Abstract

The greenhouse gas emissions due to the energy use in production and distribution in a supply chain are of interest to industries aiming to achieve decarbonization. The industry subjected to carbon regulations require recycling and reusing materials to promote a circular economy through a closed-loop supply chain (CLSC). In this research, we propose a two-stage stochastic model to design the CLSC under a carbon trading scheme in the multi-period planning context by considering the uncertain demands and carbon prices. We also provide a four-step solution procedure with scenario reduction that enables the proposed model to be solved using popular commercial solvers efficiently. This solution makes the proposed model distinguished from the existing models that assume the firms can purchase or sell carbon credits without quantity limitation. The application of the proposed model is demonstrated via simulation-based analysis of the aluminum industry. The results that the proposed stochastic model generates a network with capacity redundancy to cope with the varying customer demands and carbon prices, while only a slight increase in cost and emission is observed compared with the deterministic model. Furthermore, using scenario reduction, the model solved with 80% of the scenarios share the same CLSC network configuration with the model with full scenarios, while the deviation of the total costs is less than 0.53% and the computational burden can be diminished by more than 40%. This research is expected to be useful to solve optimization problems facing large-scale scenarios with known occurrence probabilities aiming for energy conservation and emissions reduction.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Recent years have witnessed an upsurge of interest in sustainability and environmentally friendly products and services. In this context, many countries have introduced environmental regulations to cap and reduce carbon emissions, mainly from energy-intensive sectors such as the manufacturing sector, which contributes to about a quarter of the greenhouse gas (GHG) emissions (Xia et al., 2021).

Environmental regulations have a significant impact on the supply chains (SCs) due to sourcing, manufacturing, distributing, storing, and disposing of products. Many firms reuse end-of-life or used product parts to remanufacture the products. Such a type of integration of used parts and new parts for developing the final product is called a closed-loop supply chain (CLSC). In a CLSC structure, collecting and reprocessing of used products may contribute to reducing energy and emissions on total production, and at the same time, it promotes the circular economy. It is to note that energy use and emissions in CLSC are also subject to change with product configuration (Xu, Elomri, et al., 2017; Yavari & Geraeli, 2019; Yolmeh & Saif, 2020), use of alternate materials, and changes in the distribution system.

Cap-and-trade is amongst the most common carbon emissions regulations. In order to implement this regulation, the government authority sets a level for emissions discharged up to a specific quantity (also known as carbon cap) for a given time period. This specific quantity is then split into allowances (called permits) and distributed to the firms in a bid to reduce their emissions. The firms would have to adopt measures to reduce the emissions, and if they reduce the emissions below the permit, they can sell the remaining part of the permit in the carbon market. Similarly, a firm that is not able to reduce the emissions to the permitted level can purchase emissions from the market to offset their emissions and remain within the permitted level (Du et al., 2020). That means cap-and-trade regulation will require a firm to consider a trade-off between the investment in emissions reduction operations and the carbon prices in the trading market (Khalifehzadeh & Fakhrzad, 2019). Achieving emission-effective operations can be reached by investing in energy-efficient equipment and technology as well as by reprocessing used/end-of-life products (Baptista et al., 2019). Overall, this regulation allows firms to make decisions on emissions reduction based on their financial incentives and helps to reduce the overall cost of emissions reduction. Therefore, the variabilities in the trading price of carbon and demand for the products, and the types of inputs to the production system become essential in the design of a CLSC (Wang et al., 2017).

In this paper, CLSC facing cap-and-trade regulation is analyzed to obtain an eco-friendly design. The design considers uncertainty in carbon price as well as the uncertainties in demand for multiple products. A set of decision factors, like remanufacturing, green supplier selection and facility location, selection of transportation modes based on their carbon emissions, and the logistics flow, are used to develop the CLSC. Three perspectives motivate the design presented in this paper:

-

(1)

A CLSC can produce multiple products in multiple periods. The interactions in different periods for different products can increase complexity in the CLSC network configuration.

-

(2)

The implementation of environmental regulation by the government can affect the viability of a business because such a policy can create a new environmental and economic impact. Therefore, fuel switching, changes in inputs, and changes in the purchase and production behavior are important for an eco-friendly CLSC design.

-

(3)

A firm is subjected to uncertainties on the carbon price. There are also uncertainties on the demand for multiple products in different periods. Therefore, the design of an eco-friendly CLSC becomes challenging.

In this study, a mixed-integer linear programming (MILP) based model is proposed. The contributions in this paper are listed as the following:

-

(1)

Most of the existing CLSC models consider a single period or deterministic situation. However, the model presented here considers CLSC design in the context of the multi-period stochastic situation. The uncertain demands and carbon prices are first represented by a set of discrete scenarios with given probabilities of occurrence.

-

(2)

Based on the review, this is one of the first papers that address the impact of the price volatility (for both purchasing and selling carbon credits unlimitedly) in carbon trading for a CLSC design in multiple planning contexts. The modeling approach proposed in this paper allows the firm to make the decision on carbon trading based on carbon credits. The firm can decide on the amount to trade so that its CLSC is green.

-

(3)

A four-step solution procedure is proposed to assistant to solve the multi-period two-stage stochastic model with popular commercial solvers, like Cplex or Gurobi, and avoids long run times. This solution makes the proposed model distinguished from the existing models that assume that the firms can purchase or sell carbon credits without quantity limitation. The main advantage of the proposed approach lies in that the firms are allowed to make decisions on purchasing or selling carbon credits firstly, and then to decide the optimal quantity.

-

(4)

The results of the simulation-based analysis contribute to the understanding of strategic and tactical policies by the policymakers when they consider applying the carbon trading policy.

In the remaining sections of the paper, the literature in this area is analyzed in Sect. 2. The eco-friendly CLSC design problem is introduced in Sect. 3. The multi-period formulations are given in Sect. 4. The computational experiment and the data used in the analysis are given in Sect. 5. The results and discussions are given in Sect. 6. The conclusions from the study and potential research direction are given in Sect. 7.

2 Literature review

2.1 Eco-friendly supply chain design under carbon trading scheme

The carbon trading scheme is one of the most popular policy constraints in supply chain design and also affects the cost and emission of the supply system as well as its network structure. Urata et al. (2017) propose a supply chain design method for the determination of location for suppliers and processing units (factories) in multiple countries. The authors optimize the costs by considering emissions reduction ratios and found that the lower factory cost is an important criterion for assembling products, even if there is an increase in the emission reduction ratio. The study also shows that the location of the factories should be switched between the countries when the costs of achieving the emission reduction ratio target are higher than the procurement costs. Shu et al. (2018) establish a trade-off model using subsidies and carbon taxes to account for exchanges between the old and the remanufactured product. The model helps to develop pricing and production decisions for the companies. M. Wang et al. (2018) considered a refrigerated food supply in a fresh food supply chain and show that the cap-and-trade policy can increase supply chain competitiveness through the utilization of refrigerated logistics and emission permits. Alkhayyal (2019) develop a MILP model to optimize a reverse supply chain and show that the current carbon tax policy may not be effective to limit emissions. Manupati et al. (2019) develop a non-linear mixed-integer programming-based mathematical model for production–distribution supply chain design with lead time consideration. Considering both sustainability and reliability factors in supply chain design, Kabadurmus and Erdogan (2020) develop a MILP model to design a sustainable supply chain by considering supplier reliability. Li et al. (2020) use an approach base on the interpretative structural model to address the impacts of the four policies (emission cap, carbon tax, carbon trade, and carbon offset) on coal supply chain design. The differential evolution strategy combined with the salp swarm algorithm is used to solve this problem. Elhedhli et al. (2021) investigate the green supply chain design problem with emission-sensitive demand. In this study, a mixed-integer second-order cone programming reformulation is used so that the nonlinear model can be solved using commercial software.

A few studies also investigate the supply chain design under a carbon trading scheme in an uncertain environment. A set of uncertain input parameters, like transportation costs and demands, are taken into account by Boronoos et al. (2021) in supply chain design under different carbon emission policies (i.e., the carbon tax, cap, cap-and-trade, and offset mechanisms). In this study, a robust mixed flexible‑possibilistic programming approach is used and the result shows that the cap-and-trade policy outperforms other policies in most cases. A MILP model is developed by Valderrama et al. (2020) to design a multi-echelon, multi-period, and multi-product environmental mining supply chain design under a carbon trading scheme. This study reveals that the total supply chain cost and carbon emission increase if the decision-maker is risk-averse. Considering the uncertainty in the quality of the returned products, Samuel et al. (2020) build a scenario-based robust model in CLSC design. The results show that the carbon cap policy affects the network structure much more than does the carbon cap and trade policy. Homayouni et al. (2021) adopt the robust-heuristic optimization approach to design a green supply chain by contemplating uncertainty in all main costs, like transportation and shortage costs. To address the uncertainty in transportation cost in CLSC design, Liu et al. (2021) established a distributionally robust fuzzy model to optimize the worst-case performance of the network.

2.2 Modeling uncertainty with scenario-based approaches in supply chain design

The scenario-based modeling approach is effective and efficient if uncertainties in the supply chain have to be considered. This approach helps in finding a robust solution for changes in the environment (Zhou et al., 2019). As a result, more tractable models can be generated by allowing parameters to be statistically dependent (Snyder, 2006). Consequently, the scenario approach is often preferred by the industry and it is generally suitable in a combined situation where decisions can be delayed through the ‘‘wait-and-see’’ and taken instantly through the ‘‘here-and-now’’ approach (Georgiadis et al., 2011).

Some of the observed studies are performed in a single-period context. Rezaee et al. (2017) develop a scenario-based stochastic model considering the uncertainty in demand and carbon price. The authors find that carbon price distribution is a sensitive factor in CLSC design. Two types of SCs, one with an increased level of robustness called robustly green supply chain and another with an increased level of greenness called greenly robust SCs are compared by Fahimnia et al. (2018). The authors mention that having a robustly green supply chain may be more attractive in terms of financial and branding terms, however, these conclusions may differ when the parameters governing the design of the supply chain change. Zhen et al. (2019) address the uncertain demand in the stochastic programming model for green and sustainable CLSC design. Hamdan and Diabat (2019) investigate the two-stage stochastic blood supply chain problem minimizing the cost, delivery time, and the number of outdated units of the system. The problem is solved in CPLEX with the epsilon-constraint method. A scenario-based robust approach is adopted by Haghjoo et al. (2020) to reliable blood supply chain network design with periodic variation in demands and facilities disruptions. The self-adaptive imperialist competitive algorithm is used to solve the proposed model. Similarly, Fattahi et al. (2020) a two-stage stochastic model for the supply chain network design under disruption events. The sample average approximation (SAA) method is used to handle a large number of disruption scenarios.

Multi-period models are also considered by various authors for the design of CLSC. Haddadsisakht and Ryan (2018) propose a three-stage stochastic model. The authors combine uncertainties in the rates of the carbon tax and probabilistic scenarios for the quantity of product demand and product return. Mohammed et al. (2017) propose multiple periods based stochastic model. The uncertain demand and the relevant returned products are modeled in multiple scenarios with a known probability of occurrence. However, the study does not consider the volatility of the carbon price in the carbon trading scheme and it only considers a limited number of scenarios. Salehi et al. (2019) develop a robust stochastic model for designing a blood supply chain network in crisis. However, only two periods including the first 24 h, and the 48 h after the crisis are considered. Alizadeh et al. (2019) present a robust three-stage stochastic model for an olefin supply chain network design with biomass feedstock seasonality and uncertain carbon emission tax rate. The SAA method is used to solve a large-scale problem with numerous scenarios. Fattahi and Govindan (2020) develop a multi-stage stochastic model to supply chain distribution networks under disruption and demand uncertainty. In this study, the scenarios are reduced with a bundling method. Tolooie et al. (2020) develop a multi-period two-stage stochastic model for reliable supply chain network design under uncertain disruptions and demand. The L-shaped method is proved to solve large-scale problems efficiently. Azaron et al. (2021) establish a multi-objective two-stage stochastic programming model in responsive supply chains considering uncertain demands and selling prices. In this study, the SAA scheme is used to handle an infinite number of scenarios.

2.3 Research gap analysis

The customer demand and carbon price are the two major sources of uncertainties in eco-friendly CLSC design. The uncertain demands have been discussed explicitly (Haddadsisakht & Ryan, 2018; Xu, Elomri, et al., 2017; Xu, Pokharel, et al., 2017; Yavari & Geraeli, 2019), however, research is limited in terms of considering carbon price volatility in CLSC design (Rezaee et al., 2017; Xu et al., 2019). When the carbon trading policy is enforced, the organizations are required to make operational decisions periodically to account for factors like sold or purchased carbon quantities. Furthermore, whether the single-period or multi-period problems, a large number of scenarios could be involved in solving the scenario-based models (Alizadeh et al., 2019; Fattahi et al., 2020; Hamdan & Diabat, 2020; Tolooie et al., 2020). A solution that can be adapted to commercial solvers in solving large-sized real-world problems is still scarce. The uncertain demands and carbon prices create a more challenging decision-making situation in terms of the modeling approach and solving the supply chain design problem. The review also shows that if uncertainties are considered, the scenario-based approach is better for a CLSC design (Pan & Nagi, 2010; Zhou et al., 2019). Thus, the research proposed in Sect. 3 onwards focuses on a scenario-based multiple period stochastic model to simultaneously capture uncertain customer demand and carbon trading price for the design of a CLSC.

3 Problem description

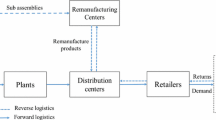

Figure 1 shows a general CLSC network. The products manufactured from plants are sent to the market (customers) through the distribution channel, and the used products are collected and sorted to either transport them for remanufacturing or to dispose of them. The emissions due to the operations along the CLSC are calculated by considering the flows of the raw materials, and new and used (collected) products.

In this study, the random fluctuations of the carbon price and the customer demand during each planning period are taken into account. It is common to assume that the expected occurrence of those random events follows a known probability distribution (Azaron et al., 2021; Khalifehzadeh & Fakhrzad, 2019). Thus, the realization of the random parameters during a time period forms the decision scenario, whose occurrence probabilities is also can be obtained. The scenarios can help to generate the possible outcomes for decision-making. The decisions during each time period should consider a set of scenarios that are incorporated in both the current time period and former time periods in a path, as shown in Fig. 2. Each scenario represents a history of the processes with the occurrence probabilities of the uncertain parameters. The scenarios are created when all uncertain parameters are realized. Since the carbon price and demand are dynamic and modeled as independent stochastic processes, the uncertain information is captured in a multi-layered scenario tree containing both ‘‘wait-and-see’’ and “here-and-now’’ decisions (Fattahi & Govindan, 2020). The former is a pre-determined variable which refers to those such as facility location, which is required for a decision on a basic network design when the demand realization or the carbon trading activity is not considered. The latter are control variables including the selection of supplier and transportation mode, logistics decisions, and the carbon trading decisions, which are required to address any feasibility owing to a particular set of carbon prices and demands.

The assumptions made to develop the model are given below:

-

(1)

Demand uncertainty for the multiple products is considered independent of each other.

-

(2)

The carbon credit is allowed to be purchased or sold simultaneously during any period.

-

(3)

The products differ from each other in raw material consumption, cost, and emission due to the operation, but with the same customer demand pattern.

-

(4)

The transport is outsourced and several modes are provided by transporters with the negotiated price.

-

(5)

The selections of the non-strategic supplier for parts or materials and logistics with different transportation modes can be changed at the beginning of each period, but not during a period (Mohajer Tabrizi et al., 2016). The shift or the reallocation of their orders with extreme inequality between several suppliers is a common tactic to gain resilience in the manufacturing industry, like the automobile industry and the metal-processing industry.

-

(6)

Though the carbon price is time-varying, it is unnecessary to make decisions on carbon trading activity every day. Because whether carbon credit is purchased or sold, the enterprise should take some measures to offset the credits. However, it would take a relatively long time to arrange such operational measurements and see the results of those efforts. The managers are required to make decisions on purchasing or selling the carbon credits at the beginning of each period.

4 Mathematical model

4.1 Parameters and sets

- P :

-

\(\mathrm{ Products }\,\left(p=1..P\right)\)

- R :

-

\(\mathrm{ Supplier \,candidates }(r=1..R)\)

- M :

-

\(\mathrm{ Factory \,or\, plant \,candidates }\,(\mathrm{m}=1\dots M)\)

- D :

-

\(\mathrm{ Distribution\, center \,candidates}\,(\mathrm{d}=1\dots D)\)

- U :

-

\(\mathrm{ Collection \,center \,candidates \,}(w=1\dots U)\)

- V :

-

\(\mathrm{ Disposal\, center\, candidates\, }(u=1\dots V)\)

- C :

-

\(\mathrm{ Customer\, zones\, }(\mathrm{c}=1\dots \mathrm{C})\)

- N :

-

\(\mathrm{ All \,nodes \,}(n=1..N)\), N = \(\mathrm{R}\cup \mathrm{M}\cup \mathrm{D}\cup \mathrm{U}\cup \mathrm{V}\)

- F :

-

\(\mathrm{ Transportation \,modes \,}(f\,=\,1..F)\)

- T :

-

Periods, (t = 1…T)

- HD :

-

Discrete events associated with the demand levels of products, indexed by hd

- HP :

-

Discrete events associated with the carbon prices\(,\mathrm{ Indexed\, by\, }hp\)

- \(\mathrm{\varnothing }\) :

-

Combined events belonging to HD and HP {(hd, hp) | (hd ∈ HD, hp ∈ HP}; CSC CSC = \({\mathrm{\varnothing }}_{1}\times {\mathrm{\varnothing }}_{2}\times \cdots {\mathrm{\varnothing }}_{t}\), set of scenarios

- \({\mathrm{\varnothing }}_{st}:\) :

-

Combined event of the scenario s at period t, s ∈ CSC

- CT ft :

-

\(\mathrm{ Unit\, transportation \,cost}\) using \(\mathrm{transportation}\) mode f in period t;

- C rt :

-

\(\mathrm{ Unit \,purchasing \,cost \,at \,supplier\, }r\mathrm{ in\, period }t\)

- CF pit :

-

\(\mathrm{ Unit\, processing\, cost\, of \,product\, }p\mathrm{ at\, facility\, }i\mathrm{ in\, forward\, logistics\, in\, period\, }t, i\in M\cup D\)

- CB pjt :

-

\(\mathrm{ Unit\, processing \,cost\, of \,product \,}p\mathrm{ at\, facility\, }j\mathrm{ in\, reverse\, logistics\, in\, period\, }t, j\in U\cup V\cup M\)

- CF i :

-

\(mathrm{ Fixed\, cost\, for\, the \,facility\, }i\)

- \({d}_{ij}\) :

-

\(\mathrm{ Distance \,between \,nodes }i\mathrm{ and\, }j, i,j\in N\)

- \({CP}_{r}\) :

-

\(\mathrm{ Manufacturing capacity of supplier }r\)

- \({CPF}_{m}\) :

-

\(\mathrm{ Manufacturing\, capacity \,of\, manufacturer \,}m\);

- \({CPF}_{d}\) :

-

\(\mathrm{ Distributing \,capacity \,of\, distribution\, center \,}d\)

- \({CPB}_{m}\) :

-

\(\mathrm{ Remanufacturing\, capacity\, of\, manufacturer\, }m\)

- \({CPB}_{n}\) :

-

\(\mathrm{ The\, capacity\, of\, facility\, }n\mathrm{ in\, reverse\, logistics}\)

- \({CUH}_{p}\) :

-

\(\mathrm{ Capacity\, utilization \,rate \,of \,per\, unit product \,}p\)

- \({DM}_{pct}^{hd}\) :

-

\(\mathrm{Demand \,of\, customer\, }c\mathrm{ for \,product\, }p\mathrm{ in\, period\, }t,\mathrm{ when\, occurring\, event\, }hd\in HD\)

- \({RR}_{p}\) :

-

\(\mathrm{ Recovery\, rate \,for\, product\, }p\)

- \({RD}_{p}\) :

-

\(\mathrm{ Disposal \,ratio \,of\, products\, }p\)

- \({RM}_{p}\) :

-

\(\mathrm{ Remanufacturing\, rate \,of \,products\, }p\)

- \(RL\) :

-

Number limitation of suppliers in each period

- \({ET}_{ft}\) :

-

\(\mathrm{ Emission}\) using \(\mathrm{transportation}\) mode f \(\mathrm{in \,period\, }t,\mathrm{ in\, ton\, per \,mile}\)

- \({ER}_{rt}\) :

-

\(\mathrm{ Emission\, for\, handling\, unit \,material \,at\, supplier\, }r\mathrm{ in\, period \,}t\)

- \({EF}_{pit}\) :

-

\(\mathrm{ Emission\, for \,handling \,unit\, product\, }p\mathrm{ at\, facility\, }i\mathrm{ in \,forward\, logistics\, in\, period\, }t, i\in M\cup D\)

- \({EB}_{pjt} \) :

-

\(\mathrm{ Emission\, for\, handling \,unit \,product\, }p\mathrm{ at \,facility\, }j\mathrm{ in\, reverse \,logistics\, in\, period }t, j\in U\cup V\cup \)

- Max: :

-

A very large number

- \({Cap}_{t}\) :

-

\(\mathrm{ Carbon\, cap\, in \,period \,}t\)

- \({\delta }_{t}^{hp}:\) :

-

\(\mathrm{Carbon \,price\, in\, the\, carbon\, market\, in \,period\, }t,\mathrm{ considering\, event \,}hp\in HP\)

- \({PB}_{hd}\) :

-

Occurrence probability of the demand level, \(hd\in HD\)

- \({PB}_{hp}\) :

-

Occurrence probability of the carbon price, \(hp\in HP\)

- \({PB}_{s}\) :

-

Occurrence probability of scenario s, \({PB}_{s}=({PB}_{hd}{PB}_{hp}){\mathrm{\varnothing }}_{s1}({PB}_{hd}{PB}_{hp}){\mathrm{\varnothing }}_{s2}\cdots ({PB}_{hd}{PB}_{hp}){\mathrm{\varnothing }}_{st}\)

4.2 Decision variables

\(\mathrm{M},\mathrm{D},\mathrm{C},\mathrm{or \,U \,separately\, for \,shipping \,the \,products\, to\, its \,customers\,};0\mathrm{ otherwise}\);

- \({x}_{i}\) :

-

\(1\mathrm{\, If \,the \,facility \,at\, location\, }i \mathrm{is\, chosen\,};\,0\mathrm{ \,otherwise},\, i\in \,N\)

- \({y}_{rt}\) :

-

\(1\mathrm{ \,If\, the \,supplier \,}r\mathrm{ \,is\, selected \,in\, period\, }t ;\,0\mathrm{ \,otherwise},\, i\in S\cup M\cup D\cup U\cup V\)

- \({Q}_{t}^{rmfs}\) :

-

\(\mathrm{ Material\, quantity \,shipped\, from\, supplier\, }r\mathrm{\, to \,plant\, }m\mathrm{ using\, transportation\, mode\, }f\mathrm{ at}\)

\(\mathrm{time }t,\mathrm{ in \,scenario }s\)

- \({Q}_{pt}^{ijfs}\) :

-

Quantity of product p shipped from i to j using transportation mode f at time t in scenario s, \(i,j\in N\)

- \({\varphi }_{t}^{s}\) :

-

carbon credit bought or sold in period t \(\mathrm{under scenario }s\), φ ≥ 0 if the carbon credit is purchased from.

the market, \(\mathrm{otherwise}\) φ < 0.

4.3 Objective function

The objective function for cost minimization is given in Eq. (1) with the fixed cost (\(ZF\)), cost of product purchase (\(ZP\)), the cost for manufacturing (\(ZM\)), the cost for distribution (\(ZD\)), costs for transportation cost (\(ZT\)), costs to handle reverse logistics (\(ZB\)), and the costs of emissions. Since the uncertainties are modeled through multiple scenarios, the expected variable cost is the sum of probability multiplied by the resulting cost for all scenarios. As the emission cost is determined by the quantities traded in the carbon market, the cost is estimated after calculating the total emissions.

Fixed cost:

Purchasing cost:

Manufacturing cost:

Distributing cost:

Transportation cost:

In particular, the processing cost in reverse logistics includes collecting cost, disposal cost, and the remanufacturing cost of the used products.

4.4 Constraints

The constraints set eqs. (8–11) consider the balance of materials. Constraint (8) ensures that the quantity of shipped and manufactured products are equal. Constraint (9) ensures flow balance in a distribution center. Constraint (10) guarantees that the used products would be collected as per the estimated return rate. Constraint (11) ensures the flow balance in collection centers.

The constraints set in Eqs. (12–18) consider capacities. Constraint (12) represents that all customer demands would be satisfied. Constraint (13) ensures that for each supplier the raw material supply quantities are less than its handling capacity. Constraints (14) and (15) limit the manufacturing and remanufacturing of products based on the available capacity. Constraints (16–18) control the flows in and out of a distribution or a collection center.

The constraints in Eqs. (19–28) force the selection of only one transportation mode during each period. Constraint (29) states that all the used products that are collected would be handled rightly. Constraint (30) confirms that the total number of suppliers should be within the limit. Since it is not possible to anticipate which scenario will happen, this decision must be unique for all scenarios passing by this node. Constraint (31) ensure non-anticipative while \(W_{\tau t}^{\sigma s} \) denotes the decision variables in the model, which are \(Q_{t}^{rmfs} , Q_{pt}^{ijfs} or \varphi_{t}^{hp} . \) The index \(\sigma and \tau \) represent other indices incorporated in the mentioned three variables. The non-anticipative constraint guarantees the decision variables of a node on different paths have the same values.

Constraint (28) limits the total emission during each period.

4.5 Emissions

Given that the carbon trading decisions are control variables, the total emissions should be estimated in each period so that the firms can decide on the quantity of emissions for trading (purchasing or selling). The total emissions refer to the emissions from suppliers (\({EP}_{t}\)), emissions from manufacturing (\({EM}_{t}\)), emissions due to distribution (\({ED}_{t}\)), emission from reverse logistics (\({EB}_{t}\)), and emissions from transportation (\({ET}_{t}\)) as given in Eqs. (29–33).

5 Solution procedure

The solution to the CLSC design model cannot be obtained using most of the commercials solvers (like Gurobi and Cplex solvers) directly mainly for two reasons: (1) numerous scenarios need to be created to account for the uncertainties in planning periods; (2) carbon trading decision, for purchasing or selling carbon credit, should be determined before deciding the amount of the carbon credits should be traded on the carbon market during each period. Therefore, a four-step solution procedure is proposed in this paper, as shown in Fig. 3.

In the first step, the scenario tree is built up and the probabilities of all the scenarios are calculated. Given a problem with p probable values of the carbon price and q probable values of the demand during a time period (\(p \in P,p \in Q\)), the structure of the node-based scenario tree is shown in Fig. 4. There are \((\left( {pq} \right)^{T + 1} - 1)/\left( {pq - 1} \right) \) nodes and \(\left( {pq} \right)^{T}\) scenarios. Each complete path from the root node n1 to one of the leaves represents a determinative scenario. Assume that the probabilities of values of the carbon price and demand during a time period are \((PB_{hd} \left( 1 \right)\),\( PB_{hd} \left( i \right)\),\(\ldots , PB_{hd} \left( p \right)) and (PB_{hp} \left( 1 \right)\),\( PB_{hp} \left( j \right)\),\(\ldots , PB_{hp} \left( q \right))\) respectively, the nodes at the first layer of the scenario tree (t = 1) have the probabilities of:

The probabilities of the nodes or scenarios at the time period k of the scenario tree are as follows:

The probabilities of the scenarios of the whole scenario tree can be obtained using Eqs. (38, 39).

The full scenarios are created when all uncertain parameters are realized (You & Grossmann, 2008). The scenarios help to generate the possible outcomes for consideration by the decision-makers. For instance, consider a problem with two periods (t1–t2) problem and two uncertain parameters with known probabilities of p1, p2, p3, and q1 and q2. In this case, an event includes the combined occurrence of all the uncertain parameters. Thus, a node in the scenario tree represents an event. In such a case, there are six events in the first period and thirty-six events in the second period, and the probabilities have to be obtained accordingly as shown in Fig. 5. For instance, the nodes n0, n1, and n7 form a scenario with a probability of (p1*q1)*(p1*q1). Figure 5 shows that there are thirty-six such probability scenarios in the given tree.

In the second step, scenario reduction is performed to alleviate the computational burden. The scenario method is a straightforward way to model the problem. However, with the increasing number of scenarios, the problem size rises exponentially (You & Grossmann, 2008). As shown in Fig. 4, when the numbers of the periods and the uncertain parameters are large, the scenarios that should be taken into account would experience an exponential increase. This results in a significant increase in the computational burden. Hence, a combined forward and reverse scenario reduction technique proposed by Dupačová et al. (2003); Heitsch and Römisch (2003) is adopted to reduce the computing time. The reduction algorithms focus on narrowing the distance between the expected and reduced (new) probabilities (Dvorkin et al., 2014; Zeballos et al., 2014). The control parameters are used to guide the reduction and to obtain the set of scenarios that can be used in future runs. Consequently, the retained scenarios could be used to solve the stochastic model, rather than considering all the scenarios,

In the third step, the carbon trading strategy, purchasing or selling, is examined. In the existing literature, it is common to assume that the market is capable of dealing with any quantity of carbon credit that the firms plan to purchase or sell under the estimated price. However, in a real-world situation, there is always a limitation concerning the exact amount of sold or purchased carbon credits, and it is impossible to know the amount in advance. When several carbon prices exist in the same period, the best strategy for the firm would be to sell carbon credits at the highest price and purchase them at the lowest price. However, this would not happen in a real-world situation. Following the assumption (6) in Sect. 3, only one of the two carbon trading strategies, which are purchasing (\(\sum_{hp}{\varphi }_{t}^{hp}\ge 0\)) or selling (\(\sum_{hp}{\varphi }_{t}^{hp}<0\)) credits, can be selected in each period. Thus, in this stage, the carbon trading strategies are examined by solving the proposed MILP model initially by limiting \({\varphi }_{t}^{hp}\) within a given range.

In the fourth step, since the best carbon trading decisions on purchasing or selling are known during each period, the optimal solution for the eco-friendly CLSC design can be obtained by solving the proposed MILP model over the remained scenarios.

6 Experiment research

6.1 Data description

Two types of family products are considered in this simulation-based case analysis. The CLSC has three potential suppliers (R1, R2, R3), three possible plants (M1, M2, M3), four candidate distribution centers (D1, D2, D3, D4), five customers (C1, C2, C3, C4, C5) for the manufactured/remanufactured products, three potential disposal centers (U1, U2, U3), and three candidate collection centers (W1, W2, W3). The data used for the analysis is given in the next section.

The base reference data on the distance between the facilities is adopted from Paksoy et al. (2011). The overall planning horizon consists of three periods. Based on the data given by Ndjebayi (2017), the fixed cost and the processing cost of the facilities are estimated as given in Table 1, and the emissions generated from the processing of alumina, new products, and the used products, are presented in Table 2. The statistics performed by Aluminum Association (2011) are used to estimate the reused product flow in the reverse network: \({RR}_{p}\) is between (0.6 and 0.8); \({RD}_{p}\) is between (0.05 and 0.15); \({RM}_{p}\) is between (0.85 and 0.95). The carbon cap is assumed to be 10,000 in the first period and will decrease 10% during the following planning period.

For the medium and long-distance road freight transportation, the alternative transport modes are grouped according to their fuel use. Four emerging low-carbon fuels, including biofuels, synthetic fuels, methane, and gas, are considered in the case study. Using the statistical data provided in Ambel and Earl (2019); (Department for Transport, Great Minster House, 2018), the emissions for the transport modes in the first period are estimated in Table 3. As technological development on low-carbon fuels is continuous, it is assumed that transportation costs will be reduced by 5% in the following periods (McKinsey, 2019).

In many practical applications, practitioners generally specify a set of optimistic, neutral, and pessimistic outlooks to represent the trends in customers’ demand. The demand levels of products p1 and p2 and corresponding probabilities of hd1, hd2, and hd3 in each period are presented in Table 4. The daily spot carbon price is selected from the European Climate Exchange (ECX) from April 2020 to July 2021 and analyzed using the K-means clustering method with two cluster centroids to simulate the actual distribution of the carbon price. The estimated carbon prices are generated as $35.3/ton and $57.9/ton with the probabilities of 0.59 and 0.41, respectively. There are three periods (t1, t2, and t3), two carbon prices, and five demands with specific probabilities in each period. Therefore, the combination of uncertain parameters results in 6 (2*3) scenarios during the first period, 36 scenarios (6*2*3) scenarios during the second period, and 1296 (6*6*6*6) scenarios during the fourth period.

Given the scenario tree, a group of lumped scenarios can be given to elaborate the non-anticipative constraint in Eq. (31). For instance, in the first time period, there are 6 lumped sets of constraints, and each constraint consists of 36 scenarios, as shown in Eq. (40):

where \((k*36+1)*s\) represents the numbered scenario. For instance, when k = 0, the Eq. (40) transformed to be

The Eq. (41) ensures that the decision variable \(Q_{t1}^{rmfs} \left( {or Q_{pt1}^{ijfs} or \varphi_{t1}^{hp} } \right)\) have identical values from scenario1 to scenario 36.

Similarly, there are 36 lumped sets of constraints, and each constraint consists of 6 scenarios in the second period, as shown in Eq. (42):

The proposed model is validated by solving a set of instances of the experiment. The experiments are coded in GAMS 24.1.3 and solved with GAMS/CPLEX 12.5 on a PC with Intel Core2 i7, and with 16 GB DDR II at 1.8 GHz.

6.2 Cost and emission across different scenarios

6.2.1 Overall performance of the CLSC design

Table 5 provides the performance of the CLSC design. The retained scenarios from Case 1 to Case 11 represent different uncertain events that are considered for CLSC design. Case 11 considers all of the events formed by the combination of the occurrence of all the uncertain parameters in CLSC design. Case 2 has 130 retained scenarios, of the 1296 total scenarios, to solve the model and generate the results in Table 5. Moreover, Case 0 represents the results of the deterministic model where there is no uncertainty considered. The carbon trading quantity includes both the purchased and sold carbon credits.

With more scenarios included in the problem, the number of variables also increases. This leads to an increase in CPU times for the computation of the solution. Table 5 shows that from Case 1 to Case 11, there is a jump of also almost 356 times for variables, and the CPU time is increased by 900% to find an optimum solution.

6.2.2 Cost and emission under in different cases

In general, the total cost and emissions rise from Case 1 to Case 4 due to the requirements of more materials, new products, and used products to meet the demand resulted from a higher level of uncertainties. Such uncertainties require large capacities to be considered in CLSC, which will increase total cost and emissions. The analysis shows that if the CLSC faces the Case 4 situation, it will have both high cost and high emissions; (1) due to higher demand than those in other cases leading to higher costs, and (2) due to higher transportation and manufacturing costs compared to that in other cases leading to higher emissions in remanufacturing and transportation. Furthermore, it is interesting to observe that the total cost sequence converges to an optimum solution in Case 11 with full scenarios (1296 scenarios). The experiment with full scenarios in Case 11 represents the real decision uncertain environment, while other cases only consider part of the uncertain events. That means neglecting some of the uncertain events would result in unexpected results that could be far from the best possible performance. Because the combinations of the selected uncertain events could create a decision environment that leads to increased cost, for instance, a higher customer demand. Similar findings are also obtained in three-period and five-period experiments (See Appendix Tables 7 and 8).

It is to note that under the given carbon cap, the firms can balance their emissions by purchasing or selling (trading) carbon credits in the market. The trading quantity is positive if the firms purchase carbon credit from the market, and negative if the firms sell carbon credit. Between Cases 1 and 4, the carbon trading quantity increases by 277% due to the rise in total emissions. However, for the remaining cases, the trading quantity is reduced, as shown in Fig. 6. This reduction occurs as the cost burden brought by the trading is less than that brought by other CLSC decisions. Further investigation shows that the emission in other cases is lower than the Case 4; as a result, firms have less available carbon credit to sell during the first period, and their emission goals can be fulfilled through the purchase of carbon credits in the following periods. This means firms can use the trading strategies to make the CLSC more greener when they are faced with carbon regulations.

6.2.3 Network structure configuration and transportation mode selection

Table 6 shows the CLSC facilities selected under different scenarios in the planning periods. For example, in Case 0, supplier R3 is to be considered in the second, third, and fourth periods. However, the suppliers R4 are selected during the first period. When the uncertain events increase from Case 1 to Case 4, large facilities or more facilities should be included in the CLSC. The fixed cost, which accounts for almost 40% of the total cost, is one of the main contributions of the changes of the total cost in Table 5, for instance, Case 2. It is worthy to be noted that the CLSC network structure is very stable from Case 7 to Case 11. Furthermore, the supplier selection decisions are not changed associated with CLSC network configuration from Case 1 to Case 11. Although the supplier R2 and R3 have a higher unit emission, their lower cost is the main reason to be joined in the CLSC.

It also indicates that the proposed model generates a network with capacity redundancy to address the varying customer demands and carbon prices. The Case 0 model represents the deterministic model and shows the lowest cost and provides the network with a fewer number of facilities. Therefore, compared with the Case 0 model, the total emission and total costs for Case 11 are increased by 3.2% and 4.8%, respectively.

The analysis also reveals that only the diesel (f5) is selected as fuel for transportation in all of the arcs of the CLSC. It means that the current carbon price in the current ECX failed to work as an incentive tool to motivate the firms to use low-carbon fuels-based transportation mode in the CLSC design.

In the analysis of the three above subsections, Case 8, which represents 80% of the 1296 scenarios, shares the same network structure, the same carbon trading strategy in all the time periods, and similar transportation mode selection decisions with Case 11. Moreover, the difference in the total costs of the two Cases is less than 0.53%, as is the lowest difference compared with Cases that share the same network structure as Case 11. Similar results are also gained in three-period and five-period experiments (See Appendix Tables 7 and 8). It indicates that 80% of retained scenarios can be used to represent the full scenarios when solving the proposed stochastic model while almost 40% of the CPU time can be saved.

6.3 Sensitivity analysis concerning carbon price level and cap

The impact of the carbon price at the carbon cap on the cost, emissions, and carbon trading quantity are investigated using sensitivity analysis. The prices in L1 are 35.3$/ton and 57.9$/ton (as mentioned before) with known probabilities are assumed as the base carbon prices. In Fig. 7, LX denotes that the carbon price reaches X times the original prices. From the figure, it can be observed total emission gets reduced when the carbon prices increase from L1 to L7. In this case, the reduction is due to the choice of energy-efficient suppliers in CLSC. Figure 8 also shows a sharp increase in the total cost coupled with a dramatic drop in the total emission from L1 to L1.5. Further analysis reveals that the carbon trading cost contributes to more than 30% of the cost increase in L15. Also, the greener supplier and manufacturer with a higher production cost are selected to reduce the impact of the increased carbon prices. This type of supplier sourcing network configure coupled with the increasing emission cost leads to a rise in the total cost. Thus, the increase in the carbon price alters the CLSC network configuration.

As to the carbon trading quantity, a reduction of 36.5% is obtained from L1 to L4. It indicates that the firms get less active at high carbon price levels, as shown in Fig. 8. Because for the CLSC which has to purchase carbon credits to meet their emission constraint, a low-carbon internal operation is a more cost-efficient approach to reduce the emission, rather than the external carbon market. In contrast, further analysis reveals that a greener CLSC or a CLSC under the loose carbon cap could be more active at high carbon price levels to gain more revenue by selling carbon credits.

Figure 9 reports that the total cost and total emission of the CLSC associated with various carbon caps. It is interesting to observe that a tightening carbon cap leads to not only a higher total cost but also a lower total emission. One of the reasons is that we have used gradual tightening carbon caps, as a result, the exact carbon caps during each period are different. For instance, the carbon cap is 10000 in the first period, while it is 7290 in the four periods. Consequently, different carbon trading decisions are made across the planning periods, as can be seen in Fig. 8. The second is that different carbon price occurs to the carbon trading activities. Further analysis reveals that the carbon credits are sold with a price of 57.9$/ton with a probability in the scenario when the selling strategy is adopted. However, the carbon credits would be purchased with a price of 35.3$/ton with a probability in the scenario when the purchasing strategy is pursued. Thus, it allowed the decisions maker to take advantage of the fluctuation of the carbon price to gain revenue or reduce cost.

Further analysis shows that the choice of fuel in transportation doesn’t change even when the carbon price increases from L1 to L4. It indicates that diesel fuel is the most competitive transportation mode not only at the current trading price but also when the carbon price is increased by 4 times. This insensitivity could be due to the lower contribution, less than 18%, of fuel cost in the total costs. Therefore, the adoption of less carbon-emitting transportation mode in CLSC can only be selected if the cost of those fuels is subsidized.

7 Conclusions

In this paper, a multiple period two-stage stochastic model is proposed for the design of an eco-friendly CLSC design by considering a multi-product supply chain in a multi-echelon and multi-period setting. The problem considers time-varying demand and carbon price under the carbon trading scheme. This type of problem is prevalent in industries such as the aluminum industry, stainless steel manufacturing, and plastic product production. The model considers uncertainties through the development of scenarios for a particular network lifecycle. A four-step solution method is proposed to solve the model.

The applicability of the model for CLSC design is verified via simulation with publicly available data. The results show that the eco-friendly CLSC design can be obtained through a reduction of emissions in production and transportation. Emissions may be reduced due to the larger facilities and the use of returned product parts. Larger facilities are good if there are expected higher fluctuations in product demand. However, higher demand fluctuations increase the total costs. Although firms can leverage with carbon credits that they can sell in the beginning, they may face a different situation at a later period. Based on the observations in the simulations, the options explored in this paper for eco-friendly CLSC design are summarized below.

-

(1)

Carbon trading is a cost-effective way to fulfill the organization's emission targets under carbon price and demand uncertainties. Based on the emissions from transportation and the cost of the carbon price, it appears that CLSC should focus less on switching to cleaner fuel transportation mode. This may be one of the reasons for the low take up of cleaner fuels for transportation. In these cases, decarbonization can be obtained through the selection of emissions-efficient facilities and suppliers.

-

(2)

The total cost of the CLSC increases under uncertainty; however, the solution generated by the stochastic model is more flexible in terms of incorporating unexpected demand and coping with the fluctuation in the carbon price.

-

(3)

Both the total cost and total emission of the CLSC may rise under increasing uncertainties as shown in different case scenarios used in the study. Therefore, when higher uncertainties are expected, the firm should develop larger facilities and emissions-efficient suppliers and this would lead to eco-friendly CLSC and firms may improve their cost through the sale of carbon credits in the trading market.

-

(4)

The sensitivity analysis reveals that if the carbon price keeps rising, it would alter the CLSC network configuration and result in emission reduction and cost increase. However, the varying carbon cap affects little the facility selection and emission because of the low carbon price in the current market. Furthermore, for the industry, both the total cost and total emission can be raised under a tight carbon cap.

The type of analysis proposed in this paper can be conducted by the researchers or the practitioners to develop effective carbon trading mechanisms that will support an eco-friendly CLSC design. For organizations, the proposed model can be used to develop a supply chain when they are expecting to face uncertainties and the need to ensure a reduction in carbon emission. As the numerical study provides specific results for a supply chain, the model and solution presented here are generic and can be extended in other application areas as well.

7.1 Research direction

The research presented here can be extended in different directions, as mentioned below.

-

(1)

Like virgin materials, used products also incur costs for acquisition. The variations in purchase price based on the demand for remanufactured products have been studied in Pokharel and Liang (2012)_ENREF_15. When there are multiple types of products to be collected, the price variations in each type of used product will also impact the design of CLSC. Therefore, the inclusion of product prices would help to design better CLSC.

-

(2)

In this study, the uncertain parameters of customer demand and carbon prices are estimated for tactical level decisions such as logistics decisions at each period. It should be understood that there can be other kinds of problems in the network during the operation level, such as device failure or the lack of operator, which requires operational level decisions. These situations can change the cost and potentially the carbon as well. Therefore, further research can also consider the implication of such uncertainties on tactical and operational decisions.

-

(3)

One of the limitations of this study is the operational decisions, like inventory level, which is not considered in the current model. As the model is proposed with uncertain parameters, considering inventory in the model in different echelons can support the supply chain entities to provide a higher level of service with optimized cost and emission levels. The model can provide answers to the level of inventory when there are changes in the carbon emission quantities and the energy options adopted in the supply chain. This type of inclusion might require the development of additional heuristics as developing different decisions through the current model is time-consuming. Nevertheless, as the current model provides the basis for the analysis, the addition of inventory coupled with a new heuristic algorithm can provide solutions faster.

-

(4)

In the numerical study conducted in this paper, it is observed solving the CLSC design problem with more time periods with the proposed method is time-consuming. For instance, the five-period experiment in the case study required more than 60 h to generate the optimum solution. Therefore, the solution procedure for the model can be augmented by developing innovative algorithms, for instance, heuristic algorithms, to solve large-scale networks and large-scale scenarios.

References

Alizadeh, M., Ma, J., Marufuzzaman, M., & Yu, F. (2019). Sustainable olefin supply chain network design under seasonal feedstock supplies and uncertain carbon tax rate. Journal of Cleaner Production, 222, 280–299.

Alkhayyal, B. A. (2019). Designing an optimization carbon cost network in a reverse supply chain. Production & Manufacturing Research, 7(1), 271–293.

Ambel, C.C. & Earl, T. (2019). How to decarbonize European transport by 2050. European Federation for Transport and Environment AISBL. Brussels, Belgium, 2018 (Available online at: https://www.transportenvironment.org/sites/te/files/publications/2018_11_2050_synthesis_report_transport_decarbonisation.pdf: Accessed last on May 10, 2019).

Aluminum Association (2011). Aluminum: The element of sustainability, A North American Aluminum Industry Sustainability Report (Available online at: http://www.aluminum.org/sites/default/files/Aluminum_The_Element_of_Sustainability.pdf: Accessed last on Dec 10, 2017).

Azaron, A., Venkatadri, U., & Farhang Doost, A. (2021). Designing profitable and responsive supply chains under uncertainty. International Journal of Production Research, 59(1), 213–225.

Baptista, S., Barbosa-Póvoa, A. P., Escudero, L. F., Gomes, M. I., & Pizarro, C. (2019). On risk management of a two-stage stochastic mixed 0–1 model for the closed-loop supply chain design problem. European Journal of Operational Research, 274(1), 91–107.

Boronoos, M., Mousazadeh, M., & Torabi, S. A. (2021). A robust mixed flexible-possibilistic programming approach for multi-objective closed-loop green supply chain network design. Environment, Development and Sustainability, 23(3), 3368–3395.

Dupačová, J., Gröwe-Kuska, N., & Römisch, W. (2003). Scenario reduction in stochastic programming. Mathematical Programming, 95(3), 493–511.

Department for Transport, Great Minster House. (2018). Transport Energy Model (Available online at: https://assets.publishing.service.gov.uk/government/uploads/system/uploads/attachment_data/file/739462/transport-energy-model.pdf: Accessed last on July 10, 2021.

Du, S., Qian, J., Liu, T., & Hu, L. (2020). Emission allowance allocation mechanism design: A low-carbon operations perspective. Annals of Operations Research, 291(1), 247–280.

Dvorkin, Y., Wang, Y., Pandzic, H. & Kirschen, D. (2014). Comparison of scenario reduction techniques for the stochastic unit commitment, PES General Meeting| Conference & Exposition, IEEE. IEEE, pp. 1–5.

Elhedhli, S., Gzara, F., & Waltho, C. (2021). Green supply chain design with emission sensitive demand: Second order cone programming formulation and case study. Optimization Letters, 15(1), 231–247.

Fahimnia, B., Jabbarzadeh, A., & Sarkis, J. (2018). Greening versus resilience: A supply chain design perspective. Transportation Research Part e: Logistics and Transportation Review, 119, 129–148.

Fattahi, M., & Govindan, K. (2020). Data-driven rolling horizon approach for dynamic design of supply chain distribution networks under disruption and demand uncertainty. Published online.

Fattahi, M., Govindan, K., & Maihami, R. (2020). Stochastic optimization of disruption-driven supply chain network design with a new resilience metric. International Journal of Production Economics, 230, 107755.

Georgiadis, M. C., Tsiakis, P., Longinidis, P., & Sofioglou, M. K. (2011). Optimal design of supply chain networks under uncertain transient demand variations. Omega, 39(3), 254–272.

Haddadsisakht, A., & Ryan, S. M. (2018). Closed-loop supply chain network design with multiple transportation modes under stochastic demand and uncertain carbon tax. International Journal of Production Economics, 195, 118–131.

Haghjoo, N., Tavakkoli-Moghaddam, R., Shahmoradi-Moghadam, H., & Rahimi, Y. (2020). Reliable blood supply chain network design with facility disruption: A real-world application. Engineering Applications of Artificial Intelligence, 90, 103493.

Hamdan, B., & Diabat, A. (2019). A two-stage multi-echelon stochastic blood supply chain problem. Computers & Operations Research, 101, 130–143.

Hamdan, B., & Diabat, A. (2020). Robust design of blood supply chains under risk of disruptions using Lagrangian relaxation. Transportation Research Part e: Logistics and Transportation Review, 134, 101764.

Heitsch, H., & Römisch, W. (2003). Scenario reduction algorithms in stochastic programming. Computational Optimization and Applications, 24(2), 187–206.

Homayouni, Z., Pishvaee, M.S., Jahani, H. & Ivanov, D. (2021). A robust-heuristic optimization approach to a green supply chain design with consideration of assorted vehicle types and carbon policies under uncertainty. Annals of Operations Research, 1–41.

Jenkins, B. M. (1997). A comment on the optimal sizing of a biomass utilization facility under constant and variable cost scaling. Biomass and Bioenergy, 13(1–2), 1–9.

Kabadurmus, O., & Erdogan, M. S. (2020). Sustainable, multimodal and reliable supply chain design. Annals of Operations Research, 292, 47–70.

Khalifehzadeh, S., & Fakhrzad, M. B. (2019). A Modified Firefly Algorithm for optimizing a multi stage supply chain network with stochastic demand and fuzzy production capacity. Computers & Industrial Engineering, 133, 42–56.

Li, J., Wang, L., & Tan, X. (2020). Sustainable design and optimization of coal supply chain network under different carbon emission policies. Journal of Cleaner Production, 250, 119548.

Liu, Y., Ma, L., & Liu, Y. (2021). A novel robust fuzzy mean-UPM model for green closed-loop supply chain network design under distribution ambiguity. Applied Mathematical Modelling, 92, 99–135.

Manupati, V. K., Jedidah, S. J., Gupta, S., Bhandari, A., & Ramkumar, M. (2019). Optimization of a multi-echelon sustainable production-distribution supply chain system with lead time consideration under carbon emission policies. Computers & Industrial Engineering, 135, 1312–1323.

McKinsey. (2019). Making electric vehicles profitable (Available online at: <https://www.mckinsey.com/~/media/McKinsey/Industries/Automotive%20and%20Assembly/Our%20Insights/Making%20electric%20vehicles%20profitable/Making-electric-vehicles-profitable.pdf: Accessed last on July 30, 2020).

Mohajer Tabrizi, M., Karimi, B., & Mirhassani, S. A. (2016). A novel two-stage stochastic model for supply chain network design under uncertainty. Scientia Iranica, 23(6), 3046–3062.

Mohammed, F., Selim, S. Z., Hassan, A., & Syed, M. N. (2017). Multi-period planning of closed-loop supply chain with carbon policies under uncertainty. Transportation Research Part d: Transport and Environment, 51, 146–172.

Ndjebayi, J. N. (2017). Aluminum Production Costs. (Doctoral Dissertation, Walden University).

Paksoy, T., Bektaş, T., & Özceylan, E. (2011). Operational and environmental performance measures in a multi-product closed-loop supply chain. Transportation Research Part e: Logistics and Transportation Review, 47(4), 532–546.

Pan, F., & Nagi, R. (2010). Robust supply chain design under uncertain demand in agile manufacturing. Computers & Operations Research, 37(4), 668–683.

Pokharel, S., & Liang, Y. (2012). A model to evaluate acquisition price and quantity of used products for remanufacturing. International Journal of Production Economics, 138(1), 170–176.

Römisch, W. (2003). Approximations of stochastic programs. Scenario tree reduction and construction. GAMS Workshop (pp. 1–3). Heidelberg.

Rezaee, A., Dehghanian, F., Fahimnia, B., & Beamon, B. (2017). Green supply chain network design with stochastic demand and carbon price. Annals of Operations Research, 250(2), 463–485.

Salehi, F., Mahootchi, M., & Husseini, S. M. M. (2019). Developing a robust stochastic model for designing a blood supply chain network in a crisis: A possible earthquake in Tehran. Annals of Operations Research, 283(1), 679–703.

Samuel, C. N., Venkatadri, U., Diallo, C., & Khatab, A. (2020). Robust closed-loop supply chain design with presorting, return quality and carbon emission considerations. Journal of Cleaner Production, 247, 119086.

Shu, T., Huang, C., Chen, S., Wang, S., & Lai, K. K. (2018). Trade-Old-for-remanufactured closed-loop supply chains with carbon tax and government subsidies. Sustainability, 10(11), 3935.

Snyder, L. V. (2006). Facility location under uncertainty: A review. IIE Transactions, 38(7), 547–564.

Tolooie, A., Maity, M., & Sinha, A. K. (2020). A two-stage stochastic mixed-integer program for reliable supply chain network design under uncertain disruptions and demand. Computers & Industrial Engineering, 148, 106722.

Urata, T., Yamada, T., Itsubo, N., & Inoue, M. (2017). Global supply chain network design and Asian analysis with material-based carbon emissions and tax. Computers & Industrial Engineering, 113, 779–792.

Valderrama, C. V., Santibanez-González, E., Pimentel, B., Candia-Vejar, A., & Canales-Bustos, L. (2020). Designing an environmental supply chain network in the mining industry to reduce carbon emissions. Journal of Cleaner Production, 254, 119688.

Wang, M., Zhao, L., & Herty, M. (2018). Modelling carbon trading and refrigerated logistics services within a fresh food supply chain under carbon cap-and-trade regulation. International Journal of Production Research, 56(12), 4207–4225.

Wang, Z., Wei, L., Niu, B., Liu, Y., & Bin, G. (2017). Controlling embedded carbon emissions of sectors along the supply chains: A perspective of the power-of-pull approach. Applied Energy, 206, 1544–1551.

Xia, L., Kong, Q., Li, Y. & Qin, J. (2021). Effect of equity holding on a supply chain’s pricing and emission reduction decisions considering information sharing. Annals of operations research, 1–38.

Xu, Z., Elomri, A., Pokharel, S., & Mutlu, F. (2019). The design of green supply chains under carbon policies: A literature review of quantitative models. Sustainability, 11(11), 3094.

Xu, Z., Elomri, A., Pokharel, S., Zhang, Q., Ming, X. G., & Liu, W. (2017). Global reverse supply chain design for solid waste recycling under uncertainties and carbon emission constraint. Waste Management, 64, 358–370.

Xu, Z., Pokharel, S., Elomri, A., & Mutlu, F. (2017b). Emission policies and their analysis for the design of hybrid and dedicated closed-loop supply chains. Journal of Cleaner Production, 142, 4152–4168.

Yavari, M., & Geraeli, M. (2019). Heuristic method for robust optimization model for green closed-loop supply chain network design of perishable goods. Journal of Cleaner Production, 226, 282–305.

Yolmeh, A. & Saif, U. (2020). Closed-loop supply chain network design integrated with assembly and disassembly line balancing under uncertainty: an enhanced decomposition approach. International Journal of Production Research, 1–18.

You, F., & Grossmann, I. E. (2008). Design of responsive supply chains under demand uncertainty. Computers & Chemical Engineering, 32(12), 3090–3111.

Zeballos, L. J., Méndez, C. A., Barbosa-Povoa, A. P., & Novais, A. Q. (2014). Multi-period design and planning of closed-loop supply chains with uncertain supply and demand. Computers & Chemical Engineering, 66, 151–164.

Zhen, L., Huang, L., & Wang, W. (2019). Green and sustainable closed-loop supply chain network design under uncertainty. Journal of Cleaner Production, 227, 1195–1209.

Zhou, X., Zhang, H., Qiu, R., Lv, M., Xiang, C., Long, Y., & Liang, Y. (2019). A two-stage stochastic programming model for the optimal planning of a coal-to-liquids supply chain under demand uncertainty. Journal of Cleaner Production, 228, 10–28.

Acknowledgment

This research was made possible by a NPRP award NPRP No.5-1284-5-198 from the Qatar National Research Fund (a member of The Qatar Foundation). The statements made herein are solely the responsibility of the authors. The partial contribution by Zhitao Xu in this paper was possible due to the funding provided to the author by National Natural Science Foundation of China (Grant No. 71702073), the China Postdoctoral Science Foundation (Grant No. 2018M640483), and the Fundamental Research Funds for the Central Universities (Grant No. NR2020006).

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Xu, Z., Pokharel, S. & Elomri, A. An eco-friendly closed-loop supply chain facing demand and carbon price uncertainty. Ann Oper Res 320, 1041–1067 (2023). https://doi.org/10.1007/s10479-021-04499-x

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10479-021-04499-x