Abstract

This paper ranks two widely used command-and-control environmental instruments, in terms of relevant equilibrium variables such as output, profits, consumer surplus and social welfare. Specifically, we consider n symmetric and polluting firms that compete in quantity, have access to an exogenous cleaning technology (that cannot be modified by the firms) and are subject to environmental regulation by means of either emission or performance standards. We consider a one-stage game, where the instruments are exogenously fixed in such a way that pollution coincides for both regimes. In this game, the performance standard dominates in terms of output and consumer surplus, but the firms prefer the emission standard. In terms of social welfare, the performance standard may dominate the emission standard when the number of firms is limited, which contrasts with the case of perfect competition, where the emission standard is welfare-superior. These results on social welfare prevail when we introduce a previous stage where the environmental authority optimally chooses the instrument by maximizing social welfare, that is, when we endogenize the policies.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Environmental issues have become a serious and growing problem; since the 1950s, a wide literature has emerged to develop and analyze possible regimes to face pollution and improve the quality of the environment (Pearce 2002). Requate (2005, 2006) presents thorough surveys of many theoretical studies on several policies imposed to polluting firms, with the objective of reducing damaging emissions discharged to the atmosphere as a result of the production process. Such works analyze many market structures, including the Cournot oligopoly, which is the one that concerns this work.Footnote 1 In his surveys, Requate (2005, 2006) emphasizes the relevance of studying the implications on social welfare of the different policies used to reduce pollution; however, few works have been written on the subject.

As a contribution to fill this gap in the literature, we compare the performance of two command-and-control regulatory instruments in terms of social welfare, when the abatement technology is exogenously given and under imperfect competition; such regimes are the emission and the performance standard. The first one provides the firms with an absolute emission cap that should not be exceeded; in contrast, the performance standard is a relative instrument, it sets the fraction of emissions that should be abated.

The study of the emission and the performance standard is particularly relevant because compared to other market-based instruments, like taxes or tradable permits, standards are observed to be the dominant policy in practice (Harrington et al. 2004; Hueth and Melkonyan 2009; Viscusi et al. 2005); the performance standard is the most common, but also one of the least studied (Requate 2005).

Besides analyzing which standard provides a higher social welfare, we compare other variables of interest, such as output, consumer surplus and profits. Specifically, we consider n symmetric and polluting firms that compete à la Cournot and are subject to environmental regulation. To comply with the regulation, the firms possess an exogenous abatement technology, which corresponds to an end-of-pipe cleaning technology. We abstract from any production cost to focus on the regulations and abatement technology effects. Then we analyze the performance of the industry under both standards, to see which one generates more production, consumer surplus, profits and social welfare. We study two different cases: when the regimes are exogenous and they incentivize the same amount of pollution, and when they are endogenously set to maximize social welfare.

For the one-stage game, we show that the firms produce more with the performance standard but it is more profitable for them to face the emission one. It stands out that in the presence of market power, it is possible that the performance standard provides a higher social welfare than the emission standard, we provide a sufficient condition for that to happen. With perfect competition, it is always the emission standard that dominates.

The difference in the equilibrium outcomes between regulatory instruments is due to the difference in the marginal abatement costs tacitly imposed by the regimes. By definition of the performance standard, when the firms increase their production, they have to abate only a fraction of it; on the other hand, if the emission standard is the regulation, the firms have to abate one unit of emission for every additional unit of production (we assume that one unit of production generates one unit of emission). Hence, the performance standard represents a lower marginal abatement cost for the firms, even though the cleaning technology is the same under both regulations. As a consequence, the firms produce more with this instrument, which benefits the consumers and may improve social welfare.

In a similar study, Lahiri and Ono (2007) show that the performance standard is welfare-superior than a tax (they only consider the one-stage game), but they do not incorporate the emission standard in their study. Amir et al. (2018) study a similar setting to ours, but they add a stage where prior to competing in quantity, the firms invest in R&D to lower their abatement cost. This additional stage complicates the analysis of a general industry and, therefore, the authors restrict their study to a particular industry with linear demand and abatement cost. When the regimes are exogenous, the comparison of social welfare can go either way. If the instruments maximize social welfare, the performance standard dominates. For both games (exogenous or endogenous regimes), the propensity of the firms to produce and invest in R&D varies between the instruments and with the parameters.

Works like Amir et al. (2018) or Montero (2002b)Footnote 2 suggest that a general ranking of the environmental regulations in terms of their effects on the equilibrium variables is not clear-cut when investment in R&D is included in the model. But when the abatement technology is fixed and cannot be modified by means of R&D, the analysis provides general conclusions for production and profits, and a guide to compare social welfare. Hence, our results are complementary to those of Amir et al. (2018) and Montero (2002b).

Besides studying their effects on social welfare, there are several other ways in the literature to rank policy instruments. For example, by analyzing their cost-effectiveness (which policy improves the environment at the least cost), political and institutional feasibility, effects on income distribution, ease of monitoring, enforcement and administration, pre-existing taxes, and the incentives they provide to develop new and cleaner technologies.Footnote 3

The following section introduces the model, including the definitions of the command-and-control instruments under study. Section 3 presents the standard assessment, considering the cases where the regimes are exogenous (one-stage game) and endogenous (two-stage game); studying the one-stage game becomes really useful to analyze the two-stage game. Conclusions are in Sect. 4 and the last one contains the proofs.

2 Preliminaries

Consider a polluting industry with n symmetric firms that compete in quantity. Firm \(i=1,\ldots ,n\) produces \(q_i \ge 0\) units of output, whose price is given by the inverse demand function P(Q), where \(P:[0,\infty ) \rightarrow [0,\infty )\) and \(Q=q_1+q_2+\cdots +q_n\) is the total output produced in the industry. Without regulation, every unit of output produced generates a unit of polluting emission,Footnote 4 which causes a damage to the environment measured by the function \(D:[0,\infty ) \rightarrow [0,\infty )\). Since production harms the society, the firms are subject to environmental regulation. To this end, the regulator may choose between the emission and the performance standard, both of them will be described in detail below.

Whatever the environmental policy is set, it will force the firms to reduce their amount of emissions. To comply with the regulation, the firms possess an abatement technology, which allows them to reduce their emissions in y units at cost C(y), \(C:[0,\infty ) \rightarrow [0,\infty )\). Observe that such technology is exogenous, such as in Boom and Dijkstra (2009), and cannot be modified by means of R&D. For simplicity, we assume that production is costless so that we concentrate solely on the effects of the abatement technology and the environmental instruments. Our results can be generalized in a relatively easy way for a more general joint cost function C(q, e), where q is individual output and e individual emissions, that satisfies Assumption 4 in Requate (2006).Footnote 5 But some additional assumptions would be required, especially to satisfy the second-order condition (5). Further discussion will be provided in Sect. 4.

Throughout this study, we adopt the following assumptions that are standard in the literature:

- (A1)

\(P(\cdot )\) is twice continuously differentiable, \(P'<0\) and \(P'+QP''<0\);

- (A2)

\(D(\cdot )\) is continuously differentiable and \(D'>0\);

- (A3)

\(C(\cdot )\) is twice continuously differentiable, \(C'>0\) and \(C''\ge 0\).

Assumption (A1) reflects the law of demand and guarantees the stability of the equilibrium, (A2) establishes that damage increases with the number of emissions, and (A3), that the cleaning cost increases with the abatement at an increasing rate. Next, we describe the two regulatory instruments under study and their role in the firms’ decisions. Since the firms are symmetric, we assume that they are subject to the same regulation, that is, they all face the same instrument and level.

2.1 Emission standards

Under this regime, the regulator chooses the maximum amount of emissions that each firm is allowed to generate, let us call this amount e, which is greater than zero (the regulator chooses an absolute emission cap). Since the cost of abatement is strictly increasing, the firms will choose to pollute as much as they can, and firm i, \(i=1,2, \ldots ,n\), will discharge e emissions to the atmosphere. As a consequence, the firm must reduce its emissions in \(q_i-e\) and its optimization problem becomes:

where \(q_{-i}\) denotes the output produced by the firms other than firm i, i.e., \(q_{-i}=Q-q_i\).

Assuming differentiability, the first-order condition (FOC) of the firm is given by

the second-order condition (SOC)

is satisfied by assumptions (A1) and (A3), then we have a unique and stable solution.

For ease in the notation, we denote the equilibrium individual output by \(q^e\), given \(e \ge 0\). If e is big enough, it may be the case that in equilibrium, \(e\ge q^e\) which implies that the firms are allowed to pollute as much as they want. Then they would not have to abate any emissions and the regulation would not modify the firms’ behavior. To make the problem economically interesting, we focus on those cases where \(e<q^e\), i.e., where the standard changes the firms’ decisions.

In the two-stage game, the regulator sets e that maximize social welfare, that is, before the firms compete in quantity, it solves

2.2 Performance standards

With this instrument, the regulator sets the relative amount of pollution that firm i can generate, at most, fraction h of their production; thus, \(0\le h\le 1\). Throughout this paper, we refer to this policy as “performance standard”, yet, several other terms are also used, for example, “relative”, “intensity”, “specific”, “rate-based” or “output-based” emission caps (Quirion 2005), and “intensity targets” (Fischer and Springborn 2011). Since \(C'>0\), the firms will pollute as much as they are allowed by the regulation. This means that the final emissions of firm i will be \(q_i h\), and the abatement, \(q_i(1-h)\).

Firm i solves

with FOC

and SOC

Assumptions (A1) and (A3) guarantee that the SOC (5) holds and a unique a stable equilibrium exists, which will be denoted as \(q^h\).

If the instrument is optimally chosen, the environmental authority first announces h that maximizes social welfare, i.e., that solves

and after observing it, the firms compete in quantity.

The emission and the performance standards are known in the literature as command-and-control instruments since they tell the firms exactly how much they are allowed to pollute. Although they are designed for the same purpose of fighting pollution, Eqs. (1) and (4) reveal that they do not necessarily lead to identical results. Specifically, observe that the marginal abatement cost is lower for the performance standard and thus, the firms have incentives to produce more under this regime whenever the instruments allow for the same number of emissions.

The following section formalizes this result and ranks both instruments in terms of the rest of the equilibrium variables of interest, such as profits, consumer surplus and social welfare, for the one- and the two-stage games.

3 Results

3.1 One-stage game

In this part of the study, we consider the situation where the standards are exogenously fixed and do not necessarily maximize social welfare. This setting is plausible if, for instance, the abatement technology of the firms is unknown to the regulator. In addition, it provides the basis to study the effects of endogenizing the instruments in the next section. Since the firms are symmetric, we assume that they all face the same regulation, i.e., the same standard and the same level.

Then the firms observe the regulation and compete à la Cournot by maximizing their profits. Recall that under the emission standard e, each firm produces \(q^e\) in equilibrium, and under the performance standard h, \(q^h\) is the notation for the equilibrium individual output. In any case, the looser the regulation is (higher e or higher h), the larger the production will be. This result is summarized in Lemma 1Footnote 6; all the proofs are shown in Sect. 5.

Lemma 1

For any number of firms\(n\ge 1\),

- (i)

Production\(q^e\)is increasing ineunder emission standards.

- (ii)

Production\(q^h\)is increasing inhunder performance standards.

Recall that a firm regulated through an emission standard will generate e emissions, if the instrument is the performance standard, the emissions will be \(q^h h\). From Lemma 1, production increases with e or h and becomes obvious that so do the emissions.

Similarly, with a more relaxed regulation, consumers are better off given that production increases and prices go down. These two straightforward results are summarized in Remark 1 since the results are immediate, we omit its proof.

Remark 1

For any number of firms \(n\ge 1\),

- (i)

Individual (and total) emissions are increasing in e and h under emission and performance standards, respectively.

- (ii)

Consumer surplus is increasing in e and h under emission and performance standards, respectively.

Now we compare the performance of both regulatory instruments under study, in terms of the equilibrium variables: production, price, consumer surplus, profits and social welfare. We focus on the situation where both instruments are designed to allow the same amount of pollution, that is, when \(e=q^h h\). As for notation, if the equilibrium variable corresponds to the emission standard, we will superscript it with an e; if it corresponds to the performance standard, the superscript will be h.

Proposition 1

Leteandhbe such that\(e=q^h h\), then

- (i)

Production is higher under the performance standard, \(q^h \ge q^e.\)

- (ii)

Individual (and total) profits are higher under the emission standard, \(\pi ^e \ge \pi ^h\) (\(n\pi ^e \ge n\pi ^h\)).

- (iii)

If in addition, \(P(nq^h)-C'(q^h(1-h))\ge 0\), social welfare is higher under the performance standard, \(W^h \ge W^e\).

As stated by Proposition 1-i, whenever damage to the environment coincides for both standards, production is unambiguously higher with the performance one. As an immediate consequence, consumers prefer this kind of regulation. Since there is more production, the price is lower and the consumers are better off. Corollary 1 summarizes this fact.

Corollary 1

Leteandhbe such that\(e=q^h h\), then

- (i)

Price is lower under the performance standard, \(p^h \le p^e\).

- (ii)

Consumer surplus is higher under the performance standard, \(\mathrm{{CS}}^h \ge \mathrm{{CS}}^e\).

Contrary to the consumers, Proposition 1-ii predicts that the firms prefer the emission standard. Overall, the comparison of social welfare is ambiguous, Proposition 1-iii provides a sufficient condition for the performance standard to be welfare superior. Such condition, \(P(nq^h)-C'(q^h(1-h))\ge 0\), is a stricter version of the FOC (4), and thus, it is not always satisfied. The FOC (4) establishes that in equilibrium (under the performance standard), price is higher than the marginal cost of abatement, \(P(nq^h)-C'(q^h(1-h))(1-h)=-q^hP'(nq^h)>0\). Since \(P\ge 0,\)\(C'>0\) and \(0 \le h \le 1\), \(P(nq^h)-C'(q^h(1-h))(1-h)\ge P(nq^h)-C'(q^h(1-h)),\) and then the right-hand side of the last inequality might be positive, negative or zero.

Since perfect competition is the limiting case of the Cournot oligopoly when the number of firms go to infinity, all of our results hold for perfectly competitive firms. In particular, under perfect competition, the situation in Proposition 1-iii cannot happen and the emission standard welfare dominates the performance standard. That is, the presence of market power allows a change in the comparison, so that the performance standard may provide a higher social welfare.

Proposition 2

Leteandhbe such that\(e=q^h h\). Under perfect competition, social welfare is higher under the emission standard, \(W^e \ge W^h\).

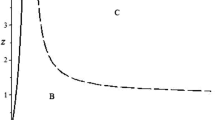

To provide more insight into the feasibility of the condition \(P(nq^h)-C'(q^h(1-h))\ge 0\) and \(W^h \ge W^e\) (Proposition 1-iii), we present the following example with linear demand and linear abatement cost. In a nutshell, when the number of firms is relatively small, the performance standard welfare dominates the emission one, but when n becomes sufficiently large, the welfare dominant policy changes to the emission standard. Since the performance standard leads to higher output, it corrects for imperfect competition that contracts production, but when the number of firms is sufficiently large, such output becomes excessive, and thus the negative impact on the profit of each firm increases under the performance standard.

Example 1

Consider an industry with n symmetric firms that face a linear inverse demand function \(P(Q)=a-bQ\), \(a, b> 0\), and have a linear abatement cost \(C(y)=cy\), with \(a>c>0\). One unit of production causes one unit of polluting emission that damages the environment according to \(D(x)=sx^2/2\), \(s>0\). Suppose that e and h are exogenously set.

The reader can easily verify that \(q^e=\frac{a-c}{b(1+n)}\), \(q^h=\frac{a-c(1-h)}{b(1+n)}\), \(p^e=\frac{a+nc}{1+n}\), \(p^h=\frac{a+nc(1-h)}{1+n}\), \(\pi ^e=\frac{(a-c)^2}{b(1+n)^2}+ce\) and \(\pi ^h=\frac{[a-c(1-h)]^2}{b(1+n)^2}\).

Observe that the firms have a dominant strategy under the emission standard, and production is clearly higher under the performance standard, in line with Proposition 1-i. When \(n \rightarrow \infty\), we have the perfectly competitive outcome. On the other hand, social welfare results in \(W^e=\frac{(a-c)^2n(2+n)}{2b(1+n)^2}+nce-\frac{sn^2e^2}{2}\) and \(W^h=\frac{(a-c(1-h))^2n((2+n)b-h^2ns)}{2b^2(1+n)^2}\); when \(e=q^h h\), the difference is given by

Clearly, the performance standard provides a higher social welfare if and only if \(n\le \frac{2(a-c)}{ch}\), that is, if n is sufficiently small. When the number of firms grows, the comparison eventually reverses and society is better off with the emission standard. Given the specific primitives of this industry, it is possible to provide a sufficient and necessary condition for the performance standard to dominate the emission one, but unfortunately we cannot do this in general. Instead, we provide the sufficient condition \(P(nq^h)-C'(q^h(1-h))\ge 0\), which in this example is equivalent to \(n\le \frac{a-c}{ch}\); in line with the sufficient and necessary condition above, the latter is less likely to be satisfied when the number of firms grow.

Intuitively, the performance standard is preferable for a low number of firms since it incentivizes more production that corrects for market power. With more firms (including perfect competition), this excessive production becomes inefficient, and the comparison of social welfare reverses. \(_{||}\)

The next section studies the comparison of social welfare when the standards are chosen to maximize social welfare. Since the main result builds on Proposition 1-iii, the condition is analogous.

3.2 Two-stage game

Now suppose that there is a regulator or environmental authority that in a first stage chooses the efficient level of emission or performance standard that maximizes social welfare. In the second stage, the firms compete à la Cournot after observing the environmental regulation, which is the same for all of them. The regulator faces two sources of market failure, the negative externality caused by pollution and the market power of the oligopoly. To achieve a higher social welfare, the regulator could choose both the number of firms and the regulation, yet, in the industry under study, the number of firms is exogenous and the regulator cannot affect it. The internalization of the number of firms is left for future research. As detailed in Sect. 2, if the policy instrument is the emission standard, the regulator will solve problem (3), otherwise, it will solve problem (6).

We provide a sufficient condition such that performance standard dominates the emission standard in terms of social welfare. To do so, we first show that the optimal amount of emissions under the emission standard, \(e^*\), can be replicated with the performance standard (Lemma 2). We use the super-index \(^*\) to indicate that the standard is the one that maximizes social welfare.

Lemma 2

There exists\(0 \le h \le 1\)such that\(e^*=q^h h\).

Observe that Lemma 2 is not obvious since we have to rule out the possibility that the optimal emission standard is looser than the most relaxed performance standard, \({\bar{h}}=1\). On the other hand, e such that \(e=q^h h\) always exists for all \(0\le h \le 1\), including \(h^*\). Lemma 2 is key in stating the following result.

Proposition 3

In the two-stage game, social welfare is higher under the performance standard, \(W^{h^*} \ge W^{e^*}\), if\(P(nq^h)-C'(q^h(1-h))\ge 0\)forhsuch that\(e^*=q^h h\).

Proposition 3 is clearly linked to Proposition 1-iii. The key relies on Lemma 2, which guarantees that there exists h that generates the emissions \(e^*\). If social welfare is higher for such h (guaranteed by the condition in Propositions 1-iii and 3), then society will be better off with \(h^*\) since the latter is the performance standard that maximizes social welfare. A similar argument shows that society is better off with the emission standard under perfect competition.

Proposition 4

Under perfect competition, optimal social welfare is higher under the emission standard, \(W^{e^*} \ge W^{h^*}\).

The connection between Propositions 3 and 4 is similar to that of Propositions 1-iii and 2 discussed in the previous section. When n is relatively small, the higher production obtained with the performance standard corrects for the market imperfection of having a small number of firms. As n increases, this excessive output eventually becomes inefficient and the emission standard welfare dominates. Moreover, the performance standard may lead to a higher level of emissions, as we will see later in Table 1.

In what follows, we discuss the comparison of the rest of the equilibrium variables; unfortunately, we cannot establish a clear ranking. From Proposition 1-i, we know that when the policies incentivize the same amount of emissions, the firms will produce more with the performance standard. Since \(q^e\) decreases in e, we have that if we diminish the emissions allowed under the emission standard, production decreases and thus, the performance standard is output-superior whenever it allows for more pollution. This result is summarized in Proposition 5, and it is valid for any e and h such that \(q^{h} h\ge e\), including the optimal ones, \(e^*\) and \(h^*\).

Proposition 5

If\(q^{h} h\ge e\), then, \(q^{h} \ge q^{e}.\)

The previous result implies that whenever the performance standard leads to higher pollution, it will also lead to a lower price and thus, to a higher consumer surplus.

Corollary 2

If\(q^{h} h\ge e\),

- (i)

\(p^{h} \le p^{e}\);

- (ii)

\(\mathrm{{CS}}^{h} \ge \mathrm{{CS}}^{e}.\)

In this case, it is not possible to predict the preference of the firms. Specifically, if under the optimal policies we have \(q^{h^*} h^*\ge e^*\), Propositions 3 and 4, and Corollary 2-ii suggest that they may prefer any of the policy instruments, depending on the primitives of the industry. Moreover, \(q^{h^*} h^*\ge e^*\) is not the general case. Example 2 shows that the comparison of optimal final emissions can go either way.

Example 2

Reconsider Example 1 with a previous stage where the regulator optimally chooses \(e^*\) and \(h^*\) that maximize social welfare. If the regime corresponds to the emission standard, the environmental authority solves problem (3); otherwise, the policy is given by the solution to problem (6).

The level of emissions that maximize social welfare under the emission standard is \(e^*=\frac{c}{ns}\); it is also possible to find an explicit solution for \(h^*\), but since it is algebraically complicated, we illustrate the results for the parameters \(a=5\), \(b=2\), \(c=s=1\) and \(n=2\) in Table 1. Observe that final emissions are higher with the performance standard. The abbreviation e.s. stands for emission standards, and p.s. for performance standards.

Now, instead of linear, suppose that the abatement cost is quadratic, \(C(y)=cy^2\), \(c>0\). The reader can easily verify that in the second stage, the firms choose to produce \(q^e=\frac{a + 2 c e}{2 c + b (n+1)}\) and \(q^h=\frac{a }{2 c(1-h)^2 + b (n+1)}\).

The standards that maximize social welfare, \(e^*\) and \(h^*\), are shown in Table 2 when \(a = 5,\)\(b=2\), \(c=s=1\) and \(n=2\). Notice that now, the final emissions are higher under the emission standard.

Intuitively, when the abatement cost is quadratic, it is cheaper for the firms to abate emissions whenever the abatement belongs to the interval (0, 1), such as in the case of Table 1. The environmental authority internalizes this fact and regulation becomes stricter, as can be seen in Table 2 (lower standards with respect to Table 1). Since it is relatively cheaper for the firms to comply with the stricter regulation, profits and social welfare expand, while the final emissions contract (due to the more stringent regulation). Recall that with the performance standard, the marginal abatement cost is the fraction \((1-h)\) of the marginal abatement cost under the emission standard, which leads to a larger drop in the final emissions, enough to under-cut the pollution under the emission standard.

Finally, observe that in both cases, whether the abatement cost is linear or quadratic, production and social welfare are higher under the performance standards, but the firms prefer the emission standard. \(_{||}\)

4 Final remarks

This paper ranks two command-and-control environmental instruments, emission and performance standards, in terms of the equilibrium variables. We focus on these regimes because they are widely used in practice. To this end, we consider two games; first, a one-stage game where n symmetric firms compete à la Cournot after observing the exogenous environmental policy, here, the instruments allow for the same amount of pollution. Then we introduce a previous stage to the one-stage game where the regulator establishes the optimal policy that maximizes social welfare. For both games, we show that in the presence of market power, the performance standard can lead to a higher social welfare, which does not happen under perfect competition, where the emission standard unambiguously dominates.

We also provide a full-fledged comparison of the rest of the equilibrium variables in the one-stage game, which is not the case for the two-stage game. Numerical simulations suggest that in the latter game, the industry produces more under the performance standard but is better off with the emission standard (profits are higher). The first result is robust whenever the optimal performance standard is looser in terms of pollution, that is, when it allows for more pollution than the emission standard. But using an example, we show that the comparison of the final emissions varies according to the primitives of the industry.

As we mentioned in Sect. 2, our results can be generalized for a joint cost function \({\tilde{C}}(q,e)\) that accounts for both the production and the abatement costs—q denotes output and e emissions—and satisfy the assumptions in Requate (2006) (see Footnote 5). That is, we could substitute \(C(q_i-e)\) by \({\tilde{C}}(q_i,e)\) under the emission standard, and \(C(q_i(1-h))\) by \({\tilde{C}}(q_i,q_ih)\) with the performance standard. In the FOC (1) and SOC (2), \(C'(q_i-e)>0\) would be replaced by \({\tilde{C}}_1(q_i,e)>0\), and \(C''(q_i-e)\ge 0\) by \({\tilde{C}}_{11}(q_i,e)>0\), which does not affect the analysis since the signs of the first and second derivatives with respect to q prevail (according to (A3) and Footnote 5).

With the performance standard, \(q_i\) also appears in the second argument of \({\tilde{C}}(q_i,q_ih)\); hence, \(C'(q_i(1-h))(1-h)\) in Eq. (4) would become \({\tilde{C}}_1(q_i,q_ih)+{\tilde{C}}_2(q_i,q_ih)h\) (which preserves the positive sign by Footnote 5), and \(C''(q_i(1-h))(1-h)^2\) in Eq. (5) would be \({\tilde{C}}_{11}(q_i,q_ih)+2{\tilde{C}}_{12}(q_i,q_ih)h+{\tilde{C}}_{22}(q_i,q_ih)h^2\). The latter expression has an ambiguous sign, and thus, some additional assumptions would be necessary to guarantee the uniqueness and stability of the equilibrium. The rest of the results can be replicated in a similar way. Observe that the abatement costs in Examples 1 and 2 can be seen as specific joint cost functions \({\tilde{C}}(q,e)=c(q-e)\) and \({\tilde{C}}(q,e)=c(q-e)^2\), respectively, with \(C'(q-e)={\tilde{C}}_1(q,e)=-{\tilde{C}}_2(q,e)\) and \(C''(q-e)={\tilde{C}}_{11}(q,e)={\tilde{C}}_{22}(q,e)=-{\tilde{C}}_{12}(q,e)\). In particular, the strict inequalities dealing with second-order partial derivatives in Footnote 5 should be relaxed to include linear relationships such as that in Example 1.

This work pretends to serve as a guide for environmental authorities to choose the right regulation provided their goals and information. Similarly, it aims to show that the performance standard should not be discarded to maximize social welfare when the number of firms is limited, even though the emission standard is the best alternative for a society with a sufficiently large number of firms.

5 Proofs

Lemma 1:

- (i)

Recall that in equilibrium, the FOC (1) holds,

$$\begin{aligned} q^eP'(nq^e)+P(nq^e)-C'(q^e-e)=0; \end{aligned}$$in other words, the unique (by (A1) and (A2)) equilibrium output \(q^e\) corresponds to the fixed point of the function

$$\begin{aligned} f_e(x)=-\frac{P(nx)-C'(x-e)}{P'(nx)}. \end{aligned}$$Notice that \(f_e(x)\) is increasing in e given \(P'<0\) and \(C''\ge 0\); then its unique fixed point, \({q}^e\), is also increasing in e.

- (ii)

Similarly, taking the FOC (4), \(q^h\) corresponds to the fixed point of the function

$$\begin{aligned} f_h(x)=-\frac{P(nx)-C'(x(1-h))(1-h)}{P'(nx)}, \end{aligned}$$which is increasing in h under our assumptions. Then the unique equilibrium output, \({q}^h\), is increasing in h. \(\square\)

Proposition 1:

- (i)

Notice that in equilibrium, the FOCs (1) and (4) hold, i.e.,

$$\begin{aligned} q^eP'(nq^e)+P(nq^e)-C'(q^e-e)=0 \end{aligned}$$and

$$\begin{aligned} q^hP'(n q^h)+P(n q^h)-C'(q^h(1-h))(1-h)=0. \end{aligned}$$Under the assumption \(e= q^h h\), the second FOC becomes

$$\begin{aligned} q^hP'(n q^h)+P(n q^h)-C'(q^h-e)(1-h)=0. \end{aligned}$$In other words, the equilibria \(q^e\) and \(q^h\) are fixed points of the functions

$$\begin{aligned} f_e(x)=-\frac{P(nx)-C'(x-e)}{P'(nx)} \end{aligned}$$and

$$\begin{aligned} f_{h}(x)=-\frac{P(nx)-C'(x-e)(1-h)}{P'(nx)}, \end{aligned}$$respectively. Finally, \(C'>0\), \(P'<0\) and \(0 \le h \le 1\) imply that

$$\begin{aligned} -\frac{P(nx)-C'(x-e)(1-h)}{P'(nx)}\ge -\frac{P(nx)-C'(x-e)}{P'(nx)}, \end{aligned}$$and hence, \(q^h \ge q^e\).

- (ii)

To show that profits are higher under emission standards, we follow the next inequalities:

$$\begin{aligned} \pi ^e= & {} q^eP[q^e+(n-1)q^e]-C(q^e-e) \\\ge & {} q^hP[q^h+(n-1)q^e]-C(q^h-e) \\\ge & {} q^hP[q^h+(n-1)q^h]-C(q^h-q^h h) \\= & {} q^hP(nq^h)-C(q^h(1- h))=\pi ^h. \end{aligned}$$The first inequality follows by equilibrium and the second one, by \(q^h\ge q^e\), \(P'<0\) and \(e=q^h h\).

- (iii)

Now we show that if \(P(nq^h)-C'(q^h(1-h))>0,\) the performance standard leads to higher social welfare. To this end, notice that in general, social welfare can be written as

$$\begin{aligned} W_e(q)=\int _0^{nq}P(z)\mathrm{{d}}z-nC(q-e)-D(ne), \end{aligned}$$(7)where q denotes individual output and e, individual emissions; given that all the firms produce and pollute the same. Observe that \(W_e(q)\) is strictly concave since \(W_e''(q)=n(nP'(nq)-C''(q-e))<0\) given (A1) and (A3). When \(e=q^h h\), we have

$$\begin{aligned} W^h-W^e= & {} W_e(q^h)-W_e(q^e) \\&\ge W'_e(q^h)(q^h - q^e)\ge 0. \end{aligned}$$The equality follows by definition; the first inequality, by strict concavity of \(W_e(q)\), and the last one, by \(q^h\ge q^e\) (part i), and \(W'_e(q^h) =n(P(nq^h)-C'(q^h(1-h))\ge 0\) by hypothesis. \(\square\)

Proposition 2:

Under perfect competition, the FOC (1) becomes \(p=C'(q^e-e),\) where p is the exogenous market price. Then

The first equation follows by definition and equation (7). The inequality follows by strict concavity of \(W_e(q)\), and the last equality by \(W'_e(q^e) =n(p-C'(q^e-e))= 0\). \(\square\)

Lemma 2:

First, we proceed by contradiction to show that \(e^*\le q^{{\bar{h}}}\), \({\bar{h}}=1\). Suppose that \(e^*>q^{{\bar{h}}}\) since \(q^{e^*}\ge e^*\), we have \(q^{e^*}>q^{{\bar{h}}}\).

By FOC (1),

and by FOC (4),

By \(P'+QP''<0\), \(P'<0\), \(C'>0\) and \(q^{e^*}>q^{{\bar{h}}}\), we have

which contradicts FOC (1); then \(e^*\le q^{{\bar{h}}}\).

Now, by Remark 1-i, \(hq^h\) is increasing in h, then it exists \(0 \le h \le 1\) such that \(e^*= q^h h\), which completes our proof. \(\square\)

Proposition 3:

By Lemma 2, let h be such that \(q^h h=e^*\), then we have

The first equality follows by definition. The first inequality is given by optimality, the second one, by Proposition 1-iii and \(e^*=q^h h\). Finally, the last equality follows by definition. \(\square\)

Proposition 4:

Let e be such that \(e=q^{h^*} h^*\), then we have

The equalities follow by definition. The first inequality follows by optimality and the second one, by Proposition 2 and \(e=q^{h^*} h^*\). \(\square\)

Proposition 5:

Let \(e'=q ^{h}h\), then, by Proposition 1-i, \(q^{h} \ge q^{e'}\). Since we assume that \(e\le e'\), Lemma 1-i implies that \(q^{e}\le q^{e'}\le q^{h}\), which proves the result. \(\square\)

Notes

Barnett (1980) started with the rigorous research on environmental regulation and imperfect competition, by estimating second-best taxes in monopolies. Later on, Levin (1985) introduced the study of Cournot oligopolies and taxes, followed by Ebert (1992) and Simpson (1995), that calculate optimal taxes in this industry. A wide literature focuses on the study of taxes and market power, but there are also works such as Montero (2002a, b) that analyze other regulatory instruments like standards and permits.

Montero (2002b) analyzes the incentives of four policy regimes on the R&D investment to improve the firms’ abatement technology under imperfect competition. To this end, the author considers a two-stage game; in the first stage, n symmetric firms decide how much to invest in R&D, and in the second one, the firms compete à la Cournot. The four instruments under study are emission and performance standards (command-and-control instruments), and tradable and auctioned permits (market-based instruments). Although his study suggests that command-and-control instruments may provide higher incentives for R&D investment, Montero (2002b) cannot predict a full-fledged comparison among regimes.

The ranking of regulatory instruments have always been an important subject of study, for example, see Weitzman (1974). Downing and White (1986) or Hahn and Stavins (1992), among many others, focus on the ranking of environmental policies. Fischer et al. (2003) and Goulder et al. (1999) compare some environmental instruments in terms of cost-effectiveness. Incentives for technology adoption and innovation have been studied for perfect and imperfect competition; Requate (2005) presents a detailed survey on such studies, that were motivated by Kneese and Schultz (1975), that highlight the relevance of innovation in the design of environmental policies.

This simplifying assumption is adopted from works such as Amir et al. (2018) and Montero (2002b), but can be relaxed in such a way that the emissions are given as a function of production, as in Lahiri and Ono (2007), which includes the commonly studied case where pollution is proportional to production.

Such assumption establishes that \(C(\cdot ,\cdot )\) is twice continuously differentiable with \(C_1>0\), \(C_{11}> 0\), \(C_{22}>0\), \(C_{12}<0\), \(C_{11}C_{22}-C_{12}^2> 0\), \(C_2<0\) for all \(e<e(q)\) such that \(C_2(q,e(q))=0\), and \(C_2\ge 0\) if \(e>e(q)\).

References

Amir R, Gama A, Werner K (2018) On environmental regulation of oligopoly markets: emission versus performance standards. Environ Resour Econ 70(1):147–167

Barnett AH (1980) The Pigouvian tax rule under monopoly. Am Econ Rev 70(5):1037–1041

Boom JT, Dijkstra BR (2009) Permit trading and credit trading: a comparison of cap-based and rate-based emissions trading under perfect and imperfect competition. Environ Resour Econ 44:107–136

Downing PB, White LJ (1986) Innovation in pollution control. J Environ Econ Manag 13(1):18–29

Ebert U (1992) Pigouvian tax and market structure: the case of oligopoly and different abatement technologies. Public Finance Anal (FinanzArchiv) 49(2):154–166

Ebert U (1998) Relative standards: a positive and normative analysis. J Econ 67(1):17–38

Fischer C, Springborn M (2011) Emissions targets and the real business cycle: intensity targets versus caps or taxes. J Environ Econ Manag 62:352–366

Fischer C, Parry IW, Pizer WA (2003) Instrument choice for environmental protection when technological innovation is endogenous. J Environ Econ Manag 45(3):523–545

Goulder LH, Parry IW, Williams RC III, Burtraw D (1999) The cost-effectiveness of alternative instruments for environmental protection in a second-best setting. J Public Econ 72(3):329–360

Hahn RW, Stavins RN (1992) Economic incentives for environmental protection: integrating theory and practice. Am Econ Rev Pap Proc Hundred Fourth Annu Meet Am Econ Assoc 82(2):464–468

Harrington W, Morgenstern RD, Sterner T (eds) (2004) Choosing environmental policy: comparing instruments and outcomes in the United States and Europe. RFF Press, Washington, DC

Hueth B, Melkonyan T (2009) Standards and the regulation of environmental risk. J Regul Econ 36(3):219–246

Kneese AV, Schultz CL (1975) Pollution, prices, and public policy. Washington Brookings Institution, Washington

Lahiri S, Ono Y (2007) Relative emission standard versus tax under oligopoly: the role of free entry. J Econ 91(2):107–128

Levin D (1985) Taxation within Cournot oligopoly. J Public Econ 27(3):281–290

Montero JP (2002a) Market structure and environmental innovation. J Appl Econ 2:293–325

Montero JP (2002b) Permits, standards, and technology innovation. J Environ Econ Manag 44:23–44

Pearce D (2002) An intellectual history of environmental economics. Annu Rev Energy Environ 27(1):57–81

Quirion P (2005) Does uncertainty justify intensity emission caps? Resour Energy Econ 27(4):343–353

Requate T (2005) Dynamic incentives by environmental policy instruments: a survey. Ecol Econ 54(2):175–195

Requate T (2006) Environmental policy under imperfect competition. Int Yearb Environ Resour Econ 2006(2007):120–207

Simpson RD (1995) Optimal pollution taxation in a Cournot duopoly. Environ Resour Econ 6(4):359–369

Viscusi WK, Harrington JE, Vernon JM (2005) Economics of regulation and antitrust. MIT Press, Cambridge

Weitzman ML (1974) Prices vs. quantities. Rev Econ Stud 41(4):477–491

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

I gratefully acknowledge three anonymous referees for their thorough reports that significantly improved this work. I also thank Rabah Amir, Daniel Flores, Laura Juarez, and Mario Samano for many helpful comments, and PROMEP-SEP for their financial support.

About this article

Cite this article

Gama, A. Standards and social welfare in Cournot oligopolies. Environ Econ Policy Stud 22, 467–483 (2020). https://doi.org/10.1007/s10018-020-00265-8

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10018-020-00265-8