Abstract

Along with the significant improvement of environmental consciousness, consumers not only consider the price and quality level of products, but also pay more attention to their green level. In order to strengthen the competitive advantage, the manufacturers should consider the green level of products in addition to their price and the quality level. In this paper, we investigate the green investment of two competing manufacturers in a supply chain based on price and quality competition and analyze the effect of green investment on the quality level of the product. The research shows that the manufacturer is willing to make a green investment with a relatively low value of green sensitivity regardless of whether the manufacturer’s rival makes a green investment. Further, we find that the profit of the manufacturer who makes a green investment is greater than the profit of the manufacturer who does not invest regardless of the market size. When both competing manufacturers make green investments, the profit of the manufacturer who is in a large potential market is higher than that of the manufacturer who is in a small potential market. While in a same potential market, the profits of the two competing manufacturers are the same. Finally, we conclude that the green investment counterintuitively will not always improve the quality level of the products.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

1 Introduction

In recent years, green supply chain management has received lots of attention, which has been driven by customer pressures, competitor pressures and social responsibilities. Customers’ environmental consciousness plays a crucial role in facilitating the development of green supply chain. It is suggested that more than 80% of those surveyed prefer to buy green products. Carbon Trust surveys show that about 20% of interviewees are willing to purchase green products even if they would pay more for them than regular products (Yu et al. 2016). Therefore, more and more firms have invested in green technology to produce green products in order to alleviate the pressure from the market and government. For example, BYD has four great green dreams, which is to change the traditional way of energy consumption, improve the environment and realize the sustainable development of human beings through solar power station, energy storage power station, electric vehicle and rail transit (www.bydauto.com.cn).

Consumers buy products not only considering the price of the product but also considering the quality level of the product. Based on the above considerations, firms compete with each other to determine the price and quality level of the products to maximize the benefits. For example, the Gree who is one of three major air-conditioning giants in Chinese market gives a slogan, that is, “Leadership of quality to win market” on Gree’s home page. When Internet service providers (ISPs) compete in the emerging broadband Internet market in Japan, they find that the customers consider not only an acceptable price, but also quality levels which is a comfortable download of broadband content (Matsubayashi 2007).

However, with the significant improvement of consumer’s environmental consciousness, in addition to the price and quality level of the product, green level of the product is also an important factor affecting consumer choice. Nevertheless, there is little literature to study the green investment in a price and quality-based supply chain. Based on this consideration, the question of the green investment of two competing manufacturers in a supply chain based on price and quality competition is worth exploring. We will analyze it from the following three aspects. First, what factors affect the green investment strategy of the two manufacturers in a supply chain based on price and quality competition? Second, how will two competing manufacturers interact with each other in the supply chain? Third, how does green investment affect the quality level of products in the supply chain?

To solve the questions mentioned above, we present the model in which a retailer purchases the products with different qualities from two competing manufactures, and then sells them to customers. To meet the needs of customers with environmental consciousness, the two competing manufacturers choose to make green investments to produce green products. Based on the proposed model, we propose three scenarios to explore the green investment preferences of two competing manufacturers: (1) Neither manufacturer chooses to make a green investment. (2) One manufacturer chooses to make a green investment, while the other does not choose to make a green investment. (3) Both manufacturers make green investments. Based on the equilibrium solutions of the three scenarios, we obtain some findings given in details as follows:

First, when one manufacturer’s rival does not make a green investment, the manufacturer prefers to make a green investment when the green sensitivity coefficient is relatively low. Further, we can find that when a manufacturer’s rival makes a green investment, the manufacturer prefers to make a green investment under a low green sensitivity coefficient value. This may be due to that, lower green sensitivity leads to lower green competition, which leads to lower green investment cost. In order to expand the market, the manufacturers are willing to make green investments. We also conclude that the manufacturer is willing to make a green investment with a relatively low value of green sensitivity regardless of whether the manufacturer’s rival makes a green investment. Otherwise, the manufacturer will not invest.

Second, when a manufacturer’s rival does not make a green investment, the profit of the manufacturer who makes a green investment is always greater than his rival’s profit regardless of the market size. When both manufacturers make green investments, the profit of the manufacturer who is in a large potential market is always larger than the profit of the manufacturer who is in a small potential market. However, when both manufacturers are in the same size market, the two manufacturers’ profits are the same. This implies that the potential market size and the green level affect the profits of the two competing manufacturers.

Third, when a manufacturer’s rival does not make a green investment, the manufacturer who makes a green investment will improve the quality level of the product regardless of potential market size, while the manufacturer’s rival will reduce the quality level of the product. When both manufacturers make green investments, the manufacturer in a large potential market will improve the quality level of the product, while the manufacturer in a small potential market will reduce the quality level of the product. While in the same potential market size, the quality level of the two manufacturers remains unchanged.

This paper is organized as follows. The related literature is reviewed in Sect. 2. A supply chain consisting of two manufacturers and a retailer is introduced in Sect. 3. The two manufacturers’ preferences are separately analyzed in three scenarios in Sect. 4. In Sect. 5, the equilibrium outcomes regard to the two manufacturer’s green investments are compared with each other. In Sect. 6, a sensitivity analysis with respect to green sensitivity coefficient is introduced. All proofs of this paper are in Appendix.

2 Literature review

Our research is related to two research streams: green supply chain management and supply chain based on quality competition.

The first stream is related to green supply chain management. With the improvement of consumers’ environmental awareness, green supply chain management has become an important research topic in recent years. Because green supply chain leads a firm to obtain competitive advantage as a firm’s innovative strategy (Bititci et al. 2012). In order to maximize the benefits to the members of the supply chain, many studies investigate the coordination issues in a green supply chain. For example, Ghosh and Shah (2015) study the coordination issues in a green supply chain and the impact of cost-sharing contracts on the green of products. Xu et al. (2017) investigate green Supply chain coordination under cap and trade regulation. Hong and Guo (2018) examine three cooperation contracts in a green supply chain and analyse their environmental performance. Meantime, some papers explore the dual-channel supply chain. Li et al. (2016) illustrate the pricing strategies in a competitive dual-channel green supply chain. Yan et al. (2018a) explore two competing retailers’ green investment in a supply chain and the performance of the equilibrium outcome. Further, Yan et al. (2017) investigate the group buying and individual purchasing in asymmetric retailer. Yan et al. (2018b) explore whether the marketplace channel should be introduced in online retailing. Some studies which are related to our study also focus on these areas, such as different contracts (Lan et al. 2015, 2017; Wang et al. 2017b; Chen et al. 2018), project management (Yang et al. 2016, 2017) and supply chain contracting (Feng et al. 2017). Unlike the research mentioned above, in addition to the green level of products, our research also focuses on the quality level of products. Because customers not only prefer environmentally friendly products, but also pay attention to the quality level of products. For example, TeslaMotors is not only a green pure electric vehicle, but also has the certain high quality level which is popular with customers with environmental awareness.

The second stream is related to the supply chain based on quality competition. Choudhary et al. (2005) investigate personalized pricing strategies for products of different quality levels. Matsubayashi and Yamada (2008) explore the price and quality competition between two asymmetric firms. Karaer and Erhun (2015) study the use of quality facing a potential entry deterrence in a price and quality-based setting. Lan et al. (2018) explore the question of voluntary quality disclosure with information value under competition. Some papers have studied the influence of quality competition on channel selection. Choi (2003) explores the channel choices of two manufacturers under the price and quality competition. Chen et al. (2017) study price and quality decisions in dual-channel supply chains. Further, Wang et al. (2017a) take into account consumer loyalty in two manufacturers’ channel choice based on price and quality competition. Some studies have extended quality competition to research on quality-differentiated brands products. Li and Chen (2018a) examine backward integration strategy of two quality-differentiated brands in a retailer Stackelberg supply chain. Li and Chen (2018b) explore pricing and quality competition in a brand-differentiated supply chain. Our paper differs from the researches mentioned above in that they do not consider green investment, while we take into account the green investment. Based on the above considerations, this paper explores the green investment of two competing manufacturers in a supply chain based on price and quality competition and analyzes the effect of green investment on the quality level of the product.

3 Model setting

We consider a supply chain, in which a retailer purchases the products with different qualities from two competing manufactures, denoted by \(M_{1}\) and \(M_2\), and then sells them to customers. The different quality products produced by the two manufacturers, which have the same functionality, are substitutable. Each customer who buys a product from manufacturer \(M_{1}\) or manufacturer \(M_2\) usually considers the price and quality level of the product. But there are some customers with environment awareness not only focus on the product’s price and quality level but also prefer to environmentally friendly products. Therefore, the two manufacturers should consider to make green investment to products with different quality level to increase the market demand. We assume that the two competing manufacturers can independently and simultaneously choose either to make green investment or not. Furthermore, we assume that the two manufacturers compete in a Nash game. The two manufacturers’ choices can cause three cases in the market: (1) Neither manufacturer chooses to make a green investment. This strategy is denoted by the superscript \(\mathrm{NN}\). (2) One manufacturer chooses to make a green investment, while the other does not choose to make a green investment. This strategy is denoted by the superscript \(\mathrm{GN}\) or \(\mathrm{NG}\). (3) Both manufacturers make green investments. This strategy is denoted by \(\mathrm{GG}\). Note that the two competing manufacturers in the scenarios \(\mathrm{GN}\) and \(\mathrm{NG}\) are symmetrical, so they have the same results. Therefore, we just discuss the scenario \(\mathrm{GN}\) in this paper.

Similar to Wang et al. (2017a), we will discuss a linear demand function. Then, the demand functions of product 1 and 2 are, respectively, expressed as follows:

where \(a_i\) is the potential market size of product i. \(p_i\) is the retail price determined by the retailer, \(\alpha \) is the price sensitivity coefficient which represents the sensitivity of demand to the price of rival’s product. \(q_i\) is the quality level of product i, and \(\beta \) is the quality sensitivity coefficient which captures the sensitivity of demand to the quality level of the rival’s product. It is noted that we assume that \(\alpha <1\) and \(\beta <1\), which implies that the demand of product i depends more on the own price and quality level than on the rival’s price and the rival’s quality level, respectively. \(\theta _i\) is the green level of the product produced by manufacturer \(M_i\). \(\gamma \) is the green sensitivity coefficient denoting the sensitivity of demand to the green level, which is assumed \(\gamma <1\). Note that this type of demand function has been adopted by Wang et al. (2017a).

The fixed production cost of product i produced by manufacturer \(M_i\) contains two parts. The first part is the fixed cost of producing a product i with quality level \(q_i\). We assume that the fixed production cost is \(\frac{1}{2} \tau q_i^2\), where \(\tau >0\) is the production cost coefficient. Similar type of cost function is used by Wang et al. (2017a), Desai et al. (2001) and Matsubayashi and Yamada (2008). The other is the fixed production cost of product i with green level \(\theta _i\). We assume that the total green investment cost imposed to the manufacturer \(M_i\) is \(\frac{1}{2}\mu \theta _{i}^2\), in which \(\mu \) is the green investment cost coefficient. Such type of cost function is also assumed in the literature (e.g., Zhang et al. 2015; Ghosh and Shah 2015; Zahra and Jafar 2017). Table 1 lists the notations used in this paper.

In general, the event sequence in the three strategies is as follows. First, the two manufacturers decide whether to make green investments to their products. Second, after knowing the manufacturers’ green investments scenarios, the two manufacturers compete in a Nash game. In each supply chain, the manufacturer is the Stackelberg leader and determines his optimal quality level, green level and wholesale price simultaneously. Finally, the retailer as Stackelberg follower decides the retail price of two products.

4 Analysis of three scenarios

In this section, we discuss the equilibrium outcomes in the three scenarios: neither manufacturer chooses to make a green investment (\(\mathrm{NN}\)), only one manufacturer makes a green investment (\(\mathrm{GN}\)), both manufacturers make green investments (\(\mathrm{GG}\)). Further, we discuss the monotonicity of decision variables.

4.1 Scenario \(\mathrm{NN}\)

In this scenario, neither manufacturer chooses to make a green investment. And then, the demand functions of product i are expressed as follows:

We first discuss the equilibriums under the scenario of \(\mathrm{NN}\) by backward induction. As the Stackelberg follower, the retailer maximizes her profit function

and obtains the optimal retail price

As the Stackelberg leaders, the manufactures, considering the retailer’s reaction, maximize their profit functions

By substituting Eq. (4) into Eq. (5) and solving the manufactures’ decision model, we have the manufacturers’ and the retailer’s optimal decisions and optimal profits. The Stackelberg equilibriums are as follows in Proposition 1.

Proposition 1

In scenario \(\mathrm{NN}\), the manufactures’ and retailer’s optimal decisions and profits are as follows:

- (1)

The manufacturers’ optimal quality level and the optimal wholesale price are

$$\begin{aligned} q_{i}^{\mathrm{NN}}= & {} {\frac{a_{i}\, \left( 4\,\tau -1 \right) +a_{j}\, \left( 2\,\alpha \, \tau -\beta \right) }{\left( 4\,\tau -1 \right) ^{2}- \left( 2\,\alpha \,\tau -\beta \right) ^{2}}},\nonumber \\ w_{i}^{\mathrm{NN}}= & {} {\frac{2\,\tau \, \left( a_{i}\, \left( 4\,\tau -1 \right) +a_{j}\, \left( 2\,\alpha \,\tau -\beta \right) \right) }{ \left( 4\,\tau -1 \right) ^{2}- \left( 2\,\alpha \,\tau -\beta \right) ^{2}}}. \end{aligned}$$(6) - (2)

The retailer’s optimal retail price and demands are

$$\begin{aligned}&p_{i}^{\mathrm{NN}}={\frac{a_{i}\, \left( -3\,\alpha \,\tau \, \left( 2\,\alpha \,\tau -\beta \right) +3\,\tau \, \left( 4\,\tau -1 \right) +2\,\alpha \,\tau \, \left( \alpha -2\,\beta \right) \right) +a_{j}\, \left( 5\,\tau \, \left( 2\,\alpha \,\tau -\beta \right) +\tau \, \left( \alpha -2\,\beta \right) +2\,{\alpha }^{2} \left( -2\,\alpha \,{\tau }^{2}+\beta \right) \right) }{ \left( \left( 2\,\alpha \,\tau -\beta \right) ^{2}- \left( 4\,\tau -1 \right) ^{2} \right) \left( {\alpha }^{2}-1 \right) }},\nonumber \\&D_{i}^{\mathrm{NN}}={\frac{\tau \, \left( a_{i}\, \left( 4\,\tau -1 \right) +a_{j}\, \left( 2\,\alpha \,\tau -\beta \right) \right) }{ \left( 4\,\tau -1 \right) ^{2}- \left( 2\,\alpha \,\tau -\beta \right) ^{2}}}. \end{aligned}$$(7) - (3)

The manufacturers’ and the retailer’s optimal profits are

$$\begin{aligned} \pi ^{\mathrm{NN}}_{m_{i}}= & {} \frac{1}{2}{\frac{\tau \, \left( 4\,\tau -1 \right) \left( a_{i}\, \left( 4 \,\tau -1 \right) +a_{j}\, \left( 2\,\alpha \,\tau -\beta \right) \right) ^{2}}{ \left( \left( 4\,\tau -1 \right) ^{2}- \left( 2\, \alpha \,\tau -\beta \right) ^{2} \right) ^{2}}},\nonumber \\ \pi ^{\mathrm{NN}}_{r}= & {} -\,{\frac{{\tau }^{2} \left( a_{1}\,a_{2}\,A_{1} + \left( {a_{1}}^{2}+{a_ {2}}^{2} \right) A_{2} \right) }{ \left( 4\,{\alpha }^{2}{\tau }^{2}-4\, \alpha \,\beta \,\tau +{\beta }^{2}-16\,{\tau }^{2}+8\,\tau -1 \right) ^{2} \left( {\alpha }^{2}-1 \right) }},\nonumber \\ \end{aligned}$$(8)where \(i, j=1, 2, i\ne j\), \(A_1= \left( 8\,{\alpha }^{3}+64\,\alpha \right) {\tau }^{2}- \left( 8\,{\beta \alpha }^{2}+24\,\alpha +16\,\beta \right) \tau +2\,\alpha \,{\beta }^{2}+4\,\beta +2\,\alpha \), \(A_2= \left( 20\,{\alpha }^{2}+16 \right) {\tau }^{2}- \left( 4\,{\alpha }^{2}+12\,\alpha \,\beta +8 \right) \tau +{\beta }^{2}+2\,\beta \alpha +1.\)

Proposition 1 introduces the optimal decisions and the optimal profits in Scenario \(\mathrm{NN}\). Since the decision variables and profits are positive, we need \(\max \{-\,(4\tau -1),\frac{-\,(4\tau -1)a_i}{a_j}\}<2\alpha \tau -\beta <(4\tau -1)\), in which \(4\tau -1>0\).

Next, we analyze how the sensitivity coefficients affect the decision variables and the profits, as shown in the following corollaries.

Corollary 1

When neither manufacturer makes a green investment, with regard to the increasing sensitivity coefficients \(\alpha , \beta \), we have the following properties for the decision variables and the profits.

- (i)

Regarding \(\alpha \), when \(a_i<a_j\), we have \(\frac{\partial q_i^{\mathrm{NN}}}{\partial \alpha }>0\), \(\frac{\partial w_i^{\mathrm{NN}}}{\partial \alpha }>0\), \(\frac{\partial D_i^{\mathrm{NN}}}{\partial \alpha }>0\), \(\frac{\partial \pi _{m_{i}}^{\mathrm{NN}}}{\partial \alpha }>0\). When \(a_i>a_j\), we can conclude \(\frac{\partial q_i^{\mathrm{NN}}}{\partial \alpha }<0\), \(\frac{\partial w_i^{\mathrm{NN}}}{\partial \alpha }<0\), \(\frac{\partial D_i^{\mathrm{NN}}}{\partial \alpha }<0\), \(\frac{\partial \pi _{m_{i}}^{\mathrm{NN}}}{\partial \alpha }<0\) if

$$\begin{aligned} -\,(4\tau -1)<2\alpha \tau -\beta <\frac{-\,a_i+\sqrt{a_{i}^{2}-a_{j}^{2}}}{a_{j}}(4\tau -1). \end{aligned}$$(9)Furthermore, we can obtain \(\frac{\partial q_i^{\mathrm{NN}}}{\partial \alpha }>0\), \(\frac{\partial w_i^{\mathrm{NN}}}{\partial \alpha }>0\), \(\frac{\partial D_i^{\mathrm{NN}}}{\partial \alpha }>0\), \(\frac{\partial \pi _{m_{i}}^{\mathrm{NN}}}{\partial \alpha }>0\) if

$$\begin{aligned} \frac{-\,a_i+\sqrt{a_{i}^{2}-a_{j}^{2}}}{a_{j}}(4\tau -1)<2\alpha \tau -\beta <4\tau -1. \end{aligned}$$(10) - (ii)

Regarding \(\beta \), when \(a_i<a_j\), we get \(\frac{\partial q_i^{\mathrm{NN}}}{\partial \beta }<0\), \(\frac{\partial w_i^{\mathrm{NN}}}{\partial \beta }<0\), \(\frac{\partial D_i^{\mathrm{NN}}}{\partial \beta }<0\), \(\frac{\partial \pi _{m_{i}}^{\mathrm{NN}}}{\partial \beta }<0\). When \(a_i>a_j\), we conclude \(\frac{\partial q_i^{\mathrm{NN}}}{\partial \beta }>0\), \(\frac{\partial w_i^{\mathrm{NN}}}{\partial \beta }>0\), \(\frac{\partial D_i^{\mathrm{NN}}}{\partial \beta }>0\), \(\frac{\partial \pi _{m_{i}}^{\mathrm{NN}}}{\partial \beta }>0\) if (9) holds. Furthermore, we can conclude \(\frac{\partial q_i^{\mathrm{NN}}}{\partial \beta }<0\), \(\frac{\partial w_i^{\mathrm{NN}}}{\partial \beta }<0\), \(\frac{\partial D_i^{\mathrm{NN}}}{\partial \beta }<0\), \(\frac{\partial \pi _{m_{i}}^{\mathrm{NN}}}{\partial \beta }<0\) if (10) holds.

Result (i) in Corollary 1 shows the trends of the quality level, the wholesale price, the green level, the demands of products and the profit of manufacturers with sensitivity coefficient \(\alpha \). We find that the quality level \(q_i^{\mathrm{NN}}\), the wholesale price \(w_i^{\mathrm{NN}}\), the demands \(D_i^{\mathrm{NN}}\) and the manufacturer’s profits \(\pi _{m_{i}}^{\mathrm{NN}}\) increase with \(\alpha \) when \(a_i<a_j\) or under conditions (10) when \(a_i>a_j\). This finding is due to that higher price sensitivity leads to more intense price competition. When \(a_i<a_j\), to alleviate the intense competition and expand market size, manufacturer \(M_i\) is willing to improve the quality level of product and increase the demand of the product. Accordingly, the wholesale price and the profit of the manufacturer \(M_i\) increase. When \(a_i>a_j\), in a price-sensitive market \((2\alpha \tau -\beta >0)\), which implies that the price is more important than the quality in the market, the quality level, the wholesale price, the green level, the demand of the product and the profit of the manufacturer increase with \(\alpha \). This is somewhat counterintuitive, since one intuitively admits that manufacturer should reduce the quality level to maintain the advantage of the price of the product in a price sensitivity market. The reason may be that, to alleviate the intense competition, the manufacturer \(M_i\) is willing to improve the quality level and increase the demand of product in the case of \(a_i>a_j\), which increases the wholesale price and the profit of the manufacturer \(M_i\) accordingly. When \(a_i>a_j\), in a quality-sensitive market \((2\alpha \tau -\beta <0)\), which implies that the quality is more important than the price in the market. We find that the quality level, the wholesale price, the green level, the demand of the product and the profit of the manufacturer decrease with \(\alpha \). The reason may be that, higher price sensitivity leads to more intense price competition, which forces the manufacturer \(M_i\) to reduce the quality level of the product and maintain a price advantage. Accordingly, the wholesale price and the profit of the manufacturer \(M_i\) decrease.

Result (ii) in Corollary 1 presents the trends of the quality level, the wholesale price, the green level, the demand of the product and the profit of manufacturers with sensitivity coefficient \(\beta \). We find that the quality level, the wholesale price, the demand of the product and the manufacturer’s profits decrease with \(\beta \) when \(a_i<a_j\) or under condition (10) when \(a_i>a_j\). The reason may be that higher quality sensitivity leads to more intense competition on the quality level. When \(a_i<a_j\), to alleviate the intense competition, manufacturer \(M_i\) who is in a small potential market is forced to reduce the quality level of the product, and shrink the demand of the product. Accordingly, the wholesale price and the profit of manufacturer \(M_i\) also decrease. When \(a_i>a_j\), in a price-sensitive market \((2\alpha \tau -\beta >0)\), the quality level, the wholesale price, the green level, the demand of the product and the profit of the manufacturer decrease with \(\beta \). To alleviate the quality competition, manufacturer \(M_i\) decrease the quality level of the product and reduce the demand of the product. Then, the wholesale price and the retail price decrease, which maintains the price advantage of the product. Finally, the profit of the manufacturer \(M_i\) decreases accordingly. We also find that the quality level, the wholesale price, the demand of the product and the manufacturer’s profits increase with \(\beta \) under condition (9) when \(a_i>a_j\). When \(a_i>a_j\), in a quality-sensitive market (\(2\alpha \tau -\beta <0\)), higher quality sensitivity leads to intense competition on the quality level of products, which makes the manufacture \(M_i\) to increase the quality level of product i and further expand the demands of product i. Then, the wholesale price and the profit of the manufacture \(M_i\) increase accordingly.

4.2 Scenario \(\mathrm{GN}\)

In this scenario, we assume the manufacturer \(M_1\) makes a green investment while the other manufacturer \(M_2\) refuses to make a green investment, which is denoted by \(\mathrm{GN}\). And then, the demand functions of product \(i~ (i=1, 2)\) are defined as follows:

where \(\theta _1\) is the green level of the product produced by manufacturer \(M_1\), and \(\gamma \) is the customer’s sensitivity coefficient to the green level.

We first discuss the equilibriums under scenario \(\mathrm{GN}\) by backward induction. As the Stackelberg follower, the retailer maximizes the retailer’s profit function

and obtains the optimal retail price

As the Stackelberg leaders, the manufacturers, considering the retailer’s reaction, maximize their profit functions

By substituting Eq. (13) into Eq. (14) and solving the manufacturers’ decision model, we have the manufacturers’ and the retailer’s optimal decisions and optimal profits. The Stackelberg equilibriums are as follows in Proposition 2.

Proposition 2

In scenario \(\mathrm{GN}\), the manufacturers’ and retailer’s optimal decisions and profits are as follows:

- (1)

The manufacturers’ optimal quality level, the optimal wholesale price and the optimal green level are

$$\begin{aligned} q_{1}^{\mathrm{GN}}= & {} {\frac{\mu \, \left( a_{2}\, \left( 2\,\alpha \, \tau -\beta \right) +a_{1}\, \left( 4\,\tau -1 \right) \right) }{ \left( 2\,\alpha \,\tau -\beta -\,4\,\tau +1 \right) \left( {\gamma }^{2}\tau -\mu \, \left( 2\,\alpha \, \tau -\beta \right) -\mu \, \left( 4\,\tau -1 \right) \right) }},\nonumber \\ q_{2}^{\mathrm{GN}}= & {} -\,{\frac{a_{1}\, \left( {\gamma }^{2}\tau -\mu \, \left( 2\,\alpha \,\tau - \beta \right) \right) +a_{2}\, \left( {\gamma }^{2}\tau -\mu \, \left( 4 \,\tau -1 \right) \right) }{ \left( 2\,\alpha \,\tau -\beta -4\,\tau +1 \right) \left( {\gamma }^{2}\tau -\mu \, \left( 2\,\alpha \,\tau -\beta \right) -\mu \, \left( 4\,\tau -1 \right) \right) }},\nonumber \\ w_{1}^{\mathrm{GN}}= & {} {\frac{2\tau \,\mu \, \left( a_{2}\, \left( 2\,\alpha \,\tau -\beta \right) +a_{1}\, \left( 4\,\tau -1 \right) \right) }{ \left( 2\, \alpha \,\tau -\beta -4\,\tau +1 \right) \left( {\gamma }^{2}\tau -\mu \, \left( 2\,\alpha \,\tau -\beta \right) -\mu \, \left( 4\,\tau -1 \right) \right) }},\nonumber \\ w_{2}^{\mathrm{GN}}= & {} -\,{\frac{2 \tau \, \left( a_{1}\, \left( {\gamma }^{2}\tau -\mu \, \left( 2\,\alpha \,\tau -\beta \right) \right) +a_{2}\, \left( {\gamma }^{2}\tau -\mu \, \left( 4\,\tau -1 \right) \right) \right) }{ \left( 2 \,\alpha \,\tau -\beta -4\,\tau +1 \right) \left( {\gamma }^{2}\tau -\mu \, \left( 2\,\alpha \,\tau -\beta \right) -\mu \, \left( 4\,\tau -1 \right) \right) }},\nonumber \\ \theta _{1}^{\mathrm{GN}}= & {} {\frac{\gamma \,\tau \, \left( a_{2}\, \left( 2\,\alpha \,\tau -\beta \right) +a_{1}\, \left( 4\,\tau -1 \right) \right) }{ \left( {\gamma } ^{2}\tau -\mu \, \left( 2\,\alpha \,\tau -\beta \right) -\mu \, \left( 4\, \tau -1 \right) \right) \left( 2\,\alpha \,\tau -\beta -4\,\tau +1 \right) }}.\nonumber \\ \end{aligned}$$(15) - (2)

The retailer’s optimal retail price and demands are

$$\begin{aligned} p_{1}^{\mathrm{GN}}= & {} {\frac{ \left( a_{1}\,B_{1}+a_{2}\,B_{2} \right) \tau }{ \left( {\gamma } ^{2}\tau -\mu \, \left( 2\,\alpha \,\tau -\beta \right) -\mu \, \left( 4\, \tau -1 \right) \right) \left( 2\,\alpha \,\tau -\beta -4\,\tau +1 \right) \left( { \alpha }^{2}-1 \right) }},\nonumber \\ p_{2}^{\mathrm{GN}}= & {} {\frac{ \left( a_{1}\,C_{1}+a_{2}\,C_{2} \right) \tau }{ \left( {\gamma } ^{2}\tau -\mu \, \left( 2\,\alpha \,\tau -\beta \right) -\mu \, \left( 4\, \tau -1 \right) \right) \left( 2\,\alpha \,\tau -\beta -4\,\tau +1 \right) \left( { \alpha }^{2}-1 \right) }},\nonumber \\ D_{1}^{\mathrm{GN}}= & {} {\frac{\tau \,\mu \, \left( a_{2}\, \left( 2\,\alpha \,\tau -\beta \right) +a_{1}\, \left( 4\,\tau -1 \right) \right) }{ \left( {\gamma } ^{2}\tau -\mu \, \left( 2\,\alpha \,\tau -\beta \right) -\mu \, \left( 4\, \tau -1 \right) \right) \left( 2\,\alpha \,\tau -\beta -4\,\tau +1 \right) }},\nonumber \\ D_{2}^{\mathrm{GN}}= & {} -\,{\frac{\tau \, \left( a_{1}\, \left( {\gamma }^{2} \tau -\mu \, \left( 2 \,\alpha \,\tau -\beta \right) \right) +a_{2}\, \left( {\gamma }^{2}\tau -\mu \, \left( 4\,\tau -1 \right) \right) \right) }{ \left( {\gamma }^{ 2}\tau -\mu \, \left( 2\,\alpha \,\tau -\beta \right) -\mu \, \left( 4\, \tau -1 \right) \right) \left( 2\,\alpha \,\tau -\beta -4\,\tau +1 \right) }}.\nonumber \\ \end{aligned}$$(16) - (3)

The manufacturers’ and the retailer’s optimal profits are

$$\begin{aligned} \pi ^{\mathrm{GN}}_{m_{1}}= & {} -\,\frac{1}{2}\,{\frac{\mu \,\tau \, \left( a_{2}\, \left( 2\,\alpha \,\tau -\beta \right) +a_{1}\, \left( 4\,\tau -1 \right) \right) ^{2} \left( {\gamma }^{2}\tau -\mu \, \left( 4\,\tau -1 \right) \right) }{ \left( {\gamma }^{2}\tau - \mu \, \left( 2\,\alpha \,\tau -\beta \right) -\mu \, \left( 4\,\tau -1 \right) \right) ^{2} \left( 2\,\alpha \,\tau -\beta -4\,\tau +1 \right) ^{2}}},\nonumber \\ \pi ^{\mathrm{GN}}_{m_{2}}= & {} {\frac{2 \tau \, \left( a_{1}\, \left( {\gamma }^{2}\tau -\mu \, \left( 2\,\alpha \,\tau -\beta \right) \right) +a_{2}\, \left( {\gamma }^{2} \tau -\mu \, \left( 4\,\tau -1 \right) \right) \right) ^{2} \left( \tau -1/4 \right) }{ \left( \mu \, \left( 2\,\alpha \,\tau -\beta \right) +\mu \, \left( 4\,\tau -1 \right) -{\gamma }^{2}\tau \right) ^{2} \left( 2\, \alpha \,\tau -\beta -4\,\tau +1 \right) ^{2}}},\nonumber \\ \pi ^{\mathrm{GN}}_{r}= & {} -\,{\frac{ \tau ^{2} \left( {a_{1}}^{2}{\mu }^{2}+{a_{2}}^{2}{\mu }^{2} \right) E_{1}+a_{1}\,a_{2}\,{\tau }^{2}{\mu }^{2}E_{2}- \left( a_{1}+a_{2} \right) {\tau }^{3}\mu \,{\gamma }^{2}E_{3}+{\tau }^{4 }{\gamma }^{4} \left( a_{1}+a_{2} \right) ^{2}}{ \left( 2\,\alpha \,\mu \,\tau -{\gamma }^{2}\tau -\beta \,\mu +4\,\mu \,\tau -\mu \right) ^{2} \left( 2\,\alpha \,\tau -\beta -4\,\tau +1 \right) ^{2} \left( {\alpha }^{ 2}-1 \right) }}, \end{aligned}$$(17)where

$$\begin{aligned} B_{1}= & {} \mu \, \left( 2\,{\alpha }^{2}-3 \right) \left( 4\,\tau -1 \right) - \alpha \left( {\gamma }^{2}\tau -\mu \, \left( 2\,\alpha \,\tau -\beta \right) \right) ,\\ B_{2}= & {} \mu \, \left( 2\,\alpha \,\tau -\beta \right) \left( 2\,{\alpha }^{2}-3 \right) +\alpha \left( {\gamma }^{2}\tau -\mu \left( 4\tau -1 \right) \right) ,\\ C_{1}= & {} \left( \mu \, \left( 2\,\alpha \,\tau -\beta \right) -{\gamma }^{2}\tau \right) \left( 2\,{\alpha }^{2}-3 \right) -\mu \,\alpha \, \left( 4\, \tau -1 \right) ,\\ C_{2}= & {} {\gamma }^{2}\tau \, \left( -2\,{\alpha }^{2}+3 \right) -3\,\mu \, \left( 4\,\tau -1 \right) +3\,\mu \,\alpha \, \left( 2\,\alpha \,\tau -\beta \right) \\&+2\,\mu \,\alpha \, \left( 2\,\beta -\alpha \right) \\ E_{1}= & {} 20\,{\alpha }^{2}{\tau }^{2}+2\,\alpha \,\beta -12\,\alpha \,\beta \tau +{\beta }^{2}+16\,{\tau }^{2}\\&-\,4\,{\tau \alpha }^{2}-8\,\tau +1,\\ E_{2}= & {} 8\,{\tau }^{2}{\alpha }^{3}+2\,\alpha \,{\beta }^{2}-8\,{\tau \alpha }^{2}\beta -16\,\tau \,\beta +64\,{\alpha \tau }^{2}\\&+2\,\alpha +4\, \beta -24\,\tau \alpha ,\\ E_{3}= & {} a_{2} \left( -2\,\alpha \,\beta +4\,{\tau \alpha }^{2}+8\,\tau -2\right) \\&+a_{1} \left( 12\,\tau \alpha -2\,\beta +2\,\alpha \right) . \end{aligned}$$

Proposition 2 introduces the optimal decisions and the optimal profits in Scenario \(\mathrm{GN}\). In order to maintain all decision variables and profits to be positive, we need \(\frac{\gamma ^{2}\tau }{\mu }< 2\alpha \tau -\beta <4\tau -1 \).

Next, we analyze how the sensitivity coefficients \(\alpha ,~\beta ,~\gamma \) affect the decision variables and profits of manufacturers.

Corollary 2

When manufacturer \(M_1\) makes a green investment, with the increasing sensitivity coefficient \(\alpha , \beta , \gamma \), we obtain the following properties for the decision variables and profits.

- (i)

For any given \(\alpha \), when \(\frac{\gamma ^{2}\tau }{\mu }< 2\alpha \tau -\beta <4\tau -1 \), from (32), we conclude \(\frac{\partial q_1^{\mathrm{GN}}}{\partial \alpha }>0\), \(\frac{\partial q_2^{\mathrm{GN}}}{\partial \alpha }<0\), \(\frac{\partial w_1^{\mathrm{GN}}}{\partial \alpha }>0\), \(\frac{\partial w_2^{\mathrm{GN}}}{\partial \alpha }<0\), \(\frac{\partial \theta _1^{\mathrm{GN}}}{\partial \alpha }>0\), \(\frac{\partial D_1^{\mathrm{GN}}}{\partial \alpha }>0\), \(\frac{\partial D_2^{\mathrm{GN}}}{\partial \alpha }<0\), \(\frac{\partial \pi _{m_{1}}^{\mathrm{GN}}}{\partial \alpha }>0\), \(\frac{\partial \pi _{m_{2}}^{\mathrm{GN}}}{\partial \alpha }<0\).

- (ii)

For any given \(\beta \), when \(\frac{\gamma ^{2}\tau }{\mu }< 2\alpha \tau -\beta <4\tau -1 \), from (33), we can derive \(\frac{\partial q_1^{\mathrm{GN}}}{\partial \beta }<0\), \(\frac{\partial q_2^{\mathrm{GN}}}{\partial \beta }>0\), \(\frac{\partial w_1^{\mathrm{GN}}}{\partial \beta }<0\), \(\frac{\partial w_2^{\mathrm{GN}}}{\partial \beta }>0\), \(\frac{\partial \theta _1^{\mathrm{GN}}}{\partial \beta }<0\), \(\frac{\partial D_1^{\mathrm{GN}}}{\partial \beta }<0\), \(\frac{\partial D_2^{\mathrm{GN}}}{\partial \beta }>0\), \(\frac{\partial \pi _{m_{1}}^{\mathrm{GN}}}{\partial \beta }<0\), \(\frac{\partial \pi _{m_{2}}^{\mathrm{GN}}}{\partial \beta }>0\).

- (iii)

For any given \(\gamma \), when \(\frac{\gamma ^{2}\tau }{\mu }< 2\alpha \tau -\beta <4\tau -1 \), from (34), we have \(\frac{\partial q_1^{\mathrm{GN}}}{\partial \gamma }>0\), \(\frac{\partial q_2^{\mathrm{GN}}}{\partial \gamma }<0\), \(\frac{\partial w_1^{\mathrm{GN}}}{\partial \gamma }>0\), \(\frac{\partial w_2^{\mathrm{GN}}}{\partial \gamma }<0\), \(\frac{\partial \theta _1^{\mathrm{GN}}}{\partial \gamma }>0\), \(\frac{\partial D_1^{\mathrm{GN}}}{\partial \gamma }>0\), \(\frac{\partial D_2^{\mathrm{GN}}}{\partial \gamma }<0\), \(\frac{\partial \pi _{m_{2}}^{\mathrm{GN}}}{\partial \gamma }<0\). For the profit of manufacturer \(\mathrm{M_1}\) with a green investment, we have \(\frac{\partial \pi _{m_{1}}^\mathrm{GN}}{\partial \gamma }>0\) if \(\frac{\gamma ^{2}\tau }{\mu }< 2\alpha \tau -\beta < \frac{\mu (4\tau -1)-\gamma ^{2}\tau }{\mu }\), we have \(\frac{\partial \pi _{m_{1}}^\mathrm{GN}}{\partial \gamma }<0\) if \(\max \left\{ \frac{\gamma ^{2}\tau }{\mu },\frac{\mu (4\tau -1)-\gamma ^{2}\tau }{\mu } \right\}< 2\alpha \tau -\beta <4\tau -1 \).

Result (i) in Corollary 2 shows the trends of the quality level, the wholesale price, the green level, the demand of products and the profit of manufacturers with sensitivity coefficient \(\alpha \). We find that the quality level, the wholesale price, the green level, the demand and the profit of manufacturer of product 1 always increase with \(\alpha \). In this scenario, higher price sensitivity leads to more intense competition in the price sensitivity market. In order to alleviate the competition, manufacturer \(M_1\) who makes green investment is willing to improve the green level and the quality level, which further increases demand for products. Accordingly, the wholesale price and the profit of manufacturer \(M_1\) also increase. Meantime, intense price competition makes the other manufacturer \(M_2\) who not make a green investment to reduce the quality level and shrink the demand of product, which leads to a corresponding decrease in the wholesale price and the profit of manufacturer \(M_2\).

Result (ii) in Corollary 2 presents the trends of the quality level, the wholesale price, the green level, the demand of products and the profit of manufacturers with sensitivity coefficient \(\beta \). Note that as \(\beta \) increases, the quality level, the wholesale price, the green level, the demand of product decrease and the profit of manufacturer \(M_1\) increases. In this scenario, higher quality sensitivity leads to more intense competition with respect to the quality level of products. To alleviate the competition, manufacturer \(M_1\) is forced to reduce the quality level and the green level of the product and shrink the demand of the product. Accordingly, the wholesale price and the profit of the manufacturer decrease. Meantime, intense quality competition makes the other manufacturer \(M_2\) to improve the quality level and increase the demand of product, which increase the wholesale price and the profit of the manufacturer accordingly.

Result (iii) in Corollary 2 demonstrates the trends of the quality level, the wholesale price, the green level, the demand of products and the profit of manufacturers with sensitivity coefficient \(\gamma \). Note that as \(\gamma \) increases, the quality level, the wholesale price, the green level and the demand of product increase. When the value of \(2\alpha -\beta \) is small, the profit of manufacturer \(M_1\) increases and when the value of \(2\alpha -\beta \) is large, the profit of manufacturer \(M_1\) decreases. In this scenario, higher green sensitivity makes manufacturer \(M_1\) willing to increase green investment, which improves the quality level and increases the demand of product. Accordingly the wholesale price also increases. When the value of \(2\alpha -\beta \) is small, that is, the price is slightly more important than quality for customers, the green investment increases the profit of manufacturer \(M_1\). Otherwise, when the value of \(2\alpha -\beta \) is large, that is, the price is more important than quality for customers, the green investment increases the investment cost and wholesale price, which will reduce retail price and the profit of the manufacturer. Manufacturer \(M_2\) who does not making a green investment is forced to reduce the quality level and the demand of product, which also decreases the wholesale price and the profit of manufacturer \(M_2\).

4.3 Scenario \(\mathrm{GG}\)

In this scenario, both manufacturers make green investments (\(\mathrm{GG}\)). And then, the demand functions of product \(i ~(i=1, 2)\) are function (1) defined above.

We first discuss the equilibriums under scenario \(\mathrm{GG}\) by backward induction. As the Stackelberg follower, the retailer maximizes the retailer’s profit function

and obtains the optimal retail price

where \(i, j=1, 2, i\ne j.\)

As the Stackelberg leaders, the manufacturers, considering the retailer’s reaction, maximize their profit functions

By substituting Eq. (19) into Eq. (20) and solving the manufacturers’ decision model, we have the manufacturers’ and the retailer’s optimal decisions and optimal profits. The Stackelberg equilibriums are as follows in Proposition 3.

Proposition 3

In scenario \(\mathrm{GG}\), the manufacturers’ and retailer’s optimal decisions and profits are as follows:

- (1)

The manufacturers’ optimal quality level, optimal wholesale price and optimal green level are

$$\begin{aligned} q_{i}^{^{\mathrm{GG}}}= & {} {\frac{a_{i}\, \left( {\gamma }^{2}\tau -\mu \, \left( 4\,\tau -1\right) \right) +a_{j}\, \left( {\gamma }^{2}\tau -\mu \, \left( 2\, \alpha \,\tau -\beta \right) \right) }{ \left( 2\,\alpha \,\tau -\beta -4 \,\tau +1 \right) \left( \mu \, \left( 2\,\alpha \,\tau -\beta \right) + \mu \, \left( 4\,\tau -1 \right) -2\,{\gamma }^{2}\tau \right) }} ,\nonumber \\ w_{i}^{^{\mathrm{GG}}}= & {} {\frac{2\,\tau \, \left( a_{i}\, \left( {\gamma }^{2}\tau -\mu \, \left( 4\,\tau -1 \right) \right) +a_{j}\, \left( {\gamma }^{2}\tau -\mu \, \left( 2\,\alpha \,\tau -\beta \right) \right) \right) }{ \left( 2\, \alpha \,\tau -\beta -4\,\tau +1 \right) \left( \mu \, \left( 2\,\alpha \, \tau -\beta \right) +\mu \, \left( 4\,\tau -1 \right) -2\,{\gamma }^{2} \tau \right) }} ,\nonumber \\ \theta _{i}^{^{\mathrm{GG}}}= & {} {\frac{\tau \,\gamma \, \left( a_{i}\, \left( {\gamma }^{2}\tau -\mu \, \left( 4\,\tau -1 \right) \right) +a_{j}\, \left( {\gamma }^{2}\tau - \mu \, \left( 2\,\alpha \,\tau -\beta \right) \right) \right) }{\mu \, \left( 2\,\alpha \,\tau -\beta -4\,\tau +1 \right) \left( \mu \, \left( 2 \,\alpha \,\tau -\beta \right) +\mu \, \left( 4\,\tau -1 \right) -2\,{ \gamma }^{2}\tau \right) }}.\nonumber \\ \end{aligned}$$(21) - (2)

The retailer’s optimal retail price and demands are

$$\begin{aligned} p_{i}^{^{\mathrm{GG}}}&{=}&{\frac{a_{i}\,\tau \,F_{1}+a_{j}\,\tau \,F_{2}}{ \left( 2\, \alpha \,\tau -\beta -4\,\tau +1 \right) \left( \mu \, \left( 2\,\alpha \,\tau -\beta \right) +\mu \, \left( 4\,\tau -1 \right) -2\,{\gamma }^{2}\tau \right) \left( 1- {\alpha }^{ 2} \right) }},\nonumber \\ D_{i}^{^{\mathrm{GG}}}&{=}&{\frac{\tau \, \left( a_{i}\, \left( {\gamma }^{2}\tau -\mu \, \left( 4\, \tau -1 \right) \right) +a_{j}\, \left( {\gamma }^{2}\tau -\mu \, \left( 2\,\alpha \,\tau -\beta \right) \right) \right) }{ \left( 2\,\alpha \, \tau -\beta -4\,\tau +1 \right) \left( \mu \, \left( 2\,\alpha \,\tau - \beta \right) +\mu \, \left( 4\,\tau -1 \right) -2\,{\gamma }^{2}\tau \right) }}. \end{aligned}$$(22) - (3)

The manufacturers’ and the retailer’s optimal profits are

$$\begin{aligned}&\pi ^{\mathrm{GG}}_{m_{i}}=\frac{1}{2} {\frac{\tau \, \left( a_{i}\, \left( {\gamma }^{2}\tau -\mu \, \left( 4\,\tau -1 \right) \right) +a_{j}\, \left( {\gamma }^{2}\tau - \mu \, \left( 2\,\alpha \,\tau -\beta \right) \right) \right) ^{2} \left( \mu \, \left( 4\,\tau -1 \right) -{\gamma }^{2}\tau \right) }{\mu \, \left( 2\,\alpha \,\tau -\beta -4\,\tau +1 \right) ^{2} \left( 2\,{ \gamma }^{2}\tau -\mu \, \left( 2\,\alpha \,\tau -\beta \right) -\mu \, \left( 4\,\tau -1 \right) \right) ^{2}}},\nonumber \\&\pi ^{\mathrm{GG}}_r= {\frac{ \left( {a_{1}}^{2}+{a_{2}}^{2} \right) {\tau }^{2}{\mu }^{2}H_ {1}+ \left( a_{1}+a_{2} \right) ^{2} \left( \alpha +1 \right) {\tau }^{2 }{\gamma }^{2}H_{2}}{ \left( 2\,\alpha \,\tau -\beta -4\,\tau +1 \right) ^{ 2} \left( \mu \, \left( 2\,\alpha \,\tau -\beta \right) +\mu \, \left( 4\,\tau -1 \right) -2\,{\gamma }^{2}\tau \right) ^{2} \left( 1- {\alpha }^{2} \right) }}, \end{aligned}$$(23)where \(i=1, 2, i\ne j\),

$$\begin{aligned} F_{1}= & {} 3\,\mu \,\alpha \, \left( 2\,\alpha \,\tau -\beta \right) +2\,\mu \,\alpha \, \left( 2\,\beta -\alpha \right) \nonumber \\&-{\gamma }^{2}\tau \, \left( 2\,\alpha -3 \right) \left( \alpha +1 \right) -3\,\mu \, \left( 4\,\tau -1 \right) ,\\ F_{2}= & {} \mu \, \left( 2\,\alpha \,\tau -\beta \right) \left( 2\,{\alpha }^{2}-5 \right) \nonumber \\&-{\gamma }^{2}\tau \, \left( 2\,\alpha -3 \right) \left( \alpha +1 \right) -\mu \, \left( 2\,\beta -\alpha \right) ,\\ H_{1}= & {} 20\,{\alpha }^{2}{\tau }^{2}-4\,\tau \,{\alpha }^{2} -12\,\beta \,\alpha \,\tau +2\,\beta \,\alpha +{\beta }^{2}\nonumber \\&+16\,{\tau }^{2}-8\,\tau +1,\\ H_{2}= & {} -\,\,4\,\mu \,{\tau }^{2} \left( \alpha +2 \right) +2\,\mu \tau \beta +2\,\mu \tau +2\,{\tau }^{2}{\gamma }^{2}. \end{aligned}$$

Proposition 3 introduces the optimal decisions and the optimal profits in Scenario \(\mathrm{GG}\). In order to maintain all decision variables and profits to be positive, we need \(\frac{\gamma ^{2}\tau }{\mu }< 2\alpha \tau -\beta <4\tau -1 \).

Next, we analyze how the sensitivity coefficients \(\alpha ,~\beta \) and \(\gamma \) affect the decision variables and the profits of both manufacturers.

Corollary 3

When both manufacturers make green investments, with the increasing sensitivity coefficient \(\alpha , \beta \) and \(\gamma \), we obtain the following properties for the decision variables and profits.

- (i)

For any given \(\alpha \), when \(\frac{\gamma ^{2}\tau }{\mu }< 2\alpha \tau -\beta <4\tau -1 \), we get \(\frac{\partial q_i^\mathrm{GG}}{\partial \alpha }>0\), \(\frac{\partial w_i^\mathrm{GG}}{\partial \alpha }>0\), \(\frac{\partial \theta _i^\mathrm{GG}}{\partial \alpha }>0\), \(\frac{\partial D_i^\mathrm{GG}}{\partial \alpha }>0\), \(\frac{\partial \pi _{m_{i}}^\mathrm{GG}}{\partial \alpha }>0\),

- (ii)

For any given \(\beta \), when \(\frac{\gamma ^{2}\tau }{\mu }< 2\alpha \tau -\beta <4\tau -1 \), we can conclude that \(\frac{\partial q_i^\mathrm{GG}}{\partial \beta }<0\), \(\frac{\partial w_i^\mathrm{GG}}{\partial \beta }<0\), \(\frac{\partial \theta _i^\mathrm{GG}}{\partial \beta }<0\), \(\frac{\partial \pi _{m_{i}}^\mathrm{GG}}{\partial \beta }<0\),

- (iii)

For any given \(\gamma \), when \(a_i<a_j \), we have \(\frac{\partial q_i^\mathrm{GG}}{\partial \gamma }<0\), \(\frac{\partial w_i^\mathrm{GG}}{\partial \gamma }<0\), \(\frac{\partial D_i^\mathrm{GG}}{\partial \gamma }<0\), \(\frac{\partial \pi _{m_{i}}^\mathrm{GG}}{\partial \gamma }<0\). \(\frac{\partial \theta _i^\mathrm{GG}}{\partial \gamma }>0\), if \(\frac{3\gamma ^2 \tau }{\mu }< 2\alpha \tau -\beta <4\tau -1 \).

Result (i) in Corollary 3 shows the trends of the quality level, the wholesale price, the green level, the demand of products and the profit of manufacturers with the sensitivity coefficient \(\alpha \). We find that the quality level, the wholesale price, the green level, the demand of products and the profit of manufacturers increase with \(\alpha \). This may be due to that higher price sensitivity leads to intense price competition in the price sensitivity retail market. To alleviate the competition, in the scenario \(\mathrm{GG}\) manufacturer \(M_1\) and manufacturer \(M_2\) are willing to improve the green level and quality level of products, which further increases the demand of products. Then, with the increasing investment and the demand, the wholesale price and the profit of manufacturer \(M_1\) and \(M_2\) will increase accordingly.

Result (ii) in Corollary 3 presents the trends of the quality level, the wholesale price, the green level, the demand of product and the profit of manufacturers with the sensitivity coefficient \(\beta \). We find that the quality level, the wholesale price, the green level, the demand of products and the profit of manufacturers decrease with \(\beta \). The reason is that higher quality sensitivity leads to intense quality competition in the price sensitivity retail market. To expand the market size and increase the demand of products, manufacturer \(M_1\) and manufacturer \(M_2\) are forced to reduce the green level and quality level of products. Then, along with the green investment increasing, the wholesale price and the profit of manufacturer \(M_1\) and \(M_2\) will decrease accordingly.

Result (iii) in Corollary 3 presents the trends of the quality level, the wholesale price, the green level, the demand of products and the profit of manufacturers with the sensitivity coefficient \(\gamma \). We find that the quality level, the wholesale price, the demand of products and the profit of manufacturers decrease with \(\gamma \) and the green level increases with \(\gamma \). The reason is that higher green sensitivity results in more intense green competition in the price sensitivity market. To improve the green level and strengthen the advantage of price competition, manufacturer \(M_1\) who is in a small potential market reduces the quality level and decreases the demand of product. Then along with the quality level and the demand increasing, the wholesale price and the profit of manufacturer \(M_1\) will also decrease accordingly.

5 Comparison of equilibrium outcomes

We firstly compare the manufacturers’ profits explored in the previous section. And then, we investigate that the two manufacturers decide whether or not to make green investments.

Proposition 4

For different green sensitivity coefficient \(\gamma \), we conclude the following equilibrium outcomes:

- (i)

When a manufacturer’s rival does not make a green investment, we have \(\pi _{m_1}^{\mathrm{GN}}>\pi _{m_1}^{\mathrm{NN}}\) and \(\pi _{m_2}^{\mathrm{NG}}>\pi _{m_2}^{\mathrm{NN}}\) if \(\gamma \leqslant \sqrt{{\frac{\mu \, \left( \left( 4\,\tau -1 \right) ^{2}-\left( 2\,\alpha \,\tau -\beta \right) ^{2} \right) }{\tau \, \left( 4\,\tau -1 \right) }}}\). Otherwise, the manufacturer will not make a green investment.

- (ii)

When a manufacturer’s rival makes a green investment, we have \(\pi _{m_1}^{\mathrm{GG}}>\pi _{m_1}^{\mathrm{NG}}\) and \(\pi _{m_2}^{\mathrm{GG}}>\pi _{m_2}^{\mathrm{GN}}\) if

$$\begin{aligned}&\gamma \leqslant \sqrt{{\frac{2\,\mu \, \left( 2\, \alpha \,\tau -\beta \right) -\mu \, \left( 4\,\tau -1 \right) +\mu \, \sqrt{ \left( 4\,\tau -1 \right) \left( -8\,\alpha \,\tau +4\,\beta +20\,\tau -5 \right) }}{2\tau }}}. \end{aligned}$$Otherwise, the manufacturer will not make a green investment.

Proposition 4 shows the equilibrium outcomes compared with each other for different green sensitivity coefficient \(\gamma \). Result (i) indicates that, when a manufacturer’s rival does not make a green investment, the manufacturer prefers to make a green investment when the green sensitivity coefficient \(\gamma \) is relatively low. This may be due to that, lower green sensitivity leads to lower green investment cost, which makes the manufacturer willingly to make a green investment. Furthermore, the manufacturer who makes a green investment will attract more consumers than the manufacturer who does not make a green investment and will get larger profit. From result (ii), we can find that when a manufacturer’s rival makes a green investment, the manufacturer prefers to make a green investment under a low green sensitivity coefficient \(\gamma \). This may be due to that, lower green sensitivity leads to lower green competition, which leads to lower green investment cost. In order to expand the market, the manufacturer is willing to make a green investment. We also conclude that the manufacturer is willing to make a green investment with a relatively low \(\gamma \) regardless of whether the manufacturer’s rival makes a green investment. Otherwise, the manufacturer will not invest.

6 Sensitivity analysis

To investigate the effect of the manufacturers’ green investment on the manufacturers’ profit, the retailer’s profits, the retail price, the quality level, and the green level, we conduct the sensitivity analysis on green sensitivity coefficient \(\gamma \) in different market sizes.

We take the parameters as follows: \(\alpha =0.8, \beta =0.6, \gamma =0.2, \tau =0.5, \mu =1\). When \(a_1>a_2\), we take \(a_1=150, a_2=100.\) When \(a_1=a_2\), we take \(a_1= a_2=100.\)

- (1)

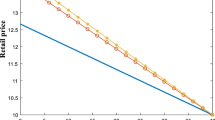

The effect of green sensitivity coefficient \(\gamma \) on the quality level

Figure 1 shows the effect of \(\gamma \) on the quality level in different market sizes. From Fig. 1a, when \(a_1>a_2\), we can conclude that the quality levels \(q_1^{\mathrm{GN}}\) and \(q_1^{\mathrm{GG}}\) increase with \(\gamma \), while the quality levels \(q_2^{\mathrm{GN}}\) and \(q_2^{\mathrm{GG}}\) decrease with \(\gamma \). The quality level \(q_1^{\mathrm{NN}}\) and the quality level \(q_2^{\mathrm{NN}}\) remain constant as \(\gamma \) increases. Furthermore, we find that the relationship between the quality levels are as follows: \(q_1^{\mathrm{GN}}>q_1^{\mathrm{GG}}> q_1^{\mathrm{NN}}>q_2^{\mathrm{NN}}>q_2^{\mathrm{GG}}>q_2^{\mathrm{GN}}.\) This may be due to that higher green sensitivity leads to more intense competition. In a large potential market, the manufacturer who makes a green investment will improve the quality level of products to strengthen the competition of products, while the manufacturer in a small potential market is forced to reduce the quality level of products to raise the advantage of the price of products. From Fig. 1b, when \(a_1=a_2\), we can find that the quality level \(q_1^{\mathrm{GN}}\) increases with \(\gamma \) while the quality level \(q_2^{\mathrm{GN}}\) decreases with \(\gamma \). Moreover, the quality levels \(q_1^{\mathrm{GG}}\), \(q_2^{\mathrm{GG}}\), \(q_1^{\mathrm{NN}}\) and \(q_2^{\mathrm{NN}}\) remain the same constant as \(\gamma \) increases. This implies that the quality level of products only in the scenario \(\mathrm{GN}\) is affected by \(\gamma \), while the quality level of products in the scenario \(\mathrm{GG}\) is not affected by \(\gamma \).

- (2)

The effect of green sensitivity coefficient \(\gamma \) on the green level

Figure 2 shows the effect of \(\gamma \) on the green level in different market sizes. As it can be seen in Fig. 2a, when \(a_1>a_2\), the green levels \(\theta _1^{\mathrm{GN}}\) and \(\theta _1^{\mathrm{GG}}\) increase with \(\gamma \), and the green levels \(\theta _2^{\mathrm{GG}}\) increases with \(\gamma \ (0<\gamma <0.8)\) and decreases with \(\gamma \)\((0.8<\gamma <1)\). We also find that the green level \(\theta _1^{\mathrm{GN}}\) is higher than the green level \(\theta _1^{\mathrm{GG}}\) and \(\theta _2^{\mathrm{GG}}\) for all the values of \(\gamma \). This implies that higher the green sensitivity coefficient \(\gamma \) leads to higher the green level for the scenarios \(\mathrm{GN}\) and \(\mathrm{GG}\). The reason is that the manufacturer who makes a green investment is willing to increase the green level facing the intense competition as \(\gamma \) increases in a large potential market. However, in a small potential market, the manufacturer who makes a green investment is willing to increase the green level for the lower values of \(\gamma \), while the manufacturer is forced to decrease the green level for the higher values of \(\gamma \) for alleviating the intense competition. From Fig. 2b, when \(a_1=a_2\), the green level \(\theta _1^{\mathrm{GN}}\) increases with \(\gamma \), and the green levels \(\theta _1^{\mathrm{GG}}\) and \(\theta _2^{\mathrm{GG}}\) also increase as \(\gamma \) increases. Furthermore, we find that the quality level \(\theta _1^{\mathrm{GN}}\) is greater than the quality levels \(\theta _1^{\mathrm{GG}}\) and \(\theta _2^{\mathrm{GG}}\) for all the values of \(\gamma \). This implies that in the same market size both manufacturers in the scenario \(\mathrm{GG}\) produce products with the same green level.

- (3)

The effect of green sensitivity coefficient \(\gamma \) on the retail price

Figure 3 presents the effect of \(\gamma \) on the retail price of the product in different market sizes. According to Fig. 3a, when \(a_1>a_2\), the retail prices \(p_1^{\mathrm{GN}}\) and \(p_1^{\mathrm{GG}}\) increase with \(\gamma \), while the retail prices \(p_2^{\mathrm{GN}}\) and \(p_2^{\mathrm{GG}}\) decrease with \(\gamma \). The retail prices \(p_1^{\mathrm{NN}}\) and \(p_2^{\mathrm{NN}}\) remain constant as \(\gamma \) increases. Furthermore, the relationship between the retail prices are as follows: \(p_1^{\mathrm{GN}}>p_1^{\mathrm{GG}}>p_1^{\mathrm{NN}}> p_2^{\mathrm{NN}}>p_2^{\mathrm{GG}}>p_2^{\mathrm{GN}}.\) This may be due to that higher green sensitivity leads to more intense green competition. In a large potential market, the manufacturer who makes a green investment is willing to increase the green level of products to strengthen the competition of products, which implies that the retailer will increase the retail price with \(\gamma \). However, the manufacturer in a small potential market is forced to reduce the green level of products, and then the retail will reduce the retail price to raise the advantage of the price of products. From Fig. 3b, when \(a_1=a_2\), the retail price \(p_1^{\mathrm{GN}}\) increases with \(\gamma \), while the retail price \(p_2^{\mathrm{GN}}\) decreases with \(\gamma \). Moreover, the retail prices \(p_1^{\mathrm{GG}}\), \(p_2^{\mathrm{GG}}\), \(p_1^{\mathrm{NN}}\) and \(p_2^{\mathrm{NN}}\) remain the same constant as \(\gamma \) increases. This implies that the retail price of products only in the scenario \(\mathrm{GN}\) is affected by \(\gamma \), while the retail price of products in the scenario \(\mathrm{GG}\) is not affected by \(\gamma \).

- (4)

The effect of green sensitivity coefficient \(\gamma \) on the retailer’s profit

Figure 4 illustrates the effect of \(\gamma \) on the retailer’s profit in different market sizes. According to Fig. 4a, when \(a_1>a_2\), the retailer’s profits \(\pi _R^{\mathrm{GN}}\) and \(\pi _R^{\mathrm{GG}}\) decrease as \(\gamma \) increases. Moreover, the retailer’s profit \(\pi _R^{\mathrm{NN}}\) remains unchanged with \(\gamma \). We also find that the retailer’s profit \(\pi _R^{\mathrm{GN}}\) is greater than the retailer’s profit \(\pi _R^{\mathrm{GG}}\) for all the values of \(\gamma \), but the retailer’s profits \(\pi _R^{\mathrm{GN}}\) and \(\pi _R^{\mathrm{GG}}\) are lower than the retailer’s profit \(\pi _R^{\mathrm{NN}}\) for all the value of \(\gamma \). This result implies that the retailer prefers that neither manufacturer makes a green investment. From Fig. 4b, when \(a_1=a_2\), the effect of \(\gamma \) on the retailer’s profit has a similar conclusion obtained in the case of \(a_1>a_2\).

- (5)

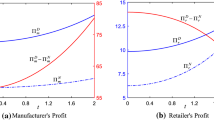

The effect of green sensitivity coefficient \(\gamma \) on the manufacturers’ profits

Figure 5 shows the effect of \(\gamma \) on the manufacturers’ profits in different market sizes. From Fig. 5a, when \(a_1>a_2\), the manufacturer’s profit \(\pi _{m_1}^{\mathrm{GN}}\) increases with \(\gamma \) and the manufacturer’s profit \(\pi _{m_1}^{\mathrm{GG}}\) decreases with \(\gamma \) (\(0<\gamma <0.8\)) while increases with \(\gamma \) (\(0.8<\gamma <1 \)). The manufacturer’s profits \(\pi _{m_2}^{\mathrm{GN}}\) and \(\pi _{m_2}^{\mathrm{GG}}\) decrease as \(\gamma \) increases. This implies that when only one manufacturer chooses to make a green investment, while the other refuses to invest, in a large potential market, the manufacturer who makes a green investment is willing to improve the green level which further leads to the wholesale price and the demand increase as \(\gamma \) increases. Therefore, the profit of the manufacturer who makes a green investment increases with \(\gamma \). However, in a small potential market, the manufacturer who refuses to invest is forced to decrease the quality level of products, which leads to lower the wholesale price and lower the demand. Further, the profit of the manufacturer who refuses to invest decreases with \(\gamma \). When both manufacturers make green investments, as \(\gamma \) increases in \(0<\gamma <0.8\), the manufacturer \(M_1\) who has a large potential market is willing to improve the green level and the quality level of products, which implies that the investment cost and the wholesale price increase accordingly. Further, we can conclude that the profit of the manufacturer decreases with \(\gamma \). However, the other manufacturer \(M_2\) who has a small potential market will increase the green investment when \(0<\gamma <0.8\), while decrease the green investment when \(0.8<\gamma <1\), which makes the wholesale price increase and the demand decrease. Further, the profit of the manufacturer \(M_2\) decreases accordingly with \(\gamma \). Meantime, we find that the profit of manufacturer \(\pi _{m_1}^{\mathrm{GG}}\) increases with \(\gamma \ (0.8<\gamma <1)\). The reason is that the manufacturer \(M_1\) continues to increase the green investment when \(0.8<\gamma <1\) while the manufacturer \(M_2\) decreases the green investment when \(0.8<\gamma <1\). We also find that the relationship between the manufacturers’ profits is as follows: \(\pi _{m_1}^{\mathrm{GN}}>\pi _{m_1}^{\mathrm{NN}}>\pi _{m_1}^{\mathrm{GG}}>\pi _{m_2}^{\mathrm{NN}}>\pi _{m_2}^{\mathrm{GG}}>\pi _{m_2}^{\mathrm{GN}}\) when \(0<\gamma <0.95\) and \(\pi _{m_1}^{\mathrm{GN}}>\pi _{m_1}^{\mathrm{GG}}>\pi _{m_1}^{\mathrm{NN}}>\pi _{m_2}^{\mathrm{NN}}>\pi _{m_2}^{\mathrm{GG}}>\pi _{m_2}^{\mathrm{GN}}\) when \(0.95<\gamma <1\). This implies that the manufacturer’s profit \(\pi _{m_1}^{\mathrm{GN}}\) is the largest among all the manufacturers’ profits. From Fig. 5b, when \(a_1=a_2\), the manufacturers’ profits \(\pi _{m_1}^{\mathrm{GN}}\) increase with \(\gamma \), while the manufacturers’ profits \(\pi _{m_2}^{\mathrm{GN}}\), \(\pi _{m_1}^{\mathrm{GG}}\), \(\pi _{m_2}^{\mathrm{GN}}\) decrease as \(\gamma \) increases. The manufacturers’ profits \(\pi _{m_1}^{\mathrm{NN}}\) and \(\pi _{m_2}^{\mathrm{NN}}\) remain constant. We also find the relationship between the manufacturers’ profits is \(\pi _{m_1}^{\mathrm{GN}}>\pi _{m_1}^{\mathrm{NN}}=\pi _{m_2}^{\mathrm{NN}}>\pi _{m_1}^{\mathrm{GG}}=\pi _{m_2}^{\mathrm{GG}}>\pi _{m_2}^{\mathrm{GN}}\).

Therefore, we can conclude that the manufacturer prefers to make a green investment when the other manufacturer refuses to invest. When one manufacturer makes a green investment, the other manufacturer will also make a green investment.

7 Conclusion and discussion

In this study, we investigate the green investment of two competing manufacturers in a supply chain based on price competition and quality competition and analyze the effect of green investment on product quality level. In this supply chain, two competing manufacturers produce substitutable products with different qualities and then sell them to the retailer. Based on this model, we study the preference of the two manufacturers for the green investment in three scenarios: (i) \(\mathrm{NN}\): neither manufacturer makes a green investment, (ii) \(\mathrm{GN}\) or \(\mathrm{NG}\): one manufacturer makes a green investment, while the other refuses to invest, (iii) \(\mathrm{GG}\): both manufacturers make green investments.

Our research can derive several suggestions for manufacturers’ green investment under competition. First, when one manufacturer’s rival does not make a green investment, the manufacturer prefers to make a green investment when the green sensitivity coefficient is relatively low. Further, we can find that when a manufacturer’s rival makes a green investment, the manufacturer prefers to make a green investment under a low green sensitivity coefficient value. This implies that the manufacturer is willing to make a green investment with a relatively low value of green sensitivity regardless of whether the manufacturer’s rival makes a green investment. Second, we find that the profit of the manufacturer who makes a green investment is greater than the profit of the manufacturer who does not invest regardless of the market size. When both competing manufacturers make green investments, the profit of the manufacturer who is in a large potential market is higher than that of the manufacturer who is in a small potential market. While in a same potential market, the profits of the two competing manufacturers are the same. This implies that the manufacturer who is in a large potential market prefers to make a green investment, while in a same market the manufacturer prefers to make a green investment when his rival does not invest. Third, when a manufacturer’s rival does not make a green investment, the manufacturer who makes a green investment will improve the quality level of the product regardless of potential market size, while the manufacturer’s rival will reduce the quality level of the product. When both manufacturers make green investments, the manufacturer in a large potential market will improve the quality level of the product, while the manufacturer in a small potential market will reduce the quality level of the product. While in the same potential market size, the quality level of the two manufacturers remains unchanged. This implies that the green investment will improve the quality level of products when the manufacturer is in a large potential market. While in a same potential market, the green investment improves the quality level only in the scenario \(\mathrm{GN}\).

There are some limitations in our research, and we can continue to expand our research in the future work. In our research, we find that the profits of the retailer in the scenarios \(\mathrm{GN}\) and \(\mathrm{GG}\) are always smaller than that in the scenario \(\mathrm{GG}\). This implies that the retailer prefers that neither manufacturer makes a green investment. This is due to that green investment hurts the profit of the retailer. In the future research, how to coordinate the relationship between manufacturers and retailer to increase the profit of the retailer is worthy of exploring.

References

Bititci U, Garengo P, Drfler V, Nudurupati S (2012) Performance measurement: challenges for tomorrow. Int J Manag Rev 14(3):305–327

Chen J, Liang L, Yao D, Sun S (2017) Price and quality decisions in dual-channel supply chains. Eur J Oper Res 259(3):935–948

Chen Z, Lan Y, Zhao R (2018) Impacts of risk attitude and outside option on compensation contracts under different information structures. Fuzzy Optim Decis Mak 17:13–47

Choi S (2003) Expanding to direct channel: market coverages as entry barrier. J Interact Market 17(1):25–40

Choudhary V, Ghose A, Mukhopadhyay T, Rajan U (2005) Personalized pricing and quality differentiation. Manag Sci 51(7):1120–1130

Desai PS, Kekre S, Radhakrishnan S, Srinivasan K (2001) Product differentiation and commonality in design: balancing revenues and cost drivers. Manag Sci 47(1):37–51

Feng J, Lan Y, Zhao R (2017) Impact of price cap regulation on supply chain contracting between two monopolists. J Ind Manag Optim 13(1):347–371

Ghosh D, Shah J (2015) Supply chain analysis under green sensitive consumer demand and cost sharing contract. Int J Prod Econ 164:319–329

Hong Z, Guo X (2018) Green product supply chain contracts considering environmental responsibilities. Omega. https://doi.org/10.1016/j.omega.2018.02.010

Karaer O, Erhun F (2015) Quality and entry deterrence. Eur J Oper Res 240(1):292–303

Lan Y, Zhao R, Tang W (2015) An inspection-based price rebate and effort contract model with incomplete information. Comput Ind Eng 83:264–272

Lan Y, Liu Z, Niu B (2017) Pricing and design of after-sales service contract: the value of mining asymmetric sales cost information. Asia Pac J Oper Res 34(1):1740002

Lan Y, Peng J, Wang F, Gao C (2018) Quality disclosure with information value under competition. Int J Mach Learn Cybern 9(9):1489–1503

Li B, Zhu M, Jiang Y, Li Z (2016) Pricing policies of a competitive dual-channel green supply chain. J Clean Prod 112:2029–2042

Li W, Chen J (2018a) Backward integration strategy in a retailer Stackelberg supply chain. Omega 75(2):118–130

Li W, Chen J (2018b) Pricing and quality competition in a brand-differentiated supply chain. Int J Prod Econ. https://doi.org/10.1016/j.ijpe.2018.04.026

Matsubayashi N (2007) Price and quality competition: the effect of differentiation and vertical integration. Eur J Oper Res 180(2):907–921

Matsubayashi N, Yamada Y (2008) A note on price and quality competition between asymmetric firms. Eur J Oper Res 187(2):571–581

Wang S, Hu Q, Liu W (2017a) Price and quality-based competition and channel structure with consumer loyalty. Eur J Oper Res 262(2):563–574

Wang X, Lan Y, Tang W (2017b) An uncertain wage contract model for risk-averse worker under bilateral moral hazard. J Ind Manag Optim 13(4):1815–1840

Xu X, He P, Xu H, Zhang Q (2017) Supply chain coordination with green technology under cap-and-trade regulation. Int J Prod Econ 183:433–442

Yan Y, Zhao R, Lan Y (2017) Asymmetric retailers with different moving sequences: group buying versus individual purchasing. Eur J Oper Res 261(3):903–917

Yan Y, Zhao R, Liu Z (2018a) Strategic introduction of the marketplace channel under spillovers from online to offline sales. Eur J Oper Res 267(1):65–77

Yan Y, Zhao R, Chen H (2018b) Prisoner’s dilemma on competing retailers’ investment in green supply chain management. J Clean Prod 184:65–81

Yang K, Zhao R, Lan Y (2016) Impacts of uncertain project duration and asymmetric risk sensitivity information in project management. Int Trans Oper Res 23(4):749–774

Yang K, Lan Y, Zhao R (2017) Monitoring mechanisms in new product development with risk-averse project manager. J Intell Manuf 28(3):667–681

Yu Y, Han X, Hu G (2016) Optimal production for manufacturers considering consumer environmental awareness and green subsidies. Int J Prod Econ 182:397–408

Zahra B, Jafar H (2017) A mathematical model for green supply chain coordination with substitutable products. J Clean Prod 145:232–249

Zhang L, Wang J, You J (2015) Consumer environmental awareness and channel coordination with two substitutable products. Eur J Oper Res 241(1):63–73

Acknowledgements

The study of Dr. Wu was funded by the National Natural Science Foundation of China (Grant Number: 71601141) and the study of Yang was funded by Yanta Scholars Foundation of Xian University of Finance and Economics.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflicts of interest

The authors declare that they have no conflict of interest.

Ethical approval

This study does not contain any studies with human participants or animals performed by any of the authors.

Additional information

Communicated by Y. Ni.

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendix: Green investment in a price and quality-based supply chain

Appendix: Green investment in a price and quality-based supply chain

Proof of Proposition 1

For given \(w_i\) and \(q_i\), \(i=1,2,\) we conclude that \(\pi ^\mathrm{NN}_{r}\) is jointly concave in \(p_1\) and \(p_2\) because the Hessian matrix of \(\pi ^\mathrm{NN}_{r}\), which are \(\frac{\partial ^2 \pi ^{\mathrm{N N}}_{r}}{\partial p_{1}^2}=-\,2<0\), \(\frac{\partial ^2 \pi ^{\mathrm{N N}}_{r}}{\partial p_{1}^2} \frac{\partial ^2 \pi ^{\mathrm{N N}}_{r}}{\partial p_{2}^2} -\frac{\partial ^2 \pi ^{\mathrm{N N}}_{r}}{\partial p_{1}\partial p_2} \frac{\partial ^2 \pi ^{\mathrm{N N}}_{r}}{\partial p_{2}\partial p_1}=4(1-\alpha ^2)>0\), is negative definite. By solving the following first-order condition, \(\frac{\partial \pi ^\mathrm{NN}_{r}}{\partial p_1}=0\) and \(\frac{\partial \pi ^\mathrm{NN}_{r}}{\partial p_2}=0\), we obtain the unique optimal retail price (4).

Thus, substituting Eq. (4) into the manufacturers’ profit functions we obtain \(\pi ^\mathrm{NN}_{m_{i}}\). To ensure that \(\pi ^\mathrm{NN}_{m_{i}}\) is jointly concave in \(q_i\) and \(w_i\), we require that \(\frac{\partial ^2\pi ^{\mathrm{NN}}_{m_{i}}}{\partial q_{i}^2}=-\,\tau <0\), \(\frac{\partial ^2\pi ^{\mathrm{NN}}_{m_{i}}}{\partial q_{i}^2} \frac{\partial ^2\pi ^{\mathrm{NN}}_{m_{i}}}{\partial w_{i}^2} -\frac{\partial ^2\pi ^{\mathrm{NN}}_{m_{i}}}{\partial q_{i}\partial w_{i}} \frac{\partial ^2\pi ^{\mathrm{NN}}_{m_{i}}}{\partial w_{i}\partial q_{i}}=\tau -\frac{1}{4}>0\), which implies the Hessian matrix of \(\pi ^\mathrm{NN}_{m_{i}}\) is negative definite. By solving the first-order condition, that is \(\frac{\pi ^\mathrm{NN}_{m_{i}}}{\partial q_{i}}=0\) and \(\frac{\pi ^\mathrm{NN}_{m_{i}}}{\partial w_i}=0\), we have the unique optimal quality levels \(q_{i}^{\mathrm{NN}}\) and wholesale price \(w_{i}^{\mathrm{NN}}\) (6).

Thus substituting Eq. (6) into Eq. (4) and demands function (2), the optimal retail price \(p_{i}^{\mathrm{NN}}\) and the demand \(D_{i}^{\mathrm{NN}}\) (7) are obtained.

Substituting Eqs. (6) and (7) into \(\pi ^\mathrm{NN}_{r}\) and \(\pi ^\mathrm{NN}_{m_{i}}\), we obtain the retailer’s and the manufacturers’ optimal profits \(\pi ^\mathrm{NN}_{m_{i}}\) and \(\pi ^\mathrm{NN}_{r}\) (8).

The proof is completed. \(\square \)

Proof of Corollaries 1

From the concavity of the retailer’s profit and the manufacturers’ profit, we derive \(4\tau -1>0\). In order to make decision variables to be positive, we require

or

For \( f(2\alpha \tau -\beta )=a_{j} \left( 2\,\alpha \,\tau -\beta \right) ^{2}+ a_{j}\left( 4\,\tau -1 \right) ^{2} +2\,a_{i} \left( 4\,\tau -1 \right) \left( 2\,\alpha \,\tau -\beta \right) \), we conclude that \(f(2\alpha \tau -\beta )>0\) when \(a_i<a_j\), and \(f(2\alpha \tau -\beta )\) has two different roots \(\frac{-\,a_i\pm \sqrt{a_{i}^{2}-a_{j}^{2}}}{a_{j}}(4\tau -1)\) when \(a_i>a_j\). Therefore, we have \(f(2\alpha \tau -\beta )<0\) when

and \(f(2\alpha \tau -\beta )>0\) when

From (24) (25) and (26), we can derive \(f(2\alpha \tau -\beta )<0\) when

or

From (24) (25) and (27), we can derive \(f(2\alpha \tau -\beta )>0\) when

or

- (i)

For any given \(\alpha \), we have

$$\begin{aligned} \frac{\partial q_i^{\mathrm{NN}}}{\partial \alpha }= & {} {\frac{2\,\tau \, \left( a_{j} \left( 2\,\alpha \,\tau -\beta \right) ^{2}+ a_{j} \left( 4\,\tau -1 \right) ^{2} +2\,a_{i} \left( 4\,\tau -1 \right) \left( 2\,\alpha \,\tau -\beta \right) \right) }{ \left( 4\,{\alpha }^{2}{\tau }^{2}-4\,\alpha \,\beta \,\tau +{\beta }^{2}- 16\,{\tau }^{2}+8\,\tau -1 \right) ^{2}}},\\ \frac{\partial w_i^{\mathrm{NN}}}{\partial \alpha }= & {} {\frac{4\,\tau ^2\, \left( a_{j} \left( 2\,\alpha \,\tau -\beta \right) ^{2}+ a_{j} \left( 4\,\tau -1 \right) ^{2} +2\,a_{i} \left( 4\,\tau -1 \right) \left( 2\,\alpha \,\tau -\beta \right) \right) }{ \left( 4\,{\alpha }^{2}{\tau }^{2}-4\,\alpha \,\beta \,\tau +{\beta }^{2}- 16\,{\tau }^{2}+8\,\tau -1 \right) ^{2}}},\\ \frac{\partial D_i^{\mathrm{NN}}}{\partial \alpha }= & {} {\frac{2\,\tau ^2\, \left( a_{j} \left( 2\,\alpha \,\tau -\beta \right) ^{2}+ a_{j}\left( 4\,\tau -1 \right) ^{2} +2\,a_{i} \left( 4\,\tau -1 \right) \left( 2\,\alpha \,\tau -\beta \right) \right) }{ \left( 4\,{\alpha }^{2}{\tau }^{2}-4\,\alpha \,\beta \,\tau +{\beta }^{2}- 16\,{\tau }^{2}+8\,\tau -1 \right) ^{2}}},\\ \frac{\partial \pi _{m_{i}}^{\mathrm{NN}}}{\partial \alpha }= & {} {\frac{-2\,{\tau }^{2} \left( 4\,\tau -1 \right) \left( a_{j}\, \left( 2\,\tau \,\alpha -\beta \right) +a_{i}\, \left( 4\,\tau -1 \right) \right) \left( a_{j}\, \left( 2\,\tau \,\alpha -\beta \right) ^{2}+a_{j}\, \left( 4\,\tau -1 \right) ^{2}+2\,a_{i}\, \left( 4\,\tau -1 \right) \left( 2\,\tau \,\alpha -\beta \right) \right) }{ \left( 4\,{\alpha }^{2}{\tau }^{2}-4\,\alpha \,\beta \,\tau +{\beta }^{2}- 16\,{\tau }^{2}+8\,\tau -1 \right) ^{3}}}. \end{aligned}$$When \(a_i<a_j\), we have \( f(2\alpha \tau -\beta )>0\). Therefore, we conclude \(\frac{\partial q_i^{\mathrm{NN}}}{\partial \alpha }>0\), \(\frac{\partial w_i^{\mathrm{NN}}}{\partial \alpha }>0\), \(\frac{\partial D_i^{\mathrm{NN}}}{\partial \alpha }>0\), \(\frac{\partial \pi _{m_{i}}^{\mathrm{NN}}}{\partial \alpha }>0\). When \(a_i>a_j\), we have \( f(2\alpha \tau -\beta )<0\) from (28) and (29). Therefore, we obtain \(\frac{\partial q_i^{\mathrm{NN}}}{\partial \alpha }<0\), \(\frac{\partial w_i^{\mathrm{NN}}}{\partial \alpha }<0\), \(\frac{\partial D_i^{\mathrm{NN}}}{\partial \alpha }<0\), \(\frac{\partial \pi _{m_{i}}^{\mathrm{NN}}}{\partial \alpha }<0\). Similarly, we obtain \( f(2\alpha \tau -\beta )>0\) from (30) and (31), which make \(\frac{\partial q_i^{\mathrm{NN}}}{\partial \alpha }>0\), \(\frac{\partial w_i^{\mathrm{NN}}}{\partial \alpha }>0\), \(\frac{\partial D_i^{\mathrm{NN}}}{\partial \alpha }>0\), \(\frac{\partial \pi _{m_{i}}^{\mathrm{NN}}}{\partial \alpha }>0\) to be hold.

- (ii)

For any given \(\beta \), we have