Abstract

Based on uncertainty theory, this paper mainly studies the uncertainties and the information value in the two-stage uncertain programming with recourse. We first define three fundamental concepts and investigate their theoretical properties, based on which we present two optimal indices, i.e., EVPI and VUS. Then, we introduce a method to calculate the expected value of the second-stage objective function involving discrete uncertain variables. Due to the complexity of calculation, the upper bound and lower bound for the two indices are studied, respectively. Finally, two examples are given to illustrate these concepts clearly. The results obtained in this paper can provide theoretical basis for studying uncertainties and information value in decision-making process under uncertain systems.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

1 Introduction

1.1 Motivation

Nowadays, the two-stage stochastic programming (SP) with recourse is more practical, and it has become a fundamental planning tool in the fields of engineering, economics, etc. If we neglect the randomness in the two-stage stochastic programming, such as replacing the random vectors (or variables) by their expected value, some unacceptable results may happen. Obviously, the perfect (or accurate) stochastic information in future can help to make more profits (or less cost) if it is available before taking the first-step decision; thus, how to evaluate the stochastic information value is important in the decision-making process. Under the random environment, many researchers have studied the importance of randomness and the stochastic information value in two-stage stochastic programming and obtain some results based on probability theory.

As is known to all, a fundamental premise of employing probability theory is that the estimated probability is close enough to the real frequency. Due to the lack of observed data, we have to invite some experts to provide their belief degree that each event will occur. Researches showed that human beings tend to overweight unlikely events, and the belief degree may have a much larger range than the real frequency. If we insist on considering the belief degree as probability, some counterintuitive results will happen. In this uncertain environment, how to investigate the importance of such uncertain factors and how to evaluate their perfect information value are practically important and theoretical challenging issues for the real-world applications. In addition, we know that complexity of computation is a distinctive feature of two-stage stochastic programming; therefore, under the uncertain environment, the computation of two-stage uncertain programming would be difficult. Focusing on these problems proposed above, this research will deal with them explicitly.

1.2 Literature review

An initial example of the two-stage SP problem was given by Dantzig (1955) who applied the linear programming to aircraft flight with the random factors. Then, Birge and Louveaux (2011) investigated the theoretical properties of two-stage SP with recourse and solution method. He also defined the “here-and-now” solution, “wait-and-see” solution, “expected results by using the expected value solution,” which represented three types of decision-making schemes. Then, based on the three concepts, the expected value of perfect information (EVPI) and the value of stochastic solution (VSS) were introduced. Shapiro and Dentcheva (2014) investigated how to solve the two-stage SP by dual theory and presented multistage stochastic programming model. Romeijnders et al. (2014) presented an approximation method to two-stage integer programming. Leovey and Romisch (2015) presented quasi-Monte Carlo methods for linear two-stage stochastic programming. Since two-stage SP is closer to the real-world problem, recently, it has been developed rapidly in applications, such as Parisio and Jones (2015) applied the two-stage SP approach to employee scheduling; Fan et al. (2015) investigated water resource allocation planning by fuzzy two-stage SP method. Eckermann and Willan (2007) applied the EVPI to the health treatment assignment. More applications can be referred to Wolf et al. (2014), Hoomans et al. (2009), Eckermann et al. (2010), etc.

As introduced in the motivation, the frequently used probability distribution is not appropriate to the some problems due to the shortage of sample data (or even no sample). To deal with this inaccurate phenomenon, the uncertainty theory was founded by Liu (2007) in 2007 and refined by Liu (2010a) in 2010 based on normality, duality, subadditivity and product axioms. Since then, uncertainty theory has been developed continuously such as Liu (2013), Sheng and Yao (2014), which provides a theoretical foundation for uncertain programming just like the role of probability theory for stochastic programming. The pioneering research on uncertain programming and its application was started by Liu (2009a) in 2009, Liu and Chen (2015) investigated multiobjective programming and uncertain goal programming in 2015, Wang et al. (2015) studied the solution method to the uncertain multiobjective programming, and Zheng et al. (2017a) further proposed several types of efficient solutions to the uncertain multiobjective programming and studied their relations. The application of efficient solutions to the uncertain multiobjective programming can be referred to Zheng et al. (2016); Liu and Yao (2015) studied an uncertain multilevel programming for modeling decentralized decision systems; Zheng et al. (2017b) first proposed the model of two-stage uncertain programming and investigated its solution method; Liu (2010a) applied the uncertain programming to the machine scheduling problem with uncertain process times, vehicle routing problem and project scheduling problem; Liu (2010b) initially studied uncertain risk analysis and uncertain reliability analysis; and Zhang and Peng (2013) applied the uncertain programming to the optimal assignment problem.

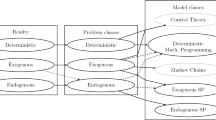

1.3 Proposed approaches

To the best of our knowledge, the majority of existing literatures devoted the study of the two-stage programming problem under the environment, including the theoretical properties and algorithm. However, under the uncertain environment, there are few researches work except Zheng et al. (2017b), who presented the model of two-stage uncertain programming with recourse (UPR) and investigated its properties. Therefore, following the idea of the two-stage UP problem by Zheng et al. (2017b), this paper mainly deals with the uncertainties and the information value in the two-stage UP problem. We first define three fundamental concepts, i.e., “here-and-now” (HN) solution, “wait-and-see” (WS) solution, “expected results by the expected value” (EEV) solution, which represent three types of decision-making schemes to the two-stage UP problem, and we discuss their theoretical properties. Based on the three concepts above, we define the difference between WS and HN (i.e., HN-WS) as the expected value of perfect information (EVPI), and the difference between WS and HN (i.e., EEV-HN) as the value of uncertainty (VUS) (considering the minimum of objective function). The quantity, EVPI, measures the maximum amount that a decision maker would pay in return for accurate information, and the quantity, VUS, reflects the importance of the uncertainties in the actual problem. In addition, this paper presents a method for calculating the expected value of the second-stage objective function involving discrete uncertain variables. Duo to the complexity of calculation, we, respectively, investigate the upper bound and lower for the two indices. Finally, two examples are given to illustrate the three concepts and the two optimal indices clearly. The results obtained in this paper can provide theoretical basis for studying uncertainties and information value in decision-making process under uncertain systems.

This paper is organized as follows. In Sect. 2, we review some basic results in uncertainty theory. Two optimal indices and the related concepts are proposed in Sect. 3. Section 4 studies the properties of the concepts proposed in this paper and obtains the upper bound and lower bound on the two optimal indices. In Sect. 5, two numerical examples are given to demonstrated these concepts explicitly. Finally, a brief summary is given in Sect. 6.

2 Preliminaries

Let \({\Gamma }\) be a nonempty set, and \(\mathscr {L}\) a \(\sigma \)-algebra over \({\Gamma }\). Each element \({\Lambda }\) in \(\mathscr {L}\) is called an event. A set function \(\mathscr {M}\) from \(\mathscr {L}\) to [0, 1] is called an uncertain measure if it satisfies the following axioms (Liu 2007):

Axiom 1

(Normality Axiom) \(\mathscr {M}\{\mathrm {\Gamma }\}=1\) for the universal set \(\mathrm {\Gamma }\).

Axiom 2

(Duality Axiom) \(\mathscr {M}\{\mathrm {\Lambda }\}+\mathscr {M}\{\mathrm {\Lambda }^{c}\}=1\) for any event \(\mathrm {\Lambda }\).

Axiom 3

(Subadditivity Axiom) For every countable sequence of events \(\mathrm {\Lambda }_{1},\mathrm {\Lambda }_{2}, \ldots \), we have

The triplet \((\mathrm {\Gamma },\mathscr {L},\mathscr {M})\) is called an uncertainty space. Furthermore, Liu (2009b) defined a product uncertain measure by the fourth axiom:

Axiom 4

(Product Axiom) Let \((\mathrm {\Gamma }_{k},\mathcal {L}_{k},\mathscr {M}_{k})\) be uncertainty space for \(k=1,2,\ldots \). The product uncertain measure \(\mathscr {M}\) is an uncertain measure satisfying

where \(\mathrm {\Lambda }_{k}\) are arbitrarily chosen events from \(\mathcal {L}_{k}\) for \(k=1,2,\ldots \), respectively.

Definition 2.1

(Liu 2007) An uncertain variable is a measurable function \(\xi \) from an uncertainty space \(({\Gamma }, \mathscr {L}, \mathscr {M})\) to the set of real numbers, i.e., for any Borel set B of real numbers, the set

is an event.

Definition 2.2

(Liu 2007) The uncertainty distribution \(\mathrm {\Phi }\) of an uncertain variable \(\xi \) is defined by \(\mathrm {\Phi }(x)= \mathscr {M}\{\xi \le x\}\) for any real number x.

Definition 2.3

(Liu 2010a) An uncertain distribution \(\mathrm {\Phi }\) is said to be regular if its inverse function \(\mathrm {\Phi }^{-1}(\alpha )\) exists and is unique for each \(\alpha \in (0,1.)\)

Definition 2.4

(Liu 2010a) Let \(\xi \) be an uncertain variable with regular uncertainty distribution \(\mathrm {\Phi }\). Then, the inverse function \(\mathrm {\Phi }^{-1}\) is called the inverse uncertainty distribution of \(\xi \).

Definition 2.5

(Liu 2007) Let \(\xi \) be an uncertain variable. Then, the expected value of \(\xi \) is defined by

provided that at least one of the two integrals is finite.

Definition 2.6

(Liu 2007) A k-dimensional uncertain vector is a function \(\varvec{\xi }\) from an uncertainty space \(({\mathrm {\Gamma }}, \mathscr {L}, \mathscr {M})\) to the set of k-dimensional real vectors such that \(\{\varvec{\xi } \in B \}\) is an event for any Borel set B of k-dimensional real vectors.

Theorem 2.1

(Liu 2010a) Let \(\xi \) and \(\eta \) be independent uncertain variables with finite expected values. Then, for any real numbers a and b, we have

Theorem 2.2

(Liu 2010a) Let \(\xi \) be an uncertain variable with regular uncertainty distribution \(\mathrm {\Phi }\). If the expected value exists, then

Theorem 2.3

(Liu 2010a) Let \(\xi _{1},\xi _{2},\ldots ,\xi _{n}\) be independent uncertain variables with regular uncertainty distributions \(\mathrm {\Phi }_{1},\mathrm {\Phi }_{2},\ldots ,\mathrm {\Phi }_{n}\), respectively. If the function \(f(x_{1}, x_{2},\ldots ,x_{n})\) is strictly increasing with respect to \(x_{1},x_{2},\ldots , x_{m}\) and strictly decreasing with respect to \(x_{m+1},x_{m+2},\ldots , x_{n}\), then \(\xi =f(\xi _{1},\xi _{2},\ldots ,\xi _{n})\) is an uncertain variable with inverse uncertainty distribution

Theorem 2.4

(Liu 2007) Let \(\xi \) be an uncertain variable and f a convex function. If \(E[\xi ]\) and \(E[f(\xi )]\) are finite, then

3 Three concepts and two optimal indices in two-stage UPR problem

In order to present the three expected value solution concepts, we first discuss the basic model of two-stage UPR problem. Under the uncertain environment, a two-stage uncertain programming with recourse problem can be formulated as follows by Zheng et al. (2017b)

where \(x\in R^{n_1}, y\in R^{n_2}\) are decision variables, c is a known vector in \(R^{n_1}, b\) is a known vector in \(R^{m_1}, A\) and W are known matrices of size \(m_1\times n_1\) and \(m_2\times n_2\), respectively, W is called recourse matrix which is assumed to be fixed for the convenience computation.

For each realization \(\gamma \in \varGamma , T(\gamma )\) is \(m_2\times n_1, q(\gamma )\in R^{n_2}, h(\gamma )\in R^{m_2}\). Piecing together the uncertain components of the problem (4), we obtain an uncertain vector \(\varvec{\xi }^T(\gamma )=(q(\gamma )^T, h(\gamma )^T, T_1(\gamma ),\ldots , T_{m_2}(\gamma ))\) with \(N=n_2+m_2+(m_2+n_1)\) components, where \( T_{i}(\gamma )\) is the ith row of the technology matrix \(T(\gamma )\). Let \(\varXi \subset R^n\) be the support of \(\xi \) which is the smallest closed subset in \(R^n\) such that \(\mathscr {M}\{\varXi \}=1.\)

The decision-observation schemecan be described as follows

According to this scheme, the problem (4) obtains two unsolved optimization problems. Assuming that x and \(\gamma \) are given, the second-stage problem, or recourse problem can be formulated as follows

where x belongs to the feasible set \(S_1=\{x\mid Ax=b, x\ge 0\}.\) By the above analysis, we know that the second-stage problem is a more difficult one. For each \(\gamma \in \varXi \), the value \(y(\gamma )\) is the solution of a linear programming. To stress this fact, sometimes we use the notion of a deterministic equivalent programming. For a given realization \(\gamma \) of uncertain variable \(\xi \), let

be the second-stage value function, where \(\varvec{\xi }\) is an uncertain vector.

Next, we will define three basic concepts of expected value solution for the model (4). For convenience, \(Q(x,\varvec{\xi }(\gamma ))\) is indiscriminately denoted by \(Q(x,\gamma )\) throughout this paper.

3.1 HN solution

Denote the expected second-stage value function (or recourse function) as

where \(\mathrm {E}_{\varvec{\xi }}\) is the expected value operator with respect to uncertain vector \(\varvec{\xi }\).

Therefore, the two-stage UPR problem can be rewritten as follows

where \(\mathscr {Q}_\mathrm {E}(x)=\mathrm {E}_{\varvec{\xi }}[Q(x,\gamma )]\), and

Obviously, by the above discussion, the problem (7) can be rewritten as follows

where \(\varvec{\xi }\) is an uncertain vector defined on the uncertainty space \((\mathrm {\Gamma }, \mathscr {L}, \mathscr {M})\).

Definition 3.1

We define the “here-and-now” solution (HN) (or recourse problem) in the problem (9) as

with an optimal solution, \(x^*\).

3.2 WS solution

Suppose that the uncertainties in the problem (9) can be modeled through a number of scenarios. Let \(\varvec{\xi }\) be the uncertain vector whose realizations correspond to the various scenarios. Define

as the optimization problem associated with one particular scenario \(\gamma \).

We may also reasonably assume that there exists at least one \(x\in R^{n_1}\) such that \(z(x, \varvec{\xi }(\gamma ))< +\infty \). If not, there would exist no feasible solution for at least one scenario; in such a situation, no reasonable stochastic programming model could be established. This assumption implies that, for all \(\varvec{\xi }(\gamma )\in \varXi \), there exists at least one feasible solution which in turn means the existence of at least one optimal solution. Let \(\bar{x}(\varvec{\xi }(\gamma ))\) denote some optimal solution to problem (10). As in a scenario method, we might be interested in finding all solutions \(\bar{x}(\varvec{\xi }(\gamma ))\) of problem (10) for all scenarios and the related optimal objective values \(z(\bar{x}(\varvec{\xi }(\gamma )),\varvec{\xi }(\gamma ))\).

Here, we assume that we somehow have the ability to find these decisions \(\bar{x}(\varvec{\xi }(\gamma )\) and their objective value \(z(\bar{x}(\varvec{\xi }(\gamma )),\varvec{\xi }(\gamma ))\) so that we can in a position to calculate the expected value of the correspondingly optimal objective value, which is called “wait-and-see” (WS) solution.

Definition 3.2

We define the “wait-and-see” (WS) solution as

3.3 EEV solution

For practical purpose, we would believe that finding the WS solution is still too much work because it delivers a set of solutions instead of one solution that would be implementable. Therefore, a natural temptation is to solve a much simpler problem: the one obtained by replacing all uncertain vectors or uncertain variables in problem (9) with their expected values. This is called expected value (EV) problem, which is simply

with optimal solution \(\bar{x}(\bar{\varvec{\xi }})\), where \(\bar{\varvec{\xi }}\) is the expected value of \(\varvec{\xi }\), and \(\bar{x}(\bar{\varvec{\xi }})\) (called expected value solution(EV)) is an optimal solution to the EV problem.

In practical decision-making process, we would feel at least a little insecure about advising to take decision \(\bar{x} (\bar{\varvec{\xi }})\). Indeed, unless \(\bar{x} (\varvec{\xi })\) is somehow independent of \(\varvec{\xi }\), there is no reason to believe that \(\bar{x} (\bar{\varvec{\xi }})\) is in any way near the solution of the problem (9). Therefore, in order to precisely measure how good or, more frequently, how bad a decision \(\bar{x} (\bar{\varvec{\xi }})\) is in terms of the problem (9), we should find a method to evaluate the value of the uncertain solution which begins with defining the following concept of expected results of using the EV solution.

Definition 3.3

We define the expected results of using the EV solution (EEV) to be

3.4 The EVPI and VUS

If we can obtain the precise uncertain information in the problem (9) by purchasing or other means, there is no doubt that it is helpful to make decisions. There is a natural question: How much is the information? Based on uncertainty theory, we present a concept called the expected value of perfect information (EVPI) to solve this problem. Unfortunately, in some practical problems, we cannot obtain any information by all means. Under these circumstances, how can we evaluate the uncertainties in the problems? Therefore, the concept of the value of uncertain solution (VUS) is also proposed in this subsection.

Definition 3.4

The expected value of perfect information is the difference between the wait-and-see solution and the here-and-now solution, namely

Remark 1

The quantity, EVPI, measures the maximum amount that a decision maker would be ready to pay in return for complete or accurate information about the future.

Definition 3.5

The value of fuzzy solution is the difference between the here-and-now solution and the EEV, namely

Remark 2

The quantity, VUS, reflects the importance of the uncertainties in the problem.

4 Basic properties

Theorem 4.1

For the two-stage UPR problem (9), we have

Proof

For any realization, \(\varvec{\xi }(\gamma ),\) we have

where, as described before, \(x^*\) denotes the optimal solution to the here-and-now problem.

By the definition of uncertain vector, it is easy to obtain

which, by the definitions, is

On the other hand, since \(\bar{x}(\bar{\varvec{\xi })}\) is just one feasible solution to the two-stage UPR problem (9), evidently,

that is,

The proof is complete. \(\square \)

Theorem 4.2

For the two-stage UPR problem (9) with fixed recourse matrix W and fixed objective coefficients q, we can obtain

Proof

We first prove that the \(f(\varvec{\xi })=\min \limits _x z(x,\varvec{\xi }(\gamma ))\) is a convex function with respect to \(\varvec{\xi }\). Since

it is evidently sufficient to prove that the second-stage optimal objective function \(Q(x,\varvec{\xi })\) is convex with respect to \(\varvec{\xi }\).

Denote

Suppose that \(\gamma _1,\gamma _2\in \varGamma \), and \(T(\gamma _1), h(\gamma _1), T(\gamma _2), h(\gamma _2)\in \varXi \). Denote

If \(y_1^*\) and \(y_2^*\) are the optimal solutions to the problems \(g(T(\gamma _1), h(\gamma _1))\) and \(g(T(\gamma _2), h(\gamma _2))\), respectively. Then, \(\forall \lambda \in (0,1), \lambda y_1^*+(1-\lambda )y_2^*\) is a feasible solution to the problem \(g(T_{\lambda },h_{\lambda })\). Let \(y^*\) be the optimal solution to the \(g(T_{\lambda },h_{\lambda })\), we have

which shows that the \(g(T(\gamma ), h(\gamma ))\) is a convex function; thus, the function \(f(\varvec{\xi })=\min \limits _x z(x,\varvec{\xi }(\gamma ))\) is a convex function with respect to \(\varvec{\xi }\).

By Theorem 2.4, we obtain

namely,

which, by the definitions of EV and WS, is

The proof is complete. \(\square \)

Theorem 4.2 does not hold for general two-stage UPR problem. For example, if only the q in problem (9) is uncertain, similarly, we can easily prove that \(z(x,\varvec{\xi })\) is a concave function and the Jensen’s inequality cannot be applied.

Theorem 4.3

For the fixed recourse matrix W and fixed objective coefficients q, let \(x^*\) be an optimal solution to the problem (9) and \(\bar{x}(\bar{\varvec{\xi }})\) an optimal solution to the problem EV problem (11). Then,

where \(\eta \in \partial E_{\varvec{\xi }}(z(\bar{x}(\bar{\varvec{\xi }}),\varvec{\xi }))\), the subdifferential set of \(E_{\varvec{\xi }}(z(x,\varvec{\xi }))\) at \(\bar{x}(\bar{\varvec{\xi }})\).

Proof

By the proof of Theorem 4.2 and properties of convex function, it is easy to obtain that \(E_{\varvec{\xi }}(z(x,\varvec{\xi }))\) is convex. By the subgradient inequality, the relation

holds at point \(x_1\) for any \(x_2\). Substitute \(\bar{x}(\bar{\varvec{\xi }})\) and \(x^*\) for the points \(x_1\) and \(x_2\), respectively, and we have

which is

In order to obtain the another bound on the HN solution, we consider a slightly different version of the recourse problem defined as follows

Compared with the problem (10), only the right-hand side of the problem (12) is uncertain and the second-stage constraints are inequalities. We can easily apply all definitions and relations to \(z_p\). If we further assume that \(h(\varvec{\xi })\) is bounded above, an additional inequality results as follows. \(\square \)

Theorem 4.4

Consider the problem (12) and the related definition

Suppose that \(h(\varvec{\xi })\) is bounded above by a fixed quantity \(h_{max}\). Let \(x_{max}\) be an optimal solution to \(z_p(x,h_{max})\). Then,

Proof

For any \(\varvec{\xi }\) in \(\varXi \) and \(x\ge 0\), a feasible solution to \(Wy\ge h_{max}- Tx, y\ge 0\) is also a feasible solution to \(Wy\ge h(\varvec{\xi })- Tx, y\ge 0\). Thus, \(z_p(x,h_{max})\ge z_p(x,h(\varvec{\xi }))\). Hence, \(z_p(x,h_{max})\ge E_{\varvec{\xi }}z_p(x,h(\varvec{\xi }))\). Evidently,

The proof is complete. \(\square \)

Similarly, if we consider the following the problem

then a similar conclusion can be obtained as follows.

Theorem 4.5

Consider the problem (13) and the related definition

Suppose that \(h(\varvec{\xi })\) is bounded below by a fixed quantity \(h_{min}\). Let \(x_{min}\) be an optimal solution to \(z_q(x,h_{min})\). Then,

Proof

Similar to Theorem 4.4, this proof can be easily obtained. The proof is complete. \(\square \)

Theorem 4.6

Suppose that the uncertain vector in the two-stage UPR problem is discrete taking on finite values \(\gamma _j\) with correspondingly weights \(p_j\) defined by the following Eq.(15), \(j=1, 2, \ldots , N,\) we have

where

Proof

From the following Eq.(16), we know that

Thus, for any \(\gamma _j\), we have

namely

where \(\bar{x}(\varvec{\xi }(\gamma _j),\varvec{\xi }(\gamma _j))\) is the optimal solution to the problem \(\min z(x(\varvec{\xi }(\gamma _j),\varvec{\xi }(\gamma _j))\) for any \(\gamma _j\). It follows from the definition of WS and the inequality (14) that

thus,

The proof is complete. \(\square \)

Theorem 4.7

For the two-stage UPR problem (9), we have

Proof

It is evident to obtain this conclusion by Theorem 4.1. This proof is complete. \(\square \)

Theorem 4.8

For the two-stage UPR problem (9) with fixed recourse matrix W and fixed objective coefficients q, we can obtain

Proof

Evidently, it can be verified by Theorem 4.2. The proof is complete. \(\square \)

Remark 3

From Theorem 4.8, we can obtain that the EVPI and the VUS are nonnegative (anyone would be surprised if this is not true) and are both bounded above by the same quantity. When \(EEV=EV\), both the EVPI and VUS are vanished. A sufficient condition to this is to have \(\bar{x} {(\varvec{\xi })}\) independent of \(\varvec{\xi }\). In such situations, the optimal solutions are insensitive to the value of the uncertain elements, and we can find them by any given uncertain vector such as \(\bar{\xi }\). Hence, it is unnecessary to solve a recourse problem. Such extreme situations occur rarely.

5 Numerical examples

In this section, we take two examples to illustrate how to calculate the EVPI and VUS. To further study the properties of the two optimal indices, these two examples are also designed to demonstrate the cases in which one of the two concepts is null and the other is positive.

Let us begin with the expected value of discrete uncertain variable in order to deal with the two-stage UPR problem involving discrete uncertain variables. Assume that the discrete uncertain variable \(\xi \) takes the expert’s experimental data

which meet the following consistence conditions (perhaps after rearrangement)

Based on the experimental data, discrete uncertain variable \(\xi \) has the following experimental uncertain distribution

where \(0=\alpha _1<\alpha _2\cdots <\alpha _n=1\).

Define

as the weights of discrete point \(\xi _i, ~i=1,2, \ldots , n\), respectively.

Then, it is easy to know that the corresponding weights satisfy the following constraints

By Definition 2.5, we can deduce that the expectation of discrete uncertain variable \(\xi \) is represented in the formula

Assume that the second-stage value functions satisfy the condition

Then, the second-stage objective function \(\mathscr {Q}_\mathrm {E}(x)\) can be calculated by the following formula

Next, we will take two examples to illustrate the properties of the two optimal indices.

\(a.~ EVPI=0 ~and~ VUS\ne 0\)

Example 5.1

Consider the following two-stage UPR problem

where \(\xi \) is a linear uncertain variable with the following uncertainty distribution

Calculate the EVPI and VUS.

For a given x and \(\xi \), we can obtain

Hence,

Note that the first-stage constraint \(x_1+x_2=1\), evidently, we have \(z(x,\xi )=2+\xi \) in the first of these three regions. By the first-stage constraint and the definition of the regions, we can easily check that \(z(x,\xi )\ge 2+\xi \) in the other two regions.

Thus, \(\forall x^*\in \{(x_1, x_2)|x_1+x_2=1, x\ge 0\}\) is an optimal solution to the problem (19) for \(-x_1+2x_2\le \xi \le 2-x_1+2x_2\), or equivalently, for \(2-3x_1\le \xi \le 4-3x_1\).

By the analysis on the solutions, we can obtain that the solution \(\bar{x}=(1/3, 2/3)\) is the optimal solution to the problem (19) for all \(\xi \). We can also obtain different optimal solutions for various uncertain variable \(\xi \). For example, \(\bar{x}_1^*=(0, 1)\) is optimal for \(\xi \in [2,3]\), and \(\bar{x}_2^*=(1, 0)\) is optimal for only \(\xi ={1}\).

Note that the solution \(\bar{x}=(1/3, 2/3)\) is optimal for all \(\xi \), by the definition of HN solution and WS solution we can conclude that HN=WS. Next we will calculate the objective value of the optimal solution \(\bar{x}=(1/3, 2/3)\) to the initial problem (19), i.e., the HN solution. Evidently, in this situation, we know that \(z(x^*,\xi )=2+\xi \) for all \(\xi \in [1,3]\). By Definition 2.4, we can obtain the universe distribution of linear uncertain variable \(\xi \) as follows

By Theorem 2.2, the expected value of \(\xi \) can be obtained as follows

It follows from Theorem 2.1 that

which implies that HN=WS=4.

Hence,

Next, we will discuss the EEV solution.

In the problem (19), we replace the uncertain variable \(\xi \) with its expected value, i.e., \(\bar{\xi }=2\), and then obtain the following deterministic programming problem

Easily, we can obtain that the optimal solutions to the problem (19) are \(\bar{x}(2)=\{x|x_1+x2=1, 0\le x\le 2/3\}\) and the corresponding optimal objective value is 4, i.e., \(EV=\min \limits _xE[z(x, \bar{\xi })]=4\).

Without loss of generality, take the optimal solution \(\bar{x}(\bar{\xi })=(2/3, 1/3)\) in the problem (19), and we have

Hence, by the definition of EEV, we have

It follows from the definition of VUS that

\(b.~ EVPI\ne 0 ~and~ VUS=0\)

Example 5.2

Replace the uncertain variable in the Example 5.1 with discrete uncertain variable \(\xi \sim (0, 3/2, 2, 3)\) which has belief degrees 0, 1/2, 2/3, 1, respectively, and then calculate the EVPI and VUS.

By the analysis above, we can obtain:

-

For \(\xi =0, \bar{x}(0)=\left\{ x|x_1+x_2=1, ~\frac{2}{3}\le x_1\le 1\right\} \);

-

For \(\xi =\frac{3}{2}, \bar{x}(\frac{3}{2})=\left\{ x|x_1+x_2=1, ~\frac{1}{6}\le x_1\le \frac{5}{6}\right\} \);

-

For \(\xi =2, \bar{x}(2)=\left\{ x|x_1+x_2=1,~0\le x_1\le \frac{2}{3}\right\} \);

-

For \(\xi =3, \bar{x}(3)=\left\{ x|x_1+x_2=1,~ 0 \le x_1\le \frac{1}{3}\right\} \).

It follows from Eq.(17) that the expected value of \(\xi \) is obtained as follows

Let us take \(\bar{x}(\bar{\xi })=(2/3, 1/3)\), and it follows from the definition of EV that

Evidently,

It follows from Eq.(18) that

In order to obtain the WS solution, we should consider the different optimal solutions for all three cases. Evidently, there are many optimal solutions, such as \(\bar{x}(0)=(1,0), \bar{x}(3/2)=(1/2,1/2), \bar{x}(2)=(1/4, 3/4), \bar{x}(3)=(0,1)\) for the three cases, respectively.

Evidently,

Hence, by the definition of WS solution and Eq.(18), we can get

In order to obtain the HN solution, we should solve the uncertain programming \(\min \limits _x E_{\xi }[z(x,\xi )]\). For any given x and \(\xi \), we have

whose optimal solution is \(x^*=(2/3,1/3)\). Evidently,

Thus,

and

6 Conclusions

Based on three types of decision-making schemes, three expected value solutions to two-stage UP problems were presented; then, the concepts of two optimal indices, i.e., EVPI and VUS, were defined. Due to the complexity of calculation, the general solution method to calculate the expected value of the second-stage objective function only involving discrete uncertain variables was introduced. Two numerical examples were given to illustrate these concepts explicitly. The theoretical results obtained in this paper can provide theoretical basis for studying uncertainties and information value in decision-making process under uncertain systems.

References

Birge JR, Louveaux F (2011) Introduction to stochastic programming. Springer, Berlin

Dantzig GB (1955) Linear programming under uncertainty. Manag Sci 1(3–4):197–206

Eckermann S, Karnon J, Willan AR (2010) The value of value of information: best informing research design and prioritization using current methods. Pharmacoeconomics 28(9):699

Eckermann S, Willan AR (2007) Expected value of information and decision making in HTA. Health Econ 16(2):195

Fan Y et al (2015) Planning water resources allocation under multiple uncertainties through a generalized fuzzy two-stage stochastic programming method. IEEE Trans Fuzzy Syst 23(5):1488–1504

Hoomans T, Fenwick EA, Palmer S, Claxton K (2009) Value of information and value of implementation: application of an analytic framework to inform resource allocation decisions in metastatic hormone-refractory prostate cancer. Value Health 12(2):315–324

Leovey H, Romisch W (2015) Quasi-Monte Carlo methods for linear two-stage stochastic programming problems. Math Program 151(1):315–345

Liu B (2007) Uncertainty theory, 2nd edn. Springer, Berlin

Liu B (2009a) Theory and practice of uncertain programming. Springer, Berlin

Liu B (2009b) Some research problems in uncertainty theory. J Uncertain Syst 3:3–10

Liu B (2010a) Uncertainty theory: a branch of mathematics for modeling human uncertainty. Springer, Berlin

Liu B (2010b) Uncertain risk analysis and uncertain reliability analysis. J Uncertain Syst 4(4):163–170

Liu B (2013) Polyrectangular theorem and independence of uncertain vectors. J Uncertain Anal Appl, 1, Article 9

Liu B, Chen XW (2015) Uncertain multiobjective programming and uncer- 340 tain goal programming. J Uncertain Anal Appl, 3, Article 10

Liu B, Yao K (2015) Uncertain multilevel programming: algorithm and applications. Comput Ind Eng 89:235–240

Parisio A, Jones CN (2015) A two-stage stochastic programming approach to employee scheduling in retail outlets with uncertain demand. Omega 53:97–103

Romeijnders W, Stougie L, Vlerk MHVD (2014) Approximation in two-stage stochastic integer programming. Surv Oper Res Manag Sci 19(1):17–33

Shapiro A, Dentcheva D (2014) Lectures on stochastic programming: mod- eling and theory, Siam

Sheng Y, Yao K (2014) Some formulas of variance of uncertain random variable. J Uncertain Anal Appl 2, Article 12

Wang Z, Guo J, Zheng M, Wang Y (2015) Uncertain multiobjective traveling salesman problem. Eur J Oper Res 241(2):478–489

Wolf C, Fabian CI, Koberstein A, Suhl L (2014) Applying oracles of on-demand accuracy in two-stage stochastic programming-a computational study. Eur J Oper Res 239(2):437–448

Zhang B, Peng J (2013) Uncertain programming model for uncertain optimal assignment problem. Appl Math Model 37(9):6458–6468

Zheng M, Yi Y, Wang Z, Liao T (2017a) Relations among efficient solutions in uncertain multiobjective programming. Fuzzy Optim Decis Mak, doi:10.1007/s10700-016-9252-x, to be published

Zheng M, Yi Y, Wang Z, Liao T (2016) Efficient solution concepts andtheir application in uncertain multiobjective programming. Appl SoftComputing, doi:10.1016/j.asoc.2016.07.021, to be published

Zheng M, Yi Y, Wang Z, Chen JF (2017b) Study on two-stage uncertain programming based on uncertainty theory. J Intell Manuf 28(3):633–642

Acknowledgements

The author gratefully acknowledges the financial support provided by State Key Laboratory Development Program of China (Grant No. 9140C890302) and National Natural Science Foundation of China (Grant Nos.61502523, 61502521).

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

The authors declare that they have no conflict of interest.

Ethical approval

This article does not contain any studies with human participants or animals performed by any of the authors. This work was carried out in collaboration between all authors. All authors read and approved the final manuscript.

Additional information

Communicated by Y. Ni.

Rights and permissions

About this article

Cite this article

Zheng, M., Yi, Y., Wang, X. et al. The information value and the uncertainties in two-stage uncertain programming with recourse. Soft Comput 22, 5791–5801 (2018). https://doi.org/10.1007/s00500-017-2662-z

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00500-017-2662-z