Abstract

Tests for error autocorrelation (AC) are derived under the assumption of independent and identically distributed errors. The tests are not asymptotically valid if the errors are conditionally heteroskedastic. In this article we propose wild bootstrap (WB) Lagrange multiplier tests for error AC in vector autoregressive (VAR) models. We show that the WB tests are asymptotically valid under conditional heteroskedasticity of unknown form. WB tests based on a version of the heteroskedasticity-consistent covariance matrix estimator are found to have the smallest error in rejection probability under the null and high power under the alternative. We apply the tests to VAR models for credit default swap prices and Euribor interest rates. An important result that we find is that the WB tests lead to parsimonious models while the asymptotic tests suggest that a long lag length is required to get white noise residuals.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

It is good practice to check the adequacy of an estimated time series model by testing for error autocorrelation (AC), heteroskedastic errors and autoregressive conditional heteroskedasticity (ARCH) errors, among others. Tests are commonly performed independent of each other. Thus, in testing for error AC one assumes that heteroskedasticity and ARCH are not present. Similarly, in testing for ARCH errors one assumes that error AC is not present.

Standard tests for error AC are derived under the assumption of independent and identically distributed (IID) errors. Well-known examples of such tests are portmanteau tests and Lagrange multiplier (LM) tests (Breusch 1978; Godfrey 1978, 1991). The tests are not asymptotically valid if the errors are conditionally heteroskedastic. Diebold (1986) shows that in the presence of ARCH errors, portmanteau tests for error AC do not have standard asymptotic distributions. Furthermore, as shown by Bera et al. (1992), the expression for the information matrix in LM tests for error AC depends on the ARCH parameters. Consequently, standard LM tests will be misleading if the presence of ARCH is neglected. Bera et al. (1992) derive LM tests for error AC based on transformed residuals obtained by dividing the residuals by an estimate of the conditional standard deviation. This requires the form of conditional heteroskedasticity to be known. Typically, a GARCH process is assumed, but there is no guarantee that it provides an adequate description of the conditional heteroskedasticity. Moreover, implementation of their tests requires reliable estimates of the GARCH parameters, which may be difficult to obtain (Gonçalves and Kilian 2004). Further difficulties arise in the multivariate case. Estimating the parameters of multivariate GARCH models is substantially more complicated than estimating the parameters of univariate GARCH models (see e.g. Engle and Kroner 1995).

There is a lot of empirical evidence against the assumption of IID errors in time series models of economic and financial variables. The results of Hafner and Herwartz (2000) indicate conditional heteroskedasticity in stock returns. Gonçalves and Kilian (2004) summarise the evidence against IID errors in univariate autoregressive models. In the context of vector autoregressive (VAR) models, Hafner and Herwartz (2009) present evidence of conditional heteroskedasticity in systems of inflation expectations. Ahlgren and Catani (2014a) document evidence of strong persistence in volatility in VAR models for credit default swap (CDS) prices and credit spreads in the form of constant conditional correlation generalised autoregressive conditional heteroskedasticity (CCC-GARCH) errors.

Tests for error AC which are robust to heteroskedasticity of unknown form exist (Kyriazidou 1998; Whang 1998). The tests are quite cumbersome to perform and have not been much used. In contrast to these tests, heteroskedasticity-consistent covariance matrix estimators (HCCMEs) (Eicker 1963; White 1980) while retaining the convenience of least squares (LS)-based tests lead to LM tests for error AC which are asymptotically valid under conditional heteroskedasticity. However, as shown by MacKinnon and White (1985), and Davidson and Flachaire (2008) in the context of regression models with heteroskedastic errors, HCCME-based tests can be seriously size-distorted in finite samples. Hafner and Herwartz (2009) suggest multivariate HCCME-based tests for parameter restrictions in VAR models with conditionally heteroskedastic errors.

VAR models have become standard tools for studying macroeconomic and financial time series (see e.g. Breitung et al. 2010; Lütkepohl 2006, 2010). Multivariate LM tests for error AC are frequently used in such models (see e.g.Lütkepohl 2006). The likelihood ratio (LR) test for cointegration rank was derived by Johansen (1996) in the VAR model with IID errors. Brüggemann et al. (2006) show that LM tests for error AC are valid in integrated and cointegrated VAR models with IID errors. The LM statistic has the same asymptotic distribution as in stationary VAR models. To the best of our knowledge, multivariate LM tests for error AC in VAR models which are valid when the errors are conditionally heteroskedastic are not available.

Bootstrap methods for inference in VAR models have been developed, see e.g. Kilian (1998a, b), Kilian (1999), Lütkepohl (2000, 2013), Benkwitz et al. (2001), Lütkepohl et al. (2015) for impulse response analysis, and for cointegration rank determination, van Giersbergen (1996), Swensen (2006, 2009), Ahlgren and Antell (2008), Cavaliere et al. (2012). Inference based on the conventional IID bootstrap may be misleading in the presence of (conditional) heteroskedasticity.

To overcome the problem with (conditional) heteroskedasticity, Wu (1986) and Mammen (1993) proposed the wild bootstrap (WB). Hafner and Herwartz (2000) investigate WB procedures for autoregressions under heteroskedasticity. WB procedures for stationary autoregressions with conditional heteroskedasticity are proposed by Gonçalves and Kilian (2004, 2007). Godfrey and Tremayne (2005) report simulation results on WB tests for error AC in dynamic regression models. Horowitz et al. (2006) propose a block bootstrap procedure for estimating the distribution of the Box-Pierce statistic when the errors are uncorrelated but not independent. Davidson and Flachaire (2008) show that the WB improves the finite-sample properties of HCCME-based tests in regression models. Xu (2008) considers WB inference in autoregressions with non-stationary volatility. In a multivariate context, Hafner and Herwartz (2009) propose a fixed-design WB procedure to test parameter restrictions in VAR models that is robust under conditional heteroskedasticity of unknown form. Cavaliere et al. (2010a, b, 2014) consider WB procedures for determining the cointegration rank in heteroskedastic VAR models. Jouini (2010) finds that WB tests for structural change have good size properties under conditional heteroskedasticity. Baltagi et al. (2013) propose a WB F-test for cross-sectional dependence in panel factor models, where large dimensions and heteroskedasticity cause asymptotic tests to be unreliable. Finally, Brüggemann et al. (2014) extend the WB procedures of Gonçalves and Kilian (2004) to the case of stationary VAR models. Brüggemann et al. (2014, 2015) consider a residual-based moving block bootstrap procedure for impulse response analysis in VAR models with conditional heteroskedasticity of unknown form.

In this article we propose WB Lagrange multiplier tests for error AC in VAR models. We show that the WB tests are asymptotically valid under conditional heteroskedasticity of unknown form. We consider a number of possible forms of the HCCME proposed in MacKinnon and White (1985), and investigate the finite-sample properties of the tests by Monte Carlo simulations. The simulation experiments provide evidence that the asymptotic tests for error AC are severely oversized, whereas HCCME-based tests are undersized and have low power in the presence of strong persistence in volatility in the form of ARCH errors. The WB tests perform well when the errors are conditionally heteroskedastic. The WB tests based on a version of the HCCME proposed by MacKinnon and White (1985) have the smallest error in rejection probability under the null and high power under the alternative.

In two empirical applications, we consider asymptotic and WB tests for error AC in VAR models for credit default swap (CDS) prices and Euribor interest rates. Tests for error AC are frequently used as a criterion for lag length determination in VAR models (see e.g. Lütkepohl 2006). We therefore apply the tests to determine the lag length in the VAR models. An important result that we find is that the WB tests lead to parsimonious models while the asymptotic tests suggest that a long lag length is required to get white noise residuals.

The remainder of the paper is organised as follows. LM tests for error AC in VAR models are presented in Sect. 2. The implementation of WB tests for error AC is considered in Sect. 3. The results of a Monte Carlo study on the size and power of the tests are presented in Sect. 4. Empirical applications to CDS prices and Euribor interest rates follow in Sect. 5. Conclusions are given in Sect. 6. Proofs are presented in the Appendix.

2 Tests for error autocorrelation

We consider LM tests for error AC in VAR models for stationary time series variables and vector error correction models (VECMs) for integrated and cointegrated time series variables.

2.1 Tests in stationary VAR models

The K-dimensional vector of I(0) time series variables \(\mathbf {y}_{t}\) is assumed to be generated by a vector autoregressive (VAR) model of order p:

Here \(\mathbf {A}_{1},\ldots ,\mathbf {A}_{p}\) are \((K\times K)\) parameter matrices.

The VAR(p) model can be written compactly as

where \(\mathbf {Y}=(\mathbf {y}_{1},\ldots ,\mathbf {y}_{T})\) and \(\mathbf {U}=( \mathbf {u}_{1},\ldots ,\mathbf {u}_{T})\) are \((K\times T)\) matrices, \(\mathbf { Z}=(\mathbf {Z}_{0},\ldots ,\mathbf {Z}_{T-1})\) is a \((Kp\times T)\) matrix, where \(\mathbf {Z}_{t}=(\mathbf {y}_{t}^{\prime }, \ldots , \mathbf {y}_{t-p+1}^{\prime })^{\prime }\) and \(\mathbf {B}=(\mathbf {A}_{1},\ldots ,\mathbf {A}_{p})\) is a \((K\times Kp)\) matrix. The least squares (LS) estimator of \(\mathbf {B}\) is \(\widehat{ \mathbf {B}}=\mathbf {YZ}^{\prime }(\mathbf {ZZ}^{\prime })^{-1}\) and the residuals are \(\widehat{\mathbf {U}}=\mathbf {Y}-\widehat{\mathbf {B}}\mathbf {Z} \).

For deriving the asymptotic distribution of the LS estimator \(\widehat{ \mathbf {B}}\) and LS-based statistics, it is often assumed that the error process \(\{\mathbf {u}_{t}\}\) is IID with mean zero, and nonsingular and positive definite covariance matrix \(\varvec{\Sigma }_{\mathbf {u}}\). In the following, we assume that the errors \( \{\mathbf {u}_{t}\}\) are conditionally heteroskedastic of unknown form. More specifically, the following assumption from Brüggemann et al. (2014) is made [Assumption 2.1 in Brüggemann et al. (2014)]. The assumption is the multivariate analogue of Assumption A in Gonçalves and Kilian (2004).

Assumption 1

-

(i)

\(\text{ E }(\mathbf {u}_{t}|\mathcal {F}_{t-1})=\mathbf {0}\) almost surely, where \(\mathcal {F}_{t-1}=\sigma (\mathbf {u}_{t-1},\mathbf {u} _{t-2},\ldots )\) is the \(\sigma \)-field generated by \(\{\mathbf {u}_{t-1}, \mathbf {u}_{t-2},\ldots \}\).

-

(ii)

\(\text{ E }(\mathbf {u}_{t}\mathbf {u}_{t}^{\prime })=\varvec{ \Sigma }_{\mathbf {u}}\) exists and is positive definite.

-

(iii)

\(\lim _{T\rightarrow \infty }T^{-1}\sum _{t=1}^{T}\text{ E }( \mathbf {u}_{t}\mathbf {u}_{t}^{\prime }|\mathcal {F}_{t-1})=\varvec{\Sigma }_{\mathbf {u}}\) in probability.

-

(iv)

Define the matrices

$$\begin{aligned} \varvec{\tau }_{0,a,b,c}=\text{ E }(\text{ vec }(\mathbf {u}_{t}\mathbf {u} _{t-a}^{\prime })\text{ vec }(\mathbf {u}_{t-b}\mathbf {u}_{t-c}^{\prime })^{\prime }) \end{aligned}$$(3)and assume that the elements of \(\varvec{\tau }_{0,r,0,s}\) are uniformly bounded for all \(r,s\ge 1\). The matrix \(\mathbf {L}_{K}\varvec{\tau } _{0,r,0,r}\mathbf {L}_{K}^{\prime }\) for all \(r\ge 1\) is positive definite, where \(\mathbf {L}_{K}\) is a \((\frac{1}{2}K(K+1)\times K^{2})\) elimination matrix.

-

(v)

\(\lim _{T\rightarrow \infty }T^{-1}\sum _{t=1}^{T}\text{ E }( \text{ vec }(\mathbf {u}_{t}\mathbf {u}_{t-r}^{\prime })\text{ vec }(\mathbf {u}_{t} \mathbf {u}_{t-s}^{\prime })^{\prime }|\mathcal {F}_{t-1})=\varvec{\tau } _{0,r,0,s}\) in probability for all \(r,s\ge 1\).

-

(vi)

\(\text{ E }|\mathbf {u}_{t}|^{4r}\) is uniformly bounded for some \( r\ge 2\).

Assumptions (i) and (ii) replace the IID assumption on the errors \(\{\mathbf { u}_{t}\}\) by the martingale difference (MD) sequence assumption. Assumption (iii) requires convergence of conditional moments. Assumptions (iv) and (v) restrict the fourth-order cumulants of \(\mathbf {u}_{t}\). Assumption (vi) requires the existence of at least 8th moments of the MD sequence \(\{\mathbf { u}_{t}\}\).

The alternative is a VAR(h) model for the errors:

The hypothesis being tested is

The test statistic is computed from an auxiliary model

where \(\mathbf {Z}_{t-1}=(\mathbf {y}_{t-1}^{\prime },\ldots ,\mathbf {y}_{t-p}^{\prime })^{\prime }\), \(\mathbf {\phi } =\text{ vec }(\mathbf {A}_{1},\ldots ,\mathbf {A}_{p})^{\prime }\), \(\widehat{\mathbf {U}} _{t-1}=(\widehat{\mathbf {u}}_{t-1}^{\prime },\ldots ,\widehat{ \mathbf {u}}_{t-h}^{\prime })^{\prime }\) and \(\mathbf {\psi } =\text{ vec }(\mathbf {D}_{1},\ldots ,\mathbf {D}_{h})^{\prime }\). The symbol \(\otimes \) denotes the Kronecker product and the symbol vec denotes the column vectorisation operator. The first h values of the residuals \(\widehat{\mathbf {u}}_{t}\) are set to zero in the auxiliary model, so that the series length is equal to the series length in the original VAR model.

The LM statistic is given by

where \(\widehat{\mathbf {\psi }}\) is the LS estimate of \(\mathbf {\psi } \) and \(\widehat{\varvec{\Sigma }}^{\psi \psi }\) is the block of

corresponding to \(\mathbf {\psi }\). Here \(\widehat{\varvec{\Sigma }}_{\mathbf {u} }=T^{-1}\sum _{t=1}^{T}\widehat{\mathbf {u}}_{t}\widehat{\mathbf {u}} _{t}^{\prime }\) is the estimator of the error covariance matrix from the VAR model. The test reduces to the single equation LM test when \(K=1\).

The auxiliary model can be written compactly as

where \(\mathbf {D}=(\mathbf {D}_{1},\ldots ,\mathbf {D}_{h})\) is a \((K\times Kh) \) matrix, \(\mathbf {E}=(\mathbf {e}_{1},\ldots ,\mathbf {e}_{T})\) is a \( (K\times T)\) matrix and \(\widehat{\mathcal {U}}=(\mathbf {I}_{h}\otimes \widehat{\mathbf {U}})\mathbf {F}^{\prime }\) with \(\mathbf {F}=(\mathbf {F} _{1},\ldots ,\mathbf {F}_{h})\) a \((T\times hT)\) matrix such that

The precise form of \(\mathbf {F}_{j}\), \(j=1,\ldots ,h\), is given in Lütkepohl (2006, p. 158) .

The \(Q_{\text {LM}}(h)\) statistic can be expressed in terms of the residual autocovariances

where

\(\widehat{\mathbf {C}}=(\widehat{\mathbf {C}}_{1},\ldots ,\widehat{\mathbf {C}} _{h})\), \(\widehat{\mathbf {c}}_{h}=\text{ vec }(\widehat{\mathbf {C}})\) and the scaling matrix is given by

The asymptotic distribution of \(Q_{\text {LM}}(h)\) is obtained from the representation (Lütkepohl 2006, Lemma 4.2)

where \(\mathbf {G}=\widetilde{\mathbf {G}}^{\prime }\otimes \mathbf {I}_{K}\) with

a \(((Kp+1)\times Kh)\) matrix. The \(\varvec{\Phi }_{j}\) are the MA coefficient matrices from the moving average (MA) representation of the VAR (p) process. The foregoing form of the LM statistic and derivations are based on results of Lütkepohl (2006). Lütkepohl proves Lemma 4.2 under the stronger assumption of IID errors. Because conditional heteroskedasticity does not alter the order in probability of terms and the probability limit (10), Lemma 4.2 remains valid when the errors \(\{\mathbf {u}_{t}\}\) are conditionally heteroskedastic.

If \(\{\mathbf {u}_{t}\}\) is IID, the asymptotic distribution of \(\sqrt{T} \mathbf {c}_{h}\) is multivariate normal with covariance matrix \(\mathbf {I} _{h}\otimes \varvec{\Sigma }_{\mathbf {u}}\otimes \varvec{\Sigma }_{\mathbf {u} }\) and the asymptotic distribution of \(\sqrt{T}\,\text{ vec }(\widehat{\mathbf { B}}-\mathbf {B})\) is multivariate normal with covariance matrix \(\varvec{ \Gamma }^{-1}\otimes \varvec{\Sigma }_{\mathbf {u}}\), where \(\varvec{\Gamma }=\text{ plim }\frac{1}{T}\sum _{t=1}^{T}\mathbf {Z} _{t-1}\mathbf {Z}_{t-1}^{\prime }\). It follows from these results and Lemma 4.3 of Lütkepohl (2006) that the asymptotic distribution of \( \sqrt{T}\widehat{\mathbf {c}}_{h}\) is multivariate normal with covariance matrix \(\varvec{\Sigma }_{\mathbf {c}}(h)\). Furthermore, \(\widehat{\varvec{ \Sigma }}_{\mathbf {c}}(h)\) in (9) is a consistent estimator of \(\varvec{\Sigma }_{ \mathbf {c}}(h)\). The \(Q_{\text {LM}}(h)\) statistic is asymptotically distributed as \(\chi ^{2}\) with \(hK^{2}\) degrees of freedom under the null hypothesis.

The asymptotic distribution of the LM statistic is non-standard under conditional heteroskedasticity. By Lemma A.1 of Brüggemann et al. (2014) , the asymptotic distribution of \(\sqrt{T}\mathbf {c}_{h}\) is multivariate normal with covariance matrix \(\varvec{\Omega }_{h}\), where \(\varvec{\Omega }_{h} = (\tau _{0,i,0,j})\), a \((K^{2}h \times K{^2}h)\) block matrix, where \(\tau _{0,i,0,j}\) is defined in (3). By Theorem 3 of the same source, the asymptotic distribution of \(\sqrt{T}\,\text{ vec }( \widehat{\mathbf {B}}-\mathbf {B})\) is multivariate normal with covariance matrix \((\varvec{\Gamma }^{-1}\otimes \mathbf {I}_{K})\left( \sum _{p,q=1}^{\infty }(\mathbf {C}_{p}\otimes \mathbf {I}_{K})\tau _{0,p,0,q}( \mathbf {C}_{q}\otimes \mathbf {I}_{K})^{\prime }\right) (\varvec{\Gamma }^{-1}\otimes \mathbf {I}_{K})^{\prime }\), where \(\mathbf {C}_{j}=(\varvec{\Phi }_{j-1}^{\prime },\ldots ,\varvec{\Phi }_{j-p}^{\prime })^{\prime }\) and \(\varvec{\Gamma } =\sum _{j=1}^{\infty }\mathbf {C}_{j}\varvec{\Sigma }_{\mathbf {u}}\mathbf {C} _{j}^{\prime }\). Because \(\varvec{\Sigma }_{\mathbf {c}}(h)\) is not the covariance matrix of the asymptotic distribution of \(\sqrt{T}\widehat{\mathbf {c}}_{h}\), the asymptotic distribution of the LM statistic is non-pivotal when the errors \(\{\mathbf {u}_{t}\}\) are conditionally heteroskedastic. This shows that standard LM tests for error AC are not asymptotically valid under conditional heteroskedasticity.

There are asymptotically equivalent likelihood ratio (LR) and Wald versions of the LM statistic (see e.g. Edgerton and Shukur 1999). Doornik (1996) proposes an F-statistic based on the F-approximation to the LR test of Rao (1973).

2.2 Heteroskedasticity-consistent tests

In the univariate case, Godfrey and Tremayne (2005) employ heteroskedasticity-consistent versions of the LM statistic using White’s (1980) general formula for heteroskedasticity-consistent covariance matrix estimators (HCCMEs). We employ the multivariate HCCME as in Hafner and Herwartz (2009). The multivariate HCCME for the auxiliary model in (5) is given by

where

MacKinnon and White (1985), and Davidson and Flachaire (2008) refer to the basic version (11) of the HCCME as \(HC_{0}\) and consider three modified versions of \(HC_{0}\), which they denote by \(HC_{1}\), \(HC_{2}\) and \( HC_{3}\). Rescaling \(\widehat{\mathbf {u}}_{t}\) by \(\sqrt{T/(T-Kp)}\), which amounts to multiplying the elements of \(\widehat{\mathbf {u}}_{t}\widehat{ \mathbf {u}}_{t}^{\prime }\) by \(T/(T-Kp)\), leads to the multivariate analogue of the form \(HC_{1}\) of the HCCME. In the case of no heteroskedasticity, the variance of \(\widehat{u}_{it}\), \(i=1,\ldots ,K\), is proportional to \(1-h_{t}\), where \(h_{t}=\mathbf {Z}_{t}(\mathbf {Z}^{\prime }\mathbf {Z})^{-1}\mathbf {Z}_{t}^{\prime }\) is the tth diagonal element of \(\mathbf {Z}(\mathbf {Z}^{\prime }\mathbf {Z})^{-1}\mathbf {Z}^{\prime }\). Replacing \(\widehat{ \mathbf {u}}_{t}\) by \(\widehat{\mathbf {u}}_{t}/(1-h_{t})^{1/2}\), we obtain the multivariate analogue of the form \(HC_{2}\) of the HCCME. The final form of the HCCME that we consider is \(HC_{3}\), based on arguments from the jackknife, in which \(\widehat{\mathbf {u}}_{t}\) is replaced by \(\widehat{ \mathbf {u}}_{t}/(1-h_{t})\). The form \(HC_{3}\) of the HCCME was originally proposed by MacKinnon and White (1985). See their paper for details of \( HC_{1}\), \(HC_{2}\) and \(HC_{3}\).

The HCCME-based LM statistics for error AC are obtained from (6) by replacing \(\widehat{\varvec{\Sigma }}^{\psi \psi }\) by the block of \( \mathbf {V}_{T}^{-1}\mathbf {W}_{T}\mathbf {V}_{T}^{-1}=(\varvec{\Gamma } _{T}\otimes \mathbf {I}_{K})^{-1}\mathbf {W}_{T}(\varvec{\Gamma } _{T}\otimes \mathbf {I}_{K})^{-1}\) in (11) corresponding to \(\mathbf {\psi }\) and with \( \widehat{\mathbf {u}}_{t}\) defined by \(HC_{0}\), \(HC_{1}\), \(HC_{2}\) and \(HC_{3} \), respectively. We denote the HCCME-based LM tests by \(Q_{\text {LM, HC}_{0}} \), \(Q_{\text {LM, HC}_{1}}\), \(Q_{\text {LM, HC}_{2}}\) and \(Q_{\text {LM, HC}_{3}}\), respectively.

2.3 Tests in vector error correction models

We now turn to the case where \(\mathbf {y}_{t}\) is I(1) and cointegrated. Following Brüggemann et al. (2006), we consider the cointegrated VAR model with \( r<K\) cointegrating relations. The model can be written in VECM form as

where \(\varvec{\alpha } \) and \(\mathbf {\beta } \) are \((K\times r)\) matrices with rank r, and \( \varvec{\Gamma } _{1},\ldots ,\varvec{\Gamma } _{p-1}\) are \((K\times K)\) parameter matrices such that \(\mathbf {y}_{t}\) is I(1). A formal treatment of the cointegrated VAR model, including conditions for the process to be I(1), is provided in Johansen (1996). The error process \(\{\mathbf {u}_{t}\}\) is assumed to be as before. Brüggemann et al. (2006) show that the LM statistic may be computed from the auxiliary model

Here \(\mathbf {\beta } _{\perp }\) denotes the orthogonal complement of \(\mathbf {\beta } \) such that \(\mathbf {\beta } ^{\prime }\mathbf {\beta } _{\perp }=\mathbf {0}\), and \( \widehat{\mathbf {\beta }}_{\perp }\) is an estimator of \(\mathbf {\beta } _{\perp }\). The term \(\mathbf {y}_{t-1}^{\prime }\widehat{\mathbf {\beta }}_{\perp }\otimes \widehat{\mathbf {\alpha }}\), which is related to the Gaussian scores of \( \mathbf {\beta } \), is used as an additional regressor in the auxiliary model, but may be deleted from the auxiliary model because the estimator of \(\mathbf {\beta } \) is asymptotically independent of the estimators of \(\mathbf {\phi }\) and \(\mathbf {\psi }\) (Brüggemann et al. 2006). The asymptotic distribution of the LM statistic under the null hypothesis is the same as in stationary VAR models.

The tests for error AC in the VECM require the cointegration rank to be known. The value of r is usually not known. In this case it is customary to estimate an unrestricted VAR model and test for error AC before determining the cointegrating rank. The LM statistic in the unrestricted VAR model may be computed from an auxiliary model that has the same form as the auxiliary model (5) for the stationary VAR model (Brüggemann et al. 2006).

3 Wild bootstrap tests for error autocorrelation

We use the recursive-design and fixed-design WB procedures for autoregressions of Gonçalves and Kilian (2004). They establish the asymptotic validity of the WB in stationary autoregressions under conditional heteroskedasticity of unknown form. Hafner and Herwartz (2009) show the asymptotic validity of the fixed-design WB in VAR models. Brüggemann et al. (2014) extend the results for the recursive-design WB to VAR models.

The WB errors are generated as \(\mathbf {u}_{t}^{*}=w_{t}\widehat{ \mathbf {u}}_{t}\), where \(\widehat{\mathbf {u}}_{t}\) are the LS residuals from the VAR model and \(\{w_{t}\}\) is an IID sequence with mean zero, variance one and such that \(\text{ E }^{*}|w_{t}|^{4}\le c<\infty \) (Gonçalves and Kilian 2004). Several auxiliary distributions may be considered (see e.g. Davidson and Flachaire 2008; Davidson et al. 2007). We use the Rademacher distribution, which is given by the two-point distribution

It is one of the most commonly used auxiliary distributions and is the one recommended by Davidson and Flachaire (2008).

For the asymptotic validity of the WB procedures in VAR models, Assumption 1 is made throughout.

3.1 Recursive-design wild bootstrap tests for error AC

The recursive-design WB LM test for error AC is detailed in Algorithm 1.

Algorithm 1

Recursive-design WB LM test for error AC.

-

1.

Compute the LM statistic \(Q_{\text {LM}}\) from the data. Obtain the parameter estimates and the residuals \(\widehat{\mathbf {u}}_{t}\) from the VAR model.

-

2.

Draw \(w_{t}\), \(t=1,\ldots ,T\), independently from a Rademacher distribution and construct the WB errors as \(\mathbf {u}_{t}^{*}=w_{t} \widehat{\mathbf {u}}_{t}\).

-

3.

Generate a bootstrap sample \(\{\mathbf {y}_{t}^{*}\}\) recursively from

$$\begin{aligned} \mathbf {y}_{t}^{*}=\widehat{\mathbf {A}}_{1}\mathbf {y}_{t-1}^{*}+\cdots +\widehat{\mathbf {A}}_{p}\mathbf {y}_{t-p}^{*}+\mathbf {u} _{t}^{*}, \end{aligned}$$initialised at \(\mathbf {y}_{t}^{*}=\mathbf {y}_{t}\), \(t=1,\ldots ,p\).

-

4.

Compute the bootstrap LM statistic \(Q_{\text {LM}}^{*\text {r}}\) from the bootstrap sample \(\{\mathbf {y}_{t}^{*}\}\). Define the bootstrap p value as \(p^{*\text {r}}=1-G^{*}(Q_{\text {LM}}^{*\text {r}})\), where \(G^{*}(\cdot )\) denotes the conditional (on the original data) cumulative distribution function (CDF) of \(Q_{\text {LM}}^{*\text {r}}\).

-

5.

The bootstrap test of \(H_{0}:\mathbf {D}_{1}=\cdots =\mathbf {D}_{h}= \mathbf {0}\) against \(H_{1}:\mathbf {D}_{j}\ne \mathbf {0}\) for at least one \( j\in \{1,\ldots ,h\}\) at the level \(\alpha \) rejects \(H_{0}\) if \(p^{*\text {r}}\le \alpha \).

The asymptotic validity of \(Q_{\text {LM}}^{*\text {r}}\) depends on the ability of the WB to mimic the asymptotic distribution of \(Q_{\text {LM}}\) under conditional heteroskedasticity. Proposition 1 states the asymptotic validity of the \(Q_{\text {LM}}^{*\text {r}}\) test.

Proposition 1

Under Assumption 1 and under \(H_{0}\), as \(T\rightarrow \infty \),

where \(\text{ P }^{*}\) denotes the bootstrap probability measure.

3.2 Fixed-design wild bootstrap tests for error AC

The fixed-design WB LM test for error AC is detailed in Algorithm 2.

Algorithm 2

Fixed-design WB LM test for error AC.

-

1.

Compute the LM statistic \(Q_{\text {LM}}\) from the data. Obtain the parameter estimates and the residuals \(\widehat{\mathbf {u}}_{t}\) from the VAR model.

-

2.

Draw \(w_{t}\), \(t=1,...,T\), independently from a Rademacher distribution and construct the WB errors as \(\mathbf {u}_{t}^{*}=w_{t} \widehat{\mathbf {u}}_{t}\).

-

3.

Generate a bootstrap sample \(\{\mathbf {y}_{t}^{*}\}\) from

$$\begin{aligned} \mathbf {y}_{t}^{*}=\widehat{\mathbf {A}}_{1}\mathbf {y}_{t-1}+\cdots + \widehat{\mathbf {A}}_{p}\mathbf {y}_{t-p}+\mathbf {u}_{t}^{*}, \end{aligned}$$initialised at \(\mathbf {y}_{t}^{*}=\mathbf {y}_{t}\), \(t=1,\ldots ,p\).

-

4.

Compute the bootstrap LM statistic \(Q_{\text {LM}}^{*\text {f}}\) from the bootstrap sample \(\{\mathbf {y}_{t}^{*}\}\). Define the bootstrap p value as \(p^{*\text {f}}=1-G^{*}(Q_{\text {LM}}^{*\text {f}})\), where \(G^{*}(\cdot )\) denotes the conditional (on the original data) cumulative distribution function (CDF) of \(Q_{\text {LM}}^{*\text {f}}\).

-

5.

The bootstrap test of \(H_{0}:\mathbf {D}_{1}=\cdots =\mathbf {D}_{h}= \mathbf {0}\) against \(H_{1}:\mathbf {D}_{j}\ne \mathbf {0}\) for at least one \( j\in \{1,\ldots ,h\}\) at the level \(\alpha \) rejects \(H_{0}\) if \(p^{*\text {f}}\le \alpha \).

Proposition 2 states the asymptotic validity of the \(Q_{\text {LM}}^{*\text {f}}\) test.

Proposition 2

Under Assumption 1 and under \(H_{0}\), as \(T\rightarrow \infty \),

where \(\text{ P }^{*}\) denotes the bootstrap probability measure.

4 Simulations

This section contains a Monte Carlo study on the size and power of the WB tests for error AC proposed in the previous section.

4.1 Monte Carlo design

We consider two data-generating processes (DGPs) for the conditional mean. The dimensions of the systems are \(K=2\) and 5. DGP 1 is a stationary VAR(2) model

DGP 2 is a VECM of the form used by Brüggemann et al. (2006):

The cointegration rank is \(r=1\) when \(K=2\) and \(r=2\) when \(K=5\). The parameter values are contained in Table 1.

For the errors we consider a constant conditional correlation generalised autoregressive conditional heteroskedasticity (CCC-GARCH) model (Bollerslev 1990):

where \(\mathbf {H}_{t}=\text{ diag }\left( h_{1t}^{1/2},\ldots ,h_{Kt}^{1/2}\right) \) is a diagonal matrix of conditional standard deviations of \(\mathbf {u}_{t}\), \(\mathbf {z}_{t}\sim NID (\mathbf {0},\mathbf {P})\) and \(\mathbf {P}=(\rho _{ij})\) is a positive definite covariance matrix with ones on the main diagonal. We focus on the CCC-GARCH(1, 1) model with

where \(\mathbf {u}_{t}^{(2)}=(u_{1t}^{2},\)...\(,u_{Kt}^{2})^{\prime }\) is a \((K\times 1)\) vector, \(\mathbf {h}_{t}=(h_{1t},\ldots ,h_{Kt})^{\prime }\) is a \((K\times 1)\) vector of conditional variances of \(\mathbf {u}_{t}\), \(\mathbf {a}_{0}\) is a \((K\times 1)\) vector of positive constants, and \(\mathbf {A}_{1}=(a_{ii})\) and \(\mathbf {B}_{1}=(b_{ii})\) are \((K\times K)\) parameter matrices which are diagonal with positive diagonal elements. Jeantheau (1998) proposes an extended CCC-GARCH model where some of the off-diagonal elements have non-zero values, but this extension is not considered here (see e.g. He and Teräsvirta 2004; Nakatani and Teräsvirta 2009). We consider two DGPs for the errors. The parameter values are contained in Table 1. DGP 1 is characterised by very high persistence in volatility (\( a_{ii}+b_{ii}=0.98\)). DGP 2 is characterised by very high persistence in volatility in the first equation (\(a_{11}+b_{11}=0.999\)), moderate persistence in volatility in the second equation (\(a_{22}+b_{22}=0.85\)) and large ARCH parameters (\(a_{11}=0.175\) and \(a_{22}=0.35\)). The parameter \(\rho \) is the conditional correlation coefficient. Finally, when \( K=5\) the parameter \(\rho \) is the canonical correlation between the first component and the remaining \(K-1\) components.

The CCC-GARCH processes in DGPs 1 and 2 satisfy the conditions for weak and strict stationarity (He and Teräsvirta 2004; Nakatani and Teräsvirta 2009). Recall that the validity of the WB procedures requires the existence of at least 8th moments. He and Teräsvirta (2004, p. 908) give a result concerning the existence of the 4th moment matrix of \(\mathbf {u}_{t}\). The condition is that the largest eigenvalue of a certain matrix is less than 1. DGP 1 satisfies the condition (the largest eigenvalue is 0.973). The condition is violated by DGP 2 (the largest eigenvalue is 1.059). The conditions for the existence of the 8th moment matrix of \(\mathbf {u}_{t}\) are not known. We therefore only know that the conditions are not satisfied by DGP 2.

In the simulations for power the errors \(\mathbf {u}_{t}\) have an autoregressive structure:

where \(\varvec{\Psi } _{1}=\psi _{1}\mathbf {I}_{K}\), \(\psi _{1}=0,0.04,\ldots ,0.96,0.99\), and \( \varvec{\varepsilon } _{t}\) is a \((K\times 1)\) vector of errors following DGPs 1 and 2 listed in Table 1.

The series lengths are \(T=100,200,500\) and 1000. The number of replications is 20000 in the simulations for size and 10000 in the simulations for power. The computations and simulations are performed in R, version 2.13.2 (R Development Core Team 2011). We use the ccgarch package version 0.2.0 of Nakatani (2010) for simulating the CCC-GARCH(1, 1) models and checking the 4th moment condition. The size and power of the WB tests are simulated using the fast bootstrap method of Davidson and MacKinnon (2006).

4.2 Monte Carlo results

Table 2 shows the simulated rejection probabilities of the LM tests for error AC of orders \(h=1\), 4 and 12 in the stationary VAR(2) model with \(K=2\) and 5, and \(T=100\), 200, 500 and 1000. We have set \(\rho =0\), since we found that the correlation coefficient has little effect on the size and power of the tests. No results are reported for \(K=5\) and \(h=12\) because the number of parameters in the auxiliary regression is too large relative to the number of observations, in particular when \(T=100\). The asymptotic \(Q_{\text {LM}}\) test is not valid when the errors are conditionally heteroskedastic. Not surprisingly, \(Q_{ \text {LM}}\) is severely oversized, and the size distortions increase with the series length. The size of \(Q_{\text {LM}}\) in DGP 2 with very high persistence in volatility and large ARCH parameters is at least \(27.9\,\%\) for \(h=1\), \(46.2\,\%\) for \(h=4\) and \(59.3\,\%\) for \(h=12\) (these are the rejection probabilities when \(T=1000\) in Table 2). The HCCME-based tests, which are asymptotically valid when the errors are conditionally heteroskedastic, are severely undersized in small samples, when the dimensions are large and the order of error AC tested is large. The WB tests without the HCCME have size closer to the nominal level than the HCCME-based WB tests in small samples, when the dimensions are large and the order of error AC tested is large. For the HCCME-based WB tests, we only show the results for the \(HC_{3}\) variant, which has the smallest size distortion. It is also the variant of the HCCME recommended by Davidson and Flachaire (2008) to use with the WB. In large samples the HCCME-based WB tests have better size properties than the WB tests without the HCCME. The size distortions of \(Q_{\text {LM}}^{*\text {r}}\) and \(Q_{ \text {LM,HC}_{3}}^{*\text {r}}\) disappear when \(T=1000\), whereas \(Q_{\text {LM }}^{*\text {f}}\) and \(Q_{\text {LM,HC}_{3}}^{*\text {f}}\) are slightly undersized for \(h=12\) in large samples. Finally, the simulation results show that failure of the sufficient condition for the existence of the 4th moment to hold in DGP 2 has little effect on the performance of the WB tests for error AC in finite samples.

We also compared the \(Q_{\text {LM}}\) test with the asymptotically equivalent \(Q_{\text {LR}}\), \(Q_{\text {W}}\) and \(Q_{\text {F}}\) tests. The size differences between the asymptotically equivalent tests disappear in finite samples when they are bootstrapped. This is what we would expect because the bootstrap provides a size-correction of the asymptotic tests (see Davidson and MacKinnon 2006).

Comparing the results for the stationary VAR(2) model with the results for the unrestricted VAR model in levels when the DGP is a VECM in Table 3, which shows the results for the three tests (\(Q_{\text { LM,HC}_{0}}\), \(Q_{\text {LM,HC}_{3}}^{*\text {r}}\) and \(Q_{\text {LM,HC} _{3}}^{*\text {f}}\)) that perform best in the case of the stationary VAR model, reveals small differences only. Following Brüggemann et al. (2006), we have repeated the simulations with the correct cointegration rank imposed. This case is mainly included in order to compare our results with conditionally heteroskedastic errors with the results reported in Brüggemann et al. (2006) for IID errors. Size distortions are larger in the unrestricted VAR model than in the VECM. A similar result was found by Brüggemann et al. (2006).

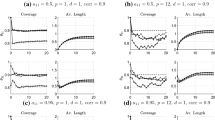

For the power analysis, we show the level-adjusted powers of the asymptotic \( Q_{\text {LM}}\) test, recursive-design WB \(Q_{\text {LM}}^{*\text {r}}\) test and fixed-design WB \(Q_{\text {LM}}^{*\text {f}}\) test without the HCCME, and the corresponding HCCME-based \(Q_{\text {LM,HC}_{3}}\), \(Q_{\text { LM,HC}_{3}}^{*\text {r}}\) and \(Q_{\text {LM,HC}_{3}}^{*\text {f}}\) tests in the stationary VAR(2) model and DGP 1 for the errors as a representative case. There is a slight decrease in power in DGP 2 compared to DGP 1, but otherwise the results are similar, and are therefore not shown. Only small differences are found in the powers of the tests in the unrestricted VAR model and cointegrated VAR model with the correct cointegration rank imposed when the DGP is a VECM. The results are therefore not shown. Figure 1 presents the simulated power functions of the asymptotic \(Q_{\text {LM}}\) test, recursive-design WB \(Q_{\text {LM} }^{*\text {r}}\) test and fixed-design WB \(Q_{\text {LM}}^{*\text {f}}\) test in the left panels, and the HCCME-based \(Q_{\text {LM,HC}_{3}}\), \(Q_{ \text {LM,HC}_{3}}^{*\text {r}}\) and \(Q_{\text {LM,HC}_{3}}^{*\text {f} }\) tests in the right panels for \(h=1\), 4 and 12 with \(K=2\) and when \( T=100\). We only show the powers of the \(HC_{3}\) variant because the powers are level-adjusted. The recursive-design WB \(Q_{\text {LM}}^{*\text {r}}\) test has low power for \(h=1\) and no power at all for \(h=4\) and 12, while the fixed-design WB \( Q_{\text {LM}}^{*\text {f}}\) has low power. The differences in power between the WB tests disappear when the HCCME is used. Figure 2 show the simulated power functions when \(T=500\). The \(Q_{\text {LM}}^{*\text {r}}\) test has lower power than the \(Q_{\text {LM}}^{*\text {f}}\) test. For \(h=1\), the HCCME-based tests have higher power than the tests without the HCCME; for \(h=4\) and 12 the HCCME-based recursive-design WB \(Q_{\text {LM,HC}_{3}}^{*\text {r}}\) test has higher power than the \(Q_{\text {LM}}^{*\text {r}}\) test without the HCCME. Figures 3 and 4 show the simulated power functions with \(K=5\) and when \(T=100\) and 500. The results for \(h=1\) when \(T=100\) are similar to the case with \(K=2\); the recursive-design WB \(Q_{\text {LM}}^{*\text {r}}\) test has lower power than the fixed-design WB \(Q_{\text {LM}}^{*\text {f}}\) test but the differences in power between the WB tests diminish when the HCCME is used. The tests have low power for \(h=4\), and the power of the HCCME-based tests are close to zero. When \(T=500\) the HCCME-based recursive-design WB \(Q_{ \text {LM,HC}_{3}}^{*\text {r}}\) test has higher power than the HCCME-based fixed-design WB \(Q_{\text {LM,HC}_{3}}^{*\text {f}}\) test.

The simulation results suggest the following guidelines for the use of the tests for error AC with real data. The asymptotic \(Q_{\text {LM}}\) test is not valid under conditional heteroskedasticity, and is severely oversized. The HCCME-based \(Q_{\text {LM,HC}}\) tests are severely undersized in small samples, when the dimensions are large and the order of AC tested is large. The WB \(Q_{\text {LM}}^{*}\) tests outperform the HCCME-based \(Q_{\text { LM,HC}}\) tests in terms of power. The fixed-design WB \(Q_{\text {LM}}^{*\text {f}}\) test has the best performance among all tests when the number of observations is small, the dimensions are large and the order of error AC tested is large. We therefore recommend the use of the \(Q_{\text {LM}}^{*\text {f} }\) test without the HCCME in small samples, when the dimensions are large and the order of error AC tested is large. If the number of observations is large relative to the dimensions and the order of error AC tested, the HCCME-based recursive-design WB \(Q_{\text {LM,HC} _{3}}^{*\text {r}}\) test has the best performance of all tests. In large samples we recommend the use of the \(Q_{\text {LM,HC}_{3}}^{*\text {r}}\) test.

5 Empirical examples

We illustrate the use of the WB LM tests for error AC with real data in empirical applications to credit default swap (CDS) prices and Euribor interest rates. In the first empirical application the sample size is large. The second empirical application is an example of a small sample size where the dimensions are large.

5.1 Credit default swap prices

Our first empirical example deals with CDS prices. A CDS is a credit derivative which provides a bondholder with protection against the risk of default by the company. If a default occurs, the holder is compensated for the loss by an amount which equals the difference between the par value of the bond and its market value after the default. The CDS price is the annualised fee (expressed as a percentage of the principal) paid by the protection buyer. We denote by \(p_{t}^{\text {CDS}}\) the CDS price and \(p_{t}^{\text {CS}}\) the credit spread on a risky bond over the risk-free rate. The basis is the difference between the CDS price and the bond spread:

If the two markets price credit risk equally in the long run, then the prices should be equal, so that the basis \(s_{t}=0\). Because \(p_{t}^{\text { CDS}}\) and \(p_{t}^{\text {CS}}\) are I(1) series, the non-arbitrage relation is tested as an equilibrium relation in the cointegrated VAR model (see Blanco et al. 2005). The vector \(\mathbf {y}_{t}\) with the value 1 appended is \( \mathbf {y}_{t}=(p_{t}^{\text {CDS}},p_{t}^{\text {CS}},1)^{\prime }\). The financial theory posits that \(\mathbf {y}_{t}\) is cointegrated with cointegrating vector \(\mathbf {\beta } =(1,-1,c)^{\prime }\), so that \(\mathbf {\beta } ^{\prime }\mathbf {y}_{t}=p_{t}^{\text {CDS} }-p_{t}^{\text {CS}}+c\) is a cointegrating relation. In theory \(c=0\), but in practice it may be different from zero (see Blanco et al. 2005, for details). Many researchers have tested the equivalence of CDS prices and credit spreads for US and European investment-grade companies and found that a parity relation holds for most companies, i.e. the bond and CDS markets price credit risk equally.

We take a subsample of the companies in Table 1 of Blanco et al. (2005). The companies in our subsample are Bank of America, Citigroup, Goldman Sachs, Barclays Bank and Vodafone, the first three of which are US and the remaining two European companies. We use 5-year maturity CDS prices and credit spreads from Datastream. Blanco et al. (2005) contains a discussion of issues related to the construction of the series. The data are daily observations from 1 January 2009 to 31 January 2012, and the number of daily observations is \(T=804\). The sample size is therefore large and the dimensions (\(K=2\)) are small.

Information criteria are used to determining the lag length in the VAR models for \(p_{t}^{\text {CDS}}\) and \(p_{t}^{\text {CS}}\). Because the sample size is large, we rely on the Schwarz (SC) and Hannan–Quinn (HQ) information criteria, and select lag length \(p=2\) for Bank of America, \(p=3\) for Citigroup, Goldman Sachs and Vodafone, and \(p=4\) for Barclays Bank. The residuals from the VAR model for Barclays Bank are shown in Figure 5 as a representative case. Notice the volatility clustering in the residuals. This is confirmed by asymptotic and bootstrap LM tests for ARCH up to order 2 (see Table 4). The bootstrap \(Q_{\text {LM}}^{*}\) test for ARCH is described in Ahlgren and Catani (2014b). The univariate tests find strong ARCH effects in the residuals for all companies. The multivariate tests are significant at the \(5\,\%\) level for all companies, with the exception of the bootstrap \(Q_{\text {LM}}^{*}\) test for Vodafone. Because there is strong evidence of ARCH in the errors, HCCME-based and WB tests for error AC should be used in place of asymptotic tests which assume IID errors.

Table 4 shows the p values of the LM tests for error AC of orders \(h=1\), 4 and 12 in the unrestricted VAR model and cointegrated VAR model with cointegration rank \(r=1\).The outcomes of the tests in the unrestricted VAR model and cointegrated VAR model are, with only a few exceptions, identical. We first discuss the overall picture and then the results for Barclays Bank in detail. The asymptotic \(Q_{\text {LM}}\) test for error AC of order \(h=1\) in the unrestricted VAR model is significant at the \(5\,\%\) level for Goldman Sachs, Barcalys Bank and Vodafone. The test of order \(h=4\) is significant for Bank of America, Barclays Bank and Vodafone, and of order \(h=12\) is significant for all companies. In contrast, the HCCME-based \(Q_{\text {LM, HC}_{0}}\) tests are all insignificant, with the exception of \(h=1\) and 12 for Vodafone. The WB tests are all insignificant, with the exception of the recursive-design WB \(Q_{\text {LM }}^{*\text {r}}\) test of \(h=12\) for Vodafone, which is significant at the \(5\,\%\) level, and the fixed-design WB \(Q_{\text {LM}}^{*\text {f}}\) test of \(h=4\) and 12 for Vodafone, which are significant at the \(1\,\%\) level. The HCCME-based recursive-design WB \(Q_{\text {LM, HC}_{3}}^{*\text {r}}\) test of \(h=1\) and 12 are significant for Vodafone at the 5 and \(1\,\%\) levels, respectively. The HCCME-based fixed-design WB \(Q_{\text {LM, HC}_{3}}^{*\text {f}}\) test of order \(h=1\) is significant for Vodafone at the \(5\,\%\) level, and of order \(h=12\) is significant for Bank of America at the \(5\,\%\) level and Vodafone at the \(1\,\%\) level. Because the sample size is large and the dimensions are small, we rely on the HCCME-based recursive-design WB \(Q_{\text {LM, HC}_{3}}^{*\text {r}}\) test. We then conclude that the VAR models provide good descriptions of the data, perhaps with the exception of some error AC of order \(h=12\) remaining in the VAR(3) model for Vodafone.

We now turn to a detailed analysis of the results for Barclays Bank. The asymptotic \(Q_{\text {LM}}\) test rejects the null hypothesis of no error AC of orders \(h=\) 1, 4 and 12 at the \(5\,\%\) level. The p value for \(h=1\) is \( 2.5\,\%\), the p value for \(h=4\) is \(0.1\,\%\) and the p value for \(h=12\) is \( 0.0\,\%\). The HCCME-based tests and the WB tests do not reject for \(h=1\), 4 and 12. The p value of the HCCME-based recursive-design WB \(Q_{\text {LM, HC}_{3}}^{*\text {r}}\) test for \(h=1\) is \(21.6\,\%\), the p value for \(h=4\) is \(9.9\,\%\) and the p value for \(h=12\) is \(74.0\,\%\).

The simulation results in the previous section and the empirical example in this section strongly suggest that the asymptotic \(Q_{\text {LM}}\) test may falsely reject the null hypothesis of no error AC if the errors are conditionally heteroskedastic. This suggests that a long lag length may be required to get residuals which pass the asymptotic test for error AC. In fact, we find that for the companies in Table 4, all VAR models with lag lengths up to \(p=25\) are rejected by the asymptotic \(Q_{\text {LM}}\) test.

In order to investigate the size and power of the tests for error AC with real data, we simulate the CDS prices data for Barclays Bank. In each simulation we use the estimated parameters from the unrestricted VAR(4) model and cointegrated VAR(4) model with cointegration rank \(r=1\) to define the DGP. The model for the errors is a CCC-GARCH(1, 1) model. We take the parameter estimates \((\widehat{a}_{01}, \widehat{a}_{11},\widehat{b}_{11},\widehat{a}_{02},\widehat{a}_{22},\widehat{ b}_{22},\widehat{\rho })\) from Ahlgren and Catani (2014a). The sum of the estimated parameters in the equation for \(p_{t}^{\text {CDS}}\) is \(\widehat{a} _{11}+\widehat{b}_{11}=0.995\) and in the equation for \(p_{t}^{\text {CS}}\) is \(\widehat{a}_{22}+\widehat{b}_{22}=0.986\). The stationarity condition is satisfied (the largest eigenvalue is 0.995). The 4th moment condition is not satisfied (the largest eigenvalue is 1.017). The estimate of the conditional correlation coefficient is \( \widehat{\rho }=0.035\). We simulate 20000 time series of length \(T=804\). The simulated size of the LM tests for error AC of orders \(h=1\), 4 and 12 is reported in Table 5. The simulated size of the asymptotic \(Q_{\text {LM}}\) test in the unrestricted VAR model is \(13.5\,\%\) for \(h=1\), \(22.5\,\%\) for \(h=4\) and \(30.7\,\%\) for \(h=12\). The HCCME-based \(Q_{\text {LM,HC}_{0}}\) test and the recursive-design WB \(Q_{\text {LM}}^{*\text {r}}\) test are undersized. The simulated size of \(Q_{\text {LM}}^{*\text {r}}\) is \(3.0\,\%\) for \(h=1\), \( 2.5\,\%\) for \(h=4\) and \(3.5\,\%\) for \(h=12\). The simulated size of the HCCME-based recursive-design WB \(Q_{\text {LM, HC}3}^{*\text {r}}\) test is \(5.4\,\%\) for \(h=1\), \(5.7\,\%\) for \(h=4\) and \(5.5\,\%\) for \(h=12\). Only small differences are observed in the simulated sizes of the tests in the unrestricted and cointegrated VAR models. This result is a consequence of the large number of observations. Figure 6 presents the simulated power functions of the asymptotic \(Q_{\text {LM}}\) test, recursive-design WB \(Q_{\text {LM} }^{*\text {r}}\) test and fixed-design WB \(Q_{\text {LM}}^{*\text {f}}\) test in the left panels, and the HCCME-based \(Q_{\text {LM,HC}_{3}}\), \(Q_{ \text {LM,HC}_{3}}^{*\text {r}}\) and \(Q_{\text {LM,HC}_{3}}^{*\text {f} }\) tests in the right panels for \(h=1\), 4 and 12. The fixed design WB \(Q_{\text {LM}}^{*\text {f}}\) test is more powerful than the recursive-design WB \(Q_{\text {LM}}^{*\text {r}}\) test. The HCCME-based tests are more powerful than the tests without the HCCME. The \( Q_{\text {LM, HC}_{3}}^{*\text {r}}\) test is more powerful than the \(Q_{ \text {LM, HC}_{3}}^{*\text {f}}\) test; the maximal difference in power is \(0.5\,\%\) for \(h=1\), \(6.2\,\%\) for \(h=4\) and \(2.4\,\%\) for \(h=12\).

5.2 Euribor interest rates

In the second empirical example we consider the problem of testing the expectations hypothesis of the term structure of interest rates. The theory makes two predictions, which can be tested in the cointegrated VAR model (Hall et al. 1992). First, if there are K interest rate series in the system, then the cointegration rank is \(r=K-1\). Second, the spreads between the interest rates at different maturities span the cointegration space.

We use monthly data from December 1998 to March 2013 on the 1, 3, 6, 9 and 12 month Euribor interest rates. All interest rates are nominal and annualised. The data were retrieved from www.euribor.org. The number of monthly observations is \(T=172\). The sample size is therefore small and the dimensions (\(K=5\)) are large. The SC and HQ information criteria select the lag length \(p=3\). Table 6 reports asymptotic and bootstrap LM tests for ARCH up to order 2. The univariate tests find a strong ARCH effect in the residuals from the equations for the 1, 3 and 6 month interest rates. The multivariate ARCH tests are significant at the \(1\,\%\) level. Because there is strong evidence of ARCH in the errors, HCCME-based and WB tests for error AC should be used in place of asymptotic tests which assume IID errors.

Table 6 shows the p values of the LM tests for error AC of orders \(h=1\), 4 and 12 in the unrestricted VAR model and cointegrated VAR model with cointegration rank \(r=1\). The asymptotic \(Q_{\text {LM}}\) tests for error AC of orders \(h=1\), 4 and 12 are all significant with p values \(0.0\,\%\). In contrast, the HCCME-based tests are all insignificant, with the exception of the \(Q_{\text {LM, HC}_{0}}\) test of \(h=1\). Because the sample size is small and the dimensions are large, we rely on the fixed-design WB \(Q_{\text {LM}}^{*\text {f}}\) test without the HCCME. The \(Q_{\text {LM}}^{*\text {f}}\) tests of \(h=1\) and 4 are insignificant with p values 10.8 and \(32.8\,\%\), whereas the test of \(h=12\) rejects with p value \(0.0\,\%\). The recursive-design WB \(Q_{\text {LM}}^{*\text {r}}\) test without the HCCME leads to similar inferences. The \(Q_{\text {LM}}^{*\text {r}}\) tests of \(h=1\) and 4 are insignificant with p values 12.4 and 51.8 %, whereas the test of \(h=12\) rejects with p value \(0.3\,\%\). In no case do the tests in the unrestricted and cointegrated VAR models lead to conflicting outcomes. We therefore conclude that the VAR(3) model provides a good description of the data, perhaps with the exception of some remaining error AC of order \(h=12\).

We do not simulate the Euribor interest rates data because the small sample size and large dimensions make it difficult to obtain reliable estimates of the parameters in the CCC-GARCH(1, 1) model for the errors.

6 Conclusions

In this article we propose WB LM tests for error AC in VAR models with conditionally heteroskedastic errors. We show that the WB tests are asymptotically valid under conditional heteroskedasticity of unknown form. Simulation experiments indicate that asymptotic tests for error AC are severely oversized when the errors are conditionally heteroskedastic. Besides, HCCME-based tests which are asymptotically valid under (conditional) heteroskedasticity are severely undersized in small samples. WB tests for error AC perform well when the errors are conditionally heteroskedastic. The fixed-design WB test without the HCCME has the best performance among all tests when the sample size is small, the dimensions are large and the order of AC tested is large. We therefore recommend that this version of the WB tests should be used in small samples. In large samples the HCCME-based recursive-design WB test has better size and power properties than other versions of the test. In large samples we recommend the use of the HCCME-based recursive-design WB test.

In an empirical example of CDS prices where the sample size is large, we find that the asymptotic test may falsely reject the null hypothesis of no error AC if the errors are conditionally heteroskedastic, whereas based on WB tests the VAR models selected by information criteria provide good descriptions of the data. In another empirical example of Euribor interest rates the sample size is small and the dimensions are large. It is found that the fixed-design WB test without the HCCME is the test for error AC which is most useful.

References

Ahlgren N, Antell J (2008) Bootstrap and fast double bootstrap tests of cointegration rank with financial time series. Comput Stat Data Anal 52:4754–4767

Ahlgren N, Catani P (2014a) Tests of cointegration rank with strong persistence in volatility: an application to the pricing of risk in the long run. In: Knif J, Pape B (eds) Contributions to mathematics, statistics, econometrics, and finance: essays in honour of Professor Seppo Pynnönen. Acta Wasaensia 296. University of Vaasa, Vaasa, pp 153–169

Ahlgren N, Catani P (2014b) Finite-sample multivariate tests for ARCH in vector autoregressive models. In: Gilli M, Gonzalez-Rodriguez G, Nieto-Reyes A (eds) Proceedings of COMPSTAT 2014. Université de Genéve, Genéve, pp 265–272

Baltagi BH, Kao C, Na S (2013) Testing for cross-sectional dependence in a panel factor model using the wild bootstrap \(F\) test. Stat Pap 54:1067–1094

Benkwitz A, Lütkepohl H, Wolters J (2001) Comparison of bootstrap confidence intervals for impulse responses of German monetary systems. Macroecon Dyn 5:81–100

Bera AK, Higgins ML, Lee S (1992) Interaction between autocorrelation and conditional heteroscedasticity: a random-coefficient approach. J Bus Econ Stat 10:133–142

Blanco R, Brennan S, Marsh IW (2005) An empirical analysis of the dynamic relation between investment-grade bonds and credit default swaps. J Finance 60:2255–2281

Bollerslev T (1990) Modelling the coherence in short-run nominal exchange rates: a multivariate generalized ARCH model. Rev Econ Stat 72:498–505

Breitung J, Brüggeman R, Lütkepohl H (2010) Structural vector autoregressive modeling and impulse responses. In: Lütkepohl H, Krätzig M (eds) Applied time series econometrics. Cambridge University Press, Cambridge, pp 159–196

Breusch TS (1978) Testing for autocorrelation in dynamic linear models. Aust Econ Pap 17:334–355

Brüggemann R, Jentsch C, Trenkler C (2014) Inference in VARs with conditional heteroskedasticity of unknown form. University of Konstanz, Department of Economics, Working Paper 2014-13

Brüggemann R, Jentsch C, Trenkler C (2015) Inference in VARs with conditional heteroskedasticity of unknown form. J Econom. (In Press)

Brüggemann R, Lütkepohl H, Saikkonen P (2006) Residual autocorrelation testing for vector error correction models. J Econom 134:579–604

Cavaliere G, Rahbek A, Taylor AMR (2010a) Co-integration rank testing under conditional heteroskedasticity. Econom Theory 26:1719–1760

Cavaliere G, Rahbek A, Taylor AMR (2010b) Testing for co-integration in vector autoregressions with non-stationary volatility. J Econom 158:7–24

Cavaliere G, Rahbek A, Taylor AMR (2012) Bootstrap determination of the co-integration rank in vector autoregressive models. Econometrica 80:1721–1740

Cavaliere G, Rahbek A, Taylor AMR (2014) Bootstrap determination of the co-integration rank in heteroskedastic VAR models. Econom Rev 33:606–650

Davidson J, Monticini A, Peel D (2007) Implementing the wild bootstrap using a two-point distribution. Econ Lett 96:309–315

Davidson R, Flachaire E (2008) The wild bootstrap, tamed at last. J Econom 146:162–169

Davidson R, MacKinnon JG (2006) The power of bootstrap and asymptotic tests. J Econom 133:421–441

Diebold FX (1986) Testing for serial correlation in the presence of ARCH. In: Proceedings of the business and economic statistics section, American Statistical Association, pp 323–328

Doornik JA (1996) Testing vector error autocorrelation and heteroscedasticity. Unpublished paper, Nuffield Collage

Eicker F (1963) Asymptotic normality and consistency of the least squares estimators for families of linear regressions. Ann Math Stat 34:447–456

Edgerton D, Shukur G (1999) Testing autocorrelation in a system perspective. Econom Rev 18:343–386

Engle RF, Kroner KF (1995) Multivariate simultaneous generalized ARCH. Econom Theory 11:122–150

Godfrey LG (1978) Testing for higher order serial correlation in regression equations when the regressors include lagged dependent variables. Econometrica 46:1303–1310

Godfrey LG (1991) Misspecification tests in econometrics. Cambridge University Press, Cambridge

Godfrey LG, Tremayne AR (2005) Wild bootstrap and heteroscedasticity-robut tests for serial correlation in dynamic regression models. Comput Stat Data Anal 49:377–395

Gonçalves S, Kilian L (2004) Bootstrapping autoregressions with conditional heteroscedasticity of unknown form. J Econom 123:89–120

Gonçalves S, Kilian L (2007) Asymptotic and bootstrap inference for AR(\(\infty \)) processes with conditional heteroskedasticity. Econom Rev 26:609–641

Hafner CM, Herwartz H (2000) Testing for linear autoregressive dynamics under heteroskedasticity. Econom J 3:177–197

Hafner CM, Herwartz H (2009) Testing for linear vector autoregressive dynamics under multivariate generalized autoregressive heteroskedasticity. Stat Neerl 63:294–323

Hall AD, Anderson HM, Granger CWJ (1992) A cointegration analysis of treasury bill yields. Rev Econ Stat 74:116–126

He C, Teräsvirta T (2004) An extended constant conditional correlation GARCH model and its fourth-moment structure. Econom Theory 20:904–926

Horowitz JL, Lobato IN, Nankervis JC, Savin NE (2006) Bootstrapping the Box-Pierce \(Q\) test: a robust test for uncorrelatedness. J Econom 133:841–862

Johansen S (1996) Likelihood-based inference in cointegrated vector autoregressive models. Oxford University Press, Oxford

Jouini J (2010) Bootstrap methods for single structural change tests: power versus corrected size and empirical illustration. Stat Pap 51:85–109

Jeantheau T (1998) Strong consistency of estimators for multivariate ARCH models. Econom Theory 14:70–86

Kilian L (1998a) Confidence intervals for impulse responses under departures from normality. Econom Rev 17:1–29

Kilian L (1998b) Small-sample confidence intervals for impulse response functions. Rev Econ Stat 80:218–230

Kilian L (1999) Finite-sample properties of percentile and percentile-\(t\) bootstrap confidence intervals for impulse responses. Rev Econ Stat 81:652–660

Kyriazidou E (1998) Testing for serial correlation in multivariate regression models. J Econom 86:193–220

Lütkepohl H (2000) Bootstrapping impulse responses in VAR analyses. In: Bethlehem JG, van der Heijden PGM (eds) Proceedings of COMPSTAT 2000. Physica-Verlag, Heidelberg

Lütkepohl H (2006) New introduction to multiple time series analysis. Springer, Berlin

Lütkepohl H (2010) Vector autoregressive and vector error correction models. In: Lütkepohl H, Krätzig M (eds) Applied time series econometrics. Cambridge University Press, Cambridge, pp 86–158

Lütkepohl H (2013) Reducing confidence bands for simulated impulse responses. Stat Pap 54:1131–1145

Lütkepohl H, Staszewska-Bystrova A, Winker P (2015) Comparison of methods for constructing joint confidence bands for impulse response functions. Int J Forecast 31:782–798

MacKinnon JG, White H (1985) Some heteroskedasticity consistent covariance matrix estimators with improved finite sample properties. J Econom 29:305–325

Mammen E (1993) Bootstrap and wild bootstrap for high dimensional linear models. Ann Stat 21:255–285

Nakatani T (2010) ccgarch: An R Package for modelling multivariate GARCH models with conditional correlations. R package version 0.2.0. http://CRAN.r-project/package=ccgarch

Nakatani T, Teräsvirta T (2009) Testing for volatility interactions in the constant conditional correlation GARCH model. Econom J 12:147–163

R Development Core Team (2011) R: a language and environment for statistical computing. R Foundation for Statistical Computing, Vienna. ISBN 3-900051-07-0. http://www.R-project.org/

Rao CR (1973) Linear statistical inference and its applications, 2nd edn. Wiley, New York

Swensen AR (2006) Bootstrap algorithms for testing and determining the cointegration rank in VAR models. Econometrica 74:1699–1714

Swensen AR (2009) Corrigendum to ’bootstrap algorithms for testing and determining the cointegration rank in VAR models’. Econometrica 77:1703–1704

van Giersbergen NPA (1996) Bootstrapping the trace statistic in VAR models: Monte Carlo results and applications. Oxf Bull Econ Stat 58:391–408

Whang YJ (1998) A test of autocorrelation in the presence of heteroskedasticity of unknown form. Econom Theory 14:87–122

White H (1980) A heteroskedasticity-consistent covariance matrix estimator and a direct test for heteroskedasticity. Econometrica 48:817–838

Wu CFJ (1986) Jackknife, bootstrap and other resampling methods in regression analysis. Ann Stat 14:1261–1343

Xu KL (2008) Bootstrapping autoregression under nonstationary volatility. Econom J 11:1–26

Acknowledgments

The authors want to thank the Editor-in-Chief, Professor Christine H. Müller, two anonymous referees, and Pentti Saikkonen and Timo Teräsvirta.

Author information

Authors and Affiliations

Corresponding author

Appendix

Appendix

Proof of Proposition 1 To prove the asymptotic validity of the recursive-design WB \(Q_{ \text {LM}}^{*}\) test, we need to show that \(\sqrt{T} \text{ vec }(\widehat{\mathbf {B}}-\mathbf {B})\) and \(\sqrt{T}\text{ vec }( \widehat{\mathbf {B}}^{*}-\widehat{\mathbf {B}})\) have the same asymptotic multivariate normal distribution, \(\sqrt{T}\mathbf {c}_{h}\) and \(\sqrt{T} \mathbf {c}_{h}^{*}\) have the same asymptotic multivariate normal distribution, and

where \(\widetilde{\mathbf {G}}\) is defined in (10).

To show that \(\sqrt{T}\text{ vec }(\widehat{\mathbf {B}}-\mathbf {B})\) and \( \sqrt{T}\text{ vec }(\widehat{\mathbf {B}}^{*}-\widehat{\mathbf {B}})\) have the same asymptotic multivariate normal distribution, we use Theorem 5.1 of Brüggemann et al. (2014). Brüggemann et al. prove consistency of the moving block bootstrap in vector autoregressive models with conditionally heteroscedastric errors. Their result also holds for the WB estimates of the mean parameters \(\mathbf {B}\) (see Brüggemann et al. 2014, p. 8). Hence, we can conclude that

in probability.

The asymptotic multivariate normal distribution of \(\sqrt{T}\mathbf {c}_{h}\) is obtained from Lemma A.1 of Brüggemann et al. (2014):

where \(\varvec{\Omega }_{h}=(\tau _{0,i,0,j})\) is a \( (K^{2}h\times K^{2}h)\) block matrix and \(\tau _{0,i,0,j}\) is defined in (3). The proof that \(\sqrt{T}\mathbf {c}_{h}^{*}\) has the same asymptotic multivariate normal distribution is entirely analogous to that in the proof of Lemma A.3 of Goncalves and Kilian. Define \(S_{t}=\varvec{\mathbf {\lambda }} ^{\prime }\mathbf {c}_{h}^{*}\) for arbitrary \(\varvec{\mathbf {\lambda }}\in \mathbf {R}^{m}\), \(m=K^{2}h\), \(\varvec{\mathbf {\lambda }}^{\prime }\varvec{\mathbf {\lambda }}=1\), and apply Theorem A.1 and the techniques of the proof of Lemma A.3 of Gonçalves and Kilian (2004) to \(S_{t}\).

The result (15) follows from the multivariate analogue of Lemma A.2 of Gonçalves and Kilian (2004).

Proof of Proposition 2 The proof of Proposition 2 is similar to the proof of Proposition 1, and is omitted. The required convergence results for the fixed-design WB were proved by Hafner and Herwartz (2009).

Rights and permissions

About this article

Cite this article

Ahlgren, N., Catani, P. Wild bootstrap tests for autocorrelation in vector autoregressive models. Stat Papers 58, 1189–1216 (2017). https://doi.org/10.1007/s00362-016-0744-0

Received:

Revised:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00362-016-0744-0

Keywords

- Autocorrelation

- Conditional heteroskedasticity

- Heteroskedasticity-consistent covariance matrix estimator

- Lagrange multiplier test

- Vector autoregressive model

- Wild bootstrap