Abstract

This paper investigates the effects of bargaining power on downstream firms’ profits. Consider a vertically related industry consisting of one upstream and two downstream firms, the latter having different marginal costs. Each pair bargains over a linear wholesale price, and then the downstream firms engage in Cournot competition. We show that the inefficient downstream firm may benefit from an increase in the bargaining power of the upstream firm. Furthermore, we obtain similar results when each downstream firm trades with its exclusive upstream agent, under non-linear demand function, or when downstream firms compete in price.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Firms need to negotiate with various agents (e.g., input suppliers, labor unions, and governments) regarding numerous important factors regarding their profits (e.g., input prices, wages, taxes).Footnote 1 Since such contract outcomes significantly affect their profitability, almost all firms might want to negotiate skillfully to induce better contract terms. Generally, to obtain better outcomes in bargaining, agents should have better outside options (threat points) and stronger bargaining power. In vertical relations, for example, the common belief is that upstream firms act as the sole input suppliers toward the downstream firms and they exploit their monopoly power to raise input price, which unambiguously reduces downstream firms’ profits. However, we show that there are situations under which the widely accepted view that downstream firms’ profits are decreasing with the bargaining power of upstream firms does not hold.Footnote 2

Following recent studies (Aghadadashli et al. 2016; Gaudin 2016, 2017), we apply the Nash bargaining approach to bargaining between downstream firms and upstream agents. Our model can be applied to the relationships between downstream firms and input suppliers, labor unions, or governments. In fact, Nash bargaining is employed in labor economics (e.g., Dowrick 1989; Koskela and Schob 1999; Haucap and Wey 2004; Lopez and Naylor 2004). Empirically, there has been a significant interest on the bargaining power of the agents (e.g., suppliers or labor unions) and its effects on downstream firms’ profitability (Hirsch 2004; Farmakis-Gamboni and Prentice 2011) over time.Footnote 3 Therefore, the purpose of this paper is to re-examine these questions when firms are inherently asymmetric.

We first consider a vertically related industry consisting of one upstream and two downstream firms, with the latter having different technology in terms of marginal costs. Each upstream-downstream pair bargains over a linear wholesale price, and, subsequently, the downstream firms engage in Cournot competition.Footnote 4 We apply the generalized Nash bargaining approach. In this setting, we find that the inefficient downstream firm may benefit from an increase in the bargaining power of the upstream firm, while the efficient one unambiguously loses. We also consider the cases where the upstream market consists of two exclusive suppliers or where downstream firms compete in price, and obtain similar results.

In our model, an increase in the bargaining power of upstream firms has two effects. The first one is the input price effect: an increase in the bargaining power of upstream firms raises both wholesale prices. This clearly harms both downstream firms. However, an increase in the bargaining power can have another effect, the anti-selection effect. When the upstream firms have no bargaining power, the efficient downstream firm can fully utilize its cost advantage in downstream competition. When the downstream firms have different efficiencies, the upstream firms with positive bargaining power charge different wholesale prices—the efficient downstream firm’s wholesale price becomes higher than that of the inefficient one. Moreover, an increase in the bargaining power of the upstream firms raises the wholesale prices for the efficient downstream firm more than for the inefficient one. Thus, an increase in the bargaining power reduces the difference of ex post efficiency between the downstream firms. This can benefit the inefficient downstream firm, whereas it always harms the efficient one.

It is essential for our results that the firms bargain over a linear wholesale price. One may think that if possible, upstream firms prefer employing two-part tariff contract to linear contrast. However, Milliou and Petrakis (2007) consider an endogenous choice of these contract types and show that an upstream monopolist chooses to trade through linear wholesale price contracts with both downstream firms when the bargaining power of upstream firm is not too large. This is consistent with the condition for Proposition 1. Although the argument cannot be applied when the upstream market consists of two exclusive suppliers, it is easy to justify when we regard upstream agents as labor unions. Additionally, linear contracts as well as two-part contracts are often observed in numerous markets. Therefore, both theoretically and empirically, many researchers employ linear contracts (e.g, Iozzi and Valletti 2014), and estimate models with bargaining over linear contracts (e.g., Draganska et al. 2010; Crawford and Yurukoglu 2012; Ho and Lee 2015) because these provide a good approximation of reality. For example, Grennan (2013) observes that price contracts for medical devices between manufacturers and hospitals are typically of the linear form.Footnote 5

It is important for our results that upstream agents can use a discriminatory price. This assumption is natural when upstream market consists of exclusive suppliers. When upstream market consists of a single agent, whether an upstream agent can use a discriminatory price or not depends on institutional reasons, preventing an upstream agent from charging discriminatory input prices. The assumption of discriminatory pricing is employed in Horn and Wolinsky (1988b), Symeonidis (2010), while Mukherjee and Wang (2013) employ uniform pricing.

The three implications of the results are presented below, which might be empirically testable. First, our results relate to the vast literature on unions’ effect on firm performance. In the context of labor economics, there has been extensive research on this effect, but the net effect of unionization on firm performance remains unclear. On the one hand, unions can raise productivity of unionized firms or sectors (Freeman and Medoff 1984). On the other hand, some papers argue that unionization can hurt firms by increasing payments and/or imposing restrictive work rules that depress productivity (e.g., Grout 1984; Van der Ploeg 1987. Many empirical studies examine the predictions of economic theory, namely profits are decreasing with union relative bargaining strength (e.g., Machin 1991). Our results show that conventional wisdom does not always hold true when firms are asymmetric in terms of efficiency. Thus, this result might provide important implications for empirical research.

The second implication is as follows. An important property of the Nash bargaining solution is that it can be implemented as the outcome of a dynamic non-cooperative alternating-offers bargaining game (Rubinstein 1982; Binmore et al. 1986). It is known that Rubinstein’s (1982) model has a broader interpretation of a measure of bargaining power. For example, it has been shown that the discount factors of player i, \(\delta _i\), in Rubinstein’s model are theoretically equivalent to the bargaining power in the generalized Nash bargaining solution. It has also been shown that bargaining power can be interpreted as risk aversion. More precisely, as Binmore et al. (1986) note, in the Rubinstein’s bargaining model with a risk of exogenous breakdown of negotiations, we can interpret a belief concerning the likelihood of a breakdown as a bargaining power. Therefore, the higher the downstream firms estimate of the probability of breakdown, the higher the upstream firms’ bargaining power becomes. This implies that a change of market environment that affects the downstream firms’ estimation of the probability of breakdown might have different impacts on their profits.

Third, our results imply that there might be some market environments where the existence of strong upstream agents causes some inefficient firms to survive (i.e., they earns positive profits) due to the anti-selection effect. Since the anti-selection effect generated by the upstream agents’ power might protect some inefficient firms, this might delay firm turnovers of the industry. This result relates to Mukherjee and Wang (2013), which show that the presence of a labor union increases efficient firm’s incentive for entry compared to the situation with no labor union. However, theirs and this paper give different implications, which can present an empirical question.

Several papers analyze theoretically the relationship between the bargaining power of downstream firms and their profits. In economics, Chen (2003) considers a dominant firm-competitive fringe model with one upstream supplier, and they bargaining over a two-part contract. He finds that the profit of the dominant retailer may decrease with its bargaining power, because an increase in the countervailing power of the dominant retailer significantly reduces the wholesale price of the fringe retailers, which, in turn, decreases the residual demand of the dominant retailer.Footnote 6

Mukherjee and Wang (2013) consider a unionized duopoly model where one firm requires one worker to produce one unit of the good while the other requires less workers. They find that the presence of a labor union may increase the efficient firm’s profitability compared to the situation with no labor union. Han and Mukherjee (2017) also consider a similar unionized oligopoly with complementary workers, and show that although cooperation among the unions reduces wages, it may make one of the downstream firms with a small labor coefficient worse off.Footnote 7 In contrast, the effect of wage is different because downstream firms have different technological coefficients in terms of labor. Basak et al. (2016) find that a higher union bargaining power may increase firm profit in a Cournot oligopoly model with decreasing returns to scale technology. Both assume that the labor union charges a uniform wage to each firm (e.g., they consider a situation of collective bargaining), whereas we employ a decentralized bargaining model.Footnote 8

The novelty of our work lies in the assumption of firm asymmetry in terms of efficiency. The implications of firm asymmetry are discussed extensively in the industrial organization literature, yet the bargaining literature did not pay much attention to this aspect. Since our assumption of cost asymmetry plays a pivotal role, our result also relates to Zanchettin (2006), which shows that when product substitution increases, an efficient firm can increase its profit while an inefficient one unambiguously loses. This is because, on one hand, a reduction of product differentiation reduces the firm’s profits since total demand decreases directly. However, the selection effect allows the efficient firm to exert a strong impact on the inefficient rival’s market share, which is a benefit for the efficient one.

The remainder of the paper is organized as follows. Sections 2 and 3 contain our core results: when the upstream market consists of exclusive suppliers or a monopolistic supplier, an inefficient downstream firm may benefit from an increase in the bargaining power of upstream firms. Section 4 considers price competition in the downstream market. Section 5 discusses our assumptions. Finally, Sect. 6 presents the concluding remarks. All proofs are shown in the “Appendix”.

2 When the upstream market consists of a monopolistic supplier

Following Horn and Wolinsky (1988a), we consider a market structure where an upstream monopolist supplies both the downstream firms.Footnote 9 We can view this upstream agent as an industry-wide union, which sets the wages as to maximize its wage bill.Footnote 10 Another application of this setup is when an upstream agent is single patent holder, which requires by multiple production firms (see Lerner and Tirole 2015; and Li and Shuai 2016 for example).

Each downstream firm, \(D_i\), faces the following inverse demand function:Footnote 11

where the parameter a represents a positive demand size and \(q_i\) is \(D_i\)’s output. We assume that each downstream firm has a constant marginal cost:

where \(w_i\) is a per-unit input price determined by Nash bargaining and \(z_i\ge 0\) measures the efficiency of downstream firm i. This implies that downstream firms are heterogeneous in terms of efficiency. We assume that \(z_2>z_1\) and then call \(D_1\) (\(D_2\)) the efficient (inefficient) firm. Firm i’s profit is given by: \(\pi _{Di}=(p(Q)-c_i)q_i\), where \(Q=q_1+q_2\).

In the second stage, each \(D_i\) chooses its quantity \(q_i\), taking \(q_j\) as given, to maximize its profits:

We obtain the equilibrium quantities for given levels of input prices:

In the first stage, the upstream-downstream pair bargains over its input price, taking as given the outcome of the simultaneously-run negotiations of the other pair. Let \(w_j^{*}\) denote the equilibrium outcome of the negotiations of the \((U, D_j)\) pair, \(w_i\) is chosen to maximize the generalized Nash bargaining product:

Note that the disagreement payoffs are \((w_j^{*} q_j(w_i^{*}, w_j^{*}), 0)\). This implies that if the bargaining were modeled as a dynamic process, this setting corresponds to a situation where if firm i and the upstream firm cannot agree, firm i earns zero profit and firm j operates at the anticipated equilibrium output.Footnote 12

The equilibrium input prices are

Consequently, we obtain the following lemma.

Lemma 1

-

(i)

An increase in the bargaining power of the upstream firm raises the wholesale prices for both downstream firms.

-

(ii)

An increase in the bargaining power of the upstream firm raises the wholesale prices for the efficient downstream firm more than for the inefficient downstream firm.

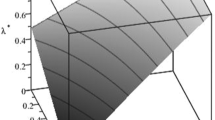

The intuition behind this lemma is as follows. As pointed by DeGraba (1990), the firm with a lower marginal cost has the more inelastic input demand, which causes the upstream firm to charge a higher price (i.e., \(w_{1}^{*}>w_{2}^{*}\)). The difference in efficiency indeed plays an important role in bargaining. When the upstream firm negotiates with an efficient downstream firm, it will not compromise by undercutting its wholesale price, because a decrease in wholesale price leads to a large loss. Compared to the negotiation between the inefficient firm, the downstream agents’ bargaining power significantly constrains the upstream agent’s pricing to the efficient firm. That is why the ex ante asymmetry creates the difference in their responses of wholesale prices in relation to a change in relative bargaining power. Figure 1 summarizes Lemma 1.

The equilibrium quantity and profit are respectively as follows:

To ensure the interior solution, we assume

We obtain the following proposition.

Proposition 1

-

(i)

An increase in the bargaining power of the upstream firm decreases the quantity and profit of the efficient downstream firm.

-

(ii)

An increase in the bargaining power of the upstream firm may raise the quantity and profit of the inefficient downstream firm. Formally,

$$\begin{aligned} \frac{d q_2^{*}}{d \theta }>0 \Leftrightarrow z_2>\frac{(2+\theta )^2a+4(4-5\theta + \theta ^2) z_1}{20-16\theta +5\theta ^2}. \end{aligned}$$(10)

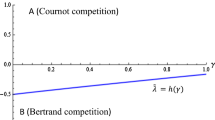

The intuition behind the proposition is as follow. An increase in the bargaining power of the upstream firm has two effects, working in opposite directions. The first one is the input price effect: an increase in the bargaining power of the upstream firm raises both wholesale prices. This clearly harms both downstream firms. However, an increase in the bargaining power has an indirect effect as well, the anti-selection effect. When the upstream firms have no bargaining power, the efficient downstream firm can fully utilize its cost advantage in downstream competition. In contrast, when downstream firms have different efficiencies, the upstream firm with positive bargaining power sets different wholesale prices—the efficient downstream firm’s wholesale price becomes higher than that of the inefficient one. Moreover, as Lemma 1 states, an increase in the bargaining power raises the wholesale price for the efficient firm more than for the inefficient. Thus, the increase reduces the difference in ex post efficiency (i.e., wholesale price and ex ante efficiency) between downstream firms. This can benefit the inefficient downstream firm while always harming the efficient one. Figure 2 summarizes the results.

Here, we clarify the difference between Mukherjee and Wang’s (2013) result and our results. They show a similar result to ours in a unionized duopoly model, where firm 1 requires one worker to produce one unit of the good and firm 2 requires less than one worker to produce one unit of the good. They assume that the labor union charges a uniform wage to both firms, whereas we employ decentralized bargaining. In their model, the wage effect is different because downstream firms have different technological coefficients in terms of labor. Additionally, they show that the presence of a labor union may increase the efficient firm’s profitability, rather than the inefficient firm’s, compared to the situation with no labor union.

As per Seade (1985), it is well-known that cost or excise-tax increases are profitable if and only if the elasticity of the slope of inverse demand exceeds two. Such a counter-intuitive result comes from “price over-shifting” (price-cost margin rises with costs). However, this never occurs under the linear demand function of our setting since the curvature of the inverse demand is zero.Footnote 13

We examine the effects of a higher upstream bargaining power on the total profits of the downstream firms. We obtain the following proposition.

Proposition 2

An increase in the bargaining power of the upstream firm decreases the total quantity and total profit of the downstream firms.

This proposition shows that the loss of the efficient firm dominates the benefit of the inefficient firm.Footnote 14

3 When the upstream market consists of exclusive suppliers

Following Horn and Wolinsky (1988a), and Lopez and Naylor (2004), we next consider an alternative scenario: a two-tier industry consisting of two symmetric upstream and two asymmetric downstream firms, denoted respectively by \(U_i\) and \(D_i\), with \(i=1, 2\). The firms play a two-stage game. In the first stage, each upstream-downstream pair negotiates over its linear input price. In the second stage, observing the input prices, the downstream firms compete in quantities in the final goods market.

The upstream and downstream firms can be considered as being input producers and final good manufacturers or wholesalers and retailers, respectively. There is a one-to-one relation between the products of the upstream and the downstream firms and an exclusive relation between \(U_i\) and \(D_i\). This is a rather common assumption in the literature on vertical relations (e.g., Horn and Wolinsky 1988a; Ziss 1995; Milliou and Petrakis 2007), and unionized oligopoly (e.g., Dowrick 1989; Haucap and Wey 2004; Lopez and Naylor 2004.). For instance, when the upstream firms produce inputs tailored for specific final goods manufacturers, there might be irreversible R&D investments that create lock-in effects and high switching costs. We can also view those upstream agents as firm-specific unions or governments, which set the unit tax to maximize tax revenues.

3.1 Analysis and results

Since the outcomes in the second stage are the same as in the previous section, we analyze the bargaining stage.

Assume that each upstream firm faces no cost.Footnote 15 Let \(w_j^{**}\) denote the equilibrium outcome of the negotiations of the \((U_j, D_j)\) pair, where \(w_i\) is chosen to maximize the generalized Nash bargaining product:

Note that, since neither \(U_i\) nor \(D_i\) have an alternative trading partner, the disagreement payoffs of both are equal to zero.

The first-order condition is as follows:

The equilibrium input prices are

Therefore, we get the following lemma.

Lemma 2

-

(i)

An increase in the bargaining power of the upstream firms increases the wholesale prices for both downstream firms.Footnote 16

-

(ii)

An increase in the bargaining power of the upstream firms increases the wholesale prices for the efficient downstream firm more than for the inefficient downstream firm.

The intuition behind the result is similar to Lemma 1. Figure 3 summarizes the lemma.

Although the results are similar to those of Lemma 1, there is a quantitative difference between when the upstream market consists of exclusive suppliers and the monopolistic supplier as in the previous section. Comparing the exclusive suppliers, the monopolistic supplier has a stronger incentive to increase its prices, because if it increases the input price for one of the downstream firms, the profit from the other downstream firm increases. That is why the difference between the wholesale prices is larger than in the monopolistic supplier case.

Substituting the wholesale prices, we have the equilibrium quantity and profit, respectively, as follows:

and

To ensure the interior solution, we assume

We obtain the following proposition.

Proposition 3

-

(i)

An increase in the bargaining power of the upstream firms decreases the quantity and the profit of the efficient downstream firm.

-

(ii)

An increase in the bargaining power of the upstream firms may raise the quantity and the profit of the inefficient downstream firm. Formally,

$$\begin{aligned} \frac{d q_2^{**}}{d \theta }>0 \Leftrightarrow z_2>\frac{(4+\theta )^2a+4 (16-10 \theta +\theta ^2) z_1}{80-32\theta +5 \theta ^2}. \end{aligned}$$(17)

The intuition behind the result is similar to that of Proposition 1. Figure 4 summarizes the results.

3.2 Robustness check: non-linear demand function

To check the robustness of the results under the linear demand function, we consider a non-linear demand function which is given by:

The quantities in the second stage are

Hereafter, we also assume \(z_1=0\) and \(z_2=0.6\). By solving the maximization problem in the first stage numerically, we have the equilibrium wholesale prices as in the following figure (Fig. 5).

Substituting these values into the profits of downstream firms, we have the equilibrium profits as in the following figure (Fig. 6).

This figure shows that the profit of the inefficient firm can increase with \(\theta \). The maximum of the profit of the inefficient firm is attained when \(\theta \approx 0.9\).

4 Extension: when downstream firms compete in price

4.1 When upstream market consists of exclusive suppliers

In this section, we consider price competition in the downstream market to check the robustness of the results of the quantity competition. Following Singh and Vives (1984), the direct demand function is as follows:

where \(\alpha >0\), \(\beta ^2-\gamma ^2>0\). For simplicity, we set \(\beta =1\). Therefore, we assume that \(0\le \gamma <1\), which implies that the products are substitutes.

By solving the maximization problem for each downstream firm, we get the equilibrium price as follows:

The resulting demands and profits become

Let \(w_j^{B}\) denote the equilibrium outcome of the negotiations of the \((U_j, D_j)\) pair, where \(w_i\) is chosen to maximize the generalized Nash bargaining product:

Note that, since neither \(U_i\) nor \(D_i\) have an alternative trading partner, the disagreement payoffs of both are equal to zero.

The first-order condition is as follows:

The equilibrium input prices are

where \(A_i=\alpha (1-\gamma )(2+\gamma )-(2-\gamma ^2)z_i+\gamma z_j\).

We get the following lemma.

Lemma 3

-

(i)

An increase in the bargaining power of the upstream firms increases the wholesale prices for both downstream firms.

-

(ii)

An increase in the bargaining power of the upstream firms increases the wholesale prices for the efficient downstream firm more than for the inefficient downstream firm.

The intuition behind the result is similar to lemmas in the previous sections. Figure 7 summarizes Lemma 3.

Inserting the input prices, the equilibrium demands and profits are obtained as

We get the following proposition.

Proposition 4

-

(i)

An increase in the bargaining power of the upstream firms decreases the quantity and the profit of the efficient downstream firm.

-

(ii)

An increase in the bargaining power of the upstream firms may raise the quantity and the profit of the inefficient downstream firm.

The intuition behind the result is similar to those in Propositions 1 and 3. Figure 8 summarizes the results.

5 Discussion

We discuss here the assumptions in our model. The following arguments relate to the limitation and robustness of our results.

We employ Horn and Wolinsky’s (1988a) setting of the disagreement payoffs in the bargaining, which is related to the observability of breakdown in a negotiation and the possibility that firms can take advantage of it (see, Iozzi and Valletti 2014, p. 114). They argue, for example, that “in a Cournot world, output can be predetermined—e.g., by capacity constraints or other complementary raw materials that cannot be ordered at short notice—so that it is not feasible to increase supply and take advantage of a rival’s inability to conclude a deal.” Assuming the linear demand function and constant marginal cost, we cannot obtain similar results when firm i does not reach an agreement with the supplier, and firm j can act as a monopolist, which is regarded as a plausible scenario in disagreement payoffs. This is because the difference of input prices cannot become very large, while the direct negative effect is sufficiently large. However, if we consider a contract between firms in the real economy, it might be unnatural that downstream firms can unilaterally change the quantity at the same price they agreed in the contract. If contracts can be changed easily, full renegotiation might be a more plausible scenario.

Our results also hold when the upstream firms are asymmetric in terms of their marginal costs. The intuition of the result is essentially the same. In this case, the inefficient upstream firm charges a higher wholesale price. An increase in the bargaining power of the upstream firm reduces the difference in their wholesale prices as well as when downstream firms are asymmetric. Similarly, our results hold when the downstream firms are asymmetric in terms of product quality rather than marginal costs. As previously mentioned, the important point of our results is the existence of the difference in the ex ante profitability of the firms, which significantly affects the outcome of the negotiation. Therefore, when we consider a vertical differentiation model, the quality-cost margin plays a pivotal role.

Following Mukherjee and Wang (2013), if we instead assume that downstream firms are also asymmetry in terms of their labor coefficients, i.e., \(c_i=z_i+\lambda _i w_i\), the equilibrium quantities and profits are independent on \(\lambda _i\). Thus, we have the same results only if \(z_1 \ne z_2\).

6 Concluding remarks

This paper challenges the conventional wisdom that strong upstream firms always make downstream firms worse off. We identify a situation under which the widely accepted view that downstream firms’ profits are decreasing with the bargaining power of upstream firms fails to manifest itself. In a market consisting of inherently asymmetric firms, an increase in the bargaining power of upstream firms harms the efficient downstream firm, but may benefit the inefficient one.

Our results might present an implication for empirical research. Many previous papers try to identify the relationship between union power and firm profit. Their empirical hypotheses (e.g., Machin 1991) are based on the theoretical prediction from the union monopoly model, because unions raise wages and firm profits are a strictly decreasing function of the wage. Moreover, in an efficient bargain, this prediction also holds since the firm’s potential profits are divided between the two parties in the bargain: that is, potential profits are decreasing in union relative bargaining strength. However, the theoretical prediction they employed does not always hold when firms have cost or quality asymmetries.

We believe that this is an important insight, especially when we examine the relationship between bargaining power and firm profits, and it is of interest to pursue this aspect, both theoretically and empirically, in future studies.

Notes

Cai and Li (2014) consider how political interaction between policymakers and domestic and foreign firms endogenously determines tariff rates.

Matsushima (2015) presents numerous real-world cases where buyers encourage suppliers to organize collective associations to negotiate with them although this would weaken the buyers’ bargaining power.

Grennan (2013) uses a bilateral Nash Bargaining to empirically analyze bargaining and price discrimination in the medical device market.

In contrast, Bonnet and Dubois (2010) find that manufacturers use two-part tariff contracts with resale price maintenance in the bottled water retail market in France. Villas-Boas (2007) also obtains results consistent with non-linear pricing by manufacturers or high bargaining power of retailers in the yogurt market in the US.

Christou and Papadopoulos (2015), in contrast, show that by correcting for payoffs and outside options in Chen (2003), the profit of the dominant retailer never decreases with buyer power. Matsushima and Yoshida (2016) find that the profit of the dominant retailer may decrease with buyer power when the dominant retailer works as sales promoter.

Dertwinkel-Kalt et al. (2015) consider a vertically related market with downstream firms that have different input efficiencies, and they find that a higher input price benefits a subset of relatively efficient downstream firms.

In management, Iyer and Villas-Boas (2003) investigate bargaining over the terms of trade between manufacturers and retailers in distribution channels. They find that when the manufacturer’s bargaining power goes from its lower to upper limit, the manufacturer’s profit first increases and subsequently decreases. Matsushima (2015) considers a Hotelling duopoly model with buyer-supplier negotiations and product positioning choices of downstream firms, and finds that a downstream firm’s profit is not always improved if it strengthens its bargaining power with its exclusive supplier.

Following Horn and Wolinsky’s (1988b) interpretation, this setting can be viewed as a situation in which the workers join forces for the purpose of bargaining. That is, suppose for example that one of the workers is authorized to represent both. When the labor market is not completely flexible (e.g., Japan), or workers must incur high switching costs, it is difficult for the low wage firm’s worker to move to the high wage firm.

We provide a numerical example of a non-linear demand function when the upstream market consists of exclusive suppliers in the next section.

We discuss implications of when disagreement profits come from the monopoly profit of the other downstream firms in the Sect. 5.

Matsumura and Yamagishi (2017) find that incumbents can have incentive to strengthen regulations, which affect the cost of all firms equally, depending on the demand condition.

This is also true when there are two upstream agents in the next section.

This assumption is not essential because the results are qualitatively the same if we consider the case where downstream firms do not incur any costs expect input prices, while each upstream firm faces a constant marginal cost of production.

Fanti (2016) analyzes the effects of two-sided cross-ownership structures in a Cournot duopoly with firm-specific unions, and shows that an increase in the degree of two-sided cross-ownership reduces wage, which implies that cross-ownership and bargaining power have a similar effect on wage.

References

Aghadadashli H, Dertwinkel-Kalt M, Wey C (2016) The Nash bargaining solution in vertical relations with linear input prices. Econ Lett 145:291–294

Basak D, Marjit S, Mukherjee A (2016) Upstream market power and downstream profits under convex costs, mimeo

Binmore K, Rubinstein A, Wolinsky A (1986) The Nash bargaining solution in economic modelling. RAND J Econ 17(2):176–188

Bonnet C, Dubois P (2010) Inference on vertical contracts between manufacturers and retailers allowing for nonlinear pricing and resale price maintenance. RAND J Econ 41(1):139–164

Cai D, Li J (2014) Protection versus free trade: lobbying competition between domestic and foreign firms. South Econ J 81(2):489–505

Chen Z (2003) Dominant retailers and the countervailing-power hypothesis. RAND J Econ 34(4):612–625

Christou C, Papadopoulos K (2015) The countervailing power hypothesis in the dominant firm-competitive fringe model. Econ Lett 126:110–113

Crawford G, Yurukoglu A (2012) The welfare effects of bundling in multichannel television markets. Am Econ Rev 102(2):643–685

DeGraba P (1990) Input market price discrimination and the choice of technology. Am Econ Rev 80(5):1246–1253

Dertwinkel-Kalt M, Haucap J, Wey C (2015) Raising rivals’ cost through buyer power. Econ Lett 126:181–184

Dowrick S (1989) Union-oligopoly bargaining. Econ J 99(398):1123–1142

Draganska M, Klapper D, Villas-Boas S (2010) A larger slice or a larger pie? An empirical investigation of bargaining power in the distribution channel. Mark Sci 29(1):57–74

Fanti L (2016) Interlocking cross-ownership in a unionised duopoly: when social welfare benefits from “more collusion”. J Econ 119(1):47–63

Farmakis-Gamboni S, Prentice D (2011) When does reducing union bargaining power increase productivity? Evidence from the Workplace Relations Act. Econ Rec 87(279):603–616

Freeman R, Medoff J (1984) What do unions do?. Basic Books, New York

Gaudin G (2016) Pass-through, vertical contracts, and bargains. Econ Lett 139:1–4

Gaudin G (2017) Vertical bargaining and retail competition: What drives countervailing power? Econ J (forthcoming)

Grennan M (2013) Price discrimination and bargaining: empirical evidence from medical devices. Am Econ Rev 103(1):145–177

Grout PA (1984) Investment and wages in the absence of binding contracts: A Nash bargaining approach. Econometrica 52(2):449–460

Han TD, Mukherjee A (2017) Labor unionization structure, innovation, and welfare. J Inst Theor Econ 173(2):279–300

Haucap J, Wey C (2004) Unionisation structures and innovation incentives. Econ J 114(494):149–165

Hirsch B (2004) What do unions do for economic performance? J Labor Res 25:415–455

Ho K, Lee R (2015) Insurer competition in health care markets (No. w19401). National Bureau of Economic Research

Horn H, Wolinsky A (1988a) Bilateral monopolies and incentives for merger. RAND J Econ 19(3):408–419

Horn H, Wolinsky A (1988b) Worker substitutability and patterns of unionisation. Econ J 98(391):484–497

Iozzi A, Valletti T (2014) Vertical bargaining and countervailing power. Am Econ J Microecon 6(3):106–135

Iyer G, Villas-Boas JM (2003) A bargaining theory of distribution channels. J Mark Res 40(1):80–100

Koskela E, Schob R (1999) Does the composition of wage and payroll taxes matter under Nash bargaining? Econ Lett 64(3):343–349

Lerner J, Tirole J (2015) Standard-essential patents. J Polit Econ 123(3):547–586

Li Y, Shuai J (2016) Licensing essential patents: the non-discriminatory commitment and hold-up, working paper

Lopez MC, Naylor RA (2004) The Cournot–Bertrand profit differential: a reversal result in a differentiated duopoly with wage bargaining. Eur Econ Rev 48(3):681–696

Machin SJ (1991) Unions and the capture of economic rents: an investigation using British firm-level data. Int J Ind Org 9:261–274

Matsumura T, Yamagishi A (2017) Lobbying for regulation reform by industry leaders. J Regul Econ (forthcoming)

Matsushima N (2015) Do poor procurement conditions always lead to poor performances? The interplay between procurement conditions and product positions. mimeo

Matsushima N, Yoshida S (2016) The countervailing power hypothesis when dominant retailers function as sales promoters. ISER Discussion Paper No. 981, Institute of Social and Economic Research, Osaka University

Milliou C, Petrakis E (2007) Upstream horizontal mergers, vertical contracts, and bargaining. Int J Ind Org 25(5):963–87

Mukherjee A (2008) Unionised labour market and strategic production decision of a multinational. Econ J 118(532):1621–1639

Mukherjee A, Wang LF (2013) Labour union, entry and consumer welfare. Econ Lett 120(3):603–605

Rubinstein A (1982) Perfect equilibrium in a bargaining model. Econometrica 50(1):97–109

Seade J (1985) Profitable cost increases and the shifting of taxation: equilibrium response of markets in oligopoly (No. 260). University of Warwick, Department of Economics

Singh N, Vives X (1984) Price and quantity competition in a differentiated duopoly. RAND J Econ 15:546–554

Symeonidis G (2010) Downstream merger and welfare in a bilateral oligopoly. Int J Ind Organ 28(3):230–243

Van der Ploeg F (1987) Trade unions, investment, and employment: a non-cooperative approach. Eur Econ Rev 31(7):1465–1492

Vetter H (2017) Pricing and market conduct in a vertical relationship. J Econ 121:239–253

Villas-Boas S (2007) Vertical contracts between manufacturers and retailers: inference with limited data. Rev Econ Stud 74:625–652

Zanchettin P (2006) Differentiated duopoly with asymmetric costs. J Econ Manag Strategy 15(4):999–1015

Ziss S (1995) Vertical separation and horizontal mergers. J Ind Econ 43(1):63–75

Acknowledgements

I am especially grateful to Noriaki Matsushima for his valuable advice. I would also like to thank Koki Arai, Keisuke Hattori, Arijit Mukherjee, and the participants of the Japanese Economic Association Conference (Nagoya University) and the seminar participants at Shinshu University for their very useful comments. The author acknowledges the financial support from Grant-in-Aid for JSPS Fellows, Grant Number 16J02442. All remaining errors are my own.

Author information

Authors and Affiliations

Corresponding author

Electronic supplementary material

Below is the link to the electronic supplementary material.

Appendix: Proofs

Appendix: Proofs

Proof of Lemma 1

Differentiating \(w_1^{*}\) with respect to \(\theta \), we have

Differentiating \(w_2^{*}\) with respect to \(\theta \), we have

Similarly, we have

which proves the lemma. \(\square \)

Proof of Proposition 1

Differentiating \(q_1^{*}\) with respect to \(\theta \), we have

Similarly, differentiating \(q_2^{*}\) with respect to \(\theta \), we have

This expression is positive if and only if

We now show that the interval between this lower bound and the upper bound of the interior solution condition is nonempty. Comparing these two values, we have

which gives the condition for Proposition 1. This completes the proof of the proposition. \(\square \)

Proof of Proposition 2

Differentiating \(Q^{*}\) with respect to \(\theta \), we have

Similarly, we have

Note that \(p^{*}-c_1+q_1^{*}>p^{*}-c_2+q_2^{*}>0\). Since \(\left| \frac{d q_1^{*}}{d \theta }\right| >\frac{d q_2^{*}}{d \theta }\), the sign of Eq. (39) becomes negative. \(\square \)

Proof of Lemma 2

Differentiating \(w_i^{**}\) with respect to \(\theta \), we have

Similarly, we have

which proves the lemma. \(\square \)

Proof of Proposition 3

Differentiating \(q_1^{**}\) with respect to \(\theta \), we have

The numerator of the expression can be written as follows:

which proves the first part of the proposition.

Similarly, differentiating \(q_2^{**}\) with respect to \(\theta \), we have

This expression is positive if and only if

We now show that the interval between this lower bound and the upper bound of the interior solution condition is nonempty.

This completes the proof of the proposition. \(\square \)

Proof of Lemma 3

Differentiating \(w_1^{B}\) with respect to \(\theta \), we have

Similarly, we have

which proves the lemma. \(\square \)

Proof of Proposition 4

Differentiating \(q_1^{B}\) with respect to \(\theta \), we have

Note that we used Lemma 3 to get the inequality on the second line.

We can relatively easy derive the sufficient condition for the result. Applying the mean-value theorem, for some \(\hat{\theta }\in (0,1)\), we have

The condition that the left-hand side of the above expression is positive is

We can confirm that the interval between the above threshold value of \(\alpha \) and that of the interior solution condition is nonempty. That is,

\(\square \)

Rights and permissions

About this article

Cite this article

Yoshida, S. Bargaining power and firm profits in asymmetric duopoly: an inverted-U relationship. J Econ 124, 139–158 (2018). https://doi.org/10.1007/s00712-017-0563-3

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00712-017-0563-3