Abstract

In this paper, I build a two-agent New Keynesian model in which households with subjective and objective beliefs about capital gains from stock prices exist. The former type of households constructs their beliefs about expected capital gains by Bayesian learning from observed growth rates of stock prices. In a homogenous agent model with only subjective beliefs, the effect of the interest rate on stock prices tends to be unrealistically strong. I show how the presence of heterogeneity improves second moments of stock prices with realistic moments of business cycle properties. This quantitative improvement in stock price behaviors allows me to conduct a realistic analysis of how the stance of monetary policy affects stock price volatilities. Strong inertia of monetary policy provides the stability of stock prices. This is because the near-term real interest rate has dominant effects on stock prices under the presence of subjective beliefs since the presence limits the forward-looking nature in pricing stocks. However, because output depends on the expected path of the real interest rate in the forward-looking manner, strong monetary policy inertia does not necessarily provide stabilities of stock prices and output at the same time.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

In this study, I build a two-agent New Keynesian model with subjective and objective beliefs about capital gains from stock prices. I show how the presence of the two agents improves second moments of stock prices with realistic moments of business cycle properties, such as output, inflation, and interest rates, which is considered to be the benefits over a homogenous agent model either with subjective or objective beliefs. To reach policy implications based on the model, I then analyze how the stance of monetary policy affects stock price volatilities under the presence of heterogeneity.

The motivation to develop a heterogeneous model is as follows. The actual stock price responses to monetary policy shocks are larger than what plain rational expectation models usually produce. Besides, studies that consider stock prices in New Keynesian models under rational expectations often assume high relative risk aversion rates than what are normally calibrated in dynamic stochastic general equilibrium models to generate large swings of stock prices as in De Paoli et al. (2010). On the other hand, having realistic moments of stock prices and business cycles at the same time is not easily attainable in a homogenous model with subjective beliefs because the impacts of interest rate shocks on stock prices are unrealistically large as in Adam and Merkel (2018).Footnote 1 These difficulties that rational models or homogenous models with subjective beliefs have in explaining stock price volatility warrant the importance of developing a heterogeneous model.

In addition to the issue regarding stock price volatility in response to monetary policy shocks, empirical studies show that the effects of unexpected monetary policy shocks on stock prices change over time. Laopodis (2013) finds that the nature of a dynamic relationship between monetary policy and the stock market was different in each of operating regimes under three chairmen of the Federal Reserve Board (pre-Volcker, Volcker, Greenspan). Paul (2019) empirically shows that stock market reactions to monetary policy are time-varying. However, existing studies have not reached a clear consensus on why the reactions of stock prices to monetary policy shocks change over time. These empirical studies imply the importance to study the impacts of the stance of monetary policy on stock prices in a model that can generate realistic moments of stock prices and business cycle properties at the same time. Understanding the relationship between the stance of monetary policy and stock price behaviors contributes to the discussion on whether monetary policy inertia (“gradualism”) helps reduce financial market volatilities in terms of stock market.Footnote 2

To generate realistic moments of stock prices and business cycle properties, and to investigate how the stance of monetary policy affects stock price volatilities, I develop a New Keynesian model with the two types of households with subjective and objective beliefs about capital gains from stock prices, respectively. Households consume goods, supply labor, and save their wealth in stocks and bonds. Households with subjective beliefs construct their expectations about capital gains by Bayesian learning from observed stock price growth rates. The subjective probability belief does not equal the objective probability density as they emerge in equilibrium. The population shares of the subjective and objective households are exogenously given. I use a general equilibrium model because under nominal rigidity monetary policy affects the real interest rates and pricing kernels, while partial equilibrium models usually assume that the consumption path and consequently pricing kernel are exogenously given. Studies using Bayesian learning about stock price growth, such as a partial equilibrium model of Adam et al. (2017) or general equilibrium models of Adam and Merkel (2018), Oshima (2019), and Winkler (2019) do not consider heterogeneity. I design the model so that the effects of the existence of subjective households are minimal, i.e., it affects only stock prices to focus on the analysis of stock price behaviors while business cycle properties are kept very standard.

The main findings are as follows. First, in the general equilibrium model with heterogeneous beliefs, the overall theoretical second moments match the data well without assuming a high risk aversion rate or high habit formation. The model is successful in generating stock price volatilities close to the data with realistic moments of business cycle properties such as output and inflation. Considering both subjective and objective beliefs is beneficial because it enhances moment matching compared to a model with only subjective beliefs or objective beliefs.

Second, the model can generate empirically plausible stock price drops in response to an interest rate shock. Challe and Giannitsarou (2014) argue that a 100 basis point increase in the nominal interest rate is associated with a 2.2–9% decrease in real stock prices empirically. The model shows a 9.3% decrease in stock prices at the timing of nominal interest rate shock of 100 basis points (annual term) in impulse response analysis. The average response over four quarters at and after the shock is a 4.5% decrease. This cannot be attained in a homogenous subjective belief model because the impacts of interest rate shocks on stock prices are unrealistically large in a homogenous model. For example, Adam and Merkel (2018), Winkler (2019), and Oshima (2019) allow only small interest rate volatilities or shocks to have realistic stock price volatilities.

Third, monetary policy inertia helps stabilize stock prices because it reduces the volatility of the near-term real interest rate, which is a key variable to explain stock prices under the presence of subjective beliefs. Under a positive productivity shock, for example, the decrease in today’s nominal interest rate in response to the shock becomes gradual and small when monetary policy is persistent. This is because the Taylor rule with high interest rate smoothing implies that the policy rate reacts weakly to real-time changes in inflation, which results in low volatility of today’s real interest rates and hence stock prices. This supports the discussion about “gradualism” of monetary policy. Strong monetary policy inertia does not necessarily provide stabilities of output and stock prices at the same time because the presence of subjective beliefs limits the forward-looking nature in pricing stocks, while output depends on the expected path of the real interest rate. This discrepancy implies the necessity for monetary policy to consider the path of the interest rate to stabilize both the financial and non-financial variables of the economy under the presence of heterogeneous beliefs.

The rest of the paper is organized as follows. Section 2 reviews the related literature. Section 3 presents my model. Section 4 discusses the quantitative results based on the model. Section 5 investigates the relation between deep parameters of monetary policy and stock price volatilities. Section 6 concludes this study and discusses future extensions.

2 Related literature

Theoretical studies which explain the volatility puzzle based on rational expectation are, for example, long-run risks by Bansal and Yaron (2004) and habit formation by Campbell and Cochrane (1999). Studies which depart from rational expectation are, for example, Timmermann (1993) and Collin-Dufresne et al. (2016). Both consider investors who form expectations about fundamentals by learning. Choi and Mertens (2013), Barberis et al. (2015), and Hirshleifer et al. (2015) assume that investors form their expectations about fundamentals by extrapolation. As another strand of belief-based approach, there is research focusing on subjective beliefs about asset prices or returns such as De Long et al. (1990) and Lansing (2010).

The work of Adam et al. (2017), which my model mainly refers to, can be categorized as this type of research. They consider the homogenous investors with subjective beliefs about stock price growth (capital gains) under exogenous consumption and dividend processes. They assume that investors who know the fundamentals have subjective beliefs about stock price growth and do not have knowledge about a pricing function of stock price mapping from the fundamentals. The investors’ expectations of capital gains are influenced by the capital gains observed in the past. In Adam et al. (2017), consumption and dividends are given by simple stochastic processes, whereas in this model they are generated through a New Keynesian model. Therefore, this model is suitable for investigating the relations between deep parameters regarding monetary policy and stock price volatilities.

Some studies consider stock price in New Keynesian models assuming rational expectations such as De Paoli et al. (2010). To generate large swings of stock prices, rational expectation models tend to assume higher relative risk aversion rates than what are normally calibrated in dynamic stochastic general equilibrium models.Footnote 3 A New Keynesian model by Wei (2009) does not have a high relative risk aversion rate. However, Wei (2009) argues that a highly persistent exogenous monetary policy shock, which is not usual in the literature, is necessary to have enough variations of marginal utility of consumption. My model can generate realistic stock price volatility without a high relative risk aversion rate or a highly persistent exogenous monetary policy shock.

Departing from rational expectation, another strand of research studies subjective beliefs about stock price growth in a general equilibrium model context. Adam and Merkel (2018) propose a real business cycle model to explain business cycles and stock price volatility. Investors/households homogenously hold subjective beliefs about capital gains following Adam et al. (2017). By regarding the capital price as stock price, this model generates feedback effects of the stock price on output fluctuation. In reality, the capital price itself does not show as large volatility as the stock price. The risk-free rate volatility in their model is quite low compared to the actual data while other theoretical moments match data well.

Winkler (2019) analyzes the stock price movements and business cycles in his New Keynesian model with homogenous agents who have subjective beliefs about capital gains. The belief structures are similar to Adam et al. (2016) and Adam et al. (2017).Footnote 4 Stock holders are risk-neutral in his model while households are risk-averse with access to the risk-free bond market. This allows to reduce the effects of interest rates on stock prices and making the near-term dividend effects important. In stock pricing, the current dividend plays a major role in determining the stock price and the interest rate affects the stock price mainly through the dividend paid to stock holders as firms’ costs in the balance sheets. Even under this setting, the stock price reaction to interest rate movements is stronger than what the usual empirical research implies. Oshima (2019) studies the stock price volatility and finds that monetary policy parameters are the keys to stock price volatility. However, he assumes homogenous subjective households and cannot generate stock price reactions to interest rate shocks with realistic sizes.

Some studies in the literature consider heterogeneous beliefs in asset pricing. Harrison and Kreps (1978) show that different beliefs about future states and short-selling restrictions lead to higher stock prices because of option values. Scheinkman and Xiong (2003) assume heterogeneity in signals under short-selling restriction. Their model also derives option values in stock price. Shiller et al. (1984) provide a model with rational and noise traders. Brock and Hommes (1998) investigate an asset pricing model with heterogeneous beliefs. Agents select different beliefs or predictors of the future price of a risky asset based on their past performances. However, because these models assume endowment economies, it is difficult to find the relations between stock price and monetary policy.

There is a growing strand of the literature to study macroeconomic questions including monetary policy transmission in New Keynesian models with heterogeneous agents; such models are often referred to as Heterogeneous Agent New Keynesian (HANK) models. These models often assume idiosyncratic shocks to individual income, incomplete market, and financial constraints. Kaplan et al. (2018) study the transmission mechanism of monetary policy focusing on empirically realistic effects of unexpected cuts of interest rates on consumption. Another strand of the literature studies Two Agent New Keynesian (TANK) model, in which two types of agents exist with different accessibilities to the financial market; these studies include Campbell and Mankiw (1990), Galí et al. (2007), Bilbiie (2008), and Debortoli and Galí (2017). My two-agent model is heterogeneous in beliefs about stock price growth. This is different from the settings of usual TANK models in which heterogeneity comes from access to financial markets. However, similarly to initial motivations of HANK and TANK, I incorporate two types of agents to provide empirically realistic responses of stock prices to interest rate shocks.

3 Model

The model is built on a standard New Keynesian model. I assume Rotemberg type price adjustment costs. Firms pay dividends to the households, which are output minus investment cash flows and price adjustment costs. Households consume goods, supply labor, and save their wealth in stocks and bonds. Two types of households exist, those with subjective and objective beliefs about stock price growth. The population share of the subjective and objective households is exogenously given. The belief structures of the subjective households follow Adam et al. (2017), a model with exogenous consumption and dividend streams, and Adam and Merkel (2018), a real business cycle model.Footnote 5

3.1 Households

Households with subjective beliefs form their beliefs about stock price growth based on Kalman filtering with expected capital gain as a state variable and realized capital gain as an observed variable. They do not know other households’ beliefs and do not know the pricing function mapping fundamentals to stock prices while they know fundamentals (given stock prices).

The subjective household’s maximization problem basically follows the “internal rationality” discussed by Adam and Marcet (2011) and Adam et al. (2017). Internal rationality requires that agents make fully optimal decisions given a well-defined system of subjective probability beliefs about payoff-relevant external variables that are beyond their control including stock prices. That is, internal rationality means standard utility maximization given subjective beliefs about variables that are beyond their control.Footnote 6 In this study, following Adam et al. (2017), households with subjective beliefs do not know the stock price function derived from fundamental variables, and choose the optimal plans of stock holdings and consumption given the subjective belief about capital gains under the probability measure “P.” They form this by learning from observed past growth rates of stock prices. Whatever the agents’ expectations about stock price growth are, the stock price level and consumption plans satisfy the Euler equation with subjective expectations of stock price growths.

Key assumptions about the belief structure are as follows. (i) Homogeneity of the households with subjective beliefs is not common knowledge among the subjective households. In addition, they do not know the preferences of households with objective beliefs. This knowledge structure prevents the households from mapping the fundamentals to market-based stock prices based only on their own preferences under any population share of the two types of households and hence enables the subjective expectations of capital gains to deviate from objective expectations.

(ii) I have additional assumptions because of heterogeneity of beliefs in this model, whereas in Adam et al. (2017) and Adam and Merkel (2018) agents are homogenous. Households with objective beliefs know preferences of the subjective households and their homogeneity, other objective households’ preferences and their homogeneity, and the population share of each household in the economy. Because of this belief structure, objective households can apply the law of iterated expectations in stock pricing, given the presence of subjective households.

3.1.1 Households with subjective beliefs

The infinitely lived representative household with subjective beliefs makes decisions on consumption, savings in stock and risk-free bonds, and labor supply. I assume that the household’s expectations about wages and dividends are rational. The household’s expectation of the growth rate of stock prices is subjective following Adam et al. (2017). The household’s utility in each period is presented by the following function with consumption habit formation,

where \(C_{s,t}\) is consumption at time t, \(L_{s,t}\) is labor at time t, \(\gamma \) is the rate of relative risk aversion, \(\phi \) is the parameter of habit formation, \(\chi \) is the weight assigned to labor, and \(\varphi \) is the inverse of Frisch elasticity. s is an index for households with subjective beliefs.

The budget constraint of the household is given by the following equation. The households have access to the financial market via stocks and bonds.

\(S_{s,t}\) is stock holdings at time t, \(p_t^s\) is real stock price at time t, \(B_{s,t}\) is real bond holding at time t, \(R_t^f\) is real interest rate at time t, \(d_t\) is real dividend at time t, and \(w_t\) is real wage at time t. \(S_{ss}\) is steady state stock holdings. \(B_{ss}\) is steady state bond holdings. \(p_{t}^{s}\frac{\zeta ^S}{2} (S_{s,t}-S_{ss})^2\) and \(\frac{\zeta ^B}{2} (B_{s,t}-B_{ss})^2\) are the stock and bond adjustment costs, respectively.Footnote 7\(\zeta ^S\) is the parameter of stock adjustment cost and \(\zeta ^B\) is the parameter of bond adjustment cost.Footnote 8 Subjective households are under the constraint of minimum and maximum stock holding positions. This allows one to have maximums in their optimization problem under subjective beliefs. In equilibrium, this constraint is not binding over the entire time path.

The household maximization problem is given by

where \(E_0^P\) denotes the subjective expectation operator at time 0. This setting basically follows Adam et al. (2017). \(\delta \) \(\in \) (0, 1) is the time preference rate. \(\exp (Z_t)\) denotes the preference shock. The preference shock process is formulated with persistency parameter \(\rho _Z\) as

where \(\epsilon _t^Z\) represents an i.i.d. stochastic shock regarding the preference shock process.

The first-order conditions with respect to \(C_{s,t}\) and \(S_{s,t}\) are given by

and

where \(\lambda _{s,t}\) represents the Lagrange multiplier for (2). The expectation operator of this Euler equation is governed by subjective beliefs, as explained later. The bond Euler equation is

The first-order condition with respect to labor supply is

3.1.2 Subjective expectation of stock price growth

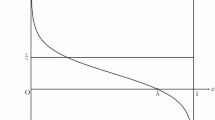

The households’ expectations of stock price growth are subjective and use the Kalman filter to form the belief. I assume that households perceive stock prices to evolve according to

where \(\epsilon _{t+1}\) is the transitory shock to price growth, \(\epsilon _{t+1}\sim N(0, \sigma _\epsilon ^2)\). \(\beta \) is the unobserved persistent price growth component following Adam et al. (2017). The persistent component of stock prices drifts according to

where \(\nu _{t+1}\) is the innovation to price growth, \(\nu _{t+1}\sim N(0, \sigma _\nu ^2)\). The Kalman filter implies that the beliefs are given by

where \(m_t\) is the conditional expectation of \(\beta _{t+1}\) and \(\sigma _\beta ^2\) is the steady state Kalman filter uncertainty.

I assume that \(\epsilon \) and \(\nu \) are independent and the variances of each shock satisfy

so that the Kalman gain for the persistent component of stock price growth becomes small.Footnote 9 With the optimal constant gain g, the Kalman gain process becomes

The optimal constant Kalman gain g is given by

and the steady state uncertainty \(\sigma _\beta \) is calculated as

Internal rationality assumes that subjective agents make fully optimal decisions given a well-defined system of subjective probability beliefs about stock prices. I assume that subjective households construct and update their expectations of capital gains at time \(t+1\), \(\frac{p_{t+1}^s}{p_{t}^s}\), by using \(m_t\) in (14) under the subjective probability measure P. Under this assumption with (7), the Euler equation becomes

\(m_t\) evolves according to (14). Because (14) includes only the present and past variables, \(m_t\) is not a stochastic variable at time t. Internal rationality implies fully rational utility maximization given the subjective beliefs about stock price growth, \(m_{t}\). Therefore, I have

where \(E_{t}\) denotes the rational expectation operator given the subjective beliefs of stock price growth.

The equation obtained by substituting (14) for \(m_t\) in (18) implies simultaneous determination of the price beliefs and prices, and could generate multiple solutions of stock price because this equation is a quadratic function of the stock price \(p_t^s\). In this study, I use the log-linearization around the steady state to solve this model. Therefore, I can avoid the simultaneity problem by setting a steady state at a point that economically makes sense, even though the learning process is set as (14). However, as often used in the learning literature such as in Eusepi and Preston (2011) and Evans and Honkapohja (2001), I can also consider another version of the Kalman gain process by modifying the observation timing as

Besides avoiding the simultaneity problem, due to superiority in data fitting, I use the belief system addressed in (19) instead of (14) in this study.

3.1.3 Households with objective belief

The optimization problem of the infinitely lived representative household with objective beliefs is standard. The households’ expectation about the growth rate of the stock price is objective. The household’s utility in each period is presented by the following function with consumption habit formation:

where \(C_{o,t}\) is consumption at time t and \(L_{o,t}\) is labor at time t. o is the index for households with objective beliefs.

The budget constraint of the household is given by the following equation,

where \(S_{o,t}\) is the stock holdings by the households at time t and \(B_{o,t}\) is the bond holdings by the households at time t. The household’s maximization problem is given by

where \(E_0\) denotes the objective expectation operator at time 0. The first-order conditions with respect to \(C_{o,t}\) and \(S_{o,t}\) are given by

and

where \(\lambda _{o,t}\) represents the Lagrange multiplier for (21). The bond Euler equation is

The first-order condition with respect to labor supply is

3.1.4 Market clearing and stock demand

The stock market clearing with \(\alpha \) as the population share of subjective households is

In addition, I assume that stock supply is unity,

From (18), (24), (27), and (28), I obtain the stock market clearing condition as

The bond market clearing condition becomes

From (8), (25), and (30), the bond market clearing condition becomes

The nominal risk-free rate satisfies

3.1.5 Log-linearized stock price equation

Before moving to the firm sector’s settings, I intuitively discuss how stock prices are formulated in the model. To summarize, stock prices react strongly to near-term information under subjective beliefs, while in a rational expectation case, they are determined by the infinite future information about dividends and stochastic discount factors. To observe this, I show a log-linearized version of the stock price equation. I substitute (19) for \(m_t\) in (29) and log-linearize this. Eliminating \(\lambda _{s}\) and \(\lambda _{o}\) in this equation using the log-linearized equation of (31) yields the stock price equation as

\(\hat{x}\) denotes the log deviation from the steady state value of x. Again, \(\alpha \) is the population share of households with subjective beliefs. This equation implies that the real interest rate at time t affects the stock price significantly when \(\alpha \) is close to 1 because \(\frac{\delta ^{-1}}{\delta ^{-1}-\alpha }\) is large. The impact of the interest rate is much larger than that of dividends. In contrast, as \(\alpha \) becomes close to 0, this impact becomes weaker because \(\frac{\delta ^{-1}}{\delta ^{-1}-\alpha }\) becomes smaller. In addition, future interest rates and dividends become more important as \(\alpha \) becomes closer to 0 because the last term of (33) includes \(\hat{p}^s\) at time \(t+1\). The level of g determines how sensitively the stock price moves in response to near-term past capital gain.

3.2 Firms

Monopolistically competitive intermediate goods firms maximize their profits. The intermediate goods firms pay price adjustment costs which are paid by final goods following Rotemberg (1982) when they change their prices. They hire labor from the household, own capital, and conduct capital formations. Capital formations require investment adjustment costs. \(j \in [0,1]\) is an intermediate goods firm index. Competitive final goods producers produce final goods by aggregating intermediate goods. The final goods are transformed into consumption goods and investment goods costlessly.

The final goods sector is perfectly competitive and transforms intermediate goods into final goods for consumption and investment by the CES production function,

where \(Y_{t}\) is aggregate output of final goods, \(Y_{t}(j)\) is output of intermediate goods, and \(\eta \,(>1)\) is the demand elasticity parameter. The profit maximization of the final goods firm becomes

where \(P_{t} (j)\) is an intermediate good price. This generates a downward-sloping demand for intermediate goods. The intermediate goods demand is set as

The maximization problem of the firm producing intermediate goods j is given by

where \(M_{t+i}\) is the pricing kernel under the presence of the two types of households who own the firm sector. \(d_{t+i} (j)\) denotes the real dividend of firm j. The real dividend cash flow is governed by

where \(I_{t}(j)\) is investment of firm j, and \(\zeta ^P\) is the price adjustment cost parameter.

Capital formation is defined as

where \(K_{t}(j)\) is capital of firm j. \(\psi \in (0,1]\) is the depreciation rate of capital, \(\frac{\zeta ^I}{2}(\frac{I_{t}(j)}{I_{t-1}(j)}-1)^2\) is the investment adjustment cost, and \(\zeta ^I\) is a parameter of investment adjustment costs. \(v_t\) represents the investment-specific technology shock process at time t. The shock process is formulated with the persistency parameter of \(\rho _V\) as

where \(\epsilon _t^v\) represents an i.i.d. stochastic shock regarding the investment specific technology shock process. The production technology of intermediate goods is given by

where \(A_t\) represents the technology level at time t. \(\xi \in (0,1)\) is the capital share. The productivity shock process is formulated with the persistency parameter \(\rho _A\) and an i.i.d. shock to productivity \(\epsilon _t^A\) as

The Lagrangian of this problem can be set as

where \(\varOmega _{t+i}(j)\) and \(q_{t+i}(j)\) are the Lagrange multipliers. I assume that the stochastic discount factor to discount firms’ cash flow is the weighted average of those of the two types of households. Define \(\varLambda \) as

I assume the firms are symmetric. Then, I have the first-order conditions as below.

Inflation rate is given by

I define the steady state markup \(\mu =\frac{\eta -1}{\eta }\) and add the markup shock to this equation as

with the shock process,

\(u_t\) represents the process of the markup shock, and \(\kappa = \zeta ^P (\mu -1)\) is a constant to adjust the size of the markup shock so that a \(1\%\) shock to \(u_t\) becomes a one unit shock to inflation in (50) when linearized.Footnote 10 The markup shock process is formulated with the persistency parameter \(\rho _u\) and an i.i.d. disturbance \(\epsilon _t^u\).

Aggregate capital evolution is

Aggregate real dividend is

Aggregate output is

3.3 Market clearing and monetary policy

I assume a standard Taylor rule for monetary policy as

where \(Y^f_{t}\) is output under the flexible price equilibrium at time t, \(\theta _M \in [0,1)\) is the persistence parameter of monetary policy, \(\phi _{\pi }(>1)\) is the reaction parameter of monetary policy to the inflation rate, \(\phi _{y}\) is the reaction parameter of monetary policy to the output gap, and \(\epsilon _t^M\) is an i.i.d. shock to the nominal interest rate (monetary policy shock). I define output under the flexible price equilibrium, \(Y^f_{t}\), as that with no price adjustment costs (\(\zeta ^P=0\)) at time t.

Aggregate labor supply is defined as

Aggregate consumption is

The resource constraint of the entire economy becomes

4 Quantitative analysis

In this section, I show the quantitative implications of the model economy. Using a calibrated model, I compute the theoretical moments and the impulse responses of macroeconomic variables to shocks. I assume time frequency is quarterly throughout this paper. The model is solved by the first-order perturbation method around the steady state.Footnote 11 By applying the first-order perturbation method to the simplified model setting of Adam et al. (2017), where dividends and wages are exogenous, I can generate volatility of price dividend ratio similar to Adam et al. (2017) as shown in Oshima (2019).

Theoretical moments with the presence of both of two agents show realistic stock price and risk-free rate volatilities at the same time. Homogenous models with subjective beliefs have difficulty in having this feature.

4.1 Calibration

Table 1 lists the choice of parameter values for the baseline model. Parameter values are calibrated at quarterly rates and assume those of the U.S. economy. I set the basic parameters, the rate of relative risk aversion \(\gamma \), habit formation parameter \(\phi \), inverse of Frisch elasticity \(\nu \), depreciation rate \(\psi \), capital share \(\xi \), and investment adjustment cost parameter \(\zeta ^I\) following Christiano et al. (2005). The discount rate \(\beta \) is 0.99, which is within the conventional range. The relative utility weight of labor \(\chi \) is set so that the steady state labor amount becomes 0.3. In Christiano et al. (2005), the Philips curve is not formulated based on Rotemberg type price adjustment costs, which I use in the model. For the demand elasticity parameter \(\eta \) and price adjustment parameter \(\zeta ^P\), I follow Ireland (2001), who uses Rotemberg type price adjustment costs.

The monetary policy reaction parameter to the inflation rate \(\phi _{\pi }\) has a conventional value, 1.5. The monetary policy reaction parameter to the output gap \(\phi _{y}\) is also set at a conventional value, 0.125.Footnote 12 The monetary policy persistence parameter \(\theta _M\) is 0.8 following Christiano et al. (2005) or Smets and Wouters (2007). The autoregressive parameters of productivity \(\rho _A\) and investment-specific shock \(\rho _V\) follow Smets and Wouters (2007). The autoregressive parameter of the preference shock \(\rho _Z\) follows Levin et al. (2005). The autoregressive parameter of the markup shock \(\rho _u\) is set at 0.5 so that the standard deviation of inflation becomes close to the data.

The model specific parameter is the Kalman gain g. In Adam et al. (2017), its estimated value is 0.02–0.03 depending on the assumptions. However, in my general equilibrium model, this range of g results in explosive paths. As seen in the fourth term of (33), a large value of g leads to an explosive path of stock price when this equation is solved backward. Adam et al. (2016) estimate this value at 0.007–0.008. I set the value of g at 0.007 so that the model can satisfy the Blanchard-Kahn condition and generate realistic moments of the stock price. The baseline population share of households with subjective beliefs, \(\alpha \), is set to fit the theoretical moments of stock price to the data.

The stock adjustment cost parameter \(\zeta ^S\) and the bond adjustment cost parameter \(\zeta ^B\) are set so that the relative size of the stock adjustment cost becomes larger than that of the bond adjustment cost. The calibrated values of the stock and bond adjustment costs in Table 1 do not generate notable differences in allocation variables in impulse responses under any population share of households with subjective beliefs, \(\alpha \). The reasons why the relative size of the stock adjustment cost parameter is much higher than that of the bond adjustment cost parameter are as follows.

In a heterogeneous model, when the households with subjective beliefs have a large capital gain expectation, m, they increase stock holdings \(S_{s,t}\) as implied in (18), ceteris paribus. If the stock adjustment cost \(\zeta ^S\) is large, the increase in stock holdings by the households with subjective beliefs is limited, whereas the stock holdings need to increase largely if \(\zeta ^S\) is small. To finance the increase in stock holdings, they need to decrease bond holdings. If the bond adjustment cost \(\zeta ^B\) is small, they mainly decrease bond holdings. However, as the bond adjustment cost \(\zeta ^B\) is larger, changing bond holdings is more costly, and the households are more inclined to reduce consumption as well as bond holdings. On the other hand, households with objective beliefs decrease stock holdings, increase bond holdings, and raise consumption. As I mentioned in Sect. 1, one of the purposes of this study is to describe the model so that the effects of the existence of subjective households are minimal. By setting \(\zeta ^S\) at a large value and \(\zeta ^B\) at a small value, the effects of the presence of heterogeneous beliefs on consumption and consequently on business cycles become sufficiently small.Footnote 13

Intuitive interpretations of the difference in relative sizes of the two adjustment cost parameters are as follows. The first interpretation is a transaction cost for households to change asset holdings. Adjustment costs of risk-free bonds should be small because, in reality, households can easily adjust positions of assets such as bank deposits, which have a similar role to risk-free bonds for households in this model. By setting \(\zeta ^B\) at a sufficiently low level close to 0, Eq. (8) becomes close to a standard Euler equation for the risk-free bond because the term of bond adjustment costs becomes close to 0. On the other hand, costs to change stock positions, such as transaction fees, are generally higher than those to change deposit positions in reality.

The second interpretation is that adjustment cost parameters are closely related to the variance of expected returns in a simple mean-variance optimization framework. As mentioned in Footnote 8, \(\zeta ^S\) and \(\zeta ^B\) represent the variance of expected returns of stocks and bonds in spirit, respectively. The variance of the risk-free bond return is 0 in a two-period mean-variance optimization problem because the risk-free return is known at the timing of investing. I assume a non-zero small value for \(\zeta ^B\) because it is necessary to describe heterogeneous demand for the bonds from the two agents. Though I assume a non-zero positive value for \(\zeta ^B\), it should be sufficiently small to reflect the size of the risk of the bonds. A large value for \(\zeta ^S\) implies that the variance of stock returns is much larger than that of the bonds.

4.2 Steady state values

Table 2 shows the steady state values of our model. These values are in quarterly rates and the subscript ss indicates steady state value. These values do not depend on whether the model is of subjective or objective beliefs because I set the steady state m at 1. For comparison, this table shows actual data values averaged over 1980–2017.Footnote 14\(C_{ss}/Y_{ss}\) and \(I_{ss}/Y_{ss}\) are close to the actual value. The actual data for Y in these two fractions is the sum of C and I with a deflator adjustment as explained in “Appendix A.1”. \(K_{ss}/(Y_{ss}*4)\) is within a plausible range. The actual \(Y_{ss}\) for \(K_{ss}/(Y_{ss}*4)\) is real GDP data. The price dividend ratio \(p^s_{ss}/d_{ss}\) is similar to the data.

4.3 Model moments

Table 3 compares the second moments of the baseline model with the actual data. Moments are calculated on a quarterly basis. I show the model moments with four different population shares of households with subjective beliefs (\(\alpha \) at 1, 0.94, 0.5, and 0). Theoretical moments of the models are based on 0.7% productivity shocks, 0.3% monetary policy shocks, 0.3% preference shocks, 0.7% investment-specific shocks, and 0.2% markup shocks in standard deviation on a quarterly basis.Footnote 15 Actual data moments cover 1980–2017 of the U.S. economy. I take the natural log and de-trend it by the third-order time polynomial regression, cubic detrending, except interest rate data. Details about data source are given in “Appendix A.1”.

The standard deviation of the stock price of the data is 0.204. The cases with \(\alpha =0.94\) show a realistic standard deviation of the stock price, 0.197. What to note is that the overall theoretical second moments match the data well without assuming a high risk aversion rate or high habit formation. In contrast, the standard deviation of stock price in \(\alpha =0.5\) case is 0.051 and that in \(\alpha =0\) case is 0.031. These values are too small compared to the data.

Assuming a small share of objective households in addition to subjective households provides quantitative benefits such that the model has realistic stock price and risk-free rate volatilities at the same time. In the case of homogenous subjective beliefs (\(\alpha =1\)), the standard deviation of the stock price is 0.886, which is much larger than the data, 0.204, with realistic risk-free rate volatility. This is because the reactions of stock prices to interest rate shocks are too large in this homogenous case. In the case of \(\alpha =0.94\), the standard deviation of the stock price is close to the data, with the risk-free rate volatilities close to the data as well. When \(\alpha \) is less than 1, future dividends and discount rates play the roles as seen in the last term of the right hand side of (33). This reduces the effect of the real interest rate at time t which has strong impacts on stock prices with subjective beliefs.

Several correlations in the model become close to the data when I assume positive \(\alpha \). The correlation between stock prices and dividends is negative and close to the data in \(\alpha =1\) and \(\alpha =0.94\) cases. The data show a negative correlation between stock prices and dividends while \(\alpha =0\) and \(\alpha =0.5\) cases show positive correlations.Footnote 16 When output increases under negative interest rate shocks, investment increases under the lowered real interest rates in response to these shocks. Since investment is more volatile than output, dividends are squeezed to a certain extent as implied in Eq. (38). In cases with \(\alpha =1\) and \(\alpha =0.94\), stock prices react strongly to decreases in real interest rates. Hence, stock prices and dividends show a negative correlation in these cases. In the case with \(\alpha =0\) and \(\alpha =0.5\), since the stock price is mainly determined by the sum of future discounted dividends in contrast to the cases with \(\alpha =1\) and \(\alpha =0.94\), dividends as well as real interest rates play major roles in affecting stock prices. Therefore, these cases do not show a negative correlation between stock prices and dividends.

The correlation between stock price and output in \(\alpha =0.94\) case is closer to the data than in other cases. \(\alpha =1\) case indicates a lower correlation than the data, and \(\alpha =0\) or \(\alpha =0.5\) cases shows a higher correlation than the data. When \(\alpha \) is high, near term real interest rates play an important role in stock pricing and momentum effects, by which the stock price reacts to past growths of itself, strongly affect stock prices as well. As shown in the next subsection, the momentum effects on stock prices in high \(\alpha \) cases generate oscillations that are not observed in output responses. These oscillations reduce the correlation between stock price and output. On the other hand, objective beliefs imply that stock prices are affected by future flows of real interest rates rather than near term real interest rates. In a New Keynesian model including this model, the future flow of real interest rates is a key determinant of output. Since future real interest rates matter to both stock prices and output, \(\alpha =0\) or \(\alpha =0.5\) case shows a higher correlation between stock prices and output than the data and \(\alpha =1\) or \(\alpha =0.94\) cases.

Adam et al. (2017) claim that survey measures of investors’ expected return correlate positively with the price dividend ratio, whereas rational return expectations correlate negatively with the price dividend ratio.Footnote 17 The actual correlation between survey expectations of the stock price growth and price dividend ratio provided by Adam et al. (2017) based on 1946–2012 data is 0.79. When \(\alpha =1\), the correlation between price dividend ratio \(\log P^s/d\) and stock price growth expectation \(\log \, m\) in the model is 0.88, which is close to that in Adam et al. (2017). However, I find that the positive correlation between the price dividend ratio and the weighted average of stock price growth expectation, \(\alpha m_t + (1-\alpha )E_t[p^s_{t+1}/p^s_{t}]\), are limited only to the case of \(\alpha =1\) or cases with \(\alpha \) very close to 1.

4.4 Impulse response

This subsection shows the impulse responses to productivity, monetary policy, markup, preference, and investment-specific technology shocks. I show that heterogeneity in beliefs provides more realistic impulse responses of the stock price than homogenous cases. The time frequency is quarterly. Figure 1 indicates the impulse responses to a 1.0% positive productivity shock on a quarterly basis. Figure 2 indicates the impulse responses to a 0.25% positive monetary policy shock (shock to increase the nominal interest rate) on a quarterly basis (1.0% at an annualized rate). Figure 3 indicates the impulse responses to a 1.0% markup shock on a quarterly basis. Figures 4 and 5 show the impulse responses to a 1.0% preference shock and a 1.0% investment-specific technology shock on a quarterly basis, respectively.

In these figures, I compare the responses under different shares of households with subjective beliefs (\(\alpha \)=1, 0.94, and 0). The three cases do not show differences in aggregate variables except for the responses of stock price \(p^s\) and the subjective expectation of capital gain m. This can be considered as an advantage of this model because it can generate large stock price reactions without unrealistically increasing the responses of fundamental variables.

Under positive productivity shocks (Fig. 1), stock prices increase in all of the three cases of \(\alpha \). The nominal interest rate decreases due to a decrease in inflation via a reaction of monetary policy. Dividends also increase by the shock. Consequently, the stock price increases. As \(\alpha \) increases, stock price reactions become large. Under positive markup shocks (Fig. 3), stock prices decrease in all of the three cases because the nominal interest rate increases to reduce inflation, though dividends increase against a backdrop of curbed investment caused by monetary tightening.

Impulse response to a 1.0 % positive productivity shock. The solid line indicates the subjective expectation case. The dotted line indicates the objective expectation case. The line with the circle marker indicates the heterogeneous case, \(\alpha =0.94\). 1 on the vertical axis scale amounts to 1% except for bond holdings. Bond holdings are shown in amount differences from their steady state because their steady state value is 0. Return variables, \(R^n\) and \(R^f\) are in percentage point differences from their steady states. Otherwise, variables are shown in percentage deviation from their steady state levels

Impulse response to a 0.25% positive monetary policy shock (1.0% at an annualized rate). The solid line indicates the subjective expectation case. The dotted line indicates the objective expectation case. The line with the circle marker indicates the heterogeneous case, \(\alpha =0.94\). 1 on the vertical axis scale amounts to 1% except for bond holdings. Bond holdings are shown in amount differences from their steady state because their steady state value is 0. Return variables, \(R^n\) and \(R^f\) are in percentage point differences from their steady states. Otherwise, variables are shown in percentage deviation from their steady state levels

Impulse response to a 1% positive markup shock. The solid line indicates the subjective expectation case. The dotted line indicates the objective expectation case. The line with the circle marker indicates the heterogeneous case, \(\alpha =0.94\). 1 on the vertical axis scale amounts to 1% except for bond holdings. Bond holdings are shown in amount differences from their steady state because their steady state value is 0. Return variables, \(R^n\) and \(R^f\) are in percentage point differences from their steady states. Otherwise, variables are shown in percentage deviation from their steady state levels

Impulse response to a 1% positive preference shock. The solid line indicates the subjective expectation case. The dotted line indicates the objective expectation case. The line with the circle marker indicates the heterogeneous case, \(\alpha =0.94\). 1 on the vertical axis scale amounts to 1% except for bond holdings. Bond holdings are shown in amount differences from their steady state because their steady state value is 0. Return variables, \(R^n\) and \(R^f\) are in percentage point differences from their steady states. Otherwise, variables are shown in percentage deviation from their steady state levels

Impulse response to a 1% positive investment specific technology shock. The solid line indicates the subjective expectation case. The dotted line indicates the objective expectation case. The line with the circle marker indicates the heterogeneous case, \(\alpha =0.94\). 1 on the vertical axis scale amounts to 1% except for bond holdings. Bond holdings are shown in amount differences from their steady state because their steady state value is 0. Return variables, \(R^n\) and \(R^f\) are in percentage point differences from their steady states. Otherwise, variables are shown in percentage deviation from their steady state levels

Since the model is heterogeneous, the charts include responses of stock and bond holdings and consumption of each agent. As the subjective expectation of capital gains increases under the positive productivity shock, households with subjective beliefs increase their stock holdings as implied in (18). Instead, they reduce their bond holdings to finance the purchase of the stocks. On the other hand, households with objective beliefs sell their stocks to households with subjective beliefs and increase bond holdings. Consumption of each agent behaves similarly because I calibrate \(\zeta ^S\) and \(\zeta ^B\), such that the impact of subjective beliefs on the allocation variables is minimal across any values of \(\alpha \), as discussed in Sect. 4.1.

As summarized by Challe and Giannitsarou (2014), empirical studies suggest that a 100 basis point increase of the interest rate at an annual rate is associated with a 2.2–9% decrease in stock prices. In Fig. 2, the model with \(\alpha =0.94\) shows a 9.3% decrease as an initial reaction to a shock of 100 basis points of the nominal interest rate at an annual rate (25 basis points at a quarterly rate) and 4.5% decreases over four quarters on average at and after the shock in its impulse response, which is close to the estimates of empirical studies. In contrast, the stock price in the homogenous subjective belief case (\(\alpha =1\)) reacts to the monetary policy shock too strongly. The model with \(\alpha =1\) shows a 30.3% decrease as an initial reaction and 31.6% decreases over four quarters on average at and after the shock. The case of \(\alpha =0\) shows a 0.6% decrease as an initial reaction and 0.3% decreases over four quarters on average at and after the shock, which are much smaller than the estimates of empirical studies. Thus, assuming heterogeneity helps generate realistic stock price responses to interest rate shocks.

In response to the positive preference shock (Fig. 4), the stock price decreases in \(\alpha =0\) case. This is because the real interest rate increases over time in response to the preference shock, and in the medium run, the increases in consumption crowd out investment, which consequently reduces capital accumulations and hence the capacity of production. Decreases in stock prices reacting to preference shocks are similarly observed in existing studies based on general equilibrium models. For example, Nisticò (2012) shows a decrease in the stock price in response to a preference shock.Footnote 18 Usually, existing studies of stock prices based on real business cycle models and new Keynesian models do not include preference shocks. They mainly consider productivity shocks as seen in Jermann (1998) or De Paoli et al. (2010). In this sense, the observations in my model do not contradict existing studies. However, in the cases with \(\alpha =1\) and \(\alpha =0.94\) in the model, the stock price reacts positively to the shock at least initially. This is because in these cases, the stock price reacts strongly to the current real interest rate, which decreases initially since the inflation rate increases in response to the shock given the nominal rigidity.

In Fig. 5, the stock price decreases in response to the investment-specific technology shock because of the increase in the real interest rate and decreases in dividends due to increased investment, as shown in (53). Decreases in stock prices in response to investment-specific technology shocks are similarly found in the existing studies, such as Christiano and Fisher (2003), who claim that stock prices are countercyclical relative to investment-specific shocks. Justiniano et al. (2010) discuss investment shocks and business cycles, and show that the real interest rate increases in response to the investment shock, which implies decreases in the stock price if the movement of the real interest rate in their model is applied to my model. In my model, even though dividends and stock prices decrease in the short run, increases in investment eventually expand the production capacity in the medium run. As the real interest rate goes back to the steady state over time, the impacts of the increase in the production capacity gradually lift the stock price.

Why do levels of \(\alpha \) change the stock price responses? The value of \(\alpha \) determines to what degree future values of real interest rates and dividends affect stock prices. In (33), as the value of \(\alpha \) decreases, the impact of the current real interest rate (\(\hat{R}_{t}^f\)) becomes smaller since the share of households with subjective beliefs decreases. On the other hand, as the value of \(\alpha \) decreases, the impacts of the expectation term (\(E_t \hat{p}_{t+1}^s\)) become more relevant since the share of the households with objective beliefs increases.

4.5 Benefits of assuming heterogeneity

This subsection discusses the benefit of assuming heterogeneity. A large value of the Kalman gain g leads to high volatility of the stock price. When g is large, households with subjective beliefs strongly react to observed stock price growths when they update their beliefs. The larger g becomes, the stronger the effect of momentum on stock prices becomes. So far, I have assumed that g is \(\frac{1}{150}\). In Fig. 6, I show how the Kalman gain g with different values, \(\frac{1}{50}\), \(\frac{1}{150}\), and \(\frac{1}{300}\), affects stock price reactions to productivity, monetary policy, markup, preference, and investment-specific technology shocks, given the other parameters are kept at the baseline values. A large value of g increases stock price volatilities in all cases of five shocks as shown in the figure.

Impulse response of stock price under different values of Kalman gain g to a 1.0% positive productivity shock, a 0.25% (1.0% at an annualized rate) positive monetary policy shock, a 1.0% positive markup shock, a 1.0% positive preference shock, and a 1.0% positive investment-specific technology shock. 1 on the vertical axis scale amounts to 1% deviation from steady state levels

Based on this observation, a natural question would be whether it is possible to generate moments close to the data by adjusting the value of the Kalman gain without introducing heterogeneity, that is, under \(\alpha =1\). In Sect. 4.3, I briefly mentioned that in homogenous models the standard deviation of the stock price is too large with realistic interest rate volatilities when I set g at \(\frac{1}{150}\). Here I explain the benefit of assuming heterogeneity in detail by experimenting with other values of g and other sizes of shocks.

The first column in Table 4 shows theoretical moments when the value of g is lowered to \(\frac{1}{1000}\) under \(\alpha =1\) with keeping the same sizes of shocks as the benchmark case. This leads to too large volatility of the stock price, 0.49, while the corresponding data is 0.204. To reduce the stock price volatility under \(g=\frac{1}{1000}\), I set interest rate shocks at 0.07%, which is smaller than the benchmark, and sizes of other shocks are the same as the benchmark, as shown in the second column of the table. By this revision, the stock price volatility becomes close to the data. However, the model moment of the interest rate becomes too small, 0.008, compared to the data, 0.024. Besides, the standard deviation of inflation of the model, 0.002, deviates from the data, 0.004. Similar observations are also found in a case with \(g=\frac{1}{500}\), which sets the size of interest rate shock at 0.05%. Even with different values of g, homogenous models have difficulty with matching moments of the stock price, interest rate, and inflation at the same time.Footnote 19 This is one of the benefits of assuming heterogeneity.

Being related to this moment matching, in homogenous cases with \(\alpha =1\), the stock price reaction to a 1% interest rate shock deviates from what is claimed in the existing empirical studies even under different values of g. In the case of \(g=\frac{1}{1000}\), the reaction of the stock price is a \(30\%\) decrease. Challe and Giannitsarou (2014) claim that empirical studies suggest that a 1% point increase in the interest rate at an annual rate is associated with a 2.2%-9% decrease in stock prices. In the case of \(g=\frac{1}{500}\), the reaction is a \(30\%\) decrease, too. Assuming heterogeneity as in the baseline model shows reactions close to the studies, which homogenous cases cannot attain.

Another benefit of incorporating heterogeneity is to improve theoretical moments even when one assumes the simultaneous belief updating. In the quantitative analysis thus far, I have used the lagged belief updating shown in (19), instead of the simultaneous belief updating shown in (14), as I mentioned in Sect. 3.1.2. This is mainly because the model with the simultaneous belief updating shows an inferior fitting to the data in the homogenous case (\(\alpha =1\)). Figure 7 indicates the impulse responses of stock prices to a productivity shock in the homogenous case (\(\alpha =1\)) with the simultaneous belief updating and the lagged belief updating. Clearly, the simultaneous belief updating generates larger volatility than the lagged belief updating.

Table 5 shows theoretical moments of the model with the simultaneous belief updating. The sizes of shocks are the same as those in Table 3 in Sect. 4.3. In the homogenous case (\(\alpha =1\)), the standard deviation of the stock price is much larger than the data. The correlation between the stock price and output is smaller than that in the lagged belief updating case shown in Table 3 mainly due to a large oscillation of the stock price as implied in the low values of the autocorrelation of the stock price in Table 5. However, even in the simultaneous belief updating, assuming heterogeneity helps mitigate this problem as indicated in the case of \(\alpha =0.95\) in Table 5.Footnote 20 This is another benefit of introducing heterogeneity to the subjective belief model of stock price capital gains.

5 Monetary policy and stock price reaction

How does the stance of the monetary policy rule, one of the key fundamental parts of the economy, magnify or compress stock price volatilities via the presence of subjective beliefs? In this section, I show how the parameters in the monetary policy rule affect stock price volatilities. By introducing Bayesian learning and heterogeneity, one can relate the realistic volatilities of the stock price to parameters that construct monetary policy. Models with homogenous beliefs are not suitable for this analysis because they generate unrealistically large reactions of stock prices to movements of the interest rate, which is one of the most important instruments of monetary policy. This analysis contributes to discussions about “gradualism” of monetary policy.

I examine three parameters in the monetary policy rule, the persistence parameter \(\theta _M\), parameter of reaction to inflation \(\phi _{\pi }\), and parameter of reaction to the output gap \(\phi _{y}\) in (55) as the monetary policy stance. I analyze the effects of the monetary policy stance on the stock price under five shocks: productivity, markup, preference, investment-specific technology, and monetary policy shocks. In this analysis, the shocks have the same sizes as those in Sect. 4.4: a 1.0% positive productivity shock, 1.0% positive markup shock, 1.0% positive preference shock, 1.0% investment-specific technology shock, and 0.25% (1.0% at an annualized rate) positive monetary policy shock (shock to increase the nominal interest rate). I set \(\alpha =0.94\) in this section.Footnote 21

A summary of this section is as follows. A change of the parameter in the monetary policy rule which strongly affects the volatility of “current” real interest rates has a large impact on the stock price under the presence of subjective beliefs because the presence limits forward-looking pricing of stocks. Among the three parameters in the monetary policy rule, the persistence parameter generally has large effects on stock prices. This is because the high persistence parameter reduces the volatility of “current” real interest rates regardless of the type of economic shocks originating from an economy, that is, four shocks other than the monetary policy shock. On the other hand, output is not necessarily affected as much as stock prices by a change in the persistence parameter against a backdrop of the forward-looking characteristic of a New Keynesian model, since the path of the real interest rate tends to more persistently deviate from the steady state under the high persistence parameter. Furthermore, in some cases, the stock price becomes less volatile whereas output becomes more volatile when increasing monetary policy inertia.

In contrast, changing the reaction parameter to inflation does not generate clearly twisted relations of stock price and output stabilities. A high reaction parameter to inflation simply increases the volatility of the real interest rate right after a shock and onward as well. A similar observation applies to the reaction parameter to the output gap.

5.1 Monetary policy persistence parameter and stock price

What are the impacts on stock prices of changing the level of the persistence parameter in the monetary policy rule? Figure 8 indicates the impulse responses of stock prices to positive productivity, markup, preference, investment-specific technology, and monetary policy shocks under two different persistence parameters of monetary policy, \(\theta _M=0.8\) and \(\theta _M=0\) in (55). Other parameters are the same as the baseline settings in Table 1.

Stock price responses in \(\alpha =0.94\) case with different monetary policy persistence parameters to a 1.0% positive productivity shock, a 1.0% positive markup shock, a 1.0% positive preferene shock, a 1.0% positive investment specific technology shock, and a 0.25% positive monetary policy shock (1.0% at an annualized rate). These sizes are the same as those in Sect. 4.4. The value of \(\alpha \) is 0.94. 1 on the vertical axis scale amounts to 1% deviation from steady state levels

In response to a 1% positive productivity shock, the initial reaction of the stock price becomes significantly smaller in the case with the high monetary policy persistence parameter (\(\theta _M=0.8\)), a 4.2% increase, than an 8.5% increase in the case with the low persistence parameter (\(\theta _M=0\)). The figure also includes corresponding reactions of output to see how financial and non-financial volatilities are related. Under the positive productivity shock, the strong monetary policy persistence implies that the nominal interest rate decreases only gradually in response to decreases in inflation rates. Therefore, the nominal interest rate is higher in \(\theta _M=0.8\) case than in \(\theta _M=0\) case. The inflation expectation decreases less in \(\theta _M=0.8\) case than in \(\theta _M=0\) case because of the high persistence of the nominal interest rate with the forward-looking nature of the New Keynesian model. However, the decreases in the real interest rate are smaller in \(\theta _M=0.8\) case than in \(\theta _M=0\) case since the effects of the nominal interest rates well surpass those of the inflation expectations. As implied by (33), the stochastic discount factor (or real interest rate) at time t has a dominant impact on stock prices at time t under the presence of subjective expectations. Therefore, smaller decreases in the real interest rate in \(\theta _M=0.8\) case generate smaller increases in the real stock price than \(\theta _M=0\) case. Because the initial stock price reaction is small, the momentum effect also becomes weak as implied in the last term of (33). Therefore, the overall impacts on the stock price are muted in \(\theta _M=0.8\) case. These observations imply that the persistent monetary policy significantly stabilizes stock price volatility under the productivity shock, whereas the differences in output between two cases are not necessarily large.

A high persistence in the monetary policy rule under the positive markup shock also provides large impacts on stock prices. An initial decrease in the stock price in \(\theta _M=0.8\) case, − 18%, is much smaller than that in \(\theta _M=0\) case, − 38%. Increases in the nominal interest rate in \(\theta _M=0.8\) case are smaller than those in \(\theta _M=0\) case because of the high inertia of monetary policy. Even though the inflation expectation becomes lower in \(\theta _M=0.8\) case than in \(\theta _M=0\) case, the real interest rate is lower in \(\theta _M=0.8\) case than in \(\theta _M=0\) because the effects of the nominal interest rates dominate those of the inflation expectations. When households with subjective beliefs exist, the stock price strongly reacts to the current real interest rate, rather than to the future path of real interest rates. Therefore, the stock price shows small drops in \(\theta _M=0.8\) case, whereas it indicates large decreases in \(\theta _M=0\) case during the initial periods.

A high persistence in the monetary policy rule under the positive preference shock mitigates stock price drops. Decreases in the stock price during the initial periods in \(\theta _M=0.8\) case are much smaller than those in \(\theta _M=0\) case. The average reaction over the initial three periods in \(\theta _M=0.8\) case is − 0.5% while that in \(\theta _M=0\) case is − 1.3%. In \(\theta _M=0.8\) case, the real interest rate is lower than in \(\theta _M=0\) case because of the high persistence of the nominal interest rate. The persistent monetary policy stabilizes stock price volatility under the preference shock while the differences in output between the two cases are small. Similarly, high persistence in the monetary policy rule mitigates stock price drops under the positive investment-specific technology shock. The average decrease in the stock price during the initial two periods in \(\theta _M=0.8\) case is − 2.3%, which is about half of that in \(\theta _M=0\) case, − 4.0%. In \(\theta _M=0.8\) case, the real interest rate decreases, whereas it increases in \(\theta _M=0\) case because of the difference in the nominal interest rates under positive inflation expectations. While the differences in output between the two cases are small during early periods after the shock, stock prices show relatively large differences during the corresponding periods.

These analyses provide policy implications for “gradualism” of monetary policy. In Sect. 1, I mentioned that there were discussions in actual policymaking in the Federal Open Market Committee in February 1994 with regard to whether a 25 basis point policy tightening was preferable to a 50 basis point tightening because some members considered the larger move to have a very high probability of “cracking financial markets” (FOMC Secretariat (1994)). The analysis based on the model implies that inertia of the policy rate is important for the stock price stability and supports gradualism of monetary policy. Under structural shocks that originate from the economy, such as productivity, markup, preference, and investment-specific shocks, stock price reactions stabilize with highly persistent monetary policy. This is because the high persistence parameter reduces volatility of “current” real interest rates regardless of the type of economic shocks originating from an economy.

On the other hand, output is not necessarily affected as much as stock prices by the levels of the persistence parameter. Furthermore, in some cases, the impacts on the stabilities of the stock price and output become opposite when changing the level of the parameter. For example, in response to a 1% positive productivity shock, the average deviation of the stock price from its steady state during the first five periods after the shock is 3.7% in \(\theta _M=0.8\) case and 4.5% in \(\theta _M=0\) case, whereas the average deviation of output from its steady state during the corresponding periods is 0.8% in \(\theta _M=0.8\) case and 0.7% in \(\theta _M=0\) case. Under a 1% positive markup shock, the average deviation of the stock price from its steady state during the first five periods after the shock is − 11.8% in \(\theta _M=0.8\) case and − 12.5% in \(\theta _M=0\) case, whereas the average deviation of output from its steady state during the corresponding periods is − 0.9% in \(\theta _M=0.8\) case and − 0.7% in \(\theta _M=0\) case. This implies that a high persistence of monetary policy does not necessarily provide the stability of stock prices and output at the same time under the productivity and markup shocks when heterogeneous beliefs exist.

Why do these reversed relations of reactions between the stock price and output appear when subjective beliefs exist? Heterogeneity of beliefs limits forward-looking pricing of stocks, whereas output depends on the current and expected future path of the real interest rate onward by the forward-looking characteristic of a New Keynesian model. Under the high persistence parameter, the path of the real interest rates tends to more persistently deviate from the steady state while volatilities of the “current” real rates are subdued.

Figure 8 includes reactions of the real interest rate for each shock. For example, the top right box in the figure shows the real interest rate reactions under the productivity shock. During the first three periods, the real interest rate in \(\theta _M=0\) case is lower than that in \(\theta _M=0.8\) case. However, from time four to eleven, the real interest rate in \(\theta _M=0\) case is higher than that in \(\theta _M=0.8\) case. When the economy is located at time one, the real interest rate in \(\theta _M=0\) case is clearly lower than in \(\theta _M=0.8\) case, which leads to a higher stock price in \(\theta _M=0\) case than in \(\theta _M=0.8\) case. On the other hand, the discounted sums of the current and expected future real interest rates evaluated at time one are close between the two cases, which results in similar values of output under the two cases. At time five, the discounted sum of the real interest rates is lower in \(\theta _M=0.8\) case, which leads to higher output in \(\theta _M=0.8\) case, though stock prices in the two cases show close values. A similar discussion about the paths of the real interest rates holds under the markup shock as well. The analysis implies that monetary policy might need to consider this trade-off caused by monetary policy inertia under the existence of subjective beliefs.

Figure 8 also includes an analysis of the effects of the high persistence parameter under the monetary policy shock. In discussing gradualism, however, this needs to be carefully evaluated since the characteristic of the monetary policy shock is considered to be different from other four shocks. The discussions about gradualism target inertial policy responses to shocks originating from the economy, rather than an unexpected disturbance produced by monetary policy itself. Persistent monetary policy under this shock implies that the monetary authority does not revise the disturbance for long periods. Although this seems unrealistic, I show the results to study the consequences when the monetary authority takes this policy stance.

In a response to the positive monetary policy shock (shock to increase the nominal interest rate), stock prices drop further in \(\theta _M=0.8\) case than in \(\theta _M=0\) case. A strong persistence implies that the authority maintains an increase in the nominal interest rate after an unexpected positive nominal interest rate shock. This policy management continues to push up the “current” nominal interest rates at each point of time with low inflation expectations and leads to high real interest rates. At the same time, output decreases in \(\theta _M=0.8\) case much larger than in \(\theta _M=0\) case. The impacts of the shock on output become large in the high persistence case, whereas a one-period transitory shock to the nominal interest rate does not have strong effects on output. This analysis implies that if the authority generates a monetary policy shock, revising the disturbance clearly helps stabilize the stock market as well as the non-financial side of the economy.

5.2 The parameter of monetary policy reaction to inflation and stock price

Figure 9 indicates the impulse responses of stock prices to positive productivity, markup, preference, investment-specific technology, and monetary policy shocks under two different reaction parameters of monetary policy to the inflation rate, \(\phi _{\pi }=2\) and \(\phi _{\pi }=1.1\) in (55). Other parameters are the same as the baseline settings in Table 1.

In the case of the high reaction parameter of monetary policy to inflation, \(\phi _{\pi }=2\), the stock price initially increases by 4.9% reacting to a 1% positive productivity shock while the reaction remains a 2.8% increase in \(\phi _{\pi }=1.1\) case. While the stock prices show this difference, the responses of output in the two cases indicate similar paths. In \(\phi _{\pi }=2\) case, monetary policy is more sensitive to decreases in inflation rates than in \(\phi _{\pi }=1.1\) case. The nominal interest rate becomes lower, and the inflation expectation becomes higher in \(\phi _{\pi }=2\) case than in \(\phi _{\pi }=1.1\) case. These developments generate large decreases in the near-term real interest rates and result in a large increase in the stock price in \(\phi _{\pi }=2\) case. Because output reacts to not only the current but the expected future path of the real interest rate, reactions of output in the two cases are similar.

Under a 1% positive markup shock, the initial response of the stock price in \(\phi _{\pi }=2\) case is −20.4% and that in \(\phi _{\pi }=1.1\) case is − 15.3%. Output decreases by − 0.72% in \(\phi _{\pi }=2\) case and it does by − 0.65% in \(\theta _M=0\) case in the first period. The stock price indicates a relatively larger difference between the two cases than output does. The nominal interest rate increases in \(\phi _{\pi }=2\) case more than in \(\phi _{\pi }=1.1\) case to curb inflation, and consequently, the real interest rate becomes high. Because the stock price reacts strongly to the current real interest rate under the presence of subjective beliefs, the stock price shows a larger drop in \(\phi _{\pi }=2\) case than in \(\phi _{\pi }=1.1\) case. On the other hand, reactions of output under the two cases are similar.

Stock price responses in \(\alpha =0.94\) case with different monetary policy reaction parameters to inflation to a 1.0% positive productivity shock, a 1.0% positive markup shock, a 1.0% positive preference shock, a 1.0% positive investment specific technology shock, and a 0.25% positive monetary policy shock (1.0% at an annualized rate). These sizes are the same as those in Sect. 4.4. The value of \(\alpha \) is 0.94. 1 on the vertical axis scale amounts to a 1% deviation from steady state levels

In response to a 1% positive preference shock, the stock price increases by 0.8% in the initial period in \(\phi _{\pi }=1.1\) case while it decreases by − 0.3% in \(\phi _{\pi }=2\) case. In \(\phi _{\pi }=1.1\) case, the increase in the nominal interest rate in response to the increase in inflation is subdued compared to that in \(\phi _{\pi }=2\) case. Since the nominal interest rate is lower, inflation is higher in \(\phi _{\pi }=1.1\) case, and this results in lower real interest rates. A low reaction of monetary policy to inflation supports the stock price under the preference shock.

Under a 1% positive investment-specific technology shock, the low reaction of monetary policy to inflation rate, \(\phi _{\pi }=1.1\) case, mitigates stock price drops. However, the difference of stock prices between \(\phi _{\pi }=1.1\) and \(\phi _{\pi }=2\) cases is not large. The average response of stock prices over the initial three periods in \(\phi _{\pi }=1.1\) case is − 2.2% and that in \(\phi _{\pi }=2\) case is − 2.6%. This is because the shock does not generate large volatility of inflation in this setting. The difference in the nominal interest rates is limited, and consequently, the difference in the stock prices under the two cases is small. The average reaction of output over the initial three periods in \(\phi _{\pi }=1.1\) case is 0.16%, which is higher than 0.14% in \(\phi _{\pi }=2\) case.

In response to a 0.25% positive monetary policy shock (1.0% at an annualized rate), the nominal rate hike decreases the inflation rate. In response to the decrease in inflation, the monetary policy rule simultaneously adjusts the nominal interest rate. In the case with \(\phi _{\pi }=1.1\), the monetary policy is less reactive than the case with \(\phi _{\pi }=2\). Hence, the real interest rate in the case with \(\phi _{\pi }=1.1\) becomes relatively higher than that in the case with \(\phi _{\pi }=2\). The stock price shows larger drops, −10.5%, in the initial period in \(\phi _{\pi }=1.1\) case than it does in \(\phi _{\pi }=2\) case, −8.1%. Output reactions in the initial period are − 0.22% in \(\phi _{\pi }=1.1\) case and − 0.16% in \(\phi _{\pi }=2\) case, respectively.

Under all five shocks, the stock price and output similarly increase or decrease in the same direction by changing \(\phi _{\pi }\). That is, there are no notably twisted relations or trade-offs between stock price and output stabilities by changing the reaction parameter to inflation. The difference in the strength of the reaction of monetary policy to inflation does not generate the paths of the real interest rates which could lead to trade-offs between stock price and output stabilities in contrast to what one observes in the study of monetary policy inertia.

5.3 The parameter of monetary policy reaction to output gap and stock price