Abstract

Due to a wide variety of real-world constraints, proper project portfolio selection is a critical issue for project-oriented organizations. In this paper, a bi-objective stochastic mixed-integer linear programming model is developed to cope with the project selection and scheduling problem in the presence of greenhouse gas emissions, and non-hazardous/hazardous wastes regulatory restrictions. Moreover, reinvesting proceeds of projects as well as loans are allowed to finance projects over the planning horizon. The proposed model maximizes the net present value of the expected project portfolio's terminal wealth under uncertain conditions, as well as the sustainability score of the project portfolio, simultaneously. The sustainability score is calculated by one of the recent multi-criteria decision-making methods, SECA, based on seven qualitative sustainability indicators and by solving a non-linear optimization model. To assess the performance of the proposed model, a case study of eighteen industrial projects is applied. Since the duration of industrial projects is usually uncertain, the proposed model is reformulated as a scenario-based stochastic programming model. Furthermore, the CPLEX solver and Branch and Benders algorithm are used to solve the problem. Results show that the Branch and Benders algorithm is much more efficient than the CPLEX solver. Results show that increasing the carbon and landfill tax rates is not always an appropriate decision made by policymakers to control various types of emissions. Such decisions may not only make the projects less attractive for investment but also, do not significantly reduce the negative environmental effects, which decreases sustainability in both economic and environmental dimensions. This highlights the importance of considering each problem’s attitudes for setting regulations where copying does not always create the same solutions for sustainability issues.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Due to the existing competitive environment in the real world, the issue of correct project selection is an important strategic problem that companies have to deal with (Ghorbani and Rabbani 2009; Rabbani et al. 2010). This problem is related to selecting the most appropriate set of projects among available ones which are aligned with the company’s strategies. Mostly, Regarding the existing limitations of available resources, time, workforce, budget constraints, and several other limitations of the real world, it is not possible for companies to select all the available projects. Hence, companies try to select a set of projects which address both these kinds of limitations and optimality in gaining profit (Carazo et al. 2010; Rezahosseini et al. 2020).

One of the important requirements for having proper project selection and scheduling is to identify and assess influential qualitative and quantitative factors which should be indicated by experts (Mohanty et al. 2005). Hence, different important qualitative and quantitative measures are considered in this paper. Among them, sustainability measures are important to be considered. Sustainable development emphasizes the necessity of the environment and the preservation of natural resources while considering economic and social development. Because of the influence that sustainability can have on project success and project management, it should be taken into consideration (Martens and Carvalho 2016) in the process of project selection. In this regard, organizations concentrate on both the set of financial and non-financial criteria and try to balance all of them (Khalili-Damghani and Sadi-Nezhad 2013).

As company’s economic growth makes the company’s position in the market better, the only dimension that is emphasized by many companies is the economic dimension (Dasović and Klansek 2022). But, the truth is that all three dimensions of sustainable development are important. Over the last decades, several international environmental policies, legislation, regulations, and directives have been applied to deal with sustainability-related challenges (European Union, 2023). These efforts in 2000 resulted in the introduction of the Millennium Development Goals (MDGs). Since the deadline for this document was 2015, the Sustainable Development Goals (SDGs) were introduced at the United Nations Conference in Rio de Janeiro in 2012 and initiated in 2015.

Global Warming and Climate Change resulting from human and industrial activities is one of the major environmental problems which have attracted the attention of many governments all over the world over the last two decades. Since human intervention and excessive exploitation of natural resources have disturbed the ecosystem, it is necessary for all countries to apply sustainable development in setting rules and strategies. Accordingly, in this research, selected relevant targets and indicators of SDGs 12 and 13 are considered which are expected to be influenced significantly by the available projects. Table 1 depicts the targets of SDGs 12 and 13 and their relevant indicators based on the global indicator framework for the SDGs and targets of the 2030 Agenda for Sustainable Development (United Nations 2017).

Industrial activities have a big negative impact on the environment. In fact, it has been stated that factories are responsible for as much as 2/3 of the pollution which leads to the climate change. Although the governments have taken different actions to reduce the amount of pollution which is produced by factories, what has already been done is not enough and lots of other changes must be happened (field.org.uk, 2018). Carbon pricing policies are defined to deal with the pollution resulting from human activities and accordingly effectively reduce Green House Gas (GHG) emissions. Carbon pricing policies are categorized into three main methods, including the Carbon Tax Policy (CTP), Emission Trading System (ETS), and carbon offset policy (COP). In the CTP, a specified rate is applied to penalize GHG emissions. This may encourage polluters to produce less pollution and hence, pay less amount of carbon tax. In an ETS—also known as cap and trade—a prespecified initial emission allowance (the cap) is determined for each ton of GHG emitted, and entities covered by the ETS are legally obliged to keep their emitted gas below this allowance. According to the capability of trading these allowances, if the gas emission exceeds the determined level, the entities must purchase an additional allowance from the market. On the contrary, if the emission level stays below the allowance level, selling an extra amount is possible (United Nations, nd). What makes the COP different from the CTP is that in COP a specified level of emission is determined, and any emission produced beyond this predefined target is penalized (Malladi and Sowlati 2020; Haites 2018). In this paper, the CTP is used in a way that the GHG footprint of each project, is cited in terms of \(kg\) \({CO}_{2}eq,\) and projects are penalized due to the amount of released pollution.

In addition to global warming, worldwide waste generation has increased massively in recent decades (Statista, nd) and is increasing faster than any other environmental pollutant. This arises from the development of human and industrial activities. Hence, providing adequate waste treatment and disposal services is a vital issue. To help decrease the effect of waste generation, different governments have enacted laws to manage landfills. For example, Her Majesty’s Revenue and Customs (HMRC), determined two types of rates for landfill tax (Fletcher et al. 2018):

-

Inert (inactive) waste: non-hazardous waste with a low GHG emission potential

-

Active waste: Any waste that is not classified as inert one, will be categorized as active waste, and is liable for the standard tax rate.

Accordingly, in this paper, waste generated by each project is categorized as inert or active waste and penalized according to the amount and type of waste.

Various research was conducted in the scope of project selection and scheduling while focusing on the different dimensions of sustainable development. Tabrizi (2018) considered the concept of sustainability in material ordering by presenting a bi-objective optimization model with the aim of minimization of costs and environmental impacts. They used NSGA-II and Migrating Birds Optimization (MBO) algorithms to solve the problem. In another paper, Ma et al. (2020) presented a fuzzy model to rank projects considering three pillars of sustainability. Their study calculated the environmental score of the projects by SimaPro software. In addition, the social scoring was based on the historical data of projects of the same nature. Also, the economic benchmark of projects was considered as the net present value of the project cash flows.

In some research in the scope of Project Portfolio Selection and Scheduling (PPSS), the concept of sustainability is used for ranking suppliers. For example, Habibi et al. (2019) proposed an optimization model for the simultaneous scheduling of projects and material ordering considering social and environmental competencies for selecting suppliers using the fuzzy Analytical Hierarchy Process (AHP). RezaHosseini et al. (2020) proposed a multi-objective optimization model to cope with the project selection and scheduling problem, maximizing the project portfolio profit and the project portfolio sustainability while minimizing the number of periods of interruption in the execution of projects. In this regard, they used the Analytic Network Process (ANP), VIKOR, and UTASTAR methods to calculate the sustainability utility function of the project portfolio. Another research dealing with sustainability in project scheduling is Askarifard et al. (2021), in which, a four-objective optimization model was proposed to minimize the cost resulting from the delay occurred in activities, risk, and environmental and social impacts caused by the project.

In real projects, the proximity of the parameters used in the selection and scheduling models is under the condition of uncertainty. The most common approaches to address the uncertainty of parameters used in such models are Fuzzy, Stochastic programming, and Robust optimization. Intending to deal with uncertainty, Robust Optimization is a completely appropriate approach when it comes to speaking about the project scheduling problem (Nabipoor Afruzi et al. 2020). Generally, Robust programming is applied in various project selection and scheduling optimization models. Chakrabortty et al. (2016) proposed an optimization model in which the activity durations were represented by random variables with different probability distribution functions. They used a robust optimization approach to obtain reasonably good solutions under any likely input data scenario. Moreover, Nabipoor Afruzi et al. (2020) applied a two-stage robust optimization model to multi-project scheduling under uncertain durations of activities to overcome some shortcomings in the previous models. In addition, Baluka and Cohen (2019) proposed a robust optimization model to cope with the project scheduling problem, assuming that the duration of projects is non-deterministic. Askarifard et al. (2021) used the robust optimization approach proposed by Bertsimas and Sim (2003) to address the uncertainty of cost resulting from the delay occurred in activities, risk, and environmental and social impacts caused by the project. Salehi and Jabarpour (2021) presented a multi-objective fuzzy mathematical model to cope with the project scheduling problem with the limitations of multi-skilled resources. Their proposed model assumed that changing skill levels and recruitment of skills are allowed. In addition, several papers cope with the project scheduling problem by assuming some parameters of the problem to be stochastic. For example, Choi et al. (2004) used a discrete-time Markov chain and dynamic programming to address the uncertainties of durations/costs of tasks, as well as uncertainties in success/ failure of projects in an RCPSP setting. Rafiee et al. (2014) proposed a multi-stage stochastic optimization model for multi-period project selection and scheduling problem.

Also, Pourahmadi et al. (2015) proposed a scenario-based mathematical model for project portfolio selection with stochastic parameters. Their proposed model maximizes the net present value of the project portfolio, and minimizes the positive deviations from the allocation of resources, simultaneously. Golpîra (2016) proposed a mathematical model for multi-phase project scheduling based on goal programming and scenario-based stochastic optimization formulation. In addition to the above-mentioned aspects, considering borrowing strategies is of great importance and can play a significant role in supporting projects’ costs. In this regard, Martins (2017) suggested a model for scheduling project activities considering the project finance issue via loans. This is of great importance in today’s economic environment.

This paper presents a novel scenario-based bi-objective stochastic programming model to cope with the project selection and scheduling problem in the presence of greenhouse gas emissions and non-hazardous and hazardous waste regulatory restrictions. The proposed mathematical model simultaneously maximizes the net present value of the expected cash available at the end of the planning horizon and the sustainability score of the selected portfolio of projects. This helps project manager(s) to provide sustainable schedules which are of particular importance (Dasović et al., 2022). In this regard, the sustainability score of projects is calculated by one of the multi-criteria decision-making methods entitled “SECA” (Keshavarz-Ghorabaee et al., 2018), based on seven qualitative sustainability indicators and solving a non-linear mathematical programming model. Moreover, the project finance issue via loans and reinvestments of project proceeds are considered in the proposed model. To assess the performance of the proposed model, a case study including eighteen industrial projects is applied. To solve the proposed model, the Branch and Benders algorithm (Klotz 2017) is used. All the above-mentioned issues distinguish this research from other studies in the literature. Table 2 depicts some papers in the field of project selection and scheduling problems. Table 2 illustrates the main previous studies in the project selection and scheduling area, and provides a foundation to compare them to identify research gaps and show the novelty of the proposed model.

The novel aspects of the study are as follows:

-

Taking advantages of scenario-based stochastic programing to deal with the project selection and scheduling problem under uncertainty

-

Considering the project cash flows, financing projects via loans and the reinvestment of the excess cash flow at any time period

-

Considering the impacts of greenhouse gas emissions as well as non-hazardous and hazardous waste regulatory restrictions

-

Using Branch and Benders algorithm to solve the proposed model

The rest of this paper is organized as follows. In Sect. 2, the problem description, the proposed mathematical model, and a description of the SECA method are provided. In Sect. 3, an illustrative numerical example is used to demonstrate the applicability of the proposed model. Section 4 provides detailed numerical results and analyses. Finally, Sect. 5 concludes the paper.

2 Problem description and mathematical formulation

2.1 Problem description

In this section, first, a bi-objective stochastic mixed-integer linear program is presented to deal with the resource-constrained project selection and scheduling problem (RCPSSP) considering regulatory restrictions such as carbon tax and landfill tax. Waste produced by available projects is categorized into two types: (1) waste sold for recycling by third parties, and (2) waste sent to landfills, where type (2) is categorized as inert and active waste. Also, some loans are considered to be available to finance projects, and the proceeds of projects are allowed to be reinvested in the next periods. The proposed model maximizes the terminal wealth as well as the sustainability score of the portfolio of projects.

2.1.1 Assumptions

The assumptions of the proposed mathematical model are as follows:

-

Each project has two phases including the construction and operation phases, measured in months.

-

The duration of construction and execution phases of projects are assumed to be stochastic.

-

A specified initial outlay is needed to start the construction phase of each project.

-

The implementation cost of each project is uniformly charged during the construction phase.

-

Each project is assumed to have a gross cash flow, depreciation cost, and revenue gained from selling waste during the operation phase.

-

All projects are considered to be independent.

-

Interruption is not allowed during performing projects.

-

All the selected projects must be accomplished within a fixed, prespecified planning horizon.

-

Reinvestment of proceeds is allowed with a constant, prespecified interest rate.

-

The salvage value of each project may be received in the last month of the operation phase.

-

For each project, landfill tax, income tax, and carbon tax are paid in the last month of each year of the operation phase.

-

Based on the type of landfills, an initial landfill tax rate (measured in terms of \(million Rials/ton\)) is determined for the first year of the time horizon for both hazardous and non-hazardous wastes.

-

The landfill tax rate will be increased annually for both hazardous and non-hazardous wastes with fixed rates of \(pSr\) and \(pLr\), respectively.

-

An initial carbon tax rate (measured in terms of \(million Rials/t{CO}_{2}eq\)) is determined for the first year of the time horizon and will be increased annually with a fixed rate of \(pe\).

-

Project finance via different types of loans is allowed.

-

Loans can be taken for each project at the start time of the construction phase.

-

The repayment of loans is assumed to be at the start time of the operation phase or later on.

Figure 1 shows the cash inflows and outflows for an arbitrary project \(i\) schematically.

As mentioned above, in this paper, a two-stage scenario-based stochastic program is developed to deal with the sustainable resource-constrained project selection and scheduling problem under uncertainty. In the two-stage stochastic programming approach, the decision-maker makes an initial decision in the first stage. Then, a stochastic event occurs that affects the performance of the first-stage decisions. In the second stage, other decisions are made to offset the potential adverse effects of the first-stage decisions. The uncertain parameters (the duration of construction and operation phases of projects) are represented by a set of scenarios with prespecified probabilities. In this paper, the decisions related to selecting a portfolio of projects are made in the first stage, while the decisions related to the scheduling of projects are made in the second stage. The second stage may be affected by the economic situation of the country and banks, the internal situation of the company, etc. (Kim et. Al., 2022).

2.1.2 Notations

The notations used to formulate the stochastic programming model are as follows.

Indices | |

|---|---|

\(i=1\text{,}\dots \text{,} N\) | Indices of available projects |

\(t=0\text{,}\dots \text{,} T\) | Indices of monthly periods |

\(y=1\text{,}\dots \text{,} \, Y\) | Indices of yearly periods |

\(k=1\text{,}\dots \text{,} K\) | Indices of inert waste |

\(h=1\text{,}\dots \text{,} H\) | Indices of active waste |

\(a=1\text{,}\dots \text{,} A\) | Indices of waste that can be sold |

\(l=1 \text{,}\dots \text{,} L\) | Indices of loans |

\(s=1 \text{,}\dots \text{,}\mathrm{ S}\) | Indices of scenarios |

Parameters | |

\({r}^{1}\) | Discount rate \((\%)\) |

\({r}^{2}\) | Reinvestment rate \((\%)\) |

\({r}^{3}\) | Interest rate of loans \((\%)\) |

\({r}^{re}\) | Income tax rate \((\%)\) |

\({r}^{e}\) | Carbon tax rate \((million Rials/ton{CO}_{2} eq)\) |

\({r}_{ia}^{w}\) | Selling price of waste a, produced by project \(i (million Rials/ton)\) |

\(Lr\) | Landfill tax rate for each ton of inert waste \((million Rials/ton)\) |

\(Sr\) | Landfill tax rate for each ton of active waste \((million Rials/ton)\) |

\(pLr\) | Percentage of increase in \(Lr\) |

\(pSr\) | Percentage of increase in \(Sr\) |

\(pe\) | Percentage of increase in \({r}^{e}\) |

\({\partial }_{ik}^{1}\) | Amount of inert waste \(k\), produced by project \(i\) in each period of its execution phase |

\({\partial }_{ih}^{2}\) | Amount of active waste \(h\), produced by project \(i\) in each period of its execution phase |

\({\partial }_{ia}^{3}\) | Amount of salable waste \(a\), produced by project \(i\) in each period of its execution phase |

\({\gamma }_{i}\) | Amount of emission in terms of \(tons of {CO}_{2} eq\), produced by project \(i\) in each period of its execution phase |

\({d}_{is}^{1}\) | Duration of the construction phase of project \(i\), under scenario \(s\) |

\({d}_{is}^{2}\) | Duration of the execution phase of project \(i\), under scenario \(s\) |

\({Cf}_{i}\) | Net cash inflow of project \(i\), in each period of its execution phase |

\({C}_{i}\) | Cost of project \(i\), in each period of its construction phase |

\({SV}_{i}\) | Salvage value of project \(i\) |

\({De}_{i}\) | Depreciation cost of project \(i\), in each period of its execution phase |

\({IO}_{i}\) | Initial outlay needed to start the construction phase of project \(i\) |

\(B\) | Initially available budget |

\({D}_{l}\) | Available amount of loans for each project |

\({Q}_{il}\) | Repayment duration for each loan |

\({\Psi }_{l}\) | Number of periods after the construction phase of each project until which repayment of the related loans can be postponed |

\({SP}_{i}\) | Sustainability score of project \(i\), obtained by the SECA method |

\({p}_{s}\) | The probability of scenario s |

\(TT\) | Length of horizon time |

Auxiliary Variables | |

\({ST}_{is}\) | Start time of project \(i\), under scenario \(s\) |

\({FN}_{is}\) | Finish time of project \(i\), under scenario \(s\) |

\({R}_{ts}\) | Total net cash inflow received in period \(t\), under scenario \(s\) |

\({EX}_{ts}\) | Total cost in period \(t\), under scenario \(s\) |

\({E}_{ts}\) | Surplus money in period \(t\) reinvested in period \(t+1\), under scenario \(s\) |

\({DC}_{its}\) | Depreciation cost of project \(i\) in period \(t\), under scenario \(s\) |

\({\tau }_{iys}^{re}\) | Income tax paid by project \(i\) in year \(y\), under scenario \(s\) |

\({\tau }_{ys}^{e}\) | Total carbon tax paid in year \(y\), under scenario \(s\) |

\({\tau }_{ys}^{w}\) | Total landfill tax paid in year \(y\), under scenario \(s\) |

\({TM}_{its}\) | Total amount of the principal of loans repaid for project \(i\) in period \(t\), under scenario \(s\) |

\({TI}_{its}\) | Total amount of the interest of loans paid for project \(i\) in period \(t\), under scenario \(s\) |

Decision Variables | |

\({X}_{its}\) | Equals 1 if project \(i\) is started at period \(t\), under scenario \(s\), 0 otherwise |

\({m}_{i}\) | Equals 1 if project \(i\) is selected, 0 otherwise |

\({B}{\prime}\) | Total allocated budget |

\({F}_{ilts}\) | Amount of loan \(l\), taken for project \(i\), in period \(t\), under scenario \(s\) |

2.1.3 Mathematical formulation

The formulation of the developed two-stage stochastic mixed-integer linear program is as follows.

Eqution (1) shows the first objective function, which maximizes the expected net present value of the terminal wealth at the last period of the planning horizon while subtracting from the available budjet at \(t=0\). Equation (2) illustrates the second objective function, which maximizes the sustainability score of the selected portfolio of projects. Equation (3) calculates the principal amount of the loans repaid for Equationroject \(i\), in period \(t,\) under scenario \(s\). Equation (4) calculates the interest amount of the loans repaid by project \(i\), in period \(t,\) and under scenario \(s\). In each period, different projects with specific cash flows can be running. Therefore, the net cash flow created in each period will be the result of the performance of the projects that are being implemented in that period. In this regard, Eq. (5) calculates the total cash inflow obtained by implementing projects in period \(t\), under scenario \(s\). Equation (6) ensures that if a project is selected under scenario \(s\), its start time will be unique. Equation (7) specifies the start time of project \(i\). The completion time of a project is determined based on its start time and its construction and execution durations. In this regard, Eq. (8) specifies the finish time of project \(i\). Equation (9) ensures that the finish time of project \(i\), under scenario \(s\), will be before the end of the planning horizon (\(T\)). Equation (10) calculates the total amount of carbon tax paid in year \(y\), under scenario \(s\) which depends on the projects that are running in year \(y\). Equation (11) calculates the cost of implementing selected projects in period \(t\), under scenario \(s\). This also depends on the projects that are running in period \(t\). Equation (12) balances the cash inflows and outflows for \(t=0\), under scenario \(s\). Equation (13) balances the cash inflows and outflows of all periods except \(t=0\) and multiples of twelve (last month of each year) under each scenario \(s\). Equation (14) balances the cash inflows and outflows of the last month of each year under scenario \(s\). In the balancing constraints, the most important parts of cash inflows include those provided from the money invested in the previous period, received loans, projects’ income, sale of assets and salable waste. Moreover, the important parts of cash outflows include those provided from implementing projects, depreciation of fixed assets, the payment of loan principal and interest, and various types of tax. Equation (15) calculates the depreciation cost of project \(i\), in period \(t\) and under scenario \(s\). Equation (16) calculates the amount of tax paid for the disposal of unusable waste in year \(y\), under scenario \(s\). Equation (17) calculates the amount of revenue tax paid for project \(i\), in year \(y,\) under scenario \(s\). Equation (18) indicates that the amount of loan type \(l\), taken by project \(i\), in period \(t,\) under scenario \(s\) must be less than \({D}_{l}\). Equation (19) ensures that only selected projects can be scheduled. Equation (20) ensures that the amount invested at \(t=0\), should be less than or equal to the available budget at \(t=0\).

Equations (21), (22), and (23) notify the nonnegative and binary variables.

3 Methodology

Figure 2 shows a schematic representation of the steps of the proposed approach to select and schedule a set of projects.

3.1 Steps of SECA method

Before implementing the proposed approach, a brief description of the SECA approach should be provided. Regarding the proposed model, there is a need to calculate the value of the parameter \({SP}_{i}\) (the sustainability score of project \(i\)) as the main parameter of the second objective function. In this regard, one of the new multi-criteria decision making methods called SECA is used. The Simultaneous Evaluation of Criteria and Alternatives (SECA) proposed by Keshavarz-Ghorabaee et al. (2018), uses a multi-objective non-linear program to simultaneously evaluate the weights of criteria and the rank the alternatives. The non-linear program has three objective functions: (1) maximizing the overall performance of each alternative, (2) minimizing the deviation of criterion weights from the reference point based on the between-criterion variation information which is defined by the correlation measure, and (3) minimizing the deviation of criterion weights from the reference point based on the within-criterion variation information by calculating the standard deviation. The steps of the SECA method are as follows:

Step 1 Construction of decision matrix \(X\) with \(n\) alternatives and \(m\) criteria as follows, where \(i\) is the index of alternatives, \(i\in \left\{1\text{,}\dots \text{,} n\right\}\), and \(j\) is the index of criterion, \(j\in \left\{1\text{,}\dots \text{,} m\right\}\), and \({x}_{ij}\) denotes the performance of alternative \(i\) in terms of criterion \(j\).

Step 2 Formation of the normalized decision-making matrix, where \(BC\) and \(NC\) are the sets of beneficial and non-beneficial criteria, respectively.

Step 3 Calculation of the standard deviation and degree of conflict. The standard deviation of the elements of each vector \(({\sigma }_{j})\) is the within-criterion variation information. Also, to capture the between-criterion variation information from the decision matrix, the correlation between each pair of vectors of criteria is calculated, where, \({r}_{jl}\) denotes the correlation between \({j}^{th}\) and \({i}^{th}\) vectors (\(j\) and\(i\in \{1, 2, . . . , m\}\)). Then, the degree of conflict between \({j}^{th}\) criterion and the other criteria (\({\pi }_{j}\)) is calculated as follows.

Step 4 Calculation of the normalized standard deviation and degree of conflict.

Step 5 Using the following multi-objective non-linear program to rank alternatives.

3.2 LP-metric method

The LP-metric method is one of the popular methods for multi-objective optimization. In this method, the \(p\) norm of relative deviations of the objective functions from their optimal values are minimized, \(p\in \left\{\mathrm{1,2},\dots ,\infty \right\}\). For a mathematical model with two maximization objectives, the objective function of the LP-metric method is defined as follows.

Accordingly, the LP-metric objective function of the proposed model with \(p = 1\) is as follows.

3.3 Branch and Benders method

The Branch and Benders algorithm (Laporte et al. 2002 and Codato and Fischetti 2006) is a combination of the Branch and Cut and the classic Benders algorithms. In the Branch and Cut process, the master problem is solved once. In each node, in addition to the cut that is applied on the integer variables based on the Branch and Bound algorithm, the sub-problem is also solved and the feasibility and optimality cuts are added as additional cuts to the Branch and Cut algorithm, and the linear relaxed master-problem is solved.

The Branch and Benders algorithm outperforms the classical Benders decomposition algorithm in terms of solution time. This is due to the fact that in the classical Benders process, the mixed-integer model of the master problem is solved in each iteration. However, in the Branch and Benders algorithm, this problem is solved only once. Three types of strategies can be selected to solve the model in the Branch and Benders algorithm (IBM 2017):

-

BendersStrategy 1: The decision-maker decides to specify the position of the variables in the main problem or sub-problem with the BendersPartition command.

-

BendersStrategy 2: Firstly, the model is broken down based on user preferences. In the next step, it tries to divide the sub-problem into several separate sub-problems and solve the model.

-

BendersStrategy 3: All integer variables are in the main problem and the rest are in the sub-problem.

4 Computational results

4.1 Base scenario

In order to solve the presented model, a set of 18 real projects is used. Projects \(1-6\) produce ferrosilicon 75%, projects \(7-12\) produce magnesium, and projects \(13-18\) produce thin slabs. The amounts of emission produced by each ton of ferrosilicon75%, magnesium, and thin slab, were estimated based on Haque and Norgate (2013), Ramakrishnan and Koltun (2004), and Juntueng et al. (2012). These projects are available to be selected and scheduled within 240 periods \((T=240)\). Tables 3 and 4 show the required information about the available projects. The duration information in Table 4 is related to a single scenario (called the base scenario). The information about the parameters related to waste was extracted from experts’ opinions. Three experts have been asked to assign values to the parameters. These experts have experience of working in the fields of manufacturing, mechanical and materials engineering for more than 10 years. All numerical results were obtained using a core i5-6200U 2.3 GHz, 4GB DDR4 Memory and 500 GB HDD operating system.

Values of other parameters that do not depend on projects are presented in Table 5.

4.2 SECA output

Before solving the presented model, the sustainability score (\({SP}_{i}\)) of each project should be calculated. To this end, seven criteria were derived from the SDG Indicator Framework of the United Nations (United Nations 2017). These criteria are as follows:

-

Criteria 1: Deprivation level in the area where the project is to be constructed (based on SDG 1)

-

Criteria 2: Number of R&D personnel required according to the project nature and the annual production capacity (based on Goal 9–5)

-

Criteria 3: Considering the nature of the product produced by the project and its location, and the potential for the use of renewable energy in the production process of each ton of product (based on Goal 7–2)

-

Criteria 4: The amount of raw materials used to produce each ton of product that is supplied from domestic suppliers (based on Goal 8–4)

-

Criteria 5: The number of people that will be employed as a result of the project implementation (based on Goal 9–2)

-

Criteria 6: The amount of polluting water produced and its negative effect on the environment, during the production of each ton of product in each project (based on Goal 6–3)

-

Criteria 7: The effect of construction and operation of the project on the aquatic ecosystems (based on Goal 6–6).

Table 6 presents the decision matrix for eighteen projects according to the seven above-mentioned evaluation criteria. Criteria of the degree of deprivation, amount of producing polluting water, and negative effect on the aquatic ecosystem are negative criteria \((NC)\), while four other ones are positive criteria \((PC)\).

Using the SECA model presented in Sect. 2.2, the standard deviation and degree of conflict, related to each criterion are presented in Tables 7 and 8.

As mentioned in the previous section, a non-linear mathematical model should be solved to obtain the weights of the evaluation criteria as well as the sustainability scores of the projects. Using GAMS software (version 2.1.25) and Baron solver, this model was solved. To determine the appropriate value of \(\beta\), the mathematical model was solved eight times considering different values from one to eight for \(\beta\). The value change continues until the ranking of the seven criteria weights follows an almost constant trend. Table 9 shows the weight of each criterion in eight iterations. As shown in Table 9, ranking seven criteria based on their weight has a steady trend from \(\beta =5\) onwards. Thus, the ranking of criteria in the descending trend is \(5, 7, 6, 2, 3, 1,\) and \(4\). Figure 3 shows the weight of the seven evaluation criteria based on different values of \(\beta\).

According to Table 10 and Fig. 4, the ranking of projects in terms of the value of the sustainability score, from \(\beta =3\) onwards follows an almost steady trend and from \(\beta = 6\) onwards follows a completely steady trend. Hence, \(\beta =6\) is selected to obtain the SECA model output (the highlighted column in Table 10).

4.3 Solving the proposed stochastic programming model

In this paper, for the scenario-based stochastic programming model, three scenarios (pessimistic, most probable and optimistic) are considered to determine values of \({d}_{is}^{1}\) and \({d}_{is}^{2}\). In pessimistic and optimistic scenarios, \({d}_{is}^{1}\) and \({d}_{is}^{2}\) are two months greater and less than their values in the most probable scenario, respectively. These values are shown in Table 11.

There are different policies for determining the carbon tax rate. In some countries, for example, carbon tax rates increase at a certain annual rate. Accordingly, to solve the model for the base scenario, a specific rate is set for the first year of the planning horizon and will be increased by five percent annually. Using the information in Tables 3, 4, 5, 10 and 11 and assuming a weight of \(0.5\) for both objective functions in the LP-metric method, the proposed model is solved to optimality by the Branch and Benders algorithm within \(654.259\) seconds. Since CPLEX solver in GAMS software supports Branch and Benders algorithm, Using GAMS software (version 25.2.1) and CPLEX solver, this algorithm was applied to solve the model. The CPU time for solving the model was \(5838.8384\) seconds, implying the high efficiency of the Branch and Benders algorithm. The economic objective function was equal to \(\mathrm{60,723,370}\) \(million Rials\), and the sustainability objective function was equal to \(7.658\). Also, the project selection variables are \((\mathrm{1,1},\mathrm{1,1},\mathrm{0,0},\mathrm{1,1},\mathrm{1,1},\mathrm{1,1},\mathrm{0,0},\mathrm{0,0},\mathrm{1,1})\), i.e. projects \(5, 6, 13, 14, 15\), and \(16\) were not selected by the model. However, without considering the second objective function, which maximizes the sustainability score of the project portfolio, the status of project selection changes as \((\mathrm{1,1},\mathrm{1,1},\mathrm{0,0},\mathrm{1,1},\mathrm{1,1},\mathrm{1,1},\mathrm{0,0},\mathrm{1,0},\mathrm{0,1})\). Therefore, considering the economic and social dimensions, the mathematical model did not select project \(15\), while it adds project \(17\) to the portfolio of projects.

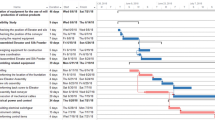

Table 12 shows the start and finish times of the selected projects, obtained by solving the bi-objective optimization model under all scenarios.

A comparison between solving the proposed optimization model with and without uncertain parameters shows that when uncertainty is considered, the economic objective function value is \(\mathrm{60,723,370}\) \(million Rials\), while without considering uncertainty, the economic objective function is equal to \(\mathrm{90,863,320}\) Million Rials. This shows the importance of implying uncertainty to the presented model.

To obtain the Value of Stochastic Solution (VSS) and Expected Value of Perfect Information (EVPI), first, Here and Now (HN), Wait and See (WS) and Expected Value (EEV) solutions are obtained. The relation among these three objective functions (in minimization problems) must be as follows:

Because both objective functions are of minimization type, they are multiplied by -1, and the model is solved by setting w = 0.8. In addition, for each case of model infeasibility, the result is recorded as ∞. The acquired result is shown in Table 13.

Generally, EVPI measures how much it is reasonable to pay to collect perfect information related to the future. In other words, it represents the loss of profit due to the presence of uncertainty. Moreover, VSS calculates the goodness of the expected solution value when the expected values are replaced by the random values for the input variables. In other words, it shows the value of knowing and also using distributions on future outcomes (Bridge and Louveaux 2004). The calculated values for VSS and EVPI are as follows:

Given that the obtained values for these two criteria are positive, the suitability of using the stochastic two-stage programming framework is confirmed. In addition, it is concluded that it is reasonable for investors to pay up to \(\mathrm{9,145,360} million rials\) to obtain perfect information about the future and the uncertain parameters.

In order to analyze and compare Branch and Benders, Augmented Epsilon Constraint (version 2), and CPLEX, two groups of small-sized and large-sized test problems are used. The parameters of the test problems are randomly generated by uniform distributions. It is noteworthy that the lower and upper bounds of the parameters, as inputs for the uniform distribution function, are determined in a way that projects remain profitable in all states. To reduce the impact of random data and errors on the results, eleven small-sized and five large-sized test problems are solved, and the mean of results is considered for each problem size. The values of the parameters for small- and large-sized test problems are shown in Tables 14 and 15.

In order to solve the proposed model by the Augmented Epsilon Constraint method (version 2), 13 grid points are defined. Due to the importance of the profitability of the selected projects from the investors’ point of view, the maximization of the net present value of terminal wealth is selected as the main objective function, and the other objective function, the maximization of the sustainability score of the selected projects, is considered as a constraint. Tables 16, 17 show the results obtained by solving small- and large-sized test problems, respectively. As Table 17 shows, in large-sized test problems, the mean CPU time for solving the test problems by Branch and Benders is remarkably less than that of the CPLEX solver. Since the time needed to solve the large-sized test problems by the augmented epsilon constraint (version 2) exceeds the reasonable time, just results obtained by using Branch and Benders and CPLEX are shown in Table 17.

Moreover, considering the fact that the second objective function of the model is discrete, despite determining \(12\) grid points for the augmented epsilon constraint (version 2), the number of points on the efficient frontier in some test problems is less than \(12\) and even equals two points. Figures 5, 6, 7, 8, 9 show all the Pareto fronts with more than three points. In each figure, it can be seen that each solution is efficient, and is not dominated by other solutions.

4.4 Sensitivity analysis

In order to assess how sensitive the model is to fluctuation in the environmental parameters, the single objective model with the economic objective function under uncertainty was considered. Considering the base real scenario, the following graphs show the changes in the amount of paid carbon tax, the amount of produced gas, the paid landfill tax, and the amount of landfill produced as a result of changing the base rate of the carbon tax and the lower landfill rate.

As shown in Fig. 10, increasing the carbon tax rate from \(-30\%\) to \(+30\%\) of the base value \((1.45 million Rials)\) leads to increase in production of gas and lessen portfolio terminal wealth. This makes an increase of \(\mathrm{5,418,000}\) \(tons\) in gas production. To this end, the best rate for policymakers with the aim of selecting a portfolio with less volume of the produced gas is the first point which is equal to \(1.015 million Rials\). As it is shown, when the carbon tax rate increases from \(1.16 to 1.305 million Rials\), projects \(16\) and \(17\) are removed and projects \(2, 3, 4,\) and \(15\) are added to the selected portfolio.

Figure 11 depicts the trend of the economic objective function value and the trend of the amount of paid carbon tax considering changing the carbon tax rate from -30% to + 30% of the base value (1.45) \(million Rials\). As can be seen, there is a relatively uniform change in each step of change. As depicted by Fig. 11, changing the carbon tax rate gives rise to a decrease in terminal wealth and to increase in paid carbon tax. Thus, the best point with the aim of producing less volume of the carbon tax is the carbon tax rate which is equal to 1.015 \(million Rials\).

As shown in Fig. 12, increasing the carbon tax rate from \(-30\%\) to \(+30\%\) of the base value \((1.45)\), resulted in decreasing in the produced landfill. The general trend of landfill production concerning the carbon tax rate is uniform, except when the carbon tax rate varies between \(1.16\) and \(1.305 million Rials\). Thus, according to Fig. 12, if policymakers want to arise a carbon tax to prevent the volume of the landfill, the rate of \(1.305\) is the best choice. Because with a rate larger than \(1.305 million Rials\), there is no change in the volume of landfill and on the other hand the attractiveness of the portfolio is diminishing dramatically.

As illustrated by Fig. 13, except for changing the rate from \(1.16\) to \(1.305 million Rial\) s per ton of \({CO}_{2}eq\), the amount of paid landfill tax will remain steady. This is because by changing the rate from \(1.16\) to \(1.305\) \(million Rial\) s per ton of \({CO}_{2}eq\), projects \(16\) and \(17\) are removed and project \(15\) is added to the portfolio. As said before, due to the dramatic decrease in the economic objective function after the rate of \(1.305\) and the steadiness of the amount of landfill tax, the rate of \(1.305\) is the best choice for policymakers.

As shown in Fig. 14, increasing lower landfill rate from \(1.05\) to \(1.2\) \(million Rial\) s, resulted in increasing gas production significantly. Again, changing the lower landfill rate from \(1.35\) to \(1.45\) \(million Rial\) s, leads to a significant decrease and a selection of the portfolio as same as the one in rate \(1.05\). According to Fig. 14, the best rate is \(1.05\). Because increasing this rate lessens the portfolio attractiveness.

As depicted in Fig. 15, changing the lower rate from \(-30\%\) to \(+30\%\) of the base amount of the lower rate makes no change in the selected project and the slight decrease in objective function comes from the change in the schedule with no change in selected portfolio. This also makes the amount of carbon tax to be remained steady. Hence \(1.05\) \(million Rial\) s is the best rate to choose.

According to Fig. 16, increasing the lower rate from \(-30\%\) to \(+30\%\) of the base amount is not a good policy for decreasing the production of landfill. And this just leads to having a negative effect on the terminal wealth of the project. Thus, the first point which is equal to \(1.05\) \(million Rial\) s is the best choice.

As shown in Fig. 17, an increase in the lower rate makes a significant increase in paid landfill tax but a decrease in the objective function. Hence, \(1.05\) \(million Rial\) s is recommended.

From a practical point of view, this paper seeks to provide an optimization model that helps project managers as well as research and development managers in the selection and implementation of large industrial projects that have important financial and environmental impacts. In other words, the presented model not only helps to create optimal cash flows and maximize the obtained profits, but also provides conditions that help to create less environmental problems. Therefore, it is clear that such an approach can be of special practical implication in today's world especially for the project-based organizations. Some managerial insights provided based on the numerical analyses conducted in this paper are as follows:

-

Setting higher tax rates for penalizing carbon/landfill production is not always an appropriate solution for decreasing the environmental side effects of industrial projects. Instead, setting a threshold for the maximum allowed amount of carbon/landfill production may be a better policy.

-

Changing the carbon tax rate can be effective in reducing the volume of landfill produced by the selected projects.

-

It is expected that increasing the lower rate is likely to reduce the amount of landfill produced. However, results show that increasing this rate leads to selecting a portfolio of projects with much more amount of landfill produced and less economic attractiveness.

5 Conclusion

In this paper, a bi-objective stochastic mixed-integer linear programming model was developed to cope with the project selection and scheduling problem in the presence of greenhouse gas emissions and non-hazardous and hazardous wastes regulatory restrictions. The proposed model aimed at maximizing the net present value of the expected project portfolio's terminal wealth under uncertain conditions, as well as the sustainability score of the project portfolio, obtained by using the SECA method, simultaneously. Furthermore, reinvesting proceeds of projects as well as loans were allowed to finance projects over the planning horizon.

The construction and operation phases belonging to the projects were considered to be uncertain. Hence, in accordance with the two-stage stochastic programming framework, the duration parameters were defined with discrete scenarios. Moreover, a case study of eighteen industrial projects was applied to assess the performance of the proposed model. Furthermore, CPLEX solver (using LP-Metric method), Augmented Epsilon Constraint (version 2), and Branch and Benders methods were used to solve the test problems. Numerical results showed that the Branch and Benders algorithm is much more efficient than the CPLEX solver. This efficiency with respect to CPU time is noticeable, especially for large-sized test problems. In addition, two important measures namely the value of stochastic solution (VSS) and expected value of perfect information (EVPI) were calculated to show the applicability of using the two-stage stochastic programming framework to deal with the problem under consideration.

Finally, a thorough sensitivity analysis was performed to analyze the objective values concerning changing parameters of the problem, especially carbon tax and landfill lower rates. Results showed that increasing the carbon and landfill tax rates is not always an appropriate decision made by policymakers to control various types of emissions. In other words, in some cases, increasing the carbon and landfill tax rates, does not significantly reduce the negative environmental effects, while making the projects less attractive for investment. This highlights the importance of coping with the problem under consideration for managers, legislators, and policymakers.

One of the limitations of the current research was the ambiguity in domestic environmental laws. To overcome this problem, the authors have used international environmental laws, which are more comprehensive, in their research. Another important challenge in this research was that the project implementation time estimation may be subject to significant errors. In this paper, the authors have tried to overcome this important problem by using the scenario-based stochastic programming approach.

Some extensions of this paper as future research might be of interest. Considering that the implementation of such projects can have an important impact on the local context of the regions, it can be useful to consider social factors in future studies. Incorporating inflation as a key economic parameter in the proposed model can also be a matter of attraction for future research. Moreover, projects can be represented and scheduled in terms of activities. Furthermore, using the parallel solving mode for solving large-sized problems as well as using other solution approaches might be matters of great interest.

References

Askarifard M, Abbasianjahromi H, Sepehri M, Zeighami E (2021) A robust multi-objective optimization model for project scheduling considering risk and sustainable development criteria. Environ Dev Sustain 23:11494–11524. https://doi.org/10.1007/s10668-020-01123-z

Balouka N, Cohen I (2021) A robust optimization approach for the multi-mode resource-constrained project scheduling problem. Eur J Oper Res 291(2):457–470. https://doi.org/10.1016/j.ejor.2019.09.052

Bertsimas D, Sim M (2003) Robust discrete optimization and network flows. Math Program 98(1–3):49–71. https://doi.org/10.1007/s10107-003-0396-4

Bridge JR, Louveaux F (2004) Introduction to Stochastic Programming. Springer, New York

Carazo AF, Gomez T, Molina J, Hernandez-Díaz AG, Guerrero FM, Caballero R (2010) Solving a comprehensive model for multiobjective project portfolio selection. Comput Oper Res 37(4):630–639. https://doi.org/10.1016/j.cor.2009.06.012

Chakrabortty RK, Sarker RA, Essam DL (2016) Multi-mode resource constrained project scheduling under resource disruptions. Comput Ind Eng 88:13–29. https://doi.org/10.1016/j.compchemeng.2016.01.004

Choi J, Realff MJ, Lee JH (2004) Dynamic programming in a heuristically confined state space: a stochastic resource-constrained project scheduling application. Comput Chem Eng 28(6–7):1039–1058. https://doi.org/10.1016/j.compchemeng.2003.09.024

Codato G, Fischetti M (2006) Combinatorial Benders’ cuts for mixed-integer linear programming. Oper Res 54(4):756–766. https://doi.org/10.1287/opre.1060.0286

Dasović B, Klanšek U (2022) A review of energy-efficient and sustainable construction scheduling supported with optimization tools. Energies 15:2330. https://doi.org/10.3390/en15072330

Dasović B, Galić M, Klanšek U (2020) A survey on integration of optimization and project management tools for sustainable construction scheduling. Sustainability 12:3405. https://doi.org/10.3390/su12083405

End-of-Life Vehicles. European Union. Retrieved June 29, 2023, from https://environment.ec.europa.eu/topics/waste-and-recycling/end-life-vehicles_en

Environmental News. field.org.uk. Retrieved July 9, 2019, from http://www.field.org.uk/how-can-factories-affect-the-environment/

European Climate Law. European Union. Retrieved June 29, 2023, from https://climate.ec.europa.eu/eu-action/european-green-deal/european-climate-law_en

Fletcher CA, Hooper PD, Dunk RM (2018) Unintended consequences of secondary legislation: a case study of the UK landfill tax (qualifying fines) order 2015. Resour Conserv Recycl 138:160–171. https://doi.org/10.1016/j.resconrec.2018.07.011

Ghorbani S, Rabbani M (2009) A new multi-objective algorithm for a project selection problem. Adv Eng Softw 40(1):9–14. https://doi.org/10.1016/j.advengsoft.2008.03.002

Golpira H (2016) A scenario based stochastic time-cost-quality trade-off model for project scheduling problem. Int J Manag Sci Bus Admin 2(5):7–12. https://doi.org/10.18775/ijmsba.1849-5664-5419.2014.25.1001

Habibi F, Barzinpour F, Sadjadi SJ (2019) A mathematical model for project scheduling and material ordering problem with sustainability considerations: a case study in Iran. Comput Ind Eng 128:690–710. https://doi.org/10.1016/j.cie.2019.01.007

Haites E (2018) Carbon taxes and greenhouse gas emissions trading systems: what have we learned? Climate Policy 18(8):955–966. https://doi.org/10.1080/14693062.2018.1492897

Heidari-Fathian H, Davari-Ardakani H (2020) Bi-objective optimization of a project selection and adjustment problem under risk controls. J Model Manag 15(1):89–111. https://doi.org/10.1287/opre.50.3.415.775110.1108/JM2-07-2018-0106

IBM (2017) IBM ILOG CPLEX Optimization Studio CPLEX User’s Manual Version 12 Release 7, 2017. Retrieved Jul 20, 2021 from https://www.ibm.com/docs/en/SSSA5P_12.8.0/ilog.odms.studio.help/pdf/usrcplex.pdf

Juntueng S, Chiarakorn S, Towprayoon S (2012) CO2 intensity and energy intensity of Iron and Steel production in Thailand. Environ Nat Resources Journal. 10(2):50–57

Keshavarz-Ghorabaee M, Amiri M, Zavadskas EK, Turskis J, Antucheviciene J (2018) Simultaneous evaluation of criteria and alternatives (SECA) for multi-criteria decision-making. Inoformatica 29(2):265–280. https://doi.org/10.15388/Informatica.2018.167

Khalili-damghani K, Sadi-nezhad S (2013) A decision support system for fuzzy multi-objective multi-period sustainable project selection. Comput Ind Eng 64(4):1045–1060. https://doi.org/10.1016/j.cie.2013.01.016

Khassiba A, Bastin F, Cafieri S, Gendron B, Mongeau M (2020) Two-stage stochastic mixed-integer programming with chance constraints for extended aircraft arrival management. Transp Sci 54:897–919. https://doi.org/10.1287/trsc.2020.0991

Kim S, Rasouli S, Timmermans HJP, Yang D (2022) A scenario-based stochastic programming approach for the public charging station location problem. Transportmetrica B: Transport Dynamics 10(1):340–367. https://doi.org/10.1080/21680566.2021.1997672

Klotz E (2017) Automatic Benders decomposition in CPLEX. Presentation, Optimization Direct at INFORMS Annual Meeting, October 21, Houston, TX. http://www.optimizationdirect.com/ 171004.php

Kudratova S, Huang X, Zhou X (2018) Sustainable project selection: optimal project selection considering sustainability under reinvestment strategy. J Clean Prod 203:469–481. https://doi.org/10.1016/j.jclepro.2018.08.259

Laporte G, Louveaux FV, van Hamme L (2002) An Integer L-shaped algorithm for the capacitated vehicle routing problem with stochastic demands. Oper Res 50(3):415–423. https://doi.org/10.1287/opre.50.3.415.7751

Ma J, Harstvedt JD, Jaradat R, Smith B (2020) Sustainability driven multi-criteria project portfolio selection under the uncertain decision-making environment. Comput Ind Eng 106236:140. https://doi.org/10.1016/j.cie.2019.106236

Malladi KT, Sowlati T (2020) Impact of carbon pricing policies on the cost and emission of the biomass supply chain: optimization models and a case study. Appl Energy 267:115069. https://doi.org/10.1016/j.apenergy.2020.115069

Martens ML, Carvalho MM (2016) The challenge of introducing sustainability into project management function: multiple-case studies. J Clean Prod 117:29–40. https://doi.org/10.1016/j.jclepro.2015.12.039

Martins P (2017) Integrating financial planning, loaning strategies and project scheduling on a discrete-time model. J Manuf Syst 44(1):217–229. https://doi.org/10.1016/j.jmsy.2017.06.001

Mohanty RP, Agarwal R, Choudhury AK, Tiwari MK (2005) A fuzzy ANP-based approach to R&D project selection: a case study. Int J Prod Res 43(24):5199–5216. https://doi.org/10.1080/00207540500219031

Nabipoor Afruzi E, Aghaie A, Najafi AA (2020) Robust optimization for the resource-constrained multi-project scheduling problem with uncertain activity durations. Scientia Iranica 27(1):361–376. https://doi.org/10.24200/SCI.2018.20801

Norgate T, Haque N (2013) Estimation of greenhouse gas emissions from ferroalloy production using life cycle assessment with particular reference to Australia. J Clean Prod 39:220–230. https://doi.org/10.1016/j.jclepro.2012.08.010

Pourahmadi K, Nouri S, Yaghoubi S (2015) A scenario-based project portfolio selection. Manag Sci Lett 5(9):883–888. https://doi.org/10.5267/j.msl.2015.6.008

Rabbani M, Aramoon BM, Baharian Khoshkhou G (2010) A multi-objective particle swarm optimization for project selection problem. Expert Syst Appl 37(1):315–321. https://doi.org/10.1016/j.eswa.2009.05.056

Rafiee M, Kianfar F, Farhadkhani M (2014) A multistage stochastic programming approach in project selection and scheduling. Int J Adv Manuf Technol 70:2125–2137. https://doi.org/10.1007/s00170-013-5362-6

Ramakrishnan S, Koltun P (2004) Global warming impact of the magnesium produced in China using the Pidgeon process. Resour Conserv Recycl 42(1):49–64. https://doi.org/10.1016/j.resconrec.2004.02.003

Restriction of Hazardous Substances in Electrical and Electronic Equipment (RoHS). European Union. Retrieved June 29, 2023, from https://environment.ec.europa.eu/topics/waste-and-recycling/rohs-directive_en

RezaHoseini A, Ghannadpour SF, Hemmati M (2020) A comprehensive mathematical model for resource-constrained multi-objective project portfolio selection and scheduling considering sustainability and projects splitting. J Clean Prod 269:122073. https://doi.org/10.1016/j.jclepro.2020.122073

Salehi M, Jabarpour E (2021) Multi-objective fuzzy modeling of project scheduling with limitations of multi- skilled resources able to change skill levels and interrupt activities. Int J in Eng Prod Res 32(3):1–16. https://doi.org/10.22068/ijiepr.32.3.1

Statista. Global waste generation - statistics & facts. (2022). Retrieved Sept 10, 2022, from https://www.statista.com/topics/4983/waste-generation-worldwide/#dossierKeyfigures

Tabrizi BH (2018) Integrated planning of project scheduling and material procurement considering the environmental impacts. Comput Ind Eng 120:103–115. https://doi.org/10.1016/j.cie.2018.04.031

Tavana M, Keramatpour M, Santos-Arteaga FJ, Ghorbaniane E (2015) A fuzzy hybrid project portfolio selection method using Data Envelopment Analysis, TOPSIS and Integer Programming. Expert Syst Appl 42(22):8432–8444. https://doi.org/10.1016/j.eswa.2015.06.057

Tavana M, Khosrojerdi Gh, Mina H, Rahman A (2020) A new dynamic two-stage mathematical programming model under uncertainty for project evaluation and selection. Comput Ind Eng 149:106795. https://doi.org/10.1016/j.cie.2020.106795

United Nations Climate Change. About Carbon Pricing. (n d). Retrieved July 9, 2019, from https://unfccc.int/about-us/regional-collaboration-centres/the-ci-aca-initiative/about-carbon-pricing#eq4

United Nations (2017). Resolution adopted by the General Assembly on 6 July 2017, Work of the Statistical Commission pertaining to the 2030 Agenda for Sustainable Development. Retrieved Feb 20, 2022 from https://ggim.un.org/documents/a_res_71_313.pdf

Waste from Electrical and Electronic Equipment (WEEE). European Union. Retrieved June 29, 2023, from https://environment.ec.europa.eu/topics/waste-and-recycling/waste-electrical-and-electronic-equipment-weee_en

Funding

This study and all authors have recieved no funding.

Author information

Authors and Affiliations

Contributions

F. Rahimi, H. Davari-Ardakani and M. Ameli formulated the stochastic programming model and obtained real data for the case study. F. Rahimi and M. Kabiri Beheshtkhah contributed to coding the mathematical model and solving the problem via Branch and Benders method. Furthermore, F. Rahimi wrote the manuscript which was later edited by H. Davari-Ardakani and M. Ameli.

Corresponding author

Ethics declarations

Competing interests

The authors declare no competing interests.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Rahimi, F., Davari-Ardakani, H., Ameli, M. et al. Sustainable project selection and scheduling using scenario-based stochastic programming: a case study of industrial projects. Stoch Environ Res Risk Assess 38, 593–619 (2024). https://doi.org/10.1007/s00477-023-02589-9

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00477-023-02589-9