Abstract

Following SOX, financial restatements increased dramatically. Prior research suggests that how investors respond to restatements, particularly those involving fraud, may mitigate or exacerbate damage suffered. We extend both accounting and management research by examining the joint effects of pre-restatement managerial reputation and the announcement of managerial corrective actions in response to a restatement on nonprofessional investors’ judgments. We find that pre-restatement managerial reputation and the announcement of managerial corrective actions jointly influence investors’ managerial fraud prevention assessments, which mediate their trust in management. These trust perceptions in turn affect investors’ investment and CEO retention judgments. Our results have implications for firms that are concerned with lessening the negative consequences associated with issuing a restatement.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

Following the Sarbanes–Oxley Act of (SOX) (2002), the number of financial restatements—each of which indicates that financial information previously issued by management, and relied upon by investors, was incorrect—increased dramatically (e.g., GAO-06-678 2006a, GAO-06-1053R 2006b; Turner and Weirich 2006; Chen et al. 2014).Footnote 1 Firms and their managers who issue restatements, especially ones due to fraud, tend to suffer reputational and financial damage (e.g., Hribar and Jenkins 2004; Palmrose et al. 2004; Desai et al. 2006; Plumlee and Yohn 2010, 2015). In response, boards of directors and top managers often take reputation-building corrective actions such as strengthening internal governance (Srinivasan 2005). While such actions, on average, may positively affect post-restatement earnings (Chakravarthy et al. 2014; Chen et al. 2014), they are costly to the firm. Accordingly, it is important for managers to understand the extent to which announcing such actions is likely to mitigate investors’ negative responses to the restatement.

The purpose of the current research is to introduce and test a model of investors’ reactions to a restatement. Specifically, our model proposes that management’s pre-existing reputation and the announcement of corrective actions jointly influence investors’ managerial fraud prevention assessments, which, in turn, influence their trust in management, and then CEO retention and investment judgments. While prior archival restatement research recognizes that restatements are likely to erode investors’ trust in management (Chakravarthy et al. 2014), our model incorporates managerial fraud prevention assessments as a precursor to trust in management. This construct captures investors’ assessments of the extent to which management is committed to preventing fraud in the future. Providing evidence about investors’ fraud prevention assessments will be of interest to regulators along with boards of directors and senior management as they evaluate how to effectively mitigate the negative effects of a restatement.

In addition, our model includes two important economic judgments about the restating firm: an investment judgment and a CEO retention judgment. After issuing a restatement, the firm’s board of directors and top management are concerned about whether investors consider the firm a less attractive investment option, which would create downward pressure on the firm’s equity value. In addition, after issuing a restatement, the board of directors also faces pressure to make changes to the firm’s top management team, including the CEO (e.g., Hennes et al. 2008). Certainly, professional investors can exert significant influence over the board (Del Guercio et al. 2008), and the likelihood that the board will acquiesce in the face of this pressure has increased dramatically in recent years (Ertimur et al. 2010). Perhaps more importantly, firing a CEO can be a costly action for the firm, presumably intended to regain credibility with investors (both professional and nonprofessional). However, little evidence exists to help the board of directors understand the circumstances that could affect investors’ preferences as to whether the CEO is fired or retained. Thus, investors’ investment and CEO retention judgments are important, but in some cases little evidence exists to help guide directors on these judgments.

As mentioned above, we expect managerial pre-restatement reputation and the announcement of corrective actions to jointly influence investors’ managerial fraud prevention assessments. We identified and selected these two variables because prior research demonstrates their relevance. First, management and accounting research find, respectively, that the effectiveness of transgression repair attempts depends, in part, on the pre-existing state of a relationship (Zaheer et al. 1998; Lewicki et al. 2005) and nonprofessional investors’ response to subsequent actions depends on management’s pre-existing reputation (e.g., Mercer 2004; Hodge et al. 2006; Cianci and Kaplan 2010). In the current setting, management’s pre-restatement reputation represents the state of its relationship with investors prior to the restatement. Second, prior management research has advocated that announcement of corrective actions is an important mechanism to restore investor confidence (Dirks et al. 2009; Gillespie and Dietz 2009). Further, several archival studies provide evidence indicating that, on average, corrective actions mitigate the damage from restatements (Hennes et al. 2008; Karpoff et al. 2008; Chen et al. 2014). However, it is unlikely that announcing corrective actions will be equally effective across firms differing in managerial characteristics (Rhee and Valdez 2009). Thus, examining the interaction of these variables is warranted.

In testing our proposed model, we use nonprofessional investors as participants. Although the prior archival research on restatements has examined equity prices, which are largely set by professional investors, as a class, nonprofessional shareholders also have a substantial presence in US equity markets. As of 2008, almost 47 percent of US households (54.5 million) owned equities, and only 29 percent of these households consistently consulted with an investment advisor before making investment decisions (ICI and SIFMA 2008). Consequently, understanding nonprofessional investors’ responses to restatements is important. Further, in testing our proposed model, we use a fraud-, rather than an error-, based restatement, as such restatements often involve more negative consequences to investors, the firm, and its management (Hennes et al. 2008; Karpoff et al. 2008). Indeed, the character and ethicality of managers is more likely to be called into question when fraud is involved (Copeland 2005), perhaps increasing the need for managers to make it clear that they have taken corrective actions.

We conduct an experiment in which 94 MBA students (i.e., nonprofessional investors) respond to a company press release, which announces a fraud-based restatement. In our 2 × 2 between-participants experiment, we manipulate management’s pre-restatement reputation (high, low) and announcement of managerial corrective actions (absent, present). In the high (low) reputation condition, management has a history of making relatively accurate (inaccurate) earnings forecasts. In the “action absent” condition, the press release only describes the reason for and the financial impact of the restatement. We hold constant the reason given for the restatement—i.e., fraudulent acts by employees outside the C-suite. In the “action present” condition, the press release contains all of the information provided in the “absent” condition and also indicates that management has taken costly corrective actions to prevent restatements from reoccurring (i.e., management improved the internal control system and hired an experienced and well-qualified ethics officer). After viewing the press release, participants make investment judgments, a CEO retention judgment, and respond to a series of measures intended to capture judgments about their managerial fraud prevention assessments and trust in management.

We find that managers’ pre-restatement reputation and their corrective action announcement interact to predict investors’ perceptions of management’s commitment to prevent fraud, which mediates their trust in management. Investors’ trust judgments, in turn, are associated with both investment and CEO retention judgments. Specifically, when management does not announce that it has taken corrective actions in response to a restatement, investors trust management with a poor reputation less than management with a good reputation because investors are less convinced that management values preventing fraud. Alternatively, when management does announce that it has taken corrective actions in response to a restatement, investors equally believe that management with either good or poor reputation values preventing fraud, and thus, trust management. Additionally, we find that investors’ managerial trust perceptions are positively associated with their judgments to invest in the company and to retain the CEO, after a restatement. Overall, our results suggest that pre-restatement managerial reputation and a managerial corrective action announcement can lessen the negative consequences from issuing a restatement.

Our research contributes to the literature in several ways. First, while archival research has primarily examined firm-level consequences of restatements (e.g., Palmrose et al. 2004; Palmrose and Scholz 2004; Desai et al. 2006; Wilson 2008; Kravet and Shevlin 2009; Chakravarthy et al. 2014; Chen et al. 2014; Hirschey et al. 2015), our understanding of the processes underlying individual-level investor reactions to restatements remains limited (Elliott et al. 2012). We extend this line of inquiry by experimentally examining individual investor responses—specifically, their managerial fraud prevention assessments, trust in management, and ultimately their investment and CEO retention judgments. In this way, our research sheds light on the causal factors underlying investor reactions to restatements. These insights are not directly observable using archival methods. Furthermore, our findings suggest that managerial reputation and announcing corrective action can mitigate nonprofessional investors’ call for executive firing, which can be extremely costly and may have other unintended negative consequences (e.g., Burks 2010). Additionally, while prior research on market reactions to restatements often controls for firm characteristics such as size (e.g., Palmrose et al. 2004), the results here suggest that management’s reputation should also be controlled for when examining how the market responds to corrective action announcements following a restatement.

Second, the current study contributes to studies on trust repair by identifying managerial reputation and corrective action, through their influence on managerial fraud prevention assessments, as important factors in repairing trust. Indeed, our understanding of trust repair is limited (e.g., Bell et al. 2002; Kim et al. 2004; Tomlinson et al. 2004; Schweitzer et al. 2006), particularly with respect to the role of announcing structural changes as a mechanism to mitigate the damage from a trust violation (e.g., Sitkin and Roth 1993; Lewicki and Bunker 1995; Kim et al. 2004; Nakayachi and Watabe 2005; Kim et al. 2006; Schweitzer et al. 2006; Ferrin et al. 2007; Dirks et al. 2009; Kramer and Lewicki 2010). As discussed further below, we extend this research by integrating two streams of management research, i.e., attribution theory and structural change research. Specifically, we characterize the announcement of corrective actions as a structural change. Based on attribution theory, we hypothesize and provide evidence that both prior management reputation and the announcement of corrective actions (i.e., announcing a structural change) ultimately impact investors’ judgments of investment and CEO retention through the mediating effect of managerial fraud prevention assessments on their trust in management.

Third, we contribute to research seeking to understand the factors that moderate the adverse consequences of restatements (Palmrose et al. 2004; Hennes et al. 2008; Files et al. 2009). Prior research has examined how companies can obtain reputational benefits from making changes to the board of directors (Farber 2005), changes to executives’ stock-based compensation (Cheng and Farber 2008), changes to the CEO or external auditor (Wilson 2008), or making changes to internal control systems (Gertsen et al. 2006; Chakravarthy et al. 2014). While one stream of this prior work considers the role of managerial reputation (e.g., Chen et al. 2014) and another considers the role of costly managerial actions (e.g., Farber 2005; Almer et al. 2008), the current study extends this line of inquiry by providing evidence of the joint effect of these factors on investors’ responses to restatements.

We organize the remainder of this paper as follows. The next section discusses the background literature and develops hypotheses. This is followed by a description of the research method and a presentation of the results. The final section offers conclusions and implications.

Background and Hypotheses Development

Restatements, by definition, indicate that a previous earnings report, thought to be correct, was, in fact, materially misstated. Because company management is responsible for preparing financial statements, the occurrence of a restatement is indicative of a reporting failure by company management (e.g., Kinney et al. 2004; Stanley and DeZoort 2007), which, in turn, raise concerns about the financial reporting process and the individuals responsible for that process. In this way, restatements, especially those involving intentional misstatements (i.e., fraud), erode trust in company management and damage management’s reputation (Arthaud-Day et al. 2006; Elliott et al. 2012). As previously mentioned, after the passage of SOX there was an increase in financial restatements (e.g., GAO-06-678 2006a, GAO-06-1053R 2006b; Turner and Weirich 2006; Chen et al. 2014). Archival research documents that these restatements, on average, resulted in negative market reactions (e.g., Hribar and Jenkins 2004; Palmrose et al. 2004; Wilson 2008; Burks 2010; Chen et al. 2014), increases in the estimated cost of equity capital (Hribar and Jenkins 2004; Kravet and Shevlin 2009), and reputational costs for managers, thereby increasing the risk of turnover (Arthaud-Day et al. 2006; Desai et al. 2006; Hennes et al. 2008).

Given the substantial negative consequences associated with restatements, boards and top managers have incentives to consider actions, such as CEO termination, that they can take to minimize and repair the damage to their companies and themselves from a restatement, particularly a fraud-based restatement. As Burks (2010, p. 195) argues, “boards have incentive to take the highly visible action of terminating a manager to satisfy demands by outsiders for more vigilant corporate governance.” Prior research provides support for this notion. Indeed, numerous studies have found that CEO termination following an irregularity-based restatement can be close to 50 percent, representing a rate that is anywhere from 2 to 5 times the rate of nonirregularity-based turnover (Persons 2006; Arthaud-Day et al. 2006; Hennes et al. 2008; Leone and Liu 2010). Thus, given such incentives to respond to investors’ demands and to mitigate negative market reactions, following a fraud-based restatement, boards may consider terminating the CEO even though such an unexpected and unplanned action often involves significant costs to the firm (e.g., severance pay, the cost of searching for and the risk of not finding a comparable replacement, and the interruption and destabilizing effects on operations). Indeed, terminating the CEO may not necessarily maximize firm value. Thus, it is important to understand what factors may mitigate investors’ preferences for these costly actions.

While research examining the effectiveness of firm actions in response to a restatement is somewhat limited (Chakravarthy et al. 2014), we assert that the necessity and effectiveness of such actions will vary depending on the pre-restatement reputation of management. We contend that a company whose management has a poor pre-restatement reputation will more likely require and benefit from announcement of post-restatement corrective actions. In addition, we argue that such actions will be most impactful and likely to restore investors’ trust in management, when they address, and to the extent practicable, prevent fraud-based restatements from occurring in the future. We examine the joint effect of pre-restatement managerial reputation and a post-restatement managerial corrective action announcement on investors’ managerial fraud prevention assessments and, in turn, on their trust in management in the following section.

Managerial Fraud Prevention Assessments and Trust in Management

Trust is “a psychological state in which one accepts vulnerability based on positive expectations regarding the intentions or behaviors of others” (Rousseau et al. 1998; Elliott et al. 2012, p. 516). Thus, trust is a future-oriented concept based on expectations about future behavior (Schoorman et al. 2007). For example, in investment settings, potential investors likely have a baseline level of trust that firms will comply with securities laws, etc. (e.g., Georgarakos and Pasini 2011). Additionally, even though a certain level of trust may develop based on a manager’s prior actions (Kramer and Lewicki 2010), future trust perceptions can be affected by his/her response(s) to negative events (Kim et al. 2006). In this section, we examine how investors may make trust judgments based on a managerial repair attempt following a restatement.

We expect that managerial pre-restatement reputation and a post-restatement corrective action announcement will interact to affect investors’ managerial fraud prevention assessments, which will then influence their trust in management. We draw on two separate streams of research on trust repair to make our predictions. First, employing attribution theory (e.g., Jones and Davis 1965; Kelley 1967, 1972, 1973; Kelly and Michela 1980; Wong and Weiner 1981; Ross and Fletcher 1985; Weiner 1986), we assert that reputation is a relatively stable or permanent characteristic so that announcing corrective actions may not be as necessary to repair reputational trust damage, particularly when management possesses a relatively favorable pre-restatement reputation. Second, based on structural change research (e.g., Sitkin and Roth 1993; Dirks et al. 2009; Dirks, Kim, Ferrin, and Cooper 2011), we assert that announcing structural corrective actions can alter future trust expectations. As described by prior research (e.g., Dirks et al. 2009, 2011), while both attribution theory and the structural change research are each useful for addressing trust repair, considering both perspectives is helpful to gain a more complete understanding of the repair process. We develop each assertion in the following paragraphs.

First, attribution theory explains how individuals make causal inferences and explanations, dispositional or situational, for the causes of others’ behaviors (Kelly and Michela 1980; Fiske and Taylor 1991). Numerous scholars have employed this theory in the study of trust repair, suggesting that trust can be rebuilt through the attribution process by taking substantive actions (Bottom et al. 2002; Lount et al. 2008; Gillespie and Dietz 2009; Desmet et al. 2011; Dirks et al. 2011). In addition, attribution theory distinguishes between relatively temporary versus relatively permanent or stable explanations or causes of negative events (Weiner 1985, 1995). Generally, a cause is stable or relatively permanent if one expects the same outcome in the future and an enduring or relatively permanent dispositional attribution or explanation is more likely to be made for another’s behavior when a situational explanation for such behavior is not readily apparent (Jones and Davis 1965).

Applied to the current setting, we suggest that management’s pre-restatement reputation can be an important factor when assessing whether the cause of a fraud-based restatement is temporary or permanent. If the manager has a favorable reputation prior to the restatement (and the fraudulent activity is not directly due to the actions of the manager), then investors are less likely to infer that the manager’s behavior played a large causal role in the fraudulent activity leading up to the restatement. Thus, investors are more likely to attribute the restatement to a situational explanation and be more likely to dismiss the restatement as a nonrecurring or nonpermanent event that is inconsistent with the manager’s high reputation. In this case, individuals are less likely to expect accounting fraud to occur in the future; thus, their managerial fraud prevention assessments will be relatively high such that an announcement of post-restatement corrective managerial actions will not be deemed as necessary. In contrast, if the manager has an unfavorable reputation prior to the restatement, then investors are more likely to view the restatement as consistent with the manager’s low-reputation, and as such, expect accounting fraud to potentially continue in the future. Thus, in this setting, their managerial fraud prevention assessments will be relatively low such that an announcement of post-restatement corrective managerial actions will likely be more necessary and impactful. This is consistent with related research which finds that, relative to low-reputation firms, high-reputation firms are given the benefit of the doubt, and are less likely to be held responsible when negative events occur (Dawar and Pillutla 2000; Wiles et al. 2010).

Second, structural change research examines how firms can use tangible corrective actions to repair a trust violation and prevent the occurrence of future negative outcomes (Sitkin and Roth 1993; Dirks et al. 2009). Many types of repair attempts can occur following a negative event, and repair methods are most effective when there is a tangible component or structural change (Gillespie and Dietz 2009), rather than just “cheap talk” (Andiappan and Treviño 2010). In this regard, Dirks et al. (2011, p. 87) state “Responses that are more ‘substantive’ (i.e., involving a tangible element) are consequently worth consideration, as they lessen concerns about ‘cheap talk’ and the ensuing limitations of mere words to repair trust after a transgression.” Similarly, Kramer and Lewicki (2010) indicate that making costly structural changes is an effective way to repair trust violations.

Applied to the current setting, announcing actions that can prevent future accounting fraud—i.e., that positively affect investors’ managerial fraud prevention assessments—can serve to repair investors’ trust in management by making investors believe that a future restatement is less likely to occur. Thus, if structural weaknesses or shortcomings within the firm contributed to the trust violation, then announcing actions that strengthen structural aspects of the firm should substantially lower the likelihood of future violations. Improving internal controls or hiring an ethics officer, for instance, are significant managerial corrective actions that can demonstrate to investors that management is serious about correcting a past transgression. Announcing such substantive changes help to demonstrate that management has made significant reformatory measures, thereby signaling that prevention of a future reoccurrence of the trust violation is less likely (Gillespie and Dietz 2009; Dietz and Gillespie 2011).

In summary, we argue that the extent to which investors view structural changes as necessary to repair trust is dependent upon management’s pre-restatement reputation. That is, for a high-reputation manager, we expect that announcing that the firm has made structural changes will be less necessary because the fraud is considered an isolated event that is out of character for the manager; consequently, managerial fraud prevention assessments should be high and the damage to trust should be limited. In contrast, for a low-reputation manager, a future of additional accounting problems and restatements seems much more plausible. As such, we expect investors will see the need for and benefits of structural changes to address the low-reputation manager’s shortcomings. For low-reputation managers, when no action is taken, investors’ managerial fraud prevention assessments will be lower, and, in turn, their trust in management will be lower. We state this reasoning formally in the following hypothesis:

H1

Managerial reputation and announcement of corrective action indirectly affect investors’ trust in management via managerial fraud prevention assessments such that reputation has a significant effect in the absence of a corrective action announcement, but no effect in the presence of a corrective action announcement.

Investors’ Trust in Management and Their Investment and CEO Retention Judgments

We next examine how investors’ trust in management affects two important judgments—investment judgments and CEO retention judgments. As discussed in the previous section, restating managers, in an attempt to repair damaged trust, often make announcements about corrective actions. In this section, we contend that the extent that restatement firms and their managers suffer is driven, to a large extent, by investors’ post-restatement trust in management.

First, trust in management is a necessary condition for investment and prior research documents that trust is positively associated with nonprofessional investors’ willingness to invest in the company (Elliott et al. 2012). Second, regarding the trust-CEO retention relation, we contend that investors who trust in company management will be more willing to agree with retaining the CEO. As previously discussed, prior archival research has found that, following a restatement, corporate boards tend to replace managers (e.g., Arthaud-Day et al. 2006; Desai et al. 2006; Hennes et al. 2008; Burks 2010), perhaps in an effort to repair trust and reputational damage (Chakravarthy et al. 2014). However, if trust in management is restored through the joint effect of a corrective action announcement and pre-existing reputation on investors’ managerial fraud prevention assessments, as hypothesized in the previous section, then the motivation underlying the impetus to terminate a CEO is assuaged.

Thus, based on this discussion and prior research described above, we hypothesize that investors’ trust in management will be positively associated with their willingness to invest in the company and with their CEO retention judgments. We state our hypothesis formally as follows:

H2

Investors’ trust in management is positively associated with their (a) willingness to invest and (b) perception that the CEO should be retained.

Method

Overview and Task

We conducted an experiment using evening MBA students as participants. Participants received instructions indicating that the study was about investors’ decision making. The materials contained background information about the XYZ Company, a fictitious publicly traded company that produces and markets agricultural nutrients, industrial products, and specialty fertilizers. The materials also contained background information about the CEO, Craig Crawford, (e.g., age, education, professional work experience, and tenure as CEO), and indicated the company has consistently issued earnings forecasts under the current CEO’s tenure. Additionally, as discussed further below, we provided information about the accuracy of the earnings forecasts. Next, we presented income statements for the last three years. For the most recent year, the company reported EPS of $1.95, which represented a substantial increase from the two previous years of $1.77 and $1.72, respectively. After reading this information, participants responded to an initial series of questions designed to reinforce our reputation manipulation and to verify that it is effective.

Next, participants received a press release from the company announcing a restatement for the most recent year based on the discovery that fictitious (i.e., fraudulent) sales had been recorded at one of the company’s operating segments. The press release indicates that the company independently investigated the misstatement. Under the classification scheme developed by Hennes et al. (2008), this restatement represents a fraud rather than an error. As described above, the findings from Hennes et al. (2008) indicate that the adverse consequences to the company and its CEO are more severe for fraud-based restatements.

The press release indicated that the firm restated several financial statement accounts, including decreases in revenue, cost of sales, net income, EPS, net accounts receivable, and an increase in inventories. Restated EPS for the most current year was $1.79, a reduction of sixteen cents from the original (misstated) EPS of $1.95. Relative to restated EPS, the change in EPS is over 8% ($.16/$1.79), which would generally be considered a material misstatement. We held constant across conditions the explanation for the restatement, indicating that it is the result of fraudulent activities by personnel at an operating segment.Footnote 2 While a press release announcing a restatement due to fraudulent acts by employees outside the C-suite may alleviate investors’ concerns that the CEO was directly involved in the fraud, it may still cause investors to question the CEO’s trustworthiness.Footnote 3 After all, they may wonder whether the CEO was complicit in some way with this fraudulent behavior. Subsequent to reviewing this information, participants responded to our dependent measures, discussed more fully below. Finally, participants completed manipulation checks and demographic questions.

Independent Variables

The experiment has a 2 × 2 between-participants design, crossing managerial reputation and the announcement of corrective actions, and we randomly assigned participants to a condition. We manipulated management’s pre-existing reputation based on prior forecast accuracy. Under the high reputation condition, the materials indicated that “the accuracy of the Company’s quarterly earnings forecasts has been high, meaning that actual earnings have been very close to forecasted earnings.” Under the low reputation condition, the materials indicated that “the accuracy of the Company’s quarterly earnings forecasts has been low, meaning that actual earnings have been very far from forecasted earnings.” This manipulation is similar to Hirst et al. (1999). The materials do not indicate whether differences between actual and forecasted earnings have been consistently biased in one direction or the other. Importantly, because forecast accuracy in the past has been consistently high (low), we expect investors will infer that management’s pre-existing reputation is favorable (unfavorable). Thus, our manipulation likely plays a key role in shaping pre-restatement perceptions about management’s reputation.Footnote 4

We also manipulated the presence or absence of management’s announcement of corrective actions. Under the action absent condition, no mention of any corrective action was included in the press release announcing the restatement. Under the action present condition, the press release also announced two corrective actions that have been taken by the CEO in response to the restatement. Both actions represent costly structural changes to the company’s internal controls and its broader ethical environment. Strengthening internal controls presumably discourages employees from engaging in unacceptable accounting and increases the likelihood of detecting such behavior (Whittington and Pany 2010). To strengthen the company’s broader ethical environment, the company hired a highly qualified person as the company’s Chief Ethics Officer. Hoffman and Rowe (2007, p. 556) identify the Chief Ethics Officer as “the person with primary responsibility for ensuring a company’s ethical performance.” In this regard, Fombrun and Foss (2004) recommend appointing a Chief Ethics Officer as an important response to ethical scandals. Under the present condition, the following additional paragraphs were included in the press releaseFootnote 5:

In response to the restatement, the Company’s CEO, Craig Crawford, announced the hiring of Rebecca Gallager as the company’s Chief Ethics Officer, a newly created position. Gallager will provide strategic focus on the ethics and values of XYZ, coordinate and communicate ethics activities, and implement and monitor programs to detect and prevent unethical or illegal conduct. Gallager has more than 25 years of experience in the fields of labor and employment law, ethics, compliance, and administration. She will report to Crawford and to the Audit Committee.

Craig Crawford also announced that a Big 4 public accounting firm had been hired and has completed a thorough analysis of the company’s internal controls. At substantial cost, the company has implemented all recommendations to improve the company’s internal controls.

Dependent Variables

Managerial Fraud Prevention Assessments

The instrument included four questions intended to measure participants’ assessment of the extent to which management would prevent fraud in the future. Namely, we ask participants to assess: the extent to which the CEO will work diligently to prevent fraud, the ease of seeing how fraud will be prevented in the future, whether the CEO has considered the importance of preventing fraud, and the strength of management’s beliefs about the value of preventing fraud. Again, participants assessed each measure on a separate seven-point scale, with lower values indicating more negative responses. Based on the results of a factor analysis (described below), we averaged responses to these four questions to create our composite management fraud prevention measure.

Trust in Management

The instrument included a series of questions intended to measure trust in management. Researchers across multiple disciplines such as psychology, sociology, and organizational behavior have proposed that trust is multidimensional, including cognitive, affective, and intended behavior (McAllister 1995; Cummings and Bromiley 1996; Dirks and Ferrin 2002). To reflect the multidimensionality of trust in management, our instrument included a series of four questions: feelings toward the CEO, truthfulness of the CEO, competence of the CEO, and participants’ emotional reaction to the misleading financial statements. Participants assess each measure on a separate seven-point scale, with lower values indicating more negative responses. Again, based on the results of a factor analysis (described below), we average responses to these four questions to create our composite trust in management measure.

Investment and CEO Retention Judgments

Finally, we capture participants’ views about investing in XYZ and their views about whether the CEO should be retained. With respect to participants’ views about investing, we adapted a question from Elliott (2006), which asked participants to make an investment allocation decision for $10,000 with any money not invested in XYZ automatically invested in a competitor. The response scale for this question ranged from $0 to $10,000 in $1,000 increments. To capture participants’ views about whether the CEO should be retained, we asked participants to indicate on a seven-point scale the extent to which they believed that the CEO should be fired, with lower values indicating a stronger desire to fire the CEO and higher values indicating a stronger desire to retain the CEO.

Participants

Consistent with prior research, we chose to use MBA students as a proxy for “reasonably informed” nonprofessional investors (Elliott et al. 2007; Elliott et al. 2012, p. 519). Using MBA students, a relatively homogeneous group of participants, allows us to improve the efficiency and effectiveness of our tests (Libby et al. 2002). Participants were evening MBA students enrolled at a large state university located in the Southwestern United States.Footnote 6 Ninety-four students enrolled in a financial accounting course completed the questionnaire. Table 1 presents background information about those participants. As shown, approximately 75% of participants had invested in the stock market in the past. On average, participants had over 9 years of work experience, had taken about 12 credit hours in accounting and about 13 credit hours in finance. Their mean self-assessed ability to read and understand financial statements is significantly above the scale mid-point of 4 (t = 7.22, p < 0.01). Thus, it appears that participants in the study are reasonably representative of nonprofessional investors and are qualified to complete the experimental task, which is low in integrative complexity (Elliott et al. 2007).

Results

Manipulation Checks

After completing the case, participants answered manipulation check questions. The first manipulation check related to the manipulation of management’s pre-existing reputation based on prior forecast accuracy and stated, “In your case, the accuracy of the Company’s quarterly earnings forecasts was described as _____.” Participants responded by circling “high” or “low.” The second manipulation check related to the announcement of management’s corrective actions and stated, “The company’s press release ____ that the CEO hired a Chief Ethics Officer with more than 25 years of experience in the fields of labor and employment law, ethics, compliance, and administration.” Participants responded by circling “announced” or “did not announce.”Footnote 7

Both manipulations were successful; correct response rates were 85 and 80% for the forecast accuracy statement and corrective action announcement, respectively, and responses were significantly correlated with the correct experimental condition (both χ2 > 46.82, both p < 0.01).Footnote 8 In addition, we conducted an analysis-of-variance using the initial composite measure of managerial reputation as the dependent variable. The independent variables were management’s pre-restatement reputation, announcement of corrective action, and the interaction term. As expected, we find a significant main effect of pre-restatement reputation (F = 42.47, p < 0.01) with participants in the high reputation condition assessing management as having a better reputation than did participants in the low reputation condition (5.43 vs. 4.29). Neither the main effect of corrective action announcement (F = 0.00, p = 0.97) nor the interaction term (F = 2.26, p = 0.14) was significant. These results provide further evidence that manipulating management’s pre-existing reputation based on prior forecast accuracy effectively influences perceptions of the CEO’s reputation.

Preliminary Analyses

Given that we developed the multiitem measures (fraud prevention and trust) for the purpose of this study, we conducted a preliminary exploratory principle components factor analysis, with oblimin rotation, on the items. As reported in Table 2, we extracted a two-factor solution with the eight items loading strongly and independently on their conceptual dimensions; the two factors explained 64.45% of the variance in the items.Footnote 9 We report means, standard deviations, internal consistency estimates, and inter-correlations between all study variables in Table 3, Panel A. We also report means and standard deviations for the 2 × 2 reputation by corrective action announcement conditions in Table 3, Panel B.Footnote 10

Hypotheses Testing

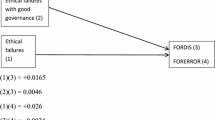

We used a two-step process to test the proposed hypotheses. First, we tested a path model based on the conceptual model represented in Fig. 1 (AMOS 21 in Arbuckle 2012). We calculated four measures of model fit: χ2, CFI, RMSEA, and SRMR. A nonsignificant χ2 indicates good model fit. A CFI value of 0.95 or higher, a RMSEA value of 0.06 or lower, and an SRMR value of 0.08 or lower are all indicative of good model fit (Hu and Bentler 1999). In the model, we regressed fraud prevention assessments onto pre-restatement managerial reputation and managerial corrective action announcements. To test the possibility that reputation and corrective action announcements interact to affect fraud prevention assessments, we computed a product interaction term between reputation and corrective action announcement and set it to predict fraud prevention assessments. We set these three exogenous variables free to correlate with one another. In turn, we set fraud prevention assessments to predict trust, wherein we set trust to predict CEO retention and investment judgments. The conceptual model fits the data well (χ2(11) = 13.81, p = 0.24, CFI = 0.99, RMSEA = 0.05, SRMR = 0.07). This model serves as a framework for conceptualizing the proposed hypotheses. We report standardized path estimates in Fig. 1. As shown in Fig. 1, we find significant relationships among our independent, mediating, and dependent variables.

Results of the structural equation Analysis. *p < 0.10; **p < 0.01. Note we manipulated the announcement that management had taken corrective actions between participants at two levels: present versus absent. In the absent condition, the press release reported the effect of the misstatement on the financials. In the present condition, the press release reported the effect of the misstatement on the financials and described the structural changes that the company implemented to prevent future misstatements. We manipulated management’s pre-restatement reputation between participants at two levels: high versus low. In the high (low) reputation condition, participants learn that the CEO has a history of high (low) forecast accuracy. Participants made an investment judgment by indicating how much of a $10,000 investment they would allocate to XYZ as opposed to other companies in the same industry. Participants used an 11-point scale that ranged from $0 to $10,000 in $1000 increments to record their judgment. Participants provided an assessment of whether the CEO should be retained using a seven-point scale anchored by “definitely be fired” (1) and “definitely not be fired” (7). We describe the questions used to elicit the trust in management and managerial fraud prevention assessment judgments in Table 2

By extension, in Step 2 of our analyses, we used procedures suggested by Hayes (2014) within the MODMED macro (Model 2) to test the conditional indirect effects described in H1. We report results from the MODMED analyses in Table 4. As shown in Table 4, and consistent with our path analysis results, following a restatement, managerial reputation and corrective action announcement interact to influence investors’ fraud prevention assessments; within the Mediator (fraud prevention assessments) Variable Model in Table 4, the unstandardized interaction term was significant (B = −0.68, p = 0.09). In turn, in the Dependent (Trust) Variable Model, fraud prevention assessments was the only variable to directly predict Trust (B = 0.56, p < 0.01); these results replicate those reported in Fig. 1, based on the path model.

Overall, the conditional indirect effects support H1. For participants in the condition where no corrective action was announced, respondents in the high reputation condition reported significantly higher trust (through fraud prevention assessments) compared to the low reputation condition (B = 0.48, p = 0.01). That is, when a corrective action announcement was absent, respondents in the high reputation condition reported a 0.48 higher trust (p = 0.01) than those in the low reputation condition. When a corrective action was announced, reputation no longer indirectly influenced trust (B = 0.10, p = 0.55) through fraud prevention assessments. Finally, turning back to the path model reported in Fig. 1, and in support of H2, trust was positively related to both CEO retention judgments (β = 0.74, p < 0.01) and investment judgments (β = 0.66, p < 0.01).Footnote 11

Discussion

We find that managers’ pre-restatement reputation and their post-restatement announcement of corrective actions interact to predict investors’ managerial fraud prevention assessments, which mediate their degree of trust in management. Investors’ trust judgments, in turn, are associated with both their investment and CEO retention judgments. Specifically, when management does not announce a corrective action in response to a restatement, investors trust management with a poor pre-restatement reputation less than management with a good pre-restatement reputation because investors do not believe that such management values preventing fraud. Alternatively, when management does announce a corrective action in response to a restatement, fraud prevention assessments no longer explain the relationship between management pre-restatement reputation and investor trust perceptions. Additionally, we find that investors’ trust in management is positively associated with their judgments to invest in the company and their judgments about retaining the CEO, after a restatement. Thus, it appears that the CEO’s pre-restatement reputation and decision to announce corrective actions in response to a restatement can act to determine investors’ judgments following a restatement, through their impact on investors’ managerial fraud prevention assessments and trust in management. Overall, our results suggest that pre-restatement managerial reputation and the announcement of managerial corrective actions can lessen the negative consequences from issuing a restatement. These findings have a number of implications.

Post-SOX, restatements dramatically increased (e.g., GAO-06-678 2006a, GAO-06-1053R 2006b; Turner and Weirich 2006; Chen et al. 2014), creating a “post-SOX phenomenon” (Burks 2011, p. 509), and even now are occurring with increasing regularity (Chasan 2013). Restatements, particularly those involving fraud, represent a “trust-destroying event” that damage companies (Hennes et al. 2008; Chen et al. 2014, p. 110). Understanding the circumstances that moderate these adverse consequences has attracted substantial attention among researchers (Palmrose et al. 2004; Hennes et al. 2008; Files et al. 2009). One stream of inquiry has considered the role of managerial reputation (e.g., Chen et al. 2014), whereas another stream has considered the role of costly managerial actions (e.g., Farber 2005; Almer et al. 2008). In this study, we extend this line of inquiry by investigating the joint effects of management’s pre-restatement reputation and management’s announcement of corrective actions on investors’ post-restatement judgments.

Additionally, we contribute to accounting literature interested in identifying interactions between disclosure characteristics and other characteristics of the firm (Mercer 2004). Specifically, we find that a managerial pre-restatement reputation plays an important role in the manner in which other unrelated disclosures, such as a restatement announcement that includes discussion of the managerial corrective actions taken to address the restatement, are interpreted by investors. That is, our evidence suggests that not all corrective action announcements are equally impactful and that investors’ response to these announcements is conditional on management’s pre-restatement reputation.

From a practical perspective, our research has important implications for firms. Boards of directors and senior managers should develop a contingency plan in the event of fraud. Certainly, the announcement of corrective actions, such as hiring an ethics officer or improving internal controls, may be a part of the firm’s contingency plan. However, these actions are financially costly to the firm and must be implemented judiciously. Management scholars contend that announcing these corrective actions are necessary to repair a relationship (Sitkin and Roth 1993; Dirks et al. 2009), implicitly suggesting that these announcements will be interpreted similarly regardless of other contextual conditions (such as management’s pre-restatement reputation). However, our results indicate that this may not be the case.

Rather, we find that investors’ response to the announcement of costly corrective actions is not necessarily the same for all firms. Our results suggest that in determining how best to react to a restatement, especially one due to fraud, boards of directors and senior managers may wish to consider how investors perceive management’s reputation before choosing (and announcing) a course of action. While there are certainly many valid reasons to strengthen corporate governance mechanisms after a restatement, boards and managers who are primarily concerned with evoking a positive market response from the announcement of such actions may find that the response is somewhat muted for companies that already have high-reputation managers. Ironically, high-reputation managers may be more likely to take corrective actions following a restatement, but simultaneously may be less likely to reap capital market benefits from announcing these actions.

Our research is also useful for regulators interested in enforcement activity related to financial statement misconduct (Juris 2013). Because such enforcement activity often involves securing monetary relief for investors that have been harmed, regulators need to be aware of the factors that individually and/or in combination with other factors can affect the severity of the damage to investors from misstated financial reports. That is, stock price decline, which is driven by negative investor sentiment, damages investors. Our results indicate that firms’ use of corrective action announcements to affect investor sentiment, and thereby mitigate damages from a restatement, may be more or less effective depending on management’s pre-restatement reputation. Thus, firm actions may affect the amount of monetary relief that regulators seek to secure on behalf of investors.

Limitations and Future Research

We note three limitations associated with our research. First, while an experimental approach is extremely useful for financial accounting research (Libby et al. 2002), such an approach is limited by its use of incomplete and hypothetical information. However, experimental research generally enhances the internal validity of the research and represents a viable method to understand better the relation between independent and dependent variables.

Second, we measured trust levels after management had already announced actions intended to repair the violation. While we assume that random assignment to a condition ensures equal pre-violation trust levels across conditions, we do not have explicit measures to confirm this assumption. Furthermore, we do not measure trust levels after the violation, but before the repair attempt. While this approach is consistent with prior research in this area (e.g., Elliott et al. 2012) and preserves the internal validity of the experiment by mitigating concerns about pretest sensitization (e.g., Aronson et al. 1990), it also leaves open the possibility that the restatement announcement damaged investor trust more in some conditions than in others.

Third, our manipulation of managerial corrective action announcement included disclosing improvements to strengthen internal controls and hiring an experienced and well-qualified ethics officer. Because research on managerial corrective actions (and their announcement) is limited, our choice was to examine a strong treatment that included the announcement of two actions. However, we cannot determine whether the effect of this announcement on investors’ judgments was due to one or both of these disclosed actions. Furthermore, we cannot determine whether our results would generalize to other types of corrective actions (e.g., enhancing the internal audit function).

The results of our study also provide a number of opportunities for future research. For example, future research could examine how variations across investors (e.g., professional versus nonprofessional investors), auditors, trust repair strategies, and trust antecedents (i.e., ability, benevolence, and integrity) could affect trust judgments and investment decisions. In addition, future research could examine whether the results obtained in our study would change if we had provided participants with an internal control attestation signed by the CEO and CFO before the fraud was discovered. Perhaps the inclusion of this common institutional feature would have negatively affected investors’ managerial fraud prevention assessments for high-, compared to low-, reputation management.

Additional opportunities for future research also emerge when we consider the importance of investors’ managerial fraud prevention assessments in our model. Research in social psychology suggests that trust is more relevant when individuals are concerned with obtaining future gains from a relationship, whereas prevention is more relevant when individuals are concerned with maintaining a current relationship (Molden and Finkel 2010). In our setting, participants assumed the role of a prospective investor, meaning that they did not have a current relationship with the firm. This could explain why prevention played a central role in investors’ response to pre-restatement managerial reputation and the announcement of post-restatement corrective actions and mediated their trust in management but did not directly affect their investment and CEO retention judgments. If, instead, our participants had assumed the role of a current investor, then their prevention judgments may have been associated with their investment and retention judgments. Future research could examine this possibility. In sum, there are many opportunities for additional research on this important topic.

Notes

In fact, Johnson (2008) reports that over 10% of public companies issued restatements in 2006.

In the attributions literature, this type of self-serving explanation or account is common when negative events occur because it reduces management’s personal responsibility for the event (Schlenker et al. 2001). In a restatement context, top management has “a natural tendency to offer excuses in response to actual or anticipated questions” as a way to distance itself from the misstatement (Reuber and Fischer 2009; Elliott et al. 2012, p. 517).

SOX holds top managers responsible for creating and maintaining an internal control system over financial reporting. In addition to signing a statement taking responsibility for the financial statements, SOX requires CEOs to sign a statement taking responsibility for the effectiveness of internal controls. By establishing a system of effective internal controls, fraud within the firm should be prevented and/or detected. Thus, even though top managers had no direct involvement in the fraud that led to the restatement, one could argue that top managers are indirectly contributing to the fraud. For example, perhaps because top managers failed to adequately create and maintain a strong control environment, other employees were not prevented from engaging in fraud. Further, top managers are in positions of authority, meaning that they are expected to anticipate negative outcomes. Thus, even if top managers were not directly involved in the circumstances leading to negative outcomes, they are likely to be held accountable (Tennan and Affleck 1990).

Mercer (2004) delineates two dimensions of managerial reputation: perceptions of competence and perceptions of trustworthiness. Our operationalization directly affects perceptions of competence (Goodman et al. 2014; Trueman 1986), and may affect perceptions of trustworthiness. That is, we are silent as to whether the inaccurate forecasts are biased in a certain direction, meaning that the forecasts could be inaccurate due to either incompetence and/or to a desire to mislead investors. Thus, we view this as a strong manipulation of managerial reputation.

Appointment of a Chief Ethics Officer or a Chief Compliance Officer became increasingly common following SOX (Clark 2006). Sometimes, this position reports directly to the Board of Directors, but just as frequently, this position may report to another senior-level position within the company (Fox 2010). In our experiment, we indicated that the Chief Ethics officer would report to both the CEO and the Audit Committee. To the extent that this choice weakens the new position, it biases against us observing treatment effects for our manipulation. Thus, we view this as a conservative design choice.

The Institutional Review Board at the university where the data were collected approved the use of human subjects in this experiment.

To provide comfort that responses to this question were not due to random chance, we also asked participants to confirm that the CEO did not make additional promises beyond the corrective actions and stated, “The company’s press release ____ that the CEO personally promised to do whatever he could to ensure that the company’s future financial reports are of the highest quality and that statement fraud never occurs.” Participants responded by circling “announced” or “did not announce.” Eighty-three percent of participants correctly indicated that the press release did not contain such a promise.

Excluding the 18 participants that failed one or both of our manipulation check questions does not change our inferences. All results reported in Fig. 1 continue to achieve conventional significance levels even when based on the 76 participants that passed both manipulation checks. Thus, the subsequent analyses include all participants.

Two items, which address blame and responsibility, did not load on either factor. Thus, we conducted the PCA without these items.

We rely on mean responses to the relevant questions for each factor, rather than on factor scores. Both approaches are used in practice (O’Rourke and Hatcher 2013). However, using mean responses makes it easier to interpret our factors vis-à-vis our response scale.

As an additional test, we examined the standardized residual errors for all omitted paths in Fig. 1 to determine whether inclusion of any of these paths would meaningfully improve model fit. None of the omitted paths excluded from the model demonstrated standardized residual covariances above 2.0, which is the generally accepted cutoff for statistically meaningful modifications (Kline 2015). Accordingly, we did not include any of these omitted paths in Fig. 1.

References

Almer, E. D., Gramling, A. A., & Kaplan, S. E. (2008). Impact of post-restatement actions by a firm on non-professional investors’ credibility perceptions. Journal of Business Ethics, 80, 61–76.

Andiappan, M., & Treviño, L. K. (2010). Beyond righting the wrong: Supervisor-subordinate reconciliation after an injustice. Human Relations, 64(3), 359–386.

Arbuckle, J. L. (2012). AMOS (version 21.0) [Computer software]. Chicago: SPSS.

Aronson, E., Ellsworth, P. C., Carlsmith, J. M., & Gonzales, M. H. (1990). Methods of research in social psychology. New York, NY: McGraw-Hill.

Arthaud-Day, M. L., Certo, S. T., Dalton, C. M., & Dalton, D. R. (2006). A changing of the guard: Executive and director turnover following corporate financial restatements. Academy of Management Journal, 49(6), 111–1136.

Bell, G. G., Oppenheimer, R. J., & Bastien, A. (2002). Trust deterioration in an international buyer-supplier relationship. Journal of Business Ethics, 36, 65–78.

Bottom, W. P., Gibson, K., Daniels, S. E., & Murnighan, J. K. (2002). When talk is not cheap: Substantive penance and expressions of intent in rebuilding cooperation. Organization Science, 13(5), 497–513.

Burks, J. J. (2010). Disciplinary measures in response to restatements after Sarbanes-Oxley. Journal of Accounting and Public Policy, 29(3), 195–225.

Burks, J. J. (2011). Are investors confused by restatements after Sarbanes-Oxley? The Accounting Review, 86(2), 507–539.

Chakravarthy, J., de Haan, E., & Rajgopal, S. (2014). Reputation repair after a serious restatement. The Accounting Review, 89(4), 1329–1363.

Chasan, E. (2013). Restatements on the rise at big companies. WSJ.com.

Chen, X., Cheng, Q., & Lo, A. K. (2014a). Is the decline in the information content of earnings following restatements short-lived? The Accounting Review, 89(1), 177–207.

Chen, K. Y., Elder, R. J., & Hung, S. (2014b). Do post-restatement firms care about financial credibility? Evidence from the pre- and post-SOX eras. Journal of Accounting and Public Policy, 33, 107–126.

Cheng, Q., & Farber, D. B. (2008). Earnings restatements, changes in CEO compensation, and firm performance. The Accounting Review, 83(5), 1217–1250.

Cianci, A. M., & Kaplan, S. E. (2010). The effect of CEO reputation and explanations for poor performance on investors’ judgments about the company’s future performance and management. Accounting, Organizations and Society, 35, 478–495.

Clark, H. (2006). Chief ethics officers: Who needs them? Available at: https://www.forbes.com/2006/10/23/leadership-ethics-hp-lead-govern-cx_hc_1023ethics.html

Copeland, J. E., Jr. (2005). Ethics as an imperative. Accounting Horizons, 19(1), 35–43.

Cummings, L. L., & Bromiley, P. (1996). The organizational trust inventory (OTI): Development and validation. In R. M. Kramer & T. R. Tyler (Eds.), Trust in organizations: Frontiers of theory and research (pp. 68–89). Thousand Oaks, CA: Sage.

Dawar, N., & Pillutla, M. M. (2000). Impact of product-harm crises on brand equity: The moderating role of consumer expectations. Journal of Marketing Research, 37, 215–226.

Del Guercio, D., Seery, L., & Woidtke, T. (2008). Do boards pay attention when institutional investor activists “just vote no”? Journal of Financial Economics, 90, 84–103.

Desai, H., Hogan, C. E., & Wilkins, M. S. (2006). The reputational penalty for aggressive accounting: Earnings restatements and management turnover. The Accounting Review, 81(1), 83–112.

Desmet, P., De Cremer, D., & Van Dijk, E. (2011). In money we trust? The use of financial compensations to repair trust in the aftermath of distributive harm. Organizational Behavior and Human Decision Processes, 114, 75–86.

Dietz, G., & Gillespie, N. (2011). Building and restoring organizational trust. London: Institute of Business Ethics.

Dirks, K. T., & Ferrin, D. L. (2002). Trust in leadership: Meta-analytic findings and implications for research and practice. Journal of Applied Psychology, 87, 611–628.

Dirks, K. T., Kim, P. H., Ferrin, D. L., & Cooper, C. D. (2011). Understanding the effects of substantive responses on trust following a transgression. Organizational Behavior and Human Decision Processes, 114, 87–103.

Dirks, K., Lewicki, R. J., & Zaheer, A. (2009). Repairing relationships within and between organizations: Building a conceptual foundation. Academy of Management Review, 34(1), 68–84.

Elliott, W. B. (2006). Are investors influenced by pro forma emphasis and reconciliations in earnings announcements? The Accounting Review, 81(1), 113–133.

Elliott, W. B., Hodge, F., Kennedy, J. J., & Pronk, M. (2007). Are MBA students a good proxy for nonprofessional investors? The Accounting Review, 82(1), 139–168.

Elliott, W. B., Hodge, F., & Sedor, L. M. (2012). Using online video to announce a restatement: Influences on investment decisions and the mediating role of trust. The Accounting Review, 87(2), 513–535.

Ertimur, Y., Ferri, F., & Stubben, S. R. (2010). Board of directors’ responsiveness to shareholders: Evidence from shareholder proposals. Journal of Corporate Finance, 16, 53–72.

Farber, D. B. (2005). Restoring trust after fraud: Does corporate governance matter? The Accounting Review, 80(2), 539–561.

Ferrin, D. L., Kim, P. H., Cooper, C. D., & Dirks, K. T. (2007). Silence speaks volumes: The effectiveness of reticence in comparison to apology and denial for repairing in integrity- and competence-based trust violations. Journal of Applied Psychology, 92, 893–908.

Files, R., Swanson, E. P., & Tse, S. (2009). Stealth disclosure of accounting restatements. The Accounting Review, 84(5), 1495–1520.

Fiske, S. T., & Taylor, S. E. (1991). Social cognition (2nd ed.). New York: McGraw-Hill.

Fombrun, C., & Foss, C. (2004). Business ethics: Corporate responses to scandal. Corporate Reputation Review, 7(3), 284–288.

Fox, T. (2010). Who does your chief compliance officer report to? Available at: http://www.corporatecomplianceinsights.com/who-does-your-chief-compliance-officer-report-to/

General Accounting Office (GAO). (2006). Financial restatements: Update of public company trends, market impacts, and regulatory enforcement activities. GAO-06-678. Washington, D.C.: GAO.

General Accounting Office (GAO). (2006). Financial statement restatement database. GAO-06-1053R. Washington, DC: GAO.

Georgarakos, D., & Pasini, G. (2011). Trust, sociability, and stock market participation. Review of Finance, 15(4), 693–725.

Gertsen, F. H. M., van Riel, C. B. M., & Berens, G. (2006). Avoiding reputation damage in financial restatements. Long Range Planning, 39(4), 429–456.

Gillespie, N., & Dietz, G. (2009). Trust repair after an organization-level failure. Academy of Management Review, 34(1), 127–145.

Goodman, T. H., Neamtiu, M., Shroff, N., & White, H. D. (2014). Management forecast quality and capital investment decisions. The Accounting Review, 89(1), 331–365.

Hatcher, L. (1994). Using SAS for factor analysis and structural equation modeling. Cary, NC: SAS Institute Inc.

Hayes, A. (2014). SPSS MODMED macro syntax reference. Available at: http://afhayes.com/public/modmed.pdf

Hennes, K. M., Leone, A. J., & Miller, B. P. (2008). The importance of distinguishing errors from irregularities in restatement research: The case of restatements and CEO/CFO turnover. The Accounting Review, 83(6), 1487–1519.

Hirschey, M., Smith, K. R., & Wilson, W. M. (2015). The timeliness of restatement disclosures and financial reporting credibility. Journal of Business, Finance & Accounting, 47(7&8), 826–859.

Hirst, D. E., Koonce, L., & Miller, J. (1999). The joint effect of management’s prior forecast accuracy and the form of its forecasts on investor judgments. Journal of Accounting Research, 37(Supplement), 1–24.

Hirst, D. E., Koonce, L., & Venkataraman, S. (2007). How disaggregation enhances the credibility of management earnings forecasts. Journal of Accounting Research, 45(September), 811–837.

Hodge, F., Hopkins, P. E., & Pratt, J. (2006). Management reporting incentives and classification credibility: The effects of reporting discretion and reputation. Accounting, Organizations and Society, 31(7), 623–634.

Hoffman, W. M., & Rowe, M. (2007). The ethics officer as agent of the board: Leveraging ethical governance capability in the post-Enron corporation. Business and Society Review, 112(4), 553–572.

Hribar, P., & Jenkins, N. T. (2004). The effect of accounting restatements on earnings revisions and the estimated cost of capital. Review of Accounting Studies, 9(2–3), 337–356.

Hu, L., & Bentler, P. M. (1999). Cutoff criteria for fit indexes in covariance structure analysis: Conventional criteria versus new alternatives. Structural Equation Modeling, 6(1), 1–55.

Investment Company Institute (ICI) and Securities Industry and Financial Markets Association (SIFMA). (2008). Equity and bond ownership in America, 2008. New York, NY: ICI and SIFMA.

Johnson, S. (2008). Proposed restatement guidelines draw investor alarm. www.CFO.com (March 17).

Jones, E. E., & Davis, K. E. (1965). From acts to dispositions: The attribution process in person perception. In L. Berkowitz (Ed.), Advances in experimental social psychology (Vol. 2, pp. 219–266). New York: Academic Press.

Juris, S. (2013). Restatements resurrected? Accounting fraud by the numbers. Forbes.com. (March 28).

Karpoff, J. M., Lee, D. S., & Martin, G. S. (2008). The cost to firms of cooking the books. Journal of Financial and Quantitative Analysis, 43(3), 581–612.

Kelley, H. H. (1967). Attribution theory in social interception. In D. L. Vine (Ed.), Nebraska symposium on motivation (pp. 192–238). Lincoln, NE: University of Nebraska Press.

Kelley, H. (1972). Causal schemata and the attribution process. In E. Jones, D. Kanouse, H. Kelley, R. Nisbett, S. Valins, & B. Weiner (Eds.), Attribution: Perceiving the causes of behavior (pp. 151–174). Morristown, NJ: General Learning Press.

Kelley, H. H. (1973). The processes of causal attribution. American Psychologist, 28, 107–128.

Kelly, H. H., & Michela, J. L. (1980). Attribution theory and research. In M. R. Rosenzweig & L. W. Porter (Eds.), Annual review of psychology (Vol. 31, pp. 457–501). Palo Alto, CA: Annual Reviews.

Kim, P. H., Dirks, K. T., Cooper, C. D., & Ferrin, D. L. (2006). When more blame is better than less: The implications of internal vs. external attributions for repair of trust after a competence- versus integrity-based trust violation. Organizational Behavior and Human Decision Processes, 99, 49–65.

Kim, P. H., Ferrin, D. L., Cooper, C. D., & Dirks, K. T. (2004). Removing the shadow of suspicion: The effects of apology versus denial for repairing competence- versus integrity-based trust violations. Journal of Applied Psychology, 89(1), 104–118.

Kinney, W. R., Palmrose, Z.-V., & Scholz, S. (2004). Auditor independence, non-audit services, and restatements: Was the US government right? Journal of Accounting Research, 42(3), 561–588.

Kline, R. B. (2015). Principles and practice of structural equation modeling (4th ed.). New York, NY: Guilford Press.

Kramer, R. M., & Lewicki, R. J. (2010). Repairing and enhancing trust: Approaches to reducing organizational trust deficits. The Academy of Management Annals, 4(1), 245–277.

Kravet, T., & Shevlin, T. (2009). Accounting restatements and information risk. Review of Accounting Studies, 15(2), 264–294.

Leone, A. J., & Liu, M. (2010). Accounting irregularities and executive turnover in founder-managed firms. The Accounting Review, 85(1), 287–314.

Lewicki, R. J., & Bunker, B. B. (1995). Trust in relationships: A model of development and decline. In B. B. Bunker & J. Z. Rubin (Eds.), Conflict, cooperation, and justice (pp. 133–173). San Francisco: Jossey-Bass Publishers.

Lewicki, R., Wiethoff, C., & Tomlinson, E. (2005). What is the role of trust in organizational justice? In J. Greenberg & J. A. Colquitt (Eds.), Handbook of organizational justice: Fundamental questions about fairness in the workplace (pp. 247–270). Mahwah, NJ: Lawrence Erlbaum Associates.

Libby, R., Bloomfield, R., & Nelson, M. W. (2002). Experimental research in financial accounting. Accounting, Organizations and Society, 27, 775–810.

Lount, R. B., Jr., Zhong, C. B., Sivanathan, N., & Murnighan, J. K. (2008). Getting off on the wrong foot: The timing of a breach and the restoration of trust. Personality and Social Psychology Bulletin, 34, 1601–1612.

McAllister, D. J. (1995). Affect- and cognitive-based trust as foundations for interpersonal cooperation in organizations. Academy of Management Journal, 38, 24–59.

Mercer, M. (2004). How do investors assess the credibility of management disclosures? Accounting Horizons, 18, 185–196.

Molden, D. C., & Finkel, E. J. (2010). Motivations for promotion and prevention and the role of trust and commitment in interpersonal forgiveness. Journal of Experimental Social Psychology, 46, 255–268.

Nakayachi, K., & Watabe, M. (2005). Restoring trustworthiness after adverse events: The signaling effects of voluntary “hostage posting” on trust. Organizational Behavior and Human Decision Processes, 97, 1–17.

O’Rourke, N., & Hatcher, L. (2013). A step-by-step approach to using SAS for factor analysis and structural equation modeling (2nd ed.). Cary, NC: SAS Institute Inc.

Palmrose, Z.-V., Richardson, V. J., & Scholz, S. (2004). Determinants of market reactions to restatement announcements. Journal of Accounting and Economics, 37(1), 59–89.

Palmrose, Z.-V., & Scholz, S. (2004). The circumstances and legal consequences of non-GAAP reporting: Evidence from restatements. Contemporary Accounting Research, 21(1), 139–180.

Persons, O. S. (2006). The effects of fraud and lawsuit revelation on US executive turnover and compensation. Journal of Business Ethics, 64, 405–419.

Plumlee, M., & Yohn, T. L. (2010). An analysis of the underlying causes attributed to restatements. Accounting Horizons, 24(1), 41–64.

Plumlee, M., & Yohn, T. L. (2015). An examination of management’s regulatory filing choices surrounding restatements. Journal of Management Accounting Research, 27(2), 121–144.

Reuber, A. R., & Fischer, E. (2009). Signaling reputation in international online markets. Strategic Entrepreneurship Journal, 3(4), 369–386.

Rhee, M., & Valdez, M. E. (2009). Contextual factors surrounding reputation damage with potential implications for reputation repair. Academy of Management Review, 34(1), 146–168.

Ross, M., & Fletcher, G. J. O. (1985). Attribution and social perception. In G. Lindsey & E. Aronson (Eds.), The handbook of social psychology (Vol. 2, pp. 73–114). New York: Random House.

Rousseau, D. M. S., Sitkin, B., Burt, R., & Camerer, C. (1998). Not so different after all: A cross-discipline view of trust. Academy of Management Review, 23(3), 393–404.

Sarbanes-Oxley Act of 2002 (SOX). (2002). Public Law No. 107–204[H.R.3763]. Washington, D.C.: Government Printing Office.

Schlenker, B. R., Pontari, B. A., & Christopher, A. N. (2001). Excuses and character: Personal and social implications of excuses. Personality and Social Psychology Bulletin, 5, 15–32.

Schoorman, F. D., Mayer, R. C., & Davis, J. H. (2007). An integrative model of organizational trust: Past, present and future. Academy of Management Review, 32(2), 344–354.

Schweitzer, M. E., Hershey, J. C., & Bradlow, E. T. (2006). Promises and lies: Restoring violated trust. Organizational Behavior and Human Decision Processes, 101, 1–19.

Sitkin, S. B., & Roth, N. L. (1993). Explaining the limited effectiveness of legalistic “remedies” for trust/distrust. Organization Science, 4(3), 367–392.

Srinivasan, S. (2005). Consequences of financial reporting failure for outside directors: Evidence from accounting restatements and audit committee members. Journal of Accounting Research, 43(2), 291–334.

Stanley, J. D., & DeZoort, F. T. (2007). Audit firm tenure and financial restatements: An analysis of industry specialization and fee effects. Journal of Accounting and Public Policy, 26, 131–159.

Tennan, H., & Affleck, G. (1990). Blaming others for threatening events. Psychological Bulletin, 108(2), 209–232.

Tomlinson, E. C., Dineen, B. R., & Lewicki, R. J. (2004). The road to reconciliation: Antecedents of victim willingness to reconcile following a broken promise. Journal of Management, 30, 165–187.

Trueman, B. (1986). Why do managers voluntarily release earnings forecasts? Journal of Accounting and Economics, 8(1), 53–71.

Turner, L. E., & Weirich, T. R. (2006). A closer look at financial statement restatements: Analyzing the reasons behind the trend. The CPA Journal, (December), pp. 12–23.

Weiner, B. (1985). An attributional theory of achievement motivation and emotion. Psychological Review, 92, 548–573.

Weiner, B. (1986). An attributional theory of motivation and emotion. New York: Springer.

Weiner, B. (1995). Judgments of responsibility: A foundation for a theory of social conduct. New York, NY: Guilford Press.

Whittington, R., & Pany, K. (2010). Principles of auditing and other assurance services (17th ed.). Boston, MA: McGraw-Hill Irwin.

Wiles, M. A., Jain, S. P., Mishra, S., & Lindsey, C. (2010). Stock market response to regulatory reports of deceptive advertising: The moderating effect of omission bias and firm reputation. Marketing Science, 29(5), 828–845.

Wilson, W. (2008). An empirical analysis of the decline in the information content of earnings following restatements. The Accounting Review, 83(2), 519–548.

Wong, P. T. P., & Weiner, B. (1981). When people ask “why” questions, and the heuristics of attributional search. Journal of Personality and Social Psychology, 40, 650–663.

Zaheer, A., McEvily, B., & Perrone, V. (1998). Does trust matter? Exploring the effects of interorganizational and interpersonal trust on performance. Organizational Science, 9(2), 141–159.

Acknowledgements

We thank the Center for Leadership and Character at the School of Business at Wake Forest University for its support of this project.

Funding

No funding was received for this study.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

The authors declare that they have no conflict of interest.

Ethical Standards

All procedures performed in studies involving human participants were in accordance with the ethical standards of the institutional and/or national research committee and with the 1964 Helsinki declaration and its later amendments or comparable ethical standards.

Informed Consent

Informed consent was obtained from all individual participants included in the study.

Rights and permissions

About this article

Cite this article

Cianci, A.M., Clor-Proell, S.M. & Kaplan, S.E. How Do Investors Respond to Restatements? Repairing Trust Through Managerial Reputation and the Announcement of Corrective Actions. J Bus Ethics 158, 297–312 (2019). https://doi.org/10.1007/s10551-018-3844-z

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10551-018-3844-z