Abstract

In this paper we examine the entry of new countries and products into world trade flows. This is manifest in our data sample by a growth in exporter–importer-product combinations from about 430 thousand in 1995 to almost 620 thousand in 2005. Most of this growth has occurred because more and more developing or emerging market countries are entering the market as exporters. To study this growth in trade at the extensive margin, we develop a firm level model based on the work of Helpman et al. (Q J Econ 123(2):441–487, 2008) of the decision to enter the export market. Using data from 129 countries and 144 industrial sectors, we then estimate this model for the years 1995 and 2005. We report evidence that rising firm-level productivity levels in our sample countries, either in overcoming the costs of direct exports or of engaging trade intermediates, provides the best explanation for the observed pattern of the growth in exporter–importer-product pairs.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Over the period 1995–2005, global trade grew at a remarkable pace. According to the United Nations Commodity Trade Statistics Database, during that period the value of total world trade (imports, nominal US dollars) doubled from US $5 to US $10 trillion. While much of the increase in the value of trade was due to a rise in trade of existing products with existing trading partners [see, for example, Husted and Nishioka (2013)], it is interesting to note that an increasing number of developing countries became involved in global trade both in terms of the goods they export and their export partners (see also Cheptea et al. 2014). For instance, the value of differentiated goods exported from developing countries more than tripled over the years 1995–2005 (see Table 1) while the number of their importer-product combinations almost doubled.Footnote 1

Growth in trade at the extensive margin has been a recent focus of study in many papers. Using disaggregated commodity level data on trade for 1913 bilateral country pairs, Kehoe and Ruhl (2013) report a “significant and robust connection between the extensive margin and total trade growth”. In this paper, we are interested in the factors that determine whether or not a country enters the export market, and, in particular, how these factors influence firms in developing countries to choose to export. We estimate a logit model that is based on the firm-level decision to export (Helpman et al. (2008); hereafter HMR) and study the causes of the increasing involvement of developing countries in global trade at the product level.Footnote 2

Our empirical analysis uses data on exports of 144 differentiated products (measured at the 3-digit SITC level) among pairs of 129 countries for the years 1995 and 2005.Footnote 3 We compare the estimation results across exporters, products, and years and find evidence that the success of those countries that have seen major growth at the extensive margin over this period is due to a broad-based rise in productivity levels for exporting firms in these countries. In particular, we find that the countries who have been most successful in adding new markets have done so not only because of high growth rates of industry productivity levels but also because they enjoyed not-too-low initial levels of productivities. Our results indicate the important roles played by self-selection into export markets due to productivity growth of potential export industries, which is probably engendered by firm level technological advance and/or the contribution of technology from foreign firms that have begun to produce in- and export from these countries.

The rest of the paper proceeds as follows. In Sect. 2 we present an overview of the expansion in global trade, focusing on market access at the product level. In Sect. 3, we estimate our industry-level version of the HMR model and show that our results can be used to quantify productivity growth in the export sector for each of the countries in our sample. The last section offers our conclusions.

2 An overview of trade growth at the extensive margin

In this section we provide an overview of the evolution of international trade patterns since 1995. In order to illustrate the growth in the number of trading partners at the product level in recent years, we restrict our attention to imports of differentiated manufacturing products disaggregated at the 3-digit SITC level.Footnote 4 Due to missing data for some least-developed countries for year 1995, we include data from years 1996 and 1997 to increase our sample to 129 countries.Footnote 5 We include countries from every continent and at various standards of living. Slightly less than one-third of the countries chosen in our sample (39 countries) are classified by the World Bank (World Development Report 2009) as high income countries. We denote these countries as developed countries and the remaining 90 countries as developing or emerging market countries. Trade among our sample of countries accounted for at least 90 % of all world trade of differentiated products in each of the two years in our sample.

Table 1 provides the export values (billions of US dollars) of differentiated goods and the numbers of observations with positive trade as an exporter of these types of products for the developed and developing countries from our data set. Because we have the bilateral trade from 129 countries for 144 products, we have 2,377,728 potential observations of exporter–importer-product combinations if each of the 129 countries imports all 144 products from the other 128 countries. Of these, developed countries (as exporter countries) have almost 719,000 possible exporter–importer-product combinations while developing countries have more than 1.66 million possible combinations. As the table shows, in 1995 developed countries had established trade in almost 40 % of their possible importer-product combinations while developing country exporters had entered less than 10 % of possible importer-product markets. By 2005, those totals had risen to 49 and 16 % respectively. Overall the numbers of exporter–importer-product combinations increased from 434,378 to 625,830, and the share of positive trade combinations in our sample increased from 18.3 to 26.3 %. Moreover, despite the fact that exporters in developing countries remained significantly below the potential for expansion into new markets their number of importer-product combinations almost doubled between 1995 and 2005.

In the last columns of Table 1, we summarize total exports of differentiated goods for our sample countries. The value of world exports of differentiated goods doubled from US $2961 billion in 1995 to US $5888 billion in 2005. Of this, total exports of developing countries in our sample more than tripled between 1995 and 2005, rising from US $504 to US $1675 billion. Developed country exports over this same period rose by about 70 %. Thus, as the table shows, relative to developed countries there has been a sharp increase in the number of differentiated products shipped from developing countries in recent years. This finding indicates that the increase in the extensive margin of trade in recent years stems mainly from the increased participation of some developing countries in global trade as exporters.

Table 2 provides similar information to that in Table 1 on the participation of a selected set of countries in this expansion of trade. The column labeled “Rank” provides information on the ranking of the individual countries listed in the table in terms of trade growth at the extensive margin (measured by changes in the number of their importer-product combinations over the 1995–2005 decade). At the top of the table, grouped together, are the ten countries whose importer-product pairs expanded the most over the period 1995–2005. Except for Australia, all of these countries are classified as developing, and, these nine countries account for the vast bulk of developing country trade. The maximum number of markets for the exporters from any one country in our sample is 18,432. As the table shows, by 2005 Chinese exporters rivaled those from both the United States and Germany in penetrating the vast majority of possible markets. With the exception of Viet Nam and Ukraine, by 2005 exporters from the other 10 leading countries had expanded their sales to more than half the potential markets. Over the 1995–2005 period, importer-product combinations for the top ten countries expanded by at least 40 %, and, in the case of Viet Nam, almost tripled.

Also included in the table are comparable data on trade of some of the largest developed economies, including Germany, Japan, and the United States. As this part of the table shows, export growth (in terms of nominal values) for many advanced economies was also relatively strong over this period. Apparently, however, most of the growth was at the intensive margin. France and Japan had the largest increases in importer-product shares, with growth of about 12 % between 1995 and 2005. Importer-product pairs for the other three developed countries in this part of the table rose by less than 10 %.

With respect to the other developing countries included in Table 2, all saw a marked increase in export value between 1995 and 2005, and many saw significant growth of exports at the extensive margin. In many cases the percentage increase in import-product pairs was similar to the increases experienced by the ten leading exporting countries. An exception to this was Russia, where these pairs rose by less than 25 %.

As the information in Tables 1 and 2 demonstrates, export growth across the world between 1995 and 2005 was very strong, especially for developing and emerging market economies. For a number of these countries growth at the extensive margin played a role in accounting for this rise in trade. In the next sections of this paper, we build and estimate a model of a firm’s decision to enter an export market. We are interested in trying to better understand the factor or factors that induce firms to expand sales in terms of both products and customer countries, and, in particular, our focus will be on trying to explain the recent growth of trade at the extensive margin.

3 Firm-heterogeneity and market access

3.1 Firm-level decision to enter global markets

In this section we provide a model of the decision by a firm to enter an export market as well as empirical estimates based on the model of firm heterogeneity (Melitz 2003). The empirical approach we take is essentially that proposed by HMR in their study of bilateral aggregate export flows. We modify it to the product level so that we can study the causes of success in market access.

Demand in each country l is obtained from a two-tier utility function of a representative consumer. The upper tier of this function is separable into sub-utilities defined for each product \(i=1,\ldots ,G: U^{l}=U[u_{1}^{l},\ldots ,u_{i}^{l},\ldots ,u_{G}^{l}]\) (e.g., Hallak 2006). The representative consumer uses a two-stage budgeting process. The first stage involves the allocation of expenditure across products. In the second stage, the representative consumer determines the demand for each variety \(\omega \) in product i subject to the optimal expenditure (\(Y_{it}^{l}\)) obtained from the first stage.

The sub-utility index is a standard CES (Constant Elasticity of Substitution) utility function: \(u_{it}^{l}=\left[ \int _{\omega \in B_{it}^{l}}\left[ q_{it}^{l}(\omega )\right] ^{\alpha _{i}}d\omega \right] ^{1/\alpha _{i}}\). Here, \(q_{it}^{l}(\omega )\) is the consumption of variety \(\omega \) in product i in time t chosen by consumers in country l, \( B_{it}^{l}\) is the set of varieties in product i available for consumers in country l, and the time-invariant product-specific parameter \(\alpha _{i}\) determines the elasticity of substitution across varieties so that \( \varepsilon _{i}=1/(1-\alpha _{i})>1\). From the utility maximization problem of a representative consumer, we can find the demand function for each variety: \(q_{it}^{l}(\omega )=\frac{\left[ p_{it}^{l}(\omega )\right] ^{-\varepsilon _{i}}Y_{it}^{l}}{\left( P_{it}^{l}\right) ^{1-\varepsilon _{i}}}\) where \(P_{it}^{l}=\left[ \int _{\omega \in B_{it}^{l}}\left( p_{it}^{l}(\omega )\right) ^{1-\varepsilon _{i}}d\omega \right] ^{1/(1-\varepsilon _{i})}\).Footnote 6

A firm in country k produces one unit of output with a cost minimizing combination of inputs that costs \(c_{it}^{k}\), which is country, industry, and time-specific cost for unit production. \(1/a_{it}^{k}\) is firm-specific productivity measure (i.e., a firm with a lower value of \(a_{it}^{k}\) is more productive and that with a higher value of \(a_{it}^{k}\) is less productive) whose product-specific cumulative distribution function \( G_{i}(a_{it}^{k})\) does not change over the period and has a time- and country-specific support \([{\bar{a}}_{it}^{k},+\infty ]\).

We assume that each variety \(\omega \) is produced by a firm with productivity \(a_{it}^{k}\). If this firm sells in its own market, it incurs no transportation costs. If this firm seeks to sell the same variety in foreign country l, it has to pay two additional costs: one is a fixed cost of serving country l (\(f_{it}^{kl}>\)0) and the other is a variable transport cost (\(\tau _{it}^{kl}>1\)). Since the market is characterized by monopolistic competition, a firm in country k with a productivity measure of \(a_{it}^{k}\) maximizes profits by charging the standard mark-up price: \( p_{it}^{k}=c_{it}^{k}a_{it}^{k}/\alpha _{i}\). If the firm exports it to country l, the delivery price is \(p_{it}^{k}=\tau _{it}^{kl}c_{it}^{k}a_{it}^{k}/\alpha _{i}\).

As a result, the associated operating profit from the sales to country l is

where the expected profit is a monotonically increasing function with respect to \(1/a_{it}^{k}\) for any pair of an exporter country k and an importer country l.

Since the profits are positive in the domestic market for surviving firms, all firms are profitable in home country k. However, sales to an export market such as country l are positive only when a firm is productive enough to cover both the fixed and variable costs of exporting. Moreover, the positive observation of country-level exports of product i depends solely on the most productive firm since the expected profit from Eq. (1) varies only with the firm-specific productivity (\( 1/a_{it}^{k} \)) in each industry.Footnote 7

Now, we define the following latent equation for the most productive firm in country k in industry i at year t whose productivity level is \({\bar{a}} _{it}^{k}\):

Equation (2) is the ratio of export profits for the most productive firm [see: Eq. (1)] to the fixed cost of exporting good i to market l. Positive exports are observed if and only if the expected profits of the most productive firms in industries are positive: \(Z_{it}^{kl}>1\).

Equation (2) provides the foundation for our empirical work. To estimate this equation, we define \(f_{it}^{kl}=\exp (\lambda _{it}\varphi _{it}^{kl}-e_{it}^{kl})\) where \(\varphi _{it}^{kl}\) is an observed measure of any country-pair-specific fixed trade costs, and \(e_{it}^{kl}\) is a random variable. Using this specification together with the empirical specification of variable trade costs: \((1-\varepsilon _{i})\ln (\tau _{it}^{kl})=-\gamma _{it}d^{kl}+u_{it}^{kl}\) where \(d^{kl}\) is the log of distance between countries k and l and \(u_{it}^{kl}\) is a random error, the log of the latent variable \(z_{it}^{kl}=\ln (Z_{it}^{kl})\) can be expressed as

where \(\beta _{it}^{k}\) is an exporter fixed effect that captures \( (1-\varepsilon _{i})\ln (c_{it}^{k})\) and \((1-\varepsilon _{i})\ln ({\bar{a}} _{it}^{k})\); \(\beta _{it}^{l}\) is an importer fixed effect that captures \( (\varepsilon _{i}-1)\ln (P_{it}^{l})\) and \(\ln (Y_{it}^{l})\); \(\eta _{it}^{kl}=u_{it}^{kl}+e_{it}^{kl}\) is random error; and the remaining variables are captured in a constant term (\(\beta _{it}\)).

We now define the indicator variable \(T_{it}^{kl}\) to be 1 when country k exports product i to country l in year t and to be 0 when it does not. Let \(\rho _{it}^{kl}\) be the probability that country k exports product i to country l conditional on the observed variables. Then, we can specify the following logit equation:Footnote 8

where \(\Lambda \) is the logistic distribution function with a time-invariant error \(\sigma _{\eta _{i}}\).

3.2 Estimation results

Equation (4) is the final statement of our empirical model. To estimate this equation for each product for each year (1995 or 2005), we employ data on bilateral trade across 129 countries (16,512 country pairs) for 144 3-digit differentiated products. We prepare the following bilateral indexes for the estimation of Eq. (4): dummy variables for common border, common language, common legal origin, free trade agreements, and common WTO membership.Footnote 9 Variables to represent the sizes of trade costs and trade infrastructure efficiency are developed from the World Development Indicators. We use the log of the sum of each index from the two (exporter and importer) countries to create these variables.Footnote 10

We report the estimation results of Eq. (4) for each of the 144 differentiated products in Table 3. For each product, we have at most 16,512 observations. The median value of observations is 14,976, of which around 18 % are non-zero observations in year 1995. In the 2005 data, the median number of observations rises to 16,000, of which around 26 % are non-zero observations, showing the increase in the extensive margin of trade over the period for many of countries in the sample. The fact that the median number is less than the maximum simply illustrates the fact that we have to drop those observations where a country exports that product to all 128 trading partners, imports that product from all 128 countries, or does not export or import the product at all. For example, Japan exported “passenger vehicles” (SITC 781) to all 128 countries in 2005. In this case, we cannot estimate the probability of exports for Japanese auto industry since the observed probability is 100 %. The fact that the median number rose reflects the fact that several of the poorest countries in our data set exported no differentiated products at all in 1995 but had begun to export at least some of these products by 2005.

We prefer to use the results from the product level estimations since they can flexibly capture the industry-specific conditions on productivity, prices, and demand spelled out in our theoretical model. In particular, Hanson (2012) finds that most developing countries specialize in narrowly defined industries. Thus, it would be important to allow the sector-specific exporter- and importer-fixed effects. Given the large number of estimates we have for each product, we do not report all the results. Instead, in the table we provide summary statistics for the estimated coefficients,Footnote 11 the proportion of coefficients that have the expected sign, and the proportion of those that are statistically significant at the 5 % level. In addition, we report the results from the pooled sample of the 144 products in the same table. Overall, as the table shows, the results of our estimations are remarkably successful. In virtually all cases, the signs of our estimated coefficients conform closely to theoretical predictions, and a large percentage of these estimates are statistically significant.

Consider the table. The probability of successful exports from country k to l (\(\rho _{it}^{kl}\)) is negatively related to the log of distance between them. 100 % of product level estimates have negative signs and are statistically significant at the 5 % level for both 1995 and 2005. Similar to the results reported by Baldwin and Harrigan (2011), geographic separation helps us to explain the zero export observations. Estimated coefficients on the WTO membership variable are expected to be positive since countries involved in WTO share lower trade barriers. As expected, 99.3 % are positive and 97.2 % are statistically significant at the 5 % level in 1995; however, only 28.5 % are positive and statistically significant in 2005. On the other hand, the positive signs on the FTA dummy variable rise from 89.6 % in 1995 to 98.6 % in 2005 with a comparable increase in the number of significant estimates.Footnote 12 In addition, for both years, many of the coefficients on the trade infrastructure variables (trade costs and trade efficiency) are statistically significant with the predicted signs, supporting the important roles played by trade costs in influencing the extensive margin of trade.

According to the Melitz model, more firms will choose to enter an export market over time if they are increasingly able to achieve positive profits in foreign markets. As we discussed above, this could be due to any of a number of factors including rising standards of living leading to higher demand for various products throughout the world, advances in transportation technology, or country-specific advances in production technology at the industry level. While our empirical model does not allow us to identify exactly which of these factors may be paramount in explaining export success, it is crucial to observe the relatively stable estimates on the trade-cost parameters. For example, the value of the pooled estimates of the coefficient on the log of distance is \(-\)0.906 in 1995 and it is \(-\)0.835 in 2005, suggesting that there was no significant advancement in the decline in transportation costs over the period in question. We find similar stability in the estimates for the coefficients of the variables such as common border, common language, and business- and trade-related cost variables.Footnote 13

Thus, conditional on possible changes on the importer-side, our estimates suggest that the most important variable to explain the distinctive success of any industry in entering foreign markets is that country’s exporter fixed effect. According to the theoretical discussion above, \(\beta _{it}^{k}\) mainly captures the unit production cost of industries (\(c_{it}^{k}\)) and the productivity of the most productive firm (\({\bar{a}}_{it}^{k}\)). While the product level productivities that correspond to our 144 products are not available from the existing data, we can access the changes over the period 1995–2005 in the unit cost of production, such as wages. As is well known, income levels in many of the countries identified as leading exporters in Table 2 increased over the period as all experienced relatively rapid growth in real GDP per capita. Thus, it is not likely that a reduction in unit cost contributed to the increased success in market access. Rather, our findings suggest that the remaining factor, productivity growth in certain industries in these countries, might play the essential role for their success in expanding market entry.Footnote 14

In our empirical exercise, we use exporter- and importer-fixed effects to overcome the endogeneity problem. Nonetheless, endogeneity problems could arise from the omission of multilateral resistances (i.e., Anderson and van Wincoop 2003; Baier and Bergstrand 2009; Behar and Nelson 2014). In particular, Behar and Nelson (2014) show that extensive margin depends systematically on multilateral resistances although their impacts on extensive margin are relatively small. So in “Appendix 3”, we use Behar and Nelson’s (2014) approach to including multilateral resistance terms in our specification. As we report there, including those terms yields virtually identical results to those we report in Table 3.

3.3 Estimating the productivity advantage at the product level

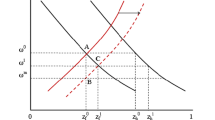

The success for firms from a country in exporting to a destination market depends on firm-specific productivity. In this section, we are interested in examining the ranges of productivities that enable firms to export from country k to l for each product i. We define the lowest productivity level or the cut-off productivity level (\(1/{\tilde{a}}_{it}^{kl}\)) as that point where a firm from country k has zero profit in a foreign market l. Note that a firm with a higher value of \(1/a_{it}^{k}\) is more productive. Thus, we should have \(1/{\tilde{a}}_{it}^{kl}<1/{\bar{a}}_{it}^{k}\) if firms in country k’s industry i succeed in exporting to country l.

Now, by using Eq. (2), it is possible to show that \( z_{it}^{kl}\) is a function of the log of the relative productivity: \( z_{it}^{kl}=(\varepsilon _{i}-1)\ln \left( {\tilde{a}}_{it}^{kl}/{\bar{a}} _{it}^{k}\right) \).Footnote 15 Remember that \(\hat{\rho } _{it}^{kl} \) is the predicted probability of market access, which is estimated from Eq. (4). Let \({\hat{z}}_{it}^{kl}/{\hat{\sigma }} _{\eta _{it}}=\Lambda ^{-1}(\hat{\rho }_{it}^{kl})\) be the predicted value of the log of the latent variable. Then, we can show the relationship between our estimates of the log of the latent variable and the log difference between the highest and the cut-off productivity:

where we have this measure for each year 1995 or 2005.

We refer to \(\ln \left( 1/{\bar{a}}_{it}^{k}\right) -\ln \left( 1/{\tilde{a}} _{it}^{kl}\right) \) as the productivity advantage. Using estimates from our model we calculate values of the productivity advantage for each of the selected countries in Table 2 for each of their possible export products and markets for 1995 and 2005. Table 4 summarizes our findings. According to our model, positive values of the productivity advantage are a necessary condition for entry into a foreign market. As the table shows, the share of positive estimates rose for all twenty countries over the years 1995–2005 but especially so for the countries ranked near the top of the table, consistent with our discussion the growth at the extensive margin for these countries detailed in Table 1.

To illustrate more clearly what these numbers imply, consider Figs. 1, 2, 3, 4, 5. Figure 1 provides a scatter plot of \({\hat{z}}_{it}^{kl}\) for year 1995 against that for year 2005 for the United States as an exporter country. Because \(\varepsilon _{i}\) and \(\sigma _{\eta _{i}}\) in Eq. (5) are assumed to be time invariant, the scatter plot shows the changes in productivity advantages, \(\ln \left( 1/{\bar{a}}_{it}^{k}\right) -\ln \left( 1/ {\tilde{a}}_{it}^{kl}\right) \), over the period without identifying which values (\({\bar{a}}_{it}^{k}\) or \({\tilde{a}}_{it}^{kl}\)) have changed. In the figure, the horizontal (vertical) axis plots values for 1995 (2005). Points found in the lower left hand quadrant represent those product-market pairs where the United States lacked the productivity advantage to export in either year. Points in the upper right hand quadrant represent product-market pairs where it could successfully export in both years. Points found in the lower left hand quadrant represent those product-market pairs where the country in question lacked the productivity advantage to export in either year. Points in the upper right hand quadrant represent product-market pairs where it could successfully export in both years. Points in the upper left hand quadrant represent positive changes in the productivity advantages allowing the most productive firms to enter certain new markets. Positive (negative) values along the 45 degree line with zero intercept (solid line) suggest no change in productivity advantage over the years 1995–2005. We also introduce a regression line (the dashed line) fitted to the plots in the figure:

The estimated intercept of this line is 0.823 for the United States. This intercept represents our estimate of a uniform shift in productivity advantages for US exporters between 1995 and 2005. We report similar estimates in Table 4 for the all of the selected countries in Table 2. Note that there are positive changes in productivity advantage for the United States, but as we will show that shift is not as impressive as those for China, India, and Indonesia.

Figures 2 through 5 provide scatter plots of \({\hat{z}}_{it}^{kl}\) for year 1995 against that for year 2005 for China, India, Indonesia, and Nigeria. Consider, for instance, the estimates for China plotted in Fig. 2. A large number of plots are found in the upper right quadrant, indicating sufficient productivity advantage in either year to warrant market entry. Many points lie above the 45\(^\circ \) line suggesting overall productivity growth in the ability to produce goods for specific markets. As shown in Table 4, the intercept in equation (shift) is 3.583, which is much greater than any of the other countries in the table.Footnote 16

Of particular interest are the plots for India (Fig. 3) and Indonesia (Fig. 4). In these cases there is a significant across-the-board shift in productivity advantages for exporters. In virtually all the cases, the observations in the figures lie well above the 45\(^\circ \) line, and, for both countries, a large mass of plots lie in the upper left quadrant. Our model suggests that the number of firms with the capacity to export successfully to foreign markets has increased dramatically and these increases have been across virtually all products and in virtually all markets contained in our sample. On the other hand and consistent with the data in Table 2, the plot for Nigeria (Fig. 5) is massed in lower left hand quadrant. This is consistent with the notion that during this period most Nigerian firms were unable to achieve the productivity cut-off level necessary to export successfully. Our estimates do suggest, however, that overall productivity for at least some Nigerian industries did rise during our sample period.

As noted earlier, we refer to \(\ln \left( 1/{\bar{a}}_{it}^{k}\right) -\ln \left( 1/{\tilde{a}}_{it}^{kl}\right) \) as the productivity advantage. Using estimates from our model we calculate values of the productivity advantage for each of the twenty countries listed in Table 2 for each of their possible export products and markets for 1995 and 2005. Table 4 summarizes our findings. According to our model, positive values of the productivity advantage are a necessary condition for entry into a foreign market. As the table shows, the share of positive estimates rose for all of these countries over the years 1995–2005. For the ten countries at the top of the table, the number of estimated positives rose, on average, by about 25 %. For the other developed countries in the table the percentage increase in estimated positives tended to be much smaller. That was also the case for the other developing countries in the table.

As Table 4 also shows, we find statistically significant upward shifts in overall productivity advantages for all of the countries in Table 2. The largest measured shifts occur for the ten countries with the largest increases in their extensive margins of trade. As already noted, China had the largest estimated shift in productivity. Again, the estimated shift in productivity tended to be much smaller for the countries in the lower two sections of the table. Of the countries in the table outside of the top ten, the largest estimated productivity shift was Mexico whose intercept rose 1.557, a value similar to those found in estimates for the top ten. Not surprisingly, Mexico ranked twelfth overall in growth at the extensive margin.

The findings in Table 4 appear to provide a strong statistical relationship between productivity shifts in a country and its ability to expand exports at the extensive margin. In Fig. 6 we plot intercept shifts for each of the 129 countries in our data set against increases in importer-product pairs. As the plots clearly show there is a strong positive relationship between the two. In the next section we explore this relationship more carefully by looking at export growth at the industry level for each country.

3.4 Industry productivity and new market entry

We now turn to analyze how the top ten countries added new markets over the period of 1995–2005. We chose the observations without trade in 1995 and look to see what factor or factors help to explain whether a firm in these countries has been able to expand into new markets between 1995 and 2005. In particular, we estimate the probability of new market entry over the period according to two product level characteristics: (1) a production-side variable (i.e., productivity advantageFootnote 17); and (2) a demand-side variable (i.e., product level total world importsFootnote 18). By including both the log changes over the time and the initial log values of these two variables, we examine which of these factors is correlated with the new market access for each of these countries across all industries. Our results are reported in Table 5.

We find that the initial conditions for both the productivity advantages and world demands are crucial. The industries with high initial productivity advantages have higher probability of accessing new markets in the future. Thus, highly productive firms are self-selected to enter new markets. We also find that the industries with bigger world markets for their products tend to be better able to expand their sales to new markets in the future. In contrast to the initial value results, growth rates of these variables over our sample period do not have the same implications. While productivity growth is crucial for new market access, world market growth does not have significant impact on new markets. Our results indicate that productivity growth is the fundamental factor to explain why countries add new markets. The success for firms from a country in exporting to a destination market depends on firm-specific productivity.

4 Conclusions

In this paper we focus on the expansion of world trade in recent years. We examine the entry of new countries and products into world trade flows. This is manifest in our data sample by a growth in exporter–importer-product combinations from about 430 thousand in 1995 to almost 620 thousand in 2005. Most of this growth has occurred because more and more developing or emerging market countries are entering the market as exporters. Some of the most prominent examples of this have been two groupings of fast growing dynamic economies such as those identified by Hanson (2012) as the “middle kingdoms”.

Our interest in this paper is on the growth of exports at the extensive margin. We develop a firm-level model based on the work of HMR of the decision to enter the export market. Using data from 129 countries and 144 industrial sectors, we then estimate this model for the years 1995 and 2005. We report evidence that rising firm-level productivity levels in our sample countries, either in overcoming the costs of direct exports or of engaging trade intermediates, provide the best explanation for the observed pattern of the growth in exporter–importer-product pairs.

Notes

Hanson (2012) finds that countries specialize in a small number of export products. By estimating the HMR model at the product level, we try to incorporate the product-specific specialization patterns. Although we introduce cross-product difference in productivity distributions, we do not impose specific patterns in cross-industry specialization (e.g., Bernard et al. 2007).

Our use of disaggregated data to study trade growth at the extensive margin is similar to that of Hillberry and Hummels (2008) who focus on intra-U.S. trade growth and Kehoe and Ruhl (2013) who use a data set very similar to ours. Our work is also related to a recent literature on export diversification that also uses disaggregated data to study the relationship between export growth and economic development. See, for instance, Cadot et al. (2011), Klinger and Lederman (2006), and Amador and Opramolla (2013). None of these studies uses the HMR model to direct their empirical analyses.

We think “import” values tend to be reported more accurately than “export” values. Thus, we use the bilateral import values from exporter country k to importer country l as our measure of exports for each product group.

We use the following 129 countries: Albania, Algeria, Azerbaijan, Argentina, Australia (*), Austria (*), the Bahamas (*), Bahrain (*), Bangladesh, Armenia, Bolivia, Brazil, Belize, Bulgaria, Burkina Faso, Burundi, Cameroon, Canada (*), Cape Verde, Central African, Chile, China, Colombia, Comoros, Costa Rica, Côte d’Ivoire, Croatia (*), Cyprus (*), the Czech Republic (*), Denmark (*), Dominica, Ecuador, Egypt, El Salvador, Ethiopia, Estonia (*), Finland (*), France (*), Gabon, Georgia, Gambia, Germany (*), Ghana, Kiribati, Greece (*), Grenada, Guatemala, Guinea, Guyana, Honduras, Hong Kong (*), Hungary (*), Iceland (*), India, Indonesia, Iran, Ireland (*), Israel (*), Italy (*), Jamaica, Japan (*), Jordan, Kazakhstan, Kenya, Kuwait (*), Kyrgyzstan, Lebanon, Latvia, Lithuania, Macedonia, Madagascar, Malawi, Malaysia, Maldives, Mali, Mauritius, Mexico, Mongolia, Moldova, Morocco, Mozambique, Oman, the Netherlands (*), New Zealand (*), Nicaragua, Niger, Nigeria, Norway (*), Pakistan, Panama, Paraguay, Peru, the Philippines, Poland (*), Portugal (*), Qatar (*), Romania, Russian Federation, Rwanda, St Kitts & Nevis, Saint Lucia, Saint Vincent and the Grenadines, Saudi Arabia (*), Senegal, Seychelles, Singapore (*), Slovakia (*), South Korea (*), Slovenia (*), Zimbabwe, Spain (*), Sudan, Suriname, Sweden (*), Switzerland (*), Thailand, Togo, Trinidad and Tobago (*), Tunisia, Turkey, Uganda, Ukraine, the United Kingdom (*), the United States (*), Uruguay, Venezuela, Viet Nam, and Zambia. We use the data from year 1996 for Albania, Azerbaijan, Bulgaria, Gabon, Georgia, Ghana, Mali, Mongolia, Russian Federation, Rwanda, Senegal, and Ukraine and from year 1997 for Armenia, the Bahamas, Cape Verde, Guyana, Iran, Lebanon, and Viet Nam. (*) indicates high-income countries.

The HMR model is based on the firm-heterogeneity model by Melitz (2003). Because the Melitz model predicts the systematic sorting of firms’ entries to foreign markets according to firm-specific productivity levels, the existence of bilateral trade between the two countries depends solely on the most productive firm in the exporter country.

See Debaere and Mostashari (2010) and Baldwin and Harrigan (2011) for product-level estimations of a similar equation using trade data of the United States. We report the estimates from a binary logit specification of Eq. (4) in order to incorporate heavier tails in the productivity distributions since we are especially interested in estimates of the productivity growth of the most productive firms in the industries we study. In certain cases such as panel data sets with large N and small T , the use of the logit (or probit) model with cross section (N) fixed effects has been criticized because the coefficient estimates will be biased and inconsistent. See Greene (2004) and Woolridge (2010). Our estimation strategy is to estimate a cross section model for each of two years, with fixed effects for both importers and exporters, which, in essence is comparable to large N (exporters) and large T (importers) in Greene (2004). We show in “Appendix 1” that our estimation strategy does not suffer from the incidental variables problem. We also estimated our model using a binary probit specification and obtained very similar estimates. These results are available on request.

These dummy variables as well as the bilateral distances are obtained from the CEPII website. See Head et al. (2010) for detail.

The World Development Indicators (the World Bank) data set does not include information on any of these three series for 1995. Consequently, in our empirical work we use 2005 data for both years. The variables we used are “ cost to export or import (US dollars per container)” and “time to export or import (days).” More precisely, the variable we call trade efficiency is measured as the log of the sum of days required to export in the exporting country and days required to import in the importing country. Our trade cost variable is the log of the sum of the costs of handling a container in the exporter and importer countries.

See “Appendix 2” for the estimates of marginal effects at the mean values of independent variables.

See Felbermayr and Kohler (2010) who estimate an empirical model similar to ours using aggregate trade data in order to determine whether or not membership in GATT and the WTO influences trade.

Unfortunately, we do not have the business- and trade-related cost variables for year 1995 and employ those variables from year 2005. Thus, it is possible that the exporter-fixed effects could capture the partial contribution of country-specific reductions in these costs.

There are several other possibilities that the exporter fixed effect captures. For example, learning by exporting (e.g., Clerides et al. 1998; Manjon et al. 2013) could be another reason why exporters can add new markets. However, in our empirical exercise, we are unable to untangle self-selection from other factors such as learning by exporting.

By replacing \({\bar{a}}_{it}^{k}\) with \({\tilde{a}}_{it}^{kl}\) in Eq. (2), we will have the following equation: \(\tilde{Z}_{it}^{kl}=\frac{ \left( 1-\alpha _{i}\right) Y_{it}^{l}\left( \tau _{t}^{kl}c_{it}^{k}/\alpha _{i}P_{it}^{l}\right) ^{1-\varepsilon _{i}}({\tilde{a}}_{it}^{kl})^{1- \varepsilon _{i}}}{f_{it}^{kl}}=1\). Thus, with \(Z_{it}^{kl}=\frac{\left( 1-\alpha _{i}\right) Y_{it}^{l}\left( \tau _{t}^{kl}c_{it}^{k}/\alpha _{i}P_{it}^{l}\right) ^{1-\varepsilon _{i}}({\bar{a}}_{it}^{k})^{1-\varepsilon _{i}}}{f_{it}^{kl}}\), we have \(Z_{it}^{kl}=\left( {\tilde{a}}_{it}^{kl}/{\bar{a}} _{it}^{k}\right) ^{\varepsilon _{i}-1}\).

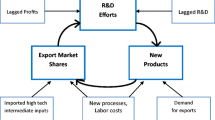

While we have chosen to interpret our findings solely in the context of the HMR model, it is possible that some of the productivity advances illustrated in Figs. 1, 2, 3, 4, 5 may be of a different kind. In a recent paper, Ahn et al. (2011) develop an extension to the Melitz model that allows firms to get around high levels of exporting costs by using intermediary firms to market their goods in foreign markets. That is, firms can choose between direct and indirect export modes to enter particular markets. In their model, choosing to use an intermediary requires a lower fixed cost but yields lower profits. Thus, even in this case, the decision to export requires achieving a cut-off productivity level sufficiently high to be able to cover the costs of the intermediary. Using the heterogeneous-firm framework of Melitz, Demidova (2008) shows that technological advances in one country could raise welfare there while reducing it in its trading partners. Although we make no attempt at measuring welfare, our findings present an empirical example of the type of advances she is modeling in her work.

We need the productivity advantages for each product. Since our objective is to examine the change in industrial productivities, we use the estimated parameters and counterfactual values of independent variables (i.e., constant values of common language, common legal origin, common border, FTA, WTO, ln (distance), trade costs, and trade efficiency for two years) to obtain the fitted values of productivity advantage. Since these values still have product-specific components (\({\hat{\sigma }}_{\eta _{i}}\) and \( \varepsilon _{i}-1\)), we estimate these values with time-invariant product-specific dummy variables and use the residuals as our measure of industry-exporter-specific productivity.

The sum of imports across all importers and exporters for each industry.

References

Ahn, J.-B., Khandelwal, A. K., & Wei, S.-J. (2011). The role of intermediaries in facilitating trade. Journal of International Economics, 84(1), 73–85.

Amador, J., & Opramolla, L. D. (2013). Product and destination mix in export markets. Review of World Economics/Weltwirtschaftliches Archiv, 149(1), 23–54.

Anderson, J. E., & van Wincoop, E. (2003). Gravity with gravitas: A solution to the border puzzle. American Economic Review, 93(1), 170–192.

Baier, S. L., & Bergstrand, J. H. (2009). Bonus vetus OLS: A simple method for approximating international trade-cost effects using the gravity equation. Journal of International Economics, 77, 77–85.

Baldwin, R., & Harrigan, J. (2011). Zeros, quality, and space: Trade theory and trade evidence. American Economic Journal: Microeconomics, 3(2), 60–88.

Behar, A., & Nelson, B. D. (2014). Trade flows, multilateral resistance, and firm heterogeneity. Review of Economics and Statistics, 96(3), 538–549.

Bernard, A. B., Redding, S., & Schott, P. K. (2007). Comparative advantage and heterogeneous firms. Review of Economic Studies, 74(1), 31–66.

Cadot, O., Carrère, C., & Strauss-Kahn, V. (2011). Export diversification: What’s behind the Hump? Review of Economics and Statistics, 93(2), 590–605.

Cheptea, A., Fontagne, L., & Zignago, S. (2014). European export performance. Review of World Economics/Weltwirtschaftliches Archiv, 150(1), 25–58.

Clerides, S. K., Lach, S., & Tybout, J. R. (1998). Is learning by exporting important? Micro-dynamic evidence from Colombia, Mexico, and Morocco. Quarterly Journal of Economics, 113(3), 903–947.

Debaere, P., & Mostashari, S. (2010). Do tariffs matter for the extensive margin of international trade? An empirical analysis. Journal of International Economics, 81(2), 163–169.

Demidova, S. (2008). Productivity improvements and falling trade costs: Boon or bane? International Economic Review, 49(4), 1437–1462.

Felbermayr, G. J., & Kohler, W. K. (2010). Modeling the extensive margin of world trade: New evidence on GATT and WTO membership. World Economy, 33(11), 1430–1469.

Greene, W. (2003). Econometric analysis (7th ed.). Upper Saddle River, NJ: Prentice Hall.

Greene, W. (2004). The behaviour of the maximum likelihood estimator of limited dependent variable models in the presence of fixed effects. Econometric Journal, 7(1), 98–119.

Hallak, J. C. (2006). Product quality and the direction of trade. Journal of International Economics, 68(1), 238–265.

Hanson, G. H. (2012). The rise of middle kingdoms: Emerging economies in global trade. Journal of Economic Perspectives, 26(2), 41–64.

Head, K., Mayer, T., & Ries, J. (2010). The erosion of colonial trade linkages after independence. Journal of International Economics, 81(1), 1–14.

Helpman, E., Melitz, M. J., & Rubinstein, Y. (2008). Estimating trade flows: Trading partners and trading volumes. Quarterly Journal of Economics, 123(2), 441–487.

Hillberry, R., & Hummels, D. (2008). Trade responses to geographic frictions: A decomposition using micro-data. European Economic Review, 52(3), 527–550.

Husted, S., & Nishioka, S. (2013). China’s fare share? The growth of chinese exports in world trade. Review of World Economics/Weltwirtschaftliches Archiv, 149(3), 565–585.

Kehoe, T. J., & Ruhl, K. J. (2013). How important is the new goods margin in international trade? Journal of Political Economy, 121(2), 358–392.

Klinger, B., & Lederman, D. (2006). Diversification, innovation, and innovation inside the global technological frontier (World Bank Policy Research Working Paper No. 3872).

Manjon, M., Manez, J. A., Rochina-Barrachina, M. E., & Sanchis-Llopis, J. A. (2013). Reconsidering learning by exporting. Review of World Economics/Weltwirtschaftliches Archiv, 149(1), 5–22.

Melitz, M. J. (2003). The impact of trade on intra-industry reallocations and aggregate industry productivity. Econometrica, 71(6), 1695–1725.

Rauch, J. E. (1999). Networks versus markets in international trade. Journal of International Economics, 48(1), 7–35.

Wooldridge, J. M. (2010). Econometric analysis of cross section and panel data. Cambridge, MA: MIT Press.

Acknowledgments

We are truly grateful to the editor, Harmen Lehment, and an anonymous referee for suggestions that substantially improved the paper.

Author information

Authors and Affiliations

Corresponding author

Appendices

Appendix 1

The incidental parameters problem may lead to biased coefficient estimates in a fixed-effect binary logit model such as the one estimated in our paper (e.g., Greene 2003, 2004; Wooldridge 2010). In particular, the logit and probit estimators are substantially biased for large-section (N) and small-time (T) panel data if it includes N fixed effects (Greene 2004). Our sector-level data consist of K exporters and L importers with exporter and importer fixed effects. In addition, we have several binary independent variables such as common language and common legal origin. Thus, it is important to make sure that our estimated coefficients from Eq. (4) are unbiased. Following Greene (2004), in this appendix, we use Monte Carlo techniques to test for whether or not our parameter estimates are biased.

We use the following experimental design for our Monte Carlo study of the fixed-effects logit and probit estimators:

We generate each of \((\beta ^{k},\beta ^{l})\) from normal distribution N[0, 1] across 129 exporter or importer countries with the correlation between exporter-specific (\(\beta ^{k}\)) and importer-specific variables (\( \beta ^{l}\)) set to equal 0.5. Then, we assume a unit root process for \( (\beta _{t}^{k},\beta _{t}^{l})\) over time: \(\beta _{0}^{c}=\beta ^{c}+\phi \mu \) for \(t=0\) and \(\beta _{t}^{c}=\beta _{t-1}^{c}+\phi \mu \) for \( t\geqq 1\) where \(c=k\) or l, \(\mu \) is normally distributed N[0, 1], and \(\phi \) is the magnitude of errors in the process. \(d^{kl}\sim N[0,1]\) is a time-invariant bilateral variable normally distributed across 16,512 country-pairs, whereas \(\varphi ^{kl}\) is a binary variable, which is generated from uniform distribution \(U^{kl}\sim U[0,1]\) such that \(\varphi ^{kl}=1\) if \(U^{kl}>0.8\) and otherwise \(\varphi ^{kl}=0\). We assume that \( d^{kl}\) represents the normalized log distance and \(\varphi ^{kl}\) represents the legal origin dummy variable. Error terms are different for a logit or a probit model: \(e_{t}^{kl}\sim \log [u_{t}^{kl}/(1-u_{t}^{kl})]\) where \(u_{t}^{kl}\sim U[0,1]\) for a logit model and \(e_{t}^{kl}\sim N[0,1]\) for a probit model. Finally, the binary variable would be \(T_{t}^{kl}=1\) if \(z_{t}^{kl}\) is greater than zero and otherwise \(T_{t}^{kl}=0\).

We estimate the binary variable (\(T_{t}^{kl}\)) with \(d^{kl}\), \(\varphi ^{kl}\) , k-specific (exporter) and l-specific (importer) fixed effects. Table 6 lists the means of the empirical sampling distribution for the logit and probit estimators of \(\gamma \) and \(\lambda \) based on 200 replications. Here, we report not only the cross-sectional data of \(K\times L\) (or \(T=1\)) as well as the panel data of \(T=2\) and 5. We report two cases: (1) \(\phi =0.1\) or \(\gamma =\lambda =1\) and (2) \(\phi =0.3\) or \(\gamma =\lambda =0.3 \). As shown in the table, there are no obvious biases for either of the estimated coefficients of \(\gamma \) and \(\lambda \). The coefficients converge precisely to the actual values regardless of the inclusion of additional time dimensions. It is important to notice that the results are robust even if the error terms are relatively larger.

In contrast to our \(K\times L\times T\) data, we find significant biases if we estimate the same equation for \(N\times T\) data with small T and \(N-1\) fixed effects (e.g., Greene 2004). Thus, we conclude that our coefficients estimated from a logit model are not biased due to the inclusion of exporter-specific and importer-specific fixed effects as well as several dummy variables.

Appendix 2

In Table 7, we provide summary statistics for the estimated marginal effects at the average values of the independent variables. The results for the proportion of marginal effects that have the expected sign, and the proportion of those that are statistically significant at the 5 % level are similar to Table 3. However, the median values of the estimated marginal effects are larger for 2005 than for 1995. These changes do not reflect the over-time changes in estimated coefficients but the over-time changes in average values of the independent variables, which include exporter- and importer-fixed effects.

Appendix 3

Behar and Nelson (2014) modify the HMR model by including Anderson and van Wincoop’s (2003) multilateral resistance terms and show that extensive margins are systematically impacted by these indexes:

where \({\hat{P}}_{it}^{l}\) corresponds to Eq. (2) in Behar and Nelson (2014), which is a function of output share \(s_{it}^{L_{k}}\) and \({\check{Z}} _{it}^{kl}=\ln ({\check{Z}}_{it}^{kl})\); \(N_{it}^{k}(\omega )\) is the number of firms in product i, time t, and country k; and \(Y_{it}^{L_{k}}\) is country l’s total output of all importers from country k. Thus, theoretically speaking, it is crucial to take account of multilateral resistance terms to study the unbiased elasticity of transportation costs on trade.

Behar and Nelson (2014) follow Baier and Bergstrand (2009) and create the multilateral resistance terms from a first-order log-linear Taylor-series approximation. In order to reflect the multilateral resistance terms, we use the following two-stage method. First, we estimate

from a logit model and obtain the predicted value of \({\check{Z}}_{it}^{kl}\). Then, using the log of bilateral distance, the predicted value of \({\check{Z}} _{it}^{kl}\), and the GDP shares, we create two components of Behar and Nelson’s equation (17). One approximates the multilateral resistance term related to the log of bilateral distance and the other approximates the term related to the export entry of firms. Then, we estimate

from a logit model by including these two multilateral resistance terms. The results from Table 3 and those with the multilateral resistance terms are almost identical. Our results with the multilateral resistance terms are available upon request.

About this article

Cite this article

Husted, S., Nishioka, S. Productivity growth and new market entry. Rev World Econ 151, 687–712 (2015). https://doi.org/10.1007/s10290-015-0226-9

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10290-015-0226-9