Abstract

We investigate the effectiveness of corporate social responsibility (CSR) disclosure in protecting corporate reputation following financial restatements. As expected under legitimacy theory, firms can signal their legitimacy via nonfinancial disclosure after the negative effects of financial restatements. Our results show that restating firms make substantial improvements to overall CSR disclosure quality by changing their standalone reports to a more conservative tone, increasing readability and report length, even though they strategically disclose less forward-looking and sustainability-related content. Such improvements are more pronounced in restating firms with prior low-quality CSR disclosure. Moreover, restating firms with CSR disclosure have smaller forecast errors than non-CSR disclosers, yet the change in CSR disclosure after restatements does not further improve analyst forecast accuracy. Finally, we find that compared with nondisclosers, restating firms with CSR disclosure suffer smaller firm value losses. Overall, the evidence supports the view that consistent CSR reporting alleviates reputational damage and plays an insurance-like or value protection role during crisis periods.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

We focus on the content and narratives of disclosed corporate social responsibility (CSR) in standalone reports to capture variation in CSR disclosure quality. While consistent CSR engagement accrues ethical capital and promotes financial performance (Dhaliwal et al. 2011; Lys et al. 2015), we investigate how firms use CSR disclosure to protect firm value and corporate reputation following negative events. There has been discussion on the value-adding role of CSR (Flammer 2013; Malik 2015), and relatively less is known about its value protection role (Bae et al. 2019; Peloza 2006). Thus, using financial restatements as events adversely affecting firm value, we address the following research questions: (1) How do firms change their CSR disclosure around financial restatements? (2) To what extent can CSR disclosure protect a firm from restatement-related effects, immediately and in the longer term? Our study sits at the intersection of three related but distinct studies: Dhaliwal et al. (2012), Muslu et al. (2019), and Chakravarthy et al. (2014). While Dhaliwal et al. (2012) and Muslu et al. (2019) examine the relationship between CSR and analyst forecasts, they are not centered on adverse events and therefore do not consider impacts on corporate reputation. Our study also differs from Chakravarthy et al. (2014) where reputation repair, rather than protection after serious accounting restatements is investigated, and there is no exclusive attention on CSR disclosure.

Financial restatements occur when financial statements have to be revised and republished because they contained material inaccuracies. The original statements are regarded as ethical failures for breaching firm fiduciary duties (Staubus 2005). Such misrepresentation reduces the reliability of financial statements, destroys the trust of investors and other stakeholders, and endangers corporate legitimacy. Devaluation of reputation capital affects firm value directly due to expected increases in financing and transaction costs (to capital providers and stakeholders) and expected decreases in future cash flows (e.g., decreased sales and increased litigation risk) (Chakravarthy et al. 2014).

Various theories such as legitimacy, reputation risk management, and agency theories have reasoned the inclusion of CSR disclosure in the discourse between an ethical firm and its stakeholders to legitimize corporate behavior and promote positive corporate reputation (Colleoni 2013; Michelon 2011). De la Fuente Sabaté and De Quevedo Puente (2003) define corporate reputation as “perceptions of how the firm behaves toward its stakeholders and the degree of informative transparency with which the firm develops relations with them” (p. 280), suggesting that corporate reputation contains both behavioral and informative aspects. That is, legitimate behavior in relation to the distribution of value created in the past leads stakeholders to expect such behavior in the future. Besides, Pérez (2015) posited that effective communication reduces asymmetric information, which further restricts the potential for managerial opportunism and builds stakeholder trust. As such, we propose that nonfinancial disclosure of CSR practices protects corporate reputation during crisis by dispelling customer concerns about environmental practices, lowering the likelihood of government regulation and compliance costs, and decreasing information asymmetry and uncertainty in overall information environment. Anecdotal evidence suggests that some restating firms (e.g., Nordstrom Inc, Manpower Group and CF Industries Holding Inc) started to issue CSR reports after experiencing financial restatements while others (e.g., American Electric Power) sought external assurance of their CSR reporting. Thus, it is worthwhile to explore the change in CSR disclosure and the issue of whether and how CSR disclosure protects firm reputation in the context of financial restatements, through disclosed CSR contents and reporting narratives other than broad CSR generalizations.

We examine the immediate and longer-term protection effects of CSR disclosure via analyst forecasts and firm value, respectively. Analyst forecasts are ideal for testing immediate effects because analysts incorporate followed firms’ CSR information in their forecasts,Footnote 1 respond immediately to the release of restatement announcements by revising their forecasts,Footnote 2 and, compared to insiders, short sellers, and institutional managers who take proactive actions prior to corrective restatements, they only react to a restatement after its announcement (Griffin 2003). We expect a faster revision process after restatement announcements for firms with CSR disclosure, since the reduced information asymmetry from voluntary nonfinancial disclosure expedites forecast revisions. Prior CSR reporting is expected to mitigate the restatement-related negative consequences and in doing so, takes an insurance-like or value protection role.

The longer-term effects of CSR disclosure are investigated because analyst forecast revisions may not fully capture them. According to Wang and Bansal (2012), the impact of CSR can take a protracted time to manifest due to its long-term strategic orientation. CSR activities can affect firm value through sales, costs, operational efficiency, financing, and litigation risk (Brown and Dacin 1997; Dhaliwal et al. 2012; Lev et al. 2010; Roberts and Dowling 2002; Starks 2009). Christensen (2016) found that when CSR-related misconduct occurs, firms reporting CSR practices experience a smaller negative price reaction. Since CSR disclosure can reduce adverse effects on a firm both financially and nonfinancially, we expect restating firms with CSR disclosure to experience less value destruction.

Our sample comprises US firms with financial restatements due to unintentional errors, and issued standalone CSR reports over the period 2000 to 2017. Using a self-constructed score to evaluate CSR disclosure quality, the results show that restating firms improve CSR disclosure quality substantially following financial restatements. Greater improvements are found in restating firms with low-quality CSR disclosure. These improvements range from a change in disclosure tone (from optimistic to pessimistic), an increase in report length, to an improvement in report readability. Despite less frequent use of forward-looking and sustainability-related words in CSR reports, we report an overall improvement of post-restatement CSR disclosure. Moreover, we find that after restatement announcements, analysts revise forecasts faster and publish positively biased forecasts for firms with CSR reporting history, despite they revise downwards for both CSR and non-CSR firms. Firms with high-quality CSR disclosure have smaller forecast errors in the pre- and post-restatement periods, although the changes in CSR disclosure do not further improve forecast accuracy. Finally, there is a positive association between CSR disclosure quality and firm value; where a change in CSR disclosure quality is more effective in increasing firm value for those with low-quality CSR disclosure from the pre-restatement period to the post-restatement period.

Our findings contribute to the risk management literature. To our knowledge, this is the first study to examine how negative events lead to changes in the linguistic content of CSR disclosure. Complementing Dhaliwal et al. (2012) and Muslu et al.’s (2019) research on CSR reporting, we show that nonfinancial disclosure of CSR activities can positively influence the market’s perception of firm reputation during times of pressure, playing an insurance-like role in the face of reputation-damaging events. While Chakravarthy et al. (2014) explore the ex post financial and nonfinancial actions of restating firms targeting capital providers, customers, employees, and geographic communities, we focus on variation in CSR disclosure quality, and provide insights to management on how to change disclosure quality in times of ethical failure and how the capital market differentiates disclosure quality among firms and allocates rewards accordingly (Gao et al. 2016).

Our study on CSR disclosure fits into the business ethics literature under Carroll’s (1983) CSR Pyramid where “corporate social responsibility involves the conduct of business so that it is economically profitable, law abiding, ethical and socially supportive” (p. 608). Nevertheless, Boda and Zsolnai (2016) note that CSR has not provided the expected improvements in ethical performance because firms in general have been unwilling to make ethical progress. Accordingly, the business case remains weak and stakeholders have not been able to compel firms to be socially responsible. However, when ethical failures occur, our findings demonstrate firms voluntarily enhancing their social (CSR) activities, signifying that a catalyst is needed to kick-start firms to do the right thing. These types of responses have been examined in marketing (Choi and La 2013; Bolton and Mattila 2015) but less so in business, even though the two concepts of CSR and business ethics overlap and are used interchangeably.

The remainder of this study is presented as follows. "Literature Review and Hypothesis Development" reviews the literature and develops the hypotheses while "Research Method" discusses the research method. "Results and Discussion" presents the descriptive statistics and results; robustness checks are given in "Robustness Tests" and "Conclusion" concludes the study.

Literature Review and Hypothesis Development

Financial Restatements and Adverse Effects

A financial restatement signals that previous financial statements were not credible. It is regarded as an ethical failure in fulfilling a firm’s fiduciary responsibility to investors and other stakeholders. Hribar and Jenkins (2004) and Park and Wu (2009) found that the cost of equity and debt financing increases after restatements, and restating firms make changes to top management. Arthaud-Day et al. (2006) found that CEOs and CFOs involved in financial restatements are more than twice as likely to exit their firms. Palmrose et al. (2004) showed that the market generally overreacts negatively to restatement announcements because of increased information uncertainty. In our sample, restating firms suffered negative abnormal returns of − 0.51% to − 1.46% in the five days after a restatement announcement. Higher audit fees are imposed on firms that restate (Feldmann et al. 2009) and there is an increasing likelihood of auditor resignations because auditors interpret restatements as increased client risk (Huang and Scholz 2012). The occurrence of financial restatements harms a firm’s reputational capital and triggers negative responses from various stakeholders. These include difficulties negotiating deferred payments with suppliers (Chakravarthy et al. 2014), attracting talented employees (Jones 1995; Treviño et al. 2006), retaining existing customers, and gaining support from local communities (O’Connor 2002). Specifically, financial restatements destroy a trust relationship between a firm and its stakeholders, impair legitimacy, and in extreme cases, threaten a firm’s survival (McGuire et al. 1988).

CSR Disclosure Quality and Organizational Legitimacy

While prior researchers document an adverse impact of restatements on firm financial performance, they also suggest a link between financial performance and CSR disclosure (Porter and van der Linde 1995; Hart 1995; Dowell et al. 2000). For example, Dowell et al. (2000) found that multinational enterprises adopting stringent global environmental standards have higher market values compared to firms adopting less stringent host country environmental standards. Paul and Siegel (2006) posited that firms strive to reach higher levels of environmental performance in order to achieve superior economic performance (i.e., profit-maximizing CSR). Kim et al. (2012) contended that CSR firms behave in a responsible manner in their financial reporting, as a consequence, deliver more transparent and reliable financial information. Plumlee et al. (2015) provided evidence of a relationship between voluntary environmental disclosures, cost of capital, and expected future cash flows.

A relatively recent strand of CSR research explores firms’ use of CSR disclosure to justify or negate poor performance (Healy and Palepu 2001; Merkl-Davies and Brennan 2007). Legitimacy theory posits that firms in reputation crisis seek to reinforce their legitimacy by communicating to stakeholders that they are in tune with societal concerns (Bebbington et al. 2008; Deegan 2002), and one way of signaling legitimacy is through CSR disclosure (Aerts and Cormier 2009; Cahan et al. 2016; Carroll and Einwiller 2014; Cho and Patten 2007; Mahoney et al. 2008; Zahller et al. 2015). Disclosed CSR reflects a firm’s understanding and acknowledgment of its responsibilities to society and the environment, and the voluntary disclosure narrative reflects commitment to accountability and transparency (Allee and DeAngelis 2015; O’Dwyer and Owen 2005; Sethi et al. 2017; Slack and Shrives 2010).

CSR disclosure with greater accuracy and completeness is considered high-quality, and is expected to exert influence on stakeholder assessments of legitimacy via their perceptions of firm credibility (Fernandez-Feijoo et al. 2014; Melloni et al. 2017; Michelon et al. 2015; Rupley et al. 2012; Simnett et al. 2009). Accurate CSR disclosure requires firms to report items clearly, using specific language and quantitative measures to achieve a comparable and verifiable description of nonfinancial performance (Cho et al. 2010; Zahller et al. 2015). For instance, truthful representation of CSR information, especially of less than desirable CSR performance, could be an indication of high-quality CSR disclosure (Pflugrath et al. 2011). Linguistic tone is a salient factor in identifying the content of qualitative disclosures where the measure of linguistic tone improves explanatory power of market models by up to 62% (Boudoukh et al. 2013). Completeness of CSR disclosure denotes “the extent of CSR information disclosed” and suggests a wide coverage of CSR-related issues (Melloni et al. 2017), including community engagement, workforce diversity, employee health and safety, waste management, product quality, and philanthropy. Greater completeness allows a better understanding of the broad scope of CSR engagement as well as the depth of firm exploration in each CSR area, leaving fewer chances for “cherry-picking” or other impression management tactics and leading to enhanced social legitimacy.

When faced with negative market reaction and social criticism, firms respond to perceived legitimacy threats by engaging in legitimacy-rebuilding activities such as CSR disclosure. Stakeholders depend on additional CSR information to assess perceived legitimacy and differentiate between restating firms based on disclosure quality, because infrequent events like financial restatements create uncertainties in the information environment. Aerts and Cormier (2009) reported that firms employ annual report environmental disclosures and environmental press releases as legitimation tools. Notably, they further pointed out that firms are able to make strategic choice to alter their legitimacy status and to cultivate the resource through corporate actions, by adapting their activities and changing perceptions. Consistently, since a firm demonstrating greater transparency and accountability through high-quality CSR disclosure is perceived as more legitimate (Aerts and Cormier 2009; Lindblom 2010; Zahller et al. 2015), firms may alleviate skepticism and further enhance their legitimacy by improving disclosure quality after financial restatements. By this means, they signal their commitment to transparency and the incorporation of societal norms.

Besides legitimacy theory, other theories such as impression management (Hooghiemstra 2000), reputation risk management (Bebbington et al. 2008), agency theory (Fama 1980; Gardberg and Fombrun 2006), and signaling theory (Spence 1974) have been used to link CSR reporting with corporate reputation. In relation to strategic reputation building, reputation risk management and agency theories appear more pertinent. Bebbington et al. (2008) considered CSR reporting to be both an outcome of and part of the process of reputation risk management. From the agency theory perspective, CSR reporting facilitates information exchange, reduction in asymmetries, and greater corporate transparency, which can curb managerial opportunism. Rather than competing, these theories demonstrate how the use of CSR disclosure can build corporate reputation in terms of legitimacy and corporate transparency. We use Hypothesis 1 to test the change in CSR disclosure quality when firms experience reputation-damaging events:

H1

Among CSR reporters, firms experiencing financial restatements improve CSR disclosure quality compared to firms with no restatements.

CSR Disclosure: Protection Effects

We examine an insurance-like or protection role of CSR reporting. CSR reporting practices consistently build ethical capital, whereby CSR firms in crisis suffer less from ethical skepticism and other crisis-related negative consequences than other firms (Bae et al. 2019; Christensen 2016; Ducassy 2013; Klein and Dawar 2004; Lins et al. 2017). Klein and Dawar (2004) investigated how CSR affects consumer behavior during a product-harm crisis.Footnote 3 They describe the impact of CSR as “an insurance policy”, arguing that even if positive corporate social performance would not boost profit immediately, it might be instrumental in reducing legitimacy risk in a product-harm crisis. Moreover, Ducassy (2013) tested the relationship between social performance and financial performance for French listed firms during the global financial crisis of 2007–2009. Her findings suggested that firms with good social performance outperform other firms and suffer less from negative publicity. The buffer effect was most prominent before and during 2007, in the early stages of the financial crisis. After that period, the buffer effect of CSR diminished and the significant positive relationship between social performance and financial performance disappeared in 2008 and early 2009. Consistently, Lins et al. (2017) reported that the stock returns for high-CSR firms are found to have four to seven percentage points higher than low-CSR firms during the 2008–2009 global financial crisis. Christensen (2016) examined the impact of firms’ CSR engagement in cases of high-profile misconduct and found that firms with prior CSR reporting enjoy the benefit of ethical capital and suffer less from negative market reaction. Bae et al. (2019) documented that CSR can reduce losses in market share when firms are highly leveraged.

Accounting researchers have long advocated the enhancement of information disclosure (Bernardi and Stark 2018; Dhaliwal et al. 2011; Hope 2003). Additional high-quality nonfinancial disclosure can improve the transparency of the overall information environment and influence the external information users, including financial analysts, who rely on the disclosed information to make their judgments on firm prospects. Recent research implies that analysts employ CSR-related information in their decision-making processes (Dhaliwal et al. 2011), that is, analysts pay attention to CSR information content disclosed by firms, because superior CSR performance adds value whereas poor CSR performance can be an early warning sign of potential operational and compliance risks (Jemel-Fornetty et al. 2011). Further, Dhaliwal et al. (2011) examined the impact of first-time CSR disclosure on analyst forecasts in the US and found a decrease in forecast errors and dispersion among firms with superior CSR performance. Taken together, considering the insurance-like role in negative events and the role of CSR disclosure in reducing information asymmetry, we argue that firms with CSR disclosure experience a less negative impact on forecast accuracy than non-CSR firms when involved in financial restatements. Hypothesis 2 is stated below:

H2

Restating firms with CSR disclosure have more accurate analyst forecasts compared with restating firms with no CSR disclosure.

Our third expectation is that CSR disclosure helps protect longer-term firm value when financial restatements are issued. Fieseler (2011) argued that instead of immediate impact on financial performance, good CSR practices add value over the longer term. According to Epstein and Roy (2001), “Achieving a successful corporate strategy for social responsibility must be viewed over a long-time horizon so that both the leading and lagging indicators of performance can be examined” (p. 602). Therefore, we examine the longer-term impact of CSR, namely, on firm value as a complement to analyst forecasts, because they are more likely to reflect immediate response to firm changes.

CSR disclosure contributes to firm value directly and indirectly. The superior quality of a firm’s social and environmental initiatives directly increases firm value by positively influencing stock returns, market capitalization, and market-to-book value (Flammer 2013; Freedman and Stagliano 1991; Klassen and McLaughlin 1996; Dowell et al. 2000). The indirect CSR-related benefits, such as increased employee productivity and accumulated ethical capital, will be carried over into future periods, which ultimately leads to higher firm value in the long run (Eccles et al. 2012; Malik 2015).

CSR disclosure can protect or maintain firm value by reducing information asymmetry and mitigating risks. It provides value-relevant information, either positive or negative, to the market about a firm’s performance, which is subsequently reflected in sales growth, lower bid-ask spread, and lower cost of capital (Cho et al. 2013; El Ghoul et al. 2011; Lev et al. 2010; Moser and Martin 2012). Moreover, CSR disclosure can maintain or boost firm value by alleviating regulatory risk, supply chain risk, litigation risk, and product and technology risk (Dowell et al. 2000; Starks 2009). In line with this, Dhaliwal et al. (2011) pointed out that CSR practices affect firm value in ways other than those related to financial disclosure, for example, by reducing compliance costs. In sum, while financial restatements can be value-destroying (Karpoff et al. 2008), depending on the value protection and enhancing capabilities of CSR, we expect CSR reporting firms to suffer less net restatement-related value destruction, compared to non-CSR firms in H3.

H3

Restating firms with CSR disclosure experience smaller losses in value compared with restating firms with no CSR disclosure.

Research Method

Sample Selection

The sample period is between 2000 and 2017, and the data on restating firms is sourced from the Audit Analytics database. Firms report on their CSR practices in various ways, and we use issued standalone CSR reports to measure CSR disclosure. We identify restating firms with CSR reports in the pre- and post-restatement periods and collected these reports.Footnote 4 Following Dhaliwal et al. (2011) and Muslu et al. (2019), the standalone reports are from the Global Reporting Initiative database, CorporateRegister.com, Corporate Social Responsibility Newswire, SocialFunds.com,Footnote 5 and company websites.

We use standalone CSR reportsFootnote 6 because they have advantages over other forms of firm-initiated nonfinancial CSR disclosure. They are a salient representation of CSR practices, showing additional costs and resources relating to their issuance and verification, and signaling strong commitment to the environment and community. There is no page limit for standalone CSR reports, allowing firms to disclose CSR activities in a more systematic and comprehensive manner.Footnote 7

Figure 1 demonstrates the timeline of CSR disclosure surrounding a financial restatement. We collect restating firms’ CSR reports three years before a financial restatement (year t − 3 to t − 1), during the restatement year (year t), and four years after the restatement (year t + 1 to t + 4).Footnote 8 Table 1 details the sample selection process. Initially we identify 361 restating firms with a history of CSR report issuance, from which we exclude 217 firms that did not issue CSR reports during the restatement period. For the remaining 144 restating firms, we eliminate 11 firms because of missing financial data. We further eliminate three firms that had more than three consecutive restatements with less than one year between each, leading to a sample of 130 restating CSR firms.

Identifying Matched Control Firms (Control Groups 1 and 2)

We conduct propensity score matching (PSM) to identify control firms for these 130 restating CSR firms. Following Chakravarthy et al. (2014), we match restating CSR firms to nonrestating CSR firms by year, industry, stock exchange, and firm size. We model a firm’s probability of making a financial restatement and matched control firms for each restating firm based on the nearest propensity score. Consequently, as shown in Table 1, 78 treatments with no matched CSR control firms are eliminated. We check the CSR report issuance of each score-matched control firm during the corresponding restatement period and only retain those with reports surrounding this event. The final sample consists of 52 restating CSR firms with 280 CSR reports. These treatment firms are matched to 83 nonrestating control firms with 463 CSR reports (Control Group 1). The PSM model and results are presented in Appendix 2.

To compare the effects of a financial restatement on analyst forecast and firm value for CSR and non-CSR firms, we create another control group (Control Group 2) for the same 52 restating firms. We require the matched firms in this control group to have same firm-specific characteristics, make a financial restatement in the same year, but not issue any CSR report in the year t − 3 to year t + 4 window around the restatement announcement (see Fig. 1). We identify control firms from the Audit Analytics restatement database, matching restating CSR firms to restating non-CSR control firms by year, industry, stock exchange, and firm sizeFootnote 9 based on the nearest propensity score. The PSM implementation results in 70 matched restating non-CSR firms (Control Group 2) for 52 restating CSR firms (see Appendix 3 for details), that is, 564 observations in Control Group 2 for 280 observations in Treatment Group.Footnote 10 Most of our firms (86.4% of firms in Treatment Group and 88.5%Footnote 11 of firms in Control Group 2) restated due to accounting rule application failures, these restatements are unintentional or less “serious” misreporting thus we do not conduct a further match on the restatement reasons.

Constructing CSR Disclosure Score

We utilize Java to construct a composite CSR disclosure score (DSCORE) to measure voluntary disclosure narratives. Inspired by Muslu et al. (2019), our DSCORE comprises seven components: optimism and pessimism tones (RATIO_OPT and RATIO_PES), readability (SMOG), report length (RESWORDS), numerical content (RATIO_NUM), horizon content (RATIO_HOR), and sustainability-related content (RATIO_SUS). We add sustainability-related content to our DSCORE because sustainability-related keywords reveal the current focus of environmental and sustainability development and concerns, and the keyword frequency reflects the width and depth of a firm’s exploration of related CSR topics. Based on prior research of CSR disclosure quality (Huang et al. 2013; Muslu et al. 2014), we expect a CSR report with a high-DSCORE to be less optimistic and more pessimistic separately in tone, to be more readable and longer in length, and to have more numerical, forward-looking, and sustainability-related content. The definitions of DSCORE and the seven components of DSCORE are described in Appendix 1.

Model Development and Variable Definition

Following Dhaliwal et al. (2012) and Muslu et al. (2019), we use the following model to test H2:

Model (1) investigates the impact of CSR disclosure during a financial restatement, proxied by forecast accuracy. Forecast accuracy is an inverse measure of forecast error and we measure forecast error over three horizons, denoted by FE0, FE1, and FE2, namely, forecast error in year t (the restatement year) for earnings in year t (the restatement year), year t + 1 (earnings one year ahead), and year t + 2 (earnings two years ahead). We distinguish the analyst forecast made for different years because forecast accuracy decreases over forecast horizon time (De Bondt and Thaler 1990; Dhaliwal et al. 2012), but limit the longest forecast horizon to two years because the majority of analysts do not make earnings forecasts beyond two years (Dhaliwal et al. 2012). Forecast error is calculated as the average absolute difference between I/B/E/S analysts’ consensus of forecasted earnings per share (EPS) and actual EPS, multiplied by 100 then divided by stock price at the beginning of the year. The variable of interest is DSCORE, where H2 predicts a negative association between DSCORE and FE. POST is an indicator variable coded 1 in a post-restatement period and 0 otherwise. To test the inter-temporal change in the relationship between DSCORE and FE, we add an interaction term, DSCORE × POST. A significant negative coefficient of DSCORE × POST indicates a stronger association between CSR disclosure and forecast accuracy in the post-restatement period.

We include several variables to control the relationship between analyst forecast accuracy and DSCORE. We control for existing CSR performance and assurance using KLD strengths and concernsFootnote 12 and CSRAUD, where CSRAUD shows whether a CSR report was assured by an external auditor. Financial disclosure quality (ADA) is controlled for because CSR disclosure can be correlated with financial transparency of firms (Dhaliwal et al. 2011).Footnote 13

Two additional variables are included to control for factors affecting analyst forecast accuracy: analyst following (LNAF) and forecast horizon (FHORIZON). LNAF is defined as the natural logarithm of total number of analysts following a firm in a fiscal year, and because more recent forecasts may incorporate more information than less recent ones, we include FHORIZON, which is the median number of days between earnings announcement date and analyst forecast date. Finally, we include firm-specific controls capturing different dimensions of information availability and uncertainty, these controls are firm size (SIZE), financial leverage (LEV), earnings volatility (ROAVOL), and firm losses (LOSS). We also include an inverse Mills ratio (IMR) calculated from Heckman’s (1979) two-stage estimation to control for self-selection bias and endogeneity (see "Heckman Two-Stage Approach" for details). In all specifications of the model, we include the industry and year fixed effects and calculate the robust standard error clustered by firm.

Hypothesis 3 tests the effect of CSR disclosure on firm value. We examine H3 with the following model:

We employ Tobin’s Q to measure the market’s assessment of a restating firm’s long-term expected value following Cahan et al. (2016), Lenz et al. (2017), and Mishra (2017), calculated as the market value of common equity plus preferred stock plus total debt scaled by book value of total assets. We expect CSR reporting firms, particularly those with high-quality reports, to have relatively lower levels of information asymmetry therefore higher firm value compared with non-CSR firms. A positive coefficient on DSCORE supports H3. We include an indicator variable POST, an interaction term DSCORE × POST for a comparison of before and after the restatement, and control for CSR performance (KLDSTR and KLDCON), report assurance (CSRAUD), financial disclosure (ADA), and self-selection (IMR). These variables are as defined earlier.

Following prior studies, we control for other potential factors affecting firm value (Myers 1977; Smith Jr and Watts 1992; Konijn et al. 2011; Daines 2001; Faleye 2007). We include research and development ratio (RD) and capital expenditure ratio (CAPX) to proxy for firm growth potential. RD is measured as research and development expenditure divided by total sales, and CAPX is capital expenditure divided by total assets. The natural logarithm of total sales controls for firm size (LNSA), ROA for profitability, computed as income before extraordinary items divided by total assets, and LEV for leverage, measured as long-term debt divided by total assets.

Results and Discussion

Descriptive Statistics

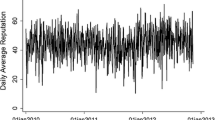

Table 2 shows the sample breakdown by year and industry for the treatment group and the two control groups. Panel A indicates an increasing trend of firms issuing CSR reports over the sample period, especially after 2009 when the number of firms issuing reports almost doubled. Panel B shows that the petroleum, utilities, and electronics industries are the most environmentally sensitive industries, with firms more likely to engage in and disclose their CSR activities.

Table 3 provides the descriptive statistics for the seven components of DSCORE. The mean (median) value of RATIO_OPT is 14.2 (14.1), whereas the mean (median) value of RATIO_PES is 8.1 (7.9). This implies that firms tend to be more optimistic and less pessimistic when conveying CSR information, and subsequently portray a positive picture of their CSR performance (Lee 2017). The average SMOG is 11.6, suggesting that about 12 years of formal education is required to understand a CSR report. The average RESWORDS is 0, consistent with Muslu et al. (2019). For the disclosure of numerical content, firms frequently use Arabic numerals and numerical words to report CSR practices—the mean (median) of RATIO_NUM is 21.7 (18.9) and the maximum value is 100. The standard deviation is 11.7, indicating that the forms of CSR communication (including text, numbers, images, tables, and graphs) vary significantly among firms. The average RATIO_HOR is 1.8, meaning that firms do not tend to disclose their strategic plans or goals in the CSR reports. A mean (median) of 32.4 (31.0) for RATIO_SUS indicates a relatively high frequency of sustainability-related word usage in CSR reports; however, a standard deviation of 7.4 indicates variability among CSR reporting firms.

Pearson correlations of DSCORE components are reported in Table 4. There is a negative correlation (− 0.17) between RATIO_OPT and RATIO_PES at the 1% significance level. SMOG is positively correlated with RATIO_OPT and negatively correlated with RATIO_PES, implying a link between disclosure tone and readability. The correlation between RESWORDS and SMOG is 0, consistent with CSR report length being measured net of report readability. Both RATIO_NUM and RATIO_HOR are positively correlated with SMOG and RESWORDS. This suggests that the inclusion of numerical and horizon contents in a CSR report facilitates readability, although it increases the length of the report. RATIO_SUS is positively correlated with the other four components of DSCORE, namely RATIO_OPT, SMOG, RATIO_NUM, and RATIO_HOR.

Table 5 presents the means for the main variables in the full sample and compares means for restating firms with CSR reports (Treatment Group) and restating firms with no CSR report (Control Group 2). The average forecast error for the sample increases from 1.08 to 4.04 for longer forecast horizons, consistent with O’Brien (1990). Mean FE0, FE1, and FE2 for restating CSR firms are 0.71, 2.26, and 3.22, respectively; these means are smaller than for non-CSR firms (1.28, 3.21, and 4.52). The mean TOBINQ for the full sample, CSR group, and non-CSR group are 1.71, 1.59, and 1.77, respectively.Footnote 14

Analysis of Hypothesis 1

H1 predicts that CSR reporters improve disclosure quality after financial restatements compared with nonrestating CSR reporters. We conduct difference in difference (DID) analysis of the DSCORE between two groups, restating firms with CSR reports (Treatment Group) and nonrestating firms with CSR reports (Control Group 1), in the pre- and post-restatement periods.

Panel A in Table 6 presents the DID results for DSCORE and the low- and high-DSCORE groups. DSCORE DID decomposition shows that there is no significant difference in DSCORE between the treatment and control groups in the pre-restatement period. However, in the post-restatement period, the difference is statistically significant for the full sample and high-DSCORE group (DSCORE post-diff = 0.43; high-DSCORE post-diff = 0.14). Moreover, in regards to the between-group difference, the low-DSCORE treatment firms underperform prior to a restatement in comparison with the matched controls in CSR reporting (low-DSCORE pre-diff = − 0.12), yet the negative difference diminishes in the post-restatement period (low-DSCORE post-diff = 0.10). For high-DSCORE firms, the between-group difference is greater after a restatement than before (high-DSCORE pre-diff = 0.03; high-DSCORE post-diff = 0.14).

From the regression results, the DID DSCORE coefficient is significantly positive for the full sample and the low-DSCORE group (DSCORE DID = 0.36; low-DSCORE DID = 0.22). When conducting DID analysis, we control for factors that may exert influence on CSR disclosure quality, such as firm characteristics and CSR report audit. Coefficients on SIZE and CSRAUD are significant and positive, showing better CSR disclosure in larger firms and those with CSR assurance. Overall, the results support H1, suggesting that restating CSR reporters improve their CSR reporting after a financial restatement more than do CSR firms without restatements. This improvement in disclosure is more evident in firms with prior low-quality CSR disclosure.

Panel B in Table 6 analyzes the change in components of CSR reporting. Pre-restatement differences are significant for SMOG, RATIO_HOR, and RATIO_SUS at the P < 0.05 level. However, these differences become insignificant in a post-restatement period. In contrast, post-restatement RATIO_OPT is significant and negative, while RATIO_PES and RESWORDS differences become significantly positive in the post-restatement period.

The DID regression shows that restating CSR firms tend to report with more conservative narratives, use more pessimistic words and fewer optimistic words (RATIO_PES DID = 1.51; RATIO_OPT DID = − 1.83), disclose less forward-looking information (RATIO_HOR DID = − 0.58), and use less sustainability-related words (RATIO_SUS DID = − 2.45) than control firms. We interpret a post-restatement change of more pessimistic words and fewer optimistic words in CSR reporting as an improvement in CSR disclosure quality. In addition, longer CSR reports (RESWORDS DID = 0.17) contain more information (Li 2008), and a lower level of reading difficulty (SMOG DID = − 0.66) indicates the presence of less obfuscation (Nazari et al. 2017), in turn implying superior CSR disclosure. According to Li (2010), firms in an uncertain environment tend to disclose less information regarding future targets or trends. Consistent with this, we construe the restating firms’ decreased use of forward-looking and sustainability-related content in the post-restatement period as strategic. That is, alleviating reputational damage caused by restatements and restoring public confidence in reporting quality take priority over predicting uncertain future performance.

Analysis of Hypothesis 2

Hypothesis 2 predicts that restating firms with CSR disclosure are associated with more accurate analyst forecasts. Before testing this hypothesis, in Table 7 we conduct univariate and multivariate analysis to compare analysts’ response to a financial restatement for restating firms with CSR reports (Treatment Group) and those with no CSR reports (Control Group 2). Table 7 Panel A shows univariate analysis from three aspects: the post-restatement analyst response speed (in days), the direction of post-restatement analyst forecast revisionsFootnote 15 (upwards or downwards), and the extent of pre- versus post-restatement analyst forecast bias (analyst optimism/pessimism). Forecast revision is calculated as the difference between the first post-restatement EPS forecast and the last pre-restatement EPS forecast for the same analyst following a firm, and analyst optimism (pessimism) is the difference between the forecast EPS and actual EPS divided by prior year stock price and multiplied by 100. A positive (negative) sign of forecast revision indicates an upward (downward) revision. Similarly, for forecast bias, a positive (negative) coefficient indicates optimism (pessimism).

Table 7 Panel A reveals that analysts respond faster to financial restatements. Specifically, the average post-restatement analyst response speed is 52.46 days for CSR firms compared with 75.72 days for non-CSR firms (Diff = − 23.26). The post-restatement revisions are negative for both treatment and control firms, implying an adverse impact of restatements on analyst forecasts because analysts revise the EPS forecasts downwards after a restatement. On average, analysts following CSR firms revise forecast downwards (− 0.09) after a restatement to a greater extent than the analysts following non-CSR firms (− 0.03). Nevertheless, the analyst forecast bias of 0.54 and 0.35 for CSR firms in the pre- and post-restatement periods suggests that analysts are optimistic about CSR firms, even after revising downwards following restatements. In contrast, analyst forecasts for non-CSR firms are biased downwards in both pre- and post-restatement periods (− 0.31 and − 0.36).

Table 7 Panel B presents the regression results of post-restatement analyst response speed and CSR disclosure. POSTDAY is defined as the average days of the first post-restatement EPS forecast from all following analysts of a firm. Following prior literature, we control for the information environment that may affect analyst forecast speed, including size, market-to-book ratio, and number of analysts following (Clement and Tse 2005; Kim and Song 2015; Mikhail et al. 1997; Stickel 1989). In Column 1, the coefficient of DSCORE is significant and negative (\({\alpha }_{DSCORE}\) = − 22.97), meaning that after a restatement analyst response speed is faster for firms with high-quality CSR disclosure. We further regress POSTDAY on seven components of DSCORE in Columns 2–8, and find that CSR firms reporting in more conservative narratives (using more pessimistic words and fewer optimistic words), with lower reading difficulty and a higher proportion of numerical content facilitate faster analyst response in the post-restatement period. Overall, these results provide some insights into the attitudes and responses of analysts around restatements.

To test Hypothesis 2, we compare forecast accuracy over three forecast horizons in restating firms with CSR reports and in firms without CSR. Regression results are presented in Table 8. In Panel A Column 1, the CSR coefficient is significant and negative (\({\alpha }_{CSR}\) = − 1.04), indicating that current-year forecast errors for CSR firms reduce by 1.04% of the share price compared with non-CSR firms. Similarly, the negative CSR coefficients in Column 3 (\({\alpha }_{CSR}\) = − 2.43) and Column 5 (\({\alpha }_{CSR}\) = − 3.83) show that forecast errors for year t + 1 and year t + 2 decrease by 2.43% and 3.83%. That is, in the post-restatement period, CSR disclosure leads to smaller forecast errors and the incremental effect of CSR disclosure on forecast accuracy is more pronounced over longer horizons. In Columns 2, 4, and 6, we test the relation between DSCORE and forecast accuracy and find that FE0, FE1, FE2 decrease significantly with DSCORE, consistent with our hypothesis that increasing disclosure quality reduces information asymmetry, thereby increasing forecast accuracy.Footnote 16

However, the interactions with POST are not significant. The insignificant coefficients on the interaction terms indicate no inter-temporal change in the overall association between disclosure and forecast accuracy. One possible explanation is that the unintentional, less “serious” compliance-related restatements in the sample have only a minor effect on overall financial reporting transparency, thus they are less likely to affect analyst forecast accuracy. Alternatively, the analysts may already incorporate CSR information into their forecasts prior to a financial restatement, hence an improvement in post-restatement CSR disclosure, such as more conservative sentiment and improved report readability, may not add much value to these sophisticated report users. For the other variables, ADA is significantly and positively correlated with only FE0. KLDCON is significant and positive for FE0 at the 10% level. The SIZE coefficient is negative in all models, although it is significant only for FE1. For FE0 and FE2, ROAVOL is marginally significant (\(p\) < 0.1).

In Panel B of Table 8, we divide the CSR firms into low- and high-CSR groups based on the median of DSCORE, where LHDS (HHDS) is an indicator variable for low-DSCORE (high-DSCORE) group. The regression results for current-year, one-year ahead and two-year ahead forecast accuracy of low and high-DSCORE groups are presented in Columns 1, 2 and 3. Column 1 shows that both low- and high-DSCORE are significantly and negatively correlated with FE0 (\({\alpha }_{LHDS}\) = − 0.96; \({\alpha }_{HHDS}\) = − 1.35), and moving from low- to high-DSCORE group reduces FE0 by 0.39%Footnote 17 of share price. In Column 2, only high-DSCORE firms are significantly and negatively associated with one-year ahead forecast error (\({\alpha }_{HHDS}\) = − 3.20). We report the negative coefficients of LHDS (\({\alpha }_{LHDS}\) = − 3.96) and HHDS (\({\alpha }_{HHDS}\) = − 3.46) in Column 3 when running the regression with two-year ahead forecast error FE2. For control variables, KLDCON and ADA are significantly and positively correlated with FE0 (\(p\) < 0.05), and ROAVOL is marginally significant for FE0 and FE2 (\(p\) < 0.1). Collectively, the findings in Panels A and B of Table 8 support H2. Consistent with the view that CSR provides strategic insurance-like effects, we find that restating CSR firms are associated with smaller forecast errors than restating non-CSR firms, and for those restating firms issuing CSR reports, better CSR disclosure quality further improves forecast accuracy.Footnote 18

Analysis of Hypothesis 3

Table 9 reports the regression results for Hypothesis 3, which predicts that restating firms disclosing CSR information are associated with higher firm value. In Panel A Column 1, the CSR coefficient (\({\beta }_{CSR}\) = 0.73) is significant and positive, where CSR reports cause an improvement of 0.73 unit in Tobin’s Q. The interaction term CSR × POST is also marginally significant and positive (\({\beta }_{CSR\times POST}\) = 0.49), suggesting that in the post-restatement period, Tobin’s Q increases 0.49 unit for CSR firms compare with that for non-CSR firms, consistent with the value protection role of CSR reporting (Christensen 2016). In Column 2, the DSCORE coefficient is significantly positive (\({\beta }_{DSCORE}\) = 0.19), indicating a positive association between DSCORE and firm value. Column 3 shows positive relations for both high- and low-DSCORE with firm value (\({\beta }_{LHDS}\) = 0.61; \({\beta }_{HHDS}\) = 1.08).

Notably, the interaction term low-DSCORE and POST in Column 3 is marginally significant and positive (\({\beta }_{LHDS\times POST}\) = 0.67), indicating a stronger positive association between lower quality disclosure and firm value in the post-restatement period. It possibly shows the improved post-restatement CSR disclosure of low-DSCORE firms resulting in higher post-restatement firm value. However, this effect only exists for low-DSCORE firms because high-DSCORE firms are already making higher quality disclosures. As for control variables, ROA, CAPX, and RD are positively correlated with TOBINQ in all model specifications, consistent with the expectation that firm value increases with operating profitability and future growth opportunities. The CSRAUD coefficient is significantly negative, contrary to expectations. We attribute these differences to additional CSR-related variables in our model as well as differences in sample characteristics.

In Panel B of Table 9, we use a lead-lag approach to address concerns about endogeneity (Christensen 2016; Dhaliwal et al. 2011), where we examine the influence of CSR disclosure at year t on future firm value at year t + n (1 ≤ n ≤ 4). We limit the longest horizon to a four-year window, because our sample period covers up to four years after the occurrence of a restatement announcement. Panel B shows a significant and positive relationship between DSCORE and future firm value (from year t + 1 to year t + 4), and the effect of CSR disclosure on future firm value gradually decreases over a long horizon. This evidence reflects the strategic nature of CSR reporting and its long-term effects in the post-restatement period. Control variables RD and ROA have significantly positive coefficients while the coefficient on LEV is significantly negative in all models expect for F1TOBINQ. Our interpretation for the sign and significance of these variables is similar to those in Panel A. Collectively, the results reported in Table 9 support H3, showing that CSR disclosure is associated with increased firm value and there is some evidence of value protection in regard to financial restatements.

Robustness Tests

We conduct robustness checks of the results by controlling for sample selection bias via the Heckman’s (1979) two-stage model and the use of alternative proxies for the dependent variable in the main hypotheses. We discuss these tests in detail below.

Heckman Two-Stage Approach

Our analyses of CSR disclosure effects are restricted to, and can be only tested on, restating firms that issue CSR reports, therefore introducing a potential sample selection bias. In the first stage, a probit regression is used to estimate the likelihood of a firm making CSR disclosure. The dependent variable is an indicator variable CSR, coded 1 if a firm has issued a CSR report in year t, and 0 otherwise. Following Dhaliwal et al. (2012), we employ several instrumental variables to control for CSR-related selection bias. The first instrument is DJSI, an indicator variable of whether a firm is included in the Dow Jones Sustainability Index in a given year, since firms with better social performance are more likely to make disclosures to differentiate themselves and gain competitive advantage (Al-Tuwaijri et al. 2004; Dhaliwal et al. 2011). Other instrumental variables include firm age (AGE), profitability (ROA), leverage (LEV), investment and growth opportunities (RD and CAPX), and market share (MKTSHARE) based on prior research (Dhaliwal et al. 2012; Jo and Harjoto 2012). Other than the instruments, we include these control variables: size (SIZE), earnings volatility (ROAVOL), financial opacity (ADA), and analyst following (LNAF).

Appendix 4 reports the first-stage probit regression results. Most variables have the expected signs, with the exceptions of MKTSHARE and LNAF. Estimated coefficients on the instrumental variables DJSI and LEV are significantly positive (\({\gamma }_{DJSI}\)= 2.65; \({\gamma }_{LEV}\) = 3.28), and a Pseudo \({R}^{2}\) of 0.49 confirms the validity of the employed instruments. In the second stage, the IMR calculated from the probit model is added to the OLS regression to control for potential selection bias.

Analyst Forecast Dispersion and CSR Disclosure

We further examine the relationship between CSR disclosure and analyst forecast dispersion (DISPER) in Table 10, where DISPER is computed as the standard deviation of analyst forecasts for current-year earnings divided by the year-end stock price. The regression results show that the dispersion of analyst forecasts on average decreases 0.82% of the share price for CSR firms than for non-CSR control firms (\({\alpha }_{CSR}\) = − 0.82 in Column 1). In Column 2, the coefficient on DSCORE is significantly negative (\({\alpha }_{DSCORE}\) = − 0.24), indicating a negative relationship between forecast dispersion and CSR disclosure quality. Consistently, Column 3 presents that a change from the low- to high-DSCORE group reduces forecast dispersion by 0.27% of the share price (\({\alpha }_{LHDS}\)= − 0.75; \({\alpha }_{HHDS}\)= − 1.02). These findings support the contention that CSR reporting, especially high-quality CSR reporting, contributes to a firm’s overall information environment, thus reducing analyst forecast dispersion during a financial restatement. H2 is supported with this additional evidence.

An Alternative Measure of Firm Value

Table 11 presents the results of CSR disclosure and firm performance as measured by ROA. Again, we employ a lead-lag design and use one-year-ahead ROAFootnote 19 (F1ROA) to capture the impact of CSR disclosure in year t on firm financial performance in year t + 1. The regression results show that the interaction term CSR × POST is marginally significant (\({\beta }_{CSR \times POST}\) = 0.06 in Column 1), providing some evidence that CSR firms are associated with superior firm performance in the post-restatement period. In Column 3, we find consistent evidence of a significant positive interaction term between low-DSCORE and POST (\({\beta }_{LHDS \times POST}\) = 0.08). Thus, we conclude that low-quality CSR firms improve their CSR disclosure subsequent to a financial restatement, which positively affects those firms’ post-restatement financial performance. H3 is further supported by this additional evidence.

Conclusion

We examine the change in restating firms’ CSR disclosure quality in response to financial restatements, and the effects of CSR disclosure quality on protecting firm reputation, proxied by analyst forecast errors and firm value. Specifically, we investigate the use of CSR disclosure around reputation-damaging events to determine whether nonfinancial disclosure plays an insurance-like role when a firm’s reputation is damaged. We find that firms improve their CSR disclosure quality after experiencing financial restatements. Restating firms with CSR disclosure have smaller forecast errors than those that do not engage in such disclosure. Also, firms with CSR disclosure suffer smaller value losses from restatements. These results point to CSR disclosure playing a value protection or insurance-like role during events that adversely affect firm reputation.

This study contributes to the growing CSR literature by showing the immediate and longer-term economic consequences of CSR reporting. It suggests that voluntarily disclosed CSR information supplements mandatory financial disclosure, affecting the information processing behavior of financial analysts. By demonstrating the role of CSR disclosure in reducing information asymmetry, these findings have broader implications for moving toward more integrated reporting, which strives to achieve overall information usefulness. Because of the increasing trend toward integrated reporting, the quality of integrated reporting is a topic of interest to both academics and regulators (International Integrated Reporting Council [IIRC] 2015; Eccles and Krzus 2014; Pistoni et al. 2018). Our results on CSR disclosure quality can be generalized to a variety of firm disclosures and accelerate the exploration process toward integrated reporting.

Future research can analyze other disclosure features of CSR reports, such as strategy frame and presentation style. Considering the ongoing evolution from sustainability to integrated reporting, it is worthwhile investigating how sustainability elements can fit into the integrated reporting framework in future research.

Notes

A survey of 388 mainstream fund managers and financial analysts initiated by Deloitte, CSR Europe, and EuroNext (2003) shows 79% of respondents indicating that CSR activities’ positive impact on firm value in the long-term, and about half of them indicating that they take CSR information into account.

Griffin (2003) reported that analyst revision occurs in the month of a restatement announcement and can last up to six months following the restatement.

A product-harm crisis is a well-publicized instance of defective or dangerous products following the definition of Dawar and Pillutla (2000).

Most firms in the sample publish periodical CSR reports (usually annually), and the frequency of CSR reporting remains largely unchanged during the financial restatement period. However, three firms (Nordstrom Inc, ManpowerGroup and CF Industries Holding Inc) started to issue CSR reports after the financial restatement. Exclusion of these restating CSR firms does not change our results.

SocialFunds.com has been inaccessible since 2019.

There is an evolving trend towards integrated reporting. However, mainstream CSR reporters still provide standalone CSR reports. A 2018 report released by the Sustainable Investments Institute (Si2) and IIRC Institute finds that a total of 395 firms among the S&P 500 (78%) issue CSR reports for the most recent reporting period, while a minority of the S&P 500 references a recognized integrated reporting framework (35 firms citing SASB and 4 firms citing IIRC). Nevertheless, we checked sample firms that publish standalone CSR reports and find that none of them adopt integrated reporting during the event window. Some CSR reporters adopted integrated reporting many years after the restatement, for example, TransAlta Corporation had a restatement in 2005 and began to issue integrated reports from 2015, which goes beyond the investigation period.

In untabulated analysis, we compare CSR-related content in standalone CSR reports to corresponding content in annual reports (or 10-Ks) for restating firms and find that firms disclose this information mostly in the Chairman’s Letter, Business Overview, and Management’s Discussion & Analysis. Standalone CSR reports are longer in length (55.6 versus 2.5 pages) and cover more general issues (9.5 versus 2.1 issues) compared to annual reports or 10-Ks. Standalone reports also divulge more details about CSR activities (27.3 specific issues on average). One example is Avery Dennison which used 10 pages to disclose its environmental efforts in 2010 CSR report, showing how it reduced environmental footprint, managed energy consumption and greenhouse emissions, reduced waste, reduced water consumption, obtained environmental certifications, achieved sustainability in its supply chain and sources responsibly. In its 2010 annual report, there was only half a page of a section titled “Environmental Matters” showing the environmental liability figures.

Some firms publish CSR reports biennially or every three years. If that is the case, we retain the CSR reports published five years before and after a financial restatement (year t − 5 to t + 5).

We checked to ensure that there is no confounding event such as change in dividend rate, M&A announcement and executive turnover in the month of the restatement announcement for both treatment and control firms, which might interfere with firms’ disclosure behavior.

Among treatment firms, there are 51 restatements due to accounting rule application failure, one restatement due to financial fraud and irregularities, four restatements due to clerical errors, and three restatements due to other significant issues. This represents 86.4% of Treatment Group (51 out of 59 restatements). Among control firms, there are 69 restatements due to accounting rule application failure, one restatement due to clerical errors, and eight restatements due to other significant issues noted. Similarly, this represents 88.5% of Control group 2 (69 out of 78 restatements).

The Pearson correlation coefficient between DSCORE and KLD strengths (KLDSTR) is 0.37 at the 1% significance level while the coefficient of DSCORE and KLD concerns (KLDCON) is − 0.07 and insignificant. This is consistent with a firm’s CSR disclosure being positively related with its CSR performance (Clarkson et al. 2008; Lyon and Maxwell 2011), yet there is a potential disconnect between voluntary CSR disclosure and third-party CSR performance ratings (Cho et al. 2013; Shane and Spicer 1983). The third-party CSR performance ratings, such as KLD indices, affect the decision-making of investors, managers, and other parties. For instance, Lee (2017) reported a positive association between CSR proxied by KLD and management forecast accuracy.

Financial disclosure quality is measured by absolute value of discretionary accruals (ADA) from the Modified Jones model (Dechow et al. 1995). A high level of ADA indicates greater financial opacity. We expect a positive coefficient on ADA, as financially opaque firms are more likely to be associated with forecast errors.

For control variables, the CSR group outperforms the non-CSR group in CSR performance with a higher KLDSTR of 4.91 and a lower KLDCON of 1.80. Compared with non-CSR firms, restating CSR firms have slightly better financial disclosure quality (0.44 compared to 0.45 of non-CSR firms), attract more financial analysts, have longer forecast horizon, are larger in size, experience less losses and less volatile earnings, and are more profitable on average.

To ensure that forecast is only affected by the restatement announcement, we keep the last forecast EPS prior to a restatement and the first forecast EPS after the restatement for all following analysts of a firm in a given year. The analyst forecast EPS refers to current-year forecast EPS, that is, forecast made in year t for earnings in year t (the restatement year).

In untabulated analysis, we use the CSR measure from Muslu et al. (2019) as an alternative to DSCORE and similar results are obtained.

The difference of 0.39 in the Column 1 is calculated as the difference of coefficients \(({\alpha }_{LHDS}-{\alpha }_{HHDS})\)= (–0.96) – (–1.35) = 0.39. The difference is not statistically significant.

In untabulated analysis, we control for corporate governance-related factors using institutional ownership and our main inferences remain largely unchanged.

Because our sample period covers the subsequent four years after a financial restatement (year t + 1 to t + 4), we also run the regression models with two-year-ahead ROA (F2ROA), three-year-ahead ROA (F3ROA), and four-year-ahead ROA (F4ROA). The untabulated results show that CSR and DSCORE are significantly positively associated with all forward-looking ROA measures.

References

Adams, M., & Hardwick, Ps. (1998). An analysis of corporate donations: United Kingdom evidence. Journal of Management Studies, 35(5), 641–654.

Aerts, W., & Cormier, D. (2009). Media legitimacy and corporate environmental communication. Accounting, Organizations and Society, 34(1), 1–27.

Allee, K. D., & DeAngelis, M. D. (2015). The structure of voluntary disclosure narratives: Evidence from tone dispersion. Journal of Accounting Research, 53(2), 241–274.

Al-Tuwaijri, S. A., Christensen, T. E., & Hughes Ii, K. (2004). The relations among environmental disclosure, environmental performance, and economic performance: A simultaneous equations approach. Accounting, Organizations and Society, 29(5–6), 447–471.

Arthaud-Day, M. L., Certo, S. T., Dalton, C. M., & Dalton, D. R. (2006). A changing of the guard: Executive and director turnover following corporate financial restatements. Academy of Management Journal, 49(6), 1119–1136.

Bae, K.-H., El Ghoul, S., Guedhami, O., Kwok, C. C., & Zheng, Y. (2019). Does corporate social responsibility reduce the costs of high leverage? Evidence from capital structure and product market interactions. Journal of Banking & Finance, 100, 135–150.

Baumann-Pauly, D., Wickert, C., Spence, L. J., & Scherer, A. G. (2013). Organizing corporate social responsibility in small and large firms: Size matters. Journal of Business Ethics, 115(4), 693–705.

Bebbington, J., Larrinaga, C., & Moneva, J. M. (2008). Corporate social reporting and reputation risk management. Accounting, Auditing & Accountability Journal, 21(3), 337–361.

Bernardi, C., & Stark, A. W. (2018). Environmental, social and governance disclosure, integrated reporting, and the accuracy of analyst forecasts. The British Accounting Review, 50(1), 16–31.

Boda, Z., & Zsolnai, L. (2016). The failure of business ethics. Society and Business Review, 11(1), 93–104.

Bolton, L. E., & Mattila, A. S. (2015). How does corporate social responsibility affect consumer response to service failure in buyer–seller relationships? Journal of Retailing, 91(1), 140–153.

Boudoukh, J., Feldman, R., Kogan, S., & Richardson, M. (2013). Which news moves stock prices? A textual analysis. National Bureau of Economic Research working paper No. 18725.

Brown, T. J., & Dacin, P. A. (1997). The company and the product: Corporate associations and consumer product responses. The Journal of Marketing, 61, 68–84.

Cahan, S. F., De Villiers, C., Jeter, D. C., Naiker, V., & Van Staden, C. J. (2016). Are CSR disclosures value relevant? Cross-country evidence. European Accounting Review, 25(3), 579–611.

Carroll, A. B. (1983). Corporate social responsibility: Will industry respond to cutbacks in social program funding. Vital Speeches of the day, 49(19), 604–608.

Carroll, C. E., & Einwiller, S. A. (2014). Disclosure alignment and transparency signaling in CSR reports. In Communication and language analysis in the corporate world (pp. 249–270). IGI Global.

Chakravarthy, J., DeHaan, E., & Rajgopal, S. (2014). Reputation repair after a serious restatement. The Accounting Review, 89(4), 1329–1363.

Cho, C. H., & Patten, D. M. (2007). The role of environmental disclosures as tools of legitimacy: A research note. Accounting, Organizations and Society, 32(7–8), 639–647.

Cho, C. H., Roberts, R. W., & Patten, D. M. (2010). The language of US corporate environmental disclosure. Accounting, Organizations and Society, 35(4), 431–443.

Cho, S. Y., Lee, C., & Pfeiffer, R. J., Jr. (2013). Corporate social responsibility performance and information asymmetry. Journal of Accounting and Public Policy, 32(1), 71–83.

Choi, B., & La, S. (2013). The impact of corporate social responsibility (CSR) and customer trust on the restoration of loyalty after service failure and recovery. Journal of Services Marketing, 27(3), 223–233.

Christensen, D. M. (2016). Corporate accountability reporting and high-profile misconduct. The Accounting Review, 91(2), 377–399.

Clarkson, P. M., Li, Y., Richardson, G. D., & Vasvari, F. P. (2008). Revisiting the relation between environmental performance and environmental disclosure: An empirical analysis. Accounting, Organizations and Society, 33(4–5), 303–327.

Clement, M. B., & Tse, S. Y. (2005). Financial analyst characteristics and herding behavior in forecasting. The Journal of Finance, 60(1), 307–341.

Colleoni, E. (2013). CSR communication strategies for organizational legitimacy in social media. Corporate Communications: An International Journal, 18(2), 228–248.

Daines, R. (2001). Does Delaware law improve firm value? Journal of Financial Economics, 62(3), 525–558.

Dawar, N., & Pillutla, M. M. (2000). Impact of product-harm crises on brand equity: The moderating role of consumer expectations. Journal of Marketing Research, 37(2), 215–226.

De Bondt, W. F., & Thaler, R. H. (1990). Do security analysts overreact? American Economic Review, 80(2), 52–57.

De la Fuente Sabaté, J. M., & De Quevedo Puente, E. (2003). Empirical analysis of the relationship between corporate reputation and financial performance: A survey of the literature. Corporate Reputation Review, 6(2), 161–177.

Dechow, P. M., Sloan, R. G., & Sweeney, A. P. (1995). Detecting earnings management. Accounting Review, 70, 193–225.

Deegan, C. (2002). Introduction: The legitimising effect of social and environmental disclosures—A theoretical foundation. Accounting, Auditing & Accountability Journal, 15(3), 282–311.

Dhaliwal, D. S., Li, O. Z., Tsang, A., & Yang, Y. G. (2011). Voluntary nonfinancial disclosure and the cost of equity capital: The initiation of corporate social responsibility reporting. The Accounting Review, 86(1), 59–100.

Dhaliwal, D. S., Radhakrishnan, S., Tsang, A., & Yang, Y. G. (2012). Nonfinancial disclosure and analyst forecast accuracy: International evidence on corporate social responsibility disclosure. The Accounting Review, 87(3), 723–759.

Dowell, G., Hart, S., & Yeung, B. (2000). Do corporate global environmental standards create or destroy market value? Management Science, 46(8), 1059–1074.

Ducassy, I. (2013). Does corporate social responsibility pay off in times of crisis? An alternate perspective on the relationship between financial and corporate social performance. Corporate Social Responsibility and Environmental Management, 20(3), 157–167.

Eccles, R. G., Ioannou, I., & Serafeim, G. (2012). The impact of a corporate culture of sustainability on corporate behavior and performance. Cambridge, MA: National Bureau of Economic Research working paper No. 17950.

Eccles, R. G., & Krzus, M. P. (2014). The integrated reporting movement: Meaning, momentum, motives, and materiality. New York: Wiley.

El Ghoul, S., Guedhami, O., Kwok, C. C., & Mishra, D. R. (2011). Does corporate social responsibility affect the cost of capital? Journal of Banking & Finance, 35(9), 2388–2406.

Epstein, M. J., & Roy, M.-J. (2001). Sustainability in action: Identifying and measuring the key performance drivers. Long Range Planning, 34(5), 585–604.

Faleye, O. (2007). Classified boards, firm value, and managerial entrenchment. Journal of Financial Economics, 83(2), 501–529.

Fama, E. F. (1980). Agency problems and the theory of the firm. Journal of Political Economy, 88(2), 288–307.

Fama, E. F., & French, K. R. (1997). Industry costs of equity. Journal of Financial Economics, 43(2), 153–193.

Feldmann, D. A., Read, W. J., & Abdolmohammadi, M. J. (2009). Financial restatements, audit fees, and the moderating effect of CFO turnover. Auditing: A Journal of Practice & Theory, 28(1), 205–223.

Fernandez-Feijoo, B., Romero, S., & Ruiz, S. (2014). Effect of stakeholders’ pressure on transparency of sustainability reports within the GRI framework. Journal of Business Ethics, 122(1), 53–63.

Fieseler, C. (2011). On the corporate social responsibility perceptions of equity analysts. Business Ethics: A European Review, 20(2), 131–147.

Flammer, C. (2013). Corporate social responsibility and shareholder reaction: The environmental awareness of investors. Academy of Management Journal, 56(3), 758–781.

Freedman, M., & Stagliano, A. (1991). Differences in social-cost disclosures: A market test of investor reactions. Accounting, Auditing & Accountability Journal, 4(1), 68–83.

Gao, F., Dong, Y., Ni, C., & Fu, R. (2016). Determinants and economic consequences of non-financial disclosure quality. European Accounting Review, 25(2), 287–317.

Gardberg, N. A., & Fombrun, C. J. (2006). Corporate citizenship: Creating intangible assets across institutional environments. Academy of Management Review, 31(2), 329–346.

Griffin, P. A. (2003). A league of their own? Financial analysts’ responses to restatements and corrective disclosures. Journal of Accounting, Auditing & Finance, 18(4), 479–517.

Hart, S. L. (1995). A natural-resource-based view of the firm. Academy of Management Review, 20(4), 986–1014.

Healy, P. M., & Palepu, K. G. (2001). Information asymmetry, corporate disclosure, and the capital markets: A review of the empirical disclosure literature. Journal of Accounting and Economics, 31(1), 405–440.

Heckman, J. J. (1979). Sample selection bias as a specification error. Econometrica, 47(1), 153–162.

Hooghiemstra, R. (2000). Corporate communication and impression management–new perspectives why companies engage in corporate social reporting. Journal of Business Ethics, 27(1–2), 55–68.

Hope, O. K. (2003). Disclosure practices, enforcement of accounting standards, and analysts’ forecast accuracy: An international study. Journal of Accounting Research, 41(2), 235–272.

Hribar, P., & Jenkins, N. T. (2004). The effect of accounting restatements on earnings revisions and the estimated cost of capital. Review of Accounting Studies, 9(2–3), 337–356.

Huang, X., Teoh, S. H., & Zhang, Y. (2013). Tone management. The Accounting Review, 89(3), 1083–1113.

Huang, Y., & Scholz, S. (2012). Evidence on the association between financial restatements and auditor resignations. Accounting Horizons, 26(3), 439–464.

International Integrated Reporting Council [IIRC]. (2015). Assurance on IR: Overview feedback and call to action. Retrieved from https://integratedreporting.org/wp-content/uploads/2015/07/IIRC-Assurance-Overview-July-2015.pdf

Jemel-Fornetty, H., Louche, C., & Bourghelle, D. (2011). Changing the dominant convention: The role of emerging initiatives in mainstreaming ESG. In Finance and sustainability: Towards a new paradigm? A post-crisis agenda (pp. 85–117). West Yorkshire: Emerald Group Publishing Limited.

Jo, H., & Harjoto, M. A. (2012). The causal effect of corporate governance on corporate social responsibility. Journal of Business Ethics, 106(1), 53–72.

Jones, T. M. (1995). Instrumental stakeholder theory: A synthesis of ethics and economics. Academy of Management Review, 20(2), 404–437.

Karpoff, J. M., Lee, D. S., & Martin, G. S. (2008). The cost to firms of cooking the books. Journal of Financial and Quantitative Analysis, 43(3), 581–611.

Kim, Y. K., Park, M. S. P., & Wier, B. (2012). Is earnings quality associated with corporate social responsibility? The Accounting Review, 87(3), 761–796.

Kim, Y., & Song, M. (2015). Management earnings forecasts and value of analyst forecast revisions. Management Science, 61(7), 1663–1683.

Klassen, R. D., & McLaughlin, C. P. (1996). The impact of environmental management on firm performance. Management Science, 42(8), 1199–1214.

Klein, J., & Dawar, N. (2004). Corporate social responsibility and consumers’ attributions and brand evaluations in a product–harm crisis. International Journal of Research in Marketing, 21(3), 203–217.

Konijn, S. J., Kräussl, R., & Lucas, A. (2011). Blockholder dispersion and firm value. Journal of Corporate Finance, 17(5), 1330–1339.

Lee, D. (2017). Corporate social responsibility and management forecast accuracy. Journal of Business Ethics, 140(2), 353–367.

Lenz, I., Wetzel, H. A., & Hammerschmidt, M. (2017). Can doing good lead to doing poorly? Firm value implications of CSR in the face of CSI. Journal of the Academy of Marketing Science, 45(5), 677–697.

Lev, B., Petrovits, C., & Radhakrishnan, S. (2010). Is doing good for you? How corporate charitable contributions enhance revenue growth. Strategic Management Journal, 31(2), 182–200.

Li, F. (2008). Annual report readability, current earnings, and earnings persistence. Journal of Accounting and Economics, 45(2–3), 221–247.

Li, F. (2010). The information content of forward-looking statements in corporate filings—A naïve Bayesian machine learning approach. Journal of Accounting Research, 48(5), 1049–1102.

Lindblom, C. (2010). The implications of organizational legitimacy for corporate social performance and disclosure. In: Social and environmental accounting volume 2: Developing the field. Sage: London, UK.

Lins, K. V., Servaes, H., & Tamayo, A. (2017). Social capital, trust, and firm performance: The value of corporate social responsibility during the financial crisis. The Journal of Finance, 72(4), 1785–1824.

Lyon, T. P., & Maxwell, J. W. (2011). Greenwash: Corporate environmental disclosure under threat of audit. Journal of Economics & Management Strategy, 20(1), 3–41.

Lys, T., Naughton, J. P., & Wang, C. (2015). Signaling through corporate accountability reporting. Journal of Accounting and Economics, 60(1), 56–72.

Mahoney, L., LaGore, W., & Scazzero, J. A. (2008). Corporate social performance, financial performance for firms that restate earnings. Issues in Social and Environmental Accounting, 2(1), 104–130.

Malik, M. (2015). Value-enhancing capabilities of CSR: A brief review of contemporary literature. Journal of Business Ethics, 127(2), 419–438.

McGuire, J. B., Sundgren, A., & Schneeweis, T. (1988). Corporate social responsibility and firm financial performance. Academy of Management Journal, 31(4), 854–872.

Melloni, G., Caglio, A., & Perego, P. (2017). Saying more with less? Disclosure conciseness, completeness and balance in Integrated Reports. Journal of Accounting and Public Policy, 36(3), 220–238.

Merkl-Davies, D. M., & Brennan, N. M. (2007). Discretionary disclosure strategies in corporate narratives: Incremental information or impression management? Journal of Accounting Literature, 27, 116–196.

Michelon, G. (2011). Sustainability disclosure and reputation: A comparative study. Corporate Reputation Review, 14(2), 79–96.

Michelon, G., Pilonato, S., & Ricceri, F. (2015). CSR reporting practices and the quality of disclosure: An empirical analysis. Critical Perspectives on Accounting, 33, 59–78.

Mikhail, M. B., Walther, B. R., & Willis, R. H. (1997). Do security analysts improve their performance with experience? Journal of Accounting Research, 35, 131–157.