Abstract

Retailers can make marketing efforts to increase the market demand, but the results from their activities are generally uncertain and influenced by free riding. This paper considers marketing strategies in a two-echelon supply chain under free riding, where a manufacturer sells products through two competitive retailers who have different powers. The dominant retailer will decide whether to make marketing efforts, and the following retailer will choose whether to follow the decision of the dominant retailer. We establish our demand functions relying on the price and marketing efforts, and then build six decentralized game models to examine how marketing strategies and power structures (manufacturer-dominant and retailer-dominant) affect supply chain members’ performances. It is found that, for the dominant retailer, he will make marketing efforts if free riding is not severe. As for the following retailer, in retailer-dominant structure, he will also make marketing efforts if the dominant retailer makes that, while his strategy varies with the degree of free riding in manufacturer-dominant structure. We also show that if the dominant retailer wants to make marketing efforts, he will make the same level of marketing efforts regardless of his market base and competitor’s decision.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

1 Introduction

In the current market, fragmented industries exist in many areas of economic activity, such as some traditional service industries (e.g., fast food, laundry), and some retail businesses (e.g., Walmart, Watsons). The characteristics of the fragmented industries are scattered, and the company has no economies of scale. If a company can overcome the fragmentation, then his return will be very high. The specific ways to overcome fragmentation include chain operations or franchising. Watsons is a typical case of success using the above ways. It is China’s largest retail chain of health and beauty products with more than 3,200 stores and more than 64 million members in 438 cities across China. These chain retailers of Watsons have unified management and unified pricing, while some retailers dominate the region because of their strong information resources and market base (Wang et al. 2018). When a customer enters these dominant retailers, he has a deeper understanding of a certain product and desire to buy through the marketing efforts (e.g., promotion) of the clerk, but for some reasons, he has not successfully purchased; for example, his place of residence is far from the retailer, and the product is not convenient to carry. At the same time, the customer realizes that there is a retailer of the same brand selling the same product near his home. Therefore, he will eventually purchase it at a retailer near his place of residence rather than the retailer he first met. This phenomenon can be explained by the free-riding effect. The basic meaning of free riding is to enjoy the benefits of others without paying the cost. For example, many shipping companies are unwilling to build lighthouses and they can get the same services as well. In supply chain management, free riding refers to that the service provided in one channel helps the other channel get a final sale without any compensation (Dan et al. 2014), which may mitigate the motivation for marketing efforts. “Just seeing not buying” is a typical free-riding behavior. The consumers enter the retail store to view the product, and accept the retailer’s marketing service, but ultimately do not purchase. Instead, they turn to other stores or channels to buy the same product.

In this paper, we consider a marketing problem in a supply chain where a common manufacturer produces and supplies products to duopoly retailers. One of the retailers is dominant to the other one, and the sales price is determined by a third party. Marketers often point out that the market demand is not only affected by the sales price, but also by the marketing investment (Esmaeili et al. 2009). To promote sales, the retailers can make marketing efforts, which is a way of promotional campaign used by many retailers to directly provide customers the brand knowledge of their products and services and other specialties of their organizations (Giri and Sharma 2014; Yang et al. 2015). However, marketing strategies are challenging in profit-oriented companies (Dogu and Albayrak 2018), and the presence of free riding may affect their impacts, and thus influence the profit of the entire supply chain. Some scholars (Wu et al. 2004; Shin 2007; Kuksov and Lin 2010) suggested that free riding may benefit the supply chain members. For instance, Wu et al. (2004) found that a seller can make positive profit by establishing itself as an information service provider under free riding. Shin (2007) showed analytically that free-riding benefits not only the free-riding retailer, but also the retailer that provides the service when customers are heterogeneous in terms of their opportunity costs for shopping. According to other scholars (Carlton and Chevalier 2001; Xing and Liu 2012; Balakrishnan et al. 2014), marketing efforts made by retailers may not be so much effective because of free riding. Therefore, what impact does free riding have on the retailers’ marketing strategies and the profits of supply chain members? And, we want to know whether the market base of the dominant retailer may affect the retailers’ strategies. The emergence and rapid development of large-sized retailers (e.g., Walmart and Carrefour) outlets creates opportunities for dominant retailers to align with the businesses in the supply chain, in which they have previously never been involved, the power of manufacturers and retailers is reversing (Huang and Ke 2017; Wang et al. 2019). Especially, Huang et al. (2016) considered the effect of power structures on the pricing and performance of supply chain members in a two-stage supply chain. Our research also analyzes the effect of power structures. However, there are some differences between the previous literature and our research. First of all, the focus of the previous literature is pricing strategy, and this paper focuses on the marketing strategy. Secondly, the previous paper assumes that there is no dominant power between the two retailers, while we take the dominant power between the two retailers into account in our paper. Finally, the effect of free riding on the performance of supply chain members is considered in our paper.

The main contributions of this paper are showed as follows: First, our research contributes to the marketing literature by investigating different marketing strategies under different power structures. We have not only considered the difference in powers between retailers and manufacturer, but also the difference in powers between two retailers. Second, we fill a significant gap in the literature of free riding. To the best of our knowledge, when free riding exists, the previous literature only considers the situation where only one retailer makes marketing efforts. We also consider two more situations where both retailers do or do not make marketing efforts. In addition, previous literature only considers the one-way free-riding effect, and we increase the consideration of bilateral free-riding behavior between two retailers.

In our setting, the retailers have different powers and the sales price is determined by the headquarter. We establish six models under different power structures based on game theory, and obtained equilibrium solutions. Then, we compare equilibria to analyze supply chain members’ performances under different power structures and examine whether the retailers’ marketing strategies change with the degree of free riding and different power structures. After that, we conduct a numerical example to evaluate what the influence of free riding is on supply chain members’ profits.

We find that if free riding is not severe, the dominant retailer will make marketing efforts. As for the following retailer, in retailer-dominant structure, once the dominant retailer makes marketing efforts, he will also do that, while his strategy will change as the degree of free riding changes in manufacturer-dominant structure. Additionally, if the dominant retailer wants to make marketing efforts, he will make the same level of marketing efforts regardless of his market base and competitor’s decision, and the marketing expenditures of the two retailers are same if both of them choose to make marketing efforts. Another finding is that if only the dominant retailer makes marketing efforts, the following retailer may prefer to see severe free riding in manufacturer-dominant structure and weak free riding in retailer-dominant structure. Some other managerial highlights are also presented in this paper.

The remainder of this paper is organized as follows. In Sect. 2, we provide a review of related literature. Then, we establish the demand functions in Sect. 3. In Sect. 4, six decentralized models are built to formulate the marketing strategy under two power structures. After that, in Sect. 5, we compare and analyze the equilibrium results from Sect. 4, and conduct a numerical example to explore free-riding effect on supply chain members’ profits. Conclusions and future research are presented in Sect. 6. The proofs of some propositions appear in Appendix.

2 Related literature

Our research focuses on a decentralized supply chain with one manufacturer and two retailers, where the market demand takes into account marketing efforts and free riding. To the best of our knowledge, the marketing efforts dependent demand and the supply chain structures with one common manufacturer and two retailers have been independently discussed by many researchers, but few researchers have combined them, and none has investigated the effects of power structure on marketing strategies when both marketing efforts and free riding are considered.

2.1 Supply chain with one common manufacturer and two retailers

Ingene and Parry (1995a) studied channel coordination in a supply chain where a manufacturer sells through competing retailers. Furthermore, they also explored wholesale pricing behavior within a two-level vertical channel (Ingene and Parry 1995b). Later, Zhao et al. (2012) studied the pricing problem of substitutable products in a supply chain with one manufacturer and two competitive retailers in a fuzzy environment. These researches with one common manufacturer usually focused on the pricing problem in the supply chain and the effects of power structure on the price and profits. Giri and Sharma (2014) studied the manufacturer’s pricing strategy in a two-level supply chain with competing retailers and advertising cost dependent demand. They showed that it is always beneficial for the manufacturer to adopt different wholesale pricing strategies for the retailers. Huang et al. (2016) built six decentralized game models to examine how pricing strategies (Bertrand and collusion) and power structures (manufacturer-dominant, retailer-dominant, and non-dominant) affect supply chain members’ performances. Chen et al. (2016) investigated the impact of power structure on pricing decisions and performance in a mixed dual-channel retail service supply chain. Furthermore, Ke et al. (2018a) focused on a pricing problem in a closed-loop supply chain (CLSC) with two competitive risk-sensitive retailers under uncertain environment. To extend, Huang et al. (2018) further developed three dynamic models of a distribution channel where a manufacturer distributes its products through two competing retailers. They found that the manufacturer as well as the supply chain always prefers to see that the retailers make same strategic behaviors, despite the fact that the retailers do not always stick to the same behaviors. The main difference between our paper and the above literature is that we focus on the retailers’ marketing strategies when demand is influenced by retailer’s marketing efforts without considering the sales price.

2.2 Marketing efforts

It is widely known that marketing efforts play a vital role in the sales price and the market demand. Therefore, lots of researchers have studied that in various aspects. Gurnani and Xu (2006) found that the sales price is strongly related to sales efforts when they studied the role of resale price maintenance (RPM) contract in a market where demand is influenced by retailer’s sales efforts. Ma et al. (2013) investigated the equilibrium behaviors of a two-stage supply chain under three supply chain structures when the market demand depends on quality and marketing efforts. They found that investing in marketing efforts is most profitable to the retailer under retailer-dominant structure. In addition, Lei et al. (2017) developed option contracts in a supplier-retailer agricultural supply chain where the market demand depends on sales effort. They revealed that both the optimal initial order quantity and the optimal option quantity increase with the sales effort. Moreover, Huang et al. (2018) considered the cooperative promotion in a supply chain consisting of a manufacturer and two competing retailers. They showed that the promotion efforts of the retailers have a positive impact on their demands, but a negative impact on the manufacturer’s brand image. In recent years, carbon emission reduction has aroused great concern, and consumers not only consider the price and quality level of products, but also pay more attention to their green level (Yang et al. 2019). Therefore, many scholars (Li et al. 2019; Lou and Ma 2018) have combined carbon emission reduction effort with marketing efforts. For example, Lou and Ma (2018) studied the complexity of sales effort and carbon emission reduction effort in a Bertrand household appliance supply chain system. They indicated that sales effort may not be so much effective to retailer’s profit. Different from the literature above, we explore the influence of retailers’ different powers and free riding on retailers’ decision making.

2.3 Free riding

Many scholars have significant insights into free riding from different perspectives. Rokkan and Buvik (2003) explored the problem of free-riding behavior in voluntary retail chains based on agency theory and group theory. Chiu et al. (2011) focused on the most popular type of cross-channel free riding: searching for product information in an online store and then purchasing in another brick-and-mortar store. They found that when consumers perceive more multichannel self-efficacy, they engage in more cross-channel free-riding behavior. In addition, Heitz-Spahn (2013) aimed to understand free riding from a consumer empowerment perspective. They showed that cross-channel free-riders mainly seek to fulfill price comparison, convenience and flexibility needs. The likelihood of free riding is higher when consumers adopt cross-channel rather than single-channel behavior.

In recent years, more and more researchers focus on free riding in dual-channel supply chain. Carlton and Chevalier (2001) found that manufacturers who distribute their goods directly through manufacturer websites tend to charge very high prices for products when free riding occurs. Furthermore, Xing and Liu (2012) studied a supply chain with one manufacturer and two retail channels. They pointed out that free-riding effect reduces brick-and-mortar retailer’s desired effort level, and thus hurts the manufacturer’s profit and the overall supply chain performance. He et al. (2016) evaluated the impact of consumer free riding on carbon emissions in a product’s life cycle across a dual channel closed loop supply chain. They found that manufacturers may gain economic benefits from consumer free-riding behavior. Additionally, Pu et al. (2017) considered the effect of free riding on sales effort in a dual-channel supply chain. They showed that under deterministic demand, both the offline store’s sales effort level and the dual-channel supply chain’s profit decrease as the number of free-riding consumers increases. Recently, Zhou et al. (2018) investigated how free riding affects the manufacturer’s and retailers’ pricing/service strategies and profits. They revealed that the service-cost sharing contract can effectively stimulate the retailer to improve his service level, while free riding occurs. When free riding exists, the previous literature only considers the situation where only one retailer makes marketing efforts. We also consider two more situations where both retailers do or do not make marketing efforts.

3 Model formulation

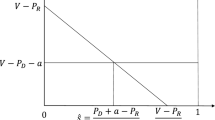

Consider a supply chain with one common manufacturer and two competitive retailers. The manufacturer (M) produces a unique product at a constant cost c and sets the common wholesale price w to the retailers (\(R_1\) and \(R_2\)). We assume the cost of production is zero for simplicity. In our setting, the headquarter determines the price, so the price is an exogenous variable for the retailers. What they can determine are their marketing strategies (making marketing efforts or not). We also assume that one of the retailers is dominant, which is \(R_1\) without loss of generality. From perceived positions of growing economic strength, the dominant retailer possesses more abundant and precise market information (Wang et al. 2018). As master of both the retailers, this retailer exercises his power to set the rules of the game; hence, he moves first over the other retailer. We assume that if the dominant retailer does not make marketing efforts, the following retailer would not do that either, because he would suffer from high cost but small impact. There are three scenarios in the end market: (i) The two retailers both make marketing efforts. (ii) Only the dominant retailer makes marketing efforts. (iii) None of the retailers makes marketing efforts. In our model, we assume that the retailers can affect the final demand by marketing efforts with the cost of \(\frac{\eta e_i^2 }{2}\) \((i=1,2)\) (Ma et al. 2013). Following the logic of Gurnani et al. (2007), we assume that the market demand \(q_i\) \((i=1,2)\) is a linear function of the sales price \((p=w+r)\) and marketing efforts level \((e_i,i=1,2)\), and establish the demand functions considering free riding, i.e.,

where r is the mark-up determined by a third party. The variable \(y_1\) and \(y_2\) are 0–1 variables. If \(y_1\) (or \(y_2\)) equals to 1, \(R_1\) (or \(R_2\)) will make marketing efforts. Table 1 shows the related variables and parameters of the model in this paper.

4 Modeling under different power structures

In this section, we build six decentralized models using game theory to obtain equilibria for possible power structures in which different strategies are taken. The dominant power in the supply chain is manifested mainly in decision-making order. The player with dominant power can move first over the others.

4.1 Manufacturer-dominant structure

In some supply chain, the manufacturer may have more power than the retailers (e.g., GM and Toyota are often much larger than their retailers), so that he can move first over the retailers.

4.1.1 MS-1: The two retailers both make marketing efforts

In this case, both of the two retailers choose to make marketing efforts. The demand functions and three-player game are showed below.

Taking the first-order derivative of \(\pi _2\) with respect to \(e_2\) and making it equal to 0, we have

From Eq. (4), we find that

Substituting Eq. (5) into \(R_1\)’s profit function, then making the first-order derivative of it to 0, we have

Substituting Eqs. (5) and (6) into the manufacturer’s profit function, then equating the first-order derivative to 0, we obtain

The profits of the supply chain members can also be obtained, as shown in Table 1.

4.1.2 MS-2: Only the dominant retailer makes marketing efforts

In this case, only the dominant retailer chooses to make marketing efforts, and the following retailer does not need to make decision. The problem becomes a two-player Stackelberg game. The demand functions and two-player game are expressed as follows:

Similarly, we have

4.1.3 MS-3: None of the retailers makes marketing efforts

In this case, the two retailers refuse to make marketing efforts, so only the manufacturer makes his decision in the whole supply chain.

Similarly, we have

4.2 Retailer-dominant structure

In some supply chain, the retailers may have more power than the manufacturer. Therefore, they can move first over the manufacturer. In this situation, the decision-making order is: The dominant retailer first chooses his marketing strategy, then the following retailer makes his choice, and at last, the manufacturer determines the wholesale price.

4.2.1 RS-1: The two retailers both make marketing efforts

In this scenario, the two retailers will make marketing efforts. Then the three-player game can be depicted as follows:

Similar to the models in manufacturer-dominant structure, we should get the follower’s reactive function first given the decisions of the leaders. By solving the above model, we can get

The profits of the supply chain members can also be obtained, as shown in Table 2.

4.2.2 RS-2: Only the dominant retailer makes marketing efforts

In this scenario, only the dominant retailer chooses to make marketing efforts. The problem becomes a two-player Stackelberg game.

Similar to the process of MS-1, we can get

4.2.3 RS-3: None of the retailers makes marketing efforts

In this scenario, the results are consistent with those in the manufacturer-dominant structure.

With the equilibria of the six models derived above, the marketing efforts, wholesale prices, and profits are presented in Tables 2 and 3.

5 Comparison and analysis

In this section, we use comparative analysis to compare the equilibrium results from Tables 2 and 3, and get some interesting propositions. First, we explore the effects of power structure on marketing efforts, wholesale price and profits of the two retailers. Then, we analyze the effects of the retailers’ marketing strategies on the supply chain members’ performances. Finally, we conduct a numerical example to evaluate what the influence of the parameter \(\lambda \) is on supply chain members’ profits.

5.1 Effects of power structure

In order to elucidate the effects of power structure on marketing efforts, wholesale price and profits of the two retailers, we compare the results in the two different power structures under the same marketing strategy. The results are showed in the following part.

Proposition 1

Referring to Tables 2 and 3, we have

In Proposition 1, we can easily find that both the wholesale price and marketing efforts are higher in manufacturer-dominant structure compared with those in retailer-dominant structure. Because the higher wholesale price leads to lower sales, the retailers need to make more marketing efforts to mitigate the adverse effects above. These results conform with the corresponding results in Ke et al. (2018b).

Proposition 2

For the equilibrium profits of the two retailers, if both of them make marketing efforts, then we have

with the common condition \(\frac{3}{8}<\lambda \le 1\) holding.

If only the dominant retailer chooses to make marketing efforts, we have

and,

with the condition \(0\le \lambda <\frac{1}{4}\) holding.

Proposition 2 reveals that if the two retailers both choose to make marketing efforts, when the value of \(\lambda \) is in (3/8, 1], the retailers will earn more profits in manufacturer-dominant structure. Besides, we can also find that if the two retailers choose differently, the dominant retailer will always be more profitable in retailer-dominant structure because he can make the most favorable decision for himself first. The following retailer will obtain more profits in retailer-dominant structure, too, if the value of \(\lambda \) is in [0, 1/4). These results indicate that if only the dominant retailer makes marketing efforts, the following retailer may prefer to see severe free riding in manufacturer-dominant structure and weak free riding in retailer-dominant structure. Combined with Proposition 1, we know that the wholesale price is higher in manufacturer-dominant structure which results in lower demand, so that the following retailer wants to get more benefits from the dominant retailer’s marketing efforts in order to weaken the harmful effects.

5.2 Effects of marketing strategies

How do the duopoly retailers’ different strategies in sales process affect the equilibrium wholesale price? What is the influence of the two retailers’ marketing strategies on the total supply chain? This part will answer these two questions.

Proposition 3

From Table 2, it can be acquired that

Proposition 3 shows that in manufacturer-dominant structure, if the dominant retailer makes marketing efforts, he will make the same level of marketing efforts regardless of his competitor’s decision and market base. The wholesale price is the highest when the two retailers make marketing efforts, while the lowest when both of them do not make marketing efforts. To some extent, the retailers’ marketing efforts may increase the wholesale price.

Proposition 4

In comparison with profits acquired from the three decentralized models in manufacturer-dominant structure, we have

and,

with the common condition \(\frac{1}{4}<\lambda \le 1\) holding.

We also obtain that

with the common condition \(0\le \lambda <\frac{1}{2}\) holding.

From Proposition 4, we can easily see that the two retailers cannot always benefit from their marketing efforts. To be specific, if the value of \(\lambda \) is in (1/4, 1/2), the profits of the two retailers are the highest in scenario 1, the second highest in scenarios 2, and the lowest in scenarios 3. Additionally, both of the retailers are always more profitable in scenario 1 compared with scenario 3 in manufacturer-dominant structure. These results mean that in manufacturer-dominant structure, the following retailer had better make marketing efforts when the value of \(\lambda \) is below 1/2. If free riding is severe, the following retailer will not do any marketing efforts because he can gain more profits from severe free riding than his own marketing efforts. However, when the dominant retailer makes the decision, he will consider the following retailer’s reaction above. Thus, the dominant retailer will not make marketing efforts, either. At last, none of the retailers makes marketing efforts, which may be unwise decisions for them.

Proposition 5

Referring to Tables 2 and 3, we see that

We also obtain that

with the condition \(0\le \lambda <\frac{3}{4}\) holding.

In Proposition 5, we find that in retailer-dominant structure, if the dominant retailer chooses to make marketing efforts, he will also make the same level of marketing efforts regardless of his competitor’s decision and market base. The level of marketing efforts is lower in retailer-dominant structure than that in manufacturer-dominant structure. Additionally, we can also find that the wholesale price will be the highest if the two retailers choose to make marketing efforts with the condition \(0\le \lambda <\frac{3}{4}\) holding.

Proposition 6

In comparison with profits acquired from Table 3, we have

and,

with the common condition \(\frac{1}{4}<\lambda <\frac{3}{4}\) holding.

We also find that

with the common condition \(0\le \lambda <\frac{3}{4}\) holding.

From Proposition 6, we can see that the dominant retailer is always more profitable in scenario 2 compared with scenario 3, and the following retailer is always more profitable in scenario 1 compared with scenario 2. In addition, if the value of \(\lambda \) is in (1/4,3/4), the dominant retailer can benefit from the follower’s marketing efforts. The above results show that in retailer-dominant structure, if the dominant retailer makes marketing efforts, it is wise for the following retailer to make marketing efforts, too. Besides, the dominant retailer can benefit from the two retailers’ marketing efforts when free riding is moderate.

5.3 Numerical example

In this section, we conduct a numerical example to verify some propositions, and examine the impact of free riding on the manufacturer’s and total supply chain’s profits. We use a fictitious data set, and set \(\alpha =3/2\), \(r=1/4\), \(\eta =1\). The results are illustrated in Figs. 1 and 2. Figure 1a shows that in manufacturer-dominant structure, the dominant retailer’s profit is always higher than that of the follower regardless of strategies, and the profit is not monotonic with \(\lambda \). When the free-riding coefficient is below 0.5, both of the duopoly retailers will make marketing efforts. Otherwise, the dominant retailer has two choices, but the following retailer will not make any marketing efforts no matter what decision is made by his competitor, because he finds that free riding brings more benefits compared with his own marketing efforts. Besides, we can also see that the two retailers can gain more profits in scenario 1 than scenario 3. These observations are consistent with Proposition 4.

From Fig. 1b, we can easily find that in retailer-dominant structure, there is no doubt that the dominant retailer also benefits more from the whole market in any situations, because he has more potential customers. When the free-riding coefficient is below 0.75, both of the duopoly retailers will make marketing efforts. In addition, we can find that the dominant retailer can gain more profits in scenario 2 than scenario 3, while the following retailer can benefit more from scenario 1 compared with scenario 2. Moreover, we can also see that once the dominant retailer makes marketing efforts, the following retailer will do it, too. These observations are consistent with Proposition 6.

Figure 2a shows that the manufacturer’s and the total supply chain’s profits are negatively correlated with \(\lambda \) in scenarios 1 and 2 in manufacturer-dominant structure. That is to say, free riding decreases the efficiency of the total supply chain. Additionally, we can easily see that, the manufacturer hopes that both of the retailers will make marketing efforts, which accords with our intuition and is partially consistent with the findings of Huang et al. (2018). Although free riding may hurt the efficiency of the supply chain, the two retailers can mitigate it by their common marketing efforts. However, in reality, the retailers do not always adhere to the same behaviors.

Figure 2b reveals that the manufacturer’s and the whole supply chain’s profits are negatively correlated with \(\lambda \) in scenarios 1 and 2 in retailer-dominant structure. This result is the same as the one in manufacturer-dominant structure. The difference is that the manufacturer and total supply chain can always acquire the highest profits in scenario 1 in manufacturer-dominant structure, while only if free riding is not severe, they can obtain the highest profits in scenario 1 in retailer-dominant structure.

We use multiple sets of data and conduct several experiments, all of which get similar results

6 Conclusions

This paper mainly investigated the retailers’ marketing strategies in two-echelon supply chain with marketing efforts induced demand considering free riding, in which a common manufacturer provides a unique product to duopoly retailers, and the two retailers in turn sell the product to the end market. We built six models to derive the equilibrium outcomes under two different power structures. When the retailers are Stackelberg leaders, they can move into the market first, and decide whether to make marketing efforts or not, and if do, how much. There are three scenarios in the end market: (i) The two retailers both make marketing efforts. (ii) Only the dominant retailer makes marketing efforts. (iii) None of the retailers makes marketing efforts.

Compared with previous literature, we considered the effect of free riding on the retailers’ marketing strategies in a supply chain with marketing efforts induced demand. Additionally, we compared supply chain members’ performances under different power structures and marketing strategies. Besides, we conducted numerical analysis to explore the effect of free riding on supply chain members’ profits under different power structures. Some interesting results were obtained: (i) For the dominant retailer, he will make marketing efforts if free riding is not severe. As for the following retailer, in retailer-dominant structure, once the dominant retailer makes marketing efforts, he will do that, too, while his strategy varies with the degree of free riding in manufacturer-dominant structure. (ii) If only the dominant retailer makes marketing efforts, the following retailer may prefer to see severe free riding in manufacturer-dominant structure and weak free riding in retailer-dominant structure. (iii) If the dominant retailer wants to make marketing efforts, he will make the same level of marketing efforts regardless of his market base and competitor’s decision. And the marketing expenditures of the two retailers are same if both of them choose to make marketing efforts. (iv) The wholesale price is not lower in manufacturer-dominant structure than that in retailer-dominant structure, and the level of marketing efforts is lower in retailer-dominant structure.

These conclusions can help competing retailers decide whether to make marketing efforts and how much marketing efforts to make based on actual market conditions. In addition, this paper suggests that manufacturers can encourage and support collective-friendly activities, thereby urging them to actively carry out their own marketing efforts and reduce free riding.

The above findings are based upon some assumptions with respect to demand function. In the real world, however, demand might behave more complicated. Our paper can be extended in several ways. One immediate extension is the inclusion of stochastic demand instead of deterministic demand. Secondly, the mark-up is made by the third party in our paper, so further research can take this factor into account in supply chain’s decision. Additionally, we find that if free riding is severe, the decision of the dominant retailer is uncertain. Therefore, it is worth further investigating mechanisms behind it.

References

Balakrishnan A, Sundaresan S, Zhang B (2014) Browse-and-switch: retail-online competition under value uncertainty. Prod Oper Manag 23(7):1129–1145

Carlton DW, Chevalier JA (2001) Free riding and sales strategies for the internet. J Ind Econ 49(4):441–461

Chen X, Wang X, Jiang X (2016) The impact of power structure on the retail service supply chain with an O2O mixed channel. J Oper Res Soc 67(2):294–301

Chiu HC, Hsieh YC, Roan J, Tseng KJ, Hsieh JK (2011) The challenge for multichannel services: cross-channel free-riding behavior. Electron Commer Res Appl 10(2):268–277

Dan B, Liu C, Xu G, Zhang X (2014) Pareto improvement strategy for service-based free-riding in a dual-channel supply chain. Asia-Pac J Oper Res 31(06):1450050

Dogu E, Albayrak YE (2018) Criteria evaluation for pricing decisions in strategic marketing management using an intuitionistic cognitive map approach. Soft Comput 22(15):4989–5005

Esmaeili M, Abad PL, Aryanezhad MB (2009) Seller-buyer relationship when end demand is sensitive to price and promotion. Asia-Pac J Oper Res 26(05):605–621

Gurnani H, Erkoc M, Luo Y (2007) Impact of product pricing and timing of investment decisions on supply chain co-opetition. Eur J Oper Res 180(1):228–248

Giri B, Sharma S (2014) Manufacturer’s pricing strategy in a two-level supply chain with competing retailers and advertising cost dependent demand. Econ Model 38:102–111

Gurnani H, Xu Y (2006) Resale price maintenance contracts with retailer sales effort: effect of flexibility and competition. Nav Res Logist 53(5):448–463

He R, Xiong Y, Lin Z (2016) Carbon emissions in a dual channel closed loop supply chain: the impact of consumer free riding behavior. J Clean Prod 134:384–394

Heitz-Spahn S (2013) Cross-channel free-riding consumer behavior in a multichannel environment: an investigation of shopping motives, sociodemographics and product categories. J Retail Consum Serv 20(6):570–578

Huang H, Ke H (2017) Pricing decision problem for substitutable products based on uncertainty theory. J Intell Manuf 28(3):503–514

Huang H, Ke H, Wang L (2016) Equilibrium analysis of pricing competition and cooperation in supply chain with one common manufacturer and duopoly retailers. Int J Prod Econ 178:12–21

Huang Z, Nie J, Zhang J (2018) Dynamic cooperative promotion models with competing retailers and negative promotional effects on brand image. Comput Ind Eng 118:291–308

Ingene CA, Parry ME (1995a) Channel coordination when retailers compete. Mark Sci 14(4):360–377

Ingene CA, Parry ME (1995b) Coordination and manufacturer profit maximization: the multiple retailer channel. J Retail 71(2):129–151

Ke H, Wu Y, Huang H (2018a) Competitive pricing and remanufacturing problem in an uncertain closed-loop supply chain with risk-sensitive retailers. Asia-Pac J Oper Res 35(01):1850003

Ke H, Wu Y, Huang H, Chen Z (2018b) Optimal pricing decisions for a closed-loop supply chain with retail competition under fuzziness. J Oper Res Soc 69(9):1468–1482

Kuksov D, Lin Y (2010) Information provision in a vertically differentiated competitive marketplace. Mark Sci 29(1):122–138

Lei Y, Tang R, Chen K (2017) Call, put and bidirectional option contracts in agricultural supply chains with sales effort. Appl Math Model 47:1–16

Li H, Wang C, Shang M, Ou W, Qin X (2019) Cooperative decision in a closed-loop supply chain considering carbon emission reduction and low-carbon promotion. Environ Prog Sustain Energy 38(1):143–153

Lou W, Ma J (2018) Complexity of sales effort and carbon emission reduction effort in a two-parallel household appliance supply chain model. Appl Math Model 64:398–425

Ma P, Wang H, Shang J (2013) Supply chain channel strategies with quality and marketing effort-dependent demand. Int J Prod Econ 144(2):572–581

Pu X, Gong L, Han X (2017) Consumer free riding: coordinating sales effort in a dual-channel supply chain. Electron Commer Res Appl 22:1–12

Rokkan AI, Buvik A (2003) Inter-firm cooperation and the problem of free riding behavior: an empirical study of voluntary retail chains. J Purch Supply Manag 9(5–6):247–256

Shin J (2007) How does free riding on customer service affect competition? Mark Sci 26(4):488–503

Wang Y, Tang W, Zhao R (2018) Information sharing and information concealment in the presence of a dominant retailer. Comput Ind Eng 121:36–50

Wang Y, Tang W, Zhao R (2019) Supplier’s strategy: align with the dominant entrant retailer or the vulnerable incumbent retailer? Soft Comput 23(10):3481–3500

Wu D, Ray G, Geng X, Whinston A (2004) Implications of reduced search cost and free riding in e-commerce. Mark Sci 23(2):255–262

Xing D, Liu T (2012) Sales effort free riding and coordination with price match and channel rebate. Eur J Oper Res 219(2):264–271

Yang S, Ding P, Wang G, Wu X (2019) Green investment in a supply chain based on price and quality competition. Soft Comput 24(4):2589–2608. https://doi.org/10.1007/s00500-019-03777-y

Yang S, Munson CL, Chen B, Shi C (2015) Coordinating contracts for supply chains that market with mail-in rebates and retailer promotions. J Oper Res Soc 66(12):2025–2036

Zhao J, Tang W, Wei J (2012) Pricing decision for substitutable products with retail competition in a fuzzy environment. Int J Prod Econ 135(1):144–153

Zhou YW, Guo J, Zhou W (2018) Pricing/service strategies for a dual-channel supply chain with free riding and service-cost sharing. Int J Prod Econ 196:198–210

Acknowledgements

This work was partly supported by the National Natural Science Foundation of China (NO. 41971252) and the Fundamental Research Funds for the Central Universities.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

The authors declare that they have no conflict of interest.

Additional information

Communicated by V. Loia.

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendix

Appendix

Proof of Proposition 2

Referring to Tables 2 and 3, it can be easily obtained that if the two retailers both make marketing efforts, we have

If \(\frac{3}{8}<\lambda \le \), then we have \(\pi _1^{\mathrm{MS}\text {-}{1}}>\pi _1^{\mathrm{RS}\text {-}{1}}\), \(\pi _2^{\mathrm{MS}\text {-}{1}}>\pi _2^{\mathrm{RS}\text {-}{1}}\).

If only the dominant retailer makes marketing efforts, we have

If \(0\le \lambda <\frac{1}{4}\), then we have

Therefore, Proposition 2 is proved.

Proof of Proposition 4

From Table 2, we can find that

If \(\frac{1}{4}<\lambda \le 1\), then we have

We also find that

If \(0\le \lambda <\frac{1}{2}\), then we have

Thus, Proposition 4 is proved.

Proof of Proposition 5

Referring to Tables 2 and 3, we have

We can also get that

If \(0\le \lambda <\frac{3}{4}\), then we have

Thus, Proposition 5 is proved.

Proof of Proposition 6

Referring to Table 3, we get

If \(\frac{1}{4}<\lambda <\frac{3}{4}\), then we have

Besides, we have

If \(0\le \lambda <\frac{3}{4}\), then we have

Thus, Proposition 6 is proved.

Rights and permissions

About this article

Cite this article

Ke, H., Jiang, Y. Equilibrium analysis of marketing strategies in supply chain with marketing efforts induced demand considering free riding. Soft Comput 25, 2103–2114 (2021). https://doi.org/10.1007/s00500-020-05281-0

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00500-020-05281-0