Abstract

In today’s ever-changing and highly uncertain environment, organizations depend on research and development (R&D) activities to adapt intensive growth of technology. One of the most important and trickiest tasks of any developing firms is to define new projects. This process gets difficult when it comes to choosing an appropriate portfolio from a set of candidate projects. Since organizations are faced with limited resources of R&D and budget constraints, they have to choose a project portfolio that mitigates the corresponding risk and enhances the overall value of portfolio. Therefore, the purpose of this study is to introduce a practical model to select the best and the most proper project portfolio while considering project investment capital, return rate, and risk. The ever-changing and highly uncertain environment of projects is addressed by utilizing interval type-2 fuzzy sets (IT2FSs). In this paper, a new model of R&D project evaluation is first introduced. This model includes a new risk-return index. This model is then extended in project portfolio selection, and as a result, a new model of R&D project portfolio selection is proposed under uncertainty. Constraints and limitations of R&D project portfolio selection are comprehensively addressed. In this model, lower semi-variance is applied to consider risk of proposed projects. Therefore, this paper offers a new model that applies IT2FSs to handle uncertainty, uses semi-variance to assess risk, synchronously considers risk and return in its selection process, and addresses the considerations and limits of real-world problems. Eventually, to verify the proposed model, a numerical example of the existing literature is solved with the model, and the results are compared. The first proposed model is used to prioritize proposed R&D projects of a gas and oil development holding firm as a real case study. To illustrate further, a practical example is also provided to demonstrate the applicability of the proposed project portfolio selection model.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

1 Introduction

Firms’ future position is highly dependent on research and development (R&D) activities. Their future existence is endangered by growing complexity of technologies and their fast increase. In these situations, R&D activities serve as a survival tool. The importance of R&D in highly industrialized economies is undeniable among economists [55]. In other words, the need to innovate is considered by many firms as central to their survival plans. New and high-tech product development is one of the most effective ways that gives firms a leading edge over rivals and opens new markets and opportunities [34]. To consider R&D projects, firms and organizations are forced to annually identify new projects to make their costs lower, bring new products to their markets, and make their quality higher (e.g., [5, 21, 22, 48–50, 60, 61]). Thus, the main goal of the project portfolio selection is to choose a proper set of projects to allocate limited resources such as equipment, people, time, and budget to them.

Despite many advantages of project portfolio selection, it is always a challenging topic in R&D management. Although a large number of studies were done on this subject, nature of this topic is so broad that always opportunities for future works exist [32, 65]. Therefore, in recent years there has been a growing interest in the area of R&D projects and portfolio selection. Through the years, a wide variety of project portfolio modeling approaches have been introduced including linear programming, scoring models and checklists [19]. Despite the complexity and problems of application of many proposed models, a survey by Cooper et al. [20] on the issue of using of portfolio management models showed that it is highly beneficial to apply some sort of portfolio selection tools or systems. Considering risk and uncertainty in R&D environment is highly essential since knowledge of the proposed projects is often vague and uncertain. This uncertainty endangers firms’ plans and strategies. Future events and opportunities have undeniable impact on R&D decisions. Therefore, most of the information used in portfolio decision-makings is at the best situation uncertain and at the worst condition very unreliable [7]. Mitigating risk and managing uncertainty is a practical subject in R&D studies.

The objective of this paper is to propose a new model for R&D project evaluation and project portfolio selection. The model could be practical in increasing an organization’s portfolio value and mitigating portfolio risk while considering the organization’s resource limitations and projects’ interdependencies and interactions under uncertain environments. In other words, uncertainty and risk peril the outcome of R&D decisions, and this paper aims to propose a new effective approach to express and manage project uncertainty. Lack of project portfolio selection studies that were based on type-2 fuzzy sets was one of the main factors that motivated proposing this paper.

In summary, the main contributions of the paper that separate it from similar studies in the literature are summarized as follows:

-

Introducing a new R&D project evaluation model that simultaneously considers risk and return. Therefore, the model gives priority to R&D projects that have the lowest risk and the highest forecasted return.

-

Using lower semi-variance to address project risk which is a highly practical downside risk measure in investment decision-makings. Therefore, only negative variations from the expected return are considered harmful and are aimed to be reduced.

-

Presenting interval type-2 fuzzy sets (IT2FSs) to model today’s highly uncertain environment. This approach provides the decision makers with a highly practical and powerful uncertainty-modeling tool. Moreover, the data associated with investment and return of projects is presented in form of IT2FSs.

-

Introducing a new project portfolio selection model that finds the optimum portfolio of R&D projects under highly uncertain environments.

-

Addressing different real-life aspects of project selection in model constraints and limitations. The possible considerations and limitations of this problem are comprehensively considered.

This paper is organized as follows. In Sect. 2, a brief review on R&D project portfolio selection literature is presented. In Sect. 3, the primarily knowledge of IT2FSs is explained. Section 4 includes the proposed model for R&D project evaluation and selection. Models’ application is first illustrated by applying data of a gas and oil holding company for the presented project evaluation model. Afterward, the proposed project portfolio selection model is used in a practical example. Finally, conclusion remarks are reported in Sect. 6.

2 Literature review

R&D project portfolio selection is a modern extension of financial investment theory initially proposed by Markowitz’s [39]. Although the financial portfolio theory is useful, it should be noted that project portfolios are not the same as financial portfolios since projects lack market price despite financial assets [11]. The issue of allocating resources to reach an optimum portfolio of R&D projects has been studied by a number of scholars [3]. Many of the initial studies were based on linear programming, scoring models and checklists (e.g., [19, 58]). Heidenberger and Stummer [28] analyzed project portfolio selection models and put them in six groups of benefit measurement methods, mathematical programming approaches, simulation and heuristics models, cognitive emulation approaches, real options, and ad hoc models. Badri et al. [2] proposed a 0–1 goal programming model for project selection. Their model was designed to be applied in health service institutions. In that paper, uncertainty was not fully considered. Chan et al. [14] presented a model to consider different modifications of the capital budgeting problem. Their model despite considering multi-criteria optimization failed to model real-world environment. One of the studies that used fuzzy sets theory to model uncertainty was a fuzzy compromise programming model based on the minimum fuzzy distance to the fuzzy ideal solution of the portfolio selection problem done by Bilbao-Terol et al. [9]. Since the model was made for investment portfolios, it was not suitable for project selection problems. Rebiasz [52] developed a model to assess projects risk with fuzzy or random parameters. This simulation-based model was only aimed at project risk evaluation and was not a project portfolio selection model. Wang and Hwang [62] used a fuzzy zero–one integer programming model that considered uncertain and flexible parameters to achieve optimal project portfolio. The fuzzy nature of uncertain elements was not fully addressed in this model. Carlsson et al. [10] applied trapezoidal fuzzy numbers to predict future cash flow and developed a fuzzy mixed integer programming model. Since this model was based on classical fuzzy sets, it could not be effective under highly uncertain environments. Huang [30] used the concept of semi-variance of fuzzy variable to develop two mean semi-variance models of portfolio selection. Huang et al. [31] introduced a fuzzy analytic hierarchy process (AHP) method for R&D project selection. Chen and Cheng [16] used multiple-criteria decision-making (MCDM) modeling and trapezoidal fuzzy numbers to designate subjective opinions of decision makers. Their model was only based on opinions of experts and did not utilize financial data like cash flow. Bhattacharyya et al. [8] used fuzzy numbers to address uncertainty of future cash flow. Moreover, they considered maximization of the outcome and minimization of the cost and the risk as three objective functions. Zhang et al. [67] used credibilistic expected value and credibilistic lower semi-variance of fuzzy variable to address uncertainty in optimal portfolio selection. The goal of that study was to find the optimal portfolio of investment projects, but the model lacked the required limitations and constraints of the sort of problem. Luo [37] emphasized on the risk of R&D project portfolio and presented a model to find optimal diversified R&D project portfolio that incorporated the risk of market and technology. Ghapanchi et al. [25] addressed project interdependencies by using fuzzy variables and modeled the uncertain interdependencies among projects by applying linguistic variables. Liesiö and Salo [36] introduced a model with application in situations where the decision maker faced a variety of obstacles to gather the information and data about risk preferences or scenario probabilities. Moreover, they addressed the impacts of uncertainties on the project selection process. Shin et al. [57] developed a future oriented portfolio that considered the future opinions of experts and the expected risks and returns of technology. In other words, their approach combined experts’ judgments with historical data. Their introduced method was useful for organizations starting new businesses. Perez and Gomez [51] developed a multi-objective project portfolio selection model with fuzzy constraints. The model was also based on classical fuzzy sets.

Review of the existing methodologies implies that since each methodology has it owns advantages and disadvantages, one methodology does not cover all the project portfolio selection aspects. On the other hand, existence of uncertainty in the project environment has made it inevitable to consider uncertain and incomplete information in the decision-making process. Uncertainty and information are two closely related concepts. The main feature of this sort of relation is that the existing uncertainty of any situation is outcome of information deficiency pertaining to the system in that the situation is conceptualized. Moreover, this information could have different characteristics such as being incomplete, imprecise, fragmentary, unreliable, vague, or even contradictory. However, forming a mathematical theory that addresses uncertainty of decision-making situation requires assuming that it is possible to measure certain amount of uncertainty [53, 54]. Two main groups of fuzzy sets theory-based and stochastic-based tools have been applied in this problem. Since many projects lack adequate historical data in practice and highly depend on experts’ judgments, fuzzy sets theory has been applied more in this problem. As it was reviewed, most of the fuzzy studies were based on the concept of classical fuzzy logic and they were not suitable for today’s environment. The previous studies did not have the merits of type-2 fuzzy sets in expressing uncertainty and was not aimed at R&D projects. Moreover, real-life constraints and limitations were not fully addressed. Type-2 fuzzy sets were developed to address inadequacies of classical sets. Type-1 fuzzy sets are fuzzy sets with crisp membership functions in interval [0, 1] which consequently cannot fully support many types of uncertainties that appear in linguistic descriptions of numerical quantities or in subjectively expressed knowledge of experts [6, 12]. Therefore, addressing membership in a set with “a grade of membership” instead of classical “all or none membership” has been proven to be more practical. This approach raises the question of “How can a grade of membership be measured?” [59]. Many scholars have tried various approaches to answer this question. Zadeh [66] developed type-2 and higher-type fuzzy sets for this purpose. Type-2 fuzzy sets possess fuzzy membership functions (MFs), which are also known as “membership of membership”. In type-2 fuzzy sets unlike type-1 fuzzy sets, each element has membership value expressed by fuzzy set in [0, 1], instead of a crisp number in [0, 1]. Moreover, Type-2 MFs are three-dimensional which consider possibilities by using the weights in the membership domain. The novel third dimension gives new design degrees of freedom for coping with secondary uncertainties [38, 42].

Recently using IT2FSs has been an interesting subject in addressing other project selection problems; for instance, Asan et al. [1] developed a prioritization approach to address the assessment process of project risks by using IT2FSs. Sari and Kahraman [56] used IT2FSs to address capital budgeting problem. To better present the features of recent studies on this subject and characteristics of the proposed model, in Table 1 a number of recent studies are presented. Moreover, this table provides a brief presentation of the literature gap and the motivation along with main contributions of the introduced model.

It is concluded from the above that despite novelty of using IT2FSs in the project related studies, they are still new in R&D project selection problem and in R&D project portfolio selection problem. Some of the main reasons that motivated proposing this paper are as follows: (1) In spite of the number of studies carried out on R&D projects, this topic is still a challenging and interesting issue that attracts many scholars and has many aspects that need further explorations; (2) R&D projects are very uncertain and in order to propose an effective model to evaluate this sort of project, uncertainty has to be modeled by powerful tools. However, using IT2FSs, which model uncertainty with more flexibility, to handle uncertainty of R&D environments is still new to the literature; (3) Downside risk measures, despite their effectiveness, are still new to R&D project evaluation studies and models; (4) Addressing return and risk of R&D projects at the same time in the evaluation and selection process is a practical and yet new approach in R&D studies; and (5) This practical problem has many real-world considerations which have to be regarded in project selection models. Therefore, in this study a novel model of R&D project evaluation and project portfolio selection is introduced under uncertainty. In the first part, a new index is proposed that simultaneously considers risk and return. Risk is addressed by using lower semi-variance of expected net present value of the proposed projects. It should be noted that investment capital and net cash flow are expressed by IT2FSs. In the second part, a new model of project portfolio selection based on IT2FSs is developed to choose an optimal portfolio of R&D projects. To make the model more suitable in R&D problems, constraints of this sort of problem are fully addressed.

3 Preliminary

A classical fuzzy set also known as type-1 fuzzy set is identified by its crisp membership function whereas a type-2 fuzzy set is known by its fuzzy membership functions [44]. Type-2 fuzzy sets include a measure of dispersion that expresses inherent uncertainties which are practical when determining the exact membership function of a fuzzy set is complex [43]. Eventually, type-2 fuzzy sets are better in dealing with more subjective and more imprecise conditions. Computational intensiveness of general type-2 fuzzy sets has caused interval type-2 fuzzy sets to be more popular in applications [33]. Type-2 fuzzy sets are capable of handling situations in which there is uncertainty about the membership degrees themselves. In other words, these sets are useful in situations that are so fuzzy, in which determining the membership degree even as a crisp number in [0, 1] is not easily and efficiently done [13, 24]. In this section, a brief presentation of the basic concepts and operations of interval type-2 fuzzy sets are presented [17, 18, 35, 45, 63].

Definition 1

A type-2 fuzzy set \( \tilde{\tilde{A}} \) in the universe of discourse X can be expressed by a type-2 membership function \( \mu_{{\tilde{\tilde{A}}}} \), displayed in the following.

where J x represents an interval in [0, 1]. The type-2 fuzzy set \( \tilde{\tilde{A}} \) can be displayed as follows:

where J x ⊆ [0, 1] and ∫∫ shows union over all admissible x and u.

Definition 2

If in \( \tilde{\tilde{A}} \) all \( \mu_{{\tilde{\tilde{A}}}} \left( {x,u} \right) = 1 \), then \( \tilde{\tilde{A}} \) is an interval type-2 fuzzy set. This set is regarded as a special case of a type-2 fuzzy set, displayed as follows:

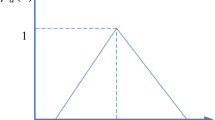

where J x ⊆ [0, 1]. Interval type-2 fuzzy set \( \tilde{\tilde{A}} \) is displayed in Fig. 1 [17].

Let A 1 and A 2 be two trapezoidal interval type-2 fuzzy numbers:

The addition operation between them is defined as follows [29].

The subtraction operation is defined as follows [29]:

The multiplication operation is defined as follows [29]:

where

The multiplication operation between a crisp value (λ) and A 1 is defined as follows [29]:

A 1 in power of a crisp value (λ) is defined as follows [29]:

Division by an ordinary nonzero number (l) is defined as follows:

The expected value of A is defined as follows [29]:

4 Proposed R&D project evaluation and portfolio selection model

In this section in order to enable the R&D project evaluation and portfolio selection model to calculate uncertainties, IT2F-numbers are presented to handle the uncertain parameters in the evaluations.

4.1 Project evaluation model

First step in the proposed model is to calculate net present value of proposed R&D project. Interval type-2 fuzzy net present value (IT2FNPV) calculations require interval type-2 fuzzy net cash flow at the end of tth year (IT2FNCF t ) and interval type-2 fuzzy investment capital (IT2FI). Therefore, IT2FNPV is calculated as follows:

Expected value of IT2FNPV can be calculated as follows:

E(IT2FNPV) shows future profit of project. Therefore, if it is negative, the project is not expected to be profitable. Using E(IT2FNPV) as a measure of project evaluation results in giving projects with higher E(IVFFNPV) a higher priority. Since this approach is solely based on returns, it requires risk considerations to be more practical.

Based on previous studies of project risk management (e.g., [15, 26]), in turbulent project environment addressing the downside potential of projects is essential to help the managers obtain the most favorable project conditions by finding and dealing with potential negative circumstances. Actually, in comparison among different risk measurement techniques greater explanatory power in risk measurement could be reached by applying downside risk measures [46]. Variance is a very popular measure of risk. In variance calculations the positive and negative deviations from the mean value have the same importance. In reality, decision makers often rely more on downside risk—the risk of failure. Semi-variance is a risk measure that considers risk of failure by measuring the probability and distribution below the mean return [4]. In addition, semi-variance is a direct, clear and easy to apply risk measure [30]. It was initially introduced by Markowitz [40] and its advantages have made it popular among scholars and decision makers. In this paper, the lower semi-variance is introduced in the IT2F-environment to measure project risk under uncertainty; it is presented as follows:

where

Conventional return index of an investment project based on capital recovery factor and expected value of the fuzzy net present value is presented under IT2F-environment considering E(IT2FNPV) as IT2F-expected valued of NPV and d as the capital recovery factor. This new index (IT2PI) is introduced as follows:

IT2PI indicates viability of project and its results are similar to those of NPV and the internal of return rate. This index could find the project with the highest return rate among projects with equal investment capitals. Consequently, as IT2PI gets bigger, project return increases [67].

Since this index lacks risk considerations, a risk index is defined under IT2F uncertainty. In this downside risk index DRV (IT2FNPV) indicates lower semi-variance of project and d is capital recovery factor. The resulting risk index is presented as follows:

DRI could be used in measuring project risk. It could also be applied to find the project with lowest risk among projects with equal investment capitals. It can be concluded that lower value of DRI indicate lower risk and higher desirability.

None of the aforementioned indexes were able to simultaneously address risk and return. Therefore, a novel composite risk-return project evaluation index that is not affected by lifetime and investment capitals of projects is introduced to simultaneously consider risk and return. DRI/IT2PI with the following project selection procedure is introduced:

-

1.

If DRI A /IT2PI A ≤ DRI B /IT2PI B , then project A is not less advantageous than project B.

-

2.

If DRI A /IT2PI A ≤ DRI B /IT2PI B and DRI B /IT2PI B ≤ DRI A /IT2PI A , then project A and project B have the same evaluation results.

-

3.

If DRI A /IT2PI A < DRI B /IT2PI B , then project A is more favorable than project B.

4.2 R&D project portfolio selection model

This subsection includes a new model of R&D project portfolio selection under IT2F uncertainty. In order to choose an optimized portfolio of R&D projects among n viable projects with IT2F-net cash flow and investment capital requirements, the model and its corresponding notations are described as follows:

Investment capital of project i;

Annual net cash flows of project i at the end of tth year; \( T_{i} ,{\mkern 1mu} i = 1,2, \ldots ,n, \) lifetime of project i; \( \bar{r} \), discount rate or base earnings ratio; I, total capital budget of the organization; x i , decision variable, described as:

IT2F-net present value of project i is:

Considering \( d_{i} = \left( {A/P,\bar{r},T_{i} } \right) = \bar{r}/(1 - (1 + \bar{r})^{{ - T_{i} }} ) \) as the capital recovery factor, the return index and risk index can be written as IT2PI i = E(IT2FNPV i ) × h i and DRI i = DRV(IT2FNPV i ) × d 2 i , respectively. In order to extend the single R&D project evaluation model to R&D project portfolio selection model, investment proportion allocated to each project has to be considered. This measure is displayed as w i for project i and is introduced as follows:

Therefore, the introduced IT2FNPV of R&D project portfolio could be obtained as follows:

Since IT2FNPV results in an IT2FN, for the purpose of simplification, the result is depicted as follows:

The return index of R&D project portfolio can be obtained as follows:

The downside risk index of project portfolio is obtained by:

where

The risk-return index of project portfolio is obtained as:

Minimizing the aforementioned index in R&D project portfolio selection yields a portfolio that has the highest return rate with the lowest risk. Thus, the following objective function is introduced:

Constraints in this sort of problem are specified in different groups to help fulfill the necessities of the solution. These groups are proposed as follows.

After careful review of the recent papers in the related literature (e.g., [23, 41]), constraints in this sort of problem are specified in different groups to help fulfill the necessities of the solution. These groups are introduced as follows.

4.2.1 Resource constraints

This sort of constraint includes financial, human resource, and equipment limitations which are:

-

Financial resource:

$$ \begin{aligned} L_{B} & \le \sum\limits_{i = 1}^{n} {\left( {fi_{1}^{U} ,fi_{2}^{U} ,fi_{3}^{U} ,fi_{4}^{U} ;H_{1} \left( {fi_{1}^{U} } \right),H_{2} \left( {fi_{1}^{U} } \right)} \right),} \\ & \quad \left( {fi_{1}^{L} ,fi_{2}^{L} ,fi_{3}^{L} ,fi_{4}^{L} ;H_{1} \left( {fi_{1}^{L} } \right),H_{2} \left( {fi_{1}^{L} } \right)} \right) \cdot x_{i} \le M_{B} \\ \end{aligned} $$(35)where L B and M B are the least and the most acceptable levels of investment, respectively.

-

Human resource limits:

$$ \begin{aligned} & \sum\limits_{i = 1}^{n} {E\left( {{\text{HR}}_{i1}^{U} ,{\text{HR}}_{i2}^{U} ,{\text{HR}}_{i3}^{U} ,{\text{HR}}_{i4}^{U} ;H_{1} \left( {{\text{HR}}_{i1}^{U} } \right),H_{2} \left( {{\text{HR}}_{i1}^{U} } \right)} \right),} \\ & \quad \left( {{\text{HR}}_{i1}^{L} ,{\text{HR}}_{i2}^{L} ,{\text{HR}}_{i3}^{L} ,{\text{HR}}_{i4}^{L} ;H_{1} \left( {{\text{HR}}_{i1}^{L} } \right),H_{2} \left( {{\text{HR}}_{i1}^{L} } \right)} \right) \cdot x_{i} \le M_{\text{HR}} \\ \end{aligned} $$(36)where HR i is the interval type-2 fuzzy human resource requirements of project i and M HR is the maximum number of human resources available.

-

Equipment constraints:

$$ \begin{aligned} & \sum\limits_{i = 1}^{n} {\left( {{\text{FE}}_{i1}^{U} ,{\text{FE}}_{i2}^{U} ,{\text{FE}}_{i3}^{U} ,{\text{FE}}_{i4}^{U} ;H_{1} \left( {{\text{FE}}_{i1}^{U} } \right),H_{2} \left( {{\text{FE}}_{i1}^{U} } \right)} \right),} \\ & \quad \left( {{\text{FE}}_{i1}^{L} ,{\text{FE}}_{i2}^{L} ,{\text{FE}}_{i3}^{L} ,{\text{FE}}_{i4}^{L} ;H_{1} \left( {{\text{FE}}_{i1}^{L} } \right),H_{2} \left( {{\text{FE}}_{i1}^{L} } \right)} \right) \cdot x_{i} \le A_{E} \\ \end{aligned} $$(37)where FE i is the interval type-2 fuzzy equipment requirements of project i and A E is the available equipment.

4.2.2 Compulsory and regulatory constraints

Since the legal, environmental, political, and strategic considerations have major impacts on project portfolio selection, any effective portfolio selection method should address these considerations. Any project selection or rejection considering legal, environmental, political, and strategic issues can be addressed as follows:

Required projects:

where A is the group of projects that must be included.

Abandoned projects:

where R is the group of projects that must be rejected.

4.2.3 Mutual inclusions or exclusions

If two projects are preferred to be either selected or rejected together, the constraint can be expressed as follows:

If two projects are preferred not to be selected at the same time, the constraint can be expressed as follows:

4.2.4 Perquisite constraints

If selection of a project requires successfully fulfillment of a set of perquisites, the constraint can be expressed as follows:

where H p is the set of projects’ perquisite for project p and C is the cardinality of H p.

4.2.5 Time horizon

If the decision maker has to balance the time horizon of investment, the following can be applied:

This approach enables the decision maker to set a constraint on the level of budget spent of each group of short-, mid-, and long-term investments.

5 Applications of proposed interval type-2 fuzzy optimization model

In this section in order to illustrate IT2F-optimization model applicability, first data from the study of Zhang et al. [67] is used to verify the proposed model and the results are displayed and discussed. Then, the project evaluation approach is applied in a case study of a gas and oil development holding firm to evaluate its R&D project proposals. To illustrate the effectiveness of the introduced model under larger data sets after careful review of the studies in the existing literature (e.g., [27, 67]), a data set consisting of 20 candidate projects has been made and adopted to be used in the proposed project portfolio selection process. Eventually, the managerial implications of applying model in the provided case study are presented.

5.1 Numerical example

In this part, data from numerical example of Zhang et al. [67] is solved with the proposed project portfolio selection model. Table 2 displays the original data of the studied example. In Tables 3 and 4, the results of the existing method and the proposed model are displayed, respectively. To ease comparison of results, Table 5 displays the results of both methods. The proposed model offers the decision maker a powerful uncertainty-modeling tool in addition to a higher flexibility in expressing and calculating uncertainty.

5.2 Case study

Proposed R&D projects of an Iranian gas and oil development holding are evaluated in this section. Therefore, data from the firm are adopted and used. The primary priority of this company is to invest in the oil, gas and petrochemical sectors. Moreover, the company is pursuing an active role in the capital market of the country to reach its long-term goals of becoming the biggest holding in Iran’s petrochemical sector. The company also aims to expand its presence in local, regional, and international markets through creating a competitive edge over other similar companies. Consequently, the company has reserved the information of candidate projects as confidential. Due to confidentiality of the information, limited details of the R&D projects are illustrated.

The company is presented with four R&D project proposals with different investment capitals and future cash flows. These projects are geographically distributed in different provinces of Iran. Table 2 presents some characteristics of the aforementioned R&D projects. To use a more flexible uncertainty-addressing tool, annual net cash flow and investment capitals of projects are expressed by IT2F-numbers. In Fig. 2, map of Iran is provided to depict the locations of the provinces mentioned in Table 6. To show the aforementioned provinces, they are colored in pink.

Net cash flow of each project at the end of each year is presented in Table 7. These values are based on the values presented in the project proposals and are adapted to IT2F-numbers. The considered interest rate is 0.05.

Net present value, return index, and downside risk index of each project is calculated and presented in Table 8. For the purpose of illustration, calculations of E(IT2FNPV), IT2PI, DRI, and DRI/IT2PI for project A are presented in Eqs. (47)–(52).

In Table 8, project D has the highest net present value. It also has the highest value of return index. Project D has the lowest DRI. While comparing the DRI/IT2PI index, it can be concluded that project D is most desirable project. Projects A, C, and B are next, respectively. To provide comparison of results, the same process of project evaluation is carried out by triangular type-1 fuzzy sets (TT1FSs). The results are presented in Table 9. It should be noted that using type-1 fuzzy sets in this case study despite providing lower values for DRI/IT2PI, significantly reduces the flexibility and ability of the model to operate under very uncertain environment of R&D projects.

5.3 Practical example

A project-oriented firm is presented with 20 independent candidate R&D projects with different investment capitals and future cash flows. IT2F-numbers are used to express annual net cash flow and investment capital of each R&D project. Discount rate of capital per year is set to 5 %. The proposed model of project portfolio selection is applied to find the optimum portfolio of projects. Predictions of project cash flows and their capital requirements are presented in Table 10.

The model is used with the provided data. In order to demonstrate models ability in finding the optimum portfolio different levels of available resources are set. The resulting portfolios are presented in Table 11. In this table, 0 shows rejection and 1 denotes selection of the project in the optimum portfolio.

Finally, to present a better illustration of advantages of the proposed models over the existing similar methods, the numerical examples and the case study along with comparing the results with the method of Zhang et al. [67] and type-1 fuzzy sets are provided; then, summary of the outcomes and findings are reported in Table 12.

5.4 Managerial implications

Implementation of the proposed approach in a real case study of an oil and gas holding company provides several managerial implications:

First, it proposes a highly powerful tool to express and calculate the existing uncertainty of project environments. In real-world problems, many of the project factors such as net cash flow due to the uncertain environment of projects cannot be expressed in crisp values. Furthermore, in complex situations, like today’s highly competitive business environment, even using classical fuzzy sets and expressing the degree of membership in a crisp value cannot fully express the existing uncertainty.

Second, using an effective downside risk measure enables the decision maker to have comprehensive understanding of the negative risk associated with each R&D project. Therefore, only the negative impacts of each project are considered in project evaluation process.

Third, this model provides a thorough understanding of each project in case of its return, risk and the risk to return ratio. The decision makers can easily analyze each project according to its financial factors under highly uncertain environment.

6 Conclusion

Markets changes and the growing complexity of technologies are making many organizations plan on R&D as a survival tool in today’s environment. R&D project portfolio selection is a complicated task with the objective of selecting a number of projects that best serve the organizational goals and respect the existing limitations and constraints. In this paper, a new model of project evaluation and a model of project portfolio selection with application in R&D projects were presented. In this approach, uncertain factors were addressed by IT2FSs. This uncertainty-modeling tool provided the model with more flexibility in addressing and calculating risk and uncertainty. The proposed model simultaneously considered risk and expected return. In other words, the optimum portfolio not only had the best return rate but also has the least risk. For measuring risk, lower semi-variance was applied which could be a downside risk measure. Moreover, constraints and limitations of this sort of problem were comprehensively reviewed and presented. This approach gave the model high capabilities in real-world applications. Consequently, this paper offers a new approach in R&D project evaluation and project portfolio selection by using IT2FSs, addressing risk and return at the same time, using lower semi-variance as a downside risk measure to evaluate project risk and considering different practical considerations. Furthermore, to illustrate the capabilities of the proposed model, first the project evaluation model was applied in real case study of an oil and gas company. Then, a practical example was provided to show model’s capability in larger data sets. The results were displayed and discussed. For further research, applying this model in a decision support system could be an interesting research direction.

References

Asan UMUT, Soyer AYBERK, Bozdag C (2016) An interval type-2 fuzzy prioritization approach to project risk assessment. J Multiple-Valued Logic Soft Comput (Accepted)

Badri MA, Davis D, Davis D (2001) A comprehensive 0–1 goal programming model for project selection. Int J Proj Manag 19(4):243–252

Bard JF, Balachandra R, Kaufmann PE (1988) An interactive approach to R&D project selection and termination. IEEE Trans Eng Manag 35(3):139–146

Belaid F (2011) Decision-making process for project portfolio management. Int J Serv Oper Inf 6(1):160–181

Bernardo AE, Cai H, Luo J (2001) Capital budgeting and compensation with asymmetric information and moral hazard. J Financ Econ 61(3):311–344

Bezdek JC (2013) Pattern recognition with fuzzy objective function algorithms. Springer, Berlin

Bhattacharyya R (2015) A grey theory based multiple attribute approach for R&D project portfolio selection. Fuzzy Inf Eng 7(2):211–225

Bhattacharyya R, Kumar P, Kar S (2011) Fuzzy R&D portfolio selection of interdependent projects. Comput Math Appl 62(10):3857–3870

Bilbao-Terol A, Pérez-Gladish B, Antomil-Lbias J (2006) Selecting the optimum portfolio using fuzzy compromise programming and Sharpe’s single-index model. Appl Math Comput 182(1):644–664

Carlsson C, Fullér R, Heikkilä M, Majlender P (2007) A fuzzy approach to R&D project portfolio selection. Int J Approx Reason 44(2):93–105

Casault S, Groen AJ, Linton JD (2013) Selection of a portfolio of R&D projects. In: Link AN, Vonortas NS (eds) Handbook on the theory and practice of program evaluation, Chapter 4. Edward Elgar Publishing, Cheltenham, UK, pp 89–111. ISBN: 978-0-85793-239-6

Celikyilmaz A, Turksen IB (2009) Modeling uncertainty with fuzzy logic. Stud Fuzziness Soft Comput 240:149–215

Cervantes L, Castillo O (2015) Type-2 fuzzy logic aggregation of multiple fuzzy controllers for airplane flight control. Inf Sci 324:247–256

Chan Y, DiSalvo JP, Garrambone MW (2005) A goal-seeking approach to capital budgeting. Socio-econ Plan Sci 39(2):165–182

Chapman CB, Ward SC, Klein JH (2006) An optimised multiple test framework for project selection in the public sector, with a nuclear waste disposal case-based example. Int J Proj Manag 24(5):373–384

Chen CT, Cheng HL (2009) A comprehensive model for selecting information system project under fuzzy environment. Int J Proj Manag 27(4):389–399

Chen SM, Lee LW (2010) Fuzzy multiple attributes group decision-making based on the ranking values and the arithmetic operations of interval type-2 fuzzy sets. Expert Syst Appl 37(1):824–833

Chen SM, Yang MW, Lee LW, Yang SW (2012) Fuzzy multiple attributes group decision-making based on ranking interval type-2 fuzzy sets. Expert Syst Appl 39(5):5295–5308

Coldrick S, Longhurst P, Ivey P, Hannis J (2005) An R&D options selection model for investment decisions. Technovation 25(3):185–193

Cooper R, Edgett S, Kleinschmidt E (2001) Portfolio management for new product development: results of an industry practices study. R&D Manag 31(4):361–380

Edgett Scott J (2001) Portfolio management for new product development: results of an industry practices study. R&D Manag 13:90–120

Floricel Serghei, Miller Roger (2001) Strategizing for anticipated risks and turbulence in large-scale engineering projects. Int J Proj Manag 19(8):445–455

Gang J, Hu R, Wu T, Tu Y, Feng C, Li Y (2015) R&D project portfolio selection in a bi-level investment environment: a case study from a research institute in China. In: Proceedings of the ninth international conference on management science and engineering management. Springer, Berlin, pp 563–574

Gaxiola F, Melin P, Valdez F, Castro JR, Castillo O (2016) Optimization of type-2 fuzzy weights in backpropagation learning for neural networks using GAs and PSO. Appl Soft Comput 38:860–871

Ghapanchi AH, Tavana M, Khakbaz MH, Low G (2012) A methodology for selecting portfolios of projects with interactions and under uncertainty. Int J Proj Manag 30(7):791–803

Ghorbal-Blal Ines (2011) The role of middle management in the execution of expansion strategies: the case of developers’ selection of hotel projects. Int J Hosp Manag 30(2):272–282

Gupta P, Inuiguchi M, Mehlawat MK, Mittal G (2013) Multiobjective credibilistic portfolio selection model with fuzzy chance-constraints. Inf Sci 229:1–17

Heidenberger K, Stummer C (1999) Research and development project selection and resource allocation: a review of quantitative modelling approaches. Int J Manag Rev 1(2):197–224

Hu J, Zhang Y, Chen X, Liu Y (2013) Multi-criteria decision making method based on possibility degree of interval type-2 fuzzy number. Knowl-Based Syst 43:21–29

Huang X (2008) Mean-semivariance models for fuzzy portfolio selection. J Comput Appl Math 217(1):1–8

Huang CC, Chu PY, Chiang YH (2008) A fuzzy AHP application in government-sponsored R&D project selection. Omega 36(6):1038–1052

Iamratanakul S, Patanakul P, Milosevic D (2008) Project portfolio selection: from past to present. In: Proceedings of the 2008 IEEE ICMIT, pp 287–292

Kiliç M, Kaya İ (2015) Investment project evaluation by a decision making methodology based on type-2 fuzzy sets. Appl Soft Comput 27:399–410

Lawson CP, Longhurst PJ, Ivey PC (2006) The application of a new research and development project selection model in SMEs. Technovation 26(2):242–250

Lee LW, Chen SM (2008) A new method for fuzzy multiple attributes group decision-making based on the arithmetic operations of interval type-2 fuzzy sets. In: 2008 international conference on IEEE machine learning and cybernetics, vol 6, pp 3084–3089

Liesiö J, Salo A (2012) Scenario-based portfolio selection of investment projects with incomplete probability and utility information. Eur J Oper Res 217(1):162–172

Luo LM (2011) Optimal diversification for R&D project portfolios. Scientometrics 91(1):219–229

Maity S, Sil J (2009) Color image segmentation using type-2 fuzzy sets. Int J Comput Electr Eng 1(3):1793–8163

Markowitz H (1952) Portfolio selection. J Finance 7(1):77–91

Markowitz HM (1968) Portfolio selection: efficient diversification of investments, vol 16. Yale University Press, New Haven

Mavrotas G, Pechak O (2013) The trichotomic approach for dealing with uncertainty in project portfolio selection: combining MCDA, mathematical programming and Monte Carlo simulation. Int J Multicrit Decis Mak 3(1):79–96

Mendel JM (2003) Type-2 fuzzy sets: some questions and answers. IEEE Conn Newsl IEEE Neural Netw Soc 1:10–13

Mendel JM (2007) Type-2 fuzzy sets and systems: an overview. IEEE Comput Intell Mag 2(1):20–29

Mendel J, Wu D (2010) Perceptual computing: aiding people in making subjective judgments, vol 13. Wiley, London

Mendel JM, John R, Liu F (2006) Interval type-2 fuzzy logic systems made simple. IEEE Trans Fuzzy Syst 14(6):808–821

Miller Kent D, Reuer Jeffrey J (1996) Measuring organizational downside risk. Strateg Manag J 17(9):671–691

Mohagheghi V, Mousavi SM, Siadat A (2015) A new approach in considering vagueness and lack of knowledge for selecting sustainable portfolio of production projects. In: IEEE international conference on industrial engineering and engineering management (IEEM), 2015, pp 1732–1736

Mousavi SM, Tavakkoli-Moghaddam R, Vahdani B, Hashemi H, Sanjari MJ (2013) A new support vector model-based imperialist competitive algorithm for time estimation in new product development projects. Robot Comput-Integr Manuf 29:157–168

Mousavi SM, Torabi SA, Tavakkoli-Moghaddam R (2013) A hierarchical group decision-making approach for new product selection in a fuzzy environment. Arab J Sci Eng 38(11):3233–3248

Mousavi SM, Vahdani B, Abdollahzade M (2015) An intelligent model for cost prediction in new product development projects. J Intell Fuzzy Syst 29:2047–2057

Perez F, Gomez T (2014) Multiobjective project portfolio selection with fuzzy constraints. Ann Oper Res. doi:10.1007/s10479-014-1556-z

Rebiasz B (2007) Fuzziness and randomness in investment project risk appraisal. Comput Oper Res 34(1):199–210

Sanchez MA, Castillo O, Castro JR (2015) Information granule formation via the concept of uncertainty-based information with interval type-2 fuzzy sets representation and Takagi–Sugeno–Kang consequents optimized with Cuckoo search. Appl Soft Comput 27:602–609

Sanchez MA, Castillo O, Castro JR (2015) Generalized type-2 fuzzy systems for controlling a mobile robot and a performance comparison with interval type-2 and type-1 fuzzy systems. Expert Syst Appl 42(14):5904–5914

Santamaría L, Barge-Gil A, Modrego A (2010) Public selection and financing of R&D cooperative projects: credit versus subsidy funding. Res Policy 39(4):549–563

Sari IU, Kahraman C (2015) Interval type-2 fuzzy capital budgeting. Int J Fuzzy Syst 17(4):635–646

Shin J, Coh BY, Lee C (2013) Robust future-oriented technology portfolios: Black–Litterman approach. R&D Manag 43(5):409–419

Tidd J, Bessant J, Pavitt K (2005) Managing innovation integrating technological, market and organizational change, 3rd edn. Wiley, Sussex

Turksen IB (1999) Type I and type II fuzzy system modeling. Fuzzy Sets Syst 106(1):11–34

Vahdani B, Mousavi SM, Tavakkoli-Moghaddam R (2011) Group decision making based on novel fuzzy modified TOPSIS method. Appl Math Model 35:4257–4269

Vahdani B, Iranmanesh H, Mousavi SM, Abdollahzade M (2012) A locally linear neuro-fuzzy model for supplier selection in cosmetics industry. Appl Math Model 36:4714–4727

Wang Juite, Hwang W-L (2007) A fuzzy set approach for R&D portfolio selection using a real options valuation model. Omega 35(3):247–257

Wang W, Liu X, Qin Y (2012) Multi-attribute group decision making models under interval type-2 fuzzy environment. Knowl-Based Syst 30:121–128

Wei CC, Chang HW (2011) A new approach for selecting portfolio of new product development projects. Expert Syst Appl 38(1):429–434

Yeh TM, Pai FY, Liao CW (2014) Using a hybrid MCDM methodology to identify critical factors in new product development. Neural Comput Appl 24(3–4):957–971

Zadeh LA (1974) The concept of a linguistic variable and its application to approximate reasoning. Springer, USA, pp 1–10

Zhang WG, Mei Q, Lu Q, Xiao WL (2011) Evaluating methods of investment project and optimizing models of portfolio selection in fuzzy uncertainty. Comput Ind Eng 61(3):721–728

Acknowledgments

The authors express sincere appreciation to anonymous reviewers for their valuable comments which are helpful in enhancing the quality of primary research.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Mohagheghi, V., Mousavi, S.M., Vahdani, B. et al. R&D project evaluation and project portfolio selection by a new interval type-2 fuzzy optimization approach. Neural Comput & Applic 28, 3869–3888 (2017). https://doi.org/10.1007/s00521-016-2262-3

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00521-016-2262-3