Abstract

In this article we extend the research on risk-based asset allocation strategies by exploring how using an SRI universe modifies properties of risk-based portfolios. We focus on four risk-based asset allocation strategies: the equally weighted, the most diversified portfolio, the minimum variance and the equal risk contribution. Using different estimators of the matrix of covariances, we apply these strategies to the EuroStoxx universe of stocks, the Advanced Sustainability Performance Index (ASPI) and the complement of the ASPI in the EuroStoxx universe from March 15, 2002 to May 1, 2012. We observe several impacts but one is particularly important in our mind. We observe that risk-based asset allocation strategies built on the entire universe, concentrate their solution on non-SRI stocks. Such risk-based portfolios are therefore under-weighted in socially responsible firms.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 What are smart beta strategies and socially responsible investment?

Against a background of market disappointments, such as poor performance of market capitalisation weighted indices and active portfolios, risk-based strategies stand out as financial vehicles for sophisticated institutional investors. Risk-based strategies are heuristic and quantitative asset allocation strategies that are special cases of the risk budgeting allocation approach. It is one type of alternative weighting approach to asset allocation, the other being the fundamental allocation (Arnott et al. 2005). The different alternative weighting strategies are also known as smart beta strategies. Risk-based strategies define the weights of assets in portfolios as functions of individual and common asset risks. These strategies are heuristic because they do not rely on any formal equilibrium model of expected return.

The adoption of risk-based strategies is justified by different arguments (Maillard et al. 2010). The main one is that when back-tested, risk-based strategies outperform the traditional CW investment strategy. However, risk-based strategies also have several drawbacks. One of them is a lack of theoretical background supporting their historical efficiency. These strategies also involve issues of stability (i.e. turnover) and concentration in terms of weighting of the components of portfolios. To overcome these drawbacks, asset managers follow different implementation approaches.Footnote 1

In parallel with the rise of risk-based strategies and fuelled by the increasing public concern for sustainable development, a type of investment generally called socially responsible investment (SRI), is rapidly gaining favour with institutional investors. Briefly, SRI incorporates non-financial criteria into the construction of financial portfolios. These criteria include respecting simple subjective rules (e.g. no investment in gambling or tobacco businesses), or meeting a minimum level of extra-financial performance (e.g. investment in issuers that have low carbon emissions or low rate of fatalities compared to industry competitors). Extra-financial performance is evaluated by extra-financial rating agencies such as VIGEO.

The popularity of SRI is partly explained by a large literature showing that corporate extra-financial performance can lead to superior economic and/or financial performance through different mechanisms (Renneboog et al. 2008; Kitzmueller and Shimshack 2012). One of the motivations to adopt SRI is therefore to capture unpriced extra-financial characteristics so as to obtain higher risk-adjusted returns when market decide to price them. The financial motivation for adoption of SRI resembles the intuition justifying alternative weighting schemes. Actually, SRI can be considered a risk-based approach, between fundamental and risk based allocations,Footnote 2 where assets that do not match extra-financial criteria are given a weight equal to zero. Note that SRI can also be considered as an additional secondary non-financial goal in the mean-variance portfolio selection model as in Calvo et al. (2014).

In the light of these two parallel trends, risk-based strategies and SRI, we seek to extend the research on risk-based allocation by examining the impact of using an SRI universe on certain characteristics of risk-based portfolios. We look at four risk-based strategies, the equally weighted (EW), the most diversified portfolio (MDP), the minimum variance (MV) and the equal risk contribution (ERC). Using different estimators of the matrix of covariances, we apply these strategies to the EuroStoxx universe of stocks, the Advanced Sustainability Performance Index (ASPI) universe and the complement of the ASPI universe in the EuroStoxx universe.Footnote 3

At least five types of impact of using the ASPI universe of stocks emerge from our study. Based on the latter we are able to conclude that combining the risk-based strategies with the SRI approach does modify some properties of risk-based portfolios. This means that the adoption of SRI is not neutral, and needs particular attention from the institutional investors. In particular, we observed that risk-based strategies applied on the EuroStoxx favour stocks that do not belong to the ASPI universe. It means that an investor who follows one of those strategies will underweight firms that are socially responsible while this is not an explicit constraint of its allocation strategy.

In the rest of the paper we first present the four risk-based strategies examined. Section 2 gives the data and methodology for our back-tests and in Sect. 3 we analyze portfolios characteristics. The last section reviews the robustness of our results regarding risk models and concludes.

2 Smart beta strategies: calculation of weights

Usually there are four common types of risk-based strategies yielding four types of risk-based portfolios. In this section we review these four strategies and their particular risk contribution properties.

The first type is the EW portfolio. The EW portfolio depends solely on the number n of components and its weights \(w_i\) are given by:

This portfolio is straightforward and presents good out-of-sample performance compared to optimal portfolios (DeMiguel et al. 2009). It is perfectly diversified in weights, by construction.

The second type is the MV portfolio. The vector of weights w of the MV portfolio, with the variance-covariance matrix \(\varSigma \), is given by the following optimisation program:

This portfolio is straightforward to understand: it has the lowest ex ante volatility, does not rely on expected return input and offers good relative performance (Clarke et al. 2006; Scherer 2011). In addition, marginal risks (MR) are equal for all the components with a weight different from zero.

The third type of portfolio, the MDP (Choueifaty and Coignard 2008). To obtain the vector of weights w of this portfolio, Choueifaty and Coignard (2008) introduce a diversification measure that is maximized:

This portfolio is more diversified and less sensitive to small modifications in inputs than the MV portfolio. In addition, relative marginal risk (RMR) is equal for all the components with a weight different from zero.

The last type is the ERC portfolio (Maillard et al. 2010) where the risk contribution (RC) of each asset is the same.

It can be shown (Maillard et al. 2010) that the composition of this portfolio is given by the following program:

This portfolio does not explicitly rely on expected return input, by construction it is well diversified in terms of weightsFootnote 4 and risk, and it is less sensitive to slight modifications in inputs than the MV or MDP portfolios.

Table 1, based on the literature, summarizes how the different risk-based strategies stand in relation to each other, and to the tangent portfolio. Note that depending on the statistical properties of the stocks included in the portfolios, different strategies can yield the same allocation and the latter can be the tangent portfolio. In particular, the ERC and the MDP portfolios are to be identical when pairwise correlation is uniform. Since we use the constant correlation matrix of covariances in our analyses, it is important to control for this case.

Finally these different approaches, apart from the EW portfolio, rely on the matrix of variances and covariances \(\varSigma \). In the next section we present the different risk models we use to estimate our four portfolios.

3 Data and methodology of the study

We run our back-tests using daily returns (adjusted price and arithmetic returns) for three different universes of stocks: the EuroStoxx, the ASPI and the complement of the ASPI in the EuroStoxx universe. We use data from March 15, 2002 to May 1, 2012. Our data sources are, Datastream for prices and composition of the EuroStoxx, and IEMFootnote 5 for composition of the ASPI index. Finally, we calculate all returns in EurosFootnote 6 and, following the indices calculation methodology, we rebalance the portfolios at closing on the third Friday of March, June, September and December. Portfolios’ weights are allowed to drift between rebalancing dates and we exclude short-selling.

For the EuroStoxx and the complement universes of stocks, the weights of CW portfolios are calculated using free float market capitalisation based on Datastream information. The EW portfolios weights are given by the number of components, which is around 300 for EuroStoxx and around 180 for the complement of ASPI in the EuroStoxx universe.Footnote 7 For MV, MDP, ERC portfolios, we estimate weights by optimizing the respective objective functions introduced in the previous section. For the three optimisation programs, constraints are no short-sells and no cash holdings. For the ASPI universe of stocks, the weights of CW portfolios are calculated using information given by IEM. The EW portfolio weights are given by \(\hbox {N}=120\), the number of components of ASPI.Footnote 8 For MV, MDP, ERC portfolios, we estimate weights by optimizing the respective objective functions introduced in previous section. For EuroStoxx and the complement universe, optimisation constraints are no short-sells and no cash holdings.

Note that the solutions of the MV, MDP and ERC optimisation programs depend on the matrix of variances and covariances (the VCV matrix) of stock returns. The estimation of the VCV matrix is challenging. Hence without any imposed structure the challenge is that the number of parameters to estimate requires amount of data that are not always available to obtain reliable estimates. Extreme case is when the number of stocks is larger or equal to the number of historical returns per stock: the VCV matrix is singular or close to singularity. Imposing some structure allows to diminish the number of parameters to estimate, but in that case the challenge is to determine which structure to impose. Consequence of these challenges is that estimates and therefore solutions given by the optimisations are not stable, leading to high turnover. Different estimators of the VCV matrix have been proposed in the literature, a reminder of the diversity of implementation that investors may face. To control for the possible impact of the VCV matrices, we use four estimators: the empirical, the constant correlation,Footnote 9 the shrinkage estimator with the constant correlation VCV matrix, and the shrinkage estimator with the one-factor model VCV matrix (Ledoit and Wolf 2004).Footnote 10 At the outset and at each rebalancing, we update the VCV matrix from a 260-day rolling window of the most recent historical data.Footnote 11 Another problem in MV and MDP optimisations is the high concentration of solutions. As examined and proposed by Maillard et al. (2010), we run MV and MDP optimisation programs with upper-bound constraints (5 or 10 %) for weights.

As for our method of analysis, we first describe the portfolios that we obtain in terms of number of components, number of differences between portfolios yielded by the same strategy on different universes and, differences in weights for identical components in portfolios yielded by the same strategy applied to different universes. This enables us to compare portfolios. Second we focus on diversification, by analyzing for each portfolio and universe, the relative mean difference coefficients for weights, risk budget,Footnote 12 marginal risk, relative marginal risk and risk contribution. The use of relative mean difference will be explained later. Third we focus on turnover, by analyzing for each portfolio and universe, turnover of components and turnover of weights. Regressions are performed for all three steps to analyze the correlation of particular characteristics of portfolios with the strategy and the universe used. These regressions give us the economic and statistical significance of the relations of interest while controlling for particular parameters. Finally, we focus on performance. For each portfolio and universe we report descriptive statistics regarding the statistical properties of the distribution of returns of the different portfolios. We report annualized mean of daily return, volatility, skewness and kurtosis of daily returns, historical maximum draw down, volatility of daily tracking error and daily information ratio.Footnote 13

Our default case is the empirical VCV matrix. To develop analyses that are not dependent on the VCV matrix, we also run the regressions on datasets that pool the back tests obtained with the four VCV matrices. We discuss the impact of changing the risk model in Section 6.

4 Analysis of portfolios characteristics

4.1 Composition and differences in composition of portfolios

First, we analyzed portfolio composition. By counting the number of components, we distinguished two types of strategy: strategies that invest in the entire available universe (i.e. CW, EW, ERC) and strategies that pick some stocks from the available universe (i.e. MV, MDP and their bounded versions). Although this typology is obtained with the empirical VCV matrix, it is stable when we switch to other types of VCV. Only the MDP strategy with a constant VCV matrix is modified. In that case, it is similar to the ERC strategy (cf. Table 1).

Second, we built two measures to calculate differences in portfolio. Our first measure \(D_1\) is one minus portfolios A and B overlap. \(D_1\) is also half the absolute difference in weights \(w_i\) between the components of portfolios A and B. With n as overlapping components, this measure is given by the following formulas:

When \(D_1\) equals 1, it means that the two portfolios do not overlap. The portfolios have different lists of components. When \(D_1\) equals 0, it means that the two portfolio are identical. Our second measure \(D_2\) is the relative number of differences in the list of components of portfolio A with respect to the list of components of portfolio B. It is given by the following formula:

When \(D_2\) equals 1, it means that the two lists of components do not intersect. When \(D_2\) equals 0 it means that one list is equal to, or included in, the other. Using \(D_1\) in combination with \(D_2\), enables us to allow for the fact that certain strategies only pick some stocks from the available universe. Hence, while the two measures are consistent in the two extreme situations (perfect overlap and perfect difference), they can differ in other situations, especially where there are highly concentrated solutions. Thus, we think it is important to explicitly track differences in lists of components to avoid misleading comparisons based solely on differences in weights.

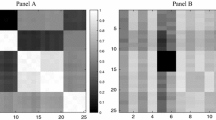

Figure 1 presents time series of measure \(D_1\) for each strategy built on different universes.Footnote 14 For each strategy we calculate the three possible measures of differences \(D_1\). The first measures differences between a given strategy built on the ASPI universe and on its complement in the EuroStoxx. The second and third respectively measure differences between a given strategy built on the ASPI universe and on the EuroStoxx, and between a given strategy built on the complement and on the EuroStoxx.

This analysis of the overlap of components yields several results. First, we observe a case where \(D_1\) is always equals to one. It is the trivial case that measures differences between strategy built on the ASPI universe and on its complement in the EuroStoxx. A second trivial result is about measures of differences for the EW and the ERC strategies. Those measures are driven by the number of components in studied universes and by the allocation rules that invest same amount of money (or almost same amount for the ERC) in all stocks of universes. Third, the CW portfolio built on the ASPI has fewer differences in weights compared to the CW portfolio built on the EuroStoxx (i.e. high weight overlapping) than the CW portfolio built on the complement universe. Because there are less stocks in the ASPI universe, our proposed explanation is the positive correlation between belonging to ASPI and size of firms in our sample.Footnote 15

The fourth and last result is new and important. Within our sample, the MDP and the MV asset allocation strategies built on the ASPI universe have very low overlap with portfolios built on the EuroStoxx universe (i.e. low weight overlapping), while same allocations built on the complement of the ASPI universe have very high overlap with portfolios built on the EuroStoxx universe (i.e. high weight overlapping). This means that the optimisation programs behind the MDP and the MV asset allocation strategies concentrate the program solutions on firms that are not socially responsible. Our proposed explanation for this tendency to invest in the complement of ASPI universe is the combination of two facts: the characteristics of stocks selected in the ASPI universe, and theoretical exposure of the different risk-based strategies to usual factors (Bertrand and Lapointe 2015; Clarke et al. 2013). Indeed by construction large firms are correlated to market, their beta tend to be close to one. For medium and small firms their beta can diverge below and above one. Hence because of size bias, firms in ASPI universe have a beta closer to one than firms in ASPI universe, which have a beta that can diverge from one. For instance in Fig. 2 the historical median of beta for stocks in ASPI is 0.93 while median of beta for stocks in ASPI is 0.79. Finally we note that the MV and the MD allocation strategies favor low-beta stocks. So the tendency to invest in the complement of ASPI universe can be explained by differences in size of universe and by low-beta exposition of universes.

Hence, an investor that uses those two strategies on the EuroStoxx universe will under-weight stocks in the ASPI universe while he did not state this as an explicit constraint of its allocation program. A second consequence is that, on an ex ante basis, MDP and MV portfolios built on the ASPI universe are less optimal than portfolios built on the EuroStoxx and complement of ASPI universes; the latter will be recalled in the section on performance.

4.2 Diversification of portfolios

The literature suggests that the advantage of risk-based allocations is better diversification than with the CW allocation. Thus, given that SRI is criticized for reducing opportunities for diversification, our main objective is to analyze how using an SRI universe impacts this strong point of risk-based strategies. We now analyze the diversification of portfolios through diversification of weights and diversification of risk budget, marginal risk, relative marginal risk and risk contribution.

Usually, diversification is measured with the Gini coefficient; however the Gini coefficient is valid only if the support of the analyzed distribution is null or positive. Since some of the characteristics we analyze can take negative values, we measure diversification via relative mean differenceFootnote 16 (RMD). For a given variable v, with n observations, the RMD is given by the following formula:

For each strategy, for each universe and for each VCV matrix, we calculate the RMDs on the entire universe available and at each rebalancing date, for the weight distributions and the four risk measures. We obtain four samples of time series of RMDs. The analysis of time series yields one main interesting observation: contrary to usual criticism it emerges that portfolios constructed on the ASPI universe tend to be the most diversified.Footnote 17

After a brief analysis of RMD time series we analyze jointly the measures of diversification of the different characteristics of portfolios. Indeed the diversification of a portfolio is a notion that covers different characteristics of a portfolio. We pool the five portfolios’ characteristics of interest (i.e. weight, risk budget, marginal risk, relative marginal risk and risk contribution) and run regressions of the RMDs on different factors we detail later. The purpose is to identify, in an unconditional and controlled statistical approach the relationship between diversification and the use of the ASPI universe, while testing for statistical significance.

The approach consists in regressing two samples of pooled RMDs of weights and risk measures on universe dummies, strategy dummies, interaction dummies, control dummies and number of components in respective portfolios and universes. Sample A groups RMDs obtained with the empirical VCV. Sample B groups RMDs obtained with the four VCV matrices. The control dummies control for size of portfolio, size of universe of reference, time and other technical controls. We control for the case of perfect diversification for the different VCV matrices. That is, the EW and weights, the MDP, ERC and the risk contribution. We control for the different types of characteristics analyzed.

The main resultFootnote 18 of the controlled regressions (Table 2) is that the ASPI universe is correlated with higher diversification (cf. negative coefficient for ASPI), how strongly depending on the strategy used. With the MV and the MDP, the effect on diversification is weaker than with the CW, the EW, the ERC, whatever the VCV matrix used. We point out that these negative interactions between strategies and universe constraints are consistent with cost of constraining optimisations with a reduced universe. Therefore we can say that reducing the universe has two opposite effects. It increases the diversification by grouping SRI and not SRI stocks together, and it decreases the diversification effect of risk-based strategies because of reducing universe of investment. The overall effect of using the ASPI universe is nonetheless to increase diversification of risk-based portfolios.

4.3 Turnover of portfolios

The literature identifies one drawback of risk-based allocations as being a higher level of turnover than with CW allocation, leading to higher transaction costs. Here, therefore, we examine how using an SRI universe impacts this disadvantage of risk-based allocations, in two steps.

First, we calculate two measures of the turnover of portfolios. \(T_1\) measures the turnover of the weights, and is commonly defined by the following formula:

By definition \(T_1\) is between 0 and 2 for one rebalancing and, for the first rebalancing, the turnover equals 1. \(T_2\) measure the turnover of components at a rebalancing date. For a portfolio that contains set of stocks \(A_t\) at time t, with \(IN_t\) the set of entering components at time t and \(OUT_t\) the set of exiting components at time t, component turnover is given by the following formula:

By definition \(T_2\) is between 0 and 2 for one rebalancing and, for the first rebalancing, the turnover equals 1. Using measure of turnover \(T_1\) with measure \(T_2\) enables us to allow for the fact that some strategies only pick some stocks out of the available universe. Since there is a difference between handling concentrated turnover and handling a diversified turnover, we think it is important to explicitly keep track of the number of components that change at rebalancing date. We calculate the two measures of turnover at each rebalancing date, for each strategy, for each universe and for each VCV matrix. In total, we obtain 8 samples of time series of measures of turnover.

The analysis of time series yields several observations,Footnote 19 but overall we cannot tell whether the utilisation of ASPI leads to higher turnover or not by simply looking at these time series (Fig. 3).

To answer our question we run regressions of each measure of turnover on different factors. As with diversification, the aim is to have controlled statistical measurements of the relationship between turnover and use of the ASPI universe while testing for statistical significance. The approach consists in regressing two samples of measure \(T_1\) and two samples of measure \(T_2\) against universe dummies, strategy dummies and number of components in portfolios and universes. For each measure, one sample groups the measures of turnover obtained with the empirical VCV, while the other sample groups the measures of turnover obtained with the four VCV matrices.

Finally the results of the controlled regressions show that the utilization of the ASPI universe is associated to a larger turnover than the complement of ASPI and the EuroStoxx universe, but this relationship is not statistically significant.Footnote 20 The reason is that ASPI universe has its own turnover which cumulates with turnovers of EuroStoxx universe and of the allocation strategies.

4.4 Performance of portfolios

We recall that strategies investing in the entire available universe (i.e. CW, EW, ERC) can be distinguished from those that pick some stocks out of the available universe (i.e. MV, MDP and their bounded versions). When all the strategies are compared (Table 3), all except the unbounded MV strategy outperform the CW portfolio in the three universes. This is in line with the literature.Footnote 21

The MV and the MDP portfolios only invest in some stocks and they are seen to be taking big bets. The results of our back tests illustrate what happens when one of these bets is “lost” or “won”. For instance, at the end of February 2009, Petroleos (CEPSA) lost 57 % of its value in three days. At that time, using the EuroStoxx universe, the MV strategy had more that 80 % invested in that stock and the MDP strategy had about 53 % invested. Conversely, the performance of the MV strategy applied to the ASPI universe of stocks illustrates what happens when the bets are “won”. Because of this manner of weighting, the MV and MDP strategies have the highest kurtosis and skewness of all the strategies.

When strategies investing in the entire available universe of stocks are compared to stock picking strategies, we observe that they show distributions of returns that are less asymmetric and prone to extremes. Moreover, of the strategies investing in the entire available universe of stocks, it is the ERC strategy that has the lowest ex-post volatility, the smallest maximum drawdown and the highest TEV. The ERC strategy also has the highest return and the lowest ex-post volatility (Table 3).

We now turn to the impact of the universe of stocks on the characteristics of a given type of strategy.

When we analyze the impact of the ASPI universe on the performance of strategies, the main result is that the unbounded MV and MDP strategies on the ASPI universe outperform all the other strategies on all the other universes (Table 3). This observation, together with that on the optimality of risk-based solutions (cf. page 8), illustrates the gap between ex ante optimisation and ex post realisation. These strategies yield better mean-variance portfolios with high kurtosis and positive skewness. The latter is also true for the strategies that invest in the entire universe (i.e. CW, EW, ERC). However, despite their positive skewness, the CW, EW and ERC strategies yield significantly poorer mean-variance portfolios. Using the ASPI universe has protected the MV and MDP strategies against extreme negative events experienced by some firms with poor extra-financial performance. With that protection, the advantage of the MV and MDP strategies in a context of financial crisis has been complete.

When the complement of ASPI universe is used, the strategies investing in the entire universe yield the best performing portfolios, with highest returns and lowest ex-post volatility (Table 3). However the distribution of returns of the CW, EW and ERC portfolios built on the complement of ASPI tends to be exposed to negative extreme returns. This trend gets stronger when we switch to strategies that pick some stocks out of the available universe. Hence, the distribution of returns of the MV and MDP portfolios built on the complement of ASPI have high kurtosis and negative skewness. This is consistent with the observation that investors perceive a correlation between extreme specific risk and weak social performance (Waddock and Graves 1997; Hong and Kacperczyk 2009), and with empirical findings (Boutin-Dufresne and Savaria 2004).

When the EuroStoxx universe is used, we obtain statistics that are similar to these obtained with the complement of ASPI. This is consistent with the high level of overlapping previously revealed. The MV portfolios built on the EuroStoxx and complement of ASPI universes also have ex-post volatilities higher than the volatility of the ASPI MV portfolio. Again this observation, together with that on the optimality of risk-based solutions (cf. page 8), illustrates the gap between ex ante optimisation and ex post realisation. It may also illustrate the lower quality of the statistical inputs obtained with the EuroStoxx and complement of ASPI universes.

5 Conclusion

Our intention here was to further explore risk-based allocations by examining how using an SRI universe impacts the characteristics of risk-based portfolios. We studied four risk-based strategies, the EW, the MDP, the MV and the ERC, using three universes of stocks, the EuroStoxx, the ASPI and the complement of ASPI universe. We worked with four different estimators of the VCV matrix: the empirical, the constant, the matrices shrunk towards a constant and towards a one-actor model.

At least five types of impact of using the ASPI universe of stocks emerge from our study. First, risk-based strategies applied on the EuroStoxx favour stocks that do not belong to the ASPI universe. In fact, the lists of components and the weights of overlapping components in EuroStoxx and ASPI differ widely. We consider the latter impact to be the most important result of our study because it means that risk-based portfolios are under-weighted in socially responsible investment firms. Second, grouping SRI firms together increases diversification of the weight and risk measure distributions, but decreases the effect of risk-based asset allocation strategies on diversification. These observations do not depend on type of VCV and are consistent with the constraints imposed on optimisations program. Third, risk-based portfolios built on the ASPI universe tend to present higher weight and component turnovers. Again, these observations do not depend on type of VCV. Fourth, the distributions of returns of portfolios built on the ASPI universe have positive skewness, while with the two other universes, portfolios have distributions of returns with negative skewness. Fifth, on the ASPI universe, all the risk-based strategies dominate the CW strategy, which is similar to findings on the two other universes and consistent with the empirical literature.

Note that whatever the VCV estimator, using an SRI universe is seen to impact the characteristics (i.e. diversification) of risk-based portfolios to the same degree. We only find some differences in the degree to which use of risk-based strategies affects the performance of SRI portfolios (Bertrand and Lapointe 2015). In addition more sophisticated VCV matrices significantly decrease the turnover of weights and components.

Finally, while recalling the usual limitations of back-testing, we conclude that using risk-based strategies in combination with the SRI approach somewhat modifies the properties of risk-based portfolios. Adopting SRI thus cannot be considered neutral and warrants careful attention from institutional investors. A first valuable extension of this work would be to check the robustness of our results using a different SRI universe with different rating methodology and covering different geographical zones. A second extension of this work would be to deal with the effect of using a SRI universe on strategies based on Value-at-Risk, Expected Shortfall or third and fourth moments.

Notes

Some of the implementation choices will be discussed in this paper, in the section on data and methodology.

Fundamental allocations define the weights as a function of issuers’ fundamental statistics see Arnott et al. (2005).

The EuroStoxx is a subset of the EuroStoxx 600 that contains a variable number of stocks, roughly 300, traded in Eurozone countries. The ASPI universe is a subset of EuroStoxx that contains the 120 best rated stocks. This social performance rating is given by VIGEO. The complement of the ASPI universe in the EuroStoxx universe is the universe of about 180 stocks that are in the EuroStoxx but not in the ASPI universe.

IEM is the firm in charge of calculation methodology for the ASPI. VIGEO is a provider of social performance ratings and sponsor of the ASPI.

By construction EuroStoxx is a Euro Zone universe.

As previously stated, the EuroStoxx is a subset of the EuroStoxx 600 that contains a variable number of stocks, roughly 300 depending on the methodology stated by STOXX.

For 2 rebalancing dates ASPI is defined by \(\hbox {N}=118\) and \(\hbox {N}=119\).

The empirical VCV matrices is \(VCV_e = \frac{1}{n-1} * \sum _{i=1}^n (r_i - \bar{r})(r_i - \bar{r})'\). The constant correlation matrix is a VCV matrix with empirical variances on the diagonal and average of empirical covariances on lower and upper part of the VCV matrix.

See also Maillet et al. (2015) for an approach that is robust to parameter uncertainty.

For some stocks historical series are shorter than the VCV estimation window. For the ASPI universe, this concerns two stocks out of 238, the smallest window is 100 days. For EuroStoxx and complement of ASPI universe, this concerns 53 stocks out of 536, the smallest windows is 12 days.

Risk budget is defined as the product of the weight of component i combined with its volatility.

The benchmark used is our replication of EuroStoxx CW indice.

Our results are confirmed by measures \(D_2\).

We recall that \(D_1\), our difference in weight, is one minus the sum of the lowest weights of stocks that are in the two portfolios based on the two different universes. As ASPI rules discard about 60 % of the EuroStoxx stocks, while we observe only 30 % of weight differences, the remaining 40 % stocks then must concentrate about 70 % of the weights. Consistent with this explanation by size of firms, on average the market values of firms in the ASPI are 3.74 times greater than the market values of firms in complement of ASPI in EuroStoxx universe. Finally, the relative mean differences of weights in the CW ASPI we calculate in the next sub-section indicate that firms in the ASPI are in general larger than in the EuroStoxx.

The RMD is closely related to the Gini coefficient. The closer the relative mean difference gets to zero the less concentrated the distribution is.

When we focus on the degree of diversification of strategies built on the same universe, we observe rankings similar to Maillard et al. (2010). The most diversified are the EW and the ERC, followed by the CW, and finally the MDP and the MV, which are the most concentrated in risk and weights. When we focus on the degree of diversification of strategies over the three universes and the five measures, we observe no modification in ranking when switching from ASPI to EuroStoxx or to the complement of the ASPI in the EuroStoxx universe of stocks.

Four further observations emerge from the regressions: first, adding bounds to the MV and MDP strategies improves diversification but this improvement is not statistically significant; second, the complement of the ASPI universe is also correlated with more diversified distributions; once again, however this is not statistically significant. Third, portfolio size is positively related to diversification of distributions: the larger the portfolio, the more diversified it is. Fourth, regressions confirm that the four risk-based strategies yield more diversified distributions than the CW strategy, and that the EW and ERC strategies are the most strongly correlated with higher diversification.

The weight turnover is the lowest for EW portfolios (Fig. 3), the second lowest turnover being for the CW strategy. The CW strategy is not the one with the lowest turnover in our case, contrary to Carvalho et al. (2012). The third lowest turnover is for the ERC strategy. MV and MDP portfolios have similar weight turnovers, those of the MV portfolios, however, being more volatile than the turnovers of the MDP portfolios. Similarly, component turnover is the lowest for the EW, the CW and the ERC strategies. However, when measure \(T_2\) is used, the three strategies have the same component turnover. Since they invest in the entire available universe, this component turnover requests solely from universe modifications. MV and MDP strategies have similar component turnovers; however the turnover of the MV strategy is more volatile than that of the MDP strategy. No modification in these results is observed when switching from ASPI to EuroStoxx or to the complement of the ASPI in the EuroStoxx universe of stocks.

We do not report the results because of space constraints. They are available from the authors upon request.

Please see also Bertrand and Lapointe (2015) for a detailed analysis of the effect of using a SRI universe on performance of risk-based strategies.

References

Arnott, R., Hsu, J., & Moore, P. (2005). Fundamental indexation. Financial Analysts Journal, 61, 83–99.

Beck, N., & Katz, J. (1995). What to do (and not to do) with time-series cross-section data. The American Political Science Review, 89, 643–647.

Bertrand, P., & Lapointe, V. (2015). How performance of risk-based strategies is modified by socially responsible investment universe? International Review of Financial Analysis, 38, 175–190.

Boutin-Dufresne, F., & Savaria, P. (2004). Corporate social responsibility and financial risk. Journal of Investing, 13, 57–66.

Calvo, C., Ivorra, C. & Liern, V. (2014). Fuzzy portfolio selection with non-financial goals: Exploring the efficient frontier. Annals of Operations Research, 1–16. doi:10.1007/s10479-014-1561-2.

Choueifaty, Y., & Coignard, Y. (2008). Towards maximum diversification. Journal of Portfolio Management, 34, 40–51.

Clarke, R., de Silva, H., & Thorley, S. (2006). Minimum-variance portfolios in the US equity market. Journal of Portfolio Management, 33, 10–24.

Clarke, R., de Silva, H., & Thorley, S. (2013). Risk parity, maximum diversification, and minimum variance: An analytic perspective. Journal of Portfolio Management, 39, 39–53.

de Carvalho, R. L., Lu, X., & Moulin, P. (2012). Demystifying equity risk-based strategies: A simple alpha plus beta description. Journal of Portfolio Management, 38, 56–70.

DeMiguel, V., Garlappi, L., & Uppal, R. (2009). Optimal versus naive diversification: How inefficient is the 1/n portfolio strategy? Review of Financial Studies, 22, 1915–1953.

Hong, H., & Kacperczyk, M. (2009). The price of sin: The effects of social norms on markets. Journal of Financial Economics, 93, 15–36.

Kitzmueller, M., & Shimshack, J. (2012). Economic perspectives on corporate social responsibility. Journal of Economic Literature, 50, 51–84.

Ledoit, O., & Wolf, M. (2004). Honey, I shrunk the sample covariance matrix. Journal of Portfolio Management, 30, 110–119.

Maillard, S., Roncalli, T., & Teiletche, J. (2010). On the properties of equally-weighted risk contributions portfolios. Journal of Portfolio Management, 36, 60–70.

Maillet, B., Tokpavi, S., & Vaucher, B. (2015). Global minimum variance portfolio optimisation under some model risk: A robust regression-based approach. European Journal of Operational Research, 244, 289–299.

Renneboog, L., Horst, J. T., & Zhang, C. (2008). Socially responsible investments: Institutional aspects, performance, and investor behavior. Journal of Banking and Finance, 32, 1723–1742.

Scherer, B. (2011). A note on the returns from minimum variance investing. Journal of Empirical Finance, 18, 652–660.

Waddock, S., & Graves, S. (1997). The corporate social performance-financial performance link. Strategic Management Journal, 18, 303–319.

Acknowledgments

We benefited from comments by Lloyd Kurtz, Raul Leote de Carvalho, Thierry Roncalli and Guillaume Weisang. We also benefited from comments by referee of the 1st Geneva Summit on Sustainable Finance and by participants to the 5th ARCS Conference at the University of Berkeley, the 30th AFFI Conference at the EM Lyon Business School and the 3rd FEBS International Conference at the ESCP Europe Business School. We are grateful to Vigeo for granting us access to their data. We thank Fouad Benseddik and Antoine Begasse from Vigeo for their support in understanding the methodology of these data. An early version of this work was presented in a working paper entitled “Smart Beta Strategies: the Socially Responsible Investment case”.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Bertrand, P., Lapointe, V. Risk-based strategies: the social responsibility of investment universes does matter. Ann Oper Res 262, 413–429 (2018). https://doi.org/10.1007/s10479-015-2081-4

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10479-015-2081-4