Abstract

Large volumes of online product reviews generated by customers have important strategic values for new product development. We consider a duopoly setting where two manufacturers aim to develop their own new products and services. Applying a differential game framework, we examine how online customer reviews can be leveraged as external knowledge for manufacturers to develop new products. In our base models, we assume that the products supplied by the manufacturers are homogenous. First, we consider a closed innovation setting as a benchmark case in which both manufacturers develop new products by their internal R&D without leveraging online customer reviews. Second, we propose a model in which one manufacturer leverages online customer reviews as external knowledge, while the other manufacturer only relies on internal R&D effort. We derive analytical equilibrium solutions to both models. We find that when one manufacturer uses online customer reviews, if the manufacturer’s R&D process becomes more effective in improving its new product performance or reducing its cost, it certainly hurts the other manufacturer, but it may sometimes hurt this particular manufacturer as well. Furthermore, we demonstrate that when the manufacturer utilizes online customer reviews more in R&D, both manufacturers’ profits can either increase or decrease. In an extended model, we relax the product homogeneity assumption and obtain the equilibrium solution analytically. We show that main managerial insights still hold in the extend model.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

1 Introduction

Nowadays, global competition becomes increasingly intense, and technology advances more quickly than ever. Therefore, innovation becomes essential to ensure a firm’s survival and growth in such a dynamic business environment. Companies are willing to invest considerable resources in research and development (R&D) for new product development (NPD). NPD is an innovation process that conceives better new products, which are different or unique in some ways from existing products (Chesbrough 2006a, b). A recent study finds that the main reason for low returns on NPD is lack of knowledge about market needs (CB Insights 2018). Because of the information asymmetry between firms and customers, firms need to find a way to acquire customers’ preference and need information that can be used to evaluate the potential of NPD projects (Courtney et al. 2017). Hence, to alleviate the information gap, both scholars and practitioners propose relevant strategies, such as subsidization strategies (Li et al. 2020) and leveraging online customer reviews (Zhou et al. 2018), to involve market participants in product development. These strategies may help customers signal their potential needs that firms understand and lead to a joint creation of innovative products that meet market demands (Creane 2002; Tams 2018). In the era of open innovation, the absorption of external knowledge has become crucial to improve NPD performance (Robert and Candi 2014; Chuang and Lin 2015; Lichtenthaler 2016). Nonetheless, there are a few challenges in involving customers in NPD (Sashi 2012; Bowden et al. 2015). One key challenge is simply to get in touch with customers in an effective way (Nambisan 2002), because information related to customers’ needs is often costly for product developers to capture (Füller et al. 2006). However, emerging information technology has turned the average customers into an incessant generator of transactional, traditional, structured data as well as unstructured, behavioral data (Wamba et al. 2015). The magnitude and diverse richness of big data such as online customer reviews are transforming NPD (Zhan et al. 2018).

New product development is driven by technical factors and market factors jointly, which is a complex process that requires sound investment in research and development, as well as significant marketing expertise that focuses on satisfying customers’ wants and needs (Dunk 2011). Empirical evidence shows that about 50% output of product innovation is pushed by market factors (Myers and Marquis 1965). Internal R&D has been considered costly and vague in technical factors aspect (Prahalad and Ramaswamy 2004; Steinfeld and Beltoft 2014). Many firms transfer internal R&D procedures to incorporate customer-oriented components into NPD swiftly (Maruping et al. 2009). On the one hand, products that meet customers’ demand will increase their willingness to purchase (Priem 2007). On the other hand, internal R&D alone may hinder the firms from identifying new market trend (Von Hippel 2005), and customers sometimes may propose better innovative ideas than R&D personnel (Poetz and Schreier 2012). Therefore, customers are important sources of information and knowledge (Cooper 2014), and it is well acknowledged that customer involvement can improve NPD (Cooper and Kleinschmidt 2011). Customer involvement has been extensively employed as an approach to stiffening the feedback loop in the process of NPD (Robert and Candi 2014).

Traditionally, firms often gain access to customers’ ideas about their products through surveys and interviews with representative sample users (or lead users) to develop and improve their products. These customers’ ideas only represent general users’ partial needs rather than their diversified demands (Von Hippel 2005). In recent years, emerging information technologies (i.e., Web2.0, mobile internet) have promoted rapid development of online platforms such as review platforms, online stores, and innovation communities. These platforms have accumulated a large amount of online customer reviews for various products and services since it has become increasingly convenient for customers to post reviews on online platforms. Customers can easily share their experience on online platforms and propose suggestions for product improvement. Additionally, online platforms promote the flow and sharing of knowledge, break the boundaries of traditional laboratory and innovative activities, and provide sources of technology and information for the firms to execute open innovation using online customer reviews (Chesbrough 2003). Many researchers point out that firm can understand customers’ preferences and needs better by leveraging the data available through online platforms in the process of NPD (Tsai et al. 2013; Wamba and Carter 2014). The big data of online customer reviews play a critical role in customer involvement and constitute an important data resource that enables value co-creation between firms and customers (Priem 2007; Zhan et al. 2018). Therefore, firms that are able to recognize customers’ latent needs via online customer reviews will be much more likely to achieve successful NPD (Sarin and O’ Connor 2009; Robert and Candi 2014).

From a practice perspective, it is a curial strategy for firms to incorporate online customer reviews into NPD (Von Hippel 2001). There are many successful cases in which various firms aggregate customers’ reviews for product development through online platforms. For example, Procter & Gamble releases R&D tasks to search for innovative ideas on its incentive online platform which accounts for 35%. Nike, Dell, Starbucks, and Xiaomi have collected customers’ ideas and suggestions through self-sponsored online platforms. Furthermore, many independent online platforms also accumulate a large volume of online customer reviews. For example, in 2015, approximately 145 million visitors posted 102 million reviews each month on Yelp, a primary U.S. e-commerce site (Zhou et al. 2018). In Apple’s App Store, more than 17.4 million app reviews have been generated for 3101 game apps since the store opened in 2008. Online customer reviews can be considered as big data due to their high volume, velocity, and variety. It is often difficult for firms to utilize demand-side knowledge which is embedded in large-volume online customer reviews due to the complexity and high costs (Boudreau 2012). Hence, there is a trade-off between cost and revenue when firms incorporate online customer reviews into NPD.

Our research focuses on NPD driven by the acquisition of external knowledge, which refers to innovations that source demand-side knowledge from online customer reviews. The extant papers regarding open innovation highlight the necessity of absorbing customers’ demand-side knowledge for product development (Priem et al. 2012). However, they often focus on a relatively small group of lead customers (Nishikawa et al. 2013). Large volumes of online customer reviews enable firms to gain knowledge from regular customers, making the embedded demand-side knowledge less biased and more valuable (Poetz and Schreier 2012). In addition, prior studies on online customer reviews focus on how reviews could influence other customers’ purchasing decisions through word-of-mouth effect (Duan et al. 2008a, b; Zhu and Zhang 2010). These papers have mainly focused on review ratings, depth, volume, and sentiment with little attention to review text. For example, Mudambi and Schuff (2010) examine the impact of review rating extremity and review depth on the helpfulness of customer reviews. Duan et al. (2008a) show that review volume would significantly influence box office sales. Zhu and Zhang (2010) find that review volume, review rating, and the variance of ratings all have a positive impact on unpopular online games. Salehan and Kim (2016) conduct a sentiment analysis on review texts and find a positive relationship between review sentiment and helpfulness of online customer reviews. However, these studies do not consider utilizing rich information embedded in the review texts, which contain valuable customer feedback. Zhan et al. (2018) investigate a new product development project at an electronics company and introduce a customer involvement approach as a new means of customer-centered new product development. Zhou et al. (2018) adopt a big data analytical approach to investigate the impact of online customer reviews on customer agility and subsequent product performance. Customer agility is a specific type of capability that product developers need to have in order to detect and respond to demands embedded in online customer reviews (Roberts and Grover 2012). These studies have explored the effect of online customer reviews empirically by text analytics, econometrics, and survey approach in NPD.

In summary, prior studies on online customer reviews often focus on how reviews influence other customers’ purchasing decisions, how valuable reviews are in NPD, and how to mine demand-side knowledge embedded in large-volume online customer reviews. But little is known about: (1) how product manufacturers can respond to these reviews by incorporating customers’ requests into NPD? (2) what’s the impact of customer agility on product performance when manufacturers leverage online customer reviews in NPD? (3) how the firms can make optimal decisions to develop new products by internal R&D and leveraging external online customer reviews jointly. To answer these research questions, we develop a differential game model to examine the impact of both internal R&D and leveraging online customer reviews on product performance in NPD.

The existing literature focuses on the static sequential game (Yoon et al. 2018). However, NPD is a long-term and dynamic process. In order to capture the dynamic and strategic interactions between the two manufacturers, we propose a differential game model in this paper and derive the equilibrium R&D effort levels for two manufacturers in a duopoly setting. Differential game can be considered as a fusion of game theory and optimal control theory. They not only incorporate strategic decision making and continuous change simultaneously, but also combine the dynamic effects of the current state and decision with future states and decisions (Ouardighi et al. 2020). Dockner et al. (2000) provide a detailed discussion of differential game. Due to the inherent difficulty in solving differential game, there are only a few studies using differential game approach in the field of Information System (Mookerjee et al. 2011; Liu et al. 2012; Demirezen et al. 2016).

The remainder of this paper is organized as follows. Section 2 introduces the problem description and definitions. In Sect. 3, we propose and investigate a base scenario where both manufacturers only invest in internal R&D for their NPD. In Sect. 4, first, we analyze our main model in which one manufacturer utilizes both internal R&D and external knowledge (i.e., online customer reviews) in NPD, while the other manufacturer exercises internal R&D only; second, we present managerial implications of the main model. In Sect. 5, we relax the product homogeneity assumption by studying an extended model in which the two manufacturers’ products are heterogeneous. Section 6 concludes the study and provides directions for future research. All mathematical proofs are provided in the “Appendix”.

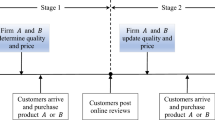

2 Problem description and notation definitions

We consider a duopoly market of homogenous products. The products are supplied by two manufacturers, which are represented by subscripts A and B. We denote the R&D effort level of manufacturer \( i \) (\( i = A,B \)) at time \( t \) by \( I_{i} \left( t \right) \). Inspired by Demirezen et al. (2016), we model the respective outputs of the manufacturers, denoted by \( q_{i} \left( t \right) \) (\( i = A,B \)), as continuous, twice differentiable, strictly concave nondecreasing functions of \( I_{i} \left( t \right) \). Manufacturer i’s output is related to its R&D effort level and external knowledge (i.e., online customer reviews). In addition, there exist natural loss in output because of defective products, improper management of product inventory, etc. In sum, following Nerlove and Arrow (1962), we model the instantaneous increase in the output of manufacturer \( i \) as

where \( r \) is the productivity multiplier, and \( \delta \) is the natural loss multiplier of output with \( \delta \ge 0 \), and customer agility (\( K_{i} \)) here is defined as the extent that manufacturer i leverages online customer reviews in its R&D process for its NPD. Moreover, according to Tsai et al. (2013) and Zhan et al. (2018), \( \tilde{\alpha }_{i} \left( {K_{i} } \right) \) is a function of customer agility, which measures the effectiveness of utilizing online customer reviews. Inspired by Fonseca and Domingues (2017), we define \( \tilde{\alpha }_{i} \left( {K_{i} } \right) \) as follows:

where \( \alpha_{i} + \beta_{i} \bar{K}_{i} = \bar{\alpha }_{i} \), \( \alpha_{i} < \bar{\alpha }_{i} , \) and \( \beta_{i} > 0 \) measures the marginal change in \( \tilde{\alpha }_{i} \) per unit of customer agility. \( \tilde{\alpha }_{i} \left( 0 \right) = \alpha_{i} \) represents the case in which manufacturer i does not utilize online customer reviews. Leveraging online customer reviews can offer manufacturers supportive product ideas, and hence it can improve manufacturers’ efficiency in NPD (Tsai et al. 2013; Bharadwaj et al. 2012). However, overresponding to online customer reviews would eventually suppress new product improvement (e.g. features, functions) due to excessive emphasis on customers’ current needs (McAfee and Brynjolfsson 2012). Therefore, we assume \( \tilde{\alpha }_{i} \left( {K_{i} } \right) \) in Eq. (2) follows the following dynamics: when manufacturer i’s customer agility is below a certain threshold (\( \bar{K}_{i} = \frac{{\bar{\alpha }_{i} - \alpha_{i} }}{{\beta_{i} }} \)), a higher customer agility means that the customers’ reviews are more helpful, and so the manufacturer’s R&D effort can achieve a higher performance; when customer agility reaches the threshold (\( \bar{K}_{i} \)), the manufacturer’s product performance improved by its R&D effort will also reach a maximum level and remain constant thereafter.

Since we consider a duopoly market where products are supplied by manufacturers A and B, we have

where \( Q \)(t) denotes the aggregate output in the market at time t. We assume the inverse demand function in this duopoly market is as follows (Elsadany and Awad 2019)

where \( a \) denotes the maximum price when the outputs of the manufacturers are zero, \( b \) denotes the sensitivity coefficient of the price to the market demand.

Manufacturer i’s cost is directly related to its R&D effort involved and customer agility. For instance, such costs should be increasing with its R&D effort level. Following Tsay and Agrawal (2000) and Bertinelli et al. (2014), we assume manufacturer i’s cost is

where \( C_{i} \left( t \right) \) denotes manufacturer i’s cost at time \( t \). \( \tilde{c}_{i} \left( {K_{i} } \right) \) measures the cost multiplier for the R&D effort level exerted by manufacturer \( i \), which is a function of customer agility.

Leveraging online customer reviews is a continuous process of learning and experimentation in NPD, which affects manufacturer i’s cost multiplier for its R&D effort. The large amount of reviews posted by diverse customers represent heterogeneous preferences and feedback from the customers. Product developers or designers need to identify such heterogeneous requests, detect product defects, and incorporate a variety of new functions into new products, so the product development costs are heightened (Zhou et al. 2018). Consequently, in the initial stage, cost multiplier for R&D effort increases with an increase in customer agility. However, after the introductory stage, an increase in customer agility may lead to a reduction in cost multiplier for R&D effort due to economies of scale. Additionally, we assume that the cost multiplier for R&D effort will become constant when customer agility exceeds the threshold value \( (\bar{K}_{i} ) \). That is, we model the relationship between the cost multiplier for R&D effort and customer agility as an inversed “U” shape curve, defined formally as below

where \( c_{i} + \bar{K}_{i} - \gamma_{i} \bar{K}_{i}^{2} = \bar{c}_{i} \), and \( \tilde{c}_{i} \left( 0 \right) = c_{i} \) denotes the cost multiplier for R&D effort without leveraging online customer reviews.

We summarize the key notations of our model parameters and variables in Table 1 below.

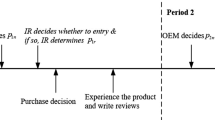

3 Benchmark: R&D without leveraging online customer reviews

In this section, we only consider a closed innovation setting in which both manufacturers A and B develop new products by their internal R&D effort only without leveraging online customer reviews. Manufacturer i’s (i = A, B) objective is maximizing its overall profit, \( J_{i}^{N} , \) by choosing its R&D effort level, \( I_{i} \left( t \right) \), in an infinite horizon, where superscript \( N \) signifies neither manufacturer leverages online customer reviews in the process of NPD.

where \( \rho \) is the discount rate for manufacturer \( i \) in the infinite horizon with \( \rho \ge 0 \) following Demirezen et al. (2016) and Jorgensen and Gromova (2016). Note that due to the product homogeneity, the prices of manufacturers \( A \) and \( B \) are equal and their inverse demand function satisfies \( p_{i} \left( t \right) = p\left( t \right) = a - bQ\left( t \right) \).

In the Eq. (7), \( q_{i} \left( t \right)p\left( t \right) \) measures the total revenue of manufacturer \( i \) which is a product of its output and market-clearing price at time t. Hence, \( q_{i} \left( t \right)p\left( t \right) - \frac{{c_{i} I_{i} (t)^{2} }}{2} \) represents the overall profit of manufacturer \( i \) at time t. According to the optimal control theory, \( V_{i}^{N} \left( {q_{i} } \right) \) is the optimal value function of the manufacturer \( i \) satisfying the Hamilton–Jacobi-Bellman (HJB) equation for \( q_{i} \ge 0 \).

We assume that both manufacturers decide on their respective R&D effort levels simultaneously. This assumption is valid as long as neither party knows the other party’s decision when it makes its own decision, even if they do not make their decisions at the same time. Thus, the intersection point of the manufacturers’ best-response functions will be the equilibrium. By solving the best response functions simultaneously, we obtain the equilibrium which is formally presented below.

Lemma 1

In equilibrium, if manufacturers develop new products by their internal R&D without leveraging online customer reviews,

(a) respective R&D effort levels for manufacturers A and B are

(b) respective outputs for the manufacturers A and B are

(c) respective profits for manufacturers A and B are

4 R&D with leveraging online customer reviews

In the previous section, we study the benchmark case in which both manufacturers do not utilize their online customer reviews in the process of NPD. However, in recent years, more and more manufacturers acquire innovative ideas from external sources, such as competitors, suppliers, distributors, and customers. Especially, nowadays it is getting easier for customers to post their reviews about the price, function, and appearance of products on social media, which provides valuable external knowledge for NPD. NPD is now as an open innovation of a closed-loop process with internal R&D and external knowledge (i.e., online customer reviews here). Due to differences in technology, business process and strategies, some manufacturers may be able to utilize online customer reviews sooner than other manufacturers in NPD. Therefore, we assume one manufacturer develops its new product using online customer reviews, but the other **manufacturer does not utilize online customer reviews. In Sect. 4.1, we formally present our model and its equilibrium outcomes. In Sect. 4.2, we provide some managerial insights.

4.1 Model formulation and results

Without loss of generality, we assume manufacturer A utilizes online customer reviews, but manufacturer B does not. The superscript D denotes that manufacturer A develops its new product leveraging online customer reviews. The superscript DN denotes that manufacturer B develops its new product without leveraging online customer reviews. Hence, manufacturer i’s (i = A,B) objective is maximizing its overall profit by choosing its R&D effort level, i.e., \( I_{i} \), in an infinite horizon

where \( \dot{q}_{A} \left( t \right) = r\tilde{\alpha }_{A} \left( {K_{A} } \right)I_{A} \left( t \right) - \delta q_{A} \left( t \right) \), \( C_{A} \left( t \right) = \frac{{\tilde{c}_{A} \left( {K_{A} } \right)}}{2}I_{A}^{2} \left( t \right) \),

where \( \dot{q}_{B} \left( t \right) = r\alpha_{B} I_{B} \left( t \right) - \delta q_{B} \left( t \right) \), \( C_{B} \left( t \right) = \frac{{c_{B} }}{2}I_{B}^{2} \left( t \right) \). Note that when \( K_{A} > \bar{K}_{A} \), the effectiveness and the cost multiplier, i.e., \( \tilde{\alpha }_{A} \left( {K_{A} } \right) \) and \( \tilde{c}_{A} \left( {K_{A} } \right) \) become constant, so the equilibrium results are independent on \( K_{A} \). Hence, we only consider the interesting case such that \( K_{A} \le \bar{K}_{A} \).

According to optimal control theory, \( V_{A}^{D} \left( {q_{A} } \right) \) and \( V_{B}^{DN} \left( {q_{B} } \right) \) are the respective optimal value functions of manufacturers A and B satisfying the Hamilton–Jacobi-Bellman (HJB) equations for \( q_{A} \ge 0 \) and \( q_{B} \ge 0 \). Hence, we have

The equilibrium solutions to problems (13) and (14) are provided in the following lemma.

Lemma 2

In equilibrium,

(a) respective R&D effort levels for manufacturers A and B are

(b) respective outputs for manufacturers A and B are

(c) respective profits for manufacturers A and B are

where \( \tilde{\alpha }_{A} \left( {K_{A} } \right) = \alpha_{A} + \beta_{A} K_{A} \), \( \tilde{c}_{A} \left( {K_{i} } \right) = c_{A} + K_{A} - \gamma_{A} K_{A}^{2} \). Lemma 2 enables us to conduct some sensitivity analysis on various model parameters to draw managerial insights in Sect. 4.2 below.

4.2 Managerial implications

In this subsection, we explore how variations in model parameters would affect both manufacturers’ decisions and profits in equilibrium.

4.2.1 Natural loss multiplier of output

The effect of a change in the natural loss multiplier of output on the equilibrium R&D effort levels, and outputs can be characterized as follows. For simplicity of exposition, we define \( S = D \) when \( i = A \) and \( S = DN \) when \( i = B \) for the remainder of this paper.

Proposition 1

When \( \delta \) increases, we have

(a) \( q_{i}^{S*} \) (i = A, B) decreases;

(b) if \( \delta < \hat{\delta } \), then \( I_{i}^{S*} \) increases, otherwise,\( I_{i}^{S*} \) decreases, where \( \hat{\delta } = \sqrt {\frac{{r^{2} \tilde{\alpha }_{A} \left( {K_{A} } \right)^{2} c_{B} b + r^{2} \alpha_{B}^{2} \tilde{c}_{A} \left( {K_{A} } \right)b}}{{\tilde{c}_{A} \left( {K_{A} } \right)c_{B} }}} \).

Part (a) of Proposition 1 shows that when the natural loss multiplier of output (\( \delta \)) increases, both manufacturers’ equilibrium outputs would decrease. Moreover, part (b) of Proposition 1 implies that it may not always incentivize the manufacturers to increase their R&D effort levels when \( \delta \) increases. When the natural loss multiplier of output is low (i.e., \( \delta < \hat{\delta } \)), both manufacturers would increase their R&D effort levels with an increase in \( \delta \) in order to compensate for their output loss. However, if the natural loss multiplier of output is too high (i.e., \( \delta > \hat{\delta } \)), increasing the manufacturers’ R&D effort levels would raise their R&D costs too much. Hence, in this case, both manufacturers would become more conservative in their R&D effort in equilibrium.

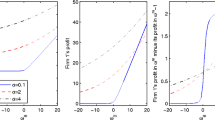

Note that Proposition 1 does not specify how manufacturer i’s equilibrium profit (\( J_{i}^{S*} ) \) would change as \( \delta \) increases. Our numerical experiments show that \( J_{i}^{S*} \) may either increase or decrease in \( \delta \). As an illustrative example, we use \( \alpha_{A} { = 5} \), \( c_{A} { = 2} \), \( \alpha_{B} { = 5} \), \( c_{B} { = 3} \), \( \rho = 0. 8 \), \( r = 1,a = 5 0 \), \( b = 0. 5 \), \( \beta_{A} = 0. 7 5 \), \( \gamma_{A} = 0. 2 \), \( K_{A} = 1 \) and vary \( \delta \). Figure 1 shows the numerical result.

As shown in Fig. 1, when \( \delta \) is low, manufacturer i’s profit increases with \( \delta \), but the reverse is true at the higher values of \( \delta \). Since both manufacturers’ equilibrium outputs decrease with an increase in \( \delta \), the prices would increase as a result. When the increase in the price outweighs the increase in the output, the manufacturer’s profit would increase, otherwise, it would decrease.

4.2.2 Discount rate

Next, we shall discuss the effect of the discount rate on the equilibrium R&D effort levels, outputs, and profits.

Proposition 2

When \( \rho \) increases, we have

(a) \( I_{i}^{S*} \) and \( q_{i}^{S*} \) (i = A, B) both decrease;

(b) if \( \rho < \hat{\rho } \), then \( J_{i}^{S*} \) increases, otherwise, \( J_{i}^{S*} \) decreases,

where \( \hat{\rho } = \frac{{r^{2} \tilde{\alpha }_{A} \left( {K_{A} } \right)^{2} c_{B} b + r^{2} \alpha_{B}^{2} \tilde{c}_{A} \left( {K_{A} } \right)b}}{{\delta \tilde{c}_{A} \left( {K_{A} } \right)c_{B} }} \).

The discounting rate here reflects the excess risk involved in the manufacturers’ R&D process (Fibich et al. 2003). In the presence of discounting, part (a) of Proposition 2 indicates that both manufacturers tend to invest less in their R&D efforts and produce less with an increase in \( \rho \), because manufacturers are facing higher risks. As shown in part (b) of Proposition 2, when the discount rate increases, both manufacturers’ profits first increase then decrease.

4.2.3 Effectiveness of effort

In Proposition 3, we characterize the impact of effectiveness of manufacturer \( A \)’s effort on the equilibrium R&D effort levels, outputs, and profits below.

Proposition 3

If \( \alpha_{A} \) or \( \beta_{A} \) increases, then \( \tilde{\alpha }_{A} \left( {K_{A} } \right) \) increases, and we have

(a) \( q_{A}^{D*} \) increases and \( q_{B}^{DN*} \) decreases;

(b) \( I_{B}^{DN*} \) and \( J_{B}^{DN*} \) both decrease;

(c) if \( \tilde{\alpha }_{A} \left( {K_{A} } \right) < \hat{\alpha }_{A} \left( {K_{A} } \right) \), then \( I_{A}^{D*} \) and \( J_{A}^{D*} \) increase; otherwise,\( I_{A}^{D*} \) and \( J_{A}^{D*} \) decrease, where \( \hat{\alpha }_{A} \left( {K_{A} } \right) = \sqrt {\frac{{\tilde{c}_{A} \left( {K_{A} } \right)\alpha_{B}^{2} }}{{c_{B} }} + \frac{{\left( {\rho + \delta } \right)\delta \tilde{c}_{A} \left( {K_{A} } \right)}}{{r^{2} b}}} \).

When \( \alpha_{A} \) or \( \beta_{A} \) increases, the effectiveness of manufacturer A’s effort, i.e., \( \tilde{\alpha }_{A} \left( {K_{A} } \right) \), increases, which means that the efficiency of manufacturer \( A \)’s R&D effort in utilizing its online customer reviews improves. Part (a) of Proposition 3 indicates that when manufacturer A’s R&D effectiveness increases, this manufacturer tends to produce more, because its demand increases in its product performance (e.g., functions and features). While the other manufacturer \( B \) produces less. As shown in part (b) of Proposition 3, when manufacturer A’s R&D effectiveness improves, the other manufacturer \( B \), as the competitor, would become more conservative in investing in its own R&D effort and achieve a lower profitability. Interestingly, part (c) of Proposition 3 shows that when manufacturer \( A \) improves its own R&D effectiveness, it may not necessarily benefit the manufacturer itself. When manufacturer A’s R&D effectiveness is low (i.e., \( \tilde{\alpha }_{A} \left( {K_{A} } \right) < \hat{\alpha }_{A} \left( {K_{A} } \right) \)), manufacturer A has an incentive to increase its R&D effort level with an increase in \( \tilde{\alpha }_{A} \left( {K_{A} } \right) \). In this case, manufacturer A’s revenue gain outweighs the cost increase in its R&D effort, which means that there is an incentive for this manufacturer to explore and leverage more online customer reviews in NPD. However, if manufacturer A’s R&D effectiveness is already high (i.e., \( \tilde{\alpha }_{A} \left( {K_{A} } \right) > \hat{\alpha }_{A} \left( {K_{A} } \right) \)), the decrease in the market price, due to the increase in the market aggregate output, outweighs the increase in its output \( q_{A}^{D*} \), so manufacturer A’s profit decreases.

4.2.4 Cost multiplier for R&D effort

In Proposition 4 below, we will discuss the effect of manufacturer A’s cost multiplier for R&D effort on the equilibrium R&D effort levels, outputs, and profits.

Proposition 4

If \( c_{A} \) increases or \( \gamma_{A} \) decreases, then \( \tilde{c}_{A} \left( {K_{A} } \right) \) increases, and we have

(a) \( q_{A}^{D*} \) decreases and \( q_{B}^{DN*} \) increases;

(b)\( I_{A}^{D*} \) decreases and \( I_{B}^{DN*} \) increases;

(c) \( J_{B}^{DN*} \) increases;

(d) if \( \tilde{c}_{A} \left( {K_{A} } \right) < \hat{c}_{A} \left( {K_{A} } \right) \), then \( J_{A}^{D*} \) increases, otherwise,\( J_{A}^{D*} \) decreases, where \( \hat{c}_{A} \left( {K_{A} } \right) = \frac{{r^{2} \tilde{\alpha }_{A} \left( {K_{A} } \right)^{2} c_{B} b}}{{r^{2} \alpha_{B}^{2} b + \left( {\rho + \delta } \right)\delta c_{B} }}. \)

It follows directly from Eq. (6) that when \( c_{A} \) increases or \( \gamma_{A} \) decreases, the cost multiplier for manufacturer A’s R&D effort, i.e., \( \tilde{c}_{A} \left( {K_{A} } \right) \), increases. As manufacturer A’s R&D effort becomes more expensive, manufacturer A naturally tends to produce less, while the other manufacturer (B) tends to produce more. Hence, part (a) of Proposition 4 echoes with our intuition. As shown in part (b) and (c) of Proposition 4, when manufacturer A’s cost multiplier for its R&D effort increases, it is quite intuitive that manufacturer A would invest less effort in its R&D, while the other manufacturer (B) tends to invest more in its R&D effort and achieve a higher profitability. Interestingly, part (d) of Proposition 4 shows that when manufacturer A suffers from its own cost inflation in R&D effort, it may not necessarily hurt itself. The reason is that, an increase in \( \tilde{c}_{A} \left( {K_{A} } \right) \) would reduce the market aggregate output in equilibrium, thus lead to an increase in the equilibrium market-clearing price. When manufacturer A’s cost multiplier for R&D effort is low (i.e., \( \tilde{c}_{A} \left( {K_{A} } \right) < \hat{c}_{A} \left( {K_{A} } \right) \)), the increase in its price and the decrease in its R&D effort level would outweigh the decrease in output. Thus, manufacturer A’s overall profit would increase in this case. However, if manufacturer A’s cost multiplier for R&D effort is already high (i.e., \( \tilde{c}_{A} \left( {K_{A} } \right) > \hat{c}_{A} \left( {K_{A} } \right) \)), manufacturer A’s R&D effort becomes too expensive which would hurt its profitability as \( \tilde{c}_{A} \left( {K_{A} } \right) \) further increases.

4.2.5 Customer agility

As discussed in Sects. 4.2.3 and 4.2.4, the effect of effectiveness and cost multiplier on equilibrium results are significantly different when manufacturer A leverages online customer reviews in NPD. Hence, in this subsection, we will investigate the direct impact of customer agility (\( K_{A} \)) on the equilibrium R&D effort level, output, and profit. It follows directly from Eqs. (2) and (6) that effectiveness and cost multiplier for manufacturer A’s R&D effort become constant when its customer agility is greater than a threshold, i.e., \( K_{A} > \bar{K}_{A} \). In this case, the equilibrium outcomes become independent of \( K_{A} \). Hence, here we focus on the more interesting case in which manufacturer A’s customer agility is less than the threshold (\( 0 \le K_{A} < \bar{K}_{A} \)), which includes the benchmark model (\( K_{A} = 0 \)) shown in Sect. 3 where both manufacturers don’t utilize online customer reviews in NPD. In other words, we can also analyze the difference of the manufacturers’ equilibrium decisions between the benchmark model (\( K_{A} = 0 \)) of Sect. 3 and the main model (\( 0 < K_{A} < \bar{K}_{A} \)) of Sect. 4 in the following Proposition.

Proposition 5

When \( K_{A} \) increases, we have

(a) if \( 0 \le K_{A} \le \bar{K}_{A2} \), then \( q_{A}^{D*} \) decreases, \( I_{B}^{DN*} \), \( q_{B}^{DN*} \), and \( J_{B}^{DN*} \) increase where \( \bar{K}_{A2} = \frac{{\alpha_{A} - 2\beta_{A} c_{A} }}{{2\alpha_{A} \gamma_{A} + \beta_{A} }} \);

(b) if \( K_{A} > \bar{K}_{A2} \), then \( q_{A}^{D*} \) increases,\( I_{B}^{DN*} \), \( q_{B}^{DN*} \), and \( J_{B}^{DN*} \) decrease.

It follows from Eq. (6) that the cost multiplier of manufacturer A’s R&D effort first increases then decreases as \( K_{A} \) increases. Hence, as shown in Proposition 5, manufacturer A tends to produce less when \( K_{A} \le \bar{K}_{A2} \) and produce more when \( K_{A} > \bar{K}_{A2} \). Manufacturer B, as the competitor, would become more positive in investing in its R&D effort, and achieve a higher output and profitability as \( K_{A} \) increases when \( K_{A} \le \bar{K}_{A2} \). When \( K_{A} > \bar{K}_{A2} \), manufacturer B would invest less in R&D, produce less, and obtain a lower profit as \( K_{A} \) increases.

Note that Proposition 5 does not specify how manufacturer A’s equilibrium R&D effort level \( \left( {I_{A}^{D*} } \right) \) and equilibrium profit (\( J_{A}^{D*} ) \) would change as \( K_{A} \) increases. Our numerical experiments show that both \( I_{A}^{D*} \) and \( J_{A}^{D*} \) either increase or decrease in \( K_{A} \). To illustrate these results, we use the following numerical example with \( \alpha_{A} { = 5} \), \( c_{A} { = 2} \), \( \alpha_{B} { = 5} \), \( c_{B} { = 3} \), \( \delta = 0. 5 \), \( \rho = 0. 8 \), \( r = 1,a = 1 0 0 \), \( b = 2 \), \( \beta_{A} = 0. 7 5 \), \( \gamma_{A} = 0. 2 \). Figure 2 shows the results of numerical analysis.

As \( K_{A} \) increases, Eq. (2) implies that the effectiveness of manufacturer A’s R&D effort, i.e., \( \tilde{\alpha }_{A} \left( {K_{A} } \right) \), always improves, but Eq. (6) implies that the cost multiplier of manufacturer A’s R&D effort, i.e., \( \tilde{c}_{A} \left( {K_{A} } \right) \), first increases then decreases. Therefore, these two conflicting driving forces could incentivize manufacturer A either increase or decrease its R&D effort level. Additionally, when \( K_{A} \) increases, it means that manufacturer A utilizes online customer reviews more significantly in NPD, which may benefit or hurt manufacturer A’s profitability. Therefore, there exists an optimal level of customer agility which would maximize manufacturer A’s overall profit.

Since the benchmark model of Sect. 3 corresponds to \( K_{A} = 0 \) in the main model of Sect. 4, Proposition 1 and Fig. 2 also establish the difference of the manufacturers’ equilibrium outcomes between the benchmark model and the main model. That is, when manufacturer A utilizes its online customer reviews in its NPD, both manufacturers’ R&D effort levels, outputs, and profits in the main model could be higher or lower than those in the benchmark model depending on the specific values of customer agility (\( K_{A} ) \). This result is driven by the fact that utilizing online customer reviews not only improves the effectiveness of the manufacturer’s R&D effort but also increases its R&D cost.

4.3 Extension: product differentiation

In the previous sections, we assume that the manufacturers’ products are homogenous. In this section, we relax this assumption and study an extended setting in which the products are heterogeneous with different prices and outputs. Specifically, we use a competition framework inspired by Singh and Vives (1984), Fanti and Gori (2012), where manufacturer i (i = A, B) faces an inverse demand function

where the parameter \( R \) measures the degree of product differentiation with \( 0 \le R \le 1 \). The two boundary cases, \( R = 0 \) and \( R = 1 \), represent the maximum (independent products) and the minimum (homogeneous products) degree of differentiation, respectively.

Since the benchmark model in Sect. 3 is just a special case of the main model in Sect. 4, we here only follow the main model setup, i.e., manufacturer A utilizes online customer reviews, but manufacturer B does not. Hence, we have

where \( p_{A} = a - bq_{A} - bRq_{B} \) and \( p_{B} = a - bq_{B} - bRq_{A} \). We obtain the equilibrium solutions to problems (16) and (17), formally presented in the following Lemma.

Lemma 3

In equilibrium,

(a) respective R&D effort levels manufacturers A and B are

(b) respective outputs for manufacturers A and B are

(c) respective profits for manufacturers A and B are

where \( L = r^{2} \left( {\rho + \delta } \right)\delta b\left( {\tilde{\alpha }_{A} \left( {K_{A} } \right)^{2} c_{B} + \alpha_{B}^{2} \tilde{c}_{A} \left( {K_{A} } \right)} \right) + \left( {\rho + \delta } \right)^{2} \delta^{2} \tilde{c}_{A} \left( {K_{A} } \right)c_{B} + r^{4} \tilde{\alpha }_{A} \left( {K_{A} } \right)^{2} \alpha_{B}^{2} \left( {1 - R^{2} } \right)b^{2} \).

Similar to Sect. 4.2, we also explore how variations in the model parameters would affect the equilibrium outcomes of manufacturers when the manufacturers’ products are differentiated. Due to the complexity of the equilibrium in Lemma 3, we are not able to conduct the sensitivity analysis on these parameters (\( \delta \), \( \rho \), \( \tilde{\alpha }_{A} \left( {K_{A} } \right) \), \( \tilde{c}_{A} \left( {K_{A} } \right) \) and \( K_{A} \)) analytically. Our numerical experiments show that the effect of a change in any of the parameters on the equilibrium \( I_{i}^{S*} \), \( q_{i}^{S*} \) and \( J_{i}^{S*} \) is similar to those of Propositions 1-5. As an illustrative example, we use \( \alpha_{A} { = 5} \), \( c_{A} { = 2} \), \( \alpha_{B} { = 5} \), \( c_{B} { = 3} \), \( \delta = 0. 5 \), \( \rho = 0. 8 \), \( r = 1,a = 5 0 \), \( b = 0. 5 \), \( \beta_{A} = 0. 7 5 \), \( \gamma_{A} = 0. 2 \), \( K_{A} = 1 \), and \( R = 0. 5 \) as the basis and vary one parameter at a time.

First, the effect of a change in the natural loss multiplier of output (\( \delta ) \) on the equilibrium R&D effort levels and outputs can be characterized in Fig. 3 by varying \( \delta \). We find that when \( \delta \) increases, \( q_{i}^{S*} \) (i = A, B) decreases, \( I_{i}^{S*} \) and \( J_{i}^{S*} \) first increase and then decrease, which are the same as Proposition 1. The only difference is the specific values of the threshold \( \hat{\delta } \) because of the product differentiation.

Second, the effect of a change in discount rate (\( \rho \)) on the equilibrium R&D effort levels and outputs can be characterized in Fig. 4 by varying \( \rho \). We find that when \( \rho \) increases, \( q_{i}^{S*} \) and \( I_{i}^{S*} \) both decrease, \( J_{i}^{S*} \) first increases and then decreases, which are same as Proposition 2. The only difference is the values of the threshold \( \hat{\rho } \).

Third, the effect of a change in the effectiveness of effort on the equilibrium R&D effort levels and outputs can be characterized in Figs. 5 and 6 by varying \( \alpha_{A} \) or \( \beta_{A} \), repectively. We find Proposition 3 still hold except that the threshold values (\( \hat{\alpha }_{A} \) and \( \hat{\beta }_{A} ) \) change.

Fourth, the effect of a change in cost multiplier for R&D effort on the equilibrium R&D effort levels and outputs can be characterized in Figs. 7 and 8 by varying \( c_{A} \) or \( \gamma_{A} \), repectively. We observe that Proposition 4 is still valid except that the threshold values (\( \hat{c}_{A} \;{\text{and}}\; \hat{\gamma }_{A} ) \) change.

Last but not the least, the effect of a change in customer agility on the equilibrium R&D effort levels and outputs can be characterized in Fig. 9 by varying \( K_{A} \) using \( R = 0.97 \) instead of \( R = 0.5 \) to ensure that the threshold \( \bar{K}_{A2} > 0 \;{\text{and}}\;\bar{K}_{A} > 0, \) as shown in Fig. 9. We find that Proposition 5 still holds here.

Note that when \( R = 0.5 \), then \( \bar{K}_{A2} < 0 \) and \( \bar{K}_{A} < 0 \), Proposition 5 (a) is an invalid case, only Proposition 5 (b) is valid. As shown in Fig. 10, as \( K_{A} \) increases, \( I_{B}^{DN*} \), \( q_{B}^{DN*} \), and \( J_{B}^{DN*} \) decrease,\( I_{A}^{D*} \) and \( q_{A}^{D*} \) increase, \( J_{A}^{D*} \) first increase and then decrease. The results are consistent with Proposition 5 (b).

5 Conclusions and implications

5.1 Conclusions

To improve new product performance, firms progressively embrace online customer reviews to innovate their NPD process. We address two different NPD settings using a differential game approach in this study. First, we discuss the impact of online customer reviews on NPD by considering a duopoly setting where the products supplied by two manufacturers are homogenous. In the benchmark model, we propose a closed NPD setting, in which both manufacturers depend on their internal R&D effort to develop new products without leveraging online customer reviews. In our main model, we study an open NPD setting in which one manufacturer develops new products leveraging online customer reviews, but the other manufacturer only depends on their internal R&D. Second, we extend our main model by relaxing the product homogeneity assumption. We derive the equilibrium solutions analytically for all the models.

Based on the equilibrium solution, we draw a number of managerial insights which are consistent in both the main and the extended models. Our results indicate that when a manufacturer’s effectiveness of its R&D effort by leveraging online customer reviews increases, or when a manufacture’s cost multiplier of its R&D effort decreases, it always hurts the other manufacturer (the competitor), but it may not necessarily benefit this particular manufacturer. In addition, we show that when manufacturer A’s customer agility increases, both manufacturers’ profits either increase or decrease.

5.2 Implications for research and practice

In terms of theoretical contributions, our study extends the boundaries of product innovation theory and provides important evidence to support the role of online customer reviews on the customer-driven NPD approach. Prior customer-oriented innovation studies have focused primarily on utilizing demand-side knowledge from a small group of accessible customers (Nishikawa et al. 2013; Colazo 2014). In the era of big data, it is more convenient and easier for firms to collect online customer reviews and access a massive amount of general customers’ opinions from a variety of websites including review platforms, online stores, and innovation communities (Zhou et al. 2018). Leveraging big data of online customer reviews in NPD enables firms to move away from product-focused innovation and to turn their attention to innovation around customers’ preferences and needs. This is a paradigm-shifting customer involvement approach (Zhan et al. 2018), because massive online customer reviews could lead to a more comprehensive understanding of the market and thus inspire more novel ideas (Sambamurthy et al. 2003). However, the implementation of customer involvement approach utilizing online customer reviews also put considerable strain on firms such as IT infrastructure, analytical technique of unstructured big data, organizational culture, etc. We know little about how firms’ performance would be affected by utilizing online customer reviews in NPD. Our study fulfills this gap to present several settings about this tension between the benefits and costs of utilizing online customer reviews in NPD. The findings may direct future studies to pay more attention to the negative side of utilizing online customer reviews and to encourage firms to balance customer involvement in NPD.

Our study also provides some managerial implications to practice. As illustrated in this paper, big data of online customer reviews nowadays plays an important role in firms’ NPD. We intend to provide helpful insights into how online customer reviews can be used to enhance firms’ customer involvement in developing new products. First, our results imply that firms should make sufficient investment in utilizing online customer reviews in their NPD processes, but at the same time, not to exceed a certain threshold since its costs might exceed its benefits. Second, our findings help managers to design more specific NPD strategies that match various internal and external conditions. For instance, firms need to execute different strategies in customer agility when the volume of online customer reviews or its NPD phrase is different. Finally, it is necessary for managers to identify customers’ real needs from online customer reviews and to plan the customer involvement approach carefully to balance potential costs and expected benefits.

5.3 Limitations and future directions

There are several limitations in this study which need further exploration in the future. First, we assume only one manufacturer uses online customer reviews in NPD, while the other manufacturer does not. It would be interesting to explore firms’ performance when both manufacturers leverage online customer reviews. Second, we propose a differential game approach here. It is worthwhile to verify if our conclusions and managerial insights still hold using other game methodology. Third, empirical studies are needed to test what factors of online customer reviews would influence firms’ customer agility and performance in NPD. Finally, text mining approaches can be utilized to analyze massive online customer reviews in our future research.

References

Bertinelli, L., Camacho, C., & Zou, B. (2014). Carbon capture and storage and transboundary pollution: A differential game approach. European Journal of Operational Research, 237(2), 721–728.

Bharadwaj, N., Nevin, J. R., & Wallman, J. P. (2012). Explicating hearing the voice of the customer as a manifestation of customer focus and assessing its consequences. Journal of Product Innovation Management, 29(6), 1012–1030.

Boudreau, K. J. (2012). Let a thousand flowers bloom? An early look at large numbers of software app developers and patterns of innovation. Organization Science, 23(5), 1409–1427.

Bowden, J. L. H., Gabbott, M., & Naumann, K. (2015). Service relationships and the customer disengagement–engagement conundrum. Journal of Marketing Management, 31, 774–806.

CB Insights. (2018). The top 20 reasons startups fail [WWW Document]. https://www.cbinsights.com/research/startup-failure-reasons-top/. Accessed 6, December 20118.

Chesbrough, H. W. (2003). Open innovation: The new imperative for creating and profiting from technology. Harvard: Harvard Business Press.

Chesbrough, H. W. (2006a). The era of open innovation. Managing Innovation and Change, 127(3), 34–41.

Chesbrough, H. W. (2006b). Open innovation: a new paradigm for understanding industrial innovation. Berke-ley: Oxford University Press.

Chuang, S. H., & Lin, H. N. (2015). Co-creating e-service innovations: Theory, practice, and impact on firm performance. International Journal of Information Management, 35(3), 277–291.

Colazo, J. (2014). Performance implications of stage-wise lead user participation in software development problem solving. Decision Support Systems, 67, 100–108.

Cooper, R. G. (2014). What’s next? After stage-gate. Research Technology Management, 57(1), 20–31.

Cooper, R. G., & Kleinschmidt, E. J. (2011). New products: The key factors in success. Chicago: Marketing Classics Press.

Courtney, C., Dutta, S., & Li, Y. (2017). Resolving Information Asymmetry: Signaling, Endorsement, and Crowdfunding Success. Entrepreneurship Theory & Practice, 41(2), 265–290.

Creane, A. (2002). Uncertain product quality, optimal pricing and product development. Annals of Operations Research, 114(1), 83–103.

Demirezen, E. M., Kumar, S., & Shetty, B. (2016). Managing co-creation in information technology projects: A differential games approach. Information Systems Research, 27(3), 517–537.

Dockner, E. J., Jorgensen, S., Van Long, N., & Sorger, G. (2000). Differential games in economics and management science. Cambridge: Cambridge University Press.

Duan, W., Gu, B., & Whinston, A. B. (2008a). Do online reviews matter? —an empirical investigation of panel data. Decision Support Systems, 45(4), 1007–1016.

Duan, W., Gu, B., & Whinston, A. B. (2008b). The dynamics of online word-of-mouth and product sales—An empirical investigation of the movie industry. Journal of Retailing, 84(2), 233–242.

Dunk, A. S. (2011). Product innovation, budgetary control, and the financial performance of firms. British Accounting Review, 43(2), 102–111.

Elsadany, A. A., & Awad, A. M. (2019). Dynamics and chaos control of a duopolistic Bertrand competitions under environmental taxes. Annals of Operations Research, 274(1), 211–240.

Fanti, L., & Gori, L. (2012). The dynamics of a differentiated duopoly with quantity competition. Economic Modelling, 29(2), 421–427.

Fibich, G., Gavious, A., & Lowengart, O. (2003). Explicit solutions of optimization models and differential games with nonsmooth (asymmetric) reference-price effects. Operations Research, 51(5), 721–734.

Fonseca, L., & Domingues, J. P. (2017). ISO 9001: 2015 edition-management, quality and value. International Journal of Quality Research, 1(11), 149–158.

Füller, J., Hutter, K., Hautz, J., & Matzler, K. (2006). User roles and contributions in innovation-contest communities. Journal of Management Information Systems, 31(1), 273–308.

Jorgensen, S., & Gromova, E. V. (2016). Sustaining cooperation in a differential game of advertising goodwill accumulation. European Journal of Operational Research, 254(1), 294–303.

Lichtenthaler, U. (2016). Absorptive capacity and firm performance: An integrative framework of benefits and downsides. Technology Analysis & Strategic Management, 28(6), 664–676.

Li, G., Zheng, H., Sethi, S. P., & Guan, X. (2020). Inducing downstream information sharing via manufacturer information acquisition and retailer subsidy. Decision Sciences, 51(3), 691–719.

Liu, D., Kumar, S., & Mookerjee, V. S. (2012). Advertising strategies in electronic retailing: a differential games approach. Information Systems Research, 23(3), 903–917.

Maruping, L. M., Venkatesh, V., & Agarwal, R. (2009). A control theory perspective on agile methodology use and changing user requirements. Information Systems Research, 20(3), 377–399.

McAfee, A., & Brynjolfsson, E. (2012). Big data: the management revolution. Harvard Business Review, 90(10), 60–68.

Mookerjee, V., Mookerjee, R., Bensoussan, A., & Yue, W. T. (2011). When hackers talk: Managing information security under variable attack rates and knowledge dissemination. Information Systems Research, 22(3), 606–623.

Mudambi, S. M., & Schuff, D. (2010). What makes a helpful review? a study of customer reviews on Amazon.com. MIS Quarterly, 34(1), 185–200.

Myers, S., & Marquis, D. G. (1965). Successful industrial innovations: a study of factors underlying innovation in selected firms. National Science Foundation Report.

Nambisan, S. (2002). Designing virtual customer environments for newproduct development: Toward a theory. Academy of Management Review, 27(3), 392–413.

Nerlove, M., & Arrow, K. (1962). Optimal advertising policy under dynamic conditions. Economica, 39, 129–142.

Nishikawa, H., Schreier, M., & Ogawa, S. (2013). User-generated versus designer-generated products: A performance assessment at Muji. International Journal of Research in Marketing, 30(2), 160–167.

Ouardighi, F. E., Kogan, K., Gnecco, G., & Sanguineti, M. (2020). Transboundary pollution control and environmental absorption efficiency management. Annals of Operations Research, 287(2), 653–681.

Poetz, M. K., & Schreier, M. (2012). The value of crowdsourcing: can users really compete with professionals in generating new product ideas? Journal of Product Innovation Management, 29(2), 245–256.

Prahalad, C. K., & Ramaswamy, V. (2004). Co-creation experiences: The next practice in value creation. Journal of Interactive Marketing, 18(3), 5–14.

Priem, R. L. (2007). A consumer perspective on value creation. Academy of Management Review, 32(1), 219–235.

Priem, R. L., Li, S., & Carr, J. C. (2012). Insights and new directions from demand-side approaches to technology innovation, entrepreneurship, and strategic management research. Journal of Management, 38(1), 346–374.

Robert, D. L., & Candi, M. (2014). Leveraging social network sites in new product development: Opportunity or hype? Journal of Product Innovation Management, 31(S1), 105–117.

Roberts, N., & Grover, V. (2012). Leveraging information technology infrastructure to facilitate a firm’s customer agility and competitive activity: an empirical investigation. Journal of Management Information Systems, 28(4), 231–270.

Salehan, M., & Kim, D. J. (2016). Predicting the performance of online consumer reviews: a sentiment mining approach to big data analytics. Decision Support Systems, 81, 30–40.

Sambamurthy, V., Bharadwaj, A., & Grover, V. (2003). Shaping agility through digital options: Reconceptualizing the role of information technology in contemporary firms. MIS Quarterly, 27(2), 237–263.

Sarin, S., & O’ Connor, G. C. (2009). First among equals: The effect of team leader characteristics on the internal dynamics of cross-functional product development teams. Journal of Product Innovation Management, 26(2), 188–205.

Sashi, C. M. (2012). Customer engagement, buyer-seller relationships, and social media. Management Decision, 50(2), 253–272.

Singh, N., & Vives, X. (1984). Price and quantity competition in a differentiated duopoly. The Rand Journal of Economics, 15(4), 546–554.

Steinfeld, E. S., & Beltoft, T. (2014). Innovation lessons from China. MIT Sloan Management Review, 55(4), 49–55.

Tams, C., 2018. The Co-creation Imperative: How to make organizational change collaborative [WWW Document]. Forbes. http://www.forbes.com/sites/carstentams/2018/02/11/the-co-creation-imperative-how-to-make-organizationalchange-collaborative. Accessed 6, December 2018.

Tsai, J., Raghu, T. S., & Shao, B. B. M. (2013). Information systems and technology sourcing strategies of e-retailers for value chain enablement. Journal of Operations Management, 31(6), 345–362.

Von Hippel, E. (2001). Innovation by user communities: Learning from open-source software. MIT Sloan Management Review, 42(4), 82.

Von Hippel, E. (2005). Democratizing innovation. Cambridge, MA: The MIT Press.

Wamba, S. F., Akter, S., Edwards, A., Chopin, G., & Gnanzou, D. (2015). How ‘big data’ can make big impact: Findings from a systematic review and a longitudinal case study. International Journal of Production Economics, 165, 234–246.

Wamba, S. F., & Carter, L. (2014). Social media tools adoption and use by SMEs: An empirical study. Journal of Organizational and End User Computing, 26(2), 1–17.

Yoon, J., Rosales, C., & Talluri, S. (2018). Inter-firm partnerships-strategic alliances in the pharmaceutical industry. International Journal of Production Research, 56(1–2), 862–881.

Zhan, Y. Z., Tan, K. H., Li, Y. N., & Tse, Y. K. (2018). Unlocking the power of big data in new product development. Annals of Operations Research, 270(1), 577–595.

Zhou, S., Qiao, Z., Du, Q., Wang, G. A., Fan, W., & Yan, X. (2018). Measuring customer agility from online reviews using big data text analytics. Journal of Management Information Systems, 35(2), 510–539.

Zhu, F., & Zhang, X. (2010). Impact of online consumer reviews on sales: the moderating role of product and consumer characteristics. Journal of Marketing, 74(2), 133–148.

Acknowledgements

This work are supported financially by the Ministry of education of Humanities and Social Science Foundation of China (No. 17YJA630059) and Program for Liaoning Innovative Talents in University (No. WR2018002).

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendix: Mathematical Proofs

Appendix: Mathematical Proofs

Proof of Lemma 1

We differentiate \( \rho V_{i} \left( {q_{i} } \right) \), given by Eq. (10) with respect to \( I_{i} \), then equate them to zero to get

Substituting \( I_{i} \left( t \right) \) into the HJB Eq. (10), assuming that the value functions \( V_{i} \left( {q_{i} } \right) \) with respect to \( q_{i} \) is

where the parameters \( m_{1} \),\( m_{2} \) are constants. Substituting (18) and its first-order derivative of Eq. (19) with respect to \( q_{i} \) into (10), then we have:

where \( Q = q_{A}^{*} + q_{B}^{*} \). Substituting (20) into (1), we have

Substituting (21) into (3), we can solve the optimal R&D effort levels and outputs of manufacturer i provided in part(c) and part(b) of Lemma 1. Then substituting them into (7), we can solve the optimal profit of manufacturer i, as shown in part(c) of Lemma 1. Therefore, in equilibrium the market-clearing price is

□

Proof of Lemma 2

The proof of Lemma 2 is similar to that of Lemma 1. Specifically, when manufacturer A utilizes online customer reviews, its effectiveness of effort changes from \( \alpha_{A} \) to \( \tilde{\alpha }_{A} \left( {K_{A} } \right) \), and its cost multiplier for R&D effort changes from \( c_{A} \) to \( \tilde{c}_{A} \left( {K_{A} } \right) \). We differentiate \( \rho V_{A}^{D} \left( {q_{A} } \right) \) and \( \rho V_{B}^{DN} \left( {q_{B} } \right) \), given by (13) and (14), with respect to \( I_{A} \) and \( I_{B} \), respectively, then equate them to zero to get

Substituting \( I_{A} \left( t \right) \) and \( I_{B} \left( t \right) \) into the HJB Eqs. (13) and (14), respectively. Assuming that the value functions \( V_{A}^{D} \left( {q_{A} } \right) \) and \( V_{B}^{DN} \left( {q_{B} } \right) \) with respect to \( q_{A} \) and \( q_{B} \), respectively, are

where parameters \( n_{1} ,n_{2} , x_{1} ,x_{2} \) are constants. Substituting (23) and its first-order derivative of (25) with respect to \( q_{A} \) into (13), and substituting (24) and its first-order derivative of (26) with respect to \( q_{B} \) into (14), we have

where \( Q = q_{A}^{*} + q_{B}^{*} \).. Substituting (27) and (28) into (1), we have

Substituting (29) and (30) into (3), we can solve the optimal R&D effort levels and outputs of manufacturer i provided in part(c) and part(b) of Lemma 2. Then, substituting them into (11) and (12), we can solve the optimal profits of manufacturer i, as shown in part(c) of Lemma 2. Hence, the equilibrium market-clearing price is

□

Proof of Proposition 1

Taking the first derivative of Lemma 2(a) with respect to \( \delta \), we have

As \( \delta \) increases, it follows directly that if \( \delta < \sqrt {\frac{{r^{2} \tilde{\alpha }_{A} \left( {K_{A} } \right)^{2} c_{B} b + r^{2} \alpha_{B}^{2} \tilde{c}_{A} \left( {K_{A} } \right)b}}{{\tilde{c}_{A} \left( {K_{A} } \right)c_{B} }}} \), then \( I_{A}^{D *} \) and \( I_{B}^{DN *} \) increase, otherwise,\( I_{A}^{D *} {\text{and}} I_{B}^{DN *} \) decrease. And taking the first derivative of \( q_{A}^{D*} \) and \( q_{B}^{DN*} \) given in Lemma 2(b) with respect to \( \delta \), we have

Hence, as \( \delta \) increases,\( q_{A}^{D *} \) and \( q_{B}^{DN *} \) decrease.□

Proof of Proposition 2

Taking the first derivative of \( I_{A}^{D*} \) and \( I_{B}^{DN*} \) given in Lemma 2(a) with respect to \( \rho \), we have

Hence, as \( \rho \) increases, \( I_{A}^{D *} \) and \( I_{B}^{DN *} \) decrease. Taking the first derivative of \( q_{A}^{D*} \) and \( q_{B}^{DN*} \) given in Lemma 2(b) with respect to \( \rho \), we have

Therefore, as \( \rho \) increases, \( q_{A}^{D *} \) and \( q_{B}^{DN *} \) decrease. And taking the first derivative of \( J_{A}^{D*} \) and \( J_{B}^{DN*} \) given in Lemma 2(c) with respect to \( \rho \), we have

Then, it is straight forward to show that if \( \rho < \frac{{r^{2} \tilde{\alpha }_{A} \left( {K_{A} } \right)^{2} c_{B} b + r^{2} \alpha_{B}^{2} \tilde{c}_{A} \left( {K_{A} } \right)b}}{{\delta \tilde{c}_{A} \left( {K_{A} } \right)c_{B} }} \), then \( J_{A}^{D *} \) and \( J_{B}^{DN *} \) increase as \( \rho \) increases, otherwise,\( J_{A}^{D *} \) and \( J_{B}^{DN *} \) decrease. □

Proof of Proposition 3

As shown in Lemma 2, \( \tilde{\alpha }_{A} \left( {K_{A} } \right) = \alpha_{A} + \beta_{A} K_{A} \), so if \( \alpha_{A} \) or \( \beta_{A} \) increases, then \( \tilde{\alpha }_{A} \left( {K_{A} } \right) \) increases. Taking the first derivative of \( I_{A}^{D*} \) and \( I_{B}^{DN*} \) given in Lemma 2(a) with respect to \( \tilde{\alpha }_{A} \left( {K_{A} } \right) \), we have

It can then be easily verified that when \( \tilde{\alpha }_{A} \left( {K_{A} } \right) \) increases, if \( \tilde{\alpha }_{A} \left( {K_{A} } \right) < \frac{{\tilde{c}_{A} \left( {K_{A} } \right)\alpha_{B}^{2} }}{{c_{B} }} + \frac{{\left( {\rho + \delta } \right)\delta \tilde{c}_{A} \left( {K_{A} } \right)}}{{r^{2} b}} \), then \( I_{A}^{D*} \) increases; otherwise,\( I_{A}^{D*} \) decreases. As \( \tilde{\alpha }_{A} \left( {K_{A} } \right) \) increases, \( I_{B}^{DN *} \) decreases. And taking the first derivative of \( q_{A}^{D*} \) and \( q_{B}^{DN *} {\text{given in }} \) Lemma 2(b) with respect to \( \tilde{\alpha }_{A} \left( {K_{A} } \right) \), we have

It follows directly from Lemma 2(c) that we have

After some algebra, we can show that when \( \tilde{\alpha }_{A} \left( {K_{A} } \right) \) increases, if \( \tilde{\alpha }_{A} \left( {K_{A} } \right) < \frac{{\tilde{c}_{A} \left( {K_{A} } \right)\alpha_{B}^{2} }}{{c_{B} }} + \frac{{\left( {\rho + \delta } \right)\delta \tilde{c}_{A} \left( {K_{A} } \right)}}{{r^{2} b}} \), then \( J_{A}^{D *} \) increases; otherwise, \( J_{A}^{D *} \) decreases. And as \( \tilde{\alpha }_{A} \left( {K_{A} } \right) \) increases, \( J_{B}^{DN *} \) decreases. □

Proof of Proposition 4

As shown in Lemma 2, \( \tilde{c}_{A} \left( {K_{i} } \right) = c_{A} + K_{A} - \gamma_{A} K_{A}^{2} \), so if \( c_{A} \) increases or \( \gamma_{A} \) decreases, then \( \tilde{c}_{A} \left( {K_{A} } \right) \) increases. It follows directly from Lemma 2(a) that we have

Hence, we show Proposition 4(a) holds. After some algebra, Lemma 2(b) directly implies that

Therefore, Proposition 4(b) holds. It follows directly from Lemma 2(c) that we have

After some algebra, we can show that when \( \tilde{c}_{A} \left( {K_{A} } \right) \) increases, if \( \tilde{c}_{A} \left( {K_{A} } \right) < \frac{{r^{2} \tilde{\alpha }_{A} \left( {K_{A} } \right)^{2} c_{B} b}}{{r^{2} \alpha_{B}^{2} b + \left( {\rho + \delta } \right)\delta c_{B} }} \), then \( J_{A}^{D *} \) increases; otherwise, \( J_{A}^{D *} \) decreases. Hence, Proposition 4 (c)-(d) hold. □

Proof of Proposition 5

Taking the first derivative of \( I_{B}^{DN *} \) in Lemma 2(a) with respect to \( K_{A} \), we have

And taking the first derivative of \( q_{A}^{D*} \) and \( q_{B}^{DN*} \) give in Lemma 2(b) with respect to \( K_{A} \), we have

Next, taking the first derivative of \( J_{B}^{DN*} \) in Lemma 2(c) with respect to \( K_{A} \), then we have

where \( 2\tilde{\alpha }_{A} \left( {K_{A} } \right)^{'} \tilde{c}_{A} \left( {K_{A} } \right) - \tilde{\alpha }_{A} \left( {K_{A} } \right)\tilde{c}_{A} \left( {K_{A} } \right)^{'} = 2\beta_{A} c_{A} - \alpha_{A} + \left( {\beta_{A} + 2\alpha_{A} c_{A} } \right)K_{A} . \) We find that when \( K_{A} \) increases, if \( 0 \le K_{A} \le \bar{K}_{A2} \), then \( q_{A}^{D*} \) decreases,\( I_{B}^{DN*} \),\( q_{B}^{DN*} \), and \( J_{B}^{DN*} \) increase; otherwise,\( q_{A}^{D*} \) increases,\( I_{B}^{DN*} \), \( q_{B}^{DN*} \), and \( J_{B}^{DN*} \) decrease. □

Rights and permissions

About this article

Cite this article

Liu, W., Xu, K., Chai, R. et al. Leveraging online customer reviews in new product development: a differential game approach. Ann Oper Res 329, 401–424 (2023). https://doi.org/10.1007/s10479-020-03784-5

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10479-020-03784-5