“…when presented with seemingly identical opportunities and motives, why does one person or organization turn to fraud and another does not? No one really knows.”

(Wells 2004, p. 74)

Abstract

We introduce the concept of fraud tolerance, validate the conceptualization using prior studies in economics and criminology as well as our own independent tests, and explore the relationship of fraud tolerance with numerous cultural attributes using data from the World Values Survey. Applying partial least squares path modeling, we find that people with stronger self-enhancing (self-transcending) values exhibit higher (lower) fraud tolerance. Further, respondents who believe in the importance of hard work exhibit lower fraud tolerance, and such beliefs mediate the relationship between locus of control and fraud tolerance. Finally, we find that people prone to traditional gender stereotypes demonstrate higher fraud tolerance and document subtle differences in the influence of these cultural attributes across age, religiosity, and gender groups. Our study contributes to research on corporate governance, ethics, and the antecedents of work-place dishonesty.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

Introduction

Seemingly honest people will occasionally resort to dishonest behavior in their daily lives (Mazar et al. 2008). An important question is: Why? Understanding the attitudes that influence tolerance toward dishonesty is important to identify the roots of deviant behavior that can affect a business organization. Tolerance for dishonesty “stems from a complex interplay of motivations and circumstances, moderated by morality, opportunity, social norms, and institutional context” (Akbaş et al. 2019; Ariely et al. 2019; Tennyson 2008, p. 1181; Zahra et al. 2005). In a business or organizational environment, dishonesty often translates into fraudulent behavior, broadly defined as an intentional deception “to obtain an unjust or illegal [economic] advantage” (International Standard on Auditing 240, paragraph 10). Fraud can also be described as “a knowing misrepresentation of the truth or concealment of a material fact to induce another to act to his or her detriment” (Association of Fraud Examiners 2020b). The two key elements of each definition are (1) an intent to deceive and (2) a goal to obtain inappropriate benefits. In this paper, we examine the link between personal beliefs and values that are shaped by social attitudes and individual tolerance toward inappropriate behavior that involves deception for financial gain.

According to the estimates from the recent study by the Association of Fraud Examiners (ACFE), a typical organization loses around 5% of its revenue to fraud which would imply the projected annual fraud losses in the global economy of around $4.5 trillion (Association of Fraud Examiners 2020a, p. 9). While hoping that most people are honest, many organizations respond to the threat of fraud by tightening internal controls and increasing corporate surveillance. However, scholars note that such measures are not only insufficient in cases of collusion or management override of controls (Ramamoorti and Olsen 2007) but might even increase fraud risk due to eroded trust and growing resentment (Tennyson 2008). Donald Cressey, whose empirical study on the psychology of embezzlers led to the creation of the influential fraud triangle framework, notes in the introduction to his seminal book “Other People’s Money: A Study in the Social Psychology of Embezzlement”: “The general argument ordinarily is that embezzlement can be eliminated by tighter accounting controls. My response was, and is that modern business necessarily requires conditions of trust and that, therefore, accounting controls rigid enough to eliminate embezzlement … will also eliminate business” (Cressey 1973, p. xiii).

Scholars who recognize the limitations of formal organizational procedures advocate, instead, informal controls such as social and professional norms, community standards of fairness, peer pressure, belief systems and personnel/cultural controls (Merchant and White 2017; Noreen 1988; Ramamoorti and Olsen 2007; Simons 1995; Suh et al. 2020). These scholars stress the need to understand fraudster reasoning as well as the collective morality that is likely to influence an individual’s behavior (Arnaud and Schminke 2012; Bruns and Merchant 1990; Eabrasu 2020; Merchant and Rockness 1994; Soltes 2016; Umphress and Bingham 2011). Extensive studies have shown that people will not always cheat even if they have incentives and opportunities of doing so (e.g., Ariely et al. 2019; Gneezy 2005; Jolls et al. 1998; Kahneman et al. 1986; also see Fehr and Schmidt 2006 for a review). Many big frauds start small when executives blindly step on the “slippery slope” of fraud, driven by overconfidence, motivated reasoning, and self-deceit (Baron et al. 2015; Bénabou and Tirole 2016; Campana 2016; Cohen et al. 2010; Theoharakis et al. 2020; Schrand and Zechman 2012).

In this connection, an ex ante attitude toward fraud in general, which we call “fraud tolerance”, may be an important factor for assessing fraud risk; that is, tolerance toward dishonest behavior in general makes it easier for an individual to rationalize a specific fraudulent activity, thus increasing chances for fraud to occur (Alm and Torgler 2006; Alm et al. 2006; Cummings et al. 2009; Dulleck et al. 2016; Rodriguez-Justicia and Theilen 2018; Torgler 2007b, p. 201; Torgler and Schneider 2009).Footnote 1 To measure fraud tolerance we use questions from the World Values Survey (WVS) on whether people will generally justify certain deviant acts, such as cheating on taxes, avoiding payment for public transportation, and claiming undeserved government benefits. The World Values Survey is a global project that contains responses from individuals in numerous countries on a variety of social, economic, and political issues.Footnote 2

Fraud-related attitudes are socially constructed and reflect implicit assumptions acquired through socialization (Akers 1996; Sutherland 1940): “to the extent that individuals learn their attitudes from others, if … fraud is accepted by one's peers then one will be more likely to also find fraud acceptable” (Collins et al. 2009; Tennyson 2008, p. 1192). What is lacking from this literature is an understanding of how specific beliefs and values may shape fraud tolerance. Prior empirical research on determinants of fraud attitudes focused almost exclusively on cross-country institutional or macro-sociological factors such as trust toward government, courts, or parliament and was generally limited to the context of tax evasion (e.g., Frey and Torgler 2007; Heinemann 2011; Konrad and Qari 2012; Mickiewicz et al. 2019; Torgler and Schneider 2007). At the same time, limited studies in management on intra-country differences in individual attitudes toward fraud mostly focus on consumer views on insurance fraud. Those studies reported that fraud attitudes were influenced by social norms and perceptions of equity (Haithem and Jeongsoo 2019; Tseng and Kuo 2014).

We build on these two streams of research—cross-country cultural studies in sociology and management studies on the insurance fraud—to examine the role of individual beliefs and values in the intra-country individual differences in “fraud tolerance”.Footnote 3 These individual beliefs and values, while affected by the myriad of micro-sociological factors (e.g., family upbringing, belonging to a certain social group, professional expectations), can be directly targeted and transformed through informal organizational controls (e.g., Heinicke et al. 2016; O'Reilly 1989; O'Reilly and Chatman 1986; Sihag and Rijsijk 2019). Thus, the evidence on specific beliefs and values that decrease fraud tolerance could be used to design management systems to reduce fraud occurrence in any organization.

In this paper, we first review studies in criminology, sociology, and social psychology to identify several beliefs and values examined through the World Values Survey that are likely to affect fraud tolerance: (1) self-enhancing and self-transcending value orientations, (2) locus of control, (3) beliefs in importance of hard work, and (4) gender attitudes. Researchers have suggested to combine theory-building with information mining to achieve a deeper understanding and more precise modeling of a phenomenon of interest. More specifically, a researcher needs to develop “an iterative approach that uses information mining outcomes as inputs into the theory construction and validation processes” (Gopal et al. 2011, p. 730). Consistent with this perspective, we employ PLS-SEM—a method especially suitable for exploratory analysis and iterative theory-building—and examine the relationships between specific values and beliefs and our construct of fraud tolerance using data collected in the United States during the sixth wave (2011) of the WVS.

We observe that people with stronger self-enhancing (self-transcending) values exhibit higher (lower) fraud tolerance. Further, we observe that respondents who believe in the importance of hard work for success exhibit lower fraud tolerance. Locus of control does not affect fraud tolerance directly but an internal locus of control is positively associated with people’s beliefs in the importance of hard work, i.e., beliefs in importance of hard work mediate the relationship between the feeling of being in control and fraud tolerance. We also find that people prone to traditional gender stereotypes demonstrate higher fraud tolerance. A self-transcending orientation has a much stronger positive impact on fraud tolerance for women than for men. At the same time, the feeling of being in control is a more important determinant of beliefs in hard work as a success factor for men than for women. Taken as a whole, the evidence highlights significant variability in fraud tolerance in the US population that confirms the importance of customizing anti-fraud programs to specific environments.

Our study contributes to several distinct streams of literature: (1) corporate governance, (2) ethics, and (3) the antecedents of work-place dishonesty. Scholars stress the need for executives and Boards to understand the human component of fraud and avoid a check-list mentality in anti-fraud efforts (Mintchik and Riley 2019; Soltes 2016). In this connection, empirical evidence on values and beliefs that increase employee resilience to pressures and decrease employee inclination to justify financially motivated dishonesty, provides important insights to those responsible for corporate governance. Since we focus on justifications of the broadly defined “deception for personal gain”, the findings of this study should be especially relevant for addressing the risk of middle-level employee fraud such as misappropriation of assets, which accounts for 86% of cases in the 2020 ACFE study (Association of Fraud Examiners 2020a). The results related to fraud tolerance could assist corporate Boards and Audit Committees in designing customized interventions that boost desirable values and beliefs as a part of an effective enterprise risk management program.

We also contribute to extensive literature on ethics and business ethics education (e.g., Bampton and Cowton 2013; Dellaportas 2006; Martinov-Bennie and Mladenovic 2015; Mayhew and Murphy 2009; Merchant and White 2017; Mintchik and Farmer 2009; also see review in Treviño et al. 2006). For example, our study might be of interest to scholars who apply the innovative “Giving Voice to Values” (GVV) methodology in their classrooms. This emerging approach of teaching business ethics explicitly focuses on value conflicts in ethical dilemmas (Arce and Gentile 2015; Christensen et al. 2018; Cote et al. 2011; Edwards and Kirkham 2014), and our findings highlight specific values and beliefs that should be cultivated through the curriculum to decrease fraud tolerance and, therefore, fraud risk.

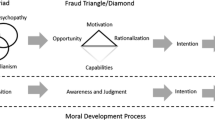

Finally, we reconcile and extend the literature on the antecedents of work-place dishonesty. In the accounting, auditing and fraud examination literature, the dominant paradigm is based on the fraud triangle which is derived from interviews with convicted embezzlers conducted in 1949 (Cressey 1953; see Morales et al. 2014 for additional details). Some scholars have argued that the American Institute of Certified Public Accountants (AICPA) “moved too quickly in adopting Cressey’s fraud triangle as the explanatory model for financial fraud” (Donegan and Ganon 2008), stressing the dearth of empirical evidence in support of the framework’s propositions and the need to better define its key constructs (Hogan et al. 2008; Mayhew and Murphy 2014; Murphy 2012; Murphy and Dacin 2011; Trompeter et al. 2013). Others have suggested the need to distinguish a general ex ante predisposition toward fraud from the specific rationalization that occurs at the time fraud is contemplated (Murphy 2012). As a result, there have been calls for more research on personality factors that may be suggestive of heightened fraud risk (Cohen et al. 2010; Dorminey et al. 2010, 2012; Epstein and Ramamoorti 2016; Johnson et al. 2013; Wolfe and Hermanson 2004).

In this paper, we introduce the construct of “fraud tolerance”, the personality factor that reflects ex ante predilection or attitudes toward fraud in general as shaped by societal and organizational culture (Coleman 1987; Donegan and Ganon 2008; Free and Murphy 2015; Murphy and Free 2016). Current auditing standards cite “an attitude, character, or set of ethical values that allow … knowingly and intentionally commit a dishonest act” among three conditions that generally are present when fraud occurs (PCAOB 2020 AS 2401, par. 7). However, this discussion is not sufficiently precise for empirical testing since it mixes together the ability to rationalize the specific fraud, a general attitude toward acceptability of fraud, and even the broader notion of a set of ethical values. These are related, but distinct, empirical constructs. Consequently, we consider “fraud tolerance” as a specific subset of ex ante fraud attitudes that reflects the degree to which a person can justify fraud in general. Adding “fraud tolerance” to the model as an underlying factor of rationalization may help overcome commonly cited limitations of the fraud triangle framework by connecting specific fraud rationalizations with broader societal forces that may shape an individual’s tolerance for fraud.

We organize the remainder of the paper as follows: In the next section we describe the World Values Survey, summarize prior research that used similar WVS questions, explain in detail the “fraud tolerance” construct, and connect fraud tolerance with fraud-related outcomes. In the subsequent sections, we develop an exploratory research model that links values and beliefs to fraud tolerance, discuss Partial Least Squares Structural Equation Modeling (further PLS-SEM) technique and explain the latent constructs, indicators, and measurements for all study variables. We proceed with the discussion of the results of PLS-SEM tests as well as additional sensitivity tests and conclude by highlighting the study’s limitations and related research opportunities.

World Values Survey and the “Fraud Tolerance” Construct

The Association of Fraud Examiners (ACFE) broadly defines fraud as “any crime for gain that uses deception as its principal modus operandus” and “any intentional or deliberate act to deprive another of property or money by guile, deception, or other unfair means” (Association of Fraud Examiners 2020b). As the unifying framework for understanding fraud, ACFE promotes the fraud triangle, which attributes occupational fraud to the simultaneous emergence of three crucial factors: (1) perceived pressure, (2) perceived opportunity, and (3) an ability to rationalize deviant behavior.Footnote 4 The ACFE founder J. T. Wells derived these three factors from the interview-based Ph.D. thesis about motivations of embezzlers of Donald Cressey (Cressey 1953), who, in turn, was extending ideas of his dissertation advisor Edwin Sutherland (1940) on differential association and cultural roots of white collar crime (see Morales et al. 2014 for details). The term fraud triangle was also promoted, and extended, in accounting literature by Steve Albrecht (see Albrecht 2014). Since its introduction in the late 1980s, the fraud triangle has become the dominating framework in accounting research and practice: it is included in auditing standards (ISA 240, AU 316), represents the focus for fraud risk assessment in the COSO framework for internal control (COSO 2013, principle 8), and is the cornerstone of forensic auditing (Albrecht and Albrecht 2004; Morales et al. 2014; Wells 1997). However, scholars suggest that the framework does not consider the societal roots of fraud (Donegan and Ganon 2008), i.e., the framework does not fully integrate the defining roles of culture and the “tone at the top” in conditioning fraudulent activity.

We argue that this perspective may be due to limited inclusion of empirical findings in sociology and criminology (Morales et al. 2014). We build on those studies (discussed later), as well as on the original Cressey’s insights, to suggest that the ease with which people can rationalize a particular fraud (keeping all other aspects the same) depends on their ex ante attitudes toward fraud in general, i.e., fraud tolerance. These attitudes do not emerge in a vacuum but instead reflect the fraudster’s socialization and internalized communal views regarding inappropriate economic behavior. As Cressey (1973) noted, all individuals are exposed to verbalizations that condone certain activities and reflect the collective morality of a social group to which the person belongs. “Such verbalizations necessarily are impressed upon the person by other persons … Before they are internalized by the individual they exist as group definitions of situations in which crime is ‘appropriate’.” (Cressey 1973, p. 96). That is, when tempted with fraud opportunities, people simply adjust group and personal general rationalizations to a specific situation formulated within a set of social interactions.Footnote 5 Several questions in the World Values Survey capture these internalized communal attitudes toward fraud and provide an opportunity to empirically test some of their determinants.

Fraud Tolerance as measured through the World Values Survey

The World Values Survey (WVS) provides a great deal of data on individual attitudes across the globe and is considered “the largest non-commercial, cross-national, time series investigation of human beliefs and values ever executed, currently including interviews with almost 400,000 respondents” on a wide range of topics (World Values Survey 2020, par. 2). Of relevance to this paper are people’s responses to the questions on the ease with which they can justify certain acts that involve deception for financial gain (assessed on a 10-point scale). More specifically, we use three WVS questions that capture people’s attitudes toward the following examples of dishonest behavior: (1) claiming undeserved governmental benefits (question V198), (2) avoiding fares on public transport (V199), and (3) cheating on taxes (V201). Scholars from economics and sociology have used these WVS questions to explore a variety of social issues.Footnote 6 For example, Halpern (2001) conducts a factor analysis of all WVS questions related to the justification of various behaviors, including divorce, euthanasia, driving while impaired, and economic crimes, to develop a metric of “moral tolerance”. Halpern (2001) stresses the multi-dimensional nature of “moral tolerance” and the consistent emergence of a “self-interest” factor that loads heavily on WVS questions on the ease of justifying dishonest actions.

Along the same lines, Knack and Keefer (1997) utilized WVS questions on justifying economic crime to develop a composite country-level measure of “civic cooperation”, a proxy for social capital. Many other researchers followed Knack and Keefer’s approach in various investigations of deviant economic behavior. For example, Cullen et al. (2004) use WVS questions to measure a manager’s “willingness to justify ethically suspect behaviors”. Letki (2006) and James (2015) focus on “generalized morality” that relates to “norms about ‘other-regarding’ attitudes and behaviors, particularly those that prohibit actions that benefit oneself but which also cause harm to others” (p. 166) and extends to people beyond the immediate family or close friends.Footnote 7 Other scholars have used WVS questions to look at “public morality”, “civic morality” or “moral restraint” (Rose 2011). Finally, the responses to the WVS question about cheating on taxes are commonly employed as a proxy for tax morality and tax compliance (Alm and Torgler 2006; Torgler 2012; Torgler and Valev 2010; Torgler et al. 2010).Footnote 8

Overall, prior research considers civic and tax morality as a subset of the broader notion of economic morality, i.e., “a particular set of justice perceptions and the moral order of the economy …, shaped by economic contexts, constrained by cultural forces and expressed through individual behavior” (Arnold 2001; Karstedt and Farrall 2006; Lopes 2010, p. 113). Beside fraud-related justifications, the area of economic morality includes people’s attitudes toward pirating software, shoplifting, and other transgressions that Karstedt and Farrall (2006) combine under the notion of “everyday crime”. In this study, we use WVS questions that capture people’s attitudes toward several instances of dishonest behavior that involves deception for personal gain as indicators of our latent construct. We distinguish between deviant economic behavior and fraud by highlighting the role of deception in situations where fraud occurs, i.e., there is more than simply opportunity at work. Since our focus is broader than tax compliance, but narrower than economic crime in general we label this construct fraud tolerance.

Previous Studies Connecting WVS Responses with Actual Behavior

Numerous studies have established the connection between WVS responses to these questions and actual deviant behavior. For example, Halpern (2001) documents a positive correlation of “self-interest” with crimes reported on the International Crime Victims Survey, i.e., crime at large. In the economic sphere, Knack and Keefer (1997) report a positive impact of “civic cooperation” on growth in per capita income and investment rates. Knack and Keefer (1997) also note the association between civic cooperation and the frequency with which lost wallets are returned intact to their owners in different countries, suggesting a link between some of the attitudes we incorporate in fraud tolerance and one specific altruistic (anti-fraud) behavior.Footnote 9 More specifically, “tax morality” has been shown to be an important driver of actual tax compliance (Cummings et al. 2009; Dulleck et al. 2016; Rodriguez-Justicia and Theilen 2018; Torgler 2016), and a higher level of tax morality in a country is associated with a smaller shadow economy and lower corruption (Alm and Torgler 2006; Alm et al. 2006; Torgler 2007b; Torgler and Schneider 2009). In accounting, Knechel et al. (2019) demonstrate that civic cooperation is positively associated with the presence of high-quality audit firms and the level of audit fees in countries with weak investor protection, suggesting that countries with a strong sense of civic cooperation place more faith in the audit function (another anti-fraud behavior).

Research Questions and Exploratory Research Model

A tolerance of fraudulent behavior does not develop in a cultural vacuum, but culture is a complex construct. The WVS survey contains many theoretical constructs that have been validated by previous studies that we expect could influence “fraud tolerance”. In the following sections, we summarize research on some of these well-established constructs and develop an exploratory research model for assessing fraud tolerance. Findings across various disciplines suggest that the three of the main cultural factors that would influence tolerance toward fraud are values, beliefs, and demographics.

Values are fundamental cultural attributes that “explain motivational bases of attitudes and behavior” (Schwartz 2012, p. 3). Studies in psychology define values as “cognitive representations of basic motives: they specify a culture’s conception of what is important and socially desirable, and they guide goal strivings and the way events and people are evaluated” (Trapnell and Paulhus 2012, p. 39). Values differ from emotions and opinions in a sense that they are more stable and “transcend specific actions and situations” (Schwartz 2012, p. 4). Internalized values also differ from externally imposed social norms and should not be confused with beliefs about the truthfulness of a particular statement (e.g., “hard work is necessary for success”). Beliefs reflect our subconscious assumptions about the outside world that we do not question (Rokeach 1968), while values motivate and direct our behavior. In this paper, we examine the relationship of several values and beliefs with our construct of fraud tolerance as summarized in Fig. 1, including: (1) self-enhancing/transcending values, (2) perceptions about locus of control, (3) belief in hard work, and (4) attitudes toward gender.Footnote 10

Self-enhancing and Self-transcending Values

Two recent commentaries suggest that an individual’s inclination to commit fraud relates to ego and value orientation. For example, Dorminey et al. (2010, 2012) consider entitlement or ego as fraud motivators in their MICE (money, ideology, coercion, ego) model. Wolfe and Hermanson (2004) also stress ego as one of the essential fraud-related attributes in their Fraud Diamond Model.Footnote 11 In psychology and criminology research, ego is linked to a self-enhancing vs. self-transcending value orientation, constructs developed by Shalom H. Schwartz as an outcome of the life-long research program that included collection and analysis of responses from more than 60,000 individuals in 64 nations (e.g., Schwartz 1992, 1994, 1999, 2012). A self-enhancing value orientation captures a person’s preference for social status, prestige, wealth, control, and influence over others. A self-transcending value orientation reflects inclination toward tolerance, appreciation, empathy, and protection of others. While most people usually adopt values from both dimensions to some extent, they tend to prioritize one over the other depending on a particular decision or situation. Schwartz (2012) stresses that values are fundamental motivators of a person’s attitudes and actions, i.e., people judge certain events, situations, or individuals as good or bad by applying their values as criteria.Footnote 12

Several studies have examined the impact of self-enhancing and self-transcending values in a business context. Fritzsche and Oz (2007) document a negative (positive) association of the self-enhancing (self-transcending) value orientation with an ethical resolution of typical business dilemmas. Steenhaut and Kenhove (2006) report that people with a stronger self-enhancing value orientation are more likely to accept inappropriate business practices.Footnote 13 Plufrey and Butera (2013) document that students with a higher self-enhancing value orientation are more tolerant toward cheating. Following these observations, we formulate our first research question:

Research Question 1 (RQ1): To what extent does adherence to self-enhancing and self-transcending values affect fraud tolerance?

Locus of Control

Another factor that has been useful in predicting criminal behavior is the concept of “locus of control” (Rotter 1966). This construct captures people’s beliefs in their ability to exercise control over the events in their lives (Rotter 1966). Individuals with a strong internal locus of control attribute the outcomes of their actions to their abilities and hard work while individuals with a strong external locus of control look to luck or the influence of powerful people to explain what happens to them.Footnote 14 Prior research has documented the connection between locus of control and deviant behavior. For example, managers with an external locus of control are more likely to model their actions after the behavior of others rather than relying on their internal values (Forte 2005). Further, auditors with an external locus of control are more accepting of premature sign-offs or underreporting of time (Donnelly et al. 2003), are more likely to concede to client pressure (Tsui and Gul 1996), and make decisions that are less consistent with their ethical attitudes (Cherry 2006). Prior studies also suggest that locus of control interacts with moral reasoning to influence a person’s actions (Frost and Wilmesmeier 1983; Murk and Addleman 1992; Trevino 1990). For example, locus of control moderates the impact of personal values on behavioral intentions (Lin and Ding 2003), ethical judgment on whistleblowing (Chiu 2003), and ethical attitudes toward bribery (Cherry 2006). This discussion leads to our second research question:

Research Question 2 (RQ2): To what extent does an internal or external locus of control affect fraud tolerance?

Belief in Hard Work

While locus of control may describe an individual’s general beliefs, the literature also stresses the importance of work-related beliefs on an individual’s behavior. A person’s values affect an individual’s definition of what constitutes success, while beliefs determine the acceptable ways to achieve success. Beliefs “function as a perpetual filter through which work experiences are interpreted” (Barling et al. 1998, p. 113). Using meta-analysis, Furnham (1990) reports that “respect for, admiration of, and willingness to take part in hard work” (p. 391) is the most important factor that emerges from the analysis of different studies on work-related beliefs.Footnote 15 For example, individuals that value hard work achieve greater productivity, experience higher job satisfaction, and are more involved in their job. They are also more resilient to negative feedback, have a stronger moral commitment to their organization, and are less likely to cheat or to exhibit Machiavellian attitudes (Jones 1997; Kidron 1978). MacDonald (1971) reports a positive correlation between beliefs in hard work and adherence to the ethics of social responsibility. Dweck (2006, 2012) shows a connection between students’ beliefs in hard work and their long-term success. Overall, prior research supports the notion that individuals who hold a stronger work ethic are likely to be more resistant to fraud temptations, leading to our third research question:

Research Question 3 (RQ3): To what extent do beliefs in hard work affect fraud tolerance?

Prior research also suggests that general beliefs, such as locus of control, affect behavioral intentions through their impact on more context-specific beliefs. For example, McCarty and Shrum (2001) report that beliefs in the importance of recycling mediate the relationship between internal locus of control and recycling behavior. Darwish (2000) and Yousef (2000) document that an Islamic work ethic mediates the relationship between locus of control and role ambiguity. Prior research has also accumulated substantial evidence that locus of control affects many work-related attitudes, including job-related affective reactions (see Galvin et al. 2018 for a review). In particular, people with an internal locus of control have a stronger need for achievement, pursue more difficult goals, and apply greater effort to professional tasks (Ng et al. 2006), leading to our next research question:

Research Question 4 (RQ4): Do beliefs in hard work mediate the impact of locus of control on fraud tolerance?

Effect of Gender Attitudes

Research has suggested that men and women possess different beliefs as to what constitutes ethical behavior (Gilligan 1993; Smith and Oakley III 1997). For example, Fritzsche (1988) reports that male marketing managers are more likely to ask for a bribe than their female colleagues, while Alm and Torgler (2006) report that women exhibit higher tax morality than men. Related to this observation, research also documents the existence of a gender bias—beliefs that men are generally stronger leaders and better professionals than women—which affects a variety of business decisions and evaluations (MacLellan and Dobson 1997; Ridgeway 1997; Scott and Brown 2006). Fay and Williams (1993) provide experimental evidence that female applicants face more challenges when applying for business loans. Along the same lines, Bigelow et al. (2014) confirm that female CEOs may be perceived as less capable than male CEOs with similar credentials. Coffman et al. (2017) demonstrate how differences in average performances between males and females on certain tasks can lead to gender discrimination in hiring. Ridgeway (2011) summarizes evidence from multiple disciplines on how gender-related beliefs affect organizational practices, stressing that people are especially prone to gender biases in novel and uncertain situations. Gender attitudes might be associated with what one considers as “fair” when dealing with others, so it might also be associated with one’s attitudes toward deviant economic behavior. However, there is little evidence on how gender attitudes link to fraud, leading to our final exploratory research question:

RQ5: To what extent does gender bias affect fraud tolerance?

Sample and Method of Analysis

Sample

The data for our analysis comes from the US responses to the World Values Survey in 2011, the most recent data available known as Wave 6 data. We restrict the sample to the US to avoid the confounding effect of country-level political, economic, and cultural differences. The sample was specifically designed to be representative of the entire adult population of the USA (i.e., 18 years and older).Footnote 16 The survey took place between 6/9/2011 and 7/5/2011 and was conducted in both English and Spanish. A total of 2,232 responses were obtained from 3,150 requests (70.86% cooperation rate) (Inglehart et al. 2014). Of the 2,232 available responses, we delete 416 observations with missing data, resulting in a final sample of 1,816 observations, of which 924 are women (50.9%) and 892 men (49.1%). The participants’ ages range from 18 years (the minimum age requirement for the survey) to 93 years. The mean (median) participant age in the sample is 49.12 (50).Footnote 17 We report other demographics on attained education, family, and immigration status in Table 1, Panel A.

Research Method: Partial Least Square Structural Equation Modeling (PLS-SEM)

We analyze our research questions using Partial Least Squares Structural Equation Modeling (PLS-SEM) (Hair et al. 2017). PLS-SEM is a second-generation multivariate technique that emerged in the late 1980s and gained popularity in the 1990s (e.g., Chin 1998; Fornell and Cha 1994; Wold 1985). PLS-SEM is a variance-based tool that combines factor analysis with regression techniques to examine the relationships between latent, non-directly observed variables and includes evaluation of two sub-models: the Measurement Model and the Structural Model. The measurement model reflects the appropriateness of the particular indicators for the measurement of the desired latent variable. The structural model represents the relationships between the latent variables of interest. The assessment of parameters of both sub-models is performed simultaneously, and the method “places minimal demands on sample size and residual distributions” (Nambisan and Baron 2010, p. 563). PLS-SEM “is ideally suited to the early stages of theory development and testing” in the areas where a generally accepted analytical theory is lacking and empirical evidence is scarce (Staples et al. 1999, p. 765). PLS offers “the high degree of flexibility … for the interplay between theory and data” and allows “learning in a data-driven fashion” (Nitzl 2016, p. 20, p. 24). PLS is also “more appropriate than maximum likelihood structural equation methods like LISREL and its derivatives” for prediction (Milberg et al. 2000, p. 45), such as inferring an individual’s fraud tolerance from observable value orientations.

Design of the World Values Survey and Common Method Bias

Torgler (2016) notes the advantage of extracting data on sensitive individual attitudes from a wide-ranging survey such as WVS because the responses are not linked to any specific purpose or viewpoint. Special purpose surveys may create a “demand effect” and “the sensitive nature of compliance information can make it difficult to obtain accurate responses” (Torgler 2007a). In this case, participants are likely to be less suspicious of answering questions about tax evasion and other fraudulent behavior. As a result, a social desirability bias—responding to a survey in a way that is prescribed by social norms or providing an answer the respondent thinks the surveyor wants to hear—is reduced.

Social desirability bias is just one of several potential biases exhibited by an individual that may contaminate survey responses and introduce measurement error in survey-based research (Podsakoff et al. 2003, 2012; Speklé and Widener 2018, p. 5). This issue is generally referred to as “common method bias” (CMB) (Podsakoff et al. 2003), and such concerns may be warranted when both dependent and independent variables represent attitudes or similar self-reported constructs (Bertrand and Mullainathan 2001; Bouwens 2017). Research suggests two broad approaches to address CMB: (1) procedural adjustments and (2) statistical remedies (Bouwens 2017; Podsakoff et al. 2012). The former strategy requires thoughtful survey design and data collection to avoid obvious sources of bias, as well as obtaining data from different sources when feasible. The second step utilizes post hoc tests for CMB presence, with post hoc adjustments if CMB is detected.

The World Values Survey clearly adopts best practices for survey design and administration. At the beginning of the survey, the respondents were assured of strict confidentiality (see Appendix 1). The survey consisted of 250 questions that were asked in different ways, in different formats, and with different scales. The questions used in this paper were separated from each other across the entire survey. We also completed several post hoc tests to assess the potential presence of CMB in our data as discussed later in the paper.

Latent Constructs, Indicators and Measurements

Except for locus of control, which is a single-item construct, we model all other variables in this study as reflective latent constructs represented by the following set of indicators:Footnote 18

-

Fraud tolerance: We use the responses to questions V198, V199, and V201 from the World Values Survey as indicators for our latent dependent variable Fraud_Tolerance: higher scores suggest higher willingness to justify fraud, i.e., higher tolerance toward fraud.Footnote 19

-

Self-enhancing and self-transcending values: We use questions V71, V73, V75, and V76 as indicators of a self-enhancing orientation (Self-Enhancing) and we use questions V74 and V78 as indicators of a self-transcending orientation (Self-Transcending). For ease of interpretation, we recode all respondent answers so that the higher score for an indicator signals a higher self-enhancing or higher self-transcending orientation. We label the converted values as V71R, V73R, V75R, V76R, V74R, and V78R.

-

Locus of control: We use a single question from the World Values Survey, V55, as the indicator for Locus_of_Control.Footnote 20

-

Belief in hard work: We use responses to two questions, V99 and V100, as indicators for a respondent’s Belief_in_Hard_Work. For ease of interpretation, we recode both questions by subtracting the response from 11, so that a higher score signals a stronger belief in hard work as a critical factor for success. We label the converted values as V99R and V100R.

-

Gender attitude: We use the responses to V51, V52, and V53 as indicators of Gender_Bias. For ease of interpretation, we recode all answers by deducting the responses from 5, i.e., a higher score signals a higher bias against female leadership. We label the converted values as V51R, V52R, and V53R.

The exact wording for each question is presented in Appendix 1, including the original WVS response scale prior to any recoding. We use SmartPLS (v3.0) with a bootstrapping resampling procedure of 5000 samples (generated from the original sample data) to test our model specification.Footnote 21

Calibration of Fraud Tolerance Measure

While numerous studies have documented high correlation of WVS responses with actual deviant behavior in a variety of contexts (e.g., Cummings et al. 2009; Dulleck et al. 2016; Halpern 2001; Knack and Keefer 1997; Rodriguez-Justicia and Theilen 2018), we conduct two additional independent tests that we call calibration to confirm the relevance of Fraud Tolerance for fraud deterrence, using macro-economic data at the level of individual states. First, we considered the correlation between state-level summary measures of the components of fraud tolerance and 2017 state statistics for (1) the rate of consumer fraud reports per 100,000 residents, (2) the number of personal bankruptcies, (3) the number of employee complaints filed with the US Equal Opportunity Commission (EEO), and (4) various statistics on violent crimes, robberies and property crime in general.Footnote 22 We find that Fraud_Tolerance is statistically associated with lower levels of personal bankruptcies, which comprise more than 95% of all filed bankruptcies in a state, as well as EEO complaints (p < .05) (but not consumer fraud). The US Department of Justice reports that around of 25% of all bankruptcy cases contain “material misstatements of income or expenditures” and one in every ten bankruptcy filings are directly associated with fraud (Welsh 2017, par. 6). So, our results suggest the lower likelihood of fraud related to personal bankruptcies and lower likelihood of employee discrimination in states with lower Fraud Tolerance.

We also find that higher values for the individual question on the appropriateness of claiming government benefits (V198) is associated with higher levels of consumer fraud, personal bankruptcy, and EEO complaints (p < .05). However, neither the composite score for Fraud_Tolerance, nor the individual questions, are correlated with violent crimes, robberies, or property crime, suggesting that our construct is not capturing attitudes toward more extreme forms of crime.

We also considered if fraud tolerance is associated with audit fees at the state level. Knack and Keefer (1997) argue that a civic cooperation measure based on WVS questions could be a good proxy for social capital. Jha and Chen (2015) reported that firms headquartered in U.S. counties with high social capital, measured by an index based on voter turnout, number of NGOs, and civic associations, pay lower audit fees. Therefore, we ran several specifications of a traditional audit fee model with standard control variables (see Hay et al. 2006 for discussion) and state-level measures of fraud tolerance. Overall, our results (non-tabulated, available as Appendix 3 on JBE web site) are consistent with those in Jha and Chen (2015) and support the notion that Fraud Tolerance relates to the potential for fraudulent behavior, i.e., firms headquartered in U.S. states with low Fraud Tolerance pay lower audit fees which suggests lower levels of audit risk.

Results

Evaluation of the Measurement Model

Table 1, Panel B contains descriptive statistics on all indicators of the model. Table 2 reports the indicators of construct reliability and validity for the variables included in our model. Tables 3 and 4 provide data on the discriminant validity of each of the reflective latent constructs. As a general rule, Cronbach’s Alpha should exceed .70 (or .60 for exploratory research), composite reliability should exceed .70, and variance explained should exceed .50. Most of the latent variables in this study satisfy these conditions. Only Belief_in_Hard_Work (.658) and Self-Transcending (.611) have Cronbach’s Alpha values below .70 but both are within the bounds for exploratory research. Table 3 demonstrates compliance with the Fornell–Larcker criterion for discriminant validity assessment. More specifically, the numbers in bold on the diagonal in Table 3 report the square root of the explained variance for each latent construct. These numbers should be higher than all of the other construct correlations on the associated rows and columns, which is the case for all latent variables.

Table 4 presents the factor loadings for the responses to the WVS questions included in our study, i.e., correlation of each item with its construct (in bold) as well as the other constructs. The factor loadings should be above .70 (or .60 for exploratory research) for their own construct and lower for the other constructs. The heterotrait–monotrait (HTMT) ratios for each construct pair (non-tabulated) does not exceed the conservative .85 benchmark (Henseler et al. 2015), indicative of sufficient discriminate validity of the latent constructs.Footnote 23 Path coefficients may be biased when the critical level of Variance Inflated Factors (VIF) exceeds 3.3 but tests (untabulated) reveal no problems with multicollinearity in our data.Footnote 24

Evaluation of the Structural Model: Tests of Path Coefficients

Figure 2 presents the path coefficients of the Structural Exploratory Research Model. Table 5 provides results of tests for the significance of these path coefficients (all p-values are two-tailed per Kock 2015b). Results in Panel A reveal that people with a higher Self-Enhancing score exhibit higher Fraud_Tolerance (path coeff. = .262, p < .001), while people with a higher Self-Transcending score exhibit lower Fraud_Tolerance (path coeff. = − .115, p < .001). At the same time, Locus_of_Control does not affect Fraud_Tolerance directly (path coeff. = − .036, p = .157) but respondents that see themselves as being in control are more likely to believe that hard work will lead to the better life in the long run (path coeff. = .227, p < .001). More importantly, people who believe in the importance of hard work show lower Fraud_Tolerance (path coeff. = − .251, p < .001). Finally, Gender_Bias is positively associated with Fraud_Tolerance (path coeff. = .098, p < .001). Overall, results suggest that this model has an acceptable degree of predictability for an exploratory study. Five of the suggested six paths are significant, and the model explains 17.2% of variance in Fraud_Tolerance. Panel B provides additional results for mediation tests (Hair et al. 2017, pp. 229–243). These results indicate a significant indirect effect of Locus_of_Control on Fraud_Tolerance.Footnote 25 Thus, Belief_in_Hard_Work fully mediates the relationship between Locus_of_Control and Fraud_Tolerance, i.e., there is a significant indirect effect paired with an insignificant direct effect.

Further analysis of the relative size of the effects suggests that most of the explained variance in Fraud_Tolerance is attributable to the influence of two factors: Self-Enhancing and Belief_in_Hard_Work. The f2 statistic for Self-Enhancing is .077, while the f2 statistic for Belief_in_Hard_Work is .072.Footnote 26 The f2 statistics of all other significant path coefficients are around .02, indicating a trivial impact of these other constructs. We also repeated our analysis using the “consistent PLS algorithm” (PLSc-SEM), recently developed by Dijkstra and Henseler (2015). In this case, our inferences about path coefficients remain the same but the R2 of the model increases to 28.5%, the f2 statistic of Self-Enhancing increases to .15, the f2 statistic of Belief_in_Hard_Work increases to .12, and the f2 statistic of the influence of Locus_of_Control on Belief_in_Hard_Work reaches .08, all signaling that the impact of these factors is not trivial.Footnote 27 In addition, the Standardized Root Mean Squared Residual (SRMR) from the PLSc-SEM (PLS-SEM) initial run is .046 (.06), which indicates sufficiently good fit for the model using the benchmark of SRMR < .08.

Supplemental Multi-group Analyses: Age, Religiosity, and Gender Differences

Prior literature in ethics suggests that demographics and religion can influence attitudes toward fraud. We examine two demographic factors, age and gender, as well as the impact of religion, using multi-group analysis (MGA). MGA allows us to test whether path coefficients based on subgroups are statistically different from each other.Footnote 28

Age Differences

Research has shown a positive association of age and moral reasoning (Pratt et al. 1983; Rawwas and Isakson 2010; Ruegger and King 1992). Specifically, Ma (1985) reports a positive association between age and law-abiding behavior. Rawwas and Isakson (2010) suggest that older students are less inclined to cheat, while Rawwas and Singhapakdi (1998) document that adults are more critical of unethical consumer actions than teenagers. Vitell et al. (1991) show that elderly consumers judge unethical actions by other consumers more harshly than the general population. Ruegger and King (1992) find that younger students are more tolerant of unethical business practices. We examine age differences (untabulated) by comparing model parameters for three age groups: young (18–39, n = 563), middle-aged (40–60, n = 740), and old (> 60, n = 513). Comparing two age groups at a time, the only significant difference we observe is that Gender_Bias has a stronger and marginally significant (p = .054) effect on Fraud_Tolerance for middle-aged adults when compared to younger individuals.

Gender Differences

As previously noted, prior studies suggest there may be significant differences in the ethical reasoning of women vs. men. For example, women have been shown to demonstrate higher ethical attitudes and are less likely to commit a crime (Arlow 1991; Chonko and Hunt 1985; Luthar et al. 1997; Ruegger and King 1992; Singhapakdi et al. 1996), although there are also studies that failed to confirm these gender differences (Doran and Littrell 2013; Forte 2004; Lan et al. 2008; Sikula and Costa 1994; Singhapakdi and Vitell 1991; Tsalikis and Ortiz-Buonafina 1990). We examine differences in the model parameters between women and men (untabulated).

The only significant difference between the two groups that we observe is the path coefficient for the impact of the Locus_of_Control on Belief_in_Hard_Work. Similar to results from our main model, the path coefficient is positive and significant in both groups, i.e., .283 for men and .180 for women, but the difference between the two groups is significant (.103, p = .023, two-tailed). This means that Locus_of_Control has a much stronger influence on the Belief_in_Hard_Work for men than women. Also, the result reported in the full sample for Self-Transcending on Fraud_Tolerance holds for women (path coefficient − .142, two-tailed p < .001) but not for men (path coefficient − .062, two-tailed p = .284). The difference in these coefficients is marginally significant at p = .097. This empirical finding is consistent with prior arguments in Gilligan (1993) that the notion of caring plays a much bigger role in ethical reasoning of women than men, who are mostly driven by the notion of justice.

Religion

Prior studies have also suggested that religiosity can affect tax morality and tolerance toward white collar crime (e.g., Corcoran et al. 2012; Stack and Kposowa 2006). For example, Stack and Kposowa (2006) document a negative relationship between an individual’s religiosity and the acceptability of tax fraud in cross-country settings. Corcoran et al. (2012) demonstrate that the importance of religion in a person’s life decreases the tolerance of white collar crime. To examine the impact of religion on the reported relationships between values and fraud tolerance, we conduct several MGA analyses.

First, we compare model parameters between those who self-identify themselves as a religious person (1225 respondents) and others who are non-religious (591). We identify only one marginally significant difference in path coefficients between these two groups: the difference in path coefficient for the impact of the Belief_in_Hard_Work on Fraud_Tolerance. Similar to results from our main model, the path coefficient is negative and significant in both groups, i.e., − .279 for religious people and − .193 for non-religious people, but the difference between the two groups is marginally significant (.086, p = .077, two-tailed). This means that Belief_in_Hard_Work has a marginally stronger influence on Fraud_Tolerance for religious individuals. We do not find any differences between people who assert that they believe in God (1597 respondents) versus those who do not (208).

Second, we compare path coefficients between those who self-identify themselves as Protestants (498 respondents) versus Catholics (391 respondents).Footnote 29 We observe significant differences in the impact of Belief_in_Hard_Work on Fraud_Tolerance between these two groups. Similar to results from our main model, the path coefficient on Belief_in_Hard_Work is negative and significant in both groups (− .210 for Protestants and − .376 for Catholics), but the .166 difference in path coefficients is significant (p = .019), i.e., the effect is stronger for Catholics than for Protestants. At the same time, the impact of Locus_of_Control on Belief_in_Hard_Work is stronger for Protestants (path coefficient = .282) than for Catholics (path coefficient = .129). The difference in path coefficients of .153 is significant (p < .01). Also, the negative impact of Self-Transcending Orientation on Fraud_Tolerance remains for Protestants (path coefficient = − .174, p < .01) but not for Catholics (path coefficient = .076, p = .499). The difference between path coefficients on the impact of Self-Transcending Orientation is .249 (p = .008). There are no other significant differences in path coefficients between these two groups. In sum, belonging to a certain religious denomination is likely to moderate the impact of the identified beliefs and values on fraud tolerance, and future research is needed to explore all these nuances in more details.

Common Method Bias (CMB)

The main challenge associated with the analysis we conducted is common method bias (CMB). CMB relates to concerns about potential "systematic error variance shared among variables measured with and introduced as a function of the same method and/or source" that might undermine validity of research conclusions (Richardson et al. 2009, p. 763). Recent literature suggests that CMB “is not a serious threat to projects that include multiple independent variables” (Lance et al. 2010; Siemsen et al. 2010; Speklé and Widener 2018, p. 10). While researchers often conduct many post hoc statistical tests to detect and adjust for CMB, simulation-based studies demonstrate that many of these popular tools can be redundant, unreliable, or misleading (Conway and Lance 2010; Richardson et al. 2009).Footnote 30

In this connection, Conway and Lance (2010, p. 325) recommend evaluating the rigor of survey-based research by focusing on four criteria: “(a) an argument for why self-reports are appropriate, (b) construct validity evidence, (c) lack of overlap in items for different constructs, and (d) evidence that authors took proactive design steps to mitigate threats of method effects”. Consistent with this view, the self-reported data used in this study is arguably the only source currently available to explore the indicators and determinants of fraud tolerance as internalized attitudes toward fraud in general. The rigorous design and administration of the World Values Survey mitigates potential common method bias.Footnote 31 Previously discussed statistics reported in Tables 2, 3, and 4 support the validity of the suggested constructs used in this study.

Robustness Test: Additional Indicators of Fraud Tolerance

Our main model does not include WVS Questions V200 (“Stealing property”) and V202 (“Accepting bribe”) as Fraud Tolerance indicators, because these items have high kurtosis and skewness, increasing the chance of bias due to multicollinearity and CMB. To explore the sensitivity of our results to this exclusion, we conduct an additional robustness test by expanding our basic model to include five, rather than three, indicators of Fraud Tolerance including “stealing property” and accepting “bribes”. Figure 3 presents the path coefficients of the Structural Exploratory Research Model with the five indicators together with the p-values of the statistical tests of their significance (in parentheses). As Fig. 3 illustrates, all conclusions derived from the model based on three indicators of Fraud Tolerance hold for the extended model, while the R2 of the model increases from 17.2 to 18.8%. We provide more detailed results of this model in Appendix 4, available on “Journal of Business Ethics” web site.

Conclusion

“To make strides … this work would have to stop asking "Why do people commit white collar crime?" and begin to ask, "Given the great rewards and low risks of detection, why do so many business people adopt the 'economically irrational' course of obeying the law?”. (Braithwaite 1985, p. 7)

Researchers in many fields have examined why individuals commit fraud. Whether it be corporate boards concerned about the behavior of individuals within the organization that they oversee, ethicists concerned with the motives of corporate fraudsters, or accountants and auditors assessing fraud risk through the lens of the fraud triangle, there is a growing recognition and interest in the cultural and personality attributes that might influence an individual’s attitudes toward deviant economic behavior and their propensity to commit fraud. Integrity, ego, ideology, and hubris are all examples of personality traits that could potentially mitigate or compound one’s tolerance toward fraud. However, these constructs are often based on anecdotes rather than empirical evidence and may not always be sufficiently well-defined for empirical testing. Building on insights from several disciplines, including sociology and social psychology, we offer several research-based constructs of attitudes such as Self-enhancing/transcending Values, Locus of Control, Belief in Hard Work, and Gender Attitudes as potential fraud predictors.

Using independently collected and publicly available data from the World Values Survey, we provide empirical evidence that these value orientations and beliefs do in fact influence fraud tolerance, i.e., the ex ante socially constructed attitudes toward deviant behavior that involves deception for personal gain. Since prior research reported a high correlation of such attitudes with actual crime, we highlight specific values and beliefs that make fraud more likely to occur in a business or organizational setting. Regulators recognize the importance of values and beliefs for fraud deterrence. For example, the COSO framework for evaluating an organization’s system of internal control emphasizes the “control environment” as a pervasive component of the organization’s system of monitoring and controlling its operations. No matter how sophisticated the control system and the extent of efforts to instill a strong tone at the top, rules and procedures must be implemented and executed by individuals, subject to their idiosyncratic values and beliefs. The empirical evidence from this study suggests specific psychological mechanisms that can either undermine or augment the control environment and the occurrence of fraud.

These observations suggest future research avenues to augment the fraud triangle framework as well as the literature on the antecedents of work-place crime in general. Tone at the top and the associated management style and philosophy not only attract certain types of employees to an organization through self-selection but also impose a particular value orientation on the existing employees that influence their attitudes and actions. The potentially destructive impact of an organizational culture that over-emphasizes self-enhancement (e.g., Enron) or hedonism (e.g., Tyco) is well documented in the business literature. Consequently, this study’s empirical evidence on the positive connection between self-enhancing value orientation and fraud tolerance is relevant. Of more interest is the observation that an individual’s belief in hard work is negatively associated with fraud tolerance. Thus, such beliefs could be potentially targeted to counterbalance the negative impact of a self-enhancing culture, which is often inevitable in a competitive business environment.

Management accounting scholars have emphasized for decades that action (code of conduct) or outcome (bonus) controls are not enough to assure organizational success. Culture-based controls are also considered to be critical in any organization (e.g., Birnberg and Snodgrass 1988; Dent 1991; Malmi and Brown 2008; Merchant and Otley 2007). As Dent (1991, p. 706) stressed: “The operation of work technologies in organizations is not a purely technical-rational affair. Rather, it is embedded in a cultural system of ideas (beliefs, knowledges) and sentiments (values)…” Simons (1995, p. 34) in his book “Levers of Control” stressed the importance of belief systems, “the explicit set of organisational definitions that senior managers communicate formally and reinforce systematically to provide basic values, purpose, and direction for the organisation”. Such systems affect organizations on three different levels: (1) organizations deliberately recruit individuals with similar values; (2) organizational employees align their values with organizational culture in the process of socialization, and (3) employees often respond according to explicit organizational values in conflict situations, even when organizational values do not reflect employees’ personal position (Malmi and Brown 2008). Our evidence on the connection between beliefs and values with Fraud Tolerance confirms findings from these studies, mostly based on field research, and draws attention to the explicit cultivation of certain beliefs and values within an organizational culture that serve to deter fraud.

Our findings also provide the specific direction for future studies in this area. Future research might use tailored surveys within an organization to examine specific organizational policies and procedures that boost or suppress such beliefs. At this point we can only speculate how existing HR policies of hiring, performance evaluation, and promotion are likely to influence fraud tolerance. A generalized process for assessing fraud tolerance within a specific environment would provide more directed guidance on the attitudes of employees and managers. For example, employees of a company with transparent performance evaluation principles and environment where hard work is rewarded are more likely to hold stronger beliefs about the importance of hard work than those employed by the company where promotions are driven by nepotism and where school or social connections matter more than job performance. While the business literature is awash with anecdotes about the detrimental effect of corporate obsession with prestigious college credentials or social standing (e.g., Gladwell 2002; Groysberg 2010), empirical research is mostly silent on the underlying reasons for these attitudes and the resulting behavior. These attitudes may be compounded by increasing generational differences in work ethics and organizational dynamics.

This study is exploratory by its very nature, and this represents its most significant limitation. Since data used in this study was collected by other researchers in the process of longitudinal international study with a rigorous research protocol, chances of measurement error and data collection mistake are reduced. However, as a consequence, we do not have control over the form and substance of the survey questions or the selection of the respondents. For example, while we approached fraud in this study in its broadest sense as obtaining something of value through deception, questions from the World Values Survey may mostly capture attitudes toward fraud against the government or community. While Association of Fraud Examiners (2020a) cites government entities among the most representative environments for fraud occurrence, it remains unclear whether such attitudes also carry over into corporate settings. Future research is needed to address separate areas identified in this exploratory study in a more focused and precise manner to refine further the suggested psychological constructs and to explore the boundaries of study conclusions.

Notes

The attitude studied in this paper has been considered in different contexts by scholars from different disciplines. Some examples include “tax morality” (focus on the single question and single context of tax compliance) and “civic cooperation” (focus on the aggregated country-level data that combined one indicator for several questions and explored its role in overall economic growth). Our use of “fraud tolerance” takes a different approach as discussed later in the paper.

The World Values Survey is a global research program that explores the evolution of people’s values around the world since 1981. Every five years researchers collect new data by administering a representative survey at a global scale that accesses people’s opinions on variety of issues. The World Values Survey web site provides open access to all this data (see World Values Survey 2020 for more details). We note numerous studies in accounting that use this data including Bhagwat and Liu (2020), Brochet et al. (2019), Isidro et al. (2020), Knechel et al. (2019), and Pevzner et al. (2015).

Such focus on individual and community-based differences in beliefs and values (i.e., intra-country rather than inter-country differences) is consistent with prior studies in criminology and allows us to avoid the confounding effects of cross-country differences in GDP, corruption, and similar macro-economic factors that might influence attitudes toward fraudulent behavior that are outside the scope of our investigation.

Fraud is inherently an interdisciplinary subject but scholars from different fields approach it from slightly different perspectives and utilize their own discipline-centric terminology. This leads to a multiplicity of labels to define similar constructs. For example, scholars from the disciplines outside accounting who are not familiar with fraud triangle framework often use the terms “attitude”, “verbalization”, “neutralization”, or “justification” to label perpetrator ability to rationalize the crime.

“Some of our most respectable citizens got their start in life by using other people’s money temporarily” or “In the real estate business there is nothing wrong about using deposits before the deal is closed” are examples of such general rationalizations (Cressey 1973, p. 96).

The examples of the specific dishonest or deviant economic acts vary across different waves of WVS but some questions such as justification of cheating on taxes are included more often than others.

Accounting scholars are more familiar with this labeling approach in the context of “generalized trust”, another proxy for social capital that relies on a single WVS question and which is extensively used in empirical accounting research.

See also summary in Torgler (2007a) and Torgler (2016). Some of these studies use the same questions from the European Value Survey. Results from these studies suggest that some individuals are “simply predisposed not to evade” taxes due to internalized social norms or potential guilt (Long and Swingen 1991, p. 130) and do not look for ways to cheat on their taxes (Alm et al. 1992; Dulleck et al. 2016).

As reported in Knack and Keefer (1997, p. 1257): “Twenty wallets containing $50 worth of cash and the addresses and phone numbers of their putative owners were ‘accidentally’ dropped in each of twenty cities, selected from fourteen different western European countries. Ten wallets were similarly ‘lost’ in each of twelve U. S. cities. … The percentage of wallets returned in each country … is correlated with TRUST at .67, and with item (d) of the CIVIC index, on the acceptability of ‘keeping money that you have found’ at .52.”.

These attributes are not randomly selected and represent some of the most studied constructs in the WVS survey, meaning that they have been extensively validated in prior research. For example, the dichotomy of self-enhancing vs. self-transcending values is a central point of the theory of Basic Human values, developed by Shalom H. Schwartz (e.g., Schwartz 1992, 1994, 1999, 2012). Locus of control is a fundamental construct capturing the differences in evaluation of environment “that has been formally studied for more than 50 years” (Galvin et al. 2018, p. 820; Johnson et al. 2015). Future research might explore other social attributes that may be relevant to fraud tolerance using other sources of data.

“Fraud diamond framework” is an extension of the “fraud triangle framework” and includes a perpetrator’s capability as a fourth fraud antecedent. According to this model, perpetrator’s capability reflects combination of personal traits and skills, including perpetrator’s position, intelligence, ego, ability to coerce, ability to lie, and resistance to stress (Wolfe and Hermanson 2004).

Sociologists often combine self-enhancing and self-transcending value orientations in a single measure to explain the societal roots of criminal behavior (Ganon and Donegan 2010; Itashiki 2011; Konty 2005), but psychologists stress the orthogonal nature of these dimensions (Frimer et al. 2011; Trapnell and Paulhus 2012; Wiggins 1991).

In sociology, self-enhancing vs. self-transcending values relate to the concept of “anomie”, the building block of “strain theory” (Donegan and Ganon 2008; Merton 1938; Messner and Rosenfeld 2001; Thorlindsson and Bernburg 2004). Konty (2005) suggested the label “micro-anomie”, measured as the difference between individual scores for self-enhancing and self-transcending values, to capture a particular cognitive state that prompts deviant behavior where self-interest dominates social-interest due to conflicting social messages. Research in psychology uses a different terminology while distinguishing two fundamental human motives: agency and communion. Similar to a self-enhancing orientation, agency “entails motives to advance the self within a social hierarchy: achievement, social power, or material wealth” (Frimer et al. 2011, p. 150). Communion, which is similar to a self-transcending orientation, reflects “benevolence to familiar others, or a more universalized concern for the well-being of disadvantaged, distant others, or the ecological well-being of the planet” (Frimer et al. 2011, p. 150). The labels of agency vs. communion are often referred to as “getting ahead” vs. “getting along” (Hogan and Holland 2003).

Early research explored work-related beliefs as part of the construct “Protestant Work Ethic” (PWE) as originally defined by Weber in 1905 (Weber 2001, reprint). In the 1970s several scholars developed measurement scales for PWE and the more general concept of “Work Ethic” (Mirels and Garrett 1971, Buchholz 1977, 1978). Consistent with this assumption about the link of hard work and morality, Aquino and Reed (2002) included the trait “hard-working” as one of nine characteristics of a moral person while developing their “moral identity” instrument.

Researchers used an internet sample designed by Knowledge Networks who completed all the field work of collecting the data. “KnowledgePanel®, created by Knowledge Networks, is a probability-based online Non-Volunteer Access Panel. Details are available at http://www.worldvaluessurvey.org/WVSDocumentationWV6.jsp accessed on 01/22/2019.

The sample size of 1,816 observations is sufficient for our analysis. Rough guideline suggests at least 10*maximum number of paths to be analyzed that lead to a single construct, or 10*8 = 80 in our case. Also, using the Cohen (1992) power table, the reasonable sample size for a model with six paths to one single construct is 157.

Jarvis et al. (2003) suggest that it is appropriate to model a construct as reflective when (1) assumed causality direction is from the construct to the indicators, (2) indicators are expected to be interchangeable and co-vary with each other, and (3) the indicators are assumed to have the same underlying antecedents and consequences. PLS also facilitates modeling of the latent constructs through formative (also known as composite) indicators. Formative indicators are not expected to be interchangeable, are not expected to correlate highly with each other, and capture different aspects of the underlying latent construct. While evaluating the appropriateness of a formative measurement model, researchers mostly focus on content validity (see Hair et al. 2017 for more details). Also, the choice of formative indicators should be grounded in theory and capture all major facets of the construct.

We exclude two questions that might be relevant to fraud: (1) “Stealing property” and (2) “Accepting a bribe”. Very few respondents openly justify such actions, resulting in high levels of kurtosis and skewness, e.g., kurtosis for “stealing the property” is 10.08, with skewness of 3.03. Our results remain substantially unchanged when we add “stealing property” and “accepting bribes” to the model (see more detailed discussion on p. 33–34), but we note high VIFs for both of these variables (> 3.3) that increase concern about common method bias. The indicators used in this study have less elevated degrees of kurtosis and skewness, e.g., kurtosis for “claiming benefits” is 4.153, with skewness of -2.17. Our approach is similar to those in other studies on “civic” or “economic” morality (e.g., Letki 2006).

While it would be desirable to use several indicators for construction of the latent variable, this is the only question in WVS that relates to locus of control.

One of the advantages of the PLS-SEM is that it does not assume a normal distribution for the data. However, this feature precludes the use of the parametric tests of significance, traditionally used in regression analyses. Instead, PLS-SEM relies on bootstrapping to estimate the significance of both outer loadings and path coefficients. “Bootstrapping is a resampling technique that draws a large number of subsamples from the original data (with replacement) and estimates models for each subsample. It is used to determine standard errors of coefficients to assess their statistical significance without relying on distributional assumptions” (Hair et al. 2017, p. 313). In theory, a larger number of bootstrapping samples leads to more reliable inferences, although improvements in the estimates of standard errors become negligible as each sample becomes a smaller portion of the entire analysis. Our results were consistent with those obtained with smaller bootstrapping samples such as 1000 and 500.

Prior research suggests that the attitudes related to civic cooperation and morality are stable over decades in large populations. Our state-level sample consists of 50 states plus the District of Columbia. We obtained the state statistics from www.statista.com except for employee complaints, which come from the website of the US Equal Opportunity Commission (https://www1.eeoc.gov/eeoc/statistics/enforcement/state_17.cfm accessed on 01/22/2019).

The heterotrait–monotrait (HTMT) ratio of correlations is a method of assessing the discriminant validity in PLS-SEM that outperforms the Fornell-Larcker criterion (Hair et al. 2017). The highest HTMT ratio in this sample was between the self-enhancing values and fraud tolerance constructs (0.358).

The highest level of collinearity between the latent constructs (Inner VIF values) was 1.09 between self-transcending values and fraud predisposition. The highest level of VIF for the indicators (Outer VIF values) was 2.56 in case of V53R: Beliefs that men make better business executives than women.

The bootstrap confidence interval does not include the “zero point” with a t value of 6.704.

The f-squared statistic of Locus of Control in explaining Beliefs in Hard work is 0.054.

In case of the “consistent PLS algorithm”, the relevant path coefficients increase in the same direction: path coefficient on self-enhancing values changes from 0.262 to 0.308 and the path coefficient on beliefs in hard work changes from -0.251 to -0.352.

We apply PLS-MGA approach with 5,000 bootstrap samples. We also conducted multi-group analyses comparing (1) people in managerial position vs. non-managerial position (as indicated by the WVS item V232 in USA version) and (2) people who characterize themselves as a “chief wage earner” vs. those who do not (as indicated by the WVS item V233 in USA version). Our tests do not reveal any significant differences in path coefficients between these groups.

Other potential denominations included Orthodox, Muslim, Jew, and Buddhist. We have fewer than 50 observations of these groups. 571 survey participants chose “None, do not belong to denominations” and 273 respondents selected “Other, non-specified”. These respondents are included in our first set of tests for religiosity overall. There were no significant differences in path coefficients between Protestants and those who selected “None, do not belong to denominations”, between Protestants and those who selected “Other, non-specified”, and between Catholics and those who selected “Other, non-specified”. The only difference between Catholics and those who selected “None, do not belong to denominations” was the stronger impact of Belief_in_Hard_Work on Fraud_Tolerance for Catholics.