Abstract

One of the major objectives of modern supply chain management is dealing with the negative impact of decentralization among the involved entities and minimizing double marginalization effect within the chain, especially when the end-customers’ demand is not deterministic. This paper investigates coordination issue in a three-level supply chain with one raw-material supplier, one manufacturer, and one retailer. The retailer determines the retail price, sales effort, and order quantity simultaneously before the selling season starts. Both the supplier and the manufacturer face random yield in production. A composite contract having two components—a contingent buyback with target sales rebate and penalty between the retailer and the manufacturer, and a revenue sharing contract between the manufacturer and the supplier is proposed. The proposed composite contract is shown to achieve supply chain coordination and allows arbitrary allocation of total channel profit among all the chain members. The impact of randomness in both demand and production, and the impact of non-existence of emergency resource for the final product on the performance of the entire supply chain are analyzed. A numerical example is provided to illustrate the developed model and draw some important managerial insights.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Recently fashionable products with higher features have become more favourable for customers than durable and long-lasting products, as customers are searching for variety and they want to use a product for a short time and look for a new one after that. In reality, such behavior can be related to products such as electronic goods (e.g. personal computer, mobile), fashion items, etc. To sustain in the competitive business environment, companies therefore have been forced to increase their production rates together with higher efforts on retailing varieties of products. It is therefore more acceptable for the companies to focus on a single transaction only, i.e., to choose to be either on the manufacturing side or on the retailing side, and that shows the picture of how today’s supply chains have initiated to decentralize.

Since price is one of the main factors for customers to decide whether to buy a product or not, joint determination of inventory and pricing decisions is of utmost importance. In addition to retail price, the retailer can also influence demand by sales efforts such as advertising, after-sales service support, providing attractive products’ display, and hiring sophisticated sales personnel to influence consumer purchase. For example, in the electronics industry, the market demand depends not only on the brand reputation of the product, but also on retailer’s after-sales service support. As reported by Dant and Berger (1996), sales effort programs finance 25–40\(\%\) of the local advertisements of retailers. In 1970, the cost of sales efforts in US has been estimated at \(\$900\) million, whilst the expenditure on sales advertising was approximately \(\$15\) billion in 2000 (Nagler 2006) and \(\$50\) billion in 2010 (Yan 2010).

In many industrial scenarios, the production yield is uncertain due to influence of many uncontrollable factors. Random production can be found in most agriculture-based industries such as egg, vegetables, cereal, etc, where parameters like weather, draught, fertility of the land affect the production yield, and the exact yield quantity can never be anticipated in advance. The randomness may cause under-production or over-production. To deal with such a situation, producers often use a secondary market as an emergency resource to satisfy the unmet demand, and also for salvaging the leftover products. Chopra et al. (2007) reported an incident where a fire took place at the Philips microchip plant in Albuquerque, NM in March 2000 which supplied chips to both Nokia and Ericsson, among whom only Nokia got rid of the shortages in supply with the help of its multi-tiered supplier strategy to obtain chips from other sources. However, the availability of emergence resource in every stage of supply chain is a simplified assumption, particularly when it comes to mitigating demand of the final product of a branded company with specific configuration and features.

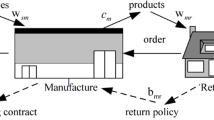

It is thus observed from the above that a supply chain may suffer from the issues of decentralization, random yield in production, and unavailability of secondary resource. In this article, a multi-echelon newsvendor problem with random yield and price and sales effort dependent random demand is considered. The proposed supply chain consists of a raw-material supplier, a manufacturer and a retailer trading a single product for a single period with short life-cycle. It is also assumed that production of raw materials and production of finished goods are both subject to random yield. The raw-material supplier can mitigate the risk of uncertainty in production by using a secondary market. Similarly, the retailer can access a secondary market for selling the leftover products at a lower price. However, the availability of secondary resource at the manufacturer level is debarred here, which is justified from the perspective of brand value or quality issue of the product produced by the manufacturer.

The main problem in such a multi-echelon supply chain is to decide how to deal with such uncertainties and influences so as to maximize profits of the chain members as well as the whole supply chain. An outstanding solution to the problem is the use of contract mechanism. A contract mechanism is a method which removes conflicts among the entities by determining a precise set of actions such that each firm’s objective becomes aligned with that of the whole system. To create that incentive to share risk and/or reward, the parties can adjust their terms of trade through introducing trade parameters between them, including the rule of transfer payment scheme of money and products. Contracts are effective instruments to get rid of information asymmetry and multiple marginalizations by providing accurate information and incentives to all entities so that the decentralized chain behaves as closer as possible, if not exactly same as the centralized chain.

In the literature, various contracts are proposed to coordinate the supply chain under different scenarios. A large body of supply chain literature focuses on a few popular contracts such as wholesale price, buyback, revenue sharing, quantity flexibility, sales rebate, quantity discount, and so on. Although most of the existing literatures on contract mechanism focus on channel coordination in two-level supply chain, the real world business supply chains consist of multiple entities. Companies like HP, Lenovo and Lakmé procure raw materials from their suppliers and sell finished products through their retailers. So these supply chains contain more than two entities. The popular contract mechanisms which are designed for two-level supply chains are thus needed to be generalized so as to fit in multi-level supply chains. Many researchers have extended the traditional contracts by establishing contract between pairs of adjacent entities in a multi-echelon supply chain. The present work aims in that direction. However, there are issues related to contract parameters information, simultaneous installation of the contract, etc. when traditional contracts are implemented in a multi-level supply chain. From this perspective, the following research questions arise:

-

1.

Can a contract mechanism be designed to coordinate the proposed multi-echelon supply chain by generalizing/combining some existing popular contracts?

-

2.

What are the impacts of uncertainties in demand and production as well as non-existence of emergency resource for the final product on optimal decisions and profits of individual members’ and the entire supply chain?

To answer these questions, we propose a composite contract by combining three popular contracts viz. a buyback contract, a sales rebate and penalty contract, and a revenue sharing contract. The integrated supply chain is first analyzed as the benchmark case for comparison. In the decentralized setting, aiming at how the risk of uncertainties in both yield and demand can be distributed among the supply chain members, we analyze the wholesale price contract as no risk sharing contract, and develop our risk sharing composite contract which distributes the risk of uncertainties among the parties to enhance the supply chain performance. In both the cases, we determine the optimal ordering, pricing, sales effort, and production decisions. We also analyze the impacts of uncertainties in demand and production as well as non-existence of emergency resource for the final product on optimal decisions of the supply chain.

The contributions of the paper with respect to the existing literature are as follows. Firstly, our paper incorporates the risks of random yield, and random demand which is sensitive to both retail price and sales effort in a multi-echelon supply chain. Secondly, we consider the situation where the manufacturer faces the yield risk but can’t access a secondary resource to mitigate yield uncertainty. We suggest that, in this situation, the retailer should set a larger order quantity than the one when the manufacturer has access to the secondary market. We also find that this strategy is beneficial to all the members of the supply chain. Thirdly, this paper contributes to the multi-echelon supply chain coordination literature by exploring a composite contract. We show that, for a three-echelon supply chain with uncertainty at each stage, a composite contract can ensure both coordination and win-win outcome that overcome the difficulties of contract parameters estimation and simultaneous installation.

The rest of the paper is organised as follows. A brief literature review is provided in Sect. 2. Section 3 presents notations and description of the problem under consideration. Section 4 discusses the centralized model and Sect. 5 illustrates the decentralized model with no risk sharing contract. A risk sharing coordination contract is presented in Sect. 6. Numerical examples are provided and the optimal results are analyzed in Sect. 7. Section 8 summarizes the paper and indicates scopes of future research.

2 Literature review

In this section, we review the relevant literature across three research domains—price and/or sales effort dependent demand, random yield, and contracts and supply chain coordination.

2.1 Price and/or sales effort dependent demand

Since retail price is one of the main factors for customers to decide about buying a product, joint determination of inventory and pricing decisions has been extensively discussed in the literature. Emmons and Gilbert (1998) developed a supply chain model with price-dependent demand and found that although the return policy fails to coordinate the supply chain, it still performs better than wholesale price contract. Yao et al. (2008) analyzed the impact of price sensitivity factors on return policy under price-dependent stochastic demand, and concluded that the manufacturer has to surrender a part of his profit to the retailer when demand variability is high. Hsieh and Wu (2008) considered a three-level supply chain with supply uncertainty and price-sensitive random demand for short life-cycle products, and observed that coordination with original equipment manufacturer (OEM) improves the manufacturer’s probability of meeting distributor’s demand as well as his expected profit, but this coordination may not be beneficial in the absence of downstream coordination. Wang and Chen (2017) framed the pricing and coordination strategies in a supply chain of fresh products with wholesale price and portfolio contracts where losses may arise during transportation. Hu et al. (2018) discussed coordination of order quantity and pricing decisions for a two-level supply chain through option contracts. Maihami et al. (2019) addressed the problem of joint determination of inventory control and pricing decision in a three-level supply chain with probabilistic demand. They introduced one integrated and three non-integrated policies, and obtain the conditions for existence of optimal solution. Yadav and Agrawal (2020) analyzed a single manufacturer multiple buyers model where demand is price-sensitive to each buyer. They suggested how to react to a certain change in some parameter to determine the right inventory policy.

In the supply chain management literature, sales effort has been used to influence the market demand. For a supply chain where demand is influenced by the retailer’s sales effort, Taylor (2002) developed a composite contract combining target sales rebate and buyback contracts to achieve coordination. Xiao et al. (2005) analyzed a model with two competing retailers who can choose to invest in sales effort to influence the demand. They examined how the price subsidy rate contract can achieve supply chain coordination. He et al. (2006) exhibited that the coordination and win-win outcome may be achieved by an augmented revenue-sharing contract based on sales rebate and penalty under effort-dependent stochastic demand. He et al. (2009) further investigated a two-echelon supply chain facing stochastic demand which is sensitive to both retail price and sales effort, and showed that although the buyback contract can’t achieve channel coordination, a properly designed composite contract is able to achieve this. Zha et al. (2015) studied the coordination of a supply chain with an effort-induced demand function under Stackelberg game strategy, and showed that a cost sharing contract can coordinate the supply chain. Yan and He (2019) examined effectiveness of cooperative advertising policy in a two-period supply chain structure in apparel industries in which the retailer provides a price discount offer in the second period. They determined the optimal product quantity, advertising efforts and pricing decision in both the integrated as well as decentralized scenarios with a cooperative advertising. The present paper extends the newsvendor model by incorporating a raw material supplier in the chain and assuming that the production stages of the raw material and the final product are subject to random yield.

2.2 Random yield and emergency resource

Production yield uncertainty is an increasing issue in many industries. Dada et al. (2007) proposed an extension to the newsvendor model served by multiple suppliers where a supplier is either reliable or suffering from yield randomness, having uncertainty in both the amount and per unit cost of product, and showed that a given supplier will be selected only if all less expensive suppliers are selected regardless of the given supplier’s reliability level. Xu (2010) studied the managerial problem regarding production and procurement in a newsvendor model, and showed that the partners within the channel are better off in the presence of option contract, where the manufacturer can either purchase option contract from a supplier before the demand is realized, or place an instant order at an uncertain price after the demand is realized under stochastic demand and random production yield. Choi et al. (2017) offered a concise review of many uncertainty factors related to supply chain, and characterised the works according to an innovative optimization model with various uncertainty factors. Considering a single supplier facing random yield and multiple downstream retailers dealing with random demands, He et al. (2019) presented several analytical models under a game structure in order to investigate the supply risk sharing mechanism within the supply chain. Karim and Nakade (2019) developed a production-inventory model in which production is subject to random disruption. They found that the incorporation of safety stock helps the system to mitigate the risk of production uncertainty. Voelkel et al. (2020) modeled a dynamic programming problem with stochastic demand, tracking cost, and random yield, and provided an adjusted value iteration algorithm that finds the optimal solution.

Emergency resource as a tool to mitigate random yield risk has been designed by several researchers. Parlar and Wang (1993) were the first to demonstrate the benefits of emergency sourcing in presence of supply uncertainty for both the EOQ model and the newsvendor model. Kazaz (2004) examined production planning and resource ordering for an olive oil producer who experiences both uncertain demand as well as random yield in production, and showed that the optimal amount of production decreases under the presence of an emergency resource, where both the sales price and the purchasing cost depend on production yield. Chopra et al. (2007) developed a single-period model with dual sourcing to integrate two types of supply uncertainty—supply disruption and random yield. Arcelus et al. (2008) developed a newsvendor model where the manufacturer shares the risk of demand uncertainty with the retailer by offering buyback contract, and mitigated his own risk by the availability of the secondary resource. He and Zhang (2008) studied the effect of random yield in a two-echelon decentralized supply chain under different risk sharing contracts, which was further extended by He and Zhang (2010) by considering the effect of secondary market on the supply chain. Giri and Bardhan (2014) addressed the problem of determining optimal order and reserve quantities at a primary supplier and a secondary supplier, respectively, where the primary supplier is prone to disruption. The work was further extended by Giri and Bardhan (2015) to incorporate random yield in production of the primary supplier.

2.3 Contracts and supply chain coordination

Due to marginalization phenomenon, supply chain members realize that collaboration is critical when they seek to maximize their own profits individually. Various types of contract agreement for supply chain coordination have been discussed in the literature. Extensive reviews of supply chain contracts and coordination literature can be found in Lariviere (1999), Tsay et al. (1998) and Cachon (2003). Cachon and Lariviere (2005) showed that the revenue sharing contract is very effective for a wide range of supply chain coordination to align the individual member’s objective with the system objective, despite certain limitations. They also compared revenue sharing contract with other popular contracts and found that revenue sharing is equivalent to buyback in newsvendor case, and equivalent to price discount in the price-setting newsvendor case. Wang and Webster (2007) considered a two-echelon supply chain with a risk-neutral manufacturer and a loss-averse retailer, and introduced a new contract combining gain/loss sharing and buyback (GLB) which coordinated the supply chain successfully and could arbitrarily allocate the expected profit. Jaber and Goyal (2008) investigated the coordination of order quantities amongst the members in a three-level supply chain assuming multiple buyers at the first level, a single vendor at the second level, and multiple suppliers at the third level. Ding and Chen (2008) imposed return policies between each pair of adjacent members in a three-echelon supply chain, and established that the multi-echelon supply chain can be fully coordinated with the above contract with arbitrary profit allocation among the members. Zhao and Zhu (2017) looked at different performances of wholesale pricing and the revenue-sharing contract under various reverse logistics linkages. This analysis takes into account two forms of uncertainty, namely, the random rate of remanufacturing of used items and the stochastic demand of remanufactured goods. Li et al. (2020) developed a two-level supply chain where the demand and the price of the product are both uncertain. They proposed two contracts, namely, capacity reservation contract and quantity flexibility contract to improve the overall performance of the supply chain. He and Zhao (2012) investigated the issue of channel coordination for a multi-echelon supply chain facing uncertain demand and uncertain production of the raw-material supplier. However, they assumed production of the manufacturer to be deterministic which was later generalized by Giri et al. (2016) who allowed the production of the manufacturer to be subject to random yield. To get rid of these production uncertainties, they access an emergency resource of the final product. However, the existence of emergency resource of the final product is not always feasible due to brand image of the manufacturer for his/her specific configuration or feature. The non-existence of emergency resource for the final product adds one more dimension to the relation among the members of a multi-echelon supply chain and highlights the necessity of coordination. Table 1 indicates the key features of significant research studies in the related field and our study’s position among the current ones.

The present work enriches the existing supply chain literature by generalizing the perfect production yield case and considering a stochastic demand to be dependent on both retail price and sales-effort. It explores how the proposed multi-echelon supply chain can be coordinated by designing a contract mechanism when the production stages of the raw material and the final product are subject to random yield, and the later one cannot access an emergency resource to mitigate the risk of production uncertainty.

3 Model assumptions and notations

Most of the assumptions of this paper are borrowed from Giri et al. (2016). The proposed model is developed for trading short life-cycle products such as personal computers, electronic or fashionable goods, etc. Since the product life cycle is short, only one-time order is considered. All the entities, namely, the supplier, the manufacturer and the retailer involved in the supply chain are assumed to be risk-neutral, and there is no information asymmetry among them. In view of various uncertainties related to weather, environment, availability of skilled labor, product quality, transportation, etc, it is assumed that productions of the raw materials and the finished goods are subject to random yield. The supplier can mitigate the risk of uncertainty in production by using a secondary market. Similarly, the retailer can access a secondary market for selling the leftover products at a lower price. However, the availability of secondary market at the manufacturer level has been debarred here, which is justified from the perspective of brand value or quality issue of the product produced by the manufacturer. Following He et al. (2009), the market demand is assumed to be stochastic but sensitive to both retail price and sales effort. The random demand is assumed to be of the form \(D=\gamma (p,e)+x\), where \(\gamma (p,e)=\alpha -\beta p+ke\), \(\alpha ,\beta ,k>0\), showing that the actual demand is linear in its deterministic and stochastic components; \(\beta \) and k denote price and sales effort sensitivity parameters, respectively; \(\alpha \) is the base demand, and x denotes a particular value of the random variable X. The notations used in the paper are provided in the following table. More notations will be defined as and when needed.

The sequence of events is as follows:

-

Firstly the retailer forecasts the market demand D, and negotiates his trade contract with the manufacturer, by placing an order of Q units to the manufacturer.

-

The manufacturer negotiates another trade contract with the supplier and passes the order to the supplier. Without loss of generality, we assume that one unit of the final product can be produced from one unit of the raw material.

-

After receiving the order quantity Q, the raw-material supplier decides his optimal production quantity R, and starts production. The produced amount is zR, where z is a particular value of the random variable Z. If the actual production quantity of the supplier is less than the amount ordered, he buys the difference from the secondary market to fulfill the order; if it is more, the excess amount is salvaged at a lower rate.

-

After receiving Q units of raw material from the supplier, the manufacturer starts production. The production output is yQ, y being a particular value of the random variable Y. If the produced amount is less than the amount ordered by the retailer, the manufacturer can’t buy the difference from the market due to non-availability of secondary resource of the final product.

-

The retailer receives yQ units of the final product. If the demand is less than the on-hand inventory, the excess amount is salvaged; otherwise, the shortage incurs a cost.

In order to avoid trivial cases, we assume the following:

(i) \(v_s<c_s<w_s\), in order to prevent the supplier from producing an infinitely large quantity, and ensure positive profit, (ii) \(w_s+c_m<w_m\) and \(w_s<c_s^{\prime }\), in order to ensure that the manufacturer makes positive profit and does not buy raw materials from the secondary market directly, (iii) \(v<w_m<p\), in order to ensure that the retailer participates in the business, and does not order infinitely large quantity, (iv) \(v<(w_s+c_m)/\bar{y}\), in order to confirm that the salvage value is less than the expected unit production cost of the final product, (v) \(p>c_s/\bar{z}+c_m/\bar{y}\), i.e., retailer’s unit selling price is higher than the expected unit cost of the product. (vi) All the density functions are strictly positive (\(f>0, g>0, h>0\)) and all the probability density functions (f, g, h) along with cumulative density functions (F, G, H) are continuous on their respective domains.

We now formulate the proposed model based on the above assumptions. Let S(Q, p, e) be the expected sales volume which can be expressed as

Using the identity \((a-b)^{+}=a-\min \{a,b\}\), the expected leftover inventory I(Q, p, e) can be written in terms of the expected sales as

The expected lost sales L(Q, p, e) can be written as

4 Centralized model—The Benchmark Case

To establish a performance benchmark, we first analyze the integrated supply chain model, i.e., the centralized model. In this model, conceptually there is only one central decision maker for the whole supply chain. Here, the wholesale price(s) charged by the upstream member(s) to the downstream member(s) may be seen as internal revenue transfer, which will not influence the supply chain performance as a whole. We assume that all the residual products are salvaged and unmet demands are lost. The expected profit of the entire supply chain can then be expressed as

where \(a^{+}=a\) if \(a\ge 0\) and 0 if \(a<0\). The first two terms denote revenues earned by selling the final product at the primary and the secondary markets, respectively; the third term indicates the cost for lost sales; the fourth and the fifth terms represent the costs for production of the finished product and the raw material, respectively; the sixth term designates the cost for buying the raw materials from the secondary market; the seventh term resents the revenue generated from selling excess raw materials at the secondary market, and the last term indicates the cost associated with sales effort.

We then have an equivalent representation of the entire supply chain’s expected profit function as given below:

As observed by Petruzzi and Dada (1999), for a price setting newsvendor problem (PSNP) containing multiple decisions variables in its’ objective function, it is often difficult to show the joint concavity of the objective function in all of its decisions variables. In the literature (for instance, Wang et al. 2020), it is a common approach to use a repetitive method to show the objective function’s concavity. In the present article, the objective function of the centralized system consists of four decision variables and the exact methods cannot be applied to obtain the optimal solution. So we apply a repetitive method. Let us assume that a finite but not necessarily unique optimal decision set \((R^{c},Q^{c},p^{c},e^{c})\) exists for the centralized model. The first order partial derivatives of \(\Pi _c(R,Q,p,e)\) with respect to each of the decision variables are as follows:

It is easy to observe that for given p and e, \(\dfrac{\partial ^2 \Pi _c(R,Q,p,e)}{\partial Q^2} =-\dfrac{(c_s^{\prime }-v_s)}{R} h\Big (\dfrac{Q}{R}\Big )- (p+g_r-v) \times \int _c^{d}y^2 f(yQ-\gamma (p,e))g(y)dy < 0\) since \((c_s^{\prime }-v_s)> 0 \) from assumptions (i) and (ii); \(p>v\) i.e., \((p+g_r-v)>0 \) from assumption (iii); f, g, and h are strictly positive from assumption (vi); \(\dfrac{\partial ^2 \Pi _c(R,Q,p,e)}{\partial Q \partial R} =\dfrac{\partial ^2 \Pi _c(R,Q,p,e)}{\partial R \partial Q} = (c_s^{\prime } -v_s)h(Q/R) \dfrac{Q}{R^2}>0\) since \((c_s^{\prime }- v_s)> 0\), \(h>0\) and Q and R are strictly positive decision variables; \(\dfrac{\partial ^2 \Pi _c(R,Q,p,e)}{ \partial R^2} =-(c_s^{\prime }-v_s)\dfrac{Q^2}{R^3} h\Big (\dfrac{Q}{R}\Big )<0 \). So from the Hessian matrix

we deduce \(|H_1|<0\) and \(|H_2|=(c_s^{\prime }-v_s)\dfrac{Q^2}{R^3} h\Big (\dfrac{Q}{R}\Big )(p+ g_r-v)\int _c^{d}y^2 f(yQ-\gamma (p,e))g(y)dy>0\). This leads to the following proposition.

Proposition 1

For given p and e, \(\Pi _c(R,Q,p,e)\) is jointly concave in R and Q, and the optimal values \(Q^{c}\) and \(R^{c}\) satisfy the equations

Again for given R and Q, \(\dfrac{\partial ^2 \Pi _c(R,Q,p,e)}{\partial p^2} = (-2\beta -\beta ^2 (p+g_r-v)) \int _c^{d} f(yQ-\gamma (p,e))g(y)dy < 0\) since \(\beta >0\), \(p>v\) i.e., \((p+g_r-v)>0 \) from assumption (iii); f and g are strictly positive from assumption (vi); \(\dfrac{\partial ^2 \Pi _c(R,Q,p,e)}{\partial p \partial e} =\dfrac{\partial ^2 \Pi _c(R,Q,p,e)}{\partial e \partial p} = k\int _c^{d}\int _l^{yQ-\gamma (p,e)} f(x)g(y)dx dy+k \beta (p+g_r-v) \int _c^{d} f(yQ-\gamma (p,e))g(y)dy>0\), and \(\dfrac{\partial ^2 \Pi _c(R,Q,p,e)}{ \partial e^2} =k^2 (p+g_r-v) \int _c^{d} f(yQ-\gamma (p,e))g(y)dy-\mu <0\). Therefore, from the Hessian matrix

we deduce \(|H_1|<0\) and \(|H_2|=2\beta \mu \int _c^{d}\int _l^{yQ-\gamma (p,e)} f(x)g(y)dx dy-k^2 (\int _c^{d}\int _l^{yQ-\gamma (p,e)} f(x)g(y)dxdy)^2 +\beta ^2 \mu (p+g_r-v) \int _c^{d} f(yQ-\gamma (p,e))g(y)dy\). This leads to the following proposition.

Proposition 2

For given R and Q, if \(2\beta \mu \int _c^{d}\int _l^{yQ-\gamma (p,e)} f(x)g(y)dx dy +\beta ^2 \mu (p+g_r-v) \int _c^{d} f(yQ-\gamma (p,e))g(y)dy > k^2 (\int _c^{d}\int _l^{yQ-\gamma (p,e)} f(x)g(y)dxdy)^2\), then \(\Pi _c(R,Q,p,e)\) is jointly concave in p and e, and the optimal values \(p^{c}\) and \(e^{c}\) satisfy the equations

Observation

Since \(\gamma (p,e)=\alpha -\beta p+ke\), therefore, from (8) and (1) we have \(\dfrac{\partial S(R,Q,p,e)}{\partial p}<0\), indicating that the expected sales quantity reduces with higher retail price, and from (9) and (1) we have \(\dfrac{\partial S(R,Q,p,e)}{\partial e}>0\), indicating that a higher sales effort boosts the expected sales quantity. Putting the optimal values in (5), the maximum expected profit of the integrated supply chain is obtained as

5 Decentralized model with wholesale price-only contract

In this section, we analyze the supply chain dynamics under wholesale price only contract scenario. Although the centralized model provides the best performance of the supply chain, it is a conceptual benchmark, whereas the decentralized system is more practical and commonly used in real business scenario. Under decentralized setting, all the supply chain members are assumed as independent decision makers, and they negotiate certain contracts specifying money and products transfer. All the firms are risk neutral, so that each of them chooses the best decision to maximize its own expected profit, resulting in possible deviation from the optimal solution obtained under centralized setting. Under this strategy, the sequence of events is as follows:

First, the raw-material supplier declares his own wholesale price to the manufacturer for the coming selling season. The manufacturer in turn determines his wholesale price and offers it to the retailer. If the retailer accepts this price, he then determines retail price, sales effort, and order quantity simultaneously, and places order at the manufacturer after forecasting the market demand. The manufacturer passes the same amount of order to the supplier, as he does not want to take any risk of overproduction. Receiving the order from the manufacturer, the raw-material supplier plans his production quantity and starts production. As there is yield uncertainty associated with raw material production, the supplier might choose a larger production quantity to fulfill the manufacturer’s order; otherwise, he has to buy the shortfall quantity from the secondary market at a higher price to deliver the order. Clearly, the manufacturer forces the supplier to bear the random yield risk alone. After receiving the ordered amount from the raw-material supplier, the manufacturer produces the final product and delivers a shipment at most equal to the order quantity of the retailer, by which the manufacturer forces the retailer to bear the risk of his production yield.

For any \(R>0\), we define \(\Pi _r(Q,p,e)\) as the expected profit of the retailer, given by

The triplet \((Q^{d},p^{d},e^{d})\), i.e., the optimal order quantity, retail price and effort level for the retailer can be derived from the following equations (derived from the first order optimality conditions):

Property 1

As p increases and \(w_m\) decreases, the retailer’s order quantity Q increases and vice versa.

Let \(\Pi _m\) be the expected profit of the manufacturer. Then

For given values of the retailer’s decision variables, the expected profit of the raw-material supplier is

The following proposition determines the supplier’s optimal production quantity and it’s relation with the retailer’s ordered quantity.

Proposition 3

-

(i)

The supplier’s expected profit is concave in R, and the optimal production quantity \(R^{d}\) satisfies the equation \(\int _a^{Q/R}zh(z)dz=\frac{c_s-v_s\bar{z}}{(c_s^{\prime }-v_s)}\).

-

(ii)

\(R^d(Q)=K_1Q\), where \(K_1(>0)\) is a constant.

Proof

(i) From (20) we have \(\frac{\partial ^2 \Pi _s(R)}{ \partial R^2} =-(c_s^{\prime }-v_s)\frac{Q^2}{R^3} H\Big (\frac{Q}{R}\Big )<0 \) since \((c_s^{\prime }- v_s)> 0\) from assumptions (i) and (ii); \(H>0\) from assumption (vi), and Q and R are strictly positive decision variables, exhibiting \(\Pi _s(R)\) to be concave in R. Also, the first order optimality condition gives

(ii) The result follows from the fact that \(K(x)=\int _0^{x}h(t)tdt\) is increasing in x for all x.

Proposition 3(i) shows that the relationship between \(R^{d}\) and \(Q^{d}\) depends only on the parameters associated with the supplier’s production and it’s random yield distribution. Moreover, the supplier’s production decision is a linear function of the retailer’s ordered quantity. Simple calculation shows that the linear coefficient \(K_1\) is influenced positively by \(c_s^{\prime }\) and negatively by \(c_s\); hence, for higher unit raw material procurement cost at the secondary market, the supplier is inclined to produce more quantity, but for higher unit production cost, the supplier produces lesser quantity, which are quite natural in real market scenario. However, the relationship between \(K_1\) and \(v_s\) is not so straightforward, and elementary calculus exhibits that \(K_1\) increases with \(v_s\) when \(\bar{z} > \frac{c_s}{c_s^{\prime }}\), and decreases with \(v_s\) when \(\bar{z} < \frac{c_s}{c_s^{\prime }}\). From managerial point of view, one can apprehend that when the expected yield is sufficiently low, a higher salvage value would result in lower production, since an extra production would incur an extra loss in addition to the extra cost already present due to lower average yield. After putting the optimal production decision from proposition 3, the profit of the supplier reduces to

Here we assume that contract prices are negotiated based on the firm’s bargaining power, keeping the profit margin above a desired level of acceptance in the decentralized setting. \(\square \)

Proposition 4

The retailer’s order quantity, the supplier’s production decision, and the total supply chain’s profit under wholesale price only contract are less than their counterparts in the integrated supply chain.

Proof

For reasonable wholesale prices offered by the supplier and the manufacturer, the relations \(w_s> v_s+(c_s^{\prime }-v_s)H\Big (\frac{Q}{R}\Big )Q\) and \(w_m>\frac{c_m+w_s}{\bar{y}}\) must hold simultaneously so as to keep profit margins positive. We have to show \(Q^{d}<Q^{c}\); however, no explicit form for \(Q^{d}\) or \(Q^{c}\) can be derived. As \(K(Q)=\int _c^{d}\int _l^{yQ-\gamma (p,e)}y f(x)g(y)dx dy\) is strictly increasing in Q, it is sufficient to show \(K(Q^{d})<K(Q^{c})\) in order to establish that \(Q^{d}<Q^{c}\). Now, we have \(w_m\bar{y}>c_m+w_s>v_s+c_m+(c_s^{\prime }-v_s)H\Big (\frac{Q}{R}\Big )\).

So, \(\dfrac{(p+g_r)\bar{y}-w_m\bar{y}}{p+g_r-v}<\dfrac{(p+g_r)\bar{y}-(v_s+c_m)-(c_s^{\prime }-v_s)H\Big (\frac{Q}{R}\Big )}{p+g_r-v}\), i.e., \(K(Q^{d})<K(Q^{c})\), implying that \(Q^{d}<Q^{c}\).

Also, we have \(\frac{Q^{d}}{R^{d}}=\frac{Q^{c}}{R^{c}}\) which implies that \(R^{d}<R^{c}\). It is now easy to verify that \(\Pi _c(R^{c},Q^{c},p^{c},e^{c})>\Pi _d(R^{d}Q^{d},p^{d},e^{d})\), where \(\Pi _d\) stands for total channel profit under price only contract.

Proposition 4 is a generalization of the result for the two-level supply chain, showing that the decentralized channel can’t reach the maximum efficiency level in terms of generating profit, even if all entities maximize their own expected profits. As coined by He and Zhao (2012), such phenomenon is known as multiple marginalization. Both the supplier’s and the manufacturer’s individual pricing policies are the reason behind system inefficiency. To overcome such sub-optimization, contract mechanisms come into play.

6 Coordination contracts

A contract is said to \(\textit{coordinate}\) the supply chain if the sum of profits of all members of the decentralized supply chain under the contract is equal to the profit of the centralized system. Besides coordination, another desirable feature of a contract mechanism is win-win outcome, where each participating firm’s profit is strictly better off under that contract compared to the wholesale price contract scenario as discussed in Sect. 5. However, as pointed out by Cachon (2003), implementation of a contract in practice is also an important feature; if adopting a fruitful contract becomes costlier to administer, the contract designer may prefer to design a simpler but leaser effective one.

6.1 Buyback contract with revenue sharing contract

Some difficulties arise while implementing a traditional contract in a multi-level supply chain. One of the major difficulties occurs when contracts are offered level-by-level from the up-stream entities to the down-stream partners. Since the contract parameters between a pair of adjacent entities depend on the contract parameters between the next adjacent pair, the contract designers may not be able to precisely anticipate the next pair’s contract parameters. Another difficulty is simultaneous installation of the contract. As observed by Van der Rhee et al. (2010), if the contracts are not installed simultaneously, situations may arise where one party may earn benefit without signing the agreement while others have already signed; hence some parties may choose to wait for others’ participation in the contract. Unfortunately, if each party chooses to wait for others’ move, the coordination can never be established in a multi-echelon supply chain.

To overcome the above mentioned obstacles, following the idea provided by Van der Rhee et al. (2010), we choose the manufacturer to be in the leading role in installing the contract, since he has significant market power over both the raw-material supplier and the retailer due to its market base and popularity among the customers through it’s brand name, justifying the existence of a manufacturer dominated supply chain. As mentioned by Guler and Bilgiç (2009), automotive industries are prototype examples of manufacturer dominated supply chain. Since the retailer has private information about the customer demand, and he deals with demand as well as supply uncertainties simultaneously, it appears realistic for the manufacturer to negotiate with the retailer first, and then with the supplier for terms of trade contract. We consider that the manufacturer first offers a buyback contract to the retailer and then a revenue sharing contract to the supplier. Under buyback contract, the manufacturer offers a per unit buyback price b (\(v<b<w_m\)) to the retailer for every unit of unsold product at the end of the selling season. Clearly, the manufacturer shares the cost incurred by the retailer due to over-stocking. Under a revenue sharing contract, the manufacturer keeps a fraction \(\phi \) of his total revenue for himself, and shares the rest with the supplier; in turn, the supplier reduces per unit wholesale price.

Under this setting, the retailer’s expected profit is given by

If the above contract coordinates the supply chain then the optimal decisions of the retailer would be same as those obtained in the centralized setting. From the first order conditions for optimality of the retailer’s profit function with respect to Q, p and e, we get

Comparing (24) with (6), (25) with (8) and (26) with (9), we find that when \(b=v\) and \(w_{m}=[c_{m}+h_{s}+(p_{s}-h_{s})H(Q/R)]/\bar{y}\), the manufacturer’s pricing strategy will be able to align the retailer’s ordering, pricing, and effort decisions with the centralized system i.e., \(Q^{c}=Q^{*}\), \(p^{c}=p^{*}\) and \(e^{c}=e^{*}\). Putting the values of the buyback price \(b=v\) and wholesale price \(w_{m}\) in (23), the retailer’s expected profit is seen to be equal to the expected total channel profit under the centralized setting, leaving other channel members at zero profit margin. This leads to the results given in Proposition 5. \(\square \)

Proposition 5

A composite contract having buyback between the retailer and the manufacturer as a component with any other contract between the supplier and the manufacturer fails to achieve win-win outcome for all the members.

6.2 Contingent buyback with SRP contract and revenue sharing contract

Now, we turn to the case where the manufacturer offers a target sales rebate and penalty (SRP) contract, in addition to contingent buyback policy with the retailer by setting the rules of pricing while postponing the determination of the final contract prices between them. In an SRP contract, the manufacturer sets up a sales target \(Q_0\) in front of the retailer. If the retailer’s sales quantity is beyond the target then he will enjoy a per unit rebate \(\tau \) for sold products beyond \(Q_0\); otherwise, the retailer has to pay a penalty \(\tau \) to the manufacturer for each unit of unsold products below the target. Using this contract, the manufacturer influences the retailer to sell more, which in turn enhances the retailer’s sales effort level and order quantity. Under this setting, the retailer’s profit is given by

The optimal order quantity \(Q_{r}^{*}\), retail price \(p^{*}\), and sales effort level \(e^{*}\) for the retailer under this setting are obtained from the first order optimality conditions as

The combined profit of the retailer and the manufacturer is

Hence, the optimal order quantity \(Q_{mr}^{*}\) for the total profit of the retailer and the manufacturer satisfies the following equation:

Although the manufacturer has random yield in production, the final order quantity of the sub-supply chain is same as that ordered by the retailer, since there is no incentive for the manufacturer to bear the risk of over-production. In order to achieve full coordination between the manufacturer and the retailer, the relation \(Q_{mr}^*=Q_r^*\) must hold. Comparing (28) with (32), we have that the optimal order quantity of the retailer and the joint order quantity of the retailer and the manufacturer are same when the optimal contract parameters are as follows:

From (34), it is easy to derive that \(w_s<w_m\), since \(\bar{y}<1\), as expected.

Next, we assume that the manufacturer offers a revenue sharing contract to the supplier, in response to which the supplier charges a lower wholesale price to the manufacturer at the beginning of the period, and receives a fraction of the revenue earned by the manufacturer at the end of the selling season. The expected profit of the manufacturer under the transfer payment with the retailer and the supplier is given by

Also, the supplier’s expected profit can be expressed as

Proposition 6

-

(i)

The optimal solution \(R^{*}\) for the supplier satisfies the equation

$$\begin{aligned} \int _a^{Q/R^{*}}zh(z)dz=\dfrac{c_{s}-v_s\bar{z}}{(c_s^{\prime }-v_s)} \end{aligned}$$(37) -

(ii)

\(R^{*}\) (Q) = \(K_2\) Q where \(K_2\) is a constant.

Proof

The proof is omitted as it is similar to that of Proposition 3.

The proposed composite contract works as follows. By contingent buyback policy with SRP, we set the rule of pricing while postponing the determination of the final contract prices (e.g., wholesale price, sales rebate and penalty) and the sales target, as the trade contract between the supplier and the manufacturer is yet to be finalized. Once the exact contract parameters are settled between the upstream members, the retailer and the manufacturer would decide their final contract parameters, according to the rule of pricing such that they would be able to secure their own profit shares in presence of the contract signed between the upstream members. In order to achieve supply chain coordination, the manufacturer’s composite contract policy (contingent buyback with SRP for retailer and revenue sharing for supplier) can be used to convince the retailer to order and the supplier to produce up to the quantity of the centralized supply chain. Comparing (28) with (10), (37) with (11), (29) with (12) and (30) with (13), we find that when the conditions (33), (34) and

hold, we have \(R^*=R^c\), \(Q_r^*=Q^c\), \(p^*=p^c\), and \(e^*=e^c\). This leads to the following Proposition 7. \(\square \)

Proposition 7

The contingent buyback contract with target sales rebate and penalty between the retailer and the manufacturer, and a revenue sharing contract between the manufacturer and the supplier with contract parameters satisfying (33), (34), and (38) can fully coordinate the supply chain, and profits may be allocated arbitrarily by varying \(\phi \), \(\tau \), and \(Q_0\).

Equation (33) gives \(b=v+\tau <\tau +(w_{s}+c_{m})/\bar{y}=w_{m}\), suggesting that a \((w_{m},b,Q_{0},\tau )\) contingent buyback scheme with SRP prevents the retailer from earning profit by over-ordering. Equation (34) implies that, in the \((w_{s},\phi )\) revenue sharing scheme, the wholesale price for raw material depends only on the prices of raw material at the secondary market and the production yield of the raw material. This feature of the \((w_{s},\phi )\) revenue sharing scheme is unique and presents an interesting implementation challenge. We would have rather expected the wholesale price of raw material (\(w_s\)) to depend on raw material production cost \((c_{s})\) and revenue sharing parameter \((\phi )\), as suggested in the existing literature. In addition, when (34) holds, there exists possibility for the supplier to cheat the manufacturer by claiming enhanced \(c_s^{\prime }\) and reduced \(v_s\) which would result in coordination failure. Successful coordination between the supplier and the manufacturer therefore needs an additional mechanism of information sharing regarding production yield and emergency resource’s prices.

Under the \((w_{m},b,Q_{0},\tau )\) contingent buyback contract with SRP, the retailer is incentivised to sell a product at a retail price even lower than the wholesale price charged by the manufacturer when his actual sale leaves the sales target behind, since selling a product beyond the sales target allows the retailer to earn a per unit profit margin \(p-w_{m}+\tau \), i.e., for a positive profit margin, \(p>w_{m}-\tau \). It is therefore deduced that after reaching the sales target, the retailer may reduce the retail price even lesser than his purchasing cost to influence the market demand, and secure profit when \(p>(w_{s}+c_{m})/\bar{y}\). When the retailer’s actual sale is below the sales target, even then the retailer is incentivised to enhance sales effort rather than claiming credit for the unsold product from the manufacturer, since selling a product allows him to earn a per unit margin \(p-w_{m}\), while buyback gives him a per unit margin \(b-w_{m}-\tau = v-\tau -(w_{s}+c_{m})/\bar{y}\) which is always negative. Thus the retailer may sell a product at a retail price \(p>w_{m}\) with a positive profit margin or may even reduce retail price to influence the market demand with \(p>v-\tau -(w_{s}+c_{m})/\bar{y}\) instead of clamming buyback credit and it is quite easy for the retailer to sell at this retail price which is lesser than it’s salvage value. In either way, the incentive of the retailer is to sell the products directly at the market.

However, it is still possible for the supplier to earn more profit by claiming fabricated values of \(c_s^{\prime }\) and \(v_s\). For successful supply chain coordination, the manufacturer therefore requires to monitor the raw material production process and verify the prices of raw material at the secondary market. Although the retailer has no such incentive to earn profit by labelling the leftover inventories as sold out products or vice versa, the manufacturer does possess information regarding salvage value of the product, since he himself sells leftover inventories there. To sum up, the manufacturer must be the dominant party and possess full control over the dynamics of the entire chain, as well as must have access to each and every information related to supply chain functioning and implementation of the contract.

Proposition 8

For a given target sales rebate, if the purchasing price of the raw material at the secondary market increases, the supplier should raise both wholesale price and planed production quantity of raw material and the manufacturer should raise wholesale price whereas the retailer should cut off his order quantity with higher retail price and lower sales effort.

Under the composite contract, the supplier’s optimal wholesale price is independent of the production cost \((c_{s})\). The supplier is incentivised to produce raw material instead of buying from the secondary market because if all the raw materials are brought from the secondary market, his expected profit would be \(\{(1-\phi )w_{m}\bar{y}+(w_s-c_s^{\prime })\}Q\), where the second term is always negative, and consequently his profit would fall down.

We find that the behavioral implications of the composite contract are very much aligned with the manufacturer’s objectives. Further, we have the following observations:

-

The supplier is motivated to produce raw material on his own instead of mitigating the gap using the secondary market.

-

The manufacturer should be dominant enough to have full control over the entire chain.

-

The retailer is motivated to sell a product with a higher sales effort.

6.3 Implementation of coordination contract

For other contract parameters settled, the manufacturer ensures profit margin at least equal to that obtained in the price only scenario by setting \(Q_0\ge [(w_{m}\bar{y}-c_{m}-w_{s})Q^{d}+(1-\phi )w_{mb}\bar{y}Q^{*}]/(b-v)\). For the manufacturer to earn maximum profit, leaving the profits of all other entities same as those obtained in price only contract scenario, \(Q_0\) should be set as \(Q_0=\) \([\Pi _b-\Pi _r-\Pi _s+(1-\phi )w_{mb}\bar{y}Q^*]/(b-v)\), providing the upper limit of \(Q_0\). We conclude that there exists a range of sales target \((Q_{0})\) for every combination of \(\tau \) and \(\phi \) for which the composite contract ensures win-win situation for all the chain members. Clearly, the sales target \(Q_0\) set by the manufacturer depends on the relative bargaining power of the manufacturer and the retailer. The manufacturer, being more powerful, wants to ensure that the retailer earns a desirable enough profit to induce him to accept coordination policy, and capture excess profit by himself through coordination. However, since the retailer has the power of setting the order quantity, retail price and sales effort simultaneously, the manufacturer can’t force the retailer for a higher sales target if he wants the retailer to set order quantity, retail price and sales effort to remain same as those in the integrated supply chain. Otherwise, if the manufacturer becomes indifferent about the retailer’s power and sets a higher sales target in front of the retailer, the retailer will reduce both order quantity and sales effort and rise retail price, resulting in coordination failure. Therefore, the manufacturer should choose a set of actions \((w_{s},\phi )\) for the supplier and a set of actions \((w_{m},b,Q_{0},\tau )\) for the retailer, which satisfy the relations (33), (34), and (38), in order to coordinate the supply chain and share the additional profit that accrued through supply chain coordination.

6.4 Difficulties of other contracts that coordinate the supply chain

We have shown that supply chain coordination is achieved when the manufacturer sets a wholesale price \(w_{m}=[c_{m}+h_{s}+(p_{s}-h_{s})H(Q/R)]/\bar{y}\), although the entire supply chain profit is bagged by the retailer. A two-part tariff contract with this wholesale price can also achieve supply chain coordination and allocate the channel profit among the chain members. Under a two-part tariff contract, the manufacturer charges a per unit fee along with a fixed sum as a stocking or licensing fee. The two-part tariff contract has been extensively discussed by Moorthy (1987) and Coughlan and Wernerfelt (1989) who have shown its effectiveness in a manufacturer-controlled supply chain. However, this contract theoretically allows the manufacturer to arbitrarily claim profit for himself. In the current scenario, as the retailer retains the power to control the retail price and the sales effort to influence the market demand, charging a high fixed fee to him might result in difficulty in implementing such a contract. Furthermore, since the manufacturer is well informed about the retailer’s power to influence the market demand, the two-part tariff contract is not profitable for the chain members. Since it is impossible to forecast accurately the customer demand, setting the fixed fee without knowing the actual sale, could leave the retailer unprofitable. Similarly, when the retailer tries to raise the retail price and reduce the order quantity, the manufacturer can’t anticipate preciously how to react against this. So, a two-part tariff contract with a wholesale price at marginal cost of the manufacturer leaves the manufacturer at worse off.

Cachon and Lariviere (2005) showed that a price-discount sharing contract is effective in the price setting newsvendor case. For successful implementation of the contract, they assumed that the retailer has computer and bar code system to track each sale. So it should not be difficult for the manufacturer to monitor his clients. However, a retailer or a raw-material supplier may not agree with such agrement all the time, since the extra investment in installing those technologies would incur extra cost. Our proposed composite contract requires no special monitoring because the supplier must submit the secondary market’s documents in revenue sharing contract. Moreover, the manufacturer need not bother about the cost to exert sales effort, since he is not sharing any part of it in any way.

7 Numerical illustration

A numerical study is provided to further illustrate the developed model. The random demand is assumed to be of the form \(D=\gamma (p,e)+x\), where \(\gamma (p,e)=\alpha -\beta p+ke\), \(\alpha ,\beta ,k>0\), showing that the actual demand is linear in its deterministic and stochastic components; \(\alpha \) is the base demand; \(\beta \) and k denote price and sales effort sensitivity parameters, respectively; x is a particular value of the random variable X defined in Notations. As proposed by He et al. (2009), the retailer’s cost to exert sales effort level e is assumed to be a convex function of e, specified by \(J(e)=\mu \frac{e^{2}}{2}\), where \(\mu \) is a parameter representing sales effort cost sensitivity. Following Giri et al. (2016), the parameter-values are set as follows: \(v=4\), \(c_m=1\), \(c_s=2.5\), \(v_s=1\), \(c_s^{\prime }=7\). Productions of the raw-material supplier as well as the manufacturer are assumed to follow uniform distributions with means and standard deviations (\(\bar{z}=0.7\), \(\sigma _z=0.1\)), and (\(\bar{y}=0.8\), \(\sigma _y=0.05\)), respectively. In view of the assumptions and optimality conditions provided in Sect. 3, we further choose remaining parameter-values as: \(g_r=9.5\), \(\alpha =700\), \(\mu =1.5\), \(\beta =25\), \(k=2\), \(Q_{0}=580\), \(\tau =5\), \(\phi =0.7\) in appropriate units. The stochastic factor x of the market demand is uniformly distributed with mean \(\bar{x}=50\) and standard deviation \(\sigma _x={50/\sqrt{3}}\).

Table 2 establishes that the proposed composite contract is able to successfully coordinate the supply chain, paying all the entities better off compared to the wholesale price-only contract. As illustrated in Table 2, the retailer’s optimal order quantity and sales effort level under the contract are higher than their counterparts in wholesale price only contract whereas the optimal selling price is much lower, resulting in generating more demand and consequently more profit for the entire chain. A higher order quantity also has the possibility to generate more profit for the supply chain by meeting more demand.

The standard deviation of the demand distribution is often taken as a measure of uncertainty; the more the uncertainty, the more the deviation. Figure 1 shows that, with higher demand uncertainty, the retailer should set lower selling price and order more products irrespective of the fact whether he is under contract or not. A higher order quantity from the retailer’s end in turn enhances production and ordered quantities of the manufacturer and the supplier. It is also an acceptable strategy for the retailer to reduce selling price to attract more demand. However, since there is no inherent risk sharing mechanism present in price only contract, the resulting lower individual expected profit under price only contract has a negative effect on sales effort; the retailer should invest less amount of money in it. Furthermore, as demand uncertainty increases, the supplier should set higher planned production quantity so as to reduce the risk of buying items from spot market at a higher rate.

Figure 2 illustrates the changes in the expected profits of the supply chain system and its individual members with varying demand uncertainty (\(\sigma _x\)). It is seen that, under composite contract, the whole chain and its individual members earn more profit. In general, a higher uncertainty has a negative effect on the system profit due to over-stocking and under-stocking risks. It is observed that, for a fixed set of contract parameters, the manufacturer loses his profit share with higher demand uncertainty, indicating that contract parameters should be redesigned in favor of the manufacturer with varying demand uncertainty.

Figure 3 exhibits that yield uncertainty at the supplier has no effect on the optimal decisions of the retailer under wholesale price contract, whereas the supplier reduces its planned production quantity to mitigate the risk. On the contrary, the composite contract compels the retailer to order lesser amount under higher yield uncertainty, and raise price and reduce effort level simultaneously to secure per unit profit margin. Nevertheless, the total profit of the system reduces with higher yield uncertainty under both the scenarios (decentralized and coordinated), as is evident from Fig. 4. Also, under price only contract, yield uncertainty affects the expected profit of the supplier only. It is also observed that, for a fixed set of contract parameters, the supplier gets benefitted whereas both the manufacturer and the retailer lose their profit shares with higher yield uncertainty.

Figures 5 and 6 illustrate the effect of yield uncertainty at the manufacturer on the supply chain performance. It is obvious that a higher yield variability exposes a bigger risk, leading the manufacturer to choose a lower production quantity. The manufacturer reduces his production input quantity to hedge the associated risks, resulting in reduction in profits for all the channel members. The manufacturer should be inclined towards improving production technology and stabilizing the production yield variability as much as possible. Also, for a fixed set of contract parameters, the manufacturer gets benefitted whereas other members lose their profit shares with higher yield uncertainty.

As observed by Lee and Whang (2002), having access to a secondary market is beneficial for any supply chain member. Table 3 suggests that the supplier should aim at reducing dependence on the secondary market by raising his planned production quantity; however, it does not affect the business strategy of the retailer under wholesale price contract. For a predetermined set of contract parameters, the supplier raises wholesale price to prevent additional loss due to tentative salvaging, and consequently enhancing the manufacturer’s wholesale price and retail price too. The retailer cuts down the order quantity and the investment in sales effort. However, the supplier manages to secure more profit share due to higher wholesale price. Similarly, a higher salvage value of raw-material induces the supplier to raise production level and reduce wholesale price to encourage upstream members to order more. A higher order quantity compels the retailer to reduce retail price and raise the sales effort level to generate additional demand, resulting in higher channel profit.

Table 4 shows that both the downstream members get benefited under composite contract except the supplier who has to compromise with his own profit share to ensure sale of product through the supply chain rather than selling them at salvage value afterwards. Finally, Table 5 shows that, a higher salvage value of the finished product raises profit margin for both the supplier and the retailer due to higher ordered and planned production quantities, but the manufacturer suffers for a predetermined set of contract parameters.

We now aim to study a predetermined market situation from the perspective of different price-demand relationships. Till now the linear relationship between demand and price has been considered which is of the specific form \(D=\alpha -\beta p+ke+x\), having parameter-values as \(\alpha =700\), \(\beta =25\), \(k=2\). Keeping the market demand fixed as may be obtained from the optimal values of the decision variables provided in Table 2, a simple computer simulation reveals that the same market scenario may also be represented by an exponential price-demand relationship of the form \(D=\alpha \beta ^{-p}e^k+x\) with parameter-values \(\alpha =899\), \(\beta =1.0659\), \(k=20.00229312\), or by a quadratic relationship as \(D=\left( \alpha p^2-\beta p+\gamma \right) k^j+x\) with parameter-values \(\alpha =0.1223\), \(\beta =30.3304\), \(k=1.001\), \(\gamma =853\). Table 6 exhibits the applicability of the proposed model under various price-demand relationships. It is suggested that the contract parameters are to be set depending on the demand pattern observed from the historical data, since a fixed set of parameter-values allocates different profit shares among the channel members for different demand patterns.

Since the market demand depends on both the retail price and the sales effort, the sensitivity parameters \(\beta \) and k are two major factors to influence demand. Figures 7, 8 and 9 illustrates the variation in profit under composite contract with different values of such parameters. We plot ‘percentage profit increase’ of the channel members along with the total supply chain, where \(\pi _{i}=100\times (\pi _{i}^{c}-\pi _{i}^{w})/\pi _{i}^{w}\) for \(i=r,m,s\) and T. Since demand decreases linearly with higher values of \(\beta \), the retailer is forced to reduce the retail price and raise the sales effort to mitigate the negative effects on demand. It is observed that a higher sales rebate \(\tau \) has a negative impact on the performance of the retailer.

7.1 Managerial insights

From the numerical study conducted in the previous section, we draw the following managerial insights:

-

The proposed composite contract is applicable to a wide range of market scenarios represented by different forms of price-effort relationship. It can reduce the double marginalization effect too.

-

Based on available information, if the manager is convinced that the demand is going to be more uncertain for reasons beyond control in a particular business cycle, he should reduce both the sales effort and the retail price, and order more stock under price only contract. Even if the proposed composite contract is established, the retail price should still be lower, but the sales effort should be set at a higher level to induce more demand. Also, contract parameters should be redesigned in favor of the manufacturer with varying demand uncertainty by raising sales target and/or raising per unit penalty.

-

Under composite contract, the manager should reduce the production and order quantities, and the retail price to mitigate a higher yield uncertainty at production level; also, more promotional effort should be made. Further, the contract parameters should be redesigned accordingly against the entity with higher yield variation. The observation is consistent with the findings of He and Zhang (2008). However, if the manager fails to implement such a contract, the retailer should keep other decisions unaltered under higher yield at the supplier whereas redesign pricing strategy to reduce demand under higher yield at the manufacturer, and reduce order quantities in both the cases.

-

If the manager can sell leftover products, be it raw materials or finished ones, at higher salvage rate, he should raise the order quantity placed at the manufacturer. Both unit penalty cost \(\tau \) and revenue fraction \(\phi \) should be raised for higher salvage value of the finished product, penalty cost \(\tau \) should be raised but revenue fraction \(\phi \) should be reduced for higher salvage value of raw material, and penalty cost \(\tau \) should be reduced but revenue fraction \(\phi \) should be raised for higher price of raw material at the secondary market.

8 Conclusion

Random yield is common in many industries. Traditional newsvendor setting allows industries to access a secondary market for emergency resource. This article considers unavailability of secondary market at the manufacturing stage in a supplier-manufacturer-retailer supply chain. The retailer faces both supply and demand uncertainties and makes joint decision on retail price, sales effort and order quantity, and the supplier makes joint decision on wholesale price and production amount. It is proven that perfect supply chain coordination can be achieved by a composite contract offered by the manufacturer. This composite contract consists of two components—one is revenue sharing contract \((w_{s},\phi )\) between the supplier and the manufacturer, and the other one is contingent buyback with target sales rebate and penalty \((w_{m},b,Q_{0},\tau )\) between the retailer and the manufacturer. The applicability of the proposed model is established and valuable managerial insights are provided from numerical results.

In this paper, we have provided insights and implications of the proposed supply chain contract under various uncertainties and influences. Certainly our work has some limitations and restrictions that can be explored in future research. For instance, we have allowed the manufacturer to control business policies unilaterally. One can study a multi-echelon supply chain model where multiple entities may dominate the supply chain. In our study, we have considered the existence of the secondary market for both the raw-material supplier and the retailer. It would be more realistic and challenging to extend the model by considering complete absence of the secondary market as backup resource anywhere throughout the chain, and develop risk sharing policies accordingly. In addition, the current study considers that the qualities of produced raw materials and the ones bought from the secondary market by the supplier are the same. Consideration of quality difference of the produced raw materials and the ones bought from the secondary market by the supplier, and developing a model where the yield of the manufacturer depends on the produced quantity of the raw-material supplier would also be potential future research directions. Finally, the current study focuses on a single-period model. Extending the present model to a multi-period model would be a difficult but challenging task.

Abbreviations

- \(c_s\)::

-

Unit production cost at the raw material supplier

- \(c_s^{\prime }\)::

-

Unit procurement cost of raw material from the secondary market

- \(c_m\)::

-

Unit manufacturing cost at the manufacturer

- v::

-

Unit salvage value of the final product

- \(v_s\)::

-

Unit salvage value of excess product at the raw material supplier

- \(g_r\)::

-

Retailer’s goodwill cost for unit unmet demand

- X::

-

A positive random variable with range [l, u], pdf \(f(\cdot )\), cdf \(F(\cdot )\), mean \(\bar{x}\), and variance \(\sigma ^2_x\) representing the stochastic portion of the customer demand

- Y::

-

A random variable with range [c,d], \(0\le c<d \le 1\), having pdf \(g(\cdot )\) and cdf \(G(\cdot )\), denoting the randomness of the production quantity produced by the manufacturer

- Z::

-

A random variable with range [a, b], \(0\le a<b \le 1\), with pdf \(h(\cdot )\) and cdf \(H(\cdot )\), denoting the randomness of the production quantity of the raw material produced by the supplier

- R::

-

Planned production quantity of the raw-material supplier, a decision variable (in units)

- Q::

-

Ordered quantity of the retailer, a decision variable (in units)

- p::

-

Unit retail price of the final product charged by the retailer, a decision variable

- e::

-

Effort level to summarize the retailer’s activities to influence market demand, a decision variable. We assume J(e) To be the retailer’s cost of exerting an effort level e with \(J(0)=0\), \(J'(e)>0\) and \(J''(e)>0\) when \(e>0\)

- \(w_s\)::

-

Unit wholesale price of the raw material offered by the supplier to the manufacturer, a decision variable

- \(w_m\)::

-

Unit wholesale price of the finished product charged by the manufacturer to the retailer, a decision variable

References

Arcelus, F. J., Kumar, S., & Srinivasan, G. (2008). Evaluating manufacturer’s buyback policies in a single-period two-echelon framework under price-dependent stochastic demand. Omega, 36(5), 808–824.

Cachon, G. P. (2003). Supply chain coordination with contracts. In S. C. Graves, A. G. de Kok (Eds.), Handbooks in operations research and management science: Supply chain management: Design, coordination and operation (Vol. 11, pp. 229–340). Elsevier.

Cachon, G. P., & Lariviere, M. A. (2005). Supply chain coordination with revenue sharing contracts: Strength and limitations. Management Science, 51(1), 30–44.

Choi, T. M., Govindan, K., Li, X., & Li, Y. (2017). Innovative supply chain optimization models with multiple uncertainty factors. Annals of Operations Research, 257(1–2), 1–14.

Chopra, S., Reinhardt, G., & Mohan, U. (2007). The importance of decoupling recurrent and disruption risks in a supply chain. Naval Research Logistics, 54(5), 544–555.

Coughlan, A., & Wernerfelt, B. (1989). Credible delegation by oligopolists: A discussion of distribution channel management. Management Science, 35(2), 226–239.

Dada, M., Petruzzi, N. C., & Schwarz, L. B. (2007). A newsvendor’s procurement problem when suppliers are unreliable. Manufacture Service and Operations Management, 9(1), 9–32.

Dant, R. P., & Berger, P. D. (1996). Modelling cooperative advertising decisions in franchising. Journal of the Operational Research Society, 47(9), 1120–1136.

Ding, D., & Chen, J. (2008). Coordinating a three level supply chain with flexible return policies. Omega, 36(5), 865–876.

Emmons, H., & Gilbert, S. (1998). The role of returns policies in pricing and inventory decisions for catalogue goods. Management Science, 44(2), 276–283.

Giri, B. C., & Bardhan, S. (2014). Coordinating a supply chain with backup supplier through buyback contract under supply disruption and uncertain demand. International Journal of Systems Science, 1(4), 193–204.

Giri, B. C., & Bardhan, S. (2015). Coordinating a supply chain under uncertain demand and random yield in presence of supply disruption. International Journal of Production Research, 53(16), 5070–5084.

Giri, B. C., Bardhan, S., & Maiti, T. (2016). Coordinating a three-layer supply chain with uncertain demand and random yield. International Journal of Production Research, 54(8), 2499–2518.

Güler, M., & Bilgiç, T. (2009). On coordinating an assembly system under random yield and random demand. European Journal of Operational Research, 196(1), 342–350.

Güler, M., & Keskin, E. (2013). On coordination under random yield and random demand. Expert Systems with Applications, 40(9), 3688–3695.

He, Y., Wang, H., Guo, Q., & Xu, Q. (2019). Coordination through cooperative advertising in a two-period consumer electronics supply chain. Journal of Retailing and Consumer Services, 50, 179–188.

He, Y., Yang, D., & Wu, Q. (2006). Revenue-sharing contract of supply chain with effort dependent demand. Computer Integrated Manufacturing Systems, 12(11), 1865–1868.

He, Y., & Zhang, J. (2008). Random yield risk sharing in a two-level supply chain. International Journal of Production Economics, 112, 769–781.

He, Y. J., & Zhang, J. (2010). Random yield supply chain with a yield dependent secondary market. European Journal of Operational Research, 206(1), 221–230.

He, Y., Zhao, X., Zhao, L., & He, J. (2009). Coordinating a supply chain with effort and price dependent stochastic demand. Applied Mathematical Modelling, 33(6), 2777–2790.

He, Y., & Zhao, X. (2012). Coordination in multi-echelon supply chain under supply and demand uncertainty. International Journal of Production Economics, 139(1), 106–115.

Hsieh, C., & Wu, C. (2008). Capacity allocation, ordering, and pricing decisions in a supply chain with demand and supply uncertainties. European Journal of Operational Research, 184(2), 667–684.

Hu, B., Qu, J., & Meng, C. (2018). Supply chain coordination under option contracts with joint pricing under price-dependent demand. International Journal of Production Economics, 205, 74–86.

Jaber, M. Y., & Goyal, S. K. (2008). Coordinating a three-level supply chain with multiple suppliers, a vendor and multiple buyers. International Journal of Production Economics, 116(1), 95–103.

Kazaz, B. (2004). Production planning under yield and demand uncertainty with yield-dependent cost and price. Manufacture Service and Operations Management, 6(3), 209–224.

Karim, R., & Nakade, K. (2019). A stochastic model of a production-inventory system with consideration of production disruption. International Journal of Advanced Operations Management, 11(4), 287–316.

Lee, H., & Whang, S. (2002). The impact of the secondary market on the supply chain. Management Science, 48(6), 719–731.

Lariviere, M. A. (1999). Supply chain contracting and coordination with stochastic demand. Quantitative Models for Supply Chain Management, 17, 233–268.

Maihami, R., Govindanb, K., & Fattahic, M. (2019). The inventory and pricing decisions in a three-echelon supply chain of deteriorating items under probabilistic environment. Transportation Research Part E, 131, 118–138.

Moorthy, S. (1987). Managing channel profits: Comment. Marketing Science, 6(4), 375–379.

Nagler, M. G. (2006). An exploratory analysis of the determinants of cooperative advertising participation rates. Marketing Letters, 17(2), 91–102.

Parlar, M., & Wang, D. (1993). Diversification under yield randomness in inventory models. European Journal of Operational Research, 66(1), 52–64.

Petruzzi, N. C., & Dada, M. (1999). Pricing and the newsvendor problem: A review with extensions. Operations Research, 47(2), 183–194.

Taylor, T. (2002). Supply chain coordination under channel rebates with sales effort effects. Management Science, 48(8), 992–1007.

Tsay, A., Nahmias, S., & Agrawal, N. (1998). Modeling supply chain contracts: A review. In S. Tayur, R. Ganeshan, & M. Magazine (Eds.), Quantitative models for supply chain management. Boston: Kluwer.

Van der Rhee, B., Van der Veen, J., Venugopal, V., & Vijayender, R. N. (2010). A new revenue sharing mechanism for coordinating multi-echelon supply chains. Operations Research Letters, 38(4), 296–301.

Voelkel, M. A., Sachs, A. L., & Thonemanna, U. W. (2020). An aggregation-based approximate dynamic programming approach for the periodic review model with random yield. European Journal of Operational Research, 281(4), 286–298.

Wang, C., & Chen, X. (2017). Option pricing and coordination in the fresh produce supply chain with portfolio contracts. Annals of Operations Research, 248(1–2), 471–491.

Wang, C., Chen, J., Wang, L., & Luo, J. (2020). Supply chain coordination with put option contracts and customer returns. Journal of Operation Research Society, 71(6), 1003–1019.