Abstract

In this article we extend the model developed by Bogliacino and Pianta (Industrial and Corporate Change 22 649, 2013, b) on the link between R&D, innovation and economic performance, considering the impact of innovation on export success. We develop a simultaneous three equation model in order to investigate the existence of a ‘virtuous circle’ between industries’ R&D, share of product innovators and export market shares. We investigate empirically – at the industry level – three key relationships affecting the dynamics of innovation and export performance: first, the capacity of firms to translate their R&D efforts in new products; second, the role of innovation as a determinant of export market shares; third, the export success as a driver of new R&D efforts. The model is tested for 38 manufacturing and service sectors of six European countries over three time periods, from 1995 to 2010. The model effectively accounts for the dynamics of R&D efforts, innovation and international performance of European industries. Moreover, important differences across countries emerge when we split our sample into a Northern group – Germany, the Netherlands and the United Kingdom – and a Southern group – France, Italy and Spain. We find that the ‘virtuous circle’ between innovation and competitiveness holds for Northern economies only, while Southern industries fail to translate innovation efforts into export success.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Technological efforts and international competitiveness are at the root of successful economic performance in advanced economies. Moreover, they are widely seen as key factors in the ability of European countries to return to growth after the 2008 crisis. The long-established debate on the relative importance of technological and cost factors in determining international economic performances - opened up among others by Fagerberg (1988) - has recently seen a new set of contributions – including Cimoli et al. (2009), Laursen and Meliciani (2010), Evangelista et al. (2015) and Dosi et al. (2015) – that have empirically identified the key role played by technological factors at the micro, meso and macro level.

In order to investigate properly how technology contributes to export dynamics, we need to take into account the role of country and sectoral heterogeneity, the uneven distribution of technological capabilities, the uncertain, cumulative and irreversible nature of innovation as well as the structural interdependences involving technological advancements and economic performances. All these features can be identified and theoretically conceptualized adopting, in line with Dosi et al. (2015), a partial disequilibrium approach as well as an evolutionary view of trade and innovation.

In this article we develop a model for the structural relationships between R&D efforts, innovation success and export performance, and we carry out an empirical test for 38 manufacturing and service sectors of six major European countries, using a highly detailed database providing information on innovation, demand dynamics and international performances – the recently enhanced Sectoral Innovation Database. The theoretical framework moves from the model developed by Bogliacino and Pianta (2013a, 2013b) and extends it to international competitiveness, captured by industries’ export market shares. We use a model of simultaneous equations exploring feedbacks and structural linkages between our key variables. First, the ability of industries’ R&D to lead to successful innovations is explored, combining supply push and demand pull drivers. Second, the determinants of export shares are identified, considering both the role of technological competitiveness and cost competitiveness factors (Soete 1981 and 1987; Fagerberg 1988; Montobbio 2003 and Dosi et al. 2015). Third, we investigate the feedbacks of export success and profits on further sectoral R&D efforts.

Our approach accounts for the role of innovation related heterogeneity – at the industry level - as well as feedback loops and structural interdependences between innovation inputs and outputs and international economic performance. A number of key elements of this complex nexus are explicitly assessed (Arthur 2013). First, we take into account the uncertainty of technological change, considering R&D efforts as distinct from the actual success in introducing new products. The contrast between technological and cost competitiveness strategies pursued by firms and industries is put at the center of the search for international competitiveness (Pianta 2001) and the broader links between technology and exports are fully addressed (Fagerberg 1988; Laursen and Meliciani 2010; Dosi et al. 1990 and 2015; Evangelista et al. 2015). Second, similarly to what is done in Crespi and Pianta (2008b) and, more recently, in Lorentz et al. (2015), we jointly consider the role of demand and supply side factors. In particular, innovation is seen as the result of both demand pull and technology push factors (Schmookler 1966; Scherer 1982; Kleinknecht and Verspagen 1990; Lucchese 2011; Lorentz et al. 2015). Third, we analyze the relative importance of technology, on the one hand, and of cost factors on the other hand, in determining export performance. Among the latter, we explicitly consider the impact of international fragmentation of production, which is increasingly considered as a key factor – strongly interconnected with innovation – affecting firms and industries’ ability to export and to gain advantage in international markets (Kleinert and Zorell 2012; Timmer et al. 2013).

In a recent set of contributions, there has been an effort to break down the innovation-performance nexus into different constituent phases in order to identify empirically its structural parameters. Usually, three equations are put forth: the decision to invest in R&D, the relationship between innovative inputs and outputs and the effect of R&D on economic performance (Crepon et al. 1998; Parisi et al. 2006). However, little attention has been devoted to the temporal structure and to feedbacks among such variables.

In addition to the large literature - both theoretical and empirical - on the relation between technology and competitiveness (see among others Dosi et al. 1990 and 2015; Amendola et al. 1993; Carlin 2001; Landesmann and Pfaffermeyr 1997), international trade studies have recently moved towards a greater attention to intra-industry and intermediate input flows, and novel research has highlighted the role of technological content in shaping more complex trade patterns (Bas and Strauss-Kahn 2010; Colantone and Crinò 2014; Timmer et al, 2013). In our model we integrate such aspects of international trade – namely the role of offshoring and intermediate inputs flows - in the simultaneous and recursive explanation of innovation dynamics and export success. Our contribution bridges such different strands of literature, allowing us to frame in a clearer way the complexity involved in the investigated set of relationships.

To the best of our knowledge, Bogliacino and Pianta (2013a) is the first contribution to explore the feedback effect of the innovation-performance nexus, including the relevance of profits, leaving aside, however, the role of exports. This article fills in this conceptual gap and investigates empirically the regularities and differences across Europe in such relationships, using a simultaneous three equations model (3SLS). Data cover 21 manufacturing and 17 service sectors (two-digits NACE classification) and are drawn from STAN and WIOD databases for production and demand variables, and from the Community Innovation Surveys (CIS hereafter) for innovation variables. Our model and econometric strategy allows for greater efficiency by controlling for correlation among errors belonging to different equations, while identifying the impact of endogenous regressors through the instrumental variables technique. As a result, it is possible to estimate the role of feedbacks and loops in an efficient and statistically parsimonious way.

This article is organized as follows. The next section is dedicated to a theoretical overview of the issues, considering separately each equation of the system. In the third section, data are illustrated and some descriptive evidence is provided. In the fourth section, the econometric strategy is described. In the fifth section, the results are presented and we provide additional findings on the contrast between patterns in Northern and Southern countries. Section six offers some concluding remarks.

2 Theoretical framework

At the root of our work is the circular loop of self-reinforcing relations between R&D, new products and profits (Bogliacino and Pianta 2013a, b). The extension proposed here has the following dynamics: R&D efforts lead to successful innovations; new products drive the acquisition of export market shares; strong exports (together with profits) enhance R&D efforts. In the following subsections, we first illustrate the theoretical foundations of our approach and the linkages with the existing literature; then we present the advantages of an analysis at the industry level; finally, we describe and conceptualize each equation of our model.

2.1 Innovation and export success: concepts and literature

The state of the literature addressing the three relationships we investigate - the determinants of R&D efforts, innovation and export success – shows different degrees of consensus.

(a) Building on evolutionary approaches, R&D is considered here as a path dependent process because the development of knowledge and technology is closely related to the relevant paradigm and trajectory of technological change, making the process of search eminently localized (Atkinson and Stiglitz 1969; Nelson and Winter 1982; Dosi 1982, 1988). The path-dependent nature of technological change has been pointed out by a recent set contributions focusing on innovation persistence (Malerba et al. 1997; Peters 2009; Antonelli et al. 2012; Triguero-Cano and Corcoles-Gonzales 2013). The latter is a key characteristic of innovation, affecting the relationships between input and output of innovation as well as the interaction of the two with economic performance. Theoretically, such persistence is explained in different ways. First, it is related to the cumulative and inexhaustible nature of innovation (Nelson 1959). Second, as argued by Arrow (1962) and Stiglitz (1987), persistency in innovation activities is associated with dynamic increasing returns that are connected, in turn, to the generation and accumulation of new knowledge. In the R&D equation of our model, we account for such persistence of commitments by including lagged R&D among the explanatory variables. The influence of technological factors on R&D operates on the one hand through the nature of the industrial structure, reflected in average firm size and, on the other hand, on the potential for new markets - two additional factors we consider in our model.

A second variables affecting R&D efforts is related to demand (Piva and Vivarelli 2007). Exports are the most dynamic component of demand in advanced countries and they lead to new demands for knowledge and competences required for international competition (Carlin 2001; Dosi et al. 1990, 2015). Moreover, export success, together with Schumpeterian profits, plays a key role in providing the resources required for R&D. The latter element has been recently highlighted by Harris and Moffat (2011), analyzing the behavior of a large panel of British firms.

A large literature has shown that R&D is financially constrained (Hall 2002; Cincera and Ravet 2010; Bogliacino and Gomez 2014) due the intangible nature of R&D, which is difficult to collateralize and also due to informational problems, namely the “radically uncertain” nature of research and the asymmetric distribution of information (Stiglitz and Weiss 1981). As a result, successful economic performance – expressed by both exports and profits – represents a vital source of resources for financing industries’ R&D.

(b) The relationship between R&D and innovative performance is the least controversial one. A large literature on both firms and industries – using a variety of models and approaches - has found that greater research efforts are generally associated with better innovative outcomes (for instance, Griliches 1979, 1995; Crepon et al. 1998; Mairesse and Mohnen 2010; Loof and Heshmati 2006; Parisi et al. 2006 for firm level studies; Crespi and Pianta 2007, 2008a, 2008b; Bogliacino and Pianta 2013b and Guarascio et al. 2015 for industry level approaches). Patterns of innovation are jointly affected by demand pull (Schmookler 1966; Scherer 1982) and technology push factors. Many authors have devoted efforts to identify the relative contribution of these mechanisms to technological progress. The available evidence is mixed; nevertheless, most of the contributions conclude that for innovation to occur, both push and pull must exist simultaneously (Mowery and Rosenberg 1979; Nemet 2009).

According to the demand-pull perspective, innovation is brought to the market when firms anticipate strong demand; in the latter view, innovation is supported by science-related developments and is triggered by relative prices in a feasible production set. Such elements have been stressed earlier by Adner and Levinthal (2001) who identified demand – also accounting for its heterogeneity among consumers – as one of the main innovation drivers. More recently, Lorentz and colleagues (2015) emphasized the role of demand in shaping innovation and structural change.

Moreover, innovation is persistently characterized by the presence of specific technological and production capabilities (Pavitt 1984; Dosi 1988; Malerba 2002; Metcalfe 2010). We distinguished between the two mechanisms using the following strategy. On the technology side, in our analysis we build on the Schumpeterian distinction pointed out by Pianta (2001) between product and process innovation that helps identify heterogeneity in the determinants of innovative success. More precisely, we rely on the concepts of technological and cost competitiveness summarizing strategies, focusing either on new markets, new products and R&D, or on efforts directed at labor saving innovation, new machinery, efficiency gains and cost reductions.Footnote 1 On the demand side, our analysis is similar to the one proposed by Crespi and Pianta (2008b). The authors analyzed - at the industry level for 22 manufacturing sectors and 17 services sectors in Europe - the impact of demand - distinguished between household consumption and exports - on innovation performance. In our specification, the demand pull effect on the development of new products is accounted for by a detailed consideration of the different components of demand, including internal demand for intermediate and final goods, and exports. In this way a comprehensive explanation of the drivers of innovative success is provided.Footnote 2

(c) Today a broad agreement exists on the importance of innovation for international competitiveness of industries and countries. This has not always been the case. Traditional neoclassical trade theory disregarded differences in technology in explaining trade flows between countries, supposing that every country has access to the same technology set, while concentrating on factor endowments and hence on factor prices instead. For a long time, this led economists to concentrate on price as the only aspect of competitiveness (Dosi et al. 1990; Amable and Verspagen 1995). With the New Trade theory, the mainstream has started to stress the importance of non-price factors in determining international competitiveness. This approach has pointed out the importance of product differentiation and quality on the supply side and of preference for variety on the demand side (Krugman 1990). Innovation is crucial to both, leading to new products, while technology becomes a strategic variable to maintain market shares. R&D and innovation have also become important in growth theory where comparative advantages become endogenous and research policy and trade influence specialization and growth (Grossman and Helpman 1991; Aghion and Howitt 1992, 1998).

Similar arguments had been developed before in the Post Keynesian literature emphasizing non-price factors in country performance (Thirlwall 1979; Kaldor 1981); explanations of international competitiveness and specialization have later explicitly included R&D and technology (Fagerberg 1988; Archibugi and Pianta 1992; Fagerberg et al. 1997). In evolutionary approaches, technological differences among countries and industries have been considered as the basis for trade and for dynamic competition (Dosi et al. 1990; Amendola et al. 1993; Verspagen 1993).

The recent developments of international production and trade, however, have led to a greater international integration and to more complex trade patterns of intermediate inputs, shaped by global value chains (Feenstra and Hanson 1996; Hummels et al. 2001; Backer and Yamano 2012; Timmer et al. 2013). Imported intermediate inputs, on the one hand, may embody advanced technology and therefore increase the quality and variety of products and their technological competitiveness. On the other hand, they provide low cost inputs when production is outsourced to low wage countries, increasing in this way industries’ cost competitiveness (Daveri and Jona-Lasinio 2007; Bas and Strauss-Kahn 2010; Colantone and Crinò 2014). This complexity in the ways innovation affects international competitiveness has to be taken into account in modelling such relationships.

2.2 The industry level approach

Studies on the topics addressed above have been carried out both at the firm and at the industry level. It is important to emphasize the differences between these two approaches and the specific value of industry level analysis.

Firm level studies have attracted increasing attention as a consequence of the emphasis on micro units of analysis that has emerged both in mainstream microeconometrics addressing causality issues, and in evolutionary approaches focusing on the heterogeneity of economic actors. While we share both concerns, we argue that firm level approaches cannot account for a number of explanatory factors in the analysis of innovation and performance that only emerge when the industry level is considered (Bogliacino and Pianta 2013a).

(a) In most cases, the small number of firms often included in panel based firm level studies is not representative of the universe. Moreover, these studies are usually focused on manufacturing alone, without taking into account service activities. Furthermore, when a panel is followed over a certain time span, it excludes firms exiting and entering the market – events where innovation, or the lack of it, is likely to play a major role. Therefore, the results of firm level studies are relevant only for the firms included in the analysis, and can rarely be generalized to other firms, or assumed to be relevant for the whole economy. On the contrary, an industry level approach identifies the changes in the structure of the economy and the links to macroeconomic patterns because sectoral data account for the totality of activities in a given sector, allowing leveling off gains and losses that may occur at the firm level (Pianta and Tancioni 2008; Bogliacino and Pianta 2013a).

(b) The specificity of technological trajectories and sectoral systems of innovation is at the heart of Neo-Schumpeterian and evolutionary approaches, which have widely documented the importance of industry level analysis. In this light, firms belonging to an industry are likely to share – to a large extent - the same technological opportunities, nature of knowledge, appropriability conditions and market structure (Dosi 1982, 1988; Pavitt 1984; Breschi et al. 2000; Malerba 2004). Technological heterogeneity of sectors is therefore effectively identifiable by an industry level approach, while in firm level studies such heterogeneity is generally expressed in a limited way by inadequate indicators of industries’ technological characteristics, or is generally left uncharted and wrapped with all sorts of other factors in industry dummies.

(c) The consideration of the role of demand determines the emergence of another fundamental asymmetry between industry and firm-level approaches. At the micro level, a perfectly elastic demand can be assumed, since an individual firm can always grow and increase its market share at the expense of competitors. By contrast, an industry’s demand has a downward slope and results from the part of aggregate demand directed to the products and services of that industry. Therefore, a fundamental difference emerges: at the firm level the relationship between innovation and improved economic performance can easily be found while, without a simultaneous expansion of demand, this relationship is much less identifiable at the industry level (Bogliacino and Pianta 2013a).

These fundamental differences between firm and industry level studies imply that the results obtained at one level cannot be automatically generalized at a more aggregate level; rather, a complementarity of analyses at the two level exists (OECD 2009). There are structural features – such as demand, technological trajectories and the macro and institutional context - that disappear when we focus on the micro level. Conversely, there are specific elements at the micro level which are lost in aggregation, such as the “turbulence underneath the big calm” (Dosi et al. 2012), rooted in the variety of firms’ learning patterns and in the operation of selection processes in markets.

2.3 The model: R&D equation

The three equations we propose break down the innovation process into three steps: from drivers to innovation input, from the latter to innovation output, and finally to economic performance. We propose a non-linear model where performance feeds back into innovative effort, promoting both persistence and divergence. Each equation is grounded on basic evolutionary theorizing: innovative effort is path dependent and pulled by demand; innovative output is driven by technological and cost competitiveness, and finally, export performance is driven by innovative success, by demand and by labor cost competitiveness.

The first equation of the model explains the determinants of R&D efforts:

where, i stands for sector at two digits level, j for country and t for time. The R&D variable is expenditure for research and development per employee (in thousands of euros); due to its path dependent nature, lagged efforts play a key role is shaping current R&D. DEMPULL stands for the potential for the introduction of new products, captured by the objective of opening up new markets reported by firms in innovation surveys (CIS). Following Schumpeterian insights, we expect that greater SIZE – average number of employees in firms – would go along with higher R&D efforts. EXPSH is the lagged export market share of industries, computed (following Carlin 2001) as the ratio between sector ij’s real exports and the sum of real exports for that industry and period for all the countries included in the sample; we expect higher export shares to be associated with greater technological efforts. PROF is the lagged growth rate of gross operating surplus - average annual compound rate of change in profits in the previous period – and is considered as a key source for internal R&D financing. The last term is the standard error term.

In discussing the determinants of R&D, a short digression is needed on the so called ‘Schumpeterian hypothesis’. According to this strand of literature it is possible to identify an effect of firm size on R&D (Cohen and Levine 1989; Cohen 2010). Since the introduction of the Schumpeter Mark II model, the concentration of R&D expenditures in larger firms has been identified as a stylized fact. However, this line of research has been criticized for being unclear as to whether it is innovation input or output that is affected by size and for the risk of endogeneity, given that both market structure and innovation are codetermined by the fundamental features of the sector (appropriability, cumulativeness and the knowledge base, as explained by Breschi et al. 2000). Relying on the contributions that have stressed the importance of past economic performance as a main driver of R&D investments (Schumpeter 1975; Brown et al. 2009), we emphasize the role of the incumbent position in export markets as a key element in determining R&D efforts in European countries. Industry level data make it possible to overcome the controversial evidence emerging from firm level studies (Greeve 2003) about the association of past economic performances and R&D efforts. From this point of view, considering lagged export market share as a performance variable allows us to take into account both the commitment of firms to exploit and reinvest the results of their past performances, and the perspectives of higher external demand as drivers of R&D. This allows including size as a control variable without incurring into the risk of endogeneity via omitted variable.

2.4 The model: product innovation equation

The specification of the product innovation equation, the second of the system, is the following:

where NEWPROD stands for the share of firms that are product innovators in the sector – an accurate indicator of the relative success in introducing new products in markets. Its first determinant is lagged R&D input (estimated in the first equation); the ability of new R&D expenditure to lead to successful innovations takes time and, for this reason, the R&D variable is inserted with a one period lag. In terms of innovation dynamics, we consider the complementary effect – or, possibly, the contrasting role - of innovation in processes, proxied by MACH – innovation related expenditure for machinery and equipment, in thousands of euros per employee. The success in the introduction of new products is also affected by demand factors; EXPGR is the compound annual growth of exports and DEMGR reflects the dynamics of internal demand, split into the growth rates of final demand and of demand for intermediate goods produced by the industry; ε the usual error term.Footnote 3

The use of both expenditure for R&D and new machinery in this equation captures the potential complementarity stressed by Parisi et al. (2006) and Antonelli et al. (2012). The demand pull perspective and the literature on structural change (Pasinetti 1981) emphasize the positive effect that a strong demand dynamics has on the development and diffusion of new products. This is a complementary approach to the Schumpeterian analysis on the way major innovations change the economy (Saviotti and Pyka 2013). However, not all demand components may play the same role; when an economy – or an industry - operates in the Walrasian (or equilibrium) “circular flow”, without major innovations, current demand for standard products may reduce the incentive to develop new products and delay their introduction. Therefore, we need to identify the more ‘dynamic’ components of demand - such as exports - that match current technological change and support the introduction of new products in a virtuous circle among capabilities, innovations and markets (as in the “learning by exporting” hypothesis assessed by Crespi et al. 2008). Conversely, demand that is related to the activity of industries where a “circular flow” prevails – such as demand for consumption and for intermediate goods – may lead to fewer incentives for the introduction of new products. In our estimations such an effect is captured by the growth of exports, while the aim of opening up new markets is already controlled for by the first equation, where demand pull is included among the regressors.

2.5 The model: export market share equation

The specification of the market share equation, the third of the system, is the following:

where success in international competitiveness is proxied by EXPSH - the export market share of sector i in country j with respect to the total of the exports of the same sector for the whole sample. For the method of calculation, we rely on the one used in Carlin (2001):

We considered the export market shares computed in (4) as a reliable measure of relative competitiveness of our sample countries and industries since their position is highly stable; an extensive analysis of the reliability of this variable as a proxy for export performances is provided in the Appendix.

Competitive success is expected to result from both technological and cost competitiveness. The former is reflected in NEWPROD - the share of product innovators among the firms of sector i (in our system the variable estimated in the product innovation equation). Efforts in process innovation may strengthen competitiveness in various ways and is proxied by MACH - expenditure in thousands of euros per employee for innovation related machinery and equipment. The major source of cost competitiveness is related to labor costs, and is proxied by the compound average annual rate of change of unit labor cost (ULC), defined as follows (Carlin 2001):

where the numerator is the wage per employee in real terms and the denominator is the ratio between the industry’s value added and the number of total engaged – a measure of productivity. Finally, the complexity of current patterns of trade flows requires the consideration of the role different intermediate inputs (INTERM) may play in contributing to an industry’s competitive success. In our equation we distinguish them on the basis of both their origin (domestic or imported) and their technological content (based on the revised Pavitt categoriesFootnote 4: high when inputs are provided by Science Based and Specialized Supplier sectors, and low when they are provided by Scale Intensive and Supplier Dominated sectors, see the Appendix). The four variables accounting for the role of intermediate inputs therefore include the following: domestically sourced inputs of high technological content; domestically sourced inputs of low technological content; imported inputs of high technological content; imported inputs of low technological content. Indicators are computed as the sum of the expenditure devoted by each industry to the acquisition of different types of inputs, divided by the total production of each user sector (Yamano et al. 2006). We expect that competitive success is driven by a greater use of inputs with higher technological content and of international origin.

Equation (3) is the crucial one in our model since it highlights the differences in terms of relevance of technological and cost competitiveness. Moreover, the estimated coefficients of this equation within our simultaneous system may allow the identification of different types of relationships between innovation and international performance that will be examined later by splitting the sample between a group of ‘Northern’ and ‘Southern’ countries.

The full system is:

3 Data and descriptive evidence

3.1 The database

The database used in this paper is the Sectoral Innovation Database (SID) developed at the University of UrbinoFootnote 5 that combines different sources of data at the two-digit NACE classification for 21 manufacturing and 17 service sectors; all data refer to the total activities of industries (Pianta and Lucchese 2011). For innovation variables data are from three European Community Innovation Surveys - CIS 3 (1998-2000), CIS 4 (2002-2004) and CIS 6 (2006-2008). Economic variables are obtained from the OECD-STAN database; demand, trade and intermediate inputs variables are drawn from the World Input Output Database (WIOD) (Timmer 2013). The country coverage of the database includes six major European countries – Germany, France, Italy, Netherlands, Spain, and United Kingdom - representing a large part of the European economy. The selection of countries and sectors has been made in order to avoid limitations in access to data, due to the low number of firms in a given sector of a given country, or to the policies on data released by national statistical institutes.

The time structure of the panel is the following. Economic and demand variables are calculated for the periods 1995-2000, 2000-2005 and 2005-2010. The export market shares variable is computed for each industry for the final year of each period – the years 2000, 2005 and 2010. Innovation variables refer to 1998-2000 (linked to the first period of economic variables); 2002-2004 (linked to the second period of economic variables) and 2006-2008 (linked to the third period of economic variables). The variables used and the main descriptive statistics are reported in Tables 1 and 2.

All economic variables are deflated using the sectoral Value Added deflator from OECD-STAN (base year 2000), corrected for PPP (using the index provided in Stapel et al. 2004). For the performance variable we compute the compound annual growth rate that approximates the difference in log. For innovation, we use the shares of firms in the sector or expenditure per employee; this can be justified considering innovative efforts as dynamic and capturing the change in the technological opportunities available to the industry.

The dataset is a panel dataset over three periods covering a time span from 1995 to 2010 across six major European countries. This kind of industry level-dataset accounts for the complexity of innovation at the sectoral level, as well as for consideration of both supply and demand determinants of economic and innovative performance.

A summary of the strengths of this dataset is provided below:

-

The industry level detail of the dataset allows us to identify the specificity of industries in terms of their innovation patterns and growth trajectories, considering both manufacturing and service sectors;

-

The detailed nature of CIS data offers the possibility to take into account different innovation strategies (cost and technological competitiveness) as well as different aims of innovation;

-

Input–output data allow to distinguish the intermediate inputs used by a sector on the basis of their technological intensity (identified by the two digit NACE sector of origin of the inputs) and of their domestic or imported origin;

-

The availability of consistent export data allows for the construction of reliable competitiveness indicators by industry.

The following table reports the main descriptive statistics:

In order to use these data in panel form, we need to test that the sample design or other statistical problems in the gathering of data are not affecting their reliability. Besides considering the time-effects capturing macroeconomic dynamics, we examined the stability of the database.

3.2 Some descriptive evidence

As we anticipated, one of the main objectives of this work is to analyze the connections and the feedbacks between innovation, labor cost and economic performances in terms of export market shares, with specific attention to the North–south divide in Europe. Table 3 contains data at the country level for the key economic and innovation variables used for the subsequent econometric analysis, providing information on national competitiveness. The figures also provide a first snapshot of the North–south divide within the EU, highlighting the dynamics of technological and cost competitiveness across EU countries. Looking at R&D expenditure, Spain and Italy lag behind the rest of the countries in the sample. Regarding product innovation, the differences between Germany and the South are striking, and are paralleled by the distance in export market shares. Unit labour cost figures show an increasing trend in Italy, the Netherlands and the UK, with the opposite trend in the other countries.

The Italian case deserves a particular attention. Italy has maintained a significant market share despite weak performance in new products and processes and a rise in unit labor costs higher than in most countries. The complexity of the patterns involved – including the role of intermediate inputs, non price competitiveness and product quality – are relevant in the explanation of such outcome; a similar investigation has been carried out by Tiffin (2014) in a recent IMF paper exploring the “Italian productivity puzzle”. In the Appendix, a more detailed descriptive analysis of the variables is provided.

4 Econometric modelling strategy

The estimation strategy adopted is the following. First, in order to verify the validity of the hypothesized relationships, we implement a WLS estimation equation-by-equation, carrying out all the needed diagnostic tests. Second, in order to identify the feedbacks and self-reinforcing loops among our variables, we use a model suitable for the estimation of systems of equations. We have chosen the Three Stage Least Squares model (3SLS) since it allows estimating a simultaneous system of equations, addressing at the same time all the endogeneity issues. Third, we replicate the 3SLS estimation adopting the interaction terms technique in order to assess the extent of a divergent dynamics between Northern and Southern countries.

The 3SLS method generalizes the two-stage least squares (2SLS) method to take account of the correlations between equations in the same way that Seemingly Unrelated Regression (SUR) generalizes OLS. 3SLS requires three steps: first-stage regressions to get predicted values for the endogenous regressors; a two-stage least-squares step to get residuals to estimate the cross-equation correlation matrix; and the final 3SLS estimation step. The 3SLS method goes one step beyond the 2SLS by using the 2SLS estimated moment matrix of the structural disturbances to estimate all coefficients of the entire system simultaneously. The method has full information characteristics to the extent that, if the moment matrix of the structural disturbances is not diagonal (that is, if the structural disturbances have nonzero “contemporaneous” covariances), the estimation of the coefficients of any identifiable equation gains in efficiency as soon as there are other equations that are over-identified. Further, the method can take account of restrictions on parameters in different structural equationsFootnote 6 (Zellner and Theil 1962).

Two further methodological points must be addressed: the choice of weights and the choice of instruments. As is well known, industry level data are grouped data of unequal size, and so we cannot expect all industries to provide the same contribution in terms of information. As a result, the consistency of the estimation is affected. Following Bogliacino and Pianta (2013a, 2013b), we achieve consistency using the weighted least squares estimator (WLS) that allows taking the relevance of industries into account (Wooldridge 2002, Ch. 17). The use of a correct weight becomes crucial and the choice is usually limited to value added and number of employees. Statistical offices tend to use the latter since the former is more unstable and subject to price variations, and we follow them in the use of employees as weights.

In order to control for endogeneity, our baseline strategy is to use the lag structure; since our time lags are of three to five years, the autoregressive character of variables is considerably softened but not eliminated, which makes them suitable instruments (Kleinbaum et al. 1988). Moreover, 3SLS is a proper estimation technique to account for endogeneity when dealing with systems of equations. Anyway, there is always a trade-off between consistency and efficiency in choosing an estimator. Due to modest sample size (inevitable with industry level data), we solve the trade-off relying on consistency instead of efficiency. In fact, with 3SLS we only have to care about orthogonality inside each equation, without taking care of what is happening elsewhere in the system (ibid., 199). As a result, we can focus on the choice of instruments equation by equation in order to guarantee identification. We identified four endogenous variables: SIZE in the first equation, EXPGR in the second, MACH and INTERDEM in the third. The set of instruments we used include the rate of change of lagged value added, lags of the endogenous variables, country, Pavitt and time dummies. Additional endogeneity tests – carried out equation by equation - and the instruments validity tests are discussed in detail in the Appendix. Moreover, we controlled for the presence of multicollinearity and heteroscedasticity. All tests confirm the robustness of the approach we have followed.

5 Results

The results of our estimates are presented separately for each equation in the three tables below. We implement the model on all manufacturing and service industries (38 sectors, Nace Rev. 1), with two different specifications: a baseline estimation and a model with country and technology dummies; in the latter we control for country specificities and technological intensity – as well as for differences in technological trajectories among sectors - using dummies for the revised Pavitt taxonomy (Bogliacino and Pianta 2010). In principle, the use of rate of change is assumed to clear fixed effects at country and industry level, but dummies may capture differences in terms of trend across them.

5.1 The weighted least squares estimations

We first provide some comments over diagnostic tests. Multicollinearity is not an issue; we have conducted the VIF test over each of the three equations, obtaining respectively the following factors: 1.32 for the first equation, 1.26 for the second and 2.55 for the third. Since the critical value for the VIF statistic in order to detect multicollinearity among regressors is near to ten (Kleinbaum et al.,1988, p. 210), we can exclude the presence of multicollinearity in our regressions. Moreover, the results of the Breusch-Pagan test for heteroskedasticity reject for each equation the null hypothesis of constant variance. As a result, we carried out all the estimations with robust standard errors. The results of the R&D equation contained in Table 4 suggest that the theoretical framework developed in Section 2 is supported by the empirical results. Both the baseline and the model with country dummies show that R&D efforts are explained by the cumulative nature of R&D, identified by the coefficient of lagged R&D expenditure. The demand pull factor, proxied by the importance of firms innovating with the aim of entering new markets, is not significant; a possible explanation could be found in the major role played by lagged profit and export market share. The latter in particular can easily capture the motivation to invest in R&D related to the opening of new markets making the New Markets Objective variable less relevant.

Supporting the Schumpeterian assumption of R&D efforts driven by large firms able to earn monopolistic profits, the Size variable is significant and positively related to the dependent variable in both the baseline and the country dummy equation. Moreover, lagged profits have an important role in determining new R&D investment. Finally, the lagged export market share is significant and positive in both estimations.

Regarding the dummy variables inserted in the second equation, country dummies do not seems to play a clear role in the case of R&D efforts, while Pavitt dummies are both positive and significant for Science Based and Specialized Supplier sectors. The interpretation of the coefficients associated with Pavitt dummies is straightforward since we can expect that sectors characterized by an intensive use of technological inputs are also those where R&D efforts are relatively higher. Including country dummies in our baseline model does not harm the significance of the estimated coefficients, so we can proceed to analyze the New product equation.Footnote 7

The results in Table 5 show that innovative performances are mainly driven by research efforts. The coefficient associated with past R&D efforts is positive and significant in both the baseline and the country/Pavitt dummy equation. On the contrary, the coefficient associated to process innovation -Expenditure for new machinery and equipment, a proxy for cost competitiveness strategies - is negative and is significant in the country dummy specification only. This result may suggest that at the industry level product and process innovation are more substitute than complement; industries tend to be characterized either by a prevalence of the search for new products, or by efforts to introduce new processes. This further supports our distinction between technological and cost competitiveness.

Among demand variables the impact on innovation of the rate of growth of exports is always positive, although it is not statistically significant. The internal demand for final consumption and intermediate goods has negative and significant coefficients that could be explained by the lack of dynamism and innovative content of domestic demand with respect to exports. Such a result is in line with the previous findings of Bogliacino and Pianta (2013b) where, in an analogous specification, they found that only exports, out of the complete set of demand components, were able to explain innovative performances.

Dummy variables point out some divergent trends in this case. In the country dummy specification Germany and the Netherlands have a positive and strongly significant role in explaining innovative performances in our sample; these results begin to delineate the divergent dynamic between Northern and Southern countries. Looking at technology dummies, Science Based and Specialized Supplier sectors have - as expected - a positive and significant impact on innovative performances.

The results of Table 6 show that industries’ export market shares are supported by both technological and cost competitiveness, confirming the view developed in the theoretical framework of Section 2. In the baseline equation, lagged new products, new processes and lower labor costs are all significant factors in strengthening exports shares. However, including country dummies in the second specification of the model leads to a loss in significance of product innovation and labor costs, as country specificities do play a key role in shaping national competitiveness.

The intermediate input mix is also relevant to explain performances of sectors. Industries’ export performance is supported by the imports of inputs from high-technology sectors that improve the quality and variety of goods produced, improving technological competitiveness. Conversely, domestic low-tech inputs have a negative impact on export shares as industries more dependent from such factors are left out of innovation dynamics; this result is in line with the findings of authors who have already analyzed the relation between imported inputs and export performance (Bas and Strauss-Kahn 2010; Colantone and Crinò 2014).

The included dummies are all significant and, also in this case, the coefficient associated with Germany has the highest positive impact on the dependent variable In the next subparagraph, the results of the full system estimation and the test for the presence of the North–south divide are reported.

5.2 The system of equation for R&D, new products and export market shares

This section provides the results of the structural 3SLS estimations. Table 7 contains the results for the whole sample estimation, while in Table 8, the results from the model with separate estimations for Northern and Southern countries are shown.

The estimated coefficients and goodness of fits are consistent with the previous regressions and – in the first two equations - with the version of the model developed in Bogliacino and Pianta (2013a, 2013b). In the R&D equation (column 1), past R&D past profits and export market shares – with strongly significant coefficients - support R&D efforts that are also ‘pulled’ by the presence of a potential market for new products and ‘pushed’ by the importance of firm size, confirming the “Schumpeter Mark II” perspective. R&D expenditures are driven by the presence of high techological opportunities, extensive profit-based financial resources and high export market power.

In the product innovation equation (column 2), the importance of new products is the result of past R&D - with a positive and significant impact – confirming the close relationship between technological inputs and outputs. The introduction of new processes appears here to play a complementary role to new products, with a positive and significant coefficient. Demand variables have - as expected - different effects on new products: export growth is associated with a higher presence of product innovators, in line with the “learning by exporting” hypothesis (Crespi et al. 2008); a large growth of final consumption and intermediate demand, conversely, is associated with lower product innovation (a result already detected in the simple OLS estimation); an increase in such components of demand may lower the need to introduce new products, a relationship that is typical of “traditional” industries and services with little R&D, more standard goods and less international openness.

Finally, export market shares (column 3) are positively explained by product and process innovation (again showing complementarity) and, negatively, by unit labor costs; competitive success is therefore driven by both technological and cost competitiveness. Firm size has a negative impact on export market shares, suggesting a greater dynamism of small firms, especially in sectors more open to trade and with higher technological intensity. The relevance of size in influencing high R&D efforts (found in equation 1) is then lost when such technological efforts have to be turned into success in international markets. Considering the intermediate input mix, we find that - as already detected in the WLS single equation estimation - a growth in imported high tech intermediate inputs has a positive and significant impact on export performance, as it may improve the technological competitiveness of an industry’s output. Conversely, a negative and significant link is found with domestic low tech intermediate inputs; they may help reduce production cost, but are of no use in gaining foreign markets. The other two types of intermediate inputs do not have significant effects.

The variables in bold in Table 7 are the key drivers of our system of feedbacks and circular loops. Consistent with the 3SLS estimation technique, the dependent variables estimated and instrumented in the first steps are then used as regressors in the next steps. Such a technique allows us to increase estimation consistency and highlights the role of R&D, new products and export market shares as engines of the recursive relationships we investigate.

An additional test has been carried out in order to check the robustness of our estimations controlling for path dependent technology factors; in a separate estimation, we also included time dummies in the R&D equation, but the results are unchanged, and the dummies are not significant. Indeed, the use of long differences, industry level data, average rate of change, and autoregressive specification is a satisfactory strategy to account for a time varying production possibilities frontier. Once detected this system of feedbacks between R&D, innovation and export performance we can go a step further and investigate the existence and magnitude of two divergent loops affecting the Northern and Southern European countries (with the obvious constraint represented by the limited number of European countries that we consider in this analysis, due to the lack of data).

In order to achieve our objective, we use the interaction terms technique. We are able to estimate the different coefficients for the groupings of Northern and Southern European countries. The interaction model allows different intercepts and slopes for all the variables considered in the model.

The North–south divide clearly emerges from the results of our 3SLS system estimation in Table 8. In the R&D equation (column 1), the technology push effect is important and significant in both areas, but in the North its value is more than twice the one in the South. Given the size of the standard error, it is clear that this difference is significant at the 5 % significance level. The demand pull effect identified by the New Market Objective variable remains significant for both clusters. The common relevance of industry characteristics means that size has an equal significance in both areas, with a higher coefficient in the South where R&D is more likely to be concentrated in a few large firms. The internal financing of R&D through past profits is significant in the South alone, as external sources of R&D funds may be more accessible in Northern countries. Export market shares affect R&D efforts with positive and significant coefficients; their value, however, is greater in the North where the feedback loop between international market power and technological efforts appears to be stronger. Nevertheless, we cannot distinguish them at a statistically significant level.

In the new product equation (column 2), the path dependency of R&D appears to be strong both in Northern countries and in the South – both coefficients are positive and significant, the Northern is larger but not statistically different from the latter. The impact on new processes loses its significance in both areas – but in Southern countries, it shows a negative coefficient, stressing the substitution between new products and processes. Coming to demand variables, the ‘pull effect’ of export growth on new products is positive and significant for Northern countries only; a key link in the innovation-performance relationship appear to be missing in Southern countries. No other element of demand is significant in either area, with the exception of the domestic demand for intermediate production in the North, showing a negative sign and confirming the hypothesis discussed above on the lower innovative dynamism of such demand component.

The export market share equation (column 3) is the one where the patterns for Northern and Southern countries are most contrasting. The key determinants of competitiveness are found to operate in the former and appear to be missing in the latter. This applies to the impact of the share of product innovators on export market share; to the significance of the contribution of new machinery to competitiveness; and even to the support that lower unit labor costs provide for cost competitiveness. The coefficients of the variables capturing the average growth in the usage of imported high tech intermediate inputs again is significant for the North only, and maintains the same order of magnitude and sign as in the previous models. While the North confirms the characteristics of the ‘virtuous circle’ between innovation inputs and outputs and competitiveness, in the South such links appear to be largely missing. Competitiveness and export success for the industries of Southern countries are not supported by innovative performances and the other expected determinants, but rather by non-technological sources that are not captured by the present model.

6 Conclusions

The results of our model – focusing on the industry level - account for important dimensions of the interconnected engines of economic change in a Schumpeterian perspective. The results derived from the system of three equations support empirically some of the main tenets of the evolutionary literature. The following figure depicts the circular and cumulative relationships we have identified.

First, R&D intensity in industries is the result of technological opportunities – summed up by the cumulative nature of research and knowledge, the demand pull effect of the potential for new products, and firm size –, of their market power, reflected in export shares, and of the resources available for financing R&D from lagged profits. Second, the determinants of product innovation show that, on the supply side, the cumulative nature of R&D is important, while new processes may reveal a complementary or a substitutive role; demand factors either stimulate the introduction of new products, in the case of strong export growth, or may delay it when consumption and intermediate demand characterize markets. Third, in the export market share equation we find that both technological and cost competitiveness matter. The direct effect of product innovation reflects a strategy of technological competitiveness in line with the literature that previously investigated the connection between technology and exports. The introduction of new machinery may improve technological capabilities and reduce costs at the same time. Lower unit labor costs contribute to higher cost competitiveness. Imported intermediate inputs originating from high technology industries also contribute to higher export market shares.

Four improvements on the existing literature emerge from our model and findings. First we strengthen the evidence on the innovation-performance links provided by Bogliacino and Pianta (2013a, 2013b), through an enlargement of the time span (the previous analysis was limited to 2005) and using data from different sources. In this way we are able to show that the recursive set of relationships depicted in Fig. 1 persists over a longer time span.

Second, the role of exports is fully addressed, pointing out the fundamental role of competitive success in ‘closing’ the ‘virtuous circle’ between innovation and performance. Its determinants in technological factors – such as new products and processes – are, for the first time to our knowledge, combined with the importance of the intermediate input mix. Export success is shown to depend on high technology imported inputs, which are playing an increasing role in the current process of fragmentation of international production.

Third, we enrich the evolutionary literature that has traditionally focused on supply and technology factors, with a full consideration of demand, broken down into its major components. Our results lend support to the ‘learning by exporting’ thesis showing that exports represent the most dynamic component of demand capable to ‘pull’ the emergence of new products. Conversely, domestic demand, particularly for intermediate products, is much less dynamic and unable to stimulate innovation. These results echo the Schumpeterian distinction between novel productions based on major innovations, on the one hand, and standard activities in the ‘circular flow’ of the economy (Schumpeter, 1942).

Fourth, we show - on empirical grounds – that this set of relationships does not necessarily hold for all countries (and, possibly, for all times, as shown for the innovation-employment nexus by Lucchese and Pianta 2012). Northern European countries do provide evidence of a ‘virtuous circle’ between innovation and international competitiveness that, however, is largely missing in Southern ones. This result shows the relevance of national differences and may help explain the observed divergent dynamics in international competitiveness between different areas of the European Union. It also has important policy implications on the need for addressing the gaps in technological efforts and capabilities in Southern economies, and on the policy proposals that may support better and more converging performances in Europe.

Notes

In our equations, technological and cost competitiveness are proxied by specific CIS variables accounting for R&D efforts, on the one hand, and new machinery, on the other.

In other contributions, Bogliacino and Pianta (2013a; 2013b) and Guarascio et al. (2015) found a differentiation in the impact that demand components have on product innovation. Exports resulted as the most dynamic component having always a positive and strongly significant impact on product innovation (similar arguments are put forth by Crespi et al. 2008). Conversely, the growth of domestic demand – without distinction between consumption and demand for capital goods - has been found to have a non-significant and, in some cases, negative impact. The role of demand in fostering innovation diffusion has been discussed theoretically by Pasinetti (1981).

In firm level literature, a recent contribution by Antonelli et al. (2012) highlights the persistence of product innovation through Transition Probability Matrices on annual data. Our data structure controls for that because it is based on long differences of four year windows (CIS waves).

An extensive description of the revised Pavitt taxonomy is provided by Bogliacino and Pianta (2010).

Pianta et al. 2011 provide a comprehensive description of the database. CIS innovation data are representative of the total population of firms and are calculated by national statistical institutes and Eurostat through an appropriate weighting procedure. A detailed description of the procedure is provided in Bogliacino and Pianta (2013a).

The simultaneous estimation performed in 3SLS further weakens the potential estimation biases associated with lagged dependent variables with respect to the 2SLS.

References

Adner R, Levinthal D (2001) Demand heterogeneity and technological evolution: implications for product and process Innovation. Manag Sci 47(5):611–628

Aghion P, Howitt P (1992) A model of growth through creative destruction. Econometrica 60(2):323–351

Aghion P, Howitt P (1998) Endogenous growth theory. The MIT Press, Cambridge

Amable B, Verspagen B (1995) The role of technology in market shares dynamics. Appl Econ 27:197–204

Amendola G, Dosi G, Papagni E (1993) The dynamics of international competitiveness. Weltwirtschaftliches Arch 129(3):451–471

Antonelli C, Crespi F, Scellato G (2012) Inside innovation persistence: New evidence from Italian micro-data. Struct Chang Econ Dyn 23(4):341–353

Archibugi D, Pianta M (1992) The technological specialization of advanced countries. a report to the ec on international science and technology activities. Kluwer, Dordrecht and Boston

Arrow KJ (1962) The economic implications of learning by doing. Rev Econ Stud 29:155–173

Arthur B. (2013) Complexity economics: a different framework for economic thought. Santa Fe Institute Working Papers Series 2013-4-012

Atkinson A, Stiglitz J (1969) A new view of technological change. Econ J 79(315):573–578

Backer K, Yamano D. (2012) International comparative evidence on global value chains, STI Working Paper 3, OECD

Bas M, Strauss-Kahn V (2010) Does importing more inputs raise exports? firm level evidence from France, MPRA Paper 27315. University Library of Munich, Germany

Bogliacino F, Gomez S (2014) Capabilities and investment in R&D: an analysis on European data. Struct Change Econ Dynam, Elsevier 31(C):101–111

Bogliacino F, Pianta M (2010) Innovation and employment. a reinvestigation using revised pavitt classes. Res Policy 39(6):799–809

Bogliacino F, Pianta M (2013a) Profits, R&D and innovation: a model and a test. Ind Corp Chang 22(3):649–678

Bogliacino F, Pianta M (2013b) Innovation and demand in industry dynamics. R&D, new products and profits. In: Pyka A, Andersen ES (eds) Long term economic development. Springer, Berlin

Breschi S, Malerba F, Orsenigo L (2000) Technological regimes and Schumpeterian patterns of innovation. Econ J 110:388–410

Brown JR, Fazzari SM, Petersen BC (2009) Financing innovation and growth: cash flow, external equity, and the 1990s R&D boom. J Financ 64:151–185

Carlin (2001) Export market performance of OECD countries: an empirical examination of the role of cost competitiveness. Econ J 111:128–162

Cimoli M, Dosi G, Stiglitz JE (eds) (2009) Industrial policy and development: the industrial policy of capability accumulation. Oxford University Press, New York

Cincera M, Ravet J (2010) Financing constraints and R&D investments of large corporations in Europe and the USA. Sci Public Policy 37(6):455–466

Cohen W (2010) Chapter 4: Fifty years of empirical studies of innovative activity and performance. In: Rosenberg N, Hall B (eds) Handbook of the economics of innovation. Elsevier, Amsterdam

Cohen WM, Levine RC (1989) Empirical studies of innovation and market structure. In: Schmalensee R, Willig RD (eds) Handbook of industrial organization, 2. Amsterdam, North-Holland, pp 1059–1107

Colantone I, Crinò R (2014) New imported inputs, new domestic products. J Int Econ 92(1):147–165

Crepon B, Duguet E, Mairesse J (1998) Research and development, innovation and productivity: an econometric analysis at the firm level’. Econ Innova New Technol 7(2):115–158

Crespi F, Pianta M (2007) Innovation and demand in European industries’. Econ Politica-J Instit Anal Econ 24(1):79–112

Crespi F, Pianta M (2008a) Demand and innovation in productivity growth’. Int Rev Appl Econ 22(6):655–672

Crespi F, Pianta M (2008b) Diversity in innovation and productivity in Europe’. J Evol Econ 18:529–545

Crespi G, Criscuolo C, Haskell J (2008) Productivity, exporting, and the learning-by-doing hypothesis: direct evidence from UK firms. Can J Econ 41(2):619–638

Daveri F, Jona-Lasinio C. (2007) Off-shoring and productivity growth in the Italian manufacturing industries, Economics Department Working Papers 2007-EP08, Parma University

Dosi G (1982) Technological paradigms and technological trajectories: a suggested interpretations of the determinants and directions of technical change. Res Policy 11:147–162

Dosi G (1988) ‘Sources, procedures and microeconomic effects of innovation’. J Econ Lit 26:1120–1171

Dosi G, Pavitt K, Soete L (1990) The economics of technical change and International Trade. Harvester Wheatsheaf, Brighton

Dosi G, Grazzi M, Tomasi C, Zeli A (2012) Turbulence underneath the big calm? the micro-evidence behind Italian productivity dynamics. Small Bus Econ 39(4):1043–1067

Dosi G, Grazzi M, Moschella D (2015) Technology and costs in international competitiveness. from countries and sectors to firms. Res Policy. doi:10.1016/j.respol.2015.05.012

Evangelista R, Lucchese M, Meliciani V (2013) Business services, innovation and sectoral growth. Struct Chang Econ Dyn 25:119–132

Evangelista R, Lucchese M, Meliciani V (2015) Business services and the export performances of manufacturing industries. J Evol Econ. doi:10.1007/s00191-015-0409-5

Fagerberg J (1988) International competitiveness. Econ J 98:355–374

Fagerberg J, Hansson P, Lundberg L, Melchior A (1997) Technology and international trade. Edward Elgar, Cheltenham

Feenstra R, Hanson GH (1996) Foreign investment, outsourcing and relative wages. In: Feenstra RC, Grossman GM, Irwin DA (eds) The political economy of trade policy: papers in honor of Jagdish Bhagwati. The MIT Press, Cambridge, pp 89–127

Greeve H. R. (2003) Organizational learning from performance feedback. Cambridge University Press

Griliches Z (1979) Issues in assessing the contribution of research and development to productivity growth. Bell J Econ 10:92–116

Griliches Z (1995) R&D and productivity: econometric results and measurement issues. In: Stoneman P (ed) Handbook of the economics of innovation and technological change. Blackwell Publishers, Oxford, p 5289

Grossman M, Helpman E (1991) Trade, innovation and growth. Am Econ Rev 80(2):86–91

Guarascio D, Pianta M, Lucchese M et al. (2015) Business cycles, technology and exports. Economia Politica – J Anal Institut Econ, Springer

Hall BH (2002) The financing of research and development’. Oxf Rev Econ Policy 18(1):35–51

Harris R, Moffat J (2011) “R&D, Innovation and exporting” SERC Discussion paper, Spatial Economic Research Center, LSE

Hummels D, Ishii J, Yi KM (2001) The nature and growth of vertical specialization in world trade. J Int Econ 54(1):959–972

Kaldor N (1981) The role of increasing returns, technical progress and cumulative causation in the theory of international trade and economic growth. Econ Appl 34(4):593–617

Kleinbaum DG, Kupper LL, Muller KE (1988) Applied regression analysis and other multivariate methods, 2nd edn. PWS Publishing, Boston

Kleinknecht A, Verspagen B (1990) Demand and innovation: Schmookler re-examined. Res Policy 19:387–394

Krugman P (1990) Increasing returns and economic geography, NBER Working Papers 3275, National Bureau of Economic Research

Landesmann M, Pfaffermeyr M (1997) Technological competition and trade performances. Appl Econ 29(2):179–196

Loof H, Heshmati A (2006) On the relationship between innovation and performance: a sensitivity analysis. Econ Innov New Technol 15(4-5):317–344

Laursen K, Meliciani V (2010) The role of ICT knowledge flows for international market share dynamics” Res Policy, Elsevier 39(5):687–697

Lorentz A, Ciarli T, Savona M, Valente M (2015) The effect of demand-driven structural transformations on growth and technological change. J Evolution Econ June 2015 Springer Berlin. doi:10.1007/s00191-015-0409-5

Lucchese M. (2011) Demand, innovation and openness as determinants of structural change. University of Urbino DEMQ WP

Lucchese M, Pianta M (2012) Innovation and employment in economic cycles. Comp Econ Stud 54:341–359

Mairesse J., Mohnen P. (2010) Using innovations surveys for econometric analysis. NBER working paper, w15857

Malerba F (2002) Sectoral systems of innovation and production. Res Policy 31:247–264

Malerba F (ed) (2004) Sectoral systems of innovation. Cambridge University Press, Cambridge

Malerba F, Orsenigo L, Peretto P (1997) Persistence of innovative activities sectoral patterns of innovation and international technological specialization. Int J Ind Organ 15:801–826

Metcalfe J (2010) Technology and economic theory. Camb J Econ 34(1):153–171

Montobbio F (2003) Sectoral patterns of technological activity and export market share dynamics. Camb J Econ 27:523–545

Mowery D, Rosenberg N (1979) The influence of market demand upon innovation: a critical review ofsome recent empirical studies. Res Policy 8:102–153

Nelson RR (1959) The simple economics of basic scientific research. J Polit Econ 67:297–306

Nelson R, Winter S (1982) An evolutionary theory of economic change. The Belknap Press of Harvard University Press, Cambridge

Nemet GF (2009) Demand-pull, technology-push, and government-led incentives for non-incremental technical change. Res Policy 38:700–709

OECD (2009) Innovation in firms. a microeconomic perspective. OECD, Paris

Parisi ML, Schiantarelli F, Sembenelli A (2006) Productivity, innovation and R&D: micro evidence for Italy’. Eur Econ Rev 50:2037–2061

Pasinetti L (1981) Structural change and economic growth. Cambridge University Press, Cambridge

Pavitt K (1984) Sectoral patterns of technical change: towards a taxonomy and a theory. Res Policy 13(6):343–373

Peters B (2009) Persistence of innovation: Stylized facts and panel data evidence. J Technol Transfer 34:226–243

Pianta M (2001) Innovation, demand and employment. In: Petit P, Soete L (eds) Technology and the future of European employment. Elgar, Cheltenham, pp 142–165

Pianta M, Lucchese M. (2011) The sectoral innovation database 2011. Methodological Notes, University of Urbino, DEMQ working paper

Pianta M, Tancioni M (2008) Innovations, profits and wages’. J Post Keynesian Econ 31(1):103–125

Piva M, Vivarelli M (2007) Is demand-pulled innovation equally important in different groups of firms? Camb J Econ 31:691–710

Saviotti P, Pyka A (2013) The co-evolution of innovation, demand and growth. Econ Innov New Technol, Taylor & Francis J 22(5):461–482

Scherer F (1982) Demand-pull and technological invention: Schmookler revisited. J Ind Econ 30(3):225–237

Schmookler J. (1966) Invention and economic growth. Harvard University Press

Schumpeter JA (1975) Capitalism, socialism and democracy, 1st edn. Harper, New York

Soete LLG (1981) A general test of the technological gap trade theory. Weltwirtschaftliches Arch 117:638–666

Soete L (1987) The impact of technological innovation on international trade patterns: the evidence reconsidered. Res Policy 16(2-4):101–130

Stapel S, Pasanen J, Reinecke S et al. (2004) Purchasing power parities and related economic indicators for EU, Candidate Countries and EFTA, Eurostat - Statistics in Focus

Stiglitz JE (1987) Learning to learn localized learning and technological progress. In: Stoneman P, Dasgupta P (eds) Economic policy and technological performance. Cambridge University Press, Cambridge

Stiglitz JE, Weiss A (1981) Credit rationing in markets with imperfect information. Am Econ Rev 71(3):393–410

Thirlwall A (1979) The balance of payment constraint as an explanation of growth rate differences. BNL Quarter Rev, Banca Nazionale del Lavoro 32(128):45–53

Tiffin A. (2014) European productivity, innovation and competitiveness: the case of Italy. IMF Working Paper Strategy, Policy and Review department

Timmer M. (2013) The World Input Output Database (WIOD): contents, sources and methods. WIOD WP 10

Timmer M, Los B, Stehrer R, de Vries G (2013) Fragmentation, incomes and jobs: an analysis of European competitiveness. Econ Policy 28(76):613–661

Triguero-Cano A, Corcoles-Gonzales D (2013) Understanding the innovation: an analysis of persistence for Spanish manufacturing firms. Res Policy 42:340–352

Verspagen B (1993) Technological and social factors in long term fluctuations. Struct Change Econ Dynam, Elsevier 4(1):210–213

Wooldridge JM (2002) Econometric analysis of cross section and panel data. The MIT Press, Cambridge

Yamano N., Ahmad N.,(2006) The OECD input-output database: 2006 Edition, OECD Science, Technology and Industry Working Papers 2006/8, OECD Publishing

Zellner A, Theil H (1962) Three-stage least squares: simultaneous estimation of simultaneous equations. Econometrica 30(1):54–78

Kleinert and Zorell (2012) The export magnification effects of offshoring. European Central Bank - Working Papers Series, 1430

Acknowledgments

The authors wish to thank the editor Uwe Cantner, an anonymous referee and, for their comments, Jan Fagerberg and all the participants at the 15th ISS Conference held in Jena – Schiller University. We are particularly grateful to Luca Zamparelli for a previous discussion of this paper. Dario Guarascio is strongly indebted with Michael Landesmann, Robert Steherer, Mario Holzner, Sebastian Leitner, Roman Stöllinger and Julia Grübler for their comments and suggestions during his visiting period at the Vienna Institute for International Economic Studies. All the usual disclaimers apply.

Author information

Authors and Affiliations

Corresponding author

Appendix

Appendix

1.1 Descriptive statistics

1.1.1 Export market shares

The six countries contained in our sample account for 95 % of the EU-15 and for the 70 % of the EU-28 exports. The percentages are obtained dividing the sum of the exports of the considered countries by the total EU exports. Data are synthetized in Table 10. Moreover, the export performance of the countries in our sample (measured by the export market shares) remain stable when different data sources are considered (calculations based on our SID database are compared with Eurostat data) and when exports are distinguished by destination. These elements bring us to consider the export market share variable used in the third equation of the system as a reliable proxy for industries performances in terms of international competitiveness.

1.1.2 Innovation vs performance variables

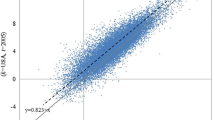

The following scatter plots relate product innovation with export and value added as proxies for economic performance; they identify countries’ heterogeneity and sectoral regularities, using Pavitt classes. Figure 2 shows a clear correlation between R&D efforts and innovation performance; Science Based and Supplier Specialized industries - those sectors for which innovation is most important – are located at the top right of the graph, as expected. Within technological intensive sectors, the best performers are from Northern countries and France. Figure 3 relates product innovation and exports and also, in this case, the correlation between the two variables is detected. As in Fig. 2, sectors with a higher technological intensity (SB and SS) are positioned in the top right of the graph and the North–south divide is again clear in the distribution.

Figure 4 provides a cross country comparison plotting product innovation versus the rate of change of value added over the sampled period. In this graph, the North–south divide is again clear, as well as the role of Germany as an outlier. The descriptive evidence provided is the background to the results of the econometric model developed in section 5.

1.1.3 Intermediate inputs

The final step of this data inspection regards the role played by intermediate inputs, distinguishing them in terms of technological content and source. Table 11 reports the share of each intermediate input over total industry production of countries. The numbers in Table 11 depict a situation where there is little variability across countries; even the high tech imported inputs have a highly stable relevance across countries. Conversely, domestic low tech intermediate inputs play a major role in Southern countries, and Italy in particular, where their share over total production is 32 %, ten point higher than the Northern average.

The final Table 12 reports the intensity in the use of domestic and imported inputs by Pavitt Categories for the period 1995-2010. As expected, the variability across Pavitt Categories is higher than the one observed among countries. Sectors belonging to Science Based and Supplier Specialized categories rely mostly on high tech intermediate inputs, and their openness to the foreign market is also remarkable. Conversely, Scale Intensive and Supplier Dominated sectors are characterized by an intensive use of low tech inputs originating principally from the domestic market. A substantial divergence in terms of economic and innovative performances across our sample’s countries emerges from this first data inspection. Moreover, technological factors turn out as a crucial element in the explanation of competitiveness for the EU countries we have considered.

1.2 Model diagnostics

1.2.1 Dummy variables estimations