Abstract

Any utility function that is unbounded either from below or from above implies paradoxical behavior. However, these paradoxes may be regarded as irrelevant if they involve wealth levels that are realistically meaningless. Employing real-world constraints on wealth reveals that CRRA utility with relative risk aversion outside of the range 0.75–1.15 yields paradoxical choices that very few individuals, if any, would ever make. Thus, relative risk aversion must be close to 1, the value corresponding to log preferences. These results shed new light on the longstanding debate about the geometric-mean criterion and the argument of stocks for the long-run.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

In the same year that Harry Markowitz revolutionized portfolio theory (Markowitz, 1952a), he also planted the seed of what decades later would become behavioral economics (Markowitz, 1952b). He also played a key role in the debate over stocks for the long-run and the geometric-mean criterion (Markowitz, 1976, 2006). This paper hopes to shed new light on this long-standing debate.

The investment with the maximal geometric mean yields a terminal wealth which is higher than that obtained by any other investment, with a probability that approaches 1 as the investment horizon increases. This leads to a strong intuition favoring the maximization of the geometric mean by the long-run investors (Kelly, 1956, Latane, 1959, Breiman, 1960, Elton & Gruber, 1974, Thorp, 1975, Markowitz, 1976, Bernstein, 1976, 2006, Vander Weide et al., 1977, Vander Weide, 2010, Levy, 2016, and Lo et al., 2018). As stocks have higher geometric means than bonds, this result leads to the popular prescription of “stocks for the long run” (Siegel, 2021). Maximizing the geometric-mean conforms with expected utility maximization for investors with log preferences, i.e. Constant relative risk aversion (CRRA) with a relative risk aversion coefficient of 1. On the other hand, Merton and Samuelson (1974) and Samuelson (1994) object to the geometric-mean criterion and argue that a CRRA investor with relative risk aversion different than 1 will generally choose an investment other than the one with the maximal geometric mean, and this choice holds regardless of the horizon. While this statement is no-doubt mathematically correct, many find its implications hard to swallow. In this paper we show that CRRA preferences imply paradoxical behavior unless the relative risk aversion coefficient is close to 1. Thus, while Merton and Samuelson’s argument is correct, it may be economically irrelevant, reinforcing Markowitz’s intuition about geometric-mean maximization.

CRRA preferences play a central role in the economic theory of decision-making. These preferences seem to provide the best existing model for decisions involving a substantial part of the individual’s wealth. Evidence supporting CRRA preferences has been found both empirically (for example, see Friend & Blume, 1975; Szpiro, 1986a, 1986b; Szpiro & Outreville, 1988; Meyer & Meyer, 2005; Brunnermeier & Nagel, 2008; Chiappori & Paiella, 2011) and experimentally (Agnew et al., 2008; Andreoni & Sprenger, 2012; Heinemann, 2008; Levy, 1994; Levy & Levy, 2021; Levy & Nir, 2012). Accordingly, most economic models of individual decision-making assume CRRA preferences.Footnote 1

When smaller stakes are involved, such as in incentivized laboratory experiments, many studies find that Prospect Theory, or alternative behavioral models provide a better description of choice (Kahneman & Tversky, 1979; Machina, 1987; Thaler, 2016; Tversky & Kahneman, 1992). Thus, it has been suggested that different models apply to decisions “in the large” and to decisions “in the small” (Rabin, 2000; Levy & Levy, 2021). In this study we focus on decision “in the large”, i.e. decisions with substantial implications for the individual’s total wealth, such as decisions about portfolio allocations and lifelong savings.

This paper scrutinizes CRRA preferences, and shows that unless the relative risk aversion coefficient is in a rather narrow range around 1, they imply paradoxical choices that very few, if any, individuals would ever make. It is well-known that any utility function that is either unbounded from above, or converges to \(-\infty \) at some wealth level, leads to paradoxical choices (see, for example, Menger, 1934; Arrow, 1974; Aumann, 1977). If the utility function is unbounded from above, then for any arbitrarily large value M and any arbitrarily small probability p, there exists a value N (N > M) such that a gamble yielding N with probability p is preferred over M for sure. This implies paradoxical choices: very few individuals would be willing to forgo $100 million (M) for sure for a 1-in-a-million (p) chance of getting a blank check (in which they can fill in the value N). This paradox has not stopped economists from taking unbounded utility functions seriously, as evident by the popularity of CRRA preferences as a modelling choice. A possible reason for this is that the value N required to ensure the preference of the risky gamble over M may be so large as to make the gamble meaningless. According to recent estimates,Footnote 2 the total wealth in the world is in the order of $1,000 trillion, i.e. $\({10}^{15}\). If the N required for the individual to paradoxically prefer the lottery is, say, $\({10}^{100}\), then the lottery is meaningless—it involves an outcome which is billions of times larger than the total wealth in the world. This may explain why most economists are not too troubled by this kind of paradox.

Similarly, utility functions that converge to \(-\infty \) at some wealth level also imply paradoxical behavior. For example, consider utility functions converging to \(-\infty \) at wealth zero, such as any CRRA utility function with relative risk aversion exceeding (or equal to) 1. For any arbitrarily large value M, there exists a value m close to 0, such that the decision-maker prefers having 1¢ for sure over a 50–50 chance gamble yielding either M or m. Clearly, very few individuals would prefer 1¢ for sure over a 50–50 chance gamble yielding either $100 million (M) or, say, $\({1}^{-10}\). Again, this sort of gamble may be considered as meaningless, and hence the paradox mute, because there is a minimal quantum of wealth, e.g. 1¢, and there is no real-world meaning to a wealth of $\({1}^{-10}\).

This paper imposes realistic constraints on the maximal possible wealth and the minimal unit of wealth, and derives the values of relative risk aversion that yield paradoxical behavior under these conditions. We find that CRRA preferences with relative risk aversion outside of the range (0.75–1.15) lead to paradoxical choices that very few, if any, individuals would ever make. Thus, the relative risk aversion coefficient must be in a rather narrow range around 1, the value corresponding to the Bernoulli log preferences.

2 A lower bound on relative risk aversion

CRRA preferences are given by the utility function \(U\left(W\right)=\frac{1}{1-\alpha }{W}^{1-\alpha }\), where \(W\) denotes wealth and \(\alpha \ge 0\) is the relative risk aversion coefficient. The logarithmic utility function is obtained as a special case of the CRRA family, with a relative risk aversion of 1.

Consider a gamble yielding a terminal wealth of $\({10}^{15}\) (roughly the entire wealth in the world) with a probability of 1%, or a wealth of $1 with probability 99%. What is the certain amount of wealth X that would make you indifferent between it and the gamble? It seems reasonable to expect that the vast majority of individuals would prefer having $10 million for sure over the above gamble. Yet, CRRA individuals with \(\alpha <0.75\) prefer the gamble over a sure $10 million, as shown below.

For a given value of \(\alpha \), the indifference value X is given as the solution to:

Figure 1 depicts the value of X as a function of the relative risk aversion, \(\alpha \). We can gain insight to the solution of Eq. (1) by noticing that the second term, 0.99, is typically negligible relative to the first term involving \({10}^{15}\). If we neglect the 0.99 term, we have:

(where log denotes base-10 logarithm), or:

The Certainty equivalent of a gamble yielding a 1% chance of having all the wealth in the world (\({\$10}^{15}\))and a 99% probability of having $1 (the exact solution to Eq. 1). The vertical axis depicts X, in $, on a logarithmic scale. CRRA individuals with relative risk aversion \(\alpha <0.75\) prefer this gamble over having $10 million with certainty

Thus, for a CRRA investor with \(\alpha =0.5\), for example, the indifference sure value X is $\({10}^{11}\). A person with this relative risk aversion coefficient is willing to forgo $100 billion for sure for a 1% chance of having all the wealth in the world and a 99% chance of having only $1. This seems as a paradoxical choice. For \(\alpha =0.75\) Eq. (3) implies an indifference value of \(X=\${10}^{7}\) or $10 million. Again, it seems that very few individuals would make such choices. As Fig. 1 shows, for values of \(\alpha \) in excess of 0.75, X sharply decreases to more reasonable values. For example, for \(\alpha =0.8\) the value of X drops to $100,000, which seems to be a much more reasonable value (for even higher values of \(\alpha \) the approximation in (3) breaks down, and one should employ the exact Eq. (1); Fig. 1 depicts this exact solution).

Running an experiment with real payoffs to elicit individuals’ indifference values X is obviously impossible. However, introspection leads to the conclusion that some values can be considered as “unreasonable” or “paradoxical”. It is hard to imagine anyone preferring a gamble with a 99% chance of ending up with only $1 and a 1% chance of having all the wealth in world over a sure wealth of $10 million. Thus, we conclude that the real-world upper bound on wealth of \({\$10}^{15}\) implies that relative risk aversion should be higher than 0.75.

3 An upper bound on relative risk aversion

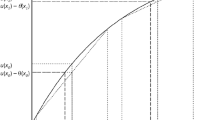

Consider the choice between two wealth gambles, as shown in Table 1. Gamble A yields a wealth of $1 with certainty. Gamble B yields a 50–50 chance of either 1¢ or X. 1¢ is taken as the real-world minimal unit of wealth. What is the value of X that would make you indifferent between the two gambles?

It seems that most people would determine the indifference value X somewhere in the range between $2 and $100. Yet, CRRA investors with \(\alpha >1.15\) prefer the sure $1 of Prospect A even if X is the entire wealth in the world. To see this, note that X satisfies:

Rearranging yields:

Figure 2 shows the solution to Eq. (5). For \(\alpha =0\) (risk-neutrality) we have \(X=1.99\). X increases with \(\alpha \), as expected. The interesting point is that at \(\alpha =1.15\) the expression on the right hand side converges to 0, and X “explodes” to infinity.Footnote 3 In other words, investors with \(\alpha >1.15\) prefer the sure $1 even if the risky gamble offers a 50% chance for all the wealth in the world. As very few, if any, individuals would make such choices, we conclude that relative risk aversion must be less than 1.15.

The value X yielding indifference between gambles A and B in Table 1 (i.e. the solution to Eq. 5). The vertical axis depicts X, in $, on a logarithmic scale. CRRA individuals with relative risk aversion \(\alpha >1.15\) prefer $1 for sure over a 50–50 gamble yielding either 1¢ or all the wealth in the world

Of course, gambles with real-world payoffs other than those considered here may imply even tighter bounds on \(\alpha \). But even the simple gambles analyzed here suffice to lead to the conclusion that relative risk aversion must be close to 1.

4 Generalization to power utility with a minimum subsistence level

Some researchers have suggested a generalization of CRRA preferences reflecting a minimum subsistence level that should be attained before any other considerations (see, for example, Roy, 1952, Samuelson, 1989, Merton, 1971, and Brocas et al., 2019). This is typically captured by a utility function of the form \(U\left(W\right)=\frac{1}{1-\alpha }{\left(W-S\right)}^{1-\alpha }\), where S is the minimum subsistence level. In this case relative risk aversion is no longer constant, but the same bounds on the power \(\alpha \) apply. Namely, in the prospects discussed in Sect. 2, which place a lower bound on \(\alpha \), replace the outcome of $1 by $S + 1, and define the certainty equivalent value by S + X, rather than X. In this case the solution to X is exactly the same as in Eq. (1) (note that S is negligible compared to \({\$10}^{15}\)). Thus, the same lower bound of 0.75 applies to \(\alpha \).

Similarly, the same upper bound of 1.15 on \(\alpha \) also applies. To see this, replace the outcome of $1 in Prospect A of Table 1 by $S + 1, and replace the outcomes in Prospect B by $S + 0.01 and $S + X, respectively. X is again the solution to Eq. (5), which is depicted in Fig. 2. Thus, the same lower and upper bounds on the value of the power \(\alpha \) hold is the case of a generalized power utility function with a minimum subsistence level.

5 Discussion

Many economists consider CRRA preferences as the best existing model of behavior when major decisions involving individuals’ total wealth are involved. Evidence supporting this preference class has been found in many empirical and experimental studies. Accordingly, CRRA preferences are a very common assumption in economic modelling. This study shows that unless the relative risk aversion coefficient is close to 1, the value corresponding to log preferences, CRRA preferences imply paradoxical choices, that very few, if any, real-world decision-makers would ever make. This result imposes structure on modelling choice: if one considers CRRA as a reasonable model of choice, this should be limited only to the case relative risk aversion close to 1.Footnote 4 Most of the estimates of the relative risk aversion coefficient are indeed in the range 0–2.Footnote 5 It is interesting to observe that the very first utility function ever suggested, almost three centuries ago (Bernoulli, 1738), is probably still the best model of choice for decisions “in the large”.

CRRA preferences are central to the longstanding debate about investment for the long-run. It is well-known that Relative risk aversion of 1 corresponds to log utility, and thus conforms with the maximization of the geometric mean.Footnote 6 Hence, the goal of maximizing the geometric mean for the long-run seems to be well-grounded: the CRRA preferences employed to justify behavior to the contrary (Merton & Samuelson, 1974) lead to behavior that not only Professor Markowitz, but even Professors Merton and Samuelson, I presume, would consider to be paradoxical.

Notes

Some examples of this vast literature are Ramsey 1928, Phelps 1962, Mossin 1968, 1977, Samuelson 1969, Merton 1969, Levhari and Srinivasan 1969, Kydland and Prsecott 1982, Long and Plosser 1983, Mehra and Prescott 1985, Zeldes 1989, Gomes et al., 2008, Dybvig and Liu 2010, and Nakamura et al., 2013. An alternative popular modelling choice is that of negative exponential preferences, implying constant absolute risk aversion. While the exponential utility function has appealing analytical properties, it is well-acknowledged that constant absolute risk aversion implies very unrealistic behavior (Arrow 1971; Markowitz et al., 1994).

See, for example, https://finance.yahoo.com/news/25-wealthiest-countries-world-assets.

The right hand side becomes zero when \(\alpha \) satisfies \(1-\alpha =\frac{\text{log}\left(2\right)}{-2}\approx -0.15\), i.e. when \(\alpha =1.15\).

Alternatively, one may abandon the idea of CRRA altogether, as some authors have suggested. Decisions may be affected by factors other than the terminal wealth, such as regret (Bell 1982; Diecidue and Somasundaram 2017; Fishburn 1982; Loomes and Sugden 1982; Somasundaram and Diecidue 2017), past consumption (Pollak 1970), status relative to peers (Gali 1994), and the perceptions of others (Ben Porath et al., 2018).

Arrow 1971 argues for a relative risk aversion of 1. Friend and Blume 1975 estimate a relative risk aversion value of 2. Hansen and Singleton 1982 estimate relative risk aversion to be in the range 0–1. Szpiro 1986a estimates relative risk aversion in the U.S. to be between 1.2 and 1.8, while in an international study he estimates values in the range of 1–2 (Szpiro 1986a, 1986b). De Mel et al., (2008) experimentally estimate an average relative risk aversion of 0.14, with a standard deviation of 1.6. Barro and Jin (2011) estimate a relative risk aversion of 3, based on the distribution of macroeconomic disasters. Other studies such as Mehra and Prescott 1985, 2003 Ferson and Constantinides 1991 and Cochrane and Hansen 1992 argue that a relative risk aversion of 1 is much too low to reconcile macroeconomic data with standard models. Gabaix and Laibson (2001) suggest that these seemingly paradoxical results can be explained by delayed adjustments to consumption.

The logarithm of the geometric mean is \(E\left[log\left(\widetilde{R}\right)\right]\). This is exactly the expected utility of an investor with log preference (up to the constant \(log\left({W}_{0}\right)\)). Thus, given a set of alternatives, the investor with log preferences chooses the alternative with the highest geometric mean, in line with the Kelly 1956 criterion.

References

Agnew, J. R., Anderson, L. R., Gerlach, J. R., & Szykman, L. R. (2008). Who chooses annuities? An experimental investigation of the role of gender, framing, and defaults. American Economic Review, 98(2), 418–422.

Andreoni, J., & Sprenger, C. (2012). Estimating time preferences from convex budgets. American Economic Review, 102(7), 3333–3356.

Arrow, K. J. (1971). Essays in the theory of risk-bearing. North-Holland.

Arrow, K. J. (1974). The use of unbounded utility functions in expected-utility maximization: Response. The Quarterly Journal of Economics, 88(1), 136–138.

Aumann, R. J. (1977). The St. Petersburg paradox: A discussion of some recent comments. Journal of Economic Theory, 14(2), 443–445.

Barro, R. J., & Jin, T. (2011). On the size distribution of macroeconomic disasters. Econometrica, 79(5), 1567–1589.

Bell, D. E. (1982). Regret in decision making under uncertainty. Operations Research, 30(5), 961–981.

Ben-Porath, E., Dekel, E., & Lipman, B. L. (2018). Disclosure and choice. The Review of Economic Studies, 85(3), 1471–1501.

Bernoulli, Daniel 1738. ‘Specimen theoriae novae de mensura sortis,’ in Commentarii Academiae Scientiarum Imperialis Petropolitanae, vol. 5. English translation by Louise Sommer with notes by Karl Menger, ‘Exposition of a new theory on the measurement of risk,’ Papers of the Imperial Academy of Sciences in Petersburg, Econometrica, 1954, 23–26.

Bernstein, P. L. (1976). The time of your life. The Journal of Portfolio Management, 2(4), 4.

Breiman, L. (1960). Investment policies for expanding businesses optimal in a long-run sense. Naval Research Logistics Quarterly, 7(4), 647–651.

Brocas, I., Carrillo, J. D., Giga, A., & Zapatero, F. (2019). Risk aversion in a dynamic asset allocation experiment. Journal of Financial and Quantitative Analysis, 54(5), 2209–2232.

Brunnermeier, M. K., & Nagel, S. (2008). Do wealth fluctuations generate time-varying risk aversion? Micro-evidence on individuals’ asset allocation. American Economic Review, 98(3), 713–736.

Chiappori, P. A., & Paiella, M. (2011). Relative risk aversion is constant: Evidence from panel data. Journal of the European Economic Association, 9(6), 1021–1052.

Cochrane, J. H., & Hansen, L. P. (1992). Asset pricing explorations for macroeconomics. NBER Macroeconomics Annual, 7, 115–165.

De Mel, S., McKenzie, D., & Woodruff, C. (2008). Returns to capital in microenterprises: Evidence from a field experiment. The Quarterly Journal of Economics, 123(4), 1329–1372.

Diecidue, E., & Somasundaram, J. (2017). Regret theory: A new foundation. Journal of Economic Theory, 172, 88–119.

Dybvig, P. H., & Liu, H. (2010). Lifetime consumption and investment: Retirement and constrained borrowing. Journal of Economic Theory, 145(3), 885–907.

Elton, E. J., & Gruber, M. J. (1974). On the optimality of some multiperiod portfolio selection criteria. The Journal of Business, 47(2), 231–243.

Ferson, W. E., & Constantinides, G. M. (1991). Habit persistence and durability in aggregate consumption: Empirical tests. Journal of Financial Economics, 29(2), 199–240.

Fishburn, P. C. (1982). Nontransitive measurable utility. Journal of Mathematical Psychology, 26(1), 31–67.

Friend, I., & Blume, M. E. (1975). The demand for risky assets. The American Economic Review, 65(5), 900–922.

Gabaix, X., & Laibson, D. (2001). The 6D bias and the equity-premium puzzle. NBER Macroeconomics Annual, 16, 257–312.

Gali, J. (1994). Keeping up with the Joneses: Consumption externalities, portfolio choice, and asset prices. Journal of Money, Credit and Banking, 26(1), 1–8.

Gomes, F. J., Kotlikoff, L. J., & Viceira, L. M. (2008). Optimal life-cycle investing with flexible labor supply: A welfare analysis of life-cycle funds. American Economic Review, 98(2), 297–303.

Hansen, L. P., & Singleton, K. J. (1982). Generalized instrumental variables estimation of nonlinear rational expectations models. Econometrica, 50(5), 1269–1286.

Heinemann, F. (2008). Measuring risk aversion and the wealth effect. In G. W. Harrison (Ed.), Risk aversion in experiments. Emerald Group Publishing Limited.

Kahneman, D., & Tversky, A. (1979). Prospect theory: An analysis of decision under Risk. Econometrica, 47(2), 263–292.

Kelly, J. L. (1956). A new interpretation of information rate. The Bell System Technical Journal, 35(4), 917–926.

Kydland, F. E., & Prescott, E. C. (1982). Time to build and aggregate fluctuations. Econometrica, 50(6), 1345–1370.

Latane, H. A. (1959). Criteria for choice among risky ventures. Journal of Political Economy, 67(2), 144–155.

Levhari, J. D., & Srinivasan, T. N. (1969). Optimal savings under uncertainty. The Review of Economic Studies, 36(2), 153–163.

Levy, H. (1994). Absolute and relative risk aversion: An experimental study. Journal of Risk and Uncertainty, 8, 289–307.

Levy, H. (2016). Aging population, retirement, and risk taking. Management Science, 62(5), 1415–1430.

Levy, H., & Levy, M. (2021). Prospect theory, constant relative risk aversion, and the investment horizon. PLoS ONE, 16(4), e0248904.

Levy, M., & Nir, A. R. (2012). The utility of health and wealth. Journal of Health Economics, 31(2), 379–392.

Lo, A. W., Orr, H. A., & Zhang, R. (2018). The growth of relative wealth and the Kelly criterion. Journal of Bioeconomics, 20, 49–67.

Long, J. B., Jr., & Plosser, C. I. (1983). Real business cycles. Journal of Political Economy, 91(1), 39–69.

Loomes, G., & Sugden, R. (1982). Regret theory: An alternative theory of rational choice under uncertainty. The Economic Journal, 92(368), 805–824.

Machina, M. J. (1987). Choice under uncertainty: Problems solved and unsolved. Journal of Economic Perspectives, 1(1), 121–154.

Markowitz, H. (1952a). Portfolio selection. The Journal of Finance, 7(1), 77–91.

Markowitz, H. (1952b). The utility of wealth. Journal of Political Economy, 60(2), 151–158.

Markowitz, H. M. (1976). Investment for the long run: New evidence for an old rule. The Journal of Finance, 31(5), 1273–1286.

Markowitz, H. M. (2006). Samuelson and investment for the long run. In M. Szenberg, L. Ramrattan, & A. A. Gottesman (Eds.), Samuelsonian Economics and the Twenty-First Century (pp. 252–261). Oxford University Press.

Markowitz, H. M., Reid, D. W., & Tew, B. V. (1994). The value of a blank check. Journal of Portfolio Management, 20(4), 82.

Mehra, R., & Prescott, E. C. (1985). The equity premium: A puzzle. Journal of Monetary Economics, 15(2), 145–161.

Mehra, R., & Prescott, E. C. (2003). The equity premium in retrospect. Handbook of the Economics of Finance, 1, 889–938.

Menger, K., (1934). Das unsicherheitsmoment in der wertlehre: Betrachtungen im anschliß an das sogenannte petersburger spiel. Zeitschrift für Nationalökonomie/ Journal of Economics, pp.459–485. English version in: Menger, К., (1967. The role of uncertainty in economics, in “Essays in Mathematical Economics in Honor of Oskar Morgenstern” (M. Shubik, Ed.). l-231, Princeton Univ. Press, pp.459–485.

Merton, R. C. (1969). Lifetime portfolio selection under uncertainty: The continuous-time case. The Review of Economics and Statistics, 51, 247–257.

Merton, R. (1971). Optimum consumption and portfolio rules in a continuous-time model. Journal of Economic Theory, 3(4), 373–413.

Merton, R. C., & Samuelson, P. A. (1974). Fallacy of the log-normal approximation to optimal portfolio decision-making over many periods. Journal of Financial Economics, 1(1), 67–94.

Meyer, D. J., & Meyer, J. (2005). Relative risk aversion: What do we know? Journal of Risk and Uncertainty, 31, 243–262.

Mossin, J. (1968). Optimal multiperiod portfolio policies. The Journal of Business, 41(2), 215–229.

Mossin, J. (1977). The Economic Efficiency of Financial Markets. Lexington Books.

Nakamura, E., Steinsson, J., Barro, R., & Ursúa, J. (2013). Crises and recoveries in an empirical model of consumption disasters. American Economic Journal: Macroeconomics, 5(3), 35–74.

Phelps, E. S. (1962). The accumulation of risky capital: A sequential utility analysis. Econometrica, 30(4), 729–743.

Pollak, R. A. (1970). Habit formation and dynamic demand functions. Journal of Political Economy, 78, 745–763.

Rabin, M. (2000). Risk Aversion and Expected-Utility Theory: A Calibration Theorem. Econometrica, 68(5), 1281–1292.

Ramsey, F. P. (1928). A mathematical theory of saving. The Economic Journal, 38(152), 543–559.

Roy, A. D. (1952). Safety first and the holding of assets. Econometrica, 20(3), 431–449.

Samuelson, P. (1969). Lifetime Portfolio Selection by Dynamic Stochastic Programming. The Review of Economics and Statistics, 51(3), 239–246.

Samuelson, P. A. (1989). A case at last for age-phased reduction in equity. Proceedings of the National Academy of Sciences, 86(22), 9048–9051.

Samuelson, P. A. (1994). The long-term case for equities. Journal of Portfolio Management, 21(1), 15.

Siegel, J. J. (2021). Stocks for the long run: The definitive guide to financial market returns & long-term investment strategies. McGraw-Hill Education.

Somasundaram, J., & Diecidue, E. (2017). Regret theory and risk attitudes. Journal of Risk and Uncertainty, 55, 147–175.

Szpiro, G. G. (1986a). Measuring risk aversion: an alternative approach. The Review of Economics and Statistics, 68, 156–159.

Szpiro, G. G. (1986b). Relative risk aversion around the world. Economics Letters, 20(1), 19–21.

Szpiro, G. G., & Outreville, J. F. (1988). Relative risk aversion around the world: Further results. Journal of Banking & Finance, 6, 127–128.

Thaler, R. H. (2016). Behavioral economics: Past, present, and future. American Economic Review, 106(7), 1577–1600.

Thorp, E. O. (1975). Portfolio choice and the Kelly criterion. In W. T. Ziemba & R. G. Vickson (Eds.), Stochastic optimization models in finance. Academic Press.

Tversky, A., & Kahneman, D. (1992). Advances in prospect theory: Cumulative representation of uncertainty. Journal of Risk and Uncertainty, 5, 297–323.

Vander Weide, J. H. (2010). Principles for lifetime portfolio selection: Lessons from portfolio theory. In J. Guerard (Ed.), The handbook of portfolio construction: Contemporary applications of Markowitz techniques (pp. 153–177). Springer.

Vander Weide, J. H., Peterson, D. W., & Maier, S. F. (1977). A strategy which maximizes the geometric mean return on portfolio investments. Management Science, 23(10), 1117–1123.

Zeldes, S. P. (1989). Optimal consumption with stochastic income: Deviations from certainty equivalence. The Quarterly Journal of Economics, 104(2), 275–298.

Funding

Open access funding provided by Hebrew University of Jerusalem.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

The author certifies that they have no affiliations with or involvement in any organization or entity with any financial interest or non-financial interest in the subject matter or materials discussed in this manuscript.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Levy, M. Relative risk aversion must be close to 1. Ann Oper Res (2024). https://doi.org/10.1007/s10479-024-06193-0

Received:

Accepted:

Published:

DOI: https://doi.org/10.1007/s10479-024-06193-0

Keywords

- Constant relative risk aversion (CRRA)

- Logarithmic utility function

- Geometric mean

- Stocks for the long-run