Abstract

Low carbon power technologies are needed to achieve net-zero emissions by 2050. Will major candidates nuclear, wind and solar power be able to scale-up multiple times? Our contribution to this inquiry focuses on the size of a typical generation plant to compare candidates across the criteria of physical scalability, building experience and financial lumpiness; the relative successes and failures of industries in recent decades are assessed. Because unit size differs by three orders of magnitude between each of these technologies, marked findings obtain. Smaller devices (power units) allow for more innovation, more financing and thus a faster uptake. Henceforth, solar photovoltaic displays the greatest ability to replace aging fossil fuel power stations, followed by wind power at some distance because its recent evolution is going contrariwise. Conversely, the outlook for nuclear power in the developed global north is somber and only mildly positive in the fast developing global south; we make a modest case for the novel nuclear modular concept. Looking ahead, alternative renewable sources, such as bioenergy, should also be actively pursued as they may provide much needed backup to intermittent wind and solar.

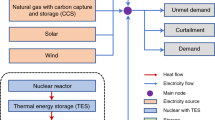

Graphical abstract

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

Introduction

The 2015 Paris climate agreement among 196 countries seeks a large reduction in GHG emissions and thus calls for an acceleration of the energy transition away from fossil fuels toward the so-called net-zero objective [as detailed by Giannakis and Zittis (2021)]. In the European Union, a novel taxonomy for sustainable activities makes the case for the prioritization of low-carbon technologiesFootnote 1 for that task remains debated, with claims often operating at different levels, which hampers a direct comparison, whereas energy economists see a clear role for nuclear as a low cost grantor of stability in electricity systems involving a large share of renewables, a vast majority of environmental economists is opposed to nuclear energy as a matter of principles regarding risk of accident, waste management or weapon proliferation. At the policy level, many OECD governments have already committed to a nuclear phase-out at the behest of their public opinion and placed their hopes onto renewables energy sources (RES) and energy efficiency. Our aim here is to bring forth a new comparative perspective for three of the main low-carbon contenders, namely nuclear, wind and solar (cf. “Appendix” for a detailed justification).

Nuclear power is a dispatchable (aka controllable) zero-carbon emitting electricity generation technology with a small lifecycle footprint (arising mostly from cement) compared to coal or gas. Against this favorable outlook, it carries the twin burdens of potential release of harmful radiation during an accident and the long-term management of radioactive waste. Since both issues involve deep uncertainties regarding the spectrum of possible outcomes and their unknown statistical distribution, it is impossible to summarize their socioeconomic impact into a single number, the way “levelized cost” does for the financial side. This important matter is however sidestepped.

Wind and solar photovoltaic power are likewise zero-carbon emitting renewable-based technologies with a low lifecycle footprint (arising from the use of steel and other metals and minerals) whose main drawbacks are intermittency (nature randomly decides when to produce) and low power density (requires large land area). The non-disruptive experience in the many countries where either wind or solar is now at the top of the electricity mix proves that the intermittency challenge has been met at a reasonable cost while land scarcity, even in densely populated western Europe, is still far from binding. Because the economic valuation in these two issues is not yet well developed, they are also excluded from our analysis.

Previously, Cherp et al. (2017) compared Germany and Japan in their development of the three technologies but not the technologies themselves. Focusing on Sweden, Hong et al. (2018) study the replacement of nuclear by renewables, highlighting the aforementioned cost of intermittency. Older articles are made obsolete by the steep fall of RES cost and, rather than pitting one technology against the other, present the alternatives side by side.

Our novel perspective compares the three sustainable technologies, not on the basis of past achievements, but with respect to replication, the ability to scale up quickly and ubiquitously, using current best commercial practices, to decarbonize the electricity sector. Three criteria are employed, all arising from a single fundamental characteristic, the physical size of a typical power plant which jumps by 3 orders of magnitude from solar to wind and then again from wind to nuclear.

Our plan is to assess each technology with respect to physical scalability (#1), i.e., whether the industry is ready to massively expand the construction of power plants, then with respect to the experience gained from past activity to reduce cost (#2) with a view to hasten diffusion. We then address conjointly how the (typical) plant size impacts industry financing (#3) in “Lumpy Finance” section. The conclusion offers an overall ranking among the three contenders and an educated guess regarding their fate within the current energy transition. Note lastly that all three technologies extensively rely on high voltage (HV) transmission to connect the remote areas of generation with urban load centers;Footnote 2 this limiting criteria can’t be used as a differentiator even though the power grid itself appears to be a very serious bottleneck for the ongoing energy transition .

Nuclear power station

Historical development

The nuclear civil industry was born after WWII to rationalize an onerous military investment and make nuclear energy socially acceptable, as explained for instance by Krige (2006). Interestingly, the nuclear power technology developed faster than wind or solar from theoretical physics in the 1940s to power plant grid connection in 1955. From then on, the scale of “first of a kind” US reactors launched by rival firms Westinghouse and General Electric grew quickly to take advantage of the scale economies achieved in coal power plants (cf. Yeh and Rubin 2007). The size of a US nuclear power plant has gained three orders of magnitude in just 15 years; momentum then slows as size only increases incrementally; the maximum of 1300 MW is reached in 1976.

This stalling is likely caused by the sheer size of the required components such as alternator, pumps, enclosing building, steel vat or concrete cover which can weight several hundred tonnes each. In all likelihood, these essential parts stood at the maximum size that specialized contractors were able to build. From 1966 on, most reactors are ordered at the maximum commercially available size, slightly above 1 GW, a benchmark figure that characterizes the nuclear technology with respect to size (of a typical unit). Additional scale economies are achieved by building up to six reactors at the same location and by employing the same design for other plants as successfully done by France, Japan, Korea or China (but not the USA due to the large number of business competing for each part of the job). Reactor builds were however sequential (spread over decades) because there were not enough skilled engineers and technicians to launch simultaneously all those budgeted. This labor restriction relates to our first criteria for comparative evaluation, scalability, which is fully developed in the next section through the lens of current efforts.

Our second criterion is the aptitude of an industry to learn from experience (e.g., better management, cost reducing innovations, financial prowess) in order to improve its building efficiency and ultimately reduce the total investment cost. On that front, the nuclear industry record is scant if not entirely absent. Koomey and Hultman (2007) document how cost spiraled out of control in the USA. Regarding pressurized water reactors, Boccard (2014) for France and Matsuo and Nei (2019) for Japan, document a mild cost increase taking place over the decades that saw the construction of several dozens reactors. Regarding light water reactors, Portugal-Pereira et al. (2018) arrive at a similar conclusion for a large world sample. The contrast with the positive learning experience for the wind and solar technologies cannot be overstated.Footnote 3

Current cost

Detailed and trustable information on any aspect of the construction of a nuclear power plant is hardly forthcoming, limiting the span of cases to be discussed. France has long been a poster child of nuclear power but is of late facing serious difficulties; the Court of Audit (2020) crudely details the problems faced by the European Pressurized Reactor (EPR).Footnote 4 The construction of two units was started in 2005 in Finland and in 2007 in France by competing French industrial actors. An issue glossed over by the report, but important with respect to the scalability criteria, is super-sizing, namely the difficulty of going beyond what downstream industrial contractors are used to or even able to build. As the EPR nameplate capacity increased \(18\%\) from 1400 to 1650 MW, so did the size of components such as core and boiler. If the historical values were the maximum ever made by industrialists in the 1990s, the novel components ordered in 2007 required inventing and testing huge pieces never built before, which is costly and time consuming. Furthermore, as the vapor flow and its pressure are increased in the new design (so as to increase output power), all structures must be made more resistant, adding to the technological challenge; it is worthwhile recalling that in a 1000 MW coal power station, components are smaller and weight less so that pressure and temperature in the steam generator can then be set at higher levels, thus increasing efficiency, the share of thermal energy turned into electricity, up to \(48\%\) for supercritical models against \(36\%\) for a nuclear reactor. Additionally, the construction lead time is shorter and certain (about 3 years) while the land footprint is similar (about 2 \({\text {km}}^{2}\)). The CCGT natural gas power stations further display improvements upon all these considerations.

Now, whenever a business has to make a special piece of equipment, its unit cost increases and it is likely to take a loss on that particular job; however, if the deed is successfully and the client orders more units, this business is now in a unique negotiating position as it is the world’s only maker of that particular equipment. For instance, Japan Steel Works (JSW) holds a de-facto monopoly for the steel cover of pressure vessels.Footnote 5 Consequently, the price paid by the reactor builder for each component includes a premium for exclusive know-how and there is no reason why after the “first of a kind” reactor is completed, the unit cost of this special item would fall for a “n-th of a kind,” this simply because no one is offering an alternative make.

Driven by what the Court of Audit (2020) qualifies as “severe mismanagement,” the monopoly effect, super-sizing, as well as a drastic increase in safety requirements after the 2011 Fukushima disaster, the overnight cost of the Flamanville EPR has ballooned. In 2004, prior to construction start, it was estimated (in good faith) at 2.8 bn€(2001) with construction under 5 years (on the basis of the performance achieved for the last N4 reactors build in the 1990s). These amounts translate into 3.65 bn€(2021) using the French CPI or 2.2 €/W to make comparisons easier. As of January 2022, the builder estimates the overnight cost to now stand at 12.7 bn€(2015), i.e., 13.5 bn€ of today’s money or 8.2 €/W, this with a minimum of 16 years of construction (i.e., grid connection scheduled in late 2023). Now, as the overnight cost excludes interest paid to creditors during construction (aka interim financial expenses), one must add a \(42\%\) premiumFootnote 6 to obtain a figure comparable to other electricity generating technologies (and later derive the levelized cost of electricity); the current building cost of a French new nuclear power is thus a staggering 11.7 €/W.Footnote 7

In Finland, the Olkiluoto EPR construction lasted 17 years with grid connection scheduled in early 2022, for an overnight cost that triples the initial estimate. Having absorbed its bankrupted challenger, Electricité de France (EDF) also started building twin EPRs at Hinkley, Great Britain, in 2017. The cost of this project has been revised in 2019 at 23 bn£ (25 bn€), i.e., 7.8 €/W. With commercial operation not scheduled before 2027, lead time will be at least 10 years which adds an extra \(23\%\) to the overnight cost to account for running interest, bringing the investment cost to 9.6 €/W. In contrast to the European experience, the two Chinese EPRs where EDF was involved successfully entered commercial operation in 2019; the total investment cost is said by authorities to be 4.5 €/W, including a \(60\%\) overrun and a 5 years delay.

From these experiences, one may conclude that the capital cost of a modern nuclear power station build in the OECD reaches a very high level; it is no surprise that the construction of two reactors, started in 2013 at the Virgil Summer plant in the US state of South Carolina, was canceled during the summer of 2017 after a financial audit revealed excessive cost increases. Similarly, the construction of two reactors at the Alvin Vogtle plant in the US state of Georgia since 2009 has run into many difficulties (cost overrun and delays) and currently continues only thanks to a federal loan. These developments illustrate the impossibility of financing the construction of nuclear reactors without heavy public support; this criterion is further explored in “Lumpy Finance” section.

Oddly enough, the OECD energy think-tank (IEA 2020) insists in predicting that a new nuclear power station may be completed in just 7 years (when the actual range of recent completions is from 9 to 17 years) at a median investment cost of solely 5 $/W, which is incidentally the actualized amount tabulated a decade earlier by IEA (2010),Footnote 8 completely ignoring the cost overruns in Europe and the US afflicting existing construction sites during that decade. The “magic-bullet” for such an optimistic outlook is to qualify the project as “n-th of a kind” under the implicit assumption that the nuclear industry will be able to reduce the high cost of a “first of a kind” with unit replication. As we indicated before, the literature has proven that this conjecture never materialized in any country over the six decades during which more than 500 nuclear reactors were constructed.Footnote 9

In the non-OECD countries where a few dozens of nuclear power stations are currently being built, cost information is inexistent or non-verifiable; it is probably much lower than in the OECD, but not only for the lower cost of labor and engineering. This author is unaware of the existence of a safety authority independent from local government, properly staffed and able to guarantee that design and construction match the latest international safety guidelines. One cannot therefore exclude the existence of a trade-off between cost and safety since the OECD high safety standards are a major source of cost.Footnote 10 Incidentally, this uncertainty makes it even more difficult to restore popular trust toward nuclear power in the OECD, independently of whether such mistrust is founded in the first place.

Political renaissance

The last decade has witnessed a call for renewing the civil-defense bond within the nuclear industry which has been deemed a national security imperative. In the USA, a former deputy secretary of defense, bluntly recognized that “the commercial case for new reactors is weak but America must remain in the commercial nuclear power business because it is the bedrock of the nuclear weapons program”, the cost of which is anticipated to rise from 30 to 50 bn$/year in the coming decades to maintain and modernize the nuclear weapons triad. A fifth of this expense goes to laboratories and support activities that have an obvious complementarity with the civil ones. The same case has been made in the UK since 2006, albeit in a more discrete fashion as explained by Cox et al. (2016). In France, the state remains the de-facto owner of the entire nuclear power chain and took a leading role in its reorganization with operator EDF absorbing loss making builder Areva and repurchasing in 2022 the famed Arabelle steam turbines from General Electric. As in the UK, a recent parliamentary vote confirmed the continued funding of nuclear deterrence and, similarly to the US case, the need to ramp up spending by at least \(50\%\). The link between the civil and military decisions is not mentioned in the media as the country’s entire political sphere remains a staunch supporter of both. In these three countries, nuclear power thus benefits from a political support not available to RES for a mission that is unrelated to the energy transition. Unsurprisingly, most nuclear reactor construction in the world today is taking place in countries who also own nuclear weapons and have the aforementioned incentives to co-maintain civil and military nuclear research.

The latest push in favor of nuclear power is its inclusion by the European Commission within the taxonomy for sustainable activities mentioned in the introduction.

Wind powered turbine

For centuries, windmills have harnessed the power of the wind to produce useful work. Once the technology for converting rotation into electrical current became standard, it was naturally applied to wind but remained a curiosity for decades. The oil crisis then triggered a push to increase the efficiency of this renewable source of energy and bring it to the market. Two physical phenomena are key to understand its development: Wind speed increases with height and energy conversion is proportional to the cube of speed. For instance, going up \(2\%\) from 50 to 51 m may bring up to \(1\%\) faster wind which in turn produces \(3\%\) additional energy. Such an efficiency effect trumps the greater cost of going higher (ridge vs. valley) and bigger (concrete vs. steel tower). Over just four decades, the size of commercial turbines has grown by two orders of magnitude from 25 kW in 1977 up to 10 MW for prototypes erected today. Yet, the typical turbine is almost three orders of magnitude smaller in physical characteristics when compared to a nuclear reactor;Footnote 11 the average delivered turbine size is 2.3 MW in 2017 for Europe (or 2.5 MW in the USA in 2019), which significantly lags with respect to the maximum size commercially available (5 MW for onshore, 6 MW for offshore); indeed, the 2 MW model started selling already 15 years ago.

This wedge between possible and undertaken is a manifestation of poor scalability (our first criterion), the difficulty of putting into practice the scale economies theoretically available. For wind power, the size evolution from kW to MW has created transportation and logistics challenges effectively limiting the height of land-based turbines and rotor diameter. In mature European and American markets, the largest land turbines (up to 4 MW) are thus located in valleys nearby highways but since these tend to be less windy than prime locations on mountain ridges, the turbine technology has evolved toward longer blades (so as to sweep larger areas), higher towers and lower power ratings so as to deliver a more steady less intermittent output (higher capacity factor). In Asia, where most capacity development now takes place, the average turbine size is still smaller but is increasing at a faster rate; it is however very likely that the same logistical issues will soon start to bind since population density is greater than in Europe.

Beyond achieving unit cost reductions, a driver toward larger turbines is multi-pronged land congestion: high-wind sites scarcity in areas already developed, rivalry with ecologists over the use of natural areas or with the tourism industry who fears a client backslash. Furthermore, in the forerunner countries where social acceptability of wind power was initially high, more and more people are developing a fear of these “threatening” sources of noise and deep waves in a manner reminiscent of the fear of radiation associated with nuclear power; this legal and political resistance ultimately shrinks the areas available to wind power sitting. The overall scalability of onshore wind power might therefore be close to its natural limit in densely populated regions.

The obvious alternative is to go offshore which represents an evolution more than a revolution since the seating of giant turbines at sea is a technical challenge that the oil industry is tackling without much difficulty. Unsurprisingly, the levelized cost is higher (vs. onshore) because of the greater cost of transport, installation, network connection and last but not least maintenance. Oddly enough, social acceptance is not meaningfully improved by “going far away” as local opponents now fight the so-called energy colonialism of developers. Another technical limitation for offshore scalability which might bind in the future is inferred from the nuclear power experience. The largest prototypes now erected by leading manufacturers include inner parts displaying the gigantism characteristic of nuclear reactors. The 9 MW Vestas V164 has a 400 tons nacelle standing at 140 m (like the visiting deck of the Eiffel tower); each blade is 80 m long and weights 35 tons; total turbine height reaches 220 m, like a skyscraper. It is then no surprise that some heavy equipment makers for the nuclear industry of the 1980s have successfully switched to the manufacture of wind turbines. Plans to build even bigger turbines exist; on the basis of the nuclear experience previously recounted, we express serious doubts they’ll become a resounding commercial success.

The (nearly) 3 orders scale difference between typical wind and nuclear units (MW vs. GW) also impacts the cost of global reliability. Dao et al. (2019) study a very large sample of wind turbines (WT) over their lifetime, finding each to suffer a mechanical or electronic issue about every two years and stop producing electricity for about a week.Footnote 12 Crucially, none of the other turbines on the wind farm where this happens is impacted so that the availability of a wind farm gathering 50 WTs of 2 MW rated power each is 49 WTs at all times, i.e., 98%. In comparison, the operating factor of nuclear power in France or the USA hovers between 75 and 80% over their lifetime; this lower benchmark is due to the existence of many causes forcing a nuclear reactor to shut down for a non-negligible duration (cf. next section). The energy produced by a wind turbine is thus close to the theoretical maximum corresponding to the wind average strength over the region, whereas nuclear power output is systematically below its theoretical maximum of 95% operating factor by some 15% (or more) which makes its electricity dearer by the same percentage.Footnote 13 The modularity of a wind farm composed from many identical units is the key for this better reliability.

Wind power is now assessed with respect to our second criterion: building experience. Globally, over 50 GW of wind power are build every year, or about 22,000 turbines allowing each of the major manufacturers to make about 3000 units each. Such large orders allow these businesses to offer dozens of varied designs, adapted to wind speed, gust variability and directionality and further, to introduce innovations every year, as opposed to a single model sold during the early years. This extended range widens the market, allowing in turn manufacturers to rip scale and scope economies and lower cost further. Although input supply constraints impacted turbine prices during the commodity boom of the 2000s, this virtuous circle has drastically cut the capital cost of wind power. This phenomenon is usually presented within the learning curve framework, stating that with each doubling of the installed base, a technology reduces its unit cost by a percentage \(\alpha \%\). Wiser and Bolinger (2019) study a large sample of wind power projects in the USA, observing that the unit cost fell in real terms from 4.5 $/W in 1983 down to 1.2 $/W in 2019 at a CAGR of \(-2.1\%\). In the meantime, world wind power capacity doubled 12 times which corresponds to a learning rate of \(6.4\%\), an impressive score for our second criterion when compared nuclear power (where a negative figure shows up). At the moment, the yearly growth rate of wind power capacity in land-poor Europe remains higher than 6% and about 10% in the land-rich USA. If these rates are maintained in the future, these regions will enjoy up to a five time over installed capacity by 2050. The main limitation to this goal is the aforementioned physical and socioeconomic forms of congestion which may become binding too early.

Solar photovoltaic panel

The quest for turning solar radiation into electricity using the photovoltaic (PV) effect is a recent endeavor, with a first prototype developed in 1954 (cf. Nemet 2019). The initial thrust is given by the space industry to power satellites; later, terrestrial applications for navigation, telecommunications and remote control created niche markets that allowed the PV industry to grow. Regarding the physical size of a generating unit, a commercial PV unit is rated in kW, that is to say three orders of magnitude below the wind power one. One could even say that the solar cell industry operates another three orders below since the standard solar cell rates 5 W and is smaller than a sheet of paper. By packing some 60 cells together, one creates a 300 W module whose size, shape and weight allow handling and transportation by a single (human) worker. The commercial product sold to homeowners is then a 1.5 kW panel, made by screwing five modules onto a metallic frame. A household rooftop installation with a handful of panels is typically enough to cover the family consumption on a yearly basis (abstracting from intermittence and seasonality). A commercial installation is about one order of magnitude larger, setting up dozens of rooftop panels on warehouses. As opposed to the previous technologies, the popular perception of solar PV is positive, appealing to progressives, conservatives and businesses alike, although for different reasons. The rooftop installation is however unavailable to city dwellers living in flats or to the shops located within buildings and malls. Similar to “wind farms,” power utilities operate “solar parks” gathering thousands of identical panels. Social acceptability remains high as these are relegated to barren areas deep in the countryside and are therefore not competing with agriculture nor beautiful landscapes. The emerging conclusion is that solar PV development is based on the serial and almost infinite easy replication of a single design; it is therefore perfectly scalable.

Reliability is another strong point of PV thanks to its modular plug&play (P&P) architecture. Indeed, a defective unit, whether a panel, power converter or control equipment, may be replaced by a new one within hours by an employee who does not require an advanced training or education and this, simply using a motorized vehicle. By comparison, wind turbine maintenance requires inspection by specialists not fearing height and in case of a malfunction, an helicopter will often be needed in order to remove the malfunctioning heavy piece of equipment from the nacelle. This additional complexity and cost however regards a unit generating thousands times more energy thus revenue, so that operation and maintenance (O&M) need not be more costly. As already mentioned, the failure of one turbine or panel does not compromise other onsite units. Conversely, as soon as one small component fails in a nuclear power plant (e.g., an innocuous pipe as shown by ASN), the latter must be stopped for possibly a long time to allow inspection and, if needed, change of the component under the strictest safety conditions. Because of the radiation risk, this requires highly qualified people and lengthy procedures. If a more serious incident occurs, then all identical reactors in the country must be stopped to perform an extensive check. Furthermore, current reactors that were designed in the 60s and even the EPR, an evolution designed in the 80s, do not have a P&P architecture which means that entire large components must be changed even if only one tiny piece or fragment inside is damaged (e.g., soldering defects on the steel cover). The P&P nature of solar PV not only yields a low maintenance cost, it also makes the entire support chain scalable as it builds on low-skilled labor. The only potential scalability brake to unbridled PV expansion is its large land requirement (aka low power density) which may be an issue for individual counties but not for a meshed continent (if the required novel HV cross-border lines may be constructed in due time).

Regarding the criterion of building experience, the aforementioned ability of the wind power industry to reap efficiency gains from the competition between a dozen of turbine makers for thousands of units is brought to another dimension for solar power cells since there are literally hundreds of academics teams and start-ups who continuously work to improve the reliability and conversion efficiency of cells. Successful innovations are then copied and practiced rapidly by dozens of businesses, which together produce billions of cells every year. Importantly, the raw materials needed are mostly cheap minerals whose price reduction (e.g., \(-7\%\) CAGR for silicon since the 2008 commodity boom peak) has contributed to lower the price of PV systems. Barbose et al. (2019) study a large sample of residential PV installations in the USA and observe that the real cost of acquiring and installing a rooftop PV system (including labor) has fallen from 12 $/W in 1992 to 3.7 $/W in 2019 at a rapid \(-5.2\%\) CAGR. Since there were 20 duplications of the installed world capacity in the meantime, this translates into a learning rate of \(7.4\%\), even faster than for wind power.

Lumpy finance

For each of the low carbon technologies under scrutiny, the upfront construction expense (aka overnight cost) represents a major share of the lifetime cost of operation. In a perfect capital market, with full information on all sides, an investment of any size will be financed if it can generate a fair return. In actual markets, large investments are at a disadvantage as they require rounding up more sources of finance and incur larger transaction costs. A lumpy technology, one with a large minimum size of operation, will, therefore, not only pay a higher risk premium, but more importantly be limited to deal with a handful of large financial actors; this scarcity results in a small number of deals signed. With a lower rate of entry into the electricity generation market, this technology will create less activity for the supply industry who will thus learn at a slower rate. Compared to other sectors of the economy or even other energy technologies, this industry becomes a laggard, being less efficient than the average; it may even be forced to exit after a strong macroeconomic shock or be pushed away by competitors relying on a fast evolving alternative technology. This section works out the practical consequences of lumpiness for our three candidate low carbon technologies.

Relation to country wealth

Lumpiness is clearly at play when comparing nuclear, wind and solar. Indeed, the exceptionally large differences in the physical size of a typical unit imply equally large differences in the minimum financial basis of operation. For each technology, the overnight cost is computed in the past (1970s or 1980s) and today, this in relation to the country’s wealth, i.e., how many individual incomes must be put together to finance one typical unit. In the heyday of nuclear power in the USA (1967–1972), when cost had not yet spiraled out of control, the overnight cost of a standard 1 GW reactor was equivalent to the income of a quarter million people. Clearly, such a large investment whose recovery is spread over a very long lifetime (50+ years) can only be funded publicly or with a public guarantee.Footnote 14 The comparison with France is instructive because one unit ordered in 1970 had a cost equivalent to the income of 84,000 people, a third of the US figure, i.e., EDF managed to build three reactors from the same kind of public money when US contractors could only build one.Footnote 15 This may explain why France kept ordering reactors throughout the 1970s while almost half of the US projects were abandoned during the same period (before the Three Mile Island accident). Today, nuclear energy is vastly more costly but the US economy is also richer to the point that our indicator has not changed. Hence, a nuclear reactor is not dearer to the American economy today when compared to the best units they build in the past. The situation is entirely different in France because the EPR price tag has risen faster than economic activity to the point that the income of 315,000 French people is needed to complete the plant. The French “advantage” in building nuclear reactors has thus evaporated.

Regarding wind power, the cost of a (then standard) 55 kW turbine from the early 1980s was about the yearly income of five Danes or eight Americans. With enough output to power a business or dozens of homes at once (whenever the wind blows), a wind turbine is an alternative to procuring electricity from the central grid. This explains the success of cooperatives gathering a few dozen people to finance the acquisition of one turbine for the local supply of green electricity. This demand pull then generates a positive feedback by giving work to new businesses that can thereafter improve and build better and cheaper turbines. As seen previously, the unit cost fell sharply but since the typical size grew by about two orders of magnitude, the acquisition today of a standard 2 MW wind turbine still requires 55 danish yearly salaries (66 in the USA). The drive to catch more wind (at higher altitude) has thus upended the design of turbines. As a consequence, these are nowadays bought solely by large undertakings, mostly utilities and sometimes large cooperatives gathering thousands of households.Footnote 16 Likewise, on the supply side, only a few dozens businesses survive at world level to produce turbines in significant numbers, so that wind power may now be deemed a “big business” without any room for tinkering and experimentation by start-ups.

Going back to 1975, the cost of a single solar PV panel is estimatedFootnote 17 to be about 13 times the yearly average income of a US citizen. This amount, though astoundingly large for the little electricity produced, was nevertheless within the reach of a small business on either side of the market, i.e., whether to acquire a PV system or to become a maker of PV systems. Crucially, this finding is independent of the resulting cost per kWh of electricity, the final product. This investment granularity is, in our opinion, the key to the rapid development of the PV industry (even faster than wind power) as dozens of firms were able to enter this market and each test its own ideas. In contrast to the wind power technology, progress has operated inside the solar cell, while keeping the same outer panel shape. Because the module cost has fallen by two orders of magnitude, a PV panel now represents a little more than one month of salary, meaning that even a middle class family may acquire it from its accumulated savings.Footnote 18 The same computation for Germany puts the 1.5 kW panel on par with a single yearly salary in 1990; it has since fallen down to 2 weeks of the average wage.

Relation to diffusion

It is a foregone conclusion that technological diffusion relies heavily on market expansion and the latter is faster when the entry cost is low, i.e., when the technology is not lumpy but granular. After an initial loss making push to jump start the production of a first version, it is essential that, for one reason or another, the second generation of the product under consideration be appealing to a larger potential client base. Most often, the successful industrialist will achieve scale economies with a larger batch, thus becoming able to lower his price and expand dramatically toward the middle class, small businesses or developing countries while still turning a profit on every unit sold. For electricity, the key selling point has traditionally been the kWh price, so that the cheaper technology tends to dominate the market as was the case in the 1990s with the Combined Cycle Gas Turbine (CCGT) whose efficiency was greatly improved with respect to previously existing gas technologies. Let us then look at the idiosyncrasies of nuclear, wind and solar.

Solar PV was initially extremely expensive, thus unthinkable for mass electricity generation but its autonomy gave it enough value to develop in niche markets, first into space, then for applications where mobility is a plus. Wind power also started at a disadvantage being intermittent, bulky and 2 or 3 times more expensive than coal power in levelized terms ($/MWh). Its breakthrough came when climate change bestowed renewables with a new non-monetary value (being zero-GHG emitting). Public subsidies in California and northern Europe kick started the aforementioned virtuous circle of diffusion. The same schemes were later applied to solar PV in order bring it to the mass market (cf. Nemet 2019). The impressive success of solar PV in the developing world (in contrast to the relatively slower uptake of wind power) is clearly driven by scalability and granularity, allowing even the most cash constrained community such as an isolated village to afford some useful solar panels. Importantly, the acquiring community or household does not need to wait for higher up authorities to endorse PV to go on, thus making diffusion even faster.

In a similar but more muted fashion, the million euro price tag of a modern mid-size wind turbine remains a manageable investment for a city council or a county; in the global north, this amount may be leveraged by a local savings bank or an ad hoc cooperative, bringing together hundreds of people, each investing a few thousand dollars. The opportunities to develop wind power projects are also increased politically since gathering the adequate support is easier. Indeed, not all localities desire wind power but in many boroughs or counties, a majority will form to erect some wind turbines (without neighbors being able to block it). Good scalability and limited lumpiness have thus allowed wind power to expand around the world much faster than nuclear power, even in the non-OECD countries that are currently building new reactors.

This virtuous circle never took off for nuclear power in either the UK or the USA and only worked for a few decades in France and Japan (who may have learned from these mistakes). The basic reason for this very limited reinforcement is that the sheer size of a reactor limits the number of concurrently build units to a handful, even in a major industrial country (which incidentally is the case for all the major developers previously cited). The opportunity to test new designs is thus absent; a single technological path resulting from chance moves rather than rational testing-and-revising is enforced by the government’s nuclear agency (cf. Boccard 2014). Next, the billion price tag forces the financing side to undertake a huge risk which a purely private player is unlikely to accept. It is therefore no surprise that all nuclear reactors in the world have been constructed either directly by the state-owned national electricity company or by a private business with a state backed loan or a recovery guarantee from a public institution (e.g., a US state utility commission).

At the outset, it seems patent that a technology displaying a combination of both limited physical size and price tag (per working unit) has a greater chance of being picked up; it is indeed much easier to finance, even if its unit capital cost ($/W) is initially much greater than that of current market leaders. The stark diffusion difference observed between nuclear, wind and solar may thus be ascribed to the three orders of magnitude size difference between each of these technologies as it trumps any other consideration. Our low-carbon technologies may now be ranked in terms of ability to propel the energy transition: The smaller the typical unit, the faster it may diffuse in the economy; hence, solar dominates wind which in turn dominates nuclear. Beware that our finding is no endorsement of the ecology motto small is beautiful for all three technologies showcase generous government funding at the R&D and seed stages, followed by profit-seeking capital infusion of successful pioneers at the replication stage. Finally, at the decisive manufacturing stage, there is only a dozen of solar panel makers who make over one bn$ of annual revenue while on the demand side, the infatuation of homeowners for solar panels should not blind the reader to the fact that the bulk of PV growth is driven by profit-seeking solar-parks operators who each invest hundreds of millions of dollars at once.

Note lastly how the successful diffusion of solar PV mimics the development of personal electronics whence decades ago, only rich corporations and governments owned the priced mainframe computers. The personal computer then entered smaller and smaller businesses until it ended-up in every house of the rich world. Today’s the Android smartphone is even more powerful and present everywhere on earth because of its low price tag (and the faster development of wireless networks compared to land lines).

Conclusion and policy implications

This perspective has recalled the ability of the wind and solar PV power technologies to constantly improve. This achievement contrasts with the woes of civil nuclear power which has only managed to replace aging stations (since the turn of the century). Since the stakeholders, scientists, engineers and technicians working in these industries are equally qualified, their differing fate may not be ascribed to a lack of intent or an intellectual deficit; rather, our analysis points to the difference in their scale of operation which is the roof of lasting consequences.

Even though the past is not always the best predictor of the future, it would seem that the cards dealt by nature are stacked against nuclear power within the energy transition toward a low-carbon all-electric society. There is indeed every indication that the already considerable cost gap between nuclear and RES (about 12$/W vs. 4$/W) will continue to widen. Even if one accounts for the intermittent nature of wind and solar and their need for a dispatchable back-up source of power (possibly fossil based), the levelized cost increase is still moderate; all the more so if one adopts a continental perspective instead of one limited to an imaginary islanded country. The decision by many governments to embark on a nuclear phase-out then reflects cold economic rationality, namely that “nuclear is too dear to build” rather than “too cheap to meter” as claimed in its heyday. Contrarywise, the governmental intent in America, Britain and France to endlessly support their civilian nuclear industry reveals their attachment to nuclear dissuasion.

In Asia, the Fukushima accident and the ensuing intensified citizen activism have eroded popular support for nuclear power in the advanced economies of Japan, Taiwan and South Korea; in the latter two countries, government is planning a phase-out. India, Pakistan and China offer a mixed case because, on the one hand, these countries aim to maintain or even develop their nuclear weaponry, which is certainly a driver of their decision to keep building nuclear power stations. On the other hand, these countries also need to expand rapidly their electricity supply and have thus warmly embraced wind and solar power. Insofar as the comparative advantage of renewables keeps improving, the case for nuclear power will also weaken in Asia.

The nuclear industry, and its governmental backing, has acknowledged some of the challenges it faces regarding scalability, experience and lumpiness; it now promotes the small modular reactor (SMR) that should, if some are finally build and connected, become akin to a very large wind turbine regarding our three criteria. Indeed, by shrinking the reactor size, one enables transportation of the main parts for faster on-site assembly. Still, the existing competing designs remain quite big at about 100 MW and thus very expensive to pull off for a risky “first of a kind” unit.Footnote 19 This feature has considerably slowed the development of the many SMR projects launched since the turn of the century; as could be expected, all are public or publicly financed, which further slows the process. At the outset, the mitigation of climate change requires us to explore all possible avenues to find workable solutions toward achieving net-zero emissions, especially as putting all hopes on a single idea or technology is highly risky. We agree with the European Commission that nuclear energy should remain within our collective portfolio. Yet, even after accounting for its low-carbon quality, nuclear power remains too expensive for the public purse to finance conjointly EPRs (or similar third generation reactors) and SMRs. We therefore advocate against the former to give a chance to the latter.

An avenue for future work will be to try estimating econometrically, at country level, the impact of more precisely defined components such as legal framework, support policies, economic structure, geography, climate and technical progress or patent publications.

Data availibility

Additional references, figures and illustrations are available in the working paper version at https://doi.org/10.2139/ssrn.3768026.

Notes

“Sustainable activities” in the jargon of the European Commission novel taxonomy which includes nuclear power, as stated in the February 2022 Complementary Climate Delegated Act.

Land suitable for massive wind or solar development tends to be far from urban centers; likewise nuclear power stations must be located at the seafront or next to large rivers unlike a natural gas plant fitting in a football field.

As duly noted by a reviewer, neither the storage cost of spent nuclear fuel nor the decommissioning power plants at the end of commercial life are accounted for, most likely because it remains a highly uncertain figure.

Renamed evolutionary after the German side walked out in 1998, foreshadowing their nuclear phase-out.

The Flamanville cover made by Areva was found risky by the safety authority ASN who nevertheless allowed use on the condition that a new one, made by JSW, be rapidly installed. At any rate, JSW is likely losing money on that line of business because of weak demand since the Fukushima accident.

The French official rate for energy investments of \(r=4.5\%\) is applied to \(\frac{(1+r)^{n}-1-rn}{r n} \) for \(n=16\).

The Court of Audit (2020) even arrives at a higher cost by considering a series of necessary additional items.

Table 3.7a authored in 2009 for a 2015 commissioning gives 4.5 and 3.8 $/W for the EPR and US equivalent model; the average is 5 $/W in today’s money. Table 3.4a authored in 2019 for a 2025 commissioning, gives an average over EU and US and over 3% and 7% interest rate of 4.9 $/W. New build length of 7 years is stated page 38.

The IEA stubborn opinion is likely due the report co-authorship by the OECD Nuclear Energy Agency (NEA).

Cf. kerfuffle at Taishan reactor with operator and constructor’s differing responses to a safety incident.

To access wholesale markets, a wind power operator needs a 100 MW portfolio which may be achieved on a single “farm” by packing dozens of identical turbines over a compact land area so as to reap scale economies by avoiding the duplication of some cost elements (e.g., access road, connection line).

Beyond these averages, there is a very large dispersion within the studied samples.

Data from the Power Reactor Information System (PRIS) at the International Atomic Energy Agency (IAEA).

No nuclear reactor has ever been build on private investment alone, the closest being US plants whose income is guaranteed by Public Utility Commisions or the UK government’s contract for difference awarded to EDF for Hinkley.

Figures from our earlier work (Boccard 2014) are used to estimate a real all-inclusive overnight cost.

The European Commission push for mini-wind is precisely aimed at restoring this direct link between the local electricity consumer and the local windmill.

There is no information regarding a PV system, only records of modules prices. Using the fact that the latter was about \(45\%\) of the overall bill, allows to recompute the cost of a 1.5 kW PV system.

In many regions, consumer credit is now extended to middle income families in order to allow for the acquisition of the PV system that is repaid by green certificates, tax exemptions or reduced electricity bills.

The NuScale projected plant in Idaho (US) binds together a dozen SMRs in the hope of lowering unit cost; it shall end up costing at least 3 bn$, like a legacy nuclear power plant.

References

Barbose G, Darghouth N, Elmallah S, Forrester S, Kristina SHK, Millstein D, Rand J, Cotton W, Sherwood S, O’Shaughnessy E (2019) Tracking the sun: pricing and design trends for distributed photovoltaic systems in the United States. Technical report, Lawrence Berkeley National Laboratory

Boccard N (2014) The cost of nuclear electricity: France after Fukushima. Energy Policy 66:450–461

Cherp A, Vinichenko V, Jewell J, Suzuki M, Antal M (2017) Comparing electricity transitions: a historical analysis of nuclear, wind and solar power in Germany and Japan. Energy Policy 101:612–628

Court of Audit (2020) The EPR sector. Technical report, French Court of Audit

Cox E, Johnstone P, Stirling A (2016) Understanding the intensity of UK policy commitments to nuclear power. Technical report, SWPS

Dao C, Kazemtabrizi B, Crabtree C (2019) Wind turbine reliability data review and impacts on levelised cost of energy. Wind Energy 22(12):1848–1871

EC (2022) EU taxonomy compass for energy. Technical report, European Commission

Giannakis E, Zittis G (2021) Assessing the economic structure, climate change and decarbonisation in Europe. Earth Syst Environ 5(3):621–633

Hong S, Qvist S, Brook BW (2018) Economic and environmental costs of replacing nuclear fission with solar and wind energy in Sweden. Energy Policy 112:56–66

IEA (2010) Projected costs of generating electricity. Technical report, International Energy Agency & Nuclear Energy Agency

IEA (2020) Projected costs of generating electricity. Technical report, International Energy Agency & Nuclear Energy Agency

Koomey J, Hultman NE (2007) A reactor-level analysis of busbar costs for US nuclear plants, 1977–2005. Energy Policy 35(11):5630–5642

Krige J (2006) Atoms for peace, scientific internationalism, and scientific intelligence. Osiris 21(1):161–181

Matsuo Y, Nei H (2019) An analysis of the historical trends in nuclear power plant construction costs: the Japanese experience. Energy Policy 124:180–198

Nemet G (2019) How solar energy became cheap: a model for low-carbon innovation. Routledge, London

Portugal-Pereira J, Ferreira P, Cunha J, Szklo A, Schaeffer R, Araújo M (2018) Better late than never, but never late is better: risk assessment of nuclear power construction projects. Energy Policy 120:158–166

Sekar M, Praveen Kumar T, Selva Ganesh Kumar M, Vaníčková R, Maroušek J (2021) Techno-economic review on short-term anthropogenic emissions of air pollutants and particulate matter. Fuel 305:121544

Wiser R, Bolinger M (2019) Wind technologies market report. Technical report, Lawrence Berkeley National Laboratory

Yeh S, Rubin ES (2007) A centurial history of technological change and learning curves for pulverized coal-fired utility boilers. Energy 32(10):1996–2005

Funding

This work is supported by Generalitat de Catalunya (AGAUR-SGR-1360) and Ministerio de Ciencia, Innovación y Universidades (PID2019-106642GB-I00).

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

The author declares no conflict of interest nor financial interest to report.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendix

Appendix

This perspective focuses on how rapidly scale up the generation of non-polluting electricity (cf. Sekar et al. 2021); the focus is thus on electricity rather than energy which already limits the renewable technologies available for comparisons. Next, because climate change is a global problem, we consider the whole world rather than a particular region (where bioenergy may be a major player); lastly, as a fast reaction is needed, only mature technologies that have already reached commercial scale qualify since all the other ones will need decades more to reach that state.

As may be observed from Table 1 sourced at the International Renewable Energy Agency (IRENA), solar photovoltaic and onshore wind have been growing fastest since 2000 and reached a meaningful share of the electricity mix; other RES candidates for a significant role in the future are biogas and municipal waste; since their shares are still testimonial, we did not consider them as viable alternatives to nuclear or fossil fuels. Neither did we consider biomass since it has been re-qualified away from carbon neutrality by the EU taxonomy (EC 2022).

Rights and permissions

About this article

Cite this article

Boccard, N. Nuclear power versus renewables: a scale perspective. Clean Techn Environ Policy 24, 1949–1959 (2022). https://doi.org/10.1007/s10098-022-02307-z

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10098-022-02307-z