real business cycle’s severity, a finding which is consistent with the results in Fischer and Springborn (2011).Footnote 19 Under the tax policy, the variations of consumption, labor, and output are similar from those of the no policy, except that investment is higher in the tax case. Under the intensity target, variations are not very different than in the no-policy case.

5.3.2 Import Competition Shock

Our model extends the previous literature by facilitating analysis on the impacts of different policy instruments in response to shocks in trade flows. In this section, we describe the economy’s response to an increase in import competition modeled as an unanticipated one standard deviation shock to the relative price of consumption.Footnote 20 We consider this case to try to capture how different policy instruments would react in response to a surge in imports driven by an exchange rate shock or other transitory change in the level of import competition. As under the productivity shock, the model is solved for the no-policy case and for the three environmental policies that reduce 20% emission from the no-policy case’s emissions level in the steady state.

The simulated trajectories of macroeconomic variables following the shock to the relative price of consumption are shown in Fig. 4. In the simulation, we find the variation of consumption in response to the shock is relatively bigger than all other variables. Output has the smallest variation followed by labor, emissions and investment. Variations in the current account and trade balance are relatively bigger. Figure 5 reports impulse response function for macroeconomic variables across the four environmental policies: (i) no policy, (ii) cap-and-trade, (iii) emission tax, and (iv) intensity target. We begin by comparing the impact of the import shock relative to the productivity shock presented in Sect. 4.3.1. The import surge generates the opposite reaction from the positive productivity shock. The model predicts a decline in consumption, output, labor, and investment. The mechanism is straightforward: in response to the import shock the trade balance deteriorates and debts increase, which leads to an increased interest rate and payments to foreign debt holders increase reducing consumption. This in turn reduces output and labor demand.

Households respond to the unanticipated increase in the relative price of consumption by reducing their private consumption while substituting to increased leisure leading to a reduced supply of labor. Households smooth consumption over time by reducing investment.

On the demand side, less expensive imports substitute for domestic output and the demand for output declines. Although consumption and investment decline under the terms of trade shock, the reduction in domestic absorption is relatively smaller than the reduction in outputs. This leads to a decline in the trade balance. The decline in spending on private consumption is small since despite the increased price of consumption because demand elasticity is near 1. As the shock subsides in the next period, the demand for output grows and households increase their investment which further reduces the trade balance. This leads to an increase in the debt and foreign interest rates. As output grows over time, the trade balance recovers.

Under the cap-and-trade policy, the increase in relative price of consumption leads to a decrease in demand for consumption and outputs because of the substitution effect. This reduces emissions permit prices counteracting the substitution effect on output leading to less decline in output than under no policy. As a result, consumption and investment decline less than no policy and the trade balance follows similar pattern as under no policy. The deviation under cap-and-trade is smaller in magnitude than under no policy. Under the emissions tax policy, with a fixed emission permit price, there is no counteracting effect. Deviations in output, consumption, investment and the trade balance are larger than the cap-and-trade policy. The intensity target policy increases the scarcity rent on emissions. However, the implicit subsidy on outputs counteract the effects from the scarcity rent. The substitution effect of increase in the relative price on consumption prevails. The response of output, consumption, investment, and trade balance are similar to the emissions tax policy.

Simulated trajectories of macroeconomic variables in response to the import shock. Note: The figures show simulated mean trajectory of output, consumption, labor, capital, investment, emissions, current account, trade balance and relative price of consumption in response to one standard deviation positive shock to the relative price of consumption. The figure presents the mean of 1000 randomly drawn shocks. For each draw the trajectory of variables is simulated for 300 periods. The first 100 periods are dropped assuming a burn-in period. Using the empirical mean of the remaining 200 periods, we construct the simulated trajectory for each variable

Impulse responses under the import shock. Note: The figures show the impulse response functions of output, consumption, labor, emissions, interest rate, and relative price of consumption in response to the import shock, which we model as one standard deviation positive shock to the relative price of consumption. Zero on the vertical axis on each graph represents corresponding variable’s steady state level. The responses are in terms of deviation from the steady-state level

International trade under different policy instruments—terms of trade shock. Note: The figures show the impulse response functions for the trade balance and current account in response to the import shock, which we model as one standard deviation positive shock to the relative price of consumption. Zero on the vertical axis on each graph represents the steady state level. The responses are in terms of deviation from the steady state level. The graph reports the first 60 periods after the shock which is sufficient for the system to return to the steady state

Figure 6 reports the trade balance and current account after the trade shock. The initial shock leads to a deterioration in the trade balance. This leads to a big reduction in consumption and after two periods the trade balance flips to above the steady state. From there it gradually declines to the steady state. Both the interest rate and debt go up in response to the import shock leading to a larger deterioration in the current account than in the productivity shock case. Comparing across policy instruments we see that under a cap-and-trade policy the initial drop in the trade balance and the subsequent bounce back are both smaller than the other three scenarios. This implies that the cap-and-trade policy can lessen the impact of an import shock compared to other policy instruments that provide the same level of pollution reduction. We will discuss the policy implications of this result in the conclusion.

Among the other three scenarios, the differences in the trade balance are relatively small. The intensity target leads to a lower trade balance than a tax or the no-policy baseline. After the shock the trade balance falls by around one percent more than in the no policy baseline and the corresponding rebound is one percent lower as well. The emissions tax leads to a slightly smaller reduction in the trade balance immediately after the shock compared to the no policy baseline, around 0.5% on average. For both policies the differences are small relative to the impact of the shock and relative to the cap-and-trade policy.

Table 5 shows coefficients of variation (CVs) for each of our four policy scenarios after the import shock. Consumption has more variation compared to the productivity shock. The CV’s for consumption and labor are similar across all four scenarios. The cap-and-trade policy consistently has the lowest CV for the economic variables, but the differences are small, with the exception of investment and trade balance. The CV of investment and the trade balance under the cap-and-trade is significantly lower than the other three scenarios. This finding is consistent with the idea that the cap-and-trade policy reduces the price of emissions which offsets the income effects of the import shock.

Under a cap-and-trade policy the quantity of emissions is fixed and the price of emissions variable. When the import surge hits domestic production demand for emissions falls. This leads to a drop in the price of emissions, which acts as a stimulus countervailing the effects of the import shock. In this sense, cap-and-trade based environmental policies may act as a type of unintended trade friction. The result is analogous to cap-and-trade’s ability to cool the economy by raising the price of emissions during a productivity shock driven boom. We discuss the policy impacts of this result further in the conclusions.

6 Additional Shocks

The early literature on the real business cycle (RBC) relied heavily on technological shocks to explain aggregate economic fluctuations. Macroeconomists developed dynamic optimizing models to incorporate these shocks and study short-term economic oscillation. Neoclassical economists identified other shocks that could potentially explain business cycle fluctuations. Financial frictions and credit constraints are two important channels that have been widely studied. To be consistent with our model, we adopt the standard neoclassical framework and incorporate other potential economic shocks that could generate economic fluctuations.Footnote 21 In this paper, we evaluated productivity and trade shocks at length. In this section, we incorporate credit risks (shocks) and preference shocks and evaluate their affects across policy instruments. Since, in our open economy model, foreign debt has important role in resource management, interest rates (shocks) could potentially explain economic fluctuations. Similarly, since we rely on an intertemporal model, preference shocks allow for changing attitude towards the future. We model uncertainty in preference shocks as a temporary unanticipated shock to the preference for the home good. We also combine all four shocks to evaluate how the policy instruments respond to correlated shocks.

We model the preference shock in the utility function as:

where, v is the preference parameter of households and holds a dimensionless unit value in the steady state.

The credit shock is introduced in the effective interest rate as

where, \(\mu\) is the credit shock with a value of 1 in the steady state. A positive shock will increase the exogenous international interest rate exposure exponentially.

We assume the shocks follow a first-order autoregressive process

where, \(\rho _v\) and \(\rho _\mu\) are persistency parameter of the shocks, assumed to be 0.7 for the simplicity. The parameters \(\epsilon _{v_t}\) and \(\epsilon _{\mu _t}\) are serially uncorrelated shocks, normally distributed with mean zero and standard deviations \(\sigma _{v}\) and \(\sigma _{\mu }\), respectively.

Here, we report summary results for each of these additional shocks in the open economy model. First, consider the case of a positive preference shock. The results of a temporary preference shock could be interpreted as the effects of temporary present bias or time preference shock. The consumer will be inclined to consume more today than next period. Since leisure is a normal good, the consumer will also prefer more leisure today. As a result, labor supply in the economy will decline at the time of the shock. This will cause the economy to invest less due to declining marginal product of capital. The corresponding decrease in employment and investment will cause output to fall in the short run. Declining output and increasing consumption tend to increase foreign debt, but decreasing domestic investment tends to improve foreign debt position. The net effect on the current account is positive (less debt) during the initial adjustment periods followed by periods of current account deterioration (more debt accumulation). The simulated trajectories of these variables are reported in Fig. 7. The percentage drop in foreign debt is larger than of output, creating a favorable debt-output position in the economy. This causes the effective cost of borrowing to decline temporarily. In the simulation, we find the variation of labor supply in response to the shock is relatively bigger than all other variables. Figures 9 and 11 (left panel) reports impulse response function for macroeconomic variables across the four environmental policies: (i) no policy, (ii) cap-and-trade, (iii) emission tax, and (iv) intensity target. Interestingly, we find intensity target reduces volatility of macro variables the most, followed by cap-and- trade. The results under an emission tax policy are similar to the no policy baseline (Table 6).

External international credit shocks are extremely significant shocks that open economies often face. Both households and firms are affected directly. Higher interest rates cause the cost of borrowing to go up. This is equivalent to an negative income shock for households. The representative agent should respond by lowering consumption of goods and leisure at the time of the shock. Though labor supply goes up in response to the shock, investment must decline is due to a higher opportunity cost of investment. Since capital is a predetermined variable, the economy will experience an instant gain in output (due to higher employment) before it declines during the transitional periods. The impulse response functions are reported in Figs. 10 and 11 (right panel). The variation in macroeconomic variables is significantly higher under a credit shock as reported in Table 7. Domestic policymakers must take these external shocks very seriously. Like all other supply side shocks, cap-and-trade appears to the most effective policy measures. It is also important to note that when the economy is subject to various shocks simultaneously, cap-and-trade reduces the volatility of the macroeconomic variables the most (see Table 8).

7 Conclusions

Policy makers can choose a variety of policy instruments to limit pollution. Among many important criteria such as cost effectiveness and political feasibility, we note that policy instrument choice can affect international trade in polluting goods. As countries become increasingly integrated into the world economy, environmental policy’s impact on trade flows has also become a consideration. To address these questions, we develop a DSGE model incorporating polluting production, international trade and capital mobility. We have evaluated a pollution tax, a cap-and-trade policy, and an intensity target across the business cycle and through a surge in import competition.

We find that cap-and-trade reduces the business cycle’s intensity by (effectively) increasing the cost of emissions over the peak and lowering the cost of emissions through the trough. The business cycle results are consistent with those in Fischer and Springborn (2011) and Annicchiarico and Dio (2015) but they employ closed economy models, meaning they cannot consider how the policy instruments respond to an import shock. We find that a cap-and-trade policy acts as a drag on the increase in exports during a productivity surge. The model is symmetric, so this result implies that a cap-and-trade policy would also act as a drag on import competition during a recession.

We find that an import surge leads to few differences in output and consumption across the different policy instruments compared to the differences from a productivity surge. The cap-and-trade policy does reduce the severity of the import surge which could be an important consideration for policy makers.

When we consider all the results presented here, and elsewhere in the literature, there appears to be an emerging consensus that a cap-and-trade policy instrument reduces the volatility of the business cycle more than other policy instruments. The cap-and-trade policy has the largest dampening effect on the business cycle, but that does not imply that it is the optimal policy instrument to reduce emissions. The fact that cap-and-trade can also lessen the severity of an import surge could be seen as either a strength or weakness of the policy instrument. Policy makers might appreciate the fact that, when faced with a sudden surge in imports, the cap-and-trade policy can lessen the intensity of the foreign competition. From a global welfare perspective the ability of cap-and-trade to reduce import shocks could serve as an impediment to the global trading leading to inefficiencies both in the regulating country and the rest of the world.

The existing literature has relied largely on closed economy models when evaluating the impacts of different environmental policy instruments. Opening these models up to international trade and capital flows does not change the results of the existing literature. Introducing an open economy allows us to evaluate the impact of policy instruments on international trade shocks, a question beyond the scope of the existing literature. We find that a cap-and-trade policy can dampen the impact of a surge in imports. This may make that policy instrument an attractive alternative to countries looking for policy alternatives to trade barriers.

Evaluating environmental policies’ macroeconomic dynamics in an open-economy modeling framework that incorporates trade and capital flows is itself an important venture, which is also discussed in Fischer and Heutel (2013). Our study presents a first-step with several possible extensions in the spirit of incorporating environmental policy into open-economy macroeconomic dynamic models. For example, this paper has focused on environmental regulation by a small open economy in isolation. It may be worthwhile to consider how the decision to regulate domestic emissions affects the levels of economic activity, pollution emissions and environmental regulation in the rest of the world.

Notes

This result is symmetric so a cap-and-trade policy acts as a brake on domestic exports when the price of consumption decreases and exports become more attractive.

Fischer and Heutel (2013) provides a nice review of the emerging literature employing real business-cycle models to evaluate environmental policy.

Heutel (2012) assumes efficient environmental policy and analyzes how that optimal policy should evolve across the business cycle. We focus on static policies, which are certainty equivalent in emission reductions, and compare the responses of static policies across the real business cycle and import price shocks.

The optimal conditions under the no environmental policy baseline and each of the policy instruments are presented in the “Appendix”.

Source: Statistics Canada. Table 380-0106—Gross domestic product.

The second moments in our model are consistent with the literature.

For more details, see PWT 8.1 in Feenstra et al. (2015).

Calculated over our sample period. Source: Statistics Canada. Table 383-0032—Multifactor productivity, gross output, value-added, capital, labor and intermediate inputs at a detailed industry level by the North American Industry Classification System (NAICS).

We also find that the share of abatement cost expenditure in manufacturing outputs is 7.5% in Canada as reported in surveys conducted during 1996–2010. However, these estimates are not reported regularly (Source: Canadian Statistics).

See the “Appendix” for details.

We thank an anonymous referee for bringing this point to our attention.

The model is solved in Dynare. See Adjemian et al. (2011) for more details.

We follow the standard procedure in creating the Impulse Response Functions (IRFs). We generate two series of simulations each lasting 300 periods. The first series was a ‘no-shock’ baseline. When simulating the second series, in period 101, we add a one standard deviation shock. We averaged the series over 1000 random draws of the shock. Finally, we subtract the first series from the second series. The difference is our IRFs.

We also explored larger (1.5 standard deviation) and more persistent shocks (90% autocorrelation). The results presented here are robust to those shock parameters. Results available by request.

We choose a twenty percent reduction in emissions to maintain comparability to the existing literature. This reduction is roughly consistent with intended national determined contributions (INDCs) under the United Nations Framework Convention on Climate Change (UNFCCC). Canada has committed to a 30% reduction below 2005 levels by 2030. The United States committed to a 26–28% reduction before withdrawing from the agreement in 2017.

The model is symmetric so a negative productivity shock modeling the business cycle’s trough would give the same results. A fall in productivity that reduces economic activity would reduce both the cap’s shadow price and the shock’s negative impact, once again dampening the business cycle.

We also explored larger shocks (1.5 standard deviations) and persistent shocks (up to 90% autocorrelation. The results presented here are robust to these types of shocks. Results are available upon request.

A Keynesian approach would rely upon wage or price rigidity to explain the business cycle. Those types of rigidities could be incorporated into our model, but would move it outside the neoclassical framework.

References

Adjemian S, Bastani H, Juillard M, Mihoubi F, Perendia G, Ratto M, Villemot S (2011) Dynare: reference manual. Working papers no. 1, CREPEMAQ

Angelopoulos K, Economides G, Philippopoulos A (2013) First-and second-best allocations under economic and environmental uncertainty. Int Tax Public Finance 20:360–380

Annicchiarico B, Dio FD (2015) Environmental policy and macroeconomics dynamics in a new Keynesian model. J Environ Econ Manag 69:1–21

Copeland BR (1994) International trade and the environment: policy reform in a polluted small open economy. J Environ Econ Manag 26(1):44–65

Copeland BR, Taylor MS (2003) Trade and the development: theory and evidence. Princeton University Press, Princeton

Ederington J, Levinson A, Minier J (2005) Footloose and pollution-free. Rev Econ Stat 87(1):92–99

Ellerman A, Wing I (2003) Absolute versus intensity-based emission caps. Clim Policy 3(SUPP 2):S7–S20

Feenstra RC, Inklaar R, Timmer MP (2015) The next generation of the Penn world table. Am Econ Rev 105(10):3150–3182

Fischer C, Heutel G (2013) Environmental macroeconomics: environmental policy, business cycles, and directed technical change. Ann Rev Resource Econ 5(1):197–210

Fischer C, Springborn M (2011) Emissions targets and the real business cycle: intensity targets versus caps or taxes. J Environ Econ Manag 62(3):352–366

Hepburn C (2006) Regulation by prices, quantities, or both: a review of instrument choice. Oxf Rev Econ Policy 22(2):226–247

Heutel G (2012) How should environmental policy respond to business cycles? Optimal policy under persistent productivity shocks. Rev Econ Dyn 15(2):244–264

McAusland C (2008) Trade, politics, and the environment: tailpipe vs. smokestack. J Environ Econ Manag 55(1):52–71

Mendoza E, Uribe M (2000) Devaluation risk and the business-cycle implications of exchange-rate management. In: Carnegie-Rochester conference series on public policy, vol 53, pp 239–296

Peterson S (2008) Intensity targets: implications for the economic uncertainties of emissions trading. In: Hansjürgens B, Antes R (eds) Economics and management of climate change. Springer, New York, pp 97–110

Pizer WA (2005) The case for intensity targets. Clim Policy 5(4):455–462

Schmitt-Grohé S, Uribe M (2001) Stabilization policy and the costs of dollarization. J Money Credit Bank 33:482–509

Schmitt-Grohé S, Uribe M (2003) Closing small open economy models. J Int Econ 61(1):163–185

Uribe M, Schmitt-Grohé S (2017) Open economy macroeconomics. Princeton University Press, Princeton

Webster M, Sue Wing I, Jakobovits L (2010) Second-best instruments for near-term climate policy: intensity targets vs. the safety valve. J Environ Econ Manag 59(3):250–259

Weitzman ML (1974) Prices vs. quantities. Rev Econ Stud 41(4):477–91

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

We thank Don Fullerton, two anonymous referees and the editor for a number of suggestions that improved this paper.

Appendix

Appendix

1.1 AR(1) Process

See Table 9.

1.2 Derived First Order Conditions of Firms

No Policy

These are standard Euler equations for the firm’s problem to choose factor inputs: labor (Eq. 21), capital (Eq. 22), and pollution emissions (Eq. 23) based on their marginal factor returns.

Cap-and-Trade

These are standard Euler equations for the firm’s problem. Firms choose factor inputs: labor (Eq. 24), capital (Eq. 25), and pollution emissions (Eq. 26) based on their marginal factor returns.

Emissions Tax

These are standard Euler equations for the firm’s problem. Firms choose factor inputs: labor (Eq. 27), capital (Eq. 28), and pollution emissions (Eq. 29) based on their marginal factor returns.

Intensity Target

These are standard Euler equations for the firm’s problem. Firms choose factor inputs: labor (Eq. 30), capital (Eq. 31), and pollution emissions (Eq. 32) based on their marginal factor returns (see Figs. 7, 8, 9, 10, 11).

Simulated trajectories of macroeconomic variables in response to the preference shock. Note: The figures show simulated mean trajectory of output, consumption, labor, capital, investment, emissions, current account, trade balance and the preference parameter in response to a random shock to the preference parameter. The figure is obtained from a series by randomly drawing the shock for 1000 times. Each time, trajectory of variables is simulated for a 300 period. The first 100 periods are dropped assuming a burn-in period. Using the empirical mean of the remaining 200 periods, we construct the simulated trajectory for each variable

Simulated trajectories of macroeconomic variables in response to the credit shock. Note: The figures show simulated mean trajectory of output, consumption, labor, capital, investment, emissions, current account, trade balance and the credit parameter in response to a random shock to the credit parameter. The figure is obtained from a series by randomly drawing the shock for 1000 times. Each time, trajectory of variables is simulated for a 300 period. The first 100 periods are dropped assuming a burn-in period. Using the empirical mean of the remaining 200 periods, we construct the simulated trajectory for each variable

Impulse responses under the preference shock. Note: The figures show the impulse response functions of output, consumption, labor, emissions, interest rate, and preference in response to the preference shock modeled as a positive 1 s.d. shock to the preference parameter. Zero on the vertical axis on each graph represents corresponding variable’s steady state level. The responses are in terms of deviation from the steady-state level

Impulse responses under the credit shock. Note: The figures show the impulse response functions of output, consumption, labor, emissions, interest rate, and credits in response to the credit shock modeled as a positive 1 s.d. shock to the credit parameter. Zero on the vertical axis on each graph represents corresponding variable’s steady state level. The responses are in terms of deviation from the steady-state level

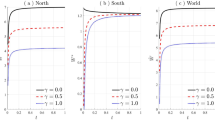

International trade under different policy instruments—preference and credit shocks. Note The figures show the impulse response functions of the trade balance and current account in response to the preference shock (left panel) and credit shock (right panel) of one standard deviation of each shock. Zero on the vertical axis on each graph represents corresponding variable’s the steady state level. The responses are in terms of deviation from the steady state level. The graph reports the first 15 periods after the shock which are sufficient for the system to return to the steady state

Rights and permissions

About this article

Cite this article

Holladay, J.S., Mohsin, M. & Pradhan, S. Environmental Policy Instrument Choice and International Trade. Environ Resource Econ 74, 1585–1617 (2019). https://doi.org/10.1007/s10640-019-00381-4

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10640-019-00381-4