Abstract

Discrete-time stochastic models of management of groundwater resources have been extensively used for understanding a number of issues in groundwater management. Most models used suffer from two drawbacks: relatively simplistic treatment of the cost of water extraction, and a lack of important structural results (such as monotonicity of extraction in stock and concavity of the value function), even in simple models. Lack of structural properties impede both practical policy simulation and clarity of understanding of the resulting models and the underlying economics. This paper provides a unifying framework for these models in two directions; first, the usual cost function is extended to encompass cases where marginal cost of pumping depends on the stock and second, the analysis dispenses with assumptions of concavity of the objective function and compactness of the state space, using instead lattice-theoretic methods. With these modifications, a comprehensive investigation of which structural properties can be proved in each of the resulting cases is carried out. It is shown that for some of the richer models more structural properties may be proved than for the simpler model used in the literature. This paper also introduces to the resource economics literature an important method of proving convergence to a stationary distribution which does not require monotonicity in stock of resource. This method is of interest in a variety of renewable resource model settings.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

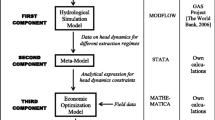

In this paper, we consider the problem of managing groundwater under random recharge in a single cell aquifer. There are two main modeling paradigms used in the large literature dealing with this issue: the first based on optimal control of the continuous-time model, e.g., Brown and Deacon (1972), Gisser and Sanchez (1980), Tsur and Graham-Tomasi (1991), Hellegers et al. (2001), Tsur and Zemel (2004), Zeitouni (2004), Roseta-Palma and Xepapadeas (2004), Rubio and Casino (2001), and the second based on a dynamic programming formulation of the discrete-time model, e.g., Burt (1964, 1966, 1967, 1970), Provencher and Burt (1993), Knapp and Olson (1995, 1996). Most continuous time models, due to the specific assumptions made, yield explicit solutions. While several discrete-time dynamic programming formulations have been proposed in the literature, few structural properties for this problem have been established. In fact, it is only Knapp and Olson (1995) who provide a first proof of the relatively straightforward property that extraction is increasing in current period stock.

Further, most of these formulations, in discrete- and continuous-time, make strong assumptions regarding the cost of extraction. In particular, two assumptions are made, usually implicitly: (i) marginal cost of pumping is independent of the quantity pumped, (ii) cost of pumping depends only on the beginning of period stock. Both of these are assumptions with little empirical support, even for unconfined aquifers (another assumption implicit in many studies). Yet, even with these assumptions, most structural properties of interest have not been established.

The main objective of this paper is to provide, in the canonical discrete-time model setting, a unified treatment of the structural properties of the dynamic programming problem of groundwater extraction. The unification is both in terms of methods of proof used (relying on lattice-theoretic methods) as well as in extending the analysis to encompass a variety of extraction cost functions. The analysis here is in the spirit of Mendelssohn and Sobel (1980), who provide a unified treatment of stochastic renewable resource extraction models in a stochastic growth framework. It differs from their analysis, however, in two key aspects: first, we abandon all assumptions of concavity of the objective function and, working in a dynamic programming framework, rely instead only on its monotonicity and supermodularity and second, we use a new (to the resource economics literature) approach to proving convergence to an invariant distribution of the stock of resource, one which needs neither monotonicity of extraction nor compactness of state space.

In discrete-time stochastic groundwater management problems, the following structural properties are of interest:

-

Property (a): The optimal withdrawal quantity in period t, \(w^*_{t}(x)\), is increasing in \(x_t\), the stock of groundwater at the start of period t.

-

Property (b): The optimal withdrawal quantity in period t, \(w^*_{t}(x)\), is the maximizer of a concave function of w.

-

Property (c): \(x_t-w^*_{t}(x)\), denoted the “re-investment function” in the literature, is nondecreasing in x.

-

Property (d): \(w_t^*(x)\) is nondecreasing in t, where the periods are indexed forward in time.

-

Property (e): The Markov Chain generated by the optimal policy \(w^*_t(x)\), \(\{X_t, t\ge 0\}\), converges to a unique, stationary distribution.

We note first that in the case of groundwater models, many of the results in Mendelssohn and Sobel (1980) are not directly applicable, primarily due to lack of concavity of the net benefit function. Further, the question regarding concavity of the value function has been answered in the negative in Knapp and Olson (1995). Models used in the literature are replete with assumptions regarding smoothness, in particular (joint) concavity of the objective function and convexity/compactness of the relevant spaces. Such assumptions appear to be an artifact of the sufficient conditions for obtaining the structural properties listed above, rather than arising from any underlying characteristic of the coupled natural-economic system being studied.

Knapp and Olson (1995, 1996) move away from such smoothness conditions and work in a lattice-theoretic framework, which we also adopt. However, their formulation of the problem side-steps the issue of uncertainty. In their set up, uncertainty is resolved prior to the farmer making the extraction decision. In such a set up, the decision maker (farmer) can directly control the succeeding period stock, as a result of which they work directly with next period’s stock. Thus, proof of monotonicity of the next period’s stock in current period stock is sufficient for them to use existing results regarding convergence of monotonic Markov chains.

The model we use, on the other hand, involves uncertainty being resolved after the farmer has made extraction decisions, and corresponds better to a real world scenario in a developing nation wherein farmers make decisions on extraction prior to recharge (rainfall) occurring. Here, the inability to directly control the subsequent period stock leads to uncertainty being central to the farmer’s extraction decisions. In this set up, as we show, monotonicity of extraction and reinvestment are not identical, even for the model studied in Knapp and Olson (1995, 1996). In addition, as a direct consequence of the assumptions made in prior literature, the Markov chain generated by the optimal policy in those settings is monotone. This, along with the assumed compactness of the state space, allows a direct application of standard theorems on convergence of monotone Markov processes to establish the necessary convergence result. In this setting, we illustrate the use of more probabilistic methods guaranteeing the existence of an invariant distribution even in cases where the Markov Chain is not monotonic. The assumptions required for the use of this method are more benign than for the methods commonly used in prior literature. These methods are applicable to a wide variety of natural resource extraction problems and are of independent interest. Finally, we extend our results on global stability to situations of stock-dependent recharge, the first such result (to our knowledge) in the resource economics literature.

To summarize, the model set-up here differs from that in Mendelssohn and Sobel (1980) in not assuming concavity of the net benefit function, and from those in Knapp and Olson (1995, 1996) in terms of the timing of uncertainty and the breadth of cost functions accommodated. Our analysis of the effect of risk on optimal decisions, while simpler than that in Knapp and Olson (1996), is more transparent and provides a link between the with- and without risk scenarios; it also clarifies the type of assumptions necessary to obtain key results. In addition, using more powerful and broadly applicable methods, we are able to establish global stability for all the Markov chains generated by the dynamic systems studied here, under weaker assumptions than in Mendelssohn and Sobel (1980), Knapp and Olson (1995, 1996).

We point out that many of the generalizations to the standard model of a single-user managing a single-cell aquifer proposed here are motivated by the necessity of studying diverse real world systems of groundwater management, in particular those from the Indian sub-continent, as we detail next. Single-user single-cell models of aquifer management have been known to be particularly weak at modeling groundwater flow complexity and decision interactions between multiple agents, some aspects of which have been explored in the recent literature.Footnote 1 This is an issue of significance in the case of semi-arid regions of the world, which are the largest users of groundwater, and is particularly the case for the Indian sub-continent, a large and hydro-geologically varied landmass, with extensive groundwater withdrawals (see e.g. Shah 2007, 2010 and references therein).

Broadly speaking, groundwater reservoirs in semi-arid regions of the Indian sub-continent are characterized by highly variable recharge, climate is highly monsoonal, with a very short and intense rainfall season, and long dry periods during which extraction typically occurs. Further, extraction is largely limited by availability of electric energy while regulation of extraction occurs (de facto) via altered electric supply (e.g. Shah et al. 2008; Fishman et al. 2011). These features of the groundwater agriculture system illustrate the importance of greater focus on extraction cost of groundwater, a characteristic not comprehensively analyzed in the economics literature focused primarily on larger-scale agriculture in the U.S. These special characteristics have resulted in a sparse yet interesting literature in economics focused on modeling certain specific aspects of the problem (see e.g. Aggarwal and Narayan 2004; Athanassoglou et al. 2012). Nonetheless, the basic model of a single user managing a single-cell aquifer has so far not been modified to accommodate the distinct features of groundwater and agricultural systems in semi-arid regions in the developing world. These features merit, we believe, greater focus on both the cost of pumping and on more complex transition equations for groundwater (see also footnote 4). This study is an attempt to integrate some of the most important features of groundwater management in the setting described above into a standard stochastic resource economics framework.

Finally, while studies such as Athanassoglou et al. (2012), Brozović et al. (2010), Madani and Dinar (2012) which model (heterogeneous or homogeneous) users with less restrictive hydrological assumptions advance understanding of the effect of complex interactions on optimal policies, they are unable to account for the effect of uncertainty, among other drawbacks. Our study, on the other hand, fully accounts for the effect of uncertainty on stock dynamics and, in addition, attempts to improve modeling of certain hydrologic features, while remaining within a single-cell framework. Thus, our analysis may be seen as both complementing analyses seeking improved modeling of complex hydrologic interactions and extending the current models of single-user groundwater management to more hydrologically diverse settings.

The plan of the paper is as follows. Section 2 presents the details of the dynamic model, including the two richer extraction cost functions. Section 3 provides an analysis of the resulting stochastic dynamic program in a finite time horizon for all of the cost functions, including extensions to risk averse agents. Section 4 discusses the properties which survive a passage to an infinite time horizon. Section 5 provides the details regarding convergence to a stationary distribution of the groundwater stock for all models discussed. Section 6 provides a discussion of possible policy applications and extensions, and concludes. Standard definitions pertaining to lattice theory and convergence of Markov chains are provided in an Appendix.Footnote 2

2 Model Structure

2.1 Setup

We describe a discrete-time stochastic groundwater management model, based on the classic paper by Burt (1964), which is standard in the literature. We consider a finite-horizon problem where T is the planning horizon, and periods are indexed forward by \(t\in \{1,2,\ldots ,T\}\). Let \(x_{t}\ge 0\) denote the groundwater stockFootnote 3 at the beginning of period t. The manager decides the withdrawal quantity \(w_{t}\ge 0\). Then a non-negative random variable corresponding to the recharge to groundwater stock, \(R_{t}\), is realized. We suppose that the \(\{R_{t}\}\) are i.i.d, but indicate generalizations where appropriate and feasible. We assume that the state transition for the groundwater stock level is given byFootnote 4

Equation (1) corresponds to a reservoir of infinite capacity and is commonly used. We however illustrate (see Remark 5) which of our results survive when a more realistic finite reservoir of groundwater \((\overline{x}<\infty )\) is assumed, with state transition

The single-period benefit (or reward) is

where B(w), concave and increasing, is the net benefit of withdrawing w units of water before deducting the pumping cost C(x, w) (which we address shortly). The objective is to maximize the present value of the benefit

where \(\delta \in (0,1]\) is the discount factor. Then, the value function of dynamic programming is given by the recursion

where \(V_{T+1}(x_{T+1})=0\).

We note that, unlike in much of the economics literature on the one-sector stochastic growth model, wherein focus is on the infinite horizon problem, we begin with a finite horizon set up and indicate extensions to an infinite horizon. The reason for this two step approach is the added understanding provided in the finite horizon case, especially with regard to such intuitive questions as the behavior of the optimal policy with a lengthening horizon. This approach also makes transparent which type of assumptions regarding the state space and the benefit functions maybe relaxed. Finally, finite horizon models are also more commonly used in the resource and agricultural economics literature.

We turn next to characterizing the cost functions we use, and comparing them to those used in the existing literature.

2.2 Cost Functions

Pumping cost functions used in the literature mostly make the assumption of constant volume pumped as well as of constant (independent of \(w_{t}\)) marginal cost of pumping i.e. that \(\dfrac{\partial C(x_{t},w_{t})}{\partial w_{t}}=c(x_{t})\). Within this broad framework, with the exception of Worthington et al. (1985) and Burness and Brill (2001), most studies (Zeitouni 2004; Aggarwal and Narayan 2004; Tsur and Graham-Tomasi 1991; Rubio and Castro 1996; Roseta-Palma and Xepapadeas 2004; Provencher and Burt 1993) use a cost function of the form

with \(c(x_{t})\) (called the marginal cost function) either linearly decreasing in \(x_{t}\) or decreasing and convex, with the most common functions being \((a-bx_{t})\) and \(\dfrac{a}{bx_{t}}\). Burness and Brill (2001) use a slightly different formulation for c(x), maintaining nonetheless the separability outlined above, while Worthington et al. (1985) use a separable marginal cost function, estimated (interpolated) from data.

In general, all cost functions used make the following two assumptions:

-

1.

marginal cost of pumping does not depend upon the quantity pumped i.e. \(\dfrac{\partial C(x_{t},w_{t})}{\partial w_{t}}=c(x)\); and

-

2.

cost of pumping (hence drawdown) does not vary within a given season. This leads to specifications in which marginal costs are based entirely on beginning-of-period water level. This assumption is implicit in most studies, discrete- and continuous-time.Footnote 5

The first characteristic is a modeling assumption and is not always in accord with hydrologic facts, as detailed subsequently. The second characteristic above is reasonable if the length of a period is sufficiently small and decisions are made frequently, in which case continuous-time models are more appropriate. In sum, in all of the literature, marginal costs of pumping do not vary within season, and are independent of the quantity pumped during the period. The implication is that, for the marginal cost of pumping in any given period, the only factor of importance is the groundwater stock at the beginning of the period; the amount of abstraction during the period does not matter. With this cost function, structural properties such as the concavity of the optimization problem in each period have not been established.

In our analysis, we generalize this formulation for cost to reflect more realistic conditions on marginal cost and study in detail the structural properties of the resulting dynamic programs. In particular, we seek to address two important questions:

-

1.

Under what conditions, for the given objective function(s), do intuitive properties (listed in Sect. 1) hold?

-

2.

Which of these properties hold under a setting where risk aversion is introduced?

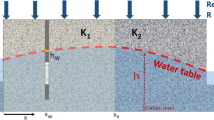

We first provide some motivation for the two cost functions we develop. We have already noted the importance of extraction cost in the context of agriculture in the Indian sub-continent. We also point out that, in the context of a single user managed resource, the effect of other users’ pumping on the user under consideration is typically assumed away. Nonetheless, even with a single user in a more realistic aquifer, two essential features are currently missing from discrete-time models in the literature: ‘path dependence’ of resource stock and the effect of formation of localized ‘cones of depression’ around a pumping well (Brozović et al. 2006, pp. 2–4).

In light of the remarks above, we generalize the cost function in two directions. In the first,

where \(\gamma \) is assumed to be non negative, decreasing and convex. This form of the cost function takes into account changes in the groundwater stock that occur during the pumping period. Further, the marginal cost of pumping depends, in general, on the quantity of water pumped.Footnote 6 We stress that the commonly used approach via Eq. (6), implying that marginal cost is independent of quantity pumped, is an assumption [recognized explicitly in Chakravorty and Umetsu (2003, p. 5)], and has little empirical or theoretical support. The cost function in Eq. (7), on the other hand, imposes a form of path dependence within a given season. This is (arguably) quite reasonable in the context considered.Footnote 7 We provide two interpretations of this cost function. In the first (ignoring the effect of other pumping wells upon the well under consideration), this is the cost function for a user extracting water over a relatively long season, and whose extraction (relative to stock) is “large”. In the second, one may consider two hypothetical pumping wells, of very similar size, located a small distance apart (since both users are homogenous, and both wells identical, each user extracts the same amount). In this scenario, this is the cost function of either user. Thus, pumping costs for either user are a function only of \(x-aw\), where a is a parameter.Footnote 8

In the second, we generalize the cost function to accommodate finite aquifer transmissivity, in the context of pumping wells located in close proximity. Note that even in the case of a single-user managing an aquifer, the assumptions made in most models are unlikely to hold for any given aquifer. For instance, most continuous time models, following Gisser and Sanchez (1980), assume an essentially bottomless aquifer. Further, most analyses assume implicitly or explicitly an unconfined aquifer. However, for confined aquifers, ongoing pumping from a well induces a localized ‘cone of depression’ around the well. These dynamics lead to increases in the per-unit cost of extraction by increasing the effective lift.Footnote 9 We seek a simplified framework to account for the increased marginal cost of pumping as a result of the formation of these cones of depression.

To understand the approach, consider first a finite difference cell approach to groundwater modeling,Footnote 10 at a relatively coarse scale (e.g. \(25 \times 25\) km resolution, commonly used for many developing countries). The drawdown calculated in these models does not represent the actual drawdown around a pumping well. However, if the relevant physical parameters are known, a term linear in extraction, q, derived from the Theis formula, may be added to correct for this difference between actual and model predicted drawdown; the correction leads to increased pumping costs.Footnote 11 In our case, given that there is only one pumping well and that therefore changes in stock due to limited aquifer transmissivity cannot affect subsequent period stock, we incorporate this effect as a linear (in w) term on the cost of extraction i.e. as a change in stock level for purposes of computing pumping cost. Alternatively, this may also be viewed as a first-order approximation to a more complicated (possibly polynomial) correction factor, and at any rate serves as an approximation to the actual increase in pumping cost. Abstracting away from parametrization, we translate this into our notation as

where the additive term aw captures the “correction” to the drawdown (change in stock) and, depending upon the transition equation, \(\overline{x}\) is interpreted as the effective or total stock. Marginal cost, \(c\left( \overline{x}-x+2aw\right) \), is evidently a function of both x and w, and is based on the beginning-of-period stock, unlike in Eq. (7). In the interests of minimizing the number of constants used, the coefficient a on w is normalized to 1 in subsequent analysis.

Again, there are two possible interpretations of Eq. (8). Similar to the case of the cost function in Eq. (7), for a scenario focused on a single pumping well and a relatively long season, accounting for cones of depression via the cost function captures the essence of the issue, that of increased cost of pumping. In addition, if seasons are long enough, there are unlikely to be effects upon next-season stock (to a first order) of finite aquifer transmissivity. A second interpretation is also available, for two homogenous users (implying identical extraction) pumping from similarly sized wells. A hydrologic fact, first, is that (to a first order approximation) a well pumping larger quantities has a deeper cone of depression (Brozović et al. 2006, p. 3). In addition, finite aquifer transmissivity implies a identical reduction in lift in both pumping wells; given that these effects are unlikely to carry over to subsequent season stocks (as already indicated), the effect of well interference upon each user then can be modelled as an identical increase in each user’s pumping cost.Footnote 12

3 Analysis: Finite Horizon

We consider separately the dynamic model of groundwater extraction using each of the three cost functions, since many features, method of proof and conclusion differ between them. The approach taken in our analysis is somewhat different from that conventionally used in the resource and environmental economics literature. We abandon, for the most part, all assumptions regarding smoothness (concavity, convexity and differentiability) of the objective function and feasible set, except insofar as these properties can be proved from physically or economically reasonable primitives. We use lattice-theoretic methods, in particular the detailed exposition of dynamic programming using lattice-theoretic methods developed in Heyman and Sobel (2003) and Topkis (1998, §3.9).

We relegate to the “Lattice Theory” section in the Appendix all standard definitions and notations regarding lattice theory. Note that, for our optimization problems, W(x) will be identified as the “feasible” set of optima i.e. \(w_t(x) \in W(x)\), where \(w_t(x)\) is extraction at time t, with start of period stock x; optimal extraction will be indicated by \(w_t^*(x)\). Unless otherwise indicated, \(w_t(x)\) and \(w_t^*(x)\) are (possibly singleton) sets. In order to minimize notation, \(w_t^*(x)\) will also represent the largest element of the set \(w_t^*(x)\), where the context should make it clear whether \(w_t^*(x)\) refers to a set or its largest element. Finally, we use \(\Pi \) and G interchangeably to denote the one-period benefit (profit) function.

Definition 1

(Re-investment function) \(a=x-w\) is the ‘reinvestment function’ which will play an important role in our analysis. Note that A(x) is the analogue to W(x) when working with reinvestment instead of with extraction.

We first list key assumptions regarding the model primitives made in our analysis, and provide a brief discussion regarding their applicability, in relation to their usage in the literature. Note that not all assumptions are always in operation; we indicate, for each of our results, the assumptions in force.

Assumption 1

\(\Pi (x,w)\) is supermodular in (x, w) and increasing in x.

Assumption 2

\(\Pi (x,a)\) is supermodular in (x, a) and increasing in x.

Assumption 3

\(\tilde{X}(x_{t},w_{t})\) is increasing in \(x_{t}\), given \((w_{t},R_{t})\) (or independent of \(x_{t}\)).

Assumption 4

\(\Pi (x,w)\ge 0\), \(\forall (x,w) \in \mathcal {C} := \{(x,w); w\in W(x)\}, x \mathrm{in} \mathcal {X}\).

Assumption 5

\(\Pi \) is finite on \(\mathcal {C}\).

Assumption 6

\(\exists B>-\infty \) s.t. \(\Pi (x,w)\ge B\), \(\forall x,w\).

Assumption 7

\(\Pi (x,a)\ge 0\).

Assumption 8

W(x) \(\left( A(x)\right) \) is ascending in x on \(\mathcal {X}\), the state space.

Assumption 9

W(x) \(\left( A(x)\right) \) is expanding in x.

Assumption 10

W(x) \(\left( A(x)\right) \) is compact.

Assumption 11

\(\tilde{X}(x_{t},w_{t})\) is stochastically supermodular.

Assumption 12

\(\tilde{X}(x_{t},a_{t})\) is stochastically supermodular

We begin with noting that Assumptions 1 and 2 shall be proved for each model considered, while Assumption 6 is clearly a very reasonable practical requirement. Assumptions 4 and 7 clearly follow from Assumption 6 (see Remark 3), and Assumption 5 is the only restrictive one. We note that in the conventional dynamic programming framework, either Assumption 5 or Assumption 6 (along with a compact \(\mathcal {C}\)), must hold; these are implicitly or explicitly assumed in the existing literature. Finally, Assumption 5, the most restrictive assumption, is only needed for proving that \(V_t \rightarrow V\), in Proposition 1. Turning now to assumptions regarding \(W(x) \left( A(x)\right) \), Assumptions 8 and 9 are clearly reasonable, and are made in all models in the literature; Assumption 10 is our only compactness assumption and is needed only to ensure uniqueness of the maximizer. Finally, Assumption 3 holds for both of our state transition Eqs. (1, 2) while Assumption 11 (and Assumption 12) is a restrictive but common one in dynamic programming with lattice theory (see Heyman and Sobel 2003, pp. 381–383).

For instance, Knapp and Olson (1995, 1996) implicitly or explicitly make Assumptions 2, 3, 7, 5, 8–10 and 12, while Mendelssohn and Sobel (1980) [and its generalizations in Heyman and Sobel (2003)] use, in addition, assumptions regarding concavity of G (or postulate a special form for G); finally, traditional dynamic programming analyses [as in Provencher and Burt (1993)] implicitly use Assumption 5 and other compactness and convexity assumptions.

The dynamic programming recursion therefore is,

3.1 Conventional Cost Function

Recall that the cost function is

where \(\overline{x}\) is as in Eq. (8). Thus, the objective function is

Two facts may be inferred from Eq. (10); first, \(\Pi \) is not jointly concaveFootnote 13 and second, \(\Pi \) is supermodular in (x, w). The latter may be shown using the differential characterization: a smooth (for instance \(\mathcal {C}^{2}\)) real valued function f(u, v) on a lattice is supermodular in (u, v) iff \(\dfrac{\partial ^{2}f(u,v)}{\partial u\partial v}\ge 0\). That this is unconditionally true is evident from the fact that \(\dfrac{\partial ^{2}\Pi (x,w)}{\partial x\partial w}=c>0\). Further, it is equally evident that \(\Pi _{x}(x,w)=cw>0\). We make a further, technical, assumption before we state our main result for this section.

Assumption 13

\(J_{t}(x_{t},.)\) is upper semi-continuous on \(W(x_{t})\) for each \(t\in \{1,2,\ldots ,T\}\) and \(V_{T+1}(x)=0\)

We are now ready to state our main theorem of this section, which is Heyman and Sobel (2003, Corollary 8-5a). We provide a detailed proof for two reasons: many subsequent proofs will be based on, or refer to, this theorem and no explicit proof is provided in Heyman and Sobel (2003).

Theorem 1

Under Assumptions 1,3,4,8,9,11 and 13, \(V_{t}(x)\) (defined in Eq. (9a)) is increasing in x and \(w_{t}^{*}(x)=\displaystyle {\mathop {{{\mathrm{arg\,max}}}}\limits _{x}} \left\{ J_{t}(x_{t},w_{t});w_{t}\in W(x)\right\} \) is ascending in x on \(\left\{ x;x\in \mathcal {X},\displaystyle {{\mathrm{arg\,max}}}\left\{ J_{t}\left( x_{t},w_{t}\right) \right\} \ne \varnothing \right\} \).

Further, under Assumption 10, there exists a least and a greatest element in the set \(w_{t}^{*}(x)\) and these are both increasing in x.

Proof

That \(V_{t}(x)\) is increasing in x is a straightforward consequence of two facts, \(V_{T+1}(x)=0\) and \(\Pi (x,w)\) is increasing in x, given w. These two facts can be used to set up a simple inductive argument, as below.

\(V_{T+1}(x)\) is trivially increasing in x, and so the induction is true for \(t=T+1\). Similarly, \(V_{T}=\max {\{\Pi (x,w);w\in W(x)\}}\) is increasing in x, since \(\Pi \) is increasing and W(x) is ascending and expanding; the hypothesis therefore holds for \(t=T\). Let it be true for \(t=k<T\) i.e. \(V_{k}(x)\) is increasing in x. Consider \(V_{k-1}(x)=\) \(\displaystyle \max \nolimits _{w\ge 0}\{J_{k-1}(x,w)\}\), where \(J_{k-1}(x,w)\) is increasing in x, since both its terms are (the second term, \(\mathbb {E}(V_{k}(x-w+R))\), is increasing by the induction assumption and the fact that integration is order preserving) and thus, so too is \(V_{k-1}.\) As an aside, observe that if \(\Pi \) is bounded, so is \(V_{t}\).

We next prove that \(\mathbb {E}\left[ V_{t}\left( \tilde{X}\left( x_{t},w_{t}\right) \right) \right] \) is supermodular in (x, w). We have already proved that \(V_{t}\) is increasing and bounded, and have assumed that the distribution function of \(\tilde{X}\left( x_{t},w_{t}\right) \), \(F_{x,w}\), is supermodular. Therefore, by Topkis [1998, Corollary 9.1(b)], \(\mathbb {E}\left[ V_{t}\left( \tilde{X}\left( x_{t},w_{t}\right) \right) \right] \) is supermodular. Thus, we have that \(J_{t}(x_{t},w_{t})\) in Eq. (9b) is supermodular (since the sum of two supermodular functions is supermodular).

Since W(x) is ascending and expanding in x, that \(w_{t}^{*}(x)=\displaystyle {\mathop {{{\mathrm{arg\,max}}}}\nolimits _{x \in \mathcal {X}}} \left\{ J_{t}(x_{t},w_{t})\right\} \) is non-empty and ascending is the content of Topkis (1998, Theorem 2.8.1). Finally, if W(x) is compact, then from Topkis [1998, Theorem 2.8.3(a)], \(w_{t}^{*}(x)\) is a sub-lattice of \(\mathbb {R}_{+}\), with a least and a greatest element, both of which are increasing in x. \(\square \)

Remark 1

(Significance of Theorem 1) We note that Theorem 1 is a key result for a variety of reasons. First, all of our results regarding the maximization (except those in Sect. 3.3) are based upon it. Second, an extension of these results to the infinite horizon i.e. directly beginning with a setting such as that in Eq. (13a), Eq. (13b), is immediate (to see this, replace \(V_t\) and \(w_t(x)\) with V(x) and w(x), and observe that all other conditions are unchanged). Thus, this result represents a key contribution, and provides a unified, comprehensive, and transparent treatment of both optimization problems, the finite [in Eqs. (9a), (9b)] and the infinite horizon [Eqs. (13a), (13b)].

Proposition 1

Under Assumptions 4 and 5, \(V_{t}(x)\) is decreasing in t, for every \(x\in \mathcal {X}\).

Proof

We provide a proof by induction. \(V_{T}=\displaystyle \max \nolimits _{w_{t}\in W(x)}\left( \Pi (x,w)\right) \ge 0=V_{T+1}\). Let the hypothesis hold for some \(k<T\) i.e. \(V_{k}(x)\ge V_{k+1}(x)\). Consider now

\(\square \)

3.1.1 The Effect of Risk Aversion

We turn now to understanding the implications of moving away from a risk neutral setting (implicitly assumed thus far) to a setting where risk does play a role. To be precise, we now consider an economic agent whose objective is to maximize expected utility from profit i.e. \(U(\Pi (x,w))\) where U is a strictly increasing and concave function. We note that the importance of using more realistic objective functions, and in particular accounting for possible risk aversion of decision makers in dynamic decision models, has been emphasized in the agricultural and resource economics literature (e.g. Krautkraemer et al. 1992; Kennedy et al. 1994). Nonetheless, apart from Knapp and Olson (1996), there has been no analysis of the structural properties of dynamic groundwater management models in a non-risk-neutral setting.

Knapp and Olson (1996) consider the problem in a recursive utility framework and show that optimal policies vary significantly when compared to a risk neutral setting. However, the analysis there is limited in that only Properties (a) and (e) are proved, and despite being an extension of Knapp and Olson (1995), there is no explicit link provided to the analysis therein. In other words, important properties in Knapp and Olson (1996) are proved more as a result of specific assumptions regarding model structure than as an extension of the model in Knapp and Olson (1995).Footnote 14 We work instead in a simpler setting using a popular utility function, \(\log \) utility. However, we treat the resultant model explicitly as an extension of our analysis for the risk neutral setting and are able to provide a link between both settings. Finally, we also show (see Remark 4) that the conditions we impose on the utility function, in the risk averse case, are closely related to those assumed in Knapp and Olson (1996).

While it is evident that the maximizer cannot change by means of this alteration in the objective function, new difficulties arise since supermodularity, unlike concavity, is a cardinal property i.e. g(f), with g strictly increasing and f supermodular, is guaranteed to be supermodular only if g is also convex. It turns out, however, that when restricted to the \(\log \) function (i.e. when \(U\left( \Pi \right) :=\log \left( \Pi \right) \)), some pleasing properties are retained. In particular, the following is true:

Claim 1

\(\Pi (x,w)\) is log super-modular (log s.p.m).

Proof

A function f is log s.p.m if \(\log f\) is s.p.m i.e. if \(\dfrac{\partial ^{2}f}{\partial u\partial v}\ge 0\) (Topkis 1998, p. 64) which implies \(ff_{uv}\ge f_{u}f_{v}\). In our case, the verification exercise involves \(\Pi \Pi _{xw}\ge \Pi _{x}\Pi _{w}\), with \(\Pi _{x}=cw\), \(\Pi _{w}=B^{\prime }-c(\bar{x}-x)\), \(\Pi _{xw}=c\). The condition to be verified yields \(c\left( B-B^{\prime }w\right) \ge 0\), which holds only if \(B\ge B^{\prime }w\). That this condition holds for the following four benefit functions: (i) \(B(w)=aw-bw^{2}\); (ii) \(B(w)=aw\); (iii) \(B(w)=ln(w+D)\), \(D=1\); and (iv) \(B(w)=1-\exp (-aw)\), is easily seen.Footnote 15 These benefit functions more than span the range of the empirical functions used in the groundwater management literature [the most popular of which is that in (i)]. \(\square \)

Replacing \(\Pi (x,w)\) in Eq. (9b) with \(\log \left( \Pi (x,w)\right) \), noting that \(\dfrac{\partial U(x,w)}{\partial x}=\dfrac{\Pi _{x}}{\Pi }\ge 0\) (whenever \(\Pi \) is bounded away from 0), it is evident that Theorem 1 is applicable, which is the content of the following proposition:

Proposition 2

Theorem 1 is applicable if Assumption 1 is replaced with Claim 1, and Assumption 4 with Assumption 6.

Remark 2

(Finiteness of \(J_t\)) We comment now on the assumption of boundedness and non-negativity of \(\Pi \). Note first that, for the purposes of Theorem 1, in particular, for the maximization operation, it is required that either \(\Pi \) be finite or that \(\mathcal {C}=\left\{ (x,w);w\in W(x), x \in \mathcal {X}\right\} \) is compact and \(J_{t}(x,w)\) is upper semi-continuous, the latter of which we assume in Theorem 1. For these purposes, it is not sufficient that \(\Pi \) is non-negative, an approach which is most commonly used with dynamic programming for unbounded benefit functions.

Remark 3

(Boundedness of \(\Pi \)) For the particular case of the logarithmic utility function (unbounded both above and below), it is not sufficient that \(\mathcal {X}\) is compact, since \(\Pi =0\) is always a possibility. However, this can be easily dealt with in a general manner, as follows: let \(\Pi \) be bounded below (trivially true whenever \(\Pi \) is finite or defined over a compact set) by \(B>-\infty \). Consider now the function \(\tilde{\Pi }=\Pi +(1+B)\). It is evident that \(\tilde{\Pi }>0\) and further, that replacing \(\Pi \) with \(\tilde{\Pi }\) yields the same optimal decision. Therefore, there is no loss of generality in assuming \(\Pi \) to be bounded away from 0.

Remark 4

(Log supermodularity) Knapp and Olson (1996), using a recursive utility framework, consider an identical problem to that in Knapp and Olson (1995). Their main assumption (A.4, p. 1007) regarding the function \(\Pi \) is

It is obvious that, for \(\sigma \ge 1\), this condition is implied by the log supermodularity of \(\Pi \). On the other hand, they use a value of \(\sigma <1\), for which this condition, in fact, is more demanding. Using the integral of the linear demand function used in Knapp and Olson (1995) and the standard cost function for the condition in Eq. (11) to hold, it is necessary that \(a\ge \left( \dfrac{\sigma -2}{\sigma -1}\right) bw\). That this condition is stronger than that implied by \(B_{w}(w)\ge 0\) \((\implies a\ge 2bw)\) for any \(\sigma <1\) is evident. They appear not to recognize the condition in Eq. (11) as a (stronger) form of log supermodularity.

3.2 Cost Function Accounting for Local Cones of Depression

We begin first with the risk neutral setting and prove that the use of a seemingly more complicated cost function does not complicate the analysis. Indeed, there is no change in the structural results obtained above. Recall from Eq. (8) that the cost function is

while the objective function is

From \(\dfrac{\partial ^{2}\Pi }{\partial x\partial w}=c>0\), it is evident that \(\Pi \) is supermodular, and that \(\Pi _{x}=cw\ge 0\). This leads immediately to the following propostion:

Proposition 3

For the net benefit function in Eq. (12), Theorem 1 is directly applicable.

Further, if we assume finiteness of \(\Pi \), then it is straightforward that Proposition 1 is directly applicable.

Proposition 4

For the net benefit function in Eq. (12), Proposition 1 is directly applicable.

We turn next to characterizing the properties of the decision problem when one uses a (strictly) concave transformation of net benefits. The issues confronted with this seemingly simple transformation are substantial, as discussed in Sect. 3.1.1. However, even with this cost function, we may show that the profit function is log supermodular, which is the content of the following claim.

Claim 2

\(\Pi \) in Eq. (12) is log supermodular, under Assumption 6.

Proof

Consider \(\Pi _{w}=B^{\prime }-c\left( \bar{x}-x+2w\right) \), \(\Pi _{x}=cw\), \(\Pi _{wx}=c\), which yields

which holds for the four functions for B exhibited in the proof of Claim 1. \(\square \)

This leads to the following proposition:

Proposition 5

Theorem 1 is applicable if Assumption 1 is replaced with Claim 2, and Assumption 4 with Assumption 6.

Remark 5

Observe that the transition function in Eq. (2) [in common with that in Eq. (1)] is increasing in x i.e. for \(x\le x'\), \(\min \left( x-w+R,\overline{x}\right) \le \min \left( x'-w+R,\overline{x}\right) \). Noting that the only property of the transition function used in the proof of Theorem 1 is precisely this, of increasing in stock x, it is evident that all of the results in the preceding two sections, using the cost functions in Eq. (8) and Eq. (6), hold for the more realistic, finite aquifer case represented by the transition in Eq. (2).

Thus far, we have not touched upon an interesting result in Knapp and Olson (1995), Corollary to Proposition 1. This Corollary is essentially a result regarding the Lipschitz continuity of w(x), and requires that \(X_{t+1}\) is increasing in \(X_{t}\). In our set-up here, except for the cost function in Eq. (7) (see Remark 8, Sect. 3.3), it is not the case that \(X_{t+1}\) is increasing in \(X_{t}\). Nonetheless, we show that under relatively mild assumptions on \(w^{\prime }\), the derivative of w(x), it is possible to establish a similar result for the other two cost functions [in Eq. (6) and (8)]. To our knowledge, ours is the first study in resource economics to provide this result for non-monotonic reinvestment functions. The key result is Claim 3:

Claim 3

\(w^{*}(x)\) is globally Lipschitz continuous.

Consider the following facts: \(w^{*}\left( x\right) \) is monotonic in x, implying that it is a.e. differentiable; making, in addition, the (relatively mild) assumption that the derivative, \(w^{* '}\), is continuous, it is immediate that \(w^{*}\left( x\right) \) is locally Lipschitz.Footnote 16 Given the intuitive property that beyond a certain point we do not anticipate further increases in X to lead to increased rate of pumping, we already anticipate that \({\displaystyle \lim \nolimits _{x\rightarrow \infty }}w^{*'}\left( x\right) \) is finite, say \(0<C_{1}<\infty \); if in addition we introduce the additional assumption that \({\displaystyle \lim \nolimits _{x\rightarrow 0}}w^{*'}\left( x\right) =C_{2}<\infty \), Claim 3 follows, as we show next.

We observe that it is reasonable that w is concave in x, with bounded derivative on \(\left[ 0, \infty \right) \). However, while a concave w can certainly be made to satsify the above two conditions, concavity is not required for, and hence not assumed in, our analysis.

Proof

Claim 3 follows from standard results indicating that every continuously differentiable function is locally Lipschitz. If in addition the derivative is bounded (by a number independent of x), then the function is globally Lipschitz. By the two assumptions already made i.e. \(w^{* '}(x)\) is continuous and \({\displaystyle \lim \nolimits _{x\rightarrow 0}}w^{*'}\left( x\right) =C_{2}<\infty \), it is evident that K, defined as \(0<K=\sup \left\{ w^{\prime }\left( x\right) ;x\ge 0\right\} <\infty \), may be used as the Lipschitz constant. \(\square \)

The following result is therefore immediate:

Corollary 1

For \(x>\hat{x}>0\) denoting two different stock levels and w, \(\hat{w}\) denoting corresponding optimal withdrawals, it is true that \(w-\hat{w}\le C\left( x-\hat{x}\right) \), for some \(0<C<\infty \).

We observe that Corollary 1 holds for the more realistic transition functions in Eqs. (2) and (18). While Corollary 1 requires assumptions regarding \(w^{* '}\), we note that these are weaker than assumptions regarding differentiability of the value function which are common in the literature using continuous time models [e.g. the existence of \(V^{\prime \prime \prime }\) in Tsur and Graham-Tomasi (1991)].

3.3 Accounting for Impact of Pumping on Marginal Cost

The results detailed next for the model with this cost function have already been published, in Huh et al. (2011) (‘HKW’, henceforth). Consequently, we provide only an extremely concise summary of the main result. These results are included here for two reasons. First, they illustrate the breadth of properties obtainable using methods similar to those used for the other two cost functions, and second, subsequent sections extend these to an infinite horizon and characterize the invariant distribution (both aspects not considered in HKW). Results from the current section are an integral part of, and a key to understanding, these extensions.

It is shown in HKW that all of Properties (a)–(d) hold for the model in Eq. (7). This is in contrast to the models in Eq. (6) and Eq. (8), for which we are able to show that only Property (b) holds. In a related model, Knapp and Olson (1995) are able to show that only (a) holds—and that with the help of an additional condition on cost C(.), as defined in Eq. (6).Footnote 17 We note that the proofs in HKW only rely on Assumptions 3, 5, 8, 9 and 10. In particular, while \(\Pi \) turns out to be supermodular, this fact is not used in the proof.

Remark 6

(Property (d)) Corollary 1 in HKW shows that with more periods to go, the optimal decision is more conservative i.e. for any x and \(t\le T\), \(w_t^*(x) \le w_{t+1}^{*}(x)\).

Remark 7

(Log supermodularity) We remark that the profit function associated with this problem [Eq. (12)] is not log supermodular; hence, there is no result analogous to Proposition 5.

Remark 8

We remark that Theorem 1(iii) of HWK indicates that \(\dfrac{\partial w_t^*(x_t)}{\partial x_t}\in [0,1]\). This result is analagous to Corollary to Proposition 1 in Knapp and Olson (1995), and to our Corollary 1.

4 Effects of the Time Horizon

We have already proved the following properties regarding the effect of the time horizon: for the cost functions in Eq. (6) and Eq. (8), \(V_{t}\) is decreasing in t (and finite, for each t) in Propositions 1 and 4; for the cost function in Eq. (7), it was proved in HKW, in addition, that the optimal policy function \(w_t(x)\) is decreasing in t. Consider next the following two equations, the infinite horizon analogues of Eq. (9a) and Eq. (9b), which may or may not be well defined at this stage,

A natural next step therefore is to ask the following questions regarding the limit functions:

-

1.

Does \(V_{t}\) converge? If so, does it converge to the Bellman equation, Eq. (13a)?

-

2.

Does the optimal policy function \(w_{t}^{*}(x)\) converge?

-

(a)

If so, does the limit function inherit monotonicity?

-

(b)

Does the limit function maximize the right hand side of Eq. (13b)?

-

(a)

We answer each of them in turn. We begin with a series of brief remarks on convergence of the value function and the one-period return function, as a prelude to answering the questions posed above.

Remark 9

We have proved that \(V_{t}\), for all three cost functions, is decreasing in t, increasing in x, and is finite (bounded). It is therefore immediate that \(\exists V<\infty \text { s.t. }V_{t}\downarrow V\) and further, that V is increasing in x. It is also evident from Eq. (9b) (and an easy recursion) that if \(V_{t+1}\le V_{t}\) then \(J_{t+1}\le J_{t}\). Further, either due to finiteness of \(\Pi \) or Assumption 13 and compactness of \(\mathcal {C}\), it is evident that \(J_{t}\) is bounded over \(\mathcal {C}\). Thus, \(\{J_{t}\}\) is a monotone, decreasing and bounded sequence. It therefore follows that \(\exists J<\infty \) s.t. \(J_{t}\downarrow J\text { for each }(x,w)\in \mathcal {C}\).

Remark 10

We have already shown, in Claims 1 and 2, that the profit functions in Eq. (10) and Eq. (12) are log supermodular. Remark 9 is therefore directly applicable to these formulations.

We make two final, technical, assumptions before we embark on our major result for this section.

Assumption 14

\(J_{t}(x,.)\) is continuous in w on W(x).

Assumption 15

\(\mathcal {C}=\left\{ (x,w);x\in \mathcal {X},w\in W(x)\right\} \) is a sub-lattice of \(\mathbb {R}_{+}^{2}\).

We now state our main result for this section, which is Heyman and Sobel (2003, Theorem 8–16), whose proof is provided in order to aid the reader’s understanding [Heyman and Sobel (2003) do not provide a proof].

Theorem 2

Under Assumptions 1, 6, 8, 9, 10, 11, 14 and 15, V(x) [defined in Eq. (13a)] is non-decreasing in x and \(\exists w(x)\) non-decreasing in x which satisfies \(V(x)=J\left( x,w(x)\right) \text { for}x\in \mathcal {X}\).

Proof

We split the proof outline into two steps. The first step involves proving that (a) \(V_{t}\downarrow V\) and that (b) V satisfies Eq. (13a). (a) is Remark 9. A proof of (b) begins by noting that since each \(V_{t}\) is bounded and increasing in x, by the monotone convergence theorem for integrals, we have that

From this, it is immediate that \(V_{t}(x)=\max \left\{ J_{t}(x,w)\right\} \ge \max \left\{ J(x,w)\right\} ,\) which implies \(\displaystyle \lim _{t\rightarrow \infty }V_{t}(x)=V(x)\ge \max \left\{ J(x,w)\right\} \). The proof will be complete if the inequality is proved the other way i.e. if it is established that \(V(x)\le \max \left\{ J(x,w)\right\} \). To prove this, consider

and taking limits, observe that \(V(x)\le \displaystyle \lim _{t\rightarrow \infty }\left[ \sup \left\{ J_{t}(x,w);w\in W(x)\right\} \right] \). The proof is complete if

From Assumptions 14 and 10, it follows that \(J_{t}(x,.)\) converges uniformly in w, for each x, to J(x, .) and finally, Eq. (14) justifies interchange of integral and limit. Thus, the interchange of \(\lim \) and \(\sup \) is valid.

The next step, to prove that \(w^{*}(x)\) is ascending in x and the greatest element of \(w^{*}(x)\) is increasing in x, is a direct consequence of Theorem 1, and is plainly a result of the supermodularity of J. \(\square \)

Remark 11

Theorem 2 addresses question 1. We note that nothing yet has been said about convergence of the optimal policy i.e. regarding \(w_{t}^{*}(x)\rightarrow w^{*}(x)\) where \(w^{*}\) is presumably increasing in x and is the maximizer of the right hand side of Eq. (13b). We address in turn questions 2, 2a and 2b. To begin addressing question 2a, we observe that if the limit function \(w^{*}\) exists, it must be increasing in x. The question thus to be addressed is 2. In the case of the cost function in Eq. (7), we have already proved that \(w_{t}^{*}\) is decreasing in t. Thus, using the upper bound \(\bar{X}\) for x, we have that \(\{w_{t}^{*}\}\) is a decreasing, bounded sequence, which must converge. For the remaining two cost functions, we have been unable to prove that \(w_{t}^{*}\) is decreasing in t, which is a sufficient condition for convergence. Thus, convergence is not assured for the remaining forms of the cost function, including the conventional cost function.Footnote 18

5 Stationary Distribution of Stock

We turn now to understanding the conditions under which the Markov chain generated by the dynamic decision problem for each of the three cost functions [in Eqs. (6)–(8)] converges to an invariant distribution. Most analyses on establishing convergence to a unique invariant distribution (termed ‘global stability’) in renewable resource management rely on the monotonicity of the ‘reinvestment function’, following the economic dynamics setting in Hopenhayn and Prescott (1992) and Mendelssohn and Sobel (1980). This approach has two major drawbacks: assumptions regarding compactness of the state space are needed, leading to bounded shocks (an undesirable artifact in many applications), and it is difficult to generalize to non-monotonic systems. There is an alternative approach, popularized in economics in Stachurski (2009), overcoming both drawbacks mentioned above. This method is particularly suited for an analysis of stability for the cost functions in Eqs. (6) and (8).

We illustrate here the use of a powerful theorem, applicable to both monotonic and non-monotonic Markov Chains, under a set of mild assumptions which are likely satisfied in a variety of natural resource extraction settings. This approach offers two major advantages over more conventional methods alluded to above:Footnote 19 (i) it allows the researcher to look beyond monotonic systems, which in many cases in resource economics are an artifact of model assumptions rather than any underlying feature of the natural-economic system being studied; and (ii) releases the researcher from the strait-jacket of compact-state-space conditions typically imposed on stochastic renewable resource models. Since the use of this approach in economics is relatively recent, and since this approach has not been used (to our knowledge) in a resource economics setting, we provide a more detailed outline of the method of verifying the conditions sufficient for its applicability.

5.1 The Setup

The generic transition equation, which [following Stachurski (2009)] we label the “Stochastic Recursive System” (S.R.S, henceforth), is

where, for now, we will assume \(R_{t}\overset{i.i.d}{\sim }\Phi \), with \(\Phi \) a continuous distribution assigning strictly positive probability to every subset of \(\mathbb {R}_{+}\), and \(\mathbb {E}\left( R_{1}\right) <\infty \). For future reference, the state and shock spaces are denoted \(\mathcal {X}\) and \(\mathcal {R}\) respectively, with \(\mathcal {P}\left( \mathcal {X}\right) \) and \(\mathcal {P}\left( \mathcal {R}\right) \) the corresponding set of all (Borel-) probability measures. For the S.R.S. in Eq. (15), we denote by M the Markov operator associated with the stochastic kernel, P, whose definitions, along with standard notations and definitions regarding Convergence of Markov Processes, are relegated to “Convergence of Markov Processes” section of Appendix. We only define below two notions which are directly used in the proof of the main result for this section, Proposition 6.

Definition 2

(Drift to small set) The kernel P, associated with the operator M, satisfies drift to a small set if \(\exists v\ge 1\), \(v:\mathcal {X}\rightarrow \mathbb {R}_{+}\), \(\alpha \in [0,1)\) and \(\beta \in \mathbb {R}_{+}\) s.t

and all sub-level sets of v are ‘small’ (see Definition 14).

Definition 3

(Global Stability) Viewing \(\left( \mathcal {P}(\mathcal {X}),M\right) \) as a dynamical system, global stability corresponds to the existence of a unique fixed point of this dynamical system.

5.2 Main Results

Consider next a (stationary) policy \(w(x_{t})\), possibly sub-optimal and non-monotonic in \(x_{t}\). Under this policy, the Markov chain that results maybe written as

The fundamental questions concern existence of at least one invariant distribution to the Markov chain generated by the policy \(w(x_{t})\), and the uniqueness of the invariant distribution. In the case of the cost functions in Eqs. (6) and (8), the optimal policy \(w(x_{t})\) is increasing in \(x_{t}\) but it is not the case that \(a(x)=x-w(x)\) is also increasing. Thus, the S.R.S \(F(x_{t},R_{t+1})\) in Eq. (16) is not increasing in x and results on stability of monotone Markov chains are not applicable. We indicate, following Stachurski (2009), a constructive method of proof which relies on far simpler assumptions than those for monotone Markov chains. We first state an important theorem and then indicate how the conditions required here are satisfied in the case of the S.R.S in Eq. (16).

Theorem 3

(Stachurski 2009, Theorem 11.3.36) If the Stochastic Kernel P is aperiodic, irreducible and satisfies drift to a small set, then the system \(\left( \mathcal {P}(\mathcal {X}),M\right) \) is globablly stable with a unique stationary distribution \(\Psi ^{*}\in \mathcal {P}\left( \mathcal {X}\right) \).

The verification of the conditions of Theorem 3 crucially depends upon the following assumption:

Assumption 16

The function a(x) in Eq. (16) is continuous, satisfies

with \(\alpha \in [0,1)\), \(c\in \mathbb {R}_{+}\).

We now indicate why this assumption is reasonable in the context of our set up. First, note that \(0<w(x_{t})\le x_{t}\) is necessaryFootnote 20 for Assumption 16 to be satisfied for \(c=0\) (with which we work, since it is not critical that c be positive). Thus, it is required that \(w(x_{t})\) is bounded away from 0 for all positive values of x, which of course is a reasonable assumption for any relatively shallow aquifer. In other words, any agent who has incurred the not-insubstantial fixed costs of accessing the resource (in the case of groundwater, pump and plumbing; in the case of fishery, capital equipment in the form of boats and nets) is unlikely to extract zero quantity for any positive stock level.

Conditions similar to Assumption 16 on stock, rather than extraction, are often imposed in models of extinction of natural resources [for instance Olson and Roy (2000, p. 194)]. It is important to note that Assumption 16 is not equivalent to stating that the stock of resources is bounded away from 0 almost surely. Rather, the assumption indicates that even at very low levels of stock, it is always optimal to extract a non-zero quantity of water and further, that this quantity is bounded below. Such will always be the case if costs are not “too convex”, relative to benefits. For instance, if costs are less convex than benefits are concave, it is very reasonable to assume that extraction will always be positive. Given that Inada-like conditions to ensure interior solutions cannot be used in this setting, this is an assumption, albeit a reasonable one.Footnote 21

We now provide two approaches to setting the value of the coefficient \(\alpha \), which is the essence of verification of the conditions in Assumption 16.

-

1.

For a differentiable a, Assumption 16 is a condition on the derivative of a i.e. \(a^{\prime }\le \alpha \). For the cost function in Eq. (7), HKW have already shown that \(\dfrac{\partial w(x)}{\partial x}\in [0,1]\). If, in addition, we make the (mild) assumption that \(\exists \beta \) s.t. \(1\ge \beta :=\inf \left\{ \dfrac{\partial w(x)}{\partial x};\text { }x\in \mathcal {X}\right\} >0\), then we can set \(\alpha =1-\beta <1 \).

-

2.

When \(w(x_{t})\) is not differentiable, there are two possible alternatives for \(\alpha \):

-

(a)

if \(1>K :=\sup \left\{ x-w(x);x\in \mathcal {X}\right\} \), then set \(\alpha =K\);

-

(b)

Another alternative is to consider \(\kappa :=\inf \left\{ \dfrac{w_t(x)}{x};x >0 \right\} \); if \(\kappa >0\), set \(\alpha =1-\kappa <1\).

-

(a)

For the developments below, we assume one of the above is true. Thus, for all the models considered here, we henceforth make Assumption 16. We now indicate the chain of reasoning verifying all the properties required of P in Theorem 3. From Stachurski (2009, p. 293), irreducibility of P follows, while it can be shown easily that every compact subset of \(\mathcal {X}\) is small for P, from which the aperiodicity of P follows (Stachurski 2009, p. 292). Finally, finding a function v satisfying Definition 2 will suffice to prove drift to a small set, a task taken up next.

Claim 4

For the function \(v=x\), the Markov operator M associated with the S.R.S in Eq. (16) satisfies the conditions (set out in Definition 2) for drift to a small set.

Proof

Using the definition of a Markov operator (Definition 8), and the expression for F from Eq. (16), \(Mv(x):=\displaystyle \int v\left[ F(x,z)\right] \Phi (dz)\), with \(F(x,z)=a(x)+z\). Thus, we have

where \(\beta :=\int z\phi (z)dz<\infty \), and the inequality follows from Assumption 16 (with \(\alpha \) taking any of the three values already defined). It is immediate that all sublevel sets of v i.e. set of the form \(\left\{ x\in \mathcal {X};v(x)\le K\}\right\} \text {, }K\in \mathbb {R}_{+} \), are compact.Footnote 22 \(\square \)

Thus, all the properties required of P in Theorem 3 are satisfied, which leads to the main result of this section:

Proposition 6

For the groundwater models defined by cost functions in Eqs. (6), (7), and (8), the stock of groundwater converges to a unique, invariant distribution, \(\Psi ^{*}.\)

We stress that this result is very general in that it depends only on three assumptions:

-

(i)

The function F in Eq. (16) is of the form \(x-w(x)\), irrespective of the form of w(.) (i.e. w(.) need not be monotonic);

-

(ii)

a stationary policy exists; and

-

(iii)

under a stationary policy, extraction (not necessarily monotonic) is bounded away from 0.

Note that (ii) is always true while (iii) is clearly an assumption and, we argue, a very reasonable one in many renewable resource settings. This result is general, and applicable to any renewable resource setting satisfying these three conditions.

5.3 Non-iid Shocks

We now revisit the issue of i.i.d shocks in the S.R.S in Eq. (16). Consider a scenario wherein the random recharge,\(R_t\), depends upon the current stock, as is true for aquifers in which recharge depends upon lateral flows that are in turn a function of the current stock. Denote by L(X) the lateral flow, with L increasing and (possibly) concave. We work with a slightly less general formulation of the problem, using the log normal distribution, letting only the mean of the recharge be a function of the stock.

Let \(\eta \overset{i.i.d}{\sim }LN\left( \mu ,\sigma \right) \) and consider the following random variable: \(R_t=\eta +L\left( X_t\right) \), with \(\mathbb {E}\left( R\right) =\mathbb {E}\left( \eta \right) +L\left( X\right) \) and \(\mathbb {V}\left( R\right) =\mathbb {V}\left( \eta \right) \) (both conditional on \(X_t\)). \(R_t\) is a random variable with a so-called “shifted” log normal distribution, whose mean is increasing in \(X_t\). Using this, we can reformulate our S.R.S as

where \(\eta _{t}\) is now an i.i.d log normal random variable. To summarize, we have reduced an S.R.S with a random variable whose mean depends upon stock \(X_{t}\) into a slightly different S.R.S with an i.i.d recharge, with the addition of the term \(L\left( X\right) \). Thus, no additional technical machinery is necessary to address the S.R.S in Eq. (18). Nonetheless, the use of the new S.R.S, Eq. (18), instead of the previous one, raises many questions, in particular:

-

1.

Is the main results regarding the nature of the optimization problem, Theorem 1, still valid?Footnote 23

-

2.

Is the proof of global stability, Proposition 6, valid?

Q1 can be answered in the affirmative, since it only depends upon the monotonicity of the transition, \(\tilde{X}\), in stock. Q2 can also be answered in the affirmative for the cost functions in Eq. (6) and Eq. (8), as we indicate below. We note, however, that the added complexity of this formulation necessitates correspondingly stronger assumptions. Nonetheless, we emphasize these assumptions are no stronger than those made in the existing literature, and we are unaware of any literature in resource economics which attempts to address explicitly this issue of dependence of the “shock” R upon the stock X.

Letting \(\tilde{a}\left( x\right) (=a\left( x\right) +L\left( x\right) )\) be the new ‘reinvestment function’, we observe that the introduction of \(L\left( X\right) \) does not alter any of the previous properties regarding \(w_{t}^{*}\left( x_{t}\right) \) in Theorem 1 [and Theorem 2 for the two cost functions in Eqs. (6) and (8)], as already noted. Thus, whenever \(a\left( .\right) \) is increasing in x, so is \(\tilde{a}(.)\). However, in cases where \(a\left( \right) \) is not increasing in x, which is true for the cost functions in Eq. (6) and Eq. (8), no conclusions can be drawn regarding \(\tilde{a}\) (for e.g., if L is sufficiently ‘large’, \(\tilde{a}\) may be increasing even if a is not). For our purposes, we will not assume that \(\tilde{a}\) is increasing in x, whenever a is not.

Our main result for this part is presented next.

Proposition 7

Theorem 3 is applicable, if \(a\left( x\right) \)is replaced with \(\tilde{a}\left( x\right) \), for cost functions in Eqs. (6) and (8).

We note that a proof of this result proceeds along lines identical to that of Proposition 6, and is hence omitted. In the interest of brevity, we provide only a bare outline of the technical issues involved. As for Proposition 6, an analogue of Assumption 16 is required for the transition in Eq. (18); essentially, we replace a in Assumption 16 with \(\tilde{a}\). The key verification step, as for the simpler case, involves finding a constant, \(\tilde{\alpha }\). Since lateral flow may be viewed as being “small” (in relation to the stock, x), one can assume that \(L\left( x\right) \) is linear (or is dominated by a linear function) with slope \(\eta \) and, finally, that \(\alpha >\eta \). Similarly, the condition that extraction be bounded away from 0, \(\forall x>0\), is evidently necessary here; in addition, given that there is a positive (in x) term, that condition is slightly more stringent. Thus, the results for a are easily extended to accommodate \(\tilde{a}\).Footnote 24

6 Conclusions and Extensions

This paper had two major objectives:

-

(i)

to investigate the implications of using more hydrologically-grounded formulations of cost functions for dynamic groundwater management, including accounting for risk aversion; and

-

(ii)

to provide weaker conditions for convergence of stock of resource.

The cost function was generalized in two directions, accounting for localized cones of depression (increasing the cost of extraction) and taking into account changes in groundwater stock within a season. With the conventional cost function, it was shown that only very few structural properties hold, notably monotonicity of extraction in groundwater stock. Quite surprisingly, this simple and intuitive result has been rigorously proved here for the first time. It was shown, with the former generalization of the cost function, that extraction is increasing in the current stock. With the latter generalization, however, it was shown, in addition, that reinvestment (next periods stock) was increasing in current groundwater stock and further, that extraction (reinvestment) was decreasing (increasing) over time.

In addition, we show that, when restricted to the \(\log \) utility function, for both the conventional cost function and the cost function accounting for formation of cones of depression around a pumping well, all of the preceding results are directly applicable. Again, apart from Knapp and Olson (1996), in whose set up uncertainty plays a less central role in decision making, ours appears to be the only explicit proof of structural results for objective functions displaying risk aversion in the groundwater management literature. In contrast to most dynamic stochastic models in the existing literature, we are able to prove most of the properties previously conjectured for these class of models. Moving away from models which require strong assumptions such as monotonic reinvestment or compact state space, we illustrate the use of a powerful method for proving convergence of the stock of resource to a unique invariant distribution. This method requires only mild assumptions on the optimal policy to yield convergence, and is potentially applicable to a wide variety of renewable resource settings.

The motivation for the modifications to existing groundwater management models was to accommodate specific scenarios encountered in many semi-arid countries, scenarios previously not modeled (or at least, not with models set up to accommodate features specific to these settings). This suggests direct implications of the work here for informing public policy, although such extensions are left for future work. First and foremost, one or both cost functions introduced here may be used, as appropriate, to quantify the benefits of different types of current, real-world policies [such as the flat-rate-with-capacity-restrictions policy advocated in Shah et al. (2008)], with relatively minimal data requirements; such an evaluation with existing cost functions is likely to lead to substantial underestimates of the cost of pumping. The hydrologically realistic multi-user framework laid out in Brozović et al. (2006) requires detailed data on pump locations and more hydrological/economic parameters than are likely available for many developing countries, or at many locations.Footnote 25 In such cases, simulations using the models outlined here may provide a second best and relatively quick means of evaluating the benefits of different policies [such as taxes, considered in Athanassoglou et al. (2012)]. Secondly, by freeing the ‘reinvestment function’ from the artificial constraint of monotonicity, a more realistic baseline is provided for evaluation of policy. Essentially, using our approach, policy simulations of the kind carried out in Knapp and Olson (1995, 1996) may be more representative of, and useful for, the scenarios envisaged.

Two directions for extension of the current work are immediately evident. First, in the case of groundwater, an important policy issue is the prevention of groundwater depletion by means of regulation. In this context, even if the optimal policy is monotone, it need not be a simple function of the stock. In the general setting of this paper, an important step towards specific applications could involve characterizing (even in the admittedly simplified case of a single-user) a variety of possibly sub-optimal but simple policies and quantifying their performance in an empirical setting. Second, in the groundwater scenario which motivated this work, crop choice determines groundwater water use and extraction, and exogenous prices determine crop choices. In this setting, it is important for policy design (e.g. price support and stabilization) to understand the conditions under which the variability in prices influences the evolution of groundwater stock. Exploring this question in the model framework above, and extending the sparse existing literature on variability and stock exploitation (see e.g. Sethi et al. 2005), we feel, is both feasible and interesting.

Notes

As is common in the literature, we work with the total stock of water instead of the ‘lift’, which is commonly used in the engineering literature. However, since both are related monotonically (lift increases as groundwater decreases) one may work with either without loss of generality.

The use of such a simplified balance equation, as remarked in Worthington et al. (1985, pp. 232–233) is a gross over simplification. Taken literally, this equation implies an instantaneous capture of all recharge by any pumping activity. However, this oversimplification can be remedied by either introducing relevant coefficients on recharge such that only a fraction of the recharge is captured or by using more detailed and accurate equations of motion for the stock. Note that in the case of many developing nations where discharge due to pumping is much larger than recharge, such an assumption is less of an oversimplification, since a large part of recharge is very likely captured within the region of pumping.

It is made explicit only in Worthington et al. (1985), wherein (Table 1, p. 236) they estimate an annual incremental drawdown given only the level of water table at the beginning of the season, independent of the quantity of water pumped.

An intuitive property of this cost function is that extraction of the nth unit of water is less costly than extraction of the \((n+m)\)th, \(\forall m,n>0\), and for all stock levels. For the particular functional form used, the marginal cost of extraction is \(\gamma (x-w)\), a function of both \(x \text { and } w\), with \(\dfrac{\partial ^2C}{\partial x \partial w}=\gamma ^{\prime } < 0\) and \(\dfrac{\partial ^2C}{\partial w^2}=-\gamma ^{\prime } > 0\).

We note the intimate relationship between model time-step and model formulation. In the context considered here, a time period is a full growing season, approximately of six-month duration, and in some part of the growing season, groundwater is the only source of water available. Given the length of the season, it is not clear that cost of extraction ought to depend upon beginning-of-period stock of water, especially if extraction is likely a large part of the stock (as is the case for the Telangana region in southern India, see Fishman et al. 2011).

Note that the latter interpretation can be justified by an appeal to the discussion accompanying figure 1.2 in Brozović et al. (2006), which makes clear that for many aquifers, if two pumping wells are only a small distance apart (certainly true for the context considered here) only pumping in the immediate past is of any relevance. Given the definition of a season, and the relatively small distance separating pumping wells in the context considered, our modeling of ‘path dependence’ in pumping as being restricted to a season, and affecting cost but not stock, is quite natural.

This issue, even with the confined aquifer assumption, has been remarked on before. For instance, Provencher and Burt (1994, p. 882) point out that groundwater levels do not adjust immediately after a local perturbation caused by pumping from the well, due to the fact that the equilibrating flows are both slow and subject to great variability. In particular, with heterogeneous aquifers and unequal pumping rates by farmers, they clearly recognized a not insubstantial lateral flow of groundwater, leading to uncertainty regarding future water availability. While their discussion was in the context of a common property problem, it is clearly applicable in the context of our modification to the cost function.

The finite difference approach is the standard approach to two- and three-dimensional groundwater flow modeling; e.g. the USGS’s MODFLOW (Harbaugh et al. 2000).

The precise correction is given by the formula \(0.3665 \dfrac{q_{i,j}(t)}{m_{i,j} T_{i,j}} \log \left( \dfrac{\Delta x}{4.81 r_{BH}}\right) \), where i, j refer to the finite difference cell index, m is the number of pumping wells in the cell with uniform pumping, T is the transmissivity, \(\Delta x\) and \(r_{BH}\) are respectively the cell size and radius of the well. See e.g. Siegfried (2004, pp. 52–53) for a description and Prickett and Lonnquist (1971) for a derivation.

This framework [cost in Eq. (8) and transition in Eq. (1)] is an uneasy combination of a particular form for stock-dependent cost with an infinite depth aquifer. See Remark 5 for a generalization. The use of the simplified transition Eq. (1) here is for the sake of unification, since our results with the cost function in Eq. (7) do not extend to the more realistic transition in Eq. (2).

To see this, note that \(C_{x}=-c\), \(C_{xx}=0\), thus \(\Pi _{xw}=-c\), \(\Pi _{xx}=-C_{xx}=0\), \(\Pi _{ww}=-B^{\prime \prime }\) . For \(\Pi \) to be jointly concave in (x, w), the Hessian is required to be negative semi-definite, implying \(B^{\prime \prime }C_{xx}\ge \left( C_{x}\right) ^{2}\) which in this case is equivalent to \(c^{2}\le 0\), evidently false.

To be more explicit, properties (a) and (e) are proved via assumptions on the objective function \(\Pi \)—which is recursive—rather than by considering a recursive utility function U operating on the profit function \(\Pi \), the latter being defined as in Knapp and Olson (1995). Thus, it is not possible to trace a direct link between the analysis in Knapp and Olson (1995) and Knapp and Olson (1996).

Consider first the function \(\log (w+D)\), \(D=1\). For \(B>B^{\prime }w\) for this function, it is required that \(\log (1+w)\ge \dfrac{w}{1+w}\). That this holds is evident from the logarithmic inequality \(\dfrac{w}{1+w}\le \log (1+w)\le w\). For the function \(B(w)=1-\exp (-aw)\), it is seen that \(B-wB^{\prime }=1-\exp (-aw)\left( 1+aw\right) \). That this is non-negative is evident from the following inequality: \(e^{-x}(1+x)<1\), with \(x=aw\).

A function f is locally Lipschitz if, for \(\forall x_{0}\in X\), \(\exists r>0\) such that f is Lipschitz continuous on \(B_{r}\left( x_{0}\right) \), an open ball centered at \(x_{0}\), with constant \(\Lambda \left( x_{0}\right) \) i.e. if \(|f\left( z\right) -f\left( x_{0}\right) |\le \Lambda \left( x_{0}\right) \) \(\forall z \in B_r \left( x_0\right) \). If \(\exists \)r for which the same Lipschitz constant \(\Lambda \) applies \(\forall x_{0}\in X\) then f is said to be globally Lipschitz.

The underlying assumption of Knapp and Olson (1995) is the supermodularity of \(B(x-y)-C(x, x-y)\) in (x, y), where B(w) is the benefit of withdrawing w units of water, but this condition sometimes fails for the model in Eq. (6); however, for Eq. (7), this supermodularity condition always holds, thereby enabling Property (c) to hold.

We have not been able to establish, for the cost function in Eq. (7), that question 2b can be answered in the affirmative. This is due to the fact that existing sufficient conditions are inapplicable to our case, and a direct proof is non-trivial. We leave this task for future work.

While powerful, the method used here suffers from a drawback, in the need for finding a function v which allows a verification of the condition of ‘drift to a small set’ (in Definition 2). The function v depends on the functional form of F(.) in Eq. (16); it is therefore not possible to provide generic conditions for convergence for arbitrary functional forms of F. Nonetheless, for commonly used functions for stock growth in renewable resource economics (e.g. linear, as here, or power functions), it is possible to find a function v for which convergence holds.

It is not difficult to see that it is not sufficient: observe that what is required is \(w(x)\ge x(1-\alpha )\), which is not guaranteed by \(w(x)>0, \forall x>0\).