Abstract

Government incentives play an important role in the development of the remanufacturing industry. It remains a challenge to determine an optimal policy (subsidy and/or tax refund) and how firms (manufacturers and retailers) can integrate it into their pricing decisions. We analyze the impacts of government financial incentives on manufacturers’ and retailers’ pricing decisions in terms of corporate profits and social welfare under different scenarios. We find that government incentives increase the recycling price and availability of used products, while the wholesale and retail prices of new products remain unchanged. Government incentives also significantly increase the manufacturer’s profits and enhance social welfare.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

1 Introduction

The surging economy in a developing country can bring about various effects. On the one hand, the economy and technology have greatly improved people’s quality of life; on the other hand, they may have aggravated the deterioration of the environment and the resource shortage. Today, environmental awareness has gradually gone deep into people’s minds. Implementing a circular economy and maintaining sustainable economic and social development has become an essential topic of general concern in modern society. According to China’s Remanufacturing Industry Development Report published in 2019, 14 million tons of materials could be saved each year through remanufacturing, enough to fill 230,000 rail cars. Remanufacturing uses only 15% of the energy of a new product, which translates to saving 16 million barrels of oil a year for six million cars. This has prompted the government and the majority of remanufacturing companies to continue to focus on the recycling and reuse of waste materials. For example, the Chinese “2015 Government Work Report” stated that the government would adhere to the concept of green development as one of the basic guidelines. As a critical part of green economic development, recycling and remanufacturing can effectively save resources, increase corporate profits and play a strong role in promoting the relationship between environmental protection and economic development.

Therefore, China has also enacted a series of policies, such as “Opinions on Accelerating the Development of Circular Economy,” “Circular Economy Promotion Law” and “Opinions on Promoting the Development of Remanufacturing Industry,” to support and encourage the development of remanufacturing. In fact, developed countries have adopted similar policies. For example, in the USA, Maryland and California have legislation to charge for recycling electronic products. Japan and Canada have also introduced much support around the development of recycling and remanufacturing industry subsidies. Germany even promulgated the “Circular Economy and Waste Disposal Law” to develop its circular economy in 1994.

Despite recent efforts, there are still some difficulties in promoting the development of the remanufacturing industry, such as the low enthusiasm for manufacturing companies to remanufacture and the limited capacity and high recovery costs for recycling companies [13]. Moreover, recycling companies must bear an excessive value-added tax (VAT) burden. VAT is a type of tax on the amount by which the value of an article has been increased at different phases of its production or distribution. It is quite difficult to obtain VAT invoices for purchased waste materials from dispersed social workers for many reasons. The recycling company must invoice the manufacturing enterprise to deduct their input tax. Thus, the recycling enterprise must face an insufficient VAT deduction issue, which reduces its willingness to recycle and hinders the development of a healthy circular economy. In response to this problem, the Ministry of Finance and other departments in China issued a preferential policy in 2015. The policy states that resource utilization enterprises that meet the requirements may be refunded a certain proportion of the VAT levied by the tax authorities. This is essentially a tax exemption and tax reduction policy—similar to the export tax rebate and investment tax rebate policies [15]—to stimulate the circular economy by providing special governmental policy support for the recycling industry.

Based on the above background, it is particularly urgent for the government to develop incentives to increase the recycling of used products and corporate profits by participating in remanufacturing activities. To unveil how government intervention impacts remanufacturing enterprises and related “industries’” activities and decision making, we specifically consider the following four scenarios based on current firm practices and the extant literature: (a) no government intervention; (b) the subsidy-only policy; (c) the VAT rebate-only policy; and (d) the VAT rebate-and-subsidy coexistence policy. Through a comparison of the results in the different scenarios above, we answer the following important research questions in supply chain management.

-

1.

What effect does the government’s involvement have on the decisions of related companies in a closed-loop supply chain? How do the government’s incentives, subsidies and VAT refunds integrate the manufacturer and retailer into their pricing decision-making processes?

-

2.

What are the effects of government involvement on manufacturers’ financial performance?

-

3.

Could the government set an optimal subsidy or tax refund to maximize social welfare?

The government can improve social welfare by “directly” subsidizing the manufacturer or “indirectly” refunding the VAT to the retailer. Therefore, it can be useful for the government to develop an effective subsidy program or a VAT refund system in the future. We use a Stackelberg game to address the questions to capture the underlying strategic interactions among the government, manufacturer and retailer. Our paper unveils the VAT refund in the research on the closed-loop supply chain and combines government subsidies with VAT refunds to analyze the government’s optimal decision from the perspective of social welfare in an original way. On a broader level, in this study, we contribute to understanding the impacts of government policy mechanisms on corporate decision making. In practice, we provide valuable guidance for government strategy policy making and preferable enterprise management decision making.

The main contributions of this paper are as follows. Based on the government subsidy and VAT refund policy, through the Stackelberg game method, we establish four closed-loop supply chain decision models consisting of the manufacturer, the retailer and consumers and derive the corresponding optimal prices, subsidies and tax refund policies. We further compare and analyze the recycling price, recycling volume, corporate profit and social welfare under four different models and obtain the optimal decision-making choices of the government and enterprises.

The remainder of this paper is organized as follows. In Sect. 2, we conduct a literature review and develop a novel analytical model in Sect. 3. After proposing the model, in Sect. 4, we investigate the optimal closed-loop supply chain structures and decision-making problems under different government support policies. In Sect. 5, we analyze and compare the results obtained in Sect. 4. In Sect. 6, we conclude the study and discuss future research directions.

2 Related literature

Our study is related to two literature streams: one from remanufacturing and the other from business economics.

2.1 Remanufacturing

For the remanufacturing literature, Wu and Kao [33] studied competition and cooperation in a closed-loop supply chain, including the OEM and the IR. They established two cooperation models to study the quality decisions of enterprises with an extension to multicycle models. Some scholars have also studied the competition between manufacturers and remanufacturers by establishing a two-stage game model [3, 11, 22]. However, the above literature has not considered the role of the government in remanufacturing activities or social welfare problems. Many researchers have addressed environmental issues concerning remanufacturing (e.g., [8, 10]. A number of authors have addressed product take-back legislation [4, 17, 32]. These works have considered the tax from environmental problems. Our work differs from the above in several dimensions,most importantly, the questions we address are focused more on corporate profits and social welfare.

Given the dilemma in developing the remanufacturing industry, many scholars have analyzed the decision making related to the remanufacturing supply chain from the perspective of government subsidies [6, 7, 25]. Ma et al. [21] studied the impact of government subsidies for consumers on the dual-channel, closed-loop supply chain and analyzed the decision making of channel members before and after the government implemented the subsidy program. Yu et al. [35] employed the home appliance subsidy programs implemented by China from 2007 to 2013 as a research background to explore whether the government should subsidize manufacturers or consumers to improve consumer welfare and corporate profits. Some researchers have also studied the impact of the government’s old-for-new subsidy policy on the decision making of members in the closed-loop supply chain from different perspectives, such as corporate profits, environmental benefits and consumer utility Li et al. [20, 24]. The above research shows that many scholars have considered government subsidies to be exogenous when considering the government’s participation in remanufacturing activities. Although some researchers have analyzed the internalization of government subsidies from consumer surplus and social welfare perspectives, few studies have combined government subsidies and taxes (especially VAT) as endogenous variables to analyze the problems related to closed-loop supply chains.

2.2 Business economics

In the business economics literature, many researchers have studied the impact of VAT on different industries [2, 16, 31]. However, these works did not involve the remanufacturing industry. Keen and Lockwood [18] explored the causes and consequences of the VAT, what has shaped its adoption, and whether it has proven to be an effective form of taxation. Aizenman et al. [1] studied the collection efficiency of VATs based on theory and international evidence. However, the research framework for the above studies is different from ours. Hoseini and Briand [14] examined the impact of VAT replacement of sales tax on productivity and informality in Indian states. The difference is that we combine economics and remanufacturing and use quantitative analysis methods to study the impact of VAT on the closed-loop supply chain.

In fact, a number of researchers combine economic literature and operational management literature to study issues related to the supply chain. Some researchers have studied how to use tax-efficient supply chain management to improve the profits of multinational firms under tax planning [30, 34], Feng and Wu [9, 27, 36]. Krass et al. [19] studied several vital aspects of adopting environmental taxes to motivate innovative and “green” emissions-reducing technologies and the role of fixed cost subsidies and consumer rebates. Arya and Mittendorf [5] researched a parsimonious model of the brick-and-mortar entry choice of online retailers in light of consumer sales taxes. Few researchers have combined the recycling economic literature and remanufacturing literature to study issues about the supply chain. Haddadsisakht et al. [12] redesigned a closed-loop supply chain that accommodates a carbon tax with tax rate uncertainty. Their works have combined taxation with supply chain research, however, VAT is not considered. The purpose of our work is to analyze issues related to the closed-loop supply chain under VAT refunds.

To the best of our knowledge, the only other study that considered the economics and operations approaches and analyzed supply chain problems with tax regulations is the paper by Hsu et al. [15]. They studied how China’s export-oriented tax and tariff rules affect the optimal supply chain design and operations for a firm with production in China and selling both inside and outside China. Given all of the individual differences from our study, they do not consider the government’s decisions or issues related to the closed-loop supply chain.

3 The models

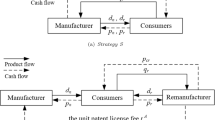

Consider a closed-loop supply chain system consisting of three members, a manufacturer, a retailer, and consumers. In this system, the manufacturer uses both new and recycled materials to produce new products, and the unit costs are \({c}_{m}\) and \({c}_{r}\), respectively; thereafter, the manufacturer sells the product to the retailer at a unit price \(w\). The retailer plays a dual role in the closed-loop supply chain system. One is responsible for recycling used products from dispersed consumers at price \({b}_{r}\) and then reselling the waste products to manufacturers at transfer price \({b}_{m}\). The other is selling new products produced by the manufacturer at price \(p\). Since the retailer cannot deduct the VAT when recycling the used products, and the manufacturer's enthusiasm to participate in the remanufacturing activities will not be high enough, the government implements the VAT refund to the retailer who resells the used products to the manufacturer. In addition, the government determines the subsidy to be given to the manufacturer per unit of new products produced using used parts. The remanufacturing closed-loop supply chain structure studied and established in this paper is shown in Fig. 1.

The modeling parameters in this paper are specified in Table 1.

Note that producing a new product using a recycled product is less expensive than using a new product, i.e., \({c}_{r}<{c}_{m}\). If we denote cost savings from reuse with \(\Delta \mathrm{per} \mathrm{unit}\), then \({\Delta =c}_{m}-{c}_{r}\). In this paper, we assume a downward sloping linear demand function, \(D\left(p\right)=\alpha -\beta p\), with \(\alpha\) and \(\beta\) being positive parameters and \(\alpha >\beta p\), and \(\alpha\) represents the potential demand at market price \(p=0\) [29]. Referring to Mukhopadhyay [26] for the assumption of the amount of waste recycling, the supply of used products is given by \({G(b}_{r})=k+h{b}_{r}\), where \(k>0\) is a certain amount of waste products on the market that consumers are willing to donate to retailers without compensation, and the greater the \(k\) is, the higher is consumers’ awareness of environmental protection, and \(h>0\) represents the sensitivity of consumers to the recovery price \({b}_{r}\).

Given the improvement in consumers’ awareness of environmental protection, their recognition of remanufactured products is also gradually increasing, and they are even willing to pay a certain price premium for environmentally friendly, low-carbon products. According to the 2022 Global Consumer Insight Survey China Report released by Price Waterhouse Coopers, many respondents are willing to buy products made of remanufactured, sustainable, or environmentally friendly materials at a higher than average price. Savaskan et al. [29] assumed that all members of the supply chain share information, and consumers are willing to pay the same price for homogeneous products. In addition, we make some modeling assumptions as follows. First, remanufactured products produced by used products and new products are homogenous [23], that is, there is no difference in price and quality between the two. Second, we assume that all of the recycled waste can be remanufactured and that the impact of remanufacturing by waste recycling on market capacity is negligible. Additionally, we assume that the fixed investment cost of recycling is 0. Third, the same information is available to all supply chain members, and all decisions are considered in a single-period setting. Finally, we assume that the market price \(p\), the wholesale price \(w\) and the transfer price of the used products \({b}_{m}\) are all tax-included; since the retailer cannot obtain the special VAT invoice for recycling the waste products from disperse consumers, the recovery price \({b}_{r}\) does not include a tax. Thus, the corresponding after-tax prices are \(\frac{p}{1+t}\), \(\frac{w}{1+t}\), \(\frac{{b}_{m}}{1+t}\) and \({b}_{r}\), respectively (Fig. 2).

We develop four decision remanufacturing models in a closed-loop supply chain and derive the optimal decision in each scenario. The four models have different levels of government involvement in remanufacturing activities. In the first scenario, no government subsidy or VAT refund is involved in the market. In the second scenario, the government offers a subsidy to the manufacturer based on the number of new products produced with used parts. In the third scenario, the government implements the VAT refund for the retailer who resells waste products to the manufacturer. In the fourth scenario, the government not only gives the manufacturer a subsidy per unit of new products produced with waste parts but also implements the VAT refund for the retailer. Finally, we show the optimal government decisions for the latter three scenarios. These four scenarios are subsequently discussed in detail.

According to Sect. 3 and the above analysis, the manufacturer’s profit function is given by

where \(\frac{w}{1+t}\left(\alpha -\beta p\right)\) is the total manufacturer revenue by wholesaling the new product to the retailer, \({c}_{m}\left[\left(\alpha -\beta p\right)-\left(k+h{b}_{r}\right)\right]\) and \({c}_{r}\left(k+h{b}_{r}\right)\) are the total product cost produced with new materials and waste products, respectively, and \(\frac{{b}_{m}}{1+t}\left(k+h{b}_{r}\right)\) is the total cost of recycling generated by the manufacturer who repurchases waste products from the retailer.

The retailer’s profit function is given by

where \(\frac{p}{1+t}\left(\alpha -\beta p\right)\) is the total revenue earned by the retailer who sells new products to consumers, \(\frac{w}{1+t}\left(\alpha -\beta p\right)\) is the total cost that the retailer pays to purchase new products from the manufacturer, \(\frac{{b}_{m}}{1+t}\left(k+h{b}_{r}\right)\) is the total retailer revenue by selling the used product to the manufacturer, and \({b}_{r}\left(k+h{b}_{r}\right)\) is the total cost of used products recycled from consumers.

3.1 Model B: no government incentives

In this scenario, there is neither a government subsidy nor a VAT rebate on the market; that is, the government is involved in any remanufacturing activity. The manufacturer and retailer make decisions based only on maximizing their profit. The decision-making goals of the manufacturer and retailer are given as follows:

We apply Stackelberg game theory to analyze this scenario, and the manufacturer is the leader of the game [28]. Therefore, the manufacturer decides the new product’s wholesale price and the used product’s transfer price to maximize its profit. Then, as the follower of the game, the retailer makes an optimal decision about the retail and recycling prices to maximize profit.

Because the retailer’s objective function is concave in\(p\), its first-order condition characterizes the best response, \(p^{B} = \left( {\alpha + \beta w} \right)/\left( {2\beta } \right)\). Similarly, the best response regarding the recycling price is given by \(b_{r}^{B} = \left[ {hb_{m} - k\left( {1 + t} \right)} \right]/\left[ {2h\left( {1 + t} \right)} \right]\). By substituting \(p^{B}\) and \(b_{r}^{B}\) into (1), the manufacturer’s problem becomes

The objective function is jointly concave in \(w\) and \(b_{m}\), and the manufacturer’s first-order conditions characterize the best response, \(w_{ }^{*B} = \frac{{\alpha + \beta c_{m} \left( {1 + t} \right)}}{2\beta }\) and \(b_{m}^{*B} = \frac{{\left( {\Delta h - k} \right)\left( {1 + t} \right)}}{2h}\). Then, the optimal retail price and recycling price are found by substitution of \(w_{ }^{*B}\), \(b_{m}^{*B}\). Therefore, we can obtain \(p_{ }^{*B} = \frac{{3\alpha + \beta c_{m} \left( {1 + t} \right)}}{4\beta }\) and \(b_{r}^{*B} = \frac{\Delta h - 3k}{{4h}}\).

By substituting the above variables, the optimal profits for the manufacturer and the retailer are as follows:

Total social welfare is the corporate profit plus the consumer surplus. Among them, the enterprise profit is the summation of the profit of the manufacturer and retailer. The consumer surplus is expressed by the area below the consumer demand curve and above the market price line, i.e., \({\text{CS}}^{B} = \mathop \smallint \limits_{0}^{{D^{*B} }} \frac{\alpha - D}{\beta }dD - p^{*B} D^{*B} = \frac{1}{2\beta }\left[ {\frac{{\alpha - \beta c_{m} \left( {1 + t} \right)}}{4}} \right]^{2}.\)

Therefore, the social welfare under Model B is expressed as

3.2 Model S: the subsidy-only policy

The government first decides the optimal subsidy \(s\) per unit of new products produced with waste products for the manufacturer. The manufacturer then determines the optimal wholesale price \(w\) and transfer price \({b}_{m}\) after the subsidy is given by the government. The retailer finally determines the retail price \(p\) and recycling price \({b}_{r}\). The decision sequence of the game is shown in the following figure.

The manufacturer and retailer make their decisions to maximize profit. The objective functions are:

Applying the same solution method as in the previous section, we obtain the following equilibrium solutions:

We substitute the variables sought above into the manufacturer’s and retailer’s profit function, which are as follows:

The government’s decision-making goal is to maximize social welfare. An additive social welfare function is used to emphasize the sum of the utility of all members of the current remanufacturing supply chain. The social welfare function can be written as follows:

Social welfare = Firms’ Profit + Consumer Surplus—Government Expenditure.

The firm’s total profit is the sum of the profit of the manufacturer and retailer, i.e.,

\(\pi_{m}^{*S} + \pi_{r}^{*S} = \frac{{3\left[ {\alpha - \beta c_{m} \left( {1 + t} \right)} \right]^{2} }}{{16\beta \left( {1 + t} \right)}} + \frac{{3\left[ {h\left( {\Delta + s} \right) + k} \right]^{2} }}{16h}.\)

Consumer surplus can be expressed as the area below the consumer demand curve and above the market price line, i.e., \({\text{CS}}^{S} = \mathop \smallint \limits_{0}^{{D^{*S} }} \frac{\alpha - D}{\beta }{\text{d}}D - p^{*S} D^{*S} = \frac{1}{2\beta }\left[ {\frac{{\alpha - \beta c_{m} \left( {1 + t} \right)}}{4}} \right]^{2}.\)

Government expenditures are expressed as \(s\left( {k + hb_{r}^{*S} } \right).\)

The government’s decision-making goal is to maximize social welfare, and the social welfare function is given by

Proposition 1.

The government’s optimal unit subsidy when maximizing social welfare under Model S is \(s^{*} = \frac{\Delta h + k}{h}\).

Note that the manufacturer’s and retailer’s profits increase with the government subsidy, and the recycling amount and recycling price of used products also increase. The social welfare under Model S shows an increase first and then a decreasing trend with the government subsidy and reaches the maximum at \(s^{*} = \frac{\Delta h + k}{h}\). Proposition 1 provides an equilibrium solution that maximizes social welfare, which increases the profit of the closed-loop supply chain members and minimizes government spending.

3.3 Model R: the VAT rebate-only policy

The VAT refund policy of this paper comes from a preferential policy issued in 2015 by the Ministry of Finance, the State Administration of Taxation and other departments.Footnote 1 The policy states that, for the resource utilization enterprises that meet the requirements, when the VAT is levied, the tax authorities may refund the tax to the taxpayer at a certain proportion in the form of an immediate withdrawal. This is essentially a tax exemption and tax reduction policy, similar to export tax rebate Hsu et al. [15] and investment tax rebate policies.

The VAT paid by the retailer to the tax authorities is the output VAT minus the input VAT. Regarding the sales node, the retailer can obtain the output VAT invoice when it sells new products to consumers and can also obtain the input VAT invoice when it purchases new products from the manufacturer, which can generate a deductible effect before and after. Regarding the recycling process, the retailer cannot obtain the input VAT invoice when collecting used products from consumers; however, when it resells used products to the manufacturer, it is required to pay the output VAT, so the deductible cannot be deducted before and after, which increases the retailer’s recycling costs. Therefore, based on the preferential VAT document issued by the Ministry of Finance and the State Administration of Taxation in 20151 and the export tax rebate policy Hsu et al. [15], we assume that \(r\)(\(0<r\le t\)) is the VAT refund rate that the government implements when the retailer resells the used product to the manufacturer.

In this scenario, the government first determines the optimal VAT rebate rate \(r\). Based on \(r\), the manufacturer decides the optimal wholesale price \(w\) and transfer price \({b}_{m}\). The retailer finally determines the optimal retail price \(p\), as well as the recycling price \({b}_{r}\). The decision order of the game is similar to that in Sect. 3.2.

The manufacturer and retailer make their decisions to maximize profits, which are as follows:

We use the same solution method as in the previous section to find the following equilibrium solution:

We substitute the variables sought above into the manufacturer’s and retailer’s profit function, which are:

The government’s goal is to maximize social welfare \(TS.\)

\(TS\) = Firms’ Profit + Consumer Surplus—Government Expenditure.

The firms’ total profit is.

\(\pi_{m}^{*R} + \pi_{r}^{*R} = \frac{{3\left[ {\alpha - \beta c_{m} \left( {1 + t} \right)} \right]^{2} }}{{16\beta \left( {1 + t} \right)}} + \frac{{\left[ {\Delta h\left( {1 + t} \right) + k\left( {1 + t - r} \right)} \right]^{2} }}{{8h\left( {1 + t} \right)\left( {1 + t - r} \right)}} + \frac{{\left[ {\Delta h\left( {1 + t} \right) + k\left( {1 + t - r} \right)} \right]^{2} }}{{16h\left( {1 + t - r} \right)^{2} }}.\)

Consumer surplus is given by \(CS^{R} = \mathop \smallint \limits_{0}^{{D^{*R} }} \frac{\alpha - D}{\beta }dD - p^{*R} D^{*R} = \frac{1}{2\beta }\left[ {\frac{{\alpha - \beta c_{m} \left( {1 + t} \right)}}{4}} \right]^{2}.\)

Government expenditure is the total amount of the tax refunds given to the retailer by the government, i.e., \(f\left( r \right) = \left[ {\frac{{b_{m}^{*R} }}{1 + t}t - \frac{{b_{m}^{*R} }}{1 + t - r}\left( {t - r} \right)} \right]\left( {k + hb_{r}^{*R} } \right).\)

The government’s decision-making goal is to maximize social welfare, and the social welfare function is given by

The first derivative of Eq. (10) is solved to have it equal to zero, giving the only maximum point: \(r^{*R} = \frac{{\left( {k + \Delta h} \right)\left( {1 + t} \right)}}{k + 2\Delta h}.\)

Proposition 2. \(r^{*R} > t\).

Proposition 2 indicates that the government’s optimal VAT rebate rate in pursuit of maximizing social welfare is higher than the VAT rate it imposes on the retailer. That is, at this time, the government not only gives retailers a tax-free policy but also subsidizes them to maximize social welfare (as shown in Fig. 3, and we set the parameters \(\alpha = 500\), \(\beta = 4\),\(c_{m} = 60\), \(c_{r} = 35\), \(\Delta = 25\), \(k = 50\), \(h = 20\), \(t = 0.16\)). If the government only considers the tax rebate rate within the interval \(\left( {0,t} \right]\), then the optimal decision of the government is \(r^{*R} = t\).

However, paying taxes to tax authorities is not only a requirement to ensure the normal operation of the country but also a basic prerequisite for improving peoples’ livelihoods and developing social production. Proposition 2 shows that the government not only implements tax exemption policies for the retailer but also subsidizes it to maximize social welfare, which is not consistent with reality. In China, for example, the proportion of the VAT rebate rate for the remanufacturing industry is 30%–70%. Therefore, if the tax exemption policy or even subsidies are all given to the retailer, why not consider giving VAT rebates to the retailer to recycle waste products and subsidize new products produced with waste products by the manufacturer to mobilize the enthusiasm of both parties to participate in remanufacturing activities?

Next, we show the scenario in which the VAT refund and a government subsidy exist simultaneously and explore the conclusions that can be made if the VAT refund and government subsidy are considered simultaneously.

3.4 Model SR: the VAT rebate-and-subsidy coexistence policy

Based on Sects. 3.2 and 3.3, in this section, we show the scenario in which the government gives the manufacturer a subsidy and implements VAT refunds for the retailer. We denote the VAT refund rate by \(r\) and simultaneously assume that the relationship between the unit subsidy \(s\) and the VAT refund rate \(r\) is \(s = xr\), \(x > 0\).

The government first decides the optimal VAT rebate rate \(r\). Based on \(r\), the manufacturer decides the optimal wholesale price \(w\) and transfer price \(b_{m}\). The retailer finally determines the optimal retail price \(p\) and the recycling price \(b_{r}\). The decision order of the game is similar to that in Sect. 3.2.

Next, the manufacturer’s and retailer’s objective functions are given as follows:

We use the same solution method as in the previous section to find the following equilibrium solution:

Then, we substitute the solutions sought above into functions (13) and (14) and acquire the manufacturer’s and retailer’s optimal profits:

\(\pi_{m}^{{*{\text{SR}}}} = \frac{{\left[ {\alpha - \beta c_{m} \left( {1 + t} \right)} \right]^{2} }}{{8\beta \left( {1 + t} \right)}} + \frac{{\left[ {h\left( {1 + t} \right)\left( {\Delta + xr} \right) + k\left( {1 + t - r} \right)} \right]^{2} }}{{8h\left( {1 + t} \right)\left( {1 + t - r} \right)}},\;\pi_{r}^{{*{\text{SR}}}} = \frac{{\left[ {\alpha - \beta c_{m} \left( {1 + t} \right)} \right]^{2} }}{{16\beta \left( {1 + t} \right)}} + \frac{{\left[ {h\left( {1 + t} \right)\left( {\Delta + xr} \right) + k\left( {1 + t - r} \right)} \right]^{2} }}{{16h\left( {1 + t - r} \right)^{2} }}\) The government’s decision-making goal is to maximize social welfare, and the social welfare function is given by

The first two items on the right side of Eq. (14) represent the sum of the manufacturer’s and retailer’s profits, i.e.,

\(\pi_{m}^{{*{\text{SR}}}} + \pi_{r}^{{*{\text{SR}}}} = \frac{{3\left[ {\alpha - \beta c_{m} \left( {1 + t} \right)} \right]^{2} }}{{16\beta \left( {1 + t} \right)}} + \frac{{\left[ {h\left( {1 + t} \right)\left( {\Delta + xr} \right) + k\left( {1 + t - r} \right)} \right]^{2} }}{{8h\left( {1 + t} \right)\left( {1 + t - r} \right)}} + \frac{{\left[ {h\left( {1 + t} \right)\left( {\Delta + xr} \right) + k\left( {1 + t - r} \right)} \right]^{2} }}{{16h\left( {1 + t - r} \right)^{2} }}\) The third item is consumer surplus, i.e.,

\({\text{CS}}^{{{\text{SR}}}} = \mathop \smallint \limits_{0}^{{D^{{*{\text{SR}}}} }} \frac{\alpha - D}{\beta }{\text{d}}D - p^{{*{\text{SR}}}} D^{{*{\text{SR}}}} = \frac{1}{2\beta }\left[ {\frac{{\alpha - \beta c_{m} \left( {1 + t} \right)}}{4}} \right]^{2}.\)

The last item is government expenditure, which consists of two parts. One is the total amount of subsidies to be given to the manufacturer, i.e., \(xr\left( {k + hb_{r} } \right)\), and the other is the total amount of VAT refunds, i.e., \(\left[ {\frac{{b_{m} }}{1 + t}t - \frac{{b_{m} }}{1 + t - r}\left( {t - r} \right)} \right]\left( {k + hb_{r} } \right)\). Therefore, the government expenditure can be expressed as.\(g\left( r \right) = \frac{{xr\left[ {h\left( {1 + t} \right)\left( {\Delta + xr} \right) + k\left( {1 + t - r} \right)} \right]}}{{4\left( {1 + t - r} \right)}} + \frac{{h\left( {1 + t} \right)\left( {\Delta + xr} \right) - k\left( {1 + t - r} \right)}}{2h}\left( {\frac{t}{1 + t} - \frac{t - r}{{1 + t - r}}} \right)\frac{{h\left( {1 + t} \right)\left( {\Delta + xr} \right) + k\left( {1 + t - r} \right)}}{{4\left( {1 + t - r} \right)}}\) Based on the maximization of Eq. (14), we first take the derivatives of \({\text{TS}}^{{{\text{SR}}}}\) concerning \(r\) and let \(\frac{{{\text{dTS}}^{{{\text{SR}}}} }}{{{\text{d}}r}} = 0\). Then, we obtain Proposition 3.

Proposition 3.

The social welfare under Model SR is maximized at \(r^{{*{\text{SR}}}} = \frac{{\left( {k + \Delta h} \right)\left( {1 + t} \right)}}{{hx\left( {1 + t} \right) + 2\Delta h + k}}\). Social welfare \({\text{TS}}^{{{\text{SR}}}}\) is monotonically increasing on \(\left( {0,r^{{*{\text{SR}}}} } \right)\) and monotonically decreasing on \(\left( {r^{{*{\text{SR}}}} ,\;t} \right)\) if and only if \(x \ge \frac{{\Delta h\left( {1 - t} \right) + k}}{{ht\left( {1 + t} \right)}}\).

Proposition 3 shows that for a sufficiently high \(x\), specifically \(x \ge \frac{{\Delta h\left( {1 - t} \right) + k}}{{ht\left( {1 + t} \right)}}\), the social welfare under Model SR first shows an increasing trend and then a decreasing trend with the VAT refund rate (as shown in Fig. 4, and we set the parameters \(\alpha = 500\),\(\beta = 4\),\(c_{m} = 60\), \(c_{r} = 35\), \(\Delta = 25\), \(k = 50\), \(h = 20\), \(t = 0.16\), \(x = 300\)). When \(r = r^{*SR}\) (i.e., \(r^{*SR} = 0.08\)), social welfare reaches its maximum. At a lower \(x\), the conclusion is similar to that in Sect. 3.3. That is, to maximize social welfare, it is an optimal choice for the government to simultaneously implement subsidy and VAT refund policies.

4 Comparison of four CLSC models

In this section, we compare the profits and optimal decisions of the manufacturer and retailer in the four scenarios and examine how these policy mechanisms influence the manufacturer’s and the retailer’s profits and decisions. In addition, we compare social welfare and government expenditure in each of the four cases and show the government’s optimal choice of policy mechanisms.

The solution sought needs to conform to the actual situation, so we impose the condition of \(\Delta h>3k\). Based on the results in Table 2, we obtain some interesting propositions.

Proposition 4.

The optimal decisions of the manufacturer and retailer in each of the four scenarios are related as follows:

(a) \(b_{r}^{*B} < b_{r}^{*R} < b_{r}^{*S} = b_{r}^{{*{\text{SR}}}}\), and \(\frac{{\partial b_{r}^{S} }}{\partial s} > 0\),\(\frac{{\partial b_{r}^{R} }}{\partial r} > 0\),\(\frac{{\partial b_{r}^{{{\text{SR}}}} }}{\partial r} > 0\). Correspondingly, \(G\left( {b_{r}^{*B} } \right) < G\left( {b_{r}^{*R} } \right) < G\left( {b_{r}^{*S} } \right) = G\left( {b_{r}^{{*{\text{SR}}}} } \right).\)\(G\left( {b_{r}^{*B} } \right) < G\left( {b_{r}^{*R} } \right) < G\left( {b_{r}^{*S} } \right) = G\left( {b_{r}^{{*{\text{SR}}}} } \right).\)

(b) \(w_{ }^{*B} = w_{ }^{*S} = w_{ }^{*R} = w_{ }^{{*{\text{SR}}}} ,\; p_{ }^{*B} = p_{ }^{*S} = p_{ }^{*R} = p_{ }^{{*{\text{SR}}}} .\)\(w_{ }^{*B} = w_{ }^{*S} = w_{ }^{*R} = w_{ }^{{*{\text{SR}}}} ,\; p_{ }^{*B} = p_{ }^{*S} = p_{ }^{*R} = p_{ }^{{*{\text{SR}}}} .\)

The (a) difference between the size relationship of the recovery price between the four cases and the size relationship of the recovery price under government intervention can be proven, and the monotonicity of the recovery price under the three kinds of government intervention can be proven by calculating the first derivative. The proof of part (b) can be directly obtained from the above calculation results.

Part (a) in Proposition 4 shows that the recycling price of waste products with government incentives is higher than that without government engagement. Furthermore, regardless of which policy mechanism the government adopts, recycling prices with government incentives increase with an improvement in the strength of the preferential policy. This is because the retailer is willing to improve the recycling price of used products to stimulate customers to sell waste products to respond to the government’s call to achieve a circular economy and increase its profits. In addition, the recycling price under the VAT rebate-and-subsidy policy equals the recycling price under the subsidy-only policy, and both are superior to the VAT rebate-only policy. Therefore, the amount of waste products recovered with government incentives also increases. This trend is enhanced with the improvement in the strength preferential policy. Both the VAT rebate-and-subsidy policy and subsidy-only policy are more efficient than others. This is because the recycling amount is a monotonously increasing function of the recycling price. Therefore, as the price of recycling increases, consumers are more willing to sell their used parts to retailers, which results in an increase in the volume of recycling.

Part (b) of Proposition 4 indicates that the wholesale and retail prices of the product do not change regardless of whether the government participates in remanufacturing activities and policy mechanisms are involved in remanufacturing activities. Government policy makers hope that the incentive packages improve waste product recycling in turn to address environmental concerns without causing any fluctuations in market demand. As seen from part (a) of Proposition 1, both the recycling amount and the recycling price of waste products increased. Since the wholesale price remains the same, the retail price and market demand remain the same. That is, the government’s incentive packages do not interfere with the market.

Proposition 5.

The manufacturer’s and retailer’s profits in the four scenarios are related as follows: \(\pi_{m}^{*B} < \pi_{m}^{*R} < \pi_{m}^{{*{\text{SR}}}} < \pi_{m}^{*S}\), and \(\frac{{\partial \pi_{m}^{S} }}{\partial s} > 0\), \(\frac{{\partial \pi_{m}^{R} }}{\partial r} > 0\), \(\frac{{\partial \pi_{m}^{{{\text{SR}}}} }}{\partial r} > 0\); \(\pi_{r}^{*B} < \pi_{r}^{*R} < \pi_{r}^{{*{\text{SR}}}} = \pi_{r}^{*S}\), and \(\frac{{\partial \pi_{r}^{S} }}{\partial s} > 0\), \(\frac{{\partial \pi_{r}^{R} }}{\partial r} > 0\), \(\frac{{\partial \pi_{r}^{{{\text{SR}}}} }}{\partial r} > 0\). Therefore, the total profits in the four scenarios are related as follows: \(\pi_{T}^{*B} < \pi_{T}^{*R} < \pi_{T}^{{*{\text{SR}}}} < \pi_{T}^{*S}\).

Proposition 5 indicates that those with government incentives are higher than those without government incentives. Regardless of the incentive packages that the government offers, the manufacturer’s and retailer’s profits increase with the strength of the preferential policy. This is because the government’s subsidy policies motivate manufacturers to integrate recycled parts into the production of new goods. The government’s VAT refund policy can significantly reduce the costs associated with recycling waste products for retailers, thereby increasing their passion to recycle used products.

It is surprising that the subsidy-only policy and not the VAT rebate-and-subsidy policy provide the manufacturer with an opportunity for the highest profit. In addition, the profits of the retailer under the tax rebate-and-subsidy policy are equal to those under the subsidy-only policy. Both are superior to the VAT rebate-only policy. Therefore, the total profits in the four scenarios are as follows: The subsidy-only policy is better than the tax rebate-and-subsidy policy, which is better than the tax rebate-only policy. Our study also reveals that the total profits of the system are the lowest if the government does not offer any incentives.

Proposition 6.

Social welfare outcomes in the four scenarios are related as follows: \({\text{TS}}^{*B} < {\text{TS}}^{*R} < {\text{TS}}^{{*{\text{SR}}}} = {\text{TS}}_{ }^{*S}\), and the government expenditure in the three scenarios in which the government participates in remanufacturing activities is related as follows: \(f\left( {r^{*R} } \right) < g\left( {r^{{*{\text{SR}}}} } \right) < s^{*} G\left( {b_{r}^{*S} } \right)\).

Proposition 6 shows that social welfare with government incentives is better than that without government incentives. The government’s implementation of a VAT refund and economic subsidy policy mobilizes the enthusiasm of the manufacturer and retailer to participate in remanufacturing activities. However, the VAT rebate-and-subsidy policy always delivers the best social welfare outcomes, which is the same as the subsidy-only policy. For the government, the subsidy-only policy costs more than the tax rebate-and-subsidy policy, while the total costs of the VAT rebate-only policy are lower than those of both.

5 Conclusion

Designing an effective remanufacturing supply chain has essential effects for firms, governments, and consumers. We study the effects of government subsidy and VAT refund policies on closed-loop supply chain decisions according to observations in China. We consider four different policy mechanisms implemented by the government (i.e., no intervention, remanufacturer subsidy, VAT refund, and the tax refund-and-subsidy coexistence policy). We compared the four governmental policies and analyzed the changes in the manufacturers’ and retailers’ responses to the government’s policies, identified the setting of government policies for the optimal outcomes and obtained the following conclusions:

-

(a)

If the goal of the government is to maximize social welfare, both the subsidy-only policy and the tax rebate-and-subsidy policy are appropriate;

-

(b)

If the goal of the government is to minimize costs only, the VAT rebate-only policy is optimal;

-

(c)

The subsidy-only policy is optimal if the goal of the government is maximizing both social welfare and the total profits of the companies along the supply chain regardless of the costs for the government; and

-

(d)

If the government pursues maximizing social welfare and decreasing costs, the tax refund-and-subsidy policy is optimal.

Although we have made new contributions in this study, there are some limitations that offer useful and additional opportunities for further research into this topic. For example, a single-period model is considered for decision making; therefore, we do not capture the details in a continuous-time or multiperiod setting, which represents an opportunity to extend this research by examining the differences with asymmetric information and/or in a multiperiod setting.

Data availability

The authors declare that the data supporting the findings of this study are available within the paper.

Notes

Cai Shui [2015] No.78, http://www.chinatax.gov.cn/chinatax/n810341/n810825/c101434/c1519869/content.html.

References

Aizenman J, Jinjarak Y (2008) The collection efficiency of the Value added tax: theory and international evidence. J Int Trade Econ Dev 17(3):391–410

Alavuotunki K, Haapanen M, Pirttilä J (2019) The effects of the value-added tax on revenue and inequality. J Dev Stud 55(4):490–508

Alegoz M, Kaya O, Bayindir ZP (2021) A comparison of pure manufacturing and hybrid manufacturing–remanufacturing systems under carbon tax policy. Eur J Oper Res. https://doi.org/10.1016/j.ejor.2021.01.018

Atasu A, Van Wassenhove LN, Sarvary M (2009) Efficient take-back legislation. Prod Oper Manag 18(3):243–258

Arya A, Mittendorf B (2018) Bricks-and-mortar entry by online retailers in the presence of consumer sales taxes. Manage Sci 64(11):5220–5233

Chen X, Cao J, Kumar S (2021) Government regulation and enterprise decision in China remanufacturing industry: evidence from evolutionary game theory. Energ Ecol Environ 6(2):148–159

Cohen MC, Lobel R, Perakis G (2015) The impact of demand uncertainty on consumer subsidies for green technology adoption. Manage Sci 62(5):1235–1258

Debo LG, Toktay LB, Van Wassenhove LN (2005) Market segmentation and product technology selection for remanufacturable products. Manage Sci 51(8):1193–1205

Feng CM, Wu PJ (2009) A tax savings model for the emerging global manufacturing network. Int J Prod Econ 122(2):534–546

Ferguson ME, Toktay LB (2006) The effect of competition on recovery strategies. Prod Oper Manag 15(3):351–368

Ferrer G, Swaminathan JM (2006) Managing new and remanufactured products. Manage Sci 52(1):15–26

Haddadsisakht A, Ryan SM (2018) Closed-loop supply chain network design with multiple transportation modes under stochastic demand and uncertain carbon tax. Int J Prod Econ 195:118–131

Heydari J, Govindan K, Jafari A (2017) Reverse and closed loop supply chain coordination by considering government role. Transp Res Part D Trans Environ 52:379–398

Hoseini M, Briand O (2020) Production efficiency and self-enforcement in value-added tax: evidence from state-level reform in India. J Dev Econ 144:102462

Hsu VN, Zhu K (2011) Tax-effective supply chain decisions under China’s export-oriented tax policies. Manuf Serv Oper Manag 13(2):163–179

Huang H, Wang T, Zhan Z (2019) From business tax to value-added tax: the effects of reform on Chinese transport industry firms. Aust Account Rev 1:158–176

Jie XA, Ctn B, Tcec B (2021) Remanufacturing strategies under product take-back regulation. Int J Prod Econ. https://doi.org/10.1016/j.ijpe

Keen M, Lockwood B (2010) The value added tax: Its causes and consequences. J Dev Econ 92(2):138–151

Krass D, Nedorezov T, Ovchinnikov A (2013) Environmental taxes and the choice of green technology. Prod Oper Manag 22(5):1035–1055

Li KJ, Xu SH (2015) The comparison between trade-in and leasing of a product with technology innovations. Omega 54:134–146

Ma WM, Zhao Z, Ke H (2013) Dual-channel closed-loop supply chain with government consumption-subsidy. Eur J Oper Res 226(2):221–227

Majumder P, Groenevelt H (2001) Competition in remanufacturing. Prod Oper Manag 10(2):125–141

Maiti T, Giri BC (2017) Two-way product recovery in a closed-loop supply chain with variable markup under price and quality dependent demand. Int J Prod Econ 183(6):259–272

Miao Z, Fu K, Xia Z, Wang Y (2017) Models for closed-loop supply chain with trade-ins. Omega 66:308–326

Mitra S, Webster S (2008) Competition in remanufacturing and the effects of government subsidies. Int J Prod Econ 111(2):287–298

Mukhopadhyay SK, Setoputro R (2005) Optimal return policy and modular design for build-to-order products. J Oper Manag 23(5):496–506

Niu B, Xu J, Lee CK, Chen L (2019) Order timing and tax planning when selling to a rival in a low-tax emerging market. Transp Res Part E Logist Transp Rev 123:165–179

Qin Z, Yang J (2008) Analysis of a revenue-sharing contract in supply chain management. Int J Logist Res Appl 11(1):17–29

Savaskan RC, Bhattacharya S, Van Wassenhove LN (2004) Closed-loop supply chain models with product remanufacturing. Manage Sci 50(2):239–252

Shunko M, Debo L, Gavirneni S (2014) Transfer pricing and sourcing strategies for multinational firms. Prod Oper Manag 23(12):2043–2057

Wang J, Shen G, Tang D (2021) Does tax deduction relax financing constraints? Evidence from China’s value-added tax reform. China Econ Rev 67:101619

Webster S, Mitra S (2007) Competitive strategy in remanufacturing and the impact of take-back laws. J Oper Manag 25(6):1123–1140

Wu CH, Kao YJ (2018) Cooperation regarding technology development in a closed-loop supply chain. Eur J Oper Res 267:523–539

Xiao W, Hsu VN, Hu Q (2015) Manufacturing capacity decisions with demand uncertainty and tax cross-crediting. Manuf Serv Oper Manag 17(3):384–398

Yu JJ, Tang CS, Shen ZJM (2018) Improving consumer welfare and manufacturer profit via government subsidy programs: subsidizing consumers or manufacturers? Manuf Serv Oper Manag 20(4):752–766

Zhen L (2014) A three-stage optimization model for production and outsourcing under China’s export-oriented tax policies. Transp Res Part E Logist Transp Rev 69:1–20

Acknowledgements

We are grateful for the editor’s and anonymous reviewers’ constructive comments and suggestions which have improved the quality of this paper. This paper was partially supported by the following fund projects: National Natural Science Foundation of China (No.71761004, 71864003, 71763003, 72243002); China Humanities and Social Sciences Youth Fund Project of the Ministry of Education (No.17XJC630006, 18YJA630063); China Postdoctoral Science Foundation (No. 2017M612868); Key Research Base of Humanities and Social Sciences in Guangxi Universities (No. 2020GDSIYB01); the Interdisciplinary Scientific Research Foundation of Applied Economics of GuangXi University (Grant No. 2023JJJXA01).

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

The authors declare that they have no known competing financial interests or personal relationships that could have appeared to influence the work reported in this paper.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendices

Appendix

Appendix A. Proof of Proposition 1

The social welfare function under Model S is given by \(\mathop {\max }\limits_{s} TS^{S} = \pi_{m}^{*S} + \pi_{r}^{*S} + CS^{S} - s\left( {k + hb_{r} } \right)\), where \(\pi_{m}^{*S} + \pi_{r}^{*S} = \frac{{3\left[ {\alpha - \beta c_{m} \left( {1 + t} \right)} \right]^{2} }}{{16\beta \left( {1 + t} \right)}} + \frac{{3\left[ {h\left( {\Delta + s} \right) + k} \right]^{2} }}{16h},\)\(CS^{S} = \frac{1}{2\beta }\left[ {\frac{{\alpha - \beta c_{m} \left( {1 + t} \right)}}{4}} \right]^{2}\) and \(s\left( {k + hb_{r}^{*S} } \right) = \frac{{\left[ {k + h\left( {\Delta + s} \right)} \right]s}}{4}\). Based on the maximization of the social welfare function, we take first derivatives of \({\text{TS}}^{S}\) with respect to \(s\), and let \(\frac{{{\text{dTS}}^{S} }}{{{\text{d}}s}} = 0\). Then, we obtain the equilibrium solution: \(s^{*} = \frac{\Delta h + k}{h}\).

Appendix B. Proof of proposition 2

\(r^{*R} - t = \frac{{\left( {k + \Delta h} \right)\left( {1 + t} \right)}}{k + 2\Delta h} - \frac{{t\left( {k + 2\Delta h} \right)}}{k + 2\Delta h} = \frac{{k + \Delta h\left( {1 - t} \right)}}{k + 2\Delta h},\) because \(t < 1\), then \(r^{*R} - t > 0,\) i.e., \(r^{*R} > t\).

Appendix C. Proof of Proposition 3

The proof of proposition 3 can be easily shown in a similar manner as the proof of proposition1. Note that the social welfare \({\text{TS}}^{{{\text{SR}}}}\) is monotonically increasing on \(\left( {0,\;r^{{*{\text{SR}}}} } \right)\), monotonically decreasing on \(\left( {r^{{*{\text{SR}}}} ,\;t} \right)\) if and only if \(0 \le r^{{*{\text{SR}}}} \le t\), that is, \(x \ge \frac{{\Delta h\left( {1 - t} \right) + k}}{{ht\left( {1 + t} \right)}}\).

Appendix D. Proof of Proposition 4

The proof of part (a) of proposition 4 can be given as follows. First, in Table 2, \(b_{r}^{*S} = b_{r}^{{*{\text{SR}}}}\) is obvious. To prove \(b_{r}^{*R} < b_{r}^{*S}\), we have to show that \(\frac{{\Delta h\left( {1 + t} \right) - 3k}}{4h} < \frac{\Delta h - k}{{2h}}.\) After simplification, this reduces to showing that \(\frac{{\Delta h\left( {1 + t} \right) - 3k}}{4h} - \frac{\Delta h - k}{{2h}} = \frac{{ - \Delta h\left( {1 - t} \right) - k}}{4h} < 0\), which is true. To prove \(b_{r}^{*B} < b_{r}^{*R}\), we have to show that \(\frac{\Delta h - 3k}{{4h}} < \frac{{\Delta h\left( {1 + t} \right) - 3k}}{4h},\) i.e., \(\frac{\Delta h - 3k}{{4h}} - \frac{{\Delta h\left( {1 + t} \right) - 3k}}{4h} = \frac{ - \Delta ht}{{4h}} < 0\), which is true. The proof of \(G\left( {b_{r}^{*B} } \right) < G\left( {b_{r}^{*R} } \right) < G\left( {b_{r}^{*S} } \right) = G\left( {b_{r}^{{*{\text{SR}}}} } \right)\) can be easily shown in a similar manner.

Second, we examine the effect of \(s\) and \(r\) on the recycling price. Hence, the proof follows from the fact that \(\frac{{\partial b_{r}^{S} }}{\partial s} > 0\),\(\frac{{\partial b_{r}^{R} }}{\partial r} > 0\) and \(\frac{{\partial b_{r}^{{{\text{SR}}}} }}{\partial r} > 0\). To show these statements, note that \(\frac{{\partial b_{r}^{S} }}{\partial s} = \frac{1}{4} > 0\), for a given \(s\), the sign of \(\frac{{\partial b_{r}^{S} }}{\partial s}\) is always positive. Similarly,

\(\frac{{\partial b_{r}^{{{\text{SR}}}} }}{\partial r} = \frac{{\left[ {xh\left( {1 + t} \right) + 3k} \right]\Delta 4h\left( {1 + t - r} \right) - \left[ {h\left( {1 + t} \right)\left( {\Delta + xr} \right) - 3k\left( {1 + t - r} \right)} \right]\Delta \left( { - 4h} \right)}}{{16h^{2} \left( {1 + t - r} \right)^{2} }} = \frac{{\left( {1 + t} \right)\left[ {\Delta + x\left( {1 + t} \right)} \right]}}{{4\left( {1 + t - r} \right)^{2} }} > 0\) The proof of part (b) of Proposition 4. Omit.

Appendix E. Proof of Proposition 5

We divide the proof into three parts:

(i) \(\pi_{m}^{*B} < \pi_{m}^{*R} < \pi_{m}^{*SR} < \pi_{m}^{*S}\), and \(\frac{{\partial \pi_{m}^{S} }}{\partial s} > 0\), \(\frac{{\partial \pi_{m}^{R} }}{\partial r} > 0\), \(\frac{{\partial \pi_{m}^{SR} }}{\partial r} > 0\). First, to prove \(\pi_{m}^{*SR} < \pi_{m}^{*S}\), we have to show that \(2X + \frac{{\left( {\Delta h + k} \right)^{2} \left[ {hx\left( {1 + t} \right) + \Delta h} \right]}}{{2h\left[ {hx\left( {1 + t} \right) + 2\Delta h + k} \right]}} < 2X + \frac{{\left( {\Delta h + k} \right)^{2} }}{2h}.\) After simplification, this reduces to showing that \(\frac{{\left( {\Delta h + k} \right)^{2} \left[ {hx\left( {1 + t} \right) + \Delta h} \right]}}{{2h\left[ {hx\left( {1 + t} \right) + 2\Delta h + k} \right]}} < \frac{{\left( {\Delta h + k} \right)^{2} \left[ {hx\left( {1 + t} \right) + 2\Delta h + k} \right]}}{{2h\left[ {hx\left( {1 + t} \right) + 2\Delta h + k} \right]}}\), which is true. To prove \(\pi_{m}^{*R} < \pi_{m}^{{*{\text{SR}}}}\), we have to show that \(2X + \frac{{\left[ {\Delta h\left( {1 + t} \right) + k} \right]^{2} }}{{8h\left( {1 + t} \right)}} < 2X + \frac{{\left( {\Delta h + k} \right)^{2} \left[ {hx\left( {1 + t} \right) + \Delta h} \right]}}{{2h\left[ {hx\left( {1 + t} \right) + 2\Delta h + k} \right]}},\) i.e., \(\frac{{\left[ {\Delta h\left( {1 + t} \right) + k} \right]^{2} }}{{8h\left( {1 + t} \right)}} < \frac{{\left( {\Delta h + k} \right)^{2} \left[ {hx\left( {1 + t} \right) + \Delta h} \right]}}{{2h\left[ {hx\left( {1 + t} \right) + 2\Delta h + k} \right]}}.\) This reduces to showing that \(\frac{{\left[ {\Delta h\left( {1 + t} \right) + k\left( {1 + t - r} \right)} \right]^{2} }}{{8h\left( {1 + t} \right)\left( {1 + t - r} \right)}} < \frac{{\left[ {h\left( {1 + t} \right)\left( {\Delta + xr} \right) + k\left( {1 + t - r} \right)} \right]^{2} }}{{8h\left( {1 + t} \right)\left( {1 + t - r} \right)}}\), which is true. To prove \(\pi_{m}^{*B} < \pi_{m}^{*R}\), we have to show that \(2X + \frac{{\left( {\Delta h + k} \right)^{2} }}{8h} < 2X + \frac{{\left[ {\Delta h\left( {1 + t} \right) + k} \right]^{2} }}{{8h\left( {1 + t} \right)}}.\) After simplification, this reduces to showing that \(\frac{{\left( {\Delta h + k} \right)^{2} }}{8h} - \frac{{\left[ {\Delta h\left( {1 + t} \right) + k} \right]^{2} }}{{8h\left( {1 + t} \right)}} = \frac{{\left[ {k^{2} - \left( {\Delta h} \right)^{2} \left( {1 + t} \right)} \right]t}}{{8h\left( {1 + t} \right)}} < 0,\) which is true (because \(\Delta h > 3k\), then \(k^{2} < \left( {\Delta h} \right)^{2} \left( {1 + t} \right)\)). Second, we examine the effect of \(s\) and \(r\) on the profit of the manufacturer. Hence, the proof follows from the fact that \(\frac{{\partial \pi_{m}^{S} }}{\partial s}\), \(\frac{{\partial \pi_{m}^{R} }}{\partial r}\) and \(\frac{{\partial \pi_{m}^{SR} }}{\partial r} > 0\). To show these statements, note that \(\frac{{\partial \pi_{m}^{S} }}{\partial s} = \frac{{h\left( {\Delta + s} \right) + k}}{4}\), for a given \(s\), the sign of \(\frac{{\partial \pi_{m}^{S} }}{\partial s}\) is always positive. Similarly,

\(\frac{{\partial \pi_{m}^{R} }}{\partial r} = \frac{{\left[ {\Delta h\left( {1 + t} \right) + k\left( {1 + t - r} \right)} \right]\left[ {\Delta h\left( {1 + t} \right) - k\left( {1 + t - r} \right)} \right]}}{{8h\left( {1 + t} \right)\left( {1 + t - r} \right)^{2} }}\). Because \(\Delta h > 3k > k > 0\) and \(1 + t > 1 + t - r\), then \(\Delta h\left( {1 + t} \right) > k\left( {1 + t - r} \right),\) i.e., \(\frac{{\partial \pi_{m}^{R} }}{\partial r} > 0\).

\(\frac{{\partial \pi_{m}^{{{\text{SR}}}} }}{\partial r} = \frac{{\left[ {h\left( {1 + t} \right)\left( {\Delta + xr} \right) + k\left( {1 + t - r} \right)} \right]\left\{ {xh\left( {1 + t} \right)\left[ {2\left( {1 + t} \right) - r} \right] + \left[ {\Delta h\left( {1 + t} \right) - k\left( {1 + t - r} \right)} \right]} \right\}}}{{8h\left( {1 + t} \right)\left( {1 + t - r} \right)^{2} }}.\) Because \(2\left( {1 + t} \right) > r\) and \(\Delta h\left( {1 + t} \right) > k\left( {1 + t - r} \right)\), then \(\frac{{\partial \pi_{m}^{{{\text{SR}}}} }}{\partial r} > 0\).

(ii) \(\pi_{r}^{*B} < \pi_{r}^{*R} < \pi_{r}^{{*{\text{SR}}}} = \pi_{r}^{*S}\), and \(\frac{{\partial \pi_{r}^{S} }}{\partial s} > 0\), \(\frac{{\partial \pi_{r}^{R} }}{\partial r} > 0\), \(\frac{{\partial \pi_{r}^{{{\text{SR}}}} }}{\partial r} > 0\). First, in Table 2, \(\pi_{r}^{{*{\text{SR}}}} = \pi_{r}^{*S}\) is obvious. To prove \(\pi_{r}^{*R} < \pi_{r}^{*SR}\), we have to show that \(\frac{{\left[ {\Delta h\left( {1 + t} \right) + k} \right]^{2} }}{16h} < \frac{{\left( {\Delta h + k} \right)^{2} }}{4h},\) i.e., \(\frac{{\left[ {\Delta h\left( {1 + t} \right) + k} \right]^{2} }}{16h} - \frac{{\left( {\Delta h + k} \right)^{2} }}{4h} = \frac{{\left( {\Delta h} \right)^{2} \left( {t + 3} \right)\left( {t - 1} \right) + 2\Delta hk\left( {t - 3} \right) - 3k^{2} }}{16h} < 0,\) which is true (because \(t < 1\)). To prove \(\pi_{r}^{*B} < \pi_{r}^{*R}\), we have to show that \(\frac{{\left( {\Delta h + k} \right)^{2} }}{16h} < \frac{{\left[ {\Delta h\left( {1 + t} \right) + k} \right]^{2} }}{16h}\), which follows from simple algebra. Second, we examine the effect of \(s\) and \(r\) on the profit of the retailer. Hence, the proof follows from the fact that \(\frac{{\partial \pi_{r}^{S} }}{\partial s}\), \(\frac{{\partial \pi_{r}^{R} }}{\partial r}\) and \(\frac{{\partial \pi_{r}^{{{\text{SR}}}} }}{\partial r} > 0\). To show these statements, note that \(\frac{{\partial \pi_{r}^{S} }}{\partial s} = \frac{{h\left( {\Delta + s} \right) + k}}{8}\), for a given \(s\), the sign of \(\frac{{\partial \pi_{r}^{S} }}{\partial s}\) is always positive. Similarly,

\(\frac{{\partial \pi_{r}^{R} }}{\partial r} = \frac{{\Delta \left( {1 + t} \right)\left[ {\Delta h\left( {1 + t} \right) + k\left( {1 + t - r} \right)} \right]}}{{8\left( {1 + t - r} \right)^{3} }} > 0\) and \(\frac{{\partial \pi_{r}^{{{\text{SR}}}} }}{\partial r} = \frac{{\left( {1 + t} \right)\left[ {\Delta + x\left( {1 + t} \right)} \right]\left[ {h\left( {1 + t} \right)\left( {\Delta + xr} \right) + k\left( {1 + t - r} \right)} \right]}}{{8\left( {1 + t - r} \right)^{3} }} > 0\).

(iii) Because \(\pi_{m}^{*B} < \pi_{m}^{*R} < \pi_{m}^{{*{\text{SR}}}} < \pi_{m}^{*S}\) and \(\pi_{r}^{*B} < \pi_{r}^{*R} < \pi_{r}^{{*{\text{SR}}}} = \pi_{r}^{*S}\), it trivially follows that \(\pi_{T}^{*B} < \pi_{T}^{*R} < \pi_{T}^{{*{\text{SR}}}} < \pi_{T}^{*S}\).

Appendix F. Proof of Proposition 6

First, in terms of the social welfare, in Table 2, \({\text{TS}}_{ }^{{*{\text{SR}}}} = {\text{TS}}_{ }^{*S}\) is obvious. To show \({\text{TS}}_{ }^{*R} < {\text{TS}}_{ }^{{*{\text{SR}}}}\), we have to show \(Y + \frac{{\left[ {\left( {\Delta h + k} \right) + \Delta ht} \right]\left[ {3\left( {\Delta h + k} \right) - \Delta ht} \right]}}{16h} < Y + \frac{{\left( {\Delta h + k} \right)^{2} }}{4h},\) i.e., \(\frac{{\left[ {\left( {\Delta h + k} \right) + \Delta ht} \right]\left[ {3\left( {\Delta h + k} \right) - \Delta ht} \right]}}{16h} - \frac{{\left( {\Delta h + k} \right)^{2} }}{4h} = \frac{{ - \left( {\Delta h} \right)^{2} \left( {1 - t} \right)^{2} - 2\Delta hk\left( {1 - t} \right) - k^{2} }}{16h} < 0\), which is always true. To show \({\text{TS}}_{ }^{*B} < {\text{TS}}_{ }^{*R}\), we have to show \(\frac{{3\left( {\Delta h + k} \right)^{2} }}{16h} < \frac{{\left[ {\left( {\Delta h + k} \right) + \Delta ht} \right]\left[ {3\left( {\Delta h + k} \right) - \Delta ht} \right]}}{16h},\) i.e., \(\frac{{3\left( {\Delta h + k} \right)^{2} }}{16h} - \frac{{\left[ {\left( {\Delta h + k} \right) + \Delta ht} \right]\left[ {3\left( {\Delta h + k} \right) - \Delta ht} \right]}}{16h} = \frac{{\Delta ht\left[ {\Delta h\left( {t - 2} \right) - 2k} \right]}}{16h} < 0\), which always holds. For the government expenditure, to prove \(g\left( {r^{{*{\text{SR}}}} } \right) < s^{*} G\left( {b_{r}^{*S} } \right)\), we have to show.\(g\left( {r^{{*{\text{SR}}}} } \right) - s^{*} G\left( {b_{r}^{*S} } \right) = \frac{{\left[ {x\left( {1 + t} \right) + \Delta } \right]\left( {\Delta h + k} \right)^{2} }}{{2\left[ {hx\left( {1 + t} \right) + 2\Delta h + k} \right]}} - \frac{{\left( {\Delta h + k} \right)^{2} }}{2h} = \frac{{ - \left( {\Delta h + k} \right)^{2} }}{{2h\left[ {hx\left( {1 + t} \right) + 2\Delta h + k} \right]}} < 0\),which always holds. To show \(f\left( {r^{*R} } \right) < g\left( {r^{{*{\text{SR}}}} } \right)^{ }\), we have to show that\(f\left( {r^{*R} } \right) - g\left( {r^{{*{\text{SR}}}} } \right) = \frac{{\left[ {\Delta h\left( {1 + t} \right) + k} \right]\left[ {\Delta h\left( {1 + t} \right) - k} \right]t}}{{8h\left( {1 + t} \right)}} - \frac{{\left[ {x\left( {1 + t} \right) + \Delta } \right]\left( {\Delta h + k} \right)^{2} }}{{2\left[ {hx\left( {1 + t} \right) + 2\Delta h + k} \right]}} = \frac{Z}{{8h\left( {1 + t} \right)\left[ {hx\left( {1 + t} \right) + 2\Delta h + k} \right]}} < 0,\) where \(Z = t\left\{ {\left[ {\Delta h\left( {1 + t} \right)} \right]^{2} - k^{2} } \right\}\left[ {hx\left( {1 + t} \right) + 2\Delta h + k} \right] - 4\left( {1 + t} \right)\left[ {hx\left( {1 + t} \right) + \Delta h} \right]\left( {\Delta h + k} \right)^{2}\). Let \(Z = A + B\), where \(A = t\left[ {hx\left( {1 + t} \right) + \Delta h} \right]\left\{ {\left( {\left[ {\Delta h\left( {1 + t} \right)} \right]^{2} - k^{2} } \right) - 4\left( {\Delta h + k} \right)^{2} } \right\} = t\left[ {hx\left( {1 + t} \right) + \Delta h} \right]\left\{ {\left( {\Delta h} \right)^{2} \left[ {\left( {1 + t} \right)^{2} - 4} \right] - 5k^{2} - 8\Delta hk} \right\} < 0\) (because \(0 < t < 1\), then \(\left( {1 + t} \right)^{2} - 4 < 0,\) i.e., \(A < 0\)), and \(B = \left( {\Delta h + k} \right)\left\{ {t\left( {\Delta h} \right)^{2} \left( {1 + t} \right)^{2} - tk^{2} - 4\left( {\Delta h + k} \right)\left[ {hx\left( {1 + t} \right) + \Delta h} \right]} \right\} = \left( {\Delta h + k} \right){\text{\{ }}\left( {\Delta h} \right)^{2} [t\left( {1 + t} \right)^{2} - 4{]} - tk^{2} - 4\left[ {\Delta h\Delta hx\left( {1 + t} \right) + k} \right[hx\left( {1 + t} \right) + \Delta h]]\} < 0\) (note that \(0 < t < 1\), hence, \(t\left( {1 + t} \right)^{2} < \left( {1 + t} \right)^{2} - 4 < 0\), i.e., \(B < 0\)). Therefore, \(Z = A + B < 0\), that is, \(g\left( {r^{{*{\text{SR}}}} } \right) < s^{*} G\left( {b_{r}^{*S} } \right)\) always holds.

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Hao, H., Ran, G., Liu, Hm. et al. Pricing strategies for remanufacturing with government incentives. Neural Comput & Applic 36, 2187–2200 (2024). https://doi.org/10.1007/s00521-023-08804-6

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00521-023-08804-6