Abstract

The previous and latest crises confirmed that stability of external financing of the economy is determined not only by the volume of capital inflow but also by its structure. It is established that a bias in gross external liabilities towards debt, especially short-term, may rise vulnerability to financial crises. Greater share of equity capital, mainly direct investment is not found to bear such financial risk. The results of Bayesian Model Averaging (BMA) show that influence of variables inherent in macroeconomic and portfolio approaches varies depending on the type of capital inflow and the group of countries. We also find some arguments that equity investment is a more desirable form of foreign capital because debt inflows are more responsive to global factors and therefore more volatile. As a word of caution, we highlight the need for diversification and careful monitoring of external financing sources and forms.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction and related theoretical background

1.1 Two hypothesis

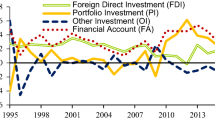

Usually four categories of capital inflow are distinguished: portfolio investment (including portfolio investment debt – PID and portfolio investment equity – PIE), foreign direct investment (FDI) and other investment (OI), mainly including bank financing. Short-term credits as a component of OI and market debt (PID) can be the most volatile and both are very sensitive to global factors determined by global liquidity and risk aversion, especially during financial turbulence. Although PIE is to some extent characterized by features similar to those of PID, episodes of its volatility are usually shorter though often more intensive. The healthiest form of capital inflows seems to be FDI because of its long-term orientation, stability, transfer of tangible and intangible assets and pro-growth impact.

The main objective of the paper is to identify the determinants of four basic forms of foreign capital gross inflows and determinants of flows within both groups of countries in question. The general objective of the study will be pursued via the verification of two research hypotheses:

-

H1: There is a marked difference between factors determining the various capital forms: FDI, PIE, OI and PID. Dissimilarities are also present between the two analyzed groups of countries.

-

H2: The relevance of push factors increases significantly for emerging economies, particularly if the observations from the years of global financial crisis are included in the sample.

1.2 International capital mobility and its drivers

There are at least three important strands of literature trying to describe international capital mobility and its drivers in a systematic way. They constitute the background and justification for our hypotheses. The first one is the standard neoclassical theory, the second is the Capital Asset Pricing Model (CAMP) and the third are theories and approaches describing moves behind FDI flows.

According to the neoclassical theory, capital is motivated by returns differentials between countries and should flow from rich countries with usually lower rates of return to poor countries with expected higher returns (“downhill”). The theory is based on the assumption that the current account is equal to the difference between savings and investment: CA = X – M = S – I, which means that national savings and investment determinants are the key factors of capital flows. The problem with the above theoretical framework is, as shown by capital flows during the recent decades, that it seems to be at least incomplete to explain some patterns in international money flows (Bonizzi 2013). Among different unsolved dilemmas are some examples like the Feldstein-Horioka puzzle (Feldstein and Horioka 1980), Lucas’ paradox (Lucas 1990), the global imbalances and the global savings glut phenomena (Bernanke 2005; Blanchard and Milesi-Ferretti 2009). Experiences of the pre-crisis (i.e. before 2008) world clearly show that (especially portfolio) capital in net terms flowed “uphill” instead of “downhill”. It was accompanied by financial globalization increasing international assets holdings and more penetration of emerging markets (Brzozowski et al. 2014; Lane and Milesi-Ferretti 2007). Private capital kept flowing in increasing amounts to emerging countries, but outflows from them also speeded up. It is difficult to rationalize all these phenomena using just the neoclassical theory based on the current accounts approach.

The second important theory trying to describe capital flows is the CAMP approach (Grubel 1968). Its main assumption is based on financial assets diversification, which is profitable due to low levels of correlations between different countries. Risk diversification through buying assets from different markets reduces its global variance. But according to the “push-pull” factors literature (Calvo et al. 1993; Taylor and Sarno 1997), as recalled by Bonizzi (2013), some empirical evidence does not fit in the theoretical model. Financial flows are susceptible to overreacting changes in global factors, especially during a crisis. Moreover, international capital markets are found to be affected by informational asymmetries which lead to a series of phenomena, e.g. home bias (French and Poterba 1991; Coval and Moskowitz 1999), positive feedback trading (Koutos 2014), herding and contagion (Belke and Setzer 2004), sudden stops and reversals (Dornbusch et al. 1995; Forbes and Warnock 2012a), usually in the case of developing countries. Mody and Taylor (2013) indicate that in the case of informational frictions, capital flows may be permanently rationed, and simultaneously subjected to procyclicality and deep changes (Pavlova and Rigobon 2010).

Third, there are different theories which attempt to explain the reasons behind FDI but they are not conclusive (Parry 1985; Itaki 1991). The main reason is that FDI is motivated by different factors specific to particular companies and there is a strong link between FDI and international trade and generally with the “real” sector. That is why FDI is rather related to long-term investment projects and is not so vulnerable to financial factors. According to the most current approach – “new” new trade theory – the ability to expand internationally through FDI is determined by individual unique features and conditions which have to be fulfilled by firms. In this framework, firms become homogenous in terms of their productivity and capability to export and FDI outflow. Successful companies have to be productive and efficient enough in order to cover fixed costs of expansion (Melitz 2003). Only “the happy few” of them can afford to use the most sophisticated modes of internationalization strategy such as FDI (Mayer and Ottaviano 2007).

Drawing from the above literature and theories as well as our further investigation outlined below, we can assume that there are important differences behind the particular forms of capital flows as we assumed in our first hypothesis. FDI theories assume that the main motivation for it lies in unique characteristics of investing companies and FDI has more long term orientation. Agiomirgianakis et al. (2003) indicated that FDI is mostly driven by multinational companies (MNCs), but not financial institutions. MNCs expand their activities for a number of reasons including the economies of scale and/or scope, the use of firms specific resources or just because they wish to withstand their competitors.Footnote 1

On the other hand, in line with the CAMP theory, portfolio investment and banking flows (especially short-term) can be traded across border many times, as a way to diversify risk and/or obtain higher yields. If international assets diversification is an instrument of lower portfolio volatility or higher returns, investors will adjust their position accordingly (Obstfeld 2012). As Minsky indicated (Wray 2009), as a result of the managed-money funds rise, many assets are actively traded. The main motivation for such phenomena is to decrease portfolio volatility or enhance its returns with the emphasis on short-term profits. Unfortunately, long-term holding of securities is less attractive and the main motivations of money managers are speculative, even including merger and acquisition transactions and leveraged buy-outs (Bonizzi 2013). Money-manager capitalism escalates the trend for international diversification and this phenomenon is accelerated by an increasing role of institutional investors, mainly pension and hedging funds.

1.3 Advanced vs emerging countries – why they are different?

When it comes to the differences between advanced and emerging countries, their main motivations lie in capital abundance (neoclassical theory) and its distribution (CAMP theory). The first group is seen as rich in capital, while the second one as poor in capital. As we argued previously, the picture is of course not clear-cut, but generally international flows take place between borrowers and debtors. Pull factors in developed countries constitute push factors for developing ones. From the theoretical point of view, justification for our second hypothesis may be the liquidity preference approach, which can be seen as a theory of asset choice completed with Minsky’s financial instability hypothesis. Many examples lead us to believe that the supply side of capital flows play a decisive role in the boom and bust phenomenon and the procyclical nature of capital flows (Broner et al. 2013). As we mentioned, according to the “push-pull” factors approach, international investors are prone to exaggerate changes in global factors and simultaneously undermine domestic (often strong) economic fundamentals. This is due to informational asymmetries, herding, contagion and sudden stop, which are more common in the case of emerging markets, especially during a crisis. Moreover, during a financial turbulence period liquidity preference can change the structure of assets (Tily 2012). In the case of a rise in liquidity preference (“flight to quality”, “flight to liquidity”), there is a shift towards broadly defined money and liquid assets decreasing long-term securities value. In this context, capital flows drivers are considered in a broader sense of the international monetary system structure. As Bonizzi (2013) indicated, according to some post-Keynesian authors, there exists a “currency hierarchy”, meaning that different currencies have different liquidity premiums and ability to store value (Andrade and Prates 2013; De Conti et al. 2013). Usually this capability is minor in the case of less developed markets and that is why their currencies have lower liquidity premiums. This subjects them to unstable capital flows and exchange rates variability, as investors quickly turn to more liquid assets in the case of an increase in their liquidity preference, i.e. during a crisis (safe heaven assets). Because of usually less developed and less liquid financial systems and more volatile currencies in emerging markets, assets are seen as a more risky part of investor portfolio (Biancareli 2009). Due to liquidity constraints (combined with positive trading, herding and contagion), the phenomena enumerated above are accelerated during financial turbulence episodes by the “peripheral” location of emerging markets in terms of their distance to global financial centers and original sin (with self-reinforcing forces as indicated in the financial accelerator concept – Bernanke et al. 1999).

The rest of the paper is structured as follows. The next section is devoted to the literature review explaining differences between examining classes of assets in a more detailed way. The methodology of the empirical part is provided in Section 3. The results are discussed in Section 4, and conclusions and policy recommendations are presented in Section 5.

2 Differences between particular forms of capital inflow

2.1 Portfolio flows – debt versus equity: are they different?

Portfolio flows are seen as the least safe form of inflows and sometimes called hot money (Bluedorn et al. 2013, p. 4). This term describes their greater volatility and susceptibility to external factors as well as pro-cyclical inflows (Smith and Valderrama 2008). Although portfolio investment is usually analyzed as one form of portfolio capital flow, it is important to distinguish between PID and PIE. PID, which means investment in debt market (public and private bonds, treasury bills, etc.), is more vulnerable to global factors, including interest rates disparity between countries that translates into different yields of debt instruments. Higher vulnerability is also a result of the obligation to repay debt and interest independently of the borrower’s financial condition, which is not true for equity. Forbes and Warnock (2012b, p.15) indicate that global factors are not so important in the case of equity, but are visible for debt. Mercado and Park (2011, p.2) also claim that PID is less stable than PIE. Equity capital flows can be more volatile, but episodes of their volatility are usually shorter than in the case of other capital forms. Furceri et al. (2011, p.6) conclude that a bigger share of debt relative to equity in financing the economies increases the risk of banking, currency and balance of payments crises.

2.2 Banking flows

Increasing role of global banks, financing their assets through short-term liabilities on international markets, exposed the role of global factors in determining supply of credit in advanced and emerging economies. The share of short-term financing continuously rose from the beginning of the 1990s and amounted to 1/3 in the first years of the 21st century. McKinsey (2013, p.41) indicates that in 2000–2011 short-term financing was approximately a half of banking flows. Therefore, i.a. Sula and Willett (2009) emphasize that banking flows can be as unstable as portfolio flows, and crises, beginning with the Asian crisis, were often transmitted through “contagion” in the interbank market. After Lehman Brothers failed in 2008, the collapse of the global interbank market was the reason why the liquidity shock hit countries whose financing structure was dominated by portfolio and banking flows more severely (Tong and Wei 2010). According to OECD (OECD 2012, p.9), the strengthening role of short-term debt in banking sector financing also increases the risk of financial instability because of a greater risk of maturity and currency mismatch.

2.3 Foreign direct investment – is it really more stable?

FDI reveals the most desirable properties and is termed cold money contrary to portfolio flows. Firstly, FDI is less susceptible to flows volatility and contagion effect, i.a. because tangible assets are more “attached” to the investment country (Fernandez and Hausmann 2000). Secondly, FDI inflows (and banking flows) entail a lower risk of real appreciation of exchange rates than portfolio capital (Combes et al. 2010). Thirdly, FDI may be a more important growth factor than other inflows because it is accompanied by knowledge and technology transfer and human capital development.

Nevertheless, there are a few opponent views that FDI can be also less stable than it was previously thought and sometimes can behave like portfolio PID and PIE flows. Broto et al. (2011, p. 1944) and Neumann et al. (2009, p. 490) point out that FDI may also become more volatile during crises. Moreover, FDI flows have been increasingly affected by global factors since the beginning of the 21st century.

What are the reasons for growing volatility of FDI flows? Firstly, Mody and Murshid (2005, p. 250) indicate that since 1990s FDI flows have been driven by diversification motives and have had smaller influence on economic growth than in previous decades. Secondly, the experiences from the latest financial crisis indicate that FDI stability and positive impact on growth depend on its sectoral composition. Growing importance of FDI in financial, housing and renting sector before the latest crisis exposed many countries to macroeconomic imbalances and higher output volatility (Christodoulakis and Sarantides 2011, p. 26; Reinhardt and Dell’Erba 2013; Aizenman and Sushko 2011). Thirdly, FDI can be less stable in the case of mergers and acquisitions, which sometimes constituted half of the global FDI flows, and behave like portfolio flows. During financial and economic crises FDI can be more volatile because of fire sale (Shleifer and Vinshny 2011). Fourthly, FDI stability may be influenced by its financing structure (World Economic and Social Survey 2005, p. 81). Foreign investment in the form of equity usually reflects strategic decisions taken by transnational corporations and is the most stable component of FDI. However, during last years the share of non-repatriated earnings and intra-corporate lending, as two other forms of financing FDI, has risen significantly. Both have a feature of debt obligation and can be less stable because they can be adjusted pro-cyclically in line with the financial conditions of the parent company (liquidity needs and risk exposure).Footnote 2

3 Empirical methodology and the data set

3.1 Dependent variables: net or gross capital flows?

For the purposes of the study, gross capital flow was assumed to be the right measure of capital mobility. The advantage of this choice is that it makes it possible to identify decisions made by foreign investors (non-residents), manifesting themselves in flows of the different capital forms.Footnote 3 Until the last crisis, the literature concerning capital flows emphasized capital mobility in terms of net flows, illustrating balanced flows that reflect the behavior of both foreign investors (non-residents) and national agents (residents). Drawing on the experiences from the latest global financial crisis, it is stressed that a separate examination of gross inflow and gross outflow is necessary as there may exist significant differences between non-residents’ motivation to invest in a particular country and motivation of residents to acquire foreign assets.Footnote 4 Furthermore, the examination of the net inflow category, which involves the balancing of foreign and domestic capital mobility, can alone be insufficient for an assessment of financial stability and exposure to external shocks (Lane 2013, p 3–10). Net flows are generally much smaller and less volatile than gross flows. Only through a detailed examination of gross inflow structure can it be assessed whether financial integration is a risk-sharing channel or a factor contributing to an exposure to the risk of contagion and external shocks. The need to pay more attention to gross flows is indicated by: Forbes and Warnock (2012a), Lane (2013) and Broner et al. (2013).Footnote 5

We performed the Bayesian Model Averaging (BMA) analysis seeking to identify the determinants of each type of foreign capital inflows expressed as ratios to GDP: FDI, PIE, PID and OI. The balance of payments statistics were kindly provided by the IMF staff. The list of examined countries can be found in Appendix Table 6.

3.2 Independent variables

In the literature examining determinants of international capital flows, a prevailing approach is based on theories resulting from a macroeconomic analysis of small open economy. It assumes that capital flows adapt to changes in the global economy (exogenous factors – push factors) and are connected with general situation in the global economy but, simultaneously, depend on local changes (endogenous factors – pull factors) resulting from internal characteristics of an economy (Fratzscher 2011, pp. 7–10; Calvo et al. 1996).

Among external (push) factors, the most frequently mentioned ones include global liquidity (money supply in international financial centers, mainly the USA), short- and long-term interest rates in highly developed countries (mainly the USA), global risk aversion or appetite and economic growth in highly developed countries or global GDP growth. These factors reflect the general macroeconomic and financial condition of the global economy and remain beyond control of a country receiving capital. They determine international synchronization of flows, whereby episodes of inflows and outflows occur simultaneously in many countries, and may imply equal treatment of countries by international investors.

In turn, different volume and structure of international capital flows in various economies suggest individual treatment of countries by investors. Country specific (pull) factors attracting capital may result from certain macroeconomic conditions. Many studies also highlight the importance of institutional determinants of financial flows which are decisive for the so-called financial openness of countries. Administrative regulations determining the level of liberalization of capital account of balance of payments can be decisive for access to foreign financing sources.

External (push) and internal (pull) determinants of capital flows can also be divided into factors determining the return on invested capital and factors affecting investment risk. This distinction makes the analysis of capital flow determinants similar to the analysis based on portfolio theories. The analysis of capital flow determinants from the point of view of this theory is based on comparison of expected return and investment risk rates between countries. The inter-country correlation of these market characteristics also affects the volume, structure and direction of capital flows (Grubel 1968; Levy and Sarnat 1970).Footnote 6

The macroeconomic push-pull factors approach and the portfolio theory form the basis for our empirical analysis. The sample includes 33–37 emerging economies and 19 developed countries and covers 1990–2011. The original set of potential candidates for robust determinants of gross capital inflows embraced 24 variables. Four of them, namely the US stock of broad money, stock of reserves, money market interest rate, and capital account openness in the recipient economy, were found to have the posterior inclusion probability below 0.1 in regression models for all types of capital flows and were therefore excluded. The remaining variables are robust determinants of at least one type of capital inflows. All data, unless otherwise stated, come from the World Bank World Development Indicators database.

The covariates fall into several categories which belong to wider classes of push and pull factors. Among the latter we have included the measures of exchange rate stability, quality of monetary and fiscal policies, degree of development of financial markets, production structure of the economy and its rate of growth and quality of physical and social infrastructure.

Exchange rate stability is measured by the ers index from the composite trillema index of Aizenman et al. (2013). We acknowledge that investors may take into account short- and medium-term volatility of the exchange rate.Footnote 7 The variable ers_lag3ymean is therefore the average of the current value of the ers index and its annual values in two previous years. The European Monetary Union membership is the second measure related to exchange rate regime. The variable emu is a dummy equal to 1 for all EMU countries and 0 otherwise.

The quality of monetary policy is measured by the value of the central bank’s ultimate goal, that is inflation rate. Since inflation is an outcome of the central bank’s action as well as short-run demand and supply shocks, we believe that an appropriate measure of monetary policy quality should be filtered out of cyclical fluctuations. The variable infl_lag5ymean is the average of the current value of CPI inflation and its annual values in the previous 4 years. The quality of fiscal policy is gauged by the value of public debt, which is a result of government profligacy in the past and an indicator of likely future austerity measures when fiscal consolidation becomes inevitable. The current value of government debt may be dependent on the current value of government savings (deficit) which may be influenced by the supply of funds including foreign savings inflows. To avoid the reverse-causation problem, we used the 1-year lagged value of the public debt in percent of GDP, L_debt, from the Abbas et al. (2011) database.

Financial market depth, liquidity, and stability are proxied by four variables. Foreign capital flows have direct impact on the situation in financial markets and to address the reverse-causation problem we relied on the lagged values of financial development indicators. The depth of financial market is measured by the stock market capitalization (L_mrkt_cap_gdp) and the stock of credit (L_credit_gdp), both expressed in percent of GDP. The liquidity of financial market is proxied by the ratio of stock market turnover to GDP (L_stocks_gdp). Financial market stability is quantified by means of three dummy variables capturing banking, exchange rate and public debt crises episodes from the Laeven and Valencia (2012) database. More precisely, crisislagmean is the average of the current value of the sum of the three dummies and its annual values in the previous 2 years. We included two lagged values of the crises dummies on the basis of the premise that investors have long memory.

The production structure of the economy is quantified by two variables, servicesgdp and industrygdp, which are equal to the share of, respectively, services and industry sector in GDP. The growth rate of an economy is measured by the average of the current value of real GDP growth and its annual values in the previous 4 years. Following standard practice in the growth literature, we used 5-year averages to remove the impact of cyclical fluctuations. Hence gdp_gr_lag5ymean captures the long-run growth dynamics. The third income-related variable, which is the level of GDP per capita in constant US dollars, denoted gdp_pc_const_usd, is intended to capture the endowment in physical capital and a country’s stage of development. Since the costs of communications play a crucial role in the information revolution era, we used telmob, defined as the number of fixed lines and mobile telephones per 100 inhabitants, as an indicator of the quality of physical infrastructure. The distance from major markets – the minimum air distance of the capital city from New York, Tokyo, or Rotterdam in kilometers – is the second variable, labeled airdist, which can be interpreted as a measure of remoteness and transportation costs proxied by geographical distance.

The quality of social infrastructure is conceived to consist in high level of social and human capital development. The former is proxied by average years of schooling, denoted sch, from the Barro and Lee (2010) dataset. As we conjecture that social development is conditional on the degree of civil liberties, we employed index of civil liberties, cl, compiled by non-governmental organization Freedom House.Footnote 8

The set of push factors contains three variables. Two of them pertain to return and risk in the US financial market. The long-run return is quantified by the 10-year government bonds interest rate, us10y_int. The short-run return is gauged by the percentage change in the S&P 500 stock market index at the end of the year, labeled usstock_return_end. Finally, the world economy business cycle phase is identified by means of the world GDP growth rate, or gdp_world_gr. Footnote 9

The summary statistics of all the variables for developed and developing countries in 1990–2011 are presented in Appendix Table 7. The values of independent variables are small, different from zero at the fifth decimal place, because they are expressed as ratios to GDP. For this reason the estimated coefficients of the independent variables are expected to be small in value.Footnote 10

4 The model and methodology

Economic theory and empirical studies surveyed above provide an extensive list of factors likely to influence all types of foreign capital inflows. The lack of widely accepted theoretical approach and empirical model specification that could be applied in a comparative analysis of the determinants of foreign debt, equity, direct and other investment flows generates uncertainty regarding composition of the set of covariates that should be included in the model. There might exist several models that provide a good fit to the data but lead to different estimated values of the parameters and their standard errors. Thus the problem of model uncertainty arises and basing inferences on one model alone becomes risky. If the theory does not provide unambiguous selection criterion that would allow for favoring one model over the others, BMA offers a solution.Footnote 11

The remarkable diversity of capital flows determinants in terms of competing theories and empirical results, obtained from substantially different model specifications, has recently led researchers to apply BMA to investigate the determinants of FDI. Using this technique, Blonigen and Piger (2011) find that traditional gravity variables, cultural distance factors, parent-country per capita GDP, relative labor endowments, and regional trade agreements are the sole variables with high inclusion probability. Similarly, Eicher et al. (2012) conclude that more than half of the previously suggested FDI determinants are not robust. To address model uncertainty, BMA has been also applied in the context of portfolio capital flows in Thailand in Yupho and Huang (2014).

A regression model focuses on data to estimate coefficients. Let D stand for the data matrix, and β for the vector of parameters of the model that seeks to explain D. The Bayesian econometrics uses Bayes’ rule to obtain the conditional probability:

where p(D|β) is the density of the data conditional on the parameters of the model, referred to as the likelihood function, and p(β) is the prior density. It stems from Eq. (1) that posterior density is proportional to the product of the likelihood function and prior density. To compare different models, defined by a likelihood function and a prior, the posterior for the parameters calculated using model M i can be expressed as:

The posterior model probability using the Bayes’ rule can be written as:

where p(M i ) is the prior model probability and p(D|M i ) is the marginal likelihood obtained by integration of both sides of Eq. (2):

To eliminate the term p(D) in the denominator of Eq. (3), which may be difficult to calculate, the comparison of two models i and j consists in computing the posterior odds ratio, defined as:

If equal prior weights are attached to each model, that is the prior odds ratio p(M i )/p(M j ) is set equal to 1, the posterior odds ratio becomes the ratio of marginal likelihoods, and is referred to as the Bayes Factor, BF, given by:

In the analysis of capital inflows determinants we have considered the linear regression model with uncertainty regarding which explanatory must be included in the right-hand side. Following Magnus et al. (2010), we distinguish between the regressor of interest X 1 and the auxiliary regressors represented by vector X 2. The model takes the following form:

where y is a n × 1 vector of dependent variable, X 1 and X 2 are, respectively, [n × k 1] and [n × k 2] matrices of regressors, and β’s and ε are vectors of, respectively, parameters and random shocks.Footnote 12 The number of possible models to be considered is 2k2, which constitutes the model space reported in the tables in the appendix.

A model averaging estimate of β is given by:

where \( {\overset{\frown }{\beta}}_i \) is a conditional estimate of the parameters vector under model M i . To obtain the conditional posterior distribution, Magnus et al. (2010) construct a general prior which allows for overcoming the problem of partially proper and partially improper priors involved in the assumed prior distribution. The authors show that the conditional estimates of β 1 and β 2i under model M i are given by:

where g = 1/max(n, k 22 ) is a constant scalar for each model.

The weights λ i are given by the models’ posterior probabilities:

Assigning equal prior probabilities to each model, Magnus et al. (2010) derive the following model weights:

The conditional estimates of the coefficient (1) and the value of weights (11) allow for computing the unconditional BMA estimates of β 1. A regressor is considered to be robustly correlated with the independent variable if either the absolute value of the t-ratio on its coefficient is greater than one or, equivalently, the corresponding two-standard error band does not include zero. In the tables displaying the detailed results of our estimates, which can be found in Appendix Table 8, we report the two-standard error bands. The significance test is based on the aforementioned two-standard error band criterion.

5 Results

5.1 Equity flows

5.1.1 Determinants of FDI and equity inflows in developing countries

Estimation using BMA indicates that in both 1990–2007 and 1990–2011 including global crisis FDI inflows were determined by similar features. They had local and global character, reflecting pull and push factors – see Table 1.

The role of local factors

The analysis of the periods 1990–2007 and 1990–2011 revealed that income level, gdp_pc_const_usd, was a significant factor discouraging FDI. This may be because income level is related to a potential investment return. According to the convergence hypothesis, a high capital per employee ratio (GDP per capita reflects physical capital resources per employee) can entail its slower increase in the future (Solow 1956). In developing countries, lower GDP per capita usually means a lower wage level, which can also make FDI attractive to investors because of potential higher productivity of capital.

The positive influence of telecommunications infrastructure quality telmob (infrastructure quality is an important factor for capital productivity) and civil liberties index cl on FDI inflow confirms the role of institutional factors. Better quality of institutional environment should increase long-term investment attractiveness of a country and lead to an inflow of stable foreign capital. Better institutions also foster economic growth (e.g. Acemoglu and Johnson 2005) and contribute to the lowering of several non-operational risks, e.g. political risk, which increases the costs of business in a given country, especially for longer-term investors.

Taking into account macroeconomic variables, the exchange rate stability ers_lag3ymean proved to be a factor reflecting investment risk which positively affected the direction and strength of FDI inflow to the analyzed group of countries. Negative influence of exchange rate volatility on FDI illustrates the fact that unstable macroeconomic conditions are an obstacle to FDI inflows. Numerous studies suggest that exchange rate volatility (as a measure of macroeconomic instability) can be a factor reducing a country’s investment attractiveness, while stable exchange rates can be conducive to FDI inflows, as documented by Escaleras and Thomakos (2008).

The role of global factors

Analyzing external factors, it should be noted that higher investment yields in developed markets (represented by the long-term interest rate on 10-year US T-bonds us10y_int) were found to be a statistically significant determinant of FDI and PIE capital inflow to developing countries. On the one hand, this can result from profits gained in developed markets, subsequently invested in developing countries. If investors behave as assumed in the portfolio theory and diversify their assets, they will increase investment in developing countries to offset the rise in the portfolio share of developed countries assets whose prices increased. On the other hand, it should be noted that high stock market return ratios are generally accompanied by their bigger unpredictability. Furthermore, rising interest rates in developed markets translate into higher capital costs, which – especially in the case of capital-intensive investment (including, in particular, FDI) – may discourage investment in markets characterized by rising interest rates and encourage investment in developing economies.

Although FDI inflow to developing countries was mainly conditioned by internal (pull) factors, a growing influence of global factors could be observed in the analysis covering also 2008–2011. It turned out that, apart from us10y_int, which was statistically significant in 1990–2007, the determinants of FDI inflow in 1990–2011 also included airdist variable specifying geographical distance from the biggest economic and financial centers. In the period comprising the global financial crisis, the farther the distance was, the more capital inflow decreased. It should be assumed that greater “peripherality” causes the weakening of economic links with the center and, simultaneously, the biggest increase in risk during crises.

Comparing FDI and PIE determinants, it should be highlighted that PIE flows are more idiosyncratic and bear little systematic relation to the explanatory variables. It appeared that the only factor affecting (in both sub-periods) positively capital inflow was capital market size L_mrkt_cap_gdp (in both periods). It should not be surprising that bigger and usually more liquid markets attract more PIE. The significance of banking market size L_credit_gdp in 1990–2011 probably reveals that, in the case of developing countries, larger credit markets – where the asymmetric information problem may be less severe – attract PIE. On the other hand, countries with a higher credit do GDP ratio underwent a deeper process of deleveraging during 2008–2011 and PIE appeared to be a substitutive form of financing. Other analyzed domestic variables did not show systematic correlations with the explanatory variable.

In the case of PIE, global factors gain statistical significance if the analysis covers 1990–2011. The variable that proved to be statistically significant was the return on S&P 500 index usstock_return_end. It goes in line with the investors’ need to increase diversification within the same class of assets as a result of a growing share of mature capital markets and subsequent overweight of emerging markets. Simultaneously, it can confirm the leading role of mature markets as a trigger of global equity markets moves.

5.1.2 Determinants of FDI and equity inflows in developed countries

Dominance of local factors

In developed countries, local factors determined FDI and PIE capital inflow in both periods (i.e. 1990–2007 and 1990–2011). It can suggest individual treatment of those countries by investors who took account of country-specific circumstances – see Table 2. It may also reflect the fact that developed countries host global financial centers where investment decisions are taken as well as provide global monetary policy.

The factor describing exchange rate stability ers_lag3ymean proved to be statistically significant for FDI in both analyzed periods. In turn, a statistically significant positive “euro effect” (emu variable describing the membership in the monetary union) on PIE inflow in the period excluding the global financial crisis was observed. It is in line with broad consensus in the literature that monetary unification in the European Union caused elimination of the home bias after euro introduction and led to the emergence of the euro bias and to capital flows (e.g. Balli et al. 2010). When the analysis was broadened to include the crisis period, the above factor lost its significance for PIE inflow. It can be a result of the euro area crisis, capital outflow from certain euro area countries (peripheries) and inflow to other (central) countries called sudden stops and reversals (Merler and Pisani-Ferry 2012; Lane 2013).

Our research showed that factors reflecting capital market size, L_mrkt_cap_gdp, were significant for FDI capital flows in both 1990–2007 and 1990–2011 covering the global crisis period. Countries with developed financial markets (which are also global financial centers and have international currencies) play the role of funding sources for FDI, which – in the case of developed countries – are mainly in the form of mergers and acquisitions. An important variable which discouraged FDI inflow was private credit to GDP. In the case of developed countries, it can be an approximation of some kind of substitution between bank financing and equity financing.

In the analysis comprising 1990–2007 extended to include the financial crisis (2008–2011), capital market size L_mrkt_cap_gdp was another statistically significant factor for PIE. It should be assumed that investors operating during the increased global risk period paid more attention to liquidity, hence portfolio investment equities were flowing to markets with bigger market-based capitalization.

As regards the role of size and liquidity of capital markets, it seems that, in developed countries, foreign portfolio investors withdrew PIE if stock market turnover was high in the previous year. It might mean that investors exploited the opportunity of increased stock market turnover (L_stocks_gdp) to close their positions, which is likely since higher turnover often occurs simultaneously with changing trends in stock markets.

5.2 Debt flows

5.2.1 Determinants of debt capital flows in developing countries

The role of local profitability and risk

Debt inflow (PID and OI) to developing countries in 1990–2007 was primarily determined by local factors related to risks and profitability – see Table 3. In the case of OI, the regression analysis shows a positive relationship between GDP growth gdp_gr_lag5ymean and quality of telecommunications infrastructure telmob on the one hand and the direction of debt flows on the other hand. OI flows were, however, negatively affected by bigger turnover on the capital market L_stocks_gdp (it can confirm overheating of an economy, which could cause banking capital outflow and substitution of these two forms of financing) and the share of industry in GDP industrygdp (OI capital inflow was accompanied by deindustrialization processes).

Increasing global risk during crises

In 1990–2007, OI and PID were less vulnerable to global variables and appeared to be particularly affected by local factors. In the analysis extended to include the period of the global financial crisis, airdist had a statistically significant impact on OI inflow, apart from local factors. Therefore, contrary to equity capital, geographical distance was an important push factor determining debt capital inflow, which increased after extending the analyzed period till 2011. Among global factors, us10y_int proved to be the only significant variable (global long-run return).

In the case of PID, the following factors affected capital inflow positively in both periods: inflation level infl_lag5ymean (which was a factor increasing macroeconomic risk on the one hand but influencing interest rates on the other hand) and institutional environment quality (education level sch and civil liberties level cl). Financial crises crisislagmean in developing countries appeared to affect PID inflow negatively. This risk factor proved to be statistically significant for PID, indicating that it is more susceptible to local risk determinants than OI. However, it should be remembered that during financial crises the international financial system is vulnerable to contagion. As a result of herd behaviors of investors, financial crises may contribute to capital outflow also from countries that seem to have no economic ties. Broner and Rigobon (2005) observed that developing countries are more prone to such contagion than developed countries. What is interesting, positive spillovers from developed markets by the influence of global short-run return during 1990–2011 activated, reflecting the condition of the American S&P 500 market.

5.2.2 Determinants of debt capital flows in developed countries

Local and global factors related to risk and profitability

In developed countries, the debt capital inflow (PID and OI in total) was determined by both local and global factors, with relatively important differences observed in the determinants of PID and OI – see Table 4. For PID, only local factors were statistically significant in both analyzed periods, when foreign investors attached great importance to risk factors. This was because bigger public debt in relation to GDP L_debt reduced capital inflow while elimination of exchange rate risk in the euro area emu had a positive effect on PID inflow. Moreover, increased financial and monetary integration in the euro area caused an improvement in macroeconomic policy, which also contributed to the reduction of investment risk and home bias.

In the period including higher risk (1990–2011), the variable that ceased to play a significant role in PID shaping was inflation infl_lag5ymean, a factor which, in 1990–2007, could be considered to increase interest rates and, consequently, yield on investment in debt securities. Countries with better telmob and a higher servicesgdp also attracted more PID.

Similarly to PID, OI was negatively correlated with public debt in relation to GDP (only in 1990–2007) but also with higher turnover on the stock market. Local risk was thus an important factor affecting the inflow of this form of capital in both analyzed periods. The positive correlation between PID and servicesgdp can merely show that the services sector (1990–2007) was a destination for debt investments. Statistically significant factors also included institutional variables describing human capital sch (1990–2007) and telecommunications infrastructure telmob (1990–2011).

In addition to local factors, global factors had a statistically significant influence on banking capital flows in developed countries. It seems that OI is pro-cyclical because increased world economic growth gdp_world_gr was translated into higher banking capital inflow to developed countries in both periods covered by econometric analysis. In turn, in the period including the global financial crisis, the variable capturing the occurrence of financial crises crisislagmean was an important factor that hampered banking capital inflow.

6 Conclusions and policy implication

The structure of external liabilities can determine countries’ vulnerability to shocks. The latest financial turmoil gave more arguments to blame debt capital, rather than equity, for excessive volatility of inflows. Simultaneously, we should be aware that global factors played an important role also for equity flows (including FDI) mainly in the emerging economies, with an increasing role during the crisis. Relying on BMA analysis of the determinants of foreign capital inflows in 1990–2011, we can draw a few conclusions (see Table 5).

Firstly, FDI and PIE flows in developing and developed countries mainly depend on local changes resulting from internal characteristics of an economy. In the first case, FDI and PIE flows were driven by local real fundamental features (GDP per capita, communications infrastructure, social capital) and financial factors (exchange rate stability, the size and depth of financial markets) and had chiefly financial character in the case of developed countries. Factors beyond control of the recipient country (global) affected equity flows (FDI, PIE as well as all four types of capital) to emerging markets and had a bigger influence in the period of higher risk.

Secondly, analyzing capital flows, it is worth to divide portfolio flows into PIE and PID because they are driven by different factors. PIE flows are rather small in both groups of countries compared with PID and simultaneously both kinds of markets are overwhelmingly better developed in advanced economies. In the case of mature countries, the only common internal factor for PIE and PID was euro introduction (about half of advanced countries in the sample are members of the euro area). For PIE flows, size and depth of capital markets were critical, while for PID, inflation, crises, public debt, the size of the services sector as a % of GDP and communications infrastructure appeared to be significant. For developed countries, size and depth of capital markets were significant for PIE, and risk and profitability factors such as inflation, social and human capital and crises proved to be important for PID.

Thirdly, particular attention should be paid to bank financing because in both groups of countries global factors appeared important both in good and crisis times. It was confirmed by statistical significance of external factors representing both global assets yield (global GDP growth in developed countries, S&P 500 index increase) and global risk and distance from financial centers in developed (1990–2007) and developing (1990–2011) countries. Banking flows may be also more pro-cyclical because of an important role of local and world GDP growth as a driver and high susceptibility to local and global risk. In the case of developed countries, banking flows were the only form of capital affected by global factors.

Fourthly, the experiences from the last crisis confirmed that it is necessary to diversify financing sources and pay more attention to equity. The empirical part of the research confirmed that debt (PID and OI) might be more vulnerable to changes in national and global risks. Equity financing (FDI and PIE) in turn contributes more to risk sharing (affected by global profitability) and seems to be less dependent on external factors (at least in good times). It may suggest reduction of debt financing in favor of equity financing. However, PIE and even FDI can also be prone to bubbles (e.g. dot.com bubble, FDI bubble in the financial and real estate sectors before 2008). The above analysis confirmed that global factors are important for FDI and PIE inflows in developing countries.

Fifthly, financial globalization and dynamic changes in the international monetary and financial systems will continue to trigger the volatility of gross capital flows. Therefore, the aim of macroeconomic and structural policies nowadays, especially in developing countries, is to strengthen national financial systems resilience against abrupt capital flows. It is necessary to stimulate the development of national financial systems which allow for greater substitution of the various forms of capital. Hence, an efficient local mechanism for transmission of savings to long-term investment capital must be established. This means that it is necessary to develop local capital markets for corporate stocks and bonds as well as complement the banking sector offer, so that it matches firms’ demand for financing. The structure of FDI inflow may also influence countries’ vulnerability to external factors.

Notes

Dunning is one of the most referenced authors in the field of FDI motives. He not only identified three main types of FDI motives (market-seeking, resource-seeking, efficiency-seeking) but also proposed an eclectic theory specifying a group of three conditions that have to be fulfilled in order to stimulate FDI (Dunning 1993; Dunning and Lundan 2008, pp. 96–108). His OLI framework is based on Ownership advantages (O), Location advantages (L) and Internalization advantages (I). All of the advantages have to be present in order to decide to expand activity abroad, which decision is supported by unique companies’ resources (e.g. ability to take risks).

According to World Investment Report (2013), in 37 highly developed economies, the share of transferred earnings in FDI outflow increased from 30 to 60% in 2007–2012.

In turn, the measure of flow was used instead of stock because the latter may include valuation changes, due to exchange rate volatility (Alfaro et al. 2008).

Gross inflow category reflects changes in foreign liabilities, and includes the purchase of national assets by foreign investors (capital inflow) and the sale of national assets by foreign investors (capital outflow). Gross outflow reflects changes in foreign assets: purchase (capital outflow) and sale (capital inflow) of foreign assets by national agents. The sum of these two figures is equivalent to net flows.

Furthermore, the authors acknowledge that gross flows are pro-cyclical: both gross inflow and gross outflow tend to rise in the periods of expansion and decrease in worse economic conditions.

The use of portfolio approach in the assessment of the four forms of capital can suggest their substitutability in the eyes of foreign investors. In reality, investors of different profiles allocate their resources only in a particular type of assets. Financial investors will mainly prefer portfolio investment. In contrast, bank financing (in particular via subsidiaries) and FDI flows generally require longer-term prospects for financing and possessing particular tangible and intangible assets allowing for these forms of investment expansion. Therefore, it is difficult to speak about full substitutability between the various asset categories. Nevertheless, the use of factors describing risk and income is justified where they allow for a comparison of countries’ investment attractiveness in the different classes of investment assets. This means that allocating capital in a particular form, investors may compare the risk-income relationship between countries.

Higher values of the index denote lower level of civil liberties. We employed the index in the models estimated for the sample of emerging countries only, because it is identically low in the sample of advanced countries.

We also included the VXO index, volatvxo, elaborated by Chicago Board Options Exchange, which is a measure of global risk. This variable is often indicated as an important push factor, but in our case it was not statistically significant. It appeared statistically significant (with negative sign) in the model specification which is not presented in the paper and relates to dependent variable measuring aggregated debt flows (sum of PID and OI) in the case of capital inflows to emerging markets during 1990–2011.

For instance, the estimated coefficient of gdp_pc_const_usd obtained for emerging countries in the 1990–2011 period for FDI flows is equal to −2.34e-06. It means that a rise in the level of per capita GDP by USD 1000 would reduce the inflow of FDI by 0.00234. This seemingly small figure represents however a 7.3% fall in the FDI inflow.

See Moral-Benito (2010).

References

Abbas SMA, Belhocine M, El-Ganainy A, Horton M (2011) Historical patterns and dynamics of public debt – evidence from a new database. IMF Econ Rev 59(4):717–742

Acemoglu D, Johnson S (2005) Unbundling institutions. J Polit Econ 113(5):949–995

Agiomirgianakis G, Asteriou D, Papathoma K (2003) The determinants of foreign direct investment: a panel data study for the OECD Countries. http://www.city.ac.uk/economics/dps/discussion_papers/0306.pdf

Aizenman J, Sushko V (2011) Capital flow types, external financing needs, and industrial growth. NBER Working Papers 17228, National Bureau of Economic Research

Aizenman J, Chinn MD, Ito H (2013) The ‘impossible trinity’ hypothesis in an era of global imbalances: measurement and testing. Rev Int Econ 21(3):447–458

Alfaro L, Kalemli-Ozcan S, Volosovych V (2008) Why doesn’t capital flow from rich to poor countries? An Empirical Investigation. Rev Econ Stat, MIT Press, 90(2):347–368

Andrade RP, Prates DM (2013) Exchange rate dynamics in a peripheral monetary economy. J Post Keynesian Econ 35(3):399–416

Balli F, Basher SA, Ozer-Balli H (2010) From home bias to Euro bias: disentangling the effects of monetary union on the European financial markets. J Econ Bus 62(5):347–366

Barro RJ, Lee JW (2010) A new data set of educational attainment in the world, 1950–2010. NBER Working Papers No. 15902

Belke A, Setzer R (2004) Contagion, herding and exchange-rate instability — a survey. Intereconomics 39(4):222–228

Bernanke B (2005) The global saving glut and the U.S. current account deficit, remarks by Governor Ben S. Bernanke: The Sandridge Lecture. Virginia Association of Economists, Richmond

Bernanke B, Gertler M, Girlchrist S (1999) The financial accelerator in a quantitative business cycle framework. In Taylor JB (ed) Handbook of Macroeconomics 1. Amsterdam: North-Holland, pp 1341–1393

Biancareli AM (2009) International liquidity cycles to developing countries in the financial globalization era, http://www3.eco.unicamp.br/cecon/images/arquivos/publicacoes/publicacoes_20_2057235698.pdf

Blanchard O, Milesi-Ferretti GM (2009) Global imbalances: in midstream? IMF Staff Position Note 09/29

Blonigen BA, Piger J (2011) Determinants of foreign direct investment. NBER Working Papers No. 16704

Bluedorn J, Duttagupta R, Guajardo J, Topalova P (2013) Capital flows are fickle: anytime, anywhere. IMF Working Paper No 183

Bonizzi B (2013) Capital flows to emerging markets: an alternative theoretical framework. SOAS Department of Economics Working Paper Series, No. 186, The School of Oriental and African Studies

Broner FA, Rigobon R (2005) Why are capital flows so much more volatile in emerging than in developed countries? Working Papers Central Bank of Chile 328, Central Bank of Chile

Broner F, Dieder T, Erce A, Schmukler SL (2013) Gross capital flows: dynamics and crises. J Monet Econ 60(1):113–133

Broto C, Diaz-Cassou J, Erce A (2011) Measuring and explaining the volatility of capital flows to emerging countries. J Bank Financ 35(8):1941–1953

Brzozowski M, Śliwiński P, Tchorek G (2014) Wpływ zmienności kursu walutowego na strukturę napływu kapitału. Implikacje dla Polski. Materiały i Studia nr 309. National Bank of Poland

Calvo G, Leiderman L, Reinhart C (1993) Capital inflows and real exchange rate appreciation in Latin America. IMF Staff Pap 40(1):108–151

Calvo G, Leiderman L, Reinhart C (1996) Inflows of capital to developing countries in the 1990s. J Econ Perspect 10(2):123–139

Christodoulakis N, Sarantides V (2011) External asymmetries in the Euro area and the role of foreign direct investment. Working Paper 132, Bank of Greece

Combes J-L, Kinda T, Plane P (2010) Capital flows and their impact on the real effective exchange rate. CERDI, Etudes et Documents, E 2010.32

Coval JD, Moskowitz TJ (1999) Home bias at home: local equity preference in domestic portfolios. J Financ 54(6):2045–2073

De Conti B, Biancarelli A, Rossi P (2013) Currency hierarchy, liquidity preference and exchange rates: a Keynesian/minskyan approach, http://afep2013.gretha.u-bordeaux4.fr/IMG/pdf/de_conti_biancarelli_rossi_-_afep_2013.pdf

Dornbusch R, Goldfajn I, Valdes RO (1995) Currency crises and collapses. Brook Pap Econ Act 2:219–270

Dunning J (1993) Multinational enterprises and the global economy. Addison-Wesley, Wokingham

Dunning J, Lundan S (2008) Multinational enterprises and the global economy, 2nd edn. Edward Elgar, Cheltenham, UK

Eicher TS, Helfman L, Lenkoski A (2012) Robust FDI determinants: Bayesian model averaging in the presence of selection bias. J Macroecon 34(3):637–651

Escaleras MP, Thomakos DD (2008) Exchange rate uncertainty, sociopolitical instability and private investment: empirical evidence from Latin America. Rev Dev Econ 12(2):372–385

Feldstein M, Horioka C (1980) Domestic saving and international capital flows. Econ J 90:314–329

Fernandez A, Hausmann R (2000) Is FDI a safer form of financing?. Research Department Publications 4201, Inter-American Development Bank

Forbes K, Warnock FE (2012a) Capital flow waves: surges, stops, flight, and retrenchment. J Int Econ 88:235–251

Forbes K, Warnock FE (2012b) Debt- and equity-led capital flow episodes, NBER Working Paper 18329

Fratzscher M (2011) Capital flows, push versus pull factors and the global financial crisis. NBER, Working Paper 17357

French K, Poterba J (1991) Investor diversification and international equity markets. Am Econ Rev 81(2):222–226

Furceri D, Guichard S, Rusticelli E (2011) Episodes of large capital inflows and the likelihood of banking and currency crisis. OECD, Economics Department Working Papers No. 865

Grubel HG (1968) Internationally diversified portfolios: welfare gains and capital flows. Am Econ Rev 58(5):1299–1314

Hoeting JA, Madigan D, Rafterty AE, Volinsky CT (1999) Bayesian model averaging: a tutorial. Stat Sci 14(4):382–401

Itaki M (1991) A critical assessment of the eclectic theory of the multinational enterprise. J Int Bus Stud 25:445–460

Koop G (2003) Bayesian econometrics. Wiley, Chichester

Koutos G (2014) Positive feedback trading: a review. Rev Behav Financ 6(2):155–162

Laeven L, Valencia F (2012) Systemic banking crises database: an update. IMF Working Paper No 163

Lane PR (2013) Capital flows in the Euro area. Economic Papers 497, European Commission

Lane PR, Milesi-Ferretti GM (2007) A global perspective on external positions. NBER Chapters. In: G7 Current Account Imbalances: Sustainability and Adjustment, National Bureau of Economic Research, pp 67–102

Levy H, Sarnat M (1970) International diversification of investment portfolios. Am Econ Rev 60(4):668–675

Lucas RE (1990) Why doesn’t capital flow from rich to poor countries? Am Econ Rev 80(2):92–96

Magnus JR, Powell O, Präufer P (2010) A comparison of two model averaging techniques with an application to growth empirics. J Econ 154:139–153

Magud N, Reinhart C, Vesperoni E (2012) Capital inflows, exchange rate flexibility and credit booms. IMF Working Paper, WP/12/41, International Monetary Fund

Mayer T, Ottaviano G (2007) The happy few: the internationalisation of European firms. Bruegel, Brussels

McKinsey (2013) Financial globalization: retreat or reset?, McKinsey Global Institute

Melitz MJ (2003) The impact of trade on intra-industry reallocations and aggregate industry productivity. Econometrica 71(6):1695–1725

Mercado R, Park C-Y (2011) What drives different types of capital flows and their volatilities in developing Asia? Working Papers on Regional Economic Integration 84, Asian Development Bank

Merler S, Pisani-Ferry J (2012) Sudden stops in the euro area, Bruegel Policy Contribution 12. doi:10.5202/rei.v3i3.97

Mody A, Murshid AP (2005) Growing up with capital flows. J Int Econ 65(1):249–266

Mody A, Taylor MP (2013) International capital crunches: the time-varying role of informational asymmetries. Appl Econ 45(20):2961–2973

Moral-Benito E (2010) Model averaging in economics. CEMFI Working Paper No. 1008

Neumann RM, Peni R, Tanku A (2009) Volatility of capital flows and financial liberalization: do specific flows respond differently? Int Rev Econ Financ 18(3):488–501

Obstfeld M (2012) Financial flows, financial crises, and global imbalances. J Int Money Finance, Elsevier 31(3):469–480

OECD (2012) International capital mobility: structural policies to reduce financial fragility. OECD Economics Department Policy Notes, No. 13

Parry TG (1985) Internalization as a general theory of foreign investment: a critique. Weltwirtschaftliches Arch 121:564–569

Pavlova A, Rigobon R (2010) International macro-finance. NBER Working Paper 16630, National Bureau of Economic Research

Reinhardt D, Dell’Erba S (2013) Not all capital waves are alike: a sector-level examination of surges in FDI inflows, Bank of England. Working Paper No. 474

Reinhart C (2012) Capital inflows, exchange rate flexibility, and domestic credit. MPRA Paper 51263. University Library of Munich

Shleifer A, Vinshny RW (2011) Fire sales in finance and macroeconomics. J Econ Perspect 25(1):29–48

Smith KA, Valderrama D (2008) The composition of capital inflows when emerging market firms face financing constraints. Working Paper Series, 2007–13. Federal Reserve Bank of San Francisco

Solow RM (1956) A contribution to the theory of economic growth. Q J Econ 70:65–94

Sula O, Willett TD (2009) The reversibility of different types of capital flows to emerging markets. Emerg Mark Rev 10(4):296–310

Taylor MP, Sarno L (1997) Capital flows to developing countries: long- and short term determinants. World Bank Econ Rev 11(3):451–470

Tily G (2012) Keynes’s monetary theory of interest. BIS papers chapters, Bank for International Settlements

Tong H, Wei SJ (2010) The composition matters: capital inflows and liquidity crunch during global economic crisis. Rev Financ Stud 24(6):2023–2052

World Economic and Social Survey. Financing for Development (2005) United Nations, New York

World Investment Report (2013) UNCTAD

Wray LR (2009) The rise and fall of money manager capitalism: a Minskian approach. J Econ 33:807–828

Yupho S, Huang X (2014) Portfolio capital flows in Thailand: a Bayesian model averaging approach. Emerg Mark Finance Trade 50(2):89–99

Author information

Authors and Affiliations

Corresponding author

Appendix

Appendix

About this article

Cite this article

Tchorek, G., Brzozowski, M. & Śliwiński, P. Determinants of capital flows to emerging and advanced economies between 1990 and 2011. Port Econ J 16, 17–48 (2017). https://doi.org/10.1007/s10258-016-0126-5

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10258-016-0126-5