Abstract

We study whether the pattern of outbound Foreign Direct Investment (FDI) is influenced by host countries’ environmental regulations. We employ a general empirical location model that captures interactions between industry attributes and host country characteristics in determining firm location. We use data on UK-based multinational activity in 64 countries and 23 industries over the period 2002–2006. Our results suggest a significant effect of environmental policy on the pattern of UK outbound FDI—a pollution haven effect. A one standard deviation increase in environmental laxity increases FDI (assets) in industries that are above-average pollution intensive by 28%.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

With the rising elimination of trade and investment barriers across the world there has been a growing interest in the question of the role of differential environmental regulations in the location decisions of multinational enterprises (MNEs) and trade flows. A dominant hypothesis addressing this question is the pollution haven hypothesis (PHH) that purports that trade liberalization results in a relocation of dirty goods production to jurisdictions with lax environmental regulation.

The PHH calls into question the efficacy of domestic environmental standards, especially with respect to climate policy, because the location of emission of greenhouse gasses is irrelevant to the problem of climate change. More generally, the PHH is at the heart of the trade and environment debate. For example, the growing discussion on the theoretical and practical merit of a ‘border carbon tax’ is a direct result of the assumption that jurisdictions with higher carbon prices will be at a competitive disadvantage (Subramanian and Mattoo 2013). Also, in several European countries that have implemented a carbon tax, industry lobby has succeeded in securing exemptions or rebates for trade- and energy-intensive firms to avoid the ‘risk of job losses and carbon-leakage’ (Martin et al. 2012). A related broader issue here is that if environmental regulations indeed impair competitiveness with the consequent migration of polluting firms to countries with weaker (or weakly enforced) regulations, there might be some ground for bringing domestic environmental regulations into the domain of trade agreements to prevent a possible ‘race to the bottom’ in environmental standards (Copeland and Taylor 2004).While theoretically plausible and widely held, the PHH is yet to receive unequivocal empirical support (see, for e.g., Millimet and Roy 2015; Poelhekke and van der Ploeg 2015; Manderson and Kneller 2012; Kellenberg 2009; Raspiller and Riedinger 2008; Cole et al. 2005).

The objective of this paper is to provide new evidence on the issue of pollution havens by examining the pattern of UK’s foreign direct investment (FDI) in 64 host countries in 23 industries over the period 2002–2006. The global share of the UK’s FDI outflows is second only to that of the US (Fig. 1). Indeed in 2007, before the 2008 financial crisis when global FDI sharply declined, the UK’s stock of FDI was over $1.7 trillion (UN World 2008). The UK has also one of the most stringent environmental regulations in the world (see Sect. 4). These two factors make the UK a suitable county for testing the pollution haven effect.

We complement the existing empirical literature of mixed evidence with an empirical strategy that estimates how high and low levels of country characteristics interact with high and low intensities of the corresponding industry attributes in location decisions of firms. We also employ a rich three way panel dataset and address the endogeneity of both environmental policy and pollution intensity. Our results are in contrast to some of the evidence documented recently: we find a significant pollution haven effect.

In the next section we present the related literature and our contribution thereto. In Sect. 3 we introduce our empirical strategy. Section 4 presents our data. In Sect. 5 we discuss our results and Sect. 6 concludes the paper.

2 Related Literature

The empirical literature on environmental regulation, investment and trade flows has a history going back to the early 1970s. As the earlier literature has been reviewed in great detail, we focus here on key recent empirical literature.Footnote 1 An overview of these studies is provided in Table A.1. A generic empirical model of FDI flows can be written as:

where FDI is a vector of a measure of a multinational enterprise’s activity (including a binary variable of 0 or 1 for the existence of a multinational enterprise) in location i, industry k and year t. Y and X are, respectively, matrices of observable control variables, namely: location characteristics and industry attributes. The variable R represents stringency of environmental regulation. \(\theta \), \(\delta \) and \(\tau \) are vectors of, respectively, time-invariant location and industry fixed effects, and location- and industry-invariant time fixed effects. \(\lambda \) and \(\gamma \) are vectors of coefficients, \(\psi \) is a coefficient and \(\varepsilon \) is a vector of error terms. Few papers have estimated this very general specification (e.g. Poelhekke and van der Ploeg (2015) albeit with rather aggregate sectors of twelve in number of which five are manufacturing). Kellenberg (2009) which uses a ‘region’ dummy instead of ‘country’ dummy for location fixed effects is closer to this general formulation. Either index i or j doesn’t appear in most other papers. The reason for this is unavailability of such a rich three-dimensional dataset; or when it is available as in the case of Kellenberg, for example, the limited year-to-year variation in most country characteristics variables (especially the environmental variable) makes estimation impossible due to multicollinearity.

While most of the empirical literature is broadly based on Eq. (1) differences abound along various dimensions: sample, especially inbound versus outbound FDI; measures of the environmental variable; data; empirical strategy, etc.

One major strand of the literature is focused on inbound FDI, mainly to the U.S. (List and Co 2000; Keller and Levinson 2002; Fredriksson et al. 2003; Millimet and Roy 2015) all find some evidence of a pollution haven effect. Studies that focus on inbound FDI to countries other than the U.S. include Javorcik and Wei (2004) who examine inbound FDI to Eastern Europe and the former Soviet Union; Dean et al. (2009) that focus on inbound FDI to China; Waldkirch and Gopinath (2008) who consider the case of inbound FDI to Mexico; and Cole and Fredriksson (2009) who analyse patterns of FDI inflows to 13 OECD and 20 developing countries. The results in each of these studies are rather heterogeneous (suggesting mixed evidence) along various dimensions: measures of environmental stringency (Javorcik and Wei 2004); measures of pollution and groups of industries (Waldkirch and Gopinath 2008); and pollution intensity and country of origin of FDI (Dean et al. 2009).

Since studies on inbound FDI typically involve a single country, namely the US there is some advantage in terms of ease in disentangling the potential effect of differential regulation across regions/states (within a country) which tend to be homogenous with respect to a variety of factors that can be related to environmental regulation. Furthermore, such studies get around the problem of reliable cross-country measures of environmental policy. However, it has been argued that a test of the PHH should primarily be based on cross country data (Taylor 2004). This is because a cross country setting will better allow the explicit consideration of various host country characteristics that determine investment location. Furthermore, some data suggest that US environmental policy has over time become less stringent than the rich world average (Poelhekke and van der Ploeg 2015). That means the disproportionate focus on the US, which is presumably to do with the notion that US’s environmental policy is relatively the most stringent hence making other countries potential pollution havens, will not be justified.

There is a growing empirical literature on outbound FDI in a multi-country setting. In this strand of the literature too, there are variations along different dimensions or issues including findings of the pollution haven effect. The first issue concerns measures of environmental regulation which has been argued to be a major factor affecting empirical findings on the subject under discussion (Levinson and Taylor 2008). Some use such proxies as government or firm spending or pollution intensity (e.g. Xing and Kolstad 2002; Eskeland and Harrison 2003) others employ one or another subjective indices (see Table A.1). One particular such index that seems to have become popular recently (e.g. Wagner and Timmins 2009; Kellenberg 2009; Poelhekke and van der Ploeg 2015) is company executives’ opinion on stringency and enforcement of environmental regulation—from the Global Competitiveness Report. This measure has some clear advantages as it represents a measure of both stringency and enforcement and in the words of Kellenberg (2009, p. 245) it “explicitly accounts for actual firm perceptions of regulation and enforcement [and] is crucial for estimating pollution haven effects.”

The second issue is data. While more and more studies use panel data (see Table A.1) which allow for modelling of unobserved heterogeneity across countries, some have to rely on cross-section data due to data limitations (e.g. Kheder and Zugravu 2012; Manderson and Kneller 2012).Footnote 2

The third issue is empirical strategy. Some focus especially on developing countries as potential pollution havens. For example, Eskeland and Harrison (2003) examine the pattern of U.S. FDI to developing countries. They find no robust evidence for the emergence of pollution havens—a result they ascribe to the potential complimentarity between capital (which the U.S. is well endowed with) and pollution abatement. In a similar vein Cole et al. (2005) investigate the pattern of U.S. FDI flows to Brazil and Mexico—countries that are not too capital-poor and hence, the authors argue, are likely pollution havens because of a strong correlation between capital intensity and pollution intensity. They find that the key forces of attraction for a U.S. industry are its capital requirements while pollution control costs in the U.S. are also a push factor. The main message from these studies is that firms’ location choice depends on a variety of factors of which environmental regulation is only one. Lax environmental regulation in developing countries might be attractive to FDI but if such countries have rigid labour laws, firms might be deterred from such countries (Hanna 2010). In this respect Kheder and Zugravu’s (2012) mixed evidence on French outbound FDI may not be surprising. They report a pollution haven effect for their pooled sample and for some subsets of the sample but not for developing countries that have ‘too lax’ environmental regulation. The same can be said about Poelhekke and van der Ploeg’s (2015) somewhat unique evidence of both pollution haven effects and green haven effects (where Corporate-Social-Responsibility-minded footloose sectors are attracted by higher environmental standards).Footnote 3

The fourth issue is potential endogeneity of environmental regulation. As can be seen in Table A.1 more and more studies appear to be addressing potential endogeneity and as observed by Copeland and Taylor (2004) accounting for endogeneity of environmental policy and unobserved location and industry heterogeneity seem to help uncover the pollution haven effect. Thus to some extent one could argue that the evidence in the literature might be converging on finding the pollution haven effect. But it is far from being conclusive; just note the “green haven effects” suggested by Poelhekke and van der Ploeg (2015). This paper complements this growing literature of inconclusive empirical evidence, especially the one and only UK outbound FDI study (of Manderson and Kneller 2012), by using a different methodology and dataset. We employ a general empirical location model that captures interactions between country and industry characteristics in determining firm location. True, Manderson and Kneller (2012) also use interaction of the pollution-intensity variable with every country characteristic variable, but what we are referring to here is interaction of every country variable (of factor endowment and the one derived from economic geography) with the corresponding industry attribute to capture the joint influence of country characteristics and industry attributes on the location of economic activities. In this respect our paper also complements Wagner and Timmins (2009) which undertakes an industry by industry analysis of only six manufacturing sectors.

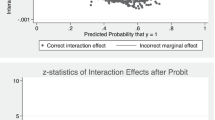

The key is to capture the likely heterogeneous impact of environmental policy across industries (Millimet and List 2004). Indeed this is the main finding of Poelhekke and van der Ploeg (2015): ‘there is no average effect of regulation and enforcement’. In this spirit, our empirical strategy is explicitly based on the idea of ‘above/below average’ levels of industry attributes such as ‘pollution intensity’ and the corresponding country characteristics, ‘stringency of environmental regulation’.

To the best of our knowledge the data in this paper have not been examined before. Similar to those of Kellenberg (2009) and Poelhekke and van der Ploeg (2015) our dataset is a three-way panel of 64 countries and 23 industries over the period 2002–2006. This allows for a more flexible specification where different structures of unobservable fixed effects can be modelled. Unlike some of the papers that focus on whether or not firms locate in countries/regions with lax environmental policy - i.e. the extensive margin of FDI (e.g. Javorcik and Wei 2004; Dean et al. 2009; Manderson and Kneller 2012) our paper examines if firms already operating in a host country change their level of activities in response to the stringency of regulation (i.e. the intensive margin of FDI). As argued by Manderson and Kneller (2012, p. 319) and Hanna (2010, p. 178), if the fixed costs of locating in a new host country is substantial or if firms perceive regulations to be only temporary, very few firms are likely to be attracted to lax regulation countries that have relatively high ‘entry costs’. If instead a firm were already in a host country and, let’s suppose, not operating full capacity, then one would expect the firm to step up its activity in response to a stringent regulation at home (Hanna 2010, p. 178). Finally, like most recent studies but unlike others such as Dean et al. (2009) and Manderson and Kneller (2012) we attempt to address the issue of endogeneity of environmental regulation which has been alleged, as discussed above, to plague the results of some of the studies in the literature.

We find a significant pollution haven effect. A one standard deviation increase in environmental laxity increases FDI (assets) in industries that are above-average pollution intensive by 28%. Comparison of our estimated effect of environmental policy with others’ estimates is not straightforward because of differences in: outcome measures (for example value added versus assets), model specifications and the specific effect presented/provided in the papers. Nonetheless we will attempt to make some broad comparisons with others’ estimates in the conclusion section.

3 Estimating Equation

To examine the relevance of various factors in industry location we adopt an empirical model similar to those of Mulatu et al. (2010) and Gerlagh et al. (2015). The main theme in these models is that the location of economic activity is determined by the interaction of country characteristics with the corresponding industry attributes. This framework has its roots in Romalis’ (2004) seminal empirical model of trade flows where he directly derives from theory an empirical equation that relates a country’s commodity trade to its characteristics (including factor endowments) and industry attributes (chiefly factor intensities). For example, evaluation of whether or not capital is a source of comparative advantage is judged by the coefficient of the interaction term of capital abundance and capital intensity. In what follows we provide a brief narrative summary of the framework. Countries are heterogeneous in various aspects such as endowments of natural resource and stringency of environmental regulation. Likewise, industries differ in their various attributes such as the intensity of use of production factors like labour and the extent of pollution intensity. So if country characteristics \(x^{j}\) matters for location, every industry would want to locate in a country that is rich in \(x^{j}\) but a country can only accommodate so many industries. We expect that industries that highly value that country characteristic, i.e. those industries with large y\(^{j}\) will gravitate towards that country. All else equal, a labour intensive industry will tend to locate in a country with abundant labour, while pollution intensive industries will be attracted to countries with a relatively lax environmental regulation.

We measure manufacturing industry activity (FDI) by assets (and in a robustness check, we also use an alternative outcome measure: turnover). The country characteristics (together with the corresponding industry attributes) can be derived from Heckscher-Ohlin type comparative advantage arguments based on the role of factor endowments and/ or from New Economic Geography (NEG) that stresses the importance of market access. Accordingly we specify our baseline econometric model as:

where i, k and t index respectively country, industry and year. X is a vector of country characteristics and y is a vector of associated industry attributes. We consider the following five pairs of country characteristics and industry attributes: environmental regulation stringency and pollution intensity, capital abundance and capital intensity, skilled labour abundance and skilled labour intensity, R&D abundance and R&D intensity and market potential and scale economies. The first four pairs, those related to environment, labour and R&D are standard variables from Heckscher-Ohlin type models of trade and industry location (Copeland and Taylor 2004) while the last pair, the one related to market potential is emphasised by NEG (see e.g. Krugman and Venables 1995). The HO predicts that industries that use a factor of production intensively will tend to locate in countries which are rich in that factor whereas NEG predicts that the attraction of a country’s market potential is greater the larger an industry’s scale economies are. The reason is that firms in such an industry are likely to locate in larger markets/central locations to minimize transport costs. Therefore, the coefficients of the interaction variables \(\beta \) are expected to be positive for all except for the environmental variable.

To ease interpretation of the estimated coefficients, we follow Michielsen (2013) and standardize each country characteristic by imposing zero mean and unit standard deviation, and specify each industry attribute in discrete terms such that it is equal to zero for industries with a value below the mean, and one for industries with a value above the average. In a robustness check, we use these variables in continuous terms.

We also include in Eq. (2) a vector of country characteristics (z) that are general in the sense that their influence on location is not industry specific. This set of variables includes: the level of crime, infrastructure quality, intellectual property protection, education quality, FDI stocks, hiring and firing practices, tariff and corruption. We will also explore standard gravity variables (distance and common language). In the equation, \(\theta \) and \(\delta \) are vectors of respectively country and industry fixed effects, \(\tau \) is a vector of time fixed effects and \(\varepsilon \) is a vector of the error terms. The country fixed effects absorb the effects of any unobserved country characteristics that affect all industries such as distance, language, geography, culture, and policy of one sort or another. The industry fixed effects control for the effects of any unobserved industry characteristics common to a particular industry such as technology and size. The time fixed effects capture the impacts of factors such as macroeconomic shocks that may affect all industries in all countries in a certain time period.Footnote 4

Ideally one would like to include the linear or constituent terms x and y in Eq. 2.Footnote 5 However, as some of the variables of industry attributes and country characteristics hardly vary over time, and also because we include fixed effects, it wouldn’t seem very practical to include the linear terms in our regression model. Thus, exclusion of these terms from our model amounts to an assumption that the linear terms are indeed absorbed by the country and industry fixed effects. However, we will still explore estimations with inclusion of these linear terms and report the results.

4 Data and Construction of Variables

We use a three-way panel dataset of 23 two-digit standard manufacturing industry classification groups, (UK SIC 2007=NACE 2), (operating in) 64 host countries over the period 2002–2006. Tables A.2 and A.3 in the Appendix report the list of countries and industries, respectively. Some countries are excluded from our sample for one reason or another, the details of which are described in the Appendix.

Detailed data description including data sources is provided in Tables 1 and 2. Here we highlight some general data issues and also provide further description of the main variables of interest in this paper, i.e. the outcome measures and the environmental variables. All monetary values are in 2005 PPP $. It has to be noted that, as is common in this literature, quite a few of our variables don’t show significant variation over time. This is likely to cause problems in terms multicolinearity and obtaining estimates that are sharply estimated.

4.1 Outcome Variables

Our key variable Foreign Direct Investment (FDI) is defined as the direct and indirect ownership or control of a single (UK) legal entity of at least 10% of voting securities of an incorporated foreign business enterprise (Orbis database, Bureau van Dijk).

FDI and multinational production activities can be measured in various ways. At one end of the spectrum one could simply look at whether or not a multinational exists in a certain location. More specific measures are also available: assets, turnover, value added, employment, net income, capital stock, etc.

Whether the appropriate measure of FDI activity is assets or more ‘fluid’ measures such as sales depends on the nature of FDI, namely horizontal (market seeking) versus vertical (those segmenting their stages of production). As argued by Poelhekke and van der Ploeg (2015, p. 1162), most FDI is found to be the latter type and hence assets would be a better measure because sales could be zero for any particular affiliate in the product chain. It can also be argued that the choice depends on whether one is interested in capturing relatively ‘permanent’ changes in FDI or ‘transitory’ ones (Hanna 2010, p. 177). For example, a firm operating under capacity might respond by increasing its operations using its existing equipment whilst keeping its assets intact.

To represent these different scenarios, our (alternative) outcome measures are industry level total assets and turnover. These data are part of Orbis dataset of Bureau van Dijk. The Orbis database provide affiliate-level information on, among other variables, assets and turnover for about 1000 UK manufacturing multinational firms (MNE) in 103 countries. The data include only majority-owned affiliates. MNE is defined as the combination of a single (UK) legal entity that has made foreign direct investment (FDI), called the parent, and at least one foreign affiliate.

The years for which data are available differ somewhat from variable to variable but generally the period extends from about 2000 to beyond 2010 and most likely with frequent updates. Our choice of the sample period was dictated by availability of data on the environmental variables. To the best of our knowledge this dataset hasn’t been employed before in the form we are using it. Manderson and Kneller (2012) have apparently used a related dataset from Bureau van Dijk that relates to year 2005.

We aggregate these data by industry-country. We considered working with firm-level data but there would be too may firm-country observations for any meaningful analysis. It is true that a firm level study would be more informative because of the potential firm-level heterogeneityFootnote 6 but it is worth noting that even in firm level studies the key variable environmental cost is measured at industry level (see Hanna 2010; Manderson and Kneller 2012) limiting the advantage of a firm level data.

There are several industry-country observations with zero entries. When we use a log function in our estimation, we add a small number (0.1) for such observations.

4.2 Country and Industry Characteristics

The industry and country characteristics are summarised in Tables 1 and 2, respectively. As already pointed out above, in addition to the environmental variables we consider four county characteristics and their corresponding industry attributes and use them as interaction variables. Three of these are factor endowment variables: capital abundance, skilled-labour abundance and R&D abundance. The respective industry attributes are capital intensity, skilled-labour intensity and R&D intensity. The fourth country characteristics is market potential proxied here by GDP. The corresponding industry attribute is economies of scale captured here by plant size (namely number of employees per plant). We also use additional country control variables that are commonly used in the literature. These include: crime, IP protection, quality of education, infrastructure, hiring and firing practices, tariff, corruption, FDI stock, distance and common language. The construction of all of these variables and the data sources are presented in Tables 1 and 2. For some of the variables of country and industry characteristics we have made use of interpolation to complete missing data the details which are explained in the Appendix. The fifth and key variables of ours are the environmental ones.

To capture both environmental regulation stringency and its enforcement we represent environmental policy stringency by the product of the stringency and enforcement indices (see Kellenberg 2009 and Poelhekke and van der Ploeg 2015). For consistency with our definition of the other factor endowment variables, we use the inverse of the stringency (defined as one minus the index divided by 50) and call it ‘environmental laxity’. Our measures of environmental stringency and enforcement come from the Global Competitiveness Report published by World Economic Forum. They are based on an annual Executive Opinion Survey (of thousands of business executives) that asks their views about respectively the stringency and enforcement of environmental regulation in their country.Footnote 7 As can be seen in Fig. 2, UK has one of the relatively stringent environmental regulation and enforcement regimes in the world. This might, all else equal, should lead home firms, at least those that are relatively pollution-intensive, to seek pollution havens.

Endogeneity of environmental regulation and pollution intensity (environmental costs)

Our measure of environmental policy is potentially endogenous, i.e. such a policy responds to the size and structure of MNE activity. Jurisdictions with large production of polluting MNE might raise their environmental standards or those with negligible amount of polluting activities may not enact stringent environmental policies (Millimet and Roy 2015). Following Kellenberg (2009) we use agricultural value added per worker and agricultural land per agricultural worker as instruments. The argument is that these variables should reflect a country’s relative technology level which determines the level of national production and is also positively correlated with environmental policy but should not directly affect manufacturing production.Footnote 8

The first of our instrument, agricultural value added per worker is obviously closely related with technology and affluence and hence higher environmental standards. In our sample the correlation between this variable and our environmental policy stringency and enforcement variable is larger 0.7. The second instrument, agricultural land per worker, is probably not as closely related to technology and environmental standards as is the first instrument. In our sample, its correlation with our environmental variable is about 0.33. Still the highest scoring countries on this measure are some of the affluent countries such as Australia, Canada, US, UK, France, Denmark and Sweden. Contrasting these are countries like the Netherlands and Norway which have relatively very low agricultural land per worker but have stringent environmental standards. Nonetheless, as we will see in our estimation results the two instruments jointly do fairly well in instrumenting environmental policy stringency and enforcement.

The corresponding industry attribute of pollution intensity is measured by ‘environmental expenditure as a share of value-added’. This is a commonly used measure in the literature. However, like our environmental regulation variable this variable of pollution intensity can also be endogenous. That is to say migration of pollution intensive industries would result in lowering of pollution intensity at home.Footnote 9It is hard to think of an appropriate instrument for this variable though. Hence, we will use the lagged value of the variable - as a somewhat crude way of handling the potential endogeneity.

5 Results and Discussion

Our main estimation results are presented in Table 3. The first two columns are results of OLS estimation. In column (1) we have a structure of fixed effects where industry, country and year fixed effects are entered individually. In column (2) industry fixed effects are interacted with year. This is a better control for unobserved industry characteristics that affect FDI across a whole industry in a given year (e.g. changes in technology or size and other industry-specific shocks). In a robustness check, we will further experiment with a similar formulation for country fixed effects—i.e. letting the country dummy interact with year. These two sets of fixed effects are meant to soak up unobserved (time-variant) industry-specific and country-specific effects, respectively.

The two sets of results reported in columns (1) and (2) are broadly similar but the later appears to be better judging by the magnitude and significance of the environmental variable and the coefficient of determination. In these OLS regressions we note that the environmental policy index (laxity) interaction variable has the expected positive impact, the coefficients of the traditional factor endowment interaction variables (excepting the capital variable) are also positive and significant. Likewise the market potential and scale economies interaction variable is positive and significant.

Columns (3)–(5) present the results of the IV-2SLS estimations where we use agricultural land per worker and agricultural value added per worker as instruments. The results in column (3) are the IV counterparts of the OLS results shown in column (2). The two sets of results are fairly similar. In column (4) the results include standard gravity variables of distance (in miles from London, UK) and the common language—instead of the country fixed effects. Both distance and common language have a significant negative impact on FDI; the former is as expected while the latter is contrary to expectation. This set of results is likely to be questionable given that there are no country fixed effects. But perhaps it shows how the fixed effects (in Column 5 and elsewhere) seem to soak up the effects of the observable country variables that are not very time-varying. The remaining results are similar to those shown in column (3). In column (5) the specification reintroduces the two sets of fixed effects together with standard control variables capturing general policy environment and infrastructure. Once again the main results are generally similar to the other IV estimation results. The results with respect to the control variables are more or less as expected (more on this below).

We begin our discussion of the validity of our IV estimation with a look at the first stage regressions of the three IV models reported in columns (3)–(5). The estimation results are shown in Table A.4 in the appendix. In all three cases we see that the first stage regressions perform well. The F-statistic is very large, because the instruments are very strong. The individual t-statistics are all large, for example in Column 3: 7.4 and 38.8, and hence the F statistic is very large, i.e. rejecting the null that both coefficients are equal to 0.

The remaining standard specification tests for the IV-2SLS estimations (reported and explained at the bottom of Tables 3 and A.5) suggest that the identification strategy using these instruments generally works well. In all cases, the Anderson canonical correlation likelihood ratio test firmly rejects the null of model under-identification and the Craig-Donald F-test rejects the null of weak instruments. To test whether the instruments are valid, we performed the Hansen J-test for over-identifying restrictions. We find that the null of valid instruments is largely rejected albeit marginally. However, given the strength of the results of the F-statistics of the weak identification tests the marginal failure of the J. Hansen validity test is not very worrisome because the exclusion restriction cannot be tested (Stock et al. 2002)—and thus the models are supported. Finally, the Anderson-Rubin Chi-Square-test rejects its null hypothesis and indicates that the endogenous regressors are relevant.

The results with respect to the environmental variable are broadly similar across the IV regressions—except that the one without the country fixed effects has a larger magnitude. The pollution haven effect is consistently present. The magnitude of the environmental variable is larger in the IV regressions compared to those in the OLS. This is consistent with much of the evidence documented in the literature (Millimet and Roy 2015).Footnote 10

For interpretation of the actual magnitudes of the estimated coefficients, let’s refer to the results reported in the last column of Table 3. The estimated coefficient of the environmental interaction variable suggests that a one standard deviation increase in environmental laxity would lead to a 28% increase in FDI (assets) in pollution intensive industries. More generally the positive estimated coefficient of the environmental variable suggests that FDI in relatively more pollution intensive industries (such as leather and related products, paper and pulp products and coke and refined petroleum products) would be drawn to countries which have relatively lax environmental standards (such as Guatemala and Ethiopia). A similar interpretation holds for the other pairs of variables. Thus, for example, FDI in industries with above-average scale economies tend to locate in countries that have relatively larger domestic market potential. The role played by environmental laxity is stronger than the other traditional factor endowment variables. We find no evidence that capital abundance plays any role in attracting FDI in capital intensive industries. One possible explanation for this is capital mobility.

The estimated coefficients of all the variables we labelled as ‘general’ country controls (excepting hiring and firing and infrastructure) have plausible signs and are mostly significant (see column 3). Crime and corruption seem to deter FDI. IP protection, education quality and FDI stock (capturing agglomeration effects) all play a positive role in attracting FDI. Tariff can arguably take a positive or negative sign. It can have a positive influence if FDI is a horizontal sort attempting to ‘jump tariffs’ or a deterring effect if FDI is a vertical type with segments of production stages and hence trade in intermediate goods is important (Kellenberg 2009). Rather surprisingly, the coefficient of hiring and firing has a perverse sign and is significant. Perhaps inevitably, with inclusion of country fixed effects in the regression almost all of these country variables turn out to be insignificant (see column 4).

Robustness checks

As mentioned above, we have experimented with alternative specifications – by way of robustness checks. The results are reported in Table A.5 in the Appendix. We have explored an alternative outcome measure—turnover. The results shown in column (1) are broadly similar to the main results where our outcome measure is assets. Especially, the estimated coefficients of the environmental variable are very similar in the two specifications. Hence we fail to confirm the above mentioned argument by Poelhekke and van der Ploeg’s (2015) that sales might not be an appropriate measure of vertical FDI which is the type that is more prevalent in practice.

The use of continuous variables for the pair of interaction variables instead of the standardized country variables interacted with ‘discretized’ industry attributes doesn’t change the results qualitatively—see column (2).

Inclusion of the constituent linear terms of the country and industry characteristics in our regression appears to confirm our main results (see column 3). Consistent with the findings thus far the interaction variables that capture the joint role of country and industry characteristics are positive and significant – with skilled labour only marginally insignificant. As always the capital variable is the exception with the wrong sign but it is not significant. The coefficients of the linear terms are largely insignificant. As already pointed out earlier, we wouldn’t expect such regression to come out particularly well given the numerous closely related industry and country characteristics in the regression and the resulting multicolinearity.

We have also explored with inclusion of country-year fixed effects to capture country-year specific effects. But the regression as a whole seems to breakdown—rather unsurprisingly given the large number of fixed effects (about 280) to be included and the resulting sever multicollinearity. As an alternative we have tried region-year specific effects.Footnote 11 Two variants are explored. Column (4) reports results with region-by-year fixed effects and industry-by-year effects while in column (5) we report results with region-by-year fixed effects and industry specific effects. In both regressions our main results remain more or less intact.

A final robustness check we undertook was clustered standard errors at country level to allow for both autocorrelation and heteroscedasticity. The results are reported in column (6). Once again the results are in line with our main story: a pollution haven effect and similarly positive coefficients for all the other interaction variables as well. The capital variable is also rather consistent in its perverse sign.

Before ending our discussion on robustness checks, one last issue we would like to mention is the question of the time-variability of our environmental policy measure. Although there is no particular ground for suspecting the validity of the time series variation of our measure of environmental policy and studies have used the measure as such (see e.g. Kellenberg 2009; Poelhekke and van der Ploeg 2015), one could argue that the small year-to-year variation of the variable might have to do with “changes in the interview process” (see Wagner and Timmins 2009). To probe this, we have explored regressions with a time constant measure: averaging (over time) the values of our stringency measure and the corresponding environmental cost variable. All the key results are intact; especially the environmental variable remains significant at the 10% level of significance. Of course such regressions that do not have country and industry fixed effects should be questionable.

6 Concluding Remarks

This paper sets out to investigate the question of whether UK-based multinational companies are attracted to countries with weaker (or weakly enforced) environmental regulations. The pollution haven hypothesis (PHH) underlying this question has yet to receive robust empirical evidence. Whilst the PHH should primarily be tested using cross-country data, most studies focus on inward FDI mainly to the US. Moreover some data suggest that US’s environmental regulation is no longer more stringent than the average in the rich world.

This paper adds to the relatively limited literature that focuses on outbound FDI patterns and hence using cross-country data. We employ a general empirical location model in which environmental regulation is one of several motives for location choices. This approach allows for the recently emerging idea that ‘there mayn’t be an average effect of environmental policy’ meaning environmental policy is likely to have heterogeneous impact across industries.

We use a novel three-way panel dataset of 23 two-digit standard manufacturing industry classification groups, (UK SIC 2007 = NACE 2), (operating in) 64 host countries over the period 2002–2006. UK is a major player in FDI globally, second only to the US at least during our sample period, and it also has one of the stringent (and strictly enforced) environmental regulations.

The results suggest that environmental policy has a significant impact on the pattern of UK outbound FDI. FDI in relatively more polluting industries (above average in terms of pollution-intensity) gravitate towards countries with relatively lax environmental regulation. The effect of environmental policy on the pattern of UK outbound FDI is stronger than that of the traditional factor endowment variables such as skilled labour and research and development abundance. In short we document a statistically and economically significant pollution haven effect. A one standard deviation increase in environmental laxity increases FDI (assets) in industries that are above-average pollution intensive by 28%.

Loosely speaking our estimate of 28% implies that if France were to lower its environmental regulation and enforcement to the level of Greece, in a year period it would have attracted about 28% more UK FDI in the pollution-intensive industries. These are 9 sectors with above average pollution intensity, including: leather and related products, paper and pulp products and coke and refined petroleum products.

As already pointed out in the introduction comparison of our estimated effect of environmental policy with others’ estimates is not easy but let’s try to make some broad comparisons with Kellenberg (2009). Kellenberg finds an elasticity figure of 2.8 and a 2.5% increase in laxityFootnote 12 over years 1999–2003 in countries in the 20th percentile in FDI growth. Hence, he finds a 2.5% increase in environmental laxity increased US affiliate value added by approximately 7%.

Now for comparison with our estimates, let us consider changes in laxity in developing countries and the resulting change in FDI. Over our sample period (2002–2006) laxity in developing countries increased by about 4%. This translates into 0.13 standard deviation unit. Our estimate predicts that a one standard deviation increase in laxity results in 28% increase in FDI. Hence, the increase in UK FDI to these developing countries is about 4% which is smaller than Kellenberg’s estimate.

Notes

Jaffe et al. (1995) and Copeland and Taylor (2004) present two prominent reviews. The earliest studies were of exploratory nature investigating trends in trade, especially in dirty goods. The results reported by these studies are mixed but suffer from a serious weakness. “The search for pollution havens in the data has obscured the role capital accumulation and natural resources must play in determining dirty-industry migration” (Copeland and Taylor 2004, p. 41).

It should be noted that the firm level study of Manderson and Kneller (2012) still allows for country and firm fixed effects because of the repeated observations of firms in their data.

This refers to firms being concerned about corporate reputation or ‘green credentials’; and already having a higher environmental standard at home might be attracted to jurisdictions with stringent environmental standards. Poelhekke and van der Ploeg (2015) examine this possibility in their regressions through interaction terms between sectoral dummy and the environmental policy variable.

We will experiment with different permutations of these three sets of fixed effects.

Mulatu et al. (2010) use cross-section data and hence include the linear terms of country characteristics and sector attributes. This in turn allows them to estimate the cut-off points. A cut-off point for a country characteristic refers to a neutral level of the characteristics such that a country with this level does not specifically attract sectors with high or low levels for the associated sector attribute. Similarly, a cut off point for a sector attribute refers to neutral level of the attribute such that a sector with this attribute level does not consider the associated country-characteristic in the selection of its location.

Differences in underlying firm characteristics might suggest the need for controlling for such characteristics in empirical modelling of outward FDI (Manderson and Kneller 2012).

We have also considered ‘agricultural machinery per worker’ as an additional instrument but data for this variable is missing for a lot of countries.

We owe this point to two anonymous referees.

Levinson and Taylor (2008) present a detailed discussion on statistical and theoretical sources of endogeneity of measures of environmental regulation and that, if unaccounted for, it can work against finding the pollution haven effect.

We consider eight regions: Sub-Saharan Africa, Eastern Europe, Latin America and Caribbean, Middle East and North Africa, South Asia, East Asia & Pacific, Western Europe and North America.

Note that we are discussing in terms of laxity for comparison with us but his discussion is in term stringency.

References

Cole MA, Fredriksson PG (2009) Institutionalized pollution havens. Ecol Econ 68:1239–1256

Cole MA, Elliott RJR, Shimamoto K (2005) Why the grass is not always greener: the competing effects of environmental regulations and factor intensities on US specialization. Ecol Econ 54:95–109

Copeland B, Taylor S (2004) Trade, growth, and the environment. J Econ Lit 42:7–71

Dean J, Lovely M, Wang H (2009) Are foreign investors attracted to weak environmental regulations? Evaluating the evidence from China. J Dev Econ 90:1–13

Debaere P, Demiroglu U (2003) On the similarity of country endowments. J Int Econ 59:101–136

Eskeland G, Harrison A (2003) Moving to greener pastures? Multinationals and the pollution haven hypothesis. J Dev Econ 70:1–23

Fredriksson GP, List JA, Millimet DL (2003) Bureaucratic corruption, environmental policy and inbound US FDI: theory and evidence. J Publ Econ 87:1407–1430

Gerlagh R, Mathys NA, Michielsen TO (2015) Energy abundance, trade and industry specialization. Energy J 36:27–37

Hanna R (2010) US environmental regulation and FDI: evidence from a panel of US-based multinational firms. Am Econ J Appl Econ 2:158–189

Jaffe A, Peterson S, Portney P, Stavins R (1995) Environmental regulation and the competitiveness of US manufacturing: what does the evidence tell us? J Econ Lit 33:132–163

Javorcik B, Wei S (2004) Pollution havens and foreign direct investment: dirty secret or popular myth? J Contrib Econ Anal Policy 3(2):1–32

Kellenberg DK (2009) An empirical investigation of the pollution haven effect with strategic environment and trade policy. J Int Econ 78:242–255

Keller W, Levinson A (2002) Pollution abatement costs and direct foreign investment inflows in the United States. Rev Econ Stat 84:691–703

Kheder S, Zugravu N (2012) Environmental regulation and French firms location abroad: an economic geography model in an international comparative study. Ecol Econ 77:48–61

Krugman P, Venables AJ (1995) Globalization and the inequality of nations. Quart J Econ 110:857–880

Levinson A, Taylor MS (2008) Unmasking the pollution haven effect. Int Econ Rev 49:223–254

List JA, Co C (2000) The effects of environmental regulation on foreign direct investment. J Environ Econ Manag 40:1–20

Manderson E, Kneller R (2012) Environmental regulations, outward FDI and heterogeneous firms: are countries used as pollution havens? Environ Resource Econ 51:317–352

Martin R, Muûls M, de Preux L, Wagner U (2012) Industry compensation under relocation risk: a firm-level analysis of the EU emissions trading scheme. CEP Discussion Paper 1150

Michielsen OT (2013) The distribution of energy-intensive sectors in the USA. J Econ Geogr 13:871–888

Millimet DL, List JA (2004) The case of the missing pollution haven hypothesis. J Regul Econ 26:239–262

Millimet DL, Roy J (2015) Three new empirical tests of the pollution haven hypothesis when environmental regulation is endogenous. J Appl Econ. doi:10.1002/jae.2451

Mulatu A, Gerlagh R, Rigby D, Wossink A (2010) Environmental regulation and industry location in Europe. Environ Resource Econ 45:459–479

Poelhekke S, van der Ploeg F (2015) Green havens and pollution havens. World Econ 38:1035–1178

Raspiller S, Riedinger N (2008) Do environmental regulations influence the location of French firms? Land Econ 84:382–395

Romalis J (2004) Factor proportions and the structure of commodity trade. Am Econ Rev 94:67–97

Spatareanu M (2007) Searching for pollution havens: the impact of environmental regulations on foreign direct investment. J Environ Dev 16:161–182

Stock J, Yogo M, Wright J (2002) A survey of weak instruments and weak identification in generalized method of moments. J Bus Econ Stat 20:518–529

Subramanian A, Mattoo A (2013) Green print: a new approach to cooperation on climate change. Brookings Institution Press, Washington

Taylor S (2004) Unbundling the pollution haven hypothesis. Adv Econ Anal Policy 4(2):1–22

UN World Investment Report (2008) Transnational corporations and the infrastructure challenge. UN New York and Geneva

Wagner U, Timmins C (2009) Agglomeration effects in foreign direct investment and the pollution haven hypothesis. Environ Resource Econ 43(2):231–256

Waldkirch A, Gopinath M (2008) Pollution control and foreign direct investment in Mexico: an industry-level analysis. Environ Resource Econ 41(3):289–313

Xing YO, Kolstad CD (2002) Do lax environmental regulations attract foreign investment? Environ Resource Econ 21:1–22

Author information

Authors and Affiliations

Corresponding author

Additional information

Financial support from the Leverhulme Trust under grant number RF-2011-550 is gratefully acknowledged. I would also like to thank Georgina Angless and Russell Dixon of Bureau van Dijk for their help with navigating through and organising the Orbis database. I also gratefully acknowledge the helpful comments by the participants of the 21st Annual Conference of the European Association of Environmental and Resource Economists in Helsinki, those of the 2016 Tinbergen Institute Annual Conference in Amsterdam and two anonymous referees. The usual disclaimer applies.

Appendix: Additional Notes on Data

Appendix: Additional Notes on Data

1.1 Sample of Countries and Excluded Observations

The list of countries used in our sample is presented in Table A.2. We dropped several countries for various reasons. The following countries were dropped because there were no data for our main variable which is environmental policy stringency and enforcement: Benin, Burkina Faso, Central African Republic, Congo, Dem. Rep. Congo, Rep. Cote d’Ivoire, Kazakhstan, Liberia, Nepal, Senegal, Sudan and Uzbekistan.

The following countries were dropped because of missing data on different country characteristics, mainly R&D: Angola, Bangladesh, Cameroon, El Salvador, Georgia, Ghana Honduras, Hong Kong SAR, China, Israel, Jamaica, Jordan, Malawi, Mozambique, Namibia, Nigeria, Panama, Peru, Serbia, Singapore, Slovakia, Tanzania, Trinidad and Tobago, Uganda, United Arab Emirates and Zimbabwe.

The following countries were dropped because they had limited observations or/and not-so-time-varying country characteristics and they were consistently dropped automatically due to multicollinearity: Kenya and Paraguay.

1.2 Extrapolation and construction of data on country and industry characteristics

The World Economic Forum database has some missing data for the following country variables and we have completed the series by simple interpolations: environmental stringency, enforcement of environmental regulation, R&D abundance, education quality, infrastructure, IP protection, and hiring and firing practices. The same applies to the tariff variable from UNCTAD, the corruption variable from Transparency International and the agricultural value added per worker variable from World Development Indicators.

In all of these cases the missing data were for one and rarely for two years here and there. Moreover most of these variables don’t normally change much over time hence our interpolation would be a fairly good approximation. In any case adding these interpolated observations in our sample haven’t made any significant change in our main results. The main issue with the missing data was that it aggravated our multicolinearity problems with the dropping of one country here and another there which was more a nuisance rather than a substantive problem.

We followed Debaere and Demiroglu, Journal of International Economics (2003) to construct the capital abundance variable, defined as capital per worker multiplied by number of workers, as follows. We used ‘GDP per worker’ and ‘capital per worker’ (both in 1985 international prices for 1990–1992 from Pen World Tables) to obtain a regression equation to predict ‘capital per worker’ for given ‘GDP per person employed’ (from WDI in 1990 PPP $) for our sample years. We used the product of ‘labor force’ and ‘employment rate’ (both from ILO) to obtain ‘number of workers’.

Mapping OECD’s R&D expenditures data which is classified in ISIC Rev. 3 to Orbis’ industry classification of UK SIC 2007 was more or less straightforward. One case that wasn’t and worth mentioning here is the case of ‘Manufacture of computer; electronic and optical products’ (UK SIC 26). This was mapped to the weighted average of three ISIC Rev. 3 industry groups: Office, accounting and computing machinery (c30), Radio, television and communication equipment (c32) and Medical, precision and optical instruments (c33). The weight used was the value of turnover in the respective industry groups.

Agricultural land per worker was calculated as follows. We used data on agricultural value added per worker and agricultural value added from WDI to obtain number of agricultural workers. We then divided agricultural land in sq. km from WDI by number of workers. For Canada, data on agricultural value added was missing from WDI database so we obtained these data from Statistics Canada: Table 002-0004—Agriculture value added account, annual.

Rights and permissions

About this article

Cite this article

Mulatu, A. The Structure of UK Outbound FDI and Environmental Regulation. Environ Resource Econ 68, 65–96 (2017). https://doi.org/10.1007/s10640-017-0145-4

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10640-017-0145-4