Abstract

This paper examines the effects of environmental innovation on material usage, using Direct Material Input (DMI) and Raw Material Input (RMI) as indicators of material usage. The analysis is conducted on European Union countries for the years 1990–2012. We utilize the Generalized Method of Moments in a dynamic panel setting. Based on patent data, we construct green knowledge stocks for specific technological domains. We find that the effect of environmental innovation differs between subdomains. Innovation in the areas of energy efficiency, and recycling and reuse is found to reduce material usage. For alternative energy production, transportation, production or processing of goods, and general green innovation no significant effect is found. We observe a distinct reducing effect of some environmental innovation areas when compared with overall innovation. The technology effects are similar for RMI and DMI. The results are discussed from the perspective of literature on the environmental effects of environmental innovation, and literature on decoupling.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Sustainable Development (SD) has become an important item on the global political agenda, reflected inter alia in the UN 2030 Agenda for Sustainable Development (United Nations 2015). However, unimpressed by resource scarcities or the danger of climate change, unfettered economic growth remains the focal point of economists and policy makers. Even the Agenda for Sustainable Development acknowledges economic growth as an integral part of the equation. Increased economic activity has undoubtedly caused a dramatic increase in environmental pressures. Even before a fundamental questioning of the growth paradigm, the consequences of economic activity on the environment are obvious (Rockström et al. 2009; Schramski et al. 2015).

Innovation is a key force for offsetting scale effects to align economic development with environmental sustainability. Achieving this forceful decoupling of economic growth from resource use and the associated environmental impacts, crucially depends on technological improvements reducing pressure stemming from production and consumption (Popp et al. 2010). This assumption is formulated more clearly in the IPAT hypothesis, which states that environmental impact (I) is not just proportional to the scale of human population (P), but depends on the level of affluence (A) and specific technology choices (T) (Steinberger et al. 2010; Weina et al. 2016).

Decoupling economic development from its environmental impact is ultimately about increasing the productivity by which environmental resources are transformed into economic goods and services (Baptist and Hepburn 2013). Some studies claim that Europe has already achieved a high level of decoupling between economic growth and material use, at least in relative terms (Moll et al. 2005; Voet et al. 2005). These claims are supported by a conviction that has begun to influence policy (OECD 2011). These endeavors are reflected in a variety of political programs and initiatives, such as the Raw Materials Initiative (European Commission 2008), the Europe 2020 strategy declaring a resource efficient Europe as one of the seven flagship initiatives (European Commission 2010), or the Roadmap to a Resource Efficient Europe (European Commission 2011a). These efforts strive towards the concept of a circular economy (European Commission 2015), although limits to circularity are inevitable (Cullen 2017). The shift to green technologies is a key component in achieving these goals. This is reflected, inter alia, in the EU Eco-Innovation Action Plan (European Commission 2011b), putting environmental technologies at the heart of environmental policy in the EU. Thus, the EU is specifically targeting the deployment of green technologies.

Despite the fact that governments are invested in encouraging innovative environmental technologies, there is little empirical evidence about whether or not these technologies have a positive environmental impact (Barbieri et al. 2016). One of the obstacles confronting researchers is the lack of a common mechanism to determine the effects innovation exerts on the environment (Barbieri et al. 2016). Still, it seems evident that if innovation is intended to lessen environmental damage, then the political pursuit of innovation can be justified. Several papers have shown that green technologies reduce environmental pressure (Carrión-Flores and Innes 2010; Wang et al. 2012; Zhang et al. 2017), or at least positively affect environmental productivity (Costantini et al. 2017; Ghisetti and Quatraro 2017; Weina et al. 2016).Footnote 1 However, findings remain ambiguous and unclear. Weina et al. (2016) come to the conclusion that green technologies contribute to improvements in environmental productivity, yet do not play a significant role in reducing the absolute emission level. All of these papers focus on the sectoral (Carrión-Flores and Innes 2010), sectoral-regional (Ghisetti and Quatraro 2017), sectoral-national (Costantini et al. 2017), or the regional level (Wang et al. 2012; Weina et al. 2016; Zhang et al. 2017), and employ emission indicators (mainly CO2) to proxy environmental pressure.

When considering global environmental performance, every nation’s efforts are important. If the governments of specific nations are responsible for reducing environmental pressure by committing to, e.g., the Paris Climate Agreement, determining whether or not environmental innovation is effective is of key importance. Hence, in this paper we will focus on European Union countries to provide insights concerning the impact of environmental innovation on environmental pressure at the national level. European Union countries are industrialized and share institutional commonalities, not the least of which is a strong commitment to pursue environmental innovation.Footnote 2

As noted above, most studies on the effects of environmental innovations made use of emission indicators to operationalize environmental pressure. Yet it can be argued that such environmental indicators fail to capture the holistic nature of environmental pressure, including pressures at different stages of the economic process, as well as at different points in time (Agnolucci et al. 2017). Some scholars have proposed indicators such as those from Material Flow Accounting as an alternative proxy of environmental pressure (among others, Fischer-Kowalski et al. 2011). The issues of environmental impact stemming from economic activity could relate to impacts on substance flows or soil erosion (Rockström et al. 2009). Some of these impacts may not be gone despite the treatment of particular pollutants. Material flow indicators are used, for example, as key indicators in the assessment of Sustainable Development Goals,Footnote 3 given that these indicators refer to various traits and qualify as a comprehensive measure of environmental pressure.

First, materials are resources that are inputs in the production function (O’Mahony and Timmer 2009), and have both economic and environmental relevance. Not being perfectly recyclable, material usage reflects an irreversible depletion of environmental assets by humans. Second, materials capture potential environmental pressure at different stages. For example, the same material flow that causes land degradation at extraction may be the cause of harmful emissions at a later point in the value chain (e.g., the burning of fossil fuels). When viewed in this way, material inputs may be interpreted as waste potential that will, sooner or later, contribute to all sorts of environmental pressures (Weisz et al. 2006). It is for these reasons that the reduction of material use has become a central policy objective from the national to the global level (European Commission 2008, 2010, 2011a; G7 2015; OECD 2016; United Nations 2015).

This paper mainly contributes to two strands of literature. First, it will provide additional insights into the environmental effects of environmental innovation by widening the scope of this research strand. Comprehensive environmental indicators will be employed and a cross-country panel analysis will be conducted. Second, the paper will add to the literature on the determinants of material flows and decoupling (among others, Agnolucci et al. 2017; Krausmann et al. 2009; Shao et al. 2017; Steinberger et al. 2010; Weisz et al. 2006) by explicitly analyzing the impact of environmental innovation on national material usage.

Given that at the national level successful decoupling may be biased due to trade and outsourcing (Schaffartzik et al. 2016; Wiedmann et al. 2015), we will employ two material indicators in this paper. First, the well-established Direct Material Input (DMI) (Canas et al. 2003) indicator captures all materials entering the socio-economic system. Second, the Raw Material Input (RMI) indicator is calculated using global multiregional input–output (MRIO) models to account for upstream flows of foreign resource extraction related to imported commodities (Wiedmann et al. 2015).

The results of our paper provide evidence that environmental innovation does reduce material usage at the national level. Neither general innovation nor overall environmental innovation is found to significantly affect material usage. Rather, specific areas of green technologies are associated with reductions in material usage, namely: recycling and reuse, and energy efficiency. We further find that GDP plays an important role in determining material usage. Our findings suggest that GDP affects RMI more strongly than DMI.

Section 2 offers a brief review of the literature dealing with the effects of environmental innovation and the determinants and decoupling of material flows. Section 3 develops the theoretical framework and hypotheses for our analysis. Section 4 introduces and describes the data. Section 5 explains the econometric model employed. Section 6 presents the empirical results and discusses the results concerning the effects of environmental innovation and decoupling. In Sect. 7 several conclusions are drawn.

2 Literature Review

This paper draws upon the literature that deals with the environmental effects of environmental innovation, as well as the literature about decoupling and determinants of material flows.

If environmental innovation (EI) creates more efficient and less wasteful processing of materials, it is clearly related to material flows.Footnote 4 Generating energy from wind or solar power should reduce our reliance on fossil fuels. A more efficient product design can reduce the amount of raw materials and energy needed for production. More efficient vehicles reduce fuel consumption while providing the same level of mobility. These examples show how environmental innovation can reduce material usage without a concomitant decline in economic activity.

While there is some evidence that EI has a positive impact on environmental pressures, some confusion remains (Barbieri et al. 2016). Carrión-Flores and Innes (2010) find that EI reduced emissions for US manufacturing industries between 1989 and 2004, and that more stringent pollution targets induce innovation by increasing the cost savings of EI. Ghisetti and Quatraro (2017) find for sectors in Italian regions that EI increases the value added obtained per unit of emissions. Similar results are obtained for the impact of EI on sectoral performance in European countries, with EI improving the environmental performance both via a direct and an indirect effect (Costantini et al. 2017). Furthermore, for industrial sectors in OECD countries, EI has led to reductions in energy intensity (Wurlod and Noailly 2016). However, the evidence in studies examining the regional level remains rather inconclusive. Zhang et al. (2017) find for Chinese provinces that EI measures reduce CO2 per capita. Focusing on total emissions in Chinese provinces, Wang et al. (2012) find no effect for innovation in fossil-fueled technologies, whereas innovation in carbon-free energy technologies is found significant for specific areas. In a study on 95 Italian regions between 1990 and 2010, Weina et al. (2016) conclude that for absolute environmental impact EI does not play a significant role, yet contributes to improved environmental performance.

A significant body of literature has emerged on the determinants of material flows (e.g. Haberl et al. 2006; Hoffrén et al. 2000; Pothen and Schymura 2015; Schaffartzik et al. 2014; Weinzettel and Kovanda 2011). This literature focuses on the influence of a wide variety of aspects, such as: economic growth (e.g. Agnolucci et al. 2017; Krausmann et al. 2009), population (e.g. Krausmann et al. 2009; Steinberger et al. 2010), affluence (e.g. Shao et al. 2017), changes in lifestyle (e.g. Steger and Bleischwitz 2011; Voet et al. 2005), internationalizationFootnote 5 (Steger and Bleischwitz 2011), country specific factors (e.g. Steinberger et al. 2010; Weisz et al. 2006), and both the sectoral and the energy supply structure (e.g. Weisz et al. 2006).

A fundamental focus concerns dematerialization (Bithas and Kalimeris 2016; De Bruyn 2002; Krausmann et al. 2011; Shao et al. 2017; Steinberger et al. 2013). Dematerialization refers to relative or absolute decoupling of material use from economic growth (UNEP 2011). Relative decoupling refers to decreases in material intensity without absolute reductions in resource use, and seems rather common (UNEP 2011). Absolute decoupling (i.e., decreasing resource use in absolute terms) is much more rare (De Bruyn 2002; Krausmann et al. 2011), being somewhat bound to phases of economic recessions (Shao et al. 2017). While the scale of the economy measured by GDP growth, should drive the environmental impact upward (Stern 2004), three factors may cause material usage to lag behind increases in economic activity. Structural change, such as shifting from an industrial structure towards a service oriented economy, could cause a decrease in material intensity (Bithas and Kalimeris 2016; Stern 2004), although doubts as to this effect have been formulated (Kander 2005; Steger and Bleischwitz 2011). Furthermore, changes in the input structure (Stern 2004), e.g., substitutions among materials (Bithas and Kalimeris 2016), could lead to reductions. Lastly, technological progress is considered to drive decreasing material intensity (Bithas and Kalimeris 2016; Stern 2004) either by a general increase in productivity and/or specific changes to reduce negative environmental consequences (Stern 2004). Recent analyses corroborate caveats concerning the achievements of decoupling (Agnolucci et al. 2017; Bithas and Kalimeris 2016; Schaffartzik et al. 2016; Wiedmann et al. 2015) that have also been raised at a more conceptual level (Ayres and Warr 2004; Daly 1987).

Although the effect of technological progress is a key component in determining material flows and achieving decoupling (Sect. 3), to the best of our knowledge there is no contribution in the literature explicitly analyzing the impact of environmental innovation on material flows. Given the high relevance of EI, its effects and associated technological change should be better understood to further the debate about technological change and decoupling.

3 Theoretical Framework and Hypotheses

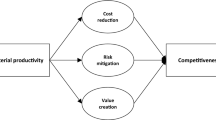

We mainly draw upon three papers to gain a framework for this analysis (Steger and Bleischwitz 2011; Steinberger et al. 2010; Voet et al. 2005). These papers are based on different theoretical foundations to identify the relevant determinants of material flows, yet converge on similar fundamental aspects. A common framework for the analysis of environmental pressure is the IPAT hypothesis (Dong et al. 2017; Steinberger et al. 2010; Weina et al. 2016). It states that environmental impact results from population size and affluence,Footnote 6 and the technologies used. As materials per unit of GDP could be a proxy for technology (Dong et al. 2017), compliance with the intensity of use hypothesis (Malenbaum 1978) is obvious.Footnote 7 This hypothesis states that materials are a function of the countries’ income multiplied by the prevailing material intensity (Voet et al. 2005).Footnote 8 Thus, these hypotheses can be grouped into three relevant effects: a growth effect influencing the scale of economic activity, a compositional effect influencing material intensity, and a technology effect influencing material intensity (Voet et al. 2005).

Defining these pillars aligns with factors considered as relevant drivers of environmental impact and material intensity mentioned in the discussion on decoupling. Stern (2004) considers proximate variables for environmental impact to be the scale of production, structural change, changes in the input mix, and technological progress. Bithas and Kalimeris (2016) consider structural change, technological progress, and substitution among materials to qualify as relevant factors for material intensity.

Based on these considerations, we group our determinants into four pillars, from which we derive our main variables. The first aspect could be referred to as a scale or growth effect. This can be considered an overall growth effect as reflected in overall GDP growth (Voet et al. 2005). The second pillar could be referred to as structural change (e.g., transitioning from an industrial base to a more services oriented economic structure), influencing the composition of production and consumption (Voet et al. 2005). Our third pillar is technological progress, as it influences the effect of economic activity on material flows (Dong et al. 2017; Hoffrén et al. 2000; Steger and Bleischwitz 2011; Voet et al. 2005). Lastly, there should be a pillar for factors that affect the material usage of countries without being subject to the aspects mentioned above. Among these factors are aspects such as the climate (Steinberger et al. 2010; Voet et al. 2005; Weisz et al. 2006) or land area (Steinberger et al. 2010; Weisz et al. 2006), which are country-specific and rather constant, complemented by institutional (Steger and Bleischwitz 2011), cultural, or other infrastructural specificities.

To include the first three pillars in our analysis we will now define three key variables. Due to the econometric model employed (Sect. 5) variables of the last pillar, which are constant within a country, need not be taken into account. Our main variable of interest is the impact of green technological change, captured by the green knowledge stock. Technological change should contribute to reducing material usage (Dong et al. 2017; Steger and Bleischwitz 2011; Voet et al. 2005). This is especially expected for our measures of green innovation. To capture the scale effect of the economy, we use GDP. Ceteris paribus, growth should lead to a proportional increase in environmental damage (Voet et al. 2005). Structural change in production is captured by the share of the industry sector in the value added of a country.Footnote 9 The industry sector is assumed to be more material-intensive (Weisz et al. 2006), contributing to higher levels of material usage.

4 Data

The dataset consists of a panel of EU-27 countries, spanning the period from 1990 to 2012. These countries are closely tied to each other both economically and politically due to the framework of the European Union. While sharing similar economic and institutional environments, they are politically pursuing environmental innovation as a means to reduce material usage (European Commission 2010, 2011b). Especially within the EU-15, a shared history and homogeneous economic structures and surroundings may prevent distinctive patterns caused by path-dependency or specific developmental stages. It can also be assumed that the preparations required for membership of the twelve countries that joined the EU in 2004 and 2007, have caused some homogeneity as well. Croatia is not included in our dataset, as it joined after the end of our observation period.

The time period considered starts after the collapse of the Soviet Union. This time restriction is mainly caused by the data availability of our dependent variable, but may support homogeneity between countries and patterns. The Soviet Union’s dismantling also marks a significant change in the global geopolitical landscape, as any number of countries were under pressure and pursued a transitional path towards market economies.

The material usage of an economy is measured by capturing its material input.Footnote 10 This reflects the material requirements of the economy for consumption and production (see Bringezu et al. 2004). The indicator is derived from the methodology of Material Flow Accounting and encompasses all materials that enter the socio-economic system of a country (Fischer-Kowalski et al. 2011). It proxies resource inputs (Bringezu et al. 2004) and is comprised of a country’s domestic extraction within a given year, plus the imports of materials. Similar indicators would be material consumption indicators, measured by subtracting exports from material input. From our perspective, consumption indicators are less suited to capture the material requirements of a country. For example, as a consequence of technological change, material inputs for the production of export goods could be reduced. Consumption indicators would fail to capture such an effect, as the materials used would not be captured in a country’s material usage.Footnote 11

We construct two distinct indicators to capture material input, namely the Direct Material Input (DMI) and the Raw Material Input (RMI). DMI is one of the most commonly used indicators, and measures the mass of domestically extracted materials plus import flows (Canas et al. 2003). The difference between DMI and RMI is based on the calculation of imported materials. DMI calculates imported materials and goods at the border by their actual weight, whereas RMI calculates imports by their so-called Raw Material Equivalents (RME) (UNEP 2016). RMEs include the upstream material requirements of imported commodities (UNEP 2016). To calculate these requirements, a global multiregional input–output analysis is applied (Wiedmann et al. 2015).

There are both advantages and disadvantages in using RMI and DMI for our analysis. RMI has the advantage that upstream flows are incorporated. Hence, the issue of offshoring environmentally-intensive production steps is controlled (Schaffartzik et al. 2016), and distortions from the positioning of countries in global value chains are avoided. Furthermore, a successful reduction of inputs required for production would be associated with an even stronger decrease of material inputs, as upstream requirements are also reduced. On the flipside, RMI may be more sensitive to changes in foreign technology if changes in material usage are not due to domestic technology but to changes in the material usage generated upstream. Furthermore, the calculation of the data by means of an input–output analysis suffers from issues and uncertainties inherent in the application of input–output models (Eisenmenger et al. 2016). For DMI, the opposite considerations apply. One disadvantage is that upstream requirements are not included. This may obscure results if reductions are basically due to offshoring material intensive production processes in the course of trade activities (Wiedmann et al. 2015). Moreover, global material reduction is not fully accounted for when imports are effectively reduced. An advantage is that DMI directly reflects the mass of materials actually processed in the economic system, without potential issues due to foreign changes in technology and production, and uncertainties stemming from the application of input–output models.

The material flow data used was obtained from the United Nations Environment Programme (UNEP) material flow dataset (UNEP 2016), available publicly for download at http://www.resourcepanel.org/global-material-flows-database. Because the time-series for Raw Material Equivalents is restricted to 1990–2012,Footnote 12 our two dependent variables are constructed for these years.Footnote 13 From the database we obtained data on the MF4 level, which separates materials into four categories: biomass, fossil fuels, metal ores, and non-metallic minerals. In this paper, we focus on the aggregated total of material input, meaning the summation of the values for the four subclasses (Agnolucci et al. 2017). Aggregating the data has the disadvantage of losing the ability to observe different effects on different subgroups. However, focusing on the aggregate material usage is in line with other works (Agnolucci et al. 2017) and a good starting point to identify aggregate dynamics. For each subgroup of materials we calculated the Direct Material Input by adding domestic extraction (DE) and imports (Im). For the Raw Material Input we added the RMEs of imports (\(RME_{IM}\)) to DE. If any of the two required subcategories (DE and Im/\(RME_{IM}\)) were missing, we set the DMI or RMI for that material class as missing. The aggregate indicator was then generated by adding up RMI and DMI of all material classes, and setting the aggregate indicator to missing if any of the subgroups were missing. Finally, we set RMI to missing if there was no data on regular imports. Thus, we have a harmonized availability of DMI and RMI for the same countries and years, facilitating a comparable analysis of both indicators.

To operationalize technological innovation, we rely upon patent counts, which are used to generate patent stocks as a measure of the installed and available technological capability (Costantini et al. 2017; Popp et al. 2011). Patents are generally considered to be a good indicator of innovative activity and are also strongly related to other measures of innovation (Griliches 1990). However, some drawbacks have been extensively discussed in the literature. First, a major issue can be differing patent quality. This may result from different propensities to patent, different patent regimes requiring different amounts of patents for the same invention, and different economic values of an invention (Johnstone et al. 2010; Popp et al. 2011). Second, although few economically significant inventions have not been patented (Dernis and Khan 2004), there are some inventions that may not be patented (Haščič and Migotto 2015). Thirdly, when searching for specific environmental patents two possible errors may arise: either the inclusion of irrelevant patents, or the exclusion of relevant patents (Lanjouw and Mody 1996).Footnote 14

In spite of these issues, there are certain advantages of using patent data for our analysis. Next to measuring intermediate output and being widely available, patent data are quantitative and can be disaggregated by technological classes (Haščič and Migotto 2015). Disaggregated technology classes allow us to formulate specific search strategies identifying specific environmental technology domains. For these reasons, we rely on patent data for this study and formulate a search strategy to minimize the issues mentioned above.

We retrieve patent data using PATSTAT 2017b.Footnote 15 Given the alternatives in generating patent based measures, we decided to rely on multinational patent applications at the European Patent Office (EPO) to avoid issues of patent value and comparability. Only innovations of high value with expected commercial profitability justify the relatively high application costs of an EPO patent (Johnstone et al. 2010). To avoid counting technologies multiple times and to enhance the value of included patent applications, we only take the first EPO patent application within a patent family. As we are interested in the economic utilization of an invention, we rely on applicant data to assign patents (Ghisetti and Quatraro 2017) and count the number of patent applications in which an applicant from a country is involved. We use patent applications instead of granted patents, thus capturing the whole innovative effort (Costantini et al. 2017). Using the earliest filing year is considered preferable because it is a better reflection of the timing of the discovery. It is not influenced by regulatory delays (Carrión-Flores and Innes 2010), and is common practice in similar empirical applications (Carrión-Flores and Innes 2010; Costantini et al. 2017; Wang et al. 2012; Weina et al. 2016; Wurlod and Noailly 2016).

We distinguish environmental and non-environmental innovation based on the technological classes of patent applications. We utilize search strategies provided by the World Intellectual Property Organization (WIPO) and the OECD. To capture environmental innovation we combine the established WIPO Green Inventory (GI) (Albino et al. 2014; Ghisetti and Quatraro 2017; Kruse and Wetzel 2014) with the latest version of the OECD EnvTech indicators (EnvTech) (Costantini et al. 2017; Ghisetti and Quatraro 2017; Haščič and Migotto 2015). The EnvTech now largely integrates the EPO Y02 scheme for climate-related technologies. Furthermore, we define search strategies identifying specific technological areas, given that some technological domains within these classifications do not relate to changes in material usage.

We construct the category overall environmental innovation (EI_Full), by including all technological classes mentioned in the GI and/or the EnvTechFootnote 16 to capture all green innovations. We also distinguish five specific EI domains that we believe have the ability to capture specific effects on material usage. We utilize subsets of the above-mentioned classifications to construct the following EI domains: alternative energy production (EI_AEP), transportation (EI_Transp), recycling and reuse (EI_Recy), energy efficiency (EI_EnEff), and climate change mitigation in the production or processing of goods (EI_ProGo). Table 1 gives an overview of the technology areas used for the construction of these domains. A comprehensive list of the included technological classes of each domain classification can be found in the “Appendix” (Table 14). A variable of general innovation was constructed including all patents (Total Inno). Non-green counterparts of our EI domains are constructed based on those patents that do not belong to any technological class included in the corresponding EI domain.Footnote 17

Following previous work (Costantini et al. 2017; Popp et al. 2011; Weina et al. 2016; Wurlod and Noailly 2016), we construct patent stocks based on the patent count data we have obtained.Footnote 18 Thus, we generate a measure of the installed technological capability (Costantini et al. 2017). We follow Popp et al. (2011) in constructing a knowledge stock that accounts for both the diffusion of new technologies and the declining influence of older technologies. Hereby, we account for the fact that the effect of new technologies may not be instantaneous and that older technologies’ effects should decrease over time (Weina et al. 2016). The generation of the patent stock for country i in year t follows the formula (Popp et al. 2011):

By multiplying the rate of diffusion with s + 1, diffusion is not constrained to zero in the current period (Popp et al. 2011). The rate of knowledge depreciation is set to 0.1 (β1) and the rate of diffusion to 0.25 (β2) (Popp et al. 2011; Weina et al. 2016).

Data on additional variables was taken from various sources. Data on Gross Domestic Product (GDP), the sectoral value added,Footnote 19 and population was retrieved from the Cambridge Econometrics European Regional Database (ERD). Data on the share of renewables in Total Primary Energy Supply (TPES) was taken from the OECD. The data on the share of the urban population as well as trade data was taken from the World Bank. The data on the share of imports and exports in relation to GDP were retrieved and summed up to generate the variable trade openness. A list of descriptive statistics can be found in the “Appendix” in Table 7. The stationarity of the variables was tested using unit root tests. Relying on the Fisher-Test with drift, the share of renewables in TPES is non-stationary in levels (“Appendix”, Table 8).

4.1 Material Inputs

We now explore in detail our chosen dependent variables of Raw Material Input (RMI) and Direct Material Input (DMI). First, we will discuss differences between the two indicators in magnitude and then their different dynamics over time. For RMI, the smallest value can be found for Malta in 1990 with 7.4 million tons (MT), while the largest value is found for Germany in 2008 with ~ 2377 MT. For DMI, the largest value is found again for Germany with ~ 1495 MT in 2007. The lowest value for this indicator is found for Malta in 1995 with 5.2 MT. These proportions between the two indicators also hold across the entire sample, as on average RMI is 1.5 times as high as DMI. Yet, this RMI/DMI ratio is variable across the sample, ranging from 0.88 to 3.28.Footnote 20 The strongest divergence between the two indicators occurs in Malta in 1991 with RMI being 3.28 times as high as DMI. Only few cases occur in which DMI is larger than RMI, namely in Bulgaria (1996 and 1997), the Netherlands (1990), Poland (1990), and Romania (1990 and 1991). The highest average deviations of the two indicators (RMI/DMI ratio) are found for Luxembourg (2.28), Slovakia (1.94), the United Kingdom (1.89), Lithuania (1.74), and Italy (1.71). The lowest average differences are found for Bulgaria (1.09), Belgium and Estonia (1.16), Romania (1.20), and the Netherlands (1.21). Some countries show a large variation in this ratio, such as Luxembourg (Min.: 1.37; Max.: 2.99), Malta (Min.: 1.26; Max.: 3.28), Slovakia (Min.: 1.43; Max.: 2.59), and the United Kingdom (Min.: 1.34; Max.: 2.37). Other countries show very little variation, for example Bulgaria (Min.: 0.96; Max.: 1.14), Estonia (Min.: 1.08; Max.: 1.24), and Sweden (Min.: 1.30; Max.: 1.48).

The share of materials extracted domestically, the so-called domestic resource dependency (DRD) (Weisz et al. 2006), plays an important role as the import of materials may hide upstream flows (Eisenmenger et al. 2016; Schaffartzik et al. 2016). In line with the observations on the RMI/DMI proportions, the DRD is higher in the case of DMI (~ 70%) than it is for RMI (~ 49%). This indicates that DMI does not value equally the fact that most imports are associated with upstream flows. These are accounted for in RMI, raise the mass of imports, and thus lower the share of domestic extraction. The DRD is expected to diminish when a country is placed further downstream in the value chain, meaning that more suppliers are upstream before materials are refined in the country. In our sample the highest average levels of DRD (> 80% in DMI and > 70% in RMI) are found for Bulgaria, Estonia, Poland, and Romania.

Additional insights into the dependent variables are acquired when analyzing their dynamics over time. First, we look at the difference between the first and the last observed value for RMI and DMI in each country. For all countries the relative increase of RMI is larger than DMI’s, although quite small in some countries (e.g., in Bulgaria RMI grew 10 percentage points more than DMI), while very large in others (e.g., in Luxembourg RMI grew 155 percentage points more than DMI). Also, the final RMI values are larger than the initial ones across all countries, while DMI shows smaller values at the end of our time-period in several countries: United Kingdom − 26%, Hungary − 23%, Romania − 22%, Italy − 5%, Greece − 3%, and the Czech Republic − 1%.

These findings correspond to the different growth dynamics of RMI and DMI. RMI grows on average at a rate of almost 3%, while DMI only about 1.4%. Across all countries average RMI growth is larger than DMI growth, with all countries having a positive RMI growth rate. The only country with less than 1% average RMI growth is Hungary (0.82%), while Cyprus, Estonia, Luxembourg, Latvia, and Malta have more than 5% growth on average. Concerning DMI, Hungary, Italy, Romania, and the United Kingdom have negative average growth rates. Hence, the two indicators do not only lead to differences in magnitude, but also represent different dynamics over time. The higher growth rate of RMI indicates an increasing importance of offshoring material-intensive production processes.

4.2 Knowledge Stocks

For each of our distinct patent search strategies we construct a knowledge stock based on Formula (1). In Table 2, we report the top 5 countries for our six environmental innovation variables and the general innovation variable, as well as the descriptive statistics. The top countries are Germany, France, Italy, Netherlands, and the United Kingdom (UK). This largely corresponds to the level of economic development, and the size of the countries. These countries, ranked by their mean value, always take the first five places. The only exception concerns transportation, where the Netherlands is ranked 7 behind Austria and Sweden.

Germany and France hold the top 2 spots in every category, although Germany has by far the largest knowledge stock in our sample with values that are almost three times as high as France. Generally, the UK follows in third place followed by the Netherlands and Italy. In the case of energy efficiency (EI_EnEff), the Netherlands shows higher values than the UK. When it comes to recycling and reuse (EI_Recy), Italy shows slightly higher values than the Netherlands, and in the case of transport (EI_Transp) the Netherlands drops out of the Top 5 being replaced by Austria. All countries involved are EU-15 countries with a larger population and a high level of economic development.

As Fig. 1 shows, knowledge stocks tend to increase over time. For the average EU-27 country, the knowledge stock increases in all EI domains. Norming all values to 1 in 2001 shows that all EI domains start at ~ 0.5 in 1990 and develop upwards to 1 in 2001. After 2001, transportation (EI_Transp) and energy efficiency (EI_EnEff) show the largest increase reaching ~ 2.4 in 2012. Production or processing of goods (EI_ProGo) also reaches a value above 2 in 2012, while overall environmental innovation (EI_Full) and alternative energy production (EI_AEP) reach ~ 1.8 of their 2001 value. The smallest increase can be found for recycling and reuse (EI_Recy) remaining below 1.5 in 2012.

In terms of absolute numbers, EI_Recy is the smallest category, followed by EI_ProGo and EI_Transp. EI_AEP is by far the largest EI domain, with an average value roughly 1.8 times as high as EI_EnEff. Descriptive statistics on the knowledge stock variables can be found in the “Appendix” (Table 7).

5 Econometric Model

In view of the literature on panel data and our research question, a dynamic approach should be adopted to account for the dependency of material flows on their own past values (see Shao et al. 2017). We will formulate equivalent equations for DMI and RMI. The model to be estimated is given by:

with the subscript \(i\) = 1,…,N denoting the countries, and \(t\) = 1,…,T the years of the panel. The vector \(X\) includes the explanatory variables, \(\beta\) denotes the vector of coefficients. \(\varphi\) is the country fixed effect, and \(\epsilon\) is the error term.

Estimating a fixed-effects model with a lagged dependent variable (LDV) as a regressor generates a biased estimate of the coefficients (Judson and Owen 1999). If the time dimension becomes sufficiently large, the correlation between the LDV and the country-specific effect might be small (Castro 2013). Even for T = 30 the bias can amount to 20% of the true value of the coefficient (Judson and Owen 1999). As in our application we are dealing with T = ~ 20, this bias should be seen as potentially strong. This suggests that a one-step difference Generalized Method of Moments (GMM) estimator, as proposed by Arellano and Bond (1991), should be used (Hwang and Sun 2018; Judson and Owen 1999).

The starting point of this estimator is given by first differencing the equation:

Thus, the country-specific effects are eliminated and instrumental variable estimators can be used. These estimators allow the inclusion of endogenous regressors, as well as predetermined and exogenous regressors. Endogenous regressors are influenced by the contemporaneous error term, while predetermined regressors may be influenced by the error term in previous periods. The differentiation process has the disadvantage that while the fixed effects are gone, \(\Delta y_{t - 1}\) is now correlated with \(\Delta \epsilon_{it}\) as \(y_{t - 1}\) is a function of \(\epsilon_{it - 1}\).

This problem can be solved by instrumental variables. Lags of the dependent variable and the regressors can be used to satisfy the moment conditions:

The orthogonality restrictions above are the basis of the one-step GMM estimation. While exogenous regressors instrument themselves in first differences, predetermined and endogenous variables are instrumented with their lagged levels. For predetermined variables lags 1 and deeper are available, for endogenous variables lags 2 and deeper.Footnote 21 An endogeneous variable is correlated with the contemporaneous error term. Thus, to instrument \(\Delta X_{t}\) one would need \(X_{t - 2}\) as \(X_{t - 1}\) would be correlated with the \(\epsilon_{t - 1}\) in \(\Delta \epsilon_{t}\). Instrumenting with lagged levels instead of lagged differences makes one time period more available.Footnote 22

The procedure requires that no second-order autocorrelation is present in the differenced equation. First-order correlation is expected in differences as the \(\Delta \epsilon_{t}\) and \(\Delta \epsilon_{t - 1}\) share a common \(\epsilon_{t - 1}\) term, thus evidence is uninformative. Autocorrelation of a higher order than one in the differenced equation would render some instruments invalid and would require deeper lags to be used as instruments, causing a loss of T (Roodman 2009). The presence of second-order autocorrelation would generate inconsistent estimates (Castro 2013).

Crucial for the validity of GMM is exogeneity of the instruments. When the number of regressors k is equivalent to the number of instruments j, the model is exactly identified and the detection of invalid instruments becomes impossible. Yet, if the model is overidentified with j > k, validity of the instruments can be tested using the Sargan specification test (Castro 2013; Roodman 2009).

Special attention, especially in a larger T context, should be given to restricting the number of instruments used, as too many instruments impose problems for GMM estimation (Roodman 2009). This consideration motivates the sparse use of instruments to avoid instrument proliferation, as is carried out in the empirical application and explained in Sect. 6. We will check the results for reductions in the instrument count.

6 Empirical Results and Discussion

We begin the empirical analysis by specifying and validating a baseline model using our three main explanatory variables and the lagged dependent variable (LDV). Then we turn to the estimation for our two dependent variables with the various classifications of green technological areas. To ensure that we identify an actual effect and avoid issues of omitted variable bias in our innovation variable, we also check for the effects of total innovation and the non-green counterparts of the green technological areas that were previously found to exert a significant effect on material usage. We further explore several variables that may be considered to affect material usage and check them for inclusion in our model. Lastly, we check the robustness of our results for reductions in the instrument count.

6.1 Main Results

In our estimations, the variables in all specifications are either in natural logarithm or share. In line with the respective tests and literature (Roodman 2009), all specifications include time-effects. Concerning the fixed-effects estimation, the Hausman test supports estimating a fixed-effects instead of a random-effects model. The regular fixed-effects model is estimated with Driscoll and Kraay standard errors (FE DK), that are robust to cross-sectional dependence, heteroscedasticity, and autocorrelation (Hoechle 2007). We use the FE estimator to initially ensure the soundness of the Arellano-Bond estimation concerning the coefficient of the LDV. We report the coefficients and in brackets the robust standard errors. As to the tests, we report the respective statistic and the p value in brackets.

To overcome bias and inconsistency in OLS estimation methods, we employ the Arellano-Bond estimator. The difference one-step GMM estimator was used, in line with econometric literature (Hwang and Sun 2018; Judson and Owen 1999) and similar applications (Castro 2013; Wang et al. 2012). In our baseline model we include one lag of the dependent variable to allow past material use levels to influence current material use (Shao et al. 2017), the stock of green knowledge (Costantini et al. 2017), GDP, and the industrial intensity as explanatory variables. In the Arellano-Bond estimation (AB), the LDV is instrumented with the second to tenth lag of the non-lagged dependent variable. Environmental innovation is treated as potentially endogenous (Costantini et al. 2017) and instrumented with the third to fifth lag. GDP is treated as endogenous and instrumented with its second and third lag. The industrial intensity is treated as exogenous. Concerning the LDV, the use of more lags as instruments presents a trade-off as a large instrument count may weaken the reliability of our results (Roodman 2009), given that we have 27 cross-sectional units in our sample. However, we check the robustness of results to different instrument choices. The robustness of our results in relation to the reduction of the instruments is shown in the “Appendix” (Table 13). Furthermore, all AB estimations are conducted with orthogonal deviations instead of a first-difference transformation (Hayakawa 2009; Hsiao and Zhou 2017; Roodman 2009). Especially, when the lag range is restricted, orthogonal deviations lead to asymptotically unbiased estimates (Hsiao and Zhou 2017). The consistence of the estimator is assured as the AR tests for serial correlation in the differenced residuals provide no evidence of second-order autocorrelation. The validity of the employed instruments is confirmed by the results of the Sargan test.

We start by checking the soundness of the AB estimation by estimating our baseline model with OLS, FE, and AB (Table 3). To be sound, the coefficient of the LDV in the AB estimation should lie in or near the range of the coefficient size of OLS (upward biased) and FE (downward biased) (Roodman 2009). This condition seems to hold, given the standard errors of the LDV. The results provide support that the AB specifications are sound, hence we will continue with AB estimation in further analysis.

Our main variable of interest is environmental innovation (EI), proxied by a knowledge stock derived from data on environmental patent applications, as we are interested in its potential to contribute to reductions of material usage. We use a green knowledge stock accounting for the diffusion and depreciation of technologies (Popp et al. 2011). Utilizing a holistic definition of green innovation (EI_Full), which includes all technologies of the Green Inventory (GI) and/or the OECD EnvTech (EnvTech), we do not find that EI affects material usage, neither when using the Raw Material Input (RMI) nor when using Direct Material Input (DMI).

We continue by briefly discussing the results concerning the other determinants of material usage included in our model before we continue analyzing our main variable of interest (EI) in more detail, focusing on specific technological areas. We include the first lag of the dependent variables for both RMI and DMI. The results indicate that a dependence of both indicators on their own past values exists. However, the coefficient size differs as the coefficient ranges at ~ 0.6 for RMI (Table 4), while it is at ~ 0.8 for DMI (Table 5).

To capture the scale of the economy, we include the contemporaneous GDP. For RMI, we find that GDP is significant with a coefficient of ~ .6, indicating that a 1% increase in GDP raises the RMI by 0.6%.Footnote 23 Turning to specifications with DMI as dependent variable, we find that the coefficient of GDP is slightly significant in the AB estimation with a coefficient roughly half as large as for RMI. This finding further holds when looking at the coefficients of GDP in Tables 4 and 5. As for RMI, it fluctuates between 0.38 and 0.65, while it remains slightly significant or insignificant for DMI. This result appears plausible, given the potential relevance of the outsourcing of material intensive production steps (Schaffartzik et al. 2016), which is not sufficiently captured in the DMI indicator. Thus, it seems reasonable that the impact of GDP is larger when accounting for upstream flows.

To capture structural change, considered highly relevant in determining material flows (Steger and Bleischwitz 2011; Weisz et al. 2006), we include the share of the industry sector in the value added of a country (Industrial Intensity). The results concerning Industrial Intensity remain somewhat inconclusive. For RMI (Table 4), it is only significant in two specifications with a coefficient of 0.35 and 0.52 respectively. For DMI (Table 5), it is found to be significant in three estimations with a coefficient size of ~ 0.3 to ~ 0 .8. These coefficients can be interpreted as stating that a one percentage point increase in the industrial sectors share is associated with a ~ 0.3 to ~ 0.8% increase in material usage. These results are in line with the consideration that the industrial sector’s comparatively high resource intensity becomes smaller as the material intensity of the service sector rises when upstream interlinkages are taken into account (Steger and Bleischwitz 2011). This is given in the RMI indicator.

We now turn to look at model estimations dealing with the more specific classifications of green technologies by technological domain. As discussed earlier we specify alternative energy production (EI_AEP), transportation (EI_Transp), recycling and reuse (EI_Recy), energy efficiency (EI_EnEff), and climate change mitigation in the production or processing of goods (EI_ProGo). The results using RMI as dependent variable are shown in Table 4.

More specific definitions of EI lead to differing results compared to the holistic definition of EI_Full. In the cases of EI_AEP, EI_Transp, and EI_ProGo, EI remains insignificant, although the coefficient size gets larger in magnitude. Innovation in the areas of EI_Recy, and EI_EnEff are found to significantly reduce material usage. The largest effect in magnitude can be found for EI_Recy as a 1% increase in the knowledge stock is associated with a ~ 0.05% decrease of material usage, significant at a 1% level. EI_EnEff is significant at a 5% level with a smaller coefficient, indicating a ~ 0.04% decrease of material usage per percentage increase of the knowledge stock.

Now we turn to the same estimations with DMI as our dependent variable. The results are reported in Table 5. It can be noted that the results for our different EI fields are qualitatively similar with our results for RMI. EI_AEP, EI_Transp, and EI_ProGo remain insignificant. EI_Recy is found to be significant at a 5% level, with a coefficient smaller in magnitude. The coefficient of EI_EnEff is larger in magnitude, significant at a 10% level.

Even though the links of EI with material usage are statistically strong, the estimated elasticities are rather small, ranging between − 0.0482 and − 0.0370. However, to assess the effect of EI on material usage, these numbers need to be seen in the context of the overall change of EI, as even small elasticities may indicate a large effect if the changes in EI are large (see also Costantini et al. 2017). To calculate the average effect of EI on material usage in a given year we multiply the elasticities with the average changes of the EI variables. The average increase in knowledge in a given year for EI_Recy is associated with a reduction of material usage by 0.57% with respect to RMI. EI_EnEff entails a similar impact on RMI with a reduction of 0.54%. For DMI, EI_EnEff has a larger effect with a reduction of 0.59%, whereas EI_Recy reduces material usage by 0.46% in a given year. Recalling that the average increases of RMI and DMI are about 3% and 1.4% respectively (Sect. 4.1), these technology effects account for a relevant reduction of material usage.

These results indicate that the effects of innovation on material usage differ based on technological domain. However, utilizing patent data can result in including too many or too few patents into the classification. An overestimation of the patent stock mainly results in a heightened risk of not finding a significant parameter (even if the true parameter is significant), while underestimating the knowledge stock limits conclusions for the technologies included (Wurlod and Noailly 2016). To secure that we have isolated an actual effect of the specific green technological domains that does not stem from mistakes in our technology boundary, we now test variables found to be significant by analyzing their non-green counterparts and total innovations (Total Inno) in our model. The results are shown in Table 6.

The results show that neither general innovation (Total Inno) nor the non-green counterparts of the EI domains have a significant impact on material usage.Footnote 24 This indicates that the EI domains have a specific effect on material usage that is different from overall technology effects. This result holds for both RMI and DMI. Hence, we are confident that we have identified an effect of our specific measures of green technology, which is sensitive to the fact that general innovation is not associated with decreases in material usage. This renders a plausible impression that our finding of EI_Full to be insignificant is due to the inclusion of certain technological areas which are unrelated to a reduction of material usage.

6.2 Robustness Checks

We will proceed by checking the robustness of the obtained results of EI. First, we will include additional explanatory variables that are considered to be potentially relevant determinants of material usage. Then we will reduce the instruments in our AB modelling, so that we use almost as many instruments as there are countries in our sample (Roodman 2009). Hereby, we ensure that the results are not sensitive to the number of instruments used. The results for the inclusion of control variables are reported in Tables 9, 10, 11 and 12 in the “Appendix”. The reduction of the instruments is reported in Table 13.

We analyze variables concerning trade openness, i.e., the embeddedness of the country in the world economy (Carattini et al. 2015), population (Krausmann et al. 2009), the share of urban population (Shao et al. 2017), and energy composition (Weisz et al. 2006) proxied by the share of renewable energy in TPES. All variables are in natural logarithm or share. The share of renewable energy was included in first-differences as the stationarity test (see “Appendix” Table 9) indicated that this variable is non-stationary in levels.

Trade openness is often considered to be relevant for countries’ environmental damage (Carattini et al. 2015). It may reflect competitive pressure as the world market forces countries’ industries to be more resource efficient (Steger and Bleischwitz 2011; Voet et al. 2005). Trade openness may also be related to structural implications (Carattini et al. 2015). However, our results show trade openness to be insignificant. An explanation could be that embeddedness in the world market also means increased supply and availability of resources.

Population is a highly relevant determinant of environmental damage, which is reflected both in the material flow literature and the IPAT hypothesis (amongst others, Krausmann et al. 2009; Steinberger et al. 2010; Weina et al. 2016). We find population to be insignificant, which seems mainly due to our estimation analyzing changes in material usage. Absolute changes in economic activity are captured in GDP, and population has a low variance in industrialized countries anyhow (Weina et al. 2016).

We check for the share of urban population as a proxy for the population prone to live according to a typical industrial metabolic profile (Shao et al. 2017). Our findings show this variable to be insignificant, which may be due to our application looking at material input in contrast to other analyses (Shao et al. 2017), as well as high density settlements reducing the per capita infrastructural requirements (Weisz et al. 2006).

The composition of the energy supply is often considered to influence material usage (Steger and Bleischwitz 2011; Weisz et al. 2006), as renewable energy may reduce the usage of, e.g., fossil fuels. The insignificance of this variable in our analysis may be due to the additional material demand required to set up renewable energy infrastructures (Steger and Bleischwitz 2011). Another possible reason for this insignificance could be due to the fact that we do not explore cross-country differences, but rather focus on changes within individual countries. Furthermore, renewable energy likely captures a substitution among materials (Bithas and Kalimeris 2016), while we analyze total material usage.

Now we turn to the reductions of the instrument count. We reduce the used lags of the innovation variable and the GDP variable to only the second lag as an instrument. The instruments for the LDV were reduced to lag two to six.Footnote 25 We find that the results concerning EI_Recy remain rather robust. EI_Recy remains significant both for RMI and DMI at the 5% and 10% level respectively. The coefficient turns a little smaller in magnitude. EI_EnEff shows to be more sensitive. Both for RMI and DMI the coefficient loses its significance. While the coefficient turns larger in magnitude for RMI, it turns substantially smaller in magnitude in the case of DMI.

6.3 Discussion

This paper contributes mainly to the debate on the environmental effects of environmental innovation (EI). Unlike previous work we have constructed indicators of material usage to operationalize environmental impact. We have focused on both Direct Material Input (DMI) and Raw Material Input (RMI) to account for the respective shortcomings that both indicators present. The role of EI was explored in more detail by defining subclasses that represent different areas of green technological change.

As discussed in Sect. 2, previous work focused on other indicators of environmental pressure when assessing the effects of EI, mainly emission indicators. On the sectoral level, reducing effects of EI were found (Carrión-Flores and Innes 2010; Costantini et al. 2017; Ghisetti and Quatraro 2017; Wurlod and Noailly 2016), while on the regional level evidence was more inconclusive (Wang et al. 2012; Weina et al. 2016; Zhang et al. 2017). The work most related to our sample of European countries is the analysis of eco-innovation effects in European sectors. Here a direct and indirect effect of EI is found, as effects occur not only in the sector where an EI originates, but also in other sectors through market transactions (Costantini et al. 2017). Such a supply chain effect is captured on a national level to some extent. Moreover, EI activities are embedded in the general national effort to upgrade the sustainability of its production (Costantini et al. 2017). On the national level, spillovers between regions are included, which are considered a channel through which EI exerts its effects (Barbieri et al. 2016).

A further contribution of this paper concerns the subdomains of EI we defined to explore various areas affecting material usage in different ways. Our findings suggest that green innovation in the areas of energy efficiency (EI_EnEff), and recycling and reuse (EI_Recy) is associated with decreases in material usage. Such effects could not be found for the EI domains of alternative energy production (EI_AEP), transportation (EI_Transp), climate change mitigation in the production or processing of goods (EI_ProGo), and overall EI (EI_Full). Energy efficiency measures can be considered to affect material usage rather directly as reduced energy demand results in associated decreases in the utilization of materials like fossil fuels or other energy carriers. A similar consideration can be applied to technological advances in recycling and reusing, as they decrease the need for newly extracted materials, and promote the concept of a circular economy (Cullen 2017; European Commission 2015).

EI in the production or processing of goods includes a broad range of technologies listed in the Y02P class. As these technologies strongly relate to resource-intensive production processes, they likely capture not only direct effects (e.g., recycling or energy efficiency measures), but also the general innovative effort to upgrade the sustainability of production and processing. Hence, the fact that this EI domain is found insignificant could be related to the inclusion of technologies unrelated to reductions of material usage, and the arising difficulty with isolating the reducing effect (see Wurlod and Noailly 2016). Concerning our measures of EI_AEP and EI_Transp, which were also found to be insignificant, two further interpretations can be considered. First, both EI_AEP and EI_Transp capture technologies which are basically related to the substitution of materials, not specifically their reduction. It remains uncertain which type of environmental pressures will arise due to the utilization of new technologies, such as electric mobility (Hepburn et al. 2018). Hence, the effects of these technologies can potentially not be sufficiently captured by our aggregated material indicators. For example, the utilization of solar energy may reduce fossil demand but, on the other hand, increase the need for specific metals or other materials as new infrastructural requirements emerge. The same seems to hold for new modes of transportation. Second, an alternative and complementary explanation concerns the empirical framework. While changes in reusing materials in industrial processes are rather quickly implementable, redefining the energy supply system or the transportation system are large scale technological and societal processes.Footnote 26 Hence, policy may play a more important role in facilitating these changes (Popp et al. 2011). Capturing them in an empirical setting seems more difficult due to the uncertain time-horizon of such transformations.

Thus, while some specific EI domains are found to reduce material usage, such results can neither be obtained for general innovation nor the non-green counterparts of our EI domains. These findings point to the relevance of narrowly defining technological areas. While some technological domains within the broad definition of EI (EI_Full) exert an effect, this effect cannot be isolated for our broad definition of EI as the inclusion of technologies that do not affect material usage (e.g., water technologies) likely causes finding no impact of general EI (Wurlod and Noailly 2016). Although we do not find an impact of general innovation or non-green subgroups, there likely are “non-green” technologies that reduce material usage. Generally, it is considered that many “normal” innovations do provide environmental improvements (Kemp and Pearson 2007). Especially in the context of material usage, we could expect such results. Improving efficiency and reducing costly materials can be considered as general aims of innovative activity that strives to enable general productivity gains. Thus, the fact that all non-green groups and general innovation were found to be insignificant should be interpreted cautiously in the sense that our EI domains exert a different effect than overall innovation.

With a focus on material usage, our results also provide further evidence contributing to the literature on decoupling.Footnote 27 We explicitly operationalize the impact of green technologies and assess both the impacts on RMI and DMI. The fact that there is a reducing impact of EI on material usage, points to the notion that at least a relative decoupling is likely as we ascertain a technology effect (Bithas and Kalimeris 2016; Stern 2004; UNEP 2011). Referring to Tables 4 and 5, it is obvious that GDP plays a role in determining material use. We observe a substantial and robust impact of GDP on RMI. For DMI, we find the influence of GDP to be more modest. Our observations concur with the consideration that European countries have profited—with respect to their DMI—from the outsourcing of material intensive activities through international trade. Therefore, resource efficiency gains may be substantially smaller when accounting for upstream flows (Schaffartzik et al. 2016; Wiedmann et al. 2015). The effects of structural change, which are more pronounced for DMI, support these observations. Nonetheless, our results show for both indicators that EI can contribute to reductions in material usage. Thus, strengthening EI seems a valid way to reduce the material usage in European economies. Reductions by technology need to be kept from being overwhelmed by rebound effects and continued economic growth (Binswanger 2001; Freire-González 2017) if an absolute reduction of environmental impact is to be achieved.

7 Conclusions

A reduction of material usage has become an important goal on the political agenda (European Commission 2011a). The aim of this paper was to empirically examine the effects that environmental innovation (EI) had on material usage within the European Union countries. Input indicators based on the methodology of Material Flow Accounting have been considered as more holistic proxies of environmental pressure (Agnolucci et al. 2017; Fischer-Kowalski et al. 2011) than single-pressure indicators such as CO2 emissions.

We provide new evidence that EI has contributed to reductions of material usage in European economies. For technologies in the areas of energy efficiency, and recycling and reuse, we find that EI did contribute to such reductions. For further classifications of technologies, we do not find significant effects on material usage. This could, however, be due to issues of capturing substitutions between materials, long time-horizons in systemic technological change, as well as too broad definitions of technological fields. These results have important implications for academics and policymakers alike, as substantial differences in the effects of technologies occur. Differences in feasibility, time requirements for changes, and overall environmental effects of technologies need to be accounted for in order to facilitate effective policies and an appropriate analysis of green technological change. Nonetheless, our main results complement earlier findings on the effects of EI on emissions and energy intensity (Carrión-Flores and Innes 2010; Costantini et al. 2017; Ghisetti and Quatraro 2017; Wurlod and Noailly 2016; Zhang et al. 2017), although the comparability of studies remains limited, given the differences in indicators, samples and econometric methods.

Differences between the two input indicators have been found. For both RMI and DMI, there is a technology effect, as for both indicators EI is found to have a significant reducing effect. Scale effects are found to be more relevant in the case of RMI. Effects of structural change are more pronounced for DMI.Footnote 28 Thus, our results support considerations present in decoupling literature suggesting that successes in decoupling may be biased upwards due to outsourcing via international trade (Schaffartzik et al. 2016; Steger and Bleischwitz 2011; Wiedmann et al. 2015).

Some further avenues of research emerge from the limitations of this analysis. First, the analysis could be refined by unpacking material classes to identify substitutional effects among materials (Bithas and Kalimeris 2016). A more detailed analysis focusing on a sectoral level (Costantini et al. 2017) might identify the potential of EI in material usage reduction in different sectors. Generally, our results support the relevance of looking at specific technological domains and of accounting for effects along entire supply chains. Hence, there is a need for research that provides an in-depth analysis of the holistic effects of specific green technologies. Given the crucial relevance of scale effects in driving material usage, especially the political dimension needs to be taken into account when striving towards Sustainable Development. This involves the relevance of public policy and governance to support the development and spreading of green technologies, but also the key issue of avoiding rebound effects and growth as a consequence of technological progress (Aghion and Howitt 1998; Binswanger 2001; Freire-González 2017). If these are not sufficiently accounted for, the merits of EI are likely eaten up or even overcompensated for by scale effects.

Despite these limitations, our results support the notion that environmental innovation can contribute to reducing material usage. Therefore, supporting environmental innovation and reducing environmentally harmful subsidies (Wilts and O’Brien 2019) could create a win–win situation. However, the holistic impacts of innovation should be taken into account, such as the long-term induced dynamics of EI, when being dealt with at the political level.

While the potential of environmental innovation to reduce environmental pressure may be far from being fully exploited, it cannot be ignored that technological advances have not as yet been able to solve our environmental issues. Rather, these issues tend to become more and more pressing. Simply hoping for future technological breakthroughs to solve our issues, would be unreasonable, if not reckless. Especially, given the limitations on decoupling (Cullen 2017; Georgescu-Roegen 1971; Meadows et al. 1972; Schramski et al. 2015), the pursuit of Sustainable Development calls for continuous adjustment and alignment with environmental necessities. Fundamental changes in lifestyles and societal structures may become inevitable and should be strengthened as required, in order to not realize too late that technology may not do the trick.

Notes

Positively affecting environmental productivity refers to reductions in environmental damage per unit of output.

The terms environmental innovation, green innovation and eco-innovation are not distinguished throughout this paper.

Material flow indicators are mentioned for Goal 12, see https://sustainabledevelopment.un.org/sdg12. Accessed August 09, 2019.

The Community Innovation Survey 2008 questionnaire makes explicit enquiries as to the material-saving character of environmental innovations.

Referring here to increased trade and embeddedness in the world economy, causing an increase in competitive pressure.

GDP per capita (Dong et al. 2017).

The application of the hypothesis to this context would be:

IPAT: Materials = Pop * GDP/Pop * Materials/GDP = GDP * Materials/GDP.

IoU: Materials = GDP * Materials/GDP.

Materials per unit of income.

The industry sector is defined on the 3-sector-data level in the Cambridge Econometrics European Regional Database (ERD). The industry sector is aggregated from the 6-sector-data by combining manufacturing and energy, and construction.

We construct the Total Material Input, which is equal to adding up the subcategories biomass, fossil fuels, metal ores, and non-metallic minerals (see also Agnolucci et al. 2017).

For example, advances in technology may cause fewer material needs from imports as intermediate inputs. However, when the goods are exported as final products, the full quantity of embodied materials would be gone, thus losing information of this kind.

Although later years are available, it is stated in the Technical Annex that data after 2012 should not be used for statistical analysis, as data is increasingly projection based.

Though data on domestic extraction and regular imports would be available for earlier years.

These issues do not prevent conclusive arguments on parameters found to be significant, while an overestimation of green patents can increase the risk of not finding statistically significant coefficients, although the true parameter value would be significant (Wurlod and Noailly 2016).

The b refers to the autumn version.

The Green Inventory can be found at: https://www.wipo.int/classifications/ipc/en/green_inventory/. [accessed August 09, 2019]. The OECD Env Tech can be found at: https://www.oecd.org/environment/consumption-innovation/ENV-tech%20search%20strategies,%20version%20for%20OECDstat%20(2016).pdf [accessed August 09, 2019].

As an illustration, NG_Recy includes all patents that do not belong to any IPC/CPC class that is mentioned in the EI_Recy technology classes list.

We initially construct our stocks starting with count data from 1980 onwards.

Sectoral value added was used to calculate the share of the industry sector.

0.88 indicates that RMI amounts only to 88 if DMI is set at 100, while 3.28 indicates that RMI is 328 if DMI equals 100.

A predetermined variable \(X_{t}\) is influenced by past error terms, e.g. \(\epsilon_{t - 1}\). Thus, in first-differences \(X_{t - 1}\) is a valid instrument for \(\Delta X_{t}\) as it is only correlated with \(\epsilon_{t - 2}\), and thus not with \(\Delta \epsilon_{t}\).

A first-difference instrument would be available for the first time in the fourth period, while a lagged level instrument is first available in the third period.

This value represents the short-run coefficient, and the same goes for all other regressor coefficients. As the dependent variable follows an autoregressive process defined by the coefficient on the LDV, the impact of changes in a regressor in t affects not only the dependent variable in t, but also in coming periods. The long-run coefficients can be computed dividing each short-run coefficient by one minus the sum of the coefficients on the lag of the dependent variable (Pesaran and Smith 1995).

Note that for reporting sound and homogenous specifications, we instrumented all innovation variables with lag three and four. For RMI we allowed lags two to thirteen for the LDV. Results are not sensitive to different instrumentation choices.

To secure a sound estimation concerning, e.g., the coefficient of the LDV.

Especially the societal aspect in these technological changes should be stressed. As soon as changes no longer just occur “behind the curtain” of production facilities and firms, but enter directly in the life and daily environment of people there can be a high degree of resistance causing such changes to turn into difficult and long-lasting societal negotiation processes, making it difficult to capture such aspects in an empirical setting as used in the proposed analysis.

Please note that given the empirical design the interpretation of the results in the sense of decoupling should be treated with caution, due to the presence of the LDV and time-effects (Plümper et al. 2005).

It should be noted that the empirical analysis does not allow for conclusions on the effects of structural change on specific material classes.

References

Aghion P, Howitt PW (1998) Endogenous growth theory. MIT Press, Cambridge

Agnolucci P, Flachenecker F, Söderberg M (2017) The causal impact of economic growth on material use in Europe. J Environ Econ Policy 6:415–432

Albino V, Ardito L, Dangelico RM, Messeni Petruzzelli A (2014) Understanding the development trends of low-carbon energy technologies: a patent analysis. Appl Energy 135:836–854

Arellano M, Bond S (1991) Some tests of specification for panel data: Monte Carlo evidence and an application to employment equations. Rev Econ Stud 58:277–297

Ayres RU, Warr B (2004) Dematerialization versus growth: Is it possible to have our cake and eat it? CMER Working Paper 2004/18/EPS/CMER, Center for the Management of Environmental and Social Responsibility

Baptist S, Hepburn C (2013) Intermediate inputs and economic productivity. Philos Trans R Soc 371:1–21

Barbieri N, Ghisetti C, Gilli M, Marin G, Nicolli F (2016) A survey of the literature on environmental innovation based on main path analysis. J Econ Surv 30:596–623

Binswanger M (2001) Technological progress and sustainable development: what about the rebound effect? Ecol Econ 36:119–132

Bithas K, Kalimeris P (2016) The material intensity of growth: implications from the human scale of production. Soc Indic Res 133:1011–1029

Bringezu S, Schütz H, Steger S, Baudisch J (2004) International comparison of resource use and its relation to economic growth: the development of total material requirement, direct material inputs and hidden flows and the structure of TMR. Ecol Econ 51:97–124

Canas Â, Ferrão P, Conceição P (2003) A new environmental Kuznets curve? Relationship between direct material input and income per capita: evidence from industrialised countries. Ecol Econ 46:217–229

Carattini S, Baranzini A, Roca J (2015) Unconventional determinants of greenhouse gas emissions: the role of trust. Environ Policy Gov 25:243–257

Carrión-Flores CE, Innes R (2010) Environmental innovation and environmental performance. J Environ Econ Manag 59:27–42

Castro V (2013) Macroeconomic determinants of the credit risk in the banking system: the case of the GIPSI. Econ Model 31:672–683

Costantini V, Crespi F, Marin G, Paglialunga E (2017) Eco-innovation, sustainable supply chains and environmental performance in European industries. J Clean Prod 155:141–154

Cullen JM (2017) Circular economy: theoretical benchmark or perpetual motion machine? J Ind Ecol 21:483–486

Daly HE (1987) The economic growth debate—What some economists have learned but many have not? J Environ Econ Manag 14:323–336

De Bruyn S (2002) Dematerialization and rematerialization as two recurring phenomena of industrial ecology. In: Ayres RU, Ayres LW (eds) A handbook of industrial ecology. Edward Elgar Publishing, Cheltenham, pp 209–222

Dernis H, Khan M (2004) Triadic patent families methodology. OECD STI Working Papers 2004/02. OECD Publishing, Paris

Dong L, Dai M, Liang H, Zhang N, Mancheri N, Ren J, Dou Y, Hu M (2017) Material flows and resource productivity in China, South Korea and Japan from 1970 to 2008: a transitional perspective. J Clean Prod 141:1164–1177