Abstract

In this paper, we study optimal dividend problems in a diffusion risk model for two different cases depending on whether reinsurance is incorporated. In either case, the dividend rate is bounded above by a constant, and the company earns investment income at a constant force of interest. Unlike existing approaches in the literature dealing with optimal problems with interest, we allow the force of interest to be greater than the discount factor, and we use a different method to solve the corresponding Hamilton–Jacobi–Bellman (HJB) equation instead of introducing a confluent hypergeometric function. We conclude that the optimal dividend policy is of a threshold type and show that the corresponding dividend barrier is nondecreasing in the dividend rate bound. In cases where there is no reinsurance, we construct an auxiliary reflecting control problem to find the nonzero dividend barrier. If proportional reinsurance is purchased, the optimal reinsurance strategy looks somewhat strange. The optimal retention level of risk first increases monotonically with risk reserve to some possible value (less than \(1\)) and then stays at level \(1\) for a while or, if \(1\) has been reached, finally, it decreases to 0.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Optimal dividend and reinsurance problems have attracted much attention in recent years. Two classical papers by [3, 16] studied the optimal dividend problem for an insurance company whose surplus process follows Browninan motion with drift. In cases where reserve processes have downward jumps, one may consult, for example, [4, 11, 18]. Furthermore, for cases where companies are allowed to invest in the financial markets, one may refer to [5, 14, 15] for some work on optimal dividend problems.

Barrier or band strategies often may be the optimal strategy when the dividend rate is unrestricted. Then the ultimate ruin of the company is usually certain, which in many circumstances is not desirable or acceptable. In addition, there may be some institutional or statutory reasons (e.g., the company is publicly owned) such that the company is regulated and is unable to simply pay dividends at any desired level. These considerations lead to the idea of imposing restrictions on the dividend policy, for example, the dividend rate is bounded above by some constant. Under such constraints the optimal dividend policy is often of a threshold type, i.e., dividends are paid out at the maximal admissible rate only when the surplus process exceeds a certain level; otherwise they are paid out at the minimum rate \(0\). Some results on this policy can be found in, for example, [6, 11, 13, 17].

In this paper, we study the optimal dividend policy with restrictions or risk control for an insurance company in two different scenarios. The first case considers the optimal dividend problem without reinsurance. In the second case, the firm controls dividend payments and risk exposure as well as profit from reinsurance. Furthermore, in either case, the dividend rate is bounded by a constant, and the company earns investment income at a constant force of interest. The objective is to find a policy consisting of a dividend payment scheme and reinsurance strategy (if reinsurance is incorporated) to maximize the expected present value of dividend distributions until time of ruin.

A similar dividend problem with a constant rate of interest was considered by [1, 7] for classical and diffusion models, respectively, but in which the dividend rate is unbounded and no reinsurance is incorporated. The interest income earned by the company can be seen as a risk-free asset return on investment in the financial markets. This suggests that our model is somewhat analogous to that of [14], where the authors study the optimal unrestricted dividend payment scheme for a large corporation that controls risk exposure by reinsurance and invests in a financial market based on a Black–Scholes model. However, when imposing restrictions on the dividend rate, we find that the value function is finite even in cases where the discount factor is smaller than the force of interest. The optimal dividend strategy turns out to be that of a threshold type, not a barrier strategy. In the case of no reinsurance, we introduce an auxiliary reflecting control problem, which keeps the firm from ruin by capital injections and helps to find the dividend barrier. In the case of buying proportional reinsurance, the optimal retention level of risk is no longer a simply increasing function of risk reserve. It first increases monotonically with risk reserve to some possible value (less than \(1\)), and then stays at the level \(1\) for a while if \(1\) has been reached, and finally, it decreases to 0. Another point differentiating our paper from the existing literature is that we directly analyze the equations satisfied by the value function rather than by introducing the confluent hypergeometric function adopted by, for example, [7, 9, 19]. This simplifies the calculations and complies with our purpose of concentrating on the conclusive results. Finally, we obtain the optimal return function expressed in terms of the solutions to these equations.

The paper is organized as follows. In the next section, we first give a rigorous mathematical formulation of the problem, and then give some properties of the value functions and state the Hamilton–Jacobi–Bellman (HJB) equations and verification theorem. Section 3 is devoted to the derivation of the value function for the case without reinsurance. In Sect. 4, when risk control is incorporated, we solve the corresponding HJB equation and show that the candidate solution coincides with the optimal return function. The optimal reinsurance and dividend strategy are also given in this section. Some technical lemmas and proofs are given in Appendices A and B.

2 Problem Formulation

Let \((\Omega ,\mathcal{{F}},\{\mathcal{F}_{t}\},P)\) be a complete, filtered probability space, where \(P\) is a real-world probability. Our results will be formulated within the framework of a controlled diffusion model. However, for the purpose of motivation, it is convenient to start from the classical Cramér–Lunberg model, in which the reserve of the insurance company is modeled as

where \(x\ge 0\) is the initial reserve, \(\{N_{t}\}\) is a Poisson process with intensity \(\beta >0\), and the individual claim sizes \(X_1,X_2,\ldots \), independent of \(\{N_{t}\}\), are independent and identically distributed (i.i.d.) positive random variables with finite first and second moments \(\mu _1\), \(\mu _2\). The premium rate \(p\) is calculated by the expected premium principle, \(p=(1+\theta )\beta \mu _1\), where \(\theta >0\) is the relative safety loading of the insurer.

We now consider proportional reinsurance for the aforementioned classical model. Let \(a\in [0,1]\) denote the (fixed) proportional retention level, and assume that the reinsurance company uses the same safety loading \(\theta \) as the cedent. Then the reserve of the cedent is given by

According to [12], the diffusion approximation is described by the stochastic differential equation

where {\(\textit{B}_{t}\)} is a standard Brownian motion, perhaps not adapted to the filtration \(\{\mathcal{F}_{t}\}\). With a slight abuse of notation, we denote by \(\{\mathcal{F}_{t}\}_{t\ge 0}\) the \(\sigma \)-algebra flow generated by the Brownian motion.

An admissible control policy \(\pi \) is described by the two-dimensional, adaptive stochastic process \((a^{\pi }_{t}, l^{\pi }_{t})\), where \(a^{\pi }_{t}\in [0,1]\) corresponds to the proportion of risk exposure at time \(t\) and \(l^{\pi }_{t}\) corresponds to the dividend rate, bounded above by a constant \(M>0\). In addition, the company invests all its surplus in the risk-free asset with a force of interest \(r>0\). For notational convenience, we replace \(\beta \theta \mu _{1}\) and \(\sqrt{\beta \mu _2}\) with \(\mu \) and \(\sigma \), respectively. Then the dynamics of the controlled surplus process evolves as

We denote by \(\Pi _x\) the set of all admissible control policies with initial value \(x\). With a given admissible policy \(\pi \), we define the corresponding ruin time as \(\tau ^{\pi }=\inf \{t\ge 0:R_{t}^{\pi }<0\}\) and the return function \(V^{\pi }_{M}(x)\) as

where \(\delta >0\) is the discount factor. Note that here we do not require, as elsewhere in the literature, that \(\delta \) be greater than the risk-free interest rate \(r\). In other words, we allow \(\delta <r\).

If no reinsurance is incorporated, i.e., \(a_{t}^{\pi }\equiv 1\) in (2.3), denote by \(\theta =(l^{\theta }_{t})_{t\ge 0}\in [0,M]\) the admissible policy in this case. Hence, (2.3) changes into

Similarly, we denote by \(\Theta _x\), \(\tau ^{\theta }\), and \(J^{\theta }_{M}(x)\) the set of all admissible policies with initial value \(x\), the ruin time with admissible policy \(\theta \), and the expected discounted dividend payments until ruin, respectively.

Our objectives are to find the optimal return functions (value functions), which are defined as

and

and to find the optimal policies \(\pi ^{*}\) and \(\theta ^{*}\), which satisfies \(V_{M}(x)=V^{\pi ^{*}}_{M}(x)\) and \(J_{M}(x)=J^{\theta ^{*}}_{M}(x)\), respectively, for all \(x\ge 0\).

In the following parts of this section, we first give some properties of these value functions, then state the corresponding HJB equations and the verification theorem. We only prove the latter two results; the first one has a proof similar to [13, Proposition 1.1], so we omit it here.

Lemma 2.1

The value function defined by (2.6) is concave.

Lemma 2.2

The value functions \(V_{M}\) and \(J_{M}\) are nondecreasing on \([0,\infty )\), with \(0\le V_{M},J_{M}\le M/\delta \), and \(V_{M}(x)=M/\delta \) for any \(x\ge M/r\).

Proof

Since the dividend rate is bounded above by the constant \(M\), the accumulated discounted dividend payments are bounded above by \(M/\delta \). In the case where cheap reinsurance is available for the company, whenever the surplus process is above the level \(M/r\), ceding all the risk to the reinsurance company and paying dividends at the maximum admissible rate \(M\), the company will obtain the maximum present value of dividends \(M/\delta \), and never fall to ruin. \(\square \)

Theorem 2.1

Assume the value function \(V_{M}\) is twice continuously differentiable; then \(V_{M}\) satisfies the HJB equation

subject to the boundary condition \(V_{M}(0)=0\). Conversely, if there exists a continuously differentiable, concave function \(W(x)\), such that \(W\) solves the preceding HJB equation on \((0,M/r)\) and \(W(x)=M/\delta \) for \(x\ge M/r\), then \(W\) coincides with the value function \(V_{M}\). Furthermore, let \(a^{*}(x)\) be the maximizer of the left-hand side of (2.8), with \(V_{M}\) replaced by \(W\) over the variable \(a\), and let \(x^{*}\) be the point where \(W'(x^{*})=1\); define \(\pi ^{*}=(a^{*}(R^{\pi ^{*}}_{t}),l^{\pi ^{*}}(R^{\pi ^{*}}_{t}))\), where \(l^{\pi ^{*}}(R^{\pi ^{*}}_{t})=M\mathbf {1}_{\{R^{\pi ^{*}}_{t}\ge x^{*}\}}\), and \(R^{\pi ^{*}}_{t}\) is a solution to the following problem:

Then \(V_{M}(x)=V^{\pi ^{*}}_{M}(x)=W(x)\).

Proof

The first part follows from a standard argument in stochastic control by using the dynamic programming principle (e.g., [10]). For the second part, let \(R_{0}=x\in (0,M/r)\) and fix an arbitrary policy \(\pi \). Due to Lemma 2.2, we can revise the policy as \((a_{t}^{\pi },l_{t}^{\pi })=(0,M)\) when \(R_{t}^{\pi }=M/r\). As a result, the surplus process will never exceed the level \(M/r\). Choose \(0<\varepsilon <x\), and let \(\tau _{\varepsilon }^{\pi }=\inf \{t: R_{t}^{\tau }\le \varepsilon \}\); then Itô’s formula yields

where the last inequality is due to (2.8). By concavity, \(W'(R_{s}^{\pi })\le W'(\varepsilon )\) on \([0,\tau _{\varepsilon }^{\pi }]\), so the term of the stochastic integral is a zero-mean martingale. Taking expectations and noting that \(W\) is bounded and \(\tau _{\varepsilon }^{\pi }\uparrow \tau ^{\pi }\) as \(\varepsilon \rightarrow 0\), and lastly letting \(t\rightarrow \infty \), we have

Since \(\pi \) is arbitrary, we get \(W(x)\ge V_{M}(x)\).

Next, considering \(\pi ^{*}\) and following the same proof as earlier, we find that all inequalities turn out to be equalities. Therefore,

which, together with the earlier result, implies \(W(x)=V_{M}(x)=V^{\pi ^{*}}_{M}(x)\). \(\square \)

Remark 2.1

In Sect. 4, we will show that the candidate solution \(W(x)\) is twice continuously differentiable except at the point \(x=M/r\).

For a twice continuously differentiable function \(q(x)\), define the operators \(\mathcal {A}\) and \(\mathcal {H}\) by

and

Similar to Theorem 2.1, assume \(J_{M}\) is sufficiently smooth; then \(J_{M}\) satisfies the HJB equation

with boundary conditions

3 The Case of No Reinsurance

This section is devoted to dealing with the optimal problem (2.7). Equivalently, we need to solve HJB equation (2.10) with boundary conditions (2.11). First we introduce an auxiliary control problem that will later be used to characterize the optimal dividend policy.

Suppose the insurance company is regulated such that whenever the surplus process \(R_t^{\theta }\) in (2.5) hits the barrier \(0\), sufficient capital injections must be made to keep the controlled process nonnegative. In other words, there is a reflection at zero. Given an admissible dividend policy \(\theta \), denote by \(L_{t}^{\theta }\) the accumulated injections until time \(t\). The injection process \(L^{\theta }\) is adapted to the filtration \(\{\mathcal {F}_{t}\}\), nondecreasing, and continuous and is constant on any interval in which \(R^{\theta ,L}>0\), where the reflected process \(R^{\theta ,L}\) satisfies

It is worth noting that because the process \(R_{t}^{\theta }\) lacks space homogeneity, \(L_{t}^{\theta }\ne -(\inf _{s\le t}R_{s}^{\theta }\wedge 0)\) for any \(t>\tau ^{\theta }\). Define the performance function by the difference between the present value of dividend payments and the expected discounted injections,

Then the corresponding value function of this reflection problem is given by

Analogous to Theorem 2.1, we have the following results, which give sufficient conditions for the optimal problem (3.3). Since one can easily prove that by applying Itô’s formula, we leave the details to the interesting reader.

Theorem 3.1

Assume there exists a twice continuously differentiable function \(P(x)\) that solves the HJB equation

subject to the boundary conditions

then \(P(x)\ge {\hat{J}}_{M}(x)\) for all \(x\ge 0\). Moreover, if \(P\) is concave, then we have \(P(x)={\hat{J}}_{M}(x)={\hat{J}}^{\theta (M)}_{M}(x)\), where \(\theta (M)\) denotes the constant dividend policy of paying dividends at the maximum admissible rate \(M\) from time \(0\), i.e., \(l_{s}^{\theta }\equiv M\) in (3.1).

We conjecture that the optimal dividend policy for the optimal problem (2.7) is of a threshold type. Therefore, the HJB equation (2.10) reads as \(\mathcal {A}J_{M}(x)=0\) in the nonintervention region and \(\mathcal {A}J_{M}(x)+(1-J_{M}'(x))M=0\) in the dividend region. Our main idea is to paste the solutions of \(J_{M}\) on different regions in smooth conditions. Define two functions on \([0,\infty )\),

where \(f\) and \(\phi _{M}\) is given in Lemmas A.1 and A.2, respectively. The following two lemmas help to find the nonzero dividend barrier.

Lemma 3.1

There exists an \(M_{0}\in (0,\infty )\) such that \(J_{M}^{2}(0)\le 0\) for any \(M\le M_{0}\) and \(J_{M}^{2}(0)>0\) for any \(M>M_{0}\).

Lemma 3.2

On \((0,\infty )\), \(J^{1}\) and \(J_{M}^{2}\) defined by (3.6) have an intersection if and only if \(M>M_{0}\). Moreover, if they do, the intersection is unique and lies on \((z_{M},\bar{z})\), where \(\bar{z}\) and \(z_{M}\) are given in Lemmas A.1ii and A.2ii, respectively.

Now we have the value function and the optimal dividend policy.

Theorem 3.2

Let \(M_{0}\) be given by Lemma 3.1, and denote by \(z^{*}\) the intersection in Lemma 3.2, otherwise setting \(z^{*}=0\) if there is no intersection on \((0,\infty )\). If \(M\le M_{0}\), then the value function defined by (2.7) is

If \(M>M_{0}\), then we have

where \(f(x)\) and \(\phi _{M}(x)\) are given in Lemmas A.1 and A.2, respectively. The optimal dividend policy is of a threshold type with the barrier \(z^{*}\).

Proof

Inspired by Theorem 3.1, we only need to show that, in either case, \(J_{M}\) given earlier solves HJB equation (2.10) and satisfies boundary conditions (2.11). First, when \(M\le M_{0}\), from the beginning part of the proof of Lemma 3.2 we know that \(\phi _{M}\) is strictly convex on \(R^{+}\). So \(J_{M}\) given by (3.7) is concave, and then \(J_{M}'(x)<1\) follows from \(J_{M}'(0)\le 1\), where the latter inequality is naturally satisfied since from Lemma 3.1 we know that \(J_{M}^{2}(0)\le 0\). These, combined with (A.2a) and (A.2b), show that \(J_{M}\) given by (3.7) is a concave solution of (2.10) and (2.11). Next, for \(M>M_{0}\), for a similar reason we only need to demonstrate that \(J_{M}\) given by (3.8) is concave on \(R^{+}\). This follows from \(z^{*}\in (z_{M},\bar{z})\) and the fact that \(f'>0\) and \(f\) is concave on \((0,\bar{z})\) by Lemma A.1, \(\phi _{M}'<0\), and \(\phi _{M}\) is convex on \((z_{M},\infty )\) by Lemma A.2. Furthermore, Lemma 3.2 and \(J_{M}'(z^{*})=1\) guarantee the smooth past condition at \(z^{*}\). The preceding analysis also implies that the optimal dividend policy is of a threshold type and the corresponding barrier is \(z^{*}\). \(\square \)

Remark 3.1

Since the class of admissible policies \(\Theta \) enlarges with increasing \(M\), so is the value function \(J_{M}\). This, in combination with the first case of (3.8) and the concavity of \(f\) on \((0,\bar{z})\), yields that \(z^{*}\) is nondecreasing in the dividend rate bound \(M\). Furthermore, taking \(M\rightarrow \infty \), if \(\delta >r\), then we have \(z^{*}\rightarrow \bar{z}\) and the value function for this limiting case

which solves the following variational inequality

If \(\delta \le r\), then by Lemma A.1ii we know that \(\bar{z}=\infty \), so there is no optimal strategy. However, thanks to Lemma A.1iii, we have \(J_{\infty }(x)=f(x)/f'(\infty )\) for the special case where \(\delta =r\). Lemma A.1iii also tells us that the value function \(J_{\infty }\) is infinite for any \(x>0\) if \(\delta <r\). One can verify this using a barrier strategy and then raising the barrier to infinity.

Remark 3.2

From Lemma 3.1 and Theorem 3.2 we know that the optimal dividend barrier \(z^{*}\) is nonzero if and only if \(J^{2}_{M}(0)>0\). This result agrees with [9, Theorem 4.1]. But a correction needs to be made since \(f_{3}(x)\) in (2.5) given in that paper is not an increasing function on \(\mathbb {R}^{+}\) if \(\alpha >\mu \).

4 The Case of Buying Reinsurance

In this section, we settle the optimal problem (2.6). By construction we solve the corresponding HJB equation (2.8). The optimal strategy, consisting of a reinsurance and dividend payment scheme, is also characterized.

Inspired by Lemmas 2.1 and 2.2 and Theorem 2.1, we will look for an increasing, concave function \(W\in \mathcal {C}^2(\mathbb {R}^{+}\setminus \{\frac{M}{r}\})\) that solves the HJB equation

subject to the boundary conditions

Let \(a^{*}(x)\) be the maximizer of the left-hand side of (4.1) over the variable \(a\). For each \(x>0\) define

Suppose \(W\) is concave; then the maximizer of \(\phi (x,a)\) over \(a\) is given by

It is easy to see that

Assume \(A(x)<1\) and \(W'(x)>1\) in a right neighborhood of \(0\); substituting (4.3) into (4.1) yields

We conjecture a solution of (4.5) in the form \(W(x)=cx^{\alpha }\), with constant \(c\) to be determined subsequently. Inserting this solution into (4.5) shows that \(\alpha \) must satisfy

In order for \(cx^{\alpha }\) to be concave, we choose the root \(\alpha ^{*}\in (0,1)\) such that \(h(\alpha ^{*})=0\). Then the solution of (4.5) can be written as

and \(A(x)\) defined via (4.3) is given by

Because of the preceding assumptions, (4.7) and (4.8) may solve (4.1) only on \([0,x_0]\), where

satisfying \(A(x_{0})=1\) and

From (4.4) and (4.8) we see that the optimal reinsurance strategy \(a^{*}(x)\) is increasing in a right neighborhood of \(0\). However, at the critical level \(M/r\), Lemma 2.2 shows that the optimal reinsurance strategy for the company is to cede out all the risk, in other words, we should have \(a^{*}(M/r)=0\). This reflects the fact that the optimal reinsurance strategy \(a^{*}(x)\) is not always increasing with risk reserve. We conjecture that in a left neighborhood of \(M/r a^*(x)\) decreases to 0 and \(W' <1\), the latter is due to the requirements that \(W\in \mathcal {C}^{1}\) and is equal to \(M/\delta \) above \(M/r\).

Based on these conjectures, in a left neighborhood of \(M/r\), HJB equation (4.1) reads

Differentiating the preceding equation and using (4.3) again gives

Let \(a(x)\) be the solution of (4.12) subject to the conjectured boundary conditions

Set \(k:= a'(\frac{M}{r}-)\); then, by l’Hôpital’s rule, \(k\) satisfies

which also induces

We conjecture the solution of (4.12) and (4.13) in the form

Setting

(4.4) implies that \(a(x)\) given by (4.16) could be used to indicate the optimal reinsurance strategy only on the interval \([x_{M},M/r]\), where

satisfying \(a(x_M)=1\).

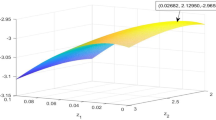

For each \(M>0\) there exists a unique intersection \(x^{*}\in (0,M/r)\) between the two lines represented by (4.8) and (4.16), respectively, and

In order for the lower parts of the crossed lines (Fig. 1) to indicate the optimal reinsurance strategy, we must have \(A(x^{*})\le 1\) or, equivalently expressed by the dividend bound \(M\),

In this case, we can suggest the following solution of (4.1) and (4.2):

and the optimal reinsurance strategy

The following theorem verifies that the previously suggested expressions indeed correspond to the value function and the optimal reinsurance strategy.

Theorem 4.1

Let \(x_0\), \(x_1\), and \(x^{*}\) be given by (4.9), (4.17), and (4.19), respectively. \(\alpha ^{*}\) and \(k\) satisfy (4.6) and (4.14), respectively. If \(M\le r(x_0+x_1)\), then \(W\) given by (4.21) belongs to \(\mathcal {C}^2(\mathbb {R}^{+}\setminus \{\frac{M}{r}\})\), is an increasing concave solution of (4.1), and coincides with the value function \(V_{M}\) defined by (2.6). The optimal reinsurance strategy \(a^{*}(x)\) is characterized by (4.22), and the optimal dividend policy is of a threshold type with the barrier \(x^{*}\).

Proof

We first show that \(W\) given by (4.21) is an increasing function, which is equivalent to proving \(\frac{x^{*}}{\alpha ^{*}}<\frac{M}{\delta }\). Keeping in mind \(A(x^{*})=a(x^{*})\), we have

where the inequality is due to (4.15) and (4.16), and the last equality is a direct consequence of (4.8) and \(h(\alpha ^{*})=0\).

Next we prove that \(W\in \mathcal {C}^2(\mathbb {R}^{+}\setminus \{\frac{M}{r}\})\) and is concave. Referring to (4.23) and (4.16) again yields

Therefore, \(W'(x^{*}-)=W'(x^{*}+)=1\), and from this and (4.3) we have that \(W''\) is also continuous at \(x^{*}\). However, the continuity of \(W''\) may fail at the critical level \(M/r\). To see this, note that in a left neighborhood of \(M/r\), using (4.3) with \(A(x)\) replaced by \(a(x)\) and (4.24), we obtain

whose left limit at \(M/r\) is equal to 0 if and only if \(\delta >\mu k+2r\), which by (4.14) is equivalent to \(\mu ^2/\sigma ^2+\delta >2r\). Since this inequality is not always true for different possible pairs of parameters, for simplicity we say that \(W\in \mathcal {C}^2(\mathbb {R}^{+}\setminus \{\frac{M}{r}\})\). The concavity of \(W\) follows from (4.3), with \(A(x)\) replaced by \(a^{*}(x)\) on \((0,\frac{M}{r})\) and the continuity of \(W'\) at \(M/r\).

Lastly, based on the preceding analysis we see that \(W\) is a classic solution of HJB equation (2.8). Thus, \(W\) coincides with the value function by Theorem 2.1, from which we also know that \(a^{*}(x)\) given by (4.22) is the optimal reinsurance strategy and the optimal dividend policy is of a threshold type with the barrier \(x^{*}\). \(\square \)

By shifting rightward the line \(a(x)\) in Fig. 1, i.e., increasing the dividend rate bound \(M\), we see that \(a^{*}(x)\) given by (4.22) is greater than \(1\) in a neighborhood of \(x^{*}\) if (4.20) fails. Then the suggested solutions (4.21) and (4.22) are no longer suitable. We conjecture that the optimal reinsurance strategy is \(a^{*}(x)=1\) on \([x_0,x_M]\), where \(x_M\) defined by (4.18) is an increasing function of \(M\). Note here that \(x_M>x_0\) if and only if \(M>r(x_0+x_1)\). Furthermore, we guess that the optimal dividend barrier lies on the interval \((x_0,x_M)\) and denote this point by \(\hat{x}\) (Fig. 2).

We now look for the optimal dividend barrier \(\hat{x}\) and then verify our conjectures for the case

Based on our suppositions, HJB equation (4.1) reads \(\mathcal {A}W(x)=0\) on \((x_0,\hat{x})\). This, in combination with (4.7), suggests that \(U(x)\) given subsequently is a canonical solution of (4.1) on the interval \((0,\hat{x})\):

where \(g(x)\) is defined in Lemma A.3. On \((\hat{x},x_M)\), HJB equation (4.1) changes into \(\mathcal {A}W(x)+(1-W'(x))M=0\), whose general solution can be expressed by \(\psi _{M}(x)\) given in Lemma A.4. By a method analogous to that used in Sect. 3, we define two functions,

and

Then, similar to Lemma 3.2, we have the following conclusion, which characterizes the optimal dividend barrier \(\hat{x}\).

Lemma 4.1

If \(M>r(x_0+x_1)\), then \(V^{1}\) and \(V^{2}_{M}\) defined respectively by (4.27) and (4.28) have a unique intersection \(\hat{x}\), which lies on \((x_0\vee \underline{x}_{M},x_M\wedge \bar{x})\), where \(\bar{x}\) and \({\underline{x}}_{M}\) are given in Lemmas A.3ii and A.4ii, respectively.

Building on the foregoing results and conjectures, we propose the following solution of HJB equation (4.1):

and the optimal reinsurance strategy

The following theorem verifies our conjectures and shows that \(W\) given (4.29) coincides with the value function and \(a^{*}(x)\) given by (4.30) is the optimal reinsurance strategy.

Theorem 4.2

Let \(x_0\) and \(x_1\) be given by (4.9) and (4.17), respectively, where \(\alpha ^{*}\) and \(k\) satisfy (4.6) and (4.14), respectively. \(U(x)\) is defined by (4.26), and \(\psi _{M}(x)\) solves differential equation (A.5). For each \(M>r(x_{0}+x_{1})\), let \(x_M\) and \(\hat{x}\) be given by (4.18) and Lemma 4.1, respectively. Then \(W\) given by (4.29) belongs to \(\mathcal {C}^2(\mathbb {R}^{+}\setminus \{\frac{M}{r}\})\), is an increasing concave solution of (4.1), and coincides with the value function \(V_{M}\) defined by (2.6). The optimal reinsurance strategy \(a^{*}(x)\) is characterized by (4.30), and the optimal dividend policy is of a threshold type with the barrier \(\hat{x}\).

Proof

Owing to Theorem 2.1, it suffices to check that \(W\) given by (4.29) is an increasing concave solution of HJB equation (4.1), and \(W\in \mathcal {C}^2(\mathbb {R}^{+}\setminus \{\frac{M}{r}\})\). To clarify more conveniently, we denote by \(W_1(x)\), \(W_2(x)\), and \(W_3(x)\) the values of \(W\) at different intervals \([0,\hat{x}]\), \((\hat{x},x_M]\), and \((x_M,M/r)\), respectively. First, from Lemma 4.1 we have that \(W\) is continuous at \(\hat{x}\). This, together with the fact that \(\mathcal {A}W_{1}(\hat{x})=\mathcal {A}W_{2}(\hat{x})=0\), shows that \(W''\) is also continuous at \(\hat{x}\). The continuity of \(W\) and \(W'\) at \(x_M\) follows from (4.17) and (4.18) and boundary conditions (A.5b). Then the continuity of \(W''\) at \(x_M\) is guaranteed by the equation

where the second equality is simply (4.14). However, for the same reason as that in the proof of Theorem 4.1, \(W\) is continuously differentiable at \(M/r\) but might fail to be second-order continuously differentiable. With the help of Lemmas A.3(i and ii) and A.4(i and ii) and inequalities (4.15), we know that \(W_1\), \(W_2\), and \(W_3\) are concave on the respective defined intervals. Thus, by the smooth conditions at \({\hat{x}}\) and \(x_{M}\), \(W\) is concave on \(R^{+}\).

Referring to Eqs. (4.3) and (4.4) and Lemmas A.3iii and A.4iii, we confirm our conjecture that \(a^{*}(x)=1\) on \((x_0,x_M)\). The results that \(W\) is concave and \(W'(\hat{x})=1\) yield the optimal dividend strategy is of a threshold type with barrier \(\hat{x}\). \(\square \)

Remark 4.1

The optimal reinsurance strategy is not unique for large reserves, for example, \(x>M/r\), but for simplicity, in (4.22) and in (4.30) we choose the strategy of ceding all the risk. Equation (4.19) shows that the optimal dividend barrier \(x^{*}\) is an increasing function of the dividend rate bound for the case (4.20). By a similar reason and argument as in Remark 3.1, one can also show that \(\hat{x}\) is nondecreasing in \(M\). Moreover, if \(\delta >r\), then Lemma 4.1 implies that \(\hat{x}\) will increase to the finite \(\bar{x}\) as \(M\) tends to infinity. When the dividend rate is unlimited, no optimal strategy for dividend payment exists for \(\delta \le r\), and the value function is infinite if \(\delta <r\). These limiting results correspond to that of [14] with a risk-free investment. An interesting phenomenon that needs to be noted is that the controlled surplus will never hit the critical level \(M/r\) from below since \(M/r-R_{t}^{\pi ^{*}}\) evolves as a geometric Brownian motion in a left neighborhood of \(M/r\). This situation also occurs in [21].

References

Albrecher, H., Thonhauser, S.: Optimal dividend strategies for a risk process under force of interest. Insur. Math. Econ. 43(1), 134–149 (2008)

Alili, L., Patie, P., Pedersen, J.L.: Representations of the first hitting time density of an Ornstein–Uhlenbeck process. Stoch. Models 21(4), 967–980 (2005)

Asmussen, S., Taksar, M.: Controlled diffusion models for optimal dividend pay-out. Insur. Math. Econ. 20(1), 1–15 (1997)

Avram, F., Palmowski, Z., Pistorius, M.R.: On the optimal dividend problem for a spectrally negative Lévy process. Ann. Appl. Probab. 17(1), 156–180 (2007)

Azcue, P., Muler, N.: Optimal investment policy and dividend payment strategy in an insurance company. Ann. Appl. Probab. 20(4), 1253–1302 (2010)

Azcue, P., Muler, N.: Optimal dividend policies for compound poisson processes: the case of bounded dividend rates. Insur. Math. Econ. 51(1), 26–42 (2012)

Cai, J., Gerber, H.U., Yang, H.: Optimal dividends in an Ornstein–Uhlenbeck type model with credit and debit interest. North Am. Actuarial J. 10(2), 94–108 (2006)

Eisenberg, J., Hanspeter, S.: Optimal control of capital injections by reinsurance with a constant rate of interest. J. Appl. Probab. 48(3), 733–748 (2011)

Fang, Y., Wu, R.: Optimal dividends in the Brownian motion risk model with interest. J. Comput. Appl. Math. 229(1), 145–151 (2009)

Fleming, W.H., Soner, H.M.: Controlled Markov Processes and Viscosity Solutions, vol. 25. Springer, Berlin (2006)

Gerber, H.U., Shiu, E.S.W.: On optimal dividend strategies in the compound Poisson model. North Am. Actuarial J. 10(2), 76–93 (2006)

Grandell, J.: Empirical bounds for ruin probabilities. Stoch. Process. Appl. 8(3), 243–255 (1979)

Højgaard, B., Taksar, M.: Controlling risk exposure and dividends payout schemes: insurance company example. Math. Fin. 9(2), 153–182 (1999)

Højgaard, B., Taksar, M.: Optimal risk control for a large corporation in the presence of returns on investments. Fin. Stoch. 5(4), 527–547 (2001)

Højgaard, B., Taksar, M.: Optimal dynamic portfolio selection for a corporation with controllable risk and dividend distribution policy. Quant. Fin. 4(3), 315–327 (2004)

Jeanblanc-Picqué, M., Shiryaev, A.N.: Optimization of the flow of dividends. Russian Math. Surv. 50, 257–277 (1995)

Kyprianou, A.E., Loeffen, R., Pérez, J.-L.: Optimal control with absolutely continuous strategies for spectrally negative Lévy processes. J. Appl. Probab. 49(1), 150–166 (2012)

Loeffen, R.L.: On optimality of the barrier strategy in de Finetti’s dividend problem for spectrally negative Lévy processes. Ann. Appl. Probab. 18(5), 1669–1680 (2008)

Paulsen, J., Gjessing, H.K.: Optimal choice of dividend barriers for a risk process with stochastic return on investments. Insur. Math. Econ. 20(3), 215–223 (1997)

Shreve, S.E., Lehoczky, J.P., Gaver, D.P.: Optimal consumption for general diffusions with absorbing and reflecting barriers. SIAM J. Control Optim. 22(1), 55–75 (1984)

Taksar, M., Markussen, C.: Optimal dynamic reinsurance policies for large insurance portfolios. Fin. Stoch. 7(1), 97–121 (2003)

Acknowledgments

The authors would like to thank the anonymous referee for his or her helpful comments and suggestions, which greatly improved the paper. This work was supported by the National Natural Science Foundation of China (NSFC Grant 11171164, 11471171, and 11371020).

Author information

Authors and Affiliations

Corresponding author

Appendices

Appendix A: Technical Lemmas

Lemma A.1

Let \(f\) be a solution of \(\mathcal {A}f(x)=0\) on \(R^{+}\) subject to the boundary conditions \(f(0)=0\) and \(f'(0)>0\).

-

(i)

\(f'(x)>0\) on \([0,\infty )\).

-

(ii)

There exists a \(\bar{z}>0\) (possibly taking the value infinity) such that \(f\) is strictly concave on \([0,\bar{z})\) and strictly convex on \(({\bar{z}},\infty )\). In particular \(\bar{z}<\infty \) if and only if \(\delta >r\), and trivially in this case \(f''(\bar{z})=0\).

-

(iii)

If \(r=\delta \), then \(\lim _{x\rightarrow \infty }f'(x)>0\); whereas if \(r>\delta \), \(\lim _{x\rightarrow \infty }f'(x)=0\).

Proof

The general solution of \(\mathcal {A}f(x)=0\) has been given by [7], expressed in terms of Kummer’s confluent hypergeometric functions. We construct the needed \(f\) as follows. Let \(f_1\) and \(f_{2}\) be two independent solutions; choose so that \(f(x)=f_{1}(0)f_{2}(x)-f_{2}(0)f_{1}(x)\) satisfies \(f'(0)>0\). \(f\) is often called a canonical solution since any solution of \(\mathcal {A}g(x)=0\) with \(g(0)=0\) has the form \(g(x)=cf(x)\) for some \(c\in \mathbb {R}\).

Suppose assertion (i) is not true; then \(\tilde{x}:=\inf \{x>0:\ f'(x)=0\}<\infty \). However, according to the boundary conditions \(f(0)=0\) and \(f'(0)>0\), we have \(f''(\tilde{x})\le 0\) and \(f(\tilde{x})>0\). These result in \(\mathcal {A}f(\tilde{x})<0\), which contradicts \(\mathcal {A}f(x)=0\) on \([0,\infty )\).

A similar argument can be used to show that \(\bar{z}<\infty \) in the case where \(\delta >r\). Differentiating \(\mathcal {A}f(x)=0\) yields

Suppose \(f''(x)<0\) on \([0,\infty )\); then by (A.1) \(f'''(x)>0\) for all \(x>0\). So \(f''(x)\) increases to 0 as \(x\rightarrow \infty \); otherwise, \(f'\) cannot always be positive on the positive axis. Dividing by \(f(x)\) on both sides of \(\mathcal {A}f(x)=0\) and then letting \(x\) tend to \(\infty \), we now have \((\mu +rx)f'(x)/f(x)\rightarrow \delta \). Moreover, \(rxf'(x)/f(x)\rightarrow \delta \) by the assumption that \(f\) is concave on \([0,\infty )\) and the boundary condition \(f(0)=0\). However, for the same reason we have \(f(x)\ge f'(x)x\), which results in \(\limsup _{x\rightarrow \infty }{rxf'(x)/f(x)}\le r\). This contradicts \(\delta >r\). So there must exist a finite point \(\bar{z}>0\) such that \(f''(x)<0\) on \([0,\bar{z})\) and \(f''(\bar{z})=0\).

The strict convexity of \(f\) on \((\bar{z},\infty )\) in the case where \(\delta >r\) and the strict concavity of \(f\) on \([0,\infty )\) in the case where \(\delta \le r\) can be proved in a similar way as that \(f'>0\), just using the differential equation (A.1) instead of \(\mathcal {A}f(x)=0\) in the proof.

Next we show that \(\lim _{x\uparrow \infty }f'(x)>0\) if \(r=\delta \). In this case, (A.1) tells us that

Integrating this equality on both sides gives

which, together with \(f(0)=0\), yields

Our conclusion follows from \(\int _{0}^{\infty }\mathrm{{e}}^{-\frac{1}{\sigma ^2}(ry^2+2\mu y)}\mathrm{{d}}y<\int _{0}^{\infty }\mathrm{{e}}^{-\frac{2\mu y}{\sigma ^2}}\mathrm{{d}}y=\frac{\sigma ^2}{2\mu }\) and the boundary condition \(f'(0)>0\).

Finally, for the remaining assertion in (iii), because of (i) and (ii) we know that the limit exists and is no smaller than \(0\). Denote this limit by \(q\). Suppose \(q>0\); then \(f\) increases to infinity certainly. Integrating \(\mathcal {A}f(x)=0\) on both sides and using integration by parts yields

Dividing by \((\mu +rx)^2\) on both sides and then taking limits as \(x\rightarrow \infty \), by l’Hôpital’s rule we have \(\frac{q}{r}=q\frac{\delta +r}{2r^2}\), which contradicts the condition \(\delta <r\). \(\square \)

Lemma A.2

For each \(M>0\), let \(\phi _{M}\) be the solution of the following singular boundary value problem:

-

(i)

\(\phi _{M}(x)>0\) and \(\phi _{M}'(x)<0\) on \([0,\infty )\).

-

(ii)

There exists a \(z_{M}\) (possibly taking the value \(0\)) such that \(\phi _{M}\) is strictly concave on \([0,z_{M})\) and strictly convex on \((z_{M},\infty )\). Moreover, for \(\delta \ge r\) or \(M\le \mu \), \(z_{M}=0\); for \(\delta <r\), if there exists an \(\bar{M}>\mu \) such that \(z_{\bar{M}}>0\), then \(z_{M}>0\) for any \(M>\bar{M}\).

Proof

A twice continuously differentiable solution of (A.2a) can be found in [8, Example 2.1] using a power series expansion. By [2, Proposition 2.1] we know in fact that \(\phi _{M}(x)=E_{x}[\mathrm{{e}}^{-\delta \tau ^{\theta (M)}}]\), where \(\theta (M)\) denotes the constant dividend rate policy, i.e., \(l_{t}^{\theta }\equiv M\) in (2.5).

Assertion (i) is a direct consequence of [20, Lemma 4.2 ] and boundary conditions (A.2b).

Rewrite (A.2) as

which, together with (i), implies that \(\phi _{M}\) is strictly convex on \([0\vee (M-\mu )/r,\infty )\). Thus, \(z_{M}=0\) if \(M\le \mu \). Differentiating (A.2a) yields

For each \(M>\mu \), define \(z_M:=\sup \{x\in [0,\frac{M-\mu }{r});\phi _{M}''(x)=0\}\), with the convention \(\sup \{\emptyset \}=0\). Suppose that \(z_M>0\) for some \(M>\mu \); according to the definition of \(z_{M}\), we should have \(\phi _{M}'''(z_M)\ge 0\). However, this, in combination with \(\phi _{M}'<0\), will lead to a contradiction in (A.3) when \(\delta >r\). For \(\delta =r\), (A.3), together with (A.2a), tells us that \(\phi _{M}''(x)=\frac{2\delta }{\sigma ^2}\phi _{M}(\frac{M-\mu }{r})\exp {(-\frac{r}{\sigma ^2}(x-\frac{M-\mu }{r})^2)}\). Thus, \(z_M=0\) by assertion (i). An analogous argument shows that \(\phi _{M}\) is strictly concave on \((0,z_M)\) if \(z_M>0\).

For the remaining part of assertion (ii), assume there exists some \(M>\bar{M}\) such that \(z_M=0\), which means \(\phi _M\) is convex on \(R^{+}\). Hence, by Theorem 3.1, we know that \({\hat{J}}_{M}(x)={\hat{J}}_{M}^{\theta (M)}(x)=M/\delta +\phi _{M}(x)/\phi _{M}'(0)\). By an argument similar to [20, Corollary 2.2], we have \({\hat{J}}^{\theta (\bar{M})}_{\bar{M}}(x)=\bar{M}/\delta +\phi _{\bar{M}}(x)/\phi _{\bar{M}}'(0)\). However, from (A.2a), in combination with \(\phi _{M}'(0),\phi _{\bar{M}}'(0)<0\) and \(\phi _{\bar{M}}''(0)<0\le \phi _{M}''(0)\), we may deduce

This results in \({\hat{J}}_{M}(0)<{\hat{J}}_{\bar{M}}(0)\), which contradicts the fact that \({\hat{J}}_{M}\) is nondecreasing in \(M\) since the class of admissible policies \(\Theta \) expands with increasing \(M\). \(\square \)

Lemma A.3

Let \(x_{0}\) be given by (4.9) and \(g\) be the solution of \(\mathcal {A}g(x)=0\) on \(x\ge x_{0}\) with the boundary conditions

-

(i)

\(g'(x)>0\) on \([x_0,\infty )\).

-

(ii)

There exists an \(\bar{x}>x_0\) (possibly taking the value infinity) such that \(g\) is strictly concave on \((x_0, \bar{x})\) and strictly convex on \((\bar{x},\infty )\). In particular, \(\bar{x}<\infty \) if and only if \(\delta >r\), and trivially in this case \(g''(\bar{x})=0\).

-

(iii)

\(\mathcal {H}g(x)<0\) for any \(x\in (x_0,\infty )\).

Proof

Assertions (i) and (ii) follow from an analogous argument used in the proof of Lemma A.1. To validate assertion (iii), first note that, by (4.10) and boundary conditions (A.4), we have \(\mathcal {H}g(x_0)=0\). Therefore,

where the inequality follows from (4.6) that \(r\alpha ^{*}-\delta =\frac{\mu ^2\alpha ^{*}}{2\sigma ^2(\alpha ^{*}-1)}<0\). Thus, \(\mathcal {H}g(x)<0\) in a right neighborhood of \(x_0\). Suppose there exists a finite \(\tilde{x}>x_0\) such that \(\mathcal {H}g(\tilde{x})=0\) and \(\mathcal {H}g(x)<0\) for all \(x\in (x_0,\tilde{x})\); we should then have \((\mathcal {H}g(x))'|_{x=\tilde{x}}\ge 0\). However, calculations similar to the preceding ones show that

which is a contradiction. \(\square \)

Lemma A.4

For each \(M>0\), let \(x_{M}\) be given by (4.18), and let \(\psi _{M}\) be the unique solution of a differential equation with boundary conditions:

-

(i)

\(\psi _{M}'(x)>0\) on \((-\infty ,x_M]\).

-

(ii)

There exists an \({\underline{x}}_{M}\) (possibly taking the value minus infinity) such that \(\psi _{M}\) is strictly concave on \(({\underline{x}}_{M}, x_M)\) and strictly convex on \((-\infty ,{\underline{x}}_{M})\). If \(\delta \ge r\), then \({\underline{x}}_{M}=-\infty \).

-

(iii)

\(\mathcal {H}\psi _{M}(x)-M\psi _{M}'(x)<0\) for any \(x<x_M\).

Proof

Since all the results can be proved in the spirit of the proof of Lemmas A.1 and A.3, for the sake of brevity, we only show that they are true in a left neighborhood of \(x_M\) and leave the details for the interested reader.

Boundary conditions (A.5b), in conjunction with (4.17) and (4.18), tell us that \(\psi _{M}'(x_M)=-\delta /(\frac{\mu }{2}+\frac{r}{k})\), which, by (4.15), is greater than \(0\). Thus, \(\psi _{M}''(x_M)=-\mu /\sigma ^{2}\psi _{M}'(x_M)<0\). This, together with (4.14), yields

which shows that \(\mathcal {H}\psi _{M}(x)-M\psi _{M}'(x)<0\) in a left neighborhood of \(x_M\). \(\square \)

Appendix B: Technical Proofs

Using the equations satisfied by \(f\) and \(\phi _{M}\) respectively, we can rewrite \(J^{1}\) and \(J^{2}_{M}\) as

and

Proof of Lemma 3.1

We prove this conclusion by dividing it into two different cases. First, if \(\delta \ge r\), then from Lemma A.2ii we know that \(\phi _{M}\) is convex on \([0,\infty )\) for any \(M>0\). This, in conjunction with Theorem 3.1, yields \({\hat{J}}_{M}(x)={\hat{J}}_{M}^{\theta (M)}(x)=M/\delta +\phi _{M}(x)/\phi _{M}'(0)\) which is nondecreasing in \(M\) since admissible policies \(\Theta \) enlarge with increasing \(M\). Taking \(M\rightarrow \infty \), we have \({\hat{J}}_{M}(0)\rightarrow \mu /\delta \), which is simply the return function of the policy that pays everything above \(0\) as dividends and injects enough capital to ensure that the surplus process will remain at \(0\). Moreover, \(\lim _{M\downarrow 0}{\hat{J}}_{M}(0)<0\). These results suggest that there must be some point, denoted by \(M_{0}\in (0,\infty )\), such that \({\hat{J}}_{M}(0)\le 0\) if \(M\le M_{0}\) and \({\hat{J}}_{M}(0)>0\) if \(M>M_{0}\). Our conclusion follows from \(J_{M}^{2}(0)={\hat{J}}_{M}(0)\).

For the case where \(\delta <r\), set \(\bar{M}:=\inf \{M;z_{M}>0\}\) with the convention \(\inf \{\emptyset \}=\infty \), where \(z_{M}\) is defined in Lemma A.2ii, from which we also know that \(\bar{M}>\mu \). If \(\bar{M}=\infty \), which means that \(\phi _{M}\) is convex on \([0,\infty )\) for each \(M>0\). If \(\bar{M}\) is finite, then \(\phi _{M}\) is convex on \([0,\infty )\) for any \(M<\bar{M}\), and for each \(M>\bar{M}\), by (B.2) and Lemma A.2ii, we have \(J_{M}^{2}(0)>\mu /\delta \). In either of the preceding cases, \(J_{M}^{2}(0)={\hat{J}}_{M}(0)\) for \(M<\bar{M}\) and \(\lim _{M\uparrow \bar{M}}J_{M}^{2}(0)=\mu /\delta \); then one can find \(M_{0}\) (\(<\bar{M}\)) by an argument analogous to that used in the case \(\delta \ge r\).

Proof of Lemma 3.2

We first show that there is no intersection if \(M\le M_{0}\). In this case, Lemma 3.1, together with \(\phi _{M}'<0\) and (B.2), tells us that \(\phi _{M}''(0)\ge 0\). Then, by Lemma A.2ii, we know that \(\phi _{M}\) is strictly convex on \(R^{+}\), which, combined with \(\phi _{M}>0\) and (B.2), induces \({J^{2}_{M}}'(x)<1\) and \(J_{M}^{2}(x)<(\mu +rx)/\delta \). Similarly, from Lemma A.1 and (B.1) we have

These inequalities, in conjunction with initial values \(J^{1}(0)=0\ge J^{2}_{M}(0)\), demonstrate that \(J^{1}\) and \(J^{2}_{M}\) have no intersection on \((0,\infty )\) when \(M\le M_{0}\).

For the case where \(M>M_{0}\), Lemma 3.1 tells us that \(J^{2}_{M}(0)>0=J^{1}(0)\), and by Lemma A.2i we know that \(J^{2}_{M}<M/\delta \), while (B.3) shows that \(J^{1}(x)\rightarrow \infty \) as \(x\rightarrow \infty \). Therefore, \(J^{1}\) and \(J^{2}_{M}\) have at least one intersection. Moreover, if \(\delta >r\), then the intersection lies on \((0,\bar{z})\) since \(J^{1}(x)>(\mu +rx)/\delta >J^{2}_{M}(x)\) on \((\bar{z},\infty )\). For the case where \(\delta <r\) and \(z_{M}>0\), from Lemmas A.1ii and A.2ii we know that \(f\) and \(\phi _M\) are concave on \((0,z_M)\). This, in combination with (B.1) and (B.2) and the fact that \(\phi _{M}'<0<f'\), shows \(J^{2}_{M}(x)>(\mu +rx)/\delta >J^{1}(x)\) on \((0,z_M)\). Thus the intersection lies above \(z_{M}\). The uniqueness follows from \({J^{1}}'(x)>1>{J^{2}_{M}}'(x)\) on \((0,\bar{z})\) if \(\delta \ge r\) and on \((z_M,\infty )\) if \(\delta <r\). \(\square \)

Proof of Lemma 4.1

Equation (4.10) manifests on \(x\in (0,x_{0}]\), \(V_{1}(x)=x/\alpha \le (\mu /2+rx)/\delta \), which, by Lemma A.4iii, is smaller than \(V^{2}_{M}(x)\), whereas from Lemma A.3iii and boundary condition (A.5b) we know that \(V^1(x_M)>(\mu /2+rx_M)/\delta =V^{2}_{M}(x_M)\). These results show that the intersection lies on \((x_{0},x_{M})\).

Uniqueness is verified by considering two different cases. First, if \(\delta \ge r\), then, by Lemma A.4ii, we know that \({V^{2}_{M}}'(x)<1\). Similarly, from Lemma A.3ii we have \({V^{1}}'(x)>1\) on \((x_0,\bar{x})\). Therefore, uniqueness is certain if \(x_M\le \bar{x}\). A typical situation for \(\delta >r\) and \(x_{M}<\bar{x}\) is shown in Fig. 3. If \(x_M>\bar{x}\) (which, according to Lemma A.3ii, happens only if \(\delta >r\)), by rewriting \(V^{1}(x)\) and \(V_{M}^{2}(x)\) on \((x_{0},x_{M})\) in the form of (B.1) and (B.2), respectively, and then using the strict convexity of \(U\) and the strict concavity of \(\psi _{M}\) on \((\bar{x},x_M)\), one gets that the unique intersection \(\hat{x}\) lies on \((x_{0},\bar{x})\). For the remaining case where \(\delta <r\), Lemma (A.4)ii tells us that \(\psi _M\) is concave on \(({\underline{x}}_{M},x_M)\) and convex on \((-\infty ,{\underline{x}}_{M})\) (possibly being an empty set). Whenever \({\underline{x}}_{M}>x_0\) or \({\underline{x}}_{M}\le x_0\), just like \(x_M>\bar{x}\) or \(x_M\le \bar{x}\) in the case of \(\delta >r\), uniqueness can be proved similarly. Moreover, if the first subcase occurs, i.e., \({\underline{x}}_{M}>x_0\), then \(\hat{x}\in ({\underline{x}}_{M},x_M)\). \(\square \)

Rights and permissions

About this article

Cite this article

Peng, X., Bai, L. & Guo, J. Optimal Control with Restrictions for a Diffusion Risk Model Under Constant Interest Force. Appl Math Optim 73, 115–136 (2016). https://doi.org/10.1007/s00245-015-9295-3

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00245-015-9295-3