Abstract

Given the ambiguous empirical results of previous research, this paper tests whether support for a climate policy-induced pollution haven effect and the pollution haven hypothesis can be found. Unlike the majority of previous studies, the analysis is based on international panel data and includes several methodological novelties: By arguing that trade flows of dirty goods to less dirty sectors may also be influenced by changes in policy stringency, trade information on primary, secondary, and tertiary sectors are included. In order to clearly differentiate between dirty sectors and sectors with high pollution abatement costs, separate measures for pollution intensity and policy stringency are implemented. For the former, two intensities, namely the sectors’ carbon dioxide emission intensity and the emission relevant energy intensity, are used to identify dirty sectors. For the latter, an internationally comparable, sector-specific measure of climate policy stringency is derived by applying a shadow price approach. Potential endogeneity between climate policy stringency, trade openness and the trade balance is controlled for by employing a dynamic panel generalized method of moments estimator. The results provide evidence for a pollution haven effect that is also present for non-dirty sectors, i.e., a sector’s net imports rise in general if the sector faces an increase in climate policy stringency. Moreover, a stronger pollution haven effect regarding carbon dioxide intensive and emission relevant energy-intensive sectors is revealed. However, no support for the stronger pollution haven hypothesis can be found.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

As some countries implement stricter environmental policies than others, it is feared that the domestic production of dirty goods is either reduced or moved to countries with less strict mitigation policies, so-called pollution havens, implying a loss in competitiveness for the more regulated countries. Of particular interest in this discussion are the potential adverse effects of climate policy in specific and along with that reservation that unilateral climate policy regulation may not be effective in cutting total greenhouse gas emissions.Footnote 1

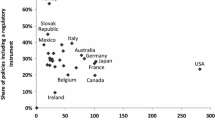

Copeland and Taylor (2004) distinguish between a pollution haven effect and the stronger pollution haven hypothesis.Footnote 2 On the one hand, according to the pollution haven effect net imports of dirty goods into highly regulated countries should rise as a more stringent regulation entails a specialization of the country in the production of cleaner goods. In Fig. 1 this effect is highlighted and connected to the issue of greenhouse gas emissions for the energy-intensive metals industry for a set of 28 countries.Footnote 3 Here, the shadow prices of emission relevant energy are used to measure the stringency of climate policy.Footnote 4 The figure suggests that the metals industry in countries with a larger shadow price, i.e., a stricter climate policy, tended to experience higher growth in net imports per value added along with smaller increases or even reductions in carbon dioxide emissions per value added. On the other hand, the pollution haven hypothesis postulates that trade liberalization will shift dirty industries from countries with a relatively stringent regulation to countries with a relatively weak regulation. While some support for the pollution haven effect has been found regarding local pollutants (Becker and Henderson 2000; Ederington and Minier 2003; Levinson and Taylor 2008), so far no compelling support for the corresponding pollution haven hypothesis has been detected (Cole and Elliot 2003; Levinson 2009).

Change in relative \(\hbox {CO}_{2}\) emissions and net imports for different levels of climate policy stringency for the basic metals and fabricated metals sector for a set of 28 countries (including a linear trend). Self-prepared using OECD (2012a, b), WIOD (2012a, b, c), and the estimated shadow prices from this paper

However, existing literature on pollution havens presents several shortcomings: Only few empirical work tests the pollution haven hypothesis compared to the large number of papers on the pollution haven effect (Copeland 2011); the same holds true with regard to empirical research specifically on pollution havens for global pollutants where the evidence is still ambiguous (Aldy and Pizer 2015; Branger et al. 2017) versus the broad body of the literature on local pollutants (Bao et al. 2011; He 2006); most papers employ US data or are mainly single country studies (Chung 2014; Greenstone 2002; Keller and Levinson 2002); and only few studies use panel datasets with sound measures of policy stringency (Copeland 2011; Dechezlepretre and Sato 2014).

This paper adds to the literature by addressing each of the points. Both the pollution haven effect and the hypothesis are tested with regard to the impact of climate policy stringency on trade flows—i.e., the paper focuses on the relationship on the left side of Fig. 1. For this reason, first, Ederington et al.’s (2004) classic approach is extended to a multi-country setting and tested for 14 manufacturing sectors. The analysis uses international panel data on 28 OECDFootnote 5 countries including developed countries, newly industrialized countries, and former transition economies for the years 1995–2009. As a consistent, internationally comparable, sector-specific measure of private sector abatement costs, a shadow price approach of climate policy stringency is utilized. Concerns about potential endogeneity of climate policy stringency as well as trade openness are accounted for by carrying out a dynamic panel generalized method of moments (GMM) estimation.

Second, separate measures for policy stringency and pollution intensity are implemented to clearly differentiate between strictly regulated sectors and dirty sectors. Unlike previous research the paper can, therefore, take into account that trade flows of dirty goods to less dirty sectors may also be influenced by changes in policy stringency. In order to analyze this postulation and to see whether the impact of climate policy regulation is larger for dirty sectors, the augmented model is tested using international data not only on the 14 manufacturing sectors, but on 33 primary, secondary, and tertiary sectors. Thereby, dirty sectors are identified with the help of two intensities, namely the sectors’ carbon dioxide emission intensity and the emission relevant energy intensity.Footnote 6 Thus, both the research on pollution havens for global pollutants is furthered and the practice of treating sectors with high pollution abatement costs as dirty is unleashed.

The results of the classic model, considering manufacturing sectors only, provide evidence for a distinct climate policy-induced pollution haven effect. However, no support is revealed that trade liberalization paired with a strict climate policy shifts manufacturing sectors to countries with a relatively weak regulation. Similarly, the estimates of the augmented model give rise for a stronger pollution haven effect regarding carbon dioxide intensive and emission relevant energy-intensive sectors. Yet, again no support for the stronger pollution haven hypothesis can be found. In addition, the augmented model provides evidence for a pollution haven effect that is also present for non-dirty sectors, i.e., a sector’s net imports tend to rise in general if the sector faces an increase in climate policy stringency. In this regard, the results of both models provide new evidence for global pollutants and complement the findings of the more recent literature on pollution havens.

The paper continues by providing a literature review on empirical results regarding the pollution haven effect and the hypothesis. Besides the methodology of the applied pollution haven models and the shadow price measure of climate policy stringency, Sect. 3 details how potential problems of endogeneity are controlled for. The used data are introduced in Sect. 4. In Sect. 5 the results of the dynamic panel GMM estimator are provided and discussed. Lastly, Sect. 6 concludes.

2 Literature review

While Jaffe et al. (1995) review early literature on pollution havens, an update including more recent work is, for instance, given by Brunnermeier and Levinson (2004) and Copeland (2011). In the next two subsections, the concepts of and previous empirical literature on the pollution haven effect and hypothesis are detailed.

2.1 Pollution haven effect

Pollution haven effect models analyze to what extent the stringency of environmental policy influences economic activity. The intuitive idea is that environmental regulation increases the costs of key inputs for goods with pollution-intensive production, which in turn decreases the jurisdiction’s comparative advantage in those dirty goods. Given significant cost increases the pollution haven effect predicts changed patterns of trade or production relocations. In order to test this, early empirical studies generally use a reduced-form regression for a cross section of manufacturing or industry sectors i (Tobey 1990):

Thereby, M is a measure of economic activity, P is a measure of regulatory stringency, X is a vector of control variables such as Heckscher–Ohlin variables or factor endowments, and \(\varepsilon \) is the error term. In previous research, three types of measures of economic activity have been commonly used, namely net exports or net imports, foreign direct investments, and the share of pollution intensive goods production (Jaffe et al. 1995). This paper and the subsequent literature review will focus on the effect of policy stringency on trade. Consequently, a positive and significant coefficient \(\hat{{\beta }}_1 \) provides evidence for the presence of a pollution haven effect when net imports are used as the measure of economic activity.Footnote 7

There exists a comparatively large body of the literature on the pollution haven effect. Overall, the early research using cross-sectional data tends to find no proof for a pollution haven effect and some studies even find the opposite, i.e., industries facing relatively high pollution abatement costs are leading exporters (Grossman and Krueger 1993; Kalt 1988; Levinson 1996). However, these studies are unable to control for unobserved heterogeneity across sectors or firms and may face problems of endogeneity and data aggregation (Levinson and Taylor 2008). With the intention of taking heterogeneity into account more recent research uses panel data and adds industry- and time-specific fixed effects, which are denoted \(\eta _{i}\) for sector iand \(\eta _{t}\) for year t, respectively:Footnote 8

Studies following this approach without taking the potential endogeneity issue into account present mixed results regarding the impact of environmental regulation on trade flows (Harris et al. 2002; Mulatu et al. 2004; van Beers and van den Bergh 2003). Yet, by neglecting that economic activity and environmental regulation may be simultaneously determined, the estimated effects may be downward biased. Reasons for the existence of this endogeneity problem of the environmental policy stringency measure along with methods to control for it will be discussed in more detail in Sect. 3.3.

Research using both panel data and estimation techniques to account for simultaneity provides growing support for the pollution haven effect. As one of the first articles Ederington and Minier (2003) address the possible endogeneity problem and reveal significantly larger pollution haven effects for the US manufacturing sectors between 1978 and 1992 when instrumental variables are employed. Similarly, Levinson and Taylor (2008) find a consistently larger effect for the US industry sectors’ trade with Canada and Mexico between 1977 and 1986 for their two-stage least squares estimates compared to the fixed effects estimates. Further US evidence for the pollution haven effect is provided by Ederington et al. (2004), who analyze panel data from 1978 to 1994. Following an analogous approach for Germany Althammer and Mutz (2010) find a significant pollution haven effect for the industry sectors for the time period 1995 to 2005. However, no support is found between 1977 and 1994 even after the data are split between trade with OECD and non-OECD countries. Analogously, Arouri et al. (2012) detect no significant impact of environmental policy stringency on Romanian trade and its components between 2001 and 2007.

In the past decade also a growing body of research analyzes the effects of regulation of global pollutants on trade flows and, thereby, provides mixed evidence. Using US manufacturing industry data for the years 1974–2009, Aldy and Pizer (2015) estimate the response of net imports to changes in climate policy stringency proxied by sector-specific energy prices. They reveal that energy-intensive sectors are more likely to face increases in net imports than sectors with lower energy intensities. Similarly, Sato and Dechezlepretre (2015) analyze an international dataset covering bilateral trade flows of 42 countries and 62 manufacturing sectors between 1996 and 2011. Even though they find that rises in energy prices result in a larger increase of imports for energy-intensive sectors, the results suggest that differences in energy prices are only a marginal driver of trade flows. Contrary to the energy price-related studies, only limited support has been found that carbon prices, as implemented through the E.U. Emissions Trading Scheme, have a significant impact on trade flows. For instance, Branger et al. (2017) analyze the energy-intensive European steel and cement sectors between 1999 and 2005 and find no significant effect of the carbon price on net imports. Moreover, no support for a pollution haven effect regarding greenhouse gas emissions has been revealed by Michel (2013), who analyzes imported intermediate materials of Belgian manufacturing sectors for the time period 1995–2007.

2.2 Pollution haven hypothesis

The pollution haven hypothesis claims that trade liberalization disproportionally influences trade in polluting goods and causes dirty industries to relocate to countries with weak environmental regulation. In order to test this, the variable trade openness TO and an interaction term between trade openness and the average environmental policy stringency are added to Eq. (2):Footnote 9

The specification deliberately includes the average environmental policy stringency for every sector i to test if changes in trade openness have a larger impact on the economic activity M for industries facing relatively higher pollution abatement costs (Ederington et al. 2004). In contrast to that the interaction with the general environmental policy stringency P would test for effects on the economic activity for industries whose pollution abatement costs increased relatively more, which is not the focus of this analysis.Footnote 10 Consequently, in the case of net imports as the measure of economic activity M the coefficient \(\hat{{\beta }}_3 \) needs to be positive and significant to provide support for the pollution haven hypothesis.Footnote 11

There exists little empirical work that tests the pollution haven hypothesis compared to the pollution haven effect. Overall, the results of these papers tend to be inconsistent with the pollution haven hypothesis and, therefore, provide no convincing support. Levinson (2009) finds that US imports have become less pollution intense relative to US exports between 1972 and 2001. This confirms earlier research for the time period 1978–1994 by Ederington et al. (2004), who address the issue of endogeneity of policy stringency and show, in addition, that pollution-intensive US manufacturing sectors are less responsive to tariff reductions than clean ones. The empirical evidence using non-US data is similar. Brunel (2016) expands Levinson (2009) to the E.U. manufacturing sectors for the years 1995–2008 and finds mainly no support for pollution offshoring. Rather the E.U. manufacturing sectors produced more pollution-intensive goods from the early 2000s onwards and imports, in particular from low-income economies, became less pollution-intensive. By analyzing cross-sectional data on 16 manufacturing industries from 13 European countries Mulatu et al. (2010) also detect no support for the pollution haven hypothesis around the year 1990. Likewise for Germany, Althammer and Mutz (2010) estimate no significant interaction effect between the tariff rate and the endogenized environmental regulation variable for both time periods 1977–1994 and 1995–2005. Furthermore, by applying an input–output analysis to India’s trade in the years 1991/1992 and 1996/1997 Dietzenbacher and Mukhopadhyay (2007) find no evidence for pollution havens in connection with trade liberalization. The composition effect of trade liberalization on emission intensities of local and global pollutants is analyzed by Cole and Elliot (2003), who use emissions data of 32 countries. Instead of a negative relationship as proposed by the pollution haven hypothesis, their paper reveals no relationship between lagged income per capita and the country-specific trade elasticities of carbon dioxide and biochemical oxygen demand.

As will be argued in Sect. 3.3 problems of endogeneity may arise not only for the measure of environmental regulation, but also for the variable trade openness. However, to the author’s knowledge so far no empirical research that jointly analyzes the relationship between trade liberalization, environmental regulation, and trade flows addresses this issue.

3 Methodology

This paper tests whether empirical evidence exists for both the pollution haven effect and the hypothesis with regard to climate policy regulation. The estimation process is accompanied by the given difficulties in measuring policy stringency and the potential endogeneity of the climate policy and the trade openness variable. In the following, the used methodology of the pollution haven models is explained. Then, the subsequent sections introduce the shadow price approach of measuring climate policy stringency and the dynamic panel GMM estimator that is employed to control for potential endogeneity.

3.1 Pollution haven models

The basic set-up for testing the presence of pollution havens based on trade flows is introduced in Sect. 2. First, this classic approach of analyzing several manufacturing sectors is extended to a multi-country environment. Second, the classic model is augmented by implementing separate measures for policy stringency and pollution intensity to clearly differentiate between strictly regulated sectors and dirty sectors.

Equations (4) and (5) reproduce the classic approach for a multi-country setting. While Eq. (4) allows for testing the pollution haven effect only, both the pollution haven effect and the hypothesis can be jointly tested with the help of Eq. (5):

In both equations net imports NI of sector i and country c in year t are used as the measure of economic activity. In order to adjust for the different sector sizes, gross values are divided by the sector’s output y. As before, Pis the measure of regulatory stringency and TO the one for trade openness. On the one hand, following previous research the regulatory stringency variable is quantified as pollution abatement costs per economic activity (Cole and Elliot 2003; Keller and Levinson 2002). In particular, the sector-specific climate policy stringency is proxied by the sector’s total shadow costs of emission relevant energy use per output. Hence, P is obtained by multiplying the sector-specific shadow price of emission relevant energy \(Z_\mathrm{E}\), which is described in detail in the subsequent Sect. 3.2, with the sector-specific emission relevant energy use \(x_\mathrm{E}\). The total costs are then divided by the respective sector’s output y—hence, \(P = Z_\mathrm{E} x_\mathrm{E} / y\). On the other hand, trade openness is commonly measured using trade intensities, either on the country or on the sectoral level (Managi et al. 2009; Pritchett 1996).Footnote 12 Given that the level of trade liberalization may vary across sectors within countries, sector-specific trade intensities are determined. Specifically, trade openness is calculated as the sum of sector-specific exports EXP and imports IMP as the share of output y—thus, TO = (EXP + IMP)/y. Differences in the sectoral trade openness may, for instance, be present if a dirty industry with a comparatively strong lobbying power manages to remain protected from international competition. On the contrary, other sectors that are internationally integrated and highly competitive may be confronted with lower trade barriers. As the trade intensity is an outcome-based measure relying on actual trade flows, it is capable of reflecting not only the policy dimension of trade liberalization, but also the sector’s integration into international markets. Moreover, CapComp, HSLabor, MSLabor, and LSLabor are sector-specific compensation for capital, high-skilled, medium-skilled, and low-skilled labor, respectively, and are in the form of capital and labor intensities used as control variables. Finally, \(\eta \) capture sector-, country-, and time-specific fixed effects and \(\varepsilon \) represents the error term.

Compared to Eqs. (2) and (3), in Eqs. (4) and (5) only the country-specific fixed effects \(\eta _\mathrm{c}\) are supplemented to account for the international dataset and the control variables are specified. Consequently, the pollution haven effect is still estimated with the help of \(\hat{{\beta }}_1 \) and evidence for the pollution haven hypothesis can be revealed from \(\hat{{\beta }}_3 \).

Two methodological questions that arise when constructing a classic model like this are how a high regulatory stringency P can be measured and how sectors using dirty inputs can be identified. For this purpose, the first model estimates a measure of regulatory stringency and uses a high share of the total shadow costs per output as an indicator for both. Similarly, several other empirical studies relying on cost measures proxy regulatory stringency as the share of pollution abatement costs per economic activity—for instance, as pollution abatement costs per total material costs or per value added (Cole and Elliot 2003; Ederington et al. 2004). The measure is then simultaneously used to determine dirty sectors, implying that sectors with high abatement costs are sectors that are using a lot of dirty inputs.Footnote 13 Consequently, such papers analyze whether sectors facing high abatement costs experience changes in trade flows.

However, less dirty sectors may also use dirty goods as inputs and, thus, may as a consequence of tighter policy regulation and increased domestic prices import relatively more of the dirty goods. For instance, several primary and tertiary sectors regularly purchase from energy and emission intensive industry sectors. The agricultural sector manures the crop area using fertilizer and applies pesticides from the chemicals sector; the construction sector uses steal and cement products; and a number of service sectors consume paper and pulp in considerable amounts. Table 1 exemplifies the situation for intermediate goods purchases from the chemicals and the metals sector for the analyzed dataset. Not only are significant amounts of intermediate goods, that are purchased from these two sectors, imported (39.1 and 24.6%, respectively), but also non-industry sectors buy a substantial share of the intermediates (31.2 and 22.9%, respectively).

Therefore, the augmented model will test whether sectors facing strict climate policy regulation, in general, experience changes in trade flows and to what extent these impacts are higher for dirty sectors. Thereby, Eq. (6) can be used to test for pollution haven effects only and Eq. (7) models both the pollution haven effect and the hypothesis:

Compared to Eqs. (4) and (5), a clear differentiation between strictly regulated sectors and dirty sectors is employed by changing both the unit of measurement of regulatory stringency and the identification of dirty sectors. On the one hand, instead of the total shadow costs per output, i.e., \(P = Z_\mathrm{E} x_\mathrm{E}/ y\), the shadow prices \(Z_\mathrm{E}\) are directly used to reflect climate policy stringency. The shadow prices are measured in pollution abatement costs per unit of emission relevant energy use. This allows taking into account that clean sectors may face stricter regulation than dirty sectors in the form of higher prices for emission relevant energy, while at the same time the dirty sectors’ aggregate abatement costs may be comparatively higher.Footnote 14 On the other hand, it becomes necessary to discriminate between dirty and non-dirty sectors, because the stringency measure does not automatically do that anymore. Dirty sectors are identified using the average sectoral intensities of carbon dioxide emissions and emission relevant energy use, which are denoted \(x_\mathrm{Dirty}\) /y in Eqs. (6) and (7). Specifically, from an output perspective and in the context of climate change this paper classifies a sector as dirty if its average sectoral carbon dioxide emission intensity \(x_{\mathrm{CO}_2 } \)/ y is relatively high compared to the ones of the other sectors. Likewise, from an input perspective a sector is regarded as dirty if its average emission relevant energy use intensity \(x_\mathrm{E}\) / y is relatively high. Using average sectoral values across the set of 28 countries acknowledges that some sectors are dirtier than others, whereas the same sector in different countries can have various pollution intensities, e.g., due to different available technologies and policy stringencies.

This clear differentiation between pollution and regulation facilitates the inclusion of non-manufacturing sectors. In contrast to previous research that predominantly looks at industry or manufacturing sectors, the augmented model is analyzed using data not only on the secondary sectors, but also on the primary and tertiary sectors. Hence, imports of potentially dirty goods to a larger number of less dirty sectors, like many service sectors, can be incorporated.

In order to analyze if changes in climate policy regulation have a larger impact on the net imports of dirty sectors, the additional interaction terms with the average pollution intensity \(x_\mathrm{Dirty}/y\) are included in Eqs. (6) and (7). Following the reasoning in Sect. 2, evidence for dissimilarities between dirty sectors and other sectors concerning pollution havens is provided by the partial derivatives with respect to the pollution intensity. In specific, the additional pollution haven effect for dirty sectors is given by \(\partial ^{2}\left( {\text{ NI }/y} \right) /\left( {\partial \left( {x_\mathrm{Dirty} /y} \right) \partial Z_\mathrm{E} } \right) \) and the corresponding pollution haven hypothesis is provided by \(\partial ^{3}\left( {\text{ NI }/y} \right) /\left( {\partial \left( {x_\mathrm{Dirty} /y} \right) \partial \text{ TO }\partial \bar{{Z}}_\mathrm{E} } \right) \).Footnote 15 Thus, positive and significant coefficients \(\hat{{\beta }}_4 \) and \(\hat{{\beta }}_5 \) provide respective evidence for a stronger impact of climate policy regulation regarding the pollution haven effect and hypothesis for dirty sectors. Similarly, \(\hat{{\beta }}_1 \) and \(\hat{{\beta }}_3 \) indicate whether sectors facing strict climate policy regulation, in general, experience a pollution haven effect or are prone to the pollution haven hypothesis. The overall pollution haven effect is then given by \(\partial \left( {\text{ NI }/y} \right) /\partial Z_\mathrm{E} =\beta _1 +\beta _4 x_\mathrm{Dirty} /y\), whereas overall evidence for the pollution haven hypothesis can be revealed by determining \(\partial ^{2}\left( {\text{ NI }/y}\right) /\left( {\partial \text{ TO }\partial \bar{{Z}}_\mathrm{E} } \right) =\beta _3 +\beta _5 x_\mathrm{Dirty} /y\).

3.2 Shadow price measure of climate policy stringency

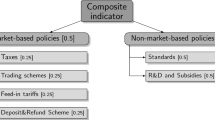

Quantifying the regression coefficients in Eqs. (4)–(7) requires a measure of the stringency of environmental regulation in general and climate policy in specific. Brunel and Levinson (2016) group and evaluate the existing measurement approaches.Footnote 16 They come to the conclusion that the majority of the used approaches in empirical literature faces conceptual problems or has a limited applicability. Common disadvantages range from the missing availability on the sectoral level to the lacking comparability in a multi-country setting and the challenge to fully reflect the multi-dimensionality of policy regulation.

The shadow price approach, which determines regulatory stringency by estimating private sector abatement costs, overcomes the shortcomings listed above.Footnote 17 At the same time, it has only few weaknesses, namely the dependence on the selected functional form of the cost function and the use of cost data for existing firms in the markets. van Soest et al. (2006) apply the cost function approach to environmental policy stringency by considering energy as a polluting input. Their analysis is furthered by Althammer and Hille (2016), who determine an internationally comparable shadow price measure of climate policy stringency based on sector-specific emission relevant energy costs. Althammer and Hille’s (2016) indicator masters the multi-dimensionality of climate policy by reflecting any policies that change the shadow price of carbon-related energies. This includes, for instance, taxes on carbon-related inputs and tradeable permits. Moreover, the measure can cope with integrated technologies improving the firm’s energy efficiency, the impact of regulation on investments, and general equilibrium effects including changes in the demand for non-polluting inputs, because they all affect the shadow price. Given the focus on global pollutants, this paper will follow Althammer and Hille (2016) and estimate the shadow prices of emission relevant energy as the consistent measure of policy stringency.

In order to indirectly estimate firm’s or sector’s pollution abatement costs, the shadow price approach makes use of microeconomic theory and the choices made by corporation revealing their profit maximizing behavior. The shadow price of a polluting input is, ceteris paribus, defined as the potential reduction in outlays spent on other variable inputs, which can be realized by using an additional unit of the polluting input (van Soest et al. 2006). In other words, if the price for a polluting input is relatively low, like in the case of no regulation, it is beneficial for firms to increase the use of the polluting input so that total expenditures decrease. In the case of a more stringent regulation, the price for the polluting input is relatively higher and firms will use less of the polluting input (Brunel and Levinson 2016). Hence, climate policy drives a wedge \(\lambda _\mathrm{E}\) between a corporation’s or the sector’s shadow price \(Z_\mathrm{E}\) for an additional unit of the polluting input E and its undistorted market price \(p_\mathrm{E}\) (Morrison Paul and MacDonald 2003; van Soest et al. 2006):Footnote 18

As the wedge \(\lambda _\mathrm{E}\) and the shadow price \(Z_\mathrm{E}\) summarize the hidden effects of all direct and indirect regulations both can serve as a measure of policy stringency (Althammer and Hille 2016). While a positive wedge and a comparatively high shadow price indicate a restrained usage of the polluting input and higher abatement costs compared to the market average, a negative wedge and a comparatively low shadow price are a sign for a subsidized usage. Thus, the wedge is a pure measure of differences in policy stringency and the shadow price includes overall market changes in stringency.

The shadow prices are determined by estimating a firm’s or a sector’s cost function based on the revealed behavior, i.e., the levels of output and the prices as well as quantities of the inputs, except for the price of the polluting input. This is a valuable characteristic, as it implies that the estimated shadow price measure reflects the actual stringency faced by the firms in the market rather than the mere variability of the implemented policies that may not be as heterogeneous. This paper applies Morrison’s (1988) Generalized Leontief variable cost function to two variable inputs. After assuming long-run constant returns to scale (Morrison 1988) and insignificant time trends (van Soest et al. 2006) the variable cost function C reads as follows:

Here, y is the output, \(p_\mathrm{L}\) is the price of the fully variable input labor L, and \(Z_\mathrm{E}\) is the shadow price of emission relevant energy E, the variable input where, e.g., due to climate regulation the shadow price may be different to the market price. The stock of the quasi-fixed capital K is specified by \(x_\mathrm{K}\).

In order to estimate the coefficients \(\alpha \) of the cost function, factor demand functions of the two variable inputs are computed with the help of Shephard’s lemma. Moreover, each factor demand function is divided by the output to make different sector sizes comparable:

and

The system of the three Eqs. (8), (10), and (11) is estimated using seemingly unrelated regressions, a method introduced by Zellner (1962) that facilitates the estimation of common coefficients across different equations. Table 2 depicts the coefficient estimates of the system of equations. Given the large size of the dataset consisting of 33 sectors in 28 countries, the exemplary results of two energy-intensive sectors, namely the chemicals and chemical products as well as the basic metals and fabricated metal sector, are presented for a set of seven countries at different development stages from across the world.Footnote 19 The two sectors are among the commonly deemed ones that are exposed to a significant risk of carbon leakage and, hence, are in particular expected to be prone to changes in the climate policy stringency (European Commission 2012).

In order to validate the specification of the system of equations, both the signs of the own-price effects of the variable inputs and the second-order partial derivatives of the cost function (9) need to be checked. With regard to the direct effects \(\alpha _\mathrm{EE}\) and \(\alpha _\mathrm{LL}\) of the variable inputs energy and labor all coefficients are estimated to be positive and highly significant, implying that variable costs rise given a price increase in either one of the variable inputs. Moreover, the second-order partial derivatives reveal that the global convexity condition concerning the quasi-fixed input capital along with the global concavity condition concerning the variable input prices of energy and labor are fulfilled.

With the help of the estimated coefficients the sector-specific wedges \(\lambda _\mathrm{E}\) and the shadow prices \(Z_\mathrm{E}\), which both can serve as a measure of climate policy stringency, can be quantified. For example, in the case of Germany positive and highly significant wedges are reported in Table 2 for the chemicals sector throughout the analyzed time period, whereas the estimated wedges of the metals sector change from a negative and highly significant coefficient until 1997 to positive and highly significant values. This can be interpreted such that the chemicals sector has continuously been confronted with a relatively restrictive climate policy. In contrast to that the stringency faced by the German metals sector indicates that it started out with a slight preferential treatment compared to the metals sectors in the other 27 countries. Yet, over time the stringency rose and altered to a comparatively strict climate policy from 1998 onwards.

In Table 3 all 28 countries are ranked based on the average shadow prices in the chemicals and the basic metals sector.Footnote 20 Compared to the earlier shadow price estimates of van Soest et al. (2006) for the years 1978–1996 as well as Althammer and Hille (2016) for the years 1995–2009, the values are in a similar range and partly larger. While the higher values may be attributed to the later base year used in this paper and the rising importance of environmental protection since the late 1970s, the comparable results confirm the reliability of the estimates. In general, the rankings are more or less consistent with popular opinions about climate policy regulation. Whereas Germany as a representative of the Western European countries is placed among the forerunners regarding climate policy stringency (7th and 10th strictest regulation out of 28 countries), the firms in the USA face comparatively lower abatement costs (22nd and 21st). Interestingly in particular former transition economies such as Poland (26th and 26th) and to some extend also newly industrialized countries are among the countries with the lowest stringency. For countries like Poland, this can be partly explained by the large share of emission relevant energy being produced from cheap coal and may provide incentives for the relocation of dirty industries. Table 3 also reports the respective minimum and maximum shadow prices between 1995 and 2009 indicating a substantial variation of the measure over time. This impression is confirmed by Fig. 2, which displays the temporal development of the estimated wedged of the chemicals and the metals sector. Overall, the wedges and the shadow prices seem to be heterogeneous not only across countries, but also across sectors and over time. Both van Soest et al. (2006) and Althammer and Hille (2016) support this finding by comparing the estimated shadow price measure to alternative measures of environmental and climate policy stringency. They find that the variability of the wedges and the shadow prices may help explaining differences in international competitiveness on the sectoral level.

In this paper, the shadow prices \(Z_\mathrm{E}\) will be used as the measure of climate policy stringency, because besides differences between the specific stringencies they include overall changes in the market average stringency—i.e., the shadow prices of emission relevant energy are a more holistic measure of climate policy stringency. Nevertheless, it should be mentioned that when the wedge coefficients are used instead of the shadow prices, analogous evidence is revealed with regard to both the pollution haven effect and the hypothesis.

3.3 Potential endogeneity of environmental policy and trade openness

As introduced in the literature review, the more recent research analyzing the relationship between environmental policy and trade flows often treats measures of environmental policy as endogenous. The same holds true with regard to the literature on the impact of trade openness on trade flows in general and on the trade balance in specific.

Regarding environmental policy stringency an endogeneity problem may arise, because the pollution haven effect predicts that environmental regulation influences the economic activity, e.g., in the form of trade flows. However, the opposite may also be true. For instance, trade can increase income, which in turn may raise voters’ demand for the normal good environmental quality and the desire for a stricter environmental regulation. Ignoring this simultaneously between the economic activity and environmental regulation is one potential reason why the pollution haven effect and hypothesis estimates may be downward biased. Alternative explanations for the downward bias are given by Ederington et al. (2005), who show that the estimated pollution haven effects become larger when distinguishing between industrialized and developing countries and accounting for transportation costs.

Problems of endogeneity may also arise between trade openness and net imports per output, the response variable in the pollution haven models (4)–(7). The impact of trade openness on the trade balance has, for instance, been analyzed because of the concern that trade liberalization in developing countries may result in a deterioration of their trade balance (Santos-Paulino and Thirwall 2004). At the same time, the level of trade openness may be influenced by the trade pattern. For example, driven by trade imbalances, by a fear of dirty or unsecure goods imports from abroad, and to protect infant industries from import competition policy makers may want to adjust tariff rates.

Endogeneity of the explanatory variables environmental policy and trade openness has been controlled for in mainly three different ways: First, panel data combined with fixed effects or first differencing can be used to avoid an endogeneity bias. This is in particular frequently applied in gravity models estimation (Baier and Bergstrand 2007; Baier et al. 2014). Second, the endogeneity can be addressed by estimating instrumental variables. Regarding environmental policy stringency, a recent overview on the instrumental variables employed is provided by Millimet and Roy (2016). Concerning trade openness, early approaches are Trefler (1993) and Lee and Swagel (1997), who use instrumental variables to account for endogeneity of non-tariff barriers. Yet, in the case of regressions analyzing the impact of trade liberalization on a trade-related response variable the instrumental variable approach has one important limitation. Namely, in order to control for endogeneity, the instrumental variable is in such a setting usually only capable to reflect one dimension of trade policy at a time, i.e., one instrumental variable is needed for the tariff barriers, one for the non-tariff barriers etc.. As this paper aims at analyzing the impact of changes in trade openness with the help of one holistic indicator, the instrumental variable estimation is not regarded as a suitable approach. Third, studies frequently apply GMM estimators to deal with potentially endogenous variables (Managi et al. 2009; Santos-Paulino and Thirwall 2004). Such estimators use lagged values of the potentially endogenous variables as instruments to control for endogeneity. Hence, potential endogeneity of a single aggregate trade openness variable can be rather easily controlled for.

Therefore, this paper applies a GMM estimator to estimate Eqs. (4)–(7). Specifically, a dynamic panel GMM estimator, which was developed by Arellano and Bover (1995) and Blundell and Bond (1998), is used. The estimator furthers Holtz-Eakin et al. (1988) and Arellano and Bond (1991). It is designed for situations with many individuals and rather few time periods, with heteroscedasticity and autocorrelation within individuals, and with fixed effects. In addition, Windmeijer’s (2005) finite-sample correction is applied to make the two-step robust estimations more efficient.

4 Data

In order to estimate both the pollution haven model and the shadow price measure of climate policy stringency, a multi-country, sector-specific panel dataset is compiled for the years 1995–2009. The majority of variables are determined on the basis of data provided by the World Input–Output Database (WIOD 2012a, b, c). Complementary energy price and capital investment data, which are needed for the shadow price estimation, are obtained from the International Energy Agency (2013) and the Penn World Tables (2011, 2012), respectively. The OECD (2012a, b) provides exchange rates and country-specific price indices.

As the WIOD (2012c) only provides capital stock data until the year 2007 and as sector-specific energy prices are not available in general, both variables need to be estimated. The capital stocks are determined with the help of the perpetual inventory method, as explained in Caselli (2005), using the capital investment data from the Penn World Tables. Afterwards the obtained country-level estimates are disaggregated to the sectoral level via the sector’s shares in the total national capital stock as reported in the WIOD.Footnote 21 Concerning the second variable, i.e., the sector-specific energy prices, the estimation procedure of Althammer and Hille (2016) is followed. They determine sector-specific energy prices for emission relevant energy based on a weighted average of the prices of seven energy carriers, the overall energy price development, and the respective sectors’ emission relevant energy use.

Lastly, all monetary variables are converted into 2005 US dollars using the exchange rates from the OECD as well as country- and sector-specific deflators. Given that the pollution haven model analyzes misdirecting incentives for investors or plant owners, prices are not calculated in purchasing power parities. An overview of the final variables and their units of measurement is given in Table 8 in “Appendix 1”.

The final dataset is comparatively large and covers sector-specific information on 33 primary, secondary, and tertiary sectors for a set of 28 OECD countries from 1995 to 2009. The sectors and countries are in correspondence with the structure of the main data source WIOD.Footnote 22 Because of the limited data coverage on energy prices and capital stocks, several countries from the original database along with the air transport and the private households sector with employed personnel had to be excluded. A list of the included nations is provided in Table 4. Not only developed countries, but also newly industrialized countries like Mexico and Turkey and former transition economies from Eastern Europe are included. Hence, the dataset allows testing for the existence of pollution havens on an international basis and includes the effects of the opening of former Eastern Bloc countries along with the implementation of the Kyoto protocol.

5 Results and discussion of the pollution haven models

By applying the dynamic panel GMM estimator, first, the two specifications of the classic model (4) and (5) are estimated using manufacturing data. Then, with the help of the augmented model the same data are used to test specifications (6) and (7) for the existence of pollution havens. Lastly, the augmented model is estimated again using an extended dataset that includes all 33 primary, secondary, and tertiary sectors.

5.1 Results of the classic pollution haven model

The results of the classic approach are shown in Table 5. The specification in column (I) tests the pollution haven effect only. With regard to the impact of the shadow costs of emission relevant energy per output P on the net imports per output, a positive and highly significant coefficient is estimated. Hence, a rise in the costs associated with climate policy stringency coincides with a relative increase in net imports. This provides first evidence for a climate policy-induced pollution haven effect.

In order to interpret the magnitude of the coefficient and to provide a value that is comparable across the different models, an elasticity of net imports is calculated following the methodology in Levinson and Taylor (2008). As a regular elasticity of net imports is certainly not very meaningful to compare coefficients,Footnote 23 they determine a unit-free indicator of the responsiveness of trade to policy stringency that does not depend on the initial value of net imports. Specifically, Levinson and Taylor (2008, p. 253) estimate lower and upper bounds of “the sum of the absolute values of the elasticities of imports and exports with respect to” the policy stringency by attributing the change in net imports entirely to changes in either gross imports or gross exports. In Table 10 in “Appendix 3” the lower and upper boundaries are reported for the two exemplary sectors used before, namely the chemicals and the metals sector. For the chemicals sector an elasticity of net imports of 0.059 is determined if the change in net imports is completely attributed to changes in gross exports. If the changes are completely attributed to gross imports the respective elasticity amounts to 0.144. Likewise for the basic metals sector the lower and upper bounds of the elasticity are 0.079 and 0.130. These elasticity estimates of the specification testing the pollution haven effect only are generally smaller than the ones of Levinson and Taylor (2008). They consider the impact of pollution abatement costs per value added on the net imports per value shipped and approximate elasticities for an average US manufacturing sector ranging between 0.17 and 0.67. This indicates that the specific impact of climate regulation on trade flows is potentially smaller than the one of the broader environmental regulation.

Concerning the control variables, a negative and highly significant coefficient is estimated for trade openness TO for all specifications and models. The coefficient estimates suggest that for the set of included countries, economies with sectors that experienced increases in trade openness between 1995 and 2009 tended to be net exporters. Similarly, the coefficient estimates of the Heckscher–Ohlin variables are negative and highly significant across all specifications and models, indicating that a rise in the capital and labor intensities is associated with lower net imports per output. The coefficients of the capital and labor intensities are not further interpreted given that the variables are regressed on net imports and, thus, no specific signs are expected for the estimates. Instead, as the coefficients are robust to changes in the specification, following earlier literature the Heckscher–Ohlin variables are kept to control for heterogeneity across sectors (Ederington et al. 2004).

Moreover, the validity of the instruments needs to be assessed by testing for autocorrelation and over-identifying restrictions. On the one hand, autocorrelation would indicate that the lags of the variables that are used as instruments are in fact endogenous. While first-order serial correlation is generally expected, no second-order serial correlation can be detected in any of the estimated equations. Consequently, it can be concluded that the instruments are valid with regard to potential autocorrelation. On the other hand, the difference-in-Hansen test allows analyzing whether the instruments, as a group, are exogenous. Also for this test the null hypothesis of exogenous instruments cannot be rejected for all specifications and models. Hence, potential endogeneity of the variables climate policy stringency and trade openness is sufficiently controlled for.

Column (II) in Table 5 reports the estimates of the classic model for the second specification, which jointly tests the existence of a pollution haven effect and the pollution haven hypothesis. As in the first specification, positive and highly significant coefficients are estimated for the shadow costs of emission relevant energy per output P, providing further support for a climate policy-induced pollution haven effect. Yet, the magnitude of the effect is larger than in the first specification, which is also reflected in the lower and upper bounds of the net import elasticities. While, for the chemicals sector the elasticity of net imports ranges between 0.130 and 0.314, the corresponding values of the basic metals sector lie between 0.172 and 0.284. Contrary to that, the interaction effect of the average sectoral climate policy stringency and trade liberalization \(\bar{{P}}\cdot \hbox {TO}\) is negative but not significant on the ten percent level. In other words, increases in trade openness do not have a larger positive impact on the net imports of sectors facing higher shadow costs of emission relevant energy per output. Hence, the results of the classic model do not support the stronger pollution haven hypothesis, confirming the findings of earlier research presented in Sect. 2.2.

5.2 Results of the augmented pollution haven model

In order to compare how the results change when separate measures are included for policy stringency and pollution intensity, the augmented model is first estimated using manufacturing data only. While it is expected that the augmented model provides new evidence for a pollution haven effect that is also present for non-dirty sectors, meaning a sector’s net imports rise in general when facing a more stringent policy regulation, it is also likely that such results are subject to the inclusion of sectors with a large range of pollution intensities. Hence, the augmented model is expected to provide more reasonable estimates for the general impact of policy stringency, if the analysis also contains non-manufacturing sectors. In Table 6 the results of the augmented model using manufacturing data only are shown for the two different measures of pollution intensity, namely the carbon dioxide emission intensity and the emission relevant energy intensity. In general, for the same specification the coefficient estimates of the same variables have the same signs with comparable magnitudes for both pollution intensities.

In columns (III) and (V), which test the pollution haven effect only, significantly negative coefficients are reported for the general impact of the shadow prices \(Z_\mathrm{E}\) on the net imports per output. Contrary to that, the coefficients of the interaction effect of the shadow price and the average sectoral pollution intensity \(Z_\mathrm{E }x_\mathrm{Dirty}/ y\) are significantly positive. The negative coefficients of the general impact of climate policy stringency may at the first sight be regarded as counterintuitive. Yet, for a set of manufacturing sectors it seems reasonable that the extent of pollution intensity largely determines the magnitude of the overall pollution haven effect. The negative coefficients for the shadow prices suggest that there exists no general pollution haven effect for these sectors. Rather the opposite is true if the isolated impact of policy stringency is considered without taking the sector’s pollution intensity into account. Overall, as the pollution intensities of the manufacturing sectors are compared to the majority of primary and tertiary sector relatively high, the positive interaction effect outweighs the negative general effect for an average manufacturing sector.

Given that the sizes of the effects of the classic and the augmented model are not directly comparable, the net import elasticities with respect to the overall impact of climate policy stringency are again approximated following the equivalent approach introduced for the classic model. The determined elasticities are mainly somewhat smaller than in the corresponding classic model in column (I) in Table 5. For instance, for the emission relevant energy use intensity estimates the lower and upper boundaries of the chemicals sector are 0.037 and 0.090.Footnote 24 Likewise, for the basic metals sector the elasticity of net imports ranges between 0.046 and 0.075.

The evidence on the pollution haven effect is similar in columns (IV) and (VI) in Table 6 representing the specification that simultaneously tests for the pollution haven effect and the hypothesis. While the estimated general effect of the shadow prices \(Z_\mathrm{E}\) on the net imports is again significantly negative, the interaction effect between the shadow price and the average sectoral pollution intensity \(Z_\mathrm{E }x_\mathrm{Dirty}/ y\) goes into the opposite direction. This results overall in positive net import elasticities and, in particular for the dirty sectors, like in the classic model in slightly larger elasticities compared to the specification that tests the pollution haven effect only. Specifically, in the case of column (VI) the net import elasticities range between 0.057 and 0.138 for the chemicals sector and between 0.069 and 0.114 for the metals sector. Concerning the pollution haven hypothesis the coefficients of both the general effect \(\bar{{Z}}_\mathrm{E} \cdot \mathrm{TO}\) and the interaction effect \(\bar{{Z}}_\mathrm{E} \cdot \mathrm{TO}\cdot x_\mathrm{Dirty} /y\), reflecting an additional adverse effect for dirty sectors, are insignificant for both pollution intensities. Thus, an increase in trade liberalization does neither have a stronger impact on the net imports of sectors facing a comparatively stringent climate regulation nor on the subset of sectors that, in addition, have a high pollution intensity. Again no support for the stronger pollution haven hypothesis is revealed. This indicates that the costs associated with climate policy are not sufficiently higher for dirty sectors compared to the ones of an average manufacturing sector to bring about a distinct incentive for plant relocations of the dirty goods production. Climate policy appears to be only one factor among others to influence the sectoral trade balance.

After comparing the results of the classic model to the one of the augmented model using manufacturing data only, the augmented models are analyzed using data on primary, secondary, and tertiary sectors. The respective results are provided in Table 7. As can be seen, the coefficient estimates of the same variables have similar magnitudes in the same specification and are robust across the two different pollution intensities.

When testing the pollution haven effect only in columns (VII) and (IX), the coefficients of the direct impact of the shadow prices \(Z_\mathrm{E}\) increase compared to the results in Table 6 and are estimated to be positive and significant. At the same time, the interaction effect of the shadow price and the pollution intensity \(Z_\mathrm{E }x_\mathrm{Dirty} / y\) is less pronounced but still significant. This change can be attributed to the fact that sectors with a larger range of pollution intensities, i.e., also non-manufacturing sectors with rather low pollution intensities, are included in the analysis. It indicates that not only manufacturing industries but also non-manufacturing sectors may be affected by changes in climate policy stringency. Hence, the results provide evidence for a general pollution haven effect that is also present for non-dirty sectors. A sector’s net imports per output tend to rise regardless of its pollution intensity if the sector faces an increase in the shadow price of emission relevant energy. In addition, the climate policy-induced pollution haven effect is stronger for dirty sectors, namely sectors with a high carbon dioxide intensity or emission relevant energy intensity. Despite the changes in the coefficient estimates, the net import elasticities for the two exemplary dirty sectors are still in a similar range when data on all sectors is used in the specification testing the pollution haven effect only. Precisely, the lower and upper bounds of the net import elasticities in column (IX) amount to 0.039 and 0.095 for the chemicals sector and to 0.054 and 0.089 for the metals sector.

The evidence on the pollution haven effect remains the same in the specification that jointly tests the pollution haven effect and the hypothesis. In columns (VIII) and (X) in Table 7 only the magnitude increases of both the general effect of the shadow prices \(Z_\mathrm{E}\) and the interaction effect \(Z_\mathrm{E }x_\mathrm{Dirty}/y\), which is dependent on the sector’s pollution intensity. Consequently, these estimates provide additional support for a general pollution haven effect, which is independent of the sector’s pollution intensity, and for a stronger pollution haven effect regarding dirty sectors. As both effects increase, the elasticities of net imports also rise. While the net import elasticity of the chemicals sector in column (X) ranges between 0.053 and 0.129, the respective lower and upper boundaries of the metals sector are 0.073 and 0.120. Thus, the elasticities are larger than the ones in column (IX) testing the pollution haven effect only, but very similar to the ones of the corresponding specification in column (VI) in Table 6 that uses manufacturing data only. Moreover, the results in columns (VIII) and (X) reveal no support for the stronger pollution hypothesis. Whereas the estimated coefficients of the general effect \(\bar{{Z}}_\mathrm{E} \cdot \mathrm{TO}\) are negative but not significant, the ones of the interaction effect \(\bar{{Z}}_\mathrm{E} \cdot \mathrm{TO}\cdot x_\mathrm{Dirty} /y\) are negative and in the case of the carbon dioxide emission intensity even highly significant. Hence, the estimates are party contrary to the stronger hypothesis that trade liberalization causes a special shift of dirty sectors to countries with a weak climate policy regulation.

6 Conclusion

Given the ambiguous empirical results of previous research on global pollutants, this paper tests whether support for a climate policy-induced pollution haven effect and the pollution haven hypothesis can be found. Thereby, the paper includes several methodological novelties. First, Ederington et al.’s (2004) classical approach is extended to a multi-country setting and tested using international panel data on manufacturing sectors. Then, by arguing that trade flows of dirty goods to less dirty sectors may also be influenced by changes in policy stringency, an augmented model is estimated using not only manufacturing data, but also trade information on primary, secondary, and tertiary sectors. In order to clearly differentiate in the augmented model between dirty sectors and sectors with high pollution abatement costs, separate measures for pollution intensity and policy stringency are implemented. For the latter a consistent, internationally comparable, sector-specific measure of climate policy stringency is estimated based on a shadow price approach. Potential problems of endogeneity between climate policy stringency, trade openness and the respective trade balance are controlled for by employing a dynamic panel GMM estimator.

The results of the classic approach exhibit international empirical evidence for a climate policy-induced pollution haven effect concerning sectors facing a rise in the shadow costs of emission relevant energy per output. Similarly, the estimates of the augmented model give rise for a stronger pollution haven effect regarding carbon dioxide intensive and emission relevant energy intensive sectors. This confirms the findings of the more recent studies on global pollutants, which use energy prices as the measure of policy stringency and analyze manufacturing or industry sectors only. The results are also similar to the more general research on the pollution haven effect, which addresses unobserved heterogeneity across sectors as well as potential endogeneity issues. In addition, the augmented model provides new evidence for a pollution haven effect that is also present for non-dirty sectors, i.e., a sector’s net imports tend to rise in general if the sector faces a higher shadow price of emission relevant energy. However, in both models no support is revealed for the hypothesis that trade liberalization causes a special shift of dirty sectors to countries with weak climate policy stringency. Rather the estimates are party contrary to the stronger pollution hypothesis and in that respect similar to earlier analyses. Yet, unlike the majority of previous research the results are based on a broad international sector-specific dataset including former transition economies from Eastern Europe and newly industrialized countries like Mexico and Turkey for the time period from 1995 to 2009. Hence, among other things, impacts of the implementation of the Kyoto protocol in a multi-country setting are taken into account.

The estimated results have valuable policy implications for climate agreement negotiations as well as for the implementation and readjustment of emission trading schemes. Even though climate policy-induced pollution haven effects are estimated for both dirty and non-dirty sectors, the effects are rather limited and, in addition, no support for the stronger pollution haven hypothesis can be found. This suggests that the costs associated with climate regulation have not been sufficiently high enough to bring about a distinct incentive for plant relocations of the dirty goods production. Climate policy seems to be only one factor among others to impact trade flows. Given that trade flows are closely connected to foreign direct investments, the same may hold true with regard to the factors influencing new plant investment decisions. Consequently, the political concerns about pollution havens for global pollutants or carbon leakage are party valid, but appear to be somewhat exaggerated. This includes that governments are, on the basis of the assumed adverse effects on the competitiveness, frequently pressured to relieve energy-intensive sectors that are exposed to international trade from the costs of climate regulation. For instance, European manufacturing sectors lobby for a continuation of the free allocation of allowances within the E.U. Emission Trading Scheme, because of the additional burdens associated with carbon pricing. Thus, future negotiators may take into account that a stringent climate policy results in increased net imports, in particular for dirty sectors, but the magnitude of the effects of climate policy is relatively small.

Future research may refine the analysis in mainly two ways. First, despite the comparatively large coverage of the dataset, the number of countries, that are not highly developed, can be further increased. Unfortunately countries like China, India, and Brazil could not be included in this paper’s pollution haven analysis, because of the limited data availability on energy prices. Yet, following the argumentation of Ederington et al. (2005) the inclusion of developing countries and non-OCED countries allows analyzing the trade flows between more countries at different stages of development and, hence, helps to verify the impact of climate policy regulation. Second, the focus on sector-specific bilateral trade and intra-national trade can potentially provide more precise estimates than the analysis of aggregated sectoral trade flows. With regard to intermediate goods, dirty sectors as well as less dirty sectors use both dirty goods and other goods for the further processing. While aggregated trade flows reflect this characteristic, the use of aggregated trade flows to only analyze the impact of climate policy stringency on the trade flows of dirty goods may result in downward biased estimates. Therefore, a sector-specific analysis of the origin and destination of dirty goods is expected to further clarify the extent of pollution havens.

Notes

Likewise, Ederington et al. (2004) distinguish between a direct and an indirect effect.

A detailed overview of the included countries can be found in Table 4.

The shadow prices of emission relevant energy are also utilized in the subsequent analysis to determine the stringency of climate policy. In Sect. 3.2 the general idea and the estimation procedure of the shadow price approach are introduced. In short, the approach indirectly estimates private sector abatement costs by relying on economic theory and the choices made by firms, revealing their profit maximization behavior. Thereby, the shadow price of a polluting input can be defined as the potential reduction in expenditures on other variable inputs, which can be realized by using additional units of the polluting input while keeping the level of output constant (van Soest et al. 2006). Thus, if a polluting input, which is in the case of this paper emission relevant energy, is weakly regulated, then the price of the polluting input is relatively low and firms will choose to use relatively more of the polluting input. Such shadow prices can be determined by estimating a firm’s or a sector’s cost function.

OECD is short for Organisation for Economic Co-operation and Development.

Following the definition in the World Input–Output Database (WIOD) the difference between emission relevant energy use and gross energy use is that the former excludes the non-energy use, e.g., asphalt for road building, and the input for transformation, e.g., crude oil transformed into refined products, of energy commodities. While gross energy use is directly linked to expenditures for energy inputs, emission relevant energy use directly relates energy use to energy-related emissions.

The pollution haven effect is measured as the first partial derivative of the economic activity M with respect to the environmental policy stringency P, i.e., \(\partial M/\partial P=\beta _1 \). Hence, a positive and significant coefficient \(\hat{{\beta }}_1 \) implies, ceteris paribus, that increasing the policy stringency results in larger net imports.

In parts empirical studies using panel or time-series data lag the regulatory stringency measure P to see whether strict environmental regulation in the previous period results in changed economic activity (Cole and Elliot 2003).

A more detailed discussion of using average time-invariant policy stringency rather than general time-specific policy stringency is given in Ederington et al. (2004). Similar to their article, the estimates of the final pollution haven Eqs. (4)–(7) in Sect. 5 are not sensitive to this change in specification.

Evidence for the pollution haven hypothesis can be revealed from \(\partial ^{2}M/\left( {\partial TO\partial \bar{{P}}} \right) =\beta _3 \). If the coefficient \(\hat{{\beta }}_3 \) is positive and significant, this implies that an increase in trade openness leads to larger increases in net imports for industries facing relatively higher environmental policy stringencies. As in Eqs. (1) and (2) the pollution haven effect is still determined by \(\partial M/\partial P\).

Alternatively, in particular, tariff rates may be used to measure trade barriers. However, given that a significant number of countries, which this paper analyzes, have signed free trade agreements with each other, tariff rates are not regarded as an appropriate measure. An overview on other trade openness and policy measures is, for example, given in Rose (2004). He classifies 68 different indicators into seven categories, namely outcome-based measures of trade openness, adjusted trade flows, tariffs, non-tariff barriers, informal or qualitative measures, composite indexes, and measures based on price outcomes.

Cole and Elliot (2003) reveal for US industry sectors that pollution-intensive sectors face high pollution abatement costs per value added and are relatively capital intensive.

For instance, in the case of the German support of renewable energies the costs are passed on to clean industries and consumers, whereas energy-intensive firms are partly relieved from the financing and have to pay lower energy prices per kilowatt hour (Diekmann et al. 2012).

As before, the impact of the regulatory stringency determines the pollution haven effect and the pollution haven hypothesis is analyzed based on the impact of the sector- and country-specific but time-invariant average regulatory stringency.

For a detailed overview on the different approaches that researchers have used to measure the stringency of environmental policy and climate policy see Brunel and Levinson (2016) or Althammer and Hille (2016). The former group the approaches into five categories, namely private sector abatement costs, direct assessments of individual regulations, composite indexes, measures based on pollution and energy use, and measures based on public sector expenditures or enforcement.

Equation (8) represents the final specification of the shadow price equation, which is estimated in the system of seemingly unrelated regressions to quantify the measure of climate policy stringency. D is a country-, sector-, and time-specific dummy variable and \(\alpha _\mathrm{E}\) as well as \(\lambda _\mathrm{E}\) are the respective regression coefficients. Given the limited number of degrees of freedom, the time-specific effect is structured in five equivalent three-year time periods.

Further regression estimates are available upon request.

The rankings remain unchanged when the countries are ordered based on the average wedges.

The WIOD data are not used directly to determine the country-level capital stocks, because extrapolating the data using prior growth rates seems problematic given the potential negative consequences of the world financial crisis starting in 2008.

Table 9 in “Appendix 2” provides an overview of the 33 included sectors. The sectors are structured using the division-level ISIC Rev. 3.1. While sector-specific data certainly represent an improvement compared to prior multi-country studies, it needs to be acknowledged that some limitations remain due to the aggregation of sectors.

For instance, if net imports are zero, a regular elasticity of net imports is going to infinity.

In Table 10 in “Appendix 3” the elasticities of net imports are for comparison reasons reported for specifications including emission relevant energy use \(x_\mathrm{E}\) only, i.e., for the classic model using the shadow costs of emission relevant energy P and for the augmented models relying on the emission relevant energy use intensity \(x_\mathrm{E}\) /y. Further estimates are available upon request.

References

Aldy JE, Pizer WA (2015) The competitiveness impacts of climate change mitigation policies. J Assoc Env Res Econ 2(4):565–595

Althammer W, Hille E (2016) Measuring climate policy stringency: a shadow price approach. Int Tax Public Finan 23(4):607–639

Althammer W, Mutz C (2010) Pollution havens: empirical evidence for Germany. Paper presented at the 4th World congress of environmental and resource economists, Montreal, 28 June–2 July 2010. http://www.webmeets.com/files/papers/WCERE/2010/1408/PollutionHavensEmpiricalEvidenceGermany.pdf

Arellano M, Bond S (1991) Some tests of specification for panel data: Monte Carlo evidence and an application to employment equations. Rev Econ Stud 58(2):277–297

Arellano M, Bover O (1995) Another look at the instrumental variable estimation of error-components models. J Econom 68(1):29–51

Arouri MEH, Caporale GM, Rault C, Sova R, Sova A (2012) Environmental regulation and competitiveness: evidence from Romania. Ecol Econ 81(C):130–139

Baier SL, Bergstrand JH (2007) Do free trade agreements actually increase members’ international trade? J Int Econ 71(1):72–95

Baier SL, Bergstrand JH, Feng M (2014) Economic integration agreements and the margins of international trade. J Int Econ 93(2):339–350

Bao Q, Chen Y, Song L (2011) Foreign direct investment and environmental pollution in China: a simultaneous equations estimation. Environ Dev Econ 16(1):71–92

Becker R, Henderson V (2000) Effects of air quality regulations on polluting industries. J Polit Econ 108(2):379–421

Blundell R, Bond S (1998) Initial conditions and moment restrictions in dynamic panel data models. J Econom 87(1):115–143

Branger F, Quirion P, Chevallier J (2017) Carbon leakage and competitiveness of cement and steel industries under the EU ETS: much ado about nothing. Energy J 37(3):109–135

Brunel C (2016) Pollution offshoring and emission reductions in EU and US manufacturing. Environ Resour Econ. Advance online publication http://springerlink.bibliotecabuap.elogim.com/article/10.1007/s10640-016-0035-1

Brunel C, Levinson A (2016) Measuring the stringency of environmental regulations. Rev Env Econ Policy 10(1):47–67

Brunnermeier SB, Levinson A (2004) Examining the evidence on environmental regulations and industry location. J Env Dev 13(1):6–41

Caselli F (2005) Accounting for cross-country income differences. In: Aghion P, Durlauf SN (eds) Handbook of economic growth. Elsevier, Amsterdam

Chung S (2014) Environmental regulation and foreign direct investment: evidence from South Korea. J Dev Econ 108(2014):222–236

Cole MA, Elliot RJR (2003) Determining the trade-environment composition effect: the role of capital, labor and environmental regulations. J Environ Econ Manag 46(3):363–383

Copeland BR (2011) Trade and the environment. In: Bernhofen D, Falvey R, Greenaway D, Kreickemeier U (eds) Palgrave handbook of international trade. Palgrave Macmillan, Basingstoke

Copeland BR, Taylor MS (2004) Trade, growth, and the environment. J Econ Lit 42(1):7–71

Dechezlepretre A, Sato, M (2014) The impacts of environmental regulations on competitiveness. Grantham Research Institute on Climate Change and the Environment Policy Brief November 2014

Diekmann J, Kemfert C, Neuhoff K (2012) The proposed adjustment of Germany’s renewable energy law: a critical assessment. DIW Econ Bull 6(1):3–9

Dietzenbacher E, Mukhopadhyay K (2007) An empirical examination of the pollution haven hypothesis for India: towards a green Leontief paradox? Environ Resour Econ 36(4):427–449

Ederington J, Minier J (2003) Is environmental policy a secondary trade barrier? An empirical analysis. Can J Econ 36(1):137–154

Ederington J, Levinson A, Minier J (2004) Trade liberalization and pollution havens. Adv Econ Anal Policy 4(2):Article 6

Ederington J, Levinson A, Minier J (2005) Footloose and pollution-free. Rev Econ Stat 87(1):92–99

European Commission (2012) Commission decision of 24 December 2009 determining, pursuant to Directive 2003/87/EC of the European Parliament and of the Council, a list of sectors and subsectors which are deemed to be exposed to a significant risk of carbon leakage. Amended by Commission Decision 2011/745/EU of 11 November 2011 and Commission Decision 2012/498/EU of 17 August 2012

Frankel JA (2009) Addressing the leakage/competitiveness issue in climate change policy proposals. In: Sorkin I, Brainard L (eds) Climate change, trade, and competitiveness: is a collision inevitable?. Brookings Institution Press, Washington

Greenstone M (2002) The impacts of environmental regulations on industrial activity: evidence from the 1970 and 1977 Clean Air Act amendments and the census of manufactures. J Polit Econ 110(6):1175–1219

Grossman GM, Krueger AB (1993) Environmental impacts of a North American free trade agreement. In: Garber PM (ed) The Mexico-U.S. free trade agreement. MIT Press, Cambridge

Harris MN, Kónya L, Mátyás L (2002) Modelling the impact of environmental regulations on bilateral trade flows: OECD, 1990–1996. World Econ 25(3):387–405

He J (2006) Pollution haven hypothesis and environmental impacts of foreign direct investment: the case of industrial emission of sulfur dioxide (SO2) in Chinese provinces. Ecol Econ 60(1):228–245

Holtz-Eakin D, Newey W, Rosen HS (1988) Estimating vector autoregressions with panel data. Econometrica 56(6):1371–1395

International Energy Agency (2013) Energy prices and taxes: end-use prices. http://wds.iea.org/WDS/Common/Login/login.aspx. Cited 04 Feb 2013

Jaffe AB, Peterson SR, Portney PR, Stavins RN (1995) Environmental regulation and the competitiveness of U.S. manufacturing: What does the evidence tell us? J Econ Lit 33(1):132–163