Abstract

This paper studies how to counter the illegal exploitation of common groundwater resource in an evolutionary game approach. The access is not free and firms have to pay a royalty depending on the quantity of water pumped. However, some firms could decide to not pay the royalty and face the risk of being sanctioned by the regulator authority. The overall sanction is composed of a fixed amount and of the royalty not payed. From the analysis of the model it emerges that coexistence at the equilibrium between compliant and non-compliant firms is possible and policy instruments are partially able to counter the unauthorized exploitation. In particular, increasing the sanction level reduces the number of non-compliant firms but raises the incidence of illegal pumping. The opposite occurs if the regulatory authority increases the royalty price. To pursue both goals, applying a balance of policies is necessary.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

The development and exploitation of water resources in a sustainable way is fundamental in a modern society. Unfortunately, during the second half of the 20th century, due to the urbanization, population growth, industrialization and intensive agricultural irrigation, there has been a considerable depletion of water resources and continued environmental degradation of river basins (United Nations Development Programme 2006). Moreover, illegal water extraction, often for agricultural use, is widespread in many areas of the world.

Martínez-Santos et al. (2008) cite official estimates that indicate that half of all firms in the Western La Mancha may be pump illegally accessing the water supplies. De Stefano and Lopez-Gunn (2012) describe several techniques of unauthorized groundwater use, including new wells drilled in aquifers that are supposed to be “closed” due to overexploitation. Dworak et al. (2010) suggest that in several Southern European countries unauthorized extraction may account for 30–60% of total extractions for agricultural use. Budds (2009) shows that agricultural expansion and increasing water use in Chile, have caused disputes among farmers. In particular, the illegal extraction is estimated at approximately double that of the sum of groundwater rights granted.

The study of groundwater depletion is not just a matter of research, rather it is a question of developing adequate countermeasures in order to preserve natural systems. To combat this phenomenon, a system of fines or penalties, and adequate monitoring can be implemented. In 2010, a European Commission conference on unauthorized water usage in agricultureFootnote 1 provided a picture of the challenges of regulating water use in Europe. Estimates suggest that unauthorized water use can possibly be larger than authorized use in several regions of the European Union, particularly in the more arid and semi-arid southern member states. For example, on the island of Malta in 2007, official sources acknowledged an unlicensed groundwater extraction of 18.5 million \(\mathrm {m}^3/\mathrm {yr}\), while authorized pumping accounted for 15 million \(\mathrm {m}^3/\mathrm {yr}\). In 2005, the former Spanish Ministry for the Environment estimated that in Spain there were about \(510\,000\) illegal wells (Confederacio Hidrografica del Guadiana 2005). This could mean an illegal water extraction of about \(3\,600\) million \(\mathrm {m}^3/\mathrm {yr}\), representing 45% of the total amount of water pumped by aquifers per year (World Wide Fund 2006).

Groundwater has always been seen as a public resource to which access is reserved based on land ownership. As a common resource, groundwater may be extracted in excessive quantities. This overexploitation occurs because water users are unaware of their effects on water levels or the withdrawals of other agents. This leads to costs in addition to the cost of pumping, which appear as negative externalities. This negligence results in inefficient pricing by the public authority, which underestimates the resource and consequently leads to the exhaustion of groundwater resources (see Koundouri 2004). The optimal price for water should recover the accumulated marginal costs, defined as the sum of the marginal cost of extraction, the cost of resource depletion and the marginal environmental cost. The implementation of such a pricing scheme by the public authority underlines the importance of active management, since most externalities are not considered in the market solutions of an open access resource.

In 1980, Gisser and Sanchez (1980) propose their seminal work about groundwater management. The authors demonstrate that if the storage capacity of the aquifer is relatively large, then no control (free market behavior) and optimal control strategies perform equally. These results have produced a large literature about groundwater management, especially using a dynamic game theoretical approach. Among others, Negri (1989) introduces competition between firms and shows the inefficiency of private exploitation without control. Conversely, the centrality of the market in preserving the aquifer is highlighted byProvencher and Burt (1993) in a stochastic framework. More recently, Rubio and Casino (2001, 2003), modeling a market composed of a fixed number of firms, lead to the same results as Gisser and Sanchez (1980). The debate on competition versus optimal control has been enriched introducing ecosystem damage (see Esteban and Albiac 2011) and firms heterogeneity (see Biancardi and Maddalena 2018).

The present paper differs from these previous studies mainly in two respects: (1) it analyzes the strategic interaction between firms that compete for a common groundwater resource in an evolutionary context, and (2) it focuses on how to reduce the illegal pumping. To the best of our knowledge, there is only one evolutionary game on this issue, proposed by Antoci et al. (2017), that deals with a two-sector evolutionary model analyzing the impact of water pricing on firms’ dynamics, without considering unauthorized pumping.

Following the evolutionary game theory approach, we assume that agents have limited rationality, namely they do not solve an inter-temporal optimization problem. Therefore, players do not take into consideration the future consequences of their choices. We adopt this context since we believe that economic agents consider the impact of their decisions on the environment as negligible and this makes the role of the policy even more important and decisive on the effects of the conservation of the resources. The selection process is determined by the replicator dynamics in which the agents choose the relatively more rewarding strategy (see, among others, Friedman 1991; Bomze and van Damme 1992; Hofbauer and Sigmund 2003; Xepapadeas 2005; Hingu et al. 2018).

In more detail, the model studies the dynamics of compliant and non-compliant firms in regards to groundwater pumping. To have access to the water resource, firms must pay a royalty that depends on the amount of water withdrawn. However, firms could decide to not pay the royalty and face the risk of receiving a penalty by the public authority. Some authors have analyzed the problem of non-compliance with resource management regimes, based on the literature on social norms in common property resources using the pioneer paper of Ostrom (1990). However, these applications relate to the case of overexploitation in fisheries (Agnew et al. 2009) and forests (Palmer 2001). A novelty of our work is the introduction of policy tools in the field of water exploitation, aimed at combating illegal withdrawal and preserving the water table.

The paper is organized in the following way. Section 2 presents the model and solves the firms’ maximization problem. Section 3 introduces the dynamics between the share of compliant firms and groundwater level, finds the steady states of the dynamic systems and performs a sensitivity analysis. Section 5 proposes numerical simulations about policy implications on evolution of market composition and illegal pumping. In Sect. 4 we augment the model assuming that the royalty price is a function of the overall extraction. Finally, Sect. 6 concludes.

2 The model

Let us consider a n-size population of firms that pump water for irrigation purposes from a common resource. Firms are of two types, compliant and non-compliant, and we denote them with subscripts \(i=c,b\) respectively. The access to the common resource is not free and firms have to pay a royalty, \(\rho \), depending on quantities of water pumped, \(w_i\). However, firms could decide to not pay the royalty and face the risk \(\phi \in (0,1)\) of being sanctioned by the regulatory authority. The sanction is composed of a fixed amount \(\sigma \ge 0\),Footnote 2 and of the unpaid royalty. Profit functions are as follows:

According to Kim et al. (1989) and Koundouri and Christou (2006), the revenue function is derived by integrating the following inverse linear demand of water:Footnote 3

where \(\alpha >0\) is the intercept and \(\beta >0\) represents the slope. Therefore, the revenue function of the i-th firm is

Regarding cost function, according to Gisser and Sanchez (1980), pumping costs are assumed to be linear:

where SL measures the elevation in feet of the irrigation surface above sea level, while H measures the water table elevation in feet above sea level. Therefore, the difference \((SL-H)\) represents the pumping lift, i.e. the distance from the water table to the surface. Moreover, \(c_{0}=c_1\cdot SL>0\) is the fixed cost due to the hydrologic cone, while \(c_1>0\) is the marginal pumping cost (\(c_1 H\) represents pumping cost per acre-foot of water per foot of lift). Finally, according to Rubio and Casino (2001), the value \(H={\overline{H}}:= c_{0}/c_{1}\) represents the maximum value of the water table elevation.

Denoting \(x \in [0,1]\) as the share of compliant firms and \(1-x\) as the share of non-compliant firms, respectively, the royalty is assumed to be a behavioral rule function of the water pumped by compliant firms:Footnote 4

where \(\delta >0\) is a parameter used by the public authority to stabilize the royalty price. One can imagine \(\delta \) as an excise duty on each unit of water pumped. Otherwise, the probability of being discovered is a function of the share of non-compliant firms, that is:

where \(\theta , \eta >0\). Probability (4) is distributed as an inverse sigmoid function in the interval [0,1] and we assume that, when the share of compliant firms x tends to zero, then the monitoring \(\phi \) goes to 1. Therefore, if the number of non-compliant firms increases, then the probability of being discovered also increases. The opposite occurs if the number of non-compliant firms decreases, i.e. when x tends to 1 then monitoring \(\phi \) approaches 0. Furthermore, the functional form chosen for \(\phi \) allows for greater monitoring than the linear case when the rate of legality x is low and vice-versa when it increases.Footnote 5 Figure 1 shows the function \(\phi \) if \(\theta =\eta =2\), as in numerical simulations of the next Sects. 3 and 5. Finally, we assume that firms consider the impact of their choices on the market composition (x) as negligible, namely \(\phi \) is ex-ante taken as given in the maximization problem. However, firms’ choices have ex-post consequences, and so value of \(\theta \) is endogenously determined (as shown in Sect. 5).

Given the value of variables x and H, the quantities \(w_{c}\) and \(w_{b}\) are chosen by solving the following maximization problem:

The following proposition holds.

Proposition 1

Let

with \({\widehat{H}}< {\overline{H}}\) and \({\widehat{H}}\le {\widetilde{H}}\), then

-

If \(H\le {\widehat{H}}\):

$$\begin{aligned} w^{\star }_b=0; \; \; \; \; \; w^{\star }_c=0 \end{aligned}$$ -

If \({\widehat{H}}<H< {\overline{H}}\):

$$\begin{aligned}&w_{c}^{\star }=\frac{\alpha -c_0+c_1H}{\beta +2\delta x n} \end{aligned}$$(7)$$\begin{aligned}&w_b^{\star }=\left\{ \begin{array}{ccc} 0 &{} if &{} H\le {\widetilde{H}}\\ \displaystyle \frac{\alpha - c_{0} + c_{1}H - \phi \sigma - \frac{\phi ^{2} \delta xn \sigma }{\beta + \left( 2-\phi \right) \delta xn} }{\beta \left( 1 + \frac{\phi \delta xn}{\beta + \left( 2-\phi \right) \delta xn} \right) } &{} if &{} H\ge {\widetilde{H}}\\ \end{array} \right. \end{aligned}$$(8)

Proof

According to the first order conditions, it follows:

Solving (9), the pumping of compliant firms’ results:

The non-negativity of the water table implies that \(w_{c}^{\star }>0\) if

otherwise \(w_{c}^{\star }=0\). Analogously, non-compliant firms could pump zero water or not, according to the level of the water table H. Solving (10) and substituting the value obtained in (7), we obtain:

for which \(w_b^{\star }>0\) if

otherwise \(w_b^{\star }=0\). Recalling that the value \(H={\overline{H}}:= c_{0}/c_{1}\) represents the maximum value of the water table elevation and that \( {\widehat{H}} \le {\overline{H}}\), the proposition is proven. \(\square \)

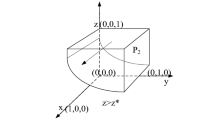

Before analyzing the evolution of x and H (see next section), we want to underline here the roles of \({\widehat{H}}\), \({\widetilde{H}}\) and \({\overline{H}}\) in separating the regions of the plane (x, H). The graph of \({\widehat{H}}\), represented in violet in Fig. 2a, separates the region of the plane (x, H) where \(w_{c}>0\) (above it) from the region where \(w_{c}=0\) (below it). The graph of \({\widetilde{H}}\), represented in red in Fig. 2(a), separates the region of the plane (x, H) where \(w_{b}>0\) (above it) from the region where \(w_{b}=0\) (below it). Notice that \({\widehat{H}} \le {\widetilde{H}}\) and, therefore, the minimum value of H, such that only the compliant firm pumps a positive amount of water, is \({\widehat{H}}\). Since below the graph of \({\widehat{H}}\) (see (5)) no firm pumps water (\(w_{c}=0, \; w_{b}=0\)) and considering that the maximum value of the water table is \({\overline{H}}\), we will consider, in the next section, due to its economic relevance, the dynamic regimes that may arise for \( {\widehat{H}} \le H \le {\overline{H}}\) and \(H\ge {\widetilde{H}}\) (i.e., function (6)), where both types of firms pump a positive amount of water (\(w_{c}>0, \; w_{b}>0\)).

Moreover, from (7) and (8) we can derive first policy implications. One can see how both \(w_{c}^{\star }\) and \(w_{b}^{\star }\) are positively related with \(\alpha \), \(c_{1}\), H, and negatively related with \(c_{0}\) and \(\beta \). Again, if \(\uparrow \delta \) then \(\downarrow w_c^\star \), as well as if \(\uparrow x\). The last outcome is particularly interesting: if the share of more compliant firms increases, then the representative compliant firm pumps less. This aspect (“the less, the merrier”) will play a key role in understanding the mechanism of simulations in Sect. 5.

3 Dynamics

In this section we introduce the dynamics of the share of compliant firms x and the water table H. Moreover, due to the non-linearity of the model we perform a sensitivity analysis to numerically investigate how many inner steady states exist and and the nature of their stability.

3.1 Steady states analysis

We assume that the evolution of compliant firms x(t) is described by the well-know replicator equation (see, among others, Weibull 1995; Cressman 2003):

where \({\dot{x}}= dx / dt\) is the time derivative of the share x. Following the evolutionary game theory approach, dynamics (11) assumes that if being compliant is more profitable than being non-compliant, i.e. \(\pi _{c}(x,H) > \pi _{b}(x,H) \), then the share of compliant firms increases; the opposite occurs if \(\pi _{c}(x,H) < \pi _{b}(x,H) \). Finally, if \(\pi _{c}(x,H) = \pi _{b}(x,H) \), then the share of compliant firms does not change over time.

Otherwise, we consider the time evolution of the water level H(t), which depends on the natural replenishment of the water source and on the pumping activity (following the literature but with the novelty of illegal pumping), that is:

where \({\dot{H}}= dH / dt\) is the time derivative of the water table H, \(r>0\) is the natural recharge, \(\gamma \in (0,1)\) is the return flow coefficient, and \(\Delta S>0\) represents the area of the aquifer times storativity. The previous conditions give rise to a two-dimensional non-linear dynamical system:

where \(w_c^{\star }\) and \(w_b^{\star }\) are given by (7) and (8). In order to obtain the equilibria points of the dynamic system (13), it results that \({\dot{x}}=0\) for \(x=0\) , \(x=1\) and for

while \({\dot{H}}=0\) for

Three types of steady states may be observed:

-

(i)

the point \((x,H)=(0,H_{0})\), with \(H_{0}=\min \left\{ 0, \displaystyle \frac{1}{c_{1}}\left[ c_{0}-\alpha +\sigma \phi +\frac{r\beta }{\left( 1-\gamma \right) n} \right] \right\} \) in which all firms are non-compliant, that always exists;

-

(ii)

the point \((x,H)=(1,H_{1})\), with \(H_{1}=\min \left\{ 0, \displaystyle \frac{1}{c_{1}}\left[ c_{0}-\alpha +\frac{\left( \beta +2\delta n \right) r}{\left( 1-\gamma \right) n} \right] \right\} \), in which all firms are compliant, that always exists;

-

(iii)

steady states in which both types of firms coexist, given by the intersection between isoclines (14) and (15).

3.2 Sensitivity analysis

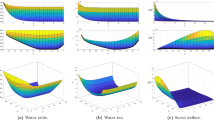

It is not possible to analytically compute the number of inner states that may be observed. However, from numerical simulations, it emerges that, above the graph \({\widetilde{H}}\) (i.e., function (6)), at most one internal state (\(x^{\star },H^{\star }\)) may exist, and that under dynamics (13) three dynamic regimes arise:

-

(i)

the case in which the state \((0,H_{0})\) is globally attractive while the state \((1,H_{1})\) is a saddle point, and the water will be pumped by only non-compliant firms (see Fig. 2b);

-

(ii)

the case in which the state \((1,H_{1})\) is globally attractive while the state \((0,H_{0})\) is a saddle point, and the water will be pumped by only compliant firms (see Fig. 2c);

-

(iii)

the case in which an inner steady state \((x,H)=(x^{\star },H^{\star })\) exists and there is coexistence between firms (see Fig. 2d).

Dynamic regimes are presented in Figure 2 and are obtained using parameter values summarized in Table 1.Footnote 6 Since it is the most realistic case, we focus on the last dynamic regime, namely when both types of firms coexist at the equilibrium (Fig. 2d). From numerical simulations it emerges that the inner steady state \((x^{\star },H^{\star })\) is a saddle point. Indeed, by rewriting the dynamic system (13) as

the determinant of the Jacobian matrix calculated in \((x^{\star },H^{\star })\), is

is always negative at increasing values of \(\sigma \) and \(\delta \), i.e. the parameters that we will use in the next section for deriving policy implications (see Fig. 3). Formally, \(\text {det}{} \mathbf{J} (x^\star ,H^\star )<0 \; \forall \; \sigma ,\delta \).Footnote 7 Therefore, the states \((0,H_{0})\) and \((1,H_{1})\) are locally attractive and their basins of attraction are separated by the stable arm of \((x^{\star },H^{\star })\), namely \({\dot{x}}=0\) isocline (see (14)). In terms of transitional dynamics it means that if the initial condition (x(0), H(0)) lies to the left of \({\dot{x}}=0\) isocline, then the economy will converge to the state \((0,H_{0})\) and all firms will be non-compliant. If (x(0), H(0)) lies to the right of \({\dot{x}}=0\) isocline, then the economy will converge to the state \((1,H_{1})\) and all firms will be compliant. Finally, if (x(0), H(0)) lies along \({\dot{x}}=0\) isocline, then the economy will converge to the state \((x^{\star },H^{\star })\) and both types of firms will coexist.

4 Royalty as a function of the overall extraction

We augment the analysis assuming that the royalty is a function of both \(w_{c}\) and \(w_{b}\):Footnote 8

Therefore the profit functions are the following:

The following proposition holds.

Proposition 2

Let

-

If \(H<\min \left\{ {\widehat{H}}', {\widetilde{H}}',{\overline{H}} \right\} \) then \({w_c'}^{\star }=0 \) and \({w_b'}^{\star }=0\).

-

Assuming \({\widehat{H}}'< {\widetilde{H}}'\)

-

If \(H>{\widehat{H}}'\) then:

$$\begin{aligned} {w_c'}^{\star }=\frac{ (c_1H+\alpha -c_0)[\beta -(1-x)(1-2\phi )n\delta ]+(1-x)n\phi \delta \sigma }{ n\delta [ (1-x)(3\delta x n +2\beta )\phi +2\beta x ]+\beta ^2 } \end{aligned}$$and

$$\begin{aligned} {w_b'}^{\star }=\left\{ \begin{array}{ccc} 0 &{} if &{} H\le {\widetilde{H}}' \\ \frac{(c_1H+\alpha -c_0)[\beta + (2-\phi )\delta x n]-\phi \sigma (\beta +2\delta x n) }{ n\delta [ (1-x)(3\delta x n +2\beta )\phi +2\beta x ]+\beta ^2 } &{} if &{} H\ge {\widetilde{H}}' \\ \end{array} \right. \end{aligned}$$

-

-

Assuming \({\widetilde{H}}'< {\widehat{H}}'\)

-

If \(H>{\widetilde{H}}'\) then:

$$\begin{aligned} {w_b'}^{\star }=\displaystyle \frac{(c_1H+\alpha -c_0)[\beta + (2-\phi )\delta x n]-\phi \sigma (\beta +2\delta x n) }{ n\delta [ (1-x)(3\delta x n +2\beta )\phi +2\beta x ]+\beta ^2 } \end{aligned}$$and

$$\begin{aligned} {w_c'}^{\star }=\left\{ \begin{array}{ccc} 0 &{} if &{} H\le {\widehat{H}}' \\ \displaystyle \frac{ (c_1H+\alpha -c_0)[\beta -(1-x)(1-2\phi )n\delta ]+(1-x)n\phi \delta \sigma }{ n\delta [ (1-x)(3\delta x n +2\beta )\phi +2\beta x ]+\beta ^2 } &{} if &{} H\ge {\widehat{H}}'\\ \end{array} \right. \end{aligned}$$

-

Proof

According to the first order condition, it follows:

Solving (16) and (17), the optimal quantities pumped by both types of firms are:

The non-negativity of the water table implies that \({w_c'}^{\star }>0\) if \(H>{\widehat{H}}'\), namely

otherwise \({w_c'}^{\star }=0\). Analogously, the non-negativity of the water table implies that \({w_b'}^{\star }>0\) if \(H> {\widetilde{H}}'\), namely

otherwise \({w_b'}^{\star }=0\). Recalling that the value \(\bar{H}:=c_0/c_1\) represents the maximum value of the water table elevation and that \({\widetilde{H}}' \lesseqgtr {\widehat{H}}'\), the proposition is, therefore, proven. \(\square \)

To compare the two versions of the model we consider only the cases in which \({\widehat{H}}\le {\widetilde{H}}\). We substitute \({w_b'}^{\star }\) and \({w_c'}^{\star }\) in the dynamic system (13), obtaining three types of steady states:

-

(i)

The point \((x,H)=(0,H'_{0})\), with \(H'_{0}=\min \left\{ 0, \displaystyle \frac{1}{c_1} \left[ c_0-\alpha +\frac{n\phi [(1-\gamma )\sigma +2r\delta ]+r\beta }{n(1-\gamma )} \right] \right\} \) in which all firms are non-compliant, that always exists;

-

(ii)

The point \((x,H)=(1,H'_{1})\), with \(H'_{1}=\min \left\{ 0, \displaystyle \frac{1}{c_{1}}\left[ c_{0}-\alpha +\frac{\left( \beta +2\delta n \right) r}{\left( 1-\gamma \right) n} \right] \right\} \), in which all firms are compliant, that always exists;

-

(iii)

Steady states in which both types of firms coexist.

Notice that the state \((1,H'_{1})\) coincides with the state \((1,H_{1})\) of Sect. 3, since \(\rho =\rho '\). As above, numerical simulations show that only one inner steady state \(({x'}^{\star },{H'}^{\star })\) exists.

5 Policy implications

We now perform numerical simulations of comparative dynamics in order to illustrate the possible effects of a government intervention on 1) market composition and 2) illegal water pumping. Considering the dynamic regime in which compliant and non-compliant firms coexist at the equilibrium \((x^{\star },H^{\star })\), we analyze the evolution of i) the share of compliant firms \( x^{\star } \) and the water table \( H^{\star }\), ii) the monitoring probability \(\phi ^{\star }\) and the royalty \(\rho ^{\star }\), iii) the total amount of water pumped by the two types of firm \( W_{c}^{\star } = x^{\star } nw_{c}^{\star } \) and \(W_{b}^{\star } = (1-x^{\star }) nw_ {b}^{\star } \) respectively, when the two policy parameters, i.e. the sanction \( \sigma \) and the royalty stabilization parameter \( \delta \), change. Notice that the steady state \((x^{\star },H^{\star })\) is a saddle point, therefore, if \(x^{\star }\) increases, then the basin of attraction of the state \((0,H_{0})\) also increases and at the end more firms will be non-compliant. Conversely, if \(x^{\star }\) increases, then the basin of attraction of the state \((1,H_{1})\) also increases and at the end more firms will be compliant. We jointly compare the simulation results of both types of royalty functions.

As expected, Fig. 4a shows that at the equilibrium \((x^{\star },H^{\star })\) as \(\sigma \) increases then so do both \(x^{\star }\) and \(H^{\star }\). This follows a counter-intuitive mechanism, namely as the sanction increases more firms will be non-compliant. It occurs because if \(\uparrow x^{\star }\), then \(\uparrow \rho ^{\star }\) (see (3)) and \(\downarrow \phi ^{\star }\) (see (4)), as Fig. 4b shows. The combined effect of these two outcomes makes the non-compliant strategy more rewarding (at the equilibrium \((x^{\star },H^{\star })\) the share \(x^\star \) varies from \(\approx 0.5\) to \(\approx 0.75\)). However, an increase in \(\sigma \) causes a rise in \(W_{c}^{\star }\) and a fall of \(W_{b}^{\star }\) (see Fig. 4c), since both \(w_b^\star \) (see (8)) and the share \(1-x\) decrease. Therefore, raising the sanction has positive effects on water pumping since it decreases the illegal activity.

Comparing these results with Fig. 5, we see that all the functions analyzed (namely \(x'\), \(H'\), \(\phi '\), \(\rho '\), \(W_c'\), \(W_b'\)) have the same trend as Fig. 4. The only difference is in Fig. 5c where \(W_c'>W_b'\). This is because a royalty price function for both \(w_c\) and \(w_b\) represents an incentive to be compliant, while a royalty price function of only \(w_c\) represents an incentive to be non-compliant. Therefore, the new royalty function can be considered as a policy suggestion since it is able to counter the illegal pumping.

Figure 6a shows that at the equilibrium \((x^{\star },H^{\star })\) as \(\delta \) rises, \(x^{\star }\) decreases while \(H^{\star }\) increases. This means that more firms will be compliant. Indeed, similar to the mechanism of the previous simulation, if \(\uparrow x^{\star }\), then \(\downarrow \phi ^{\star }\) (see Fig. 6b). However, in this case \(\rho ^{\star }\) goes up since a raise of \(\delta \) dominates a decrease of \(x^{\star }\) (see Figure 6b). Therefore, there are two conflicting forces, \(\downarrow \phi ^{\star }\) and \(\uparrow \rho ^{\star }\). Indeed, at the equilibrium \((x^{\star },H^{\star })\) the share \(x^\star \) falls “only” from \(\approx 0.735\) to \(\approx 0.675\). At the end, the first force (\(\phi ^\star \)) dominates the second on (\(\rho ^\star \)) indicating that being compliant is more rewarding. Regarding the total pumping, an increase of \(\delta \) causes an increase in \(W_{b}^{\star }\) and a decrease of \(W_{c}^{\star }\) (see Fig. 6c), since both \(w_c^\star \) and \(x^\star \) decrease. Therefore, raising the royalty stabilization parameter price has negative effects on water pumping, since it increases the illegal activity.

Again, comparing these results with Fig. 7, we see that all the functions analyzed (namely \(x'\), \(H'\), \(\phi '\), \(\rho '\), \(W_c'\), \(W_b'\)) have the same trend as Fig. 6. As for \(\sigma \), the only difference is in Fig. 7c where \(W_c'>W_b'\). This confirms the positive effect, in terms of reducing illegal exploitation, of a royalty function applied to both compliant and non-compliant water access.

In conclusion, comparing the two policy interventions (sanction and royalty), reveals, both, pros and cons. The sanction has positive effects on market composition but negative effects on illegal pumping. Conversely, the royalty stabilization parameter of royalty price has positive effects on market composition but negative effects on illegal pumping. As happens in the real world, applying a balance of both policies is necessary to reduce the number of non-compliant firms and counter illegal water pumping.

6 Conclusions

In our paper, we have presented an evolutionary game that describes the exploitation of the water resource within a context in which firms can legally or illegally withdraw it. We have assumed that access to the water resource requires payment of a royalty depending on the amount of water pumped. Compliant firms accept these conditions, while non-compliant ones decide not to pay royalties and risk being punished by the regulatory authority. If this happens, they pay a sanction and the royalties proportional to their pumping. The analysis of the evolutionary game has shown that, although it is not possible to analytically determine the equilibrium composed of the share of compliant firms and of the height of the aquifer, it can exist and is a saddle point.

The evolutionary game approach, in which firms are not forward looking and do not take into account the consequences of their choices, has emphasized how the importance of an active regulatory authority to counter illegal behaviors. In particular, we have proposed numerical simulations about i) the share of compliant firms and the water table, ii) the monitoring probability and the royalty, and iii) the total amount of water pumped by the two types of firms, when the two policy parameters, the sanction and the royalty stabilization parameter, change. It emerges that both instruments are partially effective. Indeed, the sanction has positive effects on market composition but negative on illegal pumping, while the royalty stabilization parameter has positive effects on market composition but negative on illegal pumping. It is obvious that, in reality, the best policy intervention is a combination of the two instruments according to the characteristics of the economy.

Moreover, another instrument could be represented by a royalty price that considers both legal and illegal water pumped. Indeed, in this case, the total amount of water pumped by compliant firms is always greater than the water pumped by non-compliant firms.

Notes

Conference on “Water & Agriculture” Events at Mercure Hotel, Boulevard de Lauzelle 61, Louvain-La-Nueve (Belgium), September 2010.

Although a water linear demand is not the most favorable functional form, it nevertheless simplifies the analysis of the model and for this reason it is widely used in literature.

In Sect. 4 we relax this assumption assuming \(\rho \) function of water pumped by both types of firms.

Another possibility to represent probability (4) is to model it as a function of the water table, that is the difference between the effective water level and the one compatible with compliant pumping. Also in this case, the probability of being discovered discovered, \(\phi \), will be a function of the share of non-compliant firms. Therefore, we prefer to represent it as (4), for obvious reasons of tractability, following Petrohilos-Andrianos and Xepapadeas (2017).

In all simulations, we change \(\sigma \) from 100 to 900, while \(\delta \) from 0.0007 to 0.0013. Both intervals are such that the inner steady state (\(x^\star ,H^\star \)) exists.

All the new functions will be denoted with symbol \('\).

References

Agnew, D. J., Pearce, J., Pramod, G., Peatman, T., Watson, R., Beddington, J. R., & Pitcher, T. J. (2009). Estimating the worldwide extent of illegal fishing. PloS ONE, 4(2), e4570.

Antoci, A., Borghesi, S., & Sodini, M. (2017). Water resource use and competition in an evolutionary model. Water Resources Management, 31(8), 2523–2543.

Biancardi, M., & Maddalena, L. (2018). Competition and cooperation in the exploitation of the groundwater resource. Decisions in Economics and Finance, 41(2), 219–237.

Bomze, I. M., & van Damme, E. E. (1992). A dynamical characterization of evolutionarily stable states. Annals of Operations Research, 37, 229–244.

Budds, J. (2009). Contested H2O: science, policy and politics in water resources management in Chile. Geoforum, 40(3), 418–430.

Confederacio Hidrografica del Guadiana. (2005). Plan especial del Alto Guadiana. Madrid, Spain: Borrador Documento de Directrices.

Cressman, R. (2003). Evolutionary Dynamics and Extensive Form Games. Cambridge, MA, USA: MIT Press.

De Stefano, L., & Lopez-Gunn, E. (2012). Unauthorized groundwater use: institutional, social and ethical considerations. Water Policy, 14(S1), 147–160.

Dworak, T., Schmidt, G., De Stefano, L., Palacios, E., Berglund, E., 2010. Background paper to the conference: Application of EU water-related policies at farm level.

Esteban, E., & Albiac, J. (2011). Groundwater and ecosystems damages: questioning the Gisser-Sánchez effect. Ecological Economics, 70(11), 2062–2069.

Friedman, D. (1991). Evolutionary games in economics. Econometrica, 59(3), 637–666.

Gisser, M., & Sanchez, D. A. (1980). Competition versus optimal control in groundwater pumping. Water Resources Research, 16(4), 638–642.

Hingu, D., Rao, K. M., & Shaiju, A. (2018). On superiority and weak stability of population states in evolutionary games. Annals of Operations Research, 287, 751–760.

Hofbauer, J., & Sigmund, K. (2003). Evolutionary game dynamics. Bulletin of the American Mathematical Society, 40(4), 479–519.

Kim, C., Moore, M. R., Hanchar, J. J., & Nieswiadomy, M. (1989). A dynamic model of adaptation to resource depletion: theory and an application to groundwater mining. Journal of Environmental Economics and Management, 17(1), 66–82.

Koundouri, P. (2004). Current issues in the economics of groundwater resource management. Journal of Economic Surveys, 18(5), 703–740.

Koundouri, P., & Christou, C. (2006). Dynamic adaptation to resource scarcity and backstop availability: theory and application to groundwater. Australian Journal of Agricultural and Resource Economics, 50(2), 227–245.

Martínez-Santos, P., Llamas, M. R., & Martínez-Alfaro, P. E. (2008). Vulnerability assessment of groundwater resources: a modelling-based approach to the Mancha Occidental aquifer. Spain. Environmental Modelling and Software, 23(9), 1145–1162.

Negri, D. H. (1989). The common property aquifer as a differential game. Water Resources Research, 25(1), 9–15.

Ostrom, E. (1990). Governing the Commons: the Evolution of Institutions for Collective Action. Cambridge, UK: Cambridge University Press.

Palmer, C. (2001). The extent and causes of illegal logging: an analysis of a major cause of tropical deforestation in Indonesia. Centre for Social and Economic Research on the Global Environment: London, UK.

Petrohilos-Andrianos, Y., & Xepapadeas, A. (2017). Resource harvesting regulation and enforcement: an evolutionary approach. Research in Economics, 71(2), 236–253.

Provencher, B., & Burt, O. (1993). The externalities associated with the common property exploitation of groundwater. Journal of Environmental Economics and Management, 24(2), 139–158.

Rubio, S. J., & Casino, B. (2001). Competitive versus efficient extraction of a common property resource: the groundwater case. Journal of Economic Dynamics and Control, 25(8), 1117–1137.

Rubio, S. J., & Casino, B. (2003). Strategic behavior and efficiency in the common property extraction of groundwater. Environmental and Resource Economics, 26(1), 73–87.

United Nations Development Programme. (2006). Human Development Report 2006: Beyond Scarcity - Power. Poverty and the Global Water Crisis. Palgrave Macmillan: Basingstoke, UK.

Weibull, J. W. (1995). Evolutionary Game Theory. Cambridge, MA, USA: MIT Press.

World Wide Fund, 2006. Illegal water use in Spain: causes, effects and solutions.

Xepapadeas, A. (2005). Regulation and evolution of compliance in common pool resources. Scandinavian Journal of Economics, 107(3), 583–599.

Acknowledgements

We would like to thank the two anonymous reviewers whose comments and suggestions helped improve and clarify an earlier version of this manuscript.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Biancardi, M., Iannucci, G. & Villani, G. An evolutionary game on compliant and non-compliant firms in groundwater exploitation. Ann Oper Res 318, 831–847 (2022). https://doi.org/10.1007/s10479-021-04297-5

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10479-021-04297-5