Abstract

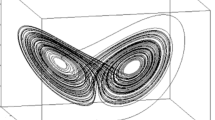

In the paper, we consider a Kaldor-type model of the business cycle with external additive and internal parametric disturbances. We study analytically and numerically the probability properties of stochastically forced equilibria and limit cycles via stochastic sensitivity function technique. In particular, we discuss the effects of additive and parametric noises on the economic variables and we detect some stochastic bifurcations such as a P-bifurcation, i.e a phenomenon of noise-induced transition from monostability to bistability. This stochastic bistability causes a new trigger regime in economic dynamics.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

The model proposed by Kaldor (1940) is one of the first and best known endogenous-business-cycle models. According to Kaldor’s idea, the main economic proxy toward business fluctuations is a non-linearity in the investment-saving mechanism. This idea was formalized in a model and studied by means of the mathematical theory of dynamical systems in Chang and Smyth (1971), where the authors using Poincare–Bendixson theorem proved rigorously that Kaldor’s assumption can indeed lead to business cycle dynamics. Since these pioneer papers, the Kaldor model has attracted the interest of many researchers in both economics and mathematics, see e.g. Lorenz (1993), Gandolfo (2009) and Wu (2011). In particular the model has been extended into two main directions. One important extension is the introduction of discrete time, see e.g. Bischi et al. (2001) and Dieci et al. (2001). These two contributions highlight the non-invertibility of the discrete-time variant of the business cycle model and the related important consequences in the dynamics of the economic variables. The second type of extension is the introduction of different types of delay in the investment-saving decisions as suggested in a seminal contribution by Kalecki (see Szydlowski and Krawiec 2005; Krawiec and Szydlowski 1999; Wu and Wang 2010; Kaddar et al. 2008 for continuous-time and Dobrescu and Opris (2009) for discrete-time Kaldor–Kalecki models with delay). All these models of business cycles exhibit different types of bifurcations, such as Andronov–Hopf, Bogdanov–Takens and Neimark–Sacker bifurcations, and different scenaria of transition to chaos.

The third and less explored generalization of the model regards the introduction of random disturbances. The introduction of random disturbances in a Kaldor model provides a deeper perspective on the qualitative and quantitative understanding of the phenomena at stake, as it allows a study of the combination of deterministic and stochastic forces that lead to the creation of a business cycle. One of the first attempts to analyze the dynamics of a stochastic version of the Kaldor model is presented in Grasman and Wentzel (1994). The authors introduce random noises as independent Wiener processes in the Kaldor model of the business cycle and show that these random perturbations generate chaotic dynamics instead of simply regular oscillations (observable in the deterministic version of the model). For other contributions on stochastic business cycle models see also Huang et al. (2010) and Mircea et al. (2011). Despite the limited number of contributions, the analysis of stochastic business cycle models and more generally the dynamics of stochastic economic models is an important area of research. Indeed, random disturbances are often considered an inevitable attribute of any economic system and the parameters of the real economic models are subject to perturbations that can be considered as stochastic or uncertain.

The main difficulties in studying stochastic business cycle models, or more in general stochastic economic models, is the lack of simple mathematical tools for the investigation of the dynamics of these models. It is worth noting that the interaction between nonlinearity and stochasticity in dynamical systems can generate various not-easy-to-analyze phenomena such as noise-induced transitions, see e.g. Horsthemke and Lefever (1984), stochastic bifurcations, see e.g. Arnold (1998), and noise-induced chaos, see e.g. Gao et al. (1999). For this reason stochastic and nonlinear dynamics are an actively developing research domain of modern mathematical economics.

The most commonly used tool for studying stochastic dynamics is direct numerical simulations based on the Monte Carlo approach, see e.g. Metropolis and Ulam (1949). This is a time-consuming method that allows a detection only of the after-effects of noises. The Kolmogorov–Fokker–Planck equation represents an alternative and, at the same time, a more sophisticated tool. This is a partial differential equation which provides the most detailed probabilistic description of stochastic dynamics of a model. However, a direct use of this equation is technically very difficult, even for the simplest possible situations. Therefore, some asymptotic methods and approximations of the solution of the Kolmogorov–Fokker–Planck equation are commonly used. For example, in physic applications it is commonly used an asymptotic method to approximate the solution of the Kolmogorov–Fokker–Planck equation called quasipotential method, see Freidlin and Wentzell (2012). As a further development of this method, in Bashkirtseva and Ryashko (2000) and Bashkirtseva and Ryashko (2004) the so-called stochastic sensitivity function (hereafter, SSF) technique was developed for the probabilistic description of stochastic attractors. This technique is based on an approximation of the quasipotential function for low-intensity noise. It helps to obtain more accurate results than a simple Monte Carlo analysis and it requires much easier calculations than the one required to solve the Kolmogorov–Fokker–Planck equation.

In this paper, using this technique as our main analytical tool, we analyzed a stochastic version of the Kaldor model of the business cycle. In particular, using this technique we are able to extend the analysis identifying how the economic parameters, such as the adjustment coefficient of the level of activity, affect the dispersion of the random states around a stochastic attractor when the model is influenced by additive noise, by multiplicative noise or by both. Moreover, we investigate the dispersion of the random states along business cycles and how this depends on the values of the parameters of the model. More generally, we show how the deterministic and stochastic forces combine together and generate different types of dynamics when the values of the parameters vary. In the final part of the paper, we also discuss a phenomenon of a noise-induced bistability, i.e. a qualitative change in the stochastic dynamics of the model due to a P-bifurcation (we refer to Arnold (1998) for a general treatment of stochastic bifurcations). This reveals that the Kaldor model of the business cycle can generate different kinds of cyclical dynamics that mimic the real fluctuations observed in the real time series.

The plan of the paper is as follows. In Sect. 2, we briefly introduce the model and study its deterministic dynamics in a subregion of the parameter space. In Sect. 3, we introduce and analyze by means of a stochastic sensitivity function technique the dynamics of the Kaldor model of the business cycle with low-intensity random perturbations. In Sect. 4, we detect the existence of a noise-induced bistability which appears through a P-bifurcation. A theoretical background of the general SSF technique for stochastic equilibria and cycles is shortly discussed in Appendix.

2 Deterministic Kaldor Model

The Kaldor original model is a one-sector business model which describes the dynamics of the level of activity Y and the stock of capital K in a closed economy, see e.g. Kaldor (1940) and Chang and Smyth (1971). The Kaldor’s main idea was to introduce a periodic regime on the correlated dynamics of Y and K as a consequence of the investment and saving decisionsFootnote 1 captured by the shape of the investment function I(Y, K) and saving function S(Y, K).

Adopting the standard capital accumulation equation as suggested in Lorenz (1993)Footnote 2, Kaldor model can be written as a system of two differential equations

where \(\alpha >0\) is an adjustment coefficient in the goods market that measures the speed of reaction of the economic system to the difference between investments and savings, and parameter \(\delta \in \left( 0,1\right) \) represents the depreciation rate of capital stock.

In order to provide some specific cases to discuss, to introduce some form of noise and to analyze how this influences the dynamics, we have to assume a specific functional form for the investment function and the saving function. The investment function is chosen to be additive in Y and K, and it takes the form

where \(\beta >0\) (it will be assumed to be stochastic in the next section). This parameter \(\beta \) measures the sensitivity of investments to a variation in the stock of capital, indeed \(\beta =-I'_{K}(Y,K)\). As far as I(Y) is concerned, following Rodano (1997), Gandolfo (2009) and Bischi et al. (2001) and given the exogenously assumed “normal” level of income as \(c>0\), we assume the following increasing S-shaped function of the difference between current income and its normal level

where \(b,d>0\).

We define the saving function as

where \(\gamma \in \left( 0,1\right) \) measures the saving propensity of the agents with respect to the income. The condition \(\gamma <1\) indicates that the marginal propensity to consume is positive and proportional to the level of activity, which is the basic principle of Keynesian investment multiplier.

Given the investment and saving functions, we obtain the following Kaldor-type model

The dynamical system (5) has always at least one equilibrium, namely \((\overline{Y}, \overline{K})\). For the sake of simplicity and without loss of generality we assume \(\overline{Y}=\overline{K}\), which implies that the marginal propensity to consume is equal to the depreciation rate of capital stock, i.e. \(\delta =\gamma \), and we normalize to one the “normal” level of income, i.e. \(c=1\). We assume also a relatively high depreciation rate of the capital stock, i.e. we fix \(\gamma =0.5\), as it is typical in the modern economies where a fast technological development accelerates the process of obsolescence. Moreover, we assume that d, which represents the minimum level of investment, is greater than half of the level of investment at the “normal” level of income, specifically we fix \(d=0.6\). This is consistent with a developed economy where the high standard of technology adopted in the production sector requires continuous investments. In addition, assuming that the system reacts quickly to correct the misalignments between the current and the “normal” level of income, we chose \(b>1\), specifically \(b=4.2\). Thus, we consider the following subset of the parameter space:

Focusing on the stochastic version of the model and interesting to understand how the deterministic forces of this model combine with the stochastic one, in this paper we provide a brief description of the deterministic dynamics of this model varying only the parameters \(\alpha \) and \(\beta \). As the deterministic analysis of the model is not the main task of this paper, we report only the results that are useful to understand the dynamics of the stochastic version of the model and we refer to Wu (2011) for a deeper and more comprehensive investigation of the deterministic model.

For each constellation of the values of the parameters in (6), system (5) has a unique equilibrium \(({\bar{Y}},{\bar{K}})\), such that \({\bar{Y}}={\bar{K}}\), and the level of activity \({\bar{Y}}\) is proportional to the investment, i.e. \(I({\bar{Y}})=(\beta +0.5){\bar{Y}}\). The Jacobian matrix calculated at the equilibrium \(({\bar{Y}},{\bar{K}})\) is a function of the two bifurcation parameters \(\alpha \) and \(\beta \) and is given by

where

Focusing on \(\beta =0.6\), we have that \(({\bar{Y}},{\bar{K}})=(1,1)\) and the Jacobian matrix at this equilibrium becomes

from which by straightforward algebra we found that the equilibrium undergoes a supercritical Andronov–Hopf bifurcation at \(\alpha _*=2\).

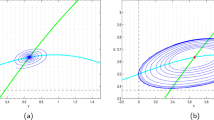

Bifurcation diagram of deterministic Kaldor model (5) for equilibria \(({\bar{Y}},{\bar{K}})\): A (stable node), B (stable focus), C (unstable focus), D (unstable node)

By standard analysis we can obtain the bifurcation curves as functions of the two bifurcation parameters \(\alpha \) and \(\beta \), see Fig. 1, which divide the (\(\alpha \),\(\beta \)) parameter space into four regions: in \(A \cup B\) the equilibrium \(({\bar{Y}},{\bar{K}})\) is the only stable attractor (a node in region A and a focus in region B); in \(C \cup D\) there are two invariant sets, a stable limit cycle and the unstable equilibrium \(({\bar{Y}},{\bar{K}})\) (a focus in region C and a node in region D). By further considerations, as the one provided in Wu (2011), we can find that the critical line of Fig. 1, separating regions B and C, is the Andronov–Hopf bifurcation curve, i.e. crossing that curve from left to right a limit cycle appears through a Andronov–Hopf bifurcation.

In the next section, we introduce one parametric and two additive stochastic disturbances to the business cycle model (5), we provide a sound economic justification for the presences of these stochastic terms, and we perform a noise-induced stability analysis of the model by means of the stochastic sensitivity matrix.

3 Stochastic Kaldor Model

In order to study the response of the Kaldor model to random disturbances, we introduce two additive noises and one parametric noise obtaining the following stochastic nonlinear dynamical system

where \(w_i\;(i=1,2,3)\) are independent standard Wiener processes such that \(\mathrm{E}(w_i(t)-w_i(s))=0\) and \(\mathrm{E}(w_i(t)-w_i(s))^2=|t-s|\), \(\sigma _i\) (\(i=1,2,3\)) are elements of matrix-valued function of disturbances and \(\varepsilon \) is a scalar parameter of noise intensity. We associate \(\sigma _{2}\) and \(\sigma _{3}\) with additive noises and \(\sigma _{1}\) with the parametric noise.

Additive noise \(\sigma _2 {\dot{w}}_2\) measures changes in the level of activity not directly related to investment and saving decisions but due to exogenous events, such as unexpected information that force economic agents to modify their production level. On the contrary, additive noise \(\sigma _3 {\dot{w}}_3\) represents the effect of external events that could affect the stock of capital, such as unexpected losses. Concerning parametric noise, in this stochastic model, we consider a unique parametric noise forcing the parameter \(\beta \) only: \(\beta \rightarrow \beta +\sigma _1{\dot{w}}_1.\) To assume that \(\beta \) is stochastic means that the propensity to invest with respect to a change on the stock of capital can be governed by a random component, which indicates that the investment decisions of the agents in the economy can be influenced by external news or events. It is well known that the investment decisions are strongly influenced by pessimistic (or optimistic) news about the state of the economy. For example, if the stock of capital is decreasing and as a consequence of this, in absence of external events, the agents would increase investments, there could be an external shock (news or events) that could modify (alter) this decision.

It is worth pointing out that a similar stochastic version of the Kaldor model with additive noise only has been proposed in Grasman and Wentzel (1994).

3.1 Stochastic Equilibria

As long as the random noise is assumed to be at a relatively low level of intensity, i.e. we assume that the dynamics of the macroeconomic variables are governed mainly by deterministic components and only slightly forced by stochastic disturbances, to study the stochastic Kaldor model we can apply the stochastic sensitivity function technique for weak noise. This function can be used to characterize the dispersion of random states around a deterministic attractor. A brief description of this technique is reported in Appendix.

Random trajectories of the stochastically forced model (10) leave a deterministic attractor (equilibrium or cycle) and form a so-called stochastic attractor around the deterministic one. It is obvious that, as noise intensity increases, the dispersion of random states around the deterministic attractor grows. However, it is not an easy task to understand how the dispersion of the random states changes as the values of the parameters of the deterministic component of the model change. In this subsection, we show that these changes can be measured and in particular we study how this dispersion depends on the deterministic adjustment parameter \(\alpha \), keeping \(\beta \) fixed and equal to 0.6. This information helps to understand how the dynamics of the stochastic system changes if some of the exogenous economic conditions, captured by the parameters, change.

Let us start considering a constellation of the values of the parameters such that \(\left( {\bar{Y}},{\bar{K}}\right) =\left( 1,1\right) \) is stable and is the unique attractor of the deterministic model, i.e. \(0<\alpha <\alpha _*\) (\(\alpha _*=2\)). When the Kaldor model is affected by noise as in (10), with \(\sigma _{2}=\sigma _{3}\), the stochastic sensitivity of equilibrium \(\left( {\bar{Y}},{\bar{K}}\right) \) can be characterized by the stochastic sensitivity matrix

where

which are obtained solving the algebraic system (20) indicated in Appendix. This matrix captures the interaction between the deterministic forces, described by Jacobian matrix (9), and the stochastic disturbances, which are described, see (20), by the following matrix

Let us point out that value \(w_{11}\) defines the stochastic sensitivity of the equilibrium along Y-axes, value \(w_{22}\) defines the stochastic sensitivity of the equilibrium along the K-axes and values \(w_{12}=w_{21}\) give a measure of the correlation between the level of activity and the capital stock. The matrix is valid as long as \(0<\alpha <2\), i.e. as long as the deterministic equilibrium \(\left( {\bar{Y}},{\bar{K}}\right) \) is stable. It is worth observing that \(w_{11}\left( \alpha ,0,1\right) >w_{22}\left( \alpha ,0,1\right) \) for all \(\alpha \in \left( 0,2\right) \). This means that the dynamics of the level of activity is more sensitive to additive noise than the dynamics of the level of capital stock.

Moreover, we have \(w_{12}\left( \alpha ,0,1\right)>w_{12}\left( \alpha ,1,0\right) >0\) for all \(\alpha \in \left( 0,2\right) \). This means that there is a positive covariance between the level of activity and the stock of capital and it follows that to a large level of capital stock corresponds a large level of production and vice versa.

For a parametric analysis of stochastic sensitivity of the equilibrium forced by random noise, it is possible to use eigenvalues \(\mu _1\), \(\mu _2\) of matrix W. These eigenvalues are depicted in Fig. 2a for \(\alpha \in [0,2]\) and \(\sigma _1=0\), \(\sigma _2=\sigma _3=1\). The plot of \(\mu _{1}\) reflects a non-monotonicity property mentioned above and both plots give a measure of the level of dispersion of random states. For small \(\alpha \), the stochastic sensitivity of the equilibrium is quite large in one component \(\mu _1\) and relatively small in the other component \(\mu _2\). This means that dispersion, which we denote by D, of random states near the equilibrium depends essentially on the specific direction. In this case, \(\max D\approx \varepsilon ^{2}\mu _{1}\) is in the direction of eigenvector \(v_{1}\) associated to the eigenvalue \(\mu _{1}\), and \(\min D\approx \varepsilon ^{2}\mu _{2}\) is in the direction of eigenvector \(v_{2}\) associated to the eigenvalue \(\mu _{2}\). This can be easily understood from Fig. 2b observing that the random attractor is flattened in the direction spanned by the eigenvector \(v_{2}\) and it is stretched in the direction of the other eigenvector \(v_{1}\). This example shows from one side how the deterministic forces acting with different strength along different directions of the state space contribute to mold the shape of the random attractor and, from the other side, the utility of the stochastic sensitivity matrix to describe the dynamics of the economic variables. Let us also note that the eigenvalues of this matrix, i.e. \(\mu _i(\alpha )\) (\(i=1,2\)), grow and tend to infinity when \(\alpha \) converges to \(\alpha ^{*}\), where \(\alpha ^{*}=2\) is the bifurcation value of the deterministic version of the model. This indicates that even the stochastic model (10) has a bifurcation at \(\alpha =\alpha ^{*}\).

For \(\beta =0.6\) and \(\sigma _1=0,\;\sigma _2=\sigma _3=1\): a plots of functions \(\mu _1(\alpha )\) and \(\mu _2(\alpha )\), b random states of model (10) with \(\varepsilon =0.01\) for \(\alpha =0.05\) (black), \(\alpha =0.8\) (light-grey), \(\alpha =1.95\) (dark-grey)

The specific effects of changing the values of \(\alpha \) on the set of random states can be observed in Fig. 2b, where the stochastic equilibrium of the Kaldor model is depicted for different values of \(\alpha \). In particular, in Fig. 2b, sets of random states of the system (10) forced by additive noise only (\(\sigma _1=0\), \(\sigma _2=\sigma _3=1\), \(\varepsilon =0.01\)) are plotted for \(\alpha =0.05\) (black), \(\alpha =0.8\) (light-grey), \(\alpha =1.95\) (dark-grey). As one can see, an increase in the value of the parameter \(\alpha \) does not necessary imply an increase in the dispersion of the random states. It is interesting to know, that the Andronov–Hopf bifurcation value \(\alpha _{*}=2\) is a critical point for both the deterministic and stochastic model. So, for \(\alpha \) in a neighborhood of \(\alpha _{*}\), the dispersion of states in the random attractor increases and tends to infinity.

For \(\beta =0.6\) and \(\sigma _1=1,\;\sigma _2=\sigma _3=0\): a plots of functions \(\mu _1(\alpha )\) and \(\mu _2(\alpha )\), b random states of model (10) with \(\varepsilon =0.01\) for \(\alpha =0.05\) (black), \(\alpha =0.8\) (light-grey), \(\alpha =1.95\) (dark-grey)

Let us now consider the influence of parametric (multiplicative) noise. In Fig. 3a, for \(\alpha \in (0,2)\) and \(\sigma _{1}=1\), \(\sigma _{2}=\sigma _{3}=0\), the eigenvalues \(\mu _{i}(\alpha )\) (\(i=1,2\)) of stochastic sensitivity matrix are plotted. It can be seen that under parametric noise both functions \(\mu _1(\alpha )\) and \(\mu _{2}(\alpha )\) are monotonous increasing for \(\alpha \in \left( 0,2\right) \). This means that the dispersion of random states around equilibrium monotonously increases as \(\alpha \) increases. Moreover, it is important to notice that this parametric noise does not alter the sign of the correlation between Y and K, which remains positive as for the additive noise.

Comparing Figs. 2a and 3a, it is observable a lower sensitivity of the Kaldor model to parametric noise than to additive noise as long as \(\alpha \) is small. This occurs because random changes in the difference between investments and savings are dumped by a small adjustment coefficient. The sets of random states generated by system (10) with parametric noise and \(\alpha =0.05\) (black), \(\alpha =0.8\) (light-grey), \(\alpha =1.95\) (dark-grey) are depicted in Fig. 3b. On the contrary, as highlighted above, the effects of additive noises \(\sigma _{2}\) and \(\sigma _{3}\) are not dumped by small values of the adjustment coefficient. All these details can be derived from the stochastic sensitivity matrices \(W\left( \alpha ,1,0\right) \) and \(W\left( \alpha ,0,1\right) \). This shows that the stochastic sensitivity matrix is a useful tool to understand the dynamics of the stochastic business cycle model and it is very easy to calculate since it requires just solving a linear system.

We can add that the analysis underlines a very important role played by the parameter \(\alpha \). Indeed, in the case of additive noise and \(\alpha \) close to zero, we have large excursion of the system out of the equilibrium value, where we easily move from situations of high levels of capital stock and investments to low level of capital stock and investment. In case of parametric noise, this is observable only for \(\alpha \) closed to the bifurcation value \(\alpha _{*}=2\). Another important feature to analyze is the amplitude of the random fluctuations of the two macroeconomic variables, which are of the same magnitude, i.e. the capital stock undergoes fluctuations of the same size as the ones of the level of activity. This feature of regularity gives indication that the system is at a regime in which the capital stock is adjusted to fit the differences in the level of activity and there are not problems of over or under accumulation of capital stock. This does not hold true in case of stochastic limit cycle as will be underlined in the next section.

3.2 Stochastic Cycles

As shown in sect. 2, for \(\alpha >\alpha _{*}\) (let us fix \(\alpha =4,\;\beta =0.6\)), the deterministic business cycle model exhibits a stable limit cycle. Instead, when we have either parametric noise (\(\sigma _1=1,\;\sigma _2=\sigma _3=0\)) or additive noise (\(\sigma _1=0,\;\sigma _2=\sigma _3=1\)), the model is characterized by a stochastic limit cycle.

The stochastic sensitivity matrix is not only useful to give information about the dispersion of random states around a stable equilibrium, but it can even be used to give information about the dispersion of the random states along the stable limit cycle. However, the calculations to obtain the stochastic sensitivity matrix \(W\left( t\right) \) are more complicated as they require solving a boundary value problem for a differential equation (22) and no longer a simple algebraic equation. Moreover, for a given limit cycle \({\varGamma }\), we have a matrix \(W\left( t\right) \) for any point of the closed orbit. In particular, for a two-dimensional dynamical system (as Kaldor model is), we have that

where p(t) is a normalized vector orthogonal to limit cycle \({\varGamma }\), \(\mu \left( t\right) \) is a scalar function (called stochastic sensitivity function), and operator \(\bullet ^{T}\) means transposition. The stochastic sensitivity function measures the dispersion of random states in a proximity of a point of the deterministic cycle (see Appendix for more details).

The stochastic sensitivity function \(\mu (t)\) calculated for the stochastic limit cycle generated by the Kaldor model (10) exhibits a cyclical pattern with wide fluctuations (see Fig. 4a). This shape of the function indicates a non-uniform dispersion of random states along the business cycle, as it can be observed in the numerical simulation of Fig. 4b. In particular we can recognize four different phases along the business cycle: two phases in which the level of activity and the capital stock move in the same direction, i.e. they both increase or decrease and two phases in which they move in different directions. For large values of Y and K we have that the first variable (i.e. the level of activity), decreases and the second one (i.e. the capital stock) increases. Those two opposite movements of the two variables reflect the basic economic property of short-period Keynesian models, i.e. an adjustment along the capital curve is much slower than the one along the income curve, see Gandolfo (2009), Kaldor (1940) and Kaldor (1971). Using the stochastic sensitivity function \(\mu \left( t\right) \) we found that these two last phases are the most sensitive to stochastic additive disturbances and the dispersion of the random states along these two phases is higher than along the other two phases. This indicates that periods of large amplitude variations are followed by periods of small amplitude variations. At a qualitative level, this dynamics along the business cycle mimics the phenomenon of “volatility clustering”, which occurs, as indicated in Mandelbrot (1963), when large changes tend to be followed by large changes, of either sign, and small changes tend to be followed by small changes.

An endogenous explanation of this phenomenon was already provided in Gaunersdorfer et al. (2008), where the authors show that volatility clustering arise when a deterministic model characterized by coexistence of two stable attractors (an equilibrium and a business cycle) is buffed by small noise. In the framework of our approach, thanks to the use of the stochastic sensitivity function, we show that even a deterministic model characterized by only one attractor can generate, once buffed by small additive noise, time series characterized by volatility clustering.

So far, we have analyzed the effects of an additive noise on the business cycle generated by the Kaldor model. Let us now turn to the parametric noise and let us compare the responses of the stochastic limit cycle of the model to additive and parametric noises of the same intensities. We observed already that Kaldor model reacts differently to parametric and to additive noise, but if at the equilibrium the dynamics of the Kaldor model was more sensitive to additive noise than to parametric noise, the order of sensitivity is reversed when the stochastic business cycle appears, i.e. when \(\alpha >\alpha ^*\). In fact, the Kaldor model is much more sensitive to parametric random disturbances along the limit cycle. See the values of \(M\left( \alpha \right) =\max \nolimits _{\gamma \in [0,T]}\mu \left( t,\alpha \right) \) in Fig. 5a. The value \(M\left( \alpha \right) \) plays an important role and measures the maximum level of dispersion of the random states along a stable closed orbit and we can consider it as a factor of sensitivity of a cycle \({\varGamma }\) to random disturbances. The sensitivity factor \(M\left( \alpha \right) \) is very useful to analyze how the sensitivity to random disturbances of the limit cycle changes as a parameter of the model changes. As the adjustment coefficient \(\alpha \) increases, the dispersion of the random states generated by parametric noise increases around the trajectory of the deterministic limit cycle, however the influence of the additive noise remains small and does not increase as \(\alpha \) increases (see Fig. 5a).

For \(\beta =0.6\): a stochastic sensitivity factor \(M(\alpha )\), b stochastic cycles (\(\alpha =10\)) for additive noise (\(\sigma _{1}=0\), \(\sigma _{2}=\sigma _{3}=1\)) with \(\varepsilon =0.001\) (black) and parametric noise (\(\sigma _{1}=1\), \(\sigma _{2}=\sigma _{3}=0\)) with \(\varepsilon =0.001\) (grey)

In Fig. 5b, random states of the stochastic cycle generated by additive noise, \(\sigma _1=0\), \(\sigma _2=\sigma _3=1\), \(\varepsilon =0.001\), are plotted in black and the ones by parametric noise, \(\sigma _1=1\), \(\sigma _2=\sigma _3=0\), \(\varepsilon =0.001\) are in grey. It is worth noting that under parametric noise the dispersion of the random states along the limit cycle is larger than the one observed with additive noise. Moreover, the two parts of the limit cycle in which the capital stock and the level of activity move in opposite directions, are characterized by a higher level of dispersion of the random states and the differences in the variance of the two economic variables along the limit cycle are more pronounced for the parametric noise in respect to the additive noise and they grow as the adjustment coefficient increases.

For both parametric and additive noise we have underlined a first important difference between the two regimes of the model, i.e. variance and covariance of the macroeconomic variables are constant at the stochastic equilibrium while they change over time at the stochastic limit cycle. Moreover, we have described how the dynamics of the Kaldor model responds to additive and parametric noise and the main differences between the dynamics of the attracting stochastic equilibrium and the dynamics of the attracting stochastic limit cycle.

Another interesting aspect is the different effect of noise on the two economic variables: level of activity and capital stock. This kind of information can be obtained from the stochastic sensitivity matrix W given in (14). For stochastic limit cycle, it is quite challenging to derive the stochastic sensitivity matrix as a function of \(\alpha \), although it is still possible to obtain this matrix for a single given value of \(\alpha \) and for different points of a limit cycle \({\varGamma }\). This is useful, as it allows us to compare how variance and covariance of the variables change passing from a single stationary equilibrium to a business cycle. Furthermore with this technique we can rely on a robust theoretical method to compute variance and covariance.

Considering additive noise only, we report the stochastic sensitivity matrix computed in two different points of the limit cycle, one point taken from the region of the phase space characterized by high volatility, high value of \(\mu (t)\), and the other one taken from the region of the phase space characterized by low volatility, low value of \(\mu (t)\):

-

W(t) calculated in correspondence of the maximum of \(\mu (t)\) is the following

$$\begin{aligned} W= \left[ \begin{array}{cc} 2.72881 \quad \quad &{} -0.89126\\ -0.89126 \quad \quad &{} 0.29110 \end{array} \right] . \end{aligned}$$(15) -

W(t) calculated in correspondence of the minimum of \(\mu (t)\) is the following

$$\begin{aligned} W=\left[ \begin{array}{cc} 0.00039 \quad \quad &{} 0.01254\\ 0.01254 \quad \quad &{} 0.39727 \end{array} \right] . \end{aligned}$$(16)

As we can see from matrix (15), in the point of maximum random state dispersion, the correlation between the level of activity and the capital stock is negative and the level of activity is characterized by a large variance, i.e. \(w_{11}\) takes a large value (\(w_{11}=2.72881\)). On the contrary, the variance of the capital stock is much smaller. Looking at matrix (16), we observe that in the point of minimum random state dispersion, the variance of the capital stock is increased, compared to the point of maximum random state dispersion, of a small amount, while the variance of the level of activity is almost null. Moreover, the correlation between the two variables is positive as for the case of the random equilibrium.

From the times series of the two economic variables Y and K (see Fig. 4c–d) we can observe that the fluctuations in the level of activity are much larger than the magnitude of fluctuations in the stock of capital. Along with this feature, we expect a different speed of reaction of the two variables to the noise, i.e. we expect that the variance of the capital stock will be sensitively lower than the variance of the level of activity. This reflects the fact that the stock of capital is an economic variable which can not change excessively in a short period as it requires time to be accumulated, and we expect a smaller variance of this variable compared to the one of the level of activity in any point of the business cycle. It is worth remembering that for a random equilibrium the variances of the two variables were almost the same.

All these elements underline the fundamental differences between the stochastic equilibrium of the Kaldor model and its stochastic business cycle, some of which are unobservable in the deterministic version of the model.

4 Noise-Induced Bistability in the Kaldor Model

In the previous section we have seen that random noise can induce quantitative changes in the stochastic dynamics of the Kaldor model. We have also presented a possible way to measure these quantitative changes and study the sensitivity to variations of the parameters. In this Section, we investigate the qualitative changes induced by random disturbances, i.e. we would like to understand if there are types of dynamics that are not observable in the deterministic version of the model. These noise-induced changes in the dynamics of the Kaldor model occur through the so-called stochastic bifurcations.

As can be seen from the bifurcation diagram of Fig. 1, if we cross, going from left to right, the Andronov-Hopf-bifurcation curve, we observe the creation of a small limit cycle which increases its amplitude as \(\alpha \) increases. On the contrary, if we cross, moving upwards, the Andronov–Hopf bifurcation curve, we observe the creation of a limit cycle which has a large amplitude. It is in this region of the space of the parameters, where equilibrium \(\left( {\bar{Y}},{\bar{K}}\right) \) is stable but crossing the Andronov-Hopf-bifurcation curve a business cycle of large amplitude appears, that the dynamical system becomes excitable to noise and stochastic bifurcations can occur. Stochastic bifurcations of randomly forced cycles were considered in (Bashkirtseva et al. 2009, 2015).

Choosing \(\alpha \) and \(\beta \) in order to be in the excitable region, in particular \(\alpha =2.2\) and \(\beta =0.593\), the noise-induced excitement found confirmation through numerical simulations (see Fig. 6). As noise intensity increases, the dispersion of random states increases too. But along with these quantitative changes, a new qualitative deformation of the probability density is observed. For weak noise, random states are concentrated in a small vicinity of the stable equilibrium (see Fig. 6a). In this case, the probability density has a single peak (see Fig. 6c). For further increasing of noise intensity, the probability density changes from unimodal to bimodal, through a P-bifurcation.Footnote 3 In this case, for \(\sigma _2=\sigma _3=1\), \(\varepsilon =0.05\), random states are concentrated in two separate areas of the phase plane (see Fig. 6b) and the corresponding probability density has two peaks (see Fig. 6d).

Example of P-bifurcation. For \(\alpha =2.2\), \(\beta =0.593\), \(\sigma _1=0\) and \(\sigma _2=\sigma _3=1\): a, b random states for model (10) for \(\varepsilon =0.001\) and \(\varepsilon =0.05\) correspondingly; probability density functions for c \(\varepsilon =0.001\) (unimodal density) and d \(\varepsilon =0.05\) (bimodal density)

In this Section, we have seen that along with the stable regime and the stable cycle, the stochastic Kaldor model can have an additional third type of dynamics characterized by bi-stability as a result of a P-bifurcation. One peak of the probability density function corresponds to the stable equilibrium of the deterministic system, while the second peak does not have a deterministic analogue. Thus, this simple two-dimensional model demonstrates how random disturbances induce a new dynamical trigger regime in nonlinear economics that can not be explained by a deterministic theory. This is important to analyze, as we show that bi-stability regimes in an economic business cycle model are observable even if the underlined deterministic component of the motion of the macroeconomic variables does not present bi-stability. In particular, the transition from a stable random equilibrium to a stochastic limit cycle is characterized by a phase of bi-stability due to the emergence of a bimodal probability density.

In Fig. 7, the time series of level of activity (Y) and capital stock (K) are plotted for monostable and bistable regimes of stochastic Kaldor model. In the monostable regime, variables Y and K randomly oscillate near equilibrium values \({\bar{Y}},\;{\bar{K}}\) (see Fig. 7a). In the bistable regime, a response of Y and K on random disturbances is quite different. Here, a capital stock K randomly oscillates with a sufficiently large dispersion while level of activity Y exhibits random jumps between two definitely separated random states. So, for high noise, a stochastic Kaldor model behaves as a trigger.

5 Conclusions

In this paper, we have analyzed the sensitivity of the Kaldor model of the business cycle to low intensity random disturbances using a stochastic sensitivity function technique. In particular, we have investigated how the adjustment coefficient in the level of activity affects the dispersion of the random states characterizing the attractors of the model for both additive and parametric noises.

The analysis reveals that the adjustment coefficient in the level of activity influences the dispersion of random states around the stochastic equilibrium of the model in a non-monotonically way if we consider additive noise. Indeed, the dispersion of the random states first decreases and then increases when the value of the adjustment coefficient increases. On the contrary, considering parametric noise and increasing the value of the adjustment coefficient, the dispersion of the random states around the equilibrium monotonically increases. At the same time, the investigations point out that the dispersion of the random states along the stochastic limit cycle is not evenly distributed, and it is possible to distinguish phases of large dispersion of random states that alternate with phases of low dispersion of random states. Stochastic sensitivity analysis shows that the dispersion of the random states along the cycle is mainly due to the perturbations on the level of activity, while the stock of capital is characterized by a small and almost constant variance along the cycle. This means that the level of activity is more sensitive to noise than the stock of capital. The fact that the level of stock of capital is less sensitive to small noise is reasonable in short-term economic models, where changes in the level of stock are expected to be limited.

Moreover, the analysis reveals that the noise affects the dynamics of the model not only quantitatively but also qualitatively. In fact, for certain parameter values we can observe a noise-induced bi-stability that occurs due to a P-bifurcation. This underlines that the Kaldor model of the business cycle can exhibit a type of behavior that is qualitatively different from the stochastic convergence to an equilibrium, oscillatory dynamics or a mix of the two (see Grasman and Wentzel (1994), for a discussion of this last type of dynamics).

As a final remark, we point out that the stochastic sensitivity function technique is a powerful method to study the dynamics of any other economic model. In particular, it could be interesting to use this technique to investigate the dynamics of a business cycle model which includes a financial sector in order to analyze the diffusion of the random disturbances through the economic and financial markets.

Notes

This idea was elaborated mathematically on the base of rigorous qualitative theory of differential equations in Chang and Smyth (1971) for the first time.

In his contribution Lorenz (1993), Lorenz proposed the Kaldor model in the so-called standard form. In this paper we adopt a similar model setup. This version of the Kaldor model differs from the one proposed in Chang and Smyth (1971) as it takes into account the depreciation of the stock of capital.

According to Arnold (1998), a P-bifurcation is a transition from a probability density function p to a new one q which is not equivalent to the first one, i.e. it does not exist two diffeomorphisms g, r such that \(p=g\circ r\circ q\). The transition from a unimodal density function to a bimodal is such a point.

References

Arnold, L. (1998). Random dynamical systems. Berlin: Springer.

Bashkirtseva, I. A., & Ryashko, L. B. (2000). Sensitivity analysis of the stochastically and periodically forced Brusselator. Physica A Statistical Mechanics and its Applications, 278, 126–139.

Bashkirtseva, I. A., & Ryashko, L. B. (2004). Stochastic sensitivity of 3D-cycles. Mathematics and Computers in Simulation, 66, 55–67.

Bashkirtseva, I. A., & Ryashko, L. B. (2011a). Analysis of excitability for the FitzHugh-Nagumo model via a stochastic sensitivity function technique. Physical Review E, 83, 061109–061116.

Bashkirtseva, I. A., & Ryashko, L. B. (2011b). Sensitivity analysis of stochastic attractors and noise-induced transitions for population model with Allee effect. Chaos, 21, 047514.

Bashkirtseva, I., Ryashko, L., & Schurz, H. (2009). Analysis of noise-induced transitions for Hopf system with additive and multiplicative random disturbances. Chaos, Solitons and Fractals, 39, 72–82.

Bashkirtseva, I., Ryazanova, T., & Ryashko, L. (2015). Stochastic bifurcations caused by multiplicative noise in systems with hard excitement of auto-oscillations. Physical Review E, 92, 042908.

Bischi, G. I., Dieci, R., Rodano, G., & Saltari, E. (2001). Multiple attractors and global bifurcations in a Kaldor-type business cycle model. Journal of Evolutionary Economics, 11, 527–554.

Chang, W. W., & Smyth, D. J. (1971). The existence and persistence of cycles in a nonlinear model: Kaldor’s 1940 model re-examined. Review of Econonic Studies, 38, 37–44.

Dembo, A., & Zeitouni, O. (2009). Large deviations techniques and applications. Berlin: Springer.

Dieci, R., Bischi, G. I., & Gardini, L. (2001). Multistability and the rule of noninvertibility in a discrete-time business cycle model. Central European Journal of Operations Research, 9(1–2), 71–96.

Dobrescu, L. I., & Opris, D. (2009). Neimark-Sacker bifurcation for the discrete-delay Kaldor model. Chaos Solitons and Fractals, 40, 2462–2468.

Freidlin, M. I., & Wentzell, A. D. (2012). Random perturbations of dynamical systems (3rd ed.). Berlin: Springer.

Gandolfo, G. (2009). Economic dynamics (4th ed.). Berlin: Springer.

Gao, J. B., Hwang, S. K., & Liu, J. M. (1999). When can noise induce chaos? Physical Review Letters, 82(6), 1132–1135.

Gaunersdorfer, A., Hommes, C. H., & Wagener, F. O. O. (2008). Bifurcation routes to volatility clustering under evolutionary learning. Journal of Economic Behavior & Organization, 67(1), 24–27.

Grasman, J., & Wentzel, J. J. (1994). Co-existence of a limit cycle and an equilibrium in Kaldor’s business cycle model and its consequences. Journal of Economic Behavior & Organization, 24, 369–377.

Horsthemke, W., & Lefever, R. (1984). Noise-Induced Transitions. Berlin: Springer.

Huang, D., Wang, H., & Yi, Y. (2010). Bifurcations in a stochastic business cycle model. International Journal of Bifurcation and Chaos, 20(12), 4111–4118.

Kaddar, A., & Talibi Alaoui, H. (2008). Hopf bifurcation analysis in a delayed Kaldor-Kalecki model of business cycle. Nonlinear Analysis: Modelling and Control, 13(4), 439–449.

Kaldor, N. (1940). A model of the trade cycle. Economic Journal, 50, 78–92.

Kaldor, N. (1971). A comment. Review of Economic Studies, 38, 45–46.

Krawiec, A., & Szydlowski, M. (1999). The Kaldor-Kalecki business cycle model. Annals of Operations Research, 89, 89–100.

Lorenz, H. W. (1993). Nonlinear dynamical economics and chaotic motion. Berlin: Springer.

Mandelbrot, B. B. (1963). The variation of certain speculative prices. The Journal of Business, 36(4), 394–419.

Metropolis, N., & Ulam, S. (1949). The Monte Carlo method. Journal of the American Statistical Association, 44(247), 335–341.

Mil’shtein, G. N., & Ryashko, L. B. (1995). A first approximation of the quasipotential in problems of the stability of systems with random non-degenerate perturbations. Journal of Applied Mathematics and Mechanics, 59(1), 47–56.

Mircea, G., Neamtu, M., & Opris, D. (2011). The Kaldor-Kalecki stochastic model of business cycle. Nonlinear Analysis, 16(2), 191–205.

Rodano, G. (1997). Lezioni Sulle Teorie Della Crescita e Sulle Teorie del Ciclo. Rome: Department of Economic Theory and Quantitative Methods, La Sapienza, University of Rome.

Ryashko, L., Bashkirtseva, I., & Stikhin, P. (2010). Noise-induced backward bifurcations of stochastic 3d-cycles. Fluctuation and Noise Letters, 9, 89–106.

Szydlowski, M., & Krawiec, A. (2005). The stability problem in the Kaldor-Kalecki business cycle model. Chaos, Solitons & Fractals, 25(2), 299–305.

Wu, X. P. (2011). Codimension-2 bifurcations of the Kaldor model of business cycle. Chaos, Solitons & Fractals, 44(1–3), 28–42.

Wu, X. P., & Wang, L. (2010). Multi-parameter bifurcations of the Kaldor-Kalecki model of business cycles with delay. Nonlinear Analysis: Real World Applications, 11(2), 869–887.

Acknowledgements

The authors would like to thank three anonymous referees and the editor for helpful comments and suggestions. A part of this paper was written while Davide Radi was visiting the Institute of Mathematics and Computer Science, Ural Federal University, in the spring of 2014. The kind hospitality and the financial support from the Ural Federal University are gratefully acknowledged.

Author information

Authors and Affiliations

Corresponding author

Appendix: Stochastic-Sensitivity-Function Technique for Equilibria and Limit Cycles

Appendix: Stochastic-Sensitivity-Function Technique for Equilibria and Limit Cycles

A standard mathematical model for the description of the results of random external disturbances is a system of stochastic differential equations (in either Ito’s or Stratonovich’s sense)

where x is an n-vector, f(x) is a n-vector function, w(t) is a l-dimensional standard Wiener process, \(\sigma (x)\) is a \(n\times l\)-matrix-valued function of disturbances and \(\varepsilon \) is a scalar parameter of noise intensity. Assuming that the deterministic system obtained by (17) fixing \(\varepsilon =0\) has an exponentially stable attractor (equilibrium or limit cycle), then the trajectories of the randomly forced system (17) leave this deterministic attractor and form a corresponding stochastic attractor which is described by a stationary probabilistic distribution \(\rho (x, \varepsilon )\). This stationary probability distribution is very difficult to obtain. In case of small noise, i.e. small \(\varepsilon \), it is possible to overcome the problem as stationary probabilistic distribution \(\rho (x, \varepsilon )\) can be approximated by

where \(v(x)=-\lim _{\varepsilon \rightarrow 0}\varepsilon ^{2}\ln \rho (x,\varepsilon )\) is called quasipotential function, see e.g. Freidlin and Wentzell (2012) and Dembo and Zeitouni (2009) for more details. According to the type of stable attractor of system (17) with \(\varepsilon =0\), i.e. a stable equilibrium or a stable closed orbit, we can obtain an approximation of the quasipotential function which helps us to understand the main features of a stochastic attractor of system (17).

Let us first consider the case of a deterministic exponentially stable equilibrium \(\bar{x}\) of system (17) with \(\varepsilon =0\). Using a quadratic approximation of the quasipotential (see Mil’shtein and Ryashko 1995) the stationary distribution of random states of the related stochastically forced equilibrium of system (17) can be approximated in Gaussian form as

where \(\varepsilon ^2 W\) is the covariance matrix, and W is a positive definite \(n\times n\)-matrix which can be easily obtained solving the matrix equation

The matrix W is called a stochastic sensitivity function (SSF) (see Ryashko et al. 2010, Bashkirtseva and Ryashko 2011, Bashkirtseva and Ryashko 2011) of the equilibrium \(\bar{x}\). This matrix characterizes the configurational arrangement and the size of the stationary distributed random states of the stochastic system (17) around the deterministic equilibrium \(\bar{x}\).

Let us now consider the case of an exponentially stable limit cycle \({\varGamma }\) for system (17) with \(\varepsilon =0\). This cycle has a natural parametrization given by function \(\xi (t)\) (T-periodic solution of system (17)). Indeed, it defines the one-to-one correspondence between orbit \({\varGamma }\) points and interval \(\left[ 0,T\right] \) time moments. Again, using a quadratic approximation of the quasipotential function v(x) in a neighborhood of the limit cycle \({\varGamma }\) (see Mil’shtein and Ryashko 1995) we can approximate the stationary distribution of random states of the stochastic forced limit cycle. Let \({\varPi }_t\) be a hyperplane orthogonal to the cycle at the point \( \xi (t)\; (0\le t < T) \). In this case, for the Poincare section \({\varPi }_t\) in the neighborhood of the point \(\xi (t)\), using a quadratic approximation of the quasipotential function v(x), the stationary distribution of random states of the stochastically limit cycle can be can approximated in Gaussian form as

where sign “\(+\)” stands for pseudoinversion and W(t) is a singular matrix called stochastic sensitivity matrix of cycle \({\varGamma }\) and it is the unique solution, see, e.g., Bashkirtseva and Ryashko (2004), of the Lyapunov equation

under conditions:

where \(J(t) = \displaystyle {\frac{\partial f}{\partial x}}(\xi (t))\), \(S(t) = \sigma (\xi (t))\sigma ^\top (\xi (t))\) , \(r(t) = f(\xi (t))\), P(t) is a matrix of the orthogonal projection onto the hyperplane \({\varPi }_t\).

For the case of two dimensional random dynamical system, which is the case of the model considered in this paper, the stochastic sensitivity matrix W(t) can be written as \(W(t)=\mu (t)P(t)\). Here, \(\mu (t)>0\) is a T-periodic scalar stochastic sensitivity function satisfying the following boundary problem (see Bashkirtseva and Ryashko 2000)

with T-periodic coefficients

where p(t) is a normalized vector orthogonal to \(f(\xi (t)).\) The explicit formula for the solution \(\mu (t)\) of the problem (24) is given by

where

The quantity \(M=\max \mu (t),\;t\in \;[0,T]\) is called stochastic sensitivity factor and it plays an important role in the analysis of the stochastic dynamics near a limit cycle as it measures the maximum degree of dispersion of the random states around the limit cycle \({\varGamma }\).

Rights and permissions

About this article

Cite this article

Bashkirtseva, I., Radi, D., Ryashko, L. et al. On the Stochastic Sensitivity and Noise-Induced Transitions of a Kaldor-Type Business Cycle Model. Comput Econ 51, 699–718 (2018). https://doi.org/10.1007/s10614-016-9634-8

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10614-016-9634-8